Abstract

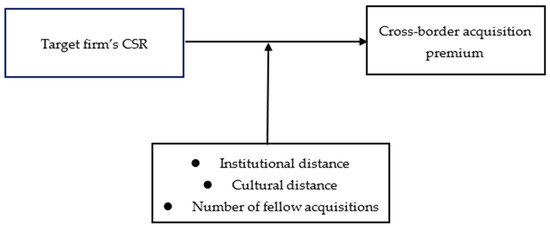

This study examines the effect of a target firm’s corporate social responsibility (CSR) on its cross-border acquisition premium. Building upon the resource-based view and the institutional theory, we argue that the target firm’s CSR positively affect the cross-border acquisition premium, while institutional distance, cultural distance, and the number of fellow acquisitions moderate the above relationship. Hypotheses are tested in a sample of 252 cross-border acquisitions between 1991 and 2016. Empirical findings show that an acquirer is more likely to pay a higher acquisition premium when acquiring a socially responsible target firm; furthermore, such an effect weakens as institutional distance, cultural distance, and the number of fellow acquisitions increase. This study extends existing research on the importance of CSR as a strategic asset and sheds new light on the role of CSR played in the setting of cross-border acquisitions.

1. Introduction

Corporate social responsibility (CSR) refers to the extent that a firm pursues sustainable development in the long run and makes balances between social benefits and economic benefits [1]. A socially responsible firm tends to consider multiple stakeholders’ interests simultaneously and adopt accountable actions in practice, which helps in gaining a respectable social image in public. Extant research has shown that a socially responsible firm is more likely to achieve higher financial performance [2], investor evaluation [3], institutional legitimacy [4], and corporate governance [5]. Accordingly, CSR has become a critical factor that influences top managers’ key investment decisions such as the selection and evaluation of a target firm for mergers and acquisitions (M&As). General Motors (GM), for example, set up a special department to conduct due diligence on a target firm’s performance on environmental protection before an acquisition [6]. Unilever claimed that a major purpose to acquire the ice-cream company Ben and Jerry’s was to learn how to design and implement socially responsible activities [7]. Similarly, L’Oréal acquired the Body Shop due to the latter’s outstanding performance in environmental protection and its non-use of animals in experimentation [7]. These business practices suggest that firms tend to acquire and learn from socially responsible target firms. Furthermore, Deloitte reported that CSR affects the evaluation of target firms and the probability of deal completion [8]. Thus, it is reasonable to infer that CSR plays an important role in the setting of M&As.

Despite anecdotal evidence on the importance of CSR, research on the relationship between CSR and M&As is relatively scarce. As Aktas et al. [9] observed, existing literature has paid little attention to the role of CSR in M&A decisions. Deng et al. [10] claimed that their work is the first large-scale study on the impact of CSR on post-merger long-term performance. Consequently, it is not clear whether CSR really matters in the context of M&As, especially in the global setting. This study responds to the call from Aktas et al. [9] and attempts to explore how a target firm’s CSR affects the acquisition premium in cross-border M&As. Furthermore, since the acquirer and the target come from different countries, their perceptions of the value of CSR could differ due to institutional variances. Thus, the second purpose of this study is to examine how institutional factors will moderate the relationship between a target firm’s CSR and the acquisition premium.

2. Literature Review

Corporate social responsibility is a multi-dimensional concept that involves corporate activities in environmental protection, social contribution, and corporate governance [11,12]. After decades of research on CSR, the focus of discussion has shifted from whether firms should fulfill their social responsibilities to how they can carry out CSR in a better way [13]. Existing literature mainly applies three theoretical perspectives to explain the role and influence of CSR on corporate decisions and performances. First, the stakeholder theory argues that CSR helps firms establish a beneficial linkage with stakeholders and achieve the effect of strategic insurance, which can protect a focal firm to some extent on the occurrence of a negative event [14]. Second, the institutional theory suggests that CSR helps firms gain better legitimacy, reputation, and social status, and overcome the liability of foreignness [15]. The resource-based view is the third theory widely applied in this literature as it points out that CSR could become a strategic asset and help firms gain sustainable competitive advantage [16]. Accordingly, scholars summarize three motives for firms to engage in CSR: Instrumental, relational, and moral [1]. Instrumental motive suggests that CSR is self-interest driven. Relational motive suggests that the purpose of CSR is to build up relationships with stakeholders. Moral motive indicates that firms pay more attention to ethical standards and moral norms.

Recently, there has been an emerging interest in studying the role of CSR in the context of cross-border M&As. One research stream focuses on the necessity of attending to CSR in cross-border M&As. Researchers point out that, despite national differences in terms of CSR standards and regulations, such gaps are reduced due to the growth of international trade, the pressure from non-government organizations (NGOs), and the appeal of global sustainability initiatives [17]. Accordingly, governmental institutions, NGOs, and investors in host countries stress more on CSR when they evaluate a foreign firm’s acquisition activities. In general, this literature shows that socially irresponsible firms are associated with higher risks in cross-border M&As [3]. As a result, commercial banks may not be willing to provide sufficient financing to firm’s with poor CSR images [18]. Similarly, industry analysts may underestimate a firm’s value due to its poor CSR performance [3]. Thus, extant work in this direction calls for more attention to be given in the role played by CSR in the setting of cross-border M&As.

The second stream builds upon the above work and directly examines the effect of CSR on M&A decisions such as the choice of target firms. For instance, some researchers argue that firms are more likely to acquire targets with good CSR performance due to two reasons: First, a socially responsible target can help the acquirer gain legitimacy and access more valuable resources from external stakeholders; and second, the acquirer can learn from its target in terms of CSR practices and improve its own CSR performance and social image [19,20]. Other researchers emphasize that managers take into consideration the CSR gap between the acquirer and the target because their dissimilarity in business ethics and ideology affects post-acquisition integration [21].

In addition to the research on how CSR influences managerial M&A decisions, scholars have also investigated the impact of CSR on acquisition performance, including the market returns and the speed of completion. Drawing on the signaling theory and the stakeholder theory, extant work has demonstrated that, when acquiring a socially responsible target, the acquirer sends a strong signal to stakeholders that its decision makers prioritize CSR in operations and are willing to learn CSR practices from the target [10]. Consequently, the stock market tends to respond positively to the acquiring firm when the deal is announced [9]. On the other hand, an acquirer with strong CSR is more likely to win the support from related parties such as labor unions and governmental institutes, which facilitates business negotiation and government approval [22]. As a result, a socially responsible acquirer can reduce potential resistances and speed up its acquisition process [10].

The above review shows that the role of CSR in cross-border M&As is an interesting topic, but not fully studied in management literature. This study fills in this gap by investigating how an acquirer evaluates a target firm’s CSR in the setting of cross-border M&As. The following section draws upon the resourced based view and the institutional theory to explore the direct linkage between a target firm’s CSR and the acquisition premium, and the moderating effects played by institutional factors in the global setting.

3. Theoretical Analysis and Research Hypotheses

3.1. Target Firm’s CSR and Cross-Border Acquisition Premium

Cross-border acquisition premium refers to the extra price paid by a foreign acquirer that exceeds its target’s real market value. Previous studies show that various factors can affect the bidding price offered by potential acquirers, including country, industry, and firm-level elements [23,24]. Thus, an acquisition premium is an outcome derived from complicated negotiations and interactions among multiple stakeholders. This paper focuses on the firm-level factors and specifically investigates the role of a target firm’s CSR in determining the acquirer’s bidding price and acquisition premium, relying on the resourced-based view and the institutional theory.

The resource-based view argues that CSR is an important source of strategic assets that can lead to sustained competitive advantage [25]. Research has found that good CSR helps firms build up a positive reputation which in turn improves its financial performance [26]. In addition, firms with good CSR performance are more likely to attract the attention of institutional investors and gain easy access to external capital [27]. Furthermore, the fulfillment of CSR helps firms establish social identity, improve social value, and attract high-quality talents [28]. Thus, good CSR reputation is an important intangible resource that is rare, valuable, and difficult to imitate and substitute. Applying this logic to the setting of cross-border M&As, we believe that the target firm’s CSR could be a potential source of sustained competitive advantage to the acquiring firm, and the latter is willing to put higher value on such an intangible asset.

First of all, the target’s CSR can help the acquiring firm improve their positive corporate image. Bidding for a responsible target firm signals to the market that the acquirer takes CSR seriously and strives for good social performance; in addition, this bidding event may also demonstrate that the acquirer is interested in learning from the target firm in terms of CSR management ability and knowledge. Consequently, markets are more likely to respond positively to an acquisition of a social responsible target. Existing studies have shown that the target’s CSR is positively related to the acquirer’s stock market returns on the date of deal announcement, and the target’s social and environmental performance also positively correlates with the acquirer’s long-term performance [9]. Such a signaling effect is particularly prominent in the setting of international acquisition due to the liability of foreignness. Thus, a socially responsible target not only represents a valuable strategic asset to the acquirer, but also helps the acquirer to achieve a better social image and institutional legitimacy in the host country.

