Abstract

Companies attempt to address global sustainability challenges through innovating products, services, and business models. This paper focuses on sustainable business model (SBM) innovations as a way to systemically transform businesses towards sustainability. It has been widely recognized that strategic approaches to using intellectual property (IP) need to be aligned with business model innovation for commercial success. Here we suggest that IP, aligned with SBMs, can also be used to create not only commercial, but also societal and environmental impact. Knowledge about how to best align IP with SBMs to drive sustainability transitions remains limited. We address this gap by developing an SBM-IP canvas that integrates IP considerations into each of the SBM canvas building blocks. We do this by employing relevant theoretical concepts from three literature streams, namely the business model (including SBM), IP, and innovation literature. We use case examples to illustrate different IP considerations that are relevant for the SBM-IP building blocks. These examples show that different IP types (e.g., patents, trademarks) and ways of using them (e.g., more or less restrictive licensing) are applied by companies in relation to the different building blocks. While covering new theoretical ground, the proposed SBM-IP canvas can help decision makers understand how they can use different IP types strategically to propose, create, deliver, and capture sustainable value for society, environment, and the business.

1. Introduction

Companies increasingly implement innovations that tackle sustainability challenges such as climate change [1], for example, by replacing fossil fuels with renewable energies, implementing zero-emission transport, and upcycling waste [2,3]. Yet with increasing levels of greenhouse gas emissions and a growing global population, sustainability transitions need to be accelerated. Sustainable business models (SBMs) become increasingly relevant to drive transitions by taking a holistic view of the impact of how business is done [4]. SBM is defined as “how an organisation creates, delivers and captures value for its stakeholders in a way that supports a safe and just operating space for humanity and all living entities to flourish” [5] (p. 2). Studying how SBMs with positive commercial, environmental, and societal impact can be developed and implemented has become increasingly relevant [4,6]. Within this, the role of intellectual property (IP) is important, but remains underexplored.

Generally, there appears to be some ambiguity about the role of IP as either a barrier or a catalyst to widespread access and use of innovations that also benefit the environment and society [7]. The UN climate negotiations have involved debates regarding the importance of IP issues to use and spread sustainable innovations [7]. Previous research suggested that companies pursue SBMs based on innovations (e.g., innovative products or green technologies), which typically involve some combination of formal (e.g., patents, trademarks) and informal IP (e.g., know-how, data, trade secrets) [8,9]. Research at the intersection of IP and “conventional” business models with a dominant profit and shareholder focus [8] is still under development and the role of IP is scarcely investigated for SBMs with a focus on sustainable value (people, profit, and planet) and broader stakeholder value [4]. An improved understanding of the linkages between IP strategy and SBMs can support companies to make better decisions for creating sustainable value.

While the debate around IP and sustainability is often framed around open sharing to speed up innovation and market diffusion and closed approaches to create competitive advantage [10], businesses may have a more differentiated approach. For example, Nutriset, a French company treating malnutrition in African countries, has patent-protected its method of producing peanut butter paste and decided to selectively license the patent to local manufacturers in Africa for a minimal royalty fee, but uses the patent rights to block large developed-country manufacturers from entering the market and competing with local producers [11].

The body of literature on IP strongly indicates that companies can strategically use their IP to foster structural changes in industries and economies, such as through shaping the appropriability regime it operates in [12,13,14,15], but with hardly any focus on sustainability-related changes. Appropriability regime denotes the “environmental factors, excluding firm and market structure, that govern an innovator’s ability to capture the profits generated by an innovation” [13] (p. 287). Companies’ attempts to strengthen or weaken the regime to their advantage can alter industry structures [12,14,16]. In the “business as usual” context, IP is widely conceived as an enabling mechanism on how to use innovations [15] and diffusion in management research, whereas in economics the benefits and issues of the monopoly that IP rights provide is contested (e.g., [17,18]).

In the context of sustainability however, whether IP can facilitate or hinder the transition towards sustainable business largely remains unexplored. Although there is a substantial body of SBM literature in relation to, e.g., patterns, archetypes, structure and governance, and network interactions [2,12,13], how the use of IP can be effectively aligned with SBMs is little understood.

This paper focuses on the relations between IP strategies and SBMs at the firm level. For the purpose of this paper we define IP strategy as the set of activities and guidance processes for decision-making regarding the exploration, generation/acquisition, protection, exploitation/enforcement, and periodic assessment of all types of IP, including formal IP rights and informal know-how to maximize value from an organization’s inventions, like technologies, products, services, literary and artistic works, design, symbols, names, and images in support of the organisation’s business objectives [19].

As part of their strategic decision-making, companies can decide from a set of IP strategies. On one extreme, companies can decide to share IP freely, e.g., through “open source” licensing approaches. On the other extreme they can restrict access and usage of their IP by others through claiming exclusivity (i.e., not agreeing to any licensing) or not even patent inventions, but rather keep IP as trade secrets [20,21]. In between these extremes more selective IP strategies exist. Examples include bilateral licensing agreements with selected partners, multilateral patent pools [22], or patent pledges with more or less restrictive clauses [21]. Which of these IP strategies will facilitate or hinder the impact of certain SBMs remains to be understood.

Currently, we are not aware of a study that provides reliable insights into whether and under which circumstances particular IP strategies are more or less relevant for companies employing different SBMs to create, deliver, and capture value from sustainable innovations. This study does not attempt to provide a comprehensive framework, which would be nearly impossible due to the many influence factors, such as the institutional framework and rule of law, as well as organizational types and contexts. We rather seek to make a contribution to the research that serves to better understand how IP strategies relate to different SBMs for generating economic, societal, and environmental value. This study thereby seeks to contribute to research focusing on the role of IP for the strategic management of open, collaborative, and distributed innovation processes, also in the circular economy.

We hope that the SBM-IP canvas can serve decision makers to make better informed choices for businesses to generate, select, and utilize IP to leverage the environmental, social, and economic impacts of their SBMs.

The remainder of the paper is structured as follows. Section 2 presents the methods with descriptions of our approach for the literature review and case examples. Section 3 presents the literature analysis, our SBM-IP canvas, and the case examples. Section 4 concludes the paper with discussions and a summary of the main contributions.

2. Materials and Methods

We used a three-step process to conceptualize the integration of SBM and IP: (1) conducting a review of three literature streams, namely, business models, IP, and innovation in the sustainability arena to identify relevant concepts; (2) integrating these concepts to develop an integrated SBM-IP canvas; and (3) using several short case examples to illustrate the relevance of IP for sustainability. Cronin et al. [23] denoted this process as “meta-synthesis”, which is a “non-statistical” way of integrating key concepts identified from different literature streams to develop a new conceptualization.

