Abstract

In this paper, we present a comparative investigation of the multifractal properties of seven Central and Eastern European (CEE) stock markets using recent financial data up to August 2018 by employing seasonal and trend decompositions before applying multifractal detrended fluctuation analysis. We find that stock indices returns exhibit long-range correlations, supporting the idea that the stock markets in question are not efficient markets and have not reached a mature stage of market development. The results of the paper are of interest to investors looking for opportunities in these stock exchanges and also to policy makers in their endeavour of realizing institutional reforms in order to increase stock market efficiency and to support the sustainable growth of the financial markets.

1. Introduction

In its list of recommendations to accelerate capital market development in emerging economies, the World Economic Forum suggested stock market efficiency and transparency, with the objective of creating more liquidity in the market and improving the ability of market participants to assess market’s costs and benefits [1]. The issue of market efficiency has attracted a lot of academic interest in the past fifty years, with application to individual or regional stock markets, due to its implications for both investors and public authorities. Investors looking for fair prices will avoid investing in inefficient markets, while other investors looking for mispriced assets in equity markets will avoid efficient markets since they do not provide the opportunity for realizing abnormal profits. Public authorities, on the other hand, will continue their efforts in realizing reforms, meant to enhance stock market efficiency, in order to ensure that all financial assets are offering optimal risk-to-reward ratios [2]. Understanding the behavior of developing stock markets is very important when adopting the right public policies in order to enhance the role of the stock exchange in the sustainable development of the economy. The positive influence of the market-based economy on the economic growth is well documented in the literature [3,4,5,6] despite some studies which prove the contrary [7] or suggest that causality flows in the opposite direction [8,9]. A more efficient financial system will enhance GDP growth. Consequently, policymakers will make all necessary efforts to minimize market failures by making transactions and capital allocation easier and exerting corporate governance principles [10,11]. On the other hand, understanding the current degree of market efficiency of the CEE countries, which are the latest members of the European Union, becomes more important in the context of their integration with other developed markets [12].

The efficient market hypothesis (EMH), as defined in the pioneering work by Fama [13], presumes that all information available on the market will be immediately reflected in the asset prices, making them fair. An emerging stream of financial literature nowadays criticizes the EMH as this assumption fails to explain ubiquitous market properties such as fat tails, long-term correlation, volatility clustering, and multifractality. In this respect, fractal theory has been proposed whereas fractal distribution was found as applicable to financial markets [14]. Fractal methods consist of single fractal and multifractal methods, the latter being superior given that they can describe the multi-scale and subtle sub-structures of fractals in complex systems. Multifractal detrended fluctuation analysis (MF-DFA) was developed in order to investigate the dynamic resources of multifractality (non-linear temporal correlation versus fat-tailed distribution) [15]. The application area for MF-DFA is widespread in several markets described by the random walk hypothesis (RWH). On the one hand, MF-DFA has been applied to agricultural or commodities markets such as oil or gold [16,17,18] and suggests that prices do not follow RWH. On the other hand, it has been adopted in financial markets, mostly capital markets [19,20,21,22,23,24,25,26,27,28,29,30,31,32], and suggests the existence of fractal properties. Due to the discovery of multifractal properties of the financial markets in the last decade, interest in financial analysis of stock markets using MF-DFA has increased. Today, multifractality is one of the most active topics in econophysics. However, most studies using multifractality rather focus on developed stock markets. The use of the technique for emerging CEE markets is uncommon [28,29,30,31,32], ignoring the potential to highlight multifractal properties in these markets.

The purpose of the paper is to assess, using MF-DFA, the degree of market efficiency in the case of the considered seven CEE countries, new members of the European Union (Bulgaria, Croatia, Czech Republic, Hungary, Romania, Poland, and Slovenia). Using daily blue-chip index data up to August 2018, our study examines the behavior of these stock markets over the long run. Our paper fills the existing literature gap in several directions. First, from a theoretical point of view, it brings further evidence for the efficiency of these markets, testing the weak form of market efficiency for the most important CEE stock exchanges (in terms of market capitalization). Previous empirical literature on this topic has failed to provide consistent results. Market efficiency, stock market development, and economic growth are connected, and the CEE stock exchanges are all developing stock markets, for which sustainable growth is highly important, as shown in the literature [6]. Second, our methodology improves previous studies in the sense that this is the first stock market study that employs STL (seasonal and trend decomposition using loess) decomposition, before applying MF-DFA. Isolating the remaining components allows us to exclude the seasonal oscillations that could be generated by the annual and sub-annual trading cycles.

2. Theoretical Background

The beneficial role of stock exchanges in ensuring long-run economic growth and sustainable development is well known in both the financial and growth literature. This relationship is mainly explained by higher domestic capital accumulation and mobilization, capital channelling towards productive sectors, risk transfer, and sharing and price discovery [3,4,5]. There are also studies that outline the reverse causality relationship between financial development and growth [8,9] while others support the unpopular belief that market-based financial development and economic growth do not share a causal relationship [7].

However, most empirical research suggests a one-way positive connection between stock market development and economic growth [3,4,5]. This positive relationship should persist even if, in the case of the new member states of European Union, the contribution of the stock markets to economic growth is limited due to the small financial depth of the markets [6]. However, in these countries, the potential role that the stock market has for economic development depends on the degree of stock market development. Stock market development, in turn, has been proven to have, a significant relationship with the degree of market efficiency, regardless of whether markets are developed, frontier or emergent, at least in the case of Europe [33]. Younger and less developed markets are usually found in the empirical literature to be less efficient than their more developed counterparts. Lower degrees of efficiency imply also higher transaction costs for market participants [24,34].

The efficient market hypothesis [13] divides itself into the well-known categories: (i) the weak form, which states that no analysis of past stock market behavior (technical or fundamental) would allow market participants to obtain abnormal returns, due to the fact that all historical and current data about price and volume would already be accounted on the market price; (ii) the semi-strong form, which can be differentiated by the latter in the sense that the market value of a financial asset adjusts, almost immediately, to all new (market and non-market) public information about it, following a random walk departure from previous prices; (iii) the strong form, which assumes that not even privileged information (insider information) made public to a certain group would allow a certain investor to gain abnormal profits.

A comprehensive list of studies which cover stock market efficiency is beyond the purpose of our study. We provide instead an overview of recent empirical work that focuses on testing the weak form of efficient markets in the case of several CEE stock markets. A sound empirical literature background regarding the efficiency of the emerging markets prior to 2011 can be found in Dragotă and Țilică [35] or Nurunnabi [36]. These studies aimed at testing the weak form of efficient market theory (the data necessary for testing strong market efficiency or semi-strong market efficiency being probably in most cases unavailable [24]) and failed to provide an unequivocal response regarding market efficiency for the CEE stock markets. There are serious doubts about whether stock markets are efficient in these countries [35]. This might be since the stock market efficiency is time varying [37]. In this case, using a rolling regression approach can help in analyzing the efficient markets hypothesis [38]. Furthermore, there is a long memory property in some CEE stock markets [39] that is not consistent with efficiency.

