Access to Rural Credit Markets in Developing Countries, the Case of Vietnam: A Literature Review

Abstract

1. Introduction

2. Materials and Methods

3. Overview of Access to Credit in Developing Countries

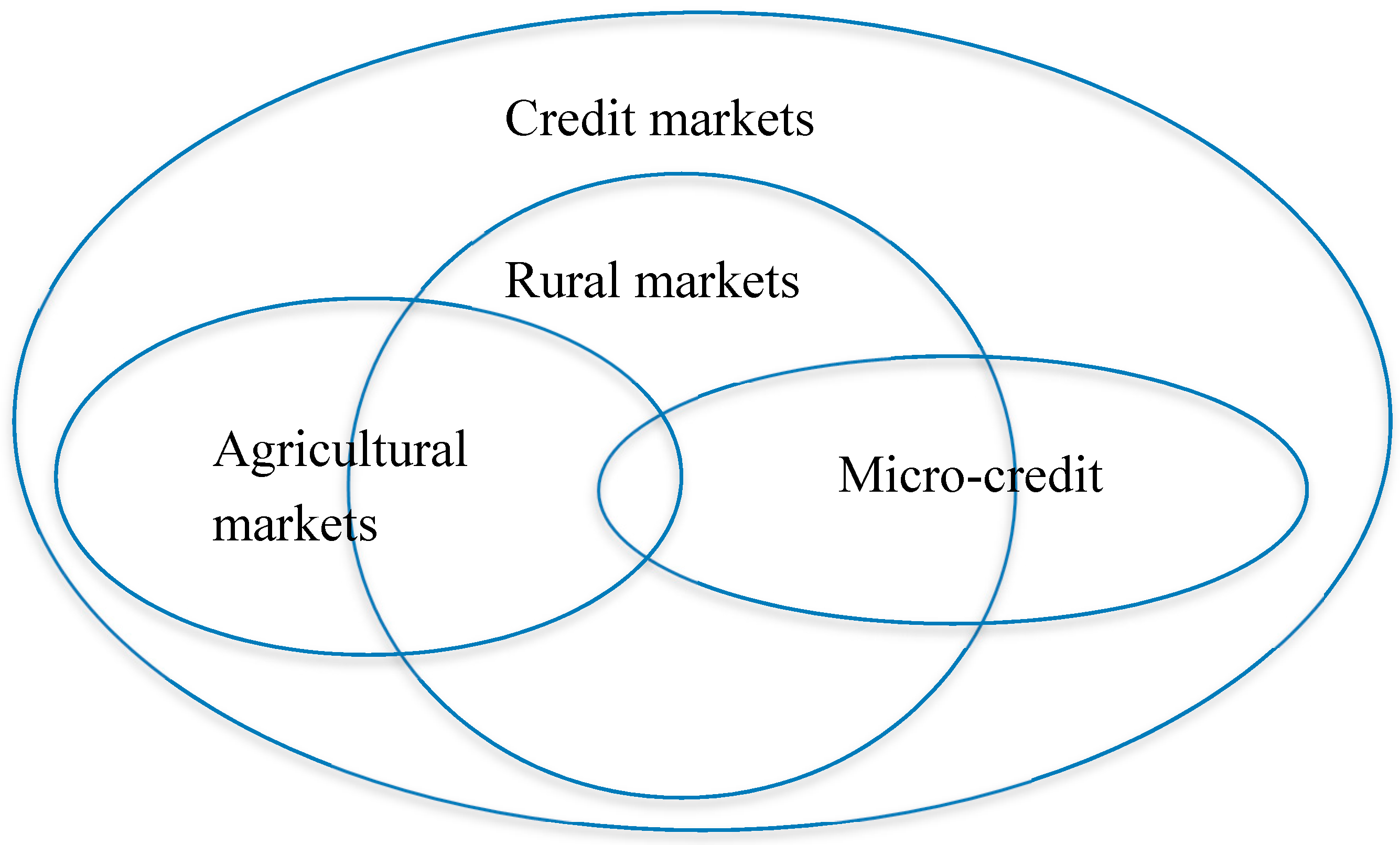

3.1. The Concept of Access to Credit

3.2. Determinants of Rural Credit Access

3.3. The Social and Economic Impacts of Credit Access in Rural Areas

4. The Issue of Access to Rural Credit in Vietnam

4.1. The Organization of Rural Credit Markets in Vietnam

4.2. Characteristics of Rural Credit Markets in Vietnam

4.2.1. Constrained Credit Market Participation with Heavy Subsidization

4.2.2. Government Intervention

4.2.3. Segmented Markets

4.3. Factors Affecting Rural Credit Access and the Socio-Economic Impacts of Credit Access in Vietnam

5. Conclusions and Managerial Implications

Author Contributions

Funding

Conflicts of Interest

References

- Soubbotina, T.P.; Sheram, K. Beyond Economic Growth: Meeting the Challenges of Global Development; World Bank Publications: Washington, DC, USA, 2000. [Google Scholar]