2.1. Identification of Relevant Articles

We conducted a bibliographic search by following a step-by-step approach [24] to identify articles with relevant concepts in the fields of business models, innovation, and IP with emphasis on sustainability over the last 15 years until October 2019. We sought articles in peer-reviewed literature (e.g., scientific journals, books, and conference proceedings) within Scopus and Web of Science. Different combinations of a group of keywords were used and included variations (e.g., plural or singular) using stemming for terms such as sustainable business model (SBM), business model for sustainability, open business model, circular business model, sustainability, sustainable development, sustainable, intellectual property (IP) (rights), IP strategy, patent, trademark, licensing, innovation, sustainable innovation, open innovation.

The articles were screened and shortlisted based on the criterion of relevance and focused on: (1) business model building blocks (e.g., customers, value proposition, and channels); (2) IP types and activities (e.g., patents, trademarks, trade secrets, pledges, licensing); and (3) sustainability. The shortlisting process exposed only eight articles that discussed some linkage between IP and business models in general, and about 18 articles that studied IP in the context of sustainability, but not from the business model aspect. A large number of articles (about 11,690 articles) focused on SBMs or business models for sustainability. None of the articles discussed IP specifically with SBMs, holistically covering the entire value mechanisms as proposed in this paper.

The authors increased the accuracy of selecting and allocating articles by conducting multiple screenings individually and checking that IP types and activities were linked directly to any building block. Accordingly, authors also held discussions through frequent meetings to align views for the screening and selection of articles. At the end of the screening process, each article was double-checked in detail.

2.2. Approach to Develop the Proposed SBM-IP Canvas

From the SBM literature, we identified the SBM canvas [25,26] as the basis for mapping IP types and activities to sustainable business. While other SBM canvases have been developed (see, e.g., [27] for an overview), the SBM canvas was chosen for its similarity to the business model canvas [26] and relatively simple layout, but with a focus on sustainability.

From the IP literature, we compiled a list of IP activities to map within each building block in the SBM canvas according to their relevance. By relevance, we denoted various kinds of associations that IP activities can have to a particular building block of the SBM canvas. For instance, it could be as simple as obtaining an IP right for protecting an intellectual asset of the building block (e.g., patenting for protecting invention); or conscious efforts to use IP as a strategic instrument to facilitate sustainable business (e.g., IP licensing for accelerated diffusion and revenue). For the purpose of this paper, we took a strategic and managerial view of IP rather than focusing on the legal system view of IP, as we argued that in a given IP legal context, the strategic IP handling by companies can facilitate or hinder the proliferation of a sustainable business.

2.3. Illustrative Case Examples

Case examples are presented to illustrate the SBM-IP canvas developed. Illustrative case examples are suitable for exploratory study to verify and discuss the relevance of different IP activities to SBM building blocks based on theoretical concepts [28]. The selection criteria of the case company was as follows: (1) the company developed one or more innovations (product, service, or business model innovations) that created sustainable impact, (2) the company implemented business models for sustainability, embedding social and environmental aspects in any of the value mechanisms, (3) the company possessed any type of IP and strategically used it for its business. We provided a collection of short case examples demonstrating the role of IP individually within each building block of the SBM. The reason for using short examples within individual building blocks was that not all businesses use IP in all mechanisms of their SBM with the same intensity. We would like to take advantage of notable examples to illustrate for all SBM components how sustainable businesses use IP.

3. Results

In Step 1, we present a brief literature overview on SBMs and IP activities and present a compilation of IP strategy-related activities from the literature. This is followed by a review of articles at the intersections between business model, IP, and sustainability. In Step 2, the derived concepts and arguments are used for conceptualizing an integrated SBM-IP canvas portraying the interactions of IP with SBM building blocks. Finally, in Step 3, we illustrate the framework with case examples.

3.1. Results Step 1: Review of Three Literature Streams and Intersections

3.1.1. Sustainable Business Models (SBMs)

Scholars have described the diverse range of SBMs [29,30], yet, Stubbs and Cocklin [4] developed an early conceptualisation and definition. They defined SBMs as models that draw on economic, environmental, and social aspects of sustainability in defining an organization’s purpose; use a triple bottom line (people, profit, planet) approach in measuring performance; consider the needs of all stakeholders rather than giving priority to shareholder expectations; treat “nature” as a stakeholder and promote environmental stewardship; and encompass a system as well as a firm-level perspective [4] (p. 120).

