Can the Famous University Experience of Top Managers Improve Corporate Performance? Evidence from China

Abstract

:1. Introduction

2. Theory and Hypotheses

2.1. Famous University Experience of Top Managers and Corporate Performance

2.2. Famous University Experience, Overconfidence and Corporate Performance

2.3. The Moderating Role of Business Complexity

3. Research Design

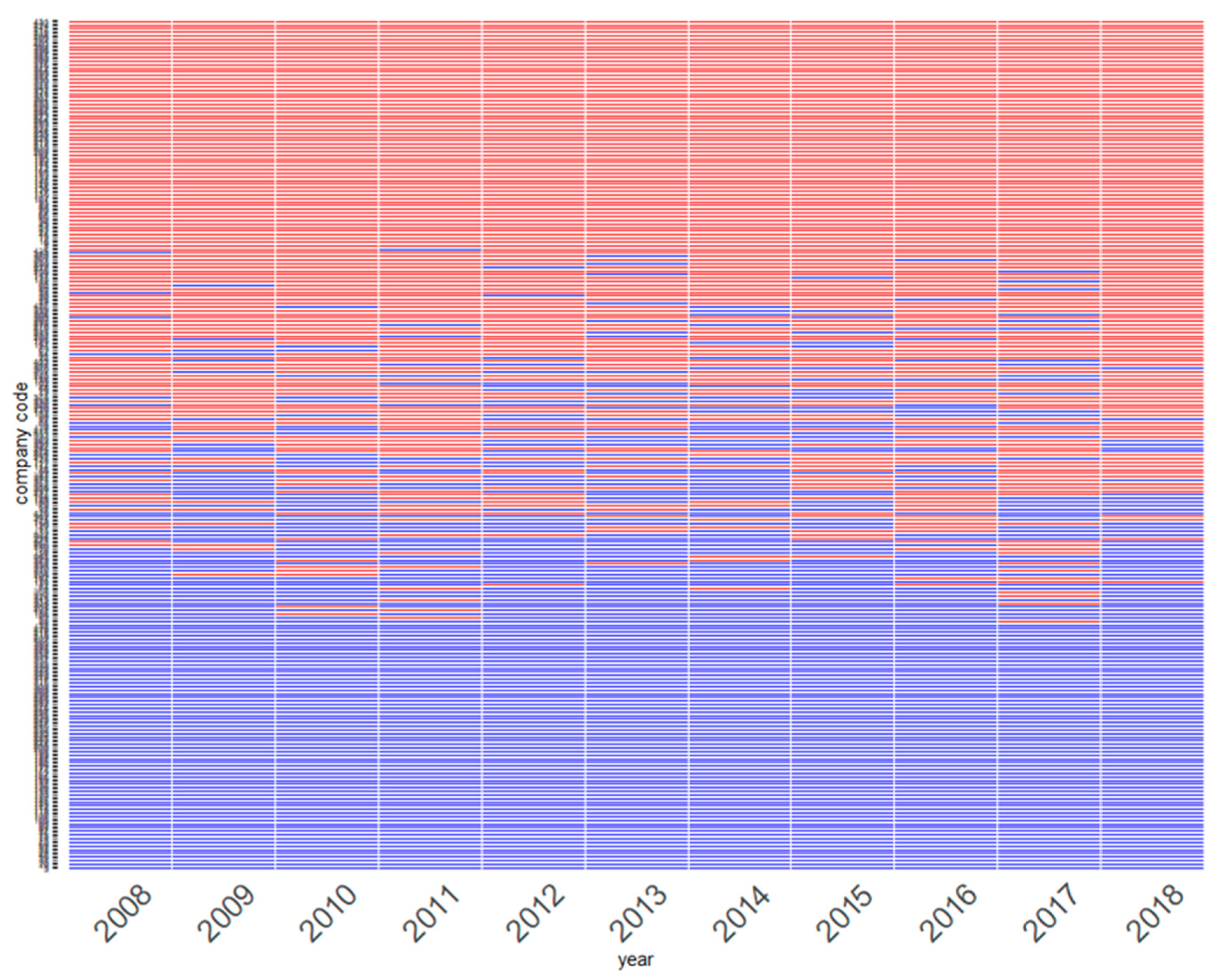

3.1. Data and Sample

3.2. Variables

3.2.1. Dependent Variable: Corporate Performance

3.2.2. Independent Variable: Proportion of Top Managers with Famous University Experience in TMT

3.2.3. Control Variables

3.2.4. Mediating Variable: Overconfidence

3.2.5. Moderating Variable: Business Complexity

3.3. Model Estimation

4. Results

4.1. Descriptive Statistics

4.2. Regression Analysis

4.2.1. Main Effect

4.2.2. Mediating Effect

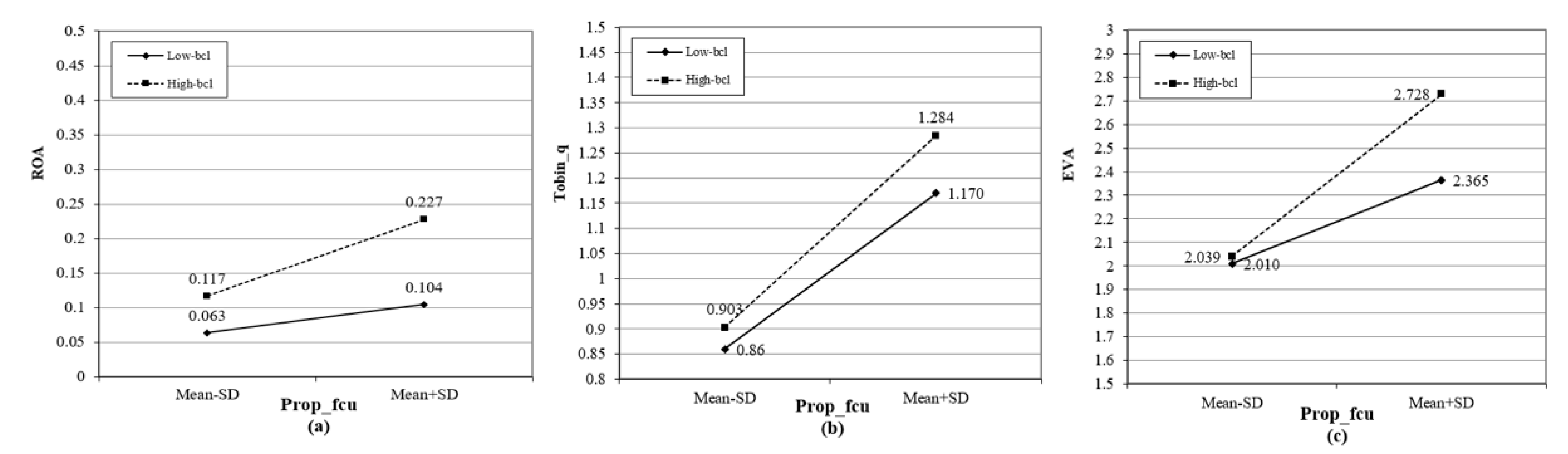

4.2.3. Moderating Effect

4.3. Panel-PSM

5. Robustness Checks

5.1. Variable Measurement

5.2. Instrumental Variable

6. Discussion

6.1. Theoretical Contributions

6.2. Practical Implications

6.3. Limitations and Future Research Directions

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zahra, S.A. Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Nickell, S. Competition and corporate performance. J. Political Econ. 1996, 104, 724–746. [Google Scholar] [CrossRef]

- Molina, L.M.; García-Morales, V.J. Combined Influence of Absorptive Capacity and Corporate Entrepreneurship on Performance. Sustainability 2019, 11, 1–26. [Google Scholar]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Feng, M.; Li, C.; McVay, S.; Skaife, H. Does ineffective internal control over financial reporting affect a firm’s operations? Evidence from firms’ inventory management. Acc. Rev. 2015, 90, 529–557. [Google Scholar] [CrossRef]

