Value Generation of Remanufactured Products: Multi-Case Study of Third-Party Companies

Abstract

1. Introduction

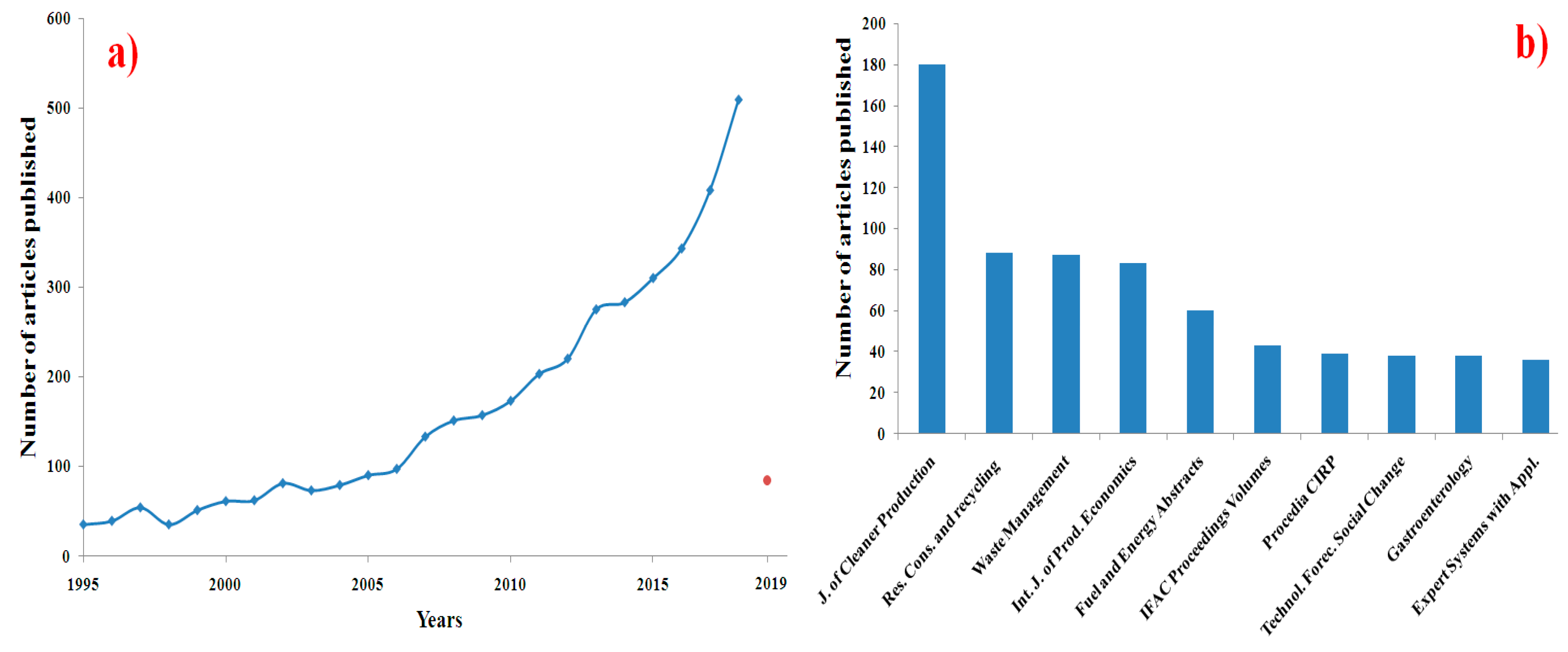

2. Literature Overview

2.1. Normatization of Waste Electrical and Electronic Equipment

2.2. Impact of Electrical and Electronic Equipment

2.3. WEEE Recycling Barriers

2.4. Viability of WEEE Recycling Techniques

2.5. Remanufactured Products

2.5.1. Quality and Warranty

2.5.2. Processing Time

2.5.3. Partnerships with Retailers and Manufacturers

3. Methodology

- formulate research questions;

- select sources for extant literature, such as Scopus, Science Direct, and Web of Science;

- reduce the number of articles by reading them and identifying the main topic;

- define a methodology to analyse the chosen articles;

- describe the main scientific results; and

- identify the scientific gaps and bottle necks.

