Modeling Co-Movement among Different Agricultural Commodity Markets: A Copula-GARCH Approach

Abstract

:1. Introduction

2. Data and Methodology

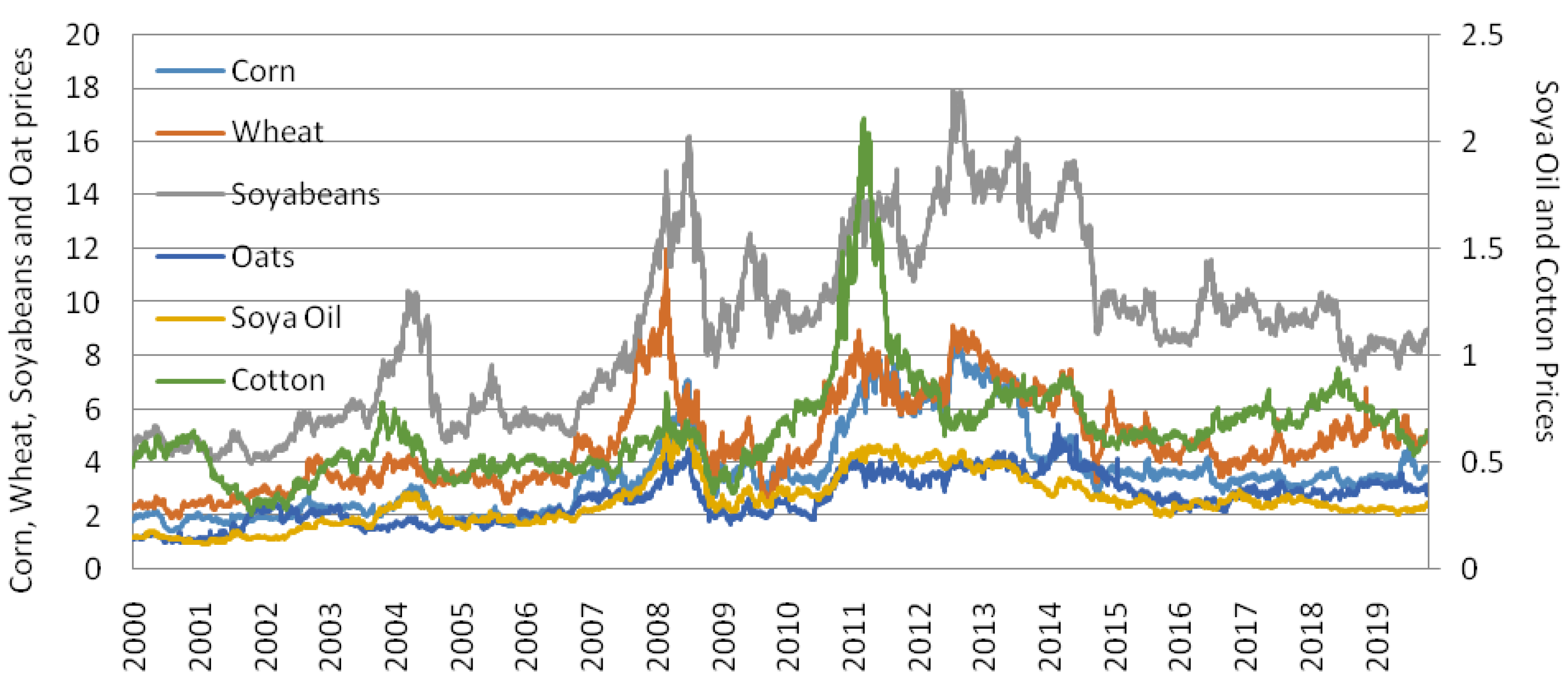

2.1. Data

2.2. Copula Function

2.3. Marginal Distribution of Agricultural Commodity Returns

2.4. The Static Copulas

2.5. The Time-Varying Copula

2.6. Estimation and Calibration of the Copula

3. Empirical Results

3.1. Preliminary Study

3.2. Correlation Analysis

3.3. Marginal Models

3.4. The Static Copulas

3.5. The Time-Varying Copula

4. Implications and Suggestions

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Giot, P. The information content of implied volatility in agricultural commodity markets. J. Futures Mark. 2013, 23, 441–454. [Google Scholar] [CrossRef]

- Du, X.; Yu, C.; Hayes, D.J. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Econ. 2011, 33, 497–503. [Google Scholar] [CrossRef]

- Gardebroek, C.; Hernandez, M. Do energy prices stimulate food price volatility? Examining volatility transmission between US oil, ethanol and corn markets. Energy Econ. 2013, 40, 119–129. [Google Scholar] [CrossRef] [Green Version]

- Mensi, W.; Beljid, M.; Boubaker, A.; Managi, S. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Econ. Model. 2013, 32, 15–22. [Google Scholar] [CrossRef] [Green Version]

- Haixia, W.; Shiping, L. Volatility spillovers in China’s crude oil, corn and fuel ethanol markets. Energy Policy 2013, 62, 878–886. [Google Scholar] [CrossRef]

