1. Introduction

Having children is associated with a series of costs—understood in economic terms as incurred expenses and lost profits. While the expenses are likely to be obvious, an analysis of lost benefits is more contentious; however, it should not be overlooked. Lost benefits include a loss of earnings as a result of changes in the career path of parents (primarily mothers) in connection with the birth and raising of a child—characterized by breaks and periods of career slowdown in professional work. Such breaks encompass periods of pregnancy, maternity, and parental leave. Additionally, the dynamics of career development are slowed by periods in which the parents need to take care of a child, such as illness in early childhood. These circumstances not only result in a reduction in current earnings, they also affect the amount of accumulated pension capital and consequently the amount of pension.

This article focuses on the individual mother’s loss of future retirement benefit caused by periods of motherhood and childcare. Rather than focusing on a gender gap, it measures the gap in pension between mothers and childless women. This work is a continuation of research on the financial gaps experienced by mothers. Earlier work analyzed the income gap (in wages) for mothers with 1–3 children, assuming a constant rate of wage growth (a linear trend) based on seniority (derived from statistical data). This article focuses on the gap in pensions. The following research thesis was the base: Breaks in work for a mother to have children exert a significant impact on the amount of retirement benefits they receive from the social security system. However, we hypothesize that this impact is not linearly dependent on the number of children. The research question in this context is how the pension gap depends on the number of children and the moment of their birth. Using the methods of financial mathematics, the retirement capital of a childless woman (without any breaks in work) was determined and compared with working mothers. The analysis was conducted on the following types of statistical data:

- -

Rate of wage growth depending on seniority [

1],

- -

Household life cycle (e.g., when starting work, having a first child, etc.) [

2],

- -

Macroeconomic situation: Inflation rate, among other aspects,

- -

The functioning of the pension system (age, premium level, algorithm for calculating the retirement benefit).

The cases of mothers with 1–4 children were analyzed with respect to their career paths. Although the approach used is universal, the calculations are presented on the basis of Polish realities.

2. Literature Review

Although a pension gap problem exists in numerous countries (e.g., [

3]), this article focuses on the situation in European countries where the nature of the problem is generally similar. Several research studies have been conducted on the features of modern pension systems that are unfavorable to women [

4] (p. 20). In most European countries, negative demographic trends mean that reforms since the 1990s have shifted from the design of systems based on defined benefits (DB) to defined contribution schemes (DC) where retirement capital, collected over years of work, derived from income-dependent contributions is the key value. Furthermore, the role of employee funds and investment is being strengthened by the pillar construction of pension systems. The specific impact of pensions reform in European countries on benefits for both women and men is summarized by Samek Lodovici [

4]. However, the main effect of reforms during this period has been to strengthen the dependence of retirement benefit on the period of employment and the amount of earnings. This represents a departure from the principles of solidarity and redistribution, with pressure on individual retirement accounts.

Based on an analysis of pension reforms in the Netherland and Denmark, Frerics, Maier, and de Graaf [

5] concluded that a shift from public schemes to occupational pensions has had a negative impact on women’s pensions. For example, Nygard et al. [

6] found that inequalities in old age start with existing redistributive pension systems, such as those in Finland and Sweden. The sources of these inequalities reside in the retirement models produced in the 1950s and 1960s, assuming that the breadwinner is a man [

7].

This negative impact on women’s pensions is the consequence of gender differences in the labour market. Despite the anti-discrimination policy established through the adoption of C100 Equal Remuneration Convention of International Labour Organization (1951) through EU Directive 75/117/EEC of 10 February 1975 on the approximation of laws of Member States relating to the application of a principle of equal pay for men and women, as well as the European Pact for Gender Equality EU (2001–2020) and the European Court of Human Rights awards, an enormous pay gap continues to exist in Europe in the XXI c. The average gender pay gap—the difference in average gross hourly wage between men and women across the economy—in the EU in 2017 was estimated (according to [

8]) to be 16.1% (ranging from less than 8% in Belgium, Italy, Luxembourg, Poland (7%), and Romania (3.5%) to more than 20% in Czechia, Germany, Estonia, and the United Kingdom), and is only slightly lower than in 2008 (17.3%).

Lower pay gaps also seem to be associated with labor market participation. Data show that in Member States with small gender pay gaps, women aged 20–64 have lower employment rates than men. In Italy, where the gap is 5.0%, the employment rate for women is 53.1%, compared with 72.9% for men. In Romania, where the gap is 3.5%, 60.6% of women are employed, compared with 78.9% of men. Conversely, in Member States with larger pay gaps, women’s employment rates are higher. For example, in Germany and Estonia, the employment rate for women is 75.8% and 75.6%, respectively, compared with 83.9% and 83.4% for men [

9].

