1. Introduction

Risk is inherent in almost all the phases of life, but when it comes to business, they are more vulnerable due to changing trends, globalization, complexity, and competitiveness of the firms [

1,

2,

3,

4,

5]. Changes in demand, uncertain supply, cost savings, and implementing agile or lean structures increase the probability of risks [

6,

7]. Whatever the reason it would be, the firm’s supply chain (SC) is exposed to numerous risks, which create disruptions. If these disruptions are not treated in a timely manner, they affect the firm’s performance [

8]. Supply chain disruptions (SCDs) can occur upstream and downstream of the supply chain or can be internal and external: supplier delivery delays, supplier insolvency, fluctuations in demand or estimation errors, natural disasters like hurricanes, floods, earthquakes, fires, etc. [

3,

9]. Recently, there have been many cases of SCDs, such as supply issues for one of the major suppliers for Boeing, which delayed the inauguration of their new model Boeing 787 [

10]. The tensions between Japan and China (recently) have created demand disruptions for Japanese commodities and vehicles [

11]. The Fukushima earthquake occurred in Japan in 2016, and it disrupted the supply for different parts to Toyota. As a result, 26 plants were shut down, and profits declined by 276.15 million USD [

12].

Managing supply chain risks (SCRs) are especially crucial to the supply chains of the automotive industry, as they depend on lean and just-in-time practices for their complex supply chain network, which leads to high vulnerabilities of SCDs [

4,

13]. JLT insurance published a report about disruptions in American automotive supply chains in 2018, which produced an increase of 30% SCDs in the American automotive industry [

14]. SCRs have enormous effects on the firm’s performance. Therefore, it is necessary to develop strategies appropriate for coping with SCRs and maintaining the firm’s performance level [

15,

16]. Adequate risk-mitigation strategies help firms in identifying, assessing, measuring, monitoring, and controlling SCRs [

17]. Previous studies focusing on managing SCRs suggest that operational practices, strategic practices, or redundancy practices effectively cope with SCRs [

