Unveiling the Effect of Mean and Volatility Spillover between the United States Economic Policy Uncertainty and WTI Crude Oil Price

Abstract

1. Introduction

2. Materials and Methods

2.1. The VAR Model

2.2. The BEKK-GARCH Model

3. Results and Discussion

3.1. Data Description

3.2. Stationarity Test

3.3. Granger Causality Test

3.4. Mean Spillover Effect

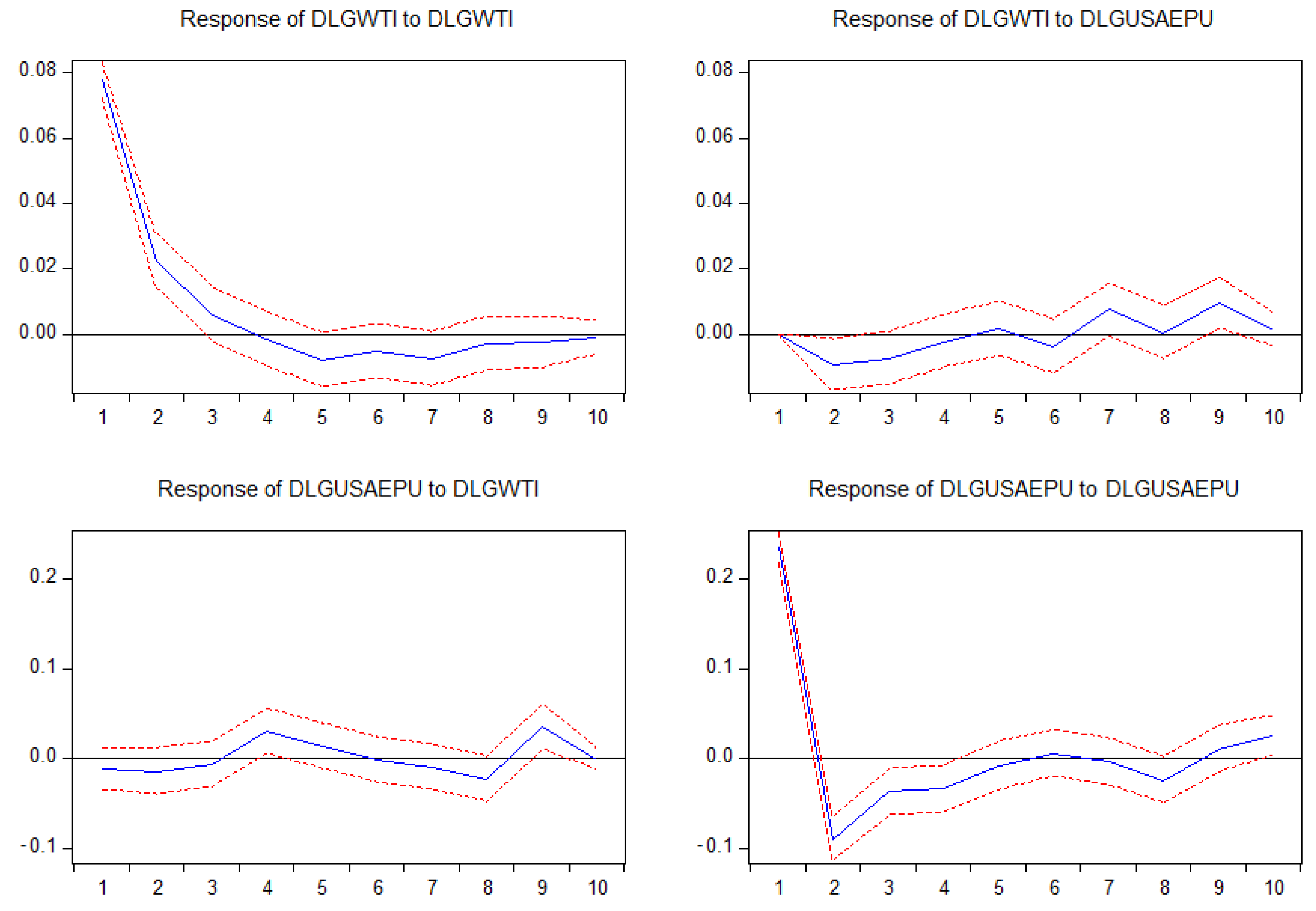

3.5. Impulse Response Analysis

3.6. Volatility Spillover Effect

4. Conclusions, Implication and Future Directions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Chen, J.; Jin, F.; Ouyang, G.; Ouyang, J.; Wen, F. Oil price shocks, economic policy uncertainty and industrial economic growth in China. PLoS ONE 2019, 14, e0215397. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Nyamela, Y.; Plakandaras, V.; Gupta, R. Frequency-dependent real-time effects of uncertainty in the United States: Evidence from daily data. Appl. Econ. Lett. 2019, 26, 1–5. [Google Scholar] [CrossRef]

- Feng, M.; Qunxing, P. Study on the dynamic correlation between economic policy uncertainty and crude oil price. Guangxi Soc. Sci. 2016, 3, 72–76. [Google Scholar]

- Ma, F.; Wahab, M.I.M.; Liu, J.; Liu, L. Is economic policy uncertainty important to forecast the realized volatility of crude oil futures? Appl. Econ. 2018, 50, 2087–2101. [Google Scholar] [CrossRef]

- Chen, X.; Sun, X.; Wang, J. Dynamic Spillover Effect Between Oil Prices and Economic Policy Uncertainty in BRIC Countries: A Wavelet-Based Approach. Emerg. Mark. Financ. Trade 2019, 55, 2703–2717. [Google Scholar] [CrossRef]

- Iqbal, U.; Gan, C.; Nadeem, M. Economic policy uncertainty and firm performance. Appl. Econ. Lett. 2020, 27, 765–770. [Google Scholar] [CrossRef]

