Abstract

The development and deployment of cost-effective and energy-efficient solutions for recycling end-of-life electric vehicle batteries is becoming increasingly urgent. Based on the existing literature, as well as original data from research and ongoing pilot projects in Canada, this paper discusses the following: (i) key economic and environmental drivers for recycling electric vehicle (EV) batteries; (ii) technical and financial challenges to large-scale deployment of recycling initiatives; and (iii) the main recycling process options currently under consideration. A number of policies and strategies are suggested to overcome these challenges, such as increasing the funding for both incremental innovation and breakthroughs on recycling technology, funding for pilot projects (particularly those contributing to fostering collaboration along the entire recycling value chain), and market-pull measures to support the creation of a favorable economic and regulatory environment for large-scale EV battery recycling.

1. Context

Lithium-ion batteries (LIBs) are the dominant electricity storage technology for applications requiring high energy density, such as portable electronic devices and electric vehicles (EVs). The growing popularity of the latter has led to tremendous growth in the demand for LIBs, and hence for the materials that are needed to manufacture them, including lithium, cobalt, and nickel. Extensive mineral reserves, as well as mining, refining, and manufacturing operations are expected to be needed to allow the mass production of EVs, leading some observers to question the sustainability of batteries as a solution for enabling decarbonized transportation.

A related issue is what to do with the small but growing stock of EV batteries that must be collected and processed at their end of life (EOL). Over 5 million metric tons of LIBs are expected to reach EOL by 2030 [1]. Large-scale recycling infrastructures will, therefore, be needed to ensure that the valuable but often toxic materials contained in LIBs are not wasted and left for future generations to deal with. In other words, battery manufacturing needs to become more “socially responsible, environmentally and economically sustainable and innovative” [2]. Indeed, a circular economy model for battery manufacturing offers the possibility to reduce both the environmental impacts of batteries and the reliance on raw mineral extraction.

As will be shown, however, significant developments are needed to achieve high LIB recycling rates, competitive costs with virgin materials, and energy and environmental footprints that offer significant improvements over non-circular value chains. Although various solutions for recycling batteries already exist, funds and other policy instruments are necessary to foster robust recycling value chains able to sustain the large-scale expansion of electrified transportation that is expected this century. EV LIB recycling is still at an infant stage (especially outside China), offering both challenges and opportunities to those willing to address the increasingly strategic issue of sustainable battery manufacturing.

2. Economic and Environmental Drivers for Recycling LIBs

The following arguments can be made in favor of recycling LIBs, especially EV LIBs.

- (a)

- To alleviate toxicity, safety, and contamination risks. LIBs contain several toxic and/or flammable materials. The presence of spent LIBs in the municipal solid waste management system poses significant safety risks considering that these can easily catch fire or even explode; fire incidents caused by consumer LIBs frequently occur in waste management facilities [3]. Moreover, the disposal of spent LIBs in landfills could lead to soil and groundwater contamination and negatively impact the ecosystems because the LIBs contain toxic and heavy metals, such as Cr, Co, Cu, Mn, Ni, Pb, and Tl [3]. Appropriate EOL battery disposal is, therefore, a public health and safety issue.

- (b)

- To reduce the carbon footprint of EVs. Although the assessment of the lifecycle emissions of LIB manufacturing is complex, it is generally recognized that at least 30–50% of lifecycle greenhouse gas (GHG) emissions from EVs are related to battery manufacturing and mineral extraction [4,5,6,7]. These numbers have attracted considerable negative publicity in the media, despite large variations in the stated per-kWh emissions (depending on country or origin, manufacturer, and battery type) and uncertainties regarding the assumptions and methods used for tracking lifecycle emissions [4,6,8]. Nevertheless, it can be stated that battery manufacturing generally has a larger environmental footprint than most typical internal combustion engine vehicle (ICEV) components. A key reason for this is that most batteries are produced in China, where the carbon intensity of power generation is one of the highest in the world. This footprint can be lowered by decarbonizing the electricity used to power battery manufacturing plants (in China and elsewhere), but another approach is to favor recycling and thus avoid part or all of the virgin material extraction and refining. Dunn et al. estimated that the lifecycle of EVs may be reduced by up to 51% through recycling [9].

- (c)

- To reduce EV costs. Raw materials account for up to 50% of the cost of a typical LIB. By substituting virgin materials with recycled materials, the total pack cost could be reduced by up to 30% [10]. Furthermore, battery disposal fees (or “gate fees”) will be avoided when spent LIBs are sent to recycling facilities instead of landfills.