The average overall gender earnings gap—which denotes the difference between average annual earnings between men and women taking into account differences in both salary and working rate—was 39.6% in the EU in 2016. Analysis indicates that this is the consequence of working fewer hours in paid jobs (and occasional jobs without compulsory pension contributions) as a result of interrupting a career to take care of children or relatives [

10]. It is also the result of lower employment rates due to women’s family status—encompassing motherhood, domestic work, and care duties (for children and other dependents).

A report by EIGE [

9] indicates that, on average, women spend fewer hours in paid work than men. This is the situation in all Member States except for Bulgaria, Czechia, Greece, Croatia, Hungary, Poland, and Romania. In the EU, the average number of weekly working hours for men is 40 h, compared with 34 h for women. Moreover, in 2015, women in all Member States, except Bulgaria and Czechia, spent more time engaged in cooking and housework than men. Women in Italy, Cyprus, Malta, and Poland spent the most time on these activities (up to 3.2 h per day). Women in France, Finland, and Sweden spent less time (1.9 h per day). More women than men also work part-time: Specifically, 31.3% of women in the EU work part-time, compared with 8.7% of men. There is considerable variation between Member States. The rate in most Central-Eastern European countries—Bulgaria, Croatia, Lithuania, Latvia, Hungary, Poland, Romania, and Slovakia—do not exceed 10.0%. By contrast, more than 39.0% of women in some Western European countries—Belgium, Germany, Netherlands, Austria, and the United Kingdom—work part-time. The average employment rate for mothers aged 20–49 with a young child (below 6 years old) is 65.4%, whereas for fathers it is 91.5%. Moreover, 15.0% of 15-to-64-year-old women are inactive for care reasons such as looking after dependents (children or incapacitated adults), compared with only 1.4% of men.

Samek Lodovici [

4] states that:

- -

The difference in employment rates between men and women aged 25–49 increases in line with the number of children across UE member States. Although several countries report higher employment rates for women with respect to men when they have no children (BE, BG, DE, EE, IE, FR, CY, LV, LT, AT, PL, PT, FI), this is not true for women with at least one child;

- -

In most Member States, the gender gap in part-time employment widens in line with the number of children, with the widest gap recorded in Germany, the Netherlands, and Austria.

All these factors have an effect on retirement contributions in a system based on defined contributions.

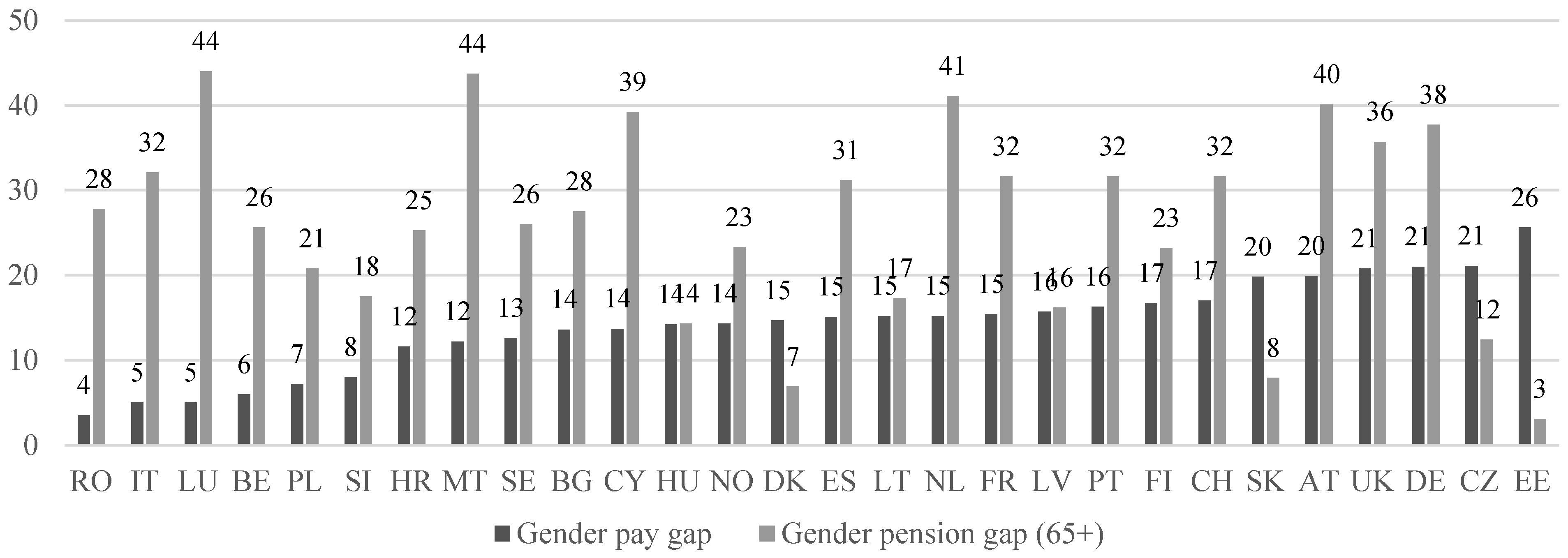

According to Dessimirova and Bustamante [

11], the gender pension gap in EU countries (EU 28) in 2017 was 36% (calculated as the difference in average pensions between men and women aged 65–79)—compared with a pay gap of 16%. This is also illustrated by the data provided by Eurostat [

8], a comparison of the pensions gap and pay gap in selected European countries is presented in

Figure 1.

