Cost and Scenario Analysis of Intermodal Transportation Routes from Korea to the USA: After the Panama Canal Expansion

Abstract

1. Introduction

2. Literature Review

2.1. Route Selection

2.2. Overview of US Logistics

3. Research Methods and Data Collection

3.1. Research Methods

- TC: Total logistics costs combined with inventory and transport costs

- R: Transportation cost per unit from origin to destination

- D: Annual demand of goods

- I: Inventory cost per unit (percentage of commodity price and interest rate on annual shipment value)

- T: Transit time (proportion of 365 days)

- C: Commodity value

- S: Cost per order

- Q: Quantity (per shipment).

- 1.

- The direct shipping cost is as follows:

- 2.

- In-transit carrying cost consists of the following:

- 3.

- Ordering cost is expressed as the following:

- 4.

- Warehouse inventory costs consist of the following:

- AT: Average transition

- AS: Average stock

- SS: Safety stock

- O: Order quantity

- ASLT: Average shipping lead time

- No: Number of order per year

- SR: Service rate

- dT: Deviation in demand during the transport

3.2. Data Collection

4. Cost Analysis

4.1. Direct Shipping Costs

4.2. In-Transit Carrying Costs

4.3. Warehouse Inventory Costs

4.4. Total Logistics Costs

5. Scenario Analysis

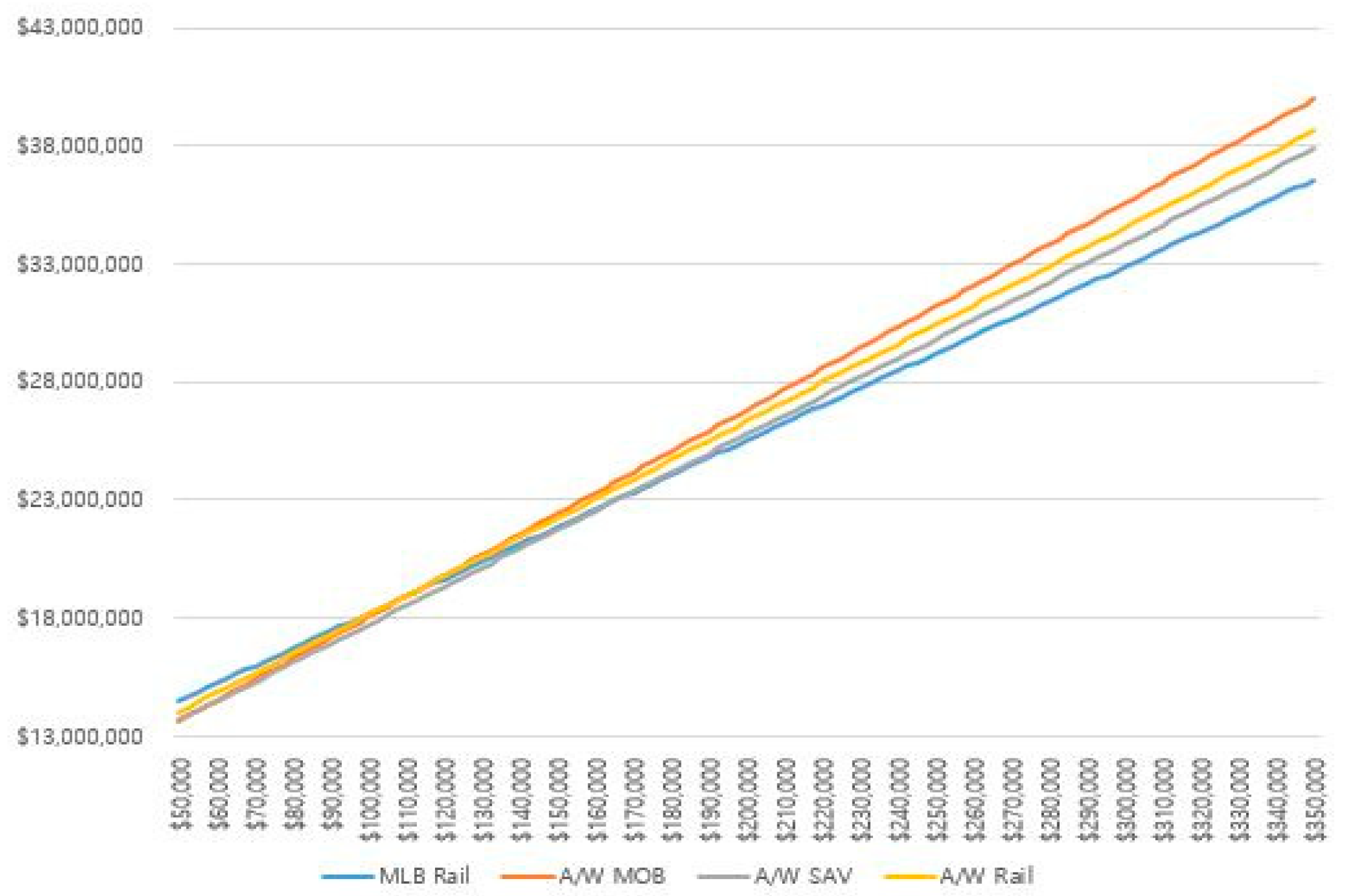

5.1. Change in Transportation Cost per Unit from Origin to Destination (r)

5.2. Change in Commodity Value (c)

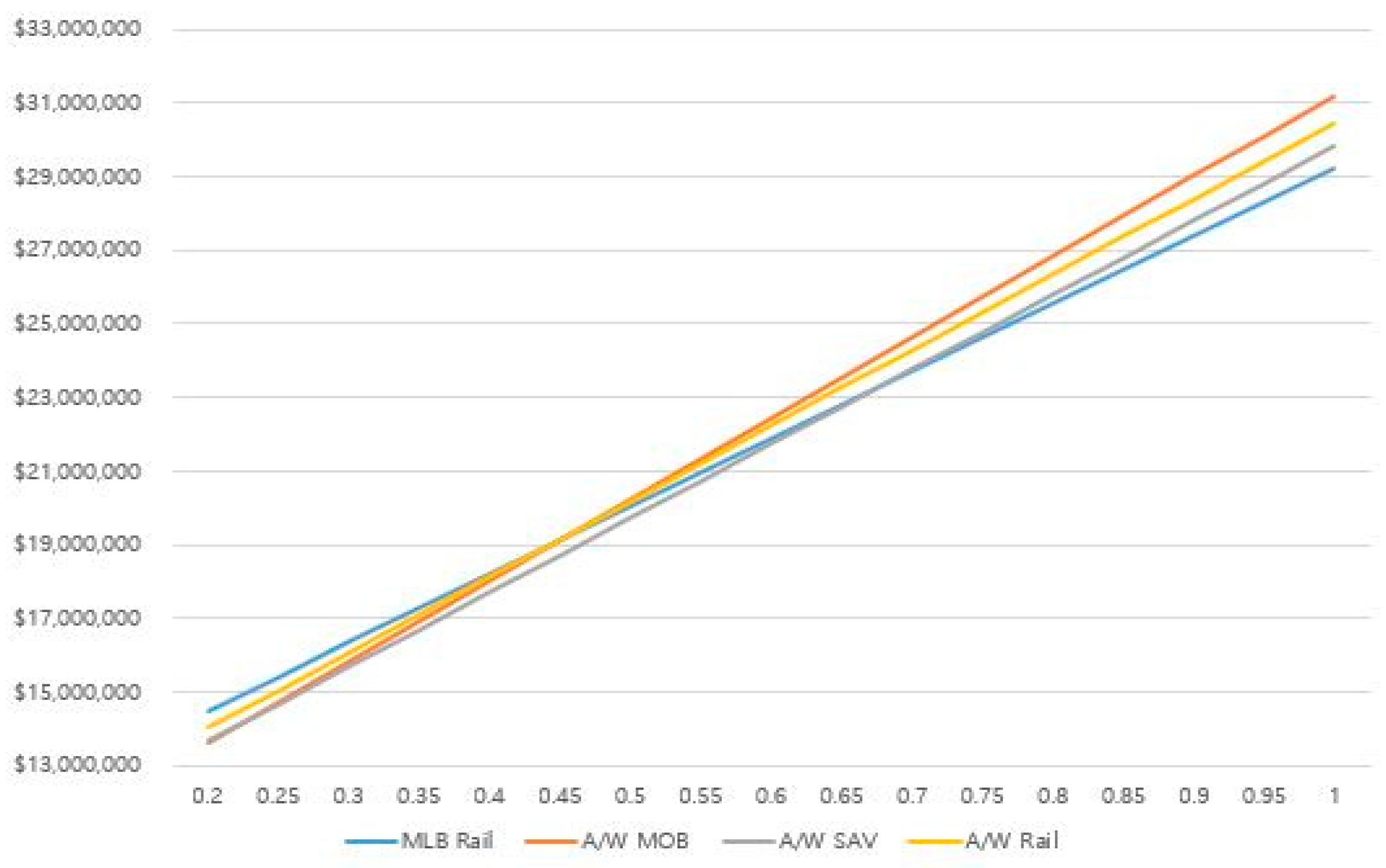

5.3. Change in Inventory Cost per Unit (Percentage of Value of Product) (I)

6. Change in Additional Condition

6.1. Applying the Terminal Free Time Conditions