- (d)

- To reduce reliance on mineral extraction. According to several lifecycle analysis (LCA) studies, EV manufacturing involves a greater reliance on mineral resources than ICEVs, mainly because of the use of cobalt, nickel, lithium, manganese, and other metals in LIBs [7,11]. This issue has led some authors to question whether EVs are more environmentally benign than ICEVs, and whether relying on non-renewable mineral resources is sustainable in the long term. EV-related mineral extraction activities are already growing quickly; analysts generally predict a large increase in the demand for LIB materials in the next decade, i.e., over 575% for lithium and 1237% for nickel [1,12]. While many argue that the mining industry will be able to meet this expected demand, it is preferable to minimize mineral extraction and processing as much as possible, as they have large environmental impacts. Recycling, which is sometimes described as “urban mining”, is clearly a part of the solution in this regard; several LCA studies concluded that battery recycling could reduce the impacts of resource utilization [11]. In one study, it is estimated that approximately 65% of the cobalt necessary to satisfy vehicle demand in the U.S. could be achieved by LIB recycling [13]. As the availability of recycled materials increases, and the growth in EV sales starts to slow down, recycled materials could satisfy a significant portion of material demand [14]. According to World Economic Forum (WEF), EVs could become the largest stock of critical battery materials by 2050 [12].

- (e)

- To reduce reliance on specific suppliers. In addition to expanding the availability of materials for battery manufacturing, recycling also offers the possibility of bypassing foreign suppliers of raw and refined LIB materials. Currently, some LIB materials are sourced from conflict zones (e.g., the Democratic Republic of the Congo for raw cobalt), whereas others are obtained from countries with monopolistic market power (e.g., China in the case of refined lithium). In the case of China, which is omnipresent in the battery value chain, one can also point to lower labor and environmental standards compared to other countries such as Canada. According to the WEF, “The massive expansion of raw material demand, with a near-term focus on cobalt but also on nickel and lithium, will cause the value chain to face social, environmental and integrity risks, involving child labor and potential forms of forced labor in the cobalt supply chain, unsafe working conditions, local air, water and soil pollution, biodiversity loss and corruption” [12]. For obvious reasons, “urban mining” is an attractive solution in this regard, as it lowers the need for raw material extraction and refining and hence reliance on countries with poor social and environmental records. The COVID-19 pandemic and related supply chain disruptions may further encourage a shift towards more localized supply chains [15].

- (f)

- To generate local economic activity. Recycling is expected to become a significant industry in the future, generating billions of dollars in revenue, tax income, and jobs, many of which would be in countries and regions that currently do not benefit from battery-related industrial activities. Due to the high cost of transporting used battery packs, there are strong incentives for localizing at least part of the recycling infrastructure. Governments thus have financial incentives for supporting EV battery recycling within their jurisdictions. For example, Canada (particularly the province of Quebec), where EV sales are growing rapidly but EV battery manufacturing is largely inexistent, has seen lively discussions surrounding the possibility of attracting more investments in this area. One proposition under consideration is offering a sustainable end-to-end battery value chain encompassing mineral extraction and refining (including for key LIB materials such as cobalt, graphite, lithium, and nickel), battery and EV manufacturing, state-of-the-art EOL infrastructure, and battery recycling, which are all powered by hydroelectricity and other forms of renewable and low-carbon energy [1,16]. As noted by Sharpe et al., attracting investments in battery production could help ensure that Canada plays a critical role in the global EV supply chain, at a time when its automotive industry faces increasing challenges, including assembly plant closures [17]. Without a footprint in EV production, Canada risks losing what is left of its automotive industry. The availability of recycled materials could play a key role in this regard, by making battery and EV production even more attractive in Canada.

In summary, safety and environmental concerns, along with economics and supply chain risk management, are the main drivers behind the increasing interest in LIB recycling and the transition to more circular business models in the EV industry.

3. Technical and Financial Challenges to LIB Recycling

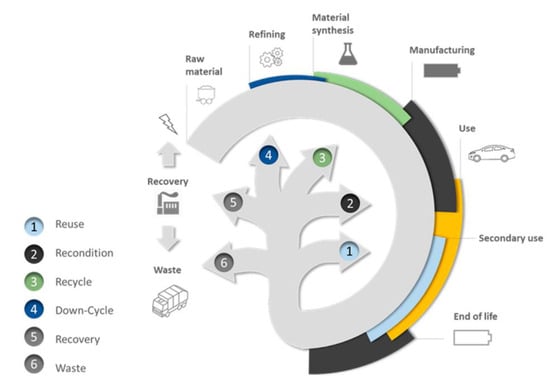

As shown in Figure 1, there are various options for extending the useful life of battery materials. One approach is to reuse or recondition used battery packs for use in “second life” applications. At the end of their first (EV) life, many batteries will still retain over 75–80% of their original capacity and could, therefore, be used in less demanding applications [6]. This generally involves collecting used EV LIB systems and re-conditioning them for lower-power applications, such as energy storage and back-up power. The lifetime of the original battery is thus extended, contributing to lower lifecycle emissions and a reduced demand for critical materials. This approach has been used in many projects.

Figure 1.

Cyclic flowchart of manufacturing, usage, and end of life (EOL) lithium-ion batteries (LIBs) [3].

