1. Introduction

Some regions of the European Union, especially Spain, Portugal and Italy, are endowed with heritage jewels of Arab origin. The presence of Muslims in the Iberian Peninsula for almost eight centuries has left an extraordinary heritage legacy with remarkable hallmarks, such as the Mosque–Cathedral in Córdoba; the Alhambra, Generalife and Albayzín in Granada; and the Cathedral and the Alcázar in Seville. All of them have been declared World Heritage sites by the United Nations Educational, Scientific and Cultural Organization (UNESCO). With such remarkable endogenous resources given by the Arab historical footprint, it is still unclear why Spain has not envisaged a more dedicated policy towards developing smart specialization for Halal or Muslim-friendly tourism. We analyse in the paper the role that Islamic Finance can play in such a specialization.

The 2019 Global Muslim Travel Index (GMTI) compiled by Mastercard-CrescentRating [

1], which is nowadays one of the entities with more of a reputation for Muslim-friendly halal tourism, positions Spain in the ninth place, jointly with France and Philippines, in the classification of the countries that do not belong to the Organization of Islamic Cooperation (OIC)—non-OIC countries. The Spanish position is much lower than that of other countries such as Singapore, Thailand, the UK, Japan and Taiwan, which are characterized by having fewer Arab cultural endowments. Cuesta-Valiño et al. [

2] advise that official entities could first invest in the development of Muslim-friendly smart applications as a way to attract the Muslim market segment. Thus, other stakeholders of the tourism industry, such as the food, culture, lodging and leisure industries, could see the hidden potential and react by providing Halal tourism products. In this sense, we would like to highlight that the role of Islamic Finances is still under-researched.

The Halal industry and Islamic Finance (IF) have developed in parallel, especially since the 1960s and the 1970s, respectively. The Halal industry moves about 2.2 trillion dollars of a wide range of economic activities, such as: food, fashion, pharmaceuticals, cosmetics, travel, and media and recreation [

3]. Halal tourism (HT) is one of the fastest-growing sectors, as reflected by the forecast of Mastercard-CrescentRating [

1], which predicts that Muslims will spend about 300 billion dollars by 2026. At the same time, the Islamic Financial Services Board [

4] has estimated IF assets to be around 2.19 trillion dollars, representing less than 1% of financial assets worldwide.

The previous figures reflect the increasing demand for Islamic products and services. The main drivers of the potential of these markets are: (1) large, young and fast-growing global Muslim demographics; (2) the importance and growth of global Islamic economies; (3) the significance of the Islamic ethos/values that increasingly drive lifestyle and business practices; (4) the role of the Organization of Islamic Cooperation (OIC) economies as a reference; (5) the participation of global multinationals in the growing Islamic/Halal market development; and (6) the globalization of the economy and technology.

In spite of the importance of the two sectors, there is a low connection between them. According to some professionals in the sector, only 5% of the Halal industry players use IF [

5,

6]. Rasheed (1 October 2019) [

7], Deputy Governor of the Central Bank of Malaysia, points out that only 11.34% of Halal businesses are bank-financed in the form of Islamic solutions. In addition, DinarStandard [

3] warns about the risk of unfulfilled potential due to the lack of collaboration between the IF and Halal industries. However, this report shows how more OIC governments are realizing the importance of IF to support the Islamic economy and broader GDP growth. For example, Indonesia, Uzbekistan and Morocco are developing national strategies for using IF as a tool to support national developments.

These figures reveal that there is still a huge margin for growth in the near future in multiple sectors and regions. In this regard, the authorities of Malaysia, the government and the central bank, have implemented a series of grants to boost IF in small and medium-sized enterprises (SMEs) [

8]. Malaysia can be considered the country of reference for the support the authorities have made since the inception of the Halal industry [

9]. To our knowledge, there are no figures about how much IF is used in HT, and the literature about the positive relationship that exists between IF and HT is very nascent [

10,

11]. There is no research that measures different stakeholders’ opinions on the relationship of IF to other Halal products and services [

12].

As the relationship between IF and HT is still under researched, this paper provides more empirical evidence of whether the agreement degree on the active role of IF in the development of HT is affected by multicultural traits and the knowledge of Halal products. The first International Halal Congress, held in Cordoba in 2015, allowed researchers to develop a first exploration pre-test to obtain a sample of 80 professionals, academics and authorities, all well connected to the Halal industry.

