Analysis of the Value of Information and Coordination in a Dyadic Closed Loop Supply Chain

Abstract

:1. Introduction

2. Literature Review

2.1. Fundamentals

2.2. Articles Where Coordination and the Value of Information Positively Impact the Supply Chain Performance

2.3. Articles Where Coordination and the Value of Information Impact the Supply Chain Performance in a Neutral or Negative Way

2.4. Findings and Research Perspectives

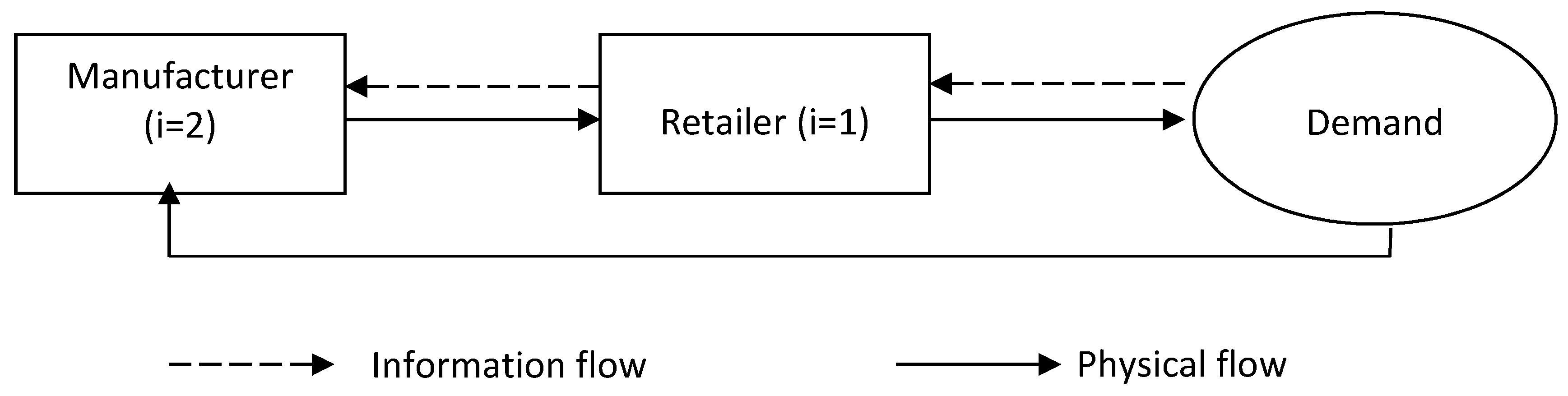

3. Materials and Methods

3.1. Linear Programming Models for Each Scenario

3.2. Design of the Experiment

4. Results

- Result 1: Information about returns is more important than information about customer demand.

- 2.