Several researchers have analyzed the gender gap in pensions by considering labor market factors. For instance, Adami et al. [

12] assessed the effects of changes in earnings distributions on pensions, while Gough ([

13] argued that factors relating to part-time working, career patterns, and types of occupation and employment serve to keep women’s working life income lower than men’s and results in them having a reduced entitlement to benefits from occupational pension schemes after retirement. Tinios et al. [

14] found that marital status was a driver of the gender gap in pensions, although in some countries the effect was minimal (as in EE, LV, SI) or in favor of married women (as in RO and HR). A report by the Global Wage of International Labour Organisations [

15] highlights occupational segregation and gender polarization in industries and economic sectors as the key factors influencing gender pay gaps.

All these studies suggest that women’s position in the labor market could be directly or indirectly influenced by or combined with having children. It is women not men who undergo a period of pregnancy, often excluding them from all or part of their work and are more likely than men to take maternity and parental leave; moreover, the uptake of part-time work is motivated by the need to undertake care duties. Despite the prohibition of discrimination, lower benefits or “career impediments” are often associated with having children in what is called a motherhood penalty [

16] or “motherhood pay gap” [

11].

In addition, more women than men are forced to either shorten their working hours or leave the labor market. Thus, as indicated by the studies referred to below, there is also a significant penalty for having children. The number of children also affects the size of the mother’s pension gap. Studies show that there are countries (e.g., France, Italy, and Sweden) where an increase in the number of children in the household significantly increases the gender pension gap for mothers. However, this is not a rule, as evidenced by the gender pension gap values obtained in Germany or the Netherlands [

16,

17].

Women with or without children are more likely to work part-time than men in all EU Member States. The difference increases with the number of children and stands at +11.6% without children, +26.1% with one child, 34.1%. with two children, and 38.7%. with three and more children [

4] (pp. 107).

Although most EU countries provide solutions through pension systems to compensate for the loss of income or pensionable years resulting from childcare credits (apart from Denmark, Slovenia, and Netherlands—[

4] (p. 21)), they were not designed to compensate for a pay gap. The classic gender gap in pensions (GGP) ratio was first proposed in [

16]:

as the percentage by which women’s average pension is lower than that of men.

A study on the size of the motherhood pension gap in OECD countries, published in [

18], examined the mother-to-childless women gap by comparing replacement rates in both cases. For the mother, a 5–10-year break from work was assumed, based on starting work at the age of 22 and giving birth to two children at the ages of 30 and 32. This is followed by continuous work until retirement. On average, a mother earning a national average wage, with a five-year break, receives a pension equal to 96% of that for a full-career female worker. This was a study based on a comparison of a selected case and then averaged for the countries analyzed.

When discussing the motherhood pension gap, it is important not to overlook the construction of pension systems. In modern pension systems, there are solutions that can positively or negatively affect the situations of people who have experienced a break in their professional work and the fact or period of reduced salary. The most important of these are listed in

Table 1. Some of them apply to not only mothers (affect the gender gap), but next to the specific features we point the dependence on the period and amount of earnings, which is disturbed by the pregnancy, motherhood, childcare—not only in the time of break but also on the future career path.

3. Polish Pension System

The Polish pension system provides a good example of a system comprising multiple elements that have a negative impact on maternal pensions. Firstly, this is despite the fact that—since it was reformed in 1999—it is a pillar system, which combines:

- (a)

State pillar—pay-as-you-go mandatory pillar, managed by state institutions, in which contributions are indexed (in part) by the real growth of contribution base plus inflation and (in part—on sub-accounts created in place of mandatory open investment funds) by the dynamics of economic growth (GDP),

- (b)

Occupational pillar—capital, mandatory, or voluntary; which consists of collective investment funds:

- -

Heavily reduced open investment funds (pl: OFE) managed by private institutions (with an imposed portfolio composition comprising a high proportion of shares) during the liquidation process in favor of state pillar or individual pensions accounts—this was mandatory from 1999 until 2014, currently based on opt-in rule with simultaneous exit of a part contribution from state sub-account;

- -

The capital employee plans (pl: PPK), introduced from 2019, non-mandatory but based on auto-enrollment mechanism and the opt-out rule (allowed for the employers only and requiring repetition every four years), built as the target-date funds, managed by private institution with imposed portfolio;

- -

Occupational pensions plans (pl: PPE)—fully voluntary for both parties, with the tax incentives, introduced in 2004; the employer who runs the PPE may be released from the obligation to create PPK under the condition of a minimum contribution and the number of people enrolled;

- (c)

Additional individual retirement savings (so-called third pillar)—non-mandatory but regulated using tax incentives, including individual investment or savings accounts provided by private institutions.