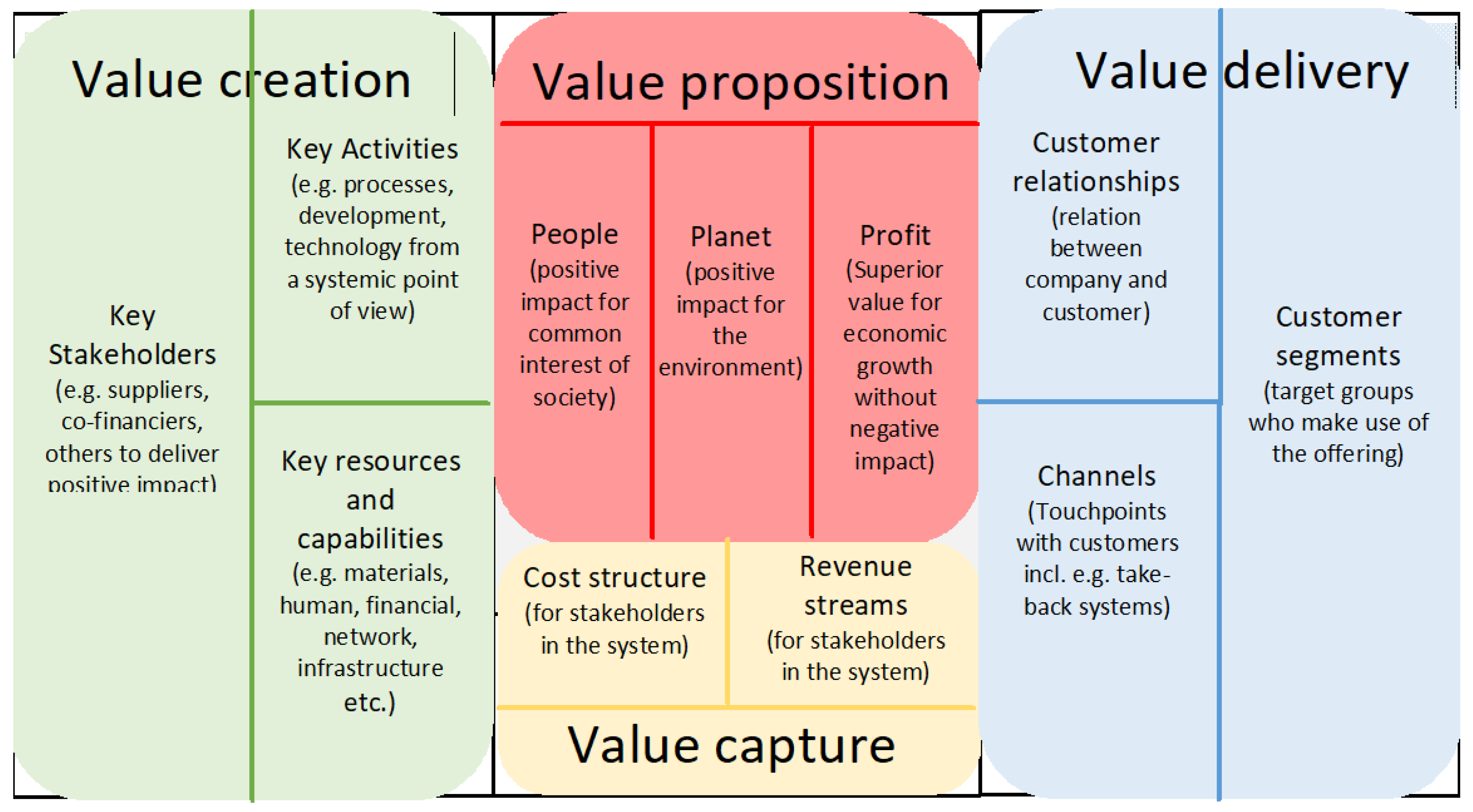

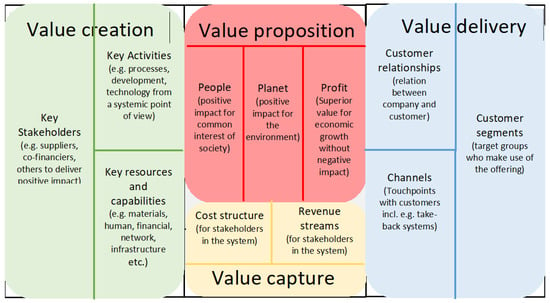

Different manifestations of tools exist to analyse SBMs [27,31,32]. The business model canvas by Osterwalder and Pigneur [26], is a widely used tool in the field of business model innovation. It is often used in parallel with approaches such as Lean Startup, developed by Eric Ries [33], focusing on quick experimentation and learning cycles to innovate the business model for novelty and impact [34,35]. The business model canvas and Lean Startup are popular tools for innovation in new ventures as well as established business, yet they have no specific sustainability focus. Here we therefore refer to the SBM canvas as an adapted version of that business model canvas, which integrates sustainability aspects [25]. Alternative SBM canvases include the flourishing business model canvas and triple bottom line canvas [27,32,36], but the SBM canvas was chosen for similarity to the business model canvas and ease of use for businesses and researchers. This conceptual template helps analyse building blocks related to sustainability and involves a broader set of stakeholders, as shown in Figure 1.

Figure 1.

Sustainable business model canvas from Bocken et al. [25] adapted from Osterwalder and Pigneur [26].

The SBM canvas advances the business model canvas by adding a value proposition focused on sustainability—people, profit, planet [4,37]—plus a clustering of the key business model components into the (1) value proposition; (2) value creation and delivery; and (3) value capture (based on Richardson [38]; Bocken and Short [39]; Sousa-Zomer and Miguel, [40]). The value proposition refers to the product–service offering (what value is provided to whom?), the value creation and delivery (how is value provided?), and value capture (how does the company make money and capture other forms of value?) [39]. Accordingly, the SBM canvas includes the building blocks of value proposition: people, planet, and profit; value creation: key stakeholders, key activities, key resources and capabilities; value delivery: customer relationships, channels, customer segments; and value capture: cost structure, and revenue stream. The SBM canvas, in contrast to the conventional business model canvas, thus includes a value proposition focus on people, profit, and planet (not just profit) and a broader focus on stakeholders in value creation and value capture mechanisms. In the case of an SBM, the growth ethos and strategy are also considered important because the SBM’s emphasis is not on profit maximisation but increasing overall stakeholder value (e.g., [39]).

Nosratabadi et al. [41] suggested that companies can design SBMs by focusing on the analysis of value mechanisms and their components, as well as generating partnership networks to meet sustainable development goals. The adoption of SBMs depends on contextual and internal factors of companies, including their available resources such as IP, as well as opportunities to propose, create, deliver, and capture value. Lee et al. [42] suggested that SBMs play a significant role in diffusing new technologies but this depends highly on the management and strategy of its IP and its alignment with business models to create sustainable impact. New technologies with IP may require new ways of thinking as well as a good fit with the appropriate SBMs to diffuse, commercialize, and improve technologies [43,44].

3.1.2. Intellectual Property (IP) Strategies

The World Intellectual Property Organization (WIPO) defines IP as “creations of the mind, such as inventions; literary and artistic works; designs; and symbols, names and images used in commerce.” Businesses typically possess IP portfolios with IP being either generated internally through in-house R&D, as used in the closed-innovation model [45], co-developed through collaboration with other actors, as seen in the open innovation models [8], or acquired from external organizations through IP purchase or mergers and acquisition [14].

Companies may choose to formally protect their IP assets by law through formal registration for obtaining IP rights, including patents, design rights, trademarks, copyrights, and geographical indications. Not all inventions need to be legally registered for IP rights ownership and a company may choose to possess IP assets not formally protected but uses semi-formal appropriation mechanisms such as secrecy, confidentiality agreements, or informal mechanisms such as lead time or complexity to protect its innovations [46,47].