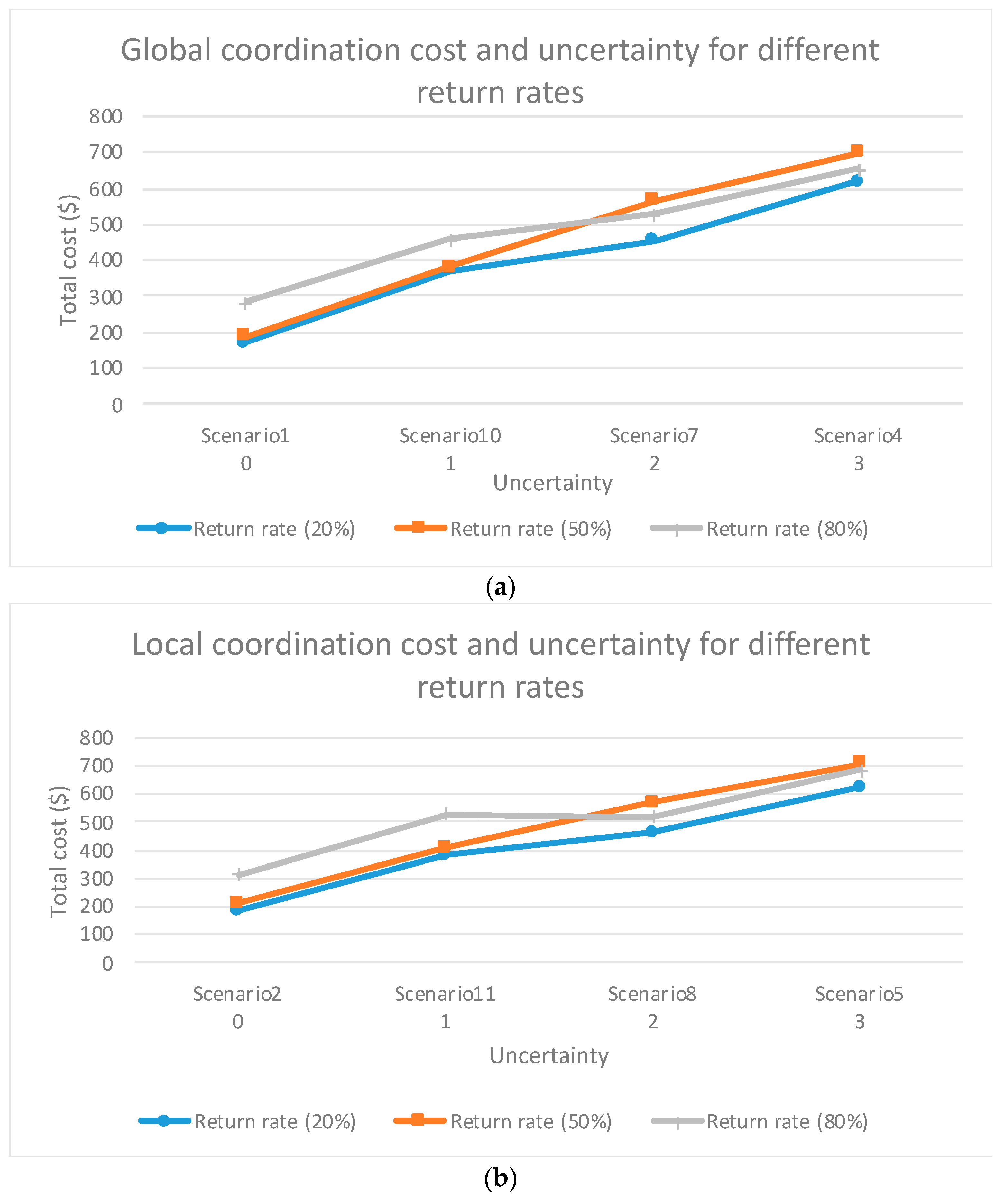

- Result 2: It is preferable to process low return rates since return rates greater than 20% imply an increase in supply chain cost due to the increase in holding costs, among others.

- 3.

