Abstract

The carbon tax is a cornerstone of the climate policy in Sweden. Historically, it has played a central role in the replacement of fossil fuels in the heating sector. The purpose of this paper was to analyze the policy-making process that led to the formulation and adoption of the carbon tax in the Swedish heating sector, from 1980 to 1991. We used the Advocacy Coalition Framework (ACF), according to which policy actors form coalitions based on shared beliefs. Drawing from both literature and empirical experiences gathered through in-depth interviews, we identified supporting and opposing coalitions that diverged in their views concerning bioenergy development and the potential impact of the carbon tax. This study illustrates the complex conditions for introduction of environmental taxes and expansion of new industries, particularly when established businesses perceive the new activities as a threat. The Swedish experience shows that countries can progress by exploring internal synergies and innovative policy designs, despite potential resistance of established constituencies. The successful adoption of the carbon tax in the Swedish heating sector serves as inspiration for policymakers in other sectors and countries, as they contemplate policies to promote the decarbonization of the energy system.

1. Introduction

Sweden was one of the first countries to introduce a carbon tax on fossil fuels [1,2]. The tax was applied on motors and heating fuels, and based on the carbon content of the fuel [3,4]. The adoption of the carbon tax led to a sharp decline in the use of fossil fuels in heating, whereas the goal of a fossil-free transport sector remains a major challenge [5]. In fact, the expansion of biomass utilization in the district heating (DH) system was one of the clearest effects of the implementation of the carbon tax in Sweden [6,7]. In-depth understanding of the process that led to the adoption of the carbon tax and its successful outcomes may help unveil valuable lessons, and serve as inspiration for policy in other country contexts. Policies are being called for to support the transition to a low-carbon energy sector, and help mitigate climate change. The experiences from Sweden as an early adopter of the carbon tax can serve as examples to other decision-makers and stakeholders who are looking for ways to promote bioenergy and sustainable energy matrices in their countries.

The objective of this paper is to analyze the process of formulation and adoption of the carbon tax in the Swedish district heating sector. For that, we apply the Advocacy Coalition Framework (ACF). ACF is used to describe the policy-making process over a certain period of time, when distinct coalitions composed by several actors are formed [8,9,10]. These coalitions work to induce change by incorporating their beliefs into governmental programs and policies [11].

The period of analysis goes from 1980 to 1991, when the tax was finally adopted. In 1980, an explicit tax cap was introduced in Sweden to curtail excessive marginal income tax rates. Later, in the tax reform of 1983–1985, marginal income taxes were further reduced, creating the need for new sources of government revenue. Meanwhile, environmental concerns had become prominent in the political agenda in Sweden by the eighties [2,3,5,6,12]. The Environmental Charge Commission (ECC) was appointed in 1987 to analyze the potential use of economic instruments to push environmental policies forward. The ECC was key to the process that culminated with the adoption of the carbon tax in 1991. Since then, the interest in economic instruments in environmental policy has remained strong. In parallel to that, the lining up of interest groups with policymakers was fundamental to push for bioenergy development in the DH sector. Carbon taxes were instrumental in that context [13]. Important actors against and in favor of the tax included industry, academics, and non-governmental organizations (NGOs), as well as national and local governments. Their mobilization and articulations were important in the process that led to the adoption of the carbon tax [2,7].

Previous research has highlighted the economic dimensions and the impact of the carbon tax in Sweden [2,6,14,15]. Various types of analysis have been carried out regarding energy policies affecting the DH sector [16], the development of DH in the country [17,18], and the increasing use of biomass in the sector [7,19,20,21,22]. ACF has been extensively applied for analyzing Swedish policy processes in diverse fields, e.g., nuclear energy [23,24,25], wind power policies [26], and forestry industry [27,28]. ACF has been used not only in political science studies but also in multidisciplinary ones, which is our case. A review carried out in 2016 identified 25 applications of ACF to analyze Swedish policy processes [29]. However, an actor-centered analysis of the process that led to the adoption of the carbon tax in the DH sector in Sweden is missing in the literature.

Energy issues has a critical role at our current modern economies, which will continue growing [30]. The significant positive environmental outcomes achieved in DH with the adoption of the carbon tax justify an in-depth analysis of the process that led to acceptance of the carbon tax concept and its adoption, and paved the way to its successful implementation. Thus, the unique contribution of our study lies in its comprehensive analysis of this process from the point of view of the formation of coalitions and alignment of beliefs, using a contemporary actor-centered framework, the ACF. The study provides an in-depth review of the policy process as a policy cycle. ACF is an appropriate choice for this study as it offers a multidisciplinary, integrated, and holistic approach for analysis of a policy process involving several actors from diverse organizations and levels of government.

The analysis of actors’ beliefs casts light on what maintains and strengthens coalitions, whereas identifying coalitions serves the purpose of understanding factors, movements, and dynamics that lead to significant outcomes in society. We analyze how the policy actors gathered to form coalitions that characterize the national climate and energy tax subsystem in Sweden, and what they contributed in the process. Our analysis begins in the 1980s, ending in 1991, when the carbon tax was adopted. Since then, the importance of the carbon tax has grown both in Sweden and in the global context, which further emphasizes the importance of the present analysis [2]. Furthermore, understanding the dynamics of interactions among the policy actors can be useful to analyze other policies involving the same actors, or similar strategies and power articulations that may emerge in similar contexts.

The paper is structured as follows. Section 2 briefly reviews historical developments leading to the formulation and adoption of the carbon tax in Sweden. Section 3 describes the methodology, along with data collection and data analysis approaches used in the analysis. We present the ACF and its key concepts, and develop a conceptual framework to guide the empirical analysis. Section 4 presents our empirical findings, analysis, and reflections on the usefulness of the ACF. Section 5 concludes and reflects on the policy implications of the results.

2. Context Leading to the Formulation and Adoption of the Carbon Tax in the Swedish Heating Sector

Government policies and district heating were fundamental for the development of bioenergy in Sweden, and multiple actors had to cooperate to make that possible [31]. The interest in district heating began in the 1950s with increased urbanization and high demand for heating. In the 1960s, fuel oil covered most of the heat demand in buildings, and DH represented only 3% of the heat market. The oil price shocks of the 1970s fostered a discussion that favored the use of domestic energy resources [32,33]. This promoted fuel shift from oil to biomass in DH and, later, also combined heat and power (CHP). The process required coordination of actions among different sectors [22,33].

