Can the National Green Industrial Policy Improve Production Efficiency of Enterprises?—Evidence from China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Previous Studies

2.2. Institutional Background

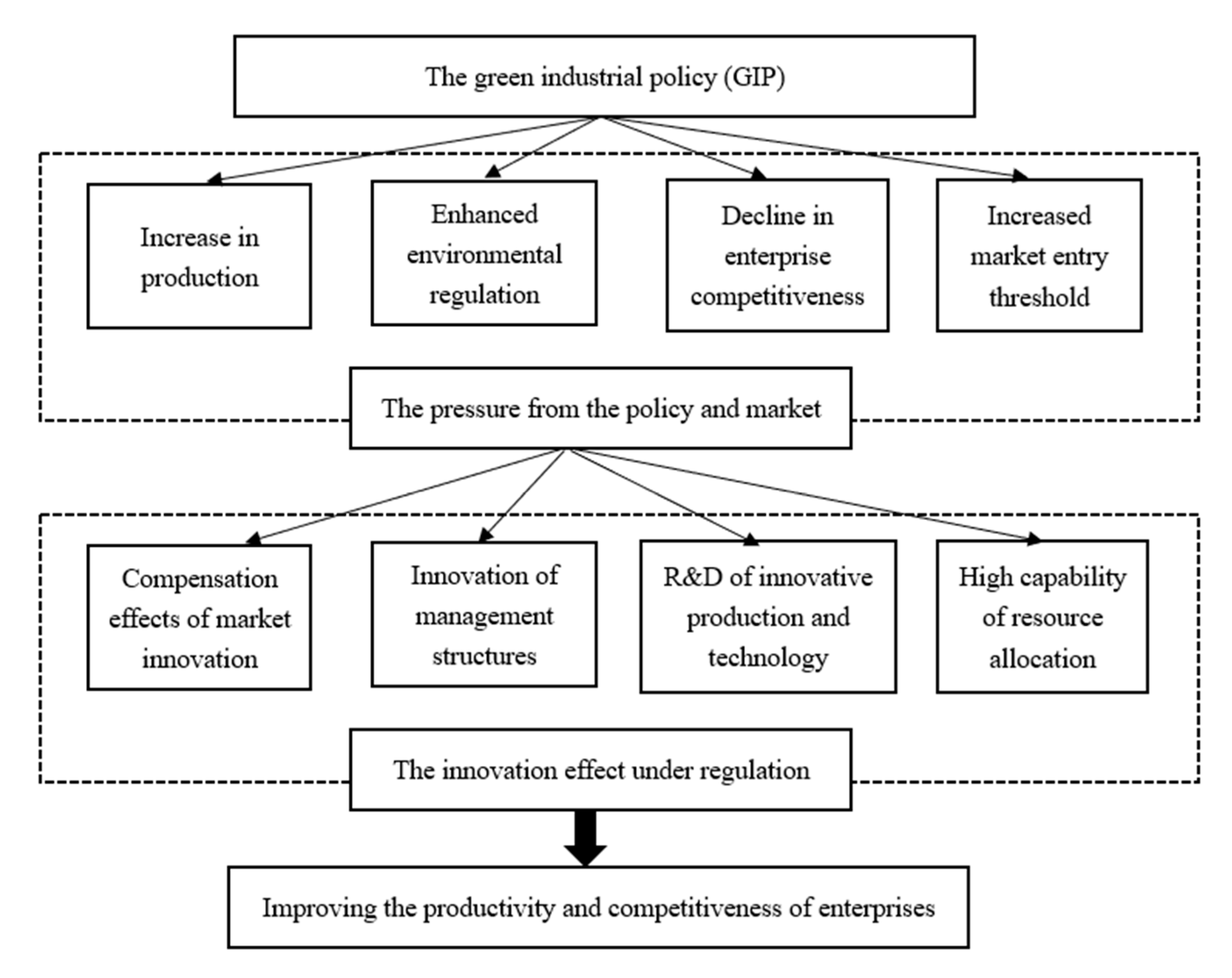

2.3. Pathway Mechanisms of GIP and Hypotheses

2.3.1. Enterprise Innovation Incentive and Compensation Mechanism

2.3.2. Market Selection and Elimination Mechanism: Entry and Exit of Enterprises

2.4. Data and Empirical Specification

2.4.1. Data Source

2.4.2. Empirical Specification

Measurement of TFP

Identification of Enterprise Status

Division of GIP Implementation Period

Estimation Model and Descriptive Statistics

Control Variables

Model to Test Pathway Mechanism

- (1)

