How Natural Resource-Based Industry Affect Sustainable Development? An Evolutionary Study of China

Abstract

:1. Introduction

2. Literature Review

2.1. Entrepreneurship and Sustainable Development

2.2. Natural Resources and Entrepreneurship

2.3. Mediating Factors Between Natural-Resource-Based Industry and Entrepreneurship

2.3.1. Organizational Scale

2.3.2. Industry Structure

2.3.3. Degree of Openness

2.3.4. Human Capital

3. Methodology

3.1. Variables Design

3.2. Research Method

4. Results and Discussion

5. Policy Implications

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Krugman, P. Geography and Trade; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Glaeser, E.L.; Kerr, W.R. Local industrial conditions and entrepreneurship: How much spatial distribution can we explain. J. Econ. Manag. Strategy 2009, 18, 623–663. [Google Scholar] [CrossRef] [Green Version]

- Parker, S. The Economics of Entrepreneurship; Cambridge University Press: New York, NY, USA, 2009. [Google Scholar]

- Carree, M.; van Stel, A.; Thurik, R.; Wenneers, S. Economic development and business ownership: An analysis using data of 23 OECD countries in the period of 1976–1996. Small Bus. Econ. 2002, 19, 271–290. [Google Scholar] [CrossRef]

- Hebert, R.F.; Link, A.N. In search of the meaning of entrepreneurship. Small Bus. Econ. 1989, 1, 39–49. [Google Scholar] [CrossRef]

- Gast, J.; Gundolf, K.; Gesinger, B. Doing business in a green way: A systematic review of the ecological sustainability entrepreneurship literature and future research. J. Clean. Prod. 2017, 147, 44–56. [Google Scholar] [CrossRef]

- Gibb, A.A. Enterprise culture and education. Int. Small Bus. J. 1993, 11, 11–34. [Google Scholar] [CrossRef]

- Erixion, L.; Johannesson, L. Is the Psychology of high profits detrimental to industrial renewal: Experimental evidence for the theory of transformation pressure. J. Evol. Econ. 2015, 25, 475–511. [Google Scholar] [CrossRef]

- Chinitz, B. Contrasts in agglomeration: New York and Pittsburgh. Am. Econ. Rev. 1961, 51, 279–289. [Google Scholar]

- Lazear, E.P. Balance skills and entrepreneurship. Am. Econ. Rev. 2004, 94, 208–211. [Google Scholar] [CrossRef]

- Lehtonen, M. The environmental-social interface of sustainable development: Capabilities, social; capital, institutions. Ecol. Econ. 2004, 49, 199–214. [Google Scholar] [CrossRef]

- Santillo, D. Reclaiming the definition of sustainability. Environ. Sci. Pollut. Res. Int. 2007, 14, 60–66. [Google Scholar] [CrossRef]

- Littig, B.; Griessler, E. Social sustainability: A catchword between political pragmatism and social theory. Int. J. Sustain. Dev. 2005, 8, 65–79. [Google Scholar] [CrossRef] [Green Version]

- Moroz, P.W.; Hindle, K. Entrepreneurship as a process: Toward harmonizing multiple perspectives. Entrep. Theory Pract. 2012, 36, 781–818. [Google Scholar] [CrossRef]

- Dean, T.J.; McMullen, J.S. Toward a theory of sustainable entrepreneurship: Reducing environmental degradation through entrepreneurial action. J. Bus. Ventur. 2007, 22, 50–76. [Google Scholar] [CrossRef]

- Allen, J.C.; Malin, S. Green entrepreneurship: A method for managing natural resource? Soc. Nat. Resour. 2008, 21, 828–844. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics; MacMillan: London, UK, 1920. [Google Scholar]

- Xu, K.; Wang, J. To explore the relationship between natural resource and economic development. Econ. Res. J. 2006, 1, 78–89. [Google Scholar]

- Gylfason, T. Natural resource, education and economic development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Fu, L.; Wang, Z. Resource curse and resource-based cities. Urban Probl. 2010, 11, 2–8. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, UK, 1934. [Google Scholar]

- Stuezer, M.; Obschoka, M.; Audretsch, D.B.; Wyrwich, M.; Rentfrow, P.J.; Coombes, M.; Shaw-Tatlor, L.; Satchell, M. Industry structure, entrepreneurship, and culture: An empirical analysis using historical coalfields. Eur. Econ. Rev. 2016, 86, 52–72. [Google Scholar] [CrossRef] [Green Version]

- Acs, Z.J.; Audretsch, D.B. Innovation in large and small firms. Am. Econ. Lett. 1987, 1, 678–690. [Google Scholar] [CrossRef]