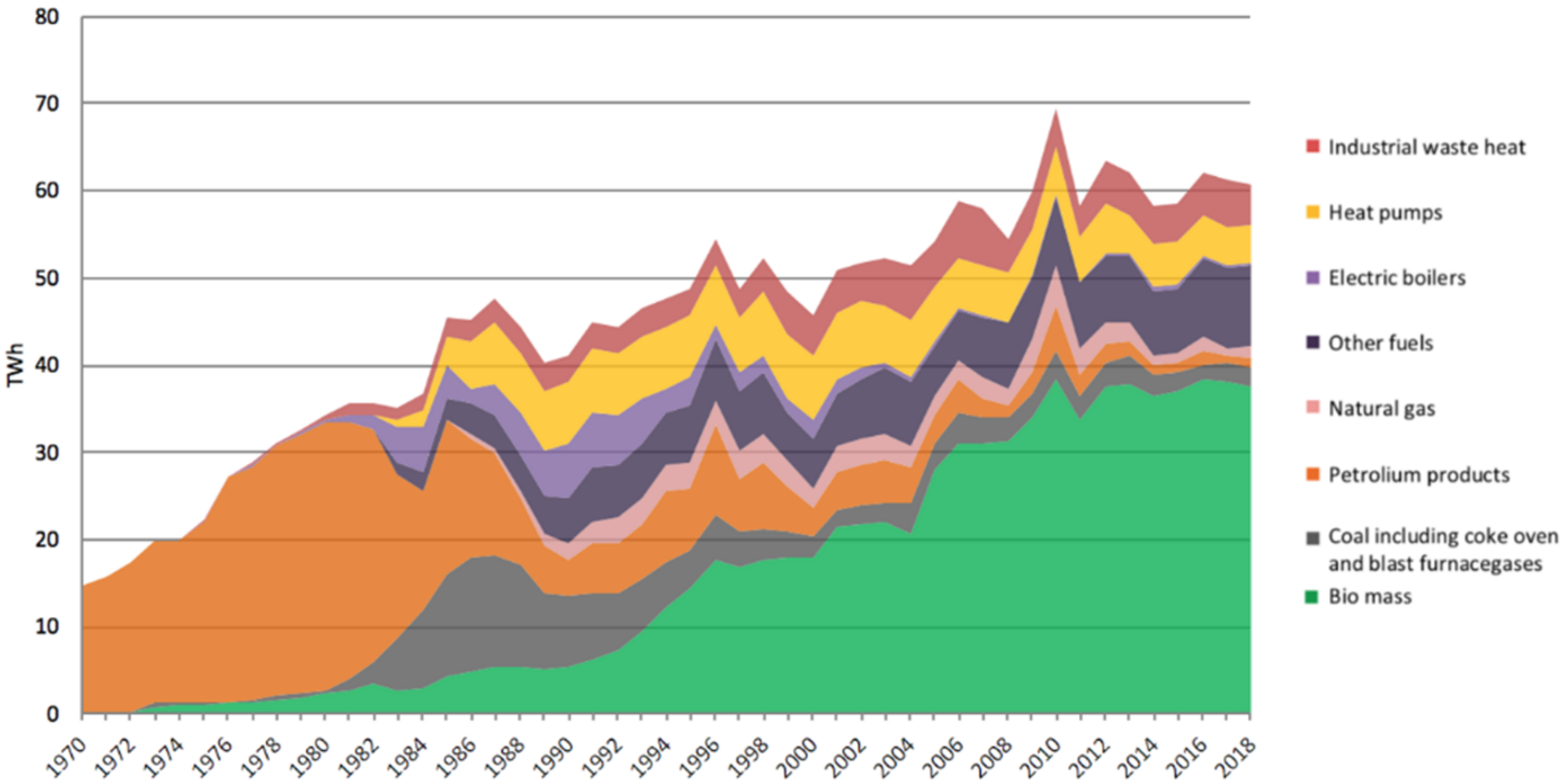

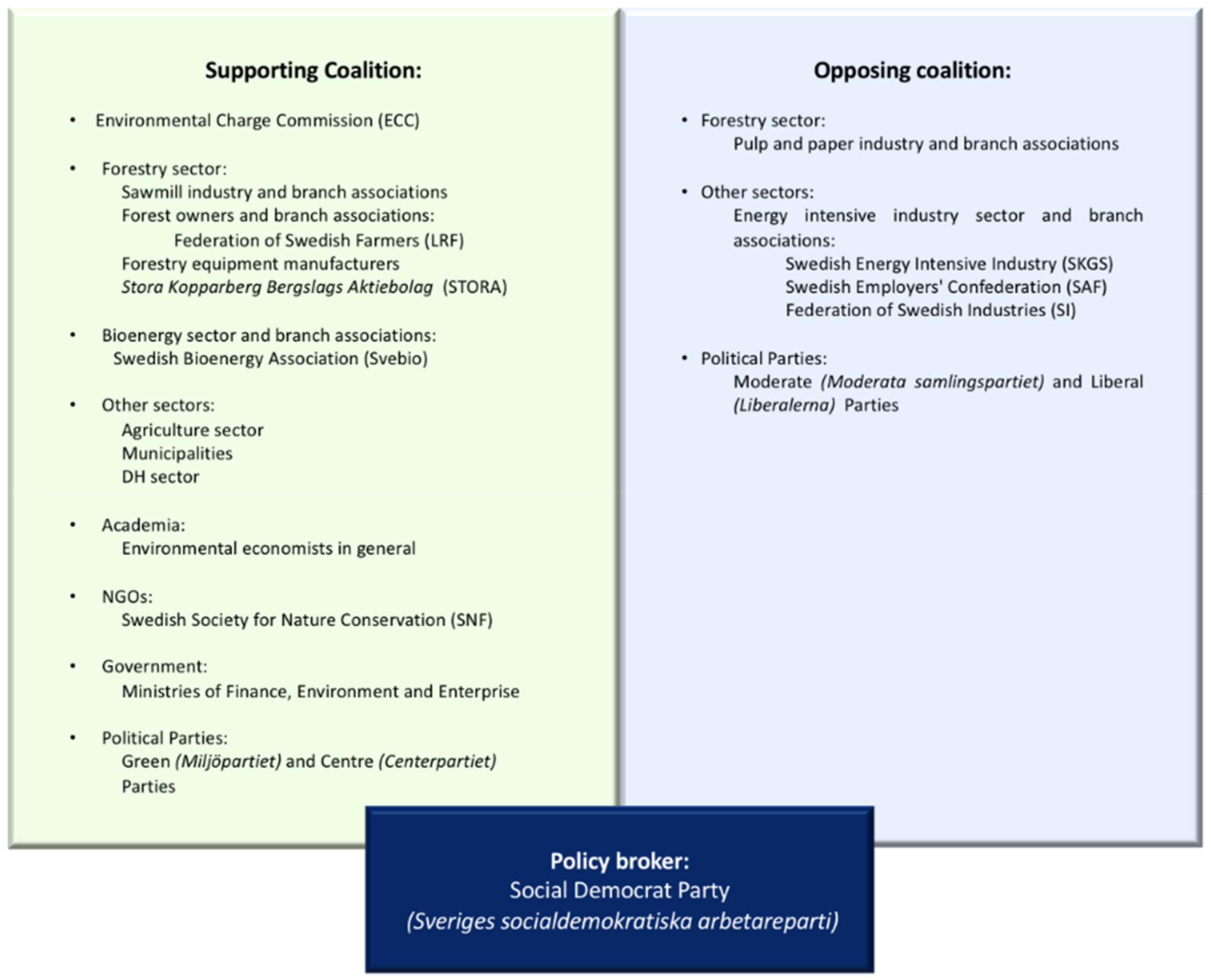

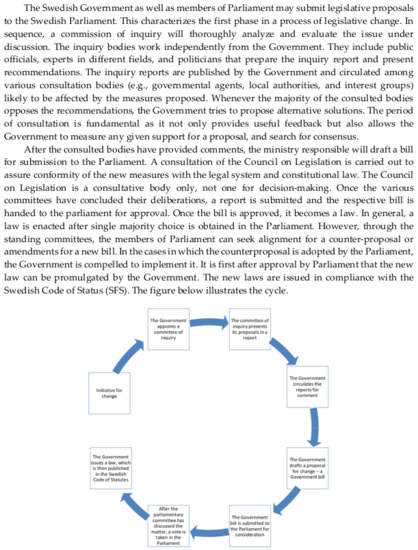

The majority of the DH systems in Sweden were developed by local governments or municipalities, which established, owned, and operated the plants [17]. This decentralized system development allowed strong local engagement, but fuel choices were generally conventional, since biomass was still an alternative fuel at that time. In the 1970s, a discussion about the potential complementarity between heating markets and the forest sector gradually arose. This paved the way for an increasing role for the forest industry in heating markets [13]. Until the 1980s, DH systems were essentially fueled by oil, see Figure 1.

Figure 1.

Input energy utilized in the production of district heating (DH) between 1970 to 2018, Twh [34].

The fuel debate in district heating sparked the development of forest-based bioenergy in Sweden. This is also a good example of how sectoral synergies can serve as catalysts for the transition towards the use of indigenous renewable resources to meet energy demand [13]. Certainly, the adoption of the carbon tax and a major tax reform put in place in the 1990s had a significant impact on the expansion of biomass utilization in the DH system [6,7]. Renewable fuels became more competitive in heating markets due to the carbon tax [7,32], and this led to a rapid reduction in the use of oil [19,32]. Later, new acquisitions and mergers that reduced the role of municipalities as owners and operators of DH systems would transform the ownership structure of the sector [17,35].

Today, DH meets almost half of the heating demand in residential and service buildings in Sweden, and biomass is responsible for approximately 63% of the energy used in DH. Nevertheless, despite the growing use of solid biofuels for heating in the past decades, the forest sector has not always supported bioenergy development [36]. The pulp and paper industry, a major player in the forest industry, has traditionally prioritized the extraction of fiber from the forests. The potential energy service provision from biomass residues was recognized but often also perceived as a risk for resource competition [37]. As the demand for biomass increased, the use of wood for heating was regulated by the Swedish Government through the Wood Fiber Act in 1987 (SFS 1987:588) to assure the supply of wood fiber to the pulp and paper industry [31]. The apparently diverging interest of a major national industry (pulp and paper industry) makes the successful planning of the carbon tax and the rapid expansion of biomass utilization in DH remarkable.

Thus, competing interests among policy actors related to the forest sector initially constrained the use of biomass for energy and delayed system integration even though technologies were available to make the leap [36,37]. An interesting aspect of the divergences to be addressed refers to the fact that the pulp and paper industry was export-oriented and international, while the emerging bioenergy segment was mainly local and regional. Eventually, the integration of biomass for energy would prove beneficial for efficiency improvements in the forest sector, as established institutions and infrastructure for wood and pulp production could provide the basis for economic diversification, and multiple economic and environmental benefits [13,31,36].

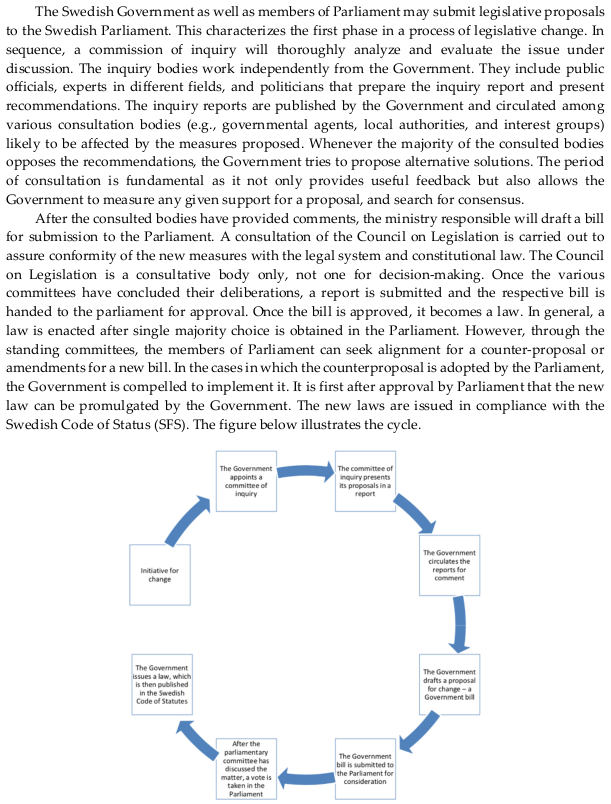

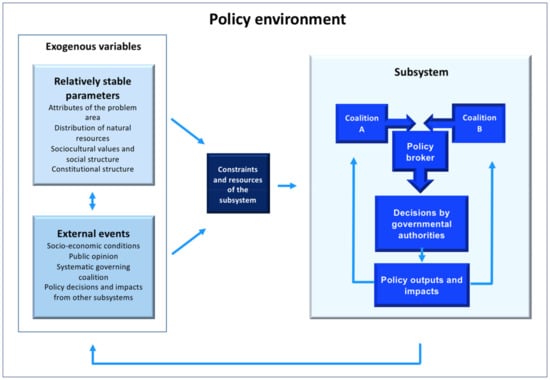

It is interesting to trace the correlation of the above developments to the formulation and adoption of the carbon tax. In the 1980s, the Environmental Charge Commission (ECC) was formed to analyze the potential use of economic instruments to push environmental policies forward. This led to a committee of inquiry to investigate the formulation and adoption of the carbon tax. In 1989, the first report on fees and taxes was published by the ECC. Several economic instruments were adopted as a result of this process, making environmental policies more prominent in the national agenda. The report of the committee of inquiry related to the carbon tax was also presented that year. This led to a Government Bill in 1990 (Prop. 1989/90:111), and a decision of the Parliament to introduce the carbon tax (SFS 1990:582), which became effective on the 1st of January 1991 [2,5]. The Swedish law-making process is presented in Figure 2.

