Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining

Abstract

1. Introduction

- Can humankind afford to condone processes that further increase global emissions in the midst of existing catastrophic event emanating from climate change?

- How rapid can we proffer solutions to massive cryptocurrency energy-consumption, should cryptocurrency mining be sustained?

- Would it be in our best interest to place bans on mining of Bitcoin and other cryptocurrencies, thus holding on to only to positive aspects of Blockchain, given that these virtual currencies have not yet been accepted in totality in many societies, in addition to the fact that such innovations may add-up to existing global climate challenges?

- How sustainable can our so-called smart cities be in the midst of huge energy deficit offered by mining virtual currencies?

2. Related Literature

2.1. The Concept of Sustainable Smart Homes and Cities in Terms of Energy Efficiency

2.2. Flaws of Conventional Financial Systems and the Birth of Cryptocurrencies

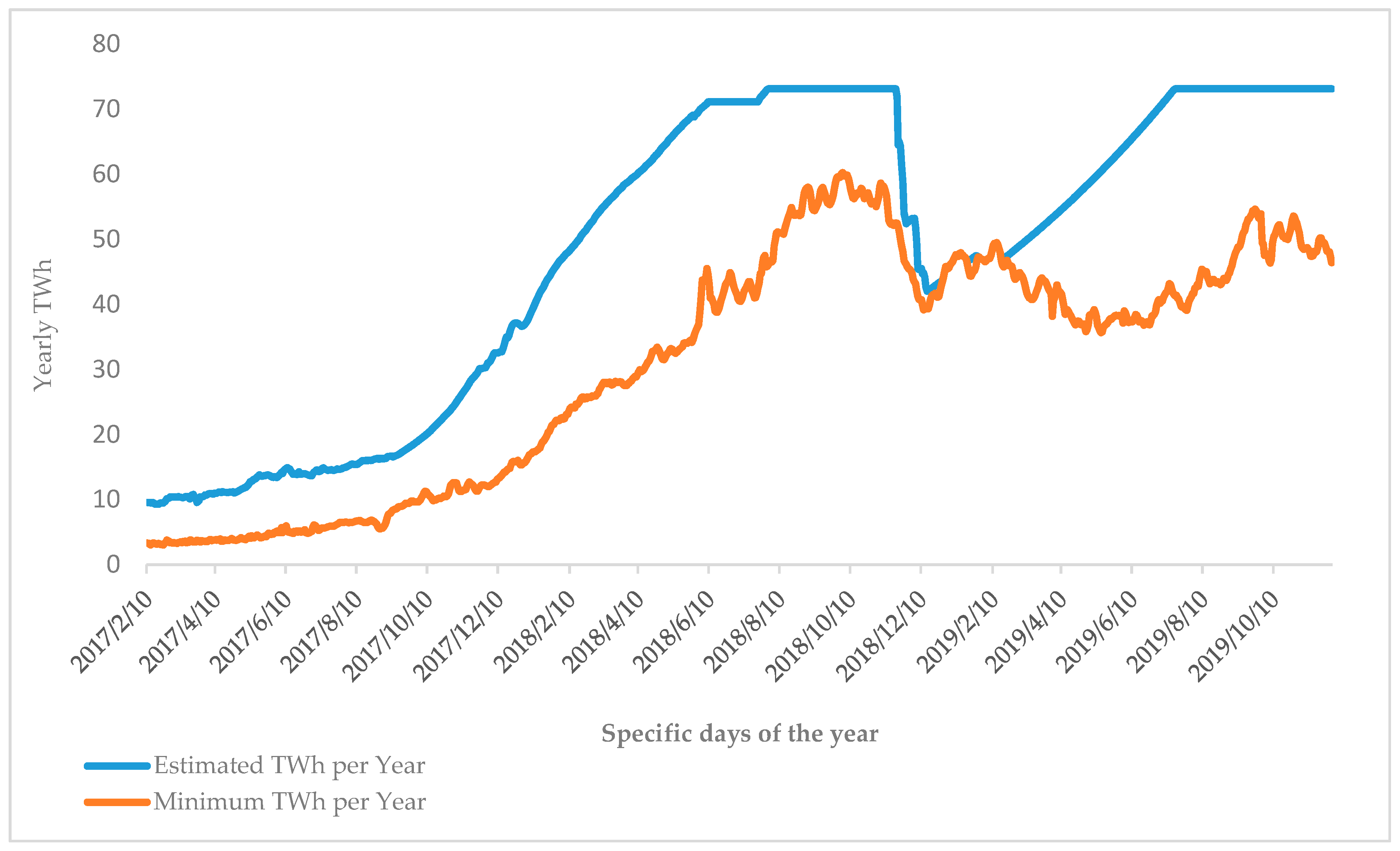

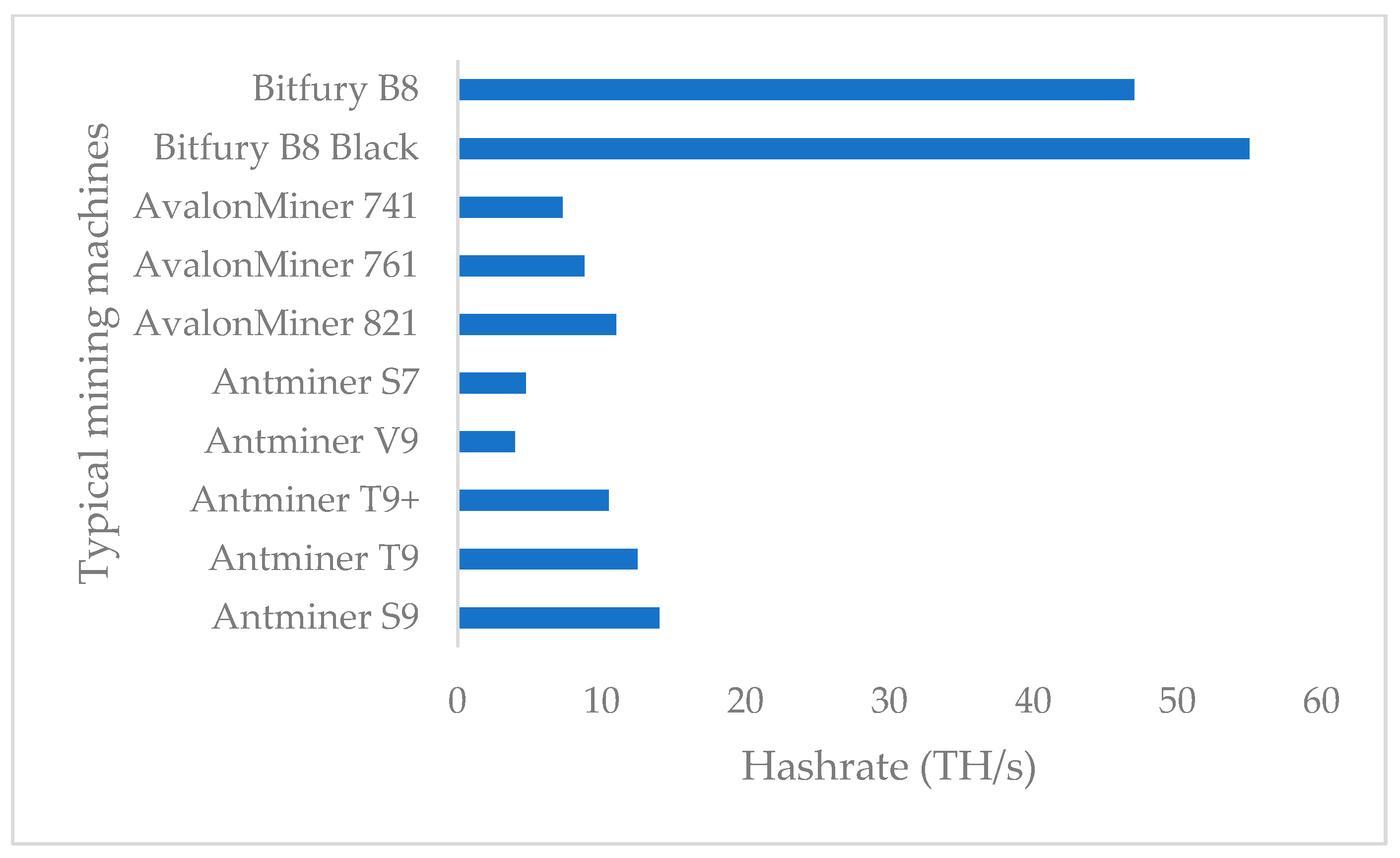

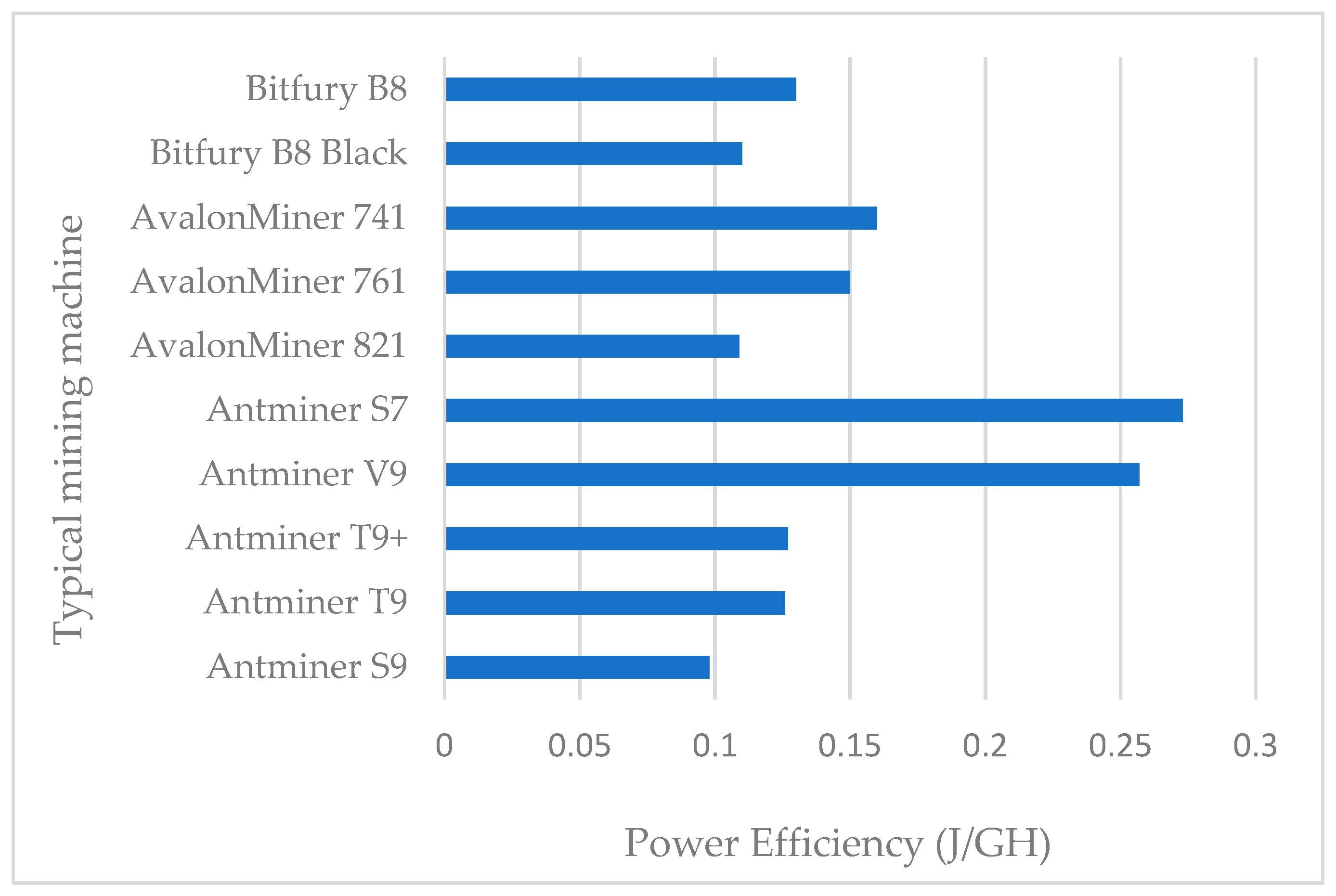

2.3. Virtual Currency Mining and Enegy Use in Smart Cities

2.4. Consensus Protocols

3. Regulating the Mining and Usage of Virtual Currencies: Relegating Energy Efficiency

The Fate of Crypto Mining in the Midst Energy Deficit: The Way forward

4. Discussion

5. Conclusions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Orru, H.; Ebi, K.L.; Forsberg, B. The Interplay of Climate Change and Air Pollution on Health. Curr. Environ. Health Rep. 2017, 4, 504–513. [Google Scholar] [CrossRef] [PubMed]

- Boehmer-Christiansen, S. Fuel for Thought Mid-December 2013 to End of January 2014. Energy Environ. 2014, 25, 419–515. [Google Scholar]

- Krause, M.J.; Tolaymat, T. Quantification of energy and carbon costs for mining cryptocurrencies. Nat. Sustain. 2018, 1, 711–718. [Google Scholar] [CrossRef]

- Chapron, G. The environment needs cryptogovernance. Nat. News 2017, 545, 403. [Google Scholar] [CrossRef]

- Wang, W.; Hoang, D.T.; Hu, P.; Xiong, Z.; Niyato, D.; Wang, P.; Wen, Y.; Kim, D.I. A Survey on Consensus Mechanisms and Mining Strategy Management in Blockchain Networks. IEEE Access 2019, 7, 22328–22370. [Google Scholar] [CrossRef]

- Maresova, P.; Sobeslav, V.; Krejcar, O. Cost–benefit analysis–evaluation model of cloud computing deployment for use in companies. Appl. Econ. 2017, 49, 521–533. [Google Scholar] [CrossRef]

- Gupta, V. A Brief History of Blockchain. Harv. Bus. Rev. 2017, 28. Available online: https://hbr.org/2017/02/a-brief-history-of-blockchain (accessed on 24 December 2019).

