Green Credit and Company R&D Level: Empirical Research Based on Threshold Effects

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Analysis of Threshold Effect

3.1. Firm Size

3.2. Bank Lending

3.3. Government Subsidies

4. Selecting Variables and Building Models

5. Empirical Results and Analysis

- (1)

- Using the level of firm size as a threshold value. When the level of firm size is lower than the first threshold value (size = 19.9682), green credit has no significant positive effect on the R&D level of the environmental protection companies, where the marginal coefficient of the effect is 0.0562938. When the level of firm size is higher than the first threshold value but lower than the second threshold value (size = 21.6431), green credit has a significant positive effect on the R&D level of environmental protection companies, where the marginal coefficient of the effect is 0.1023458. When the level of firm size is higher than the second threshold value, the significant positive effect is deepened, where the marginal coefficient of the effect is 0.1363294. Table 4 shows that green credit has a positive but nonlinear effect on the R&D level of environmental protection companies. When the level of firm size is high, green credit has a large positive effect on the R&D level; when the level of firm size is low, the positive effect is small. Therefore, large-scale environmental protection companies can further use green credit to improve R&D levels, which confirms Hypothesis 1. The findings corroborate that the positive effect of green credit on R&D of environmental protection companies is affected by the level of firm size. Larger-scale companies have higher level of technology and stronger market control. Hence, the cost of R&D innovation is lower, and R&D activities are more frequent.

- (2)