- Testing mechanism by way of enterprise entry:

- (2)

- Testing mechanism by way of enterprise exit:

- (3)

- Testing mechanism by way of enterprise innovation:

3. Results and Discussions

3.1. Baseline Main Results

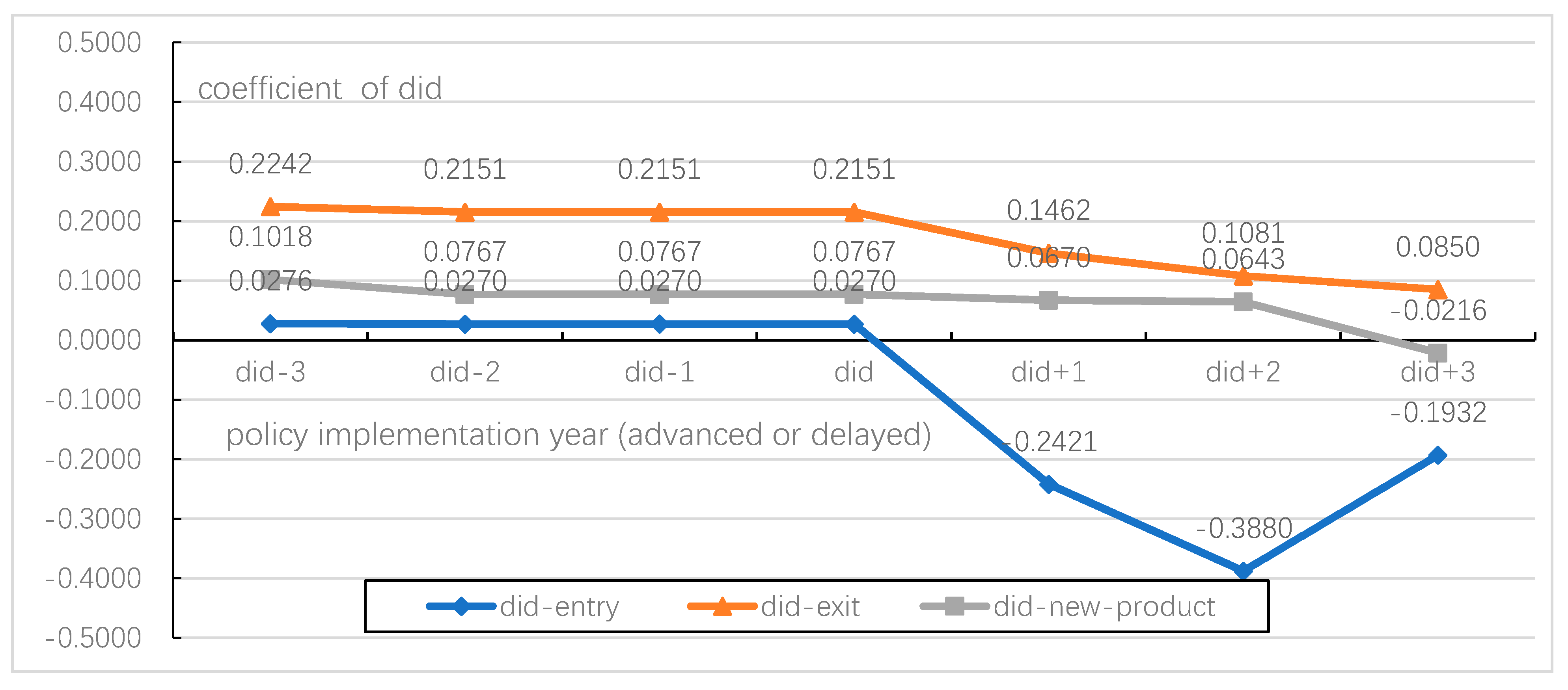

3.2. Robustness Checks and Counterfactual Test

3.3. Testing H1 and H2 through Pathway Mechanisms

3.4. Further Analysis Accounting for Enterprise Heterogeneity

3.4.1. Enterprise Heterogeneity by Ownership

3.4.2. Enterprise Heterogeneity by Pollution Intensity

3.4.3. Enterprise Heterogeneity by Factor Intensity

4. Conclusions, Policy Recommendations, Limitations, and Directions for Future Study

- The results from this big-data study provide a factual basis for policymakers to implement green industrial policy toward a low-carbon, circular, and sustainable development model. Specifically, the findings can inform policymakers to make use of the market elimination mechanism to accelerate the transformation and upgrading of industries, and promote technological innovation by compensation and incentive mechanism.

- Proper use of policy can promote economic transformation and development. The application of environmental regulation tools can incentivize existing enterprises to engage in continuous innovations, encourage entry of innovative enterprises, and gradually phase out backward enterprises, thereby effectively improving the resource allocation capability and TFP growth of enterprises. In this respect, we advocate a new preemptive green industrial policy with front-end forward-looking governance, which breaks away from the old governance mode of enduring pollution before control and containment, and develop high-tech industries, information technology industries, an internet economy, and a new-energy economy.