- Beyer, S. Blockchain Before Bitcoin: A History; Block Telegraph: London, UK, 2018. [Google Scholar]

- Haber, S.; Stornetta, W.S. How to time-stamp a digital document. J. Cryptol. 1991, 3, 99–111. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 24 December 2019).

- Drosatos, G.; Kaldoudi, E. Blockchain Applications in the Biomedical Domain: A Scoping Review. Comput. Struct. Biotechnol. J. 2019, 17, 229–240. [Google Scholar] [CrossRef]

- Tama, B.A.; Kweka, B.J.; Park, Y.; Rhee, K. A critical review of blockchain and its current applications. In Proceedings of the 2017 International Conference on Electrical Engineering and Computer Science (ICECOS), Palembang, Indonesia, 22–23 August 2017; pp. 109–113. [Google Scholar]

- Shuaib, K.; Saleous, H.; Shuaib, K.; Zaki, N. Blockchains for Secure Digitized Medicine. J. Personal. Med. 2019, 9, 35. [Google Scholar] [CrossRef]

- Khezr, S.; Moniruzzaman, M.; Yassine, A.; Benlamri, R. Blockchain Technology in Healthcare: A Comprehensive Review and Directions for Future Research. Appl. Sci. 2019, 9, 1736. [Google Scholar] [CrossRef]

- Hölbl, M.; Kompara, M.; Kamišalić, A.; Nemec Zlatolas, L. A Systematic Review of the Use of Blockchain in Healthcare. Symmetry 2018, 10, 470. [Google Scholar] [CrossRef]

- Agbo, C.C.; Mahmoud, Q.H.; Eklund, J.M. Blockchain Technology in Healthcare: A Systematic Review. Healthcare 2019, 7, 56. [Google Scholar] [CrossRef] [PubMed]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef] [PubMed]

- Christidis, K.; Devetsikiotis, M. Blockchains and Smart Contracts for the Internet of Things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- Park, J.H.; Park, J.H. Blockchain Security in Cloud Computing: Use Cases, Challenges, and Solutions. Symmetry 2017, 9, 164. [Google Scholar] [CrossRef]

- Alammary, A.; Alhazmi, S.; Almasri, M.; Gillani, S. Blockchain-Based Applications in Education: A Systematic Review. Appl. Sci. 2019, 9, 2400. [Google Scholar] [CrossRef]

- Wang, J.; Wang, S.; Guo, J.; Du, Y.; Cheng, S.; Li, X. A Summary of Research on Blockchain in the Field of Intellectual Property. Procedia Comput. Sci. 2019, 147, 191–197. [Google Scholar] [CrossRef]

- De Rose, R.; Felicetti, C.; Raso, C.; Felicetti, A.M.; Ammirato, S. A Framework for Energy-Efficiency in Smart Home Environments. In Collaborative Systems for Smart Networked Environments; Camarinha-Matos, L.M., Afsarmanesh, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2014; pp. 237–244. [Google Scholar]

- Filho, G.P.R.; Villas, L.A.; Gonçalves, V.P.; Pessin, G.; Loureiro, A.A.F.; Ueyama, J. Energy-efficient smart home systems: Infrastructure and decision-making process. Internet Things 2019, 5, 153–167. [Google Scholar] [CrossRef]

- Calvillo, C.F.; Sánchez-Miralles, A.; Villar, J. Energy management and planning in smart cities. Renew. Sustain. Energy Rev. 2016, 55, 273–287. [Google Scholar] [CrossRef]

- Navidi, A.; Khatami, F.A. Energy management and planning in smart cities. CIRED Open Access Proc. J. 2017, 2017, 2723–2725. [Google Scholar] [CrossRef]

- Chicco, G.; Mancarella, P. A unified model for energy and environmental performance assessment of natural gas-fueled poly-generation systems. Energy Convers. Manag. 2008, 49, 2069–2077. [Google Scholar] [CrossRef]

- US Environmental Protection Agency. Catalog of CHP Technologies. Available online: https://www.epa.gov/chp/catalog-chp-technologies (accessed on 7 October 2019).