15,

18,

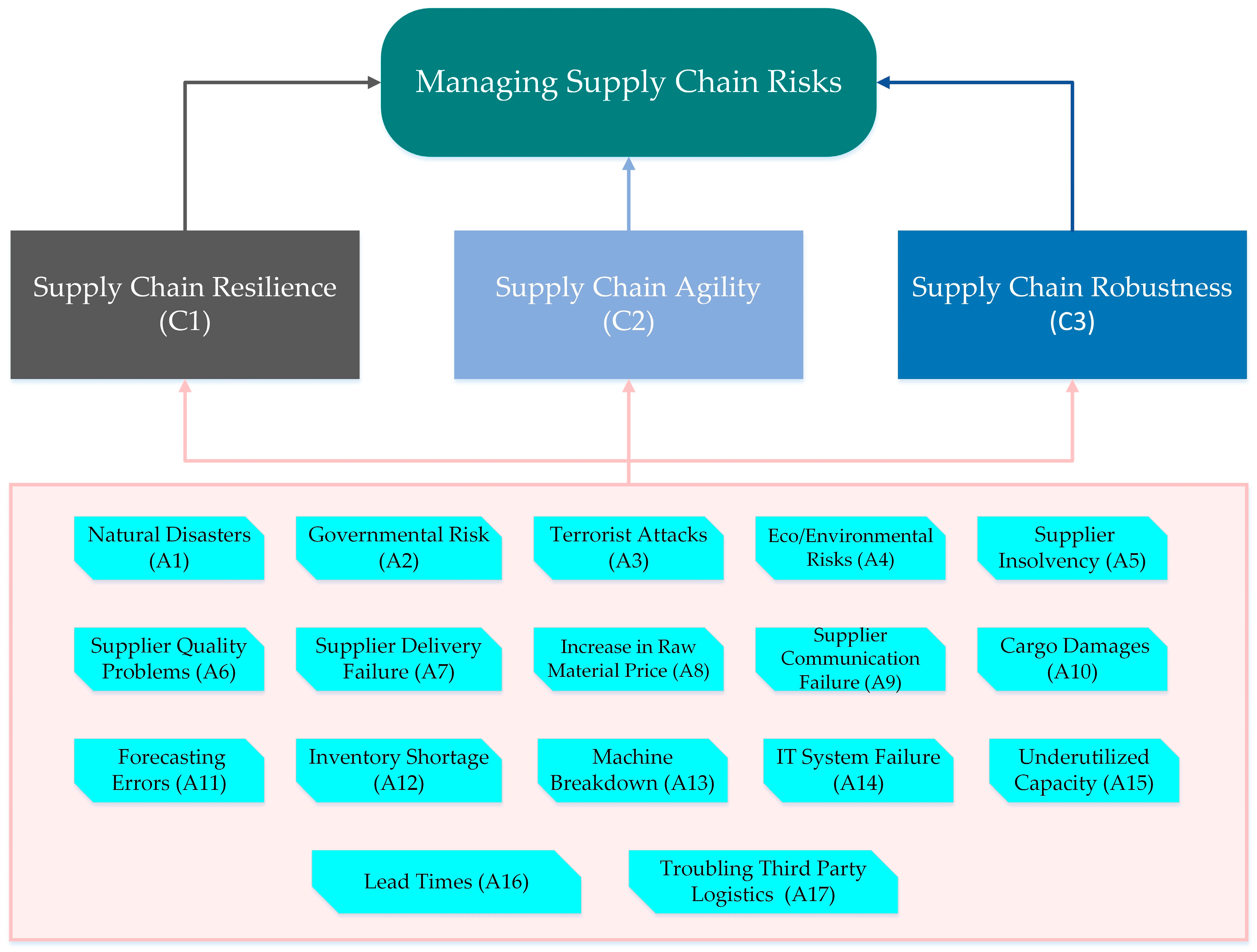

19]. Practices for managing SCRs can be categorized as SC resilience, SC agility, and SC robustness [

20,

21,

22,

23]. The previous literature suggests that these three practices are followed when SCR mitigation strategies are developed [

3,

20,

24,

25,

26,

27,

28,

29].

SC resilience is a broader concept and is well-known for its adaptive characteristics and capabilities to deal with disruptive situations. SC resilience has three dimensions, alertness, preparedness, and flexibility, which are also known as its capabilities [

30]. SC agility deals with disruptive situations quickly and tries to get back to its natural position as soon as possible, through its reactive ability to cope with changes, causing minimum or zero damage [

21,

31]. Both SC resilience and SC agility are reactive approaches for managing SCRs. SC agility refers to reaction speed and quickness to changing situations, while SC resilience deals with the situation in mature and steady manners [

11]. Alternatively, SC robustness is a proactive approach that deals with risks through a reduction in complex organization structures, complex processes, maintaining excess resources, and developing more stable processes that resist SCRs [

32,

33,

34]. Among SCR mitigation strategies based on SC resilience, SC agility, and SC robustness, previous studies have frequently cited an increase in capacity, increase in responsiveness, increase in flexibility, aggregate demand, increase in capability, redundant supplier, increase in inventory, and postponement [

17,

25,

35].

Although the previous literature suggests the importance of SC resilience, SC agility, and SC robustness for managing SCRs [

8,

28,

36], it has surprisingly treated them separately and lacks in clarifying their context to different situations and applicability. The previous literature is insufficient in explaining which practice to use in handling which type of risk. What is the most important criterion or practice among these? Implementing each practice and developing strategies for risk mitigation cost firms in many ways. Therefore, it is essential to clarify the use and applicability of each practice in managing SCRs. While quantifying SCRs, the critical questions for supply chain managers are as follows: Which are the essential criteria for managing supply chain risks? Which are the preferable risk mitigation strategies in different situations? Which are the most favorable risk assessment techniques? For each condition, which is the best criterion?

The conventional approaches for assessing and managing SCRs are unable to deal with the above questions. They cannot describe which risk has the most vulnerable effects on the firm’s supply chain and performance? Which practice/criteria can deal with which type of risk? Which strategies can be developed following the criteria for managing SCRs? Therefore, to investigate the most crucial practices/criteria among SC resilience, SC agility, and SC robustness for managing SCRs, we developed a holistic approach for managing SCRs based on multi-criteria decision-making (MCDM) approach. Neutrosophic logic is adopted due to its ability to deal with incompleteness, vagueness, and uncertainty. Smarandache introduced neutrosophic theory in 1995 which was advanced by the fuzzy theory and fuzzy intuitionistic theory [

37]. Apart from the similarity of triangular numbers, with fuzzy theory, neutrosophic sets are classified based on the degree of truthiness, falsity, and indeterminacy [

38]. To achieve research objectives, we adopted the neutrosophic theory and merged it with the analytic hierarchy process (AHP) and technique for order preference, by matching similarity to the ideal solution (TOPSIS).