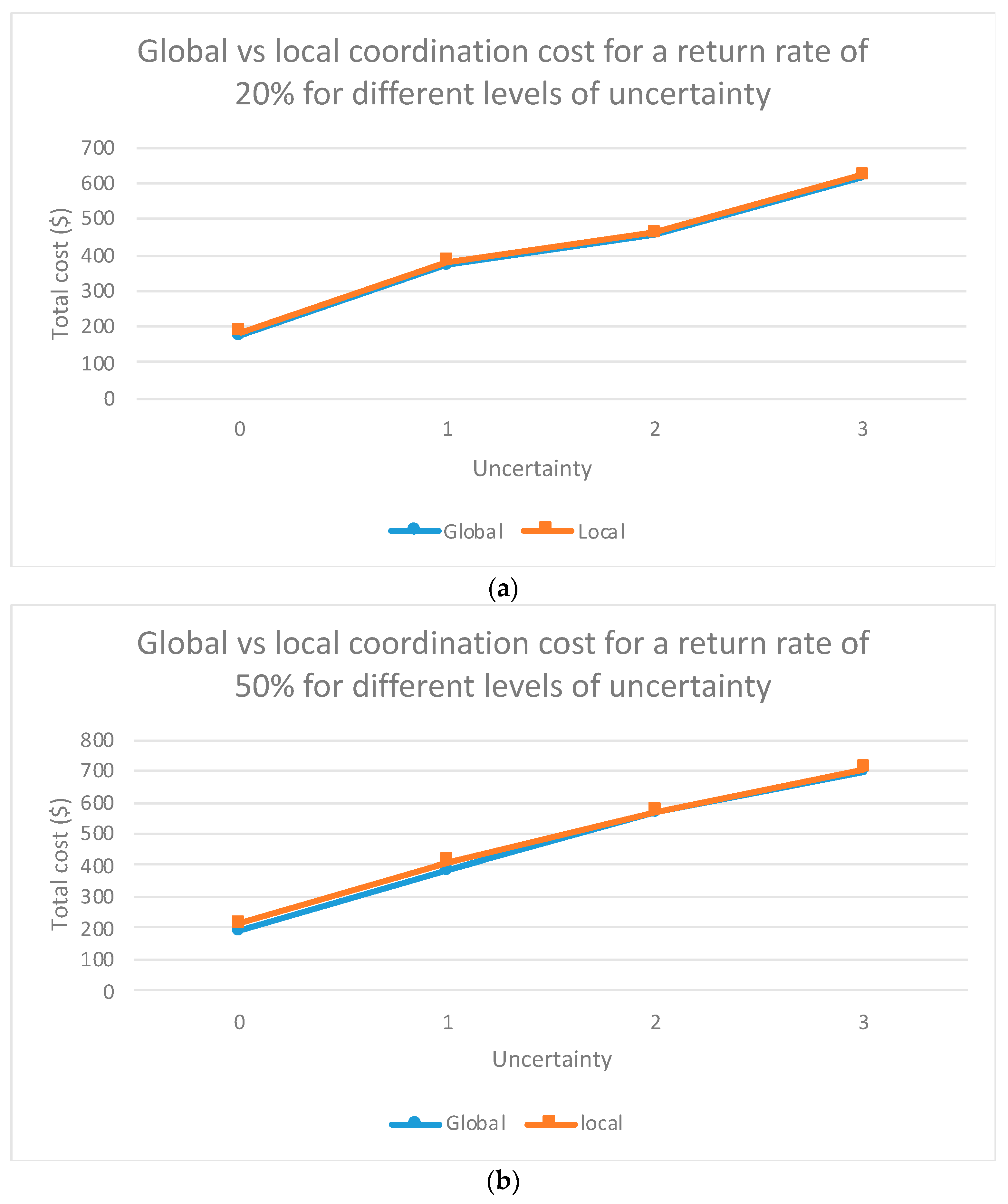

- Result 3: It is confirmed that global coordination does not necessarily achieve lower costs for the supply chain. Furthermore, this article verifies that this is still valid for different return rates and different levels of uncertainty.

- 4.