- Mensi, M.; Hammoudeh, S.; Nguyen, D.K.; Yoon, S.M. Dynamic spillovers among major energy and cereal commodity prices. Energy Econ. 2014, 43, 225–243. [Google Scholar] [CrossRef]

- Wang, S.L.; McPhail, L. Impacts of energy shocks on US agricultural productivity growth and commodity prices—A structural VAR analysis. Energy Econ. 2014, 46, 435–444. [Google Scholar] [CrossRef]

- Algieri, B. The influence of biofuels, economic and financial factors on daily returns of commodity futures prices. Energy Policy 2014, 69, 227–247. [Google Scholar] [CrossRef] [Green Version]

- Bonato, M. Realized correlations, betas and volatility spillover in the agricultural commodity market: What has changed? J. Int. Financ. Mark. Inst. Money 2019, 62, 184–202. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Hernandez, J.A.; Al-Yahyaee, K.H.; Jammazi, R. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 2018, 118, 182–198. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Roubaud, D.; Shahzad, S.J.H. Risk spillover between energy and agricultural commodity markets. Energy Econ. 2018, 75, 14–27. [Google Scholar] [CrossRef]

- Yahya, M.; Oglend, A.; Dahl, R.E. Temporal and spectral dependence between crude oil and agricultural commodities: A wavelet-based copula approach. Energy Econ. 2019, 80, 277–296. [Google Scholar] [CrossRef]

- Shiferaw, Y.A. Time-varying correlation between agricultural commodity and energy price dynamics with Bayesian multivariate DCC-GARCH models. Phys. A 2019, 526, 120807. [Google Scholar] [CrossRef]

- Nicola, F.D.; Pace, P.D.; Hernandez, M.A. Co-movement of major energy, agricultural, and food commodity price returns: A time-series assessment. Energy Econ. 2016, 57, 28–41. [Google Scholar] [CrossRef]

- Garcia, R.; Tsafack, G. Dependence structure and extreme comovements in international equity and bond markets. J. Bank. Financ. 2011, 35, 1954–1970. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Hamori, S. Gold prices and exchange rates: A time-varying copula analysis. Appl. Financ. Econ. 2014, 24, 41–50. [Google Scholar] [CrossRef]

- Benlagha, N. Dependence structure between nominal and index-linked bond returns: A bivariate copula and DCC-GARCH approach. Appl. Econ. 2014, 46, 3849–3860. [Google Scholar] [CrossRef]

- Chebbi, A.; Hedhli, A. Dynamic dependencies between the Tunisian stock market and other international stock markets: GARCH-EVT-Copula approach. Appl. Financ. Econ. 2014, 24, 1215–1228. [Google Scholar] [CrossRef]

- Tang, J.; Sriboonchitta, S.; Ramos, V.; Wong, W.L. Modelling dependence between tourism demand and exchange rate using the copula-based GARCH model. Curr. Issues Tour. 2014, 19, 1–19. [Google Scholar] [CrossRef]

- Aloui, C.; Jammazi, R. Dependence and risk assessment for oil prices and exchange rate portfolios: A wavelet based approach. Phys. A 2015, 436, 62–86. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Kumar, R.R.; Ali, S.; Ameer, S. Interdependence between Greece and other European stock markets: A comparison of wavelet and VMD copula, and the portfolio implications. Phys. A 2016, 457, 8–33. [Google Scholar] [CrossRef] [Green Version]

- Han, Y.; Gong, P.; Zhou, X. Correlations and risk contagion between mixed assets and mixed-asset portfolio VaR measurements in a dynamic view: An application based on time varying copula models. Phys. A 2016, 444, 940–953. [Google Scholar] [CrossRef]

- Boubaker, H.; Raza, S.A. On the dynamic dependence and asymmetric co-movement between the US and Central and Eastern European transition markets. Phys. A 2016, 459, 9–23. [Google Scholar] [CrossRef]

- Koirala, E.H.; Mishra, A.K.; D’Antoni, J.M.; EMehlhorn, J. Energy prices and agricultural commodity prices: Testing correlation using copulas method. Energy 2015, 81, 430–436. [Google Scholar] [CrossRef]

- Reboredo, J. Do food and oil prices co-move? Energy Policy 2012, 49, 456–467. [Google Scholar] [CrossRef]

- Delatte, A.L.; Lopez, C. Commodity and equity markets: Some stylized facts from a copula approach. J. Bank. Financ. 2013, 37, 5346–5356. [Google Scholar] [CrossRef] [Green Version]

- Sriboonchitta, S.; Nguyena, H.; Wiboonpongse, A.; Liu, J. Modeling volatility and dependency of agricultural price and production indices of Thailand: Static versus time-varying copula. Int. J. Approx. Reason. 2013, 54, 793–808. [Google Scholar] [CrossRef]

- Sklar, A. Fonctions de répartition à N dimensions et leurs marges. Publ. Dans L’institut De Stat. Univ. De Paris 1959, 8, 229–231. [Google Scholar]

- Embrechts, P.; Lindskog, F.; McNeil, A. Modelling dependence with copulas and applications to risk management. In Handbook of Heavy Tailed Distributions in Finance; Rachev, S., Ed.; Elsevier: Amsterdam, The Netherlands, 2003; pp. 25–26. [Google Scholar]

- Gumbel, E.J. Bivariate exponential distributions. J. Am. Stat. Assoc. 1960, 55, 698–707. [Google Scholar] [CrossRef]

- Clayton, D.G. Model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence. Biometrika 1978, 65, 141–152. [Google Scholar] [CrossRef]

- Abbott, P.C.; Hurt, C.; Tyner, W.E. What’s driving food prices in 2011? Available online: https://ideas.repec.org/p/ags/ffispa/112927.html (accessed on 29 December 2019).