- Aleem, I. Imperfect information, screening, and the costs of informal lending: a study of a rural credit market in Pakistan. World Bank Econ. Rev. 1990, 4, 329–349. [Google Scholar] [CrossRef]

- Saqib, S.; Kuwornu, J.K.M.; Panezia, S.; Ali, U. Factors determining subsistence farmers’ access to agricultural credit in flood-prone areas of Pakistan. Kasetsart J. Soc. Sci. 2018, 39, 262–268. [Google Scholar] [CrossRef]

- Deelstra, T.; Girardet, H. Urban agriculture and sustainable cities. In Growing Cities, Growing Food, Urban Agriculture on the Policy Agenda; Bakker, N., Dubbeling, M., Gündel, S., Sabel-Koshella, U., de Zeeuw, H., Eds.; Zentralstelle für Ernährung und Landwirtschaft (ZEL): Feldafing, Germany, 2000; pp. 43–66. [Google Scholar]

- Yadav, P.; Sharma, A.K. Agriculture credit in developing economies: A review of relevant literature. Int. J. Econ. Financ. 2015, 7, 219. [Google Scholar] [CrossRef]

- Malik, S.J.; Nazli, H. Rural poverty and credit use: Evidence from Pakistan. Pak. Dev. Rev. 1999, 38, 699–716. [Google Scholar] [CrossRef]

- Guirkinger, C.; Boucher, S.R. Credit constraints and productivity in Peruvian agriculture. Agric. Econ. 2008, 39, 295–308. [Google Scholar] [CrossRef]

- Godfray, H.C.J.; Beddington, J.R.; Crute, I.R.; Haddad, L.; Lawrence, D.; Muir, J.F.; Pretty, J.; Robinson, S.; Thomas, S.M.; Toulmin, C. Food security: The challenge of feeding 9 billion people. Science 2010, 327, 812–818. [Google Scholar] [CrossRef]

- Claessens, S. Access to financial services: A review of the issues and public policy objectives. World Bank Res. Obs. 2006, 21, 207–240. [Google Scholar] [CrossRef]

- Ellis, F. The determinants of rural livelihood diversification in developing countries. J. Agric. Econ. 2000, 51, 289–302. [Google Scholar] [CrossRef]

- Tsai, K.S. Imperfect Substitutes: The Local Political Economy of Informal Finance and Microfinance in Rural China and India. World Dev. 2004, 32, 1487–1507. [Google Scholar] [CrossRef]

- GSO. Statistic Year Book; GSO: San Ramon, CA, USA, 2017. [Google Scholar]

- Khoi, P.D.; Gan, C.; Nartea, G.V.; Cohen, D.A. Formal and informal rural credit in the Mekong River Delta of Vietnam: Interaction and accessibility. J. Asian Econ. 2013, 26, 1–13. [Google Scholar] [CrossRef]

- Duy, V.Q.; D’Haese, M.; Lemba, J.; D’Haese, L. Determinants of household access to formal credit in the rural areas of the Mekong Delta, Vietnam. Afr. Asian Stud. 2012, 11, 261–287. [Google Scholar] [CrossRef]

- CGAP. Donor Brief No.15; CGAP: Washington, DC, USA, 2003. [Google Scholar]

- Le Thi Minh, C. An Analysis of Access to Credit by Animal Producing Households in Hai Duong Province, Vietnam; Université de Liège Gembloux Agro-Bio Tech: Gembloux, Belgique, 2014. [Google Scholar]

- FAO. FAO’s Role in Urban Agriculture; FAO: Rome, Italy, 2019. [Google Scholar]

- CGAP. A Guide to Regulation and Supervision of Microfinance; CGAP: Washington, DC, USA, 2012. [Google Scholar]

- Diagne, A.; Zeller, M.; Sharma, M. Empirical Measurements of Households’ Access to Credit and Credit Constraints in Developing Countries: Methodological Issues and Evidence; Citeseer: State College, PA, USA, 2000. [Google Scholar]

- Zeldes, S.P. Consumption and liquidity constraints: An empirical investigation. J. Political Econ. 1989, 97, 305–346. [Google Scholar] [CrossRef]

- Carroll, C.D. Buffer Stock Saving and the Permanent Income Hypothesis; Board of Governors of the Federal Reserve System (US): Washington, DC, USA, 1991. [Google Scholar]

- Deaton, A. Saving and Liquidity Constraints; National Bureau of Economic Research: Cambridge, MA, USA, 1989. [Google Scholar]

- Browning, M.; Lusardi, A. Household saving: Micro theories and micro facts. J. Econ. Lit. 1996, 34, 1797–1855. [Google Scholar]