Figure 2.

The Swedish law-making process [38,39].

The carbon tax was introduced as part of the major tax reform carried out in the early 1990s [2,3]. However, it was also a response to climate change concerns, which had already made their way into Swedish politics at that time—that is, quite early in comparison with other countries. The policy goals to be achieved with the carbon tax were: (i) reduction of CO2 emissions, (ii) reduction of fossil fuel consumption, and (iii) technological innovation [4]. Whereas the energy tax had fiscal purposes, the carbon tax was strongly related to environmental concerns prioritized by the Government and the citizens [5].

Through the power of lobbies and influence from the policy actors involved in the formulation of taxes in Sweden, the industry managed to guarantee exemptions from the new energy taxes imposed. This helped overcome their reluctance to support bioenergy. Since then, the forest industry has gone through structural changes and, among other things, has developed subsidiaries to manage synergies and their own interests in fuel markets. DH expanded, and heating markets have grown in Sweden as a low-carbon solution for heat services.

The carbon tax had a major impact on fuel choices in the DH system, making biomass cost-competitive. Through DH, biomass was not only integrated but also scaled-up in the modern Swedish energy system [34]. The environmental taxes (e.g., carbon tax) together with other measures (e.g., investment subsidies, research) were instrumental in realizing the bioenergy potential available in the country. Over time, the established cooperation between national and local governments, the forest sector, industrial manufacturers, and DH systems strengthened the commitment to bioenergy. The endorsement for biomass has remained steady from the Swedish Government and society at large, despite political changes along the years. Nevertheless, the total potential for bioenergy expansion in the country is constantly subject to discussion [31].

3. Methodology

3.1. The Advocacy Coalition Framework

For the purpose of the analysis in this paper, we used the Advocacy Coalition Framework (ACF), which is an approach for understanding policy change [40]. The ACF has been employed for qualitative analyses of several policy subsystems [41] and complex public policy processes [40] involving several actors from diverse levels of government, interest groups, and institutions [11] which matches very well the interests of our study. The subsystem is a policy area in which the policymaking process occurs, gathering the interest of numerous players from diverse levels of government, interest groups, and research institutions [42].

ACF is actor-centered and attributes value the belief system of the participating actors. The belief system comprises common perceptions that binds together a group of actors [11]. Simultaneously, it emphasizes the role of external events that can potentially impact coalitions and decisions in the subsystem [43]. A large share of the existing research using ACF aims at explaining the formation and stability of coalitions, learning within and between coalitions or, ultimately, policy change and stability over a period of a decade or more [44,45]. In our case, the carbon tax is an issue of policy change, and the ACF offers insights into the formation of coalitions that guided the elaboration and adoption of the carbon tax in the Swedish heating sector.

Following general guidelines, the ACF application in empirical research relies on three basic premises, which were considered in our case. The first one is a long-term perspective (e.g., 10 years or more) to comprehend the policy change. In general, the relations amongst the coalitions will last more than decades. Past events are also relevant to comprehend the coalitions, policy change, and related issues. Additionally, positions change and the winning coalition could turn out to be the loser later. The second premise is related to the unit of analysis, which constitutes the subsystem. The third one is the recognition of belief systems, which emerge from advocacy coalitions composed of numerous actors that share common beliefs [44]. The belief system comprises the deep core and the secondary beliefs. The latter are more susceptible to shifts motivated by new events and data [11].

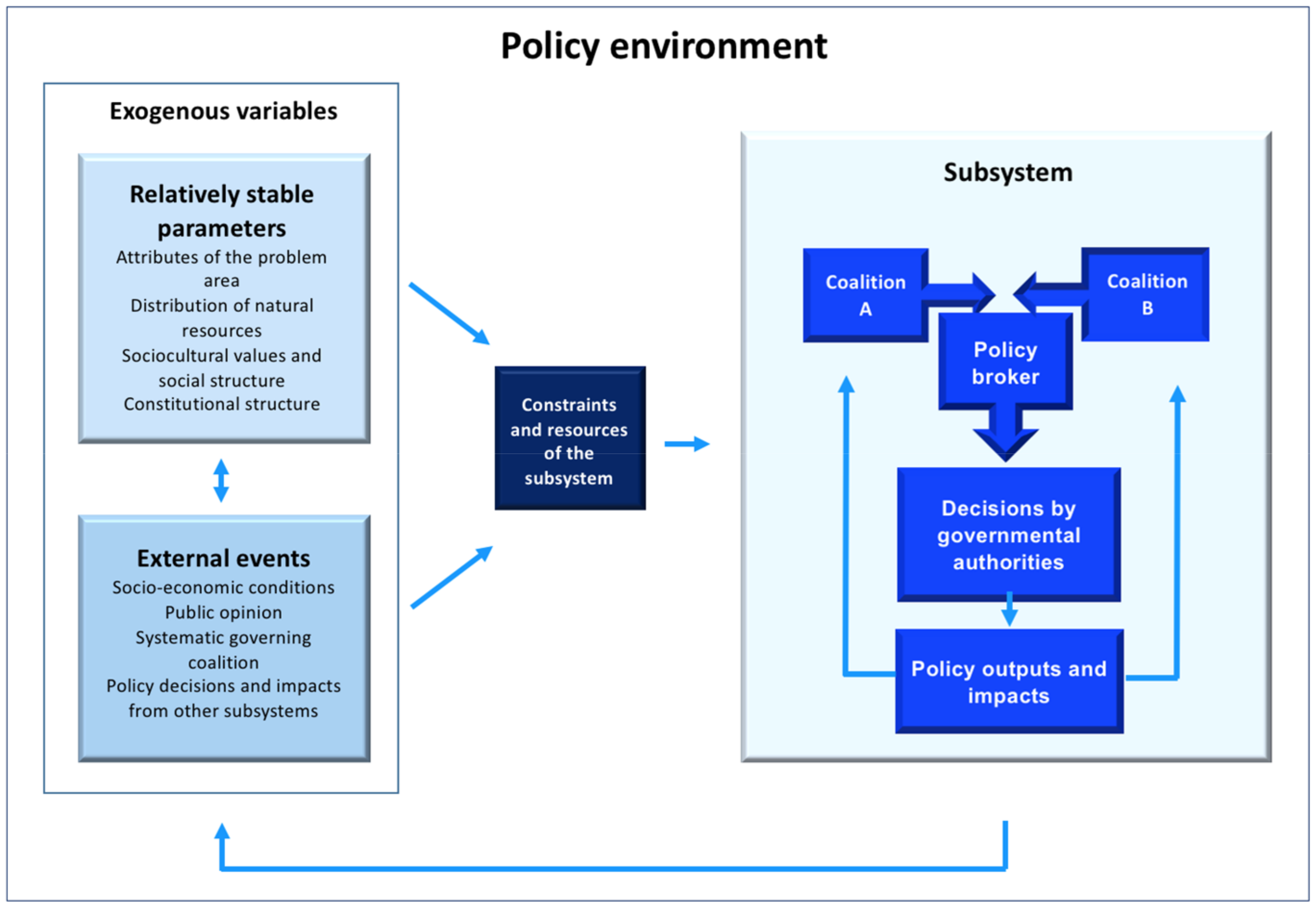

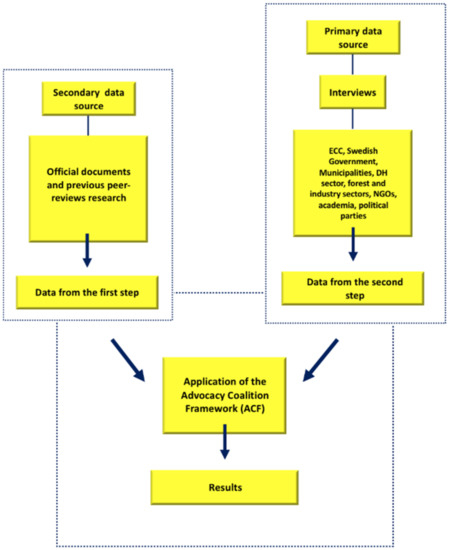

The ACF focuses on the interactions between the coalitions inside the subsystem [42]. The subsystem works in a wider policy environment, being defined by relatively stable parameters and external events. The relatively stable parameters are important to characterize the issue analyzed, structuring the nature of the problem. They present high resistance to change, being relatively constant for long periods of time [42,43]. External events are exogenous variables that can impact the limits and opportunities of the subsystem, also influencing it. This means that they cannot be controlled by the subsystem [11,43]. The ACF framework is visualized in Figure 3.

Figure 3.

Advocacy Coalition Framework (ACF) flow diagram, adapted from [44].

As shown in the diagram in Figure 3, external events can influence public attention and resources, promoting a type of shock in an established subsystem [11]. The exogenous variables are widely related to the societal context, affecting the subsystem and also being affected by it [42]. Within the subsystem, the coalitions are a set of policy actors sharing beliefs and, frequently, acting in concerted form. Commonly, two coalitions in opposite sides are considered in order to make the ACF an applicable instrument [43]. They use strategies, exploring resources (e.g., information, public opinion, financial sources) [42] and venues in order to promote their targets [11].

