A Fuzzy Demand-Profit Model for the Sustainable Development of Electric Vehicles in China from the Perspective of Three-Level Service Chain

Abstract

1. Introduction

2. New Energy Supply Service Chain

3. Model Development

3.1. The Fuzzy Demand Model for the New Energy Supply Single-Format Service Chain

3.2. The Profit Model for the New Energy Supply Single-Format Service Chain

- (a)

- The power supplier provides energy supply guarantee for the charging pile operator. In order to ensure the safe and orderly supply of energy, the power supplier needs to transform and increase the voltage of the network. This investment cannot be completed suddenly, and the charging pile operators need to provide a contract price and quantity to ensure the use of new investment can obtain a quick return on investment. Assume that before the investment of the new infrastructure, the charging pile operator and power suppliers arrive at the contract price of and quantity of and the energy supplier charges the charging pile operator at the energy supply price of ;

- (b)

- It is assumed that the power supplier adopts the same charging standard to the charging pile operator and provides a homogeneous energy supply service. The power supplier needs to invest a fixed cost of to boost voltage for ensuring the quality and stability of the contract quantity and variable costs of such as maintenance;

- (c)

- The charging price charged by the charging pile operator to provide energy supply to the end user is . This price includes charging a service fee and the energy supply fee collected by the generation power supplier;

- (d)

- The charging pile operator provides end users with continuous and stable energy supply services. The fixed costs such as the construction of the charging infrastructure is , and the variable costs such as operation management is ;

- (e)

- The price of end user using traditional fossil fuel energy is , thus fulfilling the relationship of ;

- (f)

- The cost for the end user to choose alternative charging methods (e.g., home charging stations) is ;

- (g)

- End users are advocates of low carbon emissions and will consider their contribution to the reducing carbon emissions. At the same time, they are rational economic people who pay attention to the cost of new energy use, hope to trade the reduced carbon emissions and convert them into their own economic benefits, and set the carbon emission reduction between new energy and traditional energy contribution value as ;

- (h)

- Fisker has announced that it will use the patented technology to run an electric vehicle for 800 km with a charging time of only 1 min. Volkswagen and many other car companies have released the latest technological breakthroughs, which can achieve a charging range of 450–6000 km within 15–30 min. From progress of these charging technologies, the charging time of new energy vehicles will not affect consumer demand. Therefore, this paper does not consider the impact of charging time on the charging demand.

4. Analysis Results

4.1. Research Data

4.1.1. Research Data for the Fuzzy Demand Model

4.1.2. Research Data for the Profit Model

4.2. Calculation Results

4.2.1. Calculation Results of the Fuzzy Demand Model

4.2.2. Calculation Results of the Profit Model

5. Discussion

5.1. Changes of New Energy Demand and the Optimal Contract Number among the Main Entities of the Service Chain

5.2. New Energy Demand and Changes in Expected Profit of Various Entities in the Service Chain

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Wang, H.; Fu, L.; Bi, J. CO2 and pollutant emissions from passenger cars in China. Energy Policy 2011, 39, 3005–3011. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, L. Can the development of electric vehicles reduce the emission of air pollutants and greenhouse gases in developing countries. Transp. Res. Part D Transp. Environ. 2017, 51, 129–145. [Google Scholar] [CrossRef]

- Wang, S.; Li, J.; Zhao, D. The impact of policy measures on consumer intention to adopt electric vehicles: Evidence from China. Transp. Res. Part A Policy Pract. 2017, 105, 14–26. [Google Scholar] [CrossRef]

- National Energy Administration. Energy Conservation and New Energy Vehicle Industry Development Plan (2012–2020). Available online: http://www.nea.gov.cn/2012-07/10/c_131705726.htm (accessed on 10 July 2012).