However, high battery refurbishment costs (including transaction and collection costs), as well as uncertainties regarding the quality, safety, and remaining lifetime of batteries sent for refurbishment, could hamper the large-scale development of second-life battery repurposing. Moreover, as the market price of LIBs drops and their performance attributes improve over time, the economic value of used batteries will also drop, thereby negatively affecting the incentive of investing into second-life applications. Finally, even if repurposing is clearly an attractive solution to make EV production more sustainable, it only delays the inevitable need for EOL solutions.

Realizing the vision of a circular economy in EV and battery production will, therefore, require at least some form of recycling. However, collecting, processing, and recycling large batteries is technically and economically challenging. Achieving the following may be especially difficult.

- (a)

- High product quality and supplier reliability: Ideally, recycling should be able to restore spent battery materials to their original (high purity and battery grade) condition, suitable for EV LIB manufacturing. This is often referred to as “closed-loop” recycling. In practice, many recyclers “downcycle” and sell their output to other industries, including cement producers, either out of necessity (as their process does not allow recycling toward battery-grade materials) or choice (e.g., to maximize revenue by focusing on high-value materials) [3]. Although this approach is still preferable to sending EOL batteries to landfills, it will not alleviate the supply chain pressures or reduce EV lifecycle emissions as discussed above. To displace virgin materials, recyclers must offer reliable and high-quality supplies of LIB-grade materials to battery manufacturers.

- (b)

- Competitive collection and recycling costs. In an ideal world, recycling investments are driven by the promise of profits from the sales of recycled materials. To achieve this, the market price of recycled materials should cover the costs of collecting, transporting, storing, and processing used battery packs, as well as a reasonable return on investment for the operator. The price should be competitive with the cost of raw materials, which can be low particularly if environmental externalities are not reflected. In reality, the costs of recycling are often higher than those of extracting and refining virgin resources. This is because many steps are required to collect, recycle, and deliver finished products to customers. For example, Melin estimated that the cost of recycling lithium is three times as high as that of mining new lithium. This acts as a deterrent to investment into recycling [18]. Moreover, recyclers also have to operate in a volatile market environment, where market prices of virgin materials can decrease sharply as a result of shifts in supply and demand. For example, because of the recent drops in the prices of cobalt and lithium, recycling these materials from EOL batteries has become relatively less attractive [19]. In the future, the lower cobalt content in LIBs could further reduce the financial viability of recycling.

- (c)

- Low environmental footprint: One of the aims of recycling is to alleviate the negative environmental impacts of sending used batteries to landfills, and of virgin material mining and refining. Unfortunately, recycling processes usually consume considerable amounts of electrical and thermal energies and may also generate secondary toxic gaseous emissions, water contaminants, and other unwanted gaseous and solid residues [3,11]. Collecting and transporting used batteries may also consume considerable amounts of energy, which can significantly impact the environment. The total energy and environmental footprint of recycling should be less than that required to mine, refine, and transport virgin materials.

The ultimate challenge is to simultaneously achieve these multiple (and potentially contradictory) cost and performance goals. Recycling processes should offer a reasonable balance of affordability, energy efficiency, environmental-friendliness, and safety; their output must also be comparable (or superior) to raw materials in terms of price, quality, and reliability of supplies. Moreover, closed-loop recycling should be favored as much as possible to maximize efficiency and the long-term sustainability of EVs. Achieving this vision will require considerable investments and innovation, as discussed below.

4. Current Options for Recycling Lithium-Ion Batteries

Spent LIBs, whether collected directly from EOL EVs or from “second-life” users, are generally treated via three main processes: pyrometallurgy, hydrometallurgy, and direct recycling (Table 1). Pyrometallurgy uses high temperatures (~1500 °C) to smelt the batteries and burn all carbon-based compounds. The valuable metals end up in a Co, Ni, and Mn-rich alloy, which can be further treated by the hydrometallurgical process to recover individual elements. This type of process affords the advantage of reducing the handling of spent batteries by avoiding the crushing stage and other pre-treatment steps [20]. By doing so, however, other battery components, such as electrolyte, graphite, steel, aluminum, and lithium cannot be recovered and are lost as slags or off-gas. The major disadvantages of pyrometallurgy include the considerably expensive gas effluent treatment facilities required to avoid the release of toxic compounds in air. Moreover, this process makes it impossible to gain any value from processing low-cost LIBs (e.g., LiFePO4, LiMnO2, or LiTiO4) because these elements end up in the slag [3].

Table 1.

Comparison of main recycling processes.

Hydrometallurgy exploits the high solubility of transition metals and lithium in acid. In such a process, the batteries must be crushed, and components have to be sorted out using various mechanical methods to allow the recovery of steel, copper foil, and aluminum foil, which account for approximately one quarter of the overall value [21]. Moreover, it may be possible to recover electrolytes, although this requires more complex recovery processes, and only a few studies have been performed on electrolyte recovery [22]. The significant advantage of hydrometallurgy over pyrometallurgy is the relatively facile process for lithium recovery; this is usually performed by Li2CO3 precipitation after leaching solution purification. In view of this, hydrometallurgical processes are generally perceived as the most promising approach for battery recycling [1]. This is reflected in the scientific literature; according to Melin [18], more than 75% of research papers on LIB recycling primarily address hydrometallurgical processes. In Canada, several companies, including Retriev, Lithion Recycling, Neometals, and Li-Cycle invest into hydrometallurgical recycling facilities.

