Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data

Abstract

:1. Introduction

2. Related Studies

3. Data and Methodology

3.1. Data and Summary Statistics

3.2. Methodology

4. Empirical Results

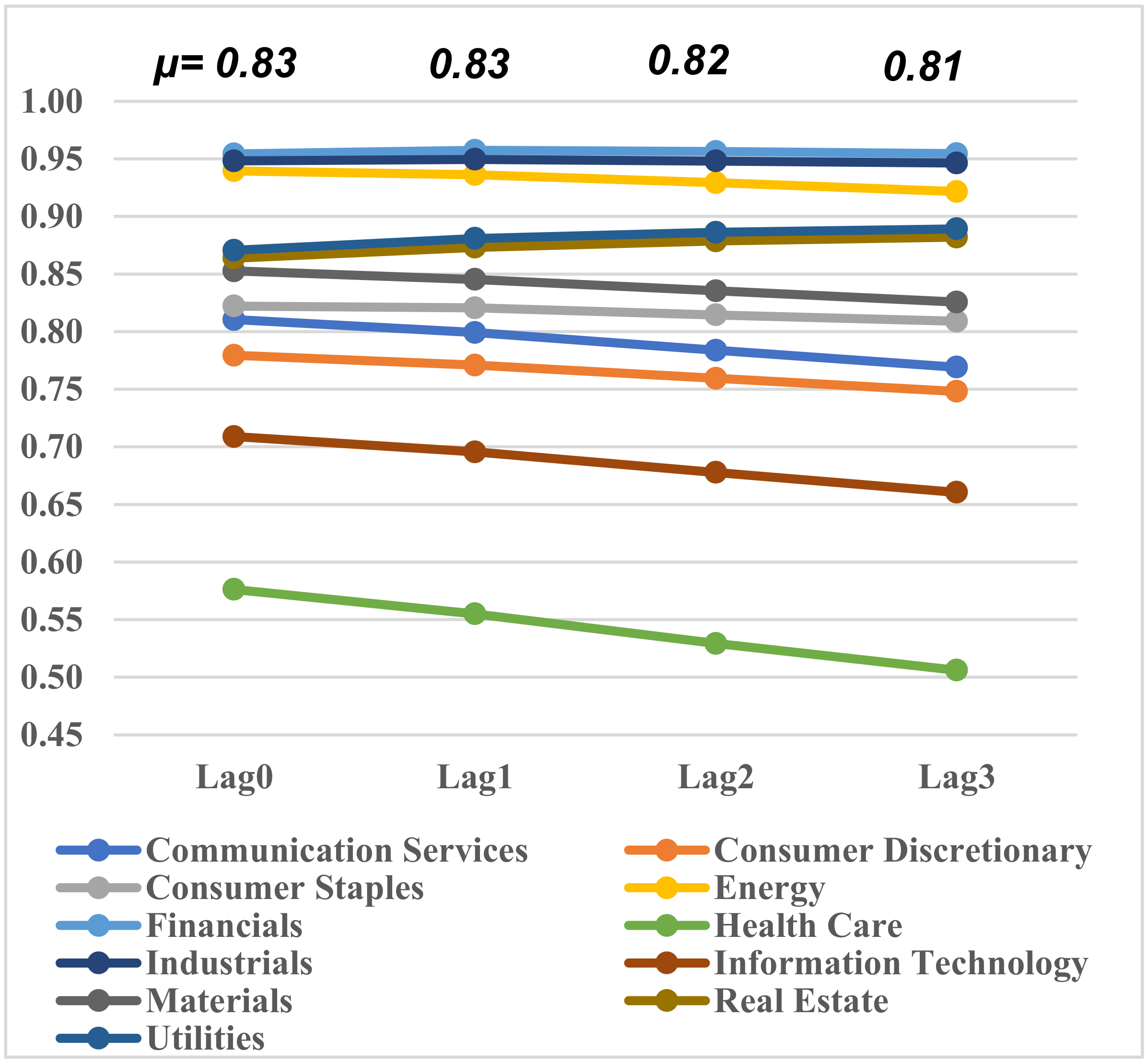

4.1. Significance of DNSI on US Stock Market by Industry

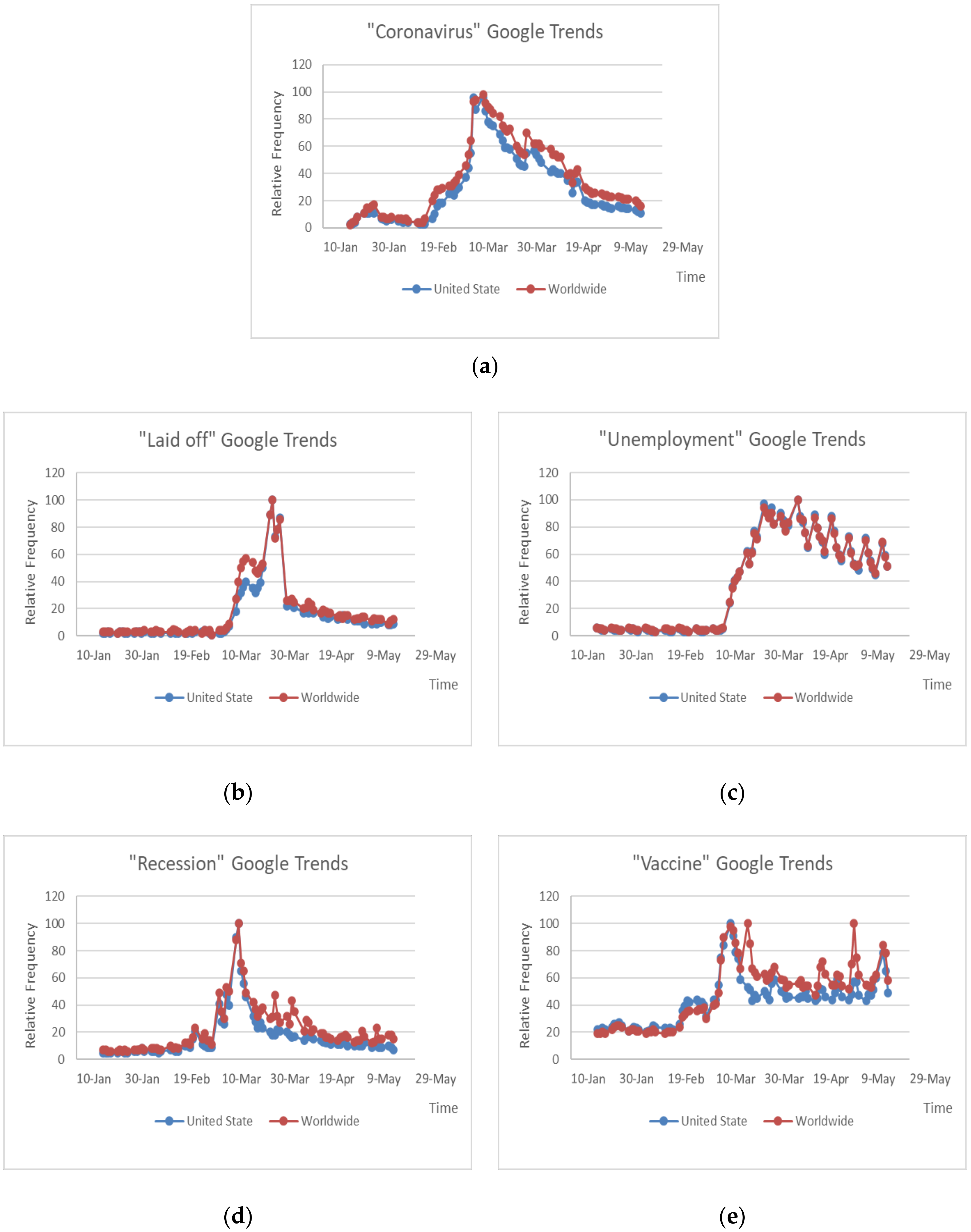

4.2. Significance of COVI-19 Related Google Searches on US Stock Market by Industry

4.3. Results from Time Series Regression Models

4.4. Discussion

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Panel A: Index correlation with US Google trend | ||||||||

| Communication Services | −0.9110 | −20.1232 | −0.9083 | −19.6672 | −0.9209 | −21.2619 | −0.9060 | −19.1422 |

| Consumer Discretionary | −0.9161 | −20.8185 | −0.9158 | −20.6413 | −0.9232 | −21.6209 | −0.9025 | −18.7400 |

| Consumer Staples | −0.7740 | −11.1356 | −0.7677 | −10.8484 | −0.7829 | −11.3258 | −0.7724 | −10.8775 |

| Energy | −0.8164 | −12.8774 | −0.8289 | −13.4192 | −0.8423 | −14.0621 | −0.8399 | −13.8405 |