The description of the history of Polish pension scheme in detail is offered, among others, by Kobyliński, Zbyszyński [

20].

The mandatory pillars are based on the defined contribution scheme, which is currently 19.52% of the basic salary. This is financed by employers and employees. From 1 October 2017, the retirement age was reduced to 60 years for women and 65 years for men. Before the reform in 2013, the retirement age of both sexes had increased and a move towards equalization at the age of 67 had begun.

Secondly, in terms of the maternity impact, there is a strong dependence on employment history. In the old system, pensions were calculated using an algorithm that included seniority, contributing periods, and periods during which no contributions were paid (e.g., unpaid parental leave). Currently, even in the pay-as-you-go first pillar, the pension depends (for people born after 1 January 1969) only on the sum of indexed contributions paid into the system (throughout the entire period of professional work, there are no earnings reference years) and further life expectancy (where at least unisex life tables are used). However, lowering the retirement age of women by five years significantly reduces the average age of female retirement which, in combination with breaks in work, particularly affect mothers.

Third, the minimum guaranteed pension unrelated to employment history is guaranteed for women with a 20-year history of contributory and non-contributory years (25 years for men). Fourth, contributions are not paid for all “maternal” breaks in professional work, although, even when they are, the reductions are based on, for example, the period of maternity leave, which could be as long as one year, and may be reduced to approximately 80% of the salary (the reduction depends on the length of the leave). Finally, the woman benefits to a small extent from her husband’s higher earnings; there is virtually no marital pension, a widow’s pension is only possible in some circumstances, and only part of the funds accumulated on her husband’s retirement account is shared in the event of divorce (entitlement coming from 12.22% of contribution are not shared).

The Polish pension system therefore provides a great example of a system in which the impact of care-related breaks will have a significant on the amount of pension. After being reformed into three pillars, based on defined contributions, the Polish pension scheme was strongly criticized by Calasanti and Zajicek [

21], Zajicek, Calasanti and Zajicek [

22], and Jefferson [

19]. Importantly, in the Melbourne Mercer Global Pension Index [

23], it is ranked 21st out of 37 OECD countries with an overall index of 57.4 and an overall index grade of C (C+ due to adequacy). In comparison, the best systems are ranked A and have index values over 80 (Netherlands and Denmark) [

23].

To universalize the problem, we do not present the conditions of the Polish system in detail, and several simplifications have been adopted in the model, focusing on the significance of the systemic dependence of pension amount on the period of professional activity.

4. Methodology

4.1. Factors Determining the Gender Pension Gap

The authors conduct their research in line with the approach adopted by Dessimirova and Bustamante [

11]. We focus on 7 factors pointed out in the abovementioned paper, influencing the creation and size of the gender pension gap. Three of these relate to employment history:

Years in employment (women work a lower average number of years due to career breaks, principally related to childcare),

Work intensity (women work part-time more often than men),

Remuneration (women’s wages are below the average).

The others concern the pension system:

- 4.

Career break compensation (granting pension rights, e.g., for the period of childcare),

- 5.

Pension redistribution (in favor of low-income employees),

- 6.

Pension indexation (adjustments to changes in the cost of living),

- 7.

Differences in retirement age.

However, because the comparison is between a woman with children and a childless woman (rather than a man), point 7 is eliminated from the calculations. Moreover, regarding point 3, it was assumed that at the beginning of the career they start from the same salary value, later differences are the result of, among others, career breaks. Furthermore, factor 6 is not analysed as the calculations are based on real values. In the calculations, the authors fully consider factor 1. Factor 2, indirectly, suggests a variant (variants “2” and “3”—described in

Section 4.2) that assumes a consistently lower rate of growth in a woman’s salary after returning to work. During a period of intensive childcare, the woman gives up training and striving to increase her professional competences. Lower expenditure on training for a young mother may also result from the attitude of an employer who does not want to invest in her. Factors 4 and 5 are included by the authors in the calculation of pension capital and in the discussion on changes to the pension system in Poland.

The authors also take account of the mother’s situation, as there are more and longer breaks in her career path than there is for a father. There can be several reasons for such breaks:

- (a)

Period of pregnancy—this is the principal break connected to maternity. It is caused by recommendations for increased rest, medical complications, performing work at increased risk, heavy physical work, and work in medical professions (a need to avoid contact with infectious diseases, etc.). In several countries, sickness benefit during pregnancy is equal to 100% of salary (e.g., in Poland), which is at a constant nominal value.