- El Anshasy, A.A.; Bradley, M.D. Oil prices and the fiscal policy response in oil-exporting countries. J. Policy Model. 2012, 34, 605–620. [Google Scholar] [CrossRef]

- Wei, Y.; Wang, Y.; Huang, D. Forecasting crude oil market volatility: Further evidence using GARCH-class models. Energy Econ. 2010, 32, 1477–1484. [Google Scholar] [CrossRef]

- He, Z.; Zhou, F. Time-varying and asymmetric effects of the oil-specific demand shock on investor sentiment. PLoS ONE 2018, 13, e0200734. [Google Scholar] [CrossRef]

- Wen, F.; Xiao, J.; Huang, C.; Xia, X. Interaction between oil and US dollar exchange rate: Nonlinear causality, time-varying influence and structural breaks in volatility. Appl. Econ. 2018, 50, 319–334. [Google Scholar] [CrossRef]

- Hamilton, J.D. Understanding crude oil prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef]

- Filis, G.; Chatziantoniou, I. Financial and monetary policy responses to oil price shocks: Evidence from oil-importing and oil-exporting countries. Rev. Quant. Financ. Account. 2014, 42, 709–729. [Google Scholar] [CrossRef]

- Alquist, R.; Kilian, L.; Vigfusson, R.J. Forecasting the price of oil. In Handbook of Economic Forecasting; Elsevier B.V: Ottawa, ON, Canada, 2013; Volume 2, pp. 427–507. [Google Scholar]

- Kilian, L.; Park, C. The impact of oil price shocks on the U.S. stock market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Feng, J.; Wang, Y.; Yin, L. Oil volatility risk and stock market volatility predictability: Evidence from G7 countries. Energy Econ. 2017, 68, 240–254. [Google Scholar] [CrossRef]

- Christoffersen, P.; Pan, X.N. Oil volatility risk and expected stock returns. J. Bank. Financ. 2018, 95, 5–26. [Google Scholar] [CrossRef]