Hence, this study aims at answering the following questions:

What are the most important criteria/practices for managing SCRs in the automotive industry?

Under which condition, what criteria perform better?

Which are the most vulnerable SCRs in the automotive industry?

We developed a model based on the neutrosophic theory for assessing SCRs and evaluating the most essential practices/criteria for managing SCRs in the automotive industry. In particular, the model evaluates criteria based on scores from decision-makers’ judgments and ranks the most important criteria. Moreover, different risks are classified from the supply chain risk literature, assessed through expert scores, and ranked based on their scores and relevant criteria.

This paper contributes to the literature in multiple ways. First, there is a lack of research providing guidance to the managers to identify strategies for managing SCRs under the criteria of SC resilience, SC agility, and SC robustness. Therefore, this study fulfills this gap by identifying the most important criteria for developing strategies and managing SCRs. Second, this study ranks the most vulnerable SCRs according to their degree of harmfulness and relative criteria for supply chain risk management (SCRM). Third, according to the author’s knowledge, there is no previous evidence of any study related to SCR assessment in the automotive industry of Pakistan. Therefore, this study fills the gap in the literature and has practical and managerial implications for SC managers and firms in the automotive industry of Pakistan.

The remainder of the paper is as follows. The next section provides the literature review about SCRs, SCRM, and SCRM practices and gives overview of risk assessment methods.

Section 3 deals with methodology and provides the information about neutrosophic logic and application of N-AHP, and N-TOPIS.

Section 4 presents the practical implementation of the proposed methodology through a case study of the automotive industry in Pakistan. Finally, the conclusion is presented in

Section 5, which also provides practical and managerial implications and study limitations.

2. Literature Review

This section contains the theoretical background of constructs and models used in this study, such as supply chain risks, criteria for managing supply chain risks, risk mitigation strategies, neutrosophic-AHP, and neutrosophic-TOPSIS. Based on the previous literature, research gaps are identified and methodology is proposed to fill these gaps.

2.1. Supply Chain Risk

Risk has three essential elements, which are loss, significance, and chances of occurrence [

22]. What should be done about a risk depends on its attributes; the options are to accept, avoid, or mitigate. Risk is defined as the “likelihood of loss and the significance of that loss to the organization or individual” [

39]. SCR has gained much consideration in recent years, and different studies [

40,

41,

42,

43] have presented the definition of SCR, but, they are dissimilar and depend on different situations and scenarios, and their applicability is limited in SCRM. However, there are few studies [

6,

41,

42,

44,

45] which are considered the backbone of the SCR literature; definitions and classification of the SCRs presented by them are useful for the firms.

Zidisin stated that “SCR is the probability of an incident associated with inbound supply from an individual supplier failure or the supply market occurring, in which its outcomes result in the inability of the purchasing firm to meet the customers demand or causes threats to the customer’s life and safety” [

44]. Juttner defined supply chain risk as “variation in the distribution of possible supply chain outcomes, their likelihood, and their subjective values” [

42]. Moreover, Lavastre et al. defined SCR as follows: “Those small events and incidents that happen to one or several parts in the supply chain and affect the whole supply chain negatively and restricts in achieving organizational goals” [

6]. Alternatively, Prakash et al. stated that “SCR is the potential occurrence of an incident or failure to seize opportunities in the Supply chain in which its outcomes result in a financial loss for the firm” [

46].

Although previous researchers have presented definitions of SCR according to the context and nature of the study, there are still some similarities between them. Most of the researchers have classified SCR into two categories, internal SCR and external SCR [

47]. Others [

48,

49,

50,

51] divided SCR into three groups: risk internal to supply chain, risk external to supply chain, and risk internal to firm but external to supply chain. The study of Chopra and Sodhi [

1] proposed nine sources for SCRs: disruptions, forecast, delays, intellectual property, systems, receivables, capacity, inventory, and procurement. This classification is more comprehensive, as it contains all the operational levels in nine categories and elaborates the internal risks more precisely [

1].

Moreover, Thun et al. categorized internal supply chain risks into two categories, internal company risks and cross-company-based risks. Internal risks are those which arise due to the internal settings of a company, while cross-company risks occur due to the noncooperation of supply chain partners and are outside the control of the focal company. It is also empirically proven that internal risks arise more frequently and affect the firm’s day-to-day operations [

52]. In contrast, external risks do not occur as regularly, but their impact on the firm is more severe compared to internal SCRs. According to Manuj and Mentzer, internal supply chain risks should gain the primary attention of the supply chain managers, to mitigate risks and timely avoid supply chain disruption [

53].

