Debt Risk Evaluation of Toll Freeways in Mainland China Using the Grey Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Debt Risk Factors of Highways

2.2. Application of the Grey Approach

3. Materials and Methods

3.1. Data Collection

3.2. Risk Factor Identification

3.3. Risk Factor Ranking and Criteria Determination

3.4. The Grey Approach

4. Application of the Grey Approach

[0.48,0.68],[0.38,0.54],[0.47,0.64],[0.68,0.86],[0.44,0.62],[0.44,0.74],[0.57,0.82]}

P{S5 ≤ Smax} = 0.523, P{S6 ≤ Smax} = 0.511, P{S7 ≤ Smax} = 0.643, P{S8 ≤ Smax} = 0.552,

P{S9 ≤ Smax} = 0.546, P{S10 ≤ Smax} = 0.579, P{S11 ≤ Smax} = 0.618, P{S12 ≤ Smax} = 0.605,

P{S13 ≤ Smax} = 0.493, P{S14 ≤ Smax} = 0.391, P{S15 ≤ Smax} = 0.489, P{S16 ≤ Smax} = 0.424,

P{S17 ≤ Smax} = 0.343, P{S18 ≤ Smax} = 0.273, P{S19 ≤ Smax} = 0.253, P{S20 ≤ Smax} = 0.364,

P{S21 ≤ Smax} = 0.632, P{S22 ≤ Smax} = 0.324, P{S23 ≤ Smax} = 0.360, P{S24 ≤ Smax} = 0.458,

P{S25 ≤ Smax} = 0.232, P{S26 ≤ Smax} = 0.258, P{S27 ≤ Smax} = 0.375, P{S28 ≤ Smax} = 0.588,