- Boucher, S.R.; Guirkinger, C.; Trivelli, C. Direct elicitation of credit constraints: Conceptual and practical issues with an application to Peruvian agriculture. Econ. Dev. Cult. Chang. 2009, 57, 609–640. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Honohan, P. Access to financial services: Measurement, impact, and policies. World Bank Res. Obs. 2009, 24, 119–145. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Thomas, L.C. A survey of credit and behavioural scoring: Forecasting financial risk of lending to consumers. Int. J. Forecast. 2000, 16, 149–172. [Google Scholar] [CrossRef]

- Zeller, M. Determinants of credit rationing: A study of informal lenders and formal credit groups in Madagascar. World Dev. 1994, 22, 1895–1907. [Google Scholar] [CrossRef]

- Zeller, M.; Ahmed, A.U.; Babu, S.C.; Broca, S.; Diagne, A.; Sharma, M.P. Rural Finance Policies for Food Security of the Poor: Methodologies for a Multicountry Research Project; International Food Policy Research Institute: Washington, DC, USA, 1996. [Google Scholar]

- Diagne, A.; Zeller, M. Access to Credit and Its Impact on Welfare in Malawi; International Food Policy Research Institute: Washington, DC, USA, 2001; Volume 116. [Google Scholar]

- Hinson, R.E. Banking the poor: The role of mobiles. J. Financ. Serv. Mark. 2011, 15, 320–333. [Google Scholar] [CrossRef]

- Pham, T.T.T.; Lensink, R. Lending policies of informal, formal and semiformal lenders: Evidence from Vietnam. Econ. Trans. 2007, 15, 181–209. [Google Scholar] [CrossRef]

- Hananu, B.; Abdul-Hanan, A.; Zakaria, H. Factors influencing agricultural credit demand in Northern Ghana. Afr. J. Agric. Res. 2015, 10, 645–652. [Google Scholar]

- Gray, A. Credit Accessibility of Small-Scale Farmers and Fisherfolk in the Philippines; Lincoln University: Oxford, PA, USA, 2006. [Google Scholar]

- Kosgey, Y.K.K. Agricultural credit access by grain growers in Uasin-Gishu County, Kenya. IOSR 2013, 2, 36–52. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y. Determinants of Credit Constraints: Evidence from Sindh, Pakistan. Emerg. Mark. Financ. Trade 2018, 54, 3401–3410. [Google Scholar] [CrossRef]

- Ugwumba, C.; Omojola, J. Credit access and productivity growth among subsistence food crop farmers in Ikole Local Government Area of Ekiti State, Nigeria. ARPN J. Agric. Biol. Sci. 2013, 8, 351–356. [Google Scholar]

- Duniya, K.; Adinah, I. Probit analysis of cotton farmers’ accessibility to credit in northern guinea savannah of Nigeria. Asian J. Agric. Ext. Econ. Sociol. 2015, 4, 296–301. [Google Scholar] [CrossRef]

- Bashir, M.K.; Azeem, M.M. Agricultural credit in Pakistan: Constraints and options. Pak. J. Life Soc. Sci. 2008, 6, 47–49. [Google Scholar]

- Mohieldin, M.S.; Wright, P.W. Formal and informal credit markets in Egypt. Econ. Dev. Cult. Chang. 2000, 48, 657–670. [Google Scholar] [CrossRef]

- Okurut, F.N.; Schoombee, A.; Van der Berg, S. Credit Demand and Credit Rationing in the Informal Financial Sector in Uganda 1. South Afr. J. Econ. 2005, 73, 482–497. [Google Scholar] [CrossRef]

- Mohamed, K. Access to Formal and Quasi-Formal Credit by Smallholder Farmers and Artisanal Fishermen: A Case Study of Zanzibar; Mkuki na Nyota Publishers: Dar es Salaam, Tanzania, 2003; ISBN 9987-686-75-3. [Google Scholar]

- Li, X.; Gan, C.; Hu, B. Accessibility to microcredit by Chinese rural households. J. Asian Econ. 2011, 22, 235–246. [Google Scholar] [CrossRef]

- Evans, T.G.; Adams, A.M.; Mohammed, R.; Norris, A.H. Demystifying nonparticipation in microcredit: A population-based analysis. World Dev. 1999, 27, 419–430. [Google Scholar] [CrossRef]

- Guirkinger, C. Understanding the Coexistence of Formal and Informal Credit Markets in Piura, Peru. World Dev. 2008, 36, 1436–1452. [Google Scholar] [CrossRef]

- Conning, J.; Udry, C. Rural financial markets in developing countries. Handb. Agric. Econ. 2007, 3, 2857–2908. [Google Scholar]

- Kochar, A. An empirical investigation of rationing constraints in rural credit markets in India. J. Dev. Econ. 1997, 53, 339–371. [Google Scholar] [CrossRef]