Along the course of the paper, we refer to the active role of IF in the development of HT as a better integration between the two sectors, or as a way to exploit their synergies. Therefore, three basic elements are explored in the study: (1) we compute a synthetic indicator of the degree of agreement regarding the role of the IF on the Spanish Halal Tourism development, analyzing a construct scale that measures the potential active role that IF can have on the development of HT; (2) we analyze whether multicultural traits and Halal knowledge have a mediating effect on the obtained agreement degree indicator; and (3) we obtain the critical assessment attributes (CAAs) that need to be reinforced in order to achieve a better integration between the two sectors.

Accordingly, a fuzzy-hybrid method is proposed to calculate the synthetic level of agreement on the role that IF could exert on the development of HT in Spain as a way to contribute to the smarter specialization of some regions, in order to be a more sustainable and Muslim-friendly destination. The index is based on a method that applies jointly the fuzzy set theory (FST) with the technique for order preference by similarity to ideal solution (TOPSIS). Thus, the synthetic indicator will be used to analyze the degree of agreement of a set of segments which is based in some chosen segmentation variables. The method is applied to a scale of five attributes that contains information about the potential synergies between the IF system and HT.

The study provides insights to the main stakeholders, in order for them to develop adequate synergies that could favor the development of HT through the involvement of IF. HT is not only an important sector that could contribute to the economy, but it can also be a crucial contributor to promote a better understanding among citizens who practice different religions and have differing cultural backgrounds, facilitating a brighter world future.

The remainder of the paper is organized as follows:

Section 2 offers some insights from the literature,

Section 3 describes the questionnaire and data gathering,

Section 4 details the methodology,

Section 5 presents and discusses the results, and

Section 6 offers some concluding remarks.

2. Literature Review

The factors of the disconnected sectors between Halal product development and IF have been analyzed in some studies. Firstly, one of the most important aspects is the difference between the concept of ‘Halal’ and ‘Islamic’. The Halal industry requires a very strict operational process control that ends in Halal brand recognition [

13]. However, these certifications, in general, do not take into account what the financing of the producers of Halal products is [

14]. Muhamed et al. [

15] conclude that there is an indulgence in the financing of Halal products in Malaysia. Thus, as other authors point out, Halal products and services would not really be totally Halal if their funding is not aligned with the application of the same rules [

16,

17]. Wilson [

17] contends that, in reality, finance and banking qualify as ‘Islamic’ and not as ‘Halal’ in the pure sense of fulfilling specific conditions to have that brand. With a more open-mind, IF can be considered Halal, but, in many cases, it is not 100% Halal. In this sense, it can be said that IF is a concept applied to a number of financial products and services that are certified.

On the other hand, Hayat et al. [

18] find that Halal products suffer from other common problems whose source is the certification of a brand, such as: (1) the lack of consensus on what is considered Halal; (2) some of the certifying agencies are also supervisors; (3) there are economic incentives in the granting of certificates; and (4) the training of the Shariah scholars to certify complex financial products is not standardized. At the institutional level, Muhamed and Ramli [

9] analyze the Islamic banks as entities, and conclude that IF has a better structured governance than the Halal sectors (p. 5). In fact, the Islamic Financial Services Board (IFSB) [

19] published the principles of governance for institutions that offer Islamic financial services.

The synergies and integration have also been hampered by obstacles such as: (1) the minority presence of Muslim producers in the Halal industry [

20]; (2) the lack of awareness and knowledge about what IF is [

21]; (3) the intrinsic characteristics of the sector, as is the case in the food industry, which is very fragmented and where SMEs predominate [

5]; (4) the higher cost of financing through Islamic banking [

16,

20]; and (5) the differing regulation and supervision by different authorities [

22], observed even in Malaysia, a reference country in both industries [

9].

In any case, there is consensus on the need for both sectors to explore and exploit potential synergies. Muhamed and Ramli [

23] point out that the majority of a group of Malaysian academics with backgrounds in Islamic Law and industrial involvement support Halal integration. Wilson [

17] asks the Islamic banks to be proactive and redirect their activity towards the Halal industry. In general, a better integration is requested as a way to exploit scale and scope economies [

24]. The support of authorities is considered crucial, as well as the development of an adequate regulatory framework and the establishment of regional and global agreements that harmonize the Halal certifications [

21].

The studies carried out so far are scarce, and have mainly been focused on each individual sector. Regarding HT, to our knowledge, there is scarce literature about its connection with IF, but the existing studies point to a positive relationship between them. Muslims tourists would prefer a tourism provider that has IF facilities [

11], and the use of Islamic banking gives a positive impression for them [

10]. The presence of Islamic financial institutions is one of prerequisite materials that a Halal tourism destination should provide [

25]. In addition, IF could address financial constraints and can offer financing solutions for developing a good tourist infrastructure [

26], a factor that improves the quality of HT [

27].