- Shippers fully use the terminal free time and subtract the storage cost in CY by the number of days used in free time.

- Since containers are stored at a distance at which they can be transported to the final destination on the very day, the number of storage usage days can be replaced for the duration of the period of the terminal free time.

- The commodity is stored as a substitute for the safety stock of the destination storage; no additional in-transit carrying cost and warehouse inventory cost are incurred.

- Since the shuttle cost moving to the CY is small and is incurred only once in all modes, it is excluded at the total logistics cost. The yard storage cost is $20 per container per day.

6.2. Change in Terminal Free Time

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Korea International Trade Association. Trade Statistical Data. Available online: http://stat.kita.net/stat/istat/uts/UsCtrImpExpList.screen (accessed on 22 March 2020).

- Pierreval, H.; Bruniaux, R.; Caux, C. A continuous simulation approach for supply chains in the automotive industry. Simul. Model. Pract. Theory 2007, 15, 185–198. [Google Scholar] [CrossRef]

- Korea Customs Service. Top 10 Import and Export Items. Available online: http://www.index.go.kr/potal/main/EachDtlPageDetail.do?idx_cd=2455 (accessed on 22 March 2020).

- Woo, S.H.; Kim, S.N.; Kwak, D.W.; Pettit, S.; Beresford, A. Multimodal route choice in maritime transportation: The case of Korean auto-parts exporters. Marit. Policy Manag. 2018, 45, 19–33. [Google Scholar] [CrossRef]

- Moon, D.S.; Kim, D.J.; Lee, E.K. A study on competitiveness of sea transport by comparing international transport routes between Korea and EU. Asian J. Shipp. Logist. 2015, 31, 1–20. [Google Scholar] [CrossRef]