Direct recycling aims to restore the initial properties and electrochemical capacity of cathodic active materials without decomposing into substituent elements, which can then be directly reused for manufacturing new LIBs [23]. This is performed by means of mechanical, thermal, chemical, and electrochemical processes; the end product is to be reused in new battery manufacturing. Although recent progress shows promise for improved efficiency, thus far, the potential for fully restoring the initial cathode capacity is yet to be proven [3]. In terms of economics, direct recycling can create added-value products, but extremely complex battery sorting and pre-treatment steps are necessary. Another key problem is that the recovered material may be obsolete by the time it is introduced to the market (up to 15 years after the original battery is manufactured) as battery technology continuously evolves.

In summary, various solutions for recycling batteries currently exist, but significant innovations are still necessary to achieve high recycling rates, competitive costs with virgin material and battery suppliers, and energy and environmental footprints that offer significant improvements over non-circular value chains.

5. Policy Implications

Large-scale LIB recycling is still at an infant stage (especially outside China), with most LIBs ending up in landfills after a few years of service; in the European Union, where there is relatively advanced regulation on battery recycling, less than 20% of spent LIBs were collected in 2016 [24]. One of the reasons for this low recycling rate is that the majority of EOL LIBs to date have been small batteries used for consumer electronic devices, which are especially challenging to recycle due to their small size and low economic value. However, EV battery recycling is also confronted with many challenges, as discussed above. Funds and other policy instruments are, therefore, necessary to foster robust recycling value chains, which can compete with virgin material supply chains in terms of cost, quality, and reliability, while also offering significant safety, environmental and energy efficiency benefits over conventional (non-circular) approaches to EOL management.

Three priorities for policymakers aiming at accelerating investments in this sector are identified: (i) funding for Research and Development (R&D), (ii) funding for pilot projects, and (iii) market-pull measures to aid in establishing a favorable investment environment for LIB collection and recycling.

5.1. R&D Priorities

The necessity of advancing recycling technology is clearly recognized by the global scientific community, which has produced a rapidly growing body of publications on this subject, notably in China [18,25]. The WEF also highlighted the necessity for “significant technology and process improvement for higher recovery rates and better environmental performance” [12].

Examples of promising R&D initiatives include the “Recycling Li-ion batteries for electric Vehicle” (ReLieVe) project involving Eramet, Suez, BASF, Chimie ParisTech and the Norwegian University of Science and Technology [26]; the ReCell Center at Argonne National Laboratory (and its plans to develop a novel direct recycling process [27]; and various projects in Canada involving the Hydro-Quebec Center of Excellence in Transportation Electrification and Energy Storage, the University of Montreal, the National Center in Environmental Technology and Electrochemistry (CNETE), and the National Research Council of Canada (NRC).

It is beyond the scope of this paper to suggest detailed recommendations for future R&D efforts, but a few points can be made. First, the entire recycling value chain should be considered. For example, battery recycling logistics, i.e., collecting, transporting, sorting, and storing EOL batteries, have been neglected in scientific literature despite their significant impacts on recycling, safety costs, and efficiency [18]. There is scope for finding better solutions for these crucial steps in the EOL value chain using advanced automation and artificial intelligence technologies. According to various sources, the cost of safely transporting spent batteries alone represents 40–50% of the overall recycling cost, while vehicle dismantling and battery pack disassembly are expensive because of the safety risks associated with this partially manual operation.

Second, R&D efforts should be focused on allowing the closed-loop recycling of all types of LIBs and most or all battery materials and components. The shift to hydrometallurgical processes is partly driven by the necessity for achieving higher recycling rates by recovering neglected components, such as electrolyte solutions, aluminum, graphite, and especially lithium. Advances are necessary to achieve even higher recycling rates and include all major battery types in the market without compromising other costs and performance goals.