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Kwiatkowski, D.; Phillips, P.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econ. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Patton, A. Modeling asymmetric exchange rate dependence. Int. Econ. Rev. 2006, 47, 527–556. [Google Scholar] [CrossRef]

- Reboredo, J. How do crude oil prices co-move? A copula approach. Energy Econ. 2011, 33, 948–955. [Google Scholar] [CrossRef]

| Corn | Wheat | Soybeans | Soya Oil | Oat | Cotton | |

|---|---|---|---|---|---|---|

| Panel A: pre-crisis | ||||||

| Mean | ||||||

| Maximum | 0.0305 | 0.0438 | 0.0261 | 0.0348 | 0.1034 | 0.0414 |

| Minimum | −0.0320 | −0.0401 | −0.0727 | −0.0348 | −0.1033 | −0.0414 |

| Std. Dev. | 0.0069 | 0.0087 | 0.0071 | 0.01205 | 0.0104 | 0.0097 |

| Skewness | −0.0081 | 0.2165 ** | −1.0887 ** | −0.0045 | −0.1344 * | 0.1193 * |

| Kurtosis | 4.7120 ** | 5.4847 ** | 13.839 ** | 5.4201 ** | 23.499 ** | 4.6313 ** |

| JB | 191.0211 ** | 414.5361 ** | 7965.4680 ** | 381.6715 ** | 27387.5100 ** | 177.1336 ** |

| ADF | −39.9734 ** | −40.9156 ** | −42.1857 ** | −27.6548 ** | −42.4205 ** | −23.9698 ** |

| KPSS | 0.0679 | 0.0548 | 0.0810 | 0.1145 | 0.0784 | 0.0918 |

| ARCH (10) | 74.7720 ** | 71.4740 ** | 57.4640 ** | 32.8610 | 170.5200 ** | 22.7650 * |

| LB (10) | 0.0908 | 0,0126 | 0.0235 | 0.0000 | 0.0016 | 0.0004 |

| Panel B: post-crisis | ||||||

| Mean | ||||||

| Maximum | 0.0473 | 0.1037 | 0.0329 | 0.0414 | 0.1099 | 0.0395 |

| Minimum | −0.0527 | −0.1071 | −0.0556 | −0.0367 | −0.1112 | −0.0452 |

| Std. Dev. | 0.0084 | 0.0115 | 0.0068 | 0.0082 | 0.0104 | 0.0081 |

| Skewness | −0.1833 ** | −0.2507 ** | −0.5861 ** | 0.0907 ** | −0.2322 ** | −0.0497 ** |

| Kurtosis | 6.2765 ** | 12.1069 ** | 8.0658 ** | 4.2983 ** | 25.6142 ** | 4.8712 ** |

| JB | 1624.2230 ** | 12429.6500 ** | 4039.7430 ** | 256.7899 ** | 76444.8100 ** | 524.6991 ** |

| ADF | −59.9848 ** | −66.2518 ** | −61.0212 ** | −70.52158 ** | −29.8184 ** | −62.11608 ** |

| KPSS | 0.2087 | 0.0848 | 0.2167 | 0.2093 | 0.0596 | 0.1021 |

| ARCH (10) | 106.7805 ** | 387.6200 ** | 296.9900 | 157.3300 ** | 618.0300 ** | 407.9600 ** |

| LB (10) | 0.0251 | 0.0000 | 0.0387 | 0.0000 | 0.0000 | 0.0181 |

| Pearson Correlation | Kendall’s Tau | Spearman’s Rho | Pearson Correlation | Kendall’’s Tau | Spearman’s Rho | |

|---|---|---|---|---|---|---|

| Panel A: Pre-Crisis | Panel B: Post-Crisis | |||||

| Corn and Wheat | 0.4176 ** | 0.3151 ** | 0.4431 ** | 0.5080 ** | 0.3810 ** | 0.5253 ** |

| Corn and Soybeans | 0.5003 ** | 0.3756 ** | 0.5141 ** | 0.5695 ** | 0.3887 ** | 0.5345 ** |

| Corn and Soya oil | 0.2801 ** | 0.2331 ** | 0.2955 ** | 0.3275 ** | 0.2232 ** | 0.2917 ** |

| Corn and Oat | 0.2424 ** | 0.2386 ** | 0.3328 ** | 0.3108 ** | 0.2855 ** | 0.4023 ** |