| Financial | −0.7071 | −9.1093 | −0.7142 | −9.2395 | −0.7336 | −9.7148 | −0.7335 | −9.6526 |

| Health Care | −0.8838 | −17.2060 | −0.8671 | −15.7608 | −0.8688 | −15.7922 | −0.8392 | −13.8035 |

| Industrials | −0.7322 | −9.7953 | −0.7460 | −10.1436 | −0.7656 | −10.7110 | −0.7671 | −10.6961 |

| Information Technology | −0.9173 | −20.9862 | −0.9005 | −18.7524 | −0.9078 | −19.4858 | −0.8794 | −16.5250 |

| Materials | −0.8755 | −16.5025 | −0.8738 | −16.2689 | −0.8793 | −16.6171 | −0.8614 | −15.1719 |

| Real Estate | −0.6889 | −8.6593 | −0.7118 | −9.1765 | −0.7513 | −10.2456 | −0.7594 | −10.4401 |

| Utility | −0.6831 | −8.5223 | −0.6946 | −8.7428 | −0.7188 | −9.3066 | −0.7171 | −9.2015 |

| Panel B: Index correlation with worldwide Google trend | ||||||||

| Communication Services | −0.9393 | −24.9424 | −0.9381 | −24.5283 | −0.9458 | −26.2095 | −0.9312 | −22.8584 |

| Consumer Discretionary | −0.9376 | −24.5761 | −0.9366 | −24.2137 | −0.9399 | −24.7847 | −0.9212 | −21.1719 |