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Morvaj, B.; Lugaric, L.; Krajcar, S. Demonstrating smart buildings and smart grid features in a smart energy city. In Proceedings of the 3rd International Youth Conference on Energetics (IYCE), Leiria, Portugal, 7–9 July 2011; pp. 1–8. [Google Scholar]

- De Vries, A. Bitcoin’s Growing Energy Problem. Joule 2018, 2, 801–805. [Google Scholar] [CrossRef]

- Chicco, G.; Mancarella, P. CO2 Emission Reduction from Sustainable Energy Systems: Benefits and Limits of Distributed Multi-Generation. In Proceedings of the Second International Conference on Bioenvironment, Biodiversity and Renewable Energies, Venice, Italy, 22–27 May 2011. [Google Scholar]

- Xu, H.; Eronini, I.U.; Mao, Z.; Jones, A.K. Towards improving renewable resource utilization with plug-in electric vehicles. IEEE Power Energy Manag. 2011, 9, 1–6. [Google Scholar]

- Maharjan, L.; Yamagishi, T.; Akagi, H. Active-Power Control of Individual Converter Cells for a Battery Energy Storage System Based on a Multilevel Cascade PWM Converter. IEEE Trans. Power Electron. 2012, 27, 1099–1107. [Google Scholar] [CrossRef]

- Xing-Guo, T.; Hui, W.; Qing-Min, L. Multi-port topology for composite energy storage and its control strategy in micro-grid. In Proceedings of the 7th International Power Electronics and Motion Control Conference, Harbin, China, 2–5 June 2012; Volume 1, pp. 351–355. [Google Scholar]

- Karnouskos, S. Demand Side Management via prosumer interactions in a smart city energy marketplace. In Proceedings of the 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies, Manchester, UK, 5–7 December 2011; pp. 1–7. [Google Scholar]

- Litos Strategic Communication. The Smart Grid: An Introduction; U.S. Department of Energy: Washington, DC, USA, 2008. [Google Scholar]

- Sun, J.; Yan, J.; Zhang, K.Z.K. Blockchain-based sharing services: What blockchain technology can contribute to smart cities. Finance Innov. 2016, 2, 26. [Google Scholar] [CrossRef]

- Craig, K. PUD Board Acts to Halt Unauthorized Bitcoin Mining. Available online: https://www.chelanpud.org/about-us/newsroom/news/2018/04/03/pud-board-acts-to-halt-unauthorized-bitcoin-mining (accessed on 2 December 2019).

- Craig, K. PUD Commissioners Halt Work on Applications from Bitcoin & Similar Data Operations. Available online: http://www.chelanpud.org/about-us/newsroom/news/2018/03/20/pud-commissioners-halt-work-on-applications-from-bitcoin-similiar-data-operations (accessed on 2 December 2019).

- Leonard, D.; Treiblmaier, H. Can Cryptocurrencies Help to Pave the Way to a More Sustainable Economy? Questioning the Economic Growth Paradigm. In Business Transformation through Blockchain: Volume II; Treiblmaier, H., Beck, R., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 183–205. ISBN 978-3-319-99058-3. [Google Scholar]

- Dyson, B.; Hodgson, G.; Van Lerven, N. Sovereign Money: An Introduction. Available online: https://positivemoney.org/2016/12/sovereign-money-an-introduction/ (accessed on 14 July 2019).

- Banco Central do Brasil. Reserve Requirement/Obligatory Reserves. Available online: https://www.rba.gov.au/publications/submissions/financial-sector/inquiry-australian-banking-industry/pdf/inquiry-australian-banking-industry.pdf (accessed on 14 July 2019).

- Federal Reserve. Reserve Requirements. Available online: https://www.federalreserve.gov/monetarypolicy/reservereq.htm (accessed on 14 July 2019).

- Reserve Bank of Australia. Inquiry into Australia’s Banking and Finance Industry. Available online: https://www.rba.gov.au/publications/submissions/financial-sector/inquiry-australian-banking-industry/pdf/inquiry-australian-banking-industry.pdf (accessed on 14 July 2019).

- Hudson, M. The Road to Debt Deflation, Debt Peonage, and Neofeudalism; Levy Economics Institute of Bad College: New York, NY, USA, 2012. [Google Scholar]

- Douthwaite, R. The Ecology of Money; Green Books: Cambridge, UK, 2000; ISBN 978-1-870098-81-6. [Google Scholar]

- Dyson, B. Positive Money: How to Fix the Creation of Money? Available online: https://www.greeneuropeanjournal.eu/positive-money-how-to-fix-the-creation-of-money/ (accessed on 15 July 2019).

- Hileman, G. The History of Alternative Currencies. Available online: https://www.fxcm.com/uk/insights/the-history-of-alternative-currencies/ (accessed on 15 July 2019).

- Boonstra, L.; Klamer, A.; Karioti, E.; Do Carmo, A.; Geenen, S. Complementary Currency Systems: Social and Economic Effects of Complementary Currencies; Erasmus Universiteit Rotterdam: Rotterdam, The Netherlands, 2013. [Google Scholar]

- Elmqvist, T.; Folke, C.; Nyström, M.; Peterson, G.; Bengtsson, J.; Walker, B.; Norberg, J. Response diversity, ecosystem change, and resilience. Front. Ecol. Environ. 2003, 1, 488–494. [Google Scholar] [CrossRef]

- Buyst, E.; Danneel, M.; Maes, I.; Pluym, W. The Bank, the Franc and the Euro. A History of the National Bank of Belgium; Racine Press: Tielt, Belgium, 2005. [Google Scholar]

- Chohan, U.W. Assessing the Differences in Bitcoin & Other Cryptocurrency Legality Across National Jurisdictions; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Digiconomist Bitcoin Energy Consumption Index. Available online: https://digiconomist.net/bitcoin-energy-consumption (accessed on 1 December 2019).