We will further discuss recent empirical tests of the weak form of efficiency in CEE stock markets (starting with 2011), which also failed in providing a unanimous response. The methodology of these tests was based on one or more of the following traditional techniques: the Jarque–Bera (JB) test (which measures the normality of the distribution), the parametric autocorrelation test (which measures the dependency of successive returns), the non-parametric runs test (which tests the randomness of a sequence of returns), the variance ratio test (which determines whether there are any uncorrelated changes in the series), unit root tests (meant to assess the stationarity of time series data), or GARCH and its variations (for the analysis of seasonality patterns: January effects, day of the month, turn of the month, day of the week or other).

Smith [34] found evidence for the weak form of efficiency when testing the Martingale hypothesis for 15 European emerging stock markets over a period of almost 9 years (February 2000–December 2009). The author used a rolling window variance ratio to capture changes in efficiency and to rank markets according to their relative inefficiency, reaching the conclusion that return predictability varies widely between the countries. The most efficient markets he studied were the Hungarian and the Polish markets, while Estonia was less efficient.

Guidi et al. [2] used autocorrelation analysis, the runs test, the variance ratio test, and GARCH-M for a period of ten years (1999–2009) to empirically prove that the seven CEE stock markets taken into consideration did not follow a random walk process. However, the authors found that since 2004, the year of accession to the European Union, CEE countries have improved their stock market efficiency. The random walk hypothesis was rejected for two of the seven considered stock markets (the Bulgarian and Slovak markets).

Karadagli and Omay [40] investigated the weak form of market efficiency for emerging economies (including some of the countries taken into consideration in our analysis) using linear and nonlinear unit root tests, which provided contradictory results, while using monthly data for the period 2002–2010. The results provided by nonlinear unit root tests suggested that the Romanian market and the Polish market were not weak-form efficient, while the linear tests suggested they were, alongside other CEE stock markets such as Bulgarian, Hungarian, and Slovenian markets. As a group, however, the authors found that the considered countries were not efficient.

Dragotă and Tilică [35] investigated the degree of market efficiency in the case of 20 East European former communist countries for the period 2008–2010, posing some doubts about market efficiency for all the considered countries, regardless of the type of methodology used (unit root tests, runs test, variance ratio test, filter rules test, or the January effect). They also suggested that the established degree of efficiency could serve as a method of selection between active and passive strategies on the market. This hypothesis was stated in Kroha and Skoula [41], who developed a new technical indicator for trading strategies (for buying and selling signals), called Moving Hurst (MF).

Boțoc [12] examined the weak form of market efficiency for five CEE stock markets in the timeframe of 1997–2014 (Croatia, Czech Republic, Hungary, Romania, and Poland), using unit root tests, a non-parametric runs test, and joint variance tests and found, with the exception of Poland, Hungary, and Croatia, that the CEE markets did not exhibit weak-form market efficiency.

Tokić et al. [24] analysed financial markets in four CEE countries (Croatia, Serbia, Slovenia, and Slovakia) for a significant timeframe (2006–2016) and show that all analysed indices, with the exception of Serbia, exhibited weak-form market efficiency. These results, in contrast with other empirical papers on the same markets, were justified by the authors by the possibility that market efficiency evolves positively over time with the level of stock market development.

As a response of econophysics literature to both EMH and RWH, the fractal theory was proposed by Benoit Mandelbrot and further developed [14,42]. The theory, originating from mathematics, present fractals as fragmented geometric shapes that when broken into parts, are similar in shape to the whole. It has started to be used as an alternative to standard tools and methods previously used in the world of finance in general and financial markets in particular. This is due to the shortcomings of GARCH processes or Brownian motion, which failed to model all relevant features of financial markets [42]. The fractal theory, also known as the theory of “roughness and self-similarity” was applied to the behavior of financial markets in connection with market efficiency, as a non-linear approach. Kantelhardt et al. [15,43] suggested MF-DFA in analyzing non-stationary time series.

The empirical literature investigating financial market behavior has concluded that there are main two factors leading to multifractal properties of financial time series: non-linear time correlations between past and current events and heavy-tailed probability distributions [18]. A large body of empirical research has proven that multifractality exists in stock market indices, the Hurst exponent being generally used to monitor the highest volatility periods in financial time series [44] or to measure the short and long-term memory of the stock market depicting the degree of market efficiency [28,45,46].

Given the rich literature related to using detrended fluctuation analysis (DFA) and its variations in financial markets (mostly developed ones), we will further limit our empirical literature review to those studies that have used MF-DFA with application to one or more of the CEE stock markets taken into consideration in our analysis.

Jagric et al. [28] used wavelet analysis and estimated the Hurst exponent on a sliding time window to test the existence of long-range dependence (LRD) in six transition economies. They divided their results into two groups: markets with strong LRD (Czech Republic, Hungary, Russia, and Slovenia) and markets with a weak form of LRD (Poland, Slovakia) while also finding evidence for the time dependence of the Hurst coefficient.

Domino [29] analyzed a large number of stocks from the Warsaw Stock Exchange (126 companies) during the period 1991–2008 and computed the Hurst exponent in order to search for the moment when changes in the long-term return rate of an investment were more likely to occur, in a way that could be used in an investment strategy. He concluded that a dropping Hurst exponent could be regarded as a signal for a potential change in the trend or in the return.

The informational efficiency of the Romanian stock market was analysed using MF-DFA by Pleșoianu et al. [30] in the case of the blue-chip Bucharest Exchange Trading (BET) and the composite BET-C index, as well as ten different stocks listed on the Bucharest Stock Exchange. Using daily time series from January 2001 until May 2012, as well as intradaily time series that ranged from January 2011 until December 2011, they confirmed the multifractal nature of this market, as well as its predictable nature.

Caraiani [31] tested for the presence of multifractality in three important CEE stock markets (Polish, Czech, and Hungarian) using MF-DFA. Using both original return time-series for the blue-chip indexes WIG, BUX, and PX (up to December 2010) and reordered (reshuffled) time series, he indicated the long-run dependence of these markets. He also tested whether the degree of multifractality changed during the financial crisis period. During this period, he found no evidence of an increase of multifractality spectrum strength, but rather of its shape.

Ferreira [32] investigated the behavior of 18 Eastern European stock markets using a sliding window DFA (with data ending in March 2017) and found that most of the considered markets were long-range dependent, suggesting a market inefficiency. One important conclusion of their paper has to do with the evolution in time of the dependence levels observed for the Czech, Hungarian, and Polish stock markets. These dependence levels were descending, even better than the benchmark indexes for the developed markets. The markets were ranked, with the help of an efficiency index, modeled after the one proposed by Kristoufek and Vosvrda [45]. The most efficient markets were Czech Republic, Hungary, and Poland.