| Corn and Cotton | 0.1098 ** | 0.0931 ** | 0.1253 ** | 0.2320 ** | 0.1490 ** | 0.2043 ** |

| Wheat and Soybeans | 0.3103 ** | 0.2343 ** | 0.3361 ** | 0.3720 ** | 0.2566 ** | 0.3643 ** |

| Wheat and Soya oil | 0.1803 ** | 0.1526 ** | 0.1967 ** | 0.2569 ** | 0.1852 ** | 0.2430 ** |

| Wheat and Oat | 0.1585 ** | 0.1672 ** | 0.2378 ** | 0.2151 ** | 0.2195 ** | 0.3117 ** |

| Wheat and Cotton | 0.0818 ** | 0.0620 ** | 0.0862 ** | 0.2012 ** | 0.1304 ** | 0.1786 ** |

| Soybeans and Soya oil | 0.4098 ** | 0.3320 ** | 0.4227 ** | 0.5075 ** | 0.3808 ** | 0.4895 ** |

| Soybeans and Oat | 0.2135 ** | 0.2107 ** | 0.2976 ** | 0.2329 ** | 0.2034 ** | 0.2921 ** |

| Soybeans and Cotton | 0.1356 ** | 0.1117 ** | 0.1539 ** | 0.2538 ** | 0.1535 ** | 0.2104 ** |

| Soya oil and Oat | 0.0704 ** | 0.1016 ** | 0.1277 ** | 0.1220 ** | 0.1239 ** | 0.1623 ** |

| Soya oil and Cotton | 0.0809 ** | 0.0892 ** | 0.1068 ** | 0.2015 ** | 0.1426 ** | 0.1782 ** |

| Oat and Cotton | 0.0163 | 0.0124 | 0.0167 | 0.1196 ** | 0.1048 ** | 0.1436 ** |

| Corn | Wheat | Soybeans | Soya Oil | Oat | Cotton | |

|---|---|---|---|---|---|---|

| Panel A: Pre-Crisis | ||||||

| 0.0002 (0.0002) | 0.0000 (0.0002) | 0.0002 (0.0001) | 0.0000 (0.0001) | 0.0002 (0.0002) | −0.0000 (0.0002) | |

| −0.0083 ** (0.0237) | −0.0985 (0.0230) | |||||

| 0.0000 (0.0000) | 0.0000 ** (0.0000) | 0.0000 (0.0000) | 0.0000 ** (0.0000) | 0.0000 (0.0000) | 0.0000 (0.0000) | |

| 0.0871 ** (0.0023) | 0.0197 (0.0131) | 0.0493 ** (0.0076) | 0.0301 ** (0.003) | 0.2139 ** (0.0876) | 0.0006 (0.0045) | |

| 0.9197 ** (0.0633) | 0.9385 ** (0.0118) | 0.9686 ** (0.0059) | 0.8680 ** (0.0101) | 0.6923 ** (0.0821) | 0.9872 ** (0.0006) | |

| −0.0462* (0.0231) | 0.0349 ** (0.0106) | −0.0420 ** (0.0071) | −0.0590 ** (0.0004) | −0.0791 (0.0835) | 0.0195* (0.0085) | |

| 5.8032 ** (0.8049) | 5.5625 ** (0.8116) | 6.3826 ** (0.3490) | 2.0100 ** (0.0007) | 2.6437 ** (0.2259) | 4.1356 ** (1.6566) | |

| 1.0357 ** (0.0309) | 1.0401 ** (0.0348) | 0.9852 ** (0.0330) | 1.0120 ** (0.0258) | 0.9883 ** (0.0287) | 1.0018 ** (0.0240) | |

| LL | 5664.544 | 5293.8270 | 5718.1430 | 6462.4430 | 5315.5800 | 5108.4490 |

| AIC | −7.2334 | −6.7594 | −7.3020 | −8.2550 | −6.7885 | −6.5223 |

| ARCH(7) | 1.9660 | 2.8910 | 2.3150 | 0.0075 | 6.0684 | 5.7310 |

| Panel B: Post-Crisis | ||||||

| 0.0001 (0.0001) | 0.0000 (0.0001) | 0.0001 (0.0000) | 0.0000 ** (0.0000) | 0.0001 (0.0001) | 0.0000 (0.0001) | |

| −0.0368 * (0.0162) | −0.0265 * (0.1290) | 0.11199 (0.0002) | −0.0703 ** (0.0165) | |||

| . | 0.0000 (0.0000) | 0.0000 (0.0000) | 0.0000 (0.0000) | 0.0000 (0.0005) | 0.0000 ** (0.0000) | 0.0000 (0.0000) |

| 0.0499 ** (0.0045) | 0.0901 ** (0.0247) | 0.0554 ** (0.0043) | 0.0312 ** (0.0051) | 0.2315 ** (0.0534) | 0.0444 ** (0.0048) | |

| 0.9436 ** (0.0034) | 0.8995 ** (0.0274) | 0.9433 ** (0.0035) | 0.9989 ** (0.0484) | 0.6413 ** (0.0770) | 0.9558 ** (0.0049) | |