The policy brokers are mediators working for reasonable agreements between hostile coalitions. They are neutral actors that are trusted by both coalitions [42]. Taking into account some empirical studies, this role is frequently developed by high-level civil servants [45]. In addition to that, political parties seek political cohesion as well as influence [46]. The outcome of the interactions between coalitions and brokers is the resource allocation and the application of institutional rules to formulate a public policy. In sequence, policy outputs and their impacts will feed back into the system, reinforcing (or not) the coalitions [11].

3.2. Data Collection and Analysis

This study was designed as a qualitative exploratory case study, which can help to develop propositions for further inquiries [47]. Case study research is the preferred strategy to investigate contemporary phenomena within its distinct (real-life) context and related “how questions” [48]. To assess the process that led to the formulation and adoption of the carbon tax in the Swedish heating sector, we applied ACF as a conceptual lens in the case study. Our analysis drew on primary and secondary data sources. The case was analyzed through document study and qualitative analysis of interviews, as described below.

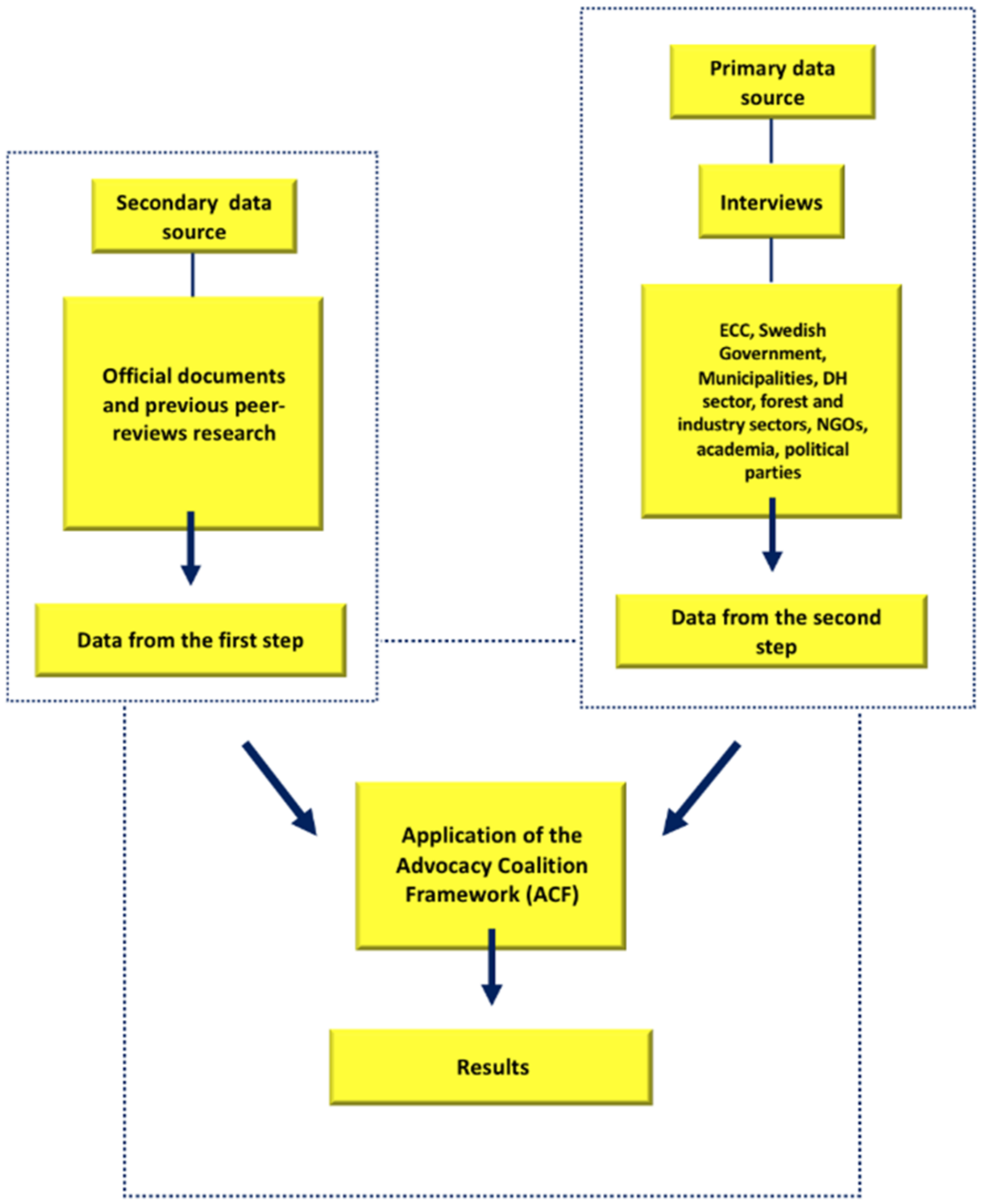

In the first phase of the research, we worked on secondary data, collecting materials that were connected to the relations and beliefs of the subsystem analyzed. Data from secondary sources included publicly available official documents and previous peer-reviewed research. We identified peer-reviewed papers in databases such as Scopus, Web of Science, and DiVA, the scientific repository in Sweden. We screened government databases to identify relevant actors from the studied period of time (1980–1991). We used documents and reports from the Swedish Parliament, the ECC report, the commission of inquiry report and official written communication related to the carbon tax. Figure 4 summarizes the different steps of the research process.

Figure 4.

Steps to conduct the analysis.

In the second phase of the research, we worked on semi-structured interviews with open-ended questions following a standard established protocol (Appendix A). Names for the sample interviewees were first identified through reports from the Swedish Parliament and the ECC. They were contacted via e-mails, phone calls, and social media. Preliminary interviews were done to test and validate the interview protocol, and identify names of key individuals not identified in our initial search. The final sample was thus the result of a snowball sampling targeting individuals involved in the formulation and adoption of the carbon tax.

The majority of the individuals contacted were willing to participate and contribute. We conducted four semi-structured interviews with open-ended questions with key experts from the ECC and the Swedish Government in the preliminary stage. Subsequently, we carried out interviews with policy actors from municipalities, DH sector, the forest and industry sectors, NGOs, academia, and the political parties. The total sample was 15 individuals from the interest groups mentioned. They contributed with important information and insights about the intricate energy-policy-making process that led to the formulation and adoption of the carbon tax for the Swedish heating sector. The interviewed did not allow listing of their names. In the third stage, data from both sources (stages 1 and 2 indicated in Figure 4) were triangulated and compared, with focus on relations, movements, and dynamics between the policy actors. Through these three phases, we identified the relations established among the policy actors, the belief system, and the subsystem according to the ACF framework.

The interview protocol included questions covering all elements of the conceptual framework (ACF). In the first part of the semi-structured interview with open-ended questions, the interviewees were inquired about the main motivations for and against the carbon tax, their main beliefs, and the relations between the adoption of carbon tax and the interest groups involved in order to understand the whole context in which the subsystem was inserted. In the second part, the interview protocol focused on the actor’s position in the process analyzed, aiming at the identification of coalitions. The interviewees were asked about participation, influence, strategies, resources, and movements of the interest groups within the subsystem-political parties, municipalities, the DH sector, the NGOs, the forest sector, among others. This provided the basis for a reflection on the general context of the formulation and adoption of the carbon tax, the belief system, the coalitions, and the perceived outcomes. Interviews were transcribed and thematically coded using coding protocol, see Appendix B.

4. The ACF Applied to the Case of Carbon Tax in the Swedish Heating Sector

4.1. Coalitions Identified—Understanding the Positioning of Actors

From the literature, we learned about (i) the support and engagement of municipalities in developing DH systems, (ii) the reluctance of the pulp and paper industry in embracing bioenergy, and (iii) the national interest in exploring the biomass potential as low-carbon fuel for DH. The instruments initially assessed by the ECC served to inform policy actors of opportunities to create incentives to address environmental concerns.