To conclude, we can say that most of the studies applying MF-DFA, but also other traditional tools in order to test weak-form market efficiency in the case of CEE stock markets, suggest that these stock exchanges are inefficient, with some exceptions. These exceptions might be caused either by the type of methodology used or by the time horizon. However, these empirical results must be treated with caution, since market efficiency could increase or decrease over time (time-varying market efficiency) due to various factors including the level of stock market development [47]. Moreover, although MF-DFA is a well-known methodology, it is not that widely applied in the case of the CEE countries, so there is still a basis for rigorous testing in order to understand better the market behavior.

3. Data and Methodology

Data regarding the daily values of CEE stock market indices (up to August 2018) as well as data regarding market capitalization were obtained from Investing.com, CEIC, and the World Federation of Exchanges (Table 1). The seven CEE stock markets included in our analysis were the top ones in term of market capitalization when considering the new member states of the European Union.

Table 1.

Stock markets considered in the analysis.

The time-series analysis of stock market returns consists of three stages. In the first step, we calculate stock market returns. In the second step, we apply seasonal and trend decompositions (STL) to isolate deterministic components. Finally, we apply multifractal detrended fluctuation analysis (MF-DFA) to the stochastic component of the financial return series.

3.1. Stage 1: Calculating Stock Market Returns

Let Pt be the index price at the end of period t. The simple return on that index over period t, rt, is given by:

The log-return on that index over period t, rL, is given by:

In our study, we use daily simple returns. Because of the daily frequency of our data, the results of the analysis based on simple and log returns are very close. For coarser data, the use of log-returns is advised because simple returns do not additively compound over time.

3.2. Stage 2: STL Decomposition

Using the Wold representation theorem [48], stock returns can be decomposed into deterministic and stochastic components. Because we are interested in the behavior of the stochastic component, we first decompose the time series of calculated stock returns (1) into deterministic and stochastic components. For this purpose, we use an STL (seasonal and trend decomposition using loess) decomposition based on the loess smoother, proposed by [49]. The STL method additively decomposes each stock return time series into a deterministic trend (Ti), seasonal (Si) components, and stochastic remainder (Ri) component, as in [50]:

The STL decomposition consists of three steps. In the first step, the trend component is initialized. The next two steps are two recursive procedures: an inner loop as well as an outer loop. The outer loop calculates robustness weights according to the remainder component. These weights are subsequently used in the next iteration of the inner loop. The outer loop role is reducing (or, in some instances, eliminating) outliers and extreme values in the time series. The inner loop corrects the trend and seasonal components [50]. The time series is then partitioned into cycle subseries which are loess (LOcalregrESSion) smoothed and then passed through a low-pass filter. The resulting seasonal components are subtracted from the raw data. The residual is loess smoothed, and the trend is re-initialized. What is left is the remainder that subsequently enters the outer loop.

To our knowledge, this is the first stock market study that employs STL decomposition before applying the MF-DFA. Isolating the remaining components allows us to exclude the seasonal oscillations that could be generated by the annual and sub-annual trading cycles. We have applied the STL decomposition with the scope of removing the seasonal components and benefiting from more reliable results but also to have information on the inner dynamics of stock market returns, as suggested by [51]. STL has several important advantages compared to other time series decomposition methods, such as TRAMO/SEATS [52] and X11 [53]. First, STL can handle any type of seasonality (not only monthly and quarterly data). Second, its seasonal component is allowed to change over time. Third, the user can specify both the rate of change in the seasonal component and the smoothness of the trend cycle. Finally, the method is more robust to outliers.

In this study, the STL decomposition is implemented in the R statistical package using the stl function of the stats library [51,54]. We set the function parameters as follows: (i) the span of the loess window for seasonal extraction (s.window) is set to 21 (i.e., the number of trading days in a calendar month); (ii) the number of backfitting iterations (inner) is set to 1; (iii), the number of outer iterations (outer) is set to 15; (iv) the degree of locally-fitted polynomial in seasonal extraction (s.degree) is set to 1; the other parameters are left as default. The parameter choices in (ii) and (iii) are robust iteration options necessary to minimize effects of outliers, and (iv) is necessary for better handling of seasonal effects.

3.3. Stage 3: MF-DFA

The multifractal detrended fluctuation analysis (MF-DFA) is the strongest technique for detecting multifractality in a time series [51]. It takes the average volatility of the time series in each interval as a statistical point that is subsequently used to calculate volatility functions. It then determines generalized Hurst exponents based on the power law of volatility functions [55]. The important advantage of MF-DFA over other approaches is its ability to detect long-term correlations in non-stationary time series. Below we outline the key steps and formulas underlying the analysis.

Let R(i) for i = 1,⋯,N be a possibly non-stationary time series of the remainder component resulting from the STL decomposition of stock market returns (2), where N indicates series length. The first step of the MF-DFA is to construct the “profile”, Y(j), by integration after subtracting from the time series, R(i) its average, [51]:

The second step of the MF-DFA is to divide the profile Y(j) into Ns ≡ int (N/s) non-overlapping segments of equal length s. Observe that time scale N is not usually an integer multiple of length s. Therefore, one can disregard a short part of the profile Y(j) at the end, and the sub-division is also realized starting from the opposite end. As a result, a total of 2 Ns segments is obtained.

In the third step of MF-DFA, we compute the local trend for each of the 2Ns segments by a least-squares fit of the series. This involves fitting a polynomial of degree m to approximate the profile in each of the 2Ns windows. The variance is then calculated using the following formulas:

for each segment ν, ν = 1,⋯,Ns, and

for ν = Ns+1,⋯,2Ns, where is the polynomial fit in segment v.

The fourth step of the MF-DFA involves averaging over all segments from the second step to obtain the qth-order fluctuation functions

And

The parameter q helps distinguishing between segments with small and large fluctuations. The negative value of the q parameter enhances the small fluctuations, whereas a positive one enhances the large fluctuations. For q = 2, we have a special case of a well-known detrended fluctuation analysis [56]. Observe that Fq(s) is an increasing function of s.

In the final step we determine the scaling exponent of the fluctuation function for any fixed q and obtain the relationship between Fq(s) and s. If Fq(s) is a power law, the series are in the log-log scale for that particular q:

The exponent hq is called a generalized Hurst exponent. In the special case of stationary series, h2 becomes the well known Hurst exponent [57]. One can use the Hurst exponents in order to measure market efficiency [23,45,46,58]. A Hurst exponent value that ranges between 0.5 and 1 would imply a positive autocorrelation (a persistent behavior), characterized by long memory effects, which occur regardless of the time scale. Values closer to 1 indicate the presence of large and abrupt changes. A Hurst exponent value that ranges between 0 and 0.5 indicates negative autocorrelation—a change of the trend (an anti-persistent behavior) [41]. Antipersistence means to cover less distance, by reverting itself more frequent than a random process. According to Peters [59], a value of H equal to 0.5 (q = 0) reflects a Brownian time series or otherwise, a classical random walk.

Generally speaking, the series is characterised by multifractality if the exponent hq depends on q, and it monotonically decreases as q increases. The series is mono-fractal when hq does not depend on q [51].