| 0.0066 (0.0118) | −0.0057 (0.0175) | −0.0114 (0.0119) | −0.0725 ** (0.0100) | −0.0920* (0.0452) | −0.0089 (0.0097) | |

| . | 4.6349 ** (0.3483) | 4.3717 ** (0.2987) | 4.5251 ** (0.3266) | 2.0111 ** (0.1679) | 3.1413 ** (0.1944) | 5.9549 ** (1.1136) |

| 1.0052 ** (0.0201) | 1.0134 ** (0.0204) | 0.9745 ** (0.0198) | 1.0048 ** (0.2402) | 1.0135 ** (0.0196) | 1.0020 ** (0.0164) | |

| LL | 12444.4800 | 11499.3500 | 13278.9600 | 12995.0600 | 12027.3100 | 12491.0400 |

| AIC | −6.9367 | −6.4090 | −7.4015 | −7.2426 | −6.7040 | −6.9621 |

| ARCH(7) | 1.3576 | 2.1008 | 0.9391 | 0.9036 | 0.8553 | 2.4167 |

| Corn | Wheat | Soybean | Soya Oil | Oat | Cotton | |

|---|---|---|---|---|---|---|

| Panel A: Pre-Crisis | ||||||

| LB test: First moment | 0.3222 | 0.1262 | 0.1545 | 0.1361 | 0.3307 | 0.1156 |

| LB test: Second moment | 0.9992 | 0.0826 | 0.0796 | 0.0923 | 0.0657 | 0.1856 |

| LB test: Third moment | 0.1975 | 0.4731 | 0.1811 | 0.5612 | 0.3312 | 0.3957 |

| LB test: Fourth moment | 0.9595 | 0.1566 | 0.2487 | 0.3817 | 0.1911 | 0.2114 |

| KS test | 0.9585 | 0.9971 | 0.9971 | 0.9381 | 0.9182 | 0.9971 |

| Panel B: Post-Crisis | ||||||

| LB test: First moment | 0.5335 | 0.2909 | 0.6270 | 0.4518 | 0.1556 | 0.1121 |

| LB test: Second moment | 0.1079 | 0.3819 | 0.1076 | 0.6661 | 0.0938 | 0.3210 |

| LB test: Third moment | 0.2482 | 0.0705 | 0.6173 | 0.3917 | 0.1151 | 0.2106 |

| LB test: Fourth moment | 0.0826 | 0.5218 | 0.0618 | 01429 | 0.3819 | 0.1082 |

| KS test | 0.9971 | 0.9381 | 0.9971 | 0.0.9971 | 0.9178 | 0.9971 |

| Corn Wheat | Corn Soybeans | Corn Soya Oil | Corn Oat | Corn Cotton | Wheat Soybeans | Wheat Soya Oil | Wheat Oat | Wheat Cotton | Soybeans Soya Oil | Soybeans Oat | Soybeans Cotton | Soya Oil Oat | Soya Oil Cotton | Oat Cotton | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Pre-Crisis | |||||||||||||||

| Gaussian Copula | |||||||||||||||

| 0.4586 ** (0.0182) | 0.5141 ** (0.0166) | 0.263 ** (0.0229) | 0.3256 ** (0.0216) | 0.107 ** (0.0250) | 0.3464 ** (0.0211) | 0.1640 ** (0.0244) | 0.2277 ** (0.0235) | 0.1040 ** (0.0250) | 0.3912 ** (0.0200) | 0.2964 ** (0.0222) | 0.1514 ** (0.0246) | 0.1221 ** (0.0249) | 0.0894 ** (0.0251) | 0.0196 (0.0254) | |

| AIC | −363.0443 | −473.1398 | −108.5808 | −170.9899 | −16.0302 | −195.4400 | −40.0453 | −80.1386 | −14.7818 | −254.6856 | −139.9072 | −33.7538 | −21.1522 | −10.3637 | 1.4032 |

| Student-t Copula | |||||||||||||||

| 0.4667 ** (0.0196) | 0.5275 ** (0.0190) | 0.2620 ** (0.0236) | 0.3359 ** (0.0231) | 0.1128 ** (0.0262) | 0.3507 ** (0.0233) | 0.1644 ** (0.0250) | 0.2441 ** (0.0252) | 0.1045 ** (0.0257) | 0.3924 ** (0.0216) | 0.3110 ** (0.0244) | 0.1539 ** (0.0255) | 0.1274 ** (0.0263) | 0.0980 ** (0.0265) | 0.0208 (0.0264) | |

| 11.1613 ** (3.0730) | 5.8577 ** (1.0490) | 30.0000 ** (3.4682) | 10.8025 ** (3.2826) | 17.2431 * (8.8803) | 15.4217 ** (6.5390) | 30.0000 ** (7.2839) | 9.4587 ** (2.5542) | 29.0201 ** (7.4319) | 12.7673 ** (4.6443) | 7.1996 ** (1.5855) | 22.6982* (11.5193) | 13.8409 ** (5.8014) | 16.0064 ** (7.5918) | 22.9956 (15.9424) | |

