Climate Change Accounting and Reporting: A Systematic Literature Review

Abstract

:1. Introduction

- (1)

- An illusion and a buzzword;

- (2)

- A concept with multiple meanings, including environmental, social, eco-efficiency, etc., issues;

- (3)

- A broad concept including information about corporate sustainability measurement and management;

- (4)

- A stakeholder engagement process for the development of measurement and management tools related to the economic, social, and environmental aspects and their mutual links.

- -

- Understand its current status;

- -

- Identify gaps to be filled;

- -

- Challenge scholars to increase their work on relevant areas for their future sustainability accounting research.

- -

- Shows the different perspectives addressed by climate change accounting and reporting research;

- -

- Points out new research areas in which sustainability accounting and reporting should be beneficial;

- -

- Identifies some perspectives of development of the accounting discipline.

- -

- In fact, “The margins of accounting change as the boundaries of accounting are redrawn. The margins are fluid and mobile, rather than static. What is on the margins at one point in time can become central or taken-for-granted, relatively fixed and durable, at a later date. Moreover, the margins of accounting vary from one national setting to another” [7]. In this context, accounting and reporting for SDGs, and more in detail to climate change-related purposes, have only become the focus of research in the accounting discipline recently.

2. Research Background

- -

- SDG no. 6 (clean water and sanitation), e.g., [25,26]. Ref. [25] focused on the intersection between accounting and human rights. Within the latter, the author questioned if the access to information can be considered as a human right, focusing specifically on environmental information related to water sources. Ref. [26] focused on the reporting of sustainability information to public water companies’ stakeholders.

- -

- SDGs no. 5 (gender equality), SDG no. 10 (reduced inequalities), and 16 (peace, justice and strong institutions), e.g., [27,28,29,30]. Among this literature, it is worth mentioning [28], containing an introductory analysis of the potential role of the International Accounting Standards Board (IASB) for the application of relevant human rights norms, and [30], dealing with social accounting research related to economic inequality, and calling for a deep involvement of social accountants in public debates about the future of resource distribution.

- -

- SDGs no. 14 and no. 15 (life below the water/life on land), e.g., [31,32,33,34,35]. Among this literature, it is worth mentioning [32], dealing with the potential role of environmental accounting in the reconstruction of the knowledge of the social, economic, and environmental risks of salmon farming and in the choice of adopting organic production methods. Ref. [34] extended the research stream of biodiversity accounting, trying to verify if Jones’ natural inventory model is applicable to a specific local context.

3. Materials and Methods

- (1)

- Selection of research questions, bibliographic database, and search terms. During this phase, the authors also selected a tool to perform science mapping analysis;

- (2)

- Definition and use of review criteria for the inclusion/exclusion of the relevant literature;

- (3)

- Development and application of a methodological review protocol;

- (4)

- Synthesis of the findings.

3.1. Selection of Research Questions, Science Mapping Analysis Tool, Bibliographic Database, and Search Terms

- (a)

- What is the knowledge base of climate change accounting/reporting and what is its intellectual structure (RQ1)?

- (b)

- What is the research front (or conceptual structure) of this research field (RQ2)?

- (c)

- What is the social network structure of the scientific community writing about this topic (RQ3)?

- (d)

- What lessons can be learned from the literature analyzed about the current state and the future developments of the climate change accounting and reporting-related literature (RQ4)?

- -

- ((“account *” OR “report *”) AND (“global reporting initiative” OR “GRI”));

- -

- ((“account *” OR “report *”) AND (“social *” OR “environment *” OR “sustainab *” OR “CSR” OR “responsib *” OR “TBL” OR “triple” OR “integr *”));

- -

- ((“account *” OR “report *”) AND (* financial));

- -

- ((“account *” OR “report *”) AND (“carbon” OR “divestment” OR “Paris agreement” OR “multigenerational benefit” OR “climate change” OR “consequential” OR “natural disaster” OR “ecological”).

3.2. Definition and Use of Review Criteria for the Inclusion/Exclusion of the Relevant Literature

- -

- Document type: only articles (with the exclusion of presentations, book reviews, comments, and patents);

- -

- Languages: only English, in order to avoid a language bias [36];

- -

- Research areas: environmental sciences, ecology, business economics, operations research management science, energy fuels, social science’s other topics, water resources;

- -

- Web of Science categories: environmental sciences, ecology, energy fuels, engineering environmental, environmental studies, management, water resources, business finance, business, social sciences interdisciplinary, green sustainable science technology, operations research management science, development studies, and ethics;

- -

- Timespan: 1999–2018. The authors used 1999, as the starting year of the analysis since in this period the first sustainability reports and similar reporting tools were published as a result of the issuing of the first GRI guidelines [7];

- -

- Citation Indexes: SCI-EXPANDED, SSCI, A&HCI, CPCI-S, CPCI-SSH, ESCI.

3.3. Development and Application of a Methodological Review Protocol

- (1)

- In the first part there were the bibliographic data of each article falling within the final sample (i.e., author(s)’ names and affiliations, year and title of publication, journal’s name, keywords and abstracts);

- (2)

- In the second part there was the coding scheme, divided into the following criteria: (A) jurisdiction, (B) location, (C) focus of the article, (D) research methods, (E) academic or practitioner author(s).

4. Results

- (1)

- the “biblioAlanalysis” function, which calculated the bibliometric measures displayed in Section 4.1;

- (2)

- the functions “summary”and “plot”, which summarized the main results that emerged from the bibliometric analysis (described in Section 4.2);

- (3)

- the “citations” function (described in Section 4.3).