Furthermore, a socially responsible target sets a solid foundation for the acquirer’s future expansion in the host country, which in turn improves the acquirer’s long-term financial performance. A target firm with good CSR performance takes multiple stakeholders’ interests into consideration, and consequently, the target is more likely to build up and maintain stable social networks with external stakeholders [29]. The potential benefits from such social embeddedness include governmental support, media coverage, and public recognition. As Knudsen and Brown have observed [30], national governments increasingly intervene firm-level CSR practices by adopting new CSR policies. Moreover, governments can reward or punish a firm according to its CSR performance and conformity to CSR policies [31]. With regards to media coverage, researchers have shown that a firm with good CSR performance has a higher chance of media exposure and positive reports [32]. Thus, when a cross-border acquisition happens, a socially responsible target can act as a bridge between the acquirer and local stakeholders and broaden the acquirer’s social networks immediately within the host country. Such a social capital effect helps the foreign acquirer expand its business networks and reduce operational uncertainty. This explains the recent phenomenon that some large multinational companies use the “buying CSR” strategy to enter a foreign market [20].

In addition, when an acquirer targets a firm with a positive social image, it is more likely to obtain the support of third-party financial institutions and access sufficient financial resources for this deal. Research has found that good CSR performance is conducive to winning the favor of banks, financial intermediaries, and other institutional investors [33]. Cross-border M&As sometimes involve a large amount of cash and cash equivalents for payment, which may lead to considerable financial stress on the purchasing party [34]. Recently some financial institutions have strengthened CSR auditing and presented favorable treatments to firms with high CSR performance [35]. This helps the acquirer relieve some financial stress when purchasing a socially responsible target.

Therefore, when a firm acquires a socially responsible target, multiple benefits may accrue to the acquirer, including better social image and larger social networks. Additionally, with the superimposed effect of financial support, it is very likely that top managers from the acquiring firm are willing to offer a high bidding price for the target firm’s CSR.

H1: The target firm’s CSR is positively associated with the cross-border acquisition premium.

3.2. The Moderating Role of Institutional Factors

While the resource-based view provides a basic framework to appraise the role of strategic assets like a firm’s CSR, such a comprehension may vary across countries due to differences in national institutions such as regulatory policies, legal systems, national culture, and social cognition. In other words, the value of CSR may change in the eyes of managers from various institutional backgrounds [36]. Giving the fact that cross-border M&As involve top managers from at least two countries, heterogeneity may exist in terms of managerial attitude and recognition towards the target firm’s CSR. Therefore, this study draws insights from the institutional theory to investigate how institutional factors affect the relationship between a target firm’s CSR and the acquisition premium.

The institutional theory aims to answer a fundamental question as what makes organizations so similar. It proposes that the similarity of organizational structures and actions comes from the homogenization process in an institutional environment [37]. Seeking legitimacy is the major driving force of organizational homogenization when the external environment is highly dynamic and uncertain. By confirming to the rules and beliefs well established and accepted within a specific environment, organizations are more likely to meet the expectations of external stakeholders, and thus to win a better chance of survival and future growth [38]. In his book Institutions and Organizations, Scott [39] summarized three pillars of institutions—regulative, normative, and cognitive—that influence organizational conformity. The regulative pillar resides in legal systems and governmental regulations that are formal and coercive. The normative pillar involves the normalization of organizational behaviors, legitimized by fitting into the moral and cultural requirements. Additionally, the cognitive pillar consists of public perceptions of organizational behaviors taken for granted, legitimized by imitating other legitimate organization [39]. According to Scott’s perspective, organizational legitimacy is a result of obeying laws and regulations, conforming to normative rules, and aligning with public cognitions.

When applying the institutional logics to the research on the linkage between a target firm’s CSR and the cross-border acquisition premium, we expect that a country’s specific institutional environment affects managerial perceptions of the value of CSR. For instance, empirical studies have shown that the effect of CSR on export performance varies across countries; in developed countries, CSR has a significantly positive effect on export performance; however, this effect disappears in developing countries [40]. Similarly, in a cross-border acquisition, both transaction parties are embedded in their unique institutional environments. Institutional distance may have an impact on how the acquirer perceives and evaluates the target firm’s CSR. Following Scott’s three institutional pillars, this paper identifies three institutional factors—institutional distance, cultural distance, and the number of fellow acquisitions—that may moderate the relationship between the target’s CSR and the cross-border acquisition premium.

3.2.1. The Moderating Role of Institutional Distance

Institutional distance refers to the gap between two countries in terms of formal institutions such as political, judicial, and economic systems [41]. The literature has shown that institutional distance has an effect on managerial decisions due to two major reasons. First, the greater the institutional distance, the more difficult it is for a focal firm’s managers to understand the foreign institutional environment and related requirements for legitimacy [42]. Second, institutional distance increases the difficulty for managers to make optimal decisions, because institutional distance implies complexity [41], friction [43], uncertainty [44], and asymmetric information in a transaction [45]. When integrating this logic to the CSR research, scholars have found that institutional distance between developed and developing economies are likely to result in different CSR implications and outcomes [46].

This study proposes a negative moderating effect of institutional distance on the relationship between the target’s CSR and the cross-border acquisition premium. First, institutional distance may affect the acquirer’s managerial evaluation of the target firm’s CSR. As the institutional theory suggests, institutional distance increases the difficulty for the management team of a foreign acquiring firm to understand the institutional and legal requirements of the host country where a target firm is embedded [42]. Any socially responsible firm must conform to the formal institutions such as laws and government regulations. A target firm’s CSR reputation is actually an outcome of the interplay between the focal firm and its embedded institutions. As institutional distance increases, the acquirer may not be able to accurately and objectively evaluate the target’s CSR because the former’s understanding is constrained by its own institutional environment. Therefore, a good CSR practice implemented by the target firm in the host country may serve no purpose in the eyes of the foreign acquirer. Previous studies have found that the macro institutional environment in a country strongly affects the effect of CSR practices [47]. For example, while most research suggests that charitable donation be positively related to a firm’s financial performance, this effect depends on the level of economic development in a specific country [48]. Similarly, scholars have found that the positive relationship between corporate philanthropy and a firm’s financial performance is stronger in developed countries than in developing countries because firms have higher visibility and transparency in developed countries [49]. These findings provide some evidence on the changeable value of CSR performance.

Second, institutional distance may negatively affect the acquirer’s capability to learn and integrate the target firm’s CSR practices. Even if the acquirer appreciates the target’s commitments to CSR and regards CSR as a strategic asset, it takes more time and costs to understand how the target’s CSR functions in a specific institutional environment. It is even more difficult to transfer certain CSR practices into other countries where formal institutions are heterogeneous. For example, after Unilever acquired Ben and Jerry’s in 2000, Ben and Jerry’s CSR performance actually declined and its socially-oriented corporate culture was weakened to some extent. Part of the reason is related to the difference of their organizational structures which must conform to their respective institutional requirements [50]. Even though this acquisition case was regarded as successful by the relevant stakeholders, and both parties spent a huge amount of time and costs to learn from each other and integrate their CSR practices.

In sum, institutional distance increases the difficulty of CSR evaluation before acquisition, and enlarges the costs of CSR integration after acquisition. Therefore, the acquirer’s managers are less likely to offer a higher price for a target’s CSR as institutional distance rises up.

H2: Institutional distance negatively moderates the relationship between the target firm’s CSR and the cross-border acquisition premium.

3.2.2. The Moderating Role of Cultural Distance

National culture is an external manifestation of the normative pillar of an institutional environment and presents a collection of informal institutions [41]. Cultural distance between countries plays a crucial role in determining organizational strategies and actions in international contexts, including entry mode choice, geographic diversification, and location selection [51]. Existing literature on cultural distance indicates that when entering a culturally distant market, the costs of understanding, communication, and control tend to rise up. Furthermore, given the dissimilarity in social norms, values, and institutions conflicts between organizations are more likely to emerge [52]. Facing all these uncertainties and complexities, managers may become less confident in decision making. These barriers tend to cause a negative impact of cultural distance on international performance.

This study extends previous work by looking into the moderating role of cultural distance on the relationship between the target firm’s CSR and the cross-border acquisition premium. Since cultural distance causes difficulty in mutual understanding, communication, and post-acquisition integration, we expect that such a moderation effect be negative and influential.

When acquiring a culturally distant target firm, it may be difficult for the acquirer to fully comprehend the target’s values and norms, which are partly embedded in its CSR orientation, routines, and practices. Literature shows that cultural distance results in a lower level of perceived similarity and empathetic responses [53]. Consequently, the acquirer is very likely to underestimate the real value of the target’s CSR due to cultural distance. Furthermore, cultural distance forms a strong barrier for effective communication between the acquirer and the target owing to different communication styles and managerial cognitions. As a result, the target firm’s managers may be unable to convey a full set of its CSR practices and experiences to the acquirer. This may cause the acquirer to miscalculate the value of the target’s CSR. In addition, literature shows that cultural distance complicates the post-acquisition integration process, which may account for the high failure rate of cross-border M&As [41]. Without full understanding of the target’s CSR knowledge and capability, and effective communication between both parties, it is very likely that the acquirer fails to transfer and integrate the target’s CSR practices.