- We also advocate for implementing different green industrial policies to match with enterprise heterogeneity in resource factor endowments, and adaptability to market risks. Specifically, we should take heed to the leading role of state-owned enterprises in the process of market-oriented reforms and industrial policy implementation, and also pay attention to the innovation capabilities of technology-intensive enterprises, as well as give full consideration to the environmental improvement effect of highly polluting industries.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Rees, W.E. Economic development and environmental protection: An ecological economics perspective. Environ. Monit. Assess. 2003, 86, 29–45. [Google Scholar] [CrossRef]

- Kaplowitz, M.D.; Lupi, F.; Yeboah, F.K.; Thorp, L.G. Exploring the middle ground between environmental protection and economic growth. Public Underst. Sci. 2013, 22, 413–426. [Google Scholar] [CrossRef]

- Li, Z.; Yang, W.; Wang, C.; Zhang, Y.; Yuan, X. Guided High-Quality Development, Resources, and Environmental Forcing in China’s Green Development. Sustainability 2019, 11, 1936. [Google Scholar] [CrossRef] [Green Version]

- Rodrik, D. Green industrial policy. Oxf. Rev. Econ. Policy 2014, 30, 469–491. [Google Scholar] [CrossRef]

- Heshmati, A.; Kumbhakar, S.C. Technical change and total factor productivity growth: The case of Chinese provinces. Technol. Forecast. Soc. Chang. 2011, 78, 575–590. [Google Scholar] [CrossRef] [Green Version]

- Mol, A.P.; Liu, Y. Institutionalizing cleaner production in China: The cleaner production promotion law. Int. J. Environ. Sustain. Dev. 2005, 4, 227–245. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 1996, 64, 1263–1298. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating Production Functions Using Inputs to Control for Unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Baily, M.N.; Hulten, C.; Campbell, D.; Bresnahan, T.; Caves, R.E. Productivity Dynamics in Manufacturing Plants. Brook. Pap. Econ. Act. Microecon. 1992, 1992, 187–267. [Google Scholar] [CrossRef] [Green Version]

- Foster, L.; Haltiwanger, J.; Krizan, C.J. Aggregate productivity growth: Lessons from microeconomic evidence. New Dev. Product. Anal. 2001, 303–372. [Google Scholar] [CrossRef]

- Griliches, Z.; Regev, H. Firm productivity in Israeli industry 1979–1988. J. Econ. 1995, 65, 175–203. [Google Scholar] [CrossRef]