- Boucher, S.; Guirkinger, C. Risk, wealth, and sectoral choice in rural credit markets. Am. J. Agric. Econ. 2007, 89, 991–1004. [Google Scholar] [CrossRef]

- Siamwalla, A.; Pinthong, C.; Poapongsakorn, N.; Satsanguan, P.; Nettayarak, P.; Mingmaneenakin, W.; Tubpun, Y. The Thai rural credit system: Public subsidies, private information, and segmented markets. World Bank Econ. Rev. 1990, 4, 271–295. [Google Scholar] [CrossRef]

- Nagarajan, G.; Meyer, R.L.; Hushak, L.J. Demand for Agricultural Loans: A Theoretical and Econometric Analysis of the Philippine Credit Market/La Demande de Prêts Agricoles: Une Analyse Théorique Et Économique Du Marché De Crédit Aux Philippines. Sav. Dev. 1998, 22, 349–363. [Google Scholar]

- Sebatta, C.; Wamulume, M.; Mwansakilwa, C. Determinants of smallholder farmers’ access to agricultural finance in Zambia. J. Agric. Sci. 2014, 6, 63. [Google Scholar] [CrossRef]

- Nguyen, T.D.; Le, H.T. Enhancing formal credit accessibility of pig production households in Thai Binh province, Vietnam. Int. J. Econ. Commer. Manag. 2015, 3, 1–15. [Google Scholar]

- Yehuala, S. Determinants of Smallholder Farmers Access to Formal Credit: The Case of Metema Woreda, North Gondar, Ethiopia; Haramaya University: Dire Dawa, Ethiopia, 2008. [Google Scholar]

- Saleem, A.; Jan, F.A.; Khattak, R.M.; Quraishi, M.I. Impact of Farm and Farmers Characteristics On Repayment of Agriculture Credit. Abasyn Univ. J. Soc. Sci. 2011, 4, 23–35. [Google Scholar]

- Field, E.; Torero, M. Do Property Titles Increase Credit Access Among the Urban Poor? Evidence from a Nationwide Titling Program; Working Paper; Department of Economics, Harvard University: Cambridge, MA, USA, 2006. [Google Scholar]

- Vaessen, J. Accessibility of rural credit in northern nicaragua: the importance of networks of information and recommendation/accessibilité du crédit rural dans le nord du nicaragua: l’importance des réseaux d’information et de recommandation. Sav. Dev. 2001, 25, 5–32. [Google Scholar]

- Okurut, F.N. Access to Credit by the Poor in South Africa: Evidence from Household Survey Data 1995 and 2000; University of Botswana: Gaborone, Botswana, 2006. [Google Scholar]

- Bigsten, A.; Collier, P.; Dercon, S.; Fafchamps, M.; Gauthier, B.; Gunning, J.W.; Oduro, A.; Oostendorp, R.; Patillo, C.; Söderbom, M. Credit constraints in manufacturing enterprises in Africa. J. Afr. Econ. 2003, 12, 104–125. [Google Scholar] [CrossRef]

- Atieno, R. Formal and Informal Institutions’ Lending Policies and Access to Credit by Small-Scale Enterprises in Kenya: An Empirical Assessment; African Economic Research Consortium: Nairobi, Kenya, 2001. [Google Scholar]

- Oboh, V.U.; Ekpebu, I.D. Determinants of formal agricultural credit allocation to the farm sector by arable crop farmers in Benue State, Nigeria. Afr. J. Agric. Res. 2011, 6, 181–185. [Google Scholar]

- Heltberg, R. Rural market imperfections and the farm size—Productivity relationship: Evidence from Pakistan. World Dev. 1998, 26, 1807–1826. [Google Scholar] [CrossRef]

- Rahman, S.; Hussain, A.; Taqi, M. Impact of agricultural credit on agricultural productivity in Pakistan: An empirical analysis. Int. J. Adv. Res. Manag. Soc. Sci. 2014, 3, 125–139. [Google Scholar]

- Swaminathan, M. Segmentation, collateral undervaluation, and the rate of interest in agrarian credit markets: Some evidence from two villages in South India. Camb. J. Econ. 1991, 15, 161–178. [Google Scholar]

- Hussain, A.; Thapa, G.B. Smallholders’ access to agricultural credit in Pakistan. Food Secur. 2012, 4, 73–85. [Google Scholar] [CrossRef]

- Saqib, S.E.; Ahmad, M.M.; Panezai, S. Landholding size and farmers’ access to credit and its utilisation in Pakistan. Dev. Pract. 2016, 26, 1060–1071. [Google Scholar] [CrossRef]

- Zeller, M.; Diagne, A.; Mataya, C. Market access by smallholder farmers in Malawi: Implications for technology adoption, agricultural productivity and crop income. Agric. Econ. 1998, 19, 219–229. [Google Scholar] [CrossRef]