In the field of finance, FinTech is becoming one of the most widespread terms used for research in technological innovation. The definition of FinTech is based on the use of innovative and disruptive technology for providing financial services [

28,

29]. The emergence of Fintech has been characterized by the need for more investors’ security and better financial services at more adjusted costs. According to Lee and Shin [

30], the Global Financial crisis and the consequent loss of confidence in the financial system triggered such an emergence. Hussain et al. [

31] contend that Islamic Financial systems could now emerge as the new banking system that could recover again the clients’ confidence in the financial system. In fact, the authors show how Islamic Finance has started to grow internationally, with some concentration in few markets. Rabbani et al. [

29] categorize the Islamic FinTech spectrum into three areas: (1) Islamic Financial technology opportunities and challenges; (2) Cryptocurrency/Blockchain sharia compliance; and (3) law/regulation.

Fintech companies can naturally be seen as opportunities by the financial institutions instead of competitors, in order to provide new innovative financial and non-financial services. Rabbani et al. [

29] analysed the Islamic FinTech opportunities and find that Islamic Fintech companies can: (1) help new startups; (2) provide a wide range of innovative products and services; (3) provide indistinctly traditional financial services, as well as new and innovative services; (4) provide cost-effective solutions to the financial services; (5) facilitate traditional Islamic banks to go digital; (6) gain customer confidence easily by being transparent, accessible and easy to use; (7) be linked to cryptocurrencies and Blockchain in order to facilitate international payments; (8) gain the confidence of Muslim investors, as they are in accordance with the rules prescribed by sharia. Haddah and Hornuf [

32] find that FinTech startup formations are more easily created when the economy is well-developed and venture capital is readily available. The authors also find that the number of secure internet servers, mobile telephone subscriptions and the available labour force all act as a catalyst for the development of this new market segment.

3. Questionnaire and Data Gathering

A pilot test of the survey was handed out during the congress ‘Halal, a Global Concept’, held in Cordoba between 24 and 26 March 2015. The conference was organized by the Instituto Halal, a Spanish Halal certification agency for goods and services apt for consumption by Muslims in Spain and Mexico. They work on three main lines: (1) to certify products and services; (2) to obtain the necessary international accreditations and recognition; and (3) to contribute to the achievement of a Halal Standard in Spain and Europe. The questionnaire was developed through the compilation and adaptation of other previous studies in the field, with the aim of identifying the relevant determinants to develop HT products in Spain [

33,

34,

35]. The survey was divided into nine sections, with a total of 70 different questions (the number of the question is given in parenthesis): (1a) demographic profile (10); (2a) knowledge of HT (3); (3a) pull and push factors to measure Spanish HT competitiveness (10); (4a) possible handicaps measuring Spanish HT competitiveness (13); (5a) important tourist attractions that could foster Spanish HT(13); (6a) analysis of the organizations involved in the development of HT (9); (7a) classification of HT (5); (8a) IF and the role on the development of Spanish HT (5); (9a) Spanish HT competitiveness in the future (2).

The survey questionnaires were prepared in four languages, English, Spanish, Arabic and French, and were implemented on-line in Google Drive. A list of 300 potential respondents was used to collect the data, based on some additional contacts, in order to complement the set of 80 respondents obtained at the conference. The list was mainly obtained from academics, hoteliers and restaurateurs. In the case of the academics, for convenience reasons, we decided to include those who have published a paper on HT and, thus, have a certain guarantee that respondents are familiar with Halal products’ existence. After five consecutive recalls, we were able to obtain 120 additional completed surveys from 150 participants who started to answer the survey at the end of 2015. Thus, the dataset was finally compiled on 31 March 2016, with 200 valid respondents. Unfortunately, it was not possible to enforce any of the contacted participants to complete the survey. Thus, the sample can be considered as a convenience sample which has a certain degree of familiarity with Halal products.

The main constructs of the survey are based on a four-point Likert scale answer format, in which all the categories are labelled. For example, the answer format for the level of agreement with the sentence is determined as: (1) strongly disagree, (2) disagree, (3) agree and (4) strongly agree. It was decided to use four-point scales in order to mitigate the effect of neutral option biased responses [

36].