In summary, cultural distance impedes mutual understanding, communication, and effective integration in the setting of cross-border M&As, which can reduce managers’ confidence and lead to more conservative decisions [54]. Thus, we propose the following hypothesis:

H3: Cultural distance negatively moderates the relationship between the target firm’s CSR and the cross-border acquisition premium.

3.2.3. The Moderating Role of the Number of Fellow Acquisitions

The cognitive pillar of institutions reflects the general knowledge and understandings of a given institutional environment [55]. Different from the regulative and normative pillars, the cognitive pillar emphasizes the importance of sensemaking of the nature of reality when facing a highly uncertain and complex environment [56]. Under this situation, corporate managers tend to mimic other organizations’ choices and actions that are regarded as legitimate and are taken for granted [39]. As a result, the cognitive pillar induces firms to imitate well-accepted routines and become more homogeneous. In the context of cross-border acquisitions, managers from the acquiring firm may face high uncertainty due to the distance issue and the liability of foreignness [57]. In order to reduce uncertainty and gain support from stakeholders, these managers may resort to other firms from the same home country who have already initiated acquisitions in the same host country. Thus, these ‘fellow acquisitions’ may have an impact on a focal firm’s acquisition decisions.

This study argues that the acquirer’s decision on its bidding price and acquisition premium may be subject to the cognitive maps of top managers [39], which could be influenced by the strategic choices taken by fellow acquirers. More specifically, we propose a negative moderating effect of the number of fellow acquisitions on the linkage between the target firm’s CSR and the acquisition premium due to the following two reasons. First, when the number of fellow acquisitions in a host country increases, it is more convenient for a focal firm to collect information from fellow acquirers about the target firm and the host country’s institutional environment [58], which leads to a more accurate assessment of the target’s assets, including the value of its CSR.

Second, as more fellow firms conduct acquisitions in the same host country, the agglomeration effect emerges whereby a focal firm can gain more recognition and legitimacy from local stakeholders. Accordingly, there is no need for the acquirer to purchase a target’s CSR as a strategic asset for the purpose of legitimacy. In other words, the value of the target’s CSR asset decreases as the acquirer’s own legitimacy rises up.

Taken together, this study expects that, as the number of fellow acquisitions increases, the positive linkage between the target firm’s CSR and the cross-border acquisition premium will be weakened.

H4: The number of fellow acquisitions negatively moderates the relationship between the target firm’s CSR and the cross-border acquisition premium.

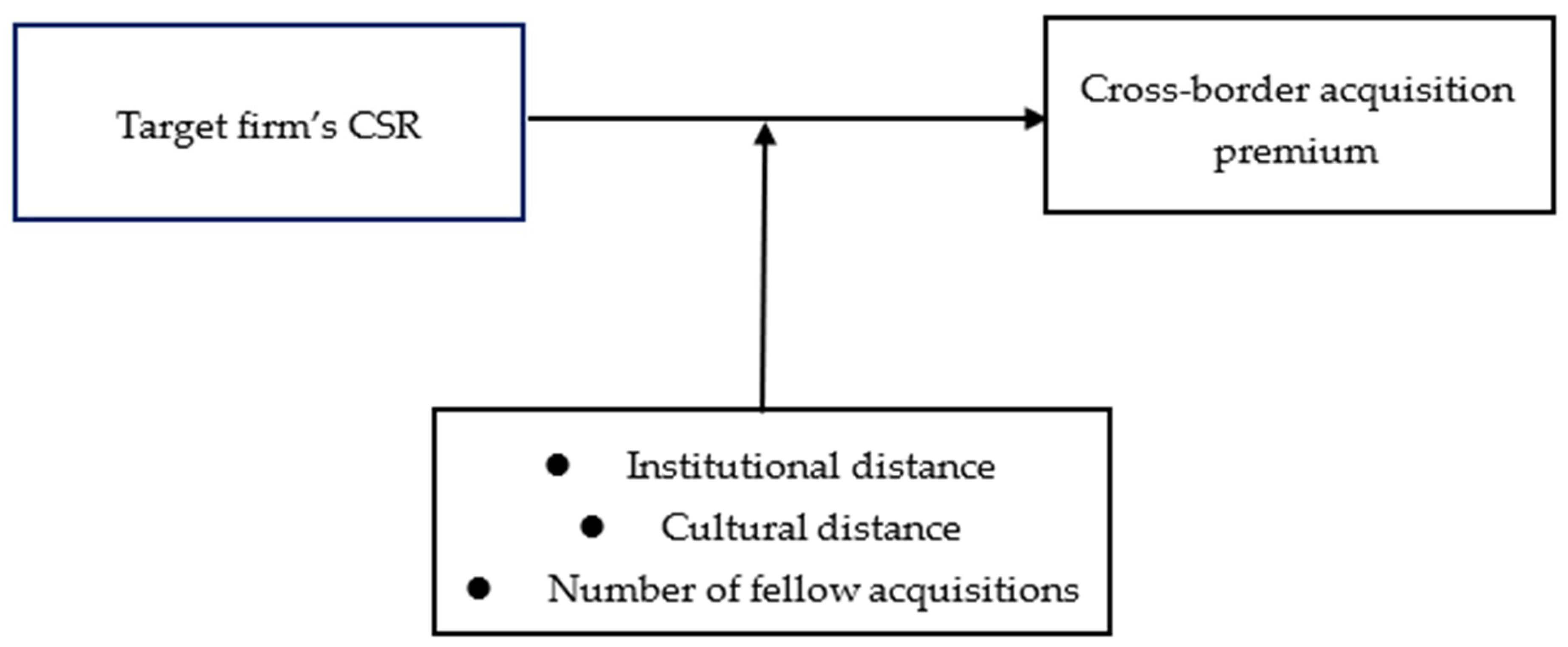

Figure 1 summarizes the theoretical framework proposed by this study.

Figure 1.

Research Model.

4. Research Methodology

4.1. Data and Sample

This study explores the relationship between a target firm’s CSR, institutional factors, and the cross-border acquisition premium. To test the above hypotheses, we relied mainly on two databases for collecting our sample and relevant information on CSR and acquisition activities: The Kinder, Lydenberg, Domini (KLD) database and the Securities Data Corporation (SDC) database. The KLD dataset has a history of more than 20 years, and covers the social performance of more than 3000 firms in the world. It has become a well-accepted source of measuring CSR in the academic field [59]. The SDC database provides information on M&As across the world and is a major source of global M&A activities. We first selected a sample of cross-border M&As from 1991 to 2016 from the SDC database whose target firms were publicly listed in the stock markets before acquisition. This selection criterion was applied because only publicly traded firms disclose the acquisition premium paid by the acquirer. The initial sample included 5056 cross-border acquisition cases. Second, we matched the acquisition cases derived from the SDC with the KLD database on the premise that the target firm also appeared in the KLD database. This step reduced our sample to 775 transaction deals. Third, we complemented the deal information with both parties’ financial data extracted from the Compustat Global database and Bureau van Dijk Osiris (BvD) databases. Eventually, a total of 252 observations were maintained after removing the missing values. This final sample consisted of 198 acquiring firms and 242 target firms.

Table 1 presents the basic information of sample distribution across years and countries. As shown in Panel A of Table 1, international acquirers mainly came from United Kingdom, Canada, France, Japan, and Switzerland. Panel B shows that the majority of target firms were located in the United States. Panel C indicates that after 2003 global M&As were more active than before.

Table 1.

Sample distribution.

4.2. Measures

4.2.1. Dependent Variable

Cross-border acquisition premium was measured by the percentage difference between the foreign acquiring firm’s offer price and the target firm’s pre-acquisition market value. Following Malhotra et al. [60] and Guo et al. [61], we used a target firm’s market value four weeks prior to the date of the deal announcement reported in the SDC database. Reuer et al. [62] argued that the four-week time lag is appropriate because it is neither too far away from the announcement date to cause value deviation, nor too close to cause confusion. In our sample, all target firms belonged to the top 3000 companies in the US stock market, and more than 70% of deals observed positive cross-border acquisition premiums. This finding is similar to the results of Moeller et al. [63] who found that firm size is positively related to acquisition premiums.