| Consumer Staples | −0.8040 | −12.3188 | −0.8040 | −12.2447 | −0.8176 | −12.7794 | −0.8091 | −12.3146 |

| Energy | −0.8567 | −15.1317 | −0.8711 | −16.0617 | −0.8825 | −16.8919 | −0.8807 | −16.6317 |

| Financial | −0.7494 | −10.3119 | −0.7606 | −10.6080 | −0.7781 | −11.1492 | −0.7814 | −11.1989 |

| Health Care | −0.8989 | −18.6948 | −0.8820 | −16.9502 | −0.8771 | −16.4361 | −0.8448 | −14.1193 |

| Industrials | −0.7742 | −11.1447 | −0.7904 | −11.6838 | −0.8081 | −12.3471 | −0.8113 | −12.4111 |

| Information Technology | −0.9379 | −24.6416 | −0.9229 | −21.7069 | −0.9242 | −21.7772 | −0.8966 | −18.1114 |

| Materials | −0.9035 | −19.2099 | −0.9045 | −19.2013 | −0.9082 | −19.5311 | −0.8940 | −17.8412 |

| Real Estate | −0.7210 | −9.4787 | −0.7471 | −10.1791 | −0.7824 | −11.3073 | −0.7936 | −11.6649 |

| Utility | −0.7148 | −9.3116 | −0.7304 | −9.6834 | −0.7547 | −10.3543 | −0.7576 | −10.3829 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Panel A: Index correlation with US Google trend | ||||||||

| Communication Services | −0.6821 | −8.4988 | −0.6565 | −7.8804 | −0.6258 | −7.2213 | −0.5810 | −6.3848 |

| Consumer Discretionary | −0.6955 | −8.8184 | −0.6703 | −8.1793 | −0.6341 | −7.3808 | −0.5802 | −6.3714 |

| Consumer Staples | −0.6210 | −7.2189 | −0.5900 | −6.6166 | −0.5574 | −6.0417 | −0.5032 | −5.2081 |

| Energy | −0.6165 | −7.1338 | −0.5956 | −6.7144 | −0.5660 | −6.1785 | −0.5237 | −5.4991 |

| Financial | −0.5702 | −6.3228 | −0.5635 | −6.1764 | −0.5485 | −5.9033 | −0.5172 | −5.4045 |

| Health Care | −0.6324 | −7.4379 | −0.5933 | −6.6749 | −0.5523 | −5.9621 | −0.4765 | −4.8478 |

| Industrials | −0.5826 | −6.5301 | −0.5701 | −6.2844 | −0.5527 | −5.9684 | −0.5188 | −5.4281 |

| Information Technology | −0.6482 | −7.7558 | −0.6145 | −7.0542 | −0.5768 | −6.3542 | −0.5180 | −5.4161 |

| Materials | −0.6636 | −8.0819 | −0.6428 | −7.5978 | −0.6093 | −6.9163 | −0.5548 | −5.9641 |

| Real Estate | −0.6332 | −7.4536 | −0.6265 | −7.2793 | −0.6110 | −6.9470 | −0.5593 | −6.0350 |

| Utility | −0.5869 | −6.6035 | −0.5844 | −6.5215 | −0.5744 | −6.3151 | −0.5338 | −5.6462 |

| Panel B: Index correlation with worldwide Google trend | ||||||||

| Communication Services | −0.7544 | −10.4712 | −0.7258 | −9.5530 | −0.6944 | −8.6849 | −0.6464 | −7.5777 |

| Consumer Discretionary | −0.8852 | −17.3314 | −0.8469 | −14.4246 | −0.8116 | −12.5030 | −0.7655 | −10.6407 |

| Consumer Staples | −0.7012 | −8.9589 | −0.6738 | −8.2563 | −0.6467 | −7.6308 | −0.5938 | −6.6009 |

| Energy | −0.6857 | −8.5813 | −0.6623 | −8.0056 | −0.6308 | −7.3174 | −0.5881 | −6.5042 |

| Financial | −0.6321 | −7.4310 | −0.6208 | −7.1711 | −0.6030 | −6.8037 | −0.5697 | −6.2002 |

| Health Care | −0.7257 | −9.6092 | −0.6847 | −8.5065 | −0.6418 | −7.5312 | −0.5638 | −6.1057 |

| Industrials | −0.6512 | −7.8164 | −0.6348 | −7.4399 | −0.6139 | −6.9992 | −0.5767 | −6.3147 |

| Information Technology | −0.7271 | −9.6479 | −0.6874 | −8.5716 | −0.6470 | −7.6371 | −0.5837 | −6.4303 |

| Materials | −0.7401 | −10.0250 | −0.7137 | −9.2269 | −0.6778 | −8.2978 | −0.6215 | −7.0962 |

| Real Estate | −0.7095 | −9.1730 | −0.6995 | −8.8635 | −0.6813 | −8.3775 | −0.6284 | −7.2248 |

| Utility | −0.6626 | −8.0604 | −0.6565 | −7.8805 | −0.6442 | −7.5801 | −0.6022 | −6.7465 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Panel A: Index correlation with US Google trend | ||||||||