- Baldwin, J.R.; Gu, W. Participation in Export Markets and Productivity Performance in Canadian Manufacturing. 15 August 2003. Economic Analysis Research Paper Series. Available online: https://ssrn.com/abstract=1402804 (accessed on 27 July 2020). [CrossRef]

- Melitz, M.J.; Polanec, S. Dynamic Olley-Pakes decomposition with entry and exit. Rand J. Econ. 2015, 46, 362–375. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Nishimizu, M.; Page, J.M. Total Factor Productivity Growth, Technological Progress and Technical Efficiency Change: Dimensions of Productivity Change in Yugoslavia, 1965–78. Econ. J. 1982, 92, 920–936. [Google Scholar] [CrossRef]

- Kalirajan, K.P.; Obwona, M.B.; Zhao, S. A Decomposition of Total Factor Productivity Growth: The Case of Chinese Agricultural Growth before and after Reforms. Am. J. Agric. Econ. 1996, 78, 331–338. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 2003, 46, 384–402. [Google Scholar] [CrossRef] [Green Version]

- Viscusi, W.K. Employment Relationships with Joint Employer and Worker Experimentation. Int. Econ. Rev. 1983, 24, 313–322. [Google Scholar] [CrossRef]

- Boyd, G.A.; Mcclelland, J.D. The Impact of Environmental Constraints on Productivity Improvement in Integrated Paper Plants. J. Environ. Econ. Manag. 1999, 38, 121–142. [Google Scholar] [CrossRef]

- Lichtenberg, F.R.; Potterie, B.V.P.D.L. International R&D Spillovers A Comment. Eur. Econ. Rev. 1998, 42, 1483–1491. [Google Scholar]

- Khanna, N.; Plassmann, F. Total factor productivity and the Environmental Kuznets Curve: A comment and some intuition. Ecol. Econ. 2007, 63, 54–58. [Google Scholar] [CrossRef]

- Mattar, Y. Arab ethnic enterprises in colonial Singapore: Market entry and exit mechanisms 1819–1965. Asia Pac. Viewp. 2004, 45, 165–179. [Google Scholar] [CrossRef]

- Pe’Er, A.; Vertinsky, I. Firm exits as a determinant of new entry: Is there evidence of local creative destruction? J. Bus. Ventur. 2008, 23, 280–306. [Google Scholar] [CrossRef]

- Disney, R.; Haskel, J.; Heden, Y. Restructuring and productivity growth in UK manufacturing. Econ. J. 2003, 113, 666–694. [Google Scholar] [CrossRef]

- Bartelsman, E.J.; Haltiwanger, J.C.; Scarpetta, S. Microeconomic Evidence of Creative Destruction in Industrial and Developing Countries. October 2004. Available online: https://ssrn.com/abstract=612230 (accessed on 27 July 2020).

- Tybout, P.A.M. The Moderating Role of Prior Knowledge in Schema-Based Product Evaluation. J. Consum. Res. 1996, 23, 177–192. [Google Scholar]

- Brandt, L.; Biesebroeck, J.V.; Zhang, Y. Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 2012, 97, 339–351. [Google Scholar] [CrossRef] [Green Version]

- Berman, E. Environmental Regulation and Productivity: Evidence from Oil Refineries. Rev. Econ. Stat. 2001, 83, 498–510. [Google Scholar] [CrossRef] [Green Version]

- Eriksson, C.; Persson, J. Economic Growth, Inequality, Democratization, and the Environment. Environ. Res. Econ. 2003, 25, 1–16. [Google Scholar] [CrossRef]

- Dunne, T.; Samuelson, R.L. Patterns of Firm Entry and Exit in U.S. Manufacturing Industries. RAND J. Econ. 1988, 19, 495–515. [Google Scholar] [CrossRef]

- Guo, X.; Zhang, J.; Wu, L. Urban scale, productivity advantage and resource allocation. Manag. World 2019, 35, 77–89. [Google Scholar]