Different definitions exist for what an IP strategy is [48]. Somaya [49] described IP and patent strategy in particular as encompassing “a set of resource allocation decisions and underlying ‘logics’ of decision making about patents that primarily occur in three broad (and interdependent) domains of activity: rights, licensing, and enforcement.” Businesses typically have different IP assets other than patents and use a combination of formal and informal IP to protect innovation [50]. Hence, we considered decisions about which IP type to use, when, and why as the important dimensions of any IP strategy. Päällysaho and Kuusisto [47] identified operations related to IP protection as an important consideration for IP strategy. As a recent development, Wang et al. [19] identified three dimensions of IP strategy as important, namely, (1) “why” IP assets are needed; (2) “how” IP assets are used to realise the business goals; (3) “when” different actions should be taken [19]. Expanding the definition by Wang et al., 2018 [19], we defined IP strategy as the set of activities and guidance processes for decision-making regarding the exploration, generation/acquisition, protection, exploitation/enforcement, and periodic assessment of IP (rights) to maximize value from an organization’s inventions, like technologies, products, services, literary and artistic works, design, symbols, names, and images in support of the organisation’s business objectives. We followed this approach by Wang et al. [19] to structure the review of IP strategy literature under two headings, namely, IP assets (why and which type of IP asset) and IP activities (how and when).

IP Activities: Types of Usage and Sharing

The scope of IP usage and sharing has grown with the emergence of a multitude of open innovation models. Studies evidence IP as an enabler of open innovation [51]. Several strategic usages of IP exist, including IP licensing [52], IP donation [43], IP pledge [15], open sharing of IP (e.g., open-source-based models) [21,53], and even IP litigation (offensive IP strategy) [49].

From the strategic IP usage point of view, broadly, companies can choose to protect their inventions and prevent access by others (e.g., conventional IP protection model). Others can choose to put the invention in the public domain, open for anyone to access and use (defensive publishing), or for use under conditions such as to share alike, following works that built on the IP (e.g., open source model), or choose to protect as well as share (e.g., licensing) [21].

Somaya [49] classified patent strategies as proprietary strategy, leveraging strategy, and defensive strategy. The choice of one particular IP strategy over the others depends on several factors and studying them is not within the scope of this study. The scope of this paper is restricted to establishing linkages between IP strategies and SBM components. Table 1 summarizes IP activities as identified from the literature. They are grouped under different IP-related actions [19] namely IP generation, IP protection, IP litigation, IP sharing, IP transfer and monetization. While IP sharing has the objective to share the IP, e.g., through licensing for facilitating market diffusion of inventions, IP transfer and monetization refers to activities that focus on monetization only, e.g., sale of patents to earn money.

Table 1.

Compilation of intellectual property (IP) activities and their descriptions (source: authors own compilation).

Companies devise their IP strategies as a deliberate choice or by chance, and its effects are felt both internally within the company and externally at the ecosystem level. When it comes to the effects of IP strategies, two views exist: (1) IP as a facilitator playing a positive role, and (2) IP as a hindrance playing no or a negative role in achieving a desired outcome. For example, studies like Gould and Gruben [72], Park and Ginarte [73] showed that IP can positively impact innovation, resulting in profits and economic growth. On the other hand, studies like Gangopadhyay and Mondal [74], Gurgula [75], Henry and Stiglitz [76] highlighted that stronger IP protective strategies hinder knowledge sharing, subsequent innovation, and societal benefits at large. A handful of corporate giants prevent the reach of potential benefits to the beneficiaries’ stakeholders largely in the pharmaceutical (e.g., IP rights protection preventing accessibility and affordability of medicines [75,77]) and agricultural sectors (restricted access to plant varieties for farmers [76]). The IP strategy literature has focused largely on the business with few insights about the role of IP strategies for sustainability, an emerging global concern.