- Baumol, W.J. The Microtheory of Innovative Entrepreneurship; Princeton and Oxford: Oxford, UK, 2010. [Google Scholar]

- Leyden, D.P.; Link, A.N. A theoretical analysis of the role of social network in entrepreneurship. Res. Policy 2014, 43, 1157–1163. [Google Scholar] [CrossRef] [Green Version]

- Turner, T.; Pennington, W. Organizational networks and the process of corporate entrepreneurship: How the motivation, opportunity, and ability to act affect firm knowledge learning and innovation. Small Bus. Econ. 2015, 2, 447–463. [Google Scholar] [CrossRef]

- Apostolos, D.Z.; Dimosthenis, T.M. Entrepreneurship and SME’s organizational structure: Elements of successful business. Procedia Soc. Behav. Sci. 2014, 148, 463–467. [Google Scholar]

- Jacobs, J. The Economy of Cities; Random House: New York, NY, USA, 1970. [Google Scholar]

- Tsvetkova, A. Do Diversity, Creativity and Localized Competition Promote Endogenous Firm Formation: Evidence of High-Tech US Industry; MPRA Paper; University of Munich: Munich, Germany, 2016; Available online: https://mpra.ub.uni-muenchen.de/72349/ (accessed on 7 December 2019).

- Keeble, D.; Wilkinson, F. Collective learning and knowledge development in the evolution of regional clusters of high technology SMEs in Europe. Reg. Stud. 1999, 33, 295–303. [Google Scholar] [CrossRef]

- Phelps, E.S.; Zoega, G. Entrepreneurship culture and openness. Entrep. Openness 2007. [Google Scholar] [CrossRef]

- Rakesh, S.; Martina, M. Institutional environment and entrepreneurship: An empirical study across countries. J. Int. Entrep. 2014, 12, 314–330. [Google Scholar]

- Dong, L.; Yan, T. Technology output, openness degree and “resource curse”: An examination of terms of trade with China’s provincial panel data. J. Int. Trade 2015, 9, 55–65. [Google Scholar]

- Yang, L.; Gong, S.; Wang, B.; Chao, Z. Human capital, technical progress and manufacturing upgrading. China Soft Sci. Mag. 2018, 1, 138–148. [Google Scholar]

- Xue, Y.; Zhang, Z.; Li, H.; Luan, J. Agglomeration of resource-based industry and regional economic growth: Empirical study of “resource curse”, China Population. Resour. Environ. 2016, 1, 78–89. [Google Scholar]

- Martin, B.C.; McNally, J.J.; Kay, M.J. Examining the formation of human capital in entrepreneurship: A meta-analysis of entrepreneurship education outcomes. J. Bus. Ventur. 2013, 28, 211–224. [Google Scholar] [CrossRef] [Green Version]

- Colombo, N.G.; Delmastro, M.; Grilli, L. Entrepreneurs’ human capital and the start-size of new technology-based firms. Int. J. Ind. Organ. 2004, 22, 1183–1211. [Google Scholar] [CrossRef]

- Andersson, M.; Koster, S. Source of persistence in regional start-up rates evidence from Sweden. J. Econ. Geogr. 2011, 11, 179–201. [Google Scholar] [CrossRef]

- Morris, M.H.; Kuratko, D.; Schindehutte, M.; Spivack, A. Framing the entrepreneurial experience. Entrep. Theory Pract. 2012, 36, 11–40. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Kuratko, D.F.; Link, A.N. Dynamic Entrepreneurship and Technology-Based Innovation; Department of Economics Working Paper; Indiana University: Bloomington, IN, USA, 2016. [Google Scholar]

- D’Abrosio, A.; Gabriele, R.; Schiavone, F.; Vilsasalero, M. The role of openness in explaining innovation performance in a regional context. J. Technol. Transf. 2017, 42, 389–408. [Google Scholar] [CrossRef] [Green Version]

- Barro, R.J.; Lee, J.W. International data on educational attainment: Updates and implications. Oxf. Econ. Pap. 2001, 53, 541–563. [Google Scholar] [CrossRef]

- Li, M.; Liu, S. The threshold effect of regional difference in terms of FDI’s outward spillover: Based on threshold regression of Chin’s panel data. Manag. World 2012, 1, 21–32. [Google Scholar]

- Du, L.; Lin, R. Outward FDI, reverse technology spillovers and provincial innovation in China: A threshold test based on interprovincial panel data in China. China Soft Sci. 2008, 1, 149–162. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS3. Available online: www.smartpls.com (accessed on 7 December 2019).