- Barrero, J.M.; Bloom, N.; Wright, I.J. Short and Long Run Uncertainty. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Huang, B.N.; Hwang, M.J.; Peng, H.P. The asymmetry of the impact of oil price shocks on economic activities: An application of the multivariate threshold model. Energy Econ. 2005, 27, 455–476. [Google Scholar] [CrossRef]

- An, L.; Jin, X.; Ren, X. Are the macroeconomic effects of oil price shock symmetric?: A Factor-Augmented Vector Autoregressive approach. Energy Econ. 2014, 45, 217–228. [Google Scholar] [CrossRef]

- Rafiq, S.; Sgro, P.; Apergis, N. Asymmetric oil shocks and external balances of major oil exporting and importing countries. Energy Econ. 2016, 56, 42–50. [Google Scholar] [CrossRef]

- Bekiros, S.; Gupta, R.; Paccagnini, A. Oil price forecastability and economic uncertainty. Econ. Lett. 2015, 132, 125–128. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A.; Vespignani, J.L. Oil price shocks and policy uncertainty: New evidence on the effects of US and non-US oil production. Energy Econ. 2017, 66, 536–546. [Google Scholar] [CrossRef]

- Chen, X.; Sun, X.; Li, J. How does economic policy uncertainty react to oil price shocks? A multi-scale perspective. Appl. Econ. Lett. 2020, 27, 188–193. [Google Scholar] [CrossRef]

- Antonakis, J.; House, R.J. Instrumental leadership: Measurement and extension of transformational-transactional leadership theory. Leadersh. Q. 2014, 25, 746–771. [Google Scholar] [CrossRef]

- Arouri, M.; Rault, C.; Teulon, F. Economic policy uncertainty, oil price shocks and GCC stock markets. Econ. Bull. 2014, 34, 1822–1834. [Google Scholar]

- Degiannakis, S.; Filis, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef]

- Rehman, M.U. Do oil shocks predict economic policy uncertainty? Phys. A Stat. Mech. Appl. 2018, 498, 123–136. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil prices and economic policy uncertainty: Evidence from a nonparametric panel data model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Engle, R.F.; Kroner, K.F. Multivariate simultaneous generalized arch. Econom. Theory 1995, 11, 122–150. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Hentschel, L. All in the family Nesting symmetric and asymmetric GARCH models. J. Financ. Econ. 1995, 39, 71–104. [Google Scholar] [CrossRef]

- Reitz, S.; Westerhoff, F. Commodity price cycles and heterogeneous speculators: A STAR-GARCH model. Empir. Econ. 2007, 33, 231–244. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Boutahar, M.; Boubaker, H. Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Econ. 2015, 49, 540–549. [Google Scholar] [CrossRef]

- Bollerslev, T.; Engle, R.F.; Wooldridge, J.M. A Capital Asset Pricing Model with Time-Varying Covariances. J. Polit. Econ. 1988, 96, 116–131. [Google Scholar] [CrossRef]

- Bollerslev, T. Modelling the Coherence in Short-Run Nominal Exchange Rates: A Multivariate Generalized Arch Model. Rev. Econ. Stat. 1990, 72, 498. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 1991, 59, 347. [Google Scholar] [CrossRef]

- Zakoian, J.M. Threshold heteroskedastic models. J. Econ. Dyn. Control 1994, 18, 931–955. [Google Scholar] [CrossRef]

- Bleuler, P.; Ganzoni, N. Arthroscopic knee diagnosis in the non-specialized surgical department. Helv. Chir. Acta 1978, 45, 13–16. [Google Scholar]

- Hansen, P.R.; Huang, Z.; Shek, H.H. Realized GARCH: A joint model for returns and realized measures of volatility. J. Appl. Econom. 2012, 27, 877–906. [Google Scholar] [CrossRef]

- Engle, R.F.; Ghysels, E.; Sohn, B. Stock market volatility and macroeconomic fundamentals. Rev. Econ. Stat. 2013, 95, 776–797. [Google Scholar] [CrossRef]