- Pham, T.Y.; Kim, K.Y.; Yeo, G.T. The Panama Canal expansion and its impact on east–west liner shipping route selection. Sustainability 2018, 10, 4353. [Google Scholar] [CrossRef]

- Ayar, B.; Yaman, H. An intermodal multicommodity routing problem with scheduled services. Comput. Optim. Appl. 2012, 53, 131–153. [Google Scholar] [CrossRef]

- Gallo, A.; Accorsi, R.; Baruffaldi, G.; Manzini, R. Designing sustainable cold chains for long-range food distribution: Energy-effective corridors on the Silk Road Belt. Sustainability 2017, 9, 2044. [Google Scholar] [CrossRef]

- Daham, H.A.; Yang, X.; Warnes, M.K. An efficient mixed integer programming model for pairing containers in inland transportation based on the assignment of orders. J. Oper. Res. Soc. 2017, 68, 678–694. [Google Scholar] [CrossRef]

- Xing, J.; Zhong, M. A reactive container rerouting model for container flow recovery in a hub-and-spoke liner shipping network. Marit. Policy Manag. 2017, 44, 744–760. [Google Scholar] [CrossRef]

- Huang, K.; Lee, Y.T.; Xu, H. A routing and consolidation decision model for containerized air-land intermodal operations. Comput. Ind. Eng. 2020, 141, 106299. [Google Scholar] [CrossRef]

- Tian, W.; Cao, C. A generalized interval fuzzy mixed integer programming model for a multimodal transportation problem under uncertainty. Eng. Optim. 2017, 49, 481–498. [Google Scholar] [CrossRef]

- Hao, C.; Yue, Y. Optimization on Combination of Transport Routes and Modes on Dynamic Programming for a Container Multimodal Transport System. Procedia Eng. 2016, 137, 382–390. [Google Scholar] [CrossRef]