The hq resulting from MF-DFA can also be expressed as a function of the Renyi exponent, :

Another illustrative way to analyze whether the time series is mono- or multifractal is by the multifractal spectrum:

where α is the Hölder exponent:

The multifractal spectrum shows the importance of each of the various fractal exponents in the series. Finally, the range of generalized Hurst exponents, , is another helpful measure of the degree of multifractality. A higher indicates a more multifractal series.

4. Results

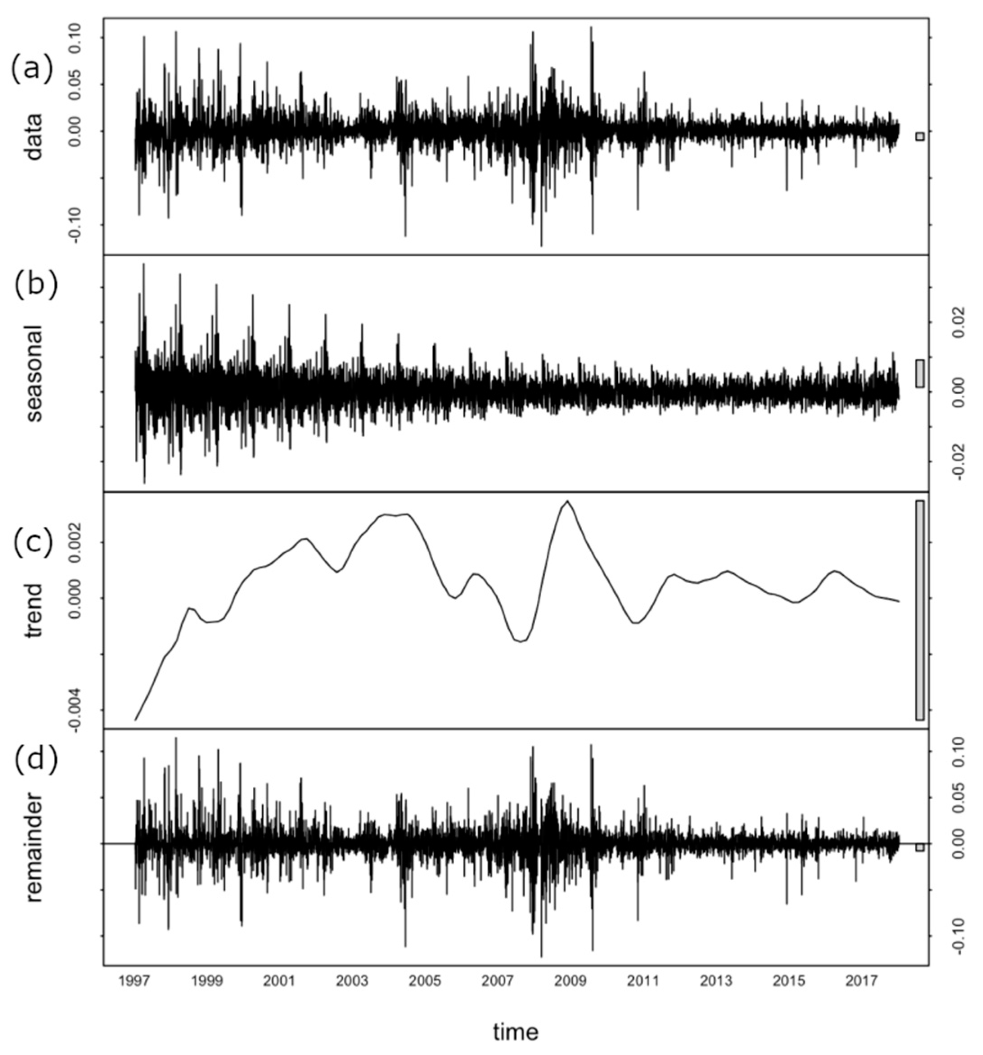

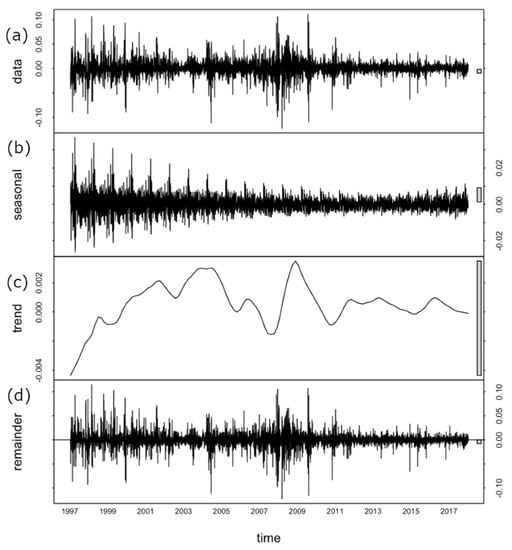

Figure 1 presents, by way of illustration, the three constituent elements for the Romanian stock market index, BET: the seasonal (Figure 1b), trend (Figure 1c), and remainder (Figure 1d). The results of STL decomposition of other stock returns time series are similar and are available in the Supplementary Materials (due to space constraints). In Figure 1, there can be noticed the annual oscillation that characterizes the seasonal component, which is consistent with earlier findings that stock market returns have a clear seasonal pattern [60]. On the contrary, the trend component does not show a large temporal evolution of stock index returns, and the range of variability is very small (i.e., its coefficient of variation is close to zero). The remainder does not follow a regular pattern, experiencing high frequency fluctuations, that could be explained by other macroeconomic determinants, such as, e.g., the financial crisis of 2008–2009 [61,62]. The remaining component presents a noisy character which is not, however, a pure random noise. As we show below, the application of MF-DFA to the remainder ensures capturing the dynamic characteristics of the inner fluctuations of the stock returns.

Figure 1.

STL decomposition of stock returns time series (Romanian stock market index, BET). (a): the original time series, (b): seasonal component, (c): trend component, (d): remaining component. Source: Authors.

We applied the MF-DFA to the remaining components of the stock market return time series for seven CEE stock market indices. The analysis was implemented in R using the mfdfa library [63]. As the time trend component was already isolated by the STL decomposition, for each of the stock market index series, we selected the first-degree (i.e., m = 1) detrending polynomial in order to realize the MF-DFA. The time scales ranged from 10 to N/5 days.