P{S29 ≤ Smax} = 0.289

S5 > S9 > S8 > S2 > S10 > S28 > S12 > S11 > S21 > S7 > S3 > S4

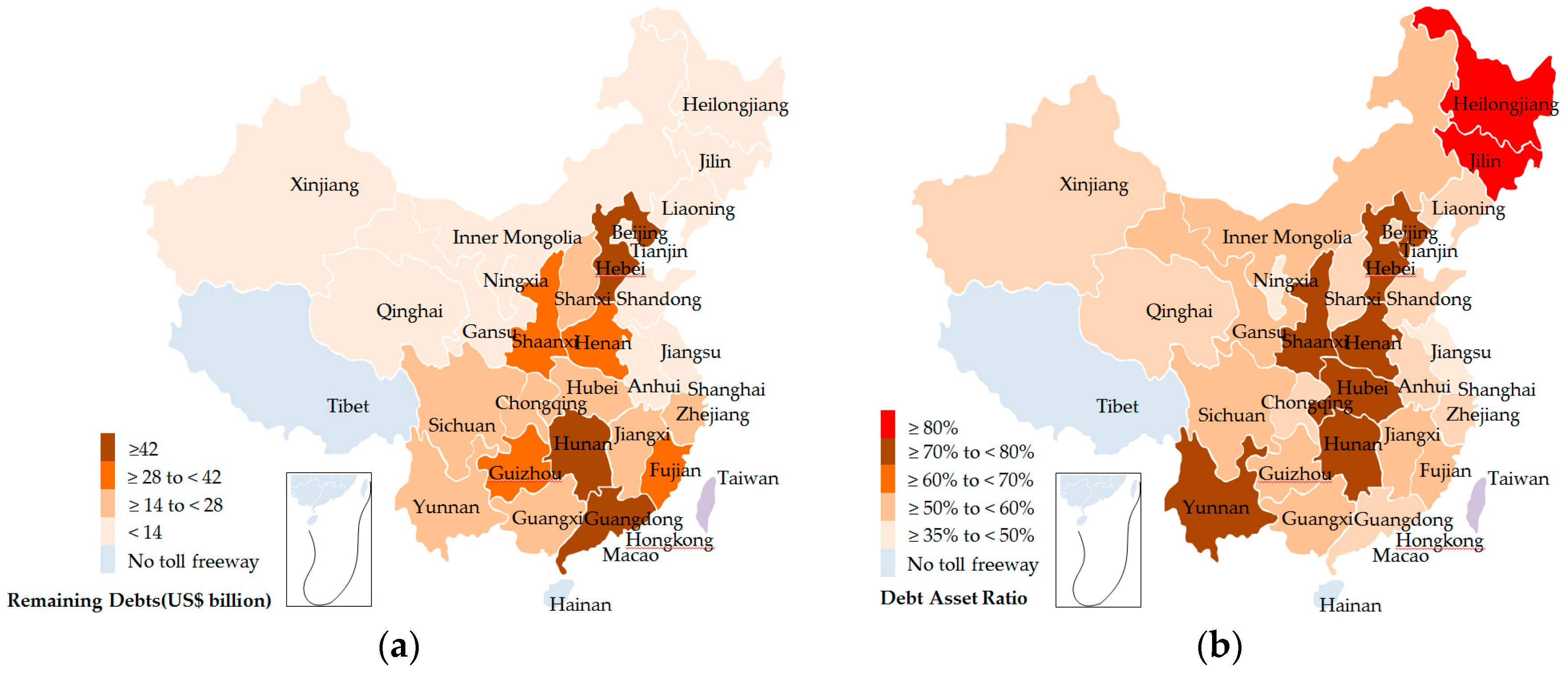

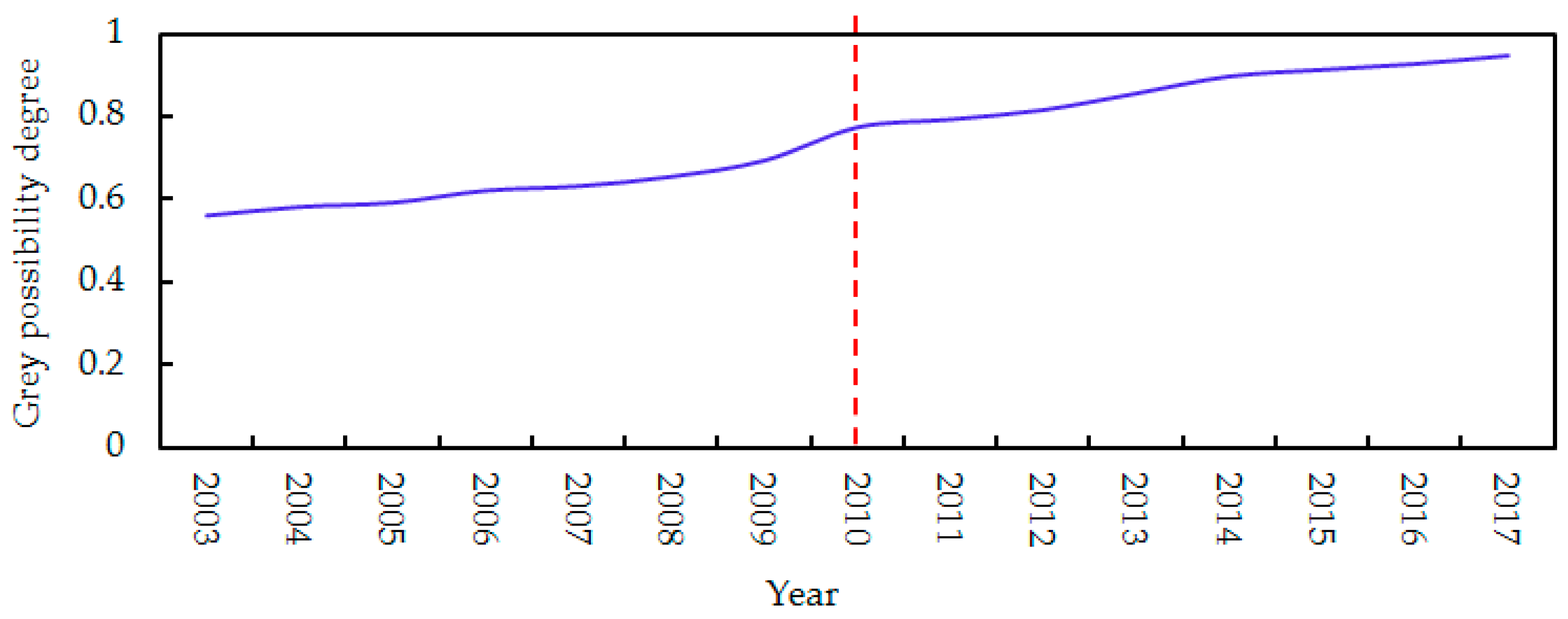

5. Results

6. Discussion

- From the IRI ranking results in Table 2, debt–asset ratio, remaining debts, investment from the government finance, proportion of short-term loans, repayment of principal and interest, commercial loan ratio, debt management system, policy, debt managers’ skill, interest rate, exchange-rate fluctuation, and inflation-rate fluctuation are determined as key risk factors affecting toll freeways debt. These factors were also identified as financial risk factors of highway projects by previous studies [9,13,18,26,28,30]. However, from the existing literature, we newly added solvency risk factors to improve the risk factor system, namely, free cash flow, toll revenue, and EBITDA margin. These factors can significantly measure the profitability and solvency of toll freeways [45,49,54].

- It was found that there was no significant correlation between debt risk level of toll freeways and GDP level of provincial governments, which is in line with several previous studies [63,64]. Additionally, the whole of Mainland China had an increasing debt risk of toll freeways in the past 15 years. To our knowledge, it is because the construction of toll freeways in the whole of Mainland China has been in a rapid development period since 2010, with an average of more than 7 km new toll freeways built per year, which brought about a large scale of debt by bank loans.

7. Policy Implications

7.1. Debt Scale Aspect

7.2. Debt Structure Aspect

7.3. Debt Management Aspect

7.4. External Environment Aspect

7.5. Solvency Aspect

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Provinces | A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 | A11 | A12 | A13 | A14 | A15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Guangdong (S1) | 55.74 | 43.53 | 5.37 | 73.58 | 47.94 | [1.24,3.56] | [2.66,4.54] | [2.01,3.89] | 5.58 | [2.47,3.27] | [3.57,5.43] | 3.64 | 1.82 | 9.60 | 6.06 |

| Hunan (S2) | 78.39 | 43.61 | 2.48 | 83.47 | 63.42 | [0.66,1.83] | [2.21,3.97] | [1.56,3.32] | 5.56 | [1.73,2.29] | [1.57,2.01] | 1.78 | −0.16 | 2.29 | 4.23 |

| Henan (S3) | 73.14 | 34.03 | 6.27 | 76.54 | 62.93 | [1.03,3.29] | [4.49,5.63] | [3.84,4.98] | 6.01 | [2.75,3.65] | [2.37,3.04] | 1.94 | 0.73 | 3.46 | 6.71 |

| Hebei (S4) | 74.67 | 43.50 | 8.90 | 78.56 | 61.22 | [0.17,1.47] | [2.66,4.54] | [2.01,3.89] | 6.02 | [1.85,2.45] | [2.45,3.15] | 2.34 | −0.45 | 3.58 | 4.57 |

| Heilongjiang (S5) | 52.55 | 13.58 | 2.20 | 69.37 | 41.19 | [5.05,7.63] | [1.28,2.11] | [0.63,1.46] | 5.58 | [4.07,5.39] | [3.15,4.04] | 3.67 | 1.09 | 4.61 | 9.98 |

| Inner Mongolia (S6) | 60.93 | 24.81 | 2.18 | 80.43 | 52.45 | [3.38,4.78] | [4.56,6.16] | [5.27,6.83] | 5.65 | [2.18,2.89] | [1.77,2.26] | 3.12 | 0.38 | 2.58 | 5.31 |

| Shaanxi (S7) | 79.38 | 42.64 | 5.37 | 74.78 | 62.27 | [0.31,1.65] | [2.66,5.56] | [1.07,3.97] | 5.65 | [2.01,2.67] | [1.89,2.42] | 1.68 | −0.49 | 2.76 | 4.97 |

| Guizhou (S8) | 64.02 | 36.77 | 2.46 | 84.51 | 56.06 | [1.36,2.45] | [3.15,5.35] | [1.56,3.76] | 5.78 | [4.52,5.99] | [2.09,3.46] | 2.43 | −0.77 | 1.59 | 1.13 |

| Jiangxi (S9) | 67.42 | 20.00 | 2.25 | 83.99 | 57.98 | [1.29,3.63] | [2.13,3.06] | [0.54,1.47] | 5.69 | [2.06,2.72] | [0.42,1.83] | 2.35 | 0.39 | 2.08 | 5.04 |

| Shanxi (S10) | 57.74 | 23.56 | 2.50 | 76.22 | 49.66 | [1.95,2.46] | [3.14,4.78] | [1.55,3.19] | 6.05 | [0.19,1.58] | [1.36,1.75] | 1.56 | −0.32 | 1.99 | 2.92 |

| Hubei (S11) | 75.39 | 28.69 | 3.77 | 79.51 | 64.84 | [4.08,5.66] | [6.15,7.52] | [4.56,5.93] | 5.95 | [2.47,3.27] | [3.61,5.07] | 1.89 | −0.17 | 2.36 | 6.08 |

| Fujian (S12) | 68.14 | 35.96 | 3.30 | 78.94 | 58.66 | [1.01,2.27] | [4.23,6.35] | [2.64,4.71] | 5.84 | [2.01,2.67] | [0.21,1.55] | 2.02 | −0.26 | 1.76 | 4.92 |

| Guangxi (S13) | 65.63 | 17.42 | 1.60 | 86.63 | 57.44 | [0.06,1.07] | [2.16,3.31] | [0.51,1.72] | 5.76 | [2.51,3.32] | [1.15,3.47] | 1.67 | 0.30 | 1.68 | 6.13 |

| Jiangsu (S14) | 47.02 | 14.22 | 6.65 | 62.07 | 47.44 | [1.08,2.37] | [2.81,5.52] | [1.22,3.91] | 5.72 | [4.23,5.61] | [4.27,5.48] | 3.54 | 1.55 | 6.24 | 10.31 |

| Sichuan (S15) | 51.39 | 12.21 | 1.40 | 67.83 | 44.25 | [2.63,3.79] | [2.31,3.46] | [0.72,1.87] | 5.82 | [3.04,4.03] | [0.54,1.98] | 2.11 | 0.97 | 2.25 | 7.49 |

| Liaoning (S16) | 57.80 | 13.21 | 1.21 | 76.3 | 43.71 | [0.41,1.52] | [1.74,3.48] | [1.91,3.82] | 6.02 | [3.29,4.36] | [1.03,1.32] | 2.27 | 0.33 | 1.51 | 0.83 |

| Xinjiang (S17) | 58.23 | 8.49 | 0.94 | 76.86 | 46.08 | [1.06,2.08] | [3.11,4.51] | [3.42,4.95] | 5.92 | [2.47,3.27] | [2.81,4.04] | 1.68 | −0.09 | 1.19 | 0.64 |