4.2.2. Independent Variable

This study’s major explanatory concept is the target firm’s CSR. Since the KLD database has been widely used in CSR research, we decided to create a proxy for the target’s CSR using the information extracted from the KLD database. The KLD database evaluates a firm’s CSR performance along three major areas: Environment, society, and corporate governance. Seven first-level dimensions are covered, including community, corporate governance, diversity, human rights, employee, product, and environment. The second-level dimensions consist of 81 items, each having a binary value as 0 or 1. Overall, the KLD database divides measures into two groups: Strengths and concerns. Following El Ghoul et al. [64] and Jha and Cox [65], we calculated the difference between strength scores and concern scores as the measure for each first-level dimension. We summed up, the seven first-level dimensions’ scores to obtain an overall CSR index for a firm in a given year. Finally, to reduce the effect of annual variation, we took the average of three-year CSR scores before the acquisition as the proxy for a target firm’s CSR.

4.2.3. Moderating Variables

This study measured institutional distance by the indicators from the PRS Group’s International Country Risk Guide (ICRG). The ICRG evaluates a country in terms of government stability, socioeconomic conditions, investment profile, internal conflict, eternal conflict, corruption, military in politics, religious tensions, law and order, ethnic tensions, democratic accountability, and bureaucracy quality. This ICRG is well accepted in previous literature because it provides comprehensive assessment of a specific country and is convenient for scholars to compare countries on an annual basis [41,66]. We measured institutional distance as the difference in ICRG scores between the home country and the host country.

Cultural distance refers to the cultural difference between the home country of acquirer and the home country of the target, which is derived from the Hofstede database. We chose the Hofstede database as our primary measure because of its validity and acceptability. Hofstede measures a nation’s culture along six orthogonal dimensions: Power distance, individualism, masculinity, uncertainty avoidance, long-term orientation, and indulgence [67]. This study adopted the method from Kogut and Singh and measured the cultural distance as follows [68]:

where SAi is the cultural score of the acquirer’s home country on dimension i, and STi is the cultural score of the target’s home country on dimension i.

The number of fellow acquisitions affects the acquirer’s cognitive understanding of the host country’s institutional environment. Researchers find that acquirers tend to imitate other firms from the home country when they conduct cross-border M&As [69]. Following Ang et al. [58], we used the number of fellow acquisitions to capture such a cognitive effect. More specifically, the number of fellow acquisitions was measured by the count of acquisitions conducted by firms from the same home country in the same host country during a five-year period prior to a specific deal [58]. We took the natural logarithm of the number of fellow acquisitions to reduce the skewness. This information was obtained by matching the data of cross-border M&A from 1986 to 2015 in the SDC database.

4.2.4. Control Variables

This study controlled for a list of variables that might influence the decision on cross-border acquisition premiums. At the firm level, we included acquirer size, target size, acquirer performance, target performance, and target’s leverage ratio as control variables. At the deal level, the number of bidders and cash payment were included in our model.

Acquirer size. The size of the acquiring firm may influence the acquisition premium in two ways: First, large firms possess greater bargaining power in negotiation; and second, large firms typically own more financial resources to pay for the target. We measured acquirer size by taking the natural logarithm of the number of employees of the acquirer in the year before the acquisition event.

Target size. Empirical evidence suggests that the target firm’s size is related to cross-border M&A premiums [63]. Accordingly, we measured target size by taking the natural logarithm of the number of employees of the target firm in the year before the acquisition event.

Acquirer performance and target performance. We applied the return on assets (ROA) to measure both parties’ performance, which was measured one year ahead of the acquisition event.

Target’s leverage ratio. Leverage ratio is a common proxy for financial risk, which may affect the bidding price [70]. To control for such a potential effect, we used the ratio of total liabilities to total assets to measure the target firm’s leverage ratio [71].

Number of bidders. Extant research shows a positive linkage between number of bidders and acquisition premiums [72], indicating that competition will boost up the bidding price. Accordingly, this study controlled this effect by including the number of firms that participated in the bidding for the same target firm.

Cash payment. The type of payment may play an important role in cross-border M&As [73]. In particular, cash payment is the most simple payment method with a high-speed settlement, which is more preferable to stock swap. We used the proportion of cash payment in the deal value to measure this variable.

Target firm’s nation. A dummy variable was created to indicate whether a target firm’s home country was the United States or not, with one indicating that the target firm came from the United States, and zero indicating from other countries.

Industry relatedness. Whether the acquirer is in the same industry as the target firm may affect the former’s capability to evaluate accurately [74,75]. Therefore, this study included industry relatedness as a control variable. We applied the first two-digit Standard Industry Classification (SIC) codes as the proxy for industry sectors. Industry relatedness was treated as one when two transaction parties had the same SIC codes, and 0 otherwise.

In addition, we also controlled for year effects because the hotness of acquisition market fluctuates across time. So each year was included into the analysis as a dummy variable, and 2015 was the reference year.

4.3. Model Estimation

Since the cross-border acquisition premium was measured as a continuous variable, we applied the Ordinary Least Square (OLS) regression model to test our hypotheses. Formula 1 aims to test the impact of the target firm’s CSR on the cross-border acquisition premium, and formula 2 is used to test the moderating effect of institutional distance, cultural distance, and the number of fellow acquisitions.

where CSR refers to the target firm’s CSR; Controls refers to control variables; INS refers to institutional distance; CUL refers to cultural distance; NUM refers to the number of fellow acquisitions; and ε is the residual term.

5. Empirical Result

5.1. Descriptive Statistics and Correlation Analysis

Table 2 presents the descriptive statistics and correlations for the variables in our study. As is seen in this table, all correlation coefficients are well below the commonly used cut-off threshold of 0.7, and an examination of the variance inflation factor (VIF) values showed that all values are well below 3, thus multicollinearity is not a serious issue in this study. We also noticed that the correlation between the target firm’s CSR and the cross-border acquisition premium is positive and marginally significant (p < 0.1), suggesting that a target firm’s CSR has a positive influence on the premium.

Table 2.

Descriptive Statistics and Correlations.

5.2. Hypothesis Testing

Table 3 presents the outcome of the OLS regression on cross-border acquisition premiums. Model 1 of Table 3 only includes control variables that might have an influence on the decision of acquisition premiums. As shown in Model 1, the effect of institutional distance is negative and significant, indicating that acquirers are less likely to pay high premiums when institutional distance between two parties is high. The effects of cultural distance and the number of fellow acquisitions are not significant. According to Sharma et al.’s [76] typology of moderator classification, institutional distance is a quasi-moderator, while cultural distance and the number of fellow acquisitions are pure-moderators.

Table 3.

Ordinary Least Squares Regression Results of Hypotheses.

Model 2 adds the key explanatory variable Target CSR to Model 1 to test H1. It turns out that the coefficient of Target firm’s CSR is positive and marginally significant (p < 0.1), suggesting that a target’s CSR has a positive relationship with the cross-border acquisition premium. Such a positive effect is consistent across models 2–6. As Model 6 shows, the regression coefficient of the target firm’s CSR is 0.002 (p < 0.1); so when the target firm’s CSR is increased by one unit, the acquisition premium will rise by 0.2%. Thus, H1 is marginally supported in this study.