- Zhao, H.; Liu, X. Analysis of transaction path of resource-based economy. Urban Probl. 2013, 7, 31–35. [Google Scholar]

- Xia, T.; Roper, S. Unpacking open innovation: Absorptive capacity, exploratory and exploitative openness, and the growth of entrepreneurial biopharmaceutical firms. J. Small Bus. Manag. 2016, 54, 931–952. [Google Scholar] [CrossRef]

- Gernter, D.; Bossink, B.A.G. The evolution of science concentration: The case of Newcastle science city. Sci. Public Policy 2015, 42, 121–138. [Google Scholar]

- He, C.; Pan, F. Research progress of industrial geography in China. J. Geogr. Sci. 2016, 26, 1057–1066. [Google Scholar] [CrossRef]

| Variable (Abbreviations) | Type | Measurement |

|---|---|---|

| Natural Resource (NR) | Independent variable | Percentage of wood, coal, resource-based cities |

| Entrepreneurship (Ent) | Dependent variable | Start-up rate(sur) and self-employee rate(ser) |

| Firm size (Escale) | Mediating variable | Average employees in each enterprise |

| Industry diversity (HHI) | Mediating variable | ratio of employees in the industries out of top-five |

| Openness (OP) | Mediating variable | Ratio of the value of export in the total regional production |