4.1. Main Information Derived from the Collection of Selected Documents

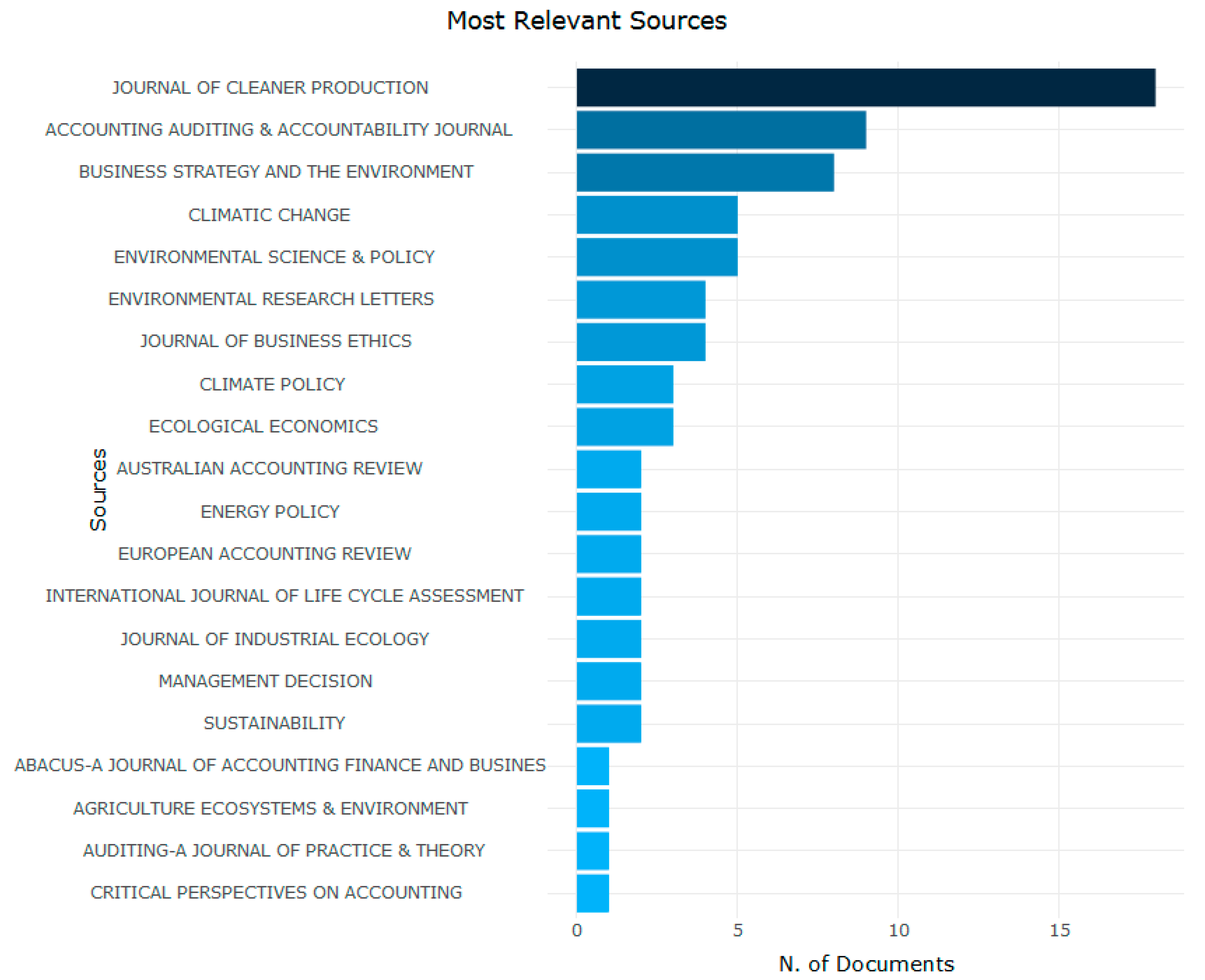

4.2. Main Results Derived from the Bibliometric Analyses

4.3. Information about Citations

- (1)

- Kolk, Levy and Pinske, 2008 [Appendix A], dealing with the institutionalization of carbon disclosure as a corporate response to emerging climate change information needs.

- (2)

- Lozano and Huisingh, 2001 [Appendix A], focusing on sustainability reporting and on the guidelines and standards addressing sustainability issues;

- (3)

- Barrett, 2013 [Appendix A], containing a case study about consumption-based GHG emission accounting in UK;

- (4)

- Bebbington and Larrinaga-Gonzalez, 2008 [Appendix A], focusing on the problems connected with the valuation of pollution allowances and their identification as assets and liabilities;

- (5)

- Brandao, Levasseur, Kirschbaum, Weidema, Jorgensen, Hauschild, Pennington, and Chomkhamsri, 2013 [Appendix A], dealing with life cycle assessment (LCA) and carbon footprinting (CF) as tools for the environmental assessment of products. It analyzes some methods for accounting the potential climate impacts of carbon sequestration.

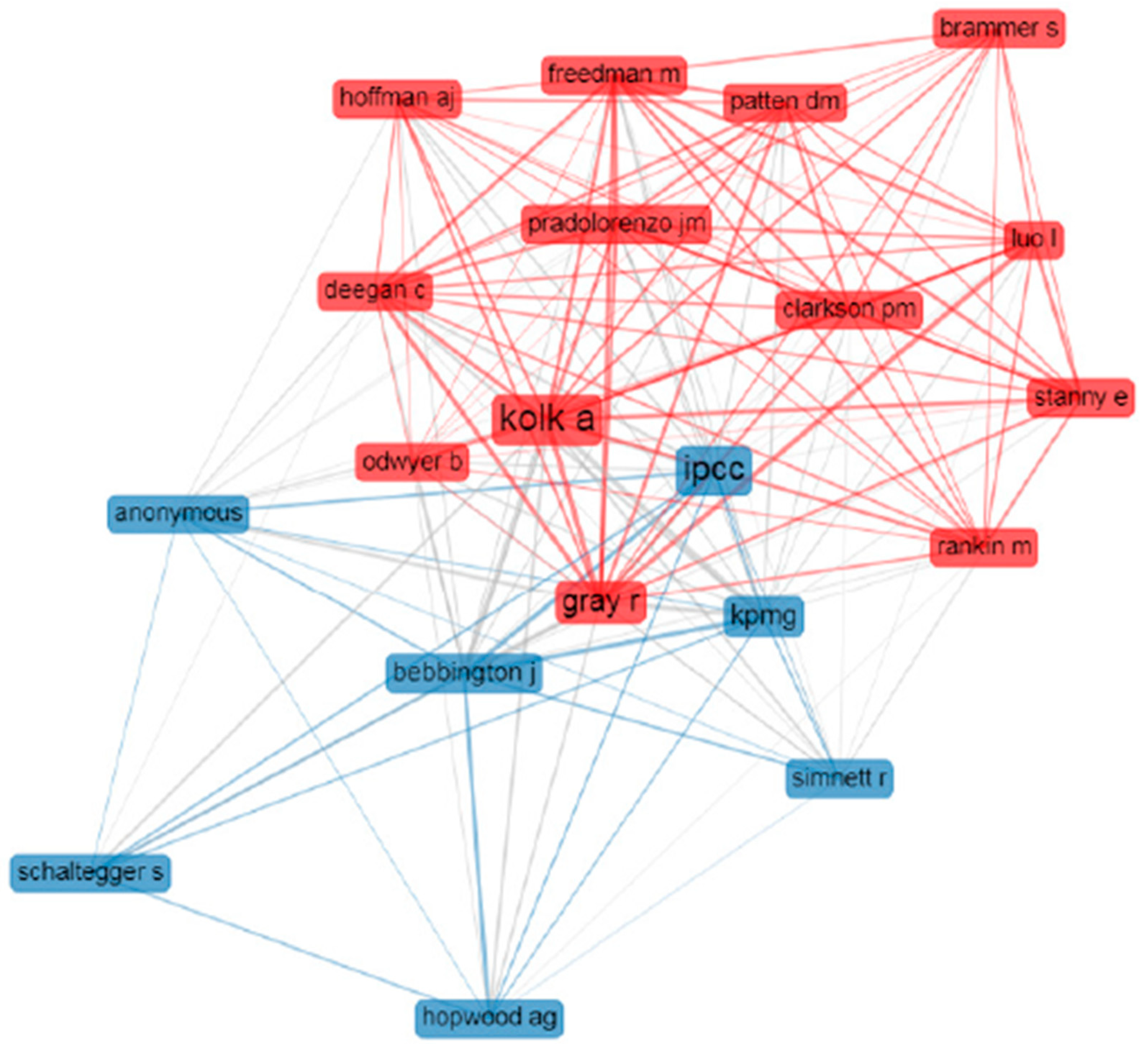

4.4. Network Analysis

- (a)

- Co-citation: this is the case in which two articles are both cited in a third article;

- (b)

- Co-words: this type of analysis helps researchers to depict the conceptual structure of a framework through a word co-occurrence network in order to map and classify words extracted from titles, keywords, or abstracts of a given bibliographic collection;

- (c)

- Collaboration: i.e., networks whose nodes are the authors and whose links are the co-authorships.

4.5. Qualitative Analysis

- -

- No. 9 authors classifiable as “accounting scholars”, since their (academic or professional) role, research interests, research areas, and scientific/professional background clearly referred to accounting-related subjects;

- -

- No. 6 authors not classifiable as “accounting scholars”, since no clear references to accounting-related subjects were found in their curricula. In most cases, their research interests referred to “carbon accounting” or “GHG accounting”, but their scientific background and/or their academic/professional roles were not related to typical accounting subjects. Some of them are scholars of atmospheric physics, environmental biology, climate change policy, and politics.