- Lovelace, B.; Bundy, J.; Hambrick, D.C.; Pollock, T.G. The shackles of CEO celebrity: Sociocognitive and behavioral role constraints on “star” leaders. Acad. Manag. Rev. 2018, 43, 419–444. [Google Scholar] [CrossRef]

- Quigley, T.J.; Hambrick, D.C. Has the “CEO effect” increased in recent decades? A new explanation for the great rise in America’s attention to corporate leaders. Strateg. Manag. J. 2015, 36, 821–830. [Google Scholar] [CrossRef]

- Wowak, A.J.; Hambrick, D.C. A model of person-pay interaction: How executives vary in their responses to compensation arrangements. Strateg. Manag. J. 2010, 31, 803–821. [Google Scholar] [CrossRef]

- Abidin, S.; Reddy, K.; Chen, L. Determinants of ownership structure and performance of seasoned equity offerings: Evidence from Chinese stock markets. Int. J. Manag. Financ. 2012, 8, 304–331. [Google Scholar] [CrossRef]

- Hambrick, D.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Hambrick, D.C. Upper Echelon Theory: An Update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Jalbert, T.; Furumo, K.; Jalbert, M. Does educational background affect CEO compensation and firm performance? J. Appl. Bus. Res. 2010, 27, 15–40. [Google Scholar] [CrossRef]

- Gottesman, A.A.; Morey, M.R. CEO Educational Background and Firm Financial Performance. J. Appl. Financ. 2010, 20, 70–82. [Google Scholar]

- Lindorff, M.; Prior, J.E. CEO business education and firm financial performance: A case for humility rather than hubris. Educ. + Train. 2013, 55, 461–477. [Google Scholar] [CrossRef]

- Çelikyurt, U.; Dönmez, B.N. Engineer CEOs and firm performance in BIST manufacturing Firms. Muhasebe Ve Finans. Derg. 2017, 75, 171–182. [Google Scholar] [CrossRef]

- Lee, H.U.; Park, J.H. The influence of top management team international exposure on international alliance formation. J. Manag. Stud. 2008, 45, 961–981. [Google Scholar] [CrossRef]

- Lin, D.; Lu, J.; Liu, X.; Choi, S.J. Returnee CEO and innovation in Chinese high-tech SMEs. Int. J. Technol. Manag. 2014, 65, 151–171. [Google Scholar] [CrossRef]

- Francis, B.; Hasan, I.; Wu, Q. Professors in the boardroom and their impact on corporate governance and firm performance. Financ. Manag. 2015, 44, 547–581. [Google Scholar] [CrossRef]

- Cho, C.H.; Jung, J.H.; Kwak, B.; Lee, J.; Yoo, C.Y. Professors on the Board: Do they contribute to society outside the classroom? J. Bus. Ethics 2017, 141, 393–409. [Google Scholar] [CrossRef]

- Morresi, O. How much is CEO education worth to a firm? Evidence from European firms. PSL Q. Rev. 2017, 70, 311–353. [Google Scholar]

- Wang, D.D. Performance-based resource allocation for higher education institutions in China. Socio Econ. Plan. Sci. 2019, 65, 66–75. [Google Scholar] [CrossRef]

- Chakravarty, S.; Hegde, P. The Joint Entrance Exam, overconfident directors and firm performance. J. Corp. Financ. 2019, 56, 298–318. [Google Scholar] [CrossRef]

- Heaton, J.B. Managerial optimism and corporate finance. Financ. Manag. 2002, 31, 33–45. [Google Scholar] [CrossRef]

- Heaton, J.B. Managerial optimism: New observations on the unifying theory. Eur. Financ. Manag. 2019, 25, 1150–1167. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO overconfidence and corporate investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef] [Green Version]

- Hackbarth, D. Determinants of corporate borrowing: A behavioral perspective. J. Corp. Financ. 2009, 15, 389–411. [Google Scholar] [CrossRef]

- Gervais, S.; Heaton, J.B.; Odean, T. Overconfidence, compensation contracts, and capital budgeting. J. Financ. 2011, 66, 1735–1777. [Google Scholar] [CrossRef]