- (b)

Paid maternity and parental leave—depending on the solutions adopted in social security systems in a given country. In some systems, parents can take this leave together; in most cases, it can only be taken by mothers. In Poland, full-paid maternity leave is equal to 20 weeks for the mother (100% paid) and an additional 32 weeks that parents can divide among themselves (with 100% for the first 6 weeks, and 60% of the salary paid for the rest)—the mother can declare that she will use the whole vacation, then she receives 80% of salary for a year. We consider the example of the mother and assume that she uses the entire 52 weeks. The mother’s wage is “frozen” and even reduced to 80% during this period.

- (c)

Unpaid extended post maternity leave—in the Polish system, the maximum length of unpaid parental leave is 36 months and should be used until the child is 5 years old. We decided not to take this possibility of a career break into consideration in the calculations.

- (d)

Period of slowdown after returning to work—this is caused by the care duties of mothers during the first few years of a child’s life (for example, because of frequent illnesses). During this period, women are often unable to exhibit a performance similar to mothers without children. For this reason, employers perceive mothers of young children to be worse than childless people and men (care responsibilities for young children in periods of illness are mainly provided by women).

- (e)

Part-time job—this solution is not taken into consideration in the subsequent analysis. Nevertheless, research indicates this is important [

4] (p. 107).

These factors cause interruptions in professional work and/or in the later period of slower wage growth. For the analysis, we consider factors (a), (b), and (d).

4.2. Numerical Examples

In the study, unlike most of the previously cited studies (except for [

18]), a version in which a woman has no children was adopted as a benchmark. Three variants were therefore defined that describe the different intensity of changes as a result of birth and raising children, as described in

Table 2.

In the analysis, we compare the total sum of real values of pension contributions over the entire career (until retirement age) for women with and without children. Therefore,

describes future value (at the age of 60—retirement) of the entire amount of pension contributions, if the first pension contribution = 1. Because pension contributions are a percentage of earnings, we assume they increase at the same rate as earnings. Thus,

is a future value of increasing annuity:

where:

Cend—age at the end of professional career (retirement age)

Cstart—age at the beginning of professional career

i—indexing ratio of contributions

Ek—sum of pension contributions in year (paid at the end of a year),

and

—additional increase in wages connected to work experience in year

k.

The formula is therefore as follows:

This describes the mother’s financial gap in %.

We also make similar calculations using actuarial annuity, where pension contribution payments are made for being alive at a particular moment of time. Contributions are therefore multiplied by the probability of surviving until the moment

. Thus, we obtain the future value of increasing term life annuity (we do not use actuarial notation because it is not a classic fixed or growing pension with a constant growth rate; therefore there is no standardised notation) as follows:

where

denotes probability of surviving the next

years for x years old person.

In the opinion of the authors, four factors have a strong influence on the results, the most important of which are connected to the mother’s age at certain moments, such as starting work, getting pregnant, and retiring. The following assumptions are adopted for the numerical examples:

- -

Age at the beginning of career—two cases are taken into consideration: A 20-year-old woman and a 25-year-old woman (after studies),

- -

The age at which pregnancy occurs: 2, 5, and 10 years from the beginning of work,

- -

The differences in age between children: 2, 5, and 10 years (in the cases of 3 and 4 children, potential variants were imposed on the mother’s age limit at the moment of birth of the youngest child—it was assumed that the maximum possible age is 50 years as both Eurostat and GUS data on fertility rates are limited to this age),

- -

The age of retirement: 60 years old.

For the sake of simplicity, it was assumed that the mother’s age is counted at the beginning of the year, and that pension contributions are paid annually at the end of the year.

The rate of wage growth above inflation is dependent on the length of working experience. This is calculated using Polish Central Statistical Office [

1] data from October 2016 on the structure of wages and salaries by occupations. Because we do not use a constant rate of wage growth, it is not possible to obtain a straight line for the nominal values of earnings and, consequently, pension contributions in variant “0” or broken lines in other variants (the comparison of variant “0” and “1” is presented in the left-hand side chart in

Figure 2. Instead, we obtain stepped lines with small jumps caused by a rate of wage growth connected to inflation, and large jumps in cases of increase associated with seniority (the middle chart in

Figure 2. When analyzing the real values of pension contributions (the right-hand side chart in

Figure 2b, we obtain stepped lines with jumps in cases of increase associated with seniority in variant “0”, and declines (down steps) caused by breaks connected to having a child (when the nominal value of salary is “frozen”, the real value declines).