| Shandong (S18) | 82.08 | 12.57 | 0.78 | 88.35 | 68.59 | [3.43,5.54] | [0.37,1.34] | [0.41,1.47] | 5.86 | [5.71,7.57] | [1.52,2.67] | 1.32 | −0.33 | 0.76 | 13.94 |

| Anhui (S19) | 66.52 | 12.40 | 0.06 | 87.81 | 53.21 | [0.47,1.59] | [1.41,2.42] | [1.55,2.66] | 5.79 | [1.07,1.42] | [2.86,3.67] | 2.14 | 0.50 | 4.18 | 2.61 |

| Zhejiang (S20) | 56.54 | 23.77 | 3.56 | 74.63 | 44.62 | [1.79,2.99] | [2.28,2.84] | [2.51,3.12] | 5.75 | [3.29,4.36] | [3.72,4.75] | 2.35 | 1.55 | 5.41 | 8.07 |

| Yunnan (S21) | 72.09 | 26.01 | 4.01 | 95.16 | 62.53 | [1.24,3.56] | [4.58,5.92] | [5.03,6.51] | 5.82 | [1.19,1.58] | [1.22,1.56] | 2.03 | −0.26 | 1.78 | 2.94 |

| Gansu (S22) | 65.19 | 14.12 | 0.89 | 86.05 | 56.06 | [0.66,1.83] | [1.16,2.72] | [1.27,2.99] | 5.68 | [3.17,4.29] | [0.52,1.95] | 1.95 | 0.01 | 2.22 | 0.94 |

| Jilin (S23) | 83.73 | 13.57 | 0.99 | 91.52 | 72.01 | [1.03,3.29] | [0.58,1.35] | [0.64,1.48] | 5.92 | [2.06,2.72] | [1.51,2.65] | 1.34 | −0.28 | 0.74 | 5.03 |

| Chongqing (S24) | 58.48 | 15.37 | 1.34 | 77.19 | 50.29 | [0.17,1.47] | [1.37,1.84] | [1.51,2.02] | 5.63 | [1.77,2.34] | [1.98,3.25] | 1.08 | 0.16 | 1.43 | 4.38 |

| Ningxia (S25) | 37.91 | 1.80 | 0.13 | 50.04 | 32.68 | [5.05,7.63] | [2.64,3.92] | [2.86,4.29] | 5.87 | [1.33,2.44] | [2.43,4.55] | 1.24 | 0.11 | 0.63 | 0.81 |

| Qinghai (S26) | 54.43 | 3.03 | 0.14 | 71.85 | 43.81 | [3.38,4.78] | [2.94,5.41] | [3.23,5.94] | 5.86 | [2.29,3.38] | [2.31,4.38] | 0.95 | 0.02 | 0.44 | 0.77 |

| Tianjin (S27) | 71.12 | 9.44 | 1.01 | 93.88 | 56.16 | [0.31,1.65] | [1.69,2.67] | [1.86,2.93] | 5.91 | [1.52,2.02] | [1.52,2.67] | 1.42 | −0.11 | 0.76 | 3.73 |

| Beijing (S28) | 59.82 | 8.54 | 2.74 | 78.96 | 56.45 | [1.36,2.45] | [0.28,1.66] | [0.31,1.82] | 6.03 | [1.89,2.51] | [1.71,2.91] | 2.06 | 0.12 | 1.04 | 4.66 |

| Shanghai (S29) | 39.67 | 3.55 | 1.05 | 52.36 | 41.12 | [1.29,3.63] | [2.61,4.33] | [2.87,4.72] | 5.97 | [3.12,4.14] | [2.52,4.67] | 1.52 | 0.20 | 0.76 | 7.62 |

| Si | A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 | A11 | A12 | A13 | A14 | A15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | 0.68 | 0.04 | 0.01 | 0.68 | 0.68 | [0.25,0.47] | [0.43,0.60] | [0.38,0.57] | 1.00 | [0.28,0.43] | [0.06,0.24] | 0.99 | 1.00 | 1.00 | 0.43 |

| S2 | 0.48 | 0.04 | 0.02 | 0.60 | 0.52 | [0.13,0.24] | [0.36,0.53] | [0.31,0.49] | 1.00 | [0.11,0.62] | [0.13,0.66] | 0.49 | 0.09 | 0.24 | 0.30 |

| S3 | 0.52 | 0.05 | 0.01 | 0.65 | 0.52 | [0.21,0.43] | [0.63,0.75] | [0.61,0.73] | 0.93 | [0.17,0.39] | [0.09,0.43] | 0.53 | 0.40 | 0.36 | 0.48 |

| S4 | 0.51 | 0.04 | 0.01 | 0.64 | 0.53 | [0.03,0.19] | [0.43,0.60] | [0.38,0.57] | 0.92 | [0.10,0.58] | [0.09,0.42] | 0.64 | 0.25 | 0.37 | 0.33 |

| S5 | 0.72 | 0.13 | 0.03 | 0.72 | 0.79 | [0.96,1.00] | [0.21,0.28] | [0.12,0.21] | 1.00 | [0.05,0.26] | [0.07,0.33] | 1.00 | 0.60 | 0.48 | 0.72 |

| S6 | 0.62 | 0.07 | 0.03 | 0.62 | 0.62 | [0.62,0.68] | [0.74,0.82] | [0.92,1.00] | 0.98 | [0.09,0.49] | [0.12,0.58] | 0.85 | 0.21 | 0.27 | 0.38 |

| S7 | 0.48 | 0.04 | 0.01 | 0.67 | 0.52 | [0.06,0.22] | [0.43,0.74] | [0.21,0.58] | 0.98 | [0.09,0.53] | [0.11,0.55] | 0.46 | 0.27 | 0.29 | 0.36 |

| S8 | 0.59 | 0.05 | 0.02 | 0.59 | 0.58 | [0.27,0.32] | [0.51,0.71] | [0.32,0.55] | 0.96 | [0.04,0.24] | [0.10,0.38] | 0.66 | 0.42 | 0.17 | 0.08 |

| S9 | 0.56 | 0.09 | 0.03 | 0.60 | 0.56 | [0.26,0.48] | [0.35,0.41] | [0.10,0.22] | 0.98 | [0.09,0.52] | [0.50,0.72] | 0.64 | 0.21 | 0.22 | 0.36 |

| S10 | 0.66 | 0.08 | 0.02 | 0.66 | 0.66 | [0.32,0.39] | [0.51,0.64] | [0.29,0.47] | 0.92 | [0.81,0.92] | [0.15,0.75] | 0.43 | 0.18 | 0.21 | 0.21 |

| S11 | 0.50 | 0.06 | 0.02 | 0.63 | 0.50 | [0.74,0.81] | [0.93,1.00] | [0.77,0.87] | 0.93 | [0.08,0.43] | [0.06,0.26] | 0.51 | 0.09 | 0.25 | 0.44 |

| S12 | 0.56 | 0.05 | 0.02 | 0.63 | 0.56 | [0.21,0.32] | [0.69,0.84] | [0.50,0.69] | 0.95 | [0.09,0.53] | [0.85,1.00] | 0.55 | 0.14 | 0.18 | 0.35 |

| S13 | 0.58 | 0.10 | 0.04 | 0.58 | 0.57 | [0.01,0.14] | [0.35,0.44] | [0.10,0.25] | 0.97 | [0.08,0.43] | [0.18,0.38] | 0.46 | 0.16 | 0.18 | 0.44 |

| S14 | 0.81 | 0.13 | 0.01 | 0.81 | 0.69 | [0.21,0.31] | [0.46,0.73] | [0.23,0.57] | 0.97 | [0.04,0.25] | [0.05,0.24] | 0.96 | 0.85 | 0.65 | 0.74 |