The study focuses on the eighth block (the IF and the role on the development of Spanish HT), which contained the following sentences about whether IF can act as a catalyst to develop HT in Spain: (1) it is a reliable finance system (Reliable); (2) it is already involved in the development of Halal Tourist Products (Development); (3) it has already financed some halal projects (Finance); (4) it is a financial system adapted to Muslims (Muslims); (5) Spain has a lot of potential to develop HT (Spain). The scale is adapted from previous studies [

37,

38].

The majority of the respondents were men 146(73%). The age groups of 26–35 years old and 36–45 years old dominate the respondents, with 63 (31.50%) people and 61(30.50%) people, respectively. Most of the respondents were married, 112 (56%), whereas 79 (39.5%) of the respondents were single, and 9 (4.5%) were either divorced or separated. A large group of respondents were academics 113(56.5%), and for that reason, the majority of the respondents also have a Masters/PhD degree; 110 (55%) and 72(36%) respondents hold a university degree. In terms of occupation, there were 40 (20%) students, 32(16%) professors at university, 21 (10.5%) respondents employed in the tourism sector, 13 (6.50%) entrepreneurs in the tourism sector and 94 (47%) entrepreneurs in other sectors. With regard to monthly personal income, most of them, i.e., 94 (47%) of the respondents, had a monthly personal income between 1000 Euros and 3000 Euros, whereas 13 (6.5%) reported an income of 6000 Euros or more.

The non-Muslims questioned represented 57 (29%) respondents, and the other 143 (71%) respondents were Muslim. Regarding the religiosity, the majority of respondents, 121 (60.5%), were moderately religious. The majority of respondents, 87 (43.5%), resided in Spain, followed by 83 (41.5%) residents in North Africa, 11 (5.5%) residents in the countries of the Arab gulf, 10 (5%) residents in other Muslim Countries, 7 (3.5%) residents in the EU and 2 (1%) residing in other countries.

4. Methodology

This section presents the basics of the proposed methodology that is based on a hybrid fuzzy method, which calculates the overall level of agreement on the catalyst role of IF in developing HT in Spain, named Islamic Finances Overall Agreement (IFOAg). The index IFOAg is based on a list of 5 attributes with information about the reliability of the IF system, the degree of involvement in the development of Halal products, whether some Halal products have already been financed by the IF, whether IF is adapted to Muslims and whether Spain has a lot of potential to develop HT. The questionnaire developed to measure IFOAg was based on subjective and very imprecise information, because the semantic scales are not easily converted into precise numerical figures. Transforming the linguistic scale ((1) strongly disagree, (2) disagree, (3) agree, and (4) strongly agree) into a cardinal scale is usually a source of strong criticism, because all the transformations suffer from the researchers’ subjectivity. For this reason, Zadeh [

39] developed the base of the fuzzy set theory as a way to deal with the subjectivity and fuzziness of human perception, because the theory is better adjusted than crisp numbers to represent the respondents’ answers related to the object of the analysis.

The essence of the fuzzy set theory resides in the fact that researchers always find it difficult to represent linguistic semantic scales by sensible crisp values. It is usual to employ an ordinal scale starting from one and ranging to the number of points of the Likert scale. In the case of the IFOAg scale, the basic crisp information will go from one to four. Afterwards, some econometric model, like cluster analysis, factor analysis, confirmatory factor analysis or structural equation models, is applied in order to obtain some relationship or association between different constructs, or in order to reduce the dimensionality of the list of the attributes [

40,

41]. These methods prefer to adjust the imprecise information provided by Likert scales employing econometric models that include error terms according to some statistical distribution. On the other hand, other authors prefer the approach of using the fundaments of the fuzzy set theory [

42,

43,

44,

45,

46]. The authors contend that the use of the fuzzy set theory adjusts much better than other methods the questionable issues mentioned by Dickson and Albaum [

47] regarding the use of semantic Likert scales “… consisting of adjectives and phrases which seem appropriate or relevant to the specific concept being studied without really testing the new scales to insure that they meet the various underlying assumptions which are critical for proper use of semantic differential instruments” (p. 87). In this respect, it can be said that fuzzy logic [

48] better deals with the purpose of ranking a group of decision makers in regard to their overall agreement over some concept or idea, as fuzzy logic does not need the crisp and accurate information provided by objective measures [

49].