For example, the company Lithion Recyling claims to be able to recover 95% of spent LIB materials into battery-grade materials [28] and cover all LIB chemistries, e.g., Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Manganese Oxide (LMO), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Lithium Iron Phosphate (LFP), as well as recovering spent electrolytes. Another example of a promising approach, developed by researchers from Hydro-Quebec, is the selective extraction of lithium in recycling LFP-based spent batteries. Indeed, the conventional lixiviation approach and total dissolution of the black mass during the recycling of many common LIB chemistries that aim at recovering valuable elements, such as Co, Ni, or Mn, are not applicable to the economic recycling of LFP-based cathode materials. Accordingly, the conventional total dissolution of the black mass will result in the loss of valuable LiFePO4 nanoparticles and the recovery of low-value iron and phosphate compounds. In contrast, the selective extraction of lithium ions from the LiFePO4 nanoparticles and the recovery of FePO4 nanoparticles (with their olivine structure preserved), followed by their relithiation, will allow the recovery of LFP nanoparticles as the original pristine material with the same activity. The patented Hydro-Quebec process for recycling LFP lithium batteries is based on such a selective lithium extraction [29]. Based on this approach, the use of highly concentrated solutions of extremely corrosive acids (e.g., H2SO4 or HCl) as leaching agents is avoided by utilizing CO2 gas to solubilize the extracted lithium as LiHCO3 without dissolving FePO4, which is recovered by filtration as intact nanoparticles. The separated LiHCO3 solution is then converted to Li2CO3, which can be used in preparing new lithium batteries, and CO2, which can be recycled back to the leaching step of the recycling process. It is observed that the development of innovative approaches may solve several important inadequacies of conventional processes, including the inability to revalue key battery materials (e.g., LFP) as well as the important environmental drawbacks of using corrosive and toxic chemicals that are not regenerated.

Third, the battery itself should be designed for recyclability to allow efficient disassembly and recycling and/or repurposing for second-life applications. Unlike lead–acid batteries, which are recycled to a considerable extent, LIBs are composed of numerous materials, including transition metals and many other components (e.g., graphite, aluminum, plastics, steel, and electrolyte solution). Battery packs also contain sensors, circuitry, and other electrical and electronic components. Further complicating the task for recyclers is the wide range of battery chemistries employed in the automotive industry (LFP, LCO, NCA, LMO, NMC, etc.), each with its own distinct mix of materials. They must also deal with significant differences in size and format (e.g., mixes of cylindrical, prismatic, and pouch-type cells).

Standardizing battery technologies is difficult, if not impossible, as variances in design and material composition are often necessary to satisfy the specific energy and power requirements of EV models. Even a single automaker may use several different battery chemistries and geometries at any given time [14]. These variances also provide the basis for competitive advantage and intellectual property rights in the battery and EV industry. Nevertheless, “design for recyclability” approaches are increasingly under consideration [14,30]. This includes making battery packs and modules that are easy to remove, disassemble, and prepare for repurposing and/or recycling as well as selecting materials and other components that are easily (and safely) removed and recycled. Recyclability could eventually become a source of competitive advantage for battery manufacturers; currently, it is typically not a primary concern due to price competition and pressure to meet a range of requirements, including high energy and power density, safety, product lifetime, and cycle life. As recycling becomes more attractive and/or unavoidable because of regulatory pressures, the necessity for “design for recyclability” approaches will increase.

Fourth, a better understanding of battery degradation over time is necessary. Among other things, this will aid in planning and optimizing the repurposing and recycling initiatives. As noted in [3], a better understanding of the aging mechanisms of LIBs, including cell degradation, structural changes, electrolyte evaporation, decomposition or degradation, and collector corrosion would facilitate the design of appropriate recycling processes, particularly direct recycling processes.

More examples could be provided. The identification of gaps in existing knowledge and the setting of priorities for R&D are an ongoing effort. A key point is that although R&D on specific recycling processes is important, a more holistic approach for rethinking and improving the entire battery design, manufacturing, EOL collecting, and recycling value chain is necessary. This is one of the objectives of a community of interest on battery recycling established with the assistance of InnovÉÉ in Quebec. By facilitating dialogue, goal-setting, and collaborative R&D and pilot projects involving stakeholders from the entire battery/recycling value chain (e.g., OEMs, battery industry, transportation companies, recyclers), this community of interest hopes to aid in bridging the gap between scientific research and market demands.

In any case, public research budgets will have to be expanded to advance the scientific and engineering expertise on LIB recycling. Unfortunately, relative to the problems of making battery value chains more sustainable, the level of R&D investments in this area remains low. Gaines et al. [14] recommended making the US federal funding for LIB recycling at least comparable to battery R&D funding; the authors also believe that this advice is applicable to other jurisdictions.

5.2. Pilot Projects

Although expanding R&D activity on recycling value chains (and battery recyclability) is highly desirable, as discussed above there are many existing solutions for recycling EV batteries. Policy priorities should, therefore, also include supporting pilot projects that seek to demonstrate the technical and financial viabilities of these solutions. Such projects can also contribute to the creation of integrated value chains around recycling and manufacturing LIBs, generate data for investment planning, and help identify gaps and priorities for further R&D. Projects should involve all the stakeholders that perform key functions in realizing large-scale LIB recycling, including companies from the automotive, battery, transportation, and recycling industries as well as the regulators and scientific research community. For example, one of the biggest challenges encountered by recyclers is securing stable supplies of spent batteries. According to industry sources, the current recycling capacity is underutilized, indicating the necessity to consolidate EOL battery supplies. These challenges could be mitigated by increased cooperation and communication along the value chain. Lastly, pilot projects allow battery manufacturers to validate the quality and suitability of recycled materials, as well as to become familiarized with closed-loop recycling approaches.