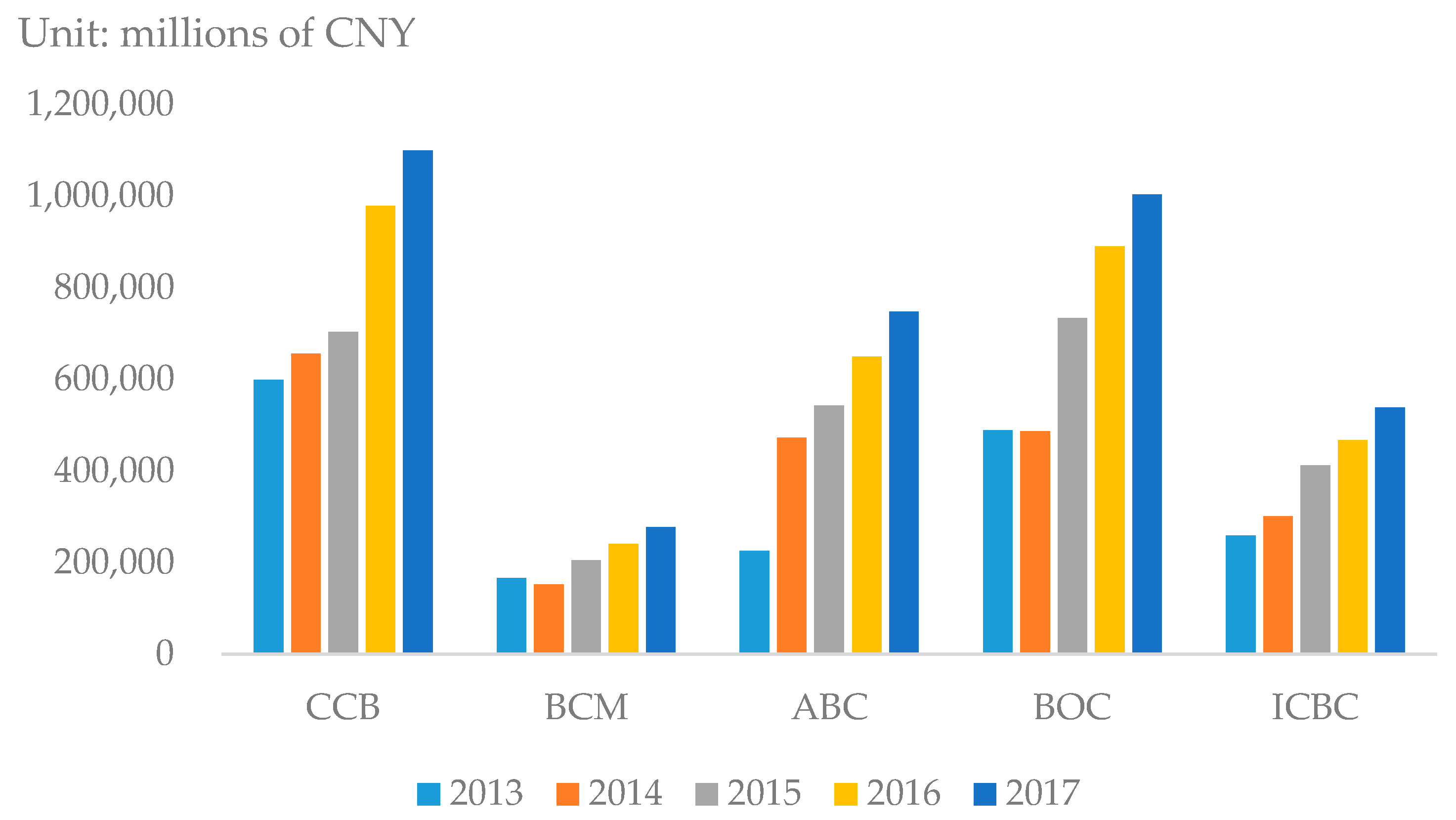

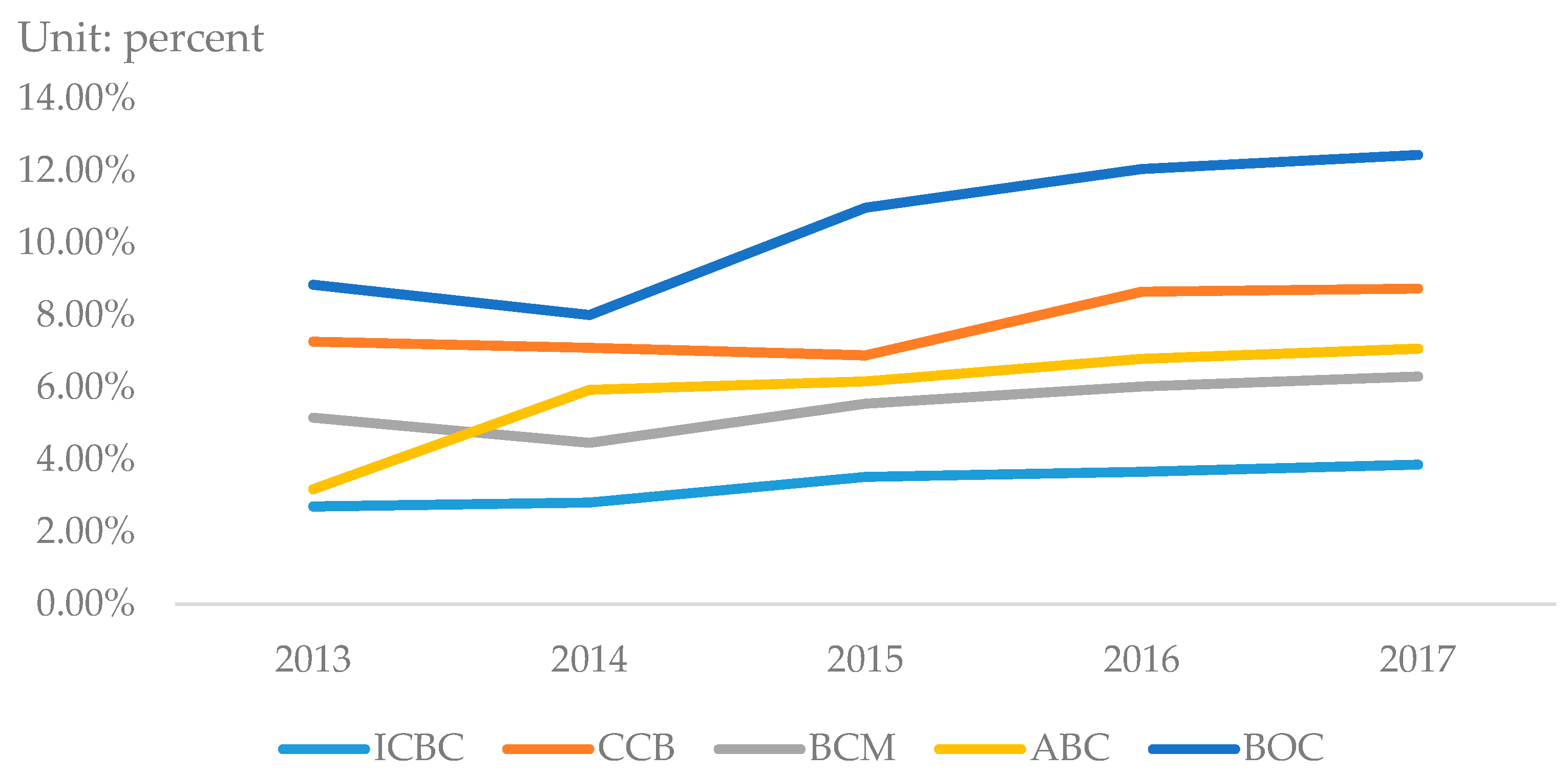

- Using the level of bank lending as a threshold value. When the level of bank lending is lower than the first threshold value (lending = 21.7710), green credit has no significant positive effect on the R&D level of environmental protection companies, where the marginal coefficient of the effect is 0.0939122. When the level of bank lending is higher than the first threshold value but lower than the second threshold value (lending = 22.8814), green credit has a significant positive effect on the R&D level of environmental protection companies, where the marginal coefficient of the effect is 0.1267195. When the level of bank lending is higher than the second threshold value, the significant positive effect is deepened, where the marginal coefficient of the effect is 0.1616295. Table 4 shows that green credit has a positive but nonlinear effect on the R&D level of environmental protection companies. When the level of bank lending is high, green credit has a large positive effect on the R&D level; when the level of bank lending is low, the positive effect is small. Therefore, environmental protection companies with larger bank lending can further use green credit to improve R&D levels, which confirms Hypothesis 2. Results prove that the positive effect of green credit on R&D innovation of environmental protection companies is affected by bank lending. When companies receive additional sustained and stable financial support from banks, they will have increased enthusiasm for R&D activities and green product innovation.

- (3)

- Using the level of government subsidies as a threshold variable. When the level of government subsidies is lower than the first threshold value (subsidy = 14.4139), green credit has a significant positive effect on the R&D level of environmental protection companies, where the marginal coefficient of the effect is 0.2886952. When the level of government subsidies is higher than the first threshold value but lower than the second threshold value (subsidy = 14.591), the positive effect is deepened, where the marginal coefficient of the effect is 0.3702444. However, when the level of government subsidies is higher than the second threshold value, the significant positive impact is