| S15 | 0.74 | 0.15 | 0.04 | 0.74 | 0.74 | [0.42,0.53] | [0.38,0.46] | [0.14,0.27] | 0.96 | [0.06,0.35] | [0.39,0.67] | 0.57 | 0.53 | 0.23 | 0.54 |

| S16 | 0.66 | 0.14 | 0.05 | 0.66 | 0.75 | [0.08,0.21] | [0.28,0.46] | [0.36,0.56] | 0.92 | [0.06,0.33] | [0.20,1.00] | 0.62 | 0.18 | 0.16 | 0.06 |

| S17 | 0.65 | 0.21 | 0.06 | 0.65 | 0.71 | [0.21,0.27] | [0.51,0.62] | [0.65,0.72] | 0.94 | [0.08,0.43] | [0.07,0.33] | 0.46 | 0.05 | 0.12 | 0.05 |

| S18 | 0.46 | 0.14 | 0.08 | 0.57 | 0.48 | [0.68,0.73] | [0.06,0.18] | [0.08,0.22] | 0.95 | [0.03,0.19] | [0.14,0.49] | 0.36 | 0.18 | 0.08 | 1.00 |

| S19 | 0.57 | 0.15 | 1.00 | 0.57 | 0.61 | [0.09,0.21] | [0.23,0.32] | [0.29,0.39] | 0.96 | [0.18,1.00] | [0.07,0.36] | 0.58 | 0.27 | 0.44 | 0.19 |

| S20 | 0.67 | 0.08 | 0.02 | 0.67 | 0.73 | [0.35,0.39] | [0.37,0.48] | [0.38,0.46] | 0.97 | [0.06,0.33] | [0.06,0.28] | 0.64 | 0.85 | 0.56 | 0.58 |

| S21 | 0.53 | 0.07 | 0.01 | 0.53 | 0.52 | [0.25,0.47] | [0.74,0.79] | [0.83,0.95] | 0.96 | [0.16,0.90] | [0.17,0.85] | 0.55 | 0.14 | 0.19 | 0.21 |

| S22 | 0.58 | 0.13 | 0.07 | 0.58 | 0.58 | [0.13,0.24] | [0.19,0.36] | [0.24,0.44] | 0.98 | [0.06,0.33] | [0.40,0.68] | 0.53 | 0.01 | 0.23 | 0.07 |

| S23 | 0.45 | 0.13 | 0.06 | 0.55 | 0.45 | [0.22,0.43] | [0.09,0.18] | [0.12,0.22] | 0.94 | [0.09,0.52] | [0.14,0.50] | 0.37 | 0.15 | 0.08 | 0.36 |

| S24 | 0.65 | 0.12 | 0.04 | 0.65 | 0.65 | [0.03,0.19] | [0.12,0.24] | [0.29,0.35] | 0.99 | [0.11,0.61] | [0.11,0.41] | 0.29 | 0.09 | 0.15 | 0.31 |

| S25 | 1.00 | 1.00 | 0.46 | 1.00 | 1.00 | [0.95,1.00] | [0.43,0.52] | [0.54,0.63] | 0.95 | [0.14,0.58] | [0.09,0.29] | 0.34 | 0.06 | 0.07 | 0.06 |

| S26 | 0.70 | 0.59 | 0.43 | 0.70 | 0.75 | [0.63,0.67] | [0.48,0.72] | [0.61,0.87] | 0.95 | [0.08,0.42] | [0.09,0.30] | 0.26 | 0.01 | 0.05 | 0.06 |

| S27 | 0.53 | 0.19 | 0.06 | 0.53 | 0.58 | [0.06,0.22] | [0.27,0.36] | [0.35,0.43] | 0.94 | [0.13,0.70] | [0.14,0.49] | 0.39 | 0.06 | 0.08 | 0.27 |

| S28 | 0.63 | 0.21 | 0.02 | 0.63 | 0.58 | [0.27,0.32] | [0.05,0.22] | [0.06,0.27] | 0.92 | [0.10,0.57] | [0.12,0.45] | 0.56 | 0.07 | 0.11 | 0.33 |

| S29 | 0.96 | 0.51 | 0.06 | 0.96 | 0.79 | [0.26,0.48] | [0.42,0.58] | [0.54,0.69] | 0.93 | [0.06,0.34] | [0.08,0.28] | 0.41 | 0.11 | 0.08 | 0.55 |

| Si | A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 | A11 | A12 | A13 | A14 | A15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S1 | [0.35,0.49] | [0.02,0.03] | [0.00,0.01] | [0.47,0.58] | [0.26,0.37] | [0.15,0.36] | [0.19,0.38] | [0.28,0.54] | [0.44,0.62] | [0.15,0.32] | [0.04,0.20] | [0.57,0.75] | [0.66,0.84] | [0.71,0.92] | [0.21,0.28] |

| S2 | [0.25,0.35] | [0.02,0.03] | [0.00,0.01] | [0.41,0.51] | [0.20,0.28] | [0.08,0.19] | [0.16,0.33] | [0.23,0.46] | [0.44,0.62] | [0.06,0.46] | [0.09,0.54] | [0.28,0.37] | [0.06,0.08] | [0.17,0.22] | [0.15,0.19] |

| S3 | [0.27,0.38] | [0.02,0.03] | [0.00,0.01] | [0.44,0.56] | [0.20,0.28] | [0.13,0.33] | [0.28,0.47] | [0.44,0.69] | [0.41,0.57] | [0.09,0.29] | [0.06,0.35] | [0.30,0.41] | [0.26,0.34] | [0.26,0.32] | [0.23,0.31] |

| S4 | [0.26,0.37] | [0.02,0.03] | [0.00,0.01] | [0.44,0.55] | [0.20,0.29] | [0.02,0.15] | [0.19,0.38] | [0.28,0.54] | [0.40,0.57] | [0.05,0.43] | [0.06,0.34] | [0.37,0.48] | [0.16,0.21] | [0.26,0.33] | [0.16,0.21] |

| S5 | [0.37,0.52] | [0.06,0.09] | [0.01,0.02] | [0.49,0.62] | [0.30,0.43] | [0.59,0.77] | [0.09,0.18] | [0.09,0.2] | [0.44,0.62] | [0.03,0.19] | [0.05,0.27] | [0.57,0.76] | [0.39,0.51] | [0.34,0.43] | [0.35,0.46] |

| S6 | [0.32,0.45] | [0.03,0.05] | [0.01,0.02] | [0.42,0.53] | [0.24,0.33] | [0.38,0.52] | [0.33,0.51] | [0.67,0.94] | [0.43,0.61] | [0.05,0.36] | [0.08,0.47] | [0.49,0.64] | [0.14,0.18] | [0.19,0.24] | [0.18,0.24] |

| S7 | [0.25,0.35] | [0.02,0.03] | [0.00,0.01] | [0.46,0.57] | [0.20,0.28] | [0.04,0.17] | [0.19,0.46] | [0.15,0.55] | [0.43,0.61] | [0.05,0.39] | [0.07,0.45] | [0.26,0.35] | [0.18,0.23] | [0.21,0.26] | [0.17,0.23] |

| S8 | [0.30,0.43] | [0.02,0.03] | [0.00,0.01] | [0.40,0.51] | [0.22,0.31] | [0.17,0.25] | [0.23,0.44] | [0.23,0.52] | [0.42,0.59] | [0.02,0.18] | [0.07,0.31] | [0.38,0.50] | [0.28,0.35] | [0.12,0.15] | [0.04,0.05] |