4. Results and Discussion

4.1. Reverse Logistics Sales Companies

4.1.1. Case A

4.1.2. Case B

4.1.3. Case C

4.1.4. Case D

4.1.5. Case E

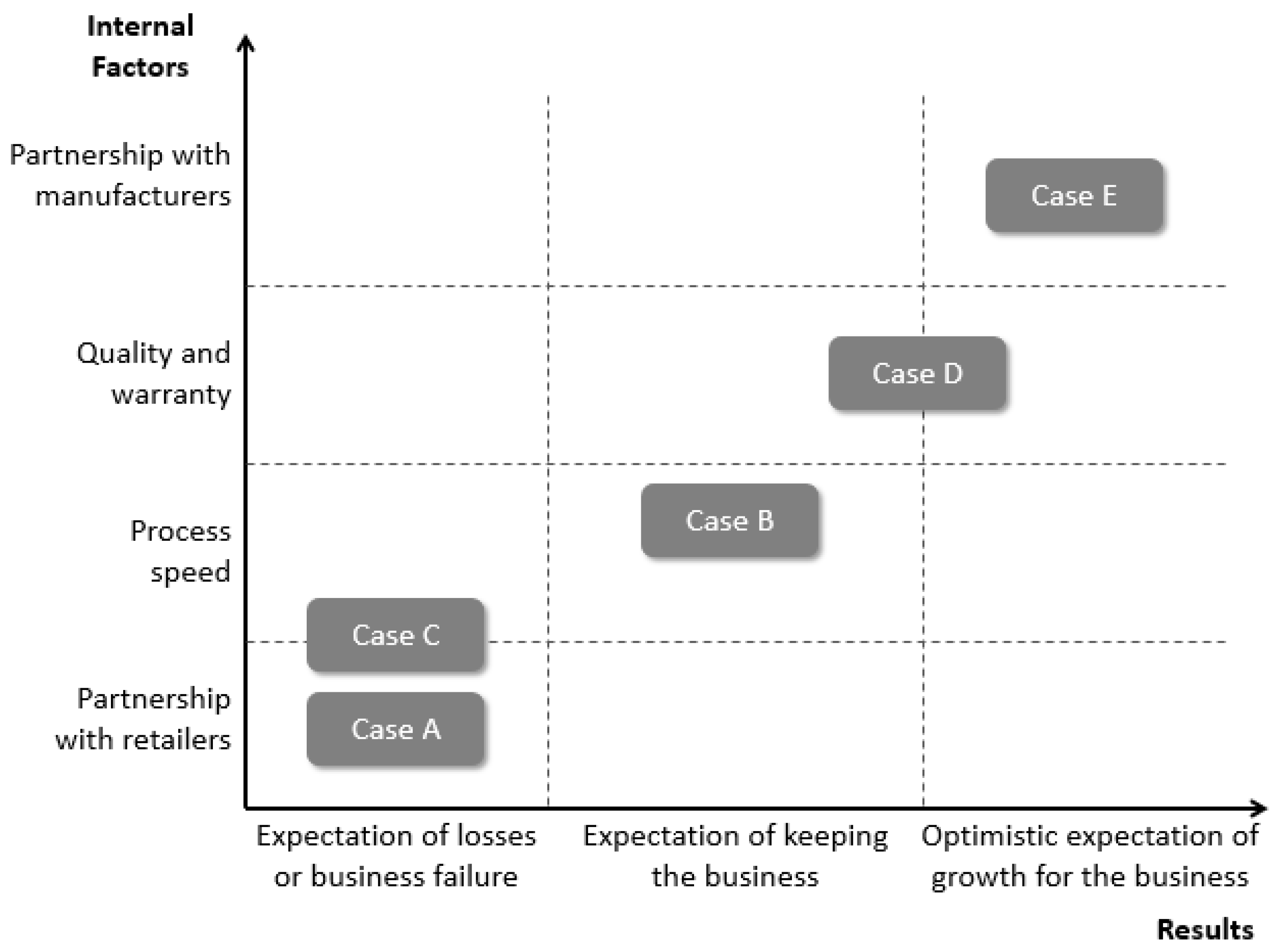

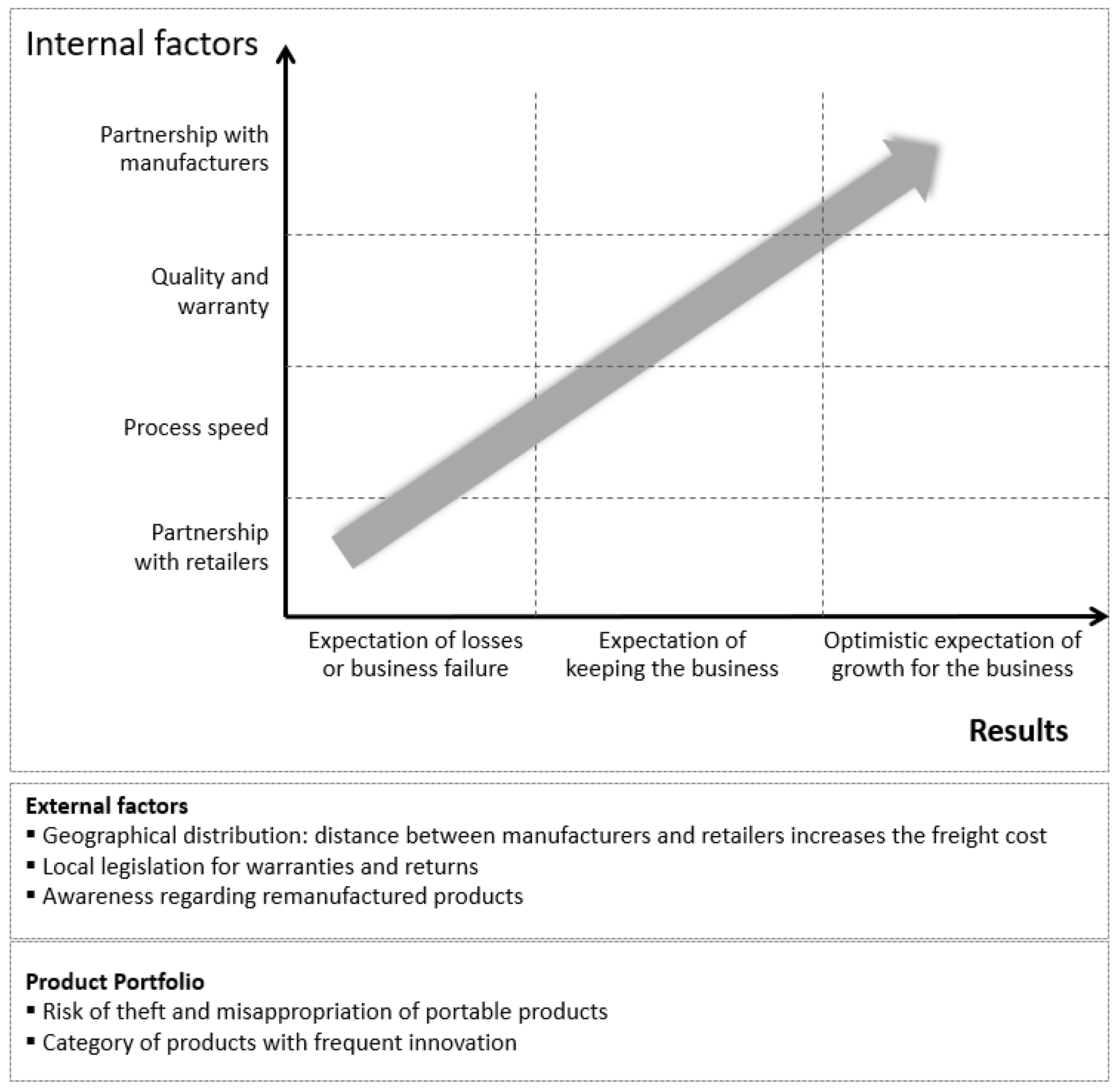

4.1.6. Results of Variables That Impact Value-Add in Remanufactured Products

- Emergence of new companies in the EEE production chain (remanufacturing, logistics, and repair companies);

- With the collection of damaged EEE products and their replacement, the customer portfolio is maintained;

- Increased circulation of capital in the productive chain;

- Reduction of fines for irregular disposal of WEEE;

- Reduction of waste treatment costs because of WEEE reuse and remanufacturing;

- Increase in profits or reduction in losses with the sale of WEEE;

- Improvement in the image of companies;Social

- Increase in the level of employment in the EEE production chain;

- Workers are registered and receive social benefits in accordance with Brazilian labour laws;

- There is no slave-like relationship in the EEA chain in Brazil, as found in other countries;

- As irregular treatments, such as open burning, do not occur, workers are not exposed to toxic substances and there will not suffer diseases caused by dangerous substances present in WEEE;

- There are no employee treatment costs because of diseases caused by WEEE toxic substances;

- Increase in the life cycle of EEE;

- Reduction of WEEE generation;

- With the reuse of EEE parts, there is lower energy consumption;

- Owing to the items mentioned above, there is a lower consumption of raw material for the production of parts and new EEE;

- Treatment of waste according to Brazilian standards;

- Minimisation of WEEE sent to the sanitary landfills;

- As there is no open burning, there is no emission of toxic gases;

- Because of the absence of metals in WEEE intended for landfills, there is no contamination of the soil and groundwater through metal leaching.

- Owing to the continental dimensions of Brazil, which makes the transportation logistics of WEEE from other regions very expensive, the process only works locally;

- Possible profits from the resale of precious minerals go to other countries;

- There are no companies specialising in the processing of the precious minerals from the WEEE;

- Moving out of specialised jobs related to the processing of precious minerals to other countries.