- Wang, Y.; Yeo, G.T. Intermodal route selection for cargo transportation from Korea to Central Asia by adopting Fuzzy Delphi and Fuzzy ELECTRE I methods. Marit. Policy Manag. 2018, 45, 3–18. [Google Scholar] [CrossRef]

- Pham, T.Y.; Yeo, G.T. A comparative analysis selecting the transport routes of electronics components from China to Vietnam. Sustainability 2018, 10, 2444. [Google Scholar] [CrossRef]

- Beresford, A.K. Modelling freight transport costs: A case study of the UK–Greece corridor. Int. J. Logist. Res. Appl. 1999, 2, 229–246. [Google Scholar] [CrossRef]

- Banomyong, R.; Beresford, A.K. Multimodal transport: The case of Laotian garment exporters. Int. J. Phys. Distrib. Logist. Manag. 2001, 31, 663–685. [Google Scholar] [CrossRef]

- Beresford, A.; Pettit, S.; Liu, Y. Multimodal supply chains: Iron ore from Australia to China. Supply Chain Manag. Int. J. 2011, 16, 32–42. [Google Scholar] [CrossRef]

- Seo, Y.J.; Chen, F.; Roh, S.Y. Multimodal transportation: The case of laptop from Chongqing in China to Rotterdam in Europe. Asian J. Shipp. Logist. 2017, 33, 155–165. [Google Scholar] [CrossRef]

- Banomyong, R. Assessing import channels for a land-locked country: The case of Lao PDR. Asia Pac. J. Mark. Logist. 2004, 16, 62–81. [Google Scholar] [CrossRef][Green Version]

- Regmi, M.B.; Hanaoka, S. Assessment of intermodal transport corridors: Cases from North-East and Central Asia. Res. Transp. Bus. Manag. 2012, 5, 27–37. [Google Scholar] [CrossRef]

- Collison, F.M. Market segments for marine liner service. Transp. J. 1984, 24, 40–54. [Google Scholar]

- McGinnis, M.A. A comparative evaluation of freight transportation choice models. Transp. J. 1989, 29, 36–46. [Google Scholar]

- Kim, G.S.; Lee, S.W.; Seo, Y.J.; Kim, A.R. Multimodal transportation via TSR for effective Northern logistics. Marit. Bus. Rev. 2020. [Google Scholar] [CrossRef]

- Cunningham, W.H. Freight modal choice and competition in transportation: A critique and categorization of analysis techniques. Transp. J. 1982, 21, 66–75. [Google Scholar]

- Liu, M.; Kronbak, J. The potential economic viability of using the Northern Sea Route (NSR) as an alternative route between Asia and Europe. J. Transp. Geogr. 2010, 18, 434–444. [Google Scholar] [CrossRef]

- Shibasaki, R.; Azuma, T.; Yoshida, T.; Teranishi, H.; Abe, M. Global route choice and its modelling of dry bulk carriers based on vessel movement database: Focusing on the Suez Canal. Res. Transp. Bus. Manag. 2017, 25, 51–65. [Google Scholar] [CrossRef]

- Wang, S.; Yang, D.; Lu, J. A connectivity reliability-cost approach for path selection in the maritime transportation of China’s crude oil imports. Marit. Policy Manag. 2018, 45, 567–584. [Google Scholar] [CrossRef]

- Verny, J.; Grigentin, C. Container shipping on the northern sea route. Int. J. Prod. Econ. 2009, 122, 107–117. [Google Scholar] [CrossRef]

- Zeng, Q.; Lu, T.; Lin, K.C.; Yuen, K.F.; Li, K.X. The competitiveness of Arctic shipping over Suez Canal and China-Europe railway. Transp. Policy 2020, 86, 34–43. [Google Scholar] [CrossRef]

- Salin, D.L. Impact of Panama Canal Expansion on the US Intermodal System. United States Department of Agriculture. Agricultural Marketing Service, Transportation and Marketing Program 2010. Available online: https://ageconsearch.umn.edu/record/147032 (accessed on 18 February 2020).