| Human Capital (HR) | Mediating variable | Weight of educational years |

| Variable | Mean | Median | Min | Max | Std. Dev |

|---|---|---|---|---|---|

| Coal | 3.67 | 1.7 | 0 | 17.7 | 4.96 |

| Wood | 3.57 | 0.5 | 0 | 35.8 | 7.21 |

| resource city | 8.86 | 10 | 0 | 17 | 4.94 |

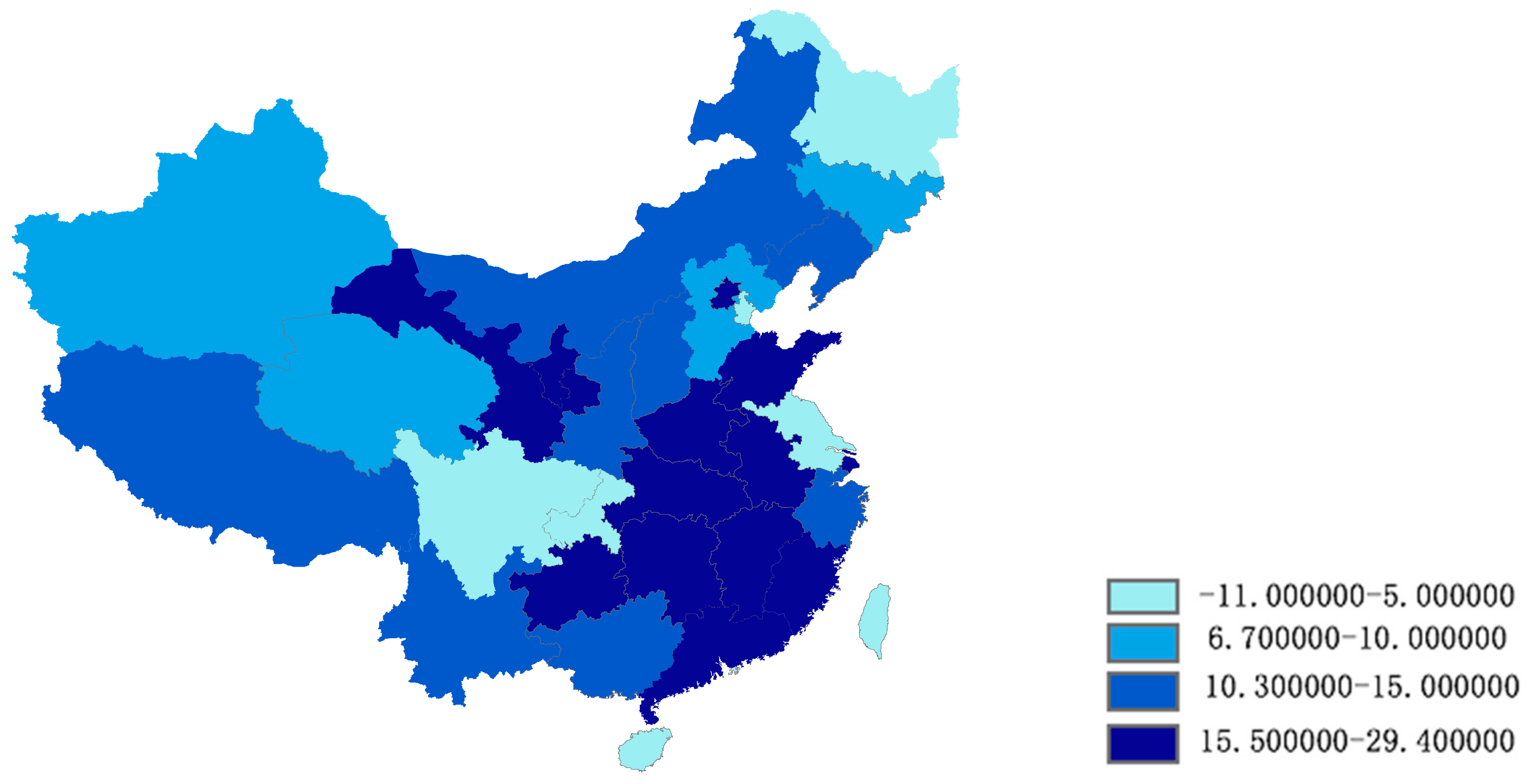

| star-up | 13.94 | 12.9 | −11 | 29.4 | 8.16 |

| self-employee | 23.04 | 20 | 9.3 | 71.6 | 14.97 |

| firm size(log) | 4.59 | 4.33 | 2.92 | 5.68 | 0.63 |

| HHI(log) | 3.76 | 3.68 | 2.57 | 4.12 | 0.36 |

| Openness | 18.41 | 12.63 | 2.2 | 73.5 | 18.05 |

| human capital | 4.21 | 4.02 | 1.8 | 9.02 | 1.47 |

| AVE | VIF | Cronbach α | Composite Reliability | |

|---|---|---|---|---|

| Coal | 0.67 | 1.65 | 0.86 | 0.92 |

| Wood | 0.58 | 1.58 | 0.92 | 0.81 |

| resource city | 0.58 | 2.98 | 0.76 | 0.74 |

| star-up | 0.68 | 2.33 | 0.77 | 0.84 |

| self-employee | 0.65 | 1.58 | 0.79 | 0.88 |

| firm size | 0.59 | 2.93 | 0.86 | 0.86 |

| Industry diversity | 0.56 | 2.21 | 0.79 | 0.87 |

| Openness | 0.57 | 1.53 | 0.81 | 0.73 |

| human capital | 0.61 | 2.42 | 0.84 | 0.76 |

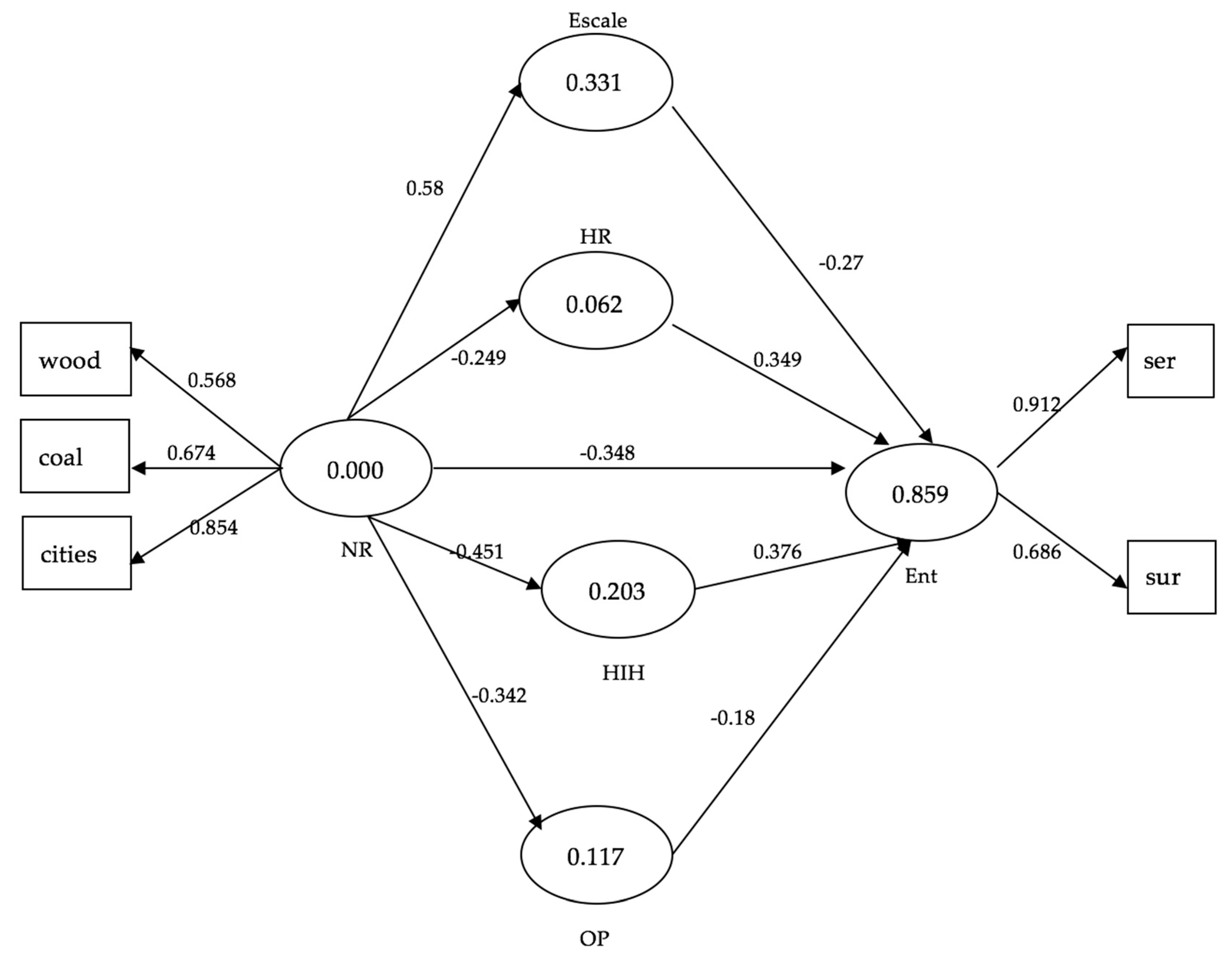

| Relationship | NR-Escale | NR-HIH | NR-OP | NR-HR | NR-Ent |

| Coefficient | 0.58 *** | −0.451 *** | −0.342 *** | −0.249 | −0.348 *** |

| T-value | 2.185 | 2.464 | 2.202 | 0.930 | 2.098 |

| Relationship | Escale-Ent | HIH-Ent | OP-Ent | HR-Ent | |

| Coefficient | −0.27 *** | 0.376 *** | −0.180 | 0.349 *** | |

| T-value | 1.998 | 2.136 | 1.396 | 1.986 |

| First Step | Second Step | |||

|---|---|---|---|---|

| Model 1 (Escale) | Model 2 (Escale) | Model 3 (Sur) | Model 4 (Ser) | |

| wood | 0.34 ** | 0.32 *** | ||

| coal | −0.18 | −0.13 | ||