- Kostka, G.; Mol, A.P.J. Implementation and Participation in China’s Local Environmental Politics: Challenges and Innovations. J. Environ. Policy Plan. 2013, 15, 3–16. [Google Scholar] [CrossRef]

- Geng, Y.; Zhu, Q.; Doberstein, B.; Fujita, T. Implementing China’s circular economy concept at the regional level: A review of progress in Dalian, China. Waste Manag. 2009, 29, 996–1002. [Google Scholar] [CrossRef] [PubMed]

- Abadie, A.; Diamond, A.; Hainmueller, J. Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program. J. Am. Stat. Assoc. 2010, 105, 493–505. [Google Scholar] [CrossRef] [Green Version]

| obs | mean | std | min | max | |

|---|---|---|---|---|---|

| tfp_op | 1201841 | 3.7985 | 1.0997 | −8.3166 | 11.6614 |

| policy | 1201841 | 0.7773 | 0.4160 | 0.0000 | 1.0000 |

| enter | 1201841 | 0.2228 | 0.4161 | 0.0000 | 1.0000 |

| exit | 1201841 | 0.1465 | 0.3536 | 0.0000 | 1.0000 |

| new-product | 1201841 | 0.0772 | 0.2669 | 0.0000 | 1.0000 |

| lncapital | 1201841 | 2.2546 | 0.1456 | −0.3665 | 2.9224 |

| debt | 1201841 | 0.0538 | 0.1436 | −15.8461 | 29.1657 |

| liquidity | 1201841 | 0.5785 | 1.5434 | −10.0498 | 1666.6670 |

| profit | 1201841 | 0.0832 | 0.3723 | −23.4114 | 291.2632 |

| lnsize | 1201841 | 1.5209 | 0.2412 | 0.7320 | 2.4786 |

| lnage | 1201841 | 2.3100 | 0.8091 | 0.0000 | 4.0943 |

| tfp_ols | tfp_fe | tfp_op | tfp_lp | Y_labor | Y_capital | |

|---|---|---|---|---|---|---|

| tfp_ols | 1.0000 | |||||

| tfp_fe | 0.9925 | 1.0000 | ||||

| tfp_op | 0.9998 | 0.9901 | 1.0000 | |||

| tfp_lp | 0.9228 | 0.9474 | 0.9154 | 1.0000 | ||

| Y_labor | 0.4311 | 0.4437 | 0.4303 | 0.3798 | 1.0000 | |

| Y_capital | 0.0739 | 0.0600 | 0.0756 | 0.0495 | 0.0637 | 1.0000 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| VARIABLES | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op |

| policy | 0.2657 *** | 0.2655 *** | 0.2396 *** | 0.2312 *** | 0.2432 *** | 0.2350 *** |

| (101.76) | (101.53) | (90.16) | (86.57) | (92.51) | (85.57) | |

| enter | −0.2544 *** | −0.2810 *** | ||||

| (−122.82) | (−16.02) | |||||

| did-entry | 0.0270 | |||||

| (1.53) | ||||||

| exit | 0.0159 *** | −0.1671 *** | ||||

| (6.26) | (−25.59) | |||||

| did-exit | 0.2151 *** | |||||

| (30.42) | ||||||

| new-product | 0.0787 *** | 0.0178 ** | ||||

| (21.42) | (2.54) | |||||

| did-new-product | 0.0767 *** | |||||

| (10.20) | ||||||

| lnsize | −0.5555 *** | −0.5555 *** | −0.5180 *** | −0.5197 *** | −0.5280 *** | −0.5269 *** |

| (−60.76) | (−60.76) | (−56.01) | (−56.23) | (−57.22) | (−57.10) | |

| lncapital | 1.8968 *** | 1.8970 *** | 2.4787 *** | 2.4628 *** | 2.4640 *** | 2.4607 *** |

| (108.17) | (108.18) | (145.21) | (144.29) | (144.48) | (144.27) | |

| lnage | −0.1854 *** | −0.1854 *** | −0.1463 *** | −0.1393 *** | −0.1440 *** | −0.1442 *** |