EV fleets could provide a particularly fertile ground for such pilot projects. The operators of fleets (e.g., transit and school buses, taxis, delivery vans, car sharing, and car rental firms) tend to be considerably attentive to asset productivity and total cost of operation (TCO) metrics; they will, therefore, be incentivized to minimize EOL disposal fees and/or maximize revenue from the resale of used components. Moreover, they can offer consolidated supplies of spent batteries to reduce transaction and transportation costs as well as a relatively homogeneous supply of batteries (provided that the fleet operator works with a limited number of vehicle models), thus simplifying recycling.

Another priority for pilot projects would be to assess the energy use and lifecycle emissions of recycling processes. Currently, data on industrial recycling processes are insufficient, for example with regards to solvent use in hydrometallurgical processes and energy use in pyrometallurgical processes [4].

5.3. Market Creation

Technology-push measures generally need to be complemented by favorable market-pull policies to provide incentives for scaling up and optimizing recycling value chains, especially during the emergence phase of this industry. As noted by Gaines et al. [14], “effective policy mechanisms, and possibly incentives, are needed to encourage battery collection, recycling process improvement, infrastructure development, and recycling cost reduction.” In the absence of such policies, recycling may encounter a “chicken and egg” problem. The low number of EOL batteries available for recycling discourages companies from investing into recycling infrastructure, which in turn discourages the industry from investing into battery collection and transportation or recycling-related R&D activities. Indeed, according to industry consultations, the lack of regulatory incentives is one of the most important barriers to LIB recycling.

The application of Extended Producer Responsibility (EPR) regulation to the EV battery industry (or EV as a whole) is one of the measures under consideration. This entails making the car manufacturers responsible for covering the cost of collecting and recycling batteries, providing them with incentives to establish (or support the establishment) of efficient recycling value chains, as well as to incorporate “design for recycling” considerations into their product development activities and those of their suppliers. Chinese regulations already mandate strict guidelines across the entire battery lifecycle, making car manufacturers and importers responsible for spent battery collection, repurposing, and recycling [14].

Other possible market-pull measures include the following.

- Setting cost and performance goals with rewards and penalties for non-compliance. For example, the US Department of Energy announced that it would award $5.5 million as prize for a recycling process that could profitably capture 90% of all spent LIBs in the US. In Europe, Battery 2030+ has set a target battery recycling rate of at least 75% and a critical raw material recycling rate close to 100%.

- Increasing “gate fees” as well as the cost of sending EOL LIBs to landfills.

- Establishing a deposit scheme at the time of vehicle purchase (the deposit could be paid by the consumer or by the car manufacturer under an EPR scheme and refunded when the battery is collected for recycling).

- Applying a special tax on virgin materials to make the price of recycled materials more competitive. This tax should be ideally based on embedded GHG emissions. Currently, carbon taxes are rarely applied to imported goods, providing an unfair advantage to foreign battery manufacturers based in countries with low-cost but with high-carbon energy and industrial infrastructures.

- Establishing regulations for the standardized labelling of batteries (including their material components) to facilitate sorting and recycling [1,6]. The WEF [12] recommends a “battery passport” to facilitate data sharing on the materials’ chemistry, origin, state of health of batteries, and chain of custody. This would allow stakeholders to identify and track batteries throughout the life cycle, facilitating both repurposing and recycling. In fact, China already requires car manufacturers to establish a tracking system for batteries [14]. According to Global Battery Alliance [2], the battery passport could be extended over time to provide transparency with respect to social and environmental dimensions, including compliance with human rights and anti-corruption legislation, as well as sustainability objectives (e.g., by disclosing embedded GHG emissions).

- Facilitating regional integration through international agreements and regulatory harmonization to reduce transportation costs without compromising safety.

As suggested above, these measures would not only accelerate the recycling of EV batteries and thus alleviate the safety and environmental risks of battery manufacturing and EOL disposal, but also generate significant local economic activity. A sustainable battery industry operating under circular economy principles thus seems attractive at many levels.

However, there are also risks that must be considered. Several of the measures listed above involve additional costs and could, therefore, have adverse effects on EV demand. This creates a dilemma for policymakers: should the drive for sustainable low-carbon batteries be pursued even at the cost of compromising the transition to electrified transportation? EVs already offer significant reductions in lifecycle GHG emissions in most countries, even after including embedded GHG emissions from battery manufacturing [6,11]. Policies aiming to incentivize “green” batteries (including the use of recycled materials) should, therefore, be introduced carefully and gradually, avoiding constraints that might jeopardize the continued efforts to make EVs more affordable and practical for consumers. As discussed in [31], the main role of policymakers should be to provide, enhance, and/or protect suitable market footholds from where technology, infrastructure, and supporting institutions can evolve and improve incrementally. In other words, a solid and growing market foothold for EVs, coupled with gradually expanded tax policies and other instruments that encourage sustainable material sourcing and recycling, may be the most effective strategy in the long run.