- Ahmad, N. Impact of Institutional Credit on Agricultural Output. Pak. Dev. Rev. 2011, 42, 469–485. [Google Scholar]

- Khandker, S.; Faruqee, R.R. The Impact of Farm Credit in Pakistan; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Xinkai, Z.; Gang, L. Dual Financial Institution and Farmers’ Choice on Consumer Credit Behavior: The Explanation and Analysis of ROSCA. Econ. Res. J. 2009, 2, 005. [Google Scholar]

- Croppenstedt, A.; Demeke, M.; Meschi, M.M. Technology adoption in the presence of constraints: The case of fertilizer demand in Ethiopia. Rev. Dev. Econ. 2003, 7, 58–70. [Google Scholar] [CrossRef]

- De Janvry, A.; Fafchamps, M.; Sadoulet, E. Peasant household behaviour with missing markets: Some paradoxes explained. Econ. J. 1991, 101, 1400–1417. [Google Scholar] [CrossRef]

- Di Falco, S.; Chavas, J.P.; Smale, M. Farmer management of production risk on degraded lands: The role of wheat variety diversity in the Tigray region, Ethiopia. Agric. Econ. 2007, 36, 147–156. [Google Scholar] [CrossRef]

- Di Falco, S.; Chavas, J.-P. On crop biodiversity, risk exposure, and food security in the highlands of Ethiopia. Am. J. Agric. Econ. 2009, 91, 599–611. [Google Scholar] [CrossRef]

- Van Bastelaer, T. Does social capital facilitate the poor’s access to credit. In Understanding and Measuring Social Capital: A Multidisciplinary Tool for Practitioners; The World Bank: Washington, DC, USA, 2002; pp. 237–264. [Google Scholar]

- Yokoyama, S.; Ali, A.K. Social capital and farmer welfare in Malaysia. Jpn. Agric. Res. Q. JARQ 2009, 43, 323–328. [Google Scholar] [CrossRef]

- Fukuyama, F. Social capital, civil society and development. Third World Q. 2001, 22, 7–20. [Google Scholar] [CrossRef]

- Grootaert, C.; Oh, G.T.; Swamy, A. Social capital, household welfare and poverty in Burkina Faso. J. Afr. Econ. 2002, 11, 4–38. [Google Scholar] [CrossRef]

- Okten, C.; Osili, U.O. Social networks and credit access in Indonesia. World Dev. 2004, 32, 1225–1246. [Google Scholar] [CrossRef]

- Bourdieu, P. The forms of capital.(1986). Cult. Theory Anthol. 2011, 1, 81–93. [Google Scholar]

- Chloupkova, J.; Bjønskov, C. Counting in social capital when easing agricultural credit constraints. J. Microfinance/ESR Rev. 2002, 4, 3. [Google Scholar]

- Van Bastelaer, T. Imperfect Information, Social Capital and the Poor’s Access to Credit. 1999. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=260058 (accessed on 5 March 2019).

- Olagunju, F. Impact of credit use on resource productivity of sweet potatoes farmers in Osun-State, Nigeria. J. Soc. Sci. 2007, 14, 177–178. [Google Scholar] [CrossRef]

- Walle, d.v.D.; Cratty, D. Is the Emerging Nonfarm Market Economy the Route out of Poverty in Vietnam? The World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Lanjouw, J.O.; Lanjouw, P. The rural non-farm sector: Issues and evidence from developing countries. Agric. Econ. 2001, 26, 1–23. [Google Scholar] [CrossRef]

- Imai, K.S.; Gaiha, R.; Kang, W. Vulnerability and poverty dynamics in Vietnam. Appl. Econ. 2011, 43, 3603–3618. [Google Scholar] [CrossRef]

- Das, T. Does credit access lead to expansion of income and multidimensional poverty? A study of rural Assam. Int. J. Soc. Econ. 2018. [Google Scholar] [CrossRef]

- Khandker, S.R. Microfinance and poverty: Evidence using panel data from Bangladesh. World Bank Econ. Rev. 2005, 19, 263–286. [Google Scholar] [CrossRef]

- Copestake, J.; Dawson, P.; Fanning, J.P.; McKay, A.; Wright-Revolledo, K. Monitoring the diversity of the poverty outreach and impact of microfinance: A comparison of methods using data from Peru. Dev. Policy Rev. 2005, 23, 703–723. [Google Scholar] [CrossRef]

- Bashir, M.K.; Mehmood, Y.; Hassan, S. Impact of agricultural credit on productivity of wheat crop: Evidence from Lahore, Punjab, Pakistan. Pak. J. Agric. Sci. 2010, 47, 405–409. [Google Scholar]

