Green Activity-Based Costing Production Planning and Scenario Analysis for the Aluminum-Alloy Wheel Industry under Industry 4.0

Abstract

:1. Introduction

2. Literature Review

2.1. Brief Introduction to Industry 4.0

2.2. Industry 4.0 and Aluminum-Alloy Wheel Industry

2.3. Green Production and Environmental Protection in the Aluminum-Alloy Wheel Industry

3. Green Production Planning Model under ABC and Industry 4.0

3.1. A Production Process for a Typical Aluminum-Alloy Wheel Company

3.2. Assumptions

- All activities in this green ABC model are divided into unit-level and batch-level.

- The related resources driven and activity driver have been chosen by the example company.

- The unit-selling prices of all products remain the same in the relevant period.

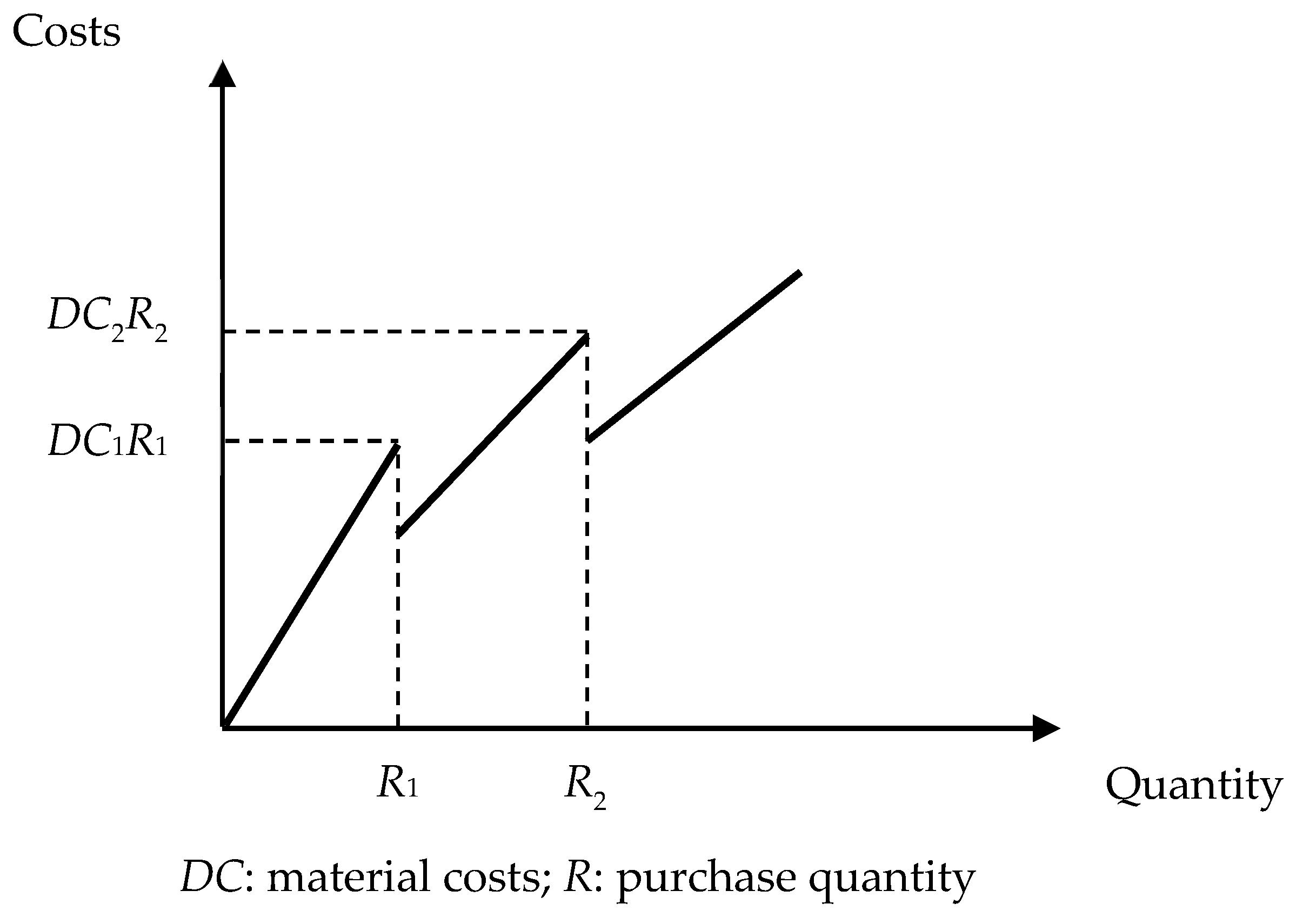

- The material cost remains the same in the relevant period during the normal and fluctuation scenarios, but when the total purchasing material quantity exceeds that of the first segment, the purchase receives a 1.4% discount for all material, and a 4.2% discount for all material when the purchase quantity exceeds that of the second segment.