- Brady, J.; Omahony, M. Development of a driving cycle to evaluate the energy economy of electric vehicles in urban areas. Appl. Energy 2016, 177, 165–178. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, J.; Wang, R.; Liu, Z.; Wang, L. Siting and sizing of fast charging stations in highway network with budget constraint. Appl. Energy 2018, 228, 1255–1271. [Google Scholar] [CrossRef]

- Xiong, Y. Electric Vehicle Charging Station Placement and Management. Ph.D. Thesis, Nanyang Technological University, Singapore, 2018. [Google Scholar]

- Reyniers, D.J.; Tapiero, C.S. The Delivery and Control of Quality in Supplier-Producer Contracts. Manag. Sci. 1995, 41, 1581–1589. [Google Scholar] [CrossRef]

- Reyniers, D.J.; Tapiero, C.S. Contract design and the control of quality in a conflictual environment. Eur. J. Oper. Res. 1995, 82, 373–382. [Google Scholar] [CrossRef]

- Cachon, G.P.; Lariviere, M.A. Contracting to Assure Supply: How to Share Demand Forecasts in a Supply Chain. Manag. Sci. 2001, 47, 629–646. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply chain coordination with contracts. Handb. Oper. Res. Manag. Sci. 2003, 11, 227–339. [Google Scholar]

- Cachon, G.P.; Larivice, M.A. Supply chain coordination with revenue sharing contracts: Strengths and limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef]

- de Kok, A.G.; Graves, S.C. Supply Chain Coordination with Contracts. In Supply Chain Management: Design, Coordination and Operation; Elsevier: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Chen, F. Information sharing and supply chain coordination. Handb. Oper. Res. Manag. Sci. 2003, 11, 341–421. [Google Scholar]

- Giannoccaro, I.; Pontrandolfo, P. Supply chain coordination by revenue sharing contracts. Int. J. Prod. Econ. 2004, 89, 131–139. [Google Scholar] [CrossRef]

- Cachon, G.P. The allocation of inventory risk in a supply chain: Push, pull, and advance-purchase discount contracts. Manag. Sci. 2004, 50, 222–238. [Google Scholar] [CrossRef]

- Rong, M.; Maiti, M. On an EOQ model with service level constraint under fuzzy-stochastic demand and variable lead-time. Appl. Math. Model. 2015, 39, 5230–5240. [Google Scholar] [CrossRef]

- Soni, H.N.; Patel, K.A. Optimal policies for integrated inventory system under fuzzy random framework. Int. J. Adv. Manuf. Technol. 2015, 78, 947–959. [Google Scholar] [CrossRef]

- Mahata, G.C.; Goswami, A. Fuzzy inventory models for items with imperfect quality and shortage backordering under crisp and fuzzy decision variables. Comput. Ind. Eng. 2013, 64, 190–199. [Google Scholar] [CrossRef]

- Sadeghi, J.; Mousavi, S.M.; Niaki, S.T.A.; Sadeghi, S. Optimizing a bi-objective inventory model of a three-echelon supply chain using a tuned hybrid bat algorithm. Transp. Res. Part E Logist. Transp. Rev. 2014, 70, 274–292. [Google Scholar] [CrossRef]

- Sadeghi, J. A multi-item integrated inventory model with different replenishment frequencies of retailers in a two-echelon supply chain management: A tuned-parameters hybrid meta-heuristic. Opsearch 2015, 52, 631–649. [Google Scholar] [CrossRef]

- Sadeghi, J.; Mousavi, S.M.; Niaki, S.T.A. Optimizing an inventory model with fuzzy demand, backordering, and discount using a hybrid imperialist competitive algorithm. Appl. Math. Model. 2016, 40, 7318–7335. [Google Scholar] [CrossRef]

- Tong, A.; Dao-zhi, Z. A supply chain model of vendor managed inventory with fuzzy demand. In Proceedings of the 2010 International Conference on System Science, Engineering Design and Manufacturing Informatization, Yichang, China, 12–14 November 2010; Volume 2, pp. 15–18. [Google Scholar]

- Xu, R.; Zhai, X. Optimal models for single-period supply chain problems with fuzzy demand. Inf. Sci. 2008, 178, 3374–3381. [Google Scholar] [CrossRef]