- Hackbarth, D. Managerial traits and capital structure decisions. J. Financ. Quant. Anal. 2008, 43, 843–881. [Google Scholar] [CrossRef] [Green Version]

- Barros, L.; Silveira, A.D. Overconfidence, Managerial Optimism, and the Determinants of Capital Structure. Braz. Rev. Financ. 2008, 6, 293–335. [Google Scholar] [CrossRef] [Green Version]

- Ramiah, V.; Zhao, Y.; Moosa, I.; Graham, M. A behavioural finance approach to working capital management. Eur. J. Financ. 2016, 22, 662–687. [Google Scholar] [CrossRef]

- Roll, R. The hubris hypothesis of corporate takeovers. J. Bus. 1986, 59, 197–216. [Google Scholar] [CrossRef]

- Hayward, M.L.; Hambrick, D.C. Explaining the premiums paid for large acquisitions: Evidence of CEO hubris. Adm. Sci. Q. 1997, 42, 103–127. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. Who makes acquisitions? CEO overconfidence and the market’s reaction. J. Financ. Econ. 2008, 89, 20–43. [Google Scholar] [CrossRef] [Green Version]

- Deshmukh, S.; Goel, A.M.; Howe, K.M. CEO overconfidence and dividend policy. J. Financ. Intermediation 2013, 22, 440–463. [Google Scholar] [CrossRef] [Green Version]

- Deshmukh, S.; Anand, M.G.; Keith, M.H. Do CEO Beliefs Affect Corporate Cash Holdings? Working Paper; DePaul University: Chicago, IL, USA; Navigant Consulting: Chicago, IL, USA, 2018. [Google Scholar]

- Hirshleifer, D.; Low, A.; Teoh, S.H. Are overconfident CEOs better innovators? J. Financ. 2012, 67, 1457–1498. [Google Scholar] [CrossRef] [Green Version]

- Ahmed, A.S.; Duellman, S. Managerial overconfidence and accounting conservatism. J. Account. Res. 2013, 51, 1–30. [Google Scholar] [CrossRef]

- Ho, P.H.; Huang, C.W.; Lin, C.Y.; Yen, J.F. CEO overconfidence and financial crisis: Evidence from bank lending and leverage. J. Financ. Econ. 2016, 120, 194–209. [Google Scholar] [CrossRef]

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Richardson, G.B. The organisation of industry. Econ. J. 1972, 82, 883–896. [Google Scholar] [CrossRef]

- Nelson, R.R. Why do firms differ, and how does it matter? Strateg. Manag. J. 1991, 12, 61–74. [Google Scholar] [CrossRef]

- Lieberson, S.; O’Connor, J.F. Leadership and organizational performance: A study of large corporations. Am. Sociol. Rev. 1972, 37, 117–130. [Google Scholar] [CrossRef]

- Hiller, N.J.; Hambrick, D.C. Conceptualizing executive hubris: The role of (hyper-) core self-evaluations in strategic decision-making. Strateg. Manag. J. 2005, 26, 297–319. [Google Scholar] [CrossRef]

- Crossland, C.; Zyung, J.; Hiller, N.J.; Hambrick, D.C. CEO career variety: Effects on firm-level strategic and social novelty. Acad. Manag. J. 2014, 57, 652–674. [Google Scholar] [CrossRef]

- Judge, T.A.; Cable, D.M.; Boudreau, J.W.; Bretz, R.D., Jr. An empirical investigation of the predictors of executive career success. Pers. Psychol. 1995, 48, 485–519. [Google Scholar] [CrossRef] [Green Version]

- Chevalier, J.; Ellison, G. Are some mutual fund managers better than others? Cross-sectional patterns in behavior and performance. J. Financ. 1999, 54, 875–899. [Google Scholar] [CrossRef]

- Child, J. Managerial and organizational factors associated with company performance-part II. A contingency analysis. J. Manag. Stud. 1975, 12, 12–27. [Google Scholar] [CrossRef]

- Hofstede, G. Motivation, leadership, and organization: Do American theories apply abroad? Organ. Dyn. 1980, 9, 42–63. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in Human Capital. The Role of Education and of Research; The Free Press: New York, NY, USA, 1971; pp. 1–18. [Google Scholar]