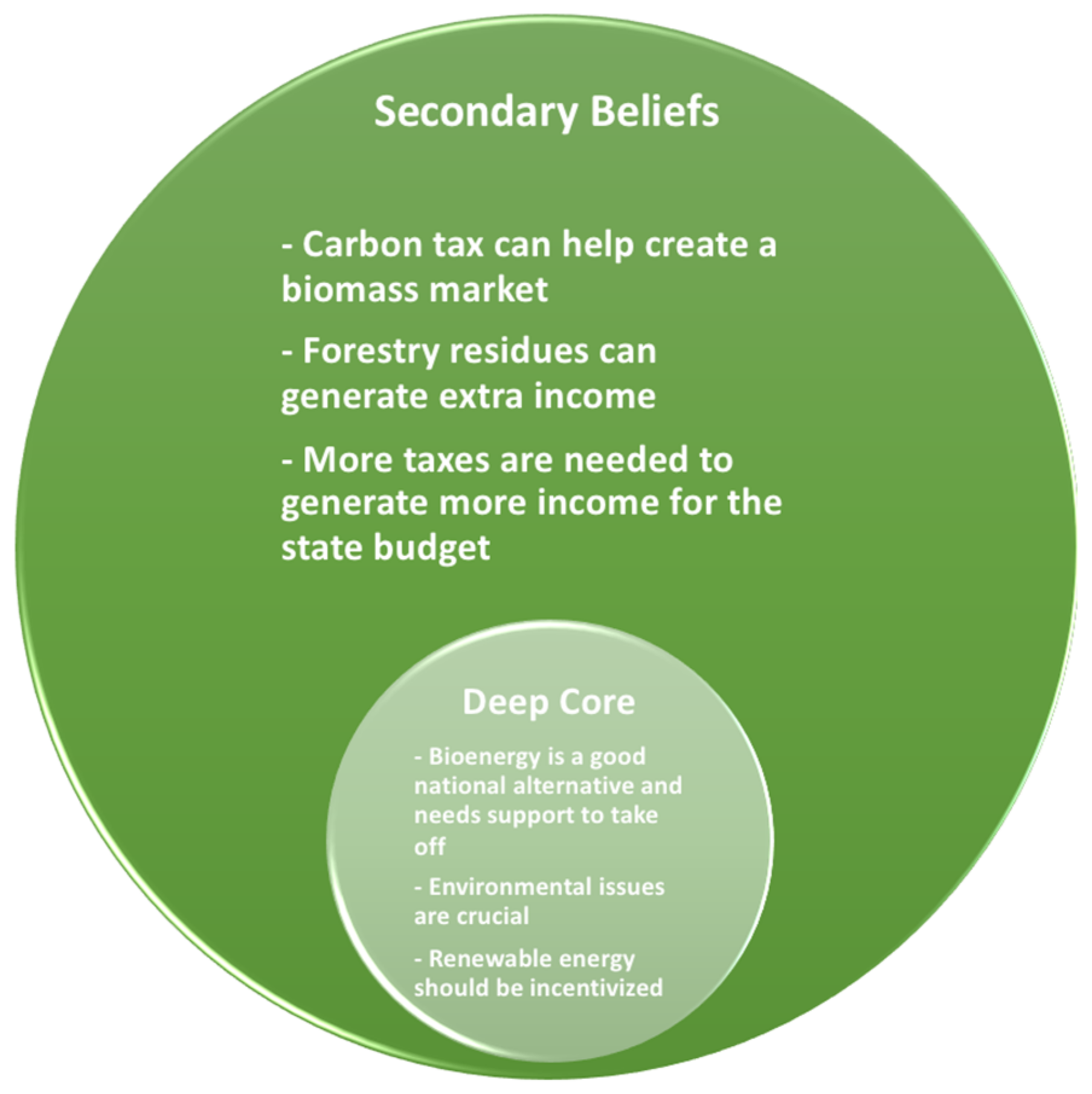

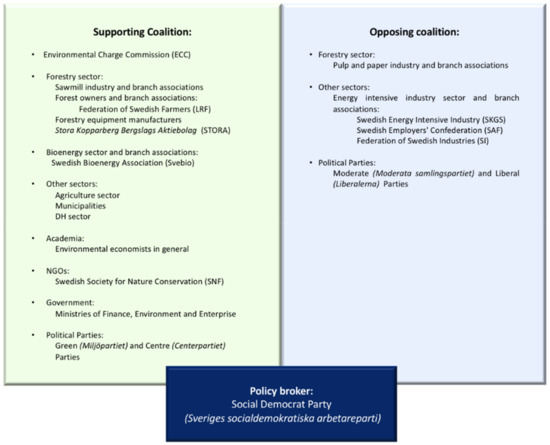

From analysis of interviews and testimonials, we identified a subsystem composed of two coalitions, as shown in Figure 5. On the left side we have the supporting coalition whereas on the right side we have the opposing one. The social democrats acted as policy broker. We will now explore the movements and dynamics of interactions between these coalitions, which culminated in the adoption of the carbon tax in the Swedish heating sector.

Figure 5.

Supporting and Opposing Coalitions Identified.

The ECC was the first step towards structuring the carbon tax in Sweden. The commission was formed with the purpose of analyzing the use of economic instruments, such as carbon taxes, to push environmental policies forward. According to all the interviewees, the ECC was formed by diverse policy actors (e.g., academics, researchers, representatives of civil society, and political parties) that supported the adoption of the carbon tax in Sweden since the initial movements. Within the forest sector, the sawmills, forest equipment manufacturers, forest owners, and branch associations, such as the Federation of Swedish Farmers (LRF), were part of the supporting coalition. LRF promoted a dialogue within the forest sector, developing an important role towards the adoption of the carbon tax.

On the same side, we found the bioenergy sector that was being developed and structured at that time. It was composed of emerging bioenergy players and their respective branch organizations, such as the Swedish Bioenergy Association (Svebio). This association has played a fundamental role in bioenergy development in Sweden since the 1980s, supporting political activity and policies to promote bioenergy. Svebio persuaded the forest equipment manufacturers to support bioenergy, as enhanced use of biomass would lead to expansion of the market for equipment and machinery in general. This was achieved through clarification meetings, reports, and briefing notes within the bioenergy sector, including the forest equipment manufacturers. The sawmills were supportive, as they were keen on finding a solution for the large quantity of forest residues generated in wood production.

The agriculture sector was also favorable to the adoption of a carbon tax, keeping the potential expansion of biomass production in mind, which could serve to improve cost-efficiency and open new opportunities for the sector. The municipalities endorsed the tax adoption as it could be aligned with the on-going expansion of DH. The support from academia was substantial, especially among environmental economists, who supported bioenergy and the shift towards market-oriented policy instruments. Overall, academics and research institutions were fundamental for bioenergy development in Sweden. Some reports conducted by them analyzing environmental and economic scenarios influenced the adoption of the carbon tax in Sweden. Regarding NGOs, the Swedish Society for Nature Conservation (SNF) supported the process, although not playing any decisive role, according to the interviewees.

The Ministries of Finance, Environment, and Enterprise took a supportive position. The major tax reform implied a reduction in the marginal income tax, so the government needed new sources of revenue to balance the State Budget. Moreover, the perception of politicians was changing, following from increasing awareness and understanding of the need to address environmental concerns. The Centre (Centerpartiet) and Green (Miljöpartiet) Parties were supportive all along the process, mainly because it was an opportunity to promote bioenergy. The Centre Party (Centerpartiet) had deep ideological identity with farmers and municipalities. The Green Party (Miljöpartiet) had a declared preference towards the development of wind and solar power. However, since bioenergy could reduce Sweden’s dependency on imported oil, the Greens supported the adoption of the tax on those merits.

On the other side, some segments of the forest sector, mainly the pulp and paper industry and branch associations, were initially against the adoption of the carbon tax. At that time, the pulp and paper industry did not support bioenergy development, fearing competition for forest biomass. The majority of the interviewees corroborated this information. For them, the main strategy of the pulp and paper industry was to create stalemates in the discussions at local and national levels, as a way to delay negotiations on the adoption of the carbon tax. In fact, the pulp and paper industry lobbied for measures to constrain the availability of forest resources for bioenergy alongside the formulation of the carbon tax.

The energy-intensive industries and branch associations, such as the Swedish Energy Intensive Industry (SKGS), the Swedish Employers Confederation (SAF), and the Federation of Swedish Industries (SI) were also against the adoption of the carbon tax. They worried about industrial competitiveness, arguing for a total exemption of the tax on their activities, in case it was created. The Liberal (Liberalerna) and Moderate (Moderata samlingspartiet) Parties had many reservations about the adoption of the carbon tax, especially because these two parties endorsed the position of the industry in general, and were concerned about the competitiveness of the Swedish industry.

It is worth pointing out that, even though the opposing coalition may seem more restricted, the lobby from the pulp and paper industry was powerful and organized in Sweden, and it was reinforced by the lobby of other industries. Since the pulp and paper industry was an important actor in the Swedish economy, it had a great influence in the Parliament, also affecting the implementation of new policies. The majority of the interviewees emphasized this fact.

Eventually, the forest sector was divided regarding the adoption of the carbon tax. However, Stora Kopparberg Bergslags Aktiebolag (STORA) became gradually involved in the discussions about the carbon tax. STORA was one of the most prominent companies in the forest sector at that time. The company’s influence and power within the sector was evident. Mining, iron, and wood activities had been the pillars of the company. In the 1970s, however, the company sold the mining and metal activities, and concentrated its activities on forest, pulp and paper. In the 1980s, STORA promoted a broad platform for cooperation within the forest sector which, at that time, was still fragmented. The sector was composed of diverse actors supporting isolated efforts and pursuing individual interests. Additionally, STORA promoted shared visions and interests to strengthen the sector. In other words, the company aimed at creating some unity within the sector in relation to policies. For them, the whole forest sector should support the adoption of the carbon tax. STORA was quite active on this issue at that time. In several meetings and events, the company argued in favor of the adoption of the tax, presenting potential benefits for the forest sector.

Still, the direct resistance from the pulp and paper industry and other energy-intensive industries was difficult to overcome. Their strong lobbies in the Swedish Parliament together with the support of the Moderate (Moderata samlingspartiet) and Liberal (Liberalerna) Parties were delaying the process. Meanwhile, the other policy actors were being fatigued with the stalemates and delays orchestrated by the pulp and paper industry. STORA led many dialogues, which were instrumental in addressing this direct resistance, and recovering legitimacy to the forest sector. The energy intensive industries kept their opposing position until the implementation of the tax, though the opposing movement became weaker without the endorsement of the pulp and paper industry.

Once massive resistance had been overcome, the Social Democrat Party (Sveriges socialdemokratiska arbetareparti) promoted a dialogue with the Moderate (Moderata samlingspartiet) and Liberal (Liberalerna) Parties in Parliament to discuss the main issues of concern with regard to the industries’ interests. Subsequently, the key issues involving the carbon tax were solved, and provisions were put in place to guarantee exemptions for the industry. The tax could finally be adopted in 1991 with a main focus on DH. The Social Democrat Party (Sveriges socialdemokratiska arbetareparti) supported a balance between the environmental interests and the industrial concerns, working as the policy broker.