| AIC | −378.9014 | −517.0141 | −169.3174 | −182.4128 | −18.1465 | −199.9978 | −45.3890 | −94.3274 | −15.5722 | −261.4485 | −163.6914 | −34.0894 | −25.6425 | −13.3224 | 1.1391 |

| Clayton Copula | |||||||||||||||

| 0.5983 ** (0.0418) | 0.7211 ** (0.0446) | 0.2938 ** (0.0359) | 0.3843 ** (0.0382) | 0.1208 ** (0.0319) | 0.3926 ** (0.0381) | 0.1597 ** (0.0327) | 0.2637 ** (0.0362) | 0.1169 ** (0.0310) | 0.5039 ** (0.0401) | 0.3482 ** (0.0376) | 0.1418 ** (0.0331) | 0.1044 ** (0.0319) | 0.0882 ** (0.0307) | 0.0338 (0.0271) | |

| AIC | −268.956 | −358.5201 | −84.5244 | −128.4241 | −15.1220 | −134.1780 | −26.8542 | −64.3549 | −15.0358 | −210.9440 | −108.0008 | −19.7274 | −10.5102 | −7.5200 | 0.3126 |

| Gumbel Copula | |||||||||||||||

| 1.3987 ** (0.0272) | 1.5106 ** (0.0302) | 1.1694 ** (0.0211) | 1.2496 ** (0.0236) | 1.0607 ** (0.0177) | 1.2639 ** (0.02380) | 1.0962 ** (0.0189) | 1.1628 ** (0.0213) | 1.0577 ** (0.0174) | 1.3055 ** (0.0248) | 1.2326 ** (0.0232) | 1.0967 ** (0.0186) | 1.0839 ** (0.0181) | 1.0587 ** (0.0177) | 1.008 ** (0.0146) | |

| AIC | −342.7825 | −484.4547 | −85.8350 | −163.0900 | −12.4766 | −184.5592 | −29.9470 | −78.9915 | −11.5462 | −228.4602 | −146.3674 | −34.8705 | −27.0259 | −11.0662 | 1.6726 |

| Panel B: Post-Crisis | |||||||||||||||

| Gaussian Copula | |||||||||||||||

| 0.5388 ** (0.0140) | 0.5660 ** (0.0098) | 0.3402 ** (0.0148) | 0.3956 ** (0.0131) | 0.2315 ** (0.0157) | 0.3829 ** (0.0133) | 0.2813 ** (0.0158) | 0.2943 ** (0.0146) | 0.2023 ** (0.0160) | 0.5334 ** (0.0109) | 0.2924 ** (0.0147) | 0.2452 ** (0.0155) | 0.1659 ** (0.0173) | 0.2232 ** (0.0170) | 0.1455 ** (0.0165) | |

| AIC | −1220.820 | −1375.3860 | −379.8913 | −603.4096 | −186.1636 | −562.7014 | −251.9902 | −320.1962 | −140.7194 | −1072.9660 | −315.9051 | −209.9698 | −82.7970 | −147.0226 | −70.9275 |

| Student-t Copula | |||||||||||||||

| 0.5569 ** (0.0124) | 0.5717 ** (0.0125) | 0.3317 ** (0.0168) | 0.4215 ** (0.0460) | 0.2252 ** (0.0178) | 0.3918 ** (0.0157) | 0.2749 ** (0.0178) | 0.3295 ** (0.0629) | 0.1973 ** (0.0183) | 0.5326 ** (0.0123) | 0.3091 ** (0.0162) | 0.2338 ** (0.0179) | 0.1764 ** (0.0187) | 0.2127 ** (0.0189) | 0.1523 ** (0.0180) | |

| 4.3864 **(0.3989) | 3.7298 **(0.3207) | 9.7162 **(1.8226) | 5.8215 **(0.6343) | 6.9595 **(0.9816) | 4.5028 **(0.4308) | 8.5044 **(1.3429) | 5.3549 **(0.5610) | 5.9040 **(0.7237) | 10.5790 **(1.9751) | 6.8157 **(0.9220) | 6.2214 **(0.7987) | 9.8464 **(1.7714) | 10.6802 **(2.1107) | 8.9171 **(1.5773) | |

| AIC | −1409.5730 | −821.5779 | −412.1649 | −725.5759 | −217.6517 | −713.3069 | −299.7956 | −437.5038 | −219.1754 | −1109.7270 | −385.2677 | −283.9827 | −117.5111 | −176.2976 | −105.9034 |

| Clayton Copula | |||||||||||||||

| 0.8310 ** (0.0311) | 0.8927 ** (0.0431) | 0.3781 ** (0.0257) | 0.5396 ** (0.0274) | 0.2670 ** (0.0234) | 0.5035 ** (0.0271) | 0.3003 ** (0.0246) | 0.3675 ** (0.0258) | 0.2205 ** (0.0229) | 0.7299 (0.0303) | 0.3541 ** (0.0251) | 0.2900 ** (0.0238) | 0.1635 ** (0.0228) | 0.2241 ** (0.0231) | 0.1582 ** (0.0218) | |