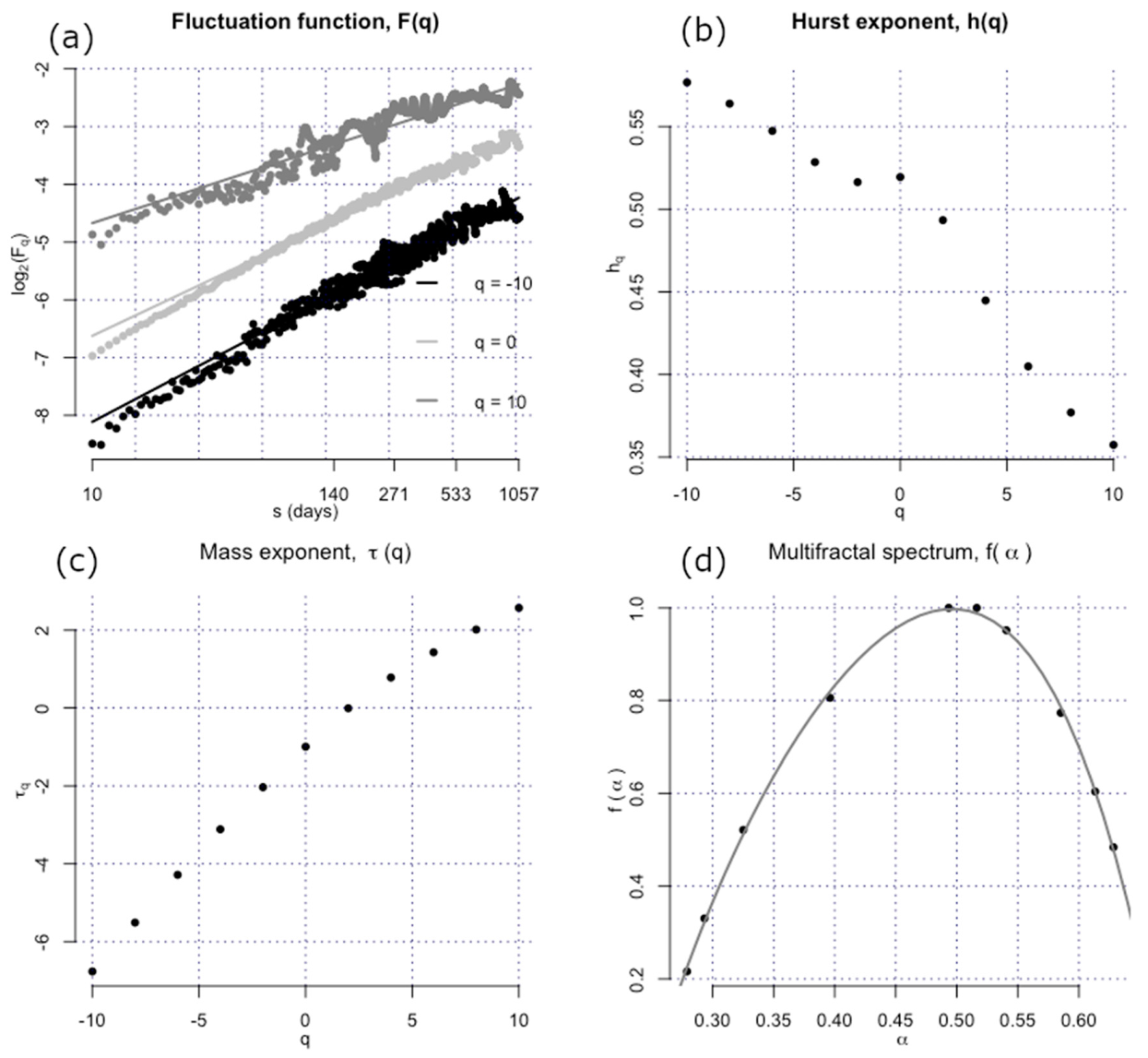

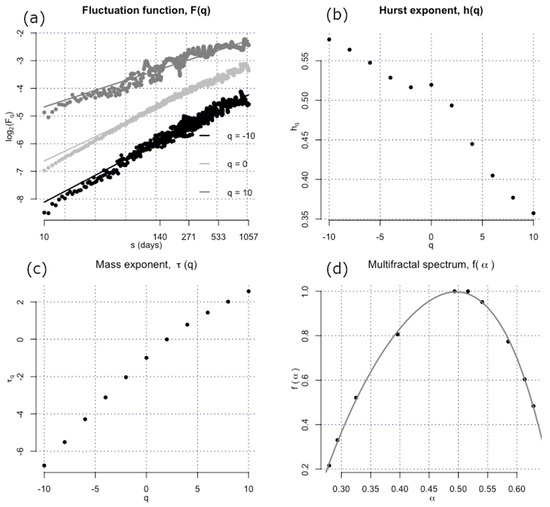

Figure 2 reveals, by way of illustration, the MF-DFA results for the remaining component of the Romanian stock market index, BET (shown in Figure 1d). The MF-DFA results of other stock returns time series are similar and are available in the Supplementary Materials. As can be seen in Figure 2, the presence of scaling for any q is pointed out by the fluctuation functions, which are well fitted and present a straight line in log–log scales. The Hurst exponent (H) is estimated with the help of F2. In the case of stationary series, the Hurst exponent is computed by setting q = 2 for the scaling exponent. In our case, H = 0.49, which suggests that there is a low persistence that characterizes the remaining component.

Figure 2.

The MF-DFA results of stock returns time series (Romanian stock market index, BET). (a) Fluctuation functions for q = −10, q = 0, q = 10. (b) Generalized Hurst exponent for each q. (c) Renyi exponent, τ(q). (d) Multifractal spectrum. Source: Authors.

Figure 2b indicates the dependence of the generalized Hurst exponent with q. One can observe that the function is decreasing, which proves the existence of patterns of multifractality in the time fluctuations of the remainder. Figure 2c shows the Renyi exponent, τ(q). For monofractal series, τ(q) is linear, while for multifractal series, it is nonlinear. We see that τ(q) has an exponential shape, which indicates multifractality. Figure 2d shows the multifractal spectrum obtained from Equations (11) and (12). Consistent with other indicators, the multifractal spectrum exhibits a single-humped shape, usually describing the multifractal series. Finally, we calculate the range of generalized Hurst exponents, . The range measures the level of multifractality, being known the fact that the larger this range the more multifractality resides in the series [15]. For the Romanian stock market index, we found = 0.22. Thus, the remainder of the stock market index is characterized by high multifractality, the time dynamics being mostly governed by large volatility.

The examination of MF-DFA of the remaining components for the other six indices shows a similar pattern. Table 2 summarizes the calculated generalized Hurst exponents for the seven CEE stock indices over the range of . We see that for all these indices, h(q) is a decreasing function, which indicates the presence of multifractality in the time fluctuations of the remaining component [51]. The range of generalized Hurst exponents, , is the widest for the Czech Republic and Bulgarian indices (0.32 and 0.35, respectively), indicating the largest degree of multifractality, and the narrowest for the Slovenian and Croatian indices (0.15 and 0.2, respectively), indicating the smallest degree of multifractality. Furthermore, nonlinear temporal correlation represents the major contribution in multifractality formation instead of a fat-tailed distribution.

Table 2.

Generalized Hurst exponents for 7 CEE stock indices and their range over

Comparing the results obtained for all seven stock market indices, keeping in consideration that the efficiency of the stock markets is associated with their multifractal properties [62], the most efficient stock market in this analysis is the Slovenian one, while the least efficient is Bulgaria. The Romanian stock market is somewhere in the middle. These results are interesting given the domestic market capitalization for the considered CEE markets, one of the usual indicators of stock market development. The statistical data for 2018 [64] rank the Polish, Czech, and Hungarian stock markets as the most developed, in terms of market capitalization, followed by Romania, Croatia, Bulgaria, with Slovenia last.