These points should be considered as governments, including those of Canada and Quebec, seek to position their jurisdictions as leaders in both battery manufacturing and clean transportation.

Author Contributions

Conceptualization, A.B.; Investigation, A.B.; Writing—Original Draft Preparation, A.B., F.L. and K.A.; Writing—Review and Editing, A.B., F.L. and K.A.; Supervision, P.B. and K.Z.; Project Administration, P.B. and K.Z. All authors have read and agreed to the published version of the manuscript

Funding

Part of this research was funded by the Quebec Ministry of Economy and Innovation.

Acknowledgments

We thank Jean-Yves Huot of the National Research Council of Canada (NRC) and Nancy Déziel and her team at the National Center in Environmental Technology and Electrochemistry (CNETE) for their comments.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Propulsion Quebec. Lithium-ion Battery Sector: Developing a Promising Sector for Quebec’s Economy; KPMG for Propulsion Quebec: Montreal, QC, Canada, 2019. [Google Scholar]

- Stanislaus, M. Actions to Drive a Responsible and Sustainable Battery Value Chain. In Proceedings of the Annual PDAC Convention, Toronto, ON, Canada, 4 March 2020. [Google Scholar]

- Larouche, F.; Tedjar, F.; Amouzegar, K.; Houlachi, G.; Bouchard, P.; Demopoulos, J.P.; Zaghib, K. Progress and status of hydrometallurgical and direct recycling of Li-ion batteries and beyond. Materials 2020, 13, 801. [Google Scholar] [CrossRef] [PubMed]

- Ellingsen, L.A.-W.; Majeau-Bettez, G.; Singh, B.; Srivastava, A.K.; Valøen, L.O.; Strømman, A.H. Lifecycle impacts of lithium-ion batteries: A review. In Proceedings of the EVS29 International Battery, Hybrid and Fuel Cell Electric Vehicle Symposium, Montréal, QC, Canada, 19–22 June 2016. [Google Scholar]

- Ellingsen, L.A.-W. Identifying Key Assumptions and Differences in Life Cycle Assessment Studies of Lithium-Ion Traction Batteries with Focus on Greenhouse Gas Emissions. Transp. Res. Part D Transp. Environ. 2017, 55, 82–90. [Google Scholar] [CrossRef]

- Hall, D.; Lutsey, N. Effects of Battery Manufacturing on Electric Vehicle Life-Cycle Greenhouse Gas Emissions. Briefing, International Council on Clean Transportation, 2018. Available online: https://theicct.org/publications/EV-battery-manufacturing-emissions (accessed on 20 March 2020).

- CIRAIG Comparative Life-Cycle Assessment: Potential Environmental Impacts of Electric Vehicles and Conventional Vehicles in the Québec. Report Prepared for Hydro-Quebec. 2016. Available online: https://www.hydroquebec.com/data/developpement-durable/pdf/analyse-comparaison-vehicule-electrique-vehicule-conventionnel.pdf (accessed on 20 March 2020).

- Beaudet, A. Lifecycle Analysis (LCA) and Technological Rivalries: The Case of Hydrogen and Electric Vehicles. Presented at the EV2017VÉ Conference and Trade Show, Markham, ON, Canada, 29 May–1 June 2017. [Google Scholar]

- Dunn, J.B.; Gaines, L.; Kelly, J.C.; James, C.; Gallagher, K.G. The significance of Li-ion batteries in electric vehicle life-cycle energy and emissions and recycling’s role in its reduction. Energy Environ. Sci. 2015, 8, 158–168. [Google Scholar] [CrossRef]

- Mayyas, A.; Steward, D.; Mann, M. The case for recycling: Overview and challenges in the material supply chain for automotive li-ion batteries. Sustain. Mater. Technol. 2019, 19, e00087:1–e00087:13. [Google Scholar] [CrossRef]

- Dolganova, I.; Rödl, A.; Bach, V.; Kaltschmitt, M.; Finkbeiner, M. A Review of Life Cycle Assessment Studies of Electric Vehicles with a Focus on Resource Use. Resources 2020, 9, 32. [Google Scholar] [CrossRef]

- World Economic Forum (WEF). A Vision for a Sustainable Battery Value Chain in 2030 Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation. 2019. Available online: http://www3.weforum.org/docs/WEF_A_Vision_for_a_Sustainable_Battery_Value_Chain_in_2030_Report.pdf (accessed on 20 March 2020).

