Does Reference Dependence Impact Intervention Mechanisms in Vaccine Markets?

Abstract

:1. Introduction

2. Literature Review

2.1. Yield Uncertainty and Vaccination Externality

2.2. Intervention Mechanism through Subsidy and Tax

2.3. Behavioral Issues and Intervention Mechanisms

3. Model

3.1. Demand Model

3.1.1. Infection Probability

3.1.2. Individuals’ Decisions

3.2. Supply Model

3.2.1. Yield Uncertainty and Reference Dependence

3.2.2. Manufacturer’s Decisions

3.3. Intervention Mechanisms

3.3.1. The First Best Solution

3.3.2. Government Decisions

4. The Positive Impact of Reference Dependence

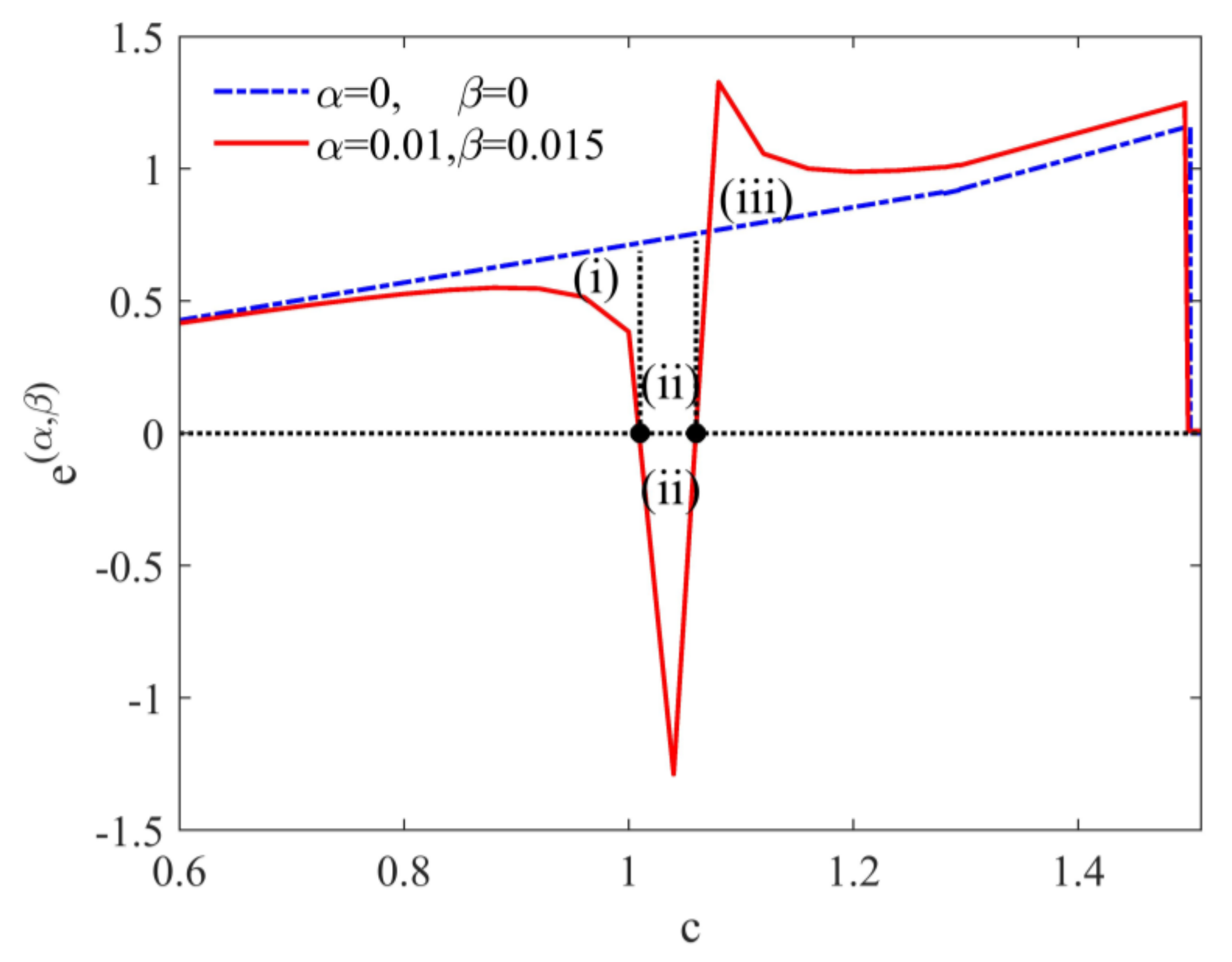

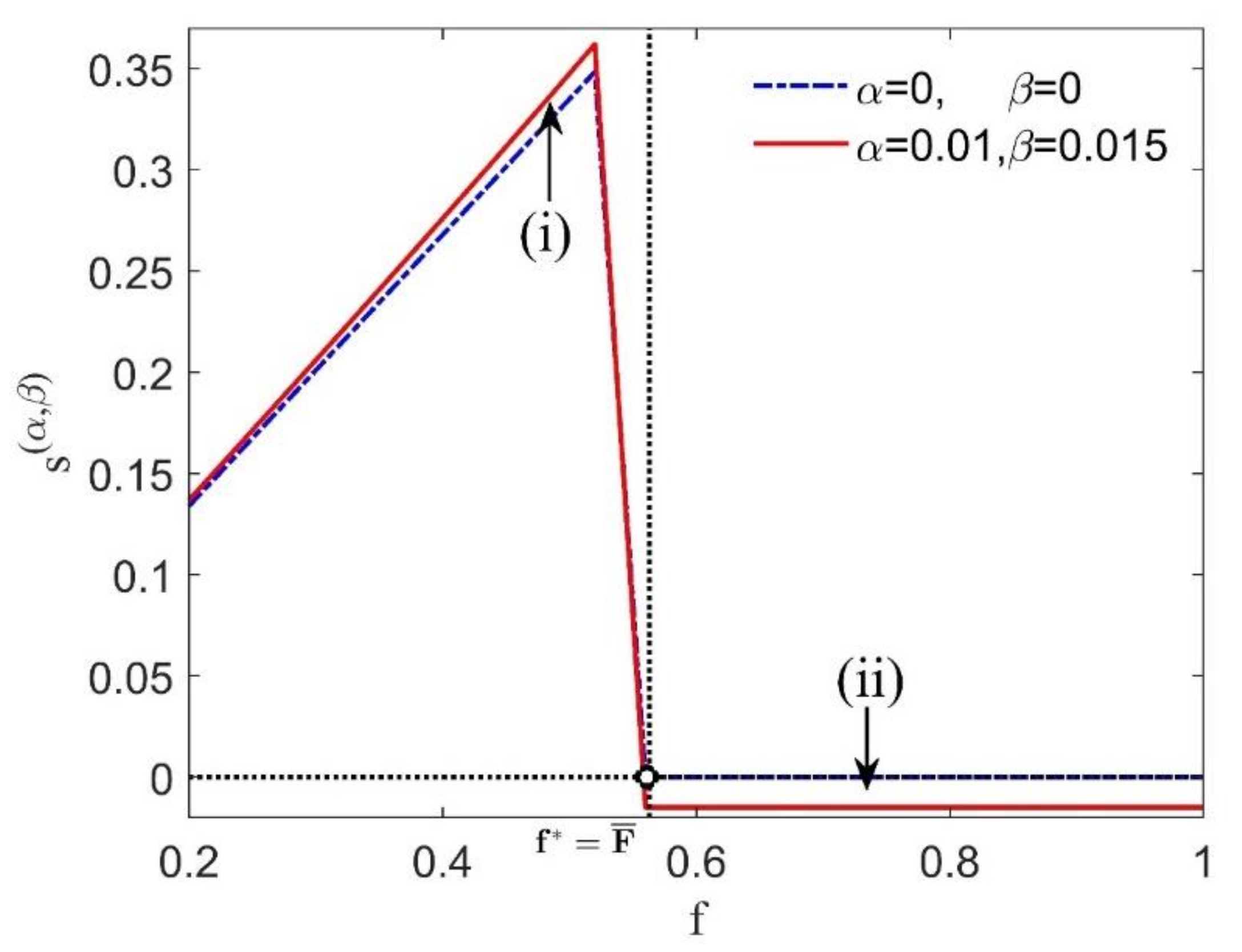

4.1. Examining the Effectiveness of Intervention Mechanisms

- (i)

- When,represents pure demand-sided intervention mechanisms and can induce a reference-dependent manufacturer to choose the first best solution;

- (ii)

- When,captures two-sided intervention mechanisms and can also do so.

- (iii)

- However,represents pure supply-sided intervention mechanisms and fails to achieve the first best solution.