4.1. Triangular Fuzzy Numbers

The use of the fuzzy logic alleviates the need to incorporate objective measures, and can deal very conveniently with imprecise information. The universe of discourse X [

50,

51] is usually represented as a subset of real numbers. A fuzzy set

A in X represents jointly the discourse and the membership function

whose value belongs to the closed interval [0, 1], and gives the probability or strength of belonging that any element of the discourse has. Thus, greater values are associated with more truth regarding the supposition that element x belongs to set

A. It can be inferred that the fuzzy set theory encapsulates much better the way human beings feel and think in a number of circumstances, with regard the philosophical idea that everything is relative. In our case, for example, two customers who operate regularly with some of the top Islamic Financial Institutions can answer very differently to the question regarding that IF can act as a catalyst to the development of Halal tourist products in Spain because the IF is reliable. The answer will probably depend on the degree of satisfaction that customers have experienced in their last transactions with the institution.

In this paper, the fuzzy set theory is represented by triangular fuzzy numbers, a triplet of real numbers characterized by the following membership function:

Thus, each linguistic answer provided by the respondents ((1) strongly disagree, (2) disagree, (3) agree, and (4) strongly agree) is then transformed into a triangular fuzzy number (TFN) whose discourse is included in the interval 0–100. Thus, the strength of the truth of each statement included in the scale is represented by a set of TFNs that represents the fuzziness associated with the imprecise information obtained from the semantic Likert scale.

Table 1 shows the TFNs used in the study to represent the four point semantic Likert scale used in the survey. Equation (1) can be used to give the probability of belonging to the interval that represents each TFN included in the table.

The aggregation of TFNs through different segments, for example English, Spanish, Arab or French, is based on the algebra of TFNs, in which the average fuzzy number of n TFNs can be calculated as follows [

52]:

4.2. Crisp Information Matrix

The aggregated TFN obtained by Equation (2) represents the imprecise information of the overall agreement that a particular segment has with each of the five attributes included in the scale. This study will focus only on nine different segments: the convenience sample with 200 respondents, the cultural segments obtained by the language used to answer the questionnaire (English, Spanish, Arab and French), and, finally, four additional segments obtained by the level of knowledge that the respondents have of Halal Products. The questionnaire provides information about 135 different segments for each of the five attributes included in the analysis. Thus, a matrix of TFNs with a dimension of 5 times 135 is obtained after applying Equation (2). This matrix provides a lot of information that needs to be summarized with a clarification or defuzzification method [

53]. In essence, all the methods are based on a real function that converts the TFNs into real numbers or crisp information, according to rational criteria, which should preserve some consensual order of overlapped TFN.

In this study, the proposal made by Chen [

54], which is based on the best-non-fuzzy performance measure, was used as the defuzzification method. The method clarifies the information as a weighted average of the triplet of the TFN that serves to measure the best-non-fuzzy performance of a fuzzy set. The clarification method is very simple, and it is obtained as: (

a1 + 2

a2 +

a3)/4. This clarification method does not require any subjective and prior information of any decision maker, and takes into consideration the theoretical properties established by Kaufmann and Gupta [

55], giving more importance to neutrality than to any other potential extraction judgement.

4.3. Similarity to Ideal Solution

The synthetic IFOAg index for each of the segments under analysis is based on a joint fuzzy multi-criteria decision-making (F-MCDM) method that applies the technique for order preference by similarity to ideal solution (TOPSIS) [

56,

57]. TOPSIS is still one of the most popular MCDM methods [

58]. The authors reviewed a total of 105 papers using the TOPSIS approach for solving decision making problems, and concluded that “dozens of scholars have applied TOPSIS to solve simple or complex problems in different areas, modified, or extended TOPSIS method to solve exclusive problems. The development trends of TOPSIS method, and more and more of its applications to solve various problems quite vividly reflect general development trends of all MCDM methods to solve simple and complex tasks”.

The method is computed as follows:

where

J and

J′ divide the different attributes included in the IFOAg scale according to whether the attribute is answered in an ascending or descending order. In our case, all the five attributes included in the IFOAg scale were answered in an ascending order; that is, all the answers show the extent to which the respondents agree with the statements included in the scale. Nevertheless, the general method is shown for the sake of exposition.

Once the ideal solutions are calculated, the relative IFOAg index for each segment can be calculated, bearing in mind the distances that exist from each observed segment to the positive and negative ideal solutions as follows:

where Zavadskas et al. [

58] contend that, in the majority of applications, researchers prefer to use the Euclidean distance in Equation (4), other distances like, for example, Manhattan (city-block) or Minkowsky distances can also be used. A particular segment

i will show a greater degree of agreement than the segment

j if and only if

. Thus, the IFOAg synthetic indicator can be used to rank the overall agreement that all the segments in the sample have about the catalyst role that IF can play in the development of HT products in Spain. The rationale behind the synthetic indicator is clear, as IFOAg is higher when the degree of agreement is greater; that is, when the defuzzified vector for the segment is closer to the virtual positive ideal solution and farther from the virtual negative ideal solution.