- Mann, M. Battery Recycling Supply Chain Analysis. In Proceedings of the DOE Vehicle Technologies Program 2019 Annual Merit Review and Peer Evaluation Meeting, Arlington, VA, USA, 10–13 June 2019. [Google Scholar]

- Gaines, L.; Richa, K.; Spangenberger, J. Key issues for Li-ion battery recycling. MRS Energy Sustain. 2018, 5, e14. [Google Scholar] [CrossRef]

- Chandrasekaran, R. Electric Vehicles: Coronavirus Wreaks Havoc across the Supply Chain. Report by Wood Mackenzie. 2016. Available online: https://www.woodmac.com/news/opinion/electric-vehicles-coronavirus-wreaks-havoc-across-the-supply-chain/?utm_source=newsletter&utm_medium=email&utm_content=ed202065iss67&utm_campaign=inside-track (accessed on 8 April 2020).

- Bhatt, M.N. Recycling and the Circular Economy. Presented at the Natural Resources Canada Workshop on Canada’s Battery Initiative, Ottawa, ON, Canada, 2019. Unpublished. [Google Scholar]

- Sharpe, B.; Lutsey, N.; Smith, C.; Kim, C. Canada’s Role in the Electric Vehicle Transition. White Paper. International Council on Clean Transportation, 2020. Available online: https://theicct.org/sites/default/files/publications/Canada-Power-Play-ZEV-04012020.pdf (accessed on 8 April 2020).

- Melin, H.E. State-of-the-Art in Reuse and Recycling of Lithium-Ion Batteries—A Research Review. Report Commissioned by The Swedish Energy Agency. 2019. Available online: https://www.energimyndigheten.se/globalassets/forskning--innovation/overgripande/state-of-the-art-in-reuse-and-recycling-of-lithium-ion-batteries-2019.pdf (accessed on 20 March 2020).

- Jacoby, M. It’s time to get serious about recycling lithium-ion batteries. Chem. Eng. News 2019, 97, 28. [Google Scholar]

- Larouche, F.; Demopoulos, P.G.; Amouzegar, K.; Bouchard, P.; Zaghib, K. Recycling of Li-Ion and Li-Solid State Batteries: The Role of Hydrometallurgy; The Minerals, Metals & Materials Series; Davis, B.R., Moats, M.S., Wang, S., Eds.; Springer: Berlin, Germany, 2018; pp. 2541–2553, (Extraction). [Google Scholar]

- Friedrich, B.; Peters, L. Status and Trends of industrialized Li-Ion battery recycling processes with qualitative comparison of economic and environmental impacts. In Proceedings of the 22nd ICBR—International Congress on Battery Recycling, Lisboa, Portugal, 20–22 September 2017. [Google Scholar]

- Hamuyuni, J.; Tesfaye, F. Advances in Lithium-Ion Battery Electrolytes: Prospects and Challenges in Recycling; The Minerals, Metals and Materials Series; Springer: Berlin, Germany, 2019; pp. 265–270. [Google Scholar] [CrossRef]

- Sloop, S.E.; Trevey, J.; Gaines, L.; Lerner, M.M.; Xu, W. Advances in Direct Recycling of Lithium-Ion Electrode Materials. ECS Trans. 2018, 85, 397–403. Available online: http://ma.ecsdl.org/content/MA2018-02/60/2171.abstract?sid=cd3b764f-423b-4e0c-b1d9-7947df9aa381 (accessed on 16 November 2018). [CrossRef]

- Eucobat, Position Paper—Collection Target for Waste Batteries. Available online: http://www.eucobat.eu/downloads (accessed on 14 March 2017).

- Hu, Y.; Yu, Y.; Huang, K.; Wang, L. Development tendency and future response about the recycling methods of spent lithium-ion batteries based on bibliometrics analysis. J. Energy Storage 2020, 27, 101111. [Google Scholar] [CrossRef]

- EIT Raw Materials, ReLieVe: Recycling Li-ion Batteries for Electric Vehicles. 2020. Available online: https://eitrawmaterials.eu/project/relieve/ (accessed on 2 July 2020).

- Department of Energy (DOE), Energy Department Announces Opening of Battery Recycling Center at Argonne National Lab. 2019. Available online: https://www.energy.gov/articles/energy-department-announces-opening-battery-recycling-center-argonne-national-lab (accessed on 20 March 2020).

- Lithion Recycling. Most of Electric Cars’ Batteries Will Be Recycled, Quebec Consortium Promises. 2019. Available online: https://www.lithionrecycling.com/most-of-electric-cars-batteries-will-be-recycled-quebec-consortium-promises/ (accessed on 2 July 2020).

- Amouzegar, K.; Bouchard, P.; Turcotte, N.; Zaghib, K. Method for Recycling Electrode Materials of Lithium Battery. U.S. Patent No. 16303268; International Patent Application No. 17798465, 23 November 2017. [Google Scholar]

- United States Advanced Battery Consortium (USABC). 2014 Recommended Practice for Recycling of xEV Electrochemical Energy Storage Systems. 2014. Available online: https://www.uscar.org/guest/view_team.php?teams_id=12 (accessed on 20 March 2020).

- Beaudet, A. Competing Pathways for the Decarbonisation of Road Transport: A Comparative Analysis of Hydrogen and Electric Vehicles. Ph.D. Thesis, Imperial College London, London, UK, 2010. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).