weakened, where the marginal coefficient of the effect is 0.2944418. Table 4 shows that green credit has a positive but nonlinear effect on the R&D level of environmental protection companies. When the level of government subsidy is high, green credit has a large positive effect on the R&D level; when the level of government subsidy is low, the positive effect is small. That is, environmental protection companies with more government subsidies can further use green credit to improve their R&D level, which confirms Hypothesis 3. Enterprises with further government subsidies have improved market failures and asymmetry information, reduced R&D innovation costs, and increased positive effect on R&D innovation after obtaining green credit. However, excessive government subsidies bring problems, such as rising market resources and inadequate supervision, which result in the abuse of subsidies. Therefore, when the government subsidizes environmental protection companies, it must find an effective range of government subsidies to achieve the potential of the policy.

6. Conclusions and Recommendations

- (1)

- When the level of firm size is below 19.9682, green credit has no significant positive effect on the R&D level of environmental protection companies. When the level of firm size is higher than 19.9682 but lower than 21.6431, green credit has a significant positive effect on the R&D level. When the level of firm size is higher than 21.6431, the significant positive effect is deepened.

- (2)

- When the level of bank lending is below 21.7710, green credit has no significant positive effect on the R&D level of environmental protection companies. When the level of bank lending is higher than 21.7710 but lower than 22.8814, green credit has a significant positive effect on the R&D level. When the level of bank lending is higher than 22.8814, the significant positive effect is deepened.

- (3)

- When the level of government subsidies is below 14.4139, green credit has a significant positive effect on the R&D level of environmental protection companies. When the level of government subsidies is higher than 14.4339 but lower than 14.5981, the positive effect is deepened. However, when the level of government subsidies is higher than 14.59, the significant positive effect is weakened.