The literature on SCR investigated two comprehensive issues, which are the background and sources of SCRs, and the impact and management of SCRs [

54]. SCRs may come up from multiple sources [

9], such as regulatory changes, customer or supplier side [

55], issues related to labor (such as strikes) [

56], logistic providers, forecasting errors [

55], machine breakdown, inventory shortage, IT malfunctioning, natural disasters, terrorist attacks [

4], and geopolitical risks [

57]. Moreover, there is an increasing trend regarding the adoption of sustainability, which requires firms to become sustainable and apply techniques in compliance with ISO 14000/14001 [

48]. Sustainability has three pillars: environmental, economic, and social, also known as triple bottom line (TBL) [

58]. Sustainable firms have different operations, and they face various risks, such as sustainable suppliers risk, sustainable demand risk, sustainable manufacturing risk, green logistics and distribution, and noncompliance with environmental management system (EMS) [

24]. These factors create complexity among organizations’ structure in achieving firms’ efficiency and increases their exposure to SCRs. The discussion on SCRs is not to one direction, as many elements trigger SCRs and can disturb a firm’s operations, which decreases SC and overall performance. Therefore, firms are required to develop a framework that helps in supply chain risk management. The authors have taken the automotive industry as a case study to implement the proposed methodology.

2.2. Managing Supply Chain Risks

Managing risks in the supply chain is essential in the automotive sector. Automotive supply chains involve more uncertainty compared to other industries’ supply chains due to their complex nature of business and structure. Previous studies on SCRM among automotive firms have explained different approaches and strategies which can be adopted for managing SCRs [

4,

46,

57,

59,

60]. According to Thun et al. [

4], there are two types of approaches for SCRM in the automotive industry: proactive and reactive. Proactive approaches are often cause-related, which lowers the chances of occurrence of SCRs. Reactive approaches are effect-oriented, which strive for decreasing the impact of SCRs. The selection of high-quality and high on-time delivery suppliers, supplier development, integration, and preventing measures for geopolitical risks are some proactive instruments. Multiple sourcing, safety stocks, and IT system backup are some reactive instruments [

23,

52,

60].

Previous studies of SCRM have stated that improving flexibility and building redundancies can help in managing SCRs and creating supply chain resilience [

15,

18,

19]. Redundancy is a measure that maintains excessive resources, such as excessive inventory, safety stocks, etc. [

18,

33,

34,

61]. On the other hand, flexibility is referred to as being a firm’s ability to react to the environmental changes that occur in the supply chain and handle these changes with little damage, less time, low cost, and high performance [

31,

62]. Flexibility is a broader term than redundancy and varies from context to context. Postponement is a highly effective SCRM strategy developed following SC flexibility [

25]. Postponement refers to the delay in activities that allow firms to cope with the changing environment [

63]. Carbonara and Pellegrino extended the postponement strategy in managing supply and demand-side risks [

25].

Previous literature on SCRM has categorized SCRM practices as either resilient, agile, or robust [

26,

28,

29,

59,

64,

65,

66,

67]. A resilient supply chain is one that returns to its original state after getting disturbed [

68]. While an agile supply chain refers to speed and quickness of recovering from the disruption in the supply chain [

20,

26,

69]. On the other hand, a robust supply chain is one that stays functional during uncertainties and can withstand disruptions and maintain the original state [

32,

70]. Although the previous literature has shown the importance of SC resilience, SC agility, and SC robustness, it is astonishing that existing studies have treated them separately. None of them has discussed which is the most important criterion among the three concepts in managing SCRs. Therefore, to fill the research gap, this study aims at analyzing which is the most important criterion among three in managing SCRs. The following section discusses SC resilience, SC agility, and SC robustness in detail.

2.2.1. Supply Chain Resilience

Resilience is an old concept that has its roots in sociology, psychology, and biological systems but is still in the development stage. Different disciplines, such as ecology, politics, and risk management, have tried to extract their essence to use in their fields. Although resilience is used in different disciplines, the existing terminology and context of resilience are contradictory. As far as resilience in the management discipline is concerned, various scholars have endeavored to provide a clear impression of resilience [

8,

26,

28,

36,

71,

72]. Supply chain disruption is an area of concern for supply chain managers due to its high rate of occurrence and severe impact on the supply chain itself and firms as a whole [

73]. For minimizing the effects of SCRs, supply chains should be prepared to respond in a timely manner and return to the original state after SCDs have occurred. Therefore, firms pursue accelerating recovery or avoiding the SCRs, through developing supply chain resilience [

74].