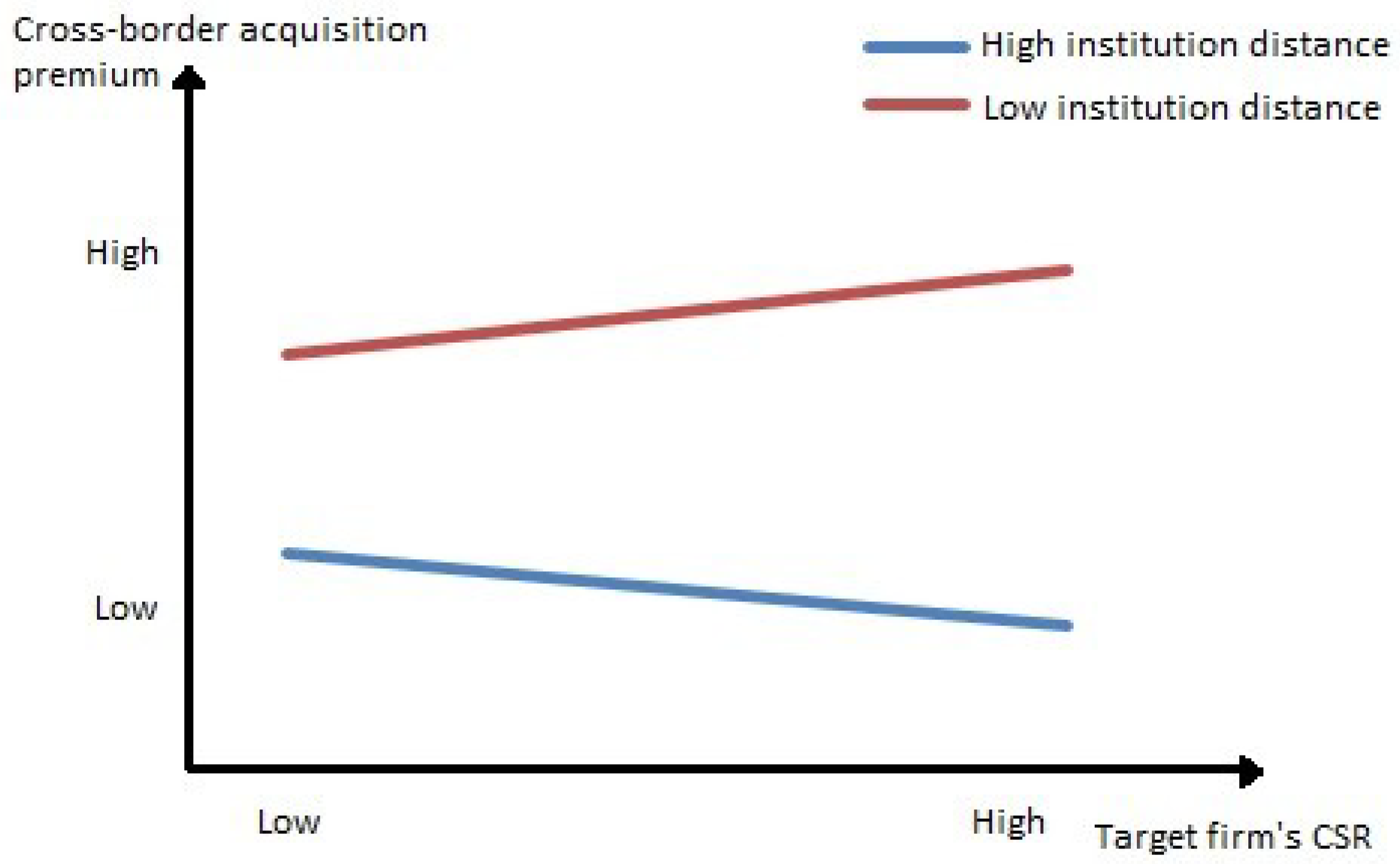

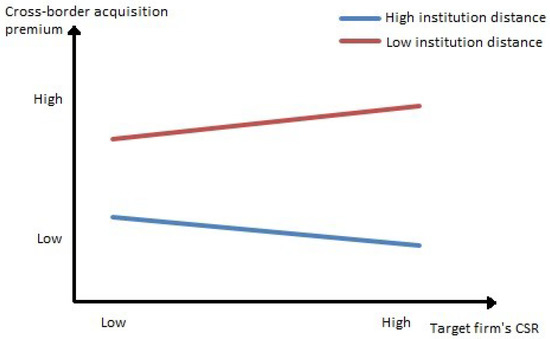

Models 3–6 aims to test the moderating effect of three institutional factors. Models 3–5 added three interaction terms, respectively, to Model 2, while Model 6 includes all terms simultaneously. This study reported the final results based on the full model (Model 6). Overall, Model 6 significantly improved the explanatory power of Model 2 as the R-squared value was increased by 0.022, indicating the existence of the moderating effects. H2 proposes a negative moderating effect of institutional distance on the relationship between the target firm’s CSR and the cross-border acquisition premium. As shown in Model 6, the coefficient of the interaction term between the target firm’s CSR and institutional distance is negative and statistically significant (p < 0.05), which extends support for H2. We further illustrated this moderation effect in Figure 2. We defined high and low-levels of institutional distance based on one standard deviation above and below the mean of the distance variable, which was a definition commonly used by researchers [77]. The figure shows that when institutional distance is high, the linear relationship between the target firm’s CSR and the cross-border acquisition premium becomes negative; on the other hand, when the institutional distance is low, the positive relationship between the target’s CSR and the cross-border acquisition premium emerges. Thus, institutional distance does influence managerial perceptions of the value of the target’s CSR and their decision on the acquisition premium.

Figure 2.

H2—Moderating effect of institutional distance on the relationship between the target firm’s corporate social responsibility and the cross-border acquisition premium.

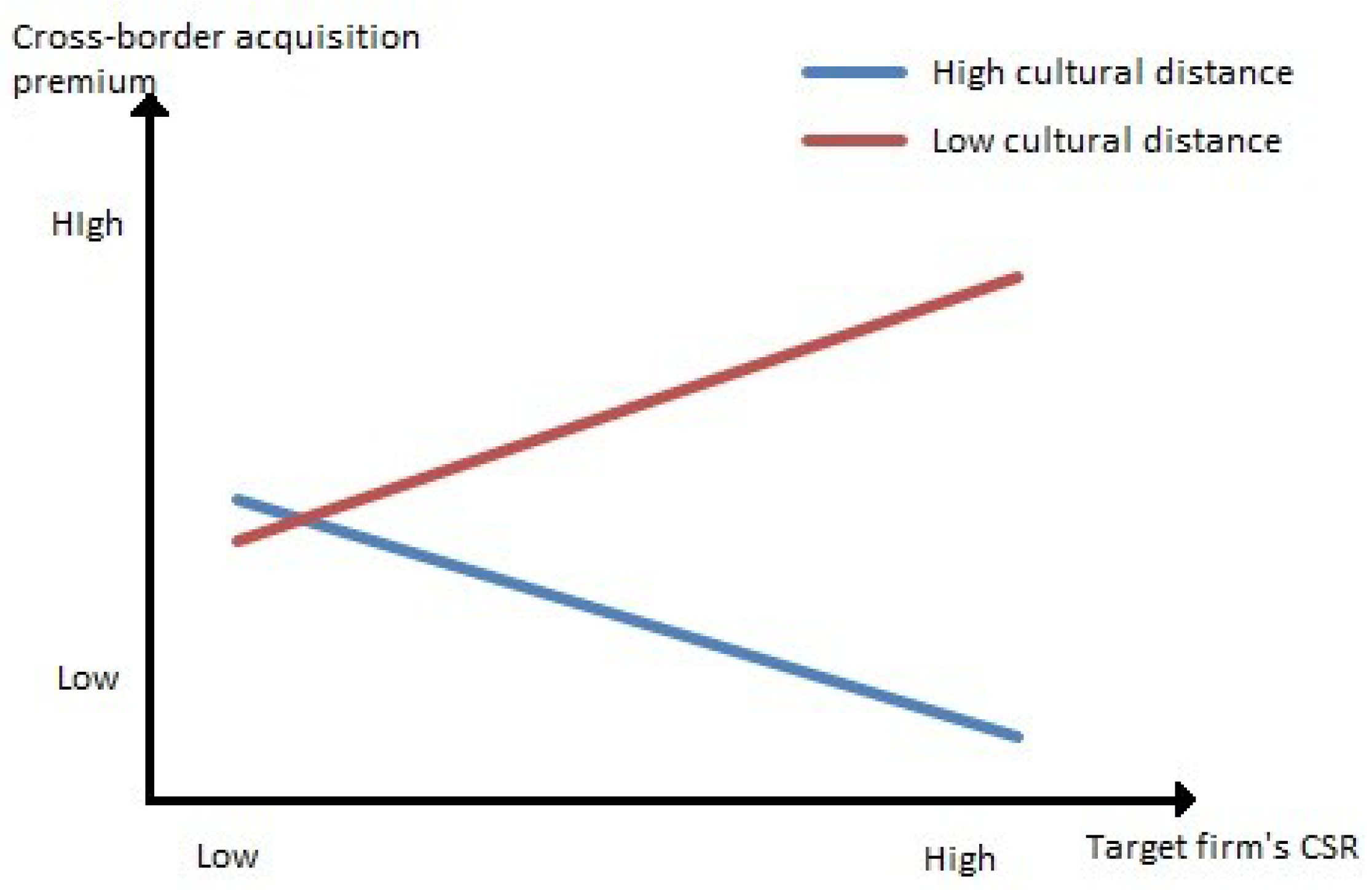

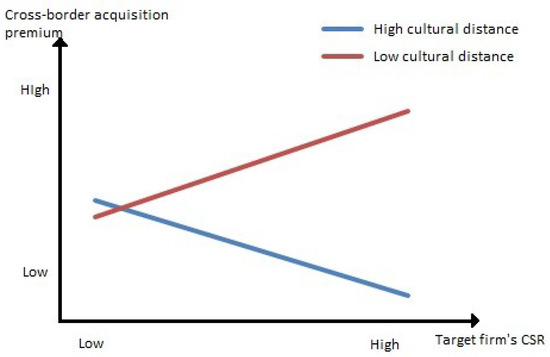

H3 predicts a negative moderating effect of cultural distance on the relationship between the target firm’s CSR and the cross-border acquisition premium. In Model 6, the coefficient of the interaction term is negative and statistically significant (p < 0.01), providing support for H3. Figure 3 illustrates this moderating effect. Similarly, when cultural distance is high, the relationship between the target’s CSR and the cross-border acquisition premium becomes negative; the positive relationship only exists when cultural distance is low.

Figure 3.

H3—Moderating effect of cultural distance on the relationship between the target firm’s corporate social responsibility and the cross-border acquisition premium.