- Xu, R.; Zhai, X. Analysis of supply chain coordination under fuzzy demand in a two-stage supply chain. Appl. Math. Model. 2010, 34, 129–139. [Google Scholar] [CrossRef]

- Chakraborty, D.; Jana, D.K.; Roy, T.K. Multi-item integrated supply chain model for deteriorating items with stock dependent demand under fuzzy random and bifuzzy environments. Comput. Ind. Eng. 2015, 88, 166–180. [Google Scholar] [CrossRef]

- Jana, D.K.; Das, B.; Maiti, M. Multi-item partial backlogging inventory models over random planninghorizon in random fuzzy environment. Appl. Soft Comput. 2014, 21, 12–27. [Google Scholar] [CrossRef]

- Xu, W. Integrated inventory problem under trade credit in fuzzy random environment. Fuzzy Optim. Decis. Mak. 2014, 13, 329–344. [Google Scholar] [CrossRef]

- Alsalloum, O.I.; Rand, G.K. Extensions to emergency vehicle location models. Comput. Oper. Res. 2006, 33, 2725–2743. [Google Scholar] [CrossRef]

- Araz, C.; Selim, H.; Ozkarahan, I. A fuzzy multi-objective covering-based vehicle location model for emergency services. Comput. Oper. Res. 2007, 34, 705–726. [Google Scholar] [CrossRef]

- Xing, H. The decision method of emergency supplies collection with fuzzy demand constraint under background of sudden disaster. Nat. Hazards 2017, 85, 869–886. [Google Scholar] [CrossRef]

- Zheng, Y.-J.; Ling, H.-F. Emergency transportation planning in disaster relief supply chain management: A cooperative fuzzy optimization approach. Soft Comput. 2013, 17, 1301–1314. [Google Scholar] [CrossRef]

- Ruan, J.; Wang, X.; Chan, F.T.; Shi, Y. Optimizing the intermodal transportation of emergency medical supplies using balanced fuzzy clustering. Int. J. Prod. Res. 2016, 54, 4368–4386. [Google Scholar] [CrossRef]

- Tang, Z.; Qin, J.; Sun, J. Railway emergency resource dispatching optimization based on fuzzy satisfaction degree under the priority principle. J. Intell. Fuzzy Syst. 2017, 33, 2677–2686. [Google Scholar] [CrossRef]

- Zarandi, M.F.; Hemmati, A.; Davari, S. The multi-depot capacitated location-routing problem with fuzzy travel times. Expert Syst. Appl. 2011, 38, 10075–10084. [Google Scholar] [CrossRef]

- Mehrjerdi, Y.Z.; Nadizadeh, A. Using greedy clustering method to solve capacitated location-routing problem with fuzzy demands. Eur. J. Oper. Res. 2013, 229, 75–84. [Google Scholar] [CrossRef]

- Ghaffari-Nasab, N.; Ahari, S.G.; Ghazanfari, M. A hybrid simulated annealing based heuristic for solving the location-routing problem with fuzzy demands. Sci. Iran. 2013, 20, 919–930. [Google Scholar]

- Nadizadeh, A.; Nasab, H.H. Solving the dynamic capacitated location-routing problem with fuzzy demands by hybrid heuristic algorithm. Eur. J. Oper. Res. 2014, 238, 458–470. [Google Scholar] [CrossRef]

- Fazayeli, S.; Eydi, A.; Kamalabadi, I.N. Location-routing problem in multimodal transportation network with time windows and fuzzy demands: Presenting a two-part genetic algorithm. Comput. Ind. Eng. 2018, 119, 233–246. [Google Scholar] [CrossRef]

- Wang, J.; Zhao, R.; Tang, W. Supply chain coordination by revenue-sharing contract with fuzzy demand. J. Intell. Fuzzy Syst. 2008, 19, 409–420. [Google Scholar]

- Wang, J.; Zhao, R.; Tang, W. Supply chain coordination by single-period and long-term contracts with fuzzy market demand. Tsinghua Sci. Technol. 2009, 14, 218–224. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar] [CrossRef]