Finally, the concept of elasticity will be presented to evaluate the sensitivity of the obtained synthetic indicator to changes of the values of each attribute included in the scale. Thus, main stakeholders can obtain very interesting insights regarding whether the overall agreement is more or less elastic with respect any individual attribute. Thus, different stakeholders—for example, the managers of IF institutions; potential Halal tourist product developers in Spain, like hoteliers or restaurateurs; or even destination management officers and tourist policy makers—can have a better understanding of what attributes have a greater incidence with the role of the IF. Mathematically, the elasticity of IFOAg for each segment

i over any attribute

j can be calculated as:

One of the most important features of the calculus of the elasticity values is that the figure is segment and attribute dependent. Thus, it is possible to differentiate the managerial procedures by taking into consideration the binomial segment and attribute.

5. Results

Table 2 shows the TFNs and the crisp values corresponding to the total, and the segments obtained by the language used by respondents. Normally, the TFN matrix is not easily interpreted at first glance, and those readers who are not familiar with the fuzzy set theory do not clearly understand the different triplets. It can be seen that the intervals of the values of the respective TFNs for each of the columns intersect. Thus, it is difficult to extract with a quick glimpse some insight about the answers given by the respondents to the IF module. For that reason, the information matrix needs to be clarified.

The total results of the sample show that the degree of the agreement is larger for the involvement and the finance of the Halal products, and lower for the issue that Spain has a lot of potential to become an important player in HT. Analyzing the segments by the mother language used to answer the questionnaire, it is observed that English mother-speakers agree, in general, more than other respondents. The only exception is observed in the attribute that IF is well adapted to Muslims. The highest level of agreement is observed by English speakers regarding the IF as a reliable finance system, and the lowest level of agreement is also observed by English speakers regarding the attribute already mentioned of IF being a system well adapted to Muslims. A further analysis of these results permits us to conclude that the English respondents answer this way because they probably consider that IF offers the products and services to other general clients, irrespective of the clients’ credo. The literature shows that religious motives in conventional or Islamic bank selection are not the only significant key drivers [

59,

60,

61]. The selection of conventional and IF banks is mainly affected by the transactional costs [

62]. Nevertheless, ethical factors and the economic and social development role of the banks are more developed in the IF banks than in the conventional banks [

59], so clients of other religions can also appreciate this factor.

Analyzing now the results for the positive and negative ideal solutions obtained by Equation (3), it can be seen (

Table 3) that both solutions are characterized by extreme observations in which the answers are 4 and 1, respectively, for all the respondents of the representative segment, which for the sake of exposition is omitted from the table. This result is not usually obtained, as normally, it is difficult to get this type of total coincidence for some segment of the sample. In this case, it is not possible to determine which attributes are more or less homogenous.

The synthetic IFOAg index for each segment can now be calculated using the fuzzy hybrid MCDM approach proposed in the study.