| S9 | [0.29,0.40] | [0.04,0.06] | [0.01,0.02] | [0.41,0.51] | [0.21,0.30] | [0.16,0.37] | [0.16,0.26] | [0.07,0.21] | [0.43,0.61] | [0.05,0.38] | [0.34,0.59] | [0.37,0.48] | [0.14,0.18] | [0.16,0.24] | [0.17,0.23] |

| S10 | [0.34,0.48] | [0.04,0.05] | [0.00,0.01] | [0.45,0.57] | [0.25,0.36] | [0.21,0.30] | [0.23,0.40] | [0.21,0.44] | [0.40,0.57] | [0.44,0.68] | [0.10,0.61] | [0.25,0.33] | [0.12,0.15] | [0.15,0.19] | [0.10,0.14] |

| S11 | [0.26,0.36] | [0.03,0.04] | [0.00,0.01] | [0.43,0.54] | [0.19,0.27] | [0.45,0.62] | [0.42,0.63] | [0.56,0.82] | [0.41,0.57] | [0.04,0.32] | [0.04,0.21] | [0.29,0.39] | [0.06,0.08] | [0.18,0.23] | [0.21,0.28] |

| S12 | [0.29,0.40] | [0.02,0.03] | [0.00,0.01] | [0.43,0.54] | [0.21,0.30] | [0.13,0.25] | [0.31,0.53] | [0.36,0.65] | [0.42,0.59] | [0.05,0.39] | [0.57,0.82] | [0.31,0.42] | [0.09,0.12] | [0.13,0.16] | [0.17,0.23] |

| S13 | [0.30,0.42] | [0.05,0.07] | [0.02,0.03] | [0.41,0.50] | [0.22,0.31] | [0.01,0.11] | [0.16,0.28] | [0.07,0.24] | [0.42,0.60] | [0.04,0.32] | [0.12,0.31] | [0.26,0.35] | [0.11,0.13] | [0.13,0.16] | [0.21,0.28] |

| S14 | [0.41,0.58] | [0.06,0.09] | [0.00,0.01] | [0.55,0.69] | [0.26,0.37] | [0.13,0.24] | [0.21,0.46] | [0.17,0.54] | [0.42,0.60] | [0.02,0.18] | [0.03,0.20] | [0.55,0.73] | [0.56,0.72] | [0.46,0.59] | [0.36,0.48] |

| S15 | [0.38,0.53] | [0.07,0.10] | [0.02,0.03] | [0.51,0.63] | [0.28,0.40] | [0.26,0.41] | [0.17,0.29] | [0.10,0.25] | [0.42,0.59] | [0.03,0.26] | [0.26,0.55] | [0.33,0.43] | [0.35,0.45] | [0.16,0.21] | [0.26,0.35] |

| S16 | [0.34,0.48] | [0.07,0.10] | [0.02,0.03] | [0.45,0.57] | [0.29,0.40] | [0.05,0.16] | [0.13,0.29] | [0.26,0.53] | [0.40,0.57] | [0.03,0.24] | [0.13,0.82] | [0.35,0.47] | [0.12,0.15] | [0.11,0.14] | [0.03,0.04] |

| S17 | [0.33,0.47] | [0.10,0.14] | [0.03,0.04] | [0.44,0.56] | [0.27,0.38] | [0.13,0.21] | [0.23,0.39] | [0.47,0.68] | [0.41,0.58] | [0.04,0.32] | [0.05,0.27] | [0.26,0.35] | [0.03,0.04] | [0.09,0.11] | [0.02,0.03] |

| S18 | [0.24,0.33] | [0.07,0.10] | [0.04,0.05] | [0.39,0.49] | [0.18,0.26] | [0.42,0.56] | [0.03,0.11] | [0.06,0.21] | [0.42,0.59] | [0.02,0.14] | [0.09,0.40] | [0.21,0.27] | [0.12,0.15] | [0.06,0.07] | [0.49,0.64] |

| S19 | [0.29,0.41] | [0.07,0.10] | [0.47,0.64] | [0.39,0.49] | [0.23,0.33] | [0.06,0.16] | [0.11,0.20] | [0.21,0.37] | [0.42,0.59] | [0.10,0.74] | [0.05,0.29] | [0.33,0.44] | [0.18,0.23] | [0.31,0.46] | [0.09,0.12] |

| S20 | [0.34,0.48] | [0.04,0.05] | [0.01,0.03] | [0.46,0.57] | [0.28,0.39] | [0.21,0.30] | [0.17,0.30] | [0.28,0.43] | [0.42,0.60] | [0.03,0.24] | [0.04,0.23] | [0.37,0.48] | [0.56,0.72] | [0.41,0.55] | [0.28,0.37] |

| S21 | [0.27,0.38] | [0.03,0.05] | [0.02,0.03] | [0.36,0.45] | [0.20,0.28] | [0.15,0.36] | [0.33,0.49] | [0.61,0.90] | [0.42,0.59] | [0.09,0.66] | [0.11,0.69] | [0.31,0.42] | [0.09,0.12] | [0.14,0.17] | [0.10,0.14] |

| S22 | [0.30,0.42] | [0.06,0.09] | [0.03,0.04] | [0.41,0.50] | [0.22,0.31] | [0.08,0.19] | [0.09,0.23] | [0.17,0.41] | [0.43,0.61] | [0.03,0.24] | [0.27,0.55] | [0.30,0.41] | [0.01,0.01] | [0.16,0.21] | [0.03,0.05] |

| S23 | [0.23,0.32] | [0.06,0.09] | [0.03,0.04] | [0.38,0.47] | [0.17,0.24] | [0.14,0.33] | [0.04,0.11] | [0.09,0.21] | [0.41,0.58] | [0.05,0.38] | [0.09,0.41] | [0.21,0.28] | [0.1,0.13] | [0.06,0.07] | [0.17,0.23] |

| S24 | [0.33,0.47] | [0.06,0.08] | [0.02,0.03] | [0.44,0.56] | [0.25,0.35] | [0.02,0.15] | [0.05,0.15] | [0.21,0.33] | [0.43,0.61] | [0.06,0.45] | [0.07,0.33] | [0.17,0.22] | [0.06,0.08] | [0.11,0.14] | [0.15,0.20] |

| S25 | [0.51,0.72] | [0.48,0.68] | [0.22,0.29] | [0.68,0.86] | [0.38,0.54] | [0.58,0.77] | [0.19,0.33] | [0.39,0.59] | [0.42,0.59] | [0.08,0.43] | [0.06,0.24] | [0.19,0.26] | [0.04,0.05] | [0.05,0.06] | [0.03,0.04] |

| S26 | [0.36,0.51] | [0.28,0.40] | [0.21,0.27] | [0.48,0.60] | [0.29,0.40] | [0.39,0.52] | [0.22,0.45] | [0.44,0.82] | [0.42,0.59] | [0.04,0.31] | [0.06,0.24] | [0.15,0.21] | [0.01,0.01] | [0.04,0.05] | [0.03,0.04] |

| S27 | [0.27,0.38] | [0.09,0.13] | [0.03,0.04] | [0.36,0.45] | [0.22,0.31] | [0.04,0.17] | [0.12,0.23] | [0.26,0.41] | [0.41,0.58] | [0.07,0.52] | [0.09,0.40] | [0.22,0.30] | [0.04,0.05] | [0.06,0.07] | [0.13,0.17] |

| S28 | [0.32,0.45] | [0.1,0.14] | [0.01,0.08] | [0.43,0.54] | [0.22,0.31] | [0.17,0.25] | [0.02,0.14] | [0.04,0.25] | [0.40,0.57] | [0.05,0.42] | [0.08,0.37] | [0.32,0.42] | [0.05,0.06] | [0.08,0.13] | [0.16,0.21] |

| S29 | [0.49,0.69] | [0.24,0.35] | [0.03,0.07] | [0.66,0.82] | [0.30,0.43] | [0.16,0.37] | [0.19,0.36] | [0.39,0.65] | [0.41,0.57] | [0.03,0.25] | [0.05,0.23] | [0.23,0.31] | [0.07,0.09] | [0.06,0.07] | [0.27,0.35] |

References

- Sun, Z.; Li, X.; Xie, Y. A comparison of innovative financing and general fiscal investment strategies for second-class highways: Perspectives for building a sustainable financing strategy. Transp. Policy 2014, 35, 193–201. [Google Scholar] [CrossRef]

- Ministry of Transport of the People’s Republic of China. Statistical Report of National Highways. 2017. Available online: http://www.mot.gov.cn/shuju/ (accessed on 5 January 2019).