Supply chain resilience deals with various kinds of SCRs at different levels of the supply chain during the SCRM process. Therefore, SC resilience is a critical element for managing SCRs [

75]. Ponomarove presented a comprehensive definition of SC resilience: SC resilience is “adaptive capability of the supply chain to prepare for unexpected events, respond to disruptions, and recover from them by maintaining continuity of operations at the desired level of connectedness and control over structure and function”. According to the definition, it seems that SC resilience has a two-way effect. On the one hand, it works as a proactive approach in SCRM due to its capability of avoiding SCDs; on the other hand, it works as a reactive approach in SCRM due to its capability of restoring the supply chain to its original state [

74].

SC resilience manages supply chain risks and increases supply chain performance through its capabilities. The primary capabilities of SC resilience are redundancy, flexibility, and collaboration among SC partners [

3,

11,

35,

73].

2.2.2. Supply Chain Agility

The concept of agility in the organization has gained popularity over the past few decades, but the concept of supply chain agility was termed by Christopher [

76] and Lee [

35]. Yusuf et al. [

69] proposed that SC agility enhances a firm’s competitive advantage through its capabilities of managing uncertainties and improving SC performance. Different researchers [

23,

66,

67,

76,

77] have presented the definition of SC agility, but Swafford et al. provided a comprehensive definition of SC agility: “SC agility is the capability of the supply chain to adapt or respond quickly to the dynamic and unpredictable business environment” [

66]. SC agility is a reactive approach to managing SCRs [

20]. SC agility is mostly misunderstood and is mistakenly interchanged with similar concepts, such as flexibility, adaptability, resilience, etc. [

78]. Flexibility is known as the capacity to handle an uncertain situation, which is one characteristic of SC agility. On the other hand, adaptability denotes the capability to adapt to the uncertainty in it, which is also a characteristic of SC agility.

While SC resilience is another concept, both SC resilience and SC agility are reactive approaches in SCRM. SC agility responds quickly to uncertain situations and tries to get back to the original state as soon as possible. Due to its quickness and rapid solutions, firms try to be agile in their operations [

54]. SC agility has different dimensions, such as demand responsiveness, customer responsiveness, supply responsiveness, supply chain integration, and joint planning. All these dimensions are key drivers of SCR mitigation and responding to market uncertainties [

79]. SC agility has three levels; organizational level, capability level, and performance level [

54]. At the organizational level, SC agility refers to the response to the changes in the needs of customers [

80,

81]. At the capability level, SC agility is about operational capabilities, such as integration amongst its supply chain partners to cope with uncertainties [

27,

82]. Performance-level SC agility refers to the outcomes and enhanced supply chain performance (SCP) [

83].

2.2.3. Supply Chain Robustness

Firms’ supply chains are facing frequent disruptions from the last decade, and they need a system to cope with these disruptions. In this regard, researchers have come up with the concept of supply chain robustness, which deals with internal and external disruptions and maintains firms operations smoothly [

64]. Weiland defined supply chain robustness as “the ability of a supply chain to resist change without adapting its initial stable configuration” [

64]. The definition explains three concepts. First, SC robustness is proactive risk management practice. Second, it has ability to resist, which means it can cope with changing situations. Third, it has ability to avoid, which means it does not adapt to the changes resists them [

29].

Moreover, SC robustness is about continuity in SC operations and resistance to supply chain disruptions [

84]. In this stage, the supply chain does not need to adapt to the changes and resists the turbulence before they occur. Supply chains adopting this approach are known as robust supply chains [

65]. Different researchers have different views about SC robustness. According to Tang and Christopher, the main characteristics of SC robustness are its physically stronger abilities to tackle disruption [

3]. On the other hand, Dong proposed that redundancy is the main characteristic of SC robustness which can decrease supply chain vulnerabilities to complex and uncertain situations [

85]. Monsotori distinguished SC robustness according to its types, such as SC robustness on a small and large scale, SC robustness on the global and local scale, SC robustness as active and passive, and SC robustness as operational and structural scales. Whatever the scale it is, SC robustness ability copes with internal and external SC disruptions and enhances SC performance [

32].