For the remainder of the analysis, we use the Polish pension system as described, which includes a retirement age of 60 for women and a contribution of 19.52% of the basic salary. The amount of old-age pension is calculated as follows: The total pension assets accumulated in the individual’s account divided by the average remaining life expectancy at the age of application.

Additionally, we assume that inflation and the discount rate are equal to 2.5%, which is in accordance with the inflation target set by the National Bank of Poland. The issue of the interest rate at which contributions will be indexed is not an obvious problem to be solved. It is worth dividing the analysis into these case development studies that:

Already fulfilled or partially realized (e.g., for the current 40–50 years old),

They will realize themselves in the future, i.e., a woman at the start of her professional path (this assumption is implemented in the article).

In the case of the analysis regarding item 1, it is worth adopting the real indexing ratio of contributions from the past. This approach, however, requires analyzing specific cases, including the year in which the woman started working, because the time distribution of indexing ratio of contributions is, in addition to the number of children, mother’s age at birth, and time intervals between them, another factor significantly affecting the size of the gap. In the event that we analyze possible future developments (point 2), it must be assumed what the expected values of indexing ratio of contributions in subsequent years may be. In addition, there is no single common indexation ratio in the Polish system, contributions in the first pillar are indexed by real growth of contribution base (which in turn depends on the increase in wages, and indirectly also on the socio-economic situation) plus inflation, dynamics in GDP is used when indexing sub-account. The problem here is high volatility of values from the past and short observation period from the past (too short for long-term forecasts—data for first pillar available since 2000, very variable values; sup-account since 2012, six available observations). It is therefore difficult to forecast.

It would be worth extending the analysis to include different case studies that take into account different scenarios for the indexing ratio of contributions, but this goes far beyond the scope of this article; they will be analyzed in the subsequent works of the authors. It this analysis, the indexing ratio of contributions is equal to the yearly inflation rate (the inflation target of the National Bank of Poland), at a constant level—in this case, changing the value of indexation ratio do not change the proportion between total amount of pension capital for childless women and mothers.

It is also necessary to make assumptions regarding the reduced rate of wage growth after returning to work in options “2” and “3”—which is accepted as being 10%. This is based on the assumption that an employee’s salary is reduced by 20% while on sick leave; and that the mother spends half the year on sick leave and her salary thus falls by 10%.

At the end of the part devoted to the assumptions, the authors like to emphasize that several assumptions have been made in the concept of the study, which are very optimistic. The first most strongly affecting the presented results is the assumption that after a two-year break related to pregnancy and parental leave, a woman returns to the same job and keeps it. Therefore, we assume that her professional career is continued, which is not always true. The second optimistic assumption is that a woman will not interrupt her work until retirement (except for breaks related to subsequent children).

Another optimistic assumption is the value of the wage growth rate reduction ratio compared to the average growth rate. For scenario “2” this reduction was adopted at the level of −10%. This reduction in the rate of future mother’s salary increases is due to two factors: Increased care for a small child (3–6 years old), i.e., more frequent sick leave due to the child’s illness, but also slower professional development of the mother. The latter factor may result from the employer’s attitude and the lack of willingness to invest in a less available employee, as well as from the mother’s “reluctance” to devote her strength to work and study at the expense of spending time with the child. It can be argued that a 10% reduction is sufficient.

5. Results and Discussion

Table 3 summarizes the pension gap results for mothers for selected cases. Calculations are performed according to the mother’s age at the time of starting work and different configurations of children—different numbers of children and varying intervals between them. The mother’s age at the start of work is either 20 years (an example of a person starting work without graduate studies) or 25 years (an example of a person starting work with a university degree). To present the results, the following options are selected: “the cheapest”, intermediate, and “most expensive” for one, two, three, and four children. The “cheapest” variants are those for which the first child is the latest and the intervals between the children are the largest, while the “most expensive” variants are those for which the time intervals between the children are the smallest and the first child is born the earliest. For the case of four children, the cheapest option is “20 + 10 + 10 + 5 + 5”, not “20 + 10 + 10 + 10 + 10”, as the variants in the mother’s age are limited to the real age at which a woman can give birth. For this calculation, the value given in the Eurostat statistics of 50 years is used.

Earlier studies [

24,

25,

26] have shown that the greatest impact on the mother’s income occurs in a situation in which two issues are combined: The first child is born close to the point at which the mother started work and more children appear at short intervals between successive births.