- Martinez, C.; Steven, A.B.; Dresner, M. East Coast vs. West Coast: The impact of the Panama Canal’s expansion on the routing of Asian imports into the United States. Transp. Res. Part E Logist. Transp. Rev. 2016, 91, 274–289. [Google Scholar] [CrossRef]

- Ungo, R.; Sabonge, R. A competitive analysis of Panama Canal routes. Marit. Policy Manag. 2012, 39, 555–570. [Google Scholar] [CrossRef]

- Van Hassel, E.; Meersman, H.; Van de Voorde, E.; Vanelslander, T. The impact of the expanded Panama Canal on port range choice for cargo flows from the US to Europe. Marit. Policy Manag. 2020. [Google Scholar] [CrossRef]

- Moryadee, S.; Gabriel, S.A. Panama Canal Expansion: Will Panama Canal Be a Game-Changer for Liquefied Natural Gas Exports to Asia? J. Energy Eng. 2017, 143, 04016024. [Google Scholar] [CrossRef]

- Liu, Q.; Wilson, W.W.; Luo, M. The impact of Panama Canal expansion on the container-shipping market: A cooperative game theory approach. Marit. Policy Manag. 2016, 43, 209–221. [Google Scholar] [CrossRef]

- Corbett, J.J.; Deans, E.; Silberman, J.; Morehouse, E.; Craft, E.; Norsworthy, M. Panama Canal expansion: Emission changes from possible US west coast modal shift. Carbon Manag. 2012, 3, 569–588. [Google Scholar] [CrossRef]

- De Marucci, S. The expansion of the Panama Canal and its impact on global CO2 emissions from ships. Marit. Policy Manag. 2012, 39, 603–620. [Google Scholar] [CrossRef]

- Carral, L.; Fernández-Garrido, C.; Vega, A.; Sabonge, R. Importance of the Panama Canal in the reduction of CO2 emissions from maritime transport. Int. J. Sustain. Transp. 2019, 1–14. [Google Scholar] [CrossRef]

- Baumol, W.J.; Vinod, H.D. An inventory theoretic model of freight transport demand. Manag. Sci. 1970, 16, 413–421. [Google Scholar] [CrossRef]

- Offshore Energy. Maersk Line Hints at Increasing Use of New Panama Canal. Available online: https://www.offshore-energy.biz/maersk-line-hints-at-increasing-use-of-new-panama-canal/ (accessed on 22 March 2020).

- Yonhap News. Asia-US East Coast Container Ships, Changing Route from Suez to Panama Canal. Available online: https://www.yna.co.kr/view/AKR20160718095200076 (accessed on 22 March 2020).

| No. | Contents | Notes |

|---|---|---|

| 1 | Transport section: Korea–Montgomery, AL, US, company A’s manufacturing plant warehouse | |

| 2 | Cargo origin: Busan Port, Incheon Airport Export condition: Delivered At Place (DAP), Montgomery, AL | |

| 3 | Shipping container: 40’HC standard container (FEU) Commodity type: automotive parts Annual commodity demand: 2600 units (50 units/week) | One 40’HC Weight: 5000 kg CBM: 23.664 |

| 4 | MLB Ocean Carrier (OC): Hyundai Merchant Marine (HMM), Ocean Network Express (ONE) A/W OC: Maersk, ZIM Line Local trucking company: GFA, SHORELINE, GET Airline: Korean Air | Rail Transportation Provided by OC |

| 5 | Sea/air/inland fares: based on freight all kind (FAK) of 3Q 2019 | |

| 6 | Does not exceed OCs and terminals’ free time No demurrage, detention or over-storage cost | |

| 7 | Exclude insurance costs and customs clearance costs such as insurance on goods and international cargo liability Ordering cost: assumed included in transportation cost Inventory cost per unit: 10% of commodity price and 10% interest rate on annual shipment value | |

| 8 | Local safety stock: 4 weeks | |

| 9 | Commodity price: $50,000/40’HC |

| No. | Modes | Port of Shipment | Port of Arrival | Rail | Transport Cost (FEU) | Transit Time (Day) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sea/Air | Rail | Truck | Sea/Air | Load and Unload/Rail | Load and Unload/Truck | ||||||

| 1 | MLB | Truck (Team) | Busan | LA | - | $1500 | - | $6500 | 11 | - | 3 |

| 2 | Truck (Single) | Busan | LA | - | $1500 | - | $6100 | 11 | - | 5 | |

| 3 | Rail + Truck | Busan | LA | Atlanta | $1500 | $2010 | $655 | 11 | 8 | 1 | |