5. Discussion

- The concepts of “assessment” and “change” were the main motor themes;

- The concept of “carbon” was within niche themes and motor themes, while “greenhouse” lay between motor and basic/transversal themes;

- The concepts of “reporting” and “accounting” were the main basic and transversal themes;

- The concepts of “climate”, “environmental”, and “companies” were the main emerging or declining themes;

- The concepts of “corporate” and “case” were the main highly developed and isolated themes.

6. Conclusions

7. Future Research Directions

- -

- A greater concentration should be invested on the concrete effects produced by climate change- related practices on the sustainability performances of firms;

- -

- A broader focus of accounting scholars on all the 17 SDGs instead of one part of them (e.g., carbon emissions, other GHG emissions, etc.) would be useful;

- -

- A greater attention toward climate- elated risk management and its concrete effects on the risks of firms is urgently needed;

- -

- A broader attention should be given to climate change management practices (including management accounting), which seems, at the moment, to be of less importance in the climate change-related accounting literature in comparison with reporting-related aspects. In fact, reporting could be driven by various motivations (e.g., greenwashing, window dressing, industry/legislative/stakeholder pressures, etc.) [47], not always coherent with the real achievement of the SDGs. A greater focus of the research community on management decisions and actions to counteract climate change, would be helpful to promote the understanding and development of such practices. The analyzed literature seemed, on the contrary, to focus mainly on reporting-related aspects (as shown by the great number of articles about sustainability reporting, both in the strict and in the broad sense). Even if disclosure is an important aspect to focus upon, it is not the main problem. The authors deem that the most urgent problem to be addressed is the management of climate change-related aspects, with specific reference to strategic and operational planning, accounting, and control of the actions implemented by the management of firms to counter climate change problems. These considerations are similar to those proposed by Gibson [77], as she stated that “reporting […] is not the real problem in addressing atmospheric pollution, but that the economic philosophy which attempts to address ecological problems in economic terms is the main culprit”.

- -

- A growth of publications about climate change-related aspects, not only in typical academic accounting journals, but also in more interdisciplinary journals;

- -

- A greater collaboration among authors, both within the accounting discipline and with scholars of other scientific areas;

- -

- A greater collaboration between academic scholars, practitioners, and policy makers.

- -

- The implementation and modification of existing and creation of new managerial tools to counteract the impacts of firms on sustainability and climate change;

- -

- The study of effective results of managerial actions designed to help companies to dramatically reduce their impact on unsustainability and climate change;

- -

- Analyses of business cases (e.g., case studies, field studies, single best practices, benchmarking among best practices, etc.) that could help the managers of firms to become involved and committed to engaging their colleagues, employees, and customers in achieving sustainability-related objectives;

- -

- Stimulating raising awareness among business managers, other accounting scholars, and students about the needs to address climate change-related problems, not only for opportunistic reasons (e.g., window dressing), but also because this is one of the main problems that individuals, public institutions, and companies (both large corporations and small businesses) should face now to achieve a better and more sustainable future for everyone.

Author Contributions

Funding

Conflicts of Interest

Appendix A. The 85 Articles Analyzed

- Ajani, J.I.; Keith, H.; Blakers, M.; Mackey, B.G.; King, H.P. Comprehensive carbon stock and flow accounting: A national framework to support climate change mitigation policy. Ecol. Econ. 2013, 89, 61–72.

- Andrew, J.; Cortese, C. Free market environmentalism and the neoliberal project: The case of the climate disclosure standards board. Crit. Perspect. Account. 2013, 24, 397–409.

- Ascui, F.; Lovell, H. As frames collide: Making sense of carbon accounting. Account. Audit. Account. J. 2011, 24.

- Ascui, F.; Lovell, H. Carbon accounting and the construction of competence. J. Clean. Prod. 2012, 36, 48–59.

- Atkins, J.; Atkins, B.C.; Thomson, Ian; Maroun, W. “Good” news from nowhere: Imagining utopian sustainable accounting. Account. Audit. Account. J. 2015, 28.

- Barrett, J.; Peters, G.; Wiedmann, T.; Scott, K.; Lenzen, M.; Roelich, K.; Le Quere, C. Consumption-based ghg emission accounting: A UK case study. Clim. Policy 2013, 13, 451–470.

- Bebbington, J.; Larrinaga-Gonzalez, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717.

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. J. Bus. Ethics 2017, 142, 369–383.

- Ben-Amar, W.; McIlkenny, P. Board effectiveness and the voluntary disclosure of climate change information. Bus. Strategy Environ. 2015, 24, 704–719.

- Birdsey, R.A. Carbon accounting rules and guidelines for the United States forest sector. J. Environ. Qual. 2006, 35, 1518–1524.

- Boston, J.; Lempp, F. Climate change explaining and solving the mismatch between scientific urgency and political inertia. Account. Audit. Account. J. 2011, 24, 1000–1021.

- Brandao, M.; Levasseur, A.; Kirschbaum, M.U.F.; Weidema, B.P.; Cowie, A.L.; Jorgensen, S.V.; Hauschild, M.Z.; Pennington, D.W.; Chomkhamsri, K. Key issues and options in accounting for carbon sequestration and temporary storage in life cycle assessment and carbon footprinting. Int. J. Life Cycle Assess. 2013, 18, 230–240.

- Brander, M. Comparative analysis of attributional corporate greenhouse gas accounting, consequential life cycle assessment, and project/policy level accounting: A bioenergy case study. J. Clean. Prod. 2017, 167, 1401–1414.

- Brander, M. Transposing lessons between different forms of consequential greenhouse gas accounting: Lessons for consequential life cycle assessment, project-level accounting, and policy-level accounting. J. Clean. Prod. 2016, 112, 4247–4256.

- Brouhle, K.; Harrington, D.R. Firm strategy and the Canadian voluntary climate challenge and registry (vcr). Bus. Strategy Environ. 2009, 18, 360–379.

- Burritt, R.L.; Schaltegger, S.; Zvezdov, D. Carbon management accounting: Explaining practice in leading German companies. Aust. Account. Rev. 2011, 21, 80–98.

- Burritt, R.L.; Tingey-Holyoak, J. Forging cleaner production: The importance of academic-practitioner links for successful sustainability embedded carbon accounting. J. Clean. Prod. 2012, 36, 39–47.

- Bustamante, M.C.; Silva, J.S.O.; Cantinho, R.Z.; Shimbo, J.Z.; Oliveira, P.V.C.; Santos, M.M.O.; Ometto, J.P.H.B.; Cruz, M.R.; Mello, T.R.B.; Godiva, D.; et al. Engagement of scientific community and transparency in C accounting: The Brazilian case for anthropogenic greenhouse gas emissions from land use, land-use change and forestry. Environ. Res. Lett. 2018, 13, 55005.

- Byrne, Susan; O’Regan, B. Material flow accounting for an Irish rural community engaged in energy efficiency and renewable energy generation. J. Clean. Prod. 2016, 127, 363–373.

- Comyns, B. Determinants of ghg reporting: An analysis of global oil and gas companies. J. Bus. Ethics 2016, 136, 349–369.

- Cooper, S.; Pearce, G. Climate change performance measurement, control and accountability in English local authority areas. Account. Audit. Account. J. 2011, 24.

- Cooper, S.A.; Raman, K.; Yin, J. Halo effect or fallen angel effect? Firm value consequences of greenhouse gas emissions and reputation for corporate social responsibility. J. Account. Public Policy 2018, 37, 226–240.

- Cordova, C.; Zorio-Grima, A.; Merello, P. Carbon emissions by South American companies: Driving factors for reporting decisions and emissions reduction. Sustainability 2018, 10, 2411.