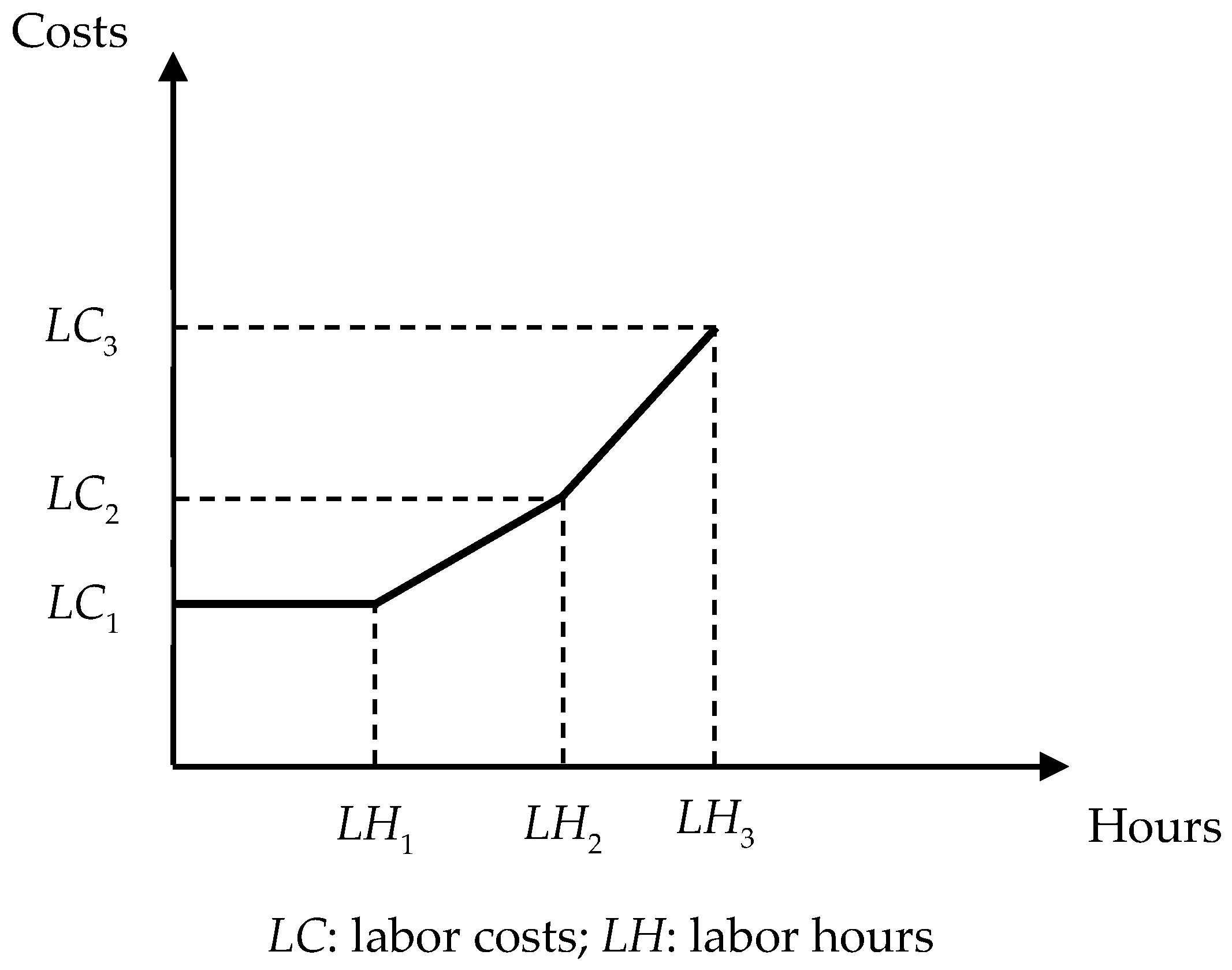

- The direct labor hours according to government policy can be extended by using first overtime work and second overtime work.

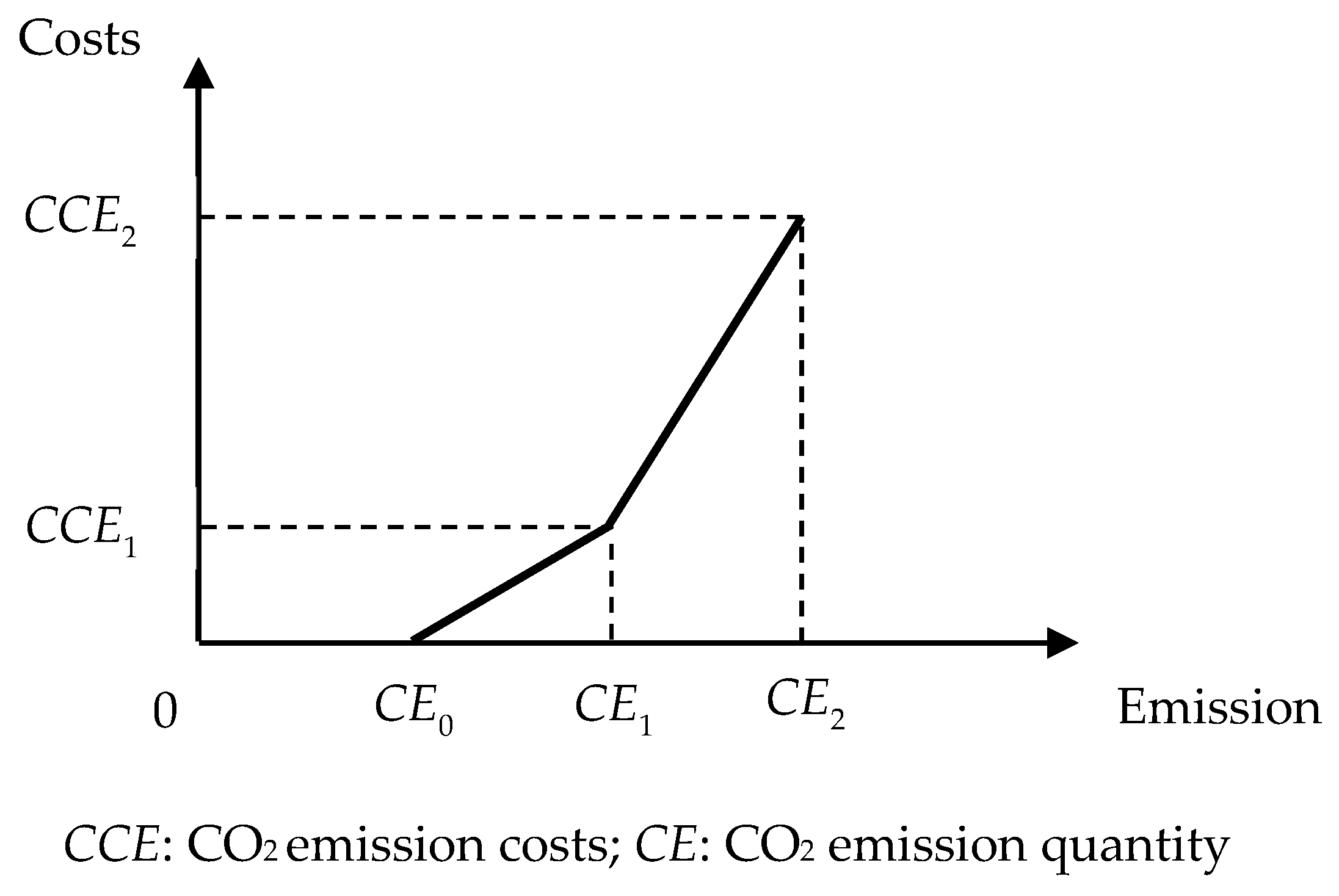

- The carbon tax is taxed at different rates of different emission quantities.