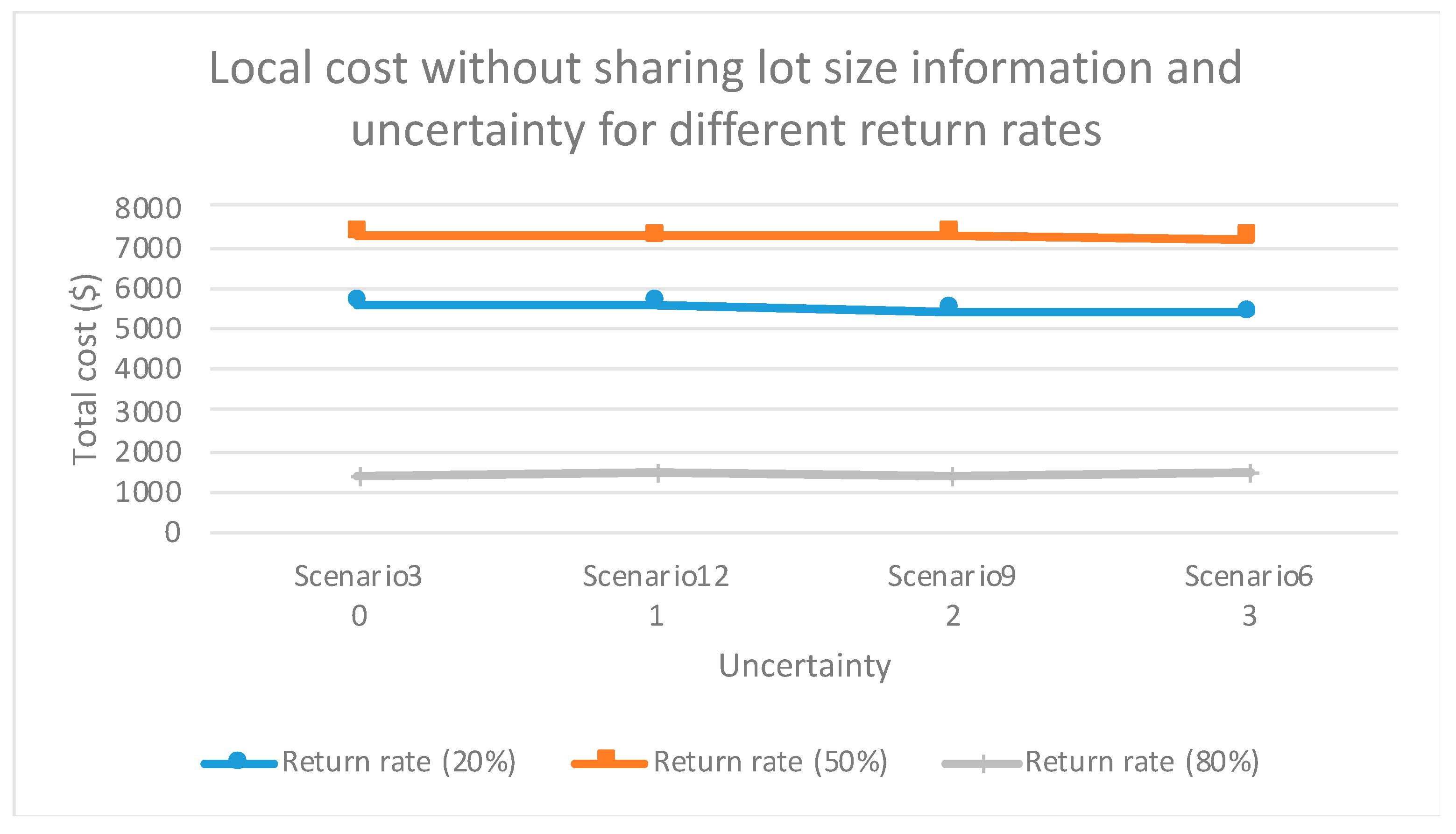

- Result 4: Without any type of coordination or information between the supply chain actors, it is preferable to have high levels of return since these returns operate as a buffer against uncertainty.

- 5.

- Result 5: If no information on lot size is exchanged, then exchanging information on demand or returns does not improve supply chain costs. Even for each return rate, the supply chain costs are almost constant.

5. Conclusions

- Managerial implication 1: A framework for the analysis of different coordination scenarios was proposed. This can help companies to position themselves in any of these scenarios and therefore define courses of action based on them. For example, what type of information to exchange, how much would they expect to gain in that case, and whether or not to undertake greater forms of collaboration with customers or suppliers.

- 2.

- Managerial implication 2: New linear programming models are proposed, which can be used by companies to determine their lot sizes in this context.

- 3.

- Managerial implication 3: By including uncertainty, returns, and different coordination scenarios, the models are closer to real life situations of the companies, therefore these models can be more useful for them.

- 4.

- Managerial implication 4: Information on returns leads to lower costs than information on demand. Therefore, if the company must make an economic effort to obtain or exchange information with the other actors in the chain, this information must be about returns.

- 5.

- Managerial implication 5: In the presence of complete or partial coordination between the actors in the chain, it is preferable to have low product return rates. However, if we are in the complete absence of coordination, high rates of return are more convenient as they function as a buffer against all the uncertainties.

- 6.