2.3. Methods for Assessing and Managing Supply Chain Risks

The first and most crucial step in SCRM is SCR assessment. Risk assessment embraces three steps: risk identification, risk analysis, and risk evaluation [

17]. Whether the risk is at an internal level, within the supply chain, or outside the supply chains, it should be identified, assessed, and managed [

86]. Risk assessment provides managers with a better understanding of the uncertain situations, which helps in running operations smoothly through the implementation of proper mitigation strategy or management practice [

87]. There are numerous techniques for supply chain risk assessment [

51], which are classified as qualitative, quantitative, and hybrid risk assessment techniques [

17].

The most used risk assessment techniques are qualitative techniques; these are used in the risk identification process. The most used qualitative methods in the literature are probability-impact matrix [

4], failure mode and effect analysis (FMEA) [

88], process–performance modeling [

89], and empirical analysis [

90].

On the other hand, quantitative techniques for risk assessment are based on analytical hierarchy and simulation methods. Several studies [

91,

92,

93] have used analytical hierarchy methods in the supply chain context. The simulation technique is based on visualization, which deals with stochastic SCRs. Over the past few years, there has been a growing trend in using simulation techniques such as Monte Carlo simulation [

94], discrete-event simulation (DES) [

59,

94], system dynamics (SD) [

95], agent-based simulation (ABS) or multi-agent-based simulation (MAS) [

50,

96,

97], and Petri nets [

98].

Hybrid risk assessment techniques are based on the qualities of both qualitative and quantitative risk-assessment techniques. Hybrid techniques are useful in an uncertain situation where the information is vague and inconsistent [

17]. The previously used hybrid techniques in SCR assessment are based on multi-criteria decision-making (MCDM) approaches, such as analytic hierarchy process (AHP) [

99,

100], fuzzy logic [

101,

102,

103], fuzzy-AHP [

46,

55,

99,

104], fuzzy-TOPSIS [

58,

105], fuzzy interference system (FIS) [

17], cluster analysis [

106], and decision tree analysis (DTA) [

107].

2.3.1. Multi-Criteria Decision-Making Approach

The multi-criteria decision-making approach is useful in a situation when there are different criteria present and are especially contradictory. Every criterion has its features, specifications, measurement units, and relative weights. It is possible to describe some features subjectively, while others can only be described numerically. Therefore, scientists developed the MCDM approach, which has evolved in the 1960s, and it can solve MCDM problems in dozens of different ways. During the 1990s, management issues have got the attention of MCDM approaches and they tend to increase rapidly [

108]. Studies like [

47,

48,

109] described the development stages and applicability of MCDM in the field of economics and management science, which demonstrates its advantages over the traditional approaches for complex and uncertain situations, such as uncertainty in the environment, supply chain disruptions, stakeholder preferences, contradictory criteria, etc. [

108].

Previous studies on SCRM have widely used MCDM approaches, such as analytic hierarchy process (AHP) [

99,

100], fuzzy logic [

101,

102,

103], fuzzy-AHP [

46,

55,

99,

104], fuzzy-TOPSIS [

58,

105], and fuzzy interference system (FIS) [

17]. Although a number of MCDM techniques were applied in the previous studies, they are not free from drawbacks and limitations. Therefore, to deal with inconsistent, uncertain, and vague information in effective and efficient manners, the neutrosophic theory was developed by Smarandache in 1995. The theory is based on triangular numbers, like fuzzy theory, but has included the degree of membership, such as truthiness, indeterminacy, and falsity, which deal better with inconsistent, uncertain, and vague information. Therefore, in this study, we have combined neutrosophic logic with AHP and TOPSIS, which are MCDM approaches.

2.3.2. Neutrosophic AHP and TOPSIS

Multi-criteria decision-making is very useful in complex decision-making, where the information is vague, imprecise, and uncertain. There are many popular MCDM techniques based on fuzzy logic that can handle complex situations. Later, researchers felt that fuzzy sets were limited in their approach to MCDM. To cope with more complex situations, researchers like Smarandache introduced more advanced theory based on neutrosophic logic. Neutrosophic sets are classified based on the degree of truthiness, indeterminacy, and falsity [

37]. Neutrosophic sets are in use for problem-solving from ways back, but the technique has merged with other techniques, such as AHP and TOPSIS recently [

47].