- Blundell, R.; Dearden, L.; Meghir, C.; Sianesi, B. Human capital investment: The returns from education and training to the individual, the firm and the economy. Fisc. Stud. 1999, 20, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Currie, J. Healthy, wealthy, and wise: Is there a causal relationship between child health and human capital development? J. Econ. Lit. 2009, 47, 87–122. [Google Scholar] [CrossRef] [Green Version]

- Wallenborn, M. Vocational Education and Training and Human Capital Development: Current practice and future options. Eur. J. Educ. 2010, 45, 181–198. [Google Scholar] [CrossRef]

- Dessler, G. Human Resource Management, 15th ed.; Florida International University: Miami, FL, USA, 2012; pp. 5–20. [Google Scholar]

- Beker, G.S. Human Capital; Columbia: New York, NY, USA, 1964; pp. 5–37. [Google Scholar]

- Bell, R.E.; Youngson, A.J. Present and Future in Higher Education; Tavistock: London, UK, 1973; pp. 47–55. [Google Scholar]

- Thomas, W.H.; Feldman, D.C. How broadly does education contribute to job performance? Pers. Psychol. 2009, 62, 89–134. [Google Scholar]

- Bourdieu, P. The social space and the genesis of groups. Information 1985, 24, 195–220. [Google Scholar]

- Moran, P. Structural vs. relational embeddedness: Social capital and managerial performance. Strateg. Manag. J. 2005, 26, 1129–1151. [Google Scholar] [CrossRef]

- Coleman, J.S. Social capital in the creation of human capital. Am. J. Sociol. 1988, 94, S95–S120. [Google Scholar] [CrossRef]

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital, and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Tsai, W.; Ghoshal, S. Social capital and value creation: The role of intrafirm networks. Acad. Manag. J. 1998, 41, 464–476. [Google Scholar]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strateg. Manag. J. 1999, 20, 397–420. [Google Scholar] [CrossRef]

- Katz, N.; Lazer, D.; Arrow, H.; Contractor, N. Network theory and small groups. Small Group Res. 2004, 35, 307–332. [Google Scholar] [CrossRef]

- Hwang, B.H.; Kim, S. It pays to have friends. J. Financ. Econ. 2009, 93, 138–158. [Google Scholar] [CrossRef]

- Hur, K.S.; Kim, D.H.; Cheung, J.H. Managerial Overconfidence and Cost Behavior of R&D Expenditures. Sustainability 2019, 11, 4878. [Google Scholar]

- Belliveau, M.A.; O’Reilly, C.A., III; Wade, J.B. Social capital at the top: Effects of social similarity and status on CEO compensation. Acad. Manag. J. 1996, 39, 1568–1593. [Google Scholar]

- Barber, B.M.; Odean, T. Boys will be boys: Gender, overconfidence, and common stock investment. Q. J. Econ. 2001, 116, 261–292. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G.Y. Overconfidence and early-life experiences: The effect of managerial traits on corporate financial policies. J. Financ. 2011, 66, 1687–1733. [Google Scholar] [CrossRef] [Green Version]

- Edward, R.J.; Schoemaker, P.H. Managing overconfidence. Sloan Manag. Rev. 1992, 33, 7–17. [Google Scholar]

- Hall, C.C.; Ariss, L.; Todorov, A. The illusion of knowledge: When more information reduces accuracy and increases confidence. Organ. Behav. Hum. Decis. Process. 2007, 103, 277–290. [Google Scholar] [CrossRef]

- Benton, M. The Knowledge Illusion: Why We Never Think Alone. Qual. Manag. J. 2017, 24, 51. [Google Scholar]

- Kumar, S.; Goyal, N. Behavioral biases in investment decision making–a systematic literature review. Qual. Res. Financ. Mark. 2015, 7, 88–108. [Google Scholar] [CrossRef]

- Smit, H.T.J.; Matawlie, N.R. Do Overconfident CEOs Ignore Toehold Strategies; Technical Report; Erasmus University: Rotterdam, The Netherlands, 2017. [Google Scholar]