| Communication Services | −0.6255 | −7.3039 | −0.5771 | −6.3983 | −0.5222 | −5.5108 | −0.4734 | −4.8064 |

| Consumer Discretionary | −0.5967 | −6.7751 | −0.5454 | −5.8931 | −0.4907 | −5.0690 | −0.4379 | −4.3565 |

| Consumer Staples | −0.6269 | −7.3304 | −0.5807 | −6.4593 | −0.5366 | −5.7235 | −0.4885 | −5.0080 |

| Energy | −0.7367 | −9.9249 | −0.6999 | −8.8741 | −0.6589 | −7.8839 | −0.6173 | −7.0180 |

| Financial | −0.7779 | −11.2798 | −0.7530 | −10.3616 | −0.7221 | −9.3950 | −0.6877 | −8.4731 |

| Health Care | −0.3479 | −3.3812 | −0.2859 | −2.7013 | −0.2174 | −2.0047 ** | −0.1492 | −1.3493 * |

| Industrials | −0.7755 | −11.1915 | −0.7459 | −10.1403 | −0.7125 | −9.1399 | −0.6771 | −8.2308 |

| Information Technology | −0.4994 | −5.2510 | −0.4477 | −4.5334 | −0.3900 | −3.8114 | −0.3405 | −3.2389 |

| Materials | −0.6490 | −7.7723 | −0.6037 | −6.8567 | −0.5566 | −6.0302 | −0.5078 | −5.2722 |

| Real Estate | −0.7585 | −10.6043 | −0.7259 | −9.5560 | −0.6873 | −8.5164 | −0.6441 | −7.5322 |

| Utility | −0.7320 | −9.7881 | −0.7009 | −8.8980 | −0.6706 | −8.1351 | −0.6343 | −7.3380 |

| Panel B: Index correlation with worldwide Google trend | ||||||||

| Communication Services | −0.6215 | −7.2280 | −0.5721 | −6.3160 | −0.5179 | −5.4481 | −0.4692 | −4.7528 |

| Consumer Discretionary | −0.5925 | −6.7007 | −0.5399 | −5.8086 | −0.4856 | −4.9989 | −0.4329 | −4.2959 |

| Consumer Staples | −0.6246 | −7.2863 | −0.5774 | −6.4032 | −0.5334 | −5.6748 | −0.4855 | −4.9671 |

| Energy | −0.7358 | −9.8990 | −0.6987 | −8.8434 | −0.6579 | −7.8617 | −0.6169 | −7.0106 |

| Financial | −0.7785 | −11.2988 | −0.7531 | −10.3659 | −0.7228 | −9.4127 | −0.6885 | −8.4908 |

| Health Care | −0.3415 | −3.3099 | −0.2776 | −2.6166 ** | −0.2099 | −1.9322* | −0.1420 | −1.2829 * |

| Industrials | −0.7762 | −11.2159 | −0.7460 | −10.1439 | −0.7128 | −9.1461 | −0.6775 | −8.2396 |

| Information Technology | −0.4948 | −5.1872 | −0.4413 | −4.4528 | −0.3848 | −3.7518 | −0.3353 | −3.1836 |

| Materials | −0.6460 | −7.7093 | −0.6001 | −6.7925 | −0.5535 | −5.9808 | −0.5052 | −5.2361 |

| Real Estate | −0.7574 | −10.5692 | −0.7244 | −9.5164 | −0.6869 | −8.5075 | −0.6436 | −7.5219 |

| Utility | −0.7321 | −9.7902 | −0.7000 | −8.8766 | −0.6699 | −8.1202 | −0.6334 | −7.3218 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Panel A: Index correlation with US Google trend | ||||||||

| Communication Services | −0.6983 | −8.8870 | −0.6930 | −8.7052 | −0.7230 | −9.4195 | −0.7311 | −9.5843 |

| Consumer Discretionary | −0.7307 | −9.7518 | −0.7343 | −9.7960 | −0.7606 | −10.5442 | −0.7532 | −10.2423 |

| Consumer Staples | −0.5783 | −6.4580 | −0.5751 | −6.3658 | −0.6595 | −7.8959 | −0.7203 | −9.2869 |

| Energy | −0.6119 | −7.0490 | −0.6293 | −7.3326 | −0.6485 | −7.6668 | −0.6430 | −7.5090 |

| Financial | −0.5137 | −5.4548 | −0.5233 | −5.5616 | −0.5573 | −6.0405 | −0.5622 | −6.0796 |

| Health Care | −0.7307 | −9.7518 | −0.7300 | −9.6720 | −0.7900 | −11.5966 | −0.8133 | −12.5015 |

| Industrials | −0.5380 | −5.8147 | −0.5563 | −6.0615 | −0.5953 | −6.6688 | −0.6067 | −6.8261 |

| Information Technology | −0.7390 | −9.9943 | −0.7196 | −9.3831 | −0.7566 | −10.4132 | −0.7582 | −10.4006 |

| Materials | −0.6816 | −8.4857 | −0.6862 | −8.5421 | −0.7152 | −9.2096 | −0.7146 | −9.1368 |

| Real Estate | −0.5215 | −5.5676 | −0.5491 | −5.9498 | −0.6189 | −7.0914 | −0.6455 | −7.5599 |