3.1.3. Intersection of IP and the SBM: The Missing Link

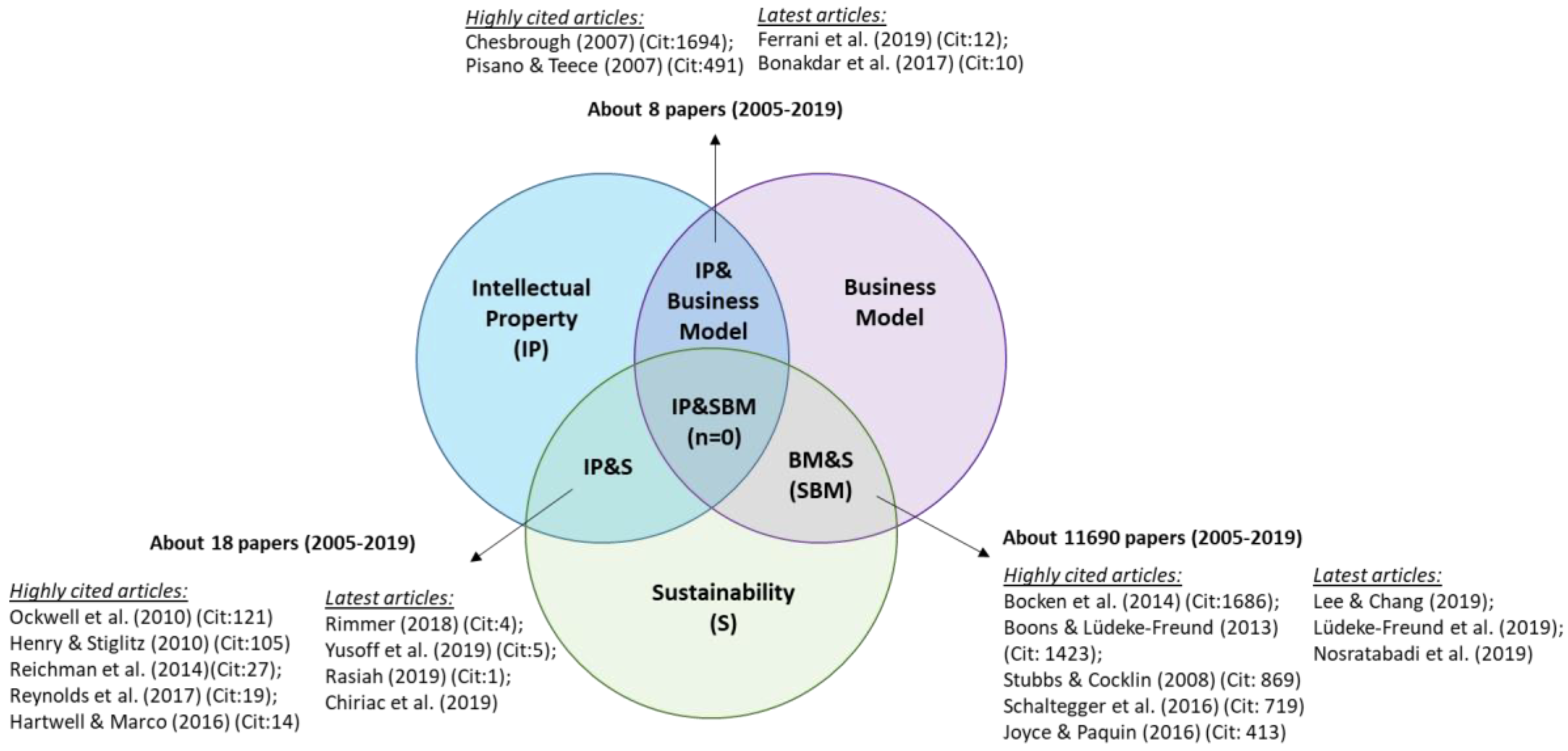

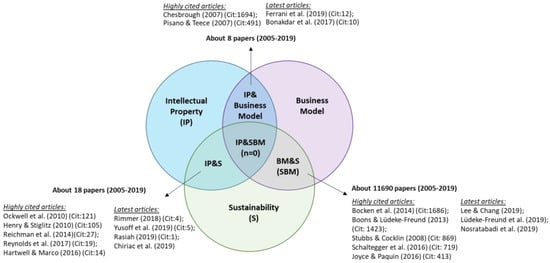

Our attempt to review the literature discussing the interactions among IP, business model, and sustainability revealed that certain intersections are better studied in literature than others. Table 2 summarizes the literature that studies interactions between business model and sustainability (~11,690 studies), IP and business model (~8 studies), and IP and sustainability (~18 studies) across years from 2005 until now, along with highly cited references within each category. Overall, the literature studying the linkages has grown over years and almost more than doubled every five years (Table 2). The most widely studied intersection is that of the business model and sustainability, and the least studied is the intersection among all three, i.e., between IP and the SBM (business model and sustainability) (Figure 2).

Table 2.

Literature on intersections: (sustainable) business models, IP, and sustainability over time.

Figure 2.

Literature on intersections among business model, IP, and sustainability.

At the intersection of IP and sustainability, we identified 18 papers. The scope and focus of these studies cut through different IP asset types, namely, patents, trade secrets, research data, and copyright, and concern IP for sustainability at macro—the international technology transfer and policy level [7,76]; meso—industry or sector level [83], technology or innovation level [76,80,81]; and micro—company level [44,84]. Different IP asset types, namely, patents, trade secrets, copyrights, and research data are associated with sustainability-focused innovations. Strong IP protection, like patents, offers protection to sustainable inventions and incentivises innovators to recoup R&D cost, but may also induce a monopoly through patenting and restrict scalability, adoption, and diffusion of sustainability-focused technologies, undermining sustainable strategies and business models when exclusivity is maintained [76,83,85]. Alongside patents, trade secrets (e.g., design secrets), copyright (e.g., software), and research data are other relevant forms of IP for green technology developers [81,82,86]. Green technology inventors may maintain trade secrets to pursue commercial development at a later time period or for business advantages [81].

The majority of studies on IP and sustainability describe monopoly rights associated with IP as problematic and offer alternative IP approaches like sharing through licensing, pooling, and pledging. For international low carbon technology transfer, Ockwell et al. [7] mentioned IP as challenging in international climate negotiations. Based on case studies from India and China, Ockwell et al. [7] showed that companies in developing countries implement activities like licensing, collaborating with developed-country companies, acquiring developed-country companies, and conducting in-house research for access to low carbon technologies. All these activities for getting access to sustainability-related technologies involve IP negotiations. International variations in IP regimes and discourses cause challenges in sustainability-focused technology transfer [7]. Rasiah [87] pointed out the need for removal of restrictions posed by IP rights to enable knowledge sharing and adoption of technologies through public ownership to support social and environmental initiatives.

Along the innovation process, IP rights, particularly patent-related concerns for green technologies, are more common for those green technologies in commercialization stages (e.g., wind energy and hybrid cars) than those in early stages [86]. For technology development, Reichman et al. [80] suggested licensing of IP and patent pools for facilitating IP sharing among green technology developers. For Solar Climate Engineering (SCE) technology, Reynolds et al. [81] suggested “research commons” and “pledging” to facilitate technology development. Studying the beer industry, Wells [83] mentioned open source design-based innovations as a way for start-ups to compete with the in-house R&D of large companies. In the education sector Nanayakkara [88] found that reuse of open access contents like Moodle helped reduce paper wastage in millions a day and saved hundreds of gigawatts of energy. Broadly, access to IP and replication of SBMs encourage expansion beyond a niche market, improvement of technology, and development of infrastructure for more sustainable pathways [83].

In summary, the literature integrating IP and sustainability recognizes the relevance of different IP assets for sustainability at different levels (e.g., policy, international technology transfer, industry, innovation, business). What is missing in the literature, however, is a framework for a company operating in a sustainability-focused business approach to incorporate IP types and activities that align with its SBM. Companies must adopt SBMs that preserve the environment, promote well-being, and satisfy customer demands through value propositions that involve green IP and green inventions [89]. While some work has generally related the concepts of IP and sustainability, more research needs to explore the details of their interrelation. Below we review the literature that discusses the linkages between IP and business models aiming to derive insights for developing our integrated SBM-IP framework.

We identified eight relevant papers at the intersection of IP and BMs. From these papers, we identified two research focuses that connect the two concepts. The first set of papers focused on the strategy of formulating BMs around IP commercialization [78]. IP-based, IP-enabled, or IP licensing (based) business models all refer to, for example, intellectual ventures or patent-aggregating companies that create, acquire, own, market, and commercialize IP to other companies [90]. A key consideration for IP commercialization is the strength of its protection, as a weak protection results in unviability to commercialize IP [91].

The second focus is on IP associated with innovations—e.g., product feature, processes, business methods—as components of business models [92,93]. Desyllas and Sako [92] identified formal IP protection strategies (i.e., patents and trademarks) and their efficacy to protect business model components, particularly in the early stages of business model innovation. Bonakdar et al. [79] characterized formal and informal IP protection mechanisms (e.g., patents, trademarks, and trade secrets) as strategies for value capture in the context of different business models. Teece and Linden [91] proposed that the strength of the IP regime is crucial for choosing a business model. They further suggested that complementary IP assets associated with new product features, design, or processes are needed in order to offer reasonable value propositions embedded in business models. Ujwary-Gil [94] suggested that IP helps create value and competitive advantage for companies, and IP as a resource in the business model is subject to transactions. To summarize, companies can adopt business models with different IP assets and strategies, and with different degrees of IP protection, e.g., IBM shifting its exclusive usage of IP protection to IP licensing [8]. IP strategy needs to be aligned with business models in order to best support creating and capturing value [95]. The emerging discussion of IP and business models calls for more research to understand how IP and innovation drive business models, against the background of proposing, creating, delivering, and capturing sustainable value. Further research needs to investigate other types of business models [79], (in our case, SBMs) as well as a network and resource flow analysis to consider a dynamic approach in evaluating business models [79], which is relevant for evaluating SBMs as they involve a wide range of stakeholders, including environment and society.