- Huang, W.; Jiang, F.; Liu, Z.; Zhang, M. Agency cost, top executives’ overconfidence, and investment-cash flow sensitivity—Evidence from listed companies in China. Pac. Basin Financ. J. 2011, 19, 261–277. [Google Scholar] [CrossRef]

- Pikulina, E.; Renneboog, L.; Tobler, P.N. Overconfidence and investment: An experimental approach. J. Corp. Financ. 2017, 43, 175–192. [Google Scholar] [CrossRef] [Green Version]

- Seo, K.; Kim, E.E.K.; Sharma, A. Examining the determinants of long-term debt in the US restaurant industry: Does CEO overconfidence affect debt maturity decisions? Int. J. Contemp. Hosp. Manag. 2017, 29, 1501–1520. [Google Scholar] [CrossRef]

- Akben, S.E. Corporate diversification and firm value: Evidence from emerging markets. Int. J. Emerg. Mark. 2015, 10, 294–310. [Google Scholar] [CrossRef]

- Mackey, T.B.; Barney, J.B.; Dotson, J.P. Corporate diversification and the value of individual firms: A Bayesian approach. Strateg. Manag. J. 2017, 38, 322–341. [Google Scholar] [CrossRef]

- Stein, J.C. Internal capital markets and the competition for corporate resources. J. Financ. 1997, 52, 111–133. [Google Scholar] [CrossRef]

- Child, P.; Diederichs, R.; Sanders, F.H.; Wisniowski, S.; Cummings, P. SMR forum: The management of complexity. Sloan Manag. Rev. 1991, 33, 73–81. [Google Scholar]

- Kingwell, R. Managing complexity in modern farming. Aust. J. Agric. Resour. Econ. 2011, 55, 12–34. [Google Scholar] [CrossRef]

- Demsetz, H.; Lehn, K. The structure of corporate ownership: Causes and consequences. J. Political Econ. 1985, 93, 1155–1177. [Google Scholar] [CrossRef]

- Bushman, R.M.; Piotroski, J.D.; Smith, A. What determines corporate transparency? J. Account. Res. 2004, 42, 207–252. [Google Scholar] [CrossRef]

- Rakhmayil, S.; Yuce, A. Executive qualification and firm value. J. Appl. Bus. Econ. 2013, 14, 52–70. [Google Scholar]

- Quigley, T.J.; Hambrick, D.C.; Misangyi, V.F.; Rizzi, G.A. CEO selection as risk-taking: A new vantage on the debate about the consequences of insiders versus outsiders. Strateg. Manag. J. 2019, 40, 1453–1470. [Google Scholar] [CrossRef]

- Cui, Y.; Zhang, Y.; Guo, J.; Hu, H.; Meng, H. Top management team knowledge heterogeneity, ownership structure and financial performance: Evidence from Chinese IT listed companies. Technol. Forecast. Soc. Chang. 2019, 140, 14–21. [Google Scholar] [CrossRef]

- Coles, J.L.; Daniel, N.D.; Naveen, L. Boards: Does one size fit all? J. Financ. Econ. 2008, 87, 329–356. [Google Scholar] [CrossRef] [Green Version]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Chen, R.; Zheng, Y.; Liu, W. Mediation Analysis: Principles, Procedures, Bootstrap Methods and Applications. J. Mark. Sci. 2015, 9, 120–135. [Google Scholar]

- Imai, K.; Kim, I.S. When should we use unit fixed effects regression models for causal inference with longitudinal data? Am. J. Political Sci. 2019, 63, 467–490. [Google Scholar] [CrossRef]

- Kim, J.B.; Wang, Z.; Zhang, L. CEO overconfidence and stock price crash risk. Contemp. Account. Res. 2016, 33, 1720–1749. [Google Scholar] [CrossRef]

- Stock, J.H.; Wright, J.H.; Yogo, M. A survey of weak instruments and weak identification in generalized method of moments. J. Bus. Econ. Stat. 2002, 20, 518–529. [Google Scholar] [CrossRef]