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Milovantseva, N.; Fitzpatrick, C. Barriers to electronics reuse of transboundary e-waste shipment regulations: An evaluation based on industry experiences. Resour. Conserv. Recycl. 2015, 102, 170–177. [Google Scholar] [CrossRef]

- Nowakowski, P. A novel, cost efficient identification method for disassembly planning of waste electrical and electronic equipment. J. Clean. Prod. 2018, 172, 2695–2707. [Google Scholar] [CrossRef]

- Almeida, S.T.; Borsato, M.; Ugaya, C.M.L. Application of exergy-based approach for implementing design for reuse: The case of microwave oven. J. Clean. Prod. 2017, 168, 876–892. [Google Scholar] [CrossRef]

- Gu, F.; Ma, B.; Guo, J.; Summers, P.A.; Hall, P. Internet of things and Big Data as potential solutions to the problems in waste electrical and electronic equipment management: An exploratory study. Waste Manag. 2017, 68, 434–448. [Google Scholar] [CrossRef] [PubMed]

- Tansel, B. From electronic consumer products to e-wastes: Global outlook, waste quantities, recycling challenges. Environ. Int. 2017, 98, 35–45. [Google Scholar] [CrossRef]

- Dindarian, A.; Gibson, A.A.P.; Quariguasi-Frota-Neto, J. Electronic product returns and potential reuse opportunities: A microwave case study in the United Kingdom. J. Clean. Prod. 2012, 32, 22–31. [Google Scholar] [CrossRef]

- Pascale, A.; Bares, C.; Laborde, A. E-waste: Environmental and health challenges. Encycl. Anthropocene 2018, 5, 269–275. [Google Scholar]

- Mimouni, F.; Abouabdellah, A.; Mharzi, H. Study of the reverse logistics’ break-even in a direct supply chain. Int. Rev. Model. on Simul. (IREMOS) 2015, 8, 277–283. [Google Scholar] [CrossRef]

- Zhu, Q.; Li, H.; Zhao, S.; Lun, V. Redesign of service modes for remanufactured products and its financial benefits. Int. J. Prod. Econ. 2016, 171, 231–240. [Google Scholar] [CrossRef]

- Govindan, K.; Soleimani, H. A review of reverse logistics and closed-loop supply chains: A Journal of Cleaner Production focus. J. Clean. Prod. 2017, 142, 371–384. [Google Scholar] [CrossRef]

- Zarbakhshnia, N.; Soleimani, H.; Ghaderi, H. Sustainable third-party reverse logistics provider evaluation and selection using fuzzy SWARA and developed fuzzy COPRAS in the presence of risk criteria. Appl. Soft. Comput. 2018, 65, 307–319. [Google Scholar] [CrossRef]

- Giri, B.C.; Chakraborty, A.; Maiti, T. Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J. Manuf. Syst. 2017, 42, 104–123. [Google Scholar] [CrossRef]

- Zhou, L.; Gupta, S. Marketing research and life cycle pricing strategies for new and remanufactured products. J. Manuf. 2018, 8, 1–22. [Google Scholar] [CrossRef]

- Guide, V.D.R. Production planning and control for remanufacturing: Industry practice and research needs. J. Oper. Manag. 2000, 18, 467–483. [Google Scholar] [CrossRef]

- Tibben-Lembke, R.S.; Rogers, D.S. Differences between forward and reverse logistics in a retail environment. Supply Chain Manag. 2002, 7, 271–282. [Google Scholar] [CrossRef]

- Liquidity Services. 2015. Available online: https://www.liquidityservices.com/globalassets/services/retail/wp_rtcb0101_1502.pdf (accessed on 4 December 2017).

- Kleiner Perkins Caufield Byers KPCB. 2017. Available online: https://www.kleinerperkins.com/perspectives/2016-internet-trends-report (accessed on 14 November 2017).

- The Retail Equation. Return Rate Miscalculations Impact Retail Chains Nationwide: Calculating Your Real Return Rate. 2017. Available online: https://appriss.com/retail/wp-content/uploads/sites/4/2017/02/wp_TRE4015-WhitePaper-ReturnRateMiscalculations_March2013.pdf (accessed on 4 December 2017).

- Ebit. Webshoppers: E-commerce Report. 2017. Available online: https://www.ebit.com.br/webshoppers (accessed on 14 November 2017).

- Agência Brasileira de Desenvolvimento Industrial—ABDI: Logística reversa de Equipamentos eletroeletrônicos: Análise de viabilidade técnica e econômica. 2017. Available online: http://webcache.googleusercontent.com/search?q=cache:http://www.abdi.com.br/Estudo/Logistica%2520reversa%2520de%2520residuos_.pdf&gws_rd=cr&dcr=0&ei=_DoLWsnICsiGwQSPn5mYDQ (accessed on 14 November 2017).