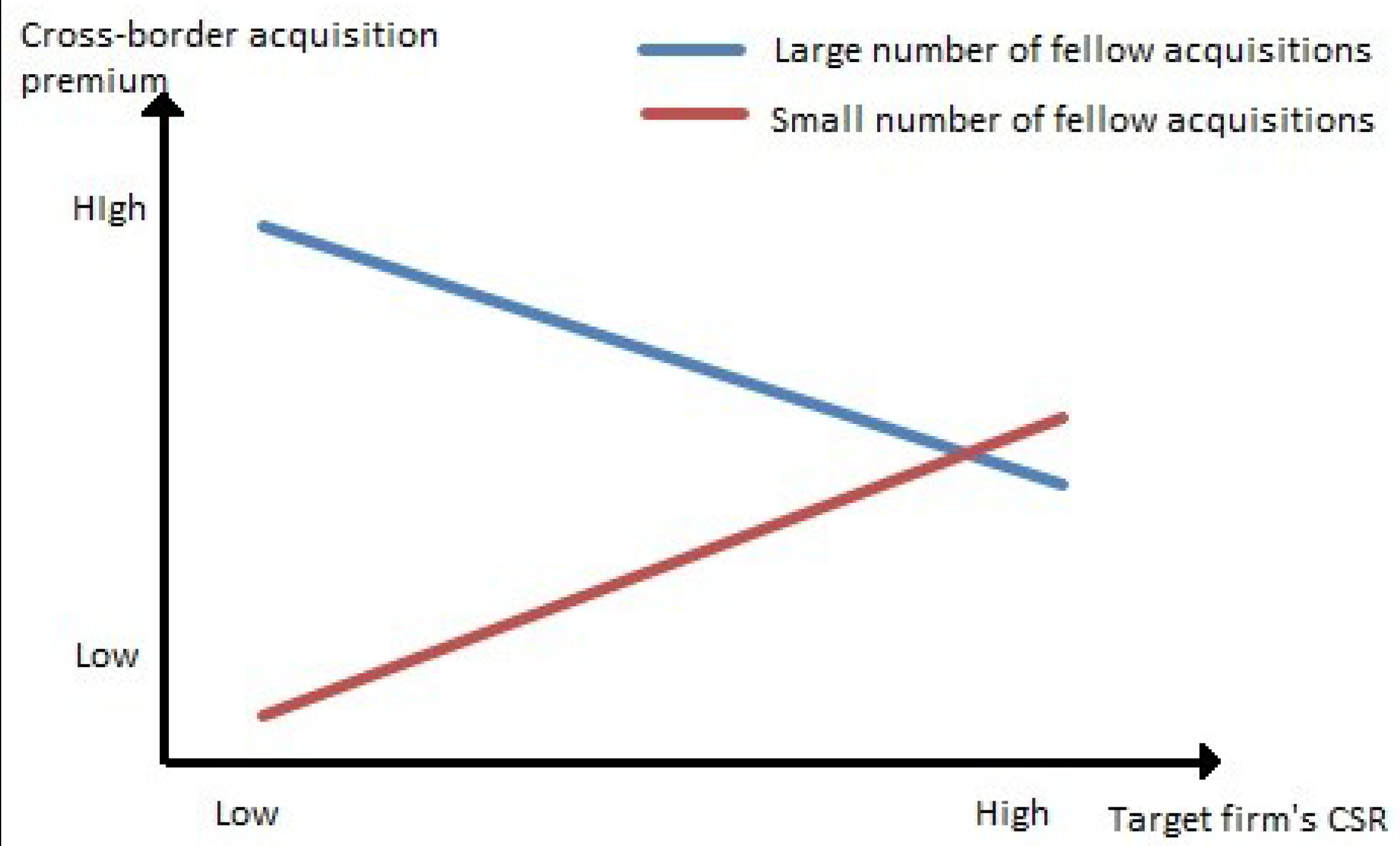

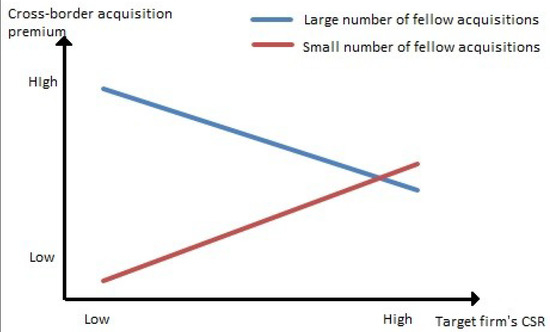

In H4, we predicted a negative moderating effect of the number of fellow acquisitions on the relationship between the target’s CSR and the cross-border acquisition premium. It turns out in Model 6 that the coefficient of the interaction term is negative and statistically significant (p < 0.05), thus supporting H4. We illustrate this moderating effect in Figure 4. The figure shows that when the number of fellow acquisitions is small, the slope of the linear relationship is positive, suggesting a more prominent effect of the target’s CSR on the premium; however, when there is a large number of fellow acquisitions, such a relationship becomes negative.

Figure 4.

H4—Moderating effect of the number of fellow acquisitions on the relationship between the target firm’s corporate social responsibility and the cross-border acquisition premium.

5.3. Robustness Test

To assure the robustness of our statistical findings, we applied a different proxy to measure the target firm’s CSR. Following Deng et al. [10], we first weighted the strength/concern scores by the number of indicators for strength/concern for each first-level dimension; then we summed up the weighted strength/concern scores for all seven dimensions. Thus, a target firm’s annual CSR score is the difference between the total strength score and the total concern score. Finally, we took the average of three-year CSR scores before acquisition as the final measure for the target firm’s CSR. As shown in Table 4, major findings remained the same in terms of the sign and significance of regression coefficients, which further corroborates our arguments on the relationship between a target firm’s CSR, institutional factors, and cross-border acquisition premiums.

Table 4.

Results of robustness test for hypotheses.

In addition, we converted the operationalization of three institutional factors from continuous measures to categorical ones. More specifically, we recalculated the value of each moderator as one if the original value was above or equal to its mean, and as zero if below its mean. The sign and significance of the regression coefficients of key variables remained almost the same, thus providing further support for our hypotheses.

6. Discussion and Conclusions

The aim of this study was to investigate how a target firm’s CSR affects the acquisition premium in the setting of cross-border M&As. Building upon the resource-based view, this study regarded the target’s CSR as a strategic asset and proposed a positive impact of the target’s CSR on the cross-border acquisition premium. Furthermore, this study took into consideration the country differences in cross-border M&As, and proposed that three institutional factors—institutional distance, cultural distance, and the number of fellow acquisitions—negatively moderate the relationship between the target’s CSR and the cross-border acquisition premium.

Based on a sample of 252 cross-border acquisition events, this research has shown that a foreign acquirer is willing to pay more for a socially responsible target firm. As the target’s CSR performance increases, its acquirer tends to bid higher for such an intangible strategic asset. Therefore, this study provides some empirical evidence that CSR does matter in the context of cross-border M&As. This study also shows that the effect of the target’s CSR on the cross-border acquisition premium is contingent on the particular institutional environment that both parties are embedded in. The multivariate regression analysis shows that all three institutional factors have significant and negative moderating effects on the main relationship. Thus, an acquirer’s preference for its target’s CSR vary across different institutional environments. When the institutional and cultural distances between two parties rise up, the acquirer’s managers hesitate to pay extra value for CSR; similarly, when the number of fellow acquisitions in the host country is high, such a positive relationship also becomes weakened to some extent. The findings from this study make several contributions to the current literature. First, it extends our understanding of the role of CSR in the global setting. Most of the literature on the role of CSR is confined to domestic domains where country-level institutions remain constant cross firms [53,78]. While extant research generally admits that domestic institutions have an impact on corporate decisions, the institutional heterogeneity across countries has not been fully studied yet. This work is one of the few attempts that directly examines the role of CSR in the global environment by considering corporate responses to institutional heterogeneity. The findings of this study show that all regulative, normative, and cognitive pillars significantly influence managerial perceptions and evaluations of CSR, which conforms to the logics of institutional theory.

In addition, the present study extends our knowledge of the relationship between CSR and cross-border acquisition. While previous research has explored the impact of CSR on acquisition performance indicators such as the possibility of completion and the speed of fulfillment [10], the linkage between the target’s CSR and the acquisition premium remains a puzzle. This study fills in this research gap by directly testing how the target’s CSR affects the cross-border acquisition premium. The empirical findings add to the growing body of research that highlights the influence of CSR on managerial decisions.

Finally, this study provides some insights on how a target firm’s CSR affects its acquirer’s decision on the bidding price and acquisition premium. Before this study, evidence of the role of a target’s CSR on acquisitions is mainly anecdotal. Existing literature primarily attend to the CSR of the acquiring party, arguing that a socially responsible acquirer is more likely to gain support from external stakeholders, and achieve a better acquisition performance [10,22]. Though an acquisition deal involves both the acquirer and the target, few scholars have explicitly examined how the target’s CSR relates to the acquisition outcome. Thus, this study provides some empirical evidence to answer this question.