- Managerial implication 6: The perimeter of decision making (global or local optimization) does not significantly improve the supply chain performance in relation to its costs. Only the exchange of information improves its performance. Therefore, we are effectively verifying the value of the information for all the scenarios analyzed in this closed-loop supply chain. Therefore, companies should make efforts to exchange information, first, on their lot sizes, then on their returns, and finally, on customer demand.

- Limitations of the study: focusing only in inventory cost without considering other costs in the objective function of the model (for example, manufacturing, remanufacturing, quality of returns, etc.) and using a dyadic supply chain (future studies could consider more complex structures and verify the results by applying to a real case).

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Zhang, C.T.; Ren, M.L. Closed-loop supply chain coordination strategy for the remanufacture of patented products under competitive demand. Appl. Math. Model. 2016, 40, 6243–6255. [Google Scholar] [CrossRef]

- Li, J.; Wang, Z.; Jiang, B.; Kim, T. Coordination strategies in a three-echelon reverse supply chain for economic and social benefit. Appl. Math. Model. 2017, 49, 599–611. [Google Scholar] [CrossRef]

- Govindan, K.; Soleimani, H.; Kannan, D. Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. Eur. J. Oper. Res. 2015, 240, 603–626. [Google Scholar] [CrossRef] [Green Version]

- Weraikat, D.; Zanjani, M.K.; Lehoux, N. Coordinating a green reverse supply chain in pharmaceutical sector by negotiation. Comput. Ind. Eng. 2016, 93, 67–77. [Google Scholar] [CrossRef]

- Goyal, S.; Esposito, M.; Kapoor, A. Circular economy business models in developing economies: Lessons from India on reduce, recycle, and reuse paradigms. Thunderbird Int. Bus. Rev. 2018, 60, 729–740. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, A.B.; Rojas Luiz, J.V.; Rojas Luiz, O.; Jabbour, C.J.C.; Ndubisi, N.O.; Caldeira de Oliveira, J.H.; Junior, F.H. Circular economy business models and operations management. J. Clean. Prod. 2019, 235, 1525–1539. [Google Scholar] [CrossRef]

- Mishra, J.L.; Hopkinson, P.G.; Tidridge, G. Value creation from circular economy-led closed loop supply chains: A case study of fast-moving consumer goods. Prod. Plan. Control 2018, 29, 509–521. [Google Scholar] [CrossRef]

- Herczeg, G.; Akkerman, R.; Hauschild, M.Z. Supply chain collaboration in industrial symbiosis networks. J. Clean. Prod. 2018, 171, 1058–1067. [Google Scholar] [CrossRef]

- Winkler, H. Closed-loop production systems-A sustainable supply chain approach. CIRP J. Manuf. Sci. Technol. 2011, 4, 243–246. [Google Scholar] [CrossRef]

- Despeisse, M.; Baumers, M.; Brown, P.; Charnley, F.; Ford, S.J.; Garmulewicz, A.; Knowles, S.; Minshall, T.H.W.; Mortara, L.; Reed-Tsochas, F.P.; et al. Unlocking value for a circular economy through 3D printing: A research agenda. Technol. Forecast. Soc. Chang. 2017, 115, 75–84. [Google Scholar] [CrossRef] [Green Version]

- Malone, T.W.; Crowston, K. The Interdisciplinary Study of Coordination. ACM Comput. Surv. 1994, 26, 87–119. [Google Scholar] [CrossRef] [Green Version]

- Chen, F. Echelon reorder points, installation reorder points, and the value of centralized demand information. Manag. Sci. 1998, 44, 221–234. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.L.; So, K.C.; Tang, C.S. The Value of Information Sharing in a Two-Level Supply Chain. Manag. Sci. 2000, 46, 626–643. [Google Scholar] [CrossRef] [Green Version]

- Cachon, G.; Fisher, M. Supply chain inventory management and the value of shared information. Manag. Sci. 2000, 46, 1032–1048. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.L. Creating value through supply chain integration. Supply Chain Manag. Rev. 2000, 4, 30–36. [Google Scholar]

- Simatupang, T.M.; Sridharan, R. The Collaborative Supply Chain. Int. J. Logist. Manag. 2002, 13, 15–30. [Google Scholar] [CrossRef]