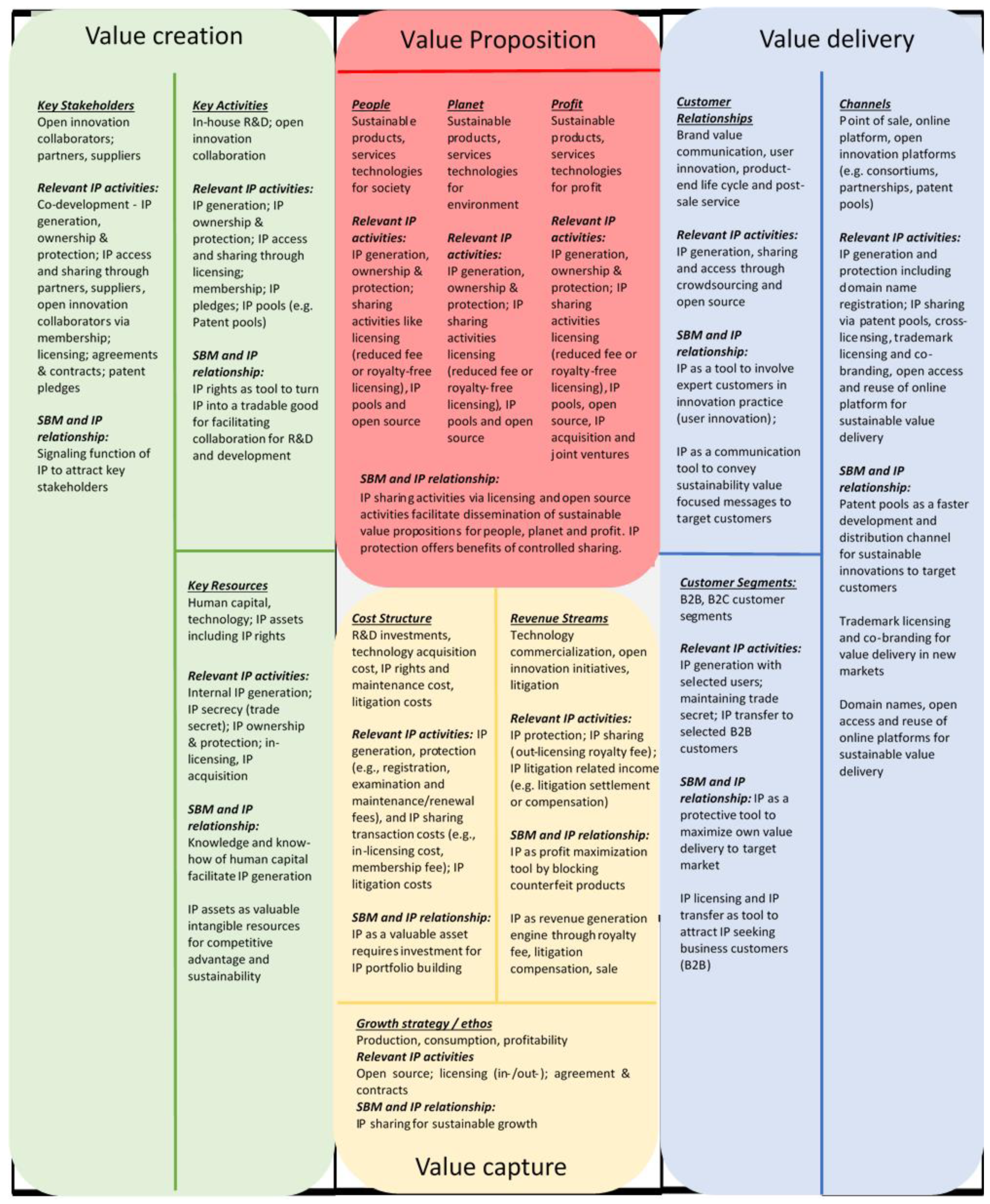

3.2. Results Step 2: Conceptual Framework

3.2.1. Bridging IP and SBM Value Mechanisms: Conceptualizing an Integrated SBM-IP Canvas

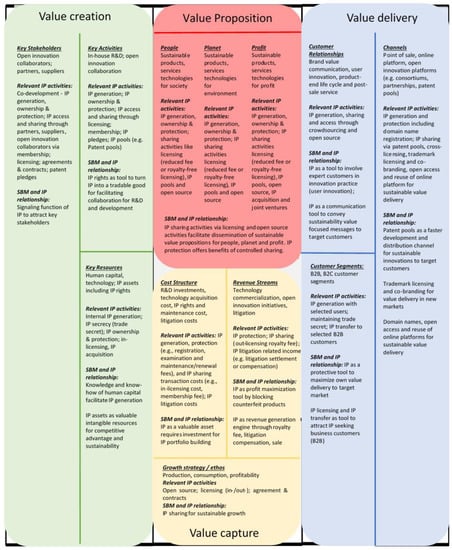

Having reviewed the literature on business models, IP, and innovation with emphasis on sustainability, we used the theoretical components and empirical findings from these research streams to build an integrated SBM-IP canvas model. The scope of this conceptualization was focused on exploring the relevance of IP for the different SBM building blocks rather than their causal relationship with each other, which deserves a separate study of its own.

To develop the SBM-IP canvas, we drew on the SBM canvas [25,26] and integrated the relevant type and use of IP for any of the SBM building blocks. The SBM canvas had four value components, namely, (i) value proposition, (ii) value creation, (iii) value delivery, and (iii) value capture [40]. Figure 3 shows the integrated SBM-IP framework. In the following, we identify and describe the relevance of IP for each of the SBM building blocks. While we found that all IP assets such as formal IP (patents, copyright, trademark, and utility models), semi-formal (trade secrets), and informal (know-how) can contribute to each building block, the relevant IP activities and the purpose they serve differs.

Figure 3.

Integrated SBM-IP canvas.