- Sang, S. Revenue Sharing Contract in a Multi-Echelon Supply Chain with Fuzzy Demand and Asymmetric Information. Int. J. Comput. Intell. Syst. 2016, 9, 1028–1040. [Google Scholar] [CrossRef]

- Chang, S.-Y.; Yeh, T.-Y. A two-echelon supply chain of a returnable product with fuzzy demand. Appl. Math. Model. 2013, 37, 4305–4315. [Google Scholar] [CrossRef]

- Yu, Y.; Jin, T. The return policy model with fuzzy demands and asymmetric information. Appl. Soft Comput. 2011, 11, 1669–1678. [Google Scholar] [CrossRef]

- Yu, Y.; Zhu, J.; Wang, C. A newsvendor model with fuzzy price-dependent demand. Appl. Math. Model. 2013, 37, 2644–2661. [Google Scholar] [CrossRef]

- Zhang, B.; Lu, S.; Zhang, D.; Wen, K. Supply chain coordination based on a buyback contract under fuzzy random variable demand. Fuzzy Sets Syst. 2014, 255, 1–16. [Google Scholar] [CrossRef]

- Moon, H.; Park, S.Y.; Jeong, C.; Lee, J. Forecasting electricity demand of electric vehicles by analyzing consumers’ charging patterns. Transp. Res. Part D Transp. Environ. 2018, 62, 64–79. [Google Scholar] [CrossRef]

- Ryan, P. Electricity Demand and Implications of Electric Vehicle and Battery Storage Adoption. In Transition Towards 100% Renewable Energy; Springer International Publishing: Cham, Switzerland, 2018; pp. 391–398. [Google Scholar]

- Yıldız, B.; Arslan, O.; Karaşan, O.E. A branch and price approach for routing and refueling station location model. Eur. J. Oper. Res. 2016, 248, 815–826. [Google Scholar] [CrossRef]

- Kim, J.-G.; Kuby, M.J. The deviation-flow refueling location model for optimizing a network of refueling stations. Int. J. Hydrogen Energy 2012, 37, 5406–5420. [Google Scholar] [CrossRef]

- Kim, J.-G.; Kuby, M. A network transformation heuristic approach for the deviation flow refueling location model. Comput. Oper. Res. 2013, 40, 1122–1131. [Google Scholar] [CrossRef]

- Camus, C.; Farias, T.L.; Esteves, J. Potential impacts assessment of plug-in electric vehicles on the Portuguese energy market. Energy Policy 2011, 39, 5883–5897. [Google Scholar] [CrossRef]

- Boqiang, L.; Xin, Y.; Xiying, L. China’s energy strategy adjustment under energy conservation and carbon emission constraints. Soc. Sci. China 2010, 31, 91–110. [Google Scholar] [CrossRef]

- Wang, Y.; Yao, X.; Yuan, P. Strategic Adjustment of China’s Power Generation Capacity Structure under the Constraint of Carbon Emission. Comput. Econ. 2015, 46, 421–435. [Google Scholar] [CrossRef]

- Grubb, M.; Butler, L.; Twomey, P. Diversity and security in UK electricity generation: The influence of low-carbon objectives. Energy Policy 2006, 34, 4050–4062. [Google Scholar] [CrossRef]

- Ruggles, K. Technology and the Service Supply Chain. Supply Chain Manag. Rev. 2005, 9, 12–14. [Google Scholar]

- Chen, W.; Xu, M.; Xing, Q. Esearch on the Two Part Dynamic Pricing Strategy of New Energy Service Chain for Single Format. Math. Pract. Theor. 2019, 49, 112–122. [Google Scholar]

- Li, J.; Yu, K.; Gao, P. Recycling and pollution control of the End of Life Vehicles in China. J. Mater. Cycles Waste Manag. 2014, 16, 31–38. [Google Scholar] [CrossRef]

- Jin, L.I.; Jian Hua, Z. Policy changes and policy instruments selection of China’s new energy vehicle industry. China Popul. Resour. Environ. 2017, 27, 198–208. [Google Scholar]