Our results based on the classical Hurst exponent (q = 2) would point to the Polish, Czech, Hungarian, and Romanian markets as being characterized by a negative autocorrelation (anti-persistent fluctuations), meaning that an increase (decrease) in the previous period will be followed by a decrease (increase) in the succeeding period. The other three markets (Bulgarian, Slovenian, and Croatian markets) show a positive autocorrelation behavior (a consistent behavior), when an increase (decrease) in the previous period would be followed by an increase (decrease) in the succeeding period. Here, we could presume (without further evidence, that must be provided) that the level of development of the CEE stock markets could have a role in the kind of efficiency behavior measured by the Hurst exponent.

These results must be interpreted with caution, considering the well-known fact that the long memory character of the time series changes with the length of time period used [61]. The few studies that were realized with a sample of the CEE stock markets had different time frames. We can say, however, that the results are in line with the previous findings [28,29,30,31,32] regarding the evidence of multifractality of all the CEE stock markets. Similar to the results reported by Ferreira [32], the Bulgarian market is seen as the market with the highest range of multifractality in the series. Consistent with the finding of Plesoianu [30], the Romanian stock market presents multifractality. However, in our study, the Romanian market is the one which partially does not reject the random walk hypothesis (when computing the classical Hurst exponent (q = 2)). This result might explain the recent FTSE Equity Country Classification from September 2019 [65] which suggests a possible reclassification for Romania from frontier to secondary emerging (i.e., an improvement in efficiency). Regarding the most developed stock markets in the region (the Polish, Czech, and Hungarian markets), the results of our study contradict the results obtained by Caraiani [31], which indicate a persistent behavior for these time series, the Hurst exponent being in their case lower than 0.5.

5. Conclusions

In this paper, we aim to determine the degree of efficiency of seven CEE stock markets, members of the European Union, for which the previous empirical literature suggests mixed results. We use MF-DFA to detect the existence of multifractality in the indices (serial dependence in stock indices). The present study suggests that stock market returns are not a random process as the efficient market hypothesis would predict, but rather a process influenced by both large and small fluctuations in some periods. This translates into a lower degree of market efficiency for all of the considered CEE stock markets. Using recent data, up to August 2018, for the daily values of the CEE blue-chip indexes, the results of our analysis do not support weak-form efficiency for any of the CEE stock markets. However, we have identified the largest degree of multifractality (i.e., the lowest market efficiency) in the case of the Bulgarian and Czech markets, while the lowest level of dependence is achieved in the Slovenian and Croatian markets. Our results do not exclude, however, the theory that stock markets can become more efficient as they develop [47]. In fact, one possible explanation for the obtained results could be the underdevelopment of these stock markets, as noted also by Ferreira [32]. The CEE stock exchanges are differently classified as follows [65]: developed (Poland), advanced emerging (Czech Republic, Hungary), and frontier (Bulgaria, Croatia, Romania, Slovenia). For instance, the four stock markets classified as frontier still failed “developed equity market” and “liquidity” criteria, and therefore sustainable growth is highly important [6]. It is likely that in the next economic cycles, with the increase of market capitalization, depth, and liquidity of the markets, a weak form of market efficiency to be found in for all the considered CEE markets.

The results must be interpreted with caution given the well-known fact that the long memory character of stock market index time series changes with the length of time period used [61]. We can say that the results are in line with the previous findings [28,29,30,31,32] regarding the existence of multifractality on the CEE stock markets. Similar to Ferreira [32], we find that the Bulgarian market is seen as the market with the highest range of multifractality in the series.

Our results are of high importance both for policy makers, in their endeavor to ensure long-term, sustainable growth of the financial markets, and for practitioners (portfolio managers and individual investors) thriving to exploit market inefficiencies and implement suitable market strategies. The less efficient markets will be of interest to those portfolio managers and individual investors looking to obtain abnormal returns, while efficient markets will better reflect the interests of agents looking for a better estimation of risk and return and of the optimal ratio between them. In accordance with the opinion of Guidi et al. [2], we consider the efficient markets hypothesis to have a dual role: as a theoretical and predictive model for the performed operations of the financial markets and as an instrument to attract investors to developing markets, such as CEE stock markets.

Our work does have some methodological issues that could be improved in the future. For example, the application of a dynamic Hurst exponent, with estimation using different window lengths (a sliding windows approach) could offer important insight into the evolution of the CEE stock markets in order to see which stock markets have become more or less efficient over time. Further research could also identify the source of market inefficiency or the drivers of the strength of multifractal spectrum, as well as the determinants of the development of the CEE stock markets and of the possible policies that could drive further sustainable development. Factors such as the traditional financing patterns for CEE companies, which are prone to internal funding and loan finance, relatively young institutional investor involvement, given the only recent pension system reform, the poor enforcement of the investor protection laws, as well as the existence of relative high trading and information costs are just a few of the possible reasons of market inefficiency. By contrast, factors such as increased financial disclosure, innovation, and enforcement of the investor protection law could spur the stock market credibility and efficiency, leading to a more sustainable growth of the CEE stock exchanges. Future research could also consider the direction taken by Bosch-Badia et al. [66], who raises awareness of the way the stock markets are evolving and approaching ethics recently, in terms of sustainability (environmental, social, and financial) and supporting the idea that stock markets become efficient when prices become equal to the sustainable value.

While the CEE stock exchanges are still underdeveloped in comparison with their western European counterparts in terms of market capitalization, trade volume, number of issuers, or availability of the financial instruments, the size and depth of the stock exchanges in the CEE economies have clearly experienced an upward trend, which emphasizes the potential role of the CEE stock markets in ensuring sustainable economic growth, as documented by the finance-growth nexus theories.

Supplementary Materials

The following are available online at https://www.mdpi.com/2071-1050/12/2/535/s1, Figure S3: STL decomposition of stock returns time series (Polish stock market index, WIG-20), Figure S4: STL decomposition of stock returns time series (Czech stock market index, PX), Figure S5: STL decomposition of stock returns time series (Croatian stock market index, CROBEX), Figure S6: STL decomposition of stock returns time series (Hungarian stock market index, BUX), Figure S7: STL decomposition of stock returns time series (Bulgarian stock market index, SOFIX), Figure S8: STL decomposition of stock returns time series (Slovenian stock market index, SBI-TOP), Figure S9: The MF-DFA results of stock returns time series (Polish stock market index, WIG-20), Figure S10: The MF-DFA results of stock returns time series (Czech stock market index, PX), Figure S11: The MF-DFA results of stock returns time series (Croatian stock market index, CROBEX), Figure S12: The MF-DFA results of stock returns time series (Hungarian stock market index, BUX), Figure S13: The MF-DFA results of stock returns time series (Bulgarian stock market index, SOFIX), Figure S14: The MF-DFA results of stock returns time series (Polish stock market index, WIG-20), Figure S15: The MF-DFA results of stock returns time series (Slovenian stock market index, SBI-TOP).