3.2.2. IP for Sustainable Value Propositions

Sustainable value proposition is the core of each business model and addresses the question of what value is provided to whom [38,39]. The value proposition of an SBM focuses on superior customer value, coupled with clear benefits for society and/or the environment, while delivering a profit [33]. To move towards sustainable value propositions, product-oriented businesses may adopt green technologies or innovations [96] for the benefit of people and the planet [95], and transition from being product providers towards solution providers offering services [97].

From the literature, we derived three key focus areas of IP and sustainable value propositions related to products, services, and technologies with benefits for people, planet, and profit. The three focus areas are described as follows.

IP generation and sharing to address social issues and benefits for people: Value propositions targeting social sustainability may involve offering products, services, and technologies for social groups that have not been served before. Hence, IP generation to facilitate innovation relevant to society to address unserved needs is important. Examples include IP related to access to renewable energy and health in rural communities [29], IP related to drug development for neglected diseases to cure people in developing countries, or IP for rare diseases in developed countries. While the first involves open innovation initiatives that facilitate IP sharing, such as WIPO Re:Search, the latter focuses on profit-based, protected IP development [98] and may or may not involve sharing. IP sharing through an open access model facilitates access to innovation with social benefits (e.g., Ecofiltro, analyzed in Section 3.3.1).

Under the open access and open source logic [99], companies freely reveal IP, e.g., open source software to test and improve software issues and deliver a better product/service to society [100].

IP generation and sharing to address environmental issues and benefits to our planet: A large proportion of innovative products, services, and technologies seeks to improve the environmental impact of alternative solutions. Products have different features that involve several IP assets in the form of patented inventions, design rights, trade secrets, and trademarks [91]. Examples are long-lasting mobile phones, eco-friendly clothing, and electric vehicles. These IP assets add superior value to products and are part of a bundled package offered in markets [101]. Product stewardship increases sustainable value for business, environment, and customers by minimizing waste, disposal, and costs [102]. Companies move from product-orientation to service-providers to fulfil customers’ needs through service innovation [32,97]. Services such as repairing, remanufacturing, and recycling involve environmental benefits by either extending or upcycling products as well as reducing costs [97] and require IP sharing (e.g., licensing) between original equipment manufacturers (OEMs), recyclers, and remanufacturers. Services through open source or licensing can help build brands or get community involvement to monitor environmental issues [103]. Like products and services, IP assets attached to technologies and their sharing can be part of environmental value propositions, e.g., licensing green technologies [104]. Green technologies, such as climate change technologies, are recognized as a tool to reduce environmental issues, and they can be licensed to facilitate technology diffusion and tackle sustainability challenges [84]. For example, Fujitsu’s licensing of its environmental technology aims at aiding better policy making for regional revitalization [105] (see Fujitso example in Section 3.3.1).

Companies adopt IP protection, licensing, or open access activities, which are relevant for different IP assets that are part of sustainable products [104], services [106], and technologies [103]. However, companies may strategically decide to keep them in secrecy to shield the business [104], affecting the development and diffusion of green technologies [107], while trademarks, design rights, and copyrights unlikely hinder their development and diffusion [107]. In order to be able to license and share IP of green technologies, companies need some IP protection to capture value [103].

IP generation and sharing for profitability and sustainable economic benefits: IP is at the core of protecting companies’ investments in the future. Hence, how to best protect and brand their offerings with a set of formal and informal IP assets is crucial to each business model and it offers the possibility of controlled and selected sharing. While being profitable for licensors, licensing may be expensive for licensees, and therefore slow down technology diffusion to address sustainability issues [83]. Licensing increases when a technology is relevant to an emergent industry and it is adopted as a standard [108]. Differentiated licensing and joint ventures for profits to enable economic growth in less developed countries is sustainable if profit equals economic sustainability and not only profitability of the firm.

3.2.3. IP for Sustainable Value Creation

The value creation in an SBM indicates how a value proposition is created, which takes into consideration sustainable practices related to key stakeholders, activities, and resources [29,40]. IP assets play a crucial role as a signalling tool to attract key stakeholders, such as investors, collaboration partners for innovation, and suppliers. Generating IP assets are part of the key activities and, lastly, may pose as a key resource.

Key stakeholders are critical for companies to achieve sustainability in value chains as well as to share green innovations in the creation process through IP rights [30]. Key stakeholders include individual collaboration partners, and larger open innovation communities, as well as suppliers.

IP access and sharing through partners’ collaborations are highly important to acquire green technologies, know-how, and IP rights in order to address environmental issues [109,110]. In this way, collaborations with partners contribute to collectively strive for sustainability through innovations and knowledge sharing [8,110]. Companies may establish contracts with partners or have open access models when both perceive benefits from collaborations [104], which can involve sharing IP rights to, for example, reduce carbon emissions in value chains (see Unilever example in Section 3.3.2). Another example is Tesla’s patent pledge to attract further collaboration with partners investing in the same sustainable technology concept [111]. Partners with relevant IP, thus, may become technology suppliers, technology co-developers, and downstream licensees.

Co-development and IP access through open innovation collaborators can also help companies in sharing or co-developing innovations, and therefore providing IP access and sharing through, e.g., memberships, licensing, or agreements [8,44]. Open innovation collaborations can diffuse green technologies by giving access to IP rights, and help companies move towards sustainability pathways [10]. In some cases, companies are part of patent pools to solve licensing and IP transaction cost issues and to use a standardized technology [90]. A patent pledge is also royalty-free but companies keep ownership of their pledges. With patent pledges, companies may attract new collaboration partners in order to create positive environmental impact [64]. However, in case of any threat against a patent holder company, it can terminate the non-assertion pledge as a defensive mechanism with another party [64].

IP licensing by working hand-in-hand with suppliers is also relevant as suppliers can be key stakeholders for licensing IP rights and simultaneously contributing to addressing sustainability challenges with sustainable practices [44,94]. Suppliers should have engagement in sustainable practices (e.g., refurbishing) and openness to lease technologies with patents and know-how to enable other parties to adopt and implement innovations across value chains [44,110]. In the manufacturing (e.g., automobile) industry, suppliers may hold product design rights and patents, which raise barriers for remanufacturing practices [82].

Key activities are essential in the sustainable value creation process [26,40]. Sustainability-related activities are relevant in order to change the way of doing business [25]. Key IP-related activities in SBMs are R&D and open innovation involvement.