AHP is an MCDM approach which was first proposed by Saaty in 1970; it is a widely used method for problem-solving and decision-making in complex situations, scenarios, and structures for designing and planning, forecasting, risk assessment, and measurements. AHP divides complex problems into criteria and sub-criteria, and then a pairwise comparison matrix is calculated, and weights are assigned to each criterion [

110]. N-AHP is based on the Saaty AHP technique and integrates it into the neutrosophic sets proposed by Smarandache. In N-AHP neutrosophic scale is used to give preferences to the criteria, and neutrosophic numbers are utilized to indicate the relative preference of the criteria, sub-criteria, and alternatives. Afterward, crisp values are generated through conversion of neutrosophic numbers by the score function [

38].

TOPSIS is an MCDM and order-preference technique that was developed in 1981 by Hwang and Yoon. The selected alternatives are based on the shortest distance to the best ideal solutions and the longest distance to the worst ideal solution. TOPSIS technique is widely used in the supply chain literature regarding supplier selection, risk assessment, ranking, and order preferences. In N-TOPSIS, the values are based on neutrosophic techniques and processes and neutrosophic numbers.

2.4. Motivation for This Study

Several reasons motivate this research work. First, although previous literature has shown the importance of SC resilience, SC agility, and SC robustness, surprisingly, the extant studies have treated them separately. None has discussed which is the essential criterion among the three concepts in managing SCRs. Second, there is a lack of research on SCRM which guides SC managers in identifying mitigation strategies based on these three principles/criteria and tells under which situation which criteria to follow while developing strategies. Third, there are various supply chain risks that affect SC performance. Assessing these risks helps SC managers in developing mitigation strategies. Therefore, to fill in the research gap, this study aims at analyzing the most important criteria among SC resilience, SC agility, and SC robustness in managing SCRs. This study also assesses the most vulnerable risks in the automotive industry of Pakistan.

Finally, since the existing qualitative, quantitative, and hybrid methods for managing risks in the supply chain are not excluded from drawbacks, it develops motivation for a more reliable method to deal with inconsistent and vague information. Qualitative techniques do not provide any mathematical expressions and are based on judgments that are inconsistent and vague. Quantitative techniques also have drawbacks, as they are dependent on the accuracy and range of the prescribed measurement scales. They lack in relating to qualitative techniques, which are the primary source of information for identification of risk. Moreover, quantitative methods are expensive and require more time and experience for accuracy. Hybrid techniques such as fuzzy logic and cluster analysis are based on subjective values and lack indeterminacy. Therefore, they also lack in handling inconsistent, uncertain, and vague information.

Therefore, to deal with inconsistent, uncertain, and vague information in effective and efficient manners, the neutrosophic theory was developed by Smarandache in 1995. The theory is based on triangular numbers, like the fuzzy theory, but has included the degree of membership, such as truthiness, indeterminacy, and falsity, which deal better with inconsistent, uncertain, and vague information. We combined neutrosophic logic with two MCDM approaches, AHP and TOPSIS, in this study as proposed by Abdel-Basset et al. [

47].

5. Discussion and Conclusions

This study was aimed at managing supply chain risks in the automotive industry of Pakistan. For this purpose, the following research questions were developed: What are the most vulnerable SCRs in the automotive industry of Pakistan? What are the most important criteria/practices for managing SCRs in the automotive industry? Under which conditions, what criteria perform better? Therefore, the results of the study are discussed in detail in this section.

Three criteria (SC resilience, SC agility, and SC robustness) for managing supply chain risk were developed after close interaction with supply chain risk literature and discussion with a panel of experts. This study employs the MCDM approach (N-AHP and N-TOPSIS) for selecting the best criteria for managing SCRS and the assessment of SCRs in the automotive industry of Pakistan. The neutrosophic-scale was used to collect the scores for each criterion from the panel of experts; then the score for each expert was aggregated, and the final matrix was generated. Using the score function of N-AHP, which is an MCDM approach, we calculated the weights for each criterion based on expert scores. The weights for the three criteria, SC resilience, SC agility, and SC robustness, for managing SCRs in the automotive industry of Pakistan are 0.68, 0.28, and 0.1, respectively. Therefore, the results of the study indicate that SC resilience is the most important criteria for managing supply chain risks, followed by SC agility and SC robustness. SC resilience has a two-way effect; on the one side, it works as a proactive approach in SCRM due to its capability in avoiding SCDs. On the other side, it works as a reactive approach in SCRM due to its capability of restoring the supply chain to its original state [

55]. The primary capabilities of SC resilience are redundancy, flexibility, and collaboration among SC partners [

3,

19,

54,

57].