- Sabbaghi, M.; Esmaeilian, B.; Mashhadi, A.R.; Behdad, S.; Cade, W. An investigation of used electronics return flows: A data-driven approach to capture and predict consumers storage and utilization behavior. Waste Manag. 2015, 36, 305–315. [Google Scholar] [CrossRef]

- Blackburn, J.; Guide, V.D.R.; Souza, G.C.; Van Wassenhove, L.N. Reverse supply chains for commercial returns. Calif. Manag. Rev. 2004, 46, 6–22. [Google Scholar] [CrossRef]

- Popescu, M.L. Waste electrical and electronic equipment management in Romania. Harmonizing national environmental law with the UE legislation. Procedia Soc. Behav. Sci. 2015, 188, 264–269. [Google Scholar] [CrossRef]

- Angouria-Tsorochidou, E.; Cimpan, C.; Parajuly, K. Optimized collection of EoL electronic products for Circular economy: A techno-economic assessment. Procedia CIRP 2018, 69, 986–991. [Google Scholar] [CrossRef]

- Lodhia, S.; Martin, N.; Rice, J. Extended producer responsibility for waste televisions and computers: A regulatory evaluation of the Australian experience. J. Clean. Prod. 2017, 164, 927–938. [Google Scholar] [CrossRef]

- Pandey, R.U.; Surjan, A.; Kapshe, M. Exploring linkages between sustainable consumption and prevailing green practices in reuse and recycling of household waste: Case of Bhopal city in India. J. Clean. Prod. 2018, 173, 49–59. [Google Scholar] [CrossRef]

- Zlamparet, G.; Tan, Q.; Stevels, A.B.; Li, J. Resource conservation approached with an appropriate collection and upgrade-remanufacturing for used electronic products. Waste Manag. 2018, 73, 78–86. [Google Scholar] [CrossRef]

- Moura, J.M.B.M.; Pinheiro, I.G.; Lischeski, D.; Valle, J.A.B. Relation of Brazilian institutional users and technical assistances with electronics and their waste: What has changed? Resour. Conserv. Recycl. 2017, 127, 68–75. [Google Scholar] [CrossRef]

- Oliveira Neto, G.C.; Correia, A.J.C.; Schroeder, A.M. Economic and environmental assessment of recycling and reuse of electronic waste: Multiple case studies in Brazil and Switzerland. Resour. Conserv. Recycl. 2017, 127, 42–55. [Google Scholar] [CrossRef]

- Krause, M.J.; Townsend, T.G. Hazardous waste status of discarded electronic cigarettes. Waste Manag. 2015, 39, 57–62. [Google Scholar] [CrossRef] [PubMed]

- Pérez-Belis, V.; Bovea, M.D.; Gómez, A. Waste electric and electronic toys: Management practices and characterisation. Resour. Conserv. Recy 2013, 77, 1–12. [Google Scholar] [CrossRef]

- Scruggs, E.C.; Nimpuno, N.; Moore, R.B.B. Improving information flow on chemicals in electronic products and e-waste to minimize negative consequences for health and the environment. Resour. Conserv. Recycl. 2016, 113, 149–164. [Google Scholar] [CrossRef]

- Cai, C.Y.; Yu, S.Y.; Li, X.Y.; Liu, Y.; Tao, S.; Liu, W.X. Emission characteristics of polycyclic aromatic hydrocarbons from pyrolytic processing during dismantling of electronic wastes. J. Hazard. Mater. 2018, 351, 270–276. [Google Scholar] [CrossRef]

- Shahata, A.; Trupp, S. Sensitive, selective, and rapid method for optical recognition of ultra-traces level of Hg(II), Ag(I), Au(III), and Pd(II) in electronic wastes. Sens. Actuators B 2017, 245, 789–802. [Google Scholar] [CrossRef]

- Peng, B.; Tu, Y.; Wei, G. Governance of electronic waste recycling based on social capital embeddedness theory. J. Clean. Prod. 2018, 187, 29–36. [Google Scholar] [CrossRef]

- Bernard, S. North–south trade in reusable goods: Green design meets illegal shipments of waste. J. Environ. Econ. Manag. 2015, 69, 22–35. [Google Scholar] [CrossRef]

- Lepawsky, J.; Araujo, E.; Davis, J.-M.; Kahhat, R. Best of two worlds? Towards ethical electronics repair, reuse, repurposing and recycling. Geoforum 2017, 81, 87–99. [Google Scholar] [CrossRef]

- Wang, H.; Gu, Y.; Li, L.; Liu, T.; Wu, Y.; Zuo, T. Operating models and development trends in the extended producer responsibility system for waste electrical and electronic equipment. Resour. Conserv. Recycl. 2017, 127, 159–167. [Google Scholar] [CrossRef]

- Nguyen, D.-Q.; Há, V.-H.; Eiji, Y.; Huynh, T.-H. Material Flows from Electronic Waste: Understanding the Shortages for Extended Producer Responsibility Implementation in Vietnam. Procedia CIRP 2017, 61, 651–656. [Google Scholar] [CrossRef]