- Li, J.; Yao, X.; Sun, X.; Wu, D. Determining the fuzzy measures in multiple criteria decision aiding from the tolerance perspective. Eur. J. Oper. Res. 2018, 264, 428–439. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1. [Google Scholar] [CrossRef]

- Matar, W.O.; Al-Fattah, S.; Atallah, T.N.; Pierru, A. An Introduction to Oil Market Volatility Analysis. SSRN Electron. J. 2013, 247–269. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Hao, L.N.; Tao, R. The stability of U.S. economic policy: Does it really matter for oil price? Energy 2020, 13, 117315. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427. [Google Scholar] [CrossRef]

- Cunado, J.; Jo, S.; Perez de Gracia, F. Macroeconomic impacts of oil price shocks in Asian economies. Energy Policy 2015, 86, 867–879. [Google Scholar] [CrossRef]

- James, A. US state fiscal policy and natural resources. Am. Econ. J. Econ. Policy 2015, 7, 238–257. [Google Scholar] [CrossRef]

- Sturm, M.; Gurtner, F.; Alegre, J.G. Fiscal policy challenges in oil-exporting countries—A review of key issues. ECB Occas. Pap. 2009, 11. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1325245 (accessed on 18 August 2020).

| Sr. | Models | Features |

|---|---|---|

| 1 | GARCH (1986) | Simple and easy to operate with few restrictions on coefficients, negatively reflecting asymmetric effects, using low-frequency data [32]. |

| 2 | VECH-GARCH (1988) | Modeling the covariance matrix, but the covariance matrix cannot be guaranteed to be a positive definite matrix [36]. |

| 3 | BEKK-GARCH (1995) | Improved on the basis of the VECH-GARCH model, the covariance matrix is a positive definite matrix, the parameters are easier to estimate, measuring the correlation and reflect the direction of spillover effects [31]. |

| 4 | CCC-GARCH (1990) | Modeling the correlation coefficient matrix but the coefficients are constant, describing univariate fluctuation characteristics, but negatively capturing the dynamic correlation between sequences [37]. |

| 5 | EGARCH (1991) | Introducing dummy variables to describe the asymmetric effect, no necessary for all estimated coefficients to be positive, but the conditional variance expression is too complicated and difficult to operate, using low-frequency data [38]. |

| 6 | TGARCH (1994) | Introducing dummy variables to describe the asymmetric effect, all estimated coefficients to be positive, using low-frequency data [39]. |

| 7 | DCC-GARCH (2001) | Improved on the basis of the CCC-GARCH model, introducing dynamic conditional correlation to capture the volatility spillover effect, applicable to large relation matrix, negatively describing asymmetric effects [40]. |

| 8 | Realized GARCH (2012) | Using high-frequency data that contain more information, but also more noise. The impact of noise cannot be measured, and further research is needed [41]. |

| 9 | GARCH-MIDAS (2013) | Using high frequency and low-frequency data, suitable to describe long-term relationships, not short-term data [42]. |

| Variables | Definitions of Variables |

|---|---|

| LGWTI | Log transformation of WTI spot price |

| DLGWTI | First log difference of WTI spot price |

| LGUSAEPU | Log transformation of US economic policy uncertainty index |

| DLGUSAEPU | First log difference of US economic policy uncertainty index |

| Variable | 1% Level | 5% Level | 10% Level | ADF | Prob. | Stationarity |

|---|---|---|---|---|---|---|

| LGUSAEPU | −2.571 | −1.942 | −1.616 | −0.088 | 0.653 | Non-stationary |

| DLGUSAEPU | −2.571 | −1.942 | −1.616 | −14.741 | 0.000 | Stationary |

| LGWTI | −3.446 | −2.869 | −2.571 | −1.951 | 0.309 | Non-stationary |

| DLGWTI | −3.446 | −2.869 | −2.571 | −15.575 | 0.000 | Stationary |

| Null Hypothesis | Obs. | F-Statistic | Prob. | Reject/Accept |

|---|---|---|---|---|

| H1: DLGUSAEPU does not Granger Cause DLGWTI | 395 | 2.278 ** | 0.028 | Not accepted |