- (1)

- Banks should formulate green credit policy based on the characteristics of company heterogeneity. The R&D innovation of environmental protection companies requires banks to provide a large amount of green financing. The country’s green development and transformation also require a large amount of financial support. Banks should formulate reasonable and effective mechanisms to invest more funds in green and sustainable development. This study finds that green credit has a positive but nonlinear effect on R&D level of environmental protection companies. Therefore, when formulating green credit policies, the heterogeneity of environmental protection companies should be fully considered. Large-scale environmental protection companies can further use green credit to improve the R&D level; hence, banks should increase green credit for large-scale companies. Companies with larger bank lending can further use green credit to improve their R&D level. Therefore, green credit should be added to companies with large bank lending. Companies that have more government subsidies can further use green credit to improve their R&D level. Therefore, green credit should be added to companies with more government subsidies.

- (2)

- According to the Schumpeter hypothesis, smaller companies are expensive to develop, and face high financing constraints. Therefore, smaller environmental protection companies cannot fully utilize green innovation when they receive green credit. Environmental protection companies with low bank lending level have insufficient stable funds to support R&D activities, and R&D costs are high. Therefore, companies with low bank lending level cannot fully utilize green innovation when they obtain green credit. Government subsidies can correct market failure and serve as a signal to reduce the adverse selection problems caused by high asymmetry information. Therefore, when government subsidies are small, the companies cannot fully utilize green innovation when they obtain green credit. Therefore, when formulating green credit policy, banks should limit the green credit use of environmental protection companies, specifically enterprises with smaller firm size, lower bank lending, and less government subsidies. Furthermore, the supervision of the use of green credit should be strengthened.

- (3)

- Strengthen the role of the government in sustainable development and promote innovation in green financial products. While providing subsidies for environmental protection companies, the government should consider the scope of government subsidies. The government should determine the optimal subsidy interval based on the evaluation results of different enterprise R&D innovation projects. Thereby, promote the smooth transformation of government subsidies into the R&D incentives of environmental protection companies, and ensure that the limited funds are used to maximum effectiveness. The government can also formulate preferential policies to encourage banks and financial institutions to implement green credit and promote the green development of environmental protection companies. Moreover, the government should encourage companies to carry out green innovation, introduce high-tech talent, and improve production technology. According to the Porter hypothesis, green innovation can enhance the competitiveness of enterprises, thereby offsetting the cost of environmental protection and promoting high-quality economic growth. Although the benefits of innovation may not be reflected in the current period, it may improve the company’s revenue and achieve sustainable development in the long run.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aizawa, M.; Yang, C. Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J. Environ. Dev. 2010, 19, 119–144. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Furman, J.L.; Hayes, R. Catching up or standing still? National innovative productivity among follower countries, 1978–1999. Res. Policy 2004, 33, 1329–1354. [Google Scholar] [CrossRef]

- Wright, C. Global banks, the environment, and human rights: The impact of the Equator Principles on lending policies and practices. Glob. Environ. Politics 2012, 12, 56–77. [Google Scholar] [CrossRef]

- Zhou, Y.S.; Liu, Q.R.; Li, J.; Zhao, Y.X. Game model for governments to promote banks as the agency to supervise the implementation of green supply chain based on green credit. Syst. Eng. Theory Pract. 2015, 35, 1744–1751. [Google Scholar]

- Chen, L.Q. Dynamic analysis of green credit development at home and abroad. Glob. Sci. Technol. Econ. Outlook 2010, 6, 45–56. [Google Scholar]

- Jeucken, M. Sustainable Finance and Banking: The Financial Sector and the Future of the Planet; Routledge: London, UK, 2010. [Google Scholar]

- Shao, Y.H.; Liu, S.B.; Zhang, C.Y. Financial development model and economic growth under the difference of innovation: Theory and evidence. Manag. World 2015, 11, 29–39. [Google Scholar]

- Zhao, W. Financial development and regional innovation output growth: Based on empirical analysis of provincial panel data in China. Mod. Econ. 2016, 7, 10. [Google Scholar] [CrossRef]