- The direct labor resources and machine hour resources cannot use outsourcing to expand.

3.3. Model A: ABC Model without Other Business Scenarios

3.3.1. Objective Function

| π | The company’s profit |

| Pi | Unit prices when selling one unit of product i |

| Xi | Total produced quantity of product i |

| Ck | Costs of material k when each unit consumed |

| qik | The consumption quantity of material k when producing one unit of product i |

| LC1, LC2, LC3 | Total direct labor cost for normal labor hours (LC1), first overtime (LC2) and second overtime (LC3) work |

| σ0, σ1, σ2 | A special ordered set of type 2 (SOS2) variable, which must be a set of positive variables; at most two variables in ordering can be non-zero [62] |

| dj | The activity cost when executing one unit of activity j |

| ηj | The batch-level activity (j ∈ B) driven requirement for material handling activity |

| γij | The batch-level activity (j ∈ B) driven requirement for product i at a setup activity |

| Bj | The quantity of batch-level activity (j ∈ B) at material handling activity |

| Bij | The quantity of batch-level activity (j ∈ B) for product i at setup activity |

| F | The company’s reaming fixed costs |

3.3.2. Unit-Level Direct Labor Cost Function

| li1, li2, li3, li5 | The usage of labor hours at the first to third and fifth activity when producing one unit of product i |

| θili4 | The usage of labor hours at the fourth activity when producing one unit of product i, and multiplying a coefficient use to determine how much work should be done in the fourth activity |

| LH1, LH2, LH3 | Maximum capacity of direct labor hours at normal (LH1), first overtime (LH2) and second overtime (LH3) work hours |

| β1, β2 | An SOS1 variable, when one of the variables is set to one, another variable must be exactly zero [62]. |

3.3.3. Batch-Level Activity Cost Function for Material Handling and Setup Activities

| ∅j | The quantity per batch of batch-level activity (j ∈ B) at material handling activity |

| Tj | The capacity of batch-level activity (j ∈ B) |

| Mij | The quantity per batch of batch-level activity (j ∈ B) for product i at setup activity |

3.3.4. Other Sale and Production Constraints

| hij | The requirement hours when producing a single unit of product i at activity j |

| MHj | The total available machine hours of activity j |

| hi3 | The requirement hours when producing a single unit of product i at the third activity |

| θihi4 | The requirement hours when producing a single unit of product i at the fourth activity, and multiplying a coefficient use to determine how much work should be done in the fourth activity |

| MHCNC | The total capacity of machine hours of the third and fourth activities |

3.4. Model B: ABC Model with Material Discount

3.4.1. Objective Function

| C2 | Unit costs of the second material |

| qi2 | The consumption quantity of the second material when producing a single unit of product i |

| DC1, DC2, DC3 | Unit costs of the first material at normal (DC1), first (DC2) and second (DC3) discount situations |

| Q1, Q2, Q3 | The consumption quantity of first material at normal (Q1), first (Q2) and second (Q3) discount situations |

3.4.2. Material Discount Function

| R1, R2 | Maximum purchase quantity of material at normal (R1) and first discount (R2) situation |

| φ1, φ2, φ3 | An SOS1 variable; when one of the variables is set to one, another variable must be exactly zero [62]. |

3.5. Model C: ABC Model with Material Discount and Carbon Tax

3.5.1. Objective Function

| CCE1, CCE2 | The CO2 emission cost at the first extended (CCE1) situation and second extended (CCE2) situation |

| δ0, δ1, δ2 | An SOS2 variable, which must be a set of positive variables; at most two variables in the ordering can be non-zero [62] |

3.5.2. Carbon Tax Function

| ei | The CO2 emission quantity when producing one unit of product i |

| CE0, CE1, CE2 | The CO2 emission quantity at normal (CE0), first extended (CCE1) situation and second extended (CCE2) situation |

| λ1, λ2 | An SOS1 variable; when one of the variable is set to one, another variable must be exactly zero [62] |

4. Illustration

4.1. Example Data and Optimal Decision Analysis

4.2. Data Analysis with Different Business Scenarios

4.2.1. Model A: ABC Model without Other Business Scenarios and ABC Model with Material Fluctuation Scenario

4.2.2. Model B: ABC Model with material discount scenario

4.2.3. Model C: ABC Model with Material Discount and Carbon Tax Scenario

4.3. Summary

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Objective function | |

| Maximum π = 4000*X1 + 6000*X2 + 8000*X3 − (700 + 100)*X1 − (1400 + 150)*X2 − (700 + 200)*X3 − 5852000 − 3883000*σ1 − 7408000*σ2 − 2500*B6 − 200*B17 − 200*B27 − 1000*B37 − F | |

| Constraints | |

| subject to direct labor hour: 4*X1 + 5*X2 + 6*X3 ≤ 44000 + 11000*σ1 + 55000*σ2 σ0 − β1 ≤ 0 σ1 − β1 − β2 ≤ 0 σ2 − β2 ≤ 0 σ0 + σ1 + σ2 = 1 β1 + β2 = 1 | subject to machine hour: j = 1: 2*X1 + 3*X2 + 2*X3 ≤ 46200 j = 2: 3*X1 + 4*X2 + 3*X3 ≤ 50400 j = 3,4: (1+0)*X1 + (1+0)*X2 + (1+0.9)*X3 ≤ 18900 j = 5: 0.1*X1 + 0.1*X2 + 0.2*X3 ≤ 2070 |