- Xu, Y.; Sun, C.; Skibniewski, M.J.; Chan, A.P.; Yeung, J.F.; Cheng, H. System Dynamics (SD)-based concession pricing model for PPP highway projects. Int. J. Proj. Manag. 2012, 30, 240–251. [Google Scholar] [CrossRef]

- Huang, H.-J. Pricing and logit-based mode choice models of a transit and highway system with elastic demand. Eur. J. Oper. Res. 2002, 140, 562–570. [Google Scholar] [CrossRef]

- Song, S. Should China Implement Congestion Pricing? Chin. Econ. 2015, 48, 57–67. [Google Scholar] [CrossRef]

- Xu, Y.; Yeung, J.F.; Jiang, S. Determining appropriate government guarantees for concession contract: Lessons learned from 10 PPP projects in China. Int. J. Strateg. Prop. Manag. 2014, 18, 356–367. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, K.; Kong, Y.; Chen, J.; Yu, B. Effectiveness of erosion control measures along the Qinghai–Tibet highway, Tibetan plateau, China. Transp. Res. Part D Transp. Environ. 2006, 11, 302–309. [Google Scholar] [CrossRef] [Green Version]

- Chen, C.; Doloi, H. BOT application in China: Driving and impeding factors. Int. J. Proj. Manag. 2008, 26, 388–398. [Google Scholar] [CrossRef]

- Grimsey, D.; Lewis, M.K. Evaluating the risks of public private partnerships for infrastructure projects. Int. J. Proj. Manag. 2002, 20, 107–118. [Google Scholar] [CrossRef]

- Dias, A., Jr.; Ioannou, P.G. Debt capacity and optimal capital structure for privately financed infrastructure projects. J. Constr. Eng. Manag. 1995, 121, 404–414. [Google Scholar] [CrossRef]

- Chou, J.-S.; Tserng, H.P.; Lin, C.; Yeh, C.-P. Critical factors and risk allocation for PPP policy: Comparison between HSR and general infrastructure projects. Transp. Policy 2012, 22, 36–48. [Google Scholar] [CrossRef]

- Liu, J.; Wei, Q. Risk evaluation of electric vehicle charging infrastructure public-private partnership projects in China using fuzzy TOPSIS. J. Clean. Prod. 2018, 189, 211–222. [Google Scholar] [CrossRef]

- Welch, I. Two common problems in capital structure research: The financial-debt-to-asset ratio and issuing activity versus leverage changes. Int. Rev. Financ. 2011, 11, 1–17. [Google Scholar] [CrossRef]

- Hoevenaars, R.P.; Molenaar, R.D.; Schotman, P.C.; Steenkamp, T.B. Strategic asset allocation with liabilities: Beyond stocks and bonds. J. Econ. Dyn. Control 2008, 32, 2939–2970. [Google Scholar] [CrossRef]

- Ertuğrul, İ.; Karakaşoğlu, N. Performance evaluation of Turkish cement firms with fuzzy analytic hierarchy process and TOPSIS methods. Expert Syst. Appl. 2009, 36, 702–715. [Google Scholar] [CrossRef]

- Wang, X.; Dennis, L.; Tu, Y.S. Measuring financial condition: A study of US states. Public Budg. Financ. 2007, 27, 1–21. [Google Scholar] [CrossRef]

- Lane, P.R.; Milesi-Ferretti, G.M. The external wealth of nations: Measures of foreign assets and liabilities for industrial and developing countries. J. Int. Econ. 2001, 55, 263–294. [Google Scholar] [CrossRef]

- Daskalakis, N.; Psillaki, M. Do country or firm factors explain capital structure? Evidence from SMEs in France and Greece. Appl. Financ. Econ. 2008, 18, 87–97. [Google Scholar] [CrossRef]

- Huang, G. The determinants of capital structure: Evidence from China. China Econ. Rev. 2006, 17, 14–36. [Google Scholar] [CrossRef]

- Altman, E.I. An emerging market credit scoring system for corporate bonds. Emerg. Mark. Rev. 2005, 6, 311–323. [Google Scholar] [CrossRef]

- Rehan, R.; Unger, A.J.; Knight, M.A.; Haas, C.T. Financially sustainable management strategies for urban wastewater collection infrastructure–Implementation of a system dynamics model. Tunn. Undergr. Space Technol. 2014, 39, 102–115. [Google Scholar] [CrossRef]

- Benito, B.; Montesinos, V.; Bastida, F. An example of creative accounting in public sector: The private financing of infrastructures in Spain. Crit. Perspect. Account. 2008, 19, 963–986. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. Interest rates and currency prices in a two-country world. J. Monet. Econ. 1982, 10, 335–359. [Google Scholar] [CrossRef]

- Ghorbani, A.; Ravanshadnia, M.; Nobakht, M.B. A survey of risks in public private partnership highway projects in Iran. In Proceedings of the 2014 International Conference on Construction and Real Estate Management (ICCREM), Kunming, China, 27–28 September 2014; pp. 482–492. [Google Scholar]

- Pantelias, A.; Zhang, Z. Methodological framework for evaluation of financial viability of public-private partnerships: Investment risk approach. J. Infrastruct. Syst. 2010, 16, 241–250. [Google Scholar] [CrossRef]

- Shaoul, J.; Stafford, A.; Stapleton, P. Highway robbery? A financial analysis of design, build, finance and operate (DBFO) in UK roads. Transp. Rev. 2006, 26, 257–274. [Google Scholar] [CrossRef]

- El-Sayegh, S.M.; Mansour, M.H. Risk assessment and allocation in highway construction projects in the UAE. J. Manag. Eng. 2015, 31, 04015004. [Google Scholar] [CrossRef]

- Wang, M.-T.; Chou, H.-Y. Risk allocation and risk handling of highway projects in Taiwan. J. Manag. Eng. 2003, 19, 60–68. [Google Scholar] [CrossRef]

- Mousavi, S.M.; Tavakkoli-Moghaddam, R.; Azaron, A.; Mojtahedi, S.; Hashemi, H. Risk assessment for highway projects using jackknife technique. Expert Syst. Appl. 2011, 38, 5514–5524. [Google Scholar] [CrossRef]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A proposal for risk allocation in social infrastructure projects applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef]

- Ebrahimnejad, S.; Mousavi, S.M.; Seyrafianpour, H. Risk identification and assessment for build–operate–transfer projects: A fuzzy multi attribute decision making model. Expert Syst. Appl. 2010, 37, 575–586. [Google Scholar] [CrossRef]