- Ekwere, G.; Edem, I. Evaluation of agricultural credit facility in agricultural production and rural development. Glob. J. Hum. Soc. Sci. Res. 2014. [Google Scholar]

- Hermes, N.; Lensink, R. Microfinance: Its impact, outreach, and sustainability. World Dev. 2011, 39, 875–881. [Google Scholar] [CrossRef]

- Amin, S.; Rai, A.S.; Topa, G. Does microcredit reach the poor and vulnerable? Evidence from northern Bangladesh. J. Dev. Econ. 2003, 70, 59–82. [Google Scholar] [CrossRef]

- Bateman, M.; Chang, H.-J. The microfinance illusion. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Niño-Zarazúa, M. The Impact of Credit on Income Poverty in Urban Mexico. An Endogeneity-Corrected Estimation; University of Sheffield: Sheffield, UK, 2007. [Google Scholar]

- Morduch, J.; Haley, B. Analysis of the Effects of Microfinance on Poverty Reduction; NYU Wagner: New York, NY, USA, 2002. [Google Scholar]

- Khaki, A.R.; Sangmi, M.-u.-D. Does access to finance alleviate poverty? A case study of SGSY beneficiaries in Kashmir Valley. Int. J. Soc. Econ. 2017, 44, 1032–1045. [Google Scholar] [CrossRef]

- Imai, K.; Arun, T. Does Microfinance Reduce Poverty in India; University of Manchester: Manchester, UK, 2008. [Google Scholar]

- Putzeys, R. Micro Finance in Vietnam: Three Case Studies. Available online: https://www.findevgateway.org/library/microfinance-vietnam-three-case-studies (accessed on 5 March 2019).

- Hof, K.; Stiglitz, J. Imperfect Inform ationand Rural Credit Markets: Puzzlesand Policy Perspectives. World Bank Econ. 1990, 4, 235–250. [Google Scholar] [CrossRef]

- Thornton, P.K.; van de Steeg, J.; Notenbaert, A.; Herrero, M. The impacts of climate change on livestock and livestock systems in developing countries: A review of what we know and what we need to know. Agric. Syst. 2009, 101, 113–127. [Google Scholar] [CrossRef]

- Nardone, A.; Ronchi, B.; Lacetera, N.; Ranieri, M.S.; Bernabucci, U. Effects of climate changes on animal production and sustainability of livestock systems. Livest. Sci. 2010, 130, 57–69. [Google Scholar] [CrossRef]

- Georgopoulou, E.; Mirasgedis, S.; Sarafidis, Y.; Vitaliotou, M.; Lalas, D.P.; Theloudis, I.; Giannoulaki, K.D.; Dimopoulos, D.; Zavras, V. Climate change impacts and adaptation options for the Greek agriculture in 2021–2050: A monetary assessment. Clim. Risk Manag. 2017, 16, 164–182. [Google Scholar] [CrossRef]

- Tanaka, T.; Camerer, C.F.; Nguyen, Q. Risk and time preferences: Linking experimental and household survey data from Vietnam. Am. Econ. Rev. 2010, 100, 557–571. [Google Scholar] [CrossRef]

- Neil Adger, W. Social Vulnerability to Climate Change and Extremes in Coastal Vietnam. World Dev. 1999, 27, 249–269. [Google Scholar] [CrossRef]

- Marsh, S.P.; MacAulay, T.G.; Hung, P.V. Agricultural Development and Land Policy in Vietnam; Australian Centre for International Agricultural Research (ACIAR): Canberra, Australia, 2006; 272p. [Google Scholar]

- Erickson, D.L.; Lovell, S.T.; Méndez, V.E. Identifying, quantifying and classifying agricultural opportunities for land use planning. Landsc. Urban Plan. 2013, 118, 29–39. [Google Scholar] [CrossRef]

- White, C. Agricultural planning, pricing policy and co-operatives in Vietnam. World Dev. 1985, 13, 97–114. [Google Scholar] [CrossRef]

- Waheed, S. Does rural micro credit improve well-being of borrowers in the Punjab (Pakistan)? Pak. Econ. Soc. Rev. 2009, 47, 31–47. [Google Scholar]

- Braverman, A.; Guasch, J.L. Rural credit markets and institutions in developing countries: Lessons for policy analysis from practice and modern theory. World Dev. 1986, 14, 1253–1267. [Google Scholar] [CrossRef]

- McCarty, A. Microfinance in Vietnam: A Survey of Schemes and Issues; Department for International Development (DFID) and the State Bank of Vietnam (SBVN): Hanoi, Vietnam, 2001. [Google Scholar]

- Nelson, R.; Howden, M.; Smith, M.S. Using adaptive governance to rethink the way science supports Australian drought policy. Environ. Sci. Policy 2008, 11, 588–601. [Google Scholar] [CrossRef]

- Freebairn, J.W. Drought assistance policy. Aust. J. Agric. Econ. 1983, 27, 185–199. [Google Scholar] [CrossRef]