- Yuan, K.F.; Ma, S.H.; He, B.; Gao, Y. Inventory decision-making models for a closed-loop supply chain system with different decision-making structures. Int. J. Prod. Res. 2015, 53, 183–219. [Google Scholar] [CrossRef]

- Chung, S.; Wee, H.; Yang, P. Optimal policy for a closed-loop supply chain inventory system with remanufacturing. Math. Comput. Model. 2008, 48, 867–881. [Google Scholar] [CrossRef]

- Cannella, S.; Bruccoleri, M.; Framinan, J.M. Closed-loop supply chains: What reverse logistics factors influence performance? Int. J. Prod. Econ. 2016, 175, 35–49. [Google Scholar] [CrossRef] [Green Version]

- Chen, W.; Kucukyazici, B.; Verter, V.; Jesús Sáenz, M. Supply chain design for unlocking the value of remanufacturing under uncertainty. Eur. J. Oper. Res. 2015, 247, 804–819. [Google Scholar] [CrossRef]

- Ketzenberg, M. The value of information in a capacitated closed loop supply chain. Eur. J. Oper. Res. 2009, 198, 491–503. [Google Scholar] [CrossRef]

- de Brito, M.P.; van der Laan, E. Inventory control with product returns: The impact of imperfect information. Eur. J. Oper. Res. 2009, 194, 85–101. [Google Scholar] [CrossRef]

- Diabat, A.; Abdallah, T.; Henschel, A. A closed-loop location-inventory problem with spare parts consideration. Comput. Oper. Res. 2015, 54, 245–256. [Google Scholar] [CrossRef]

- Ferrer, G. Yield information and supplier responsiveness in remanufacturing operations. Eur. J. Oper. Res. 2003, 149, 540–556. [Google Scholar] [CrossRef]

- Ketzenberg, M.E.; Souza, G.C.; Guide, V.D.R. Mixed Assembly and Disassembly Operations for Remanufacturing. Prod. Oper. Manag. 2003, 12, 320–335. [Google Scholar] [CrossRef]

- Bazan, E.; Jaber, M.Y.; Zanoni, S. Carbon emissions and energy effects on a two-level manufacturer-retailer closed-loop supply chain model with remanufacturing subject to different coordination mechanisms. Int. J. Prod. Econ. 2017, 183, 394–408. [Google Scholar] [CrossRef]

- Hosoda, T.; Disney, S.M.; Gavirneni, S. The impact of information sharing, random yield, correlation, and lead times in closed loop supply chains. Eur. J. Oper. Res. 2015, 246, 827–836. [Google Scholar] [CrossRef] [Green Version]

- Adenso-Díaz, B.; Moreno, P.; Gutiérrez, E.; Lozano, S. An analysis of the main factors affecting bullwhip in reverse supply chains. Int. J. Prod. Econ. 2012, 135, 917–928. [Google Scholar] [CrossRef]

- Shi, J.; Zhang, G.; Sha, J. Optimal production planning for a multi-product closed loop system with uncertain demand and return. Comput. Oper. Res. 2011, 38, 641–650. [Google Scholar] [CrossRef] [Green Version]

- Yang, P.C.; Wee, H.M.; Chung, S.L.; Ho, P.C. Sequential and global optimization for a closed-loop deteriorating inventory supply chain. Math. Comput. Model. 2010, 52, 161–176. [Google Scholar] [CrossRef]

- Ketzenberg, M.; Laan, E.; Teunter, R. Value of information in closed loop supply chains. Prod. Oper. Manag. 2006, 15, 393–406. [Google Scholar] [CrossRef]

- Aras, N.; Verter, V.; Boyaci, T. Coordination and Priority Decisions in Hybrid Manufacturing/Remanufacturing Systems. Prod. Oper. Manag. 2006, 15, 528–543. [Google Scholar] [CrossRef]

- Uncertainty—Wikipedia. Available online: https://en.wikipedia.org/wiki/Uncertainty (accessed on 10 August 2020).