- Zhou, M.; Zhu, Z. Life Cycle Sustainability Assessment of Battery Electric Vehicle in China. J. Ind. Technol. Econom. 2018, 37, 75–84. [Google Scholar]

- Song, W.-X.; Hou, H.-S.; Ji, X. Progress in the Investigation and Application of Na3V2(PO4)3 for Electrochemical Energy Storage. Acta Phys. Chim. Sin. 2017, 33, 103–129. [Google Scholar] [CrossRef]

- Li, M.; Hu, D.; Zhou, Y. Research and Practice of Renewable Energy Local Consumption Mode in Gansu Province Based on “Double Alternative” Strategy. Power Syst. Technol. 2016, 40, 2991–2997. [Google Scholar]

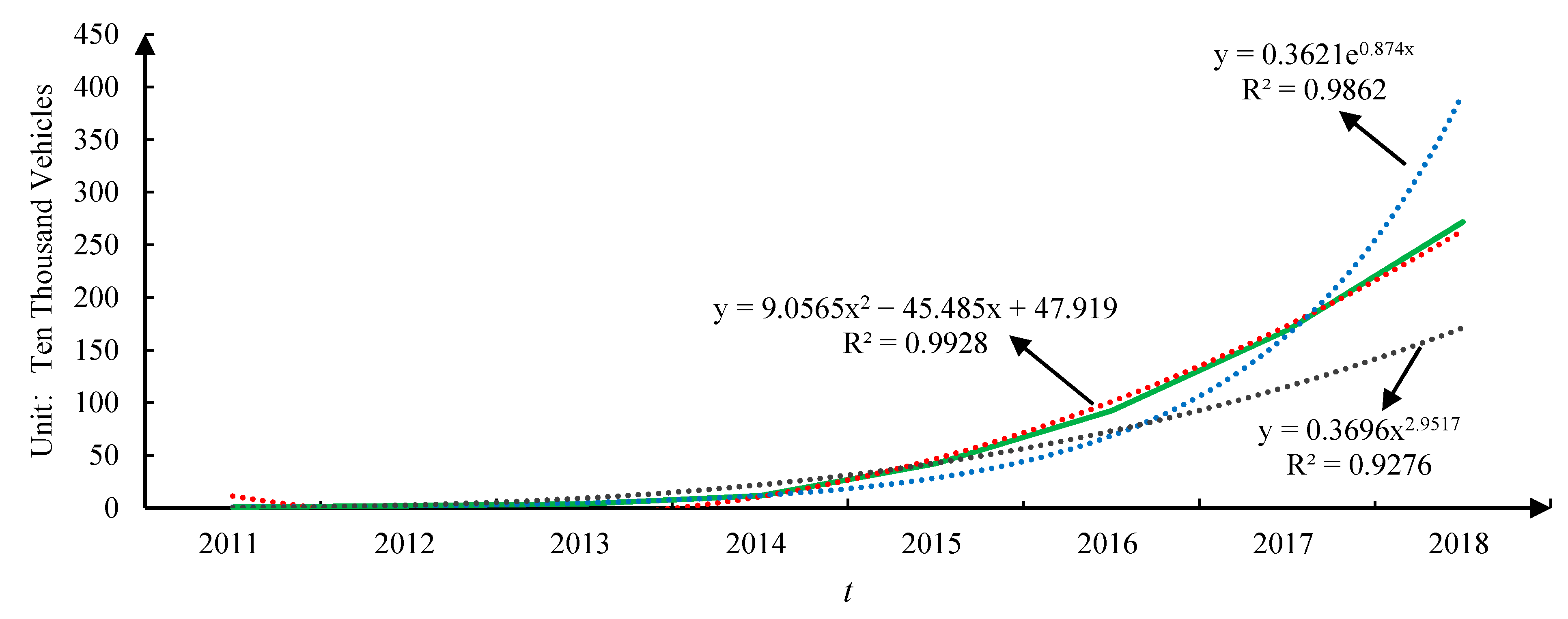

| Goodness of Fitting Model | Polynomial Function | Exponential Function | Power Function | Linear Function | Logarithm Function |