- Lee, D.; Offenhuber, D.; Duarte, F.; Biderman, A.; Ratti, C. Monitour: Tracking global routes of electronic waste. Waste Manag. 2018, 72, 362–370. [Google Scholar] [CrossRef] [PubMed]

- Ikhlayel, M. An integrated approach to establishe-waste management systems for developing countries. J. Clean Prod. 2018, 170, 119–130. [Google Scholar] [CrossRef]

- Birloaga, L.; Vegliò, F. Overview on hydrometallurgical procedures for silver recovery from various wastes. J. Environ. Chem. Eng. 2018, 6, 2932–2938. [Google Scholar] [CrossRef]

- Kaya, M. Recovery of metals and nonmetals from electronic waste by physical and chemical recycling processes. Waste Manag. 2016, 57, 64–90. [Google Scholar] [CrossRef] [PubMed]

- Dutta, T.; Kim, K.-H.; Deep, A.; Szulejko, J.E.; Vellingiri, K.; Kumar, S.; Kwon, E.E.; Yun, S.-T. Recovery of nanomaterials from battery and electronic wastes: A new paradigm of environmental waste management. Renew. Sustain. Energ. Rev. 2018, 82, 3694–3704. [Google Scholar] [CrossRef]

- Lee, H.; Mishra, B. Selective recovery and separation of copper and iron from fine materials of electronic waste processing. Min. Eng. 2018, 123, 1–7. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, M.; Tan, Q.; Wang, B.; Chen, S. Recovery of copper from WPCBs using slurry electrolysis with ionic liquid [BSO3HPy].HSO4. Hydrometallurgy 2018, 175, 150–154. [Google Scholar] [CrossRef]

- Sinha, R.; Chauhan, G.; Singh, A.; Kumar, A.; Acharya, S. A novel eco-friendly hybrid approach for recovery and reuse of copper from electronic waste. J. Environ. Chem. Eng. 2018, 6, 1053–1061. [Google Scholar] [CrossRef]

- Sheel, A.; Pant, D. Recovery of gold from electronic waste using chemical assisted microbial biosorption (hybrid) technique. Bioresour. Tech. 2018, 247, 1189–1192. [Google Scholar] [CrossRef] [PubMed]

- Avarmaa, K.; Yliaho, S.; Taskinen, P. Recoveries of rare elements Ga, Ge, In and Sn from waste electric and electronic equipment through secondary copper smelting. Waste Manag. 2018, 71, 400–410. [Google Scholar] [CrossRef] [PubMed]

- Innocenzi, V.; Prisciandaro, M.; Tortora, F.; di Celso, G.M.; Vegliò, F. Treatment of WEEE industrial wastewaters: Removal of yttrium and zinc by means of micellar enhanced ultra filtration. Waste Manag. 2018, 74, 393–403. [Google Scholar] [CrossRef] [PubMed]

- Prasad, M.N.V.; Vithanage, M. Electronic Waste Management and Treatment Technology, 1st ed.; Butterworth-Heinemann: Oxford, UK, 2019; p. 316. [Google Scholar]

- Torres, R.; Segura-Bailón, B.; Lapidus, G.T. Effect of temperature on copper, iron and lead leaching from e-waste using citrate solutions. Waste Manag. 2018, 71, 420–425. [Google Scholar] [CrossRef] [PubMed]

- Wieser, H.; Tröger, N. Exploring the inner loops of the circular economy: Replacement, repair, and reuse of mobile phones in Austria. J. Clean. Prod. 2018, 172, 3042–3055. [Google Scholar] [CrossRef]

- Soleimani, H.; Chaharlang, Y.; Ghaderi, H. Collection and distribution of returned-remanufactured products in a vehicle routing problem with pickup and delivery considering sustainable and green criteria. J. Clean. Prod. 2018, 172, 960–970. [Google Scholar] [CrossRef]

- Mavi, R.K.; Goh, M.; Zarbakhshnia, N. Sustainable third-party reverse logistic provider selection with fuzzy SWARA and fuzzy MOORA in plastic industry. Int. J. Adv. Manuf. Technol. 2017, 91, 2401–2418. [Google Scholar] [CrossRef]

- Lund, R.T. Remanufacturing: The Experience of the United States and Implications for Developing Countries; The World Bank: Washington, DC, USA, 1984; p. 126. Available online: http://documents.worldbank.org/curated/en/792491468142480141/Remanufacturing-the-experienceof-the-United-States-and-implications-for-developing-countries (accessed on 14 November 2017).