| Utility | −0.5066 | −5.3537 | −0.5228 | −5.5535 | −0.5973 | −6.7024 | −0.6409 | −7.4679 |

| Panel B: Index correlation with worldwide Google trend | ||||||||

| Communication Services | −0.8040 | −12.3192 | −0.7937 | −11.8152 | −0.8223 | −13.0075 | −0.8172 | −12.6797 |

| Consumer Discretionary | −0.8307 | −13.5935 | −0.8285 | −13.3993 | −0.8526 | −14.6867 | −0.8330 | −13.4666 |

| Consumer Staples | −0.6878 | −8.6334 | −0.6749 | −8.2825 | −0.7414 | −9.9441 | −0.7719 | −10.8598 |

| Energy | −0.7330 | −9.8163 | −0.7408 | −9.9872 | −0.7569 | −10.4246 | −0.7503 | −10.1500 |

| Financial | −0.6355 | −7.4977 | −0.6373 | −7.4888 | −0.6719 | −8.1646 | −0.6704 | −8.0806 |

| Health Care | −0.8056 | −12.3889 | −0.7924 | −11.7635 | −0.8388 | −13.8640 | −0.8378 | −13.7267 |

| Industrials | −0.6577 | −7.9551 | −0.6698 | −8.1687 | −0.7070 | −8.9963 | −0.7089 | −8.9897 |

| Information Technology | −0.8227 | −13.1849 | −0.7998 | −12.0637 | −0.8330 | −13.5517 | −0.8166 | −12.6529 |

| Materials | −0.7849 | −11.5423 | −0.7805 | −11.3055 | −0.8098 | −12.4210 | −0.8010 | −11.9673 |

| Real Estate | −0.6316 | −7.4212 | −0.6516 | −7.7786 | −0.7150 | −9.2045 | −0.7280 | −9.4973 |

| Utility | −0.6166 | −7.1344 | −0.6250 | −7.2503 | −0.6922 | −8.6330 | −0.7152 | −9.1522 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Panel A: Index correlation with US Google trend | ||||||||

| Communication Services | −0.7511 | −10.3665 | −0.7456 | −10.1304 | −0.7595 | −10.5094 | −0.7887 | −11.4742 |

| Consumer Discretionary | −0.7705 | −11.0117 | −0.7756 | −11.1260 | −0.7936 | −11.7369 | −0.8099 | −12.3485 |

| Consumer Staples | −0.7602 | −10.6601 | −0.7620 | −10.6546 | −0.7846 | −11.3876 | −0.8170 | −12.6731 |

| Energy | −0.8126 | −12.7031 | −0.8161 | −12.7875 | −0.8293 | −13.3571 | −0.8404 | −13.8704 |

| Financial | −0.8110 | −12.6296 | −0.8176 | −12.8570 | −0.8315 | −13.4700 | −0.8410 | −13.9016 |

| Health Care | −0.6340 | −7.4691 | −0.6415 | −7.5724 | −0.6703 | −8.1298 | −0.7003 | −8.7754 |

| Industrials | −0.8161 | −12.8642 | −0.8258 | −13.2617 | −0.8442 | −14.1720 | −0.8599 | −15.0702 |

| Information Technology | −0.7140 | −9.2907 | −0.7055 | −9.0156 | −0.7247 | −9.4660 | −0.7499 | −10.1391 |

| Materials | −0.8015 | −12.2102 | −0.7998 | −12.0643 | −0.8119 | −12.5154 | −0.8245 | −13.0335 |

| Real Estate | −0.7664 | −10.8683 | −0.7971 | −11.9531 | −0.8363 | −13.7290 | −0.8591 | −15.0132 |

| Utility | −0.7797 | −11.3432 | −0.7990 | −12.0309 | −0.8239 | −13.0820 | −0.8449 | −14.1250 |

| Panel B: Index correlation with worldwide Google trend | ||||||||

| Communication Services | −0.7971 | −12.0268 | −0.7656 | −10.7779 | −0.7619 | −10.5862 | −0.7529 | −10.2322 |

| Consumer Discretionary | −0.8086 | −12.5197 | −0.7803 | −11.2988 | −0.7725 | −10.9493 | −0.7572 | −10.3673 |

| Consumer Staples | −0.8656 | −15.7463 | −0.8375 | −13.8784 | −0.8262 | −13.1966 | −0.8129 | −12.4863 |

| Energy | −0.8791 | −16.8046 | −0.8603 | −15.2806 | −0.8529 | −14.7002 | −0.8433 | −14.0363 |

| Financial | −0.9010 | −18.9253 | −0.8825 | −16.9933 | −0.8752 | −16.2826 | −0.8640 | −15.3474 |

| Health Care | −0.6654 | −8.1206 | −0.6320 | −7.3848 | −0.6239 | −7.1846 | −0.6007 | −6.7200 |

| Industrials | −0.9075 | −19.6815 | −0.8878 | −17.4706 | −0.8801 | −16.6810 | −0.8720 | −15.9299 |

| Information Technology | −0.7320 | −9.7878 | −0.6887 | −8.6005 | −0.6847 | −8.4546 | −0.6683 | −8.0358 |

| Materials | −0.8599 | −15.3455 | −0.8261 | −13.2727 | −0.8119 | −12.5172 | −0.7971 | −11.8060 |

| Real Estate | −0.8886 | −17.6530 | −0.8878 | −17.4682 | −0.8903 | −17.5923 | −0.8814 | −16.6928 |

| Utility | −0.9018 | −19.0148 | −0.8873 | −17.4205 | −0.8784 | −16.5432 | −0.8631 | −15.2859 |