|---|---|---|---|---|---|

| 0.9928 | 0.9862 | 0.9276 | 0.7924 | 0.5501 |

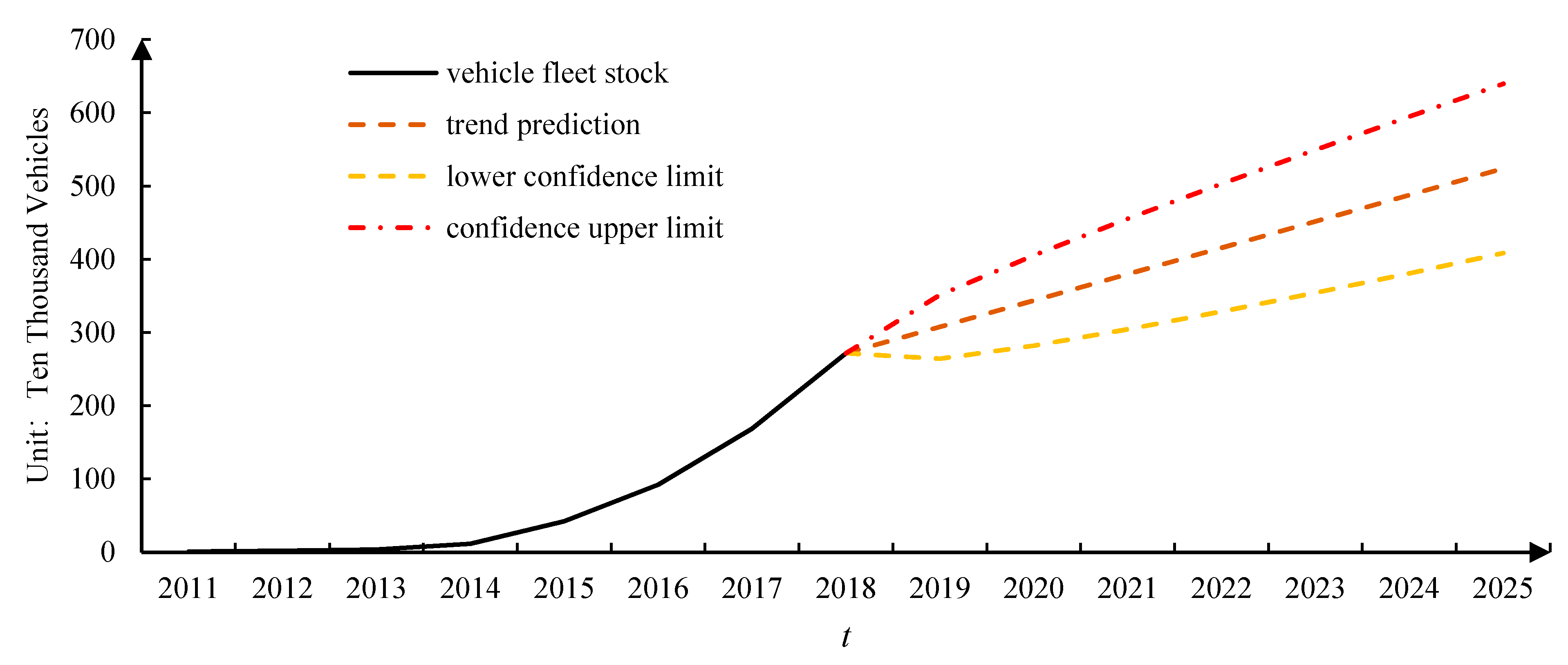

| Year | Actual Amount of Energy Vehicles (10,000) | Cumulative Amount of Energy Vehicles (10,000) | Polynomial Function | Exponential Function | Power Function | |||