| subject to batch level - material movement: 10*X1 + 20*X2 + 10*X3 ≤ 100*B6 1*B6 ≤ 17600 | subject to minimize requirement: X1 ≥ 3000 X2 ≥ 3000 |

| subject to batch level - setup hour: X1 ≤ 2*B17 X2 ≤2*B27 X3 ≤ 1*B37 1*B17 + 1*B27 + 2.5*B37 ≤ 17600 | |

| Objective function | |

| Maximum π = 4000*X1 + 6000*X2 + 8000*X3 − (1000 + 100)*X1 − (2000 + 150)*X2 − (100 + 200)*X3 − 5852000 − 3883000*σ1 − 7408000*σ2 − 2500*B6 − 200*B17 − 200*B27 − 1000*B37 − F | |

| Constraints | |

| subject to direct labor hour: 4*X1 + 5*X2 + 6*X3 ≤ 44000 + 11000*σ1 + 55000*σ2 σ0 − β1 ≤ 0 σ1 − β1 − β2 ≤ 0 σ2 − β2 ≤ 0 σ0 + σ1 + σ2 = 1 β1 + β2 = 1 | subject to machine hour: j = 1: 2*X1 + 3*X2 + 2*X3 ≤ 46200 j = 2: 3*X1 + 4*X2 + 3*X3 ≤ 50400 j = 3,4: (1+0)*X1 + (1+0)*X2 + (1+0.9)*X3 ≤ 18900 j = 5: 0.1*X1 + 0.1*X2 + 0.2*X3 ≤ 2070 |

| subject to batch level - material movement: 10*X1 + 20*X2 + 10*X3 ≤ 100*B6 1*B6 ≤ 17600 | subject to minimize requirement: X1 ≥ 3000 X2 ≥ 3000 |

| subject to batch level - setup hour: X1 ≤ 2*B17 X2 ≤ 2*B27 X3 ≤ 1*B37 1*B17 + 1*B27 + 2.5*B37 ≤ 17600 | |

| Objective function | |

| Maximum π = 4000*X1 + 6000*X2 + 8000*X3 − (500 + 100)*X1 − (1000 + 150)*X2 − (500 + 200)*X3 − 5852000 − 3883000*σ1 − 7408000*σ2 − 2500*B6 − 200*B17 − 200*B27 − 1000*B37 − F | |

| Constraints | |

| subject to direct labor hour: 4*X1 + 5*X2 + 6*X3 ≤ 44000 + 11000*σ1 + 55000*σ2 σ0 − β1 ≤ 0 σ1 − β1 − β2 ≤ 0 σ2 − β2 ≤ 0 σ0 + σ1 + σ2 = 1 β1 + β2 = 1 | subject to machine hour: j = 1: 2*X1 + 3*X2 + 2*X3 ≤ 46200 j = 2: 3*X1 + 4*X2 + 3*X3 ≤ 50400 j = 3,4: (1+0)*X1 + (1+0)*X2 + (1+0.9)*X3 ≤ 18900 j = 5: 0.1*X1 + 0.1*X2 + 0.2*X3 ≤ 2070 |

| subject to batch level - material movement: 10*X1 + 20*X2 + 10*X3 ≤ 100*B6 1*B6 ≤ 17600 | subject to minimize requirement: X1 ≥ 3000 X2 ≥ 3000 |

| subject to batch level - setup hour: X1 ≤ 2*B17 X2 ≤ 2*B27 X3 ≤ 1*B37 1*B17 + 1*B27 + 2.5*B37 ≤ 17600 | |

| Objective function | |

| Maximum π = 4000*X1 + 6000*X2 + 8000*X3 − 70*Q1 − 69*Q2 − 67*Q3 − 100*X1 − 150*X2 − 200*X3 − 5852000 − 3883000*σ1 − 7408000*σ2 − 2500*B6 − 200*B17 − 200*B27 − 1000*B37 − F | |

| Constraints | |

| subject to direct labor hour: 4*X1 + 5*X2 + 6*X3 ≤ 44000 + 11000*σ1 + 55000*σ2 σ0 − β1 ≤ 0 σ1 − β1 − β2 ≤ 0 σ2 − β2 ≤ 0 σ0 + σ1 + σ2 = 1 β1 + β2 = 1 | subject to machine hour: j = 1: 2*X1 + 3*X2 + 2*X3 ≤ 46200 j = 2: 3*X1 + 4*X2 + 3*X3 ≤ 50400 j = 3,4: (1+0)*X1 + (1+0)*X2 + (1+0.9)*X3 ≤ 18900 j = 5: 0.1*X1 + 0.1*X2 + 0.2*X3 ≤ 2070 |

| subject to batch level - material movement: 10*X1 + 20*X2 + 10*X3 ≤ 100*B6 1*B6 ≤ 17600 | subject to minimize requirement: X1 ≥ 3000 X2 ≥ 3000 |

| subject to batch level - setup hour: X1 ≤ 2*B17 X2 ≤ 2*B27 X3 ≤ 1*B37 1*B17 + 1*B27 + 2.5*B37 ≤ 17600 | subject to direct material discount: 10*X1 + 20*X2 + 10*X3 = Q1 + Q2 + Q3 0 ≤ Q1 ≤ φ1*200000 φ2*200000 < Q2 ≤ φ2*500000 φ3*500000 < Q3 φ1 + φ2 + φ3 = 1 |

| Objective function | |

| Maximum π = 4000*X1 + 6000*X2 + 8000*X3 − 70*Q1 − 69*Q2 − 67*Q3 − 100*X1 − 150*X2 − 200*X3 − 5852000 − 3883000*σ1 − 7408000*σ2 − 2500*B6 − 200*B17 − 200*B27 − 1000*B37 − 10000000*δ1 − 50000000*δ2 − F | |