- Clarke, D.J.; Grenham, D. Microinsurance and natural disasters: Challenges and options. Environ. Sci. Policy 2013, 27, S89–S98. [Google Scholar] [CrossRef]

- Bhatt, V.V.; Mundial, B. Financial Innovation and Credit Market Development; The World Bank: Washington, DC, USA, 1989. [Google Scholar]

- Bao Duong, P.; Izumida, Y. Rural Development Finance in Vietnam: A Microeconometric Analysis of Household Surveys. World Dev. 2002, 30, 319–335. [Google Scholar] [CrossRef]

- Barslund, M.; Tarp, F. Formal and informal rural credit in four provinces of Vietnam. J. Dev. Stud. 2008, 44, 485–503. [Google Scholar] [CrossRef]

- Yadav, S.; Otsuka, K.; David, C.C. Segmentation in rural financial markets: The case of Nepal. World Dev. 1992, 20, 423–436. [Google Scholar] [CrossRef]

- Dinh, Q.H.; Dufhues, T.B.; Buchenrieder, G. Do connections matter? Individual social capital and credit constraints in Vietnam. Eur. J. Dev. Res. 2012, 24, 337–358. [Google Scholar] [CrossRef]

- Luan, D.X.; Bauer, S. Does credit access affect household income homogeneously across different groups of credit recipients? Evidence from rural Vietnam. J. Rural Stud. 2016, 47, 186–203. [Google Scholar] [CrossRef]

- Tu, T.T.T.; Ha, N.P.; Yen, T.T.H. Socio-economic impact of rural credit in northern Vietnam: Does it differ between clients belonging to the ethnic majority and the minorities? Asian Soc. Sci. 2015, 11, 159. [Google Scholar]

- Duong, H.A.; Nghiem, H.S. Effects of microfinance on poverty reduction in Vietnam: A pseudo-panel data analysis. J. Account. Financ. Econ. 2014, 4, 58–67. [Google Scholar]

- Duy, V.Q. The Role of Access to Credit in Rice Production Efficiency of Rural Households in the Mekong Delta Vietnam; Center for Asian Studies: Kaunas, Lithuania, 2012. [Google Scholar]

- Duy, V.Q.; Neuberger, D.; Suwanaporn, C. Access to credit and rice production efficiency of rural households in the Mekong delta. J. Account. Bus. Res. 2012, 3, 33–48. [Google Scholar] [CrossRef]

- Linh, T.T.; Nanseki, T.; Chomei, Y. Productive efficiency of crop farms in Viet Nam: A DEA with a smooth bootstrap application. J. Agric. Sci. 2015, 7, 37. [Google Scholar] [CrossRef]

- Hoang, T.X.; Pham, C.S.; Ulubaşoğlu, M.A. Non-farm activity, household expenditure, and poverty reduction in rural Vietnam: 2002–2008. World Dev. 2014, 64, 554–568. [Google Scholar] [CrossRef]

- Tran, T.Q. Nonfarm employment and household income among ethnic minorities in Vietnam. Econ. Res. Ekon. Istraživanja 2015, 28, 703–716. [Google Scholar] [CrossRef]

- Dufhues, T.; Buchenrieder, G. Outreach of Credit Institutes and Households’ Access Constraints to Formal Credit in Northern Vietnam; Universität Hohenheim: Stuttgart, Germany, 2005. [Google Scholar]

- Saint-Macary, C.; Zeller, M. Rural Credit Policy in the Mountains of Northern Vietnam: Sustainability, Outreach and Impact; Universität Hohenheim: Stuttgart, Germany, 2011. [Google Scholar]

- Ghatak, M.; Guinnane, T.W. The economics of lending with joint liability: Theory and practice1. J. Dev. Econ. 1999, 60, 195–228. [Google Scholar] [CrossRef]

- Karlan, D.S.; Goldberg, N. Impact Evaluation for Microfinance: Review of Methodological Issues; The World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Quach, M.H. Access to Finance and Poverty Reduction: An Application to Rural Vietnam; University of Birmingham: Birmingham, UK, 2005. [Google Scholar]