References

- Bhardwaj, A.; Narayan, Y.; Dutta, M. Sentiment analysis for Indian stock market prediction using sensex and nifty. Procedia Comput. Sci. 2015, 70, 85–91. [Google Scholar] [CrossRef] [Green Version]

- Bharathi, S.; Geetha, A. Sentiment analysis for effective stock market prediction. Int. J. Intell. Eng. Syst. 2017, 10, 146–154. [Google Scholar] [CrossRef]

- Bollen, J.; Mao, H.; Zeng, X. Twitter mood predicts the stock market. J. Comput. Sci. 2011, 2, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Bollen, J.; Mao, H. Twitter mood as a stock market predictor. Computer 2011, 44, 91–94. [Google Scholar] [CrossRef]

- Bing, L.; Chan, K.C.; Ou, C. Public sentiment analysis in Twitter data for prediction of a company’s stock price movements. In Proceedings of the IEEE 11th International Conference on e-Business Engineering (ICEBE), Guangzhou, China, 5–7 November 2014; pp. 232–239. [Google Scholar]

- Bordino, I.; Battiston, S.; Caldarelli, G.; Cristelli, M.; Ukkonen, A.; Weber, I. Web search queries can predict stock market volumes. PLoS ONE 2011, 7, e40014. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, R.; Lazer, M. Sentiment Analysis of Twitter Feeds for the Prediction of Stock Market Movement; Stanford edu Retrieved January, 25:2013, 2013. CS 229; Stanford University: Stanford, CA, USA, 2013; p. 15. [Google Scholar]

- Garica, D. Sentiment during recessions. J. Financ. 2013, 68, 1267–1300. [Google Scholar] [CrossRef]

- Gilbert, E.; Karahalios, K. Widespread worry and the stock market. In Proceedings of the Fourth International AAAI Conference on Weblogs and Social Media, Washington, DC, USA, 23–26 May 2010; pp. 58–65. [Google Scholar]

- Kordonis, J.; Symeonidis, S.; Arampatzis, A. Stock price forecasting via sentiment analysis on twitter. In Proceedings of the 20th Panhellenic Conference on Informatics (PCI ’16), Patras, Greece, 10–12 November 2016. [Google Scholar]

- Li, Q.; Shah, S. Learning stock market sentiment lexicon and sentiment-oriented word vector from stocktwits. In Proceedings of the 21st Conference on Computational Natural Language Learning (CoNLL), Vancouver, BC, Canada, 3–4 August 2017; pp. 301–310. [Google Scholar]

- Lima, M.L.; Nascimento, T.P.; Labidi, S.; Timbo, N.S.; Batista, M.V.L.; Neto, G.N.; Costa, E.A.M.; Sousa, S.R.S. Using sentiment analysis for stock exchange prediction. Int. J. Artif. Intell. Appl. 2016, 7, 59–67. [Google Scholar]

- Mittal, A.; Goel, A. Stock Prediction Using Twitter Sentiment Analysis; CS229; Stanford University: Stanford, CA, USA, 2012; p. 15. [Google Scholar]

- Nguyen, T.H.; Shirai, K.; Velcin, J. Sentiment analysis on social media for stock movement prediction. Expert Syst. Appl. 2015, 42, 9603–9611. [Google Scholar] [CrossRef]

- Pagolu, V.S.; Reddy, K.N.; Panda, G.; Majhi, B. Sentiment analysis of twitter data for predicting stock market movements. In Proceedings of the International Conference on Signal Processing, Communication, Power and Embedded System (SCOPES), Paralakhemundi, India, 3–5 October 2016; pp. 1345–1350. [Google Scholar]

- Pasupulety, U.; Anees, A.; Anmol, S.; Mohan, B. Predicting stock prices using ensemble learning and sentiment analysis. In Proceedings of the IEEE Second International Conference on Artificial Intelligence and Knowledge Engineering (AIKE), Cagliari, Italy, 5–7 June 2019. [Google Scholar]

- Shah, D.; Isah, H.; Zulkernine, F. Predicting the effects of news sentimentss omn the stock market. In Proceedings of the IEEE International Conference on Big Data, Seattle, WA, USA, 10–13 December 2018. [Google Scholar]

- Sprenger, T.O.; Tumasjan, A.; Sandner, P.G.; Welpe, I.M. Tweets and trades: The information content of stock microblogs. Eur. Financ. Manag. 2014, 20, 926–957. [Google Scholar] [CrossRef]

- Tetlock, P. Giving content to investor sentiment: The role of media in the stock market. J. Financ. 2007, 62, 1139–1168. [Google Scholar] [CrossRef]