This study also offers some practical insights for corporate managers. First, a socially responsible target firm should ask for higher premiums from potential bidders, and achieve higher market gains for its existing shareholders. Good CSR performance and high social status are the outcome of long-term investments by current shareholders. Thus, managers from the target firm cannot underestimate the value of CSR and hurt its shareholders’ benefits. Second, to help an acquirer accurately assess the value of CSR performance, a target firm’s managers need to think about how to disclose its CSR information efficiently and effectively. Previous literature suggests that one possible way is to voluntarily adopt a web-based CSR reporting system, which can improve the CSR transparency between the acquirer and the target [79,80]. Finally, our empirical findings suggest that in a cross-border acquisition, a target firm with high CSR performance choose a foreign acquirer from similar institutions because this helps maximize the target’s CSR value.

While this study offers some important insights on the relationship between a target firm’s CSR, institutional factors, and cross-border acquisition premiums, there exist several limitations that future research can improve on. First, this study only selected target firms publicly listed in the stock markets in order to measure acquisition premiums. This limited most of our sampled cases to large-scale firms. Thus, the empirical findings must be interpreted with caution because they may not be applicable to small-scale firms. Future research can include small and medium-sized firms into the sample. Second, this study thought of CSR as a single construct and applied one composite indicator to measure it. However, CSR covers multiple dimensions that may exert differential influences on acquisition premiums. Future research can explore how each dimension of a target’s CSR affects the acquirer’s decision on bidding price. Finally, this study mainly focused on the role of one party’s CSR in an acquisition deal; however, any acquisition transaction involves at least two parties. It would be more meaningful for future research to consider both parties’ CSR simultaneously and test how the CSR distance of both parties influences the acquisition premium. Notwithstanding these limitations, this study offers valuable insights into how a target firm’s CSR and the institutional factors work together to determine the acquirer’s decision on cross-border acquisition premiums.

Author Contributions

Both authors have participated and contributed equally to this work. Conceptualization, L.Q. and J.W.; Formal analysis, L.Q.; Methodology, L.Q.; Writing-Original Draft Preparation, L.Q. and J.W.; Writing-Review and Editing, J.W.

Funding

This research was funded by the Fundamental Research Funds for the Central Universities in UIBE (CXTD7-03).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S Back in Corporate Social Responsibility: A Multilevel Theory of Social Change in Organizations. Acad. Manag. Rev. 2007, 32, 836–865. [Google Scholar] [CrossRef]

- Hu, Y.; Chen, S.; Shao, Y.; Gao, S. CSR and Firm Value: Evidence from China. Sustainability 2018, 10, 4597. [Google Scholar] [CrossRef]

- Hawn, O.; Chatterji, A.K.; Mitchell, W. Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones Sustainability Index (DJSI). Strateg. Manag. J. 2018, 39, 949–976. [Google Scholar] [CrossRef]

- Marano, V.; Kostova, T. Unpacking the Institutional Complexity in Adoption of CSR Practices in Multinational Enterprises. J. Manag. Stud. 2016, 53, 28–54. [Google Scholar] [CrossRef]

- Flammer, C.; Jiao, L. Corporate social responsibility as an employee governance tool: Evidence from a quasi-experiment. Strateg. Manag. J. 2016, 2014, 163–183. [Google Scholar] [CrossRef]

- Berchicci, L.; Dowell, G.; King, A.A. Environmental capabilities and corporate strategy: Exploring acquisitions among US manufacturing firms. Strateg. Manag. J. 2012, 33, 1053–1071. [Google Scholar] [CrossRef]

- Austin, J.E.; Leonard, H.B. Can the virtuous mouse and the wealthy elephant live happily ever after? Calif. Manag. Rev. 2008, 51. [Google Scholar] [CrossRef]

- Deloitte. How Green is the Deal? The Growing Role of Sustainability in M&A. 2008. Available online: https://www2.deloitte.com/content/dam/Deloitte/il/Documents/risk/CCG/other_comittees/how_green_is_the_deal_deloitte_102408.pdf. (accessed on 24 October 2008).

- Aktas, N.; De Bodt, E.; Cousin, J. Do Financial Markets Care about SRI? Evidence from Mergers and Acquisitions. J. Bank. Financ. 2011, 35, 1753–1761. [Google Scholar] [CrossRef]

- Deng, X.; Kang, J.-k.; Low, B.S. Corporate social responsibility and stakeholder value maximization: Evidence from mergers. J. Financ. Econ. 2013, 110, 87–109. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horn 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Gupta, A.; Briscoe, F.; Hambrick, D.C. Red, blue, and purple firms: Organizational political ideology and corporate social responsibility. Strateg. Manag. J. 2017, 38, 1018–1040. [Google Scholar] [CrossRef]

- Smith, N.C. Corporate Social Responsibility: Whether or How? Calif. Manag. Rev. 2003, 45, 52–76. [Google Scholar] [CrossRef]

- Shiu, Y.-M.; Yang, S.-L. Does engagement in corporate social responsibility provide strategic insurance-like effects? Strateg. Manag. J. 2017, 38, 455–470. [Google Scholar] [CrossRef]

- Mithani, M.A. Liability of foreignness, natural disasters, and corporate philanthropy. J. Int. Bus. Stud. 2017, 48, 941–963. [Google Scholar] [CrossRef]

- Menguc, B.; Ozanne, L.K. Challenges of the “green imperative”: A natural resource-based approach to the environmental orientation-business performance relationship. J. Bus. Res. 2005, 58, 430–438. [Google Scholar] [CrossRef]

- Lim, A.; Tsutsui, K. Globalization and Commitment in Corporate Social Responsibility Cross-National Analyses of Institutional and Political-Economy Effects. Am. Sociol. R 2012, 77, 69–98. [Google Scholar] [CrossRef]

- Coulson, A.B.; Monks, V. Corporate Environmental Performance Considerations within Bank Lending Decisions. Eco-Manag. Audit. 1999, 6, 10. [Google Scholar] [CrossRef]

- Saxton, T.; Dollinger, M. Target Reputation and Appropriability: Picking and Deploying Resources in Acquisitions. J. Manag. 2004, 30, 123–147. [Google Scholar] [CrossRef]

- Wickert, C.; Vaccaro, A.; Cornelissen, J. “Buying” Corporate Social Responsibility: Organisational Identity Orientation as a Determinant of Practice Adoption. J. Bus. Eth. 2017, 142, 497–514. [Google Scholar] [CrossRef]

- Cloutier, C.; Langley, A. Negotiating the Moral Aspects of Purpose in Single and Cross-Sectoral Collaborations. J. Bus. Eth. 2017, 141, 103–131. [Google Scholar] [CrossRef]

- Hawn, O.; Ioannou, I. Mind the gap: The interplay between external and internal actions in the case of corporate social responsibility. Strateg. Manag. J. 2016, 37, 2569–2588. [Google Scholar] [CrossRef]

- Kaul, A.; Wu, B. A capabilities-based perspective on target selection in acquisitions. Strateg. Manag. J. 2016, 37, 1220–1239. [Google Scholar] [CrossRef]

- Gomes, M.; Marsat, S. Does CSR impact premiums in M&A transactions? Financ. Res. Lett. 2017, 26, 71–80. [Google Scholar] [CrossRef]

- Frynas, J.G.; Yamahaki, C. Corporate social responsibility: Review and roadmap of theoretical perspectives. Bus. Eth. Eur. 2016, 25, 258–285. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Graves, S.B.; Waddock, S.A. Institutional Owners and Corporate Social Performance. Acad. Manag. J. 1994, 37, 1034–1046. [Google Scholar] [CrossRef]

- Bravo, R.; Matute, J.; Pina, J.M. Corporate Social Responsibility as a Vehicle to Reveal the Corporate Identity: A Study Focused on the Websites of Spanish Financial Entities. J. Bus. Eth. 2012, 107, 129–146. [Google Scholar] [CrossRef]

- Ahammad, M.F.; Tarba, S.; Frynas, G.; Scola, A. Integration of nonmarket and market activities in cross-border mergers and acquisitions. Br. J. Manag. 2017, 28, 629–648. [Google Scholar] [CrossRef]

- Knudsen, J.S.; Brown, D. Why governments intervene: Exploring mixed motives for public policies on corporate social responsibility. Public Policy Adm. 2014, 30, 51–72. [Google Scholar] [CrossRef]

- Luo, X.R.; Wang, D.; Zhang, J. Whose Call to Answer: Institutional Complexity and Firms’ CSR Reporting. Acad. Manag. J. 2017, 60, 321–344. [Google Scholar] [CrossRef]

- Zyglidopoulos, S.C.; Carroll, C.E.; Georgiadis, A.P.; Siegel, D.S. Does Media Attention Drive Corporate Social Responsibility? J. Bus. Res. 2010, 65, 1622–1627. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Xie, E.; Reddy, K.S.; Liang, J. Country-specific determinants of cross-border mergers and acquisitions: A comprehensive review and future research directions. J. World Bus. 2017, 52, 127–183. [Google Scholar] [CrossRef]