| Constraints | |

| subject to direct labor hour: 4*X1 + 5*X2 + 6*X3 ≤ 44000 + 11000*σ1 + 55000*σ2 σ0 − β1 ≤ 0 σ1 − β1 − β2 ≤ 0 σ2 − β2 ≤ 0 σ0 + σ1 + σ2 = 1 β1 + β2 = 1 | subject to CO2 emission: 1*X1 + 1.5*X2 + 2.5*X3 ≤ 0 + 25000*δ1 + 25000*δ2 δ0 − λ1 ≤ 0 δ1 − λ1 − λ2 ≤ 0 δ2 − λ2 ≤ 0 δ0 + δ1 + δ2 = 1 λ1 + λ2 = 1 |

| subject to batch level - material movement: 10*X1 + 20*X2 + 10*X3 ≤ 100*B6 1*B6 ≤ 17600 | subject to minimize requirement: X1 ≥ 3000 X2 ≥ 3000 |

| subject to batch level - setup hour: X1 ≤ 2*B17 X2 ≤ 2*B27 X3 ≤ 1*B37 1*B17 + 1*B27 + 2.5*B37 ≤ 17600 | subject to direct material discount: 10*X1 + 20*X2 + 10*X3 = Q1 + Q2 + Q3 0 ≤ Q1 ≤ φ1*200000 φ2*200000 < Q2 ≤ φ2*500000 φ3*500000 < Q3 φ1 + φ2 + φ3 = 1 |

| subject to machine hour: j = 1: 2*X1 + 3*X2 + 2*X3 ≤ 46200 j = 2: 3*X1 + 4*X2 + 3*X3 ≤ 50400 j = 3, 4: (1+0)*X1 + (1+0)*X2 + (1+0.9)*X3 ≤ 18900 j = 5: 0.1*X1 + 0.1*X2 + 0.2*X3 ≤2070 | |

References

- Ferber, S. Industry 4.0—Germany Takes First Steps toward the Next Industrial Revolution. 2012. Available online: https://blog.bosch-si.com/industry40/industry-40-germany-takes-first-steps-toward-next-industrial-revolution/2012 (accessed on 30 Jan. 2019).

- Advantech. Cross-System Integration of an Intelligent Factory. 2016. Available online: https://www.advantech.com/success-stories/article/e4363b7e-2e87-4019-83d2-d314038a23f9 (accessed on 30 Jan. 2019).

- Crutzen, P.J.; Arnold, F. Nitric acid cloud formation in the cold Antarctic stratosphere: A major cause for the springtime ‘ozone hole’. Nature 1986, 324, 651–655. [Google Scholar] [CrossRef]

- Vinnikov, K.Y.; Robock, A.; Stouffer, R.J.; Walsh, J.E.; Parkinson, C.L.; Cavalieri, D.J.; Mitchell, J.F.; Garrett, D.; Zakharov, V.F. Global warming and Northern Hemisphere sea ice extent. Science 1999, 286, 1934–1937. [Google Scholar] [CrossRef] [PubMed]

- Francis, J.A.; Vavrus, S.J. Evidence linking Arctic amplification to extreme weather in mid-latitudes. Geophys. Res. Lett. 2012, 39, 1–6. [Google Scholar] [CrossRef]

- Roy, R.; Stark, R.; Tracht, K.; Takata, S.; Mori, M. Continuous maintenance and the future—Foundations and technological challenges. CIRP Ann. Manuf. Technol. 2016, 65, 667–688. [Google Scholar] [CrossRef]

- Zhou, K.; Liu, T.; Zhou, L. Industry 4.0: Towards future industrial opportunities and challenges. In Proceedings of the 2015 12th International Conference on Fuzzy Systems and Knowledge Discovery (FSKD), Zhangjiajie, China, 15–17 August 2015; pp. 2147–2152. [Google Scholar]

- Kang, H.S.; Lee, J.Y.; Choi, S.; Kim, H.; Park, J.H.; Son, J.Y.; Kim, B.H.; Noh, S.D. Smart manufacturing: Past research, present findings, and future directions. Int. J. Precis. Eng. Manuf. Green Technol. 2016, 3, 111–128. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design principles for industrie 4.0 scenarios. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar]

- Lee, J.; Bagheri, B.; Kao, H.A. A Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Schlechtendahl, J.; Keinert, M.; Kretschmer, F.; Lechler, A.; Verl, A. Making existing production systems Industry 4.0-ready: Holistic approach to the integration of existing production systems in Industry 4.0 environments. Prod. Eng. 2014, 9, 143–148. [Google Scholar] [CrossRef]

- Monostori, L. Cyber-physical production systems: Roots, expectations and R&D challenges. Procedia CIRP 2014, 17, 9–13. [Google Scholar]

- Shrouf, F.; Ordieres, J.; Miragliotta, G. Smart factories in Industry 4.0: A review of the concept and of energy management approached in production based on the Internet of Things paradigm. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Selangor, Malaysia, 9–12 December 2014; pp. 697–701. [Google Scholar]

- Ungurean, I.; Gaitan, N.-C.; Gaitan, V.G. An IoT architecture for things from industrial environment. In Proceedings of the 2014 10th International Conference on Communications (COMM), Bucharest, Romania, 29–31 May 2014; pp. 1–4. [Google Scholar]

- Mosterman, P.J.; Zander, J. Industry 4.0 as a Cyber-Physical System study. Softw. Syst. Model. 2016, 15, 17–29. [Google Scholar] [CrossRef]

- Jazdi, N. Cyber physical systems in the context of Industry 4.0. In Proceedings of the 2014 IEEE International Conference on Automation, Quality and Testing, Robotics (AQTR), Cluj-Napoca, Romania, 22–24 May 2014. [Google Scholar]

- Gorecky, D.; Schmitt, M.; Loskyll, M.; Zühlke, D. Human-machine-interaction in the industry 4.0 era. In Proceedings of the 2014 12th IEEE International Conference on Industrial Informatics (INDIN), Porto Alegre, Brazil, 27–30 July 2014; pp. 289–294. [Google Scholar]