| AIC | −1000.1410 | −608.6376 | −292.7633 | −513.0657 | −172.7686 | −466.1734 | −196.9280 | −262.6091 | −121.2844 | −809.7473 | −257.6510 | −199.9438 | −61.3437 | −122.4880 | −63.7072 |

| Gumbel Copula | |||||||||||||||

| 1.5610 ** (0.0207) | 1.5884 ** (0.0284) | 1.2423 ** (0.0161) | 1.3449 ** (0.0173) | 1.1594 ** (0.0139) | 1.3300 ** (0.0169) | 1.1934 ** (0.0152) | 1.2433 ** (0.0156) | 1.1435 ** (0.0135) | 1.4849 ** (0.0201) | 1.2274 ** (0.0152) | 1.1689 ** (0.0140) | 1.1108 ** (0.0135) | 1.1391 ** (0.0142) | 1.0950 ** (0.0126) | |

| AIC | −1262.5670 | −747.0330 | −351.3830 | −615.2037 | −189.8232 | −614.2285 | −248.7963 | −354.2732 | −166.6553 | −974.2636 | −330.3811 | −216.2131 | −88.6602 | −141.5636 | −74.7373 |

| Best Fitting Copula | Panel A: Pre-Crisis | Panel B: Post-Crisis | ||||

|---|---|---|---|---|---|---|

| Student-t copula | Corn and Wheat | 0.0569 | 0.0569 | Corn and Wheat | 0.2669 | 0.2669 |

| Student-t copula | Corn and Soybeans | 0.1894 | 0.1894 | Corn and Soybeans | 0.3105 | 0.3105 |

| Student-t copula | Corn and Soya Oil | 0.0001 | 0.0001 | Corn and Soya oil | 0.0412 | 0.0412 |

| Student-t copula | Corn and Oat | 0.0324 | 0.0324 | Corn and Oat | 0.1407 | 0.1407 |

| Student-t copula | Corn and Cotton | 0.0012 | 0.0012 | Corn and Cotton | 0.0552 | 0.0552 |

| Student-t copula | Wheat and Soybeans | 0.0123 | 0.0123 | Wheat and Soybeans | 0.1764 | 0.1764 |

| Student-t copula | Wheat and Soya Oil | 0.0001 | 0.0001 | Wheat and Soya Oil | 0.0436 | 0.0436 |

| Student-t copula | Wheat and Oat | 0.0294 | 0.0294 | Wheat and Oat | 0.1208 | 0.1208 |

| Student-t copula | Wheat and Cotton | 0.0000 | 0.0000 | Wheat and Cotton | 0.0690 | 0.0690 |

| Student-t copula | Soybeans and Soya Oil | 0.0282 | 0.0282 | Soybeans and Soya Oil | 0.0856 | 0.0856 |

| Student-t copula | Soybeans and Oat | 0.0707 | 0.0707 | Soybeans and Oat | 0.0775 | 0.0775 |

| Student-t copula | Soybeans and Cotton | 0.0003 | 0.0003 | Soybeans and Cotton | 0.0708 | 0.0708 |

| Student-t copula | Soya Oil and Oat | 0.0041 | 0.0041 | Soya Oil and Oat | 0.0189 | 0.0189 |

| Student-t copula | Soya Oil and Cotton | 0.0016 | 0.0016 | Soya Oil and Cotton | 0.0179 | 0.0179 |

| Student-t copula | Oat and Cotton | 0.0001 | 0.0001 | Oat and Cotton | 0.0224 | 0.0224 |

| Corn Wheat | Corn Soybeans | Corn Soya Oil | Corn Oat | Corn Cotton | Wheat Soybeans | Wheat Soya Oil | Wheat Oat | Wheat Cotton | Soybeans Soya Oil | Soybeans Oat | Soybeans Cotton | Soya Oil Oat | Soya Oil Cotton | Oat Cotton | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Pre-Crisis | |||||||||||||||

| 0.3740 ** (0.1260) | 0.09154 (0.0686) | 0.7131 ** (0.2177) | 0.0133 (0.0086) | 0.0013 (0.0017) | 0.0489 (0.4905) | 0.6677 ** (0.1025) | 0.7115 ** (0.2604) | 0.0913 (0.1004) | 0.4387 ** (0.2097) | 0.0116 (0.0067) | 0.3499 (0.1994) | 0.0033 (0.0030) | 0.0003 (0.0005) | 0.0485 (0.0669) | |

| 0.5840 ** (0.1247) | 0.8940 ** (0.0682) | 0.3676 (0.3650) | 0.9615 ** (0.0161) | 0.9877 ** (0.0102) | 0.8055 * (0.3687) | 0.9746 ** (0.0321) | 0.3792 (0.4966) | 0.5641 (0.4586) | 0.7186 ** (0.2347) | 0.9650 ** (0.0130) | 0.1169 (0.5959) | 0.9732 ** (0.0145) | 0.9951 ** (0.0405) | 0.1401 (0.6240) | |