Author Contributions

The paper is the result of cooperation between five authors. M.C.M. and L.R.M. identified the concepts, completed the methodology and project administration, the formal analysis and investigation, and the supervision and writing of the original draft. C.H. completed the data curation, collected the data for the stock markets, used the software, validated the data, and completed data visualization. F.M.B. and C.B. completed the changes in the paper according to the reviews provided and edited the final paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- World Economic Forum. Available online: http://www3.weforum.org/docs/WEF_accelerating-capital-markets-development-in-emerging-economies.pdf (accessed on 6 December 2019).

- Guidi, F.; Gupta, R.; Maheshwari, S. Weak-form market efficiency and calendar anomalies for Eastern European equity markets. J. Emerg. Mark. Financ. 2011, 10, 337–389. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and growth: Schumpeter might be right. Q. J. Econ. 1994, 108, 717–737. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R. Stock markets, banks and growth: Panel evidence. J. Bank. Financ. 2004, 28, 423–442. [Google Scholar] [CrossRef]

- Levine, R.; Zervos, S. Stock markets, banks, and economic growth. Am. Econ. Rev. 1998, 88, 537–558. [Google Scholar]

- Caporale, G.M.; Rault, C.; Sova, A.; Sova, R. Financial development and economic growth: Evidence from 10 new European Union members. Int. J. Financ. Econ. 2015, 20, 48–60. [Google Scholar] [CrossRef]

- Nyasha, S.; Odhiambo, N.M. Do banks and stock markets spur economic growth? Kenya’s experience. Int. J. Sustain. Econ. 2015, 7, 54–65. [Google Scholar] [CrossRef]

- Arestis, P.; Demetriades, P. Financial development and economic growth: Assessing the evidence. Econ. J. 1997, 107, 783–799. [Google Scholar] [CrossRef]

- Marques, L.M.; Fuinhas, J.A.; Marques, A.C. Does the stock market cause economic growth? Portuguese evidence of economic regime change. Econ. Model. 2013, 32, 316–324. [Google Scholar] [CrossRef]

- Sinha, D.; Macri, J. Financial Development and Economic Growth: The case of Eight Asian Countries. Econ. Internazionale 2001, 54, 219–234. [Google Scholar]

- Gupta, R. Emerging Market Diversification: Are Correlations Changing Over Time? In Proceedings of the International Academy of Business & Public Administration Disciplines Conference (IABPAD 2006), Orlando, FL, USA, 3–6 January 2006. [Google Scholar]

- Botoc, C. Individual and regional efficiency in emerging stock markets: Empirical investigations. J. Appl. Econ. Sci. 2015, 10, 70–81. [Google Scholar]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Mandelbrot, B.B. Fractals and Scaling in Finance; Springer: New York, NY, USA, 1997. [Google Scholar]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef]

- Gu, R.; Chen, H.; Wang, Y. Multifractal analysis on international crude oil markets based on the multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2010, 389, 2805–2815. [Google Scholar] [CrossRef]

- Wang, Y.; Wei, Y.; Wu, C. Analysis of the efficiency and multifractality of gold markets based on multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2011, 390, 817–827. [Google Scholar] [CrossRef]

- Li, Z.; Lu, X. Multifractal analysis of China’s agricultural commodity futures markets. Energy Procedia 2011, 5, 1920–1926. [Google Scholar] [CrossRef][Green Version]

- Norouzzadeh, P.; Rahmani, B. A multifractal detrended fluctation description of Iranian rial—US dollar exchange rate. Phys. A Stat. Mech. Appl. 2006, 367, 328–336. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. Long-range dependence and multifractality in the term structure of LIBOR interest rates. Phys. A Stat. Mech. Appl. 2007, 373, 603–614. [Google Scholar] [CrossRef]

- Gorski, A.Z.; Drodz, S.; Septh, J. Financial multifractality and its subtleties: An example of DAX. Phys. A Stat. Mech. Appl. 2002, 316, 496–510. [Google Scholar] [CrossRef][Green Version]

- Cajueiro, D.O.; Tabak, B.M. Evidence of long range dependence in Asian equity markets: The role of liquidity and market restrictions. Phys. A Stat. Mech. Appl. 2004, 342, 656–664. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. The Hurst exponent over time: Testing the assertion that emerging markets are becoming more efficient. Phys. A Stat. Mech. Appl. 2004, 336, 521–537. [Google Scholar] [CrossRef]

- Tokić, S.; Bolfek, B.; Radman Peša, A. Testing efficient market hypothesis in developing Eastern European countries. Invest. Manag. Financ. Innov. 2018, 15, 281–291. [Google Scholar] [CrossRef]

- Di Matteo, T.; Aste, T.; Dacorogna, M.M. Long-term memories of developed and emerging markets: Using the scaling analysis to characterise their stage of development. J. Bank. Financ. 2005, 29, 827–851. [Google Scholar] [CrossRef]

- Barunik, J.; Aste, M.; Di Matteo, T.; Liu, R. Understanding the source of multifractality in financial markets. Phys. A Stat. Mech. Appl. 2012, 391, 4234–4251. [Google Scholar] [CrossRef]

- Matos, J.A.O.; Gama, S.M.A.; Ruskin, H.J.; Duarte, J.A.M. An econophysics approach to the Portuguese Stock Index—PSI-20. Phys. A Stat. Mech. Appl. 2004, 342, 665–676. [Google Scholar] [CrossRef]

- Jagric, T.; Podobnik, B.; Kolanovic, M. Does the efficient market hypothesis hold?: Evidence from six transition economies. East. Eur. Econ. 2005, 43, 79–103. [Google Scholar] [CrossRef]

- Domino, K. The use of the Hurst exponent to predict changes in trends on the Warsaw Stock Exchange. Phys. A Stat. Mech. Appl. 2011, 390, 98–109. [Google Scholar] [CrossRef]

- Pleșoianu, A.; Todea, A.; Căpușan, R. The informational efficiency of the Romanian stock market: Evidence from fractal analysis. Proc. Econ. Financ. 2012, 3, 111–118. [Google Scholar] [CrossRef]

- Caraiani, P. Evidence of multifractality from emerging European stock markets. PLoS ONE 2012, 7, e40693. [Google Scholar] [CrossRef]

- Ferreira, P. Long-range dependencies of Eastern European stock markets: A dynamic detrended analysis. Phys. A Stat. Mech. Appl. 2018, 505, 454–470. [Google Scholar] [CrossRef]

- Aktan, C.; Iren, P.; Omay, T. Market development and market efficiency: Evidence based on nonlinear panel unit root tests. Eur. J. Financ. 2019, 25, 979–993. [Google Scholar] [CrossRef]

- Smith, G. The changing and relative efficiency of European emerging stock markets. Eur. J. Financ. 2011, 18, 1–20. [Google Scholar] [CrossRef]