Some final elements mentioned by some of the interviewees were (i) the importance of the public opinion and (ii) the trend towards market-based policy mechanisms in Sweden. As mentioned in Section 2, the process related to the formulation of the carbon tax occurred in the context of a major tax reform. Although the public would not support the adoption of new taxes, the carbon tax represented a new mindset, and clear action to address environmental concerns. The majority of the Swedish population was demanding climate and energy policies. At the end, making the carbon tax part of the overall tax reform was a clever move to get acceptance for the latter.

Regarding the second element, time was ripe for testing market-based policy mechanisms, such as the carbon tax, as opposed to new regulatory policies. In the context of the general major tax reform, political parties seemed to align in that direction, after the solid fuel regulation and the wood fiber law had failed to provide enough support for the development of bioenergy. Since then, environmental dimensions have increasingly permeated policy in Sweden, the carbon tax being one of the successful market-oriented policies adopted. Seen retrospectively, the adoption of the carbon tax marks a clear shift towards market instruments in Swedish environmental policy.

4.2. Belief System Holding the Coalitions Together

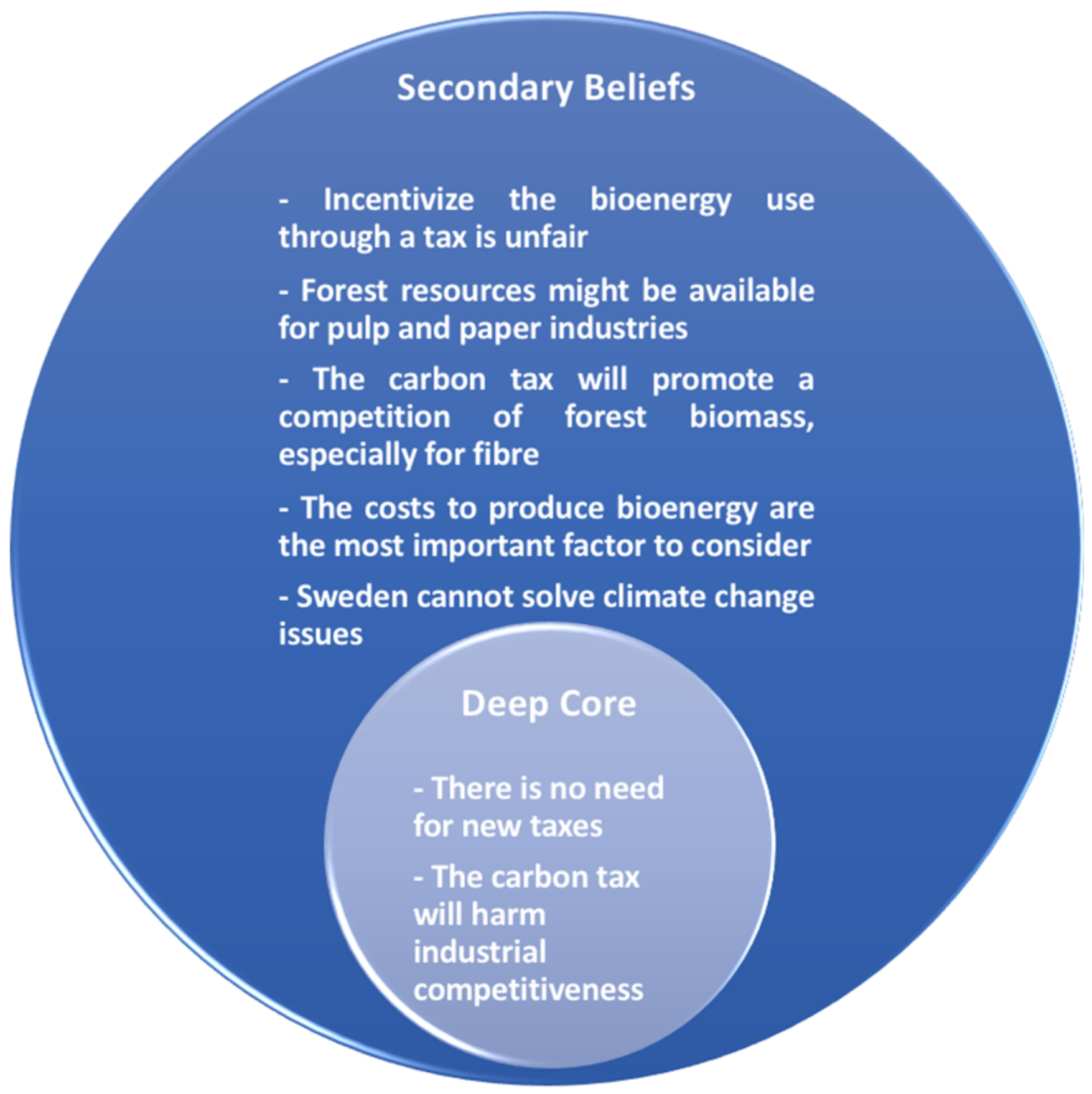

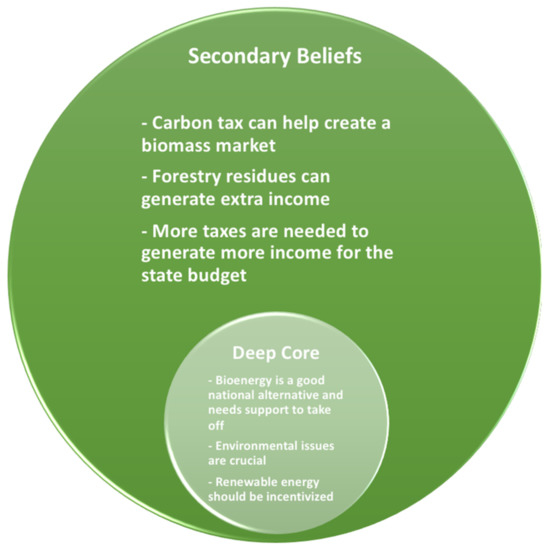

The core beliefs and secondary beliefs of the supporting coalition are summarized in Figure 6. At the core, the supporting coalition considered the development of bioenergy a good alternative, since the biomass was a national resource. It could be combined with the expansion of DH and heating markets, which was of great interest to the municipalities. The shift towards renewable energy sources was strongly supported by the Green Party (Miljöpartiet) and environmental economists from academia. Since bioenergy was still an emerging sector, it needed support to achieve scale and become cost-competitive.

Figure 6.

Belief System of the Supporting Coalition.

Secondary beliefs were no less important. The majority of the forest sector needed a solution for the forest residues generated, and the creation of a biomass market would help solve the problem. Moreover, residues would become a commercial resource with the formation of a market, generating value and income. The consensus among the agriculture sector, municipalities, DH sector, and the environmental economists was that the carbon tax would help create a biomass market. Finally, new taxes were important for the Swedish Government to balance the State Budget.

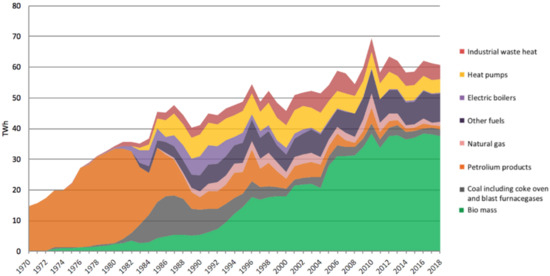

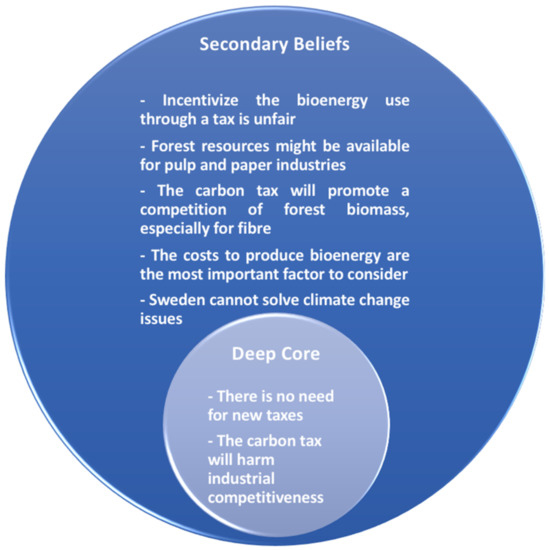

The opposing coalition saw no need for new taxes in a country with a high tax burden, such as Sweden. The industry and the Liberal (Liberalerna) and Moderate (Moderata samlingspartiet) Parties were concerned that higher production costs resulting from the adoption of the carbon tax would have a negative impact on competitiveness. Secondary beliefs in this coalition group included the position held by the pulp and paper industry and branch associations that a biomass market would increase competition for forest resources. Meanwhile, the majority of the forest industry sector that supported the adoption of the carbon tax was willing to use the forest residues after the extraction of fiber.

It is worth mentioning that, at that time, the pulp and paper industry controlled the market for forest resources in an oligopoly structure. The industry was primarily concerned with production costs and feared that support for bioenergy would imply higher costs, despite the claimed synergies. The agenda of the industry did not include environmental issues at that time and, in fact, they advocated against any responsibility associated with climate change issues in Sweden. It is quite remarkable that, seen in perspective, the carbon tax might have been the starting point for a new position of the Swedish forest industry in relation to the global environmental agenda. The beliefs shared by policy actors that formed the opposing coalition identified in our analysis are summarized in Figure 7.

Figure 7.

Belief System of the Opposing Coalition.

4.3. Achieving Policy Change

The carbon tax is typically advocated as technology neutral and technology blind, a precondition for market actors to adjust. However, for the supporting coalition, the adoption of the tax would lead to an increased use of bioenergy and, consequently, improved energy security in Sweden. At that time, bioenergy was an emerging sector that still needed support to take off. The political parties in Sweden had many reasons to support the adoption of the tax, since it was a clever way to endorse environmental concerns, and introduce a new tax that could generate government revenue and compensate for reduction in other taxes. However, multiple actors, some of which quite powerful, brought in their concerns and interests to the fore. This led to the formation of coalitions and a long process of policy formulation that, finally, culminated in the adoption of the carbon tax.