- Law, S.H.; Lee, W.C.; Singh, N. Revisiting the finance-innovation nexus: Evidence from a nonlinear approach. J. Innov. Knowl. 2018, 3, 143–153. [Google Scholar] [CrossRef]

- Emtairah, T.; Hansson, L.; Hao, G. Environmental challenges and opportunities for banks in China. Greener Manag. Int. 2006, 50, 85–95. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef]

- Bouma, J.J.; Jeucken, M.; Klinkers, L. Sustainable Banking: The Greening of Finance; Routledge: London, UK, 2017. [Google Scholar]

- Thompson, P. Bank lending and the environment: Policies and opportunities. Int. J. Bank Mark. 1998, 16, 243–252. [Google Scholar] [CrossRef]

- Schaltegger, S.; Figge, F. Environmental shareholder value: Economic success with corporate environmental management. Eco-Manag. Audit. J. Corp. Environ. Manag. 2000, 7, 29–42. [Google Scholar] [CrossRef]

- Repetto, R.; Austin, D. Pure Profit: The Financial Implications of Environmental Performance; World Resources Institute: Washington, DC, USA, 2000. [Google Scholar]

- Thompson, P.; Cowton, C.J. Bringing the environment into bank lending: Implications for environmental reporting. Br. Account. Rev. 2004, 36, 197–218. [Google Scholar] [CrossRef]

- Cilliers, E.J.; Diemont, E.; Stobbelaar, D.J.; Timmermans, W. Sustainable green urban planning: The Green Credit Tool. J. Place Manag. Dev. 2010, 3, 57–66. [Google Scholar] [CrossRef]

- Hu, N.W.; Cao, D.W. Green credit policy and environmental risk management of commercial banks. Econ. Probl. 2011, 3, 026. [Google Scholar]

- Ma, Q.J.; Liu, X. Experiences in the development of green credit business in developed countries. New Financ. 2013, 4, 57–59. [Google Scholar]

- Weng, Z.X.; Ge, C.Z.; Duan, X.M.; Long, F. Analysis on the green financial products development and innovation in China. China Popul. Resour. Environ. 2015, 25, 17–22. [Google Scholar]

- Jiang, X.L.; Xu, H.L. Green credit operation mechanism of commercial bank of China. China Popul. Resour. Environ. 2016, S1, 490–492. [Google Scholar]

- Gao, X.Y.; Gao, G. A study on the relation between the scale of green credit and the competitiveness of commercial banks. Econ. Probl. 2018, 7, 003. [Google Scholar]

- Cui, Y.; Geobey, S.; Weber, O.; Lin, H. The impact of green lending on credit risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does it pay to be good... and does it matter? A meta-analysis of the relationship between corporate social and financial performance. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Sasidharan, S.; Lukose, P.J.; Komera, S. Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. Q. Rev. Econ. Financ. 2015, 55, 28–39. [Google Scholar]

- Zou, G.P.; Liu, H.D.; Wang, G.Y. Observations on the correlation between state-owned enterprises’ scale and innovation intensity. Manag. Rev. 2015, 27, 171–179. [Google Scholar]

- Brealey, R.; Leland, H.E.; Pyle, D.H. Informational asymmetries, financial structure, and financial intermediation. J. Financ. 1977, 32, 371–387. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The Financing of R&D and Innovation. In Handbook of the Economics of Innovation; North-Holland: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. [Google Scholar]

- Heshmati, A.; Loof, H. The Impact of Public Funds on Private R&D Investment: New Evidence from a Firm Level Innovation Study; Working Paper; Royal Institute of Technology: Stockholm, Sweden, 2005. [Google Scholar]

- Hewitt-Dundas, N.; Roper, S. Output additionality of public support for innovation: Evidence for Irish manufacturing plants. Eur. Plan. Stud. 2010, 18, 107–122. [Google Scholar] [CrossRef]

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. Rand J. Econ. 2000, 31, 82–100. [Google Scholar]

- Becker, B. Public R&D policies and private R&D investment: A survey of the empirical evidence. J. Econ. Surv. 2015, 29, 917–942. [Google Scholar]