- Zhang, L. Sentiment Analysis on Twitter with Stock Price and Significant Keyword Correlation. Ph.D. Thesis, The University of Texas at Austin, Austin, TX, USA, 2013. [Google Scholar]

- Zhang, J.; Cui, S.; Xu, Y.; Li, Q.; Li, T. A novel data-driven stock price trend prediction system. Expert Syst. Appl. 2018, 97, 60–69. [Google Scholar] [CrossRef]

- Isah, H. Social Data Mining for Crime Intelligence: Contributions to Social Data Quality Assessment and Prediction Methods. Ph.D. Thesis, University of Bradford, Bradford, UK, 2017. [Google Scholar]

- Buckman, S.; Shapiro, A.; Sudof, M.; Wilson, D. News sentiment in the time of COVID-19. In FRBSF Economic Letter; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2020; p. 8. [Google Scholar]

- Shapiro, A.; Sudhof, M.; Wilson, D. Measuring News Sentiment; FRBSF Working Paper; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2017; p. 7. [Google Scholar]

- Bannigidadmath, D. Consumer sentiment and Indonesia’s stock returns. Bull. Monet. Econ. Bank. 2020, 23. [Google Scholar] [CrossRef] [Green Version]

- Fama, E.; French, K. Business conditions and expected return on stocks and bonds. J. Financ. Econ. 1989, 25, 23–49. [Google Scholar] [CrossRef]

- Newey, W.; West, K. A Simple, positive semi-fefinite, heteroskedastic and autocorrelation consistent covariance matrix. Econometrica 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Hong, H.; Stein, J.C. A Unified Theory of Underreaction, Momentum Trading, and Overreaction in Asset Markets. J. Financ. 1999, 54, 2143–2184. [Google Scholar] [CrossRef] [Green Version]

- Hou, K. Industry Information Diffusion and The Lead-Lag Effect in Stock Returns. Rev. Financ. Stud. 2007, 20, 1113–1138. [Google Scholar] [CrossRef]

| 21st Jan 2020–20th May 2020 (Time of COVID-19) | 21st Sep 2019–20th Jan 2020 (Time of NO COVID-19) | |||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Standard Deviation | Maximum | Minimum | Mean | Standard Deviation | Maximum | Minimum | |

| Panel A: Select Sector Index from S&P Dow Jones Indices | ||||||||

| Communication Services | 261.20 | 25.73 | 301.01 | 210.25 | 271.37 | 10.31 | 296.38 | 252.49 |

| Consumer Discretionary | 1148.84 | 126.86 | 1335.26 | 879.32 | 1233.77 | 25.18 | 1292.61 | 1185.98 |

| Consumer Staples | 595.59 | 39.98 | 652.44 | 489.80 | 620.53 | 9.94 | 643.76 | 604.52 |

| Energy | 420.56 | 107.33 | 603.65 | 244.44 | 603.06 | 16.92 | 633.69 | 564.38 |

| Financial | 303.23 | 53.01 | 382.62 | 217.59 | 361.78 | 15.21 | 382.63 | 329.46 |

| Health Care | 973.29 | 71.56 | 1057.54 | 755.22 | 968.82 | 51.82 | 1055.84 | 882.37 |

| Industrials | 687.88 | 108.19 | 855.87 | 491.04 | 804.05 | 25.72 | 848.29 | 744.21 |

| Information Technology | 903.17 | 82.89 | 1031.55 | 709.63 | 866.74 | 49.64 | 976.66 | 786.49 |

| Materials | 551.09 | 65.65 | 646.46 | 406.81 | 625.43 | 16.14 | 651.03 | 583.85 |

| Real Estate | 170.80 | 20.92 | 203.05 | 124.01 | 187.51 | 3.28 | 194.48 | 180.42 |

| Utility | 615.56 | 66.61 | 715.85 | 454.10 | 644.09 | 10.24 | 675.89 | 619.78 |

| S&P 500 | 2924.42 | 307.47 | 3386.15 | 2237.40 | 3099.27 | 112.62 | 3329.62 | 2887.61 |

| Panel B: Daily News Sentiment Index | ||||||||

| Daily News Sentiment Index | −0.28 | 0.23 | 0.15 | −0.49 | 0.02 | 0.13 | 0.26 | −0.23 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | |||||

|---|---|---|---|---|---|---|---|---|

| Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | Correlation | t-Statistics | |

| Communication Services | 0.8105 | 12.6048 | 0.7992 | 12.0398 | 0.7838 | 11.3581 | 0.7691 | 10.7629 |

| Consumer Discretionary | 0.7794 | 11.3332 | 0.7709 | 10.9600 | 0.7594 | 10.5059 | 0.7481 | 10.0830 |

| Consumer Staples | 0.8222 | 13.1590 | 0.8207 | 13.0053 | 0.8144 | 12.6328 | 0.8089 | 12.3071 |

| Energy | 0.9395 | 24.9940 | 0.9362 | 24.1262 | 0.9293 | 22.6388 | 0.9216 | 21.2333 |

| Financial | 0.9543 | 29.0779 | 0.9573 | 29.9874 | 0.9563 | 29.4378 | 0.9545 | 28.6152 |

| Health Care | 0.5762 | 6.4231 | 0.5550 | 6.0416 | 0.5292 | 5.6135 | 0.5061 | 5.2479 |