- Li, J.; Li, N.; Peng, J.; Cui, H.; Wu, Z. Energy consumption of cryptocurrency mining: A study of electricity consumption in mining cryptocurrencies. Energy 2019, 168, 160–168. [Google Scholar] [CrossRef]

- Hayes, A.S. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telemat. Inf. 2017, 34, 1308–1321. [Google Scholar] [CrossRef]

- Mishra, S.P.; Jacob, V.; Radhakrishnan, S. Energy Consumption—Bitcoin’s Achilles Heel; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Tahir, R.; Huzaifa, M.; Das, A.; Ahmad, M.; Gunter, C.; Zaffar, F.; Caesar, M.; Borisov, N. Mining on Someone Else’s Dime: Mitigating Covert Mining Operations in Clouds and Enterprises. In Research in Attacks, Intrusions, and Defenses; Dacier, M., Bailey, M., Polychronakis, M., Antonakakis, M., Eds.; Springer International Publishing: Berlin, Germany, 2017; pp. 287–310. [Google Scholar]

- Hileman, G.; Rauchs, M. 2017 Global Cryptocurrency Benchmarking Study; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Huang, Z.; Wong, J.I. The Lives of Bitcoin Miners Digging for Digital Gold in Inner Mongolia. Available online: https://qz.com/1054805/what-its-like-working-at-a-sprawling-bitcoin-mine-in-inner-mongolia/ (accessed on 4 October 2019).

- Xiao, E. Cheap Electricity Made China the King of Bitcoin Mining. The Government’s Stepping in. Available online: https://medium.com/@evawxiao/cheap-electricity-made-china-the-king-of-bitcoin-mining-the-governments-stepping-in-118c20725f7b (accessed on 4 October 2019).

- Peck, M.E. Why the Biggest Bitcoin Mines are in China—IEEE Spectrum. Available online: https://spectrum.ieee.org/computing/networks/why-the-biggest-bitcoin-mines-are-in-china (accessed on 4 October 2019).

- Bitcoin.com. Bitcoin Mining Pool. Available online: https://mining.bitcoin.com/ (accessed on 4 October 2019).

- Wang, J. TSMC—The World’s Largest Chip Factory—Is All About Crypto All of a Sudden. Bitmain is Buying ~20k 16nm Wafers a Month. That’s more than Nvidia. Twitter Post. 2018. Available online: https://twitter.com/jwangARK/status/954429531678543872 (accessed on 24 December 2019).

- Irfan, U. Bitcoin Is an Energy Hog. Where Is All That Electricity Coming From? Available online: https://www.vox.com/2019/6/18/18642645/bitcoin-energy-price-renewable-china (accessed on 27 September 2019).

- Fairley, P. Ethereum Will Cut Back its Absurd Energy Use. IEEE Spectr. 2019, 56, 29–32. [Google Scholar] [CrossRef]

- Fairley, P. Blockchain world—Feeding the blockchain beast if bitcoin ever does go mainstream, the electricity needed to sustain it will be enormous. IEEE Spectr. 2017, 54, 36–59. [Google Scholar] [CrossRef]

- Bonneau, J.; Miller, A.; Clark, J.; Narayanan, A.; Kroll, J.A.; Felten, E.W. SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies. In Proceedings of the 2015 IEEE Symposium on Security and Privacy, San Jose, CA, USA, 17–21 May 2015; pp. 104–121. [Google Scholar]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Pylon Network. Pylon Network Blockchain—Pylon Network. Available online: https://pylon-network.org/pylon-network-blockchain (accessed on 5 December 2019).

- Intel Corporation. Introduction to Sawtooth v1.2.3 Documentation. Available online: https://sawtooth.hyperledger.org/docs/core/releases/latest/introduction.html# (accessed on 5 December 2019).

- Buntinx, J.P. What Is Proof of Elapsed Time? The Merkle Hash. Available online: https://themerkle.com/what-is-proof-of-elapsed-time/ (accessed on 5 December 2019).

- Eurelectric Powering People—Launches Expert Discussion Platform on Blockchain. Available online: https://www.eurelectric.org/news/eurelectric-launches-expert-discussion-platform-on-blockchain (accessed on 5 December 2019).

- Castor, A. A (Short) Guide to Blockchain Consensus Protocols. Available online: https://www.coindesk.com/short-guide-blockchain-consensus-protocols (accessed on 5 December 2019).