- Longo, F.; Nicoletti, L.; Padovano, A. Smart operators in industry 4.0: A human-centered approach to enhance operators’ capabilities and competencies within the new smart factory context. Comput. Ind. Eng. 2017, 113, 144–159. [Google Scholar] [CrossRef]

- O’Donovan, P.; Leahy, K.; Bruton, K.; O’Sullivan, D.T.J. Big data in manufacturing: A systematic mapping study. J. Big Data 2015, 2, 20. [Google Scholar] [CrossRef]

- Pacaux-Lemoine, M.P.; Trentesaux, D.; Zambrano Rey, G.; Millot, P. Designing intelligent manufacturing systems through Human-Machine Cooperation principles: A human-centered approach. Comput. Ind. Eng. 2017, 111, 581–595. [Google Scholar] [CrossRef]

- Paelke, V. Augmented reality in the smart factory: Supporting workers in an industry 4.0. environment. In Proceedings of the Emerging Technology and Factory Automation (ETFA), Barcelona, Spain, 16–19 September 2014. [Google Scholar]

- Posada, J.; Toro, C.; Barandiaran, I.; Oyarzun, D.; Stricker, D.; De Amicis, R.; Pinto, E.B.; Eisert, P.; Döllner, J.; Vallarino, I., Jr. Visual Computing as a Key Enabling Technology for Industrie 4.0 and Industrial Internet. IEEE Comput. Graph. Appl. 2015, 35, 26–40. [Google Scholar] [CrossRef] [PubMed]

- Shafiq, S.I.; Sanin, C.; Toro, C.; Szczerbicki, E. Virtual engineering object (VEO): Toward experience-based design and manufacturing for industry 4.0. Cybern. Syst. 2015, 46, 35–50. [Google Scholar] [CrossRef]

- Varghese, A.; Tandur, D. Wireless requirements and challenges in Industry 4.0. In Proceedings of the 2014 International Conference on Contemporary Computing and Informatics (IC3I), Mysore, Karnataka, India, 27–29 November 2014; pp. 634–638. [Google Scholar]

- Zhan, Z.H.; Liu, X.F.; Gong, Y.J.; Zhang, J.; Chung, H.S.H.; Li, Y. Cloud computing resource scheduling and a survey of its evolutionary approaches. ACM Comput. Surv. 2015, 47, 63. [Google Scholar] [CrossRef]

- Agarwal, N.; Brem, A. Strategic business transformation through technology convergence: Implications from General Electric’s industrial internet initiative. Int. J. Technol. Manag. 2015, 67, 196–214. [Google Scholar] [CrossRef]

- Foidl, H.; Felderer, M. Research Challenges of Industry 4.0 for Quality Management. In Proceedings of the Innovations in Enterprise Information Systems Management and Engineering, Munich, Germany, 16–17 November 2015; pp. 121–137. [Google Scholar]

- Ivanov, D.; Dolgui, A.; Sokolov, B.; Werner, F.; Ivanova, M. A dynamic model and an algorithm for short-term supply chain scheduling in the smart factory industry 4.0. Int. J. Prod. Res. 2016, 54, 386–402. [Google Scholar] [CrossRef]

- Kovács, G.; Kot, S. New logistics and production trends as the effect of global economy changes. Pol. J. Manag. Stud. 2016, 14, 115–126. [Google Scholar] [CrossRef]

- Zawadzki, P.; Zywicki, K. Smart product design and production control for effective mass customization in the industry 4.0 concept. Manag. Prod. Eng. Rev. 2016, 7, 105–112. [Google Scholar] [CrossRef]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Friedlingstein, P.; Andrew, R.M.; Rogelj, J.; Peters, G.P.; Canadell, J.G.; Knutti, R.; Luderer, G.; Raupach, M.R.; Schaeffer, M.; Van Vuuren, D.P.; et al. Persistent growth of CO2 emissions and implications for reaching climate targets. Nat. Geosci. 2014, 7, 709–715. [Google Scholar] [CrossRef] [Green Version]

- Meinshausen, M.; Meinshausen, N.; Hare, W.; Raper, S.C.B.; Frieler, K.; Knutti, R.; Frame, D.J.; Allen, M.R. Greenhouse-gas emission targets for limiting global warming to 2 °C. Nature 2009, 458, 1158–1162. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bond, T.C.; Doherty, S.J.; Fahey, D.W.; Forster, P.M.; Berntsen, T.; Deangelo, B.J.; Flanner, M.G.; Ghan, S.; Kärcher, B.; Koch, D.; et al. Bounding the role of black carbon in the climate system: A scientific assessment. J. Geophys. Res. D Atmos. 2013, 118, 5380–5552. [Google Scholar] [CrossRef] [Green Version]

- Bond, T.C.; Streets, D.G.; Yarber, K.F.; Nelson, S.M.; Woo, J.H.; Klimont, Z. A technology-based global inventory of black and organic carbon emissions from combustion. J. Geophys. Res. D Atmos. 2004, 109. [Google Scholar] [CrossRef] [Green Version]

- Tsai, W.H.; Lee, K.C.; Liu, J.Y.; Lin, H.L.; Chou, Y.W.; Lin, S.J. A mixed activity-based costing decision model for green airline fleet planning under the constraints of the European Union Emissions Trading Scheme. Energy 2012, 39, 218–226. [Google Scholar] [CrossRef]

- Lee, K.C.; Tsai, W.H.; Yang, C.H.; Lin, Y.Z. An MCDM approach for selecting green aviation fleet program management strategies under multi-resource limitations. J. Air Transport Manag. 2018, 68, 76–85. [Google Scholar] [CrossRef]

- Tsai, W.H.; Yang, C.H.; Huang, C.T.; Wu, Y.Y. The impact of the carbon tax policy on green building strategy. J. Environ. Plan. Manag. 2017, 60, 1412–1438. [Google Scholar] [CrossRef]