Using the ACF to structure our analysis of the policy-making process that culminated with the adoption of the carbon taxes in the Swedish heating sector, we were able to identify shared beliefs among the policy actors involved in the process. Common beliefs helped the actors to build relations and organize themselves in two advocacy coalitions. This process is in line with the ACF’s assumption that similar beliefs serve as the aggregator element holding the coalition together. The belief system encourages the translation of shared beliefs into governmental programs, possibly leading to policy change and/or stability at the end of the process.

The movements that formed the ECC had started in the 1980s, and the identified coalitions evolved gradually during that decade, with divergent arguments supporting opposite positions. The polarization resulted particularly from differences in how the two coalition groups regarded the development of bioenergy. For the supporting coalition, bioenergy provided a solution for the utilization of forest residues, which would gain value through the formation of a solid biomass fuel market. Those who supported the tax were interested in the creation of a biomass market, and they considered the tax instrumental to promote this new energy source. For the opposing coalition led by the pulp and paper industry, a biomass market would lead to larger competition for forest resources, potentially affecting their core business.

In this scenario, STORA was an important mediator, mobilizing the productive basis within the forest sector. The company had a long-established tradition and reputation, having high bargaining power within the forest industry. Besides, STORA had concentrated its activities on forest and pulp and paper in the 1970s, and was seeking for more influence and power. At that time, the forest sector was still highly fragmented and the interests of the pulp and paper industry were not necessarily the same as those of other segments. At the end, STORA won the battle but so did also those who were in favor of the carbon tax from the beginning. During the long period of policy discussions and formulation, more information was made available for the society in general, and paved the way for broad acceptance of the carbon tax. The adoption of the tax, in its turn, paved the way for the development of a low-carbon heating market in Sweden.

The policy broker in this process was the Social Democrat Party. The party supported a balance between industrial, economic, and environmental interests, promoting dialogue with the Parliament. At that time, an alliance composed of the Central (Centerpartiet), Green (Miljöpartiet), and Social Democrat Parties (Sveriges socialdemokratiska arbetareparti) had great influence in the Parliament. The support of this alliance was fundamental for the adoption of the carbon tax in the Swedish heating sector. In addition, the Social Democrat Party (Sveriges socialdemokratiska arbetareparti) promoted a dialogue with the Moderate (Moderata samlingspartiet) and Liberal (Liberalerna) Parties to discuss the main issues of concern within the industry. Since provisions were put in place to guarantee exemptions for industry, it was possible to overcome resistance from the opposing parties.

It is important to point out that the public opinion was in favor of the adoption of the carbon tax in the Swedish DH. Most certainly, this fact influenced the movements of the political parties. Additionally, the on-going discussions in other subsystems also played a role. In particular, the negotiations of the major tax reform were strongly related to the formulation and adoption of the carbon tax in the Swedish DH. Since the majority of the policy actors in the Parliament and Government were involved in both processes and subsystems, a merge process along the intricate dynamics in the power spheres is highly probable.

5. Conclusions

This paper aimed to analyze the process of policy change that culminated with the adoption of the carbon tax in the DH sector in Sweden. We used the ACF as methodology to identify actors and belief systems that led to the formation of coalitions around the carbon tax. The ACF helped us define and empirically verify the subsystem limits created in the process. The actors that were important in the policy discussion and formulation could be identified and their motives analyzed with the support of interviews with people that were involved in the process.

Our analysis has shown that the policy actors participating in the policy debate around the carbon tax in the Swedish DH sector shared similar beliefs that gathered them in two opposite coalitions. We have also seen that the major divide between the supporting and opposing coalitions was around the development of bioenergy. This dichotomy could eventually be overcome in a broad and persistent dialogue that involved established (i.e., forest industries) as well as new players (i.e., bioenergy and DH sectors). The process took approximately a decade (1980–1991) but culminated in the adoption of the carbon tax, making Sweden one of the pioneers in this policy instrument. Thus, the supporting coalition was skilled and efficient in translating its beliefs into strong arguments, eventually contributing to a new public policy with multiple aims.

The coalition supporting the carbon tax was composed of the ECC, the Ministries of Finance, Environment and Enterprise, the Green (Miljöpartiet) and Centre (Centerpartiet) Parties, municipalities, DH sector, academia in general, the majority of the forest sector, the agriculture sector, the emerging bioenergy sector, and branch associations connected to these sectors. They were driven by the environmental concerns of Swedish constituencies, as well as the perceived need to increase renewables in the energy matrix, mainly bioenergy in this case.

On the other hand, the Moderate (Moderata samlingspartiet) and Liberal (Liberalerna) Parties, the energy intensive industry, the pulp and paper industry, and their related branch associations were against the adoption of taxes in general, since the tax burden was already heavy in Sweden. Competitiveness around forest resources was of major concern for this opposing coalition. Although this coalition had fewer actors, it was quite strong due to the powerful and organized lobby of the pulp and paper industry in the Parliament. The sticking point was in the forest sector, which was divided about the adoption of the carbon tax. In this context, STORA was a driver for change, not necessarily motivated by environmental awareness at that time, but rather by the willingness to enhance its influence in the forest sector. Since then, the forest industry has gone through many changes, and bioenergy has become fully integrated in the modern energy system in Sweden. Currently, subsidiary companies of the pulp and paper industry manage part of the wood fuel market, making their initial resistance emblematic.

The Social Democrat Party (Sveriges socialdemokratiska arbetareparti) was identified as the policy broker in the process, due to its mediating role in the Swedish Government and Parliament. The Swedish Government was determined to develop alternative and national energy sources, and saw the carbon tax as an attractive market-oriented policy instrument. Notably, the carbon tax was also applied to motor fuels but without the same positive outcomes observed in the DH sector. Therefore, a new study comparing the two outcomes could be justified as a way to identify other subsystems, their coalitions and beliefs, and potential causes of failure. As Sweden now engages in the development of a strategy for further deployment of its bioeconomy, these lessons from the past can help identify strengths and weaknesses and pave the way for a new leap in the country’s climate and environmental policy.

The successful formulation and adoption of the carbon tax in the Swedish heating sector serves as inspiration to other governments. The tax came into place as a result of the interplay of key actors in various segments of society at a time when policy for renewable energy was still incipient, and the climate convention was still in the making. Indeed, the Swedish experience shows that countries can progress by exploring internal synergies and innovating policy designs, despite potential resistance of established constituencies.

Author Contributions

Conceptualization, C.H., S.S. and M.C.; Data curation, C.H.; Formal analysis, C.H. and S.S.; Investigation, C.H.; Methodology, C.H.; Writing—original draft, C.H.; Supervision, S.S. and M.C.; Funding acquisition, S.S. and M.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Coordination for higher Education Staff Development (CAPES) in Brazil, project no. 88881.189790, which sponsored a visiting scholar period at the Royal Technology Institute (KTH) in Sweden.

Acknowledgments

We would like to thank the interviewees for contributing with their valuable time that was key for constructing the ACF analysis in this paper. We are grateful to Maryna Henrysson, from KTH for suggestions and comments on previous versions of this article. We thank the reviewers for their comments and suggestions to improve the paper.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; collection, analyses, or interpretation of data; writing of the manuscript, or decision to publish the results.

Appendix A. Interview Protocol

Information provided to the interviewee:

Through this study, we aim at understanding the complex policy making process that led to the formulation and adoption of the carbon tax in the Swedish heating sector. For that, we work on semi-structured interviews with open-ended questions following a standard established protocol. Subsequently, we will apply the ACF as method, in order to generate the results.

List of questions:

Motivations and beliefs

- The carbon tax was introduced in 1991. What motivated the carbon tax adoption in Sweden?

- What were the common beliefs or ideas of the supporters?

- On the other hand, what were the common beliefs of the opposers?

- How important was the carbon tax for the use of bioenergy in Sweden?

- How did the sectors see the formulation and adoption of the carbon tax in Sweden (forest sector, DH sector, etc.)?

Movements towards coalitions

- 6.

- How did you participate in this process?

- 7.

- Which groups or organizations influenced the process, and how?

- 7.1

- What were their main strategies?

- 7.2

- What were their main resources?

- 8.

- What was the position of the political parties in relation to the carbon tax? Were they in agreement?

- 9.

- How were the municipalities engaged and how did they influence this process?

- 10.

- What was the position of the NGOs in relation to the carbon tax implementation?

- 11.

- What was the position of the DH sector in relation to the carbon tax implementation?

- 12.

- What was the position of the forest sector in relation to the carbon tax implementation?

Appendix B. Interviews

The table presents the interviews realized. Due to confidentiality, the names of companies and interviewees are not revealed.

Table A1.

Interviews.

Table A1.

Interviews.

| Type of Organization | Occupation of Informants | Number of Interviews |

|---|---|---|

| Government | Government employee | 2 |

| Environmental Charge Commission (ECC) | Expert | 2 |

| Municipalities | Municipality employee | 1 |

| DH sector | DH sector employee | 1 |

| NGO | NGO employee | 1 |

| Forest Sector | CEO, director and employee of forest industry | 4 |

| Energy Intensive Industry | CEO | 1 |

| Academia | Professor | 1 |

| Political Parties | Politician and former minister | 2 |

Table A2.

Personal Communications during the research.

Table A2.