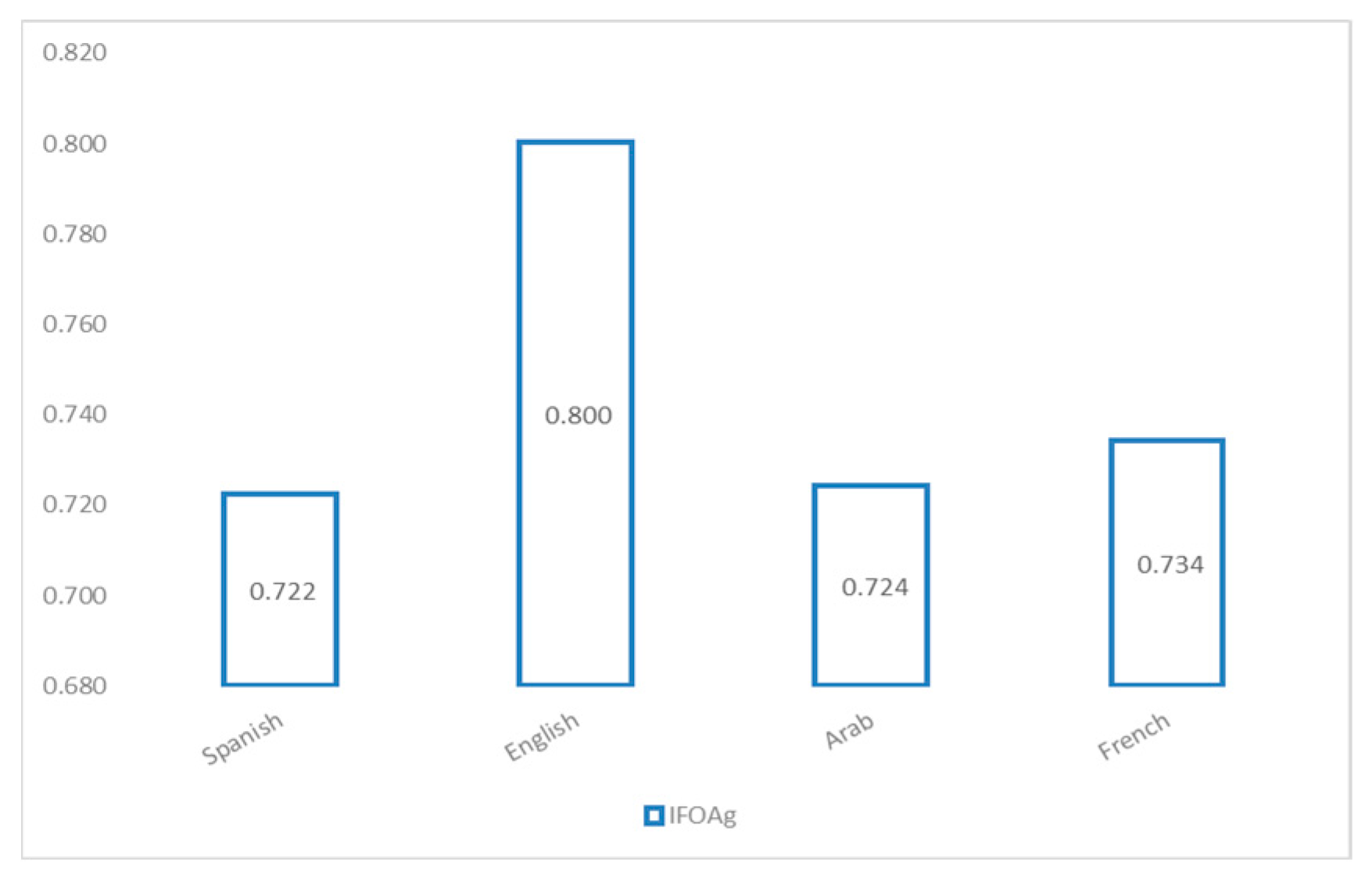

Figure 1 and

Figure 2 show the synthetic index for the relevant segments under study, according to three segmentation variables: mother language (Spanish, English, Arab and French), knowledge of Halal (knowledge of Halal (Yes/No)) and having visited a Spanish Halal establishment (Yes/No). The figures show that the English agree more with the role of the IF as a catalyst in the development of Halal Spanish tourism industry than the French, Arab and Spanish; the level of agreement is also mediated by the knowledge of Halal, being more intense in the case that the respondents have already visited a Spanish Halal establishment.

The reason is probably that the UK is the most active European country in Islamic banking and finance. Retail Islamic banking in Europe arrived for the first time to the United Kingdom in 1982. Since then, and especially in 2013, with the support of Prime Minister Cameron, the proactive policy of the British authorities for its pragmatic, realistic and inclusive approach has been the key to the success of the development of Islamic banking [

63]. Meanwhile, in France, despite a significant Muslim minority, the French authorities did not take the first steps towards boosting the IF until 2007. Reuters [

64] pointed out that, after decades of secular rule, Tunisia’s government aids to the development of Islamic banking in the country could hurt conventional banking, and some analysts suspect that the real government’s motives are more political than economic, in an attempt to win more voters’ support. Lastly, in Spain, banking and tax regulation hindered the use of IF, so the penetration degree has been very limited [

65]. In general, it can be concluded that the low level of awareness and knowledge about IF, even in the Muslim countries, is still the main important barrier for its development [

66]. The UK has pushed IF, but Spain is developing Halal as a brand, especially for food and cosmetics. Halal certification has been promoted by several organisations, with the Instituto Halal being one of them. Currently, they have almost 500 clients, and their goal is to create a Halal hub in the future (see

https://www.institutohalal.com/quienes-somos/).