- Tsai, W.H.; Yang, C.H.; Chang, J.C.; Lee, H.L. An Activity-Based Costing decision model for life cycle assessment in green building projects. Eur. J. Oper. Res. 2014, 238, 607–619. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Liu, J.Y.; Lin, W.R.; Lee, K.C. Incorporating life cycle assessments into building project decision-making: An energy consumption and CO2 emission perspective. Energy 2011, 36, 3022–3029. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Lee, Y.F.; Chang, Y.C.; Hsu, J.L. Construction method selection for green building projects to improve environmental sustainability by using an MCDM approach. J. Environ. Plan. Manag. 2013, 56, 1487–1510. [Google Scholar] [CrossRef]

- Tsai, W.H.; Tsaur, T.S.; Chou, Y.W.; Liu, J.Y.; Hsu, J.L.; Hsieh, C.L. Integrating the activity-based costing system and life-cycle assessment into green decision-making. Int. J. Prod. Res. 2015, 53, 451–465. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Lin, T.W.; Chou, W.-C. Integrating activity-based costing and environmental cost accounting systems: A case study. Int. J. Bus. Syst. Res. 2010, 4, 186–208. [Google Scholar] [CrossRef]

- Tsai, W.H.; Hung, S.J. Treatment and recycling system optimisation with activity-based costing in WEEE reverse logistics management: An environmental supply chain perspective. Int. J. Prod. Res. 2009, 47, 5391–5420. [Google Scholar] [CrossRef]

- Tsai, W.H.; Shen, Y.S.; Lee, P.L.; Chen, H.C.; Kuo, L.; Huang, C.C. Integrating information about the cost of carbon through activity-based costing. J. Clean. Prod. 2012, 36, 102–111. [Google Scholar] [CrossRef]

- Tsai, W.H.; Chang, J.C.; Hsieh, C.L.; Tsaur, T.S.; Wang, C.W. Sustainability concept in decision-making: Carbon tax consideration for joint product mix decision. Sustainability (Switzerland) 2016, 8, 1232. [Google Scholar] [CrossRef]

- Tsai, W.H.; Chen, H.C.; Leu, J.D.; Chang, Y.C.; Lin, T.W. A product-mix decision model using green manufacturing technologies under activity-based costing. J. Clean. Prod. 2013, 57, 178–187. [Google Scholar] [CrossRef]

- Kamal Abd Rahman, I.; Omar, N.; Zainal Abidin, Z. The applications of management accounting techniques in Malaysian companies: An industrial survey. J. Financ. Report. Account. 2003, 1, 1–12. [Google Scholar] [CrossRef]

- Tang, S.; Wang, D.; Ding, F.Y. A new process-based cost estimation and pricing model considering the influences of indirect consumption relationships and quality factors. Comput. Ind. Eng. 2012, 63, 985–993. [Google Scholar] [CrossRef]

- Zhang, R.; Zhang, L.; Xiao, Y.; Kaku, I. The activity-based aggregate production planning with capacity expansion in manufacturing systems. Comput. Ind. Eng. 2012, 62, 491–503. [Google Scholar] [CrossRef]

- Verein, I.C. Industrie 4.0. In Controlling im Zeitalter der intelligenten Vernetzung. Dream Car der Ideenwerkstatt im ICV; Internationaler Controller Verein eV: Wörthsee, Germany, 2015. [Google Scholar]

- Xia, F.; Yang, L.T.; Wang, L.; Vinel, A. Internet of things. Int. J. Commun. Syst. 2012, 25, 1101–1102. [Google Scholar] [CrossRef]

- Ślusarczyk, B. Industry 4.0: Are we ready? Pol. J. Manag. Stud. 2018, 17, 232–248. [Google Scholar] [CrossRef]

- Lee, J.; Kao, H.-A.; Yang, S. Service innovation and smart analytics for industry 4.0 and big data environment. Procedia Cirp 2014, 16, 3–8. [Google Scholar] [CrossRef]

- Yilmaz, T.G.; Tüfekçi, M.; Karpat, F. A study of lightweight door hinges of commercial vehicles using aluminum instead of steel for sustainable transportation. Sustainability (Switzerland) 2017, 9, 1661. [Google Scholar] [CrossRef]

- Elsayed, A.; Ravindran, C.; Murty, B.S. Effect of aluminum-titanium-boron based grain refiners on AZ91E magnesium alloy grain size and microstructure. Int. J. Metalcast. 2011, 5, 29–41. [Google Scholar] [CrossRef]

- Sharma, M.K.; Mukhopadhyay, J. Evaluation of Forming Limit Diagram of Aluminum Alloy 6061-T6 at Ambient Temperature. In Light Metals 2015; Springer: Berlin, Germany, 2015; pp. 309–314. [Google Scholar]

- Stanton, M.; Masters, I.; Bhattacharya, R.; Dargue, I.; Aylmore, R.; Williams, G. Modelling and validation of springback in aluminium U-Profiles. Int. J. Mater. Form. 2010, 3, 163–166. [Google Scholar] [CrossRef]

- Wang, N.; Yamaguchi, T.; Nishio, K. Interfacial microstructure and strength of aluminum alloys/steel spot welded joints. Nippon Kinzoku Gakkaishi 2013, 77, 259–267. [Google Scholar] [CrossRef]

- Deschamps, A.; Martin, G.; Dendievel, R.; Van Landeghem, H.P. Lighter structures for transports: The role of innovation in metallurgy. C. R. Phys. 2017, 18, 445–452. [Google Scholar] [CrossRef]

- Peng, L.; Fu, P.; Wang, Y.; Ding, W. Computer Simulation and Experimental Validation of Low Pressure Sand Casting Process of Magnesium Alloy V6 Engine Block. In Proceedings of the 5th International Conference on Thermal Process Modeling and Computer Simulation, Orlando, FL, USA, 16–18 June 2014; pp. 26–33. [Google Scholar]