| 4 | A/W | Truck | Busan | Mobile | - | $2875 | - | $685 | 28 | - | 2 |

| 5 | Truck | Busan | Savannah | - | $2625 | - | $1085 | 23 | - | 2 | |

| 6 | Rail + Truck | Busan | Savannah | Atlanta | $2625 | $505 | $685 | 23 | 2 | 1 | |

| 7 | Air | Air + Truck | Incheon | Atlanta | - | $19,500 | - | $950 | 1 | - | 1 |

| No. | Modes | Variables | Direct Shipping Cost (rD) | ||

|---|---|---|---|---|---|

| r | D | ||||

| 1 | MLB | Truck (Team) | $8000 | 2600 | $20,800,000 |

| 2 | Truck (Single) | $7600 | 2600 | $19,760,000 | |

| 3 | Rail + Truck | $4165 | 2600 | $10,829,000 | |

| 4 | A/W | Truck (via Mobile) | $3560 | 2600 | $9,256,000 |

| 5 | Truck (via Savannah | $3710 | 2600 | $9,646,000 | |

| 6 | Rail + Truck | $3815 | 2600 | $9,919,000 | |

| 7 | Air | Air + Truck | $20,450 | 2600 | $53,170,000 |

| No. | Modes | Variables | In-Transit Carrying Cost (ItDC) | ||||

|---|---|---|---|---|---|---|---|

| I | t | D | C | ||||

| 1 | MLB | Truck (Team) | 0.2 | 14/365 | 2600 | $50,000 | $997,260 |

| 2 | Truck (Single) | 0.2 | 16/365 | 2600 | $50,000 | $1,139,726 | |

| 3 | Rail + Truck | 0.2 | 20/365 | 2600 | $50,000 | $1,424,658 | |

| 4 | A/W | Truck (via Mobile) | 0.2 | 30/365 | 2600 | $50,000 | $2,136,986 |

| 5 | Truck (via Savannah) | 0.2 | 25/365 | 2600 | $50,000 | $1,780,822 | |

| 6 | Rail + Truck | 0.2 | 26/365 | 2600 | $50,000 | $1,852,055 | |

| 7 | Air | Air + Truck | 0.2 | 2/365 | 2600 | $50,000 | $142,466 |

| No. | Modes | Variables | Warehouse Inventory Cost (IC(Q ∗ 4.5)) | ||||

|---|---|---|---|---|---|---|---|

| I | C | Q × 1/2 | Q × 4 | ||||

| 1 | MLB | Truck (Team) | 0.2 | $50,000 | 25 | 200 | $2,250,000 |

| 2 | Truck (Single) | 0.2 | $50,000 | 25 | 200 | $2,250,000 | |

| 3 | Rail + Truck | 0.2 | $50,000 | 25 | 200 | $2,250,000 | |

| 4 | A/W | Truck (via Mobile) | 0.2 | $50,000 | 25 | 200 | $2,250,000 |

| 5 | Truck (via Savannah) | 0.2 | $50,000 | 25 | 200 | $2,250,000 | |

| 6 | Rail + Truck | 0.2 | $50,000 | 25 | 200 | $2,250,000 | |

| 7 | Air | Air + Truck | 0.2 | $50,000 | 25 | 200 | $2,250,000 |

| No. | Modes | Variables | Total Logistics Cost (TC) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| r | C | I | t | D | Q | ||||

| 1 | MLB | Truck (Team) | $8000 | $50,000 | 0.2 | 14/365 | 2600 | 50 | $24,047,260 |

| 2 | Truck (Single) | $7600 | $50,000 | 0.2 | 16/365 | 2600 | 50 | $23,149,726 | |

| 3 | Rail + Truck | $4165 | $50,000 | 0.2 | 20/365 | 2600 | 50 | $14,503,658 | |

| 4 | A/W | Truck (via Mobile) | $3560 | $50,000 | 0.2 | 30/365 | 2600 | 50 | $13,642,986 |

| 5 | Truck (via Savannah) | $3710 | $50,000 | 0.2 | 25/365 | 2600 | 50 | $13,676,822 | |

| 6 | Rail + Truck | $3815 | $50,000 | 0.2 | 26/365 | 2600 | 50 | $14,021,055 | |

| 7 | Air | Air + Truck | $20,450 | $50,000 | 0.2 | 2/365 | 2600 | 50 | $55,562,466 |