To assess the most vulnerable risks in the supply chain of the automotive industry in Pakistan, a questionnaire was discussed with the experts in the field and academia. Later, they were requested to list all possible risks in the automotive industry of Pakistan. This process took one and a half hours; in this time, we used the cognitive mapping technique for identifying the SCRs in the automotive industry of Pakistan. A total of seventeen risks were identified, which belong to six categories of SCRs: eco/environmental, industry-related, organizational, operational, supply-related, and demand-related risks. The identified risks are natural disasters, government restriction/tax impositions, terrorist attacks, environmental risks, insolvency of suppliers, supplier quality problems, supplier delivery failures, increase in raw material prices, communication failures, upstream cargo damages, demand fluctuations, inventory shortages, machine breakdowns, malfunction of IT systems, underutilized capacity, lead times, and troubling third-party logistics.

This is the first study of its kind that investigates SCRs relative to their management criteria and describes the degree of harmfulness of each risk under a particular criterion of management. For this purpose, the N-TOPSIS approach was applied to the case study, and the decision matrix was calculated (see

Table 9). Results indicate the degree of closeness for each risk if a certain criterion is adopted for making risk mitigation strategies. For example, supplier delivery delay has a score of 0.29, 0.33, and 0.13, respectively, which represents that the degree of closeness of supplier delivery risks is 0.29 under SC resilience, 0.33 under SC agility, and 0.13 under SC robustness. This scenario tells that SC agility is the best, and SC robustness is the worst practice followed to formulate strategies for managing supply-delivery risks. Therefore, this study provides a comprehensive solution for managing supply chain risks in the automotive industry of Pakistan.

To perform an SCR assessment in the automotive industry of Pakistan, we used the N-TOPSIS approach. Decision-makers were requested to provide scores, using a neutrosophic scale by which SCRs are analyzed. The final matrix was calculated by taking the aggregate of scores provided by the decision-makers, and then the risks were ranked based on their score for the degree of closeness to the ideal solutions (see

Table 10). The results of the study indicate that supply-related risks are the most vulnerable, and economic and environmental risks are the least vulnerable supply chain risks in the automotive industry of Pakistan. Moreover, supplier delivery delay is ranked as the most disruptive risks, and terrorist attacks are ranked as the least. According to these results, supply-side and demand-side risks are high in the automotive industry of Pakistan. Therefore, firms in the automotive industry in Pakistan are in dire need of criteria that could help them in managing these risks, which are provided through this study.

5.1. Managerial and Theoretical Implications of the Study

This study contributes to the SCRM literature by identifying key criteria for managing supply chain risks. The above discussion on the results of this study offers guiding principles to mangers in identifying, assessing, and managing SCRs in the automotive industry of Pakistan. This study provides several theoretical contributions. First, this study evaluates the principles of managing supply chain risks, which were not dealt with previously and treated separately. A framework for managing supply chain risks through its relevant criteria based on the degree of closeness is presented. Second, this study deals with identifying and assessing the most vulnerable risks in the automotive industry of Pakistan. Besides theoretical contributions, this study presents some practical implications for the managers in the automotive industry in Pakistan. First, this study has ranked SCRs based on their degree of harmfulness; managers can find which risk has what rank in the list. For example, supply delivery risk is ranked as no. 1, supplier communication is ranked as no.2, and a terrorist attack is ranked as the last one. Second, three risk-management criteria are identified and evaluated, which can be used for developing risk mitigation strategies. Finally, this study provides managers with a full understanding of under what circumstances which criteria perform better. SCRs are evaluated relative to each circumstance based on their degree of closeness, which tells what risk could be better managed with which criteria/practices. Managers in the field can follow the same procedure in making mitigation strategies and managing the supply chain risks.

5.2. Limitations and Future Research Avenues

Although this study contributes to the literature on supply chain risk management in multiple ways, it is subject to limitations which could be dealt with in future studies. First, this study deals with identifying key criteria/practices for managing supply chain risks among SC resilience, SC agility, and SC robustness, but their dimensions are not empirically tested. Therefore, a study that includes dimensions for each practice and their ability to handle supply chain risks and restoring firm performance on a large scale is proposed. Second, this study only deals with the automotive industry in Pakistan, and its applicability to other sectors is limited. Therefore, there is a huge potential to establish the research in the textile, IT, and electronics industries, to deal with risks arising in their supply chains, as they are the emerging sectors in Pakistan and other developing countries. Finally, this study explains the context of only one country, and its applicability to other countries is limited due to different behavioral and business peculiarities. Therefore, a cross-country comparison is suggested for future studies, to generalize the results.