- Zhao, T.; Sundararajan, S.K.; Tseng, C.-L. Highway development decision-making under uncertainty: A real options approach. J. Infrastruct. Syst. 2004, 10, 23–32. [Google Scholar] [CrossRef]

- Kumar, L.; Jindal, A.; Velaga, N.R. Financial risk assessment and modelling of PPP based Indian highway infrastructure projects. Transp. Policy 2018, 62, 2–11. [Google Scholar] [CrossRef]

- Vassallo, J.; Sanchez-Solino, A. Subordinated public participation loans for financing toll highway concessions in Spain. Transp. Res. Rec. J. Transp. Res. Board 2007, 1996, 1–8. [Google Scholar] [CrossRef]

- Ng, A.; Loosemore, M. Risk allocation in the private provision of public infrastructure. Int. J. Proj. Manag. 2007, 25, 66–76. [Google Scholar] [CrossRef]

- Li, H.-J.; Zhao, Z.-M.; Yu, X.-L. Grey theory applied in non-subsampled Contourlet transform. IET Image Process. 2012, 6, 264–272. [Google Scholar] [CrossRef]

- Baskaran, V.; Nachiappan, S.; Rahman, S. Indian textile suppliers’ sustainability evaluation using the grey approach. Int. J. Prod. Econ. 2012, 135, 647–658. [Google Scholar] [CrossRef]

- Chithambaranathan, P.; Subramanian, N.; Gunasekaran, A.; Palaniappan, P.K. Service supply chain environmental performance evaluation using grey based hybrid MCDM approach. Int. J. Prod. Econ. 2015, 166, 163–176. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.-J.; Zhang, X.-T.; Li, Q.-H.; Ran, L.; Cai, Z.-X. Gray theory based energy saving potential evaluation and planning for distribution networks. Int. J. Electr. Power Energy Syst. 2014, 57, 298–303. [Google Scholar] [CrossRef]

- Wu, Y.; Hu, Y.; Lin, X.; Li, L.; Ke, Y. Identifying and analyzing barriers to offshore wind power development in China using the grey decision-making trial and evaluation laboratory approach. J. Clean. Prod. 2018, 189, 853–863. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. A grey-based DEMATEL model for evaluating business process management critical success factors. Int. J. Prod. Econ. 2013, 146, 281–292. [Google Scholar] [CrossRef]

- Huang, G.; Dan Moore, R. Grey linear programming, its solving approach, and its application. Int. J. Syst. Sci. 1993, 24, 159–172. [Google Scholar] [CrossRef]

- Chan, J.W.; Tong, T.K. Multi-criteria material selections and end-of-life product strategy: Grey relational analysis approach. Mater. Des. 2007, 28, 1539–1546. [Google Scholar] [CrossRef]

- Khameneh, A.-H.; Taheri, A.; Ershadi, M. Offering a framework for evaluating the performance of project risk management system. Procedia-Soc. Behav. Sci. 2016, 226, 82–90. [Google Scholar] [CrossRef]

- Yang, H.; Meng, Q. Highway pricing and capacity choice in a road network under a build–operate–transfer scheme. Transp. Res. Part A Policy Pract. 2000, 34, 207–222. [Google Scholar] [CrossRef]

- Yang, H.; Meng, Q. A note on “highway pricing and capacity choice in a road network under a build-operate-transfer scheme”. Transp. Res. Part A Policy Pract. 2002, 36, 659–663. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, L.; He, X.; Xiong, C.; Li, Z. Surrogate-based optimization of expensive-to-evaluate objective for optimal highway toll charges in transportation network. Comput.-Aided Civ. Infrastruct. Eng. 2014, 29, 359–381. [Google Scholar] [CrossRef]

- Shan, L.; Garvin, M.J.; Kumar, R. Collar options to manage revenue risks in real toll public-private partnership transportation projects. Constr. Manag. Econ. 2010, 28, 1057–1069. [Google Scholar] [CrossRef]

- Gul, F.A.; Tsui, J.S.L. A test of the free cash flow and debt monitoring hypotheses: Evidence from audit pricing. J. Account. Econ. 1997, 24, 219–237. [Google Scholar] [CrossRef]

- Mulier, K.; Schoors, K.; Merlevede, B. Investment-cash flow sensitivity and financial constraints: Evidence from unquoted European SMEs. J. Bank. Financ. 2016, 73, 182–197. [Google Scholar] [CrossRef]

- Chong, B.S. The impact of divergence in voting and cash-flow rights on the use of bank debt. Pac.-Basin Financ. J. 2010, 18, 158–174. [Google Scholar] [CrossRef]

- Gul, F.A. Free cash flow, debt-monitoring and managers’ LIFO/FIFO policy choice. J. Corp. Financ. 2001, 7, 475–492. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Gleason, K.C.; Mathur, I.; Wiggins, R.A., III. The use of acquisitions and joint ventures by US banks expanding abroad. J. Financ. Res. 2006, 29, 503–522. [Google Scholar] [CrossRef]

- Ebneth, O.; Theuvsen, L. Large mergers and acquisitions of European brewing groups—Event study evidence on value creation. Agribus. Int. J. 2007, 23, 377–406. [Google Scholar] [CrossRef]

- Alcalde, A.; Fávero, L.P.L.; Takamatsu, R.T. EBITDA1 margin in brazilian companies Variance decomposition and hierarchical effects. Contad. Adm. 2013, 58, 197–220. [Google Scholar] [CrossRef] [Green Version]

- Fritsch, R. Comparative financial analysis of electricity utilities in West Africa. Energy Policy 2011, 39, 6055–6064. [Google Scholar] [CrossRef]

- Gaganis, C.; Pasiouras, F.; Doumpos, M. Probabilistic neural networks for the identification of qualified audit opinions. Expert Syst. Appl. 2007, 32, 114–124. [Google Scholar] [CrossRef]

- Effah Ameyaw, E.; Chan, A.P. Identifying public-private partnership (PPP) risks in managing water supply projects in Ghana. J. Facil. Manag. 2013, 11, 152–182. [Google Scholar] [CrossRef]

- Wu, Y.; Li, L.; Xu, R.; Chen, K.; Hu, Y.; Lin, X. Risk assessment in straw-based power generation public-private partnership projects in China: A fuzzy synthetic evaluation analysis. J. Clean. Prod. 2017, 161, 977–990. [Google Scholar] [CrossRef]

- Li, G.-D.; Yamaguchi, D.; Nagai, M. A grey-based decision-making approach to the supplier selection problem. Math. Comput. Model. 2007, 46, 573–581. [Google Scholar] [CrossRef]

- Golmohammadi, D.; Mellat-Parast, M. Developing a grey-based decision-making model for supplier selection. Int. J. Prod. Econ. 2012, 137, 191–200. [Google Scholar] [CrossRef]

- Lavee, D.; Beniad, G.; Solomon, C. The effect of investment in transportation infrastructure on the debt-to-GDP ratio. Transp. Rev. 2011, 31, 769–789. [Google Scholar] [CrossRef]

- Tsui, K.Y. China’s infrastructure investment boom and local debt crisis. Eurasian Geogr. Econ. 2011, 52, 686–711. [Google Scholar] [CrossRef]

- Zhang, S.; Gao, Y.; Feng, Z.; Sun, W. PPP application in infrastructure development in China: Institutional analysis and implications. Int. J. Proj. Manag. 2015, 33, 497–509. [Google Scholar] [CrossRef]