- Fangchao, X.; Yongjian, L.; Lipan, F. The influence of big data system for used product management on manufacturing–remanufacturing operations. J. Clean. Prod. 2019, 209, 782–794. [Google Scholar]

- Vorasayan, J.; Ryan, S.M. Optimal price and quantity of refurbished products. Prod. Oper. Manag. 2016, 15, 369–383. [Google Scholar] [CrossRef]

- Abbey, J.D.; Meloy, M.G.; Blackburn, J.; Guide, V.D.R. Consumer markets for remanufactured and refurbished products. Calif. Manag. 2015, 57, 26–42. [Google Scholar] [CrossRef]

- Dias, S.L.F.G.; Labegalini, L.; Csillag, J.M. Sustainability in supply chains: A comparative perspective in domestic and international journals. Production 2012, 22, 517–533. [Google Scholar] [CrossRef]

- Dos Santos, R.F.; Alves, J.M. Proposal of an integrated management model for supply chain: Application in home appliances segment. Production 2015, 25, 125–142. [Google Scholar]

- Awaysheh, A.; Klassen, R.D. The impact of supply chain structure on the use of supplier socially responsible practices. Int. J. Oper. Prod. Manag. 2010, 30, 1246–1268. [Google Scholar] [CrossRef]

- Delmas, M.; Montiel, I. Greening the supply chain: When is customer pressure effective? J. Econ. Manag. Strategy 2009, 18, 1. [Google Scholar] [CrossRef]

- Mutha, A.; Bansal, S.; Guide, V.D.R. Managing demand uncertainty through core acquisition in remanufacturing. Prod. Oper. Manag. 2016, 25, 1449–1464. [Google Scholar] [CrossRef]

- Zikopoulos, C.; Tagaras, G. Impact of uncertainty in the quality of returns on the profitability of a single-period refurbishing operation. Eur. J. Oper. Res. 2007, 182, 205–225. [Google Scholar] [CrossRef]

- Harrison, T.P.; Van Wassenhove, L.N.; Area, T.M. The challenge of closed-loop supply chains. Interfaces 2003, 33, 3–6. [Google Scholar]

- Wu, C.H.; Kao, Y.J. Cooperation regarding technology development in a closed-loop supply chain. Eur. J. Oper. Res. 2017, 20, 20–29. [Google Scholar]

- Guide, V.D.R.; Souza, G.C.; Van Wassenhove, L.N.; Blackburn, J.D. Time value of commercial product returns. Manag. Sci. 2006, 52, 1200–1214. [Google Scholar] [CrossRef]

- Choi, T.M.; Li, Y.; Xu, L. Channel leadership, performance and coordination in closed loop supply chain. Int. J. Prod. Econ. 2013, 146, 371–380. [Google Scholar] [CrossRef]

- Gan, S.-S.; Pujawan, I.N.; Suparno; Widodo, B. Pricing decision for new and remanufactured product in a closed-loop supply chain with separate sales-channel. Int. J. Prod. Econ. 2017, 190, 120–132. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and remanufactured products. Manage. Sci. 2006, 52, 15–26. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and differentiated remanufactured products. Eur. J. Oper. Res. 2010, 203, 370–379. [Google Scholar] [CrossRef]

- Sabbaghi, M.; Behdad, S.; Zhuang, J. Managing consumer behavior toward on-time return of the waste electrical and electronic equipment: A game theoretic approach. Int. J. Prod. Econ. 2016, 182, 545–563. [Google Scholar] [CrossRef]

- Van Weelden, E.; Mugge, R.; Bakker, C. Paving the way towards circular consumption: Exploring consumer acceptance of refurbished mobile phones in the Dutch market. J. Clean. Prod. 2016, 113, 743–754. [Google Scholar] [CrossRef]

- Guide, V.D.R.; Li, J. The potential of new products sales by remanufactured products. Decis. Sci. 2010, 41, 547–572. [Google Scholar] [CrossRef]

- Li, W.; Wu, H.; Jin, M.; Lai, M. Two-stage remanufacturing decision makings considering product life cycle and consumer perception. J. Clean. Prod. 2017, 161, 581–590. [Google Scholar] [CrossRef]

- Liu, H.; Lei, M.; Huang, T.; Leong, G.K. Refurbishing authorization strategy in the secondary market for electrical and electronic products. Int. J. Prod. Econ. 2018, 195, 198–209. [Google Scholar] [CrossRef]

- Ferguson, M.; Guide, D.; Souza, G.S. Supply chain coordination for false failure returns. Manuf. Serv. Oper. Manag. 2006, 8, 376–393. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; Sage Publications: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Bányai, T. Real-Time Decision Making in First Mile and Last Mile Logistics: How Smart Scheduling Affects Energy Efficiency of Hyperconnected Supply Chain Solutions. Energies 2018, 11, 1833. [Google Scholar] [CrossRef]

- Abbey, J.D.; Kleber, R.; Souza, G.C.; Voigt, G. The role of perceived quality riskin pricing remanufactured products. Prod. Oper. Manag. 2017, 26, 100–115. [Google Scholar] [CrossRef]