- Cowie, A.L.; Kirschbaum, M.U.F.; Ward, M. Options for including all lands in a future greenhouse gas accounting framework. Environ. Sci. Policy 2007, 10, 306–321.

- Csutora, M.; Mozner, Z.V. Proposing a beneficiary-based shared responsibility approach for calculating national carbon accounts during the post-Kyoto era. Clim. Policy 2014, 14, 599–616.

- Deckmyn, G.; Muys, B.B.; Quijano, J.G.; Ceulemans, R. Carbon sequestration following afforestation of agricultural soils: Comparing oak/beech forest to short-rotation poplar coppice combining a process and a carbon accounting model. Glob. Chang. Biol. 2004, 10, 1482–1491.

- Depoers, F.; Jeanjean, T.s; Tiphaine, J. Voluntary disclosure of greenhouse gas emissions: Contrasting the carbon disclosure project and corporate reports. J. Bus. Ethics 2016, 134, 445–461.

- Dilling, P.F.A.; Harris, P. Reporting on long-term value creation by Canadian companies: A longitudinal assessment. J. Clean. Prod. 2018, 191, 350–360.

- Ellison, D.; Lundblad, M.; Petersson, H. Carbon accounting and the climate politics of forestry. Environ. Sci. Policy 2011, 14, 1062–1078.

- Gallego, A.I. Impact of co2 emission variation on firm performance. Bus. Strategy Environ. 2012, 21, 435–454.

- Gallego-Alvarez, I.; Garcia-Sanchez, I.M.; Da Silva, V.C. Climate change and financial performance in times of crisis. Bus. Strategy Environ. 2014, 6, 361–374.

- Gentil, E.; Christensen, T.H.; Aoustin, E. Greenhouse gas accounting and waste management. Waste Manag. Res. 2009, 27, 696–706.

- Gerst, M.D.; Howarth, R.B.; Borsuk, M.E. Accounting for the risk of extreme outcomes in an integrated assessment of climate change. Energy Policy 2010, 38, 4540–4548.

- Giannarakis, G.; Zafeiriou, E.; Sariannidis, N. The impact of carbon performance on climate change disclosure. Bus. Strategy Environ. 2017, 26, 1078–1094.

- Gillenwater, M. Forgotten carbon: Indirect co2 in greenhouse gas emission inventories. Environ. Sci. Policy 2008, 11, 195–203.

- Gillett, N.P.; Matthews, H.D. Accounting for carbon cycle feedbacks in a comparison of the global warming effects of greenhouse gases. Environ. Res. Lett. 2010, 5, 34011.

- Grauel, J.; Gotthardt, D. The relevance of national contexts for carbon disclosure decisions of stock-listed companies: A multilevel analysis. J. Clean. Prod. 2016, 133, 1204–1217.

- Gustavsson, L.; Karjalainen, T.; Marland, G.; Savolainen, I.; Schlamadinger, B.; Apps, M. Project-based greenhouse-gas accounting: Guiding principles with a focus on baselines and additionality. Energy Policy 2000, 28, 935–946.

- Gusti, M.; Jonas, M. Terrestrial full carbon account for Russia: Revised uncertainty estimates and their role in a bottom-up/top-down accounting exercise. Clim. Chang. 2010, 103, 159–174.

- Haddock-Fraser, J.E.; Tourelle, M. Corporate motivations for environmental sustainable development: Exploring the role of consumers in stakeholder engagement. Bus. Strategy Environ. 2010, 19, 527–542.

- Halkos, G.; Skouloudis, A. Exploring the current status and key determinants of corporate disclosure on climate change: Evidence from the Greek business sector. Environ. Sci. Policy 2016, 56, 22–31.

- Hao, Y.; Su, M.; Zhang, L.; Cai, Y.; Yang, Z. Integrated accounting of urban carbon cycle in Guangyuan, a mountainous city of china: The impacts of earthquake and reconstruction. J. Clean. Prod. 2015, 103, 231–240.

- Haque, S.; Deegan, C. Corporate climate change-related governance practices and related disclosures: Evidence from Australia. Aust. Account. Rev. 2010, 20, 313–333.

- Haripriya, G.S. Carbon budget of the Indian forest ecosystem. Clim. Chang. 2003, 56, 291–319.

- Hartmann, Frank; Perego, P.; Young, A. Carbon accounting: Challenges for research in management control and performance measurement. Abacus A J. Account. Financ. Bus. Stud. 2013, 49, 539–563.

- Hasselmann, K. Intertemporal accounting of climate change—Harmonizing economic efficiency and climate stewardship. Clim. Chang. 1999, 41, 333–350.

- Hoerisch, J.; Ortas, E.; Schaltegger, S.; Alvarez, I. Environmental effects of sustainability management tools: An empirical analysis of large companies. Ecol. Econ. 2015, 120, 241–249.

- Jasinevicius, G.; Lindner, M.; Cienciala, E.; Tykkylainen, M. Carbon accounting in harvested wood products assessment using material flow analysis resulting in larger pools compared to the IPCC default method. J. Ind. Ecol. 2018, 22, 121–131.

- Jing, R.; Cheng, J.C.P.; Gan, V.J.L.; Woon, K.S.; Lo, I.M.C. Comparison of greenhouse gas emission accounting methods for steel production in China. J. Clean. Prod. 2014, 83, 165–172.

- Kalu, J.U.; Buang, A.; Aliagha, G.U. Determinants of voluntary carbon disclosure in the corporate real estate sector of Malaysia. J. Environ. Manag. 2016, 182, 519–524.

- Kolk, A.; Levy, D.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Account. Rev. 2008, 17, 719–745.

- Larsen, H.N.; Hertwich, E.G. Implementing carbon-footprint-based calculation tools in municipal greenhouse gas inventories. J. Ind. Ecol. 2010, 14, 965–977.

- Lee, K. Carbon accounting for supply chain management in the automobile industry. J. Clean. Prod. 2012, 36, 83–93.

- Liesen, A.; Hoepner, A.G.; Patten, D.M.; Figge, F. Does stakeholder pressure influence corporate ghg emissions reporting? Empirical evidence from Europe. Account. Audit. Account. J. 2015, 28.

- Liptow, C.; Janssen, M.; Tillman, A. Accounting for effects of carbon flows in LCA of biomass-based products exploration and evaluation of a selection of existing methods. Int. J. Life Cycle Assess. 2018, 23, 2110–2125.

- Lodhia, S.; Martin, N. Stakeholder responses to the national greenhouse and energy reporting act an agenda setting perspective. Account. Audit. Account. J. 2012, 25.

- Lozano, R.; Huisingh, D. Inter-linking issues and dimensions in sustainability reporting. J. Clean. Prod. 2011, 19, 99–107.

- Martire, S.; Mirabella, N.; Sala, S. Widening the perspective in greenhouse gas emissions accounting: The way forward for supporting climate and energy policies at municipal level. J. Clean. Prod. 2018, 176, 842–851.

- Milne, M.J.; Grubnic, S. Climate change accounting research: Keeping it interesting and different. Account. Audit. Account. J. 2011, 24.

- Mjelde, A.; Martinsen, K.; Eide, M.; Endresen, O. Environmental accounting for arctic shipping—A framework building on ship tracking data from satellites. Mar. Pollut. Bull. 2014, 87, 22–28.

- Mozner, Z.V. A consumption-based approach to carbon emission accounting—Sectoral differences and environmental benefits. J. Clean. Prod. 2013, 42, 83–95.

- Neelis, M.L.; Patel, M.; Gielen, D.J.; Blok, K. Modelling co2 emissions from non-energy use with the non-energy use emission accounting tables (neat) model. Resour. Conserv. Recycl. 2005, 45, 226–250.