| H2: DLGWTI does not Granger Cause DLGUSAEPU | 395 | 1.477 | 0.174 | Accepted |

| DLGWTI | DLG USAEPU | DLGWTI | DLG USAEPU | ||

|---|---|---|---|---|---|

| 0.281 *** | −0.226 | −0.040 ** | −0.3783 | ||

| [5.477] | [−1.457] | [−2.402] | [−7.466] | ||

| −0.016 | −0.122 | −0.035 ** | −0.308 | ||

| [−0.298] | [−0.768] | [−1.984] | [−5.741] | ||

| −0.049 | 0.316 ** | −0.021 | −0.328 | ||

| [−0.950] | [2.020] | [−1.130] | [−5.874] | ||

| C | 0.003 | 0.002 | |||

| [0.854] | [0.198] | ||||

| R-squared | 0.204 | 0.289 | S.E. equation | 0.078 | 0.236 |

| Adj. R-squared | 0.161 | 0.227 | F-Statistic | 4.057 | 6.631 |

| Variable | Coeff | S.E | T-Stat | Significance | |

|---|---|---|---|---|---|

| 1 | Mean (DLGWTI) | 0.00498 | 0.00398 | 1.24927 | 0.21157 |

| 2 | Mean (DLGUSAEPU) | 0.00086 | 0.01209 | 0.07137 | 0.94311 |

| 3 | C (1,1) | 0.01901 | 0.01119 | 1.69847 | 0.08942 |

| 4 | C (2,1) | 0.18612 ** | 0.04010 | 4.64121 | 0.00000 |

| 5 | C (2,2) | 0.00004 | 0.41300 | 0.00009 | 0.99993 |

| 6 | A (1,1) | 0.47397 *** | 0.06250 | 7.58366 | 0.00000 |

| 7 | A (1,2) | 0.05132 * | 0.02268 | 2.24809 | 0.02406 |

| 8 | A (2,1) | −0.07957 *** | 0.02032 | −3.91659 | 0.00009 |

| 9 | A (2,2) | −0.21010 ** | 0.08758 | −2.39899 | 0.01644 |

| 10 | B (1,1) | 0.73877 *** | 0.07260 | 10.17623 | 0.00000 |

| 11 | B (1,2) | 0.10374 *** | 0.03107 | 3.33817 | 0.00043 |

| 12 | B (2,1) | −0.11538 *** | 0.02567 | −4.49459 | 0.00001 |

| 13 | B (2,2) | 0.66395 *** | 0.17259 | 3.84697 | 0.00012 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, R.; Du, J.; Shahzad, F.; Long, X. Unveiling the Effect of Mean and Volatility Spillover between the United States Economic Policy Uncertainty and WTI Crude Oil Price. Sustainability 2020, 12, 6662. https://doi.org/10.3390/su12166662

Su R, Du J, Shahzad F, Long X. Unveiling the Effect of Mean and Volatility Spillover between the United States Economic Policy Uncertainty and WTI Crude Oil Price. Sustainability. 2020; 12(16):6662. https://doi.org/10.3390/su12166662

Chicago/Turabian StyleSu, Ruixin, Jianguo Du, Fakhar Shahzad, and Xingle Long. 2020. "Unveiling the Effect of Mean and Volatility Spillover between the United States Economic Policy Uncertainty and WTI Crude Oil Price" Sustainability 12, no. 16: 6662. https://doi.org/10.3390/su12166662

APA StyleSu, R., Du, J., Shahzad, F., & Long, X. (2020). Unveiling the Effect of Mean and Volatility Spillover between the United States Economic Policy Uncertainty and WTI Crude Oil Price. Sustainability, 12(16), 6662. https://doi.org/10.3390/su12166662