- Sanderson, E.; Windmeijer, F. A weak instrument F-test in linear IV models with multiple endogenous variables. J. Econom. 2016, 190, 212–221. [Google Scholar] [CrossRef] [Green Version]

| Category | Variables | Symbol | Meaning |

|---|---|---|---|

| Dependent Variable | Return on assets | ROA | Net profit/total assets |

| Tobin’s Q | Tobin_q | Net operating profit after tax/replacement cost | |

| Economic Value Added | EVA | (Net operating profit after tax-Total capital) × Weighted average cost of capital | |

| Independent Variables | Proportion of top managers with famous universities experience in the TMT | Prop_fcu | The proportion of top managers graduated from “985 project” universities in the TMT |

| Control Variables | Firm Size | Size | Natural logarithm of total assets |

| Firm Age | Age | Natural logarithm of years after initial public offering | |

| Top management size | TMT_size | The total number of top managers in the TMT | |

| Firm Financial Leverage | Leverage | Liabilities/assets | |

| Investment opportunities | OI | Depreciation expenditure/total sales | |

| Free cash flow | FCF | Net Operating Profits Less Adjusted Taxes + Depreciation and amortization − Increase in operating capital − Capital expenditure | |

| Cash reinvestment ratio | CIR | Net cash flow from operating activities/(net fixed assets + Net held-to-maturity securities + Net Long-term debt investments + Net Long term equity investment + Current asset-current liability) | |

| Mediating Variable | Overconfidence | OC | If the TMT is overconfident, assign 1; otherwise, assign 0 |

| Moderating Variable | Business complexity | bcl | If the business complexity is higher than median, assign 1; otherwise, assign 0 |

| Variables | Full Sample | High Business Complexity | Low Business Complexity | Mean t-Test | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | P50 | SD | Min | Max | Mean | P50 | SD | Min | Max | Mean | P50 | SD | Min | Max | ||

| ROA | 0.084 | 0.085 | 0.15 | −2.706 | 2.529 | 0.065 | 0.077 | 0.181 | −2.706 | 1.611 | 0.105 | 0.092 | 0.1 | 0 | 2.529 | 0.022 ** |

| Tobin_q | 2.44 | 1.712 | 3.212 | 0.089 | 121.5 | 1.739 | 1.148 | 3.251 | 0.089 | 121.5 | 3.26 | 2.49 | 2.962 | 0.255 | 52.83 | 1.32 * |

| EVA | 0.099 | 0.031 | 0.614 | −7.395 | 22.72 | 0.091 | 0.026 | 0.628 | −7.395 | 8.5 | 0.108 | 0.038 | 0.597 | −0.9 | 22.72 | −0.028 ** |

| Prop_fcu | 0.126 | 0.088 | 0.109 | 0 | 0.954 | 0.124 | 0.086 | 0.104 | 0 | 0.954 | 0.128 | 0.088 | 0.09 | 0 | 0.029 | 0.032 |

| OC | 0.613 | 1 | 0.487 | 0 | 1 | 0.621 | 1 | 0.485 | 0 | 1 | 0.606 | 1 | 0.489 | 0 | 1 | −0.015 |

| Variables | I | II | ||||

|---|---|---|---|---|---|---|

| ROA | Tobin_q | EVA | ROA | Tobin_q | EVA | |

| Prop_fcu | 0.0162 * | 0.0326 ** | 0.078 ** | 0.0385 *** | 0.0518 *** | 0.188 ** |

| (1.72) | (2.12) | (2.20) | (2.65) | (2.66) | (2.34) | |

| Size | 0.543 *** (4.55) | −0.563 *** (−12.90) | 0.372 *** (7.05) | |||

| Age | 0.094 (1.07) | 0.244 *** (7.49) | −0.109 *** (−2.79) | |||

| TMT_size | −0.019 (−0.64) | 0.034 ** (1.97) | 0.003 (0.14) | |||

| Leverage | −0.29 *** (−4.62) | −0.143 *** (−5.46) | −0.228 *** (−7.17) | |||

| OI | 0.307 *** (7.31) | 0.029 (1.46) | 0.265 *** (10.86) | |||

| FCF | 0.028 (1.62) | 0.018 (1.61) | 0.056 *** (4.12) | |||

| CIR | 0.077 *** (3.06) | 0.062 *** (5.17) | 0.097 *** (6.62) | |||

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 3926 | 3926 | 3926 | 3926 | 3926 | 3926 |