- Pearson, T.R.H.; Brown, S.; Andrasko, K. Comparison of registry methodologies for reporting carbon benefits for afforestation projects in the United States. Environ. Sci. Policy 2008, 11, 490–504.

- Pellegrino, C.; Lodhia, S. Climate change accounting and the Australian mining industry: Exploring the links between corporate disclosure and the generation of legitimacy. J. Clean. Prod. 2012, 36, 68–82.

- Prado-Lorenzo, J.; Rodriguez-Dominguez, L.; Gallego-Alvarez, I.; Garcia-Sanchez, I. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47.

- Pulles, T.; Yang, H. Ghg emission estimates for road transport in national ghg inventories. Clim. Policy 2011, 11, 944–957.

- Radhouane, I.; Nekhili, M.; Nagati, H.; Pache, G. The impact of corporate environmental reporting on customer-related performance and market value. Manag. Decis. 2018, 56.

- Rankin, M.; Windsor, C.; Wahyuni, D. An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system Australian evidence. Account. Audit. Account. J. 2011, 24.

- Rickels, W.; Rehdanz, K.; Oschlies, A. Methods for greenhouse gas offset accounting: A case study of ocean iron fertilization. Ecol. Econ. 2010, 69, 2495–2509.

- Rogelj, J.; Meinshausen, M.; Schaeffer, M.; Knutti, R.; Riahi, K. Impact of short-lived non-co2 mitigation on carbon budgets for stabilizing global warming. Environ. Res. Lett. 2015, 10, 75001.

- Schaltegger, S.; Csutora, M. Carbon accounting for sustainability and management. Status quo and challenges. J. Clean. Prod. 2012, 36, 1–16.

- Shvidenko, A.; Schepaschenko, D.; McCallum, I.; Nilsson, S. Can the uncertainty of full carbon accounting of forest ecosystems be made acceptable to policymakers? Clim. Chang. 2010, 103, 137–157.

- Milne, M.J.; Grubnic, S.; Solomon, J.F.; Solomon, A.; Norton, S.D.; Joseph, N.L. Private climate change reporting: an emerging discourse of risk and opportunity? Account. Audit. Account. J. 2011, 24.

- Steckel, J.C.; Kalkuhl, M.; Marschinski, R. Should carbon-exporting countries strive for consumption-based accounting in a global cap-and-trade regime? Clim. Chang. 2010, 100, 779–786.

- Sullivan, R.; Gouldson, A. Does voluntary carbon reporting meet investors’ needs? J. Clean. Prod. 2012, 36, 60–67.

- Talbot, D.; Boiral, O. Ghg reporting and impression management: An assessment of sustainability reports from the energy sector. J. Bus. Ethics 2018, 147, 367–383.

- Tang, S.; Demeritt, D. Climate change and mandatory carbon reporting: Impacts on business process and performance. Bus. Strategy Environ. 2018, 4, 437–455.

- Thomae, J.; Dupre, S.; Hayne, M. A taxonomy of climate accounting principles for financial portfolios. Sustainability 2018, 10, 328.

- Tokarska, K.B.; Gillett, N.P.; Arora, V.K.; Lee, W.G.; Zickfeld, K. The influence of non-co2 forcings on cumulative carbon emissions budgets. Environ. Res. Lett. 2018, 13, 34039.

- Trotman, A.J.; Trotman, K.T. Internal audit’s role in ghg emissions and energy reporting: Evidence from audit committees, senior accountants, and internal auditors. Audit. J. Pract. Theory 2015, 34, 199–230.

- Horacio Villarino, S.; Studdert, G.A.; Laterra, P.; Cendoya, M.G. Agricultural impact on soil organic carbon content: Testing the IPCC carbon accounting method for evaluations at county scale. Agric. Ecosyst. Environ. 2014, 185, 119–132.

- Whittaker, C.; McManus, M.C.; Smith, P. A comparison of carbon accounting tools for arable crops in the United Kingdom. Environ. Model. Softw. 2013, 46, 228–239.

- Williams, S.; Schaefer, A. Small and medium-sized enterprises and sustainability: managers’ values and engagement with environmental and climate change issues. Bus. Strategy Environ. 2013, 22, 173–186.

- Wu, L.; Mao, X.Q.; Zeng, A. Carbon footprint accounting in support of city water supply infrastructure siting decision making: A case study in Ningbo, China. J. Clean. Prod. 2015, 103, 737–746.

- Zhang, C.; Han, R.; Yu, B.; Wei, Y. Accounting process-related co2 emissions from global cement production under shared socioeconomic pathways. J. Clean. Prod. 2018, 184, 451–465.

References

- Schaltegger, S.; Burritt, R.L. Sustainability accounting for companies: Catchphrase or decision support for business leaders? J. World Bus. 2010, 45, 375–384. [Google Scholar] [CrossRef]

- Andrew, J.; Cortese, C. Accounting for climate change and the self-regulation of carbon disclosures. Acc. Forum 2011, 35, 130–138. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; Rodríguez-Domínguez, L.; Gallego-Alvarez, I.; Garcıa-Sánchez, I.M. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47, 1133–1157. [Google Scholar] [CrossRef]

- Cooper, S.; Pearce, G. Climate change performance measurement, control and accountability in English local authority areas. Account. Audit. Account. J. 2011, 24, 1097–1118. [Google Scholar] [CrossRef]

- Milne, M.J.; Grubnic, S.; Solomon, J.F.; Solomon, A.; Norton, S.D.; Joseph, N.L. Private climate change reporting: An emerging discourse of risk and opportunity. Account. Audit. Account. J. 2011, 24, 1119–1148. [Google Scholar]

- Milne, M.J.; Grubnic, S. Climate change accounting research: Keeping it interesting and different. Account. Audit. Account. J. 2011, 24, 948–977. [Google Scholar] [CrossRef] [Green Version]

- Kolk, A. Trajectories of sustainability reporting by MNCs. J. World Bus. 2010, 45, 367–374. [Google Scholar] [CrossRef] [Green Version]

- Hopwood, A.G. Whither accounting research? Account. Rev. 2007, 82, 1356–1374. [Google Scholar] [CrossRef]

- Lovell, H.; MacKenzie, D. Accounting for carbon: The role of accounting professional organisations in governing climate change. Antipode 2011, 43, 704–730. [Google Scholar] [CrossRef] [Green Version]

- Nikolaou, E.I.; Evangelinos, K.I. Financial and non-financial environmental information: Significant factors for corporate environmental performance measuring. Int. J. Manag. Financ. Account. 2012, 4, 61–77. [Google Scholar] [CrossRef]

- Hopwood, A.G.; Miller, P. Accounting as Social and Institutional Practice; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Beams, F.A.; Fertig, P.E. Pollution control through social cost conversion. J. Account. 1971, 132, 37–42. [Google Scholar]

- Mathews, M.R. Towards a mega-theory of accounting. Asia-Pac. J. Account. 1997, 4, 273–289. [Google Scholar] [CrossRef]

- Gray, R. A re-evaluation of social, environmental and sustainability accounting: An exploration of an emerging trans-disciplinary research field? Sustain. Account. Manag. Policy J. 2010, 1, 11–32. [Google Scholar] [CrossRef]

- Elkington, J.; Rowlands, I.H. Cannibals with forks: The triple bottom line of 21st century business. Altern. J. 1999, 25, 42. [Google Scholar]

- Ascui, F. A review of carbon accounting in the social and environmental accounting literature: What can it contribute to the debate? Soc. Environ. Account. J. 2014, 34, 6–28. [Google Scholar] [CrossRef] [Green Version]

- West, J.; Brereton, D. Climate Change Adaptation in Industry and Business: A Framework for Best Practice in Financial Risk Assessment, Governance and Disclosure. (National Climate Change Adaptation Research Facility, Gold Coast, Australia). 2013. Available online: file:///C:/Users/39333/Desktop/Carmela/backup%20samsung%2019_09_2015/carmela/s%20i/s%20i%20%2020/Caputo%20SDGs/p%20sent/rev%2019_06_2020/documents%20sent%2024_06_2020/West_2013_Climate_change_adaptation_industry_and_business.pdf (accessed on 2 June 2020).