- Groening, C.; Kanuri, V.K. Investor reaction to positive and negative corporate social events. J. Bus. Res. 2013, 66, 1852–1860. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. “Implicit” and “Explicit” CSR: A Conceptual Framework for a Comparative Understandingof Corporate Social Responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. R. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations. Ideas, Interests and Identities; Sage: London, UK, 1995. [Google Scholar]

- Boehe, D.M.; Barin Cruz, L. Corporate Social Responsibility, Product Differentiation Strategy and Export Performance. J. Bus. Eth. 2010, 91, 325–346. [Google Scholar] [CrossRef]

- Dikova, D.; Sahib, P.R.; van Witteloostuijn, A. Cross-border acquisition abandonment and completion: The effect of institutional differences and organizational learning in the international business service industry, 1981–2001. J. Int. Bus. Stud. 2009, 41, 223–245. [Google Scholar] [CrossRef]

- Kostova, T.; Zaheer, S. Organizational Legitimacy under Conditions of Complexity: The Case of the Multinational Enterprise. Acad. Manag. Rev. 1999, 24, 64–81. [Google Scholar] [CrossRef]

- Shenkar, O.; Luo, Y.; Yeheskel, O. From “Distance” to “Friction”: Substituting Metaphors and Redirecting Intercultural Research. Acad. Manag. Rev. 2008, 33, 905–923. [Google Scholar] [CrossRef]

- Makino, S.; Tsang, E.W. Historical ties and foreign direct investment: An exploratory study. J. Int. Bus. Stud. 2011, 42, 545–557. [Google Scholar] [CrossRef]

- Hernández, V.; Nieto, M.J.; Boellis, A. The asymmetric effect of institutional distance on international location: Family versus nonfamily firms. Glob. Strateg. J. 2018, 8, 22–45. [Google Scholar] [CrossRef]

- Julian, S.D.; Ofori-dankwa, J.C. Financial resource availability and corporate social responsibility expenditures in a sub-Saharan economy: The institutional difference hypothesis. Strateg. Manag. J. 2013, 34, 1314–1330. [Google Scholar] [CrossRef]

- Barin Cruz, L.; Dwyer, R.; Avila Pedrozo, E. Corporate social responsibility and green management. Manag. Decis. 2009, 47, 1174–1199. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate Philanthropy and Corporate Financial Performance: The Roles of Stakeholder Response and Political Access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Gautier, A.; Pache, A.-C. Research on Corporate Philanthropy: A Review and Assessment. J. Bus. Eth. 2015, 126, 343–369. [Google Scholar] [CrossRef]

- Mirvis, P.H. Commentary: Can You Buy CSR? Calif. Manag. Rev. 2008, 51, 9. [Google Scholar] [CrossRef]

- Tihanyi, L.; Griffith, D.A.; Russell, C.J. The effect of cultural distance on entry mode choice, international diversification, and MNE performance: A meta-analysis. J. Int. Bus. Stud. 2005, 36, 270–283. [Google Scholar] [CrossRef]

- Reus, T.H.; Lamont, B.T. The double-edged sword of cultural distance in international acquisitions. J. Int. Bus. Stud. 2009, 40, 1298–1316. [Google Scholar] [CrossRef]

- Campbell, J.T.; Eden, L.; Miller, S.R. Multinationals and corporate social responsibility in host countries: Does distance matter? J. Int. Bus. Stud. 2012, 43, 84–106. [Google Scholar] [CrossRef]

- Sousa, C.M.P.; Tan, Q. Exit from a foreign market: Do poor performance, strategic fit, cultural distance, and international experience matter? J. Int. Market. 2015, 15, 1–53. [Google Scholar] [CrossRef]

- Phillips, N.; Tracey, P.; Karra, N. Rethinking institutional distance: Strengthening the tie between new institutional theory and international management. Strateg. Organ. 2009, 7, 339–348. [Google Scholar] [CrossRef]

- Lord, R.G.; Kernan, M.C. Scripts as Determinants of Purposeful Behavior in Organizations. Acad. Manag. Rev. 1987, 12, 265–277. [Google Scholar] [CrossRef]

- Zaheer, S. Overcoming the Liability of Foreignness. Acad. Manag. J. 1995, 38, 341–363. [Google Scholar] [CrossRef]

- Ang, S.H.; Benischke, M.H.; Doh, J.P. The interactions of institutions on foreign market entry mode. Strateg. Manag. J. 2015, 36, 1536–1553. [Google Scholar] [CrossRef]

- Hart, T.A.; Sharfman, M. Assessing the Concurrent Validity of the Revised Kinder, Lydenberg, and Domini Corporate Social Performance Indicators. Bus. Soc. 2012, 54, 575–598. [Google Scholar] [CrossRef]

- Malhotra, S.; Zhu, P.; Reus, T.H. Anchoring on The Acquisition Premium Decisions of Others. Strateg. Manag. J. 2015, 36, 1866–1876. [Google Scholar] [CrossRef]

- Guo, W.; Clougherty, J.A.; Duso, T. Why are Chinese MNES not Financially Competitive in Cross-border Acquisitions? The Role of State Ownership. Long. Range. Plann. 2016, 49, 614–631. [Google Scholar] [CrossRef]

- Reuer, J.J.; Tong, T.W.; Wu, C.-W. A Signaling Theory of Acquisition Premiums: Evidence from IPO Targets. Acad. Manag. J. 2012, 55, 667–683. [Google Scholar] [CrossRef]

- Moeller, S.B.; Schlingemann, F.P.; Stulz, R.M. Firm size and the gains from acquisitions. J. Financ. Econ. 2004, 73, 201–228. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does Corporate Social Responsibility Affect the Cost of Capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Jha, A.; Cox, J. Corporate Social Responsibility and Social Capital. J. Bank. Financ. 2015, 60, 252–270. [Google Scholar] [CrossRef]

- Lim, M.-H.; Lee, J.-H. National economic disparity and cross-border acquisition resolution. Int. Bus. Rev. 2017, 26, 354–364. [Google Scholar] [CrossRef]

- Hofstede, G.; Minkov, M. Long-versus short-term orientation: New perspectives. Asia Pac. Bus. Rev. 2010, 16, 493–504. [Google Scholar] [CrossRef]

- Kogut, B.; Singh, H. The Effect of National Culture on the Choice of Entry Mode. J. Int. Bus. Stud. 1988, 19, 411–432. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Li, S.X.; Usher, J.M. Making the Next Move: How Experiential and Vicarious Learning Shape the Locations of Chains’ Acquisitions. Adm. Sci. Q. 2000, 45, 766–801. [Google Scholar] [CrossRef]

- Raad, E. Why Do Acquiring Firms Pay High Premiums to Takeover Target Shareholders: An Empirical Study. J. Appl. Bus. Res. 2012, 28, 725. [Google Scholar] [CrossRef]

- Liu, H.; Luo, J.-h.; Cui, V. The Impact of Internationalization on Home Country Charitable Donation: Evidence from Chinese Firms. Manag. Int. Rev. 2018, 58, 313–335. [Google Scholar] [CrossRef]

- Lim, J.; Makhija, A.K.; Shenkar, O. The Asymmetric Relationship between National Cultural Distance and Target Premiums in Cross-Border M&A. J. Corp. Financ. 2016, 41, 542–571. [Google Scholar] [CrossRef]

- Hitt, M.A.; Pisano, V. The Cross-Border Merger and Acquisition Strategy: A Research Perspective. Manag. Res. 2003, 1, 14. [Google Scholar] [CrossRef]

- Capron, L. The Long-Term Performance of Horizontal Acquisitions. Strateg. Manag. J. 1999, 20, 987–1018. [Google Scholar] [CrossRef]

- Lim, M.-H.; Lee, J.-H. The effects of industry relatedness and takeover motives on cross-border acquisition completion. J. Bus. Res. 2016, 69, 4787–4792. [Google Scholar] [CrossRef]

- Sharma, S.; Durand, R.M.; Gur-Arie, O. Identification and Analysis of Moderator Variables. J. Market. Res. 1981, 18, 291–300. [Google Scholar] [CrossRef]

- Echols, A.; Tsai, W. Niche and Performance: The Moderating Role of Network Embeddedness. Strateg. Manag. J. 2005, 26, 219–238. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 26. [Google Scholar] [CrossRef]

- Caputo, F.; Pizzi, S. Ethical Firms and Web Reporting: Empirical Evidence about the Voluntary Adoption of the Italian “Legality Rating”. Int. J. Bus. Manag. 2019, 14, 36–45. [Google Scholar] [CrossRef]

- Bosetti, L. Web-Based Integrated CSR Reporting: An Empirical Analysis. Symph. Emerg. Issues Manag. 2018, 1, 18–38. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).