| Adj_R2 | 0.0911 | 0.0842 | 0.0852 | 0.0911 | 0.0842 | 0.0852 |

| Variables | I | II | III | IV |

|---|---|---|---|---|

| OC | ROA | Tobin_q | EVA | |

| Prop_fcu | −0.118 *** (−2.67) | 0.019 * (1.72) | 0.074 ** (2.01) | 0.122 ** (2.32) |

| OC | −0.01 * (−1.78) | −0.052 * (−1.92) | −0.028 ** (−2.08) | |

| Control | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 3926 | 3926 | 3926 | 3926 |

| Adj_R 2 | 0.028 | 0.08 | 0.139 | 0.08 |

| Variables | ROA | Tobin_q | EVA |

|---|---|---|---|

| Prop_fcu | 0.042 *** | 0.325 *** | 0.372 ** |

| (3.15) | (5.93) | (2.44) | |

| bcl | 0.053 (1.06) | 0.043 ** (2.07) | 0.029 (0.99) |

| Prop_fcu×bcl | 0.07 *** (3.66) | 0.075 *** (3.43) | 0.349 * (1.95) |

| control | Yes | Yes | Yes |

| industry | Yes | Yes | Yes |

| year | Yes | Yes | Yes |

| N | 3926 | 3926 | 3926 |

| Adj_R2 | 0.0911 | 0.0842 | 0.0852 |

| τ ATT | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| T = 0 | ROA | Tobin_q | EVA | ||||||

| I Full Sample | II Low Business Complexity | III High Business Complexity | IV Full Sample | V Low Business Complexity | VI High Business Complexity | VII Full Sample | VIII Low Business Complexity | IX High Business Complexity | |

| +1 to 0 | 0.003 ** | 0.0028 *** | 0.0032 *** | 0.0126 *** | 0.0108 * | 0.021 *** | 0.013 ** | 0.0043 ** | 0.0178 *** |

| +2 to 0 | 0.012 ** | 0.002 * | 0.022 *** | 0.0052 ** | 0.0041 *** | 0.007 *** | 0.0223 * | 0.0055 *** | 0.034 *** |

| +3 to 0 | 0.006 * | 0.0012 ** | 0.0032 *** | 0.0078 ** | 0.0012 ** | 0.021 *** | 0.0164 * | 0.0103 *** | 0.0062 *** |

| +4 to 0 | 0.005 ** | 0.0032 *** | 0.0051 *** | 0.0226 *** | 0.0208 * | 0.031 *** | 0.025 * | 0.0143 ** | 0.0152 *** |

| +5 to 0 | 0.021 ** | 0.0029 * | 0.0372 *** | 0.0142 ** | 0.0044 *** | 0.0101 ** | 0.0524 * | 0.0145 *** | 0.0268 *** |

| Test Method | Chi-Square/F-Statistic | p-Value |

|---|---|---|

| Hausman Test | 16.238 | 0.000 |

| Stock and Yogo | 15.132 | 0.003 |

| Sanderson-Windmeijer | 17.622 | 0.000 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, W.; Ruan, Q.; Liu, C. Can the Famous University Experience of Top Managers Improve Corporate Performance? Evidence from China. Sustainability 2019, 11, 6975. https://doi.org/10.3390/su11246975

Xu W, Ruan Q, Liu C. Can the Famous University Experience of Top Managers Improve Corporate Performance? Evidence from China. Sustainability. 2019; 11(24):6975. https://doi.org/10.3390/su11246975

Chicago/Turabian StyleXu, Weifeng, Qingsong Ruan, and Chang Liu. 2019. "Can the Famous University Experience of Top Managers Improve Corporate Performance? Evidence from China" Sustainability 11, no. 24: 6975. https://doi.org/10.3390/su11246975