These conclusions confirm the research conducted in this study regarding retirement pay. A first child born quickly results in a loss of 6.45% of pension capital in variant “1” and 9.2% in variant “2”. If the child is born later, at the age of 30 (10 years after starting work), the loss of pension capital drops to 4.7% and 5.4% in variants “1” and “2”, respectively. The birth of two children in the most expensive variant (early) is a loss from almost 12.3% (variant “1”) to 14.8% (variant “2”). In the cheapest option (as late as possible), the loss is 7.5% and almost 8.2% for variants “1” and “2”, respectively. Regarding the birth of four children, in the most expensive case (the birth of children at 22, 24, 26, and 28 years), the pension capital decreases in relation to a childless woman by more than 22.7% in variant “1” to over 24.6% in variant “2”. It is important to note that when contributions are invested or even indexed, those that are paid at the beginning of the career “work” the longest. Thus, the loss of a certain percentage of contributions paid at the beginning of a professional career has a much stronger effect than a loss at a later stage.

To illustrate this loss, we can use average values for Poland—assuming 40 years of paying contributions equal to 19.52% of the national average salary. The total loss in pension capital for a mother of four children in the most expensive system “20 + 2 + 2 + 2 + 2”, in the worst option “2”, amounts to approximately EUR 17,200 (by 1 EUR = 4.3 PLN).

Table 4 presents similar results for a woman who began working at the age of 25. For cases of three and four children, the cheapest options were again chosen so that the mother’s age at the birth of the youngest child did not exceed 50 years. In this case, the smallest loss on pension capital is recorded in the case of one child born the latest and is approximately 4%–5%. The highest loss on pension capital occurs in the case of four children born early in the shortest intervals (“25 + 2 + 2 + 2 + 2” scenario), which is almost 23.4% in the “1” variant and almost 25.2% in the “2” variant (for the average wage in Poland, which is approximately EUR 15,9000; by 1 EUR = 4.3 PLN).

Comparing the same scenario for the birth of children (time intervals between births and the time from starting work until the birth of the first), in each case, a smaller gap occurs for a woman who starts work at the age of 20 (

Table 3) than for a 25-year-old (

Table 4). The mother also experiences a larger loss of pension capital with a larger number of children, but this is not a multiple of the loss incurred with the first child (subsequent children are “cheaper”). The greatest financial loss occurs when children are born at short intervals. This especially applies to the first two children.

It should be emphasized that, of the two factors that shape a mother’s pension gap, the interval between children is more important than their number. It is also important to note that the mother of three children in the “25 + 2 + 2 + 2” scenario incurs a greater loss than the mother of four children in the “25 + 10 + 5 + 5 + 5” scenario. The same is true for a 20-year-old mother.

For selected variants, real values at the time of starting work are also presented (see

Figure 3 for a woman who starts work at the age of 20). This allows us to determine the point at which the biggest differences between having a child and a mother’s earnings arise.

Finally, it is important to consider the case of a Polish woman. This is one whose life milestones follow the average values for women in Poland: When she starts work, gives birth to her first child, and retires (the real age of leaving the labor market in Poland is much lower than the official age, primarily due to industry retirement privileges). According to Eurostat [

2] data, the average age at which women start work is 23, the average age at which they give birth to their first child is 27, and the age of actual retirement is 56. This results in an actuarial annuity pension gap equal to −6%, −7.4%, and −6.8% for variants “1”, “2”, and “3”, respectively for a mother of one child.

6. Conclusions

Although several studies have identified the existence of a pay gap, few have analyzed the existence of a pension gap. Moreover, those studies that do exist have focused on the gender gap rather than differences between working mothers and childless women. This significantly limits the possibility of comparing our results with others. Furthermore, the number of children and the point at which they are born are not always considered. The construction of the new Polish pension system has transformed the pay gap into a pension gap in a fairly proportionate manner. Thus, it is worthwhile comparing the results with research on the pay gap.

A number of recent research studies have confirmed the existence of a motherhood penalty in countries such as the USA [

17,

27,

28,

29,

30,

31,

32,

33,

34], the UK [

33,

35,

36], Canada [

37], and Germany [

38]. However, no evidence has been found for this effect in countries such as Sweden [

39] and Denmark [

40,

41,

42]. It can therefore be concluded that the scope of social policy and maternity and parental benefits are extremely important in determining the position of mothers in the labor market, and consequently the pay and pension gap. Northern European countries (mainly Scandinavia) have a strong family policy and an equal opportunities policy based on generous provisions for maternity leave and extensive childcare.

The opposite is the case in Anglo-American countries, while continental European countries can be characterized as lying somewhere in between, with generous provisions for maternity leave but a more limited range of childcare. In liberal countries (Ireland and the UK), policies in this area are designed to promote the functioning of the market and to encourage women to participate in the labor force (especially in the services sector—see [

43] The result is a high level of employment, albeit primarily in the form of part-time work [

44]. Moreover, in these countries, there is a large gender pay gap and even greater differences between mothers and non-mothers.