- Nativi, J.J.; Lee, S. Impact of RFID information-sharing strategies on a decentralized supply chain with reverse logistics operations. Int. J. Prod. Econ. 2012, 136, 366–377. [Google Scholar] [CrossRef]

- Dekker, R.; Fleischmann, M.; Inderfurth, K.; Wassenhove, L.N. Reverse Logistics: Quantitative Models for Closed-Loop Supply Chains; Springer Science & Business Media: Berlin, Germany, 2013; ISBN 978-3-540-24803-3. [Google Scholar]

- Van der Laan, E.; Salomon, M.; Dekker, R.; Van Wassenhove, L. Inventory Control in Hybrid Systems with Remanufacturing. Manag. Sci. 2008, 45, 733–747. [Google Scholar] [CrossRef]

- Simatupang, T.M.; Wright, A.C.; Sridharan, R. The knowledge of coordination for supply chain integration. Bus. Process Manag. J. 2002, 8, 289–308. [Google Scholar] [CrossRef]

- Fisher, M.L. What is the right supply chain for your product? Harv. Bus. Rev. 1997, 75, 105–117. [Google Scholar]

- Sepulveda Rojas, J.P.; Frein, Y. Coordination and demand uncertainty in supply chains. Prod. Plan. Control 2008, 19, 712–721. [Google Scholar] [CrossRef]

- Yang, P.C.; Chung, S.L.; Wee, H.M.; Zahara, E.; Peng, C.Y. Collaboration for a closed-loop deteriorating inventory supply chain with multi-retailer and price-sensitive demand. Int. J. Prod. Econ. 2013, 143, 557–566. [Google Scholar] [CrossRef]

- Al-Salem, M.; Diabat, A.; Dalalah, D.; Alrefaei, M. A closed-loop supply chain management problem: Reformulation and piecewise linearization. J. Manuf. Syst. 2016, 40, 1–8. [Google Scholar] [CrossRef]

- Giri, B.C.; Sharma, S. Optimizing a closed-loop supply chain with manufacturing defects and quality dependent return rate. J. Manuf. Syst. 2015, 35, 92–111. [Google Scholar] [CrossRef]

- Sterman, J.D. Teaching Takes Off: Flight Simulators for Management Education; OR/MS Today: Catonsville, MD, USA, 1992; pp. 40–44. [Google Scholar]

| Author | Supply Chain Structure | Information Shared | Information About Returns | Coordination and Value of Information |

|---|---|---|---|---|

| (F. Chen, 1998) | Serial inventory system with N stages | Demand | n/a | Positive |

| (Lee, So, and Tang, 2000) | One manufacturer, one retailer | Demand, lead time | n/a | Positive |

| (Cachon and Fisher, 2000) | 1 manufacturer, N retailers | Demand | n/a | Positive |

| (Ketzenberg, 2009) | 1 manufacturer/remanufacturer | Demand, returns, capacity, return performance | Yes | Neutral or negative |

| (Aras, Verter, and Boyaci, 2006) | 1 manufacturer/remanufacturer | Priority | Yes | Neutral or negative |

| (Ketzenberg, Souza, and Guide, 2003) | 1 manufacturer/remanufacturer | Information performance | Yes | Neutral or negative |

| (Ketzenberg, Laan, and Teunter, 2006) | 1 manufacturer/remanufacturer | Demand, returns, returns performance | Yes | Neutral or negative |

| (de Brito and van der Laan, 2009) | Single echelon | Lead time, demand | Yes | Neutral or negative |

| (Yuan et al., 2015) | A retailer, a manufacturer, a supplier, and a collector | Lead time, cycle times, demand | Yes | Positive |

| (Bazan, Jaber, and Zanoni, 2017) | 1 manufacturer, 1 retail | Batch size, number of remanufactured and new products, number of times a product is remanufactured. | Yes | Neutral or negative |

| (Yang et al., 2013) | 1 manufacturer, N retailers | Inventory in retail and producer, shipments of products to and from the retailer | Yes | Positive |

| (Diabat, Abdallah, and Henschel, 2015) | l retailers, m remanufacturing centers and n distribution centers | Location, transport, and inventory stock decisions | Yes | Neutral or negative |