4.2. Making Some Intervention Mechanisms Achieve Diverse Goals While Maximizing Social Welfare

4.2.1. Designing Pure Demand-Sided Intervention Mechanisms for Reducing Government Interventions

4.2.2. Designing Specific Two-Sided Intervention Mechanisms for Achieving Budget Neutrality

5. The Negative Impact of Reference Dependence

5.1. Making General Two-Sided Intervention Mechanisms Complex in Intervention’s Extent

5.1.1. Analysis in Supply-Sided Intervention Mechanisms

5.1.2. Analysis in Demand-Sided Intervention Mechanisms

5.2. Making General Two-Sided Intervention Mechanisms Complex in Intervention’s Structure

5.2.1. Analysis in Supply-Sided Intervention Mechanisms

5.2.2. Analysis in Demand-Sided Intervention Mechanism

6. Conclusions and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

- (1)

- ;

- (2)

- ;

- (3)

- .

Appendix C

| Vaccine Market | |

|---|---|

| Constant that determines the absolute value | |

| w | Vaccine price |

| Stochastically proportional yield | |

| Upper limit of random yields | |

| Mean value of the random variable of yields | |

| q | Target production level |

| Final production output of vaccines | |

| c | Unit of the normalized cost of production |

| (or ) | Psychological per-unit cost of underproduction (or overproduction) |

| Manufacturer’s utility | |

| Expected utility of a vaccine manufacturer with reference dependence | |

| Expected utility of a profit-driven manufacturer | |

| Expected psychological disutility of reference dependence | |

| (or ) | Optimal production (or vaccination coverage) in the decentralized system |

| Vaccine price in the decentralized system | |

| Hazard rate for yield uncertainty, | |

| Manufacturer’s surplus | |

| (or ) | Vaccinated (or unvaccinated) individuals’ surplus |

| Other surplus | |

| (or ) | Per-unit benefit from underproduction (or overproduction) |

| (or ) | Socially optimal production quantity (or vaccination coverage) |

| Indirect cost to society | |

| A purchase subsidy offered to individuals | |

| A cost subsidy per unit provided to the vaccine manufacturer | |

| Expected utility of the manufacturer with mechanism M=(s, e). | |

| and satisfies | |

| (or ) | One-sided intervention mechanisms on the demand (or supply) side |

| Two-sided intervention mechanisms | |

| Modified one-sided intervention mechanisms | |

| t | Subsidies (or taxes) are offered (or imposed) for all individuals in modified one-sided intervention mechanisms |

| Infection Transmission | |

| Basic reproduction number | |

| Infection probability for the entire population | |

| Fraction of the population to vaccinate and | |

| Degree of vaccine efficacy | |

| F | Critical vaccination fraction, |

| or | Infection probability level for vaccinated or unvaccinated fractions |

| A constant that can be adjusted to satisfy | |

| A relative loss in infection disutility for the individual | |

| Let | |

| Parameter | Value | Source |

|---|---|---|

| 1 | Adida, Dey and Mamani [3] | |

| 3.3 | Mamani et al. [36] | |

| Adida, Dey and Mamani [3] | ||

| U | Uniform [0,2] | Adida, Dey and Mamani [3] |

| 1 | Adida, Dey and Mamani [3] | |

| 0.9 | Adida, Dey and Mamani [3] | |

| [0,1.6] | Adida, Dey and Mamani [3] | |

| 0.01 | This paper | |

| 0.015 | This paper | |

| 0.1 | This paper |

References

- WHO. World Health Data Platform. Available online: https://www.who.int/data/gho/data/themes/sustainable-development-goals (accessed on 5 July 2020).

- Chick, S.E.; Mamani, H.; Simchi-Levi, D. Supply Chain Coordination Influenza Vaccination. Oper. Res. 2008, 56, 1493–1506. [Google Scholar] [CrossRef] [Green Version]

- Adida, E.; Dey, D.; Mamani, H. Operational issues and network effects in vaccine markets. Eur. J. Oper. Res. 2013, 231, 414–427. [Google Scholar] [CrossRef] [PubMed]

- Yamin, D.; Gavious, A. Incentives' Effect in Influenza Vaccination Policy. Manag. Sci. 2013, 59, 2667–2686. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef] [Green Version]

- Schweitzer, M.E.; Cachon, G.P. Decision bias in the newsvendor problem with a known demand distribution: Experimental evidence. Manag. Sci. 2000, 46, 404–420. [Google Scholar] [CrossRef] [Green Version]

- Koszegi, B.; Rabin, M. A model of reference-dependent preferences. Q. J. Econ. 2006, 121, 1133–1165. [Google Scholar]

- Ho, T.H.; Lim, N.; Cui, T.H. Reference Dependence in Multilocation Newsvendor Models: A Structural Analysis. Manag. Sci. 2010, 56, 1891–1910. [Google Scholar] [CrossRef]

- GSK. Responsible Business Supplement 2016. Available online: https://www.gsk.com/media/3610/responsible-business-supplement-2016.pdf (accessed on 5 July 2020).