| No. | Modes | Direct Shipping Cost | Percent (%) | In-Transit Carrying Cost | Percent (%) | Warehouse Inventory Cost | Percent (%) | Total Logistics Cost (TC) | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | MLB | Truck (Team) | $20,800,000 | 86.5 | $997,260 | 4.1 | $2,250,000 | 9.4 | $24,047,260 |

| 2 | Truck (Single) | $19,760,000 | 85.4 | $1,139,726 | 4.9 | $2,250,000 | 9.7 | $23,149,726 | |

| 3 | Rail + Truck | $10,829,000 | 74.7 | $1,424,658 | 9.8 | $2,250,000 | 15.5 | $14,503,658 | |

| 4 | A/W | Truck (via Mobile) | $9,256,000 | 67.8 | $2,136,986 | 15.7 | $2,250,000 | 16.5 | $13,642,986 |

| 5 | Truck (via Savannah) | $9,646,000 | 70.5 | $1,780,822 | 13 | $2,250,000 | 16.5 | $13,676,822 | |

| 6 | Rail + Truck | $9,919,000 | 70.7 | $1,852,055 | 13.2 | $2,250,000 | 16.1 | $14,021,055 | |

| 7 | Air | Air + Truck | $53,170,000 | 95.7 | $142,466 | 0.3 | $2,250,000 | 4 | $55,562,466 |

| No. | Modes | r | Total Logistics Cost (TC) | ||

|---|---|---|---|---|---|

| 1 | A/W | Truck (via Mobile) | $3560 | $13,642,986 | |

| 2 | A/W | Truck (via Savannah) | Before | $3710 | $13,676,822 |

| After | $3696 | $13,640,422 | |||

| 3 | A/W | Rail + Truck | Before | $3815 | $14,021,055 |

| After | $3669 | $13,641,455 | |||

| 4 | MLB | Rail + Truck | Before | $4165 | $14,503,658 |

| After | $3833 | $13,640,458 | |||

| No. | Modes | Destination | Free Time (Day) | |

|---|---|---|---|---|

| 1 | MLB | Truck (Team) | LA | 2 |

| 2 | Truck (Single) | LA | 2 | |

| 3 | Rail + Truck | Atlanta | 2 | |

| 4 | A/W | Truck | Mobile | 14 |

| 5 | Truck | Savannah | 14 | |

| 6 | Rail + Truck | Atlanta | 2 | |

| 7 | Air | Air + Truck | Atlanta | 2 |

| No. | Modes | Total Logistics Cost (Before) | Day | Cost of Free Time (fyD) | Total Logistics Costs (After) | Variation (%) | |

|---|---|---|---|---|---|---|---|

| 1 | MLB | Rail + Truck | $14,503,658 | 2 | $104,000 | $14,399,658 | −0.72% |

| 2 | A/W | Truck (via Mobile) | $13,642,986 | 14 | $728,000 | $12,914,986 | −5.34% |

| 3 | Truck (via Savannah) | $13,676,822 | 14 | $728,000 | $12,948,822 | −5.32% | |

| 4 | Rail + Truck | $14,021,055 | 2 | $104,000 | $13,917,055 | −0.74% | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.; Kim, K.; Yuen, K.F.; Park, K.-S. Cost and Scenario Analysis of Intermodal Transportation Routes from Korea to the USA: After the Panama Canal Expansion. Sustainability 2020, 12, 6341. https://doi.org/10.3390/su12166341

Kim J, Kim K, Yuen KF, Park K-S. Cost and Scenario Analysis of Intermodal Transportation Routes from Korea to the USA: After the Panama Canal Expansion. Sustainability. 2020; 12(16):6341. https://doi.org/10.3390/su12166341

Chicago/Turabian StyleKim, Junseung, Kyungku Kim, Kum Fai Yuen, and Keun-Sik Park. 2020. "Cost and Scenario Analysis of Intermodal Transportation Routes from Korea to the USA: After the Panama Canal Expansion" Sustainability 12, no. 16: 6341. https://doi.org/10.3390/su12166341

APA StyleKim, J., Kim, K., Yuen, K. F., & Park, K.-S. (2020). Cost and Scenario Analysis of Intermodal Transportation Routes from Korea to the USA: After the Panama Canal Expansion. Sustainability, 12(16), 6341. https://doi.org/10.3390/su12166341