- Williams, H.P. Model Building in Mathematical Programming; John Wiley & Sons: London, UK, 2013. [Google Scholar]

| Products | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| j | Car Rims | Truck Rims | Customized Car Rims | Available Capacity | ||||||

| Minimize Requirement | Xi | 3000 | 3000 | - | ||||||

| Selling Price | Pi | 4000 | 6000 | 8000 | ||||||

| Unit-level Direct Material | ||||||||||

| aluminum ingots (m = 1) | normal situation | C1 = $70/unit | qi1 | 10 | 20 | 10 | ||||

| material fluctuation with higher cost | C1 = $100/unit | |||||||||

| material fluctuation with lower cost | C1 = $50/unit | |||||||||

| pigment (m = 2) | C2 = $50/unit | qi2 | 2 | 3 | 4 | |||||

| Unit-level activity | Machine hours | Casting | 1 | hi1 | 2 | 3 | 2 | MH1 = 46,200 | ||

| Heat Treatment | 2 | hi2 | 3 | 4 | 3 | MH2 = 50,400 | ||||

| CNC Processing | 3 | hi3 | 1 | 1 | 1 | MHCNC = 18,900 | ||||

| CNC 2nd Processing | 4 | θihi4 | 0 | 0 | 0.9 | |||||

| Painting | 5 | hi5 | 0.1 | 0.1 | 0.2 | MH5 = 2070 | ||||

| Labor hours | Casting | 1 | li1 | 1.2 | 1.7 | 1.2 | ||||

| Heat Treatment | 2 | li2 | 1.5 | 2 | 1.5 | |||||

| CNC Processing | 3 | li3 | 1 | 1 | 1.6 | |||||

| CNC 2nd Processing | 4 | θili4 | 0 | 0 | 1 | |||||

| Painting | 5 | li5 | 0.3 | 0.3 | 0.7 | |||||

| Batch-level activity | Handling | d6 = $2,500/batch | 6 | ηj | 1 | T6 = 17,600 | ||||

| ∅j | 100 | |||||||||

| Setup | d7 = $200/batch | 7 | γi | 1 | 1 | 2.5 | T7 = 17,600 | |||

| Mi | 2 | 2 | 1 | |||||||

| Carbon tax | CCE1 = $10,000,000 | CCE2 = $50,000,000 | ei | 1 | 1.5 | 2.5 | ||||

| Emission quantity | CE1 = 25,000 | CE2 = 50,000 | ||||||||

| Rate | 400/m.t. | 1000/m.t. | ||||||||

| Direct labor constraint-Cost | LC1 = $5,852,000 | LC2 = $9,735,000 | LC3 = $19,800,000 | |||||||

| Labor hours | LH1 = 44,000 | LH2 = 55,000 | LH3 = 99,000 | |||||||

| Wage rate | $133/h | $177/h | $200/h | |||||||

| Material cost with discount | $14,000,000 | $34,500,000 | ||||||||

| Quantity | R1 = 200,000 | R2 = 500,000 | >500,000 | |||||||

| Cost | DC1 = $70 | DC2 = $69 | DC3 = $67 | |||||||

| Scenario 1: ABC Model without other business scenario |

| π = 38,471,730; X1 = 3000; X2 = 6730; X3 = 4826; β1 = 0; β2 = 1; σ0 = 0; σ1 = 0.5544091; σ2 = 0.4455909; B6 = 2129; B17 = 1500; B27 = 3365; B37 = 4826 |

| Scenario 2a: ABC Model with material fluctuation (material cost increase) |

| π = 32,159,560; X1 = 3000; X2 = 5910; X3 = 5257; β1 = 0; β2 = 1; σ0 = 0; σ1 = 0.5888182; σ2 = 0.4111818; B6 = 2008; B17 = 1500; B27 = 2955; B37 = 5257 |

| Scenario 2b: ABC Model with material fluctuation (material cost decrease) |

| π = 42,728,930; X1 = 3000; X2 = 6730; X3 = 4826; β1 = 0; β2 = 1; σ0 = 0; σ1 = 0.5544091; σ2 = 0.4455909; B6 = 2129; B17 = 1500; B27 = 3365; B37 = 4826 |

| Scenario 3: ABC Model with material discount |

| π = 38,684,590; X1 = 3000; X2 = 6730; X3 = 4826; φ1 = 0; φ2 = 1; φ3 = 0; Q1 = 0; Q2 = 212,860; Q3 = 0; β1 = 0; β2 = 1; σ0 = 0; σ1 = 0.5544091; σ2 = 0.4455909; B6 = 2129; B17 = 1500; B27 = 3365; B37 = 4826 |

| Scenario 4: ABC model with material discount and carbon tax |

| π = 31,001,270; X1 = 3014; X2 = 5894; X3 = 5258; φ1 = 0; φ2 = 1; φ3 = 0; Q1 = 0; Q2 = 200,600; Q3 = 0; β1 = 0; β2 = 1; σ0 = 0; σ1 = 0.5892273; σ2 = 0.4107727; B6 = 2006; B17 = 1507; B27 = 2947; B37 = 5258; λ1 = 0; λ2 = 1; δ0 = 0; δ1 = 1; δ2 = 0 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H.; Chu, P.-Y.; Lee, H.-L. Green Activity-Based Costing Production Planning and Scenario Analysis for the Aluminum-Alloy Wheel Industry under Industry 4.0. Sustainability 2019, 11, 756. https://doi.org/10.3390/su11030756

Tsai W-H, Chu P-Y, Lee H-L. Green Activity-Based Costing Production Planning and Scenario Analysis for the Aluminum-Alloy Wheel Industry under Industry 4.0. Sustainability. 2019; 11(3):756. https://doi.org/10.3390/su11030756

Chicago/Turabian StyleTsai, Wen-Hsien, Po-Yuan Chu, and Hsiu-Li Lee. 2019. "Green Activity-Based Costing Production Planning and Scenario Analysis for the Aluminum-Alloy Wheel Industry under Industry 4.0" Sustainability 11, no. 3: 756. https://doi.org/10.3390/su11030756