- Amran, A.; Periasamy, V.; Zulkafli, A.H. Determinants of climate change disclosure by developed and emerging countries in Asia Pacific. Sustain. Dev. 2014, 22, 188–204. [Google Scholar] [CrossRef]

- Makarenko, I.; Plastun, A. The role of accounting in sustainable development. Account. Financ. Control 2017, 1, 4–12. [Google Scholar] [CrossRef] [Green Version]

- CDP. Carbon Disclosure Project 2007, London. Available online: https://www.rsc.org/images/CDP%20summary%20report_tcm18-100933.pdf (accessed on 26 March 2020).

- Haque, S.; Islam, A. Stakeholder pressures on corporate climate change-related accountability and disclosures: Australian evidence. Bus. Politics 2015, 17, 355–390. [Google Scholar] [CrossRef] [Green Version]

- Bebbington, J.; Unerman, J. Achieving the United Nations sustainable development goals: An enabling role for accounting research. Account. Audit. Account. J. 2018, 31, 2–24. [Google Scholar] [CrossRef]

- Cook, A. Emission rights: From costless activity to market operations. Account. Organ. Soc. 2009, 34, 456–468. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Birt, J.; Griffiths, A. The role of accounting in supporting adaptation to climate change. Account. Finance 2015, 55, 607–625. [Google Scholar] [CrossRef]

- Hazelton, J. Accounting as a human right: The case of water information. Account. Audit. Account. J. 2013, 26, 267–311. [Google Scholar] [CrossRef]

- Larrinaga-Gonzalez, C.; Pérez-Chamorro, V. Sustainability Accounting and Accountability in Public Water Companies. Public Money Manag. 2008, 28, 337–343. [Google Scholar] [CrossRef] [Green Version]

- Arnold, D. Transnational corporations and the duty to respect basic human rights. Bus. Ethics Q. 2010, 20, 371–399. [Google Scholar] [CrossRef]

- McPhail, K.; Macdonald, K.; Ferguson, J. Should the international accounting standards board have responsibility for human rights? Account. Audit. Account. J. 2016, 29, 594–616. [Google Scholar] [CrossRef] [Green Version]

- McPhail, K.; McKernan, J. Accounting for human rights: An overview and introduction. Crit. Perspect. Account. 2011, 22, 733–737. [Google Scholar] [CrossRef]

- Tweedie, D.; Hazelton, J. Social Accounting for Inequality: Applying Piketty’s Capital in the Twenty-First Century. Soc. Environ. Account. J. 2015, 35, 113–122. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga, C.; Russell, S.; Stevenson, L. Organizational, management and accounting perspectives on biodiversity. In Biodiversity in the Green Economy; Routledge: London, UK, 2015; pp. 213–239. [Google Scholar]

- Georgakopoulos, G.; Thomson, I. Organic salmon farming: Risk perceptions, decision heuristics and the absence of environmental accounting. Account. Forum 2005, 29, 4975. [Google Scholar] [CrossRef]

- Jones, M. Accounting for Biodiversity; Routledge: London, UK, 2014. [Google Scholar]

- Siddiqui, J. Mainstreaming biodiversity accounting: Potential implications for a developing economy. Account. Audit. Account. J. 2013, 26, 779–805. [Google Scholar] [CrossRef]

- Van Liempd, D.; Busch, J. Biodiversity reporting in Denmark. Account. Audit. Account. J. 2013, 26, 833–872. [Google Scholar] [CrossRef]

- Stechemesser, K.; Guenther, E. Carbon accounting: A systematic literature review. J. Clean. Prod. 2012, 36, 17–38. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga-Gonzalez, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717. [Google Scholar] [CrossRef]

- Ascui, F.; Lovell, H. Carbon accounting and the construction of competence. J. Clean. Prod. 2012, 36, 48–59. [Google Scholar] [CrossRef] [Green Version]

- Kolk, A.; Levy, D.; Pinkse, J. Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. Eur. Account. Rev. 2008, 17, 719–745. [Google Scholar] [CrossRef]

- Brander, M. Comparative analysis of attributional corporate greenhouse gas accounting, consequential life cycle assessment, and project/policy level accounting: A bioenergy case study. J. Clean. Prod. 2017, 167, 1401–1414. [Google Scholar] [CrossRef]

- Comyns, B.; Figge, F. Greenhouse gas reporting quality in the oil and gas industry. Account. Audit. Account. J. 2015, 28, 403–433. [Google Scholar] [CrossRef]

- Pellegrino, C.; Lodhia, S. Climate change accounting and the Australian mining industry: Exploring the links between corporate disclosure and the generation of legitimacy. J. Clean. Prod. 2012, 36, 68–82. [Google Scholar] [CrossRef]

- Ramírez, C.Z.; González, J.M.G. Climate change challenges to accounting. Low Carbon Econ. 2013, 4, 25–35. [Google Scholar] [CrossRef] [Green Version]

- Le Breton, M.; Aggeri, F. The emergence of carbon accounting: How instruments and dispositifs interact in new practice creation. Sustain. Account. Manag. Policy J. 2020, 11, 505–522. [Google Scholar] [CrossRef]

- Herbohn, K.; Dargusch, P.; Herbohn, J. Climate change policy in Australia: Organisational responses and influences. Aust. Account. Rev. 2012, 22, 208–222. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Pinnuck, M.; Richardson, G.D. The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. Eur. Account. Rev. 2015, 24, 551–580. [Google Scholar] [CrossRef]

- MacKenzie, D. Making things the same: Gases, emission rights and the politics of carbon markets. Account. Organ. Soc. 2009, 34, 440–455. [Google Scholar] [CrossRef] [Green Version]

- Hirschfeld, J.; Weiß, J.; Preidl, M.; Korbun, T. The Impact of German Agriculture on the Climate. Main Results and Conclusions; Working Paper; Schriftenreihe des IÖW: Berlin, Germany, 2008. [Google Scholar]

- Ngwakwe, C.C. Rethinking the accounting stance on sustainable development. Sustain. Dev. 2012, 20, 28–41. [Google Scholar] [CrossRef]

- Pignatel, I.; Brown, A. Lessons to be learned. French top accounting journals’ contribution to climate change. EuroMed J. Bus. 2010, 5, 70–84. [Google Scholar] [CrossRef]

- Searchinger, T.; Heimlich, R.; Houghton, R.A.; Dong, F.; Elobeid, A.; Fabiosa, J.; Tu, T.H. Use of US croplands for biofuels increases greenhouse gases through emissions from land-use change. Science 2008, 319, 1238–1240. [Google Scholar] [CrossRef]

- Schaltegger, S.; Csutora, M. Carbon accounting for sustainability and management, status quo and challenges. J. Clean. Prod. 2012, 36, 1–16. [Google Scholar] [CrossRef]

- Brown, A.M.; Pignatel, I.; Hanoteau, J.; Paranque, B. The silence on climate change by accounting’s top journals. Int. J. Clim. Chang. Impacts Account. 2009, 1, 81–100. [Google Scholar] [CrossRef]

- Evangelinos, K.; Nikolaou, I.; Leal Filho, W. The effects of climate change policy on the business community: A corporate environmental accounting perspective. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 257–270. [Google Scholar] [CrossRef]