| (Shi, Zhang, and Sha, 2011) | 1 manufacturer/remanufacturer | Batch sizes of new and remanufactured products | Yes | Neutral or negative |

| (Al-Salem et al., 2016) | 1 manufacturer, N distribution centers, M retailers | Warehouse allocation and inventory policy | Yes | Positive |

| (Chung, Wee, and Yang, 2008) | 1 manufacturer, 1 retail | Manufacturing and remanufacturing rates, demand, returns, setup, and holding costs. | Yes | Positive |

| (Yang et al., 2010) | A manufacturer, a retailer, a collector and a material supplier. | Number of deliveries of new and remanufactured products and acquisition of products | Yes | Positive |

| (Giri and Sharma, 2015) | A retailer, 1 manufacturer, 1 supplier and 1 collector | Production rates, number of deliveries, return rates, remanufactured products | Yes | Positive |

| (Adenso-Díaz et al., 2012) | 5 echelon supply chain | Inventories, lot sizing, shipments | Yes | Positive |

| (Cannella, Bruccoleri, and Framinan, 2016) | 1 manufacturer/remanufacturer | Backlogs, products collected, inventory, remanufactured products, and shipments. | Yes | Positive |

| (W. Chen et al., 2015) | 1 manufacturer, n distribution centers, | Market size, returns, yield recovery, shipments | Yes | Positive |

| (Hosoda, Disney, and Gavirneni, 2015) | 1 manufacturer, 1 remanufacturer | Levels of inventory, demand, and returns | Yes | Positive |

| Information Shared (Value of Information) | Decision Making Perimeter | ||||

|---|---|---|---|---|---|

| Information status | Demand | Returns | Lot Sizing | Global | Local |

| Everything is known | Yes | Yes | Yes | Scenario 1 | Scenario 2 |

| Everything is known | Yes | Yes | No | Scenario 3 | |

| Nothing is known | No | No | Yes | Scenario 4 | Scenario 5 |

| Nothing is known | No | No | No | Scenario 6 | |

| Partially known | Yes | No | Yes | Scenario 7 | Scenario 8 |

| Partially known | Yes | No | No | Scenario 9 | |

| Partially known | No | Yes | Yes | Scenario 10 | Scenario 11 |

| Partially known | No | Yes | No | Scenario 12 | |

| Demand/Return | Forecast and Uncertainty |

|---|---|

| Dt ~ U (8;12) | Fdt~Dt + U (−1;1) |

| Fdt~Dt + U (−2;2) | |

| Fdt~Dt + U (−3;3) | |

| Rt (20%) ~ Dt × 20% | Frt ~ Rt (20%) + U (−1;1) |

| Frt ~ Rt (20%) + U (−2;2) | |

| Frt ~ Rt (20%) + U (−3;3) | |

| Rt (50%) ~ Dt × 50% | Frt ~ Rt (50%) + U (−1;1) |

| Frt ~ Rt (50%) + U (−2;2) | |

| Frt ~ Rt (50%) + U (−3;3) | |

| Rt (80%) ~ Dt × 80% | Frt ~ Rt (80%) + U (−1;1) |

| Frt ~ Rt (80%) + U (−2;2) | |

| Frt ~ Rt (80%) + U (−3;3) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sepúlveda-Rojas, J.P.; Ternero, R. Analysis of the Value of Information and Coordination in a Dyadic Closed Loop Supply Chain. Sustainability 2020, 12, 8398. https://doi.org/10.3390/su12208398

Sepúlveda-Rojas JP, Ternero R. Analysis of the Value of Information and Coordination in a Dyadic Closed Loop Supply Chain. Sustainability. 2020; 12(20):8398. https://doi.org/10.3390/su12208398

Chicago/Turabian StyleSepúlveda-Rojas, Juan Pedro, and Rodrigo Ternero. 2020. "Analysis of the Value of Information and Coordination in a Dyadic Closed Loop Supply Chain" Sustainability 12, no. 20: 8398. https://doi.org/10.3390/su12208398