In our research, the cost of one child in terms of pension capital was 4.5%–9%. This can be compared to the gap identified in other research studies. For instance, Waldfogel [

32,

33,

34] found that one child reduces a woman’s wages by approximately 6% and two children by 15%. The age at which a mother has her first child is also important. In a study by Davies and Pierre [

45] conducted in 11 EU Member States, women who have their first child before the age of 25 experience a larger pay gap (the strongest effect being registered in Portugal). In the OECD [

18] research referred to previously, the motherhood pension gap is approximately 4% with large differences between countries, including the fact that, in some countries, receiving the full pension means later retirement for someone who has had a career break. In Poland, the gap between low/average earners with a five-year childcare break and workers with an uninterrupted career was calculated to be 10%.

The authors did not thoroughly study the situation for mothers with and without education. Only a 20-year-old girl and a 25-year-old girl entering the labor market with and without higher education were accepted as a model. The results did not show large differences in the loss of pension capital. Amuedo-Dorantes and Kimmel [

46], Taniguchi [

47], and Todd [

48] report that the wage gap declines with level of education. By contrast, Budig and England [

17] suggest there is no clear evidence for this effect as more skilled or committed women experience higher wage gaps. Anderson et al. [

27,

28] reported a u-shaped penalty with respect to education—in contrast to middle educated women, high- and low-educated women do not experience a pay gap.

The calculations conducted in this paper are intended to show that part of the costs associated with raising children are hidden. The loss of pension capital in Poland ranges from a small amount to 23% for a childless woman. Therefore, it would be appropriate to raise the importance of having children in the context of personal finances. However, this must be understood more broadly rather than being considered simply in terms of current consumption (child spending). This article shows that the effects of having children may be significant for a mother 30–40 years later when she retires.

If the division of responsibilities between partners leads to extreme specialization, whereby one partner devotes him/herself to professional work while the other is devoted to work in the household, then in the long run, the salary level of the economically active person will increase and the income of the other person will decrease. Consequently, the person staying at home develops an unwanted level of dependence on the working person. The long-term effect of this will be large disparities in the levels of future retirement and basic social security in old age. A longer-living woman (as demographic data indicate [

8]) who suffers from a pension gap as a result of childbirth and raising children may be left without sufficient funds after the partner’s death. It is therefore important to think about using the life insurance of a man whose beneficiary will be women.

Not all programs supporting the demographic development of the state improve the retirement situation for mothers. This conclusion is supported by CSO data for Poland relating to the labor market. In 2014, the employment rate for a mother with one child was 74.1%, while in 2017 it was 75.9%. The increase was also noticeable for mothers with two children, where it has risen from 69.6% to 70.3%. Most worrying is the fact that a decrease in the employment rate was observed for mothers with three and more children from 54% in 2014 to 51.8% in 2017. This may be due to the support of the 500+ program, which provides a monthly allowance for each subsequent child to a mother who has a minimum of two children (from mid-2019, this allowance is now available for every child). This program provides strong support with current expenses but may cause inactivity and have far-reaching pension consequences.

Another option that appears that has been incorporated into several social security systems is paternity leave, which helps reduce inactivity among women. Such changes take time because they require a change in social attitudes; however, the time the father spends with the child is not only important for their development, it also helps boost the household finances. It also significantly affects the financial situation for women.

Finally, it is important to state that the gender pay gap and pension gap are being considered by the European Parliament. In July 2019, a Directive on work-life balance for parents and carers [

49] was adopted. The solutions included in this document are designed to enable parents and people with caring responsibilities to share these more equitably between women and men and ensure a better balance between their work and family lives. The proposal includes the introduction of paternity leave (10 working days of paternity leave around the time of birth), strengthening the existing right to four months of parental leave by making two of the four months non-transferable from one parent to another, the introduction of carers’ leave (to provide personal care to a relative five days per year), and extending the existing right to request flexible working arrangements for all working parents of children up to at least eight years old and all carers.

The aforesaid considerations imply further possible directions for research:

- -

Incorporating into calculations the breaks and slowdowns caused by unpaid parental leave (access to nurseries is limited in many smaller towns) and part-time work (the wage not only increases more slowly, it is also much lower in nominal terms)—additional variants in wage trajectories over the life course,

- -

An analysis of social and systemic changes in the take-up of childcare by fathers, as well as data on part-time work,

- -

Comparison of the impact on the pension gap of the parental leave solutions employed in different pension systems,

- -

Comparison of the pension gap in the old system (defined benefit system) with the new system (defined contribution system),

- -

Comparison of research results with other countries,

- -

Identifying the relationship between fertility rates and the pay and pension gap,

- -

Basing the research on simulation approach and multistage models, including statistics on the probability of having subsequent children at a certain age.

Additionally, it is important to study the future benefits of investing in a child, including care and support in old age, which can be considered a retirement flow. The social dimension is also important, as bridging the gap may be important for investing in children and counteracting adverse demographic trends in fertility rates, which are currently extremely low in Poland (1.45 in 2019, in comparison to the EU average of 1.59).