- Ratnatunga, J. An inconvenient truth about accounting. J. Appl. Manag. Account. Res. 2007, 5, 1. [Google Scholar]

- Eckelman, M.J. Facility-level energy and greenhouse gas life-cycle assessment of the global nickel industry. Resour. Conserv. Recycl. 2010, 54, 256–266. [Google Scholar] [CrossRef]

- Jasch, C. The use of Environmental Management Accounting (EMA) for identifying environmental costs. J. Clean. Prod. 2003, 11, 667–676. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Busch, T. Corporate carbon performance indicators: Carbon intensity, dependency, exposure and risk. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- Ilinitch, Y.A.; Soderstrom, S.N.; Thomas, E.T. Measuring corporate environmental performance. J. Account. Public Policy 1998, 17, 383–408. [Google Scholar] [CrossRef]

- Hopwood, A.G. Accounting and the environment. Account. Organ. Soc. 2009, 34, 433–439. [Google Scholar] [CrossRef]

- Lohmann, L. Toward a different debate in environmental accounting: The cases of carbon and cost-benefit. Account. Organ. Soc. 2009, 34, 499–534. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Chiaroni, D.; Del Vecchio, P.; Urbinati, A. Designing business models in circular economy: A systematic literature review and research agenda. Bus. Strategy Environ. 2020, 29, 1734–1749. [Google Scholar] [CrossRef]

- Snyder, A. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Fink, A. Conducting Research Literature Reviews. From the Internet to Paper, 3rd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2010. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Kitchenham, B.; Charters, S. Guidelines for performing systematic literature reviews in software engineering version 2.3. Engineering 2007, 45, 1051. [Google Scholar]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-tool for comprehensive science mapping analysis. J. Infometr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Pritchard, A. Statistical bibliography or bibliometrics. J. Doc. 1969, 25, 348–349. [Google Scholar]

- Broadus, R. Towards a definition of bibliometrics. Scientometrics 1987, 12, 373–379. [Google Scholar] [CrossRef]

- Diodato, V. Dictionary of Bibliometrics; Haworth Press: Binghamton, NY, USA, 1994. [Google Scholar]

- Guthrie, J.; Ricceri, F.; Dumay, J. Reflections and projections: A decade of intellectual capital accounting research. Br. Account. Rev. 2012, 44, 68–82. [Google Scholar] [CrossRef]

- Dumay, J.; Guthrie, J.; Puntillo, P. IC and public sector: A structured literature review. J. Intell. Cap. 2015, 16, 267–284. [Google Scholar] [CrossRef]

- Miller, P. The margins of accounting. Eur. Account. Rev. 1998, 7, 605–621. [Google Scholar] [CrossRef]

- Messer-Davidow, E.; Shumway, D.R.; Sylvan, D.J. Knowledges: Historical and Critical Studies in Disciplinarity; University Press of Virginia: Charlottesville, VA, USA, 1993. [Google Scholar]

- Jenkins, B.; Russell, S.; Sadler, B.; Ward, M. Application of sustainability appraisal to the Canterbury Water Management Strategy. Australas. J. Environ. Manag. 2014, 21, 83–101. [Google Scholar] [CrossRef]

- Doni, F.; Gasperini, A.; Soares, J.T. SDG13-Climate Action: Combatting Climate Change and Its Impacts; Emerald Group Publishing: Bingley, UK, 2020. [Google Scholar]

- Gibson, K. The problem with reporting pollution allowances: Reporting is not the problem. Crit. Perspect. Account. 1996, 7, 655–665. [Google Scholar] [CrossRef]

| Sections | Questions | Answers: Open/Closed (Codified) |

|---|---|---|

| Bibliographic data | ||

| Author(s) | Who is/are the author(s) of the publication? | Open |

| Year | In which year was the work published? | Open |

| Title | What is the title of the publication? | Open |

| Authors’ affiliation | What is the university affiliation of the author(s)? | Open |

| Type of publication | What kind of publication? | Open |

| Journal name | If it is a journal: what is the journal’s name? | Open |

| Research framework | ||

| A. Jurisdiction | What is the context of the publication? | A1. Supranational/international comparative |

| A2. National | ||

| A3. Local government | ||

| A4. Public Business Enterprise | ||

| A5. Private company | ||

| A6. Specific economic sector | ||

| A7. One organization | ||

| A8. Other | ||

| B. Location | Which is the specific location of the publication? | B1. Europe |

| B2. North America | ||

| B3. South America | ||

| B4. Australasia | ||

| B5. Asia/China | ||

| B6. Africa | ||

| B7. Other (e.g., more locations, nowhere in particular) | ||

| C. Focus of the article | On which research field the article is focused? | C1. External reporting |

| C2. Auditing | ||

| C3. Accounting | ||

| C4. Governance | ||

| C5. Management control/strategy | ||

| C6. Performance measurement | ||

| C7. Budgeting | ||

| C8. Other | ||

| D. Research methods | Which research method is used in the publication? | D1. Case/field study/interviews |

| D2. Content analysis/historical analysis | ||

| D3. Survey/questionnaire/other empirical | ||

| D4. Commentary/normative/policy | ||

| D5. Theoretical literature review/empirical | ||

| E. Academic or practitioner author(s) | Which is the institutional background of the author(s)? | E1. Only academic(s) |

| E2. Only practitioner(s) | ||

| E3. Academic(s) and practitioner(s) | ||

| % | |

|---|---|

| Description | Results |

| Documents | 85 |

| Sources (Journals, Books, etc.) | 28 |

| Keywords Plus (ID) | 268 |

| Author’s Keywords (DE) | 275 |

| Period | 1999–2018 |

| Average citations per documents | 30.48 |

| Authors | 233 |

| Author Appearances | 249 |

| Authors of single-authored documents | 9 |

| Authors of multi-authored documents | 224 |

| Single-authored documents | 10 |

| Documents per Author | 0.36 |

| Authors per Document | 2.74 |

| Co-Authors per Documents | 2.93 |

| Collaboration Index | 2.99 |

| Document types | |

| ARTICLE | 83 |

| ARTICLE; PROCEEDINGS PAPER | 2 |

| Authors | Articles | Authors—Fractionalized | Articles—Fractionalized |

|---|---|---|---|

| Schaltegger S. | 3 | Brander M. | 2.0 |

| Ascui F. | 2 | Mozner Z.V. | 1.5 |

| Ben amar W. | 2 | Schaltegger S. | 1.1 |

| Brander M. | 2 | Alvarez I.G. | 1.0 |

| Burritt R.L. | 2 | Ascui F. | 1.0 |

| Cowie A.L. | 2 | Birdsey R.A. | 1.0 |

| Csutora M. | 2 | Comyns B. | 1.0 |

| Gallego alvarez I. | 2 | Csutora M. | 1.0 |

| Garcia sanchez I.M. | 2 | Gillenwater M. | 1.0 |

| Gillett N.P. | 2 | Haripriya G.S. | 1.0 |

| Kirschbaum M.U.F. | 2 | Hasselmann K. | 1.0 |

| Lodhia S. | 2 | Lee K.H. | 1.0 |

| Lovell H. | 2 | Lodhia S. | 1.0 |

| Mcilkenny P. | 2 | Lovell H. | 1.0 |

| Mozner Z.V. | 2 | Ben amar W. | 0.8 |

| Region | Freq | Region | Freq |

|---|---|---|---|

| UK | 28 | Finland | 5 |

| Australia | 27 | Greece | 5 |

| USA | 18 | Netherlands | 5 |

| Germany | 15 | Austria | 4 |

| Canada | 14 | Denmark | 4 |

| France | 12 | Hungary | 4 |

| China | 8 | New Zealand | 4 |

| Brazil | 7 | Norway | 4 |

| Spain | 7 | Italy | 3 |

| Sweden | 7 | Argentina | 2 |

| Keywords Plus (ID) | Occ. | Authors Keywords (DE) | Occ. | Titles | Occ. | Abstracts | Occ. |