|---|---|---|---|---|---|---|---|---|

| Fitting Value (10,000) | Differences between the Fitting Value and Cumulative Amount (10,000) | Fitting Value (10,000) | Differences between the Fitting Value and Cumulative Amount (10,000) | Fitting Value (10,000) | Differences between the Fitting Value and Cumulative Amount (10,000) | |||

| 2011 | 0.82 | 0.82 | 11.49 | 10.67 | 0.87 | 0.05 | 0.37 | −0.45 |

| 2012 | 1.28 | 2.10 | −6.83 | −8.92 | 2.08 | −0.02 | 2.86 | 0.76 |

| 2013 | 1.76 | 3.86 | −7.03 | −10.89 | 4.98 | 1.12 | 9.46 | 5.60 |

| 2014 | 7.75 | 11.61 | 10.88 | −0.72 | 11.94 | 0.34 | 22.12 | 10.52 |

| 2015 | 30.60 | 42.21 | 46.91 | 4.70 | 28.62 | −13.58 | 42.74 | 0.54 |

| 2016 | 50.07 | 92.28 | 101.04 | 8.77 | 68.59 | −23.68 | 73.22 | −19.06 |

| 2017 | 76.51 | 168.79 | 173.29 | 4.51 | 164.38 | −4.41 | 115.40 | −53.38 |

| 2018 | 102.98 | 271.77 | 263.66 | −8.11 | 393.93 | 122.16 | 171.15 | −100.61 |

| Demand | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|

| (Unit: GWh) | 68.40 | 82.08 | 90.29 | 99.32 | 109.25 | 120.17 | 132.19 |

| Variable | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Value (Yuan/kw.h) | 2.1 | 0.78 | 1.7 | 0.08 | 0.14 | 0.22 | 0.16 | 0.24 | 0.6 |

| Fuzzy Demand | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|

(Unit: GWh) | (63.40, 73.87, 84.34) | (67.72, 82.51, 97.31) | (73.04, 91.16, 109.28) | (78.87, 99.81, 120.74) | (85.04, 108.45, 131.87) | (91.44, 117.10, 142.76) | (98.01, 125.74, 153.47) |