- Guo, J.; Liu, X.; Jo, J. Dynamic joint construction and optimal operation strategy of multi-period reverse logistics network: A case study of Shanghai apparel E-commerce enterprises. J. Intell. Manuf. 2017, 28, 819–831. [Google Scholar] [CrossRef]

- Guo, J.; Shen, B.; Choi, T.M.; Jung, J. A review on supply chain contracts in reverse logistics: Supply chain structures and channel leaderships. J. Clean. Prod. 2017, 144, 387–402. [Google Scholar] [CrossRef]

- Xu, Y.; Li, J.; Tan, Q.; Peters, A.L.; Yang, C. Global status of recycling waste solar panels: A review. Waste Manag. 2018, 75, 450–458. [Google Scholar] [CrossRef]

- Marconi, M.; Favi, C.; Germani, M.; Mandolini, M.; Mengarelli, M. A collaborative End of Life platform to favour the reuse of electronic Components. Procedia CIRP 2017, 61, 166–171. [Google Scholar] [CrossRef]

- Zarbakhshnia, N.; Soleimani, H.; Goh, M.; Razavi, S.S. A novel multi-objective model for green forward and reverse logistics network design. J. Clean. Prod. 2019, 208, 1304–1316. [Google Scholar] [CrossRef]

- Diaz, L.A.; Lister, T.E. Economic evaluation of an electrochemical process for the recovery of metals from electronic waste. Waste Manag. 2018, 74, 384–392. [Google Scholar] [CrossRef] [PubMed]

- Ibanescu, D. Cailean Gavrilescu, D.; Teodosiu, C.; Fiore, S. Assessment of the waste electrical and electronic equipment management systems profile and sustainability in developed and developing European Union countries. Waste Manag. 2018, 73, 39–53. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, X.; Fang, L.; Li, K.; Yang, P.; Du, L.; Ji, K.; Wang, J.; Liu, Q.; Xu, C.; et al. Genomic instability in adult men involved in processing electronic waste in Northern China. Environ. Int. 2018, 117, 69–81. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, X.J.; Guan, J.; Wang, J.; Bing, N.; Zhu, L. Research on reusing technology for disassembling waste printed circuit boards. Procedia Environ. Sci. 2016, 31, 941–946. [Google Scholar] [CrossRef]

- Atasu, A.; Guide, V.D.R.; Van Wassenhove, L.N. So what if remanufacturing cannibalizes my new products sales? Calif. Manag. Rev. 2010, 52, 56–76. [Google Scholar] [CrossRef]

| Themes | Topics Covered | References |

|---|---|---|

| Remanufactured material | They show how remanufacturing lengthens the product life cycle | [5,6,14,21,25,27,28,31,41,51,58,59,64,65,68,71,73,74,76,77,78,83,84,85,86]. |

| Legislation | They set standards for WEEE in several countries of the world | [23,24,25,28,29,35,37]. |

| WEEE Logistics | Show the logistics of WEEE-derived materials | [3,4,5,10,15,22,25,32,37,38,39,40,41,51,53,54,87,88]. |

| Economic viability | Demonstrate how the processes of extracting and selling recycled materials from the WEEE are economically viable | [2,24,29,55,70,89]. |

| Environmental impacts | Assess the impacts of WEEE on the environment | [1,5,25,29,30,32,33,36,37,47,51,62,63,90]. |

| Health and social impacts | Assess the impacts of WEEE on human health | [1,6,7,25,26,29,30,32,36,37,50,91]. |

| Recycling | Present recycling and reuse processes for WEEE materials | [29,34,40,42,43,44,46,47,48,50,51,52,86,92]. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Berssaneti, F.T.; Berger, S.; Saut, A.M.; Vanalle, R.M.; Santana, J.C.C. Value Generation of Remanufactured Products: Multi-Case Study of Third-Party Companies. Sustainability 2019, 11, 584. https://doi.org/10.3390/su11030584

Berssaneti FT, Berger S, Saut AM, Vanalle RM, Santana JCC. Value Generation of Remanufactured Products: Multi-Case Study of Third-Party Companies. Sustainability. 2019; 11(3):584. https://doi.org/10.3390/su11030584

Chicago/Turabian StyleBerssaneti, Fernando Tobal, Simone Berger, Ana Maria Saut, Rosangela Maria Vanalle, and José Carlos Curvelo Santana. 2019. "Value Generation of Remanufactured Products: Multi-Case Study of Third-Party Companies" Sustainability 11, no. 3: 584. https://doi.org/10.3390/su11030584

APA StyleBerssaneti, F. T., Berger, S., Saut, A. M., Vanalle, R. M., & Santana, J. C. C. (2019). Value Generation of Remanufactured Products: Multi-Case Study of Third-Party Companies. Sustainability, 11(3), 584. https://doi.org/10.3390/su11030584