|---|---|---|---|---|---|---|---|

| Climate change | 16 | Climate change | 27 | Accounting | 47 | Carbon | 229 |

| Emissions | 15 | Carbon accounting | 14 | Carbon | 41 | Climate | 196 |

| Companies | 11 | Greenhouse gas emissions | 6 | Climate | 22 | Accounting | 173 |

| Environmental disclosures | 8 | Ghg emissions | 5 | Greenhouse | 16 | Emissions | 172 |

| Greenhouse gas emissions | 8 | Sustainability | 5 | Change | 15 | Change | 159 |

| Performance | 8 | Sustainable development | 5 | Gas | 15 | Reporting | 99 |

| Legitimacy | 7 | Disclosure | 4 | Reporting | 15 | Ghg | 86 |

| Strategies | 7 | Global warming | 4 | Corporate | 13 | Paper | 72 |

| Co2 | 6 | Greenhouse gas | 4 | Emissions | 13 | Disclosure | 70 |

| Management | 6 | Kyoto protocol | 4 | Disclosure | 12 | Environmental | 70 |

| Sustainability | 6 | Sustainability reporting | 4 | Assessment | 7 | Companies | 67 |

| Determinants | 5 | Carbon | 3 | Companies | 7 | Greenhouse | 57 |

| Impact | 5 | Carbon cycle | 3 | Emissions | 7 | Firms | 54 |

| Sequestration | 5 | Carbon disclosure | 3 | Ghg | 7 | Gas | 52 |

| Social responsibility | 5 | Carbon stocks | 3 | Management | 7 | Management | 50 |

| Corporate social responsibility | 4 | Climate change mitigation | 3 | Performance | 7 | Global | 49 |

| Energy | 4 | Emissions | 3 | Sustainability | 7 | Analysis | 46 |

| Financial performance | 4 | Environmental accounting | 3 | Case | 6 | Corporate | 43 |

| Governance | 4 | Environmental reporting | 3 | Energy | 6 | Study | 43 |

| International trade | 4 | G.h.g. accounting | 3 | Environmental | 6 | Methods | 41 |

| Paper | Total Cit. (TC) | TC per Year |

|---|---|---|

| Kolk and Pinske, 2008, European Accounting Review | 241 | 21.9 |

| Lozano and Huisingh, 2011, Journal of Cleaner Production | 196 | 24.5 |

| Barrett, 2013, Climate Policy | 123 | 20.5 |

| Bebbington and Larrinaga-Gonzalez, 2008, European Accounting Review | 110 | 10.0 |

| Brandao et al., 2013, International Journal of Life Cycle Assessment | 108 | 18.0 |

| Rankin, Windsor and Wahyuni, 2011, Accounting, Auditing, and Accountability journal | 86 | 10.7 |

| Schaltegger and Csutora, 2012 Journal of Cleaner Production | 84 | 12.0 |

| Williams and Schaefer, 2013, Business Strategy and the Environment | 78 | 13.0 |

| Prado-Lorenzo, Rodriguez Dominguez, Gallego Alvarez and Garcia Sanchez, 2009, Management Decision | 75 | 7.5 |

| Burritt, Schaltegger and Zvezdov, 2011, Australian Accounting Review | 67 | 8.4 |

| Gentil, Christensen and Aoustin, 2009, Waste Management and Research | 64 | 6.4 |

| Pellegrino and Lodhia, 2012 Journal of Cleaner Production | 58 | 8.3 |

| Ascui and Lovell, 2011, Accounting, Auditing, and Accountability Journal | 53 | 6.6 |

| Haddock Fraser and Tourelle, 2010, Business Strategy and the Environment | 49 | 5.4 |

| Solomon, Solomon, Norton and Joseph, 2011, Accounting, Auditing, and Accountability Journal | 48 | 6.0 |

| Lee, 2012, Journal of Cleaner Production | 48 | 6.8 |

| Gillett and Matthews, 2010, Environmental Research Letters | 44 | 4.9 |

| Milne and Grubnic, 2011, Accounting, Auditing, and Accountability Journal | 42 | 5.2 |

| Whittaker, McManus and Smith, 2013, Environmental Modelling and Software | 40 | 6.7 |

| Sullivan and Gouldson, 2012, Journal of Cleaner Production | 39 | 5.6 |

| A. Jurisdiction | Articles | % |

| A1. Supranational/international comparative | 4 | 4.71% |

| A2. National | 6 | 7.06% |

| A3. Local government | 6 | 7.06% |

| A4. Public Business Enterprise | 3 | 3.53% |

| A5. Private company | 25 | 29.41% |

| A6. Specific economic sector | 12 | 14.12% |

| A7. One organization | 0 | 0.00 |

| A8. Other | 29 | 34.12% |

| Tot. | 85 | 100% |

| B. Location | Articles | % |

| B1. Europe | 19 | 22.35% |

| B2. North America; | 5 | 5.88% |

| B3. South America; | 3 | 3.52% |

| B4. Australasia; | 4 | 4.70% |

| B5 Asia/China; | 8 | 9.41% |

| B6. Africa; | 0 | 0 |

| B7. Other. | 46 | 54.11% |

| Tot. | 85 | 100% |

| C. Focus of the Article | Articles | % |

| C1. External reporting | 22 | 25.88% |

| C2. Auditing | 0 | 0.00% |

| C3. Accounting | 23 | 27.06% |

| C4. Governance | 0 | 0.00% |

| C5. Management control/strategy | 8 | 9.41% |

| C6. Performance measurement | 6 | 7,06% |

| C7. Budgeting | 8 | 9.41% |

| C8. Other | 18 | 21.18% |

| Tot. | 85 | 100% |

| D. Research Method | Articles | % |

| D1. Case/field study/interviews; | 38 | 44.70% |

| D2. Content analysis/historical analysis; | 7 | 8.23% |

| D3. Survey/questionnaire/other empirical; | 12 | 14.11% |

| D4. Commentary/normative/policy; | 22 | 25.88% |

| D5. Theoretical: literature review/empirical | 6 | 7.05% |

| Tot. | 85 | 100% |

| E. Academics/Practitioners | Articles | % |

| E1. Only academic(s) | 69 | 81.17% |

| E2. Only practitioner(s) | 11 | 12.94% |

| E3. Academic(s) and practitioner(s) | 5 | 5.88% |

| Tot. | 85 | 100% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gulluscio, C.; Puntillo, P.; Luciani, V.; Huisingh, D. Climate Change Accounting and Reporting: A Systematic Literature Review. Sustainability 2020, 12, 5455. https://doi.org/10.3390/su12135455

Gulluscio C, Puntillo P, Luciani V, Huisingh D. Climate Change Accounting and Reporting: A Systematic Literature Review. Sustainability. 2020; 12(13):5455. https://doi.org/10.3390/su12135455

Chicago/Turabian StyleGulluscio, Carmela, Pina Puntillo, Valerio Luciani, and Donald Huisingh. 2020. "Climate Change Accounting and Reporting: A Systematic Literature Review" Sustainability 12, no. 13: 5455. https://doi.org/10.3390/su12135455

APA StyleGulluscio, C., Puntillo, P., Luciani, V., & Huisingh, D. (2020). Climate Change Accounting and Reporting: A Systematic Literature Review. Sustainability, 12(13), 5455. https://doi.org/10.3390/su12135455