| Industrials | 0.9482 | 27.1922 | 0.9495 | 27.4079 | 0.9481 | 26.8230 | 0.9463 | 26.1878 |

| Information Technology | 0.7089 | 9.1556 | 0.6955 | 8.7660 | 0.6778 | 8.2963 | 0.6605 | 7.8687 |

| Materials | 0.8526 | 14.8659 | 0.8453 | 14.3241 | 0.8354 | 13.6773 | 0.8256 | 13.0874 |

| Real Estate | 0.8638 | 15.6178 | 0.8732 | 16.2221 | 0.8787 | 16.5676 | 0.8820 | 16.7414 |

| Utility | 0.8706 | 16.1210 | 0.8809 | 16.8500 | 0.8862 | 17.2177 | 0.8892 | 17.3865 |

| Lag 0 | Lag 1 | Lag 2 | Lag 3 | R2 | |||||

|---|---|---|---|---|---|---|---|---|---|

| (Standard Error) ** | p-Value | (Standard Error) | p-Value | (Standard Error) | p-Value | (Standard Error) | p-Value | ||

| Communication Services | 0.1329 (0.0758) | 0.0420 * | −0.1730 (0.1722) | 0.1591 | 0.0668 (0.1605) | 0.3393 | −0.0125 (0.0536) | 0.4082 | 0.1832 |

| Consumer Discretionary | 0.0570 (0.0667) | 0.1978 | −0.2224 (0.1541) | 0.0767 | 0.1792 (0.1462) | 0.1121 | −0.0498 (0.0494) | 0.1584 | 0.1982 |

| Consumer Staples | 0.0453 (0.0905) | 0.3089 | −0.1385 (0.2173) | 0.2630 | 0.0978 (0.2058) | 0.3180 | −0.0244 (0.0693) | 0.3628 | 0.1921 |

| Energy | 0.4797 (0.0265) | 0.0115 * | 0.3322 (0.0966) | 0.0424 * | 0.3690 (0.4593) | 0.2122 | −0.0583 (0.1521) | 0.3512 | 0.1111 |

| Financial | 0.0941 (0.0526) | 0.0390 * | 0.0179 (0.0317) | 0.0412* | 0.1057 (0.1246) | 0.1995 | −0.0030 (0.0414) | 0.4708 | 0.1197 |

| Health Care | 0.0264 (0.0711) | 0.3560 | 0.0934 (0.1709) | 0.2933 | −0.0523 (0.1631) | 0.3746 | 0.0006 (0.0546) | 0.4955 | 0.1167 |

| Industrials | 0.1124 (0.0727) | 0.0433 * | −0.1413 (0.1720) | 0.2072 | 0.2460 (0.1628) | 0.0677 | −0.1005 (0.0542) | 0.0339 * | 0.1835 |

| Information Technology | −0.0081 (0.0501) | 0.4359 | −0.0303 (0.1232) | 0.4032 | −0.0281 (0.1177) | 0.4062 | 0.0216 (0.0396) | 0.2936 | 0.1683 |

| Materials | 0.0538 (0.0703) | 0.2233 | −0.0478 (0.1685) | 0.3889 | 0.0446 (0.1591) | 0.3901 | 0.0101 (0.0541) | 0.4260 | 0.1275 |

| Real Estate | 0.0573 (0.1172) | 0.3130 | 0.2176 (0.2850) | 0.2239 | −0.2972 (0.2708) | 0.1381 | 0.1467 (0.0930) | 0.0596 | 0.1058 |

| Utility | 0.0547 (0.1461) | 0.3546 | 0.1374 (0.3526) | 0.3489 | −0.2030 (0.3349) | 0.2732 | 0.1079 (0.1137) | 0.1730 | 0.2159 |

| Measures of COVID-19 Sentiment | Correlation Level | |||

|---|---|---|---|---|

| High (Correlation Range) | Middle (Correlation Range) | Low (Correlation Range) | ||

| DNSI | Fin., Enr., Ind. | CS., CD., CSt., IT., Mat., RE., Utl. | HC. | |

| US Google Searches | “coronavirus” | CS., CD., IT. () | CSt., Eng., HC., Ind., Mat., RE. () | Fin., Utl. () |

| “laid off” | CS., CD. () | CSt., Eng., HC., Ind., IT., Mat., RE. () | Fin., Utl. () | |

| “unemployment” | Fin., Ind. () | CS., CD., CSt., Eng., Mat., RE., Utl. () | HC. IT. () | |

| “recession” | CD., HC., IT. () | CS., CSt., Eng., Ind., Mat., RE. () | Fin., Utl. () | |

| “vaccine” | Eng., Fin., Ind., Mat. () | CS., CD., CSt., RE., Utl. () | HC., IT. () | |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, H.S. Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data. Sustainability 2020, 12, 6648. https://doi.org/10.3390/su12166648

Lee HS. Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data. Sustainability. 2020; 12(16):6648. https://doi.org/10.3390/su12166648

Chicago/Turabian StyleLee, Hee Soo. 2020. "Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data" Sustainability 12, no. 16: 6648. https://doi.org/10.3390/su12166648