- Dragotă, V.; Tilică, E.V. Market efficiency of the post communist East European stock markets. Cent. Eur. J. Oper. Res. 2014, 22, 307–337. [Google Scholar] [CrossRef]

- Nurunnabi, M. Testing weak form efficiency of emerging economies: A critical review of the literature. J. Bus. Econ. Manag. 2012, 13, 167–188. [Google Scholar] [CrossRef][Green Version]

- Lim, K.P.; Brooks, R. The evolution of stock market efficiency over time: A survey of the empirical literature. J. Econ. Surv. 2011, 25, 69–108. [Google Scholar] [CrossRef]

- Gbenro, N.; Moussa, K.R. Asymmetric mean reversion in low liquid markets: Evidence from BRVM. J. Risk Financ. Manag. 2019, 12, 38. [Google Scholar] [CrossRef]

- Kasman, S.; Turgutlu, E.; Duygu Ayhan, A. Long memory in stock returns: Evidence from the major emerging Central European stock markets. Appl. Econ. Lett. 2009, 16, 1763–1768. [Google Scholar] [CrossRef]

- Karadagli, E.; Omay, N.C. Testing weak form market efficiency for emerging economies: A nonlinear approach. J. Appl. Econ. Sci. 2012, 7, 235–245. [Google Scholar]

- Kroha, P.; Skoula, M. Hurst exponent and trading signals derived from market time series. In Proceedings of the 20th International Conference on Entreprise Information systems (ICEIS), Funchal, Madeira, Portugal, 21–24 March 2018; pp. 371–378. [Google Scholar]

- Mandelbrot, B.B. The variation of some other speculative prices. J. Bus. 1967, 40, 393–413. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Koscielny-Bunde, E.; Rego, H.H.A.; Havlin, S.; Bunde, A. Detecting long—Range correlations with detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2001, 295, 441–454. [Google Scholar] [CrossRef]

- Morales, R.; Di Matteo, T.; Gramatica, R.; Aste, T. Dynamical generalized Hurst exponent as a tool to monitor unstable periods in financial time series. Phys. A Stat. Mech. Appl. 2012, 391, 3180–3189. [Google Scholar] [CrossRef]

- Kristoufek, L.; Vosvdra, M. Measuring capital market efficiency: Global and local correlations structure. Phys. A Stat. Mech. Appl. 2013, 392, 184–193. [Google Scholar] [CrossRef]

- Zunino, L.; Tabak, B.; Figliola, A.; Perez, D.; Garavaglia, M.; Rossi, O. A multifractal approach for stock market inefficiency. Phys. A Stat. Mech. Appl. 2008, 387, 6558–6566. [Google Scholar] [CrossRef]

- Hull, M.; Mcgroarty, F. Do emerging markets become more efficient as they develop? Long memory persistence in equity indices. Emerg. Mark. Rev. 2014, 18, 45–61. [Google Scholar] [CrossRef]

- Wold, H. A Study in the Analysis of Stationary Time Series; Almqvist and Wiksell Book Co.: Uppsala, Sweden, 1938. [Google Scholar]

- Cleveland, R.B.; Cleveland, W.S.; McRae, J.E.; Terpenning, I. STL: A seasonal-trend decomposition procedure based on loess. J. Off. Stat. 1990, 6, 3–73. [Google Scholar]

- Laib, M.; Telesca, L.; Kanevski, M. Long-range fluctuations and multifractality in connectivity density time series of a wind speed monitoring network. Chaos 2018, 28, 033108. [Google Scholar] [CrossRef] [PubMed]

- Laib, M.; Golay, J.; Telesca, L.; Kanevski, M. Multifractal analysis of the time series of daily means of wind speed in complex regions. Chaos Soliton Fractals 2018, 109, 118–127. [Google Scholar] [CrossRef]

- Gomez, V.; Maravall, A. Programs TRAMO and SEATS; Ministry of the Economy and Finance: Madrid, Spain, 1996; p. 9628.

- Shiskin, J.; Eisenpress, H.; Young, A.H.; Musgrave, J.C. The X-11 Variant of Census Method II Seasonal Adjustment Program; Bureau of the Census, Dept. of Commerce: Suitland, MD, USA, 1967; p. 15.

- Seasonal Decomposition of Time Series. Available online: https://stat.ethz.ch/R-manual/R-devel/library/stats/html/stl.html (accessed on 5 July 2019).

- Wang, W.; Liu, K.; Qin, Z. Multifractal analysis on the return series of stock markets using MF-DFA method. In Service Science and Knowledge Innovation. In Proceedings of the International Conference on Informatics and Semiotics in Organizations (ICISO 2014), Shanghai, China, 23–25 May 2014; pp. 107–115. [Google Scholar]

- Peng, C.K.; Havlin, S.; Stanley, H.E.; Goldberger, A.L. Quantification of scaling exponents and crossover phenomena in nonstationary heartbeat time series. Chaos 1995, 5, 82–87. [Google Scholar] [CrossRef]

- Feder, J. Fractals; Plenum Press: New York, NY, USA, 1988. [Google Scholar]

- Han, C.; Wang, Y.; Xu, Y. Efficiency and multifractality analysis of the Chinese stock market: Evidence from stock indices before and after the 2015 stock market crash. Sustainability 2019, 11, 1699. [Google Scholar] [CrossRef]

- Peters, E.E. Fractal Market Analysis—Applying Chaos Theory to Investment and Economics; John Wiley & Sons: New York, NY, USA, 1994. [Google Scholar]

- De Bondt, W.F.M.; Thaler, R.H. Further evidence on investor overreaction and stock market seasonality. J. Financ. 1987, 42, 557–581. [Google Scholar] [CrossRef]

- Šonje, V.; Alajbeg, D.; Bubaš, Z. Efficient Market Hypothesis: Is the Croatian Stock Market as (in) Efficient as the US Market. Financ. Theory Pract. 2011, 35, 301–326. [Google Scholar] [CrossRef]

- Anagnostidis, P.; Emmanouilides, C.; Varsakelis, C. Has the 2008 financial crisis affected stock market efficiency? The case of Eurozone. Phys. A Stat. Mech. Appl. 2016, 447, 116–128. [Google Scholar] [CrossRef]

- Laib, M.; Telesca, L.; Kanevski, M. MFDFA: Multifractal Detrended Fluctuation Analysis. Available online: https://www.researchgate.net/publication/319112061_MFDFA_MultiFractal_Detrended_Fluctuation_Analysis (accessed on 5 July 2019).

- WFE. Market Statistics. 2018. Available online: https://focus.world-exchanges.org/issue/december-2018/market-statistics (accessed on 23 November 2019).

- FTSE Russel. FTSE Equity Country Classification September 2019 Annual Announcement. Available online: https://research.ftserussell.com/products/downloads/FTSE-Country-Classification-Update_latest.pdf (accessed on 6 December 2019).

- Bosch-Badia, M.T.; Montllor-Serrats, J.; Tarrazon-Rodon, M.A. Sustainability and ethics in the process of price determination in financial markets: A conceptual analysis. Sustainability 2018, 10, 1638. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).