- Deo, S.; Corbett, C.J. Cournot Competition Under Yield Uncertainty: The Case of the US Influenza Vaccine Market. MSom Manuf. Serv. Oper. 2009, 11, 563–576. [Google Scholar] [CrossRef]

- Chick, S.E.; Hasija, S.; Nasiry, J. Information Elicitation and Influenza Vaccine Production. Oper. Res. 2017, 65, 75–96. [Google Scholar] [CrossRef]

- Mamani, H.; Chick, S.E.; Simchi-Levi, D. A Game-Theoretic Model of International Influenza Vaccination Coordination. Manag. Sci. 2013, 59, 1650–1670. [Google Scholar] [CrossRef]

- Dai, T.L.; Cho, S.H.; Zhang, F.Q. Contracting for On-Time Delivery in the US Influenza Vaccine Supply Chain. MSom Manuf. Serv. Oper. 2016, 18, 332–346. [Google Scholar] [CrossRef] [Green Version]

- Brito, D.L.; Sheshinski, E.; Intriligator, M.D. Externalities and compulsary vaccinations. J. Public Econ. 1991, 45, 69–90. [Google Scholar] [CrossRef]

- Ahlskog, R. When is Blood Thicker Than Water? Variations of Other-Regard in the Vaccination Decision. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:uu:diva-311018 (accessed on 5 July 2020).

- Caso, D.; Carfora, V.; Starace, C.; Conner, M. Key Factors Influencing Italian Mothers’ Intention to Vaccinate Sons against HPV: The Influence of Trust in Health Authorities, Anticipated Regret and Past Behaviour. Sustainability 2019, 11, 6879. [Google Scholar] [CrossRef] [Green Version]

- Guo, F.; Cao, E. Can Reference Points Explain Vaccine Hesitancy? A New Perspective on Their Formation and Updating. Available online: https://doi.org/10.1016/j.omega.2019.102179 (accessed on 5 July 2020).

- MacDonald, N.E. Vaccine hesitancy: Definition, scope and determinants. Vaccine 2015, 33, 4161–4164. [Google Scholar] [CrossRef]

- Su, C.; Liu, X.; Du, W. Green Supply Chain Decisions Considering Consumers’ Low-Carbon Awareness under Different Government Subsidies. Sustainability 2020, 12, 2281. [Google Scholar] [CrossRef] [Green Version]

- Xu, D.; Long, Y. The Impact of Government Subsidy on Renewable Microgrid Investment Considering Double Externalities. Sustainability 2019, 11, 3168. [Google Scholar] [CrossRef] [Green Version]

- Yin, X.; Chen, X.; Xu, X.; Zhang, L. Tax or Subsidy? Optimal Carbon Emission Policy: A Supply Chain Perspective. Sustainability 2020, 12, 1548. [Google Scholar] [CrossRef] [Green Version]

- Levi, R.; Perakis, G.; Romero, G. On the Effectiveness of Uniform Subsidies in Increasing Market Consumption. Manag. Sci. 2017, 63, 40–57. [Google Scholar] [CrossRef] [Green Version]

- Arifoğlu, K.; Deo, S.; Iravani, S.M.R. Consumption Externality and Yield Uncertainty in the Influenza Vaccine Supply Chain: Interventions in Demand and Supply Sides. Manag. Sci. 2012, 58, 1072–1091. [Google Scholar] [CrossRef]

- Ahlskog, R. Democracy and Vaccination Uptake—A Complex Friendship. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:uu:diva-311017 (accessed on 5 July 2020).

- Chemama, J.; Cohen, M.C.; Lobel, R.; Perakis, G. Consumer Subsidies with a Strategic Supplier: Commitment vs. Flexibility. Manag. Sci. 2019, 65, 681–713. [Google Scholar] [CrossRef] [Green Version]

- Taylor, T.A.; Xiao, W. Subsidizing the distribution channel: Donor funding to improve the availability of malaria drugs. Manag. Sci. 2014, 60, 2461–2477. [Google Scholar] [CrossRef] [Green Version]

- Donohue, K.; Ozer, O.; Zheng, Y.C. Behavioral Operations: Past, Present, and Future. MSom Manuf. Serv. Oper. 2020, 22, 191–202. [Google Scholar] [CrossRef] [Green Version]

- Xie, L.; Ma, J.; Goh, M. Supply Chain Coordination in the Presence of Uncertain Yield and Demand. Available online: https://doi.org/10.1080/00207543.2020.1762942 (accessed on 5 July 2020).