Table 4 shows the elasticity values of the IFOAg index for the segments under analysis. The values show that IFOAg is inelastic with respect to all the attributes and for all the segments under analysis, and that the sensitivity pattern obtained is not very different for each attribute–segment pair. In general, it can be concluded that the synthetic index is more elastic with respect to the issue that Spain can show a lot of potential to develop HT products in the near future, and is less elastic with respect to the role of the IF as a joint developer of Halal tourist products. The Instituto Halal has certificated more than 2000 products, especially food and beverages, but also cosmetics, tourism and health products [

67]. Nevertheless, the current HT (including food) on offer in Spain is still limited and scarce, despite the remarkable potential. In 2018, there were only six Spanish tourist food companies with Halal certification.

Regarding the analysis for each of the segments, firstly, analyzing the mother language, it can be seen that the English segment is less elastic than the rest for all the attributes, with the exception of the attribute that represents how well IF is adapted to the Muslim market. On the other hand, Spanish, Arab and French speakers are more elastic with respect to the attributes that represent the reliability of the IF system (Spanish and French), as well as the attributes that correspond to the potential capacity of Spain to be an important player in the HT sector (Arabs) and to the adaptation of the IF to the Muslim market (French).

Analyzing now the segments are determined by the knowledge of HT, it can be seen that the elasticity values are more homogeneous than in the case discussed above. Thus, it can be concluded that the cultural issues captured by the mother language affect IFOAg more intensely than the knowledge of HT. Nevertheless, the small differences are characterized by the higher elasticity values obtained on the previous knowledge of HT and having visited Halal Spanish establishments in the attribute of the role of Spain in the future development of HT, and by the smaller elasticity values obtained from those respondents who do not have a previous knowledge of Halal, as observed for the attribute of the role of Spain, and for those who have visited a Spanish Halal establishment for the attribute referring to the reliability of the IF system. Thus, it can be concluded that having an experience of a Halal establishment helps to better understand what HT is. The level of knowledge of HT within the industry is not clear because there are different understandings of Halal that depend on existing prejudices and stereotypes about the level of tolerance that Muslim consumers have in relation with standard accommodation services. This concept was created as a form of religious tourism [

68], but it is also considered to be a wide concept as a familiar culture deeply rooted in Shariah [

69].

6. Conclusions

The paper aimed to analyze empirically whether IF can be seen as a catalyst for the development of HT. Additionally, such an analysis was extended to see whether two segmentation variables, the mother language used to answer the survey and the previous knowledge of HT, had a moderating effect. For this purpose, the paper obtained a synthetic IFOAg indicator using a hybrid-fuzzy multi criteria decision making method, which was based in five different indicators that condense the commented role of IF. Our results show that the ideal solutions obtained are characterized by the extreme values in which all the respondents totally disagree (negative ideal solution) or totally agree (positive ideal solution). Regarding the segments analyzed in the study, it concludes that English mother speakers do agree more than the rest of the speakers of the sample, and that those with a previous knowledge of Halal also agree more than those who are less conscious of the Halal industry. The latter result is even reinforced for those who have a previous experience of a Halal tourist establishment. This is an important issue that needs to be further analyzed in the context of tourism supply, as the perspective of the value that tourism establishments and firms obtain from servicing this niche market is still unknown.

Finally, the obtained elasticities show that the segments determined by the knowledge of HT are more homogeneous than the cultural segments obtained by the mother language. Thus, it was inferred that the cultural issues captured by the mother language affect more intensely the degree of agreement of the catalyst role of the IF on the development of the HT in Spain than the knowledge of HT. To our surprise, the degree of agreement was more elastic with respect to the potential capacity of Spain to be an important player in the HT sector for the mother Arab speakers.

Muhamed and Ramli [

9], looking at the current practice worldwide, conclude that the Halal sectors are separated, and that integration should be promoted for any type of goods, commodities and services including IF. Thus, the catalyst role of the IF in the development of the HT is advised as a way of adopting Islamic financing as the source of capital in order to start an integrated Halal business. In this respect, different stakeholders need to become visible in order to participate in HT development as a way to more adequately exploit the cultural Arab endowments of some Spanish regions. This development can also be fostered by FinTech companies that help new startups to provide a wide range of innovative products and services in the growing Halal niche market.

This study contributes to a strand of the literature that is still nascent. Nevertheless, it presents a number of limitations that need to be commented upon. First, the development of HT products goes beyond the role that IF can have as a catalyst because many other factors, like the important Muslim heritage that exists, for example, in Spain, can be even more determinant and decisive. Second, the lack of a theoretical model impedes the use of a better instrument (scale) to analyze the role of the IF, so more empirical scales are needed in order to compare the results obtained in the study. Third, the convenience sample should be enlarged in order to be more representative of the main stakeholders involved in such development, such as hoteliers and restaurateurs. These limitations open new roads for promising venues for future research.