| (−17.98) | (−17.99) | (−14.06) | (−13.39) | (−13.85) | (−13.87) | |

| debt | −0.1686 *** | −0.1686 *** | −0.1780 *** | −0.1778 *** | −0.1772 *** | −0.1764 *** |

| (−21.71) | (−21.71) | (−22.70) | (−22.69) | (−22.60) | (−22.50) | |

| profit | 0.7534 *** | 0.7534 *** | 0.8018 *** | 0.8000 *** | 0.8017 *** | 0.8017 *** |

| (182.81) | (182.82) | (193.56) | (193.22) | (193.66) | (193.67) | |

| liquidity | −0.0233 *** | −0.0234 *** | −0.0248 *** | −0.0248 *** | −0.0248 *** | −0.0248 *** |

| (−39.37) | (−39.38) | (−41.44) | (−41.37) | (−41.48) | (−41.48) | |

| Constant | 0.6051 *** | 0.6048 *** | −0.8956 *** | −0.8652 *** | −0.8591 *** | −0.8465 *** |

| (13.51) | (13.51) | (−20.58) | (−19.89) | (−19.75) | (−19.45) | |

| Fix effect | YES | YES | YES | YES | YES | YES |

| Observations | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 |

| R-squared | 0.103 | 0.103 | 0.086 | 0.087 | 0.087 | 0.087 |

| Number | 418,305 | 418,305 | 418,305 | 418,305 | 418,305 | 418,305 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | tfp_op | tfp_ols | tfp_lp | tfp_fe |

| policy | 0.2312 *** | 0.2297 *** | 0.2132 *** | 0.2174 *** |

| (86.57) | (86.16) | (80.98) | (82.52) | |

| exit | −0.1671 *** | −0.1672 *** | −0.1676 *** | −0.1675 *** |

| (−25.59) | (−25.64) | (−26.03) | (−26.01) | |

| did-exit | 0.2151 *** | 0.2147 *** | 0.2093 *** | 0.2111 *** |

| (30.42) | (30.41) | (30.02) | (30.25) | |

| Control variables | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES |

| Observations | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 |

| R-squared | 0.087 | 0.089 | 0.135 | 0.105 |

| Number of idd | 418,305 | 418,305 | 418,305 | 418,305 |

| Variables | Entering Enterprise | Exiting enterprise | Surviving Enterprise | ||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| enter | tfp_op | tfp_op | exit | tfp_op | tfp_op | tfp_op | |

| policy | 0.0927 *** | 0.2655 *** | 0.1550 *** | 0.2312 *** | 0.2548 *** | ||

| (65.24) | (101.53) | (132.60) | (86.57) | (94.82) | |||

| enter | −0.238 *** | −0.281 *** | |||||

| (−114.90) | (−16.02) | ||||||

| did-entry | 0.0270 | ||||||

| (1.53) | |||||||

| exit | −0.167 *** | −0.169 *** | |||||

| (−25.59) | (−25.85) | ||||||

| did-exit | 0.2151 *** | ||||||

| (30.42) | |||||||

| Control variables | YES | YES | YES | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES | YES | YES | YES |

| Observations | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 | 1,201,841 | 805,380 |

| R-squared | 0.096 | 0.091 | 0.103 | 0.036 | 0.077 | 0.087 | 0.109 |

| Number | 418,305 | 418,305 | 418,305 | 418,305 | 418,305 | 418,305 | 289,719 |

| Variables | Innovation of Newly Entered Enterprises | Innovation of Surviving Enterprises | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| new-product | tfp_op | tfp_op | new-product | tfp_op | tfp_op | |

| did-new-product | −0.0760 | 0.0696 *** | ||||

| (−0.22) | (9.29) | |||||

| new-product | 0.0446 | 0.1321 | 0.0620 *** | 0.0181 *** | ||

| (0.94) | (0.39) | (15.17) | (2.65) | |||

| policy | −0.118 *** | 0.5947 *** | -0.012 *** | 0.2479 *** | ||

| (−4.22) | (5.09) | (-13.50) | (88.11) | |||

| Control variables | YES | YES | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 267,772 | 267,772 | 267,772 | 805,380 | 805,380 | 805,380 |