| resource cities | 0.61 ** | 0.55 ** | ||

| Escale | −0.2 * | −0.41 ** | ||

| human | −0.54 ** | 0.38 * | 0.38 ** | |

| financial | −0.16 | −0.23 | 0.21 ** | |

| institutional | −0.06 | −0.41 * | 0.4 *** | |

| constant | 3.9 ** | 5.67 *** | 41.83 * | 73.86 *** |

| R square | 0.444 | 0.783 | 0.544 | 0.872 |

| First Step | Second Step | |||

|---|---|---|---|---|

| Model 1 (HIH) | Model 2 (HIH) | Model 3 (Sur) | Model 4 (Ser) | |

| wood | −0.01 | −0.02 * | ||

| coal | −0.09 | −0.27 * | ||

| resource cities | −0.03 ** | −0.02 | ||

| HIH | 0.528 ** | 0.21 ** | ||

| human | 0.82 *** | 0.32 | 0.62 ** | |

| institutional | 0.14 | 0.216 ** | −0.58 ** | |

| financial | −2.23 ** | −0.51 | 2.84 *** | |

| constant | 3.6 *** | 2.85 *** | 12.22 | 12.72 |

| R square | 0.476 | 0.845 | 0.448 | 0.806 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, L.; Jiang, X.; He, L. How Natural Resource-Based Industry Affect Sustainable Development? An Evolutionary Study of China. Sustainability 2020, 12, 291. https://doi.org/10.3390/su12010291

Fu L, Jiang X, He L. How Natural Resource-Based Industry Affect Sustainable Development? An Evolutionary Study of China. Sustainability. 2020; 12(1):291. https://doi.org/10.3390/su12010291

Chicago/Turabian StyleFu, Liping, Xiaodi Jiang, and Lanping He. 2020. "How Natural Resource-Based Industry Affect Sustainable Development? An Evolutionary Study of China" Sustainability 12, no. 1: 291. https://doi.org/10.3390/su12010291

APA StyleFu, L., Jiang, X., & He, L. (2020). How Natural Resource-Based Industry Affect Sustainable Development? An Evolutionary Study of China. Sustainability, 12(1), 291. https://doi.org/10.3390/su12010291