- Energy Web. The Grid’s New Digital DNA. Available online: https://www.energyweb.org/ (accessed on 5 December 2019).

- Gesley, J. Regulation of Cryptocurrency in Selected Jurisdictions: Switzerland. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Jenkinson, G. Regulatory Overview of Crypto Mining in Different Countries. Available online: https://cointelegraph.com/news/regulatory-overview-of-crypto-mining-in-different-countries (accessed on 27 September 2019).

- Levush, R. Regulation of Cryptocurrency in Selected Jurisdictions: Isreal. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Sayuri, U. Regulation of Cryptocurrency in Selected Jurisdictions: Japan. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Boring, N. Regulation of Cryptocurrency in Selected Jurisdictions: France. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Isajanyan, N. Regulation of Cryptocurrency in Selected Jurisdictions: Belarus. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Guerra, G. Regulation of Cryptocurrency in Selected Jurisdictions: Mexico. Available online: https://www.loc.gov/law/help/cryptocurrency/switzerland.php (accessed on 27 September 2019).

- Alexandre, A. Russian Parliament Considers Imposing Fines on Crypto Mining by End of June. Available online: https://cointelegraph.com/news/russian-parliament-considers-imposing-fines-on-crypto-mining-by-end-of-june (accessed on 27 September 2019).

- Partz, H. Russia to Adopt Crypto Legislation Within Two Weeks: Deputy Finance Minister. Available online: https://cointelegraph.com/news/russia-to-adopt-crypto-legislation-within-two-weeks-deputy-finance-minister (accessed on 27 September 2019).

- Partz, H. Iranian Government to Cut Off Power to Crypto Mining Until Approval of New Energy Prices. Available online: https://cointelegraph.com/news/iranian-government-to-cut-off-power-to-crypto-mining-until-approval-of-new-energy-prices (accessed on 27 September 2019).

- Post, K. Iran Considers New System of Annual Registration for Crypto Miners. Available online: https://cointelegraph.com/news/iran-considers-new-system-of-annual-registration-for-crypto-miners (accessed on 27 September 2019).

- Fischler, N. Vietnam Has a Cryptocurrency Dilemma. Available online: https://perma.cc/5VF9-MSUE (accessed on 27 September 2019).

- Gas, D. Cryptocurrency Legal Framework in Vietnam: Will be Ready by End of January. InfoCoin 2018. Available online: http://infocoin.net/en/2018/01/08/cryptocurrency-legal-framework-in-vietnam-will-be-ready-by-end-of-january/ (accessed on 23 December 2019).

- IPCC. Summary for Policymakers. In Global Warming of 1.5°C; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2018; p. 24. [Google Scholar]

- Lee, L. New Kids on the Blockchain: How Bitcoin’s Technology Could Reinvent the Stock Market. Hastings Bus. Law J. 2016, 12, 81. [Google Scholar] [CrossRef]

- Pilkington, M. Blockchain technology: Principles and applications. In Research Handbook on Digital Transformations; Edward Elgar Publishing Inc.: Cheltenham, UK, 2016; pp. 225–253. ISBN 978-1-78471-776-6. [Google Scholar]

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World; Portfolio: New York, NY, USA, 2016; ISBN 978-1-101-98013-2. [Google Scholar]

- IPCC. Renewable Energy Sources and Climate Change Mitigation; Cambridge University Press: Cambridge, UK, 2012; pp. 7–23. [Google Scholar]

- Morley, J.; Widdicks, K.; Hazas, M. Digitalisation, energy and data demand: The impact of Internet traffic on overall and peak electricity consumption. Energy Res. Soc. Sci. 2018, 38, 128–137. [Google Scholar] [CrossRef]

- Pigou, A.C. Review of Wealth and Welfare. J. Political Econ. 1915, 23, 622–629. [Google Scholar]

- Baumol, W. On Taxation and the Control of Externalities. Am. Econ. Rev. 1972, 62, 307–322. [Google Scholar]

- Coase, R.H. The Problem of Social Cost. In Classic Papers in Natural Resource Economics; Gopalakrishnan, C., Ed.; Palgrave Macmillan: London, UK, 2000; pp. 87–137. ISBN 978-0-230-52321-0. [Google Scholar]

- Halpin, A. Disproving the Coase Theorem? Social Science Research Network: Rochester, NY, USA, 2003. [Google Scholar]

- Chen, P. Complexity of Transaction Costs and Evolution of Corporate Governance. Kyoto Econ. Rev. 2007, 76, 150. [Google Scholar]

- Organisation for Economic Co-operation and Development. Environmentally Harmful Subsidies: Policy Issues and Challenges; OECD: Paris, France, 2003; ISBN 978-92-64-10447-1. [Google Scholar]

- De, N. Human-Trafficking Expert. Urges US Congress to Regulate Crypto Miners. Available online: https://www.coindesk.com/human-trafficking-expert-urges-us-congress-to-regulate-crypto-miners (accessed on 3 December 2019).