| 1.6561 ** (0.5182) | 0.8605 (0.4498) | 1.6475 ** (0.5665) | 0.4957 ** (0.1867) | 0.1622 (0.1177) | 0.8130 (0.6911) | 0.1981 (0.1690) | 0.5716 (0.5942) | 0.3676 (0.4869) | 0.6844 (0.4576) | 0.4327 ** (0.1659) | 0.4289 (0.6261) | 0.2932* (0.1390 | 0.0954 (0.0598) | 0.4794 (0.5906) | |

| 12.9271 ** (0.6502) | 5.7568 ** (0.4930) | 53.9531 ** (0.2121) | 9.9681 ** (1.3829) | 18.3019 ** (0.2758) | 15.4850 ** (0.3671) | 8.7251 ** (2.9170) | 9.5712 ** (0.3481) | 37.4290 ** (10.2901) | 12.9185 ** (0.2665) | 7.1660 ** (2.3901) | 22.0127 ** (0.2289) | 14.3228 ** (0.4018) | 18.1200* (0.5917) | 22.7434 ** (0.1373) | |

| AIC | −388.4608 | −523.0586 | −111.4026 | −194.69250 | −19.4123 | −197.7442 | −36.6833 | −91.1857 | −10.2340 | −259.4488 | −172.0219 | −30.9602 | −32.4385 | −16.7575 | 4.4635 |

| Panel B: Post–Crisis | |||||||||||||||

| 0.0511 (0.0279) | 0.0043 (0.0011) | 0.0130 (0.0100) | 0.0386 ** (0.0147) | 0.1539 (0.1219) | 0.2331 (0.2188) | 0.0865 (0.0065) | 0.0148* (0.0065) | 0.1184 (0.0922) | 0.0140 (0.0082) | 0.0255 (0.0144) | 0.2317 (0.1751) | 0.0001 (0.0003) | 0.5798 ** (0.1554) | 0.0048 (0.0029) | |

| 0.9675 ** (0.0184) | 0.8434 ** (0.0104) | 0.9772 ** (0.0173) | 0.9336 ** (0.0210) | 0.6884 ** (0.2538) | 0.7128 ** (0.2631) | 0.6975 ** (0.2299) | 0.9638 ** (0.0121) | 0.7296 ** (0.2162) | 0.9845 ** (0.0089) | 0.9428 ** (0.0274) | 0.5367 (0.3541) | 0.9966 ** (0.0152) | 0.3590 (0.3209) | 0.9766 ** (0.0112) | |

| −0.1928 (0.1090) | −0.6739* (0.3277) | 0.1221 (0.0949) | 0.6232 ** (0.1722) | −0.3561 (0.2902) | 0.2806 (0.2620) | −0.4035 (0.3211) | 0.3819 ** (0.1098) | −0.3738 (0.3042) | 0.1254 (0.0708) | 0.4618 ** (0.1772) | −0.2630 (0.3275) | 0.0866 ** (0.0300) | 1.0048 (0.06259 | 0.1668* (0.0726) | |

| 4.4678 ** (1.1156) | 3.7447 ** (0.2778) | 9.8585 ** (0.8598) | 6.2679 ** (0.1824) | 7.0565 ** (0.3950) | 4.5155 ** (0.3937) | 8.6108 ** (0.7172 | 5.5387 ** (0.5020) | 5.9539 ** (0.1857) | 10.3843 ** (0.5962) | 7.1546 ** (0.4096) | 6.2717 ** (0.3105) | 10.5600 ** (0.0274) | 10.8886 ** (1.8445) | 8.9563 ** (0.3663) | |

| AIC | −1413.5360 | −1596.7140 | −416.5988 | −764.4676 | −245.0743 | −368.1865 | −297.5022 | −464.3449 | −216.8226 | −1135.8380 | −406.7658 | −280.3931 | −144.0980 | −127.3910 | −112.6110 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, X.; Tang, J.; Wong, W.-K.; Sriboonchitta, S. Modeling Co-Movement among Different Agricultural Commodity Markets: A Copula-GARCH Approach. Sustainability 2020, 12, 393. https://doi.org/10.3390/su12010393

Yuan X, Tang J, Wong W-K, Sriboonchitta S. Modeling Co-Movement among Different Agricultural Commodity Markets: A Copula-GARCH Approach. Sustainability. 2020; 12(1):393. https://doi.org/10.3390/su12010393

Chicago/Turabian StyleYuan, Xinyu, Jiechen Tang, Wing-Keung Wong, and Songsak Sriboonchitta. 2020. "Modeling Co-Movement among Different Agricultural Commodity Markets: A Copula-GARCH Approach" Sustainability 12, no. 1: 393. https://doi.org/10.3390/su12010393

APA StyleYuan, X., Tang, J., Wong, W.-K., & Sriboonchitta, S. (2020). Modeling Co-Movement among Different Agricultural Commodity Markets: A Copula-GARCH Approach. Sustainability, 12(1), 393. https://doi.org/10.3390/su12010393