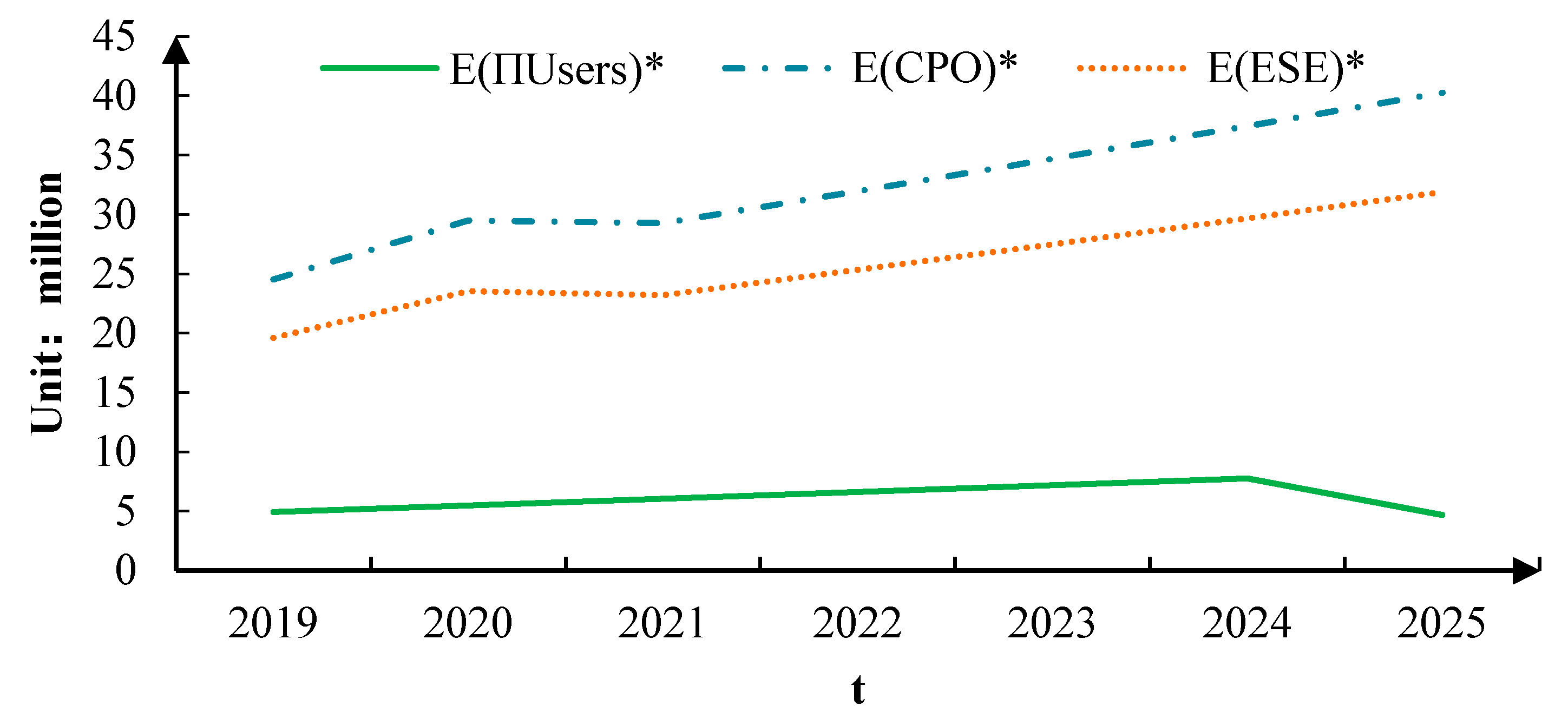

| Variable | Unit | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|

| GWh | 68.40 | 82.08 | 90.29 | 99.32 | 109.25 | 120.17 | 132.19 | |

| GWh | 77.14 | 91.07 | 96.82 | 106.35 | 115.77 | 125.12 | 134.41 | |

| GWh | 77.73 | 92.06 | 97.84 | 107.52 | 117.08 | 126.55 | 135.96 | |

| GWh | 80.15 | 96.18 | 102.03 | 112.37 | 122.50 | 132.50 | 142.38 | |

| GWh | 79.92 | 95.79 | 101.63 | 111.91 | 121.98 | 131.93 | 141.76 | |

| 1 × 106 Yuan | 4.93 | 5.48 | 6.05 | 6.62 | 7.19 | 7.76 | 4.68 | |

| 1 × 106 Yuan | 24.53 | 29.50 | 29.28 | 31.98 | 34.71 | 37.47 | 40.26 | |

| 1 × 106 Yuan | 19.61 | 23.55 | 23.22 | 25.34 | 27.51 | 29.70 | 31.91 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, W.; Xu, M.; Xing, Q.; Cui, L.; Jiao, L. A Fuzzy Demand-Profit Model for the Sustainable Development of Electric Vehicles in China from the Perspective of Three-Level Service Chain. Sustainability 2020, 12, 6389. https://doi.org/10.3390/su12166389

Chen W, Xu M, Xing Q, Cui L, Jiao L. A Fuzzy Demand-Profit Model for the Sustainable Development of Electric Vehicles in China from the Perspective of Three-Level Service Chain. Sustainability. 2020; 12(16):6389. https://doi.org/10.3390/su12166389

Chicago/Turabian StyleChen, Weiwei, Maozeng Xu, Qingsong Xing, Ligang Cui, and Liudan Jiao. 2020. "A Fuzzy Demand-Profit Model for the Sustainable Development of Electric Vehicles in China from the Perspective of Three-Level Service Chain" Sustainability 12, no. 16: 6389. https://doi.org/10.3390/su12166389

APA StyleChen, W., Xu, M., Xing, Q., Cui, L., & Jiao, L. (2020). A Fuzzy Demand-Profit Model for the Sustainable Development of Electric Vehicles in China from the Perspective of Three-Level Service Chain. Sustainability, 12(16), 6389. https://doi.org/10.3390/su12166389