- Adams, R.; Kewell, B.; Parry, G. Blockchain for Good? Digital Ledger Technology and Sustainable Development Goals. In Handbook of Sustainability and Social Science Research; Leal Filho, W., Marans, R.W., Callewaert, J., Eds.; World Sustainability Series; Springer International Publishing: Cham, Switzerland, 2018; pp. 127–140. ISBN 978-3-319-67122-2. [Google Scholar]

- Araújo, K. The emerging field of energy transitions: Progress, challenges, and opportunities. Energy Res. Soc. Sci. 2014, 1, 112–121. [Google Scholar] [CrossRef]

- Arthur, W.B. Competing Technologies, Increasing Returns, and Lock-In by Historical Events. Econ. J. 1989, 99, 116–131. [Google Scholar] [CrossRef]

- Cash, D.W. Choices on the road to the clean energy future. Energy Res. Soc. Sci. 2018, 35, 224–226. [Google Scholar] [CrossRef]

- United Nations Framework Convention on Climate Change. Paris Agreement: Conference of the Parties Twenty-First Session; UNFCC: Paris, France, 2015. [Google Scholar]

- Hassani, H.; Huang, X.; Silva, E. Big-Crypto: Big Data, Blockchain and Cryptocurrency. Big Data Cogn. Comput. 2018, 2, 34. [Google Scholar] [CrossRef]

- Blazek, P.; Krenek, J.; Kuca, K.; Krejcar, O.; Jun, D. The biomedical data collecting system. In Proceedings of the 25th International Conference Radioelektronika, Radioelektronika 2015, Pardubice, Czech Republic, 21–22 April 2015; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2015; pp. 419–422. [Google Scholar]

| Reference | Description of Existing Situation | Country | Existing Solution/Action |

|---|---|---|---|

| [82] | There was initial news on the possibility of an administrative ban on cryptocurrency mining by country’s parliament proposed for June 2019 mainly due to heavy electricity usage. | Russia | Presidential directive issued earlier in 2019 ordering the enforcement of cryptocurrency regulation [83]. |

| [84] | Initially, a ban was placed on all activities related to cryptocurrency within the country. In 2018, due to several U.S.-imposed sanctions, government reopened talks on digital currencies. Few months later, there was a cut-off in power supply to cryptocurrency mining areas prior to the review of electricity bill for cryptocurrency mining industry. | Iran | Following the review of the prices of electricity, crypto miners are now expected by law to pay €0.06 kWh, €0.01 more than what other citizens are charged. Crypto mining industry is currently an officially-recognized industry [85]. |

| [76] | There is no serious enforcement on mining as well as usage of Crypto-coins. | Czech Republic | The use of virtual currencies must be in alignment with anti-money laundering regulations [75]. |

| [64] | Fairly relaxed atmosphere for all cryptocurrency-related activities (mining included), with the government offering subsidies on electricity bills. Nevertheless, crypto coins are not accepted as a legal tender [75]. | Canada | Canada has laws in place to regulate virtual currency transactions, the law requires that firms that carryout such transactions must duly report to tax offices [75]. |

| [75] | The usage (issuance, mining and similar activities) of virtual currencies were initially declared illegal, and violating this rule attracted fines up to €8300 [86]. | Vietnam | As of early 2018, there were plans for the enactment of legal foundations for the use of cryptocurrencies within the territory [87]. |

| [76] | The legalization situation of digital currencies in the country is unstable and unclear [75]. Nevertheless, the country has Auroracoin, a form of cryptocurrency that is only useful within the boundaries of the nation. Furthermore, the country is home to Genesis Mining, a big name in European crypto setting, and which has been reported to use huge amount of energy in its activities. | Iceland | There are plans on the way to commence taxing cryptocurrency mining operations within the country as a result of huge consumption of electricity [75]. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fadeyi, O.; Krejcar, O.; Maresova, P.; Kuca, K.; Brida, P.; Selamat, A. Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability 2020, 12, 169. https://doi.org/10.3390/su12010169

Fadeyi O, Krejcar O, Maresova P, Kuca K, Brida P, Selamat A. Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability. 2020; 12(1):169. https://doi.org/10.3390/su12010169

Chicago/Turabian StyleFadeyi, Oluwaseun, Ondrej Krejcar, Petra Maresova, Kamil Kuca, Peter Brida, and Ali Selamat. 2020. "Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining" Sustainability 12, no. 1: 169. https://doi.org/10.3390/su12010169

APA StyleFadeyi, O., Krejcar, O., Maresova, P., Kuca, K., Brida, P., & Selamat, A. (2020). Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability, 12(1), 169. https://doi.org/10.3390/su12010169