Personal Communications during the research.

| Personal Communication | Number |

|---|---|

| Expert | PC1 |

| Expert | PC2 |

| Government Employee | PC3 |

| Government Employee | PC4 |

| Municipality employee | PC5 |

| Professor | PC6 |

| Former Minister | PC7 |

| CEO of forest industry | PC8 |

| Politician | PC9 |

| Branch organization | PC10 |

| Branch organization | PC11 |

| Branch organization | PC12 |

| DH sector employee | PC13 |

| CEO of energy intensive industry | PC14 |

| NGO employee | PC15 |

References

- Sovacool, B.K. Contestation, contingency, and justice in the Nordic low-carbon energy transition. Energy Policy 2017, 102, 569–582. [Google Scholar] [CrossRef]

- Scharin, H.; Wallström, J. The Swedish CO2 Tax-An Overview; Anthesis Enveco: Stockholm, Sweeden, 2018. [Google Scholar]

- Hammar, H.; Akerfeldt, S. CO2 Taxation in Sweden-20 Years of Experience and Looking Ahead; Swedish Ministry of Finance: Stockholm, Sweden, 2011.

- Partnership for Market Readiness (PMR). Carbon Tax Guide: A Handbook for Policy Makers; World Bank: Washington, DC, USA, 2017; License: Creative Commons Attribution CC BY 3.0 IGO. [Google Scholar]

- Ministry of Finance. Lessons Learned from 25 Years of Carbon Taxation in Sweden. Insights and outlook on carbon taxation in the EU non-ETS sectors. In Proceedings of the COP24, Katowice, Poland, 3–14 December 2018. [Google Scholar]

- Ackva, A.; Hope, J. The Carbon Tax in Sweden. Fact. Sheet; Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU): Berlin, Germany, 2018.

- Johansson, B. Economic instruments in practice 1: Carbon tax in Sweden. In Proceedings of the Workshop on Innovation and the Environment OECD, Paris, France, 27 June 2000. [Google Scholar]

- Sabatier, P.A.; Weible, C.M. (Eds.) Theories of the Policy Process; Westview Press: Boulder, CO, USA, 2014. [Google Scholar]

- Hoppe, R.; Peterse, A. Handling Frozen Fire; Westview Press: Boulder, CO, USA, 1993. [Google Scholar]

- Nohrstedt, D.; Olofsson, K. Advocacy coalition politics and strategies on hydraulic fracturing in Sweden. In Policy Debates on Hydraulic Fracturing; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2016; pp. 147–175. [Google Scholar]

- Sabatier, P.A.; Jenkins-Smith, H. The advocacy coalition framework: An assessment. In Theories of the Policy Process; Sabatier, P., Ed.; Westview Press: Boulder, CO, USA, 1999. [Google Scholar]

- Raab, U. Carbon tax-Determining the tax rate. Swedish experiences. In Proceedings of the PMR Technical Workshop on Carbon Tax: Design and Implementation in Practice, New Delhi, India, 22 March 2017. [Google Scholar]

- Silveira, S.; Johnson, F.X. Navigating the transition to sustainable bioenergy in Sweden and Brazil: Lessons learned in a European and international context. Energy Res. Soc. Sci. 2016, 13, 180–193. [Google Scholar] [CrossRef]

- Jagers, S.C.; Martinsson, J.; Matti, S. The impact of compensatory measures on public support for carbon taxation: An experimental study in Sweden. Clim. Policy 2018, 19, 147–160. [Google Scholar] [CrossRef]

- Shmelev, S.E.; Speck, S.U. Green fiscal reform in Sweden: Econometric assessment of the carbon and energy taxation scheme. Renew. Sustain. Energy Rev. 2018, 90, 969–981. [Google Scholar] [CrossRef]

- Difs, K. National energy policies: Obstructing the reduction of global CO2 emissions? An analysis of Swedish energy policies for the district heating sector. Energy Policy 2010, 38, 7775–7782. [Google Scholar] [CrossRef]

- Werner, S. District Heating and Cooling; Elsevier BV: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Lind, C.-E. District heating in Sweden, 1972–1977. Energy Policy 1979, 7, 74–76. [Google Scholar] [CrossRef]

- Ericsson, K.; Werner, S. The introduction and expansion of biomass use in Swedish district heating systems. Biomass-Bioenergy 2016, 94, 57–65. [Google Scholar] [CrossRef]

- Werner, S. District heating in Sweden 1948–1990. Fernwärme Int. 1991, 20, 603. [Google Scholar]

- Werner, S. Low carbon district heat in Sweden. Euroheat Power-Engl. Ed. 2007, 4, 20. [Google Scholar]

- Di Lucia, L.; Ericsson, K. Low-carbon district heating in Sweden-Examining a successful energy transition. Energy Res. Soc. Sci. 2014, 4, 10–20. [Google Scholar] [CrossRef]

- Nohrstedt, D. Crisis and Policy Reformcraft. Advocacy Coalitions and Crisis-Induced in Swedish Nuclear Energy Policy; Uppsala Universitet: Uppsala, Sweden, 2007. [Google Scholar]

- Nohrstedt, D. Do Advocacy coalitions matter? Crisis and change in Swedish nuclear energy policy. J. Public Adm. Res. Theory 2009, 20, 309–333. [Google Scholar] [CrossRef]

- Roßegger, U.; Ramin, R. Explaining the ending of Sweden’s nuclear phase-out policy: A new approach by referring to the advocacy coalition framework theory, Innovation. Eur. J. Soc. Sci. Res. 2013, 26, 323–343. [Google Scholar] [CrossRef]

- Newell, D. Locating wind power policy: The mechanics of policy subsystem interactions. PhD. Thesis, Luleå University of Technology, Luleå, Sweeden, 2017. [Google Scholar]

- Hysing, E.; Olsson, J. Contextualising the Advocacy coalition framework: Theorising change in Swedish forest policy. Environ. Politi 2008, 17, 730–748. [Google Scholar] [CrossRef]

- Elliott, C.; Schlaepfer, R. The advocacy coalition framework: Application to the policy process for the development of forest certification in Sweden. J. Eur. Public Policy 2001, 8, 642–661. [Google Scholar] [CrossRef]

- Nohrstedt, D.; Olofsson, K. A review of applications of the advocacy coalition framework in Swedish policy processes. Eur. Policy Anal. 2016, 2, 18–42. [Google Scholar] [CrossRef]

- Stram, B.N. A new strategic plan for a carbon tax. Energy Policy 2014, 73, 519–523. [Google Scholar] [CrossRef][Green Version]

- Ericsson, K.; Huttunen, S.; Nilsson, L.J.; Svenningsson, P. Bioenergy policy and market development in Finland and Sweden. Energy Policy 2004, 32, 1707–1721. [Google Scholar] [CrossRef]

- Kjell, A. Bioenergy the Swedish Experience; SVEBIO: Stockholm, Sweden, 2015; ISBN 978-91-977624-4-1. [Google Scholar]

- Dzebo, A.; Nykvist, B. A new regime and then what? Cracks and tensions in the socio-technical regime of the Swedish heat energy system. Energy Res. Soc. Sci. 2017, 29, 113–122. [Google Scholar] [CrossRef]

- Sweden. 2020. Available online: http://www.energimyndigheten.se/nyhetsarkiv/2020/energilaget-2020---en-samlad-bild-pa-energiomradet-i-sverige/ (accessed on 10 June 2020).

- Magnusson, D. Who brings the heat? From municipal to diversified ownership in the Swedish district heating market post-liberalization. Energy Res. Soc. Sci. 2016, 22, 198–209. [Google Scholar] [CrossRef]

- Ling, E.; Silveira, S. New challenges for bioenergy in Sweden. In Bioenergy-Realizing the Potential; Elsevier: Amsterdam, The Netherlands, 2005; pp. 31–46. [Google Scholar]

- Björnheden, R. Drivers behind the development of forest energy in Sweden. Biomass-Bioenergy 2006, 30, 289–295. [Google Scholar] [CrossRef]

- Sweden. 2015. Available online: https://www.government.se/how-sweden-is-governed/the-swedish-model-ofgovernment-administration/ (accessed on 7 June 2019).

- Sweden, 2016. The Swedish Law-Making Process. Available online: https://www.government.se/49c837/contentassets/4490fe7afcb040b0822840fa460dd858/the-swedish-lawmaking-process (accessed on 7 June 2019).

- Roberts, A.; Sabatier, P.A.; Jenkins-Smith, H.C. Policy change and learning: An advocacy coalition approach. Can. Public Policy 1994, 20, 334. [Google Scholar] [CrossRef]

- Pierce, J.J.; Peterson, H.L.; Jones, M.D.; Garrard, S.P.; Vu, T. There and Back Again: A Tale of the Advocacy Coalition Framework. Policy Stud. J. 2017, 45, S13–S46. [Google Scholar] [CrossRef]

- Weible, C.; Sabatier, P. A Guide to the advocacy coalition framework. In Public Administration in Post-Communist Countries; Informa UK Limited: London, UK, 2006; pp. 123–136. [Google Scholar]

- Sabatier, P.A.; Weible, C.M. The advocacy coalition framework: Innovations and clarifications. In Theories of the Policy Process, 2nd ed.; Sabatier, P.A., Ed.; Westview Press: Boulder, CO, USA, 2007. [Google Scholar]

- Sabatier, P.A. The advocacy coalition framework: Revisions and relevance for Europe. J. Eur. Public Policy 1998, 5, 98–130. [Google Scholar] [CrossRef]

- Sabatier, P.A. An advocacy coalition framework of policy change and the role of policy-oriented learning therein. Policy Sci. 1988, 21, 129–168. [Google Scholar] [CrossRef]

- Ingold, K.; Varone, F. Treating policy brokers seriously: Evidence from the climate policy. J. Public Adm. Res. Theory 2011, 22, 319–346. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 4th ed.; Sage: Los Angeles, CA, USA, 2009. [Google Scholar]

- Yin, R.K. Case Study Research and Applications: Design and Methods; SAGE Publications: New York, NY, USA, 2017. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).