- Rahji, M.; Fakayode, S. A multinomial logit analysis of agricultural credit rationing by commercial banks in Nigeria. Int. Res. J. Financ. Econ. 2009, 24, 97–103. [Google Scholar]

| Formal Markets | Semi-Formal Markets | Informal Markets | |||

|---|---|---|---|---|---|

| VBARD | VBSP | PCFs | |||

| Targeted customers | Larger-scale farmhouse | Poor households | Wide range of households | Selective clients, such as Poor women, ethnic minority communities | Wide-range of clients |

| Lending schemes | Individual | Group-based/individual | Individual | Individual | Individual |

| Loan size | Large | Small | Small to large | Small | Small to large |

| Interest rate | Low | Low | High | Low | High |

| Loan term | Short-term | Long-term | Short-term | Short-term | Depending on the relationship between lenders and borrowers |

| Collateral | Required land-use certificate | No collateral for group-based | No collateral (depending on each PCF) | No collateral | Depending on the relationship between lenders and borrowers |

| Author(s) | Year | Title of Paper | Journal | Determinants of Access to credit | Models | Places of Survey | |

|---|---|---|---|---|---|---|---|

| Determinants of Access to Rural Credit/Credit Constraints | Determinants of Borrowed Amount | ||||||

| Luan D.X. et al. [119] | 2016 | Does credit access affect household income homogeneously across different groups of credit recipients? Evidence from rural Vietnam | Journal of rural studies | Number of people known who could be asked for help (social capital); Number of contacts with agricultural extension (social capital); Age of households heads; Total value of savings; Households experience of types of shock | Not mentioned | Probit model | 12 provinces in the River Delta, Northern Mountains, the Central Coast and the Mekong River Delta |

| Khoi P.D. et al. [13] | 2013 | Formal and informal rural credit in the Mekong river delta of Vietnam: interaction and accessibility | Journal of Asian Economics | Age; marital status; ethnicity; government employees; member of credit group; poor certificate; income levels; sources of main income; direct road access to village; urbanized commune and the informal amount | From informal sources: age, education, landownership, savings, income levels, purposes of informal loan, informal interest rate, duration of informal loan, direct road access to village, urbanized commune From formal sources: education, household head’s occupation, agricultural land area, household expenditure, subsidized interest, purpose of formal loan, urbanized commune | Heckman two-step model | 15 villages of 13 communes in Mekong River Delta Vietnam |

| Dinh Q.H. et al. [118] | 2012 | Does connections matter? Individual social capital and credit constraints in Vietnam | European Journal of Development Research | Income and past income, district dummy/location Bonding link: strong ties to persons of higher social standing Past credit Ethnic | Not mentioned | Zero-Inflated Negative Binomial model | Son La province |

| Duy V.Q. et al. [14] | 2012 | Determinants of household access to formal credit in the rural areas of the Mekong delta, Vietnam | African and Asian Studies | Individual access to credit: age, value of building, ethnicity, family size, distance to the market centre, social capital Group-based access to rural credit: marital status, education, total land size, distance to the market centre | Individual: dependency ratio, family size, having job in community, household head gender, total land size, ethnicity, social capital Group-based: dependency ratio, having a community work, total land size | Heckman and Double hurdle model | T Three provinces in the Mekong Delta: Can Tho, Soc Trang, Tra Vinh |

| Barslund M. et al. [116] | 2008 | Formal and informal rural credit in four provinces of Vietnam | Journal of Development Studies | Credit demand: Land size (depending on each province), district dummy/location, connection, the number of adults, the age of household head, distance from village center Credit rationing: the age of household head, gender, the number of adults, livestock holdings, connections | Credit demand: Land size (depending on each province), assets and livestock holdings | Probit model, lognormal model, Heckman’s selection model | Long An in Mekong Delta, Quang Nam in Central Highlands, Phu Tho in North Western Highlands, Ha Tay in the Red River Delta |

| Bao Duong, P. et al. [115] | 2002 | Rural development finance in Vietnam: a microeconomic analysis of household surveys | World development | Reputation (social capital), dependency ratio, amount of credit applied to the bank | Farm size, total production value of livestock, dependency ratio | Tobit and Probit model | Ninh Binh (Red River Delta), Quang Ngai (South of Central Part) An Giang (Mekong River Delta) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Linh, T.N.; Long, H.T.; Chi, L.V.; Tam, L.T.; Lebailly, P. Access to Rural Credit Markets in Developing Countries, the Case of Vietnam: A Literature Review. Sustainability 2019, 11, 1468. https://doi.org/10.3390/su11051468

Linh TN, Long HT, Chi LV, Tam LT, Lebailly P. Access to Rural Credit Markets in Developing Countries, the Case of Vietnam: A Literature Review. Sustainability. 2019; 11(5):1468. https://doi.org/10.3390/su11051468

Chicago/Turabian StyleLinh, Ta Nhat, Hoang Thanh Long, Le Van Chi, Le Thanh Tam, and Philippe Lebailly. 2019. "Access to Rural Credit Markets in Developing Countries, the Case of Vietnam: A Literature Review" Sustainability 11, no. 5: 1468. https://doi.org/10.3390/su11051468

APA StyleLinh, T. N., Long, H. T., Chi, L. V., Tam, L. T., & Lebailly, P. (2019). Access to Rural Credit Markets in Developing Countries, the Case of Vietnam: A Literature Review. Sustainability, 11(5), 1468. https://doi.org/10.3390/su11051468