- Tong, H.; Lim, K.S. Threshold autoregression, limit cycles and cyclical data. J. R. Stat. Soc. 1980, 42, 245–292. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Chan, K.S. Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. Ann. Stat. 1993, 21, 520–533. [Google Scholar] [CrossRef]

- Hansen, B.E. Inference when a nuisance parameter is not identified under the null hypothesis. Econom. J. Econom. Soc. 1996, 64, 413–430. [Google Scholar] [CrossRef]

| Variables (Unit) | Observation | Average Value | Standard Deviation | Maximum Value | Minimum Value |

|---|---|---|---|---|---|

| R&D (CNY) | 144 | 17.74046 | 1.327389 | 19.8821 | 13.89552 |

| Green (CNY) | 144 | 20.3845 | 1.508584 | 22.78049 | 12.83468 |

| Size (CNY) | 144 | 22.47814 | 0.823423 | 24.28188 | 20.39438 |

| Lending (CNY) | 144 | 20.3845 | 1.508584 | 22.78049 | 12.83468 |

| Subsidy (CNY) | 144 | 16.3441 | 1.599552 | 20.34068 | 10.81978 |

| P (%) | 144 | 0.059484 | 0.028609 | 0.153079 | −0.075948 |

| C (%) | 144 | 12.713 | 1.074229 | 15.06218 | 9.511347 |

| Variables | f Value | p Value | BS | 10% | 5% | 1% |

|---|---|---|---|---|---|---|

| Size | 54.53 | 0.0000 | 300 | 14.9447 | 19.1788 | 27.5368 |

| Lending | 15.40 | 0.0367 | 300 | 12.1916 | 14.1570 | 17.7768 |

| Subsidy | 16.90 | 0.0100 | 300 | 10.1553 | 12.0906 | 16.1619 |

| Variables | Threshold Value 1 [Lower Upper] | Threshold Value 2 [Lower Upper] |

|---|---|---|

| Size | 19.9682 [19.8951 19.9928] | 21.6431 [21.5755 21.6619] |

| Lending | 21.7710 [21.6760 21.7811] | 22.8814 [22.8006 22.8863] |

| Subsidy | 14.4139 [14.1345 14.4228] | 14.5981 [14.4228 14.6994] |

| R&D | Threshold Effect Model | ||

|---|---|---|---|

| Size | Lending | Subsidy | |

| Green | 0.0562938(0.192) (size ≤ 19.9682) | 0.0939122(0.141) (credit ≤ 21.7710) | 0.2886952 ***(0.000) (subsidy ≤ 14.4139) |

| 0.1023458 ***(0.010) (19.9682 < size ≤ 21.6431) | 0.1267195 ***(0.028) (21.7710 < credit ≤ 22.8814) | 0.3702444 ***(0.000) (14.4139 < subsidy ≤ 14.5981) | |

| 0.1363294 ***(0.001) (size > 21.6431) | 0.1616295 ***(0.004) (credit > 22.8814) | 0.2944418 ***(0.000) (subsidy > 14.5981) | |

| P | 7.025448 ***(0.000) | 6.780357 ***(0.001) | 5.544738 ***(0.010) |

| C | 0.0741786(0.354) | 0.1009446(0.300) | 0.079902(0.443) |

| Cons | 14.22929 ***(0.000) | 13.52915 ***(0.000) | 10.39356 ***(0.000) |

| obs | 144 | 144 | 144 |

| f test | 34.46 | 20.43 | 19.81 |

| Prob > f | 0.000 | 0.000 | 0.000 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.; Liu, C.; Xie, F.; Zhang, T.; Guan, F. Green Credit and Company R&D Level: Empirical Research Based on Threshold Effects. Sustainability 2019, 11, 1918. https://doi.org/10.3390/su11071918

Chen H, Liu C, Xie F, Zhang T, Guan F. Green Credit and Company R&D Level: Empirical Research Based on Threshold Effects. Sustainability. 2019; 11(7):1918. https://doi.org/10.3390/su11071918

Chicago/Turabian StyleChen, Huiying, Chuanzhe Liu, Fangming Xie, Tong Zhang, and Fangyuan Guan. 2019. "Green Credit and Company R&D Level: Empirical Research Based on Threshold Effects" Sustainability 11, no. 7: 1918. https://doi.org/10.3390/su11071918