| R-squared | 0.021 | 0.079 | 0.083 | 0.005 | 0.094 | 0.110 |

| Number | 260,912 | 260,912 | 260,912 | 289,719 | 289,719 | 289,719 |

| Variables | Non-state-owned enterprises | State-owned enterprise | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (1) | (2) | (3) | |

| tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | |

| did-entry | 0.0442 ** | 0.1266 *** | ||||

| (2.13) | (3.00) | |||||

| did-exit | 0.2312 *** | 0.0834 *** | ||||

| (26.70) | (5.11) | |||||

| did-new-product | 0.0422 *** | 0.1416 *** | ||||

| (4.24) | (8.80) | |||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 1,044,610 | 1,044,610 | 1,044,610 | 157,231 | 157,231 | 157,231 |

| R-squared | 0.116 | 0.096 | 0.096 | 0.063 | 0.064 | 0.063 |

| Number | 373,294 | 373,294 | 373,294 | 58,772 | 58,772 | 58,772 |

| Variables | High Pollution Industry | Low Pollution Industry | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (1) | (2) | (3) | |

| tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | |

| did-enter | 0.0446 * | 0.0111 | ||||

| (1.69) | (0.47) | |||||

| did-exit | 0.2137 *** | 0.2092 *** | ||||

| (20.17) | (22.12) | |||||

| did-new-product | 0.0389 *** | 0.1016 *** | ||||

| (2.99) | (10.98) | |||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 534,072 | 534,072 | 534,072 | 667,769 | 667,769 | 667,769 |

| R-squared | 0.117 | 0.096 | 0.096 | 0.118 | 0.106 | 0.106 |

| Number | 191,138 | 191,138 | 191,138 | 237,748 | 237,748 | 237,748 |

| Variables | Labor intensive | Capital intensive | Technology intensive | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (1) | (2) | (3) | (1) | (2) | (3) | |

| tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | tfp_op | |

| did-enter | −0.0298 | 0.0415 | 0.0821 ** | ||||||

| (−1.05) | (1.45) | (2.30) | |||||||

| did-exit | 0.2275 *** | 0.2388 *** | 0.1589 *** | ||||||

| (19.36) | (21.05) | (11.38) | |||||||

| did-new-product | 0.0642 *** (3.66) | 0.0643 *** (4.50) | 0.0684 *** (6.36) | ||||||

| Control variables | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Fixed effect | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 393,135 | 393,135 | 393,135 | 455,198 | 455,198 | 455,198 | 353,508 | 353,508 | 353,508 |

| R-squared | 0.122 | 0.103 | 0.102 | 0.112 | 0.092 | 0.091 | 0.126 | 0.117 | 0.117 |

| Number | 143,035 | 143,035 | 143,035 | 162,072 | 162,072 | 162,072 | 123,944 | 123,944 | 123,944 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, P.; Huang, W.-C.; Chen, H. Can the National Green Industrial Policy Improve Production Efficiency of Enterprises?—Evidence from China. Sustainability 2020, 12, 6839. https://doi.org/10.3390/su12176839

Liu P, Huang W-C, Chen H. Can the National Green Industrial Policy Improve Production Efficiency of Enterprises?—Evidence from China. Sustainability. 2020; 12(17):6839. https://doi.org/10.3390/su12176839

Chicago/Turabian StyleLiu, Pei, Wei-Chiao Huang, and Hao Chen. 2020. "Can the National Green Industrial Policy Improve Production Efficiency of Enterprises?—Evidence from China" Sustainability 12, no. 17: 6839. https://doi.org/10.3390/su12176839

APA StyleLiu, P., Huang, W.-C., & Chen, H. (2020). Can the National Green Industrial Policy Improve Production Efficiency of Enterprises?—Evidence from China. Sustainability, 12(17), 6839. https://doi.org/10.3390/su12176839