- Giri, B.C.; Bardhan, S.; Maiti, T. Coordinating a three-layer supply chain with uncertain demand and random yield. Int. J. Prod. Res. 2016, 54, 2499–2518. [Google Scholar] [CrossRef]

- Cui, T.H.; Raju, J.S.; Zhang, Z.J. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar]

- Li, M. Overconfident Distribution Channels. Prod. Oper. Manag. 2019, 28, 1347–1365. [Google Scholar] [CrossRef]

- Ho, T.H.; Su, X.M.; Wu, Y.Z. Distributional and Peer-Induced Fairness in Supply Chain Contract Design. Prod. Oper. Manag. 2014, 23, 161–175. [Google Scholar] [CrossRef] [Green Version]

- Becker-Peth, M.; Thonemann, U.W. Reference points in revenue sharing contracts How to design optimal supply chain contracts. Eur. J. Oper. Res. 2016, 249, 1033–1049. [Google Scholar] [CrossRef]

- Xideng, Z.; Bing, X.; Fei, X.; Yu, L. Research on Quality Decisions and Coordination with Reference Effect in Dual-Channel Supply Chain. Sustainability 2020, 12, 2296. [Google Scholar] [CrossRef] [Green Version]

- Yang, D.; Xiao, T. Coordination of a supply chain with loss-averse consumers in service quality. Int. J. Prod. Res. 2017, 55, 3411–3430. [Google Scholar] [CrossRef]

- Mamani, H.; Adida, E.; Dey, D. Vaccine market coordination using subsidy. IIE Trans. Healthc. Syst. Eng. 2012, 2, 78–96. [Google Scholar] [CrossRef]

- Raz, G.; Ovchinnikov, A. Coordinating Pricing and Supply of Public Interest Goods Using Government Rebates and Subsidies. IEEE Trans. Eng. Manag. 2015, 62, 65–79. [Google Scholar] [CrossRef]

- Balakrishnan, A.; Pangburn, M.S.; Stavrulaki, E. “Stack Them High, Let ’em Fly”: Lot-Sizing Policies When Inventories Stimulate Demand. Manag. Sci. 2004, 50, 630–644. [Google Scholar] [CrossRef]

- Tereyagoglu, N.; Veeraraghavan, S. Selling to Conspicuous Consumers: Pricing, Production, and Sourcing Decisions. Manag. Sci 2012, 58, 2168–2189. [Google Scholar] [CrossRef] [Green Version]

- WHO. President BoniYayi Urges African Leaders to Strengthen Health Systems to Contain Epidemics. Available online: http://www.afro.who.int/news/president-boni-yayi-urges-african-leaders-strengthen-health-systems-contain-epidemics (accessed on 5 July 2020).

- Arifoglu, K.; Tang, C.S. A Two-Sided Budget-Neutral Incentive Program for Coordinating an Influenza Vaccine Supply Chain with Endogenous Supply and Demand under Uncertainty. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3361140 (accessed on 5 July 2020).

- Economist, T. So many possibilities, so little time. Economic 2020, 435, 13–16. [Google Scholar]

- Bowles, S.; Polania-Reyes, S. Economic Incentives and Social Preferences: Substitutes or Complements? J. Econ. Lit. 2012, 50, 368–425. [Google Scholar] [CrossRef] [Green Version]

| Intervention Types | Targets Achieved by Different Intervention Mechanisms | ||

|---|---|---|---|

| Maximizing Social Welfare | The Positive Impact | The Negative Impact | |

| Pure demand-sided mechanisms | Yes | Reduce government interventions | None |

| Pure supply-sided mechanisms | No | None | None |

| Specific two-sided mechanisms | Yes | Achieve budget neutrality | None |

| General two-sided mechanisms | Yes | None | Difference in intervention’s extent and structure |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, F.; Cao, E. Does Reference Dependence Impact Intervention Mechanisms in Vaccine Markets? Sustainability 2020, 12, 6371. https://doi.org/10.3390/su12166371

Guo F, Cao E. Does Reference Dependence Impact Intervention Mechanisms in Vaccine Markets? Sustainability. 2020; 12(16):6371. https://doi.org/10.3390/su12166371

Chicago/Turabian StyleGuo, Feiyu, and Erbao Cao. 2020. "Does Reference Dependence Impact Intervention Mechanisms in Vaccine Markets?" Sustainability 12, no. 16: 6371. https://doi.org/10.3390/su12166371