- Xu, M.; Grant-Muller, S.; Gao, Z. Evolution and assessment of economic regulatory policies for expressway infrastructure in China. Transp. Policy 2015, 41, 42–49. [Google Scholar] [CrossRef] [Green Version]

| Categories | Risk Factors | Literature |

|---|---|---|

| Debt scale risk | Debt–asset ratio | [13,14,15,16,17] |

| Remaining debts | [18,19,20] | |

| Repayment of principal and interest | [9,21,22,23] | |

| Cost of financing | [24] | |

| Debt structure risk | Commercial loan ratio | [25,26] |

| Proportion of short-term loans | [26,27] | |

| Debt management risk | Debt management system | [28] |

| Leadership and management skills | [28,29] | |

| Debt managers’ skill | [28,29] | |

| External environment risk | Policy | [28,30,31,32] |

| Interest-rate fluctuation | [25,30,31] | |

| Exchange-rate fluctuation | [27,30] | |

| Inflation rate | [25,28,33] | |

| Investment from the government finance | [32,34] | |

| Political interference | [28,35] |

| Risk Factors | OP | MI | IRI | Normalized Values of IRI | Ranking |

|---|---|---|---|---|---|

| Debt–asset ratio # | 5.33 | 5.16 | 5.26 | 0.99 | 1 |

| Remaining debts # | 5.15 | 4.86 | 5.21 | 0.98 | 2 |

| Free cash flow *,# | 4.97 | 4.62 | 5.17 | 0.96 | 3 |

| Toll revenue *,# | 4.82 | 4.65 | 5.09 | 0.94 | 4 |

| Investment from the government finance # | 5.01 | 4.54 | 4.94 | 0.92 | 5 |

| Proportion of short-term loans # | 4.67 | 4.23 | 4.85 | 0.91 | 6 |

| Repayment of principal and interest # | 4.53 | 4.36 | 4.79 | 0.89 | 7 |

| Commercial loan ratio # | 4.31 | 4.14 | 4.65 | 0.86 | 8 |

| EBITDA margin *,# | 3.95 | 3.58 | 4.43 | 0.82 | 9 |

| Debt management system @ | 3.79 | 3.62 | 4.37 | 0.81 | 10 |

| Policy @ | 3.63 | 3.43 | 4.26 | 0.79 | 11 |

| Debt managers’ skill @ | 3.32 | 3.15 | 4.17 | 0.77 | 12 |

| Interest rate # | 3.83 | 3.46 | 3.95 | 0.73 | 13 |

| Exchange-rate fluctuation @ | 3.63 | 2.96 | 3.78 | 0.68 | 14 |

| Inflation-rate fluctuation @ | 3.36 | 3.19 | 3.57 | 0.52 | 15 |

| Leadership and management skills @ | 3.23 | 2.87 | 3.14 | 0.48 | 16 |

| Cost of financing # | 3.06 | 2.75 | 3.05 | 0.42 | 17 |

| Political interference @ | 2.84 | 2.56 | 2.76 | 0.32 | 19 |

| Scale | Θw | ΘG |

|---|---|---|

| Very low (VL) | [0.0,0.1] | [0,1] |

| Low (L) | [0.1,0.3] | [1,3] |

| Medium low (ML) | [0.3,0.4] | [3,4] |

| Medium (M) | [0.4,0.5] | [4,5] |

| Medium high (MH) | [0.5,0.6] | [5,6] |

| High (H) | [0.6,0.9] | [6,9] |

| Very High (VH) | [0.9,1.0] | [9,10] |

| Categories | Risk Factors (Aj) | Unit | Θwj |

|---|---|---|---|

| Debt scale risk | Debt–asset ratio (A1) | % | [0.657,0.843] |

| Remaining debts (A2) | Billion USD | [0.714,0.900] | |

| Repayment of principal and interest (A3) | Billion USD | [0.571,0.757] | |

| Debt structure risk | Commercial loan ratio (A4) | % | [0.486,0.643] |

| Proportion of short-term loans (A5) | % | [0.614,0.771] | |

| Debt management risk | Debt management system (A6) | - | [0.729,0.943] |

| Debt managers’ skill (A7) | - | [0.451,0.625] | |

| External environment risk | Policy (A8) | - | [0.512,0.722] |

| Interest-rate fluctuation (A9) | - | [0.476,0.682] | |

| Exchange-rate fluctuation (A10) | - | [0.381,0.538] | |

| Inflation rate (A11) | % | [0.474,0.637] | |

| Investment from the government finance (A12) | Billion USD | [0.684,0.857] | |

| Solvency risk | Free cash flow (A13) | Billion USD | [0.437,0.618] |

| Toll revenue (A14) | Billion USD | [0.547,0.738] | |

| EBITDA margin (A15) | % | [0.671,0.816] |

| Grey Possibility Degree Range | Category | Provinces | Grey Possibility Degree Value | Ranking of GDP |

|---|---|---|---|---|

| 0.2 ≤ P{Si ≤ Smax} ≤ 0.3 | Low debt risk | Ningxia (S25) | 0.232 | 29 |

| Guangdong (S1) | 0.241 | 1 | ||

| Anhui (S19) | 0.253 | 13 | ||

| Qinghai (S26) | 0.258 | 30 | ||

| Shandong (S18) | 0.273 | 3 | ||

| Shanghai (S29) | 0.289 | 11 | ||

| 0.3 < P{Si ≤ Smax} ≤ 0.5 | Medium debt risk | Gansu (S22) | 0.324 | 27 |

| Xinjiang (S17) | 0.343 | 26 | ||

| Jilin (S23) | 0.360 | 23 | ||

| Zhejiang (S20) | 0.364 | 4 | ||

| Tianjin (S27) | 0.375 | 19 | ||

| Jiangsu (S14) | 0.391 | 2 | ||

| Liaoning (S16) | 0.424 | 14 | ||

| Chongqing (S24) | 0.458 | 18 | ||

| Sichuan (S15) | 0.489 | 6 | ||

| Guangxi (S13) | 0.493 | 17 | ||

| 0.5 < P{Si ≤ Smax} ≤ 0.7 | High debt risk | Inner Mongolia (S6) | 0.511 | 22 |

| Heilongjiang (S5) | 0.523 | 21 | ||

| Jiangxi (S9) | 0.546 | 16 | ||

| Guizhou (S8) | 0.552 | 25 | ||

| Hunan (S2) | 0.567 | 9 | ||

| Shanxi (S10) | 0.579 | 24 | ||

| Beijing (S28) | 0.588 | 12 | ||

| Fujian (S12) | 0.605 | 10 | ||

| Hubei (S11) | 0.618 | 7 | ||

| Yunnan (S21) | 0.632 | 20 | ||

| Shaanxi (S7) | 0.643 | 15 | ||

| Henan (S3) | 0.674 | 5 | ||

| Hebei (S4) | 0.686 | 8 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mao, X.; Gan, J.; Zhao, X. Debt Risk Evaluation of Toll Freeways in Mainland China Using the Grey Approach. Sustainability 2019, 11, 1430. https://doi.org/10.3390/su11051430

Mao X, Gan J, Zhao X. Debt Risk Evaluation of Toll Freeways in Mainland China Using the Grey Approach. Sustainability. 2019; 11(5):1430. https://doi.org/10.3390/su11051430

Chicago/Turabian StyleMao, Xinhua, Jiahua Gan, and Xilong Zhao. 2019. "Debt Risk Evaluation of Toll Freeways in Mainland China Using the Grey Approach" Sustainability 11, no. 5: 1430. https://doi.org/10.3390/su11051430

APA StyleMao, X., Gan, J., & Zhao, X. (2019). Debt Risk Evaluation of Toll Freeways in Mainland China Using the Grey Approach. Sustainability, 11(5), 1430. https://doi.org/10.3390/su11051430