IP generation for improvement through R&D either by in-house or collaborative technology development is a key activity not only to generate IP assets (e.g., patents, design rights, know-how, and data), but also to improve operational processes through innovation that can reduce carbon emissions or other sustainability challenges in companies [94]. R&D projects (internal or external) can result in developing green technologies that help innovate processes, designs, and quality of products and services [109]. R&D efforts and investments are generally expensive, which motivates companies to protect information through patents that can be licensed to monetize royalties and cover R&D costs [90]. Companies with R&D projects may alternatively choose to keep in secrecy innovations to gain competitive advantage [106]. R&D projects are not just about developing inventions (e.g., green climate-friendly technologies) but also fitting with business models that enable profitability [91], reduce environmental footprint [80] or local development, and address malnutrition in developing countries (see Nutriset example in Section 3.3.2).

IP pooling, pledging and sharing through open innovation refers to the case when companies engage in open innovation projects as members to exchange or pledge work, e.g., IP can have collective efforts to develop innovations that can be related to address sustainability challenges such as carbon emissions [104]. Members in open innovation projects must establish trust with each other. Their collective efforts can reduce costs, accelerate innovation, and share unused knowledge and innovative ideas [112]. Establishing open innovation collaborations with other organizations may be more beneficial than protecting IP [103,104,105,106,107,108,109,110,111,112,113]. Involved members are usually part of a structure such as a platform to share patents within a technical framework [85,104]. For example, GreenXchange was an open innovation platform composed by different companies to issue licenses to use patents and acquire rights to use others’ patents for addressing sustainability issues [114]. Generally, members involved in open innovation communities share efforts and IP rights to gain benefits and solve sustainability issues [100]. While getting involved in open innovation, it is important for companies to take into account the type of IP engagement, which could imply contracts, partnerships, licensing agreements, and pledges.

Key resources are relevant assets that companies need to create sustainable value. Resources can be tangible or intangible, and among intangible ones we find IP assets such as patents, copyright, trade secrets, know-how, and data [26,115]. IP assets require internal generation or purchasing to secure them for the value creation process [79]. Based on our analysis, we identified human capital in terms of their knowledge and know-how (specific IP), technology, and IP assets as crucial IP-related resources for SBMs.

Knowledge and know-how of human capital as a key resource for IP generation refers to employees who are essential within companies, not only to perform R&D activities to generate IP, but also to contribute in the execution of sustainable-related activities [94]. Knowledge and know-how of employees are considered the most relevant resources in many companies [86,116]. Besides employees working in R&D, there is evidence that many common employees working in operations have come up with inventions of machine parts or improved methods for efficiency and better operational performance that contribute to reducing carbon emissions [104]. These inventions usually become trade secrets or patents as part of a company’s IP portfolio. Accordingly, companies enforce policies and agreements to protect secrecy, loyalty and know-how disclosure with key employees [93,104,105,106].

IP assets as valuable intangible resources for competitive advantage and sustainability can help companies in sustainable value creation. Companies use different IP assets to develop competitive advantages [26,117]. From the business model perspective, patents, brands (trademarks), copyrights, data, and know-how are part of sustainable products, services, and/or technologies [26,118]. As discussed in the R&D section, IP assets are difficult to develop and therefore many companies have strong IP protection, as in the case of Lion Trunk Technology to protect its green technology to clean polluted air (see example in Section 3.3.2). In fact, companies protect a large amount of know-how, specifically in design and operation, through trade secrets, which means maintaining confidentiality of information [91]. They also acquire know-how by licensing from external sources when they lack internal ways to create sustainable value [119].

3.2.4. IP for Sustainable Value Delivery

Sustainable value delivery considers sustainable practices in terms of how the value reaches different customer segments, customer relationships, and channels for a positive environmental and social impact [117]. Next, we explain the important IP aspects for each of the three value delivery components, namely, customer segments, channels, and customer relationships.

Customer segments refer to groups of people—Business to Customer (B2C) or Business to Business (B2B)—the company serves by offering the same or different value propositions [26]. We identified from the literature two IP activities relevant for the customer segment component of the SBM, namely, IP generation and protection, and IP licensing and transfer with B2B customers in the IP market.

IP generation and protection for own exploitation in the target market segment: In the B2B segment in the manufacturing industry, OEMs (e.g., BMW with its disassembly tools and IP protection, explained in Section 3.3.3) protect designs, product materials, or prototypes from other companies, who can be customers and who are willing to remanufacture devices. In order to allow other companies to recycle, reuse, and refurbish devices, the OEM would need to provide access to IP rights such as trade secrets to ensure a more efficient remanufacturing system [82]. However, under such conditions, trade secrets can be revealed in the public domain and to competitors. Hence, the OEM tends to protect IP for maximizing its own value delivery to the target customers.

IP licensing and IP transfer to attract IP-seeking business customers (B2B): Companies may commercialize their IP instead of products in the IP market, leading to another relevant strategy—IP sharing and transfer (e.g., licensing and sale) for this customer segment involving companies. WIPO Green, for example, was founded in 2013 aiming to become a global marketplace for green sustainable technologies [120], where companies can provide or look for needed green technology solutions through licensing, collaboration, or sale to B2B potential customers.

Channels refers to the means through which the companies communicate with and reach customer segments. Channels could be for communication, distribution, or sales [26] of sustainable products, services, and technologies. We identified three IP activities related to channels. One is the use of a patent pool as a platform channel for faster development and dissemination of sustainable technologies to customers in B2B segments. The second is the trademark licensing and co-branding for distributions of value propositions to customers in new markets. The third is the use of domain name registrations for online platforms for distribution, communication, and sales to customers.

Patent pools as a faster development and distribution channel for sustainable innovations: Open innovation platforms can be a critical value delivery channel for companies whose value proposition is a sustainable technology, but its innovation effort needs access to others’ IP. In order to access and also to use its own IP rights, companies form consortiums to build patent pools [90]. Members join these consortiums to cross-license patents, which resolves patent gridlocks, transaction costs, and time (e.g., Eco-patent Common example in Section 3.3.3). These patent pools are usually related to high technologies and are available to other parties through acquisition of licenses [64]. There are non-commercial patent pools founded on royalty-free premises for members and non-members of the pool [62]. Non-commercial patent pools have the purpose and good willingness to benefit society, research, and business. Governments can sponsor patent pools by providing financial and management support in order to establish a link between research and industry [90].

Trademark licensing and co-branding for value delivery in new markets: Brick and mortar points of sale through franchising and subsidiaries are other channels for delivering services to customers and have IP relevance. Companies license trademarks in order to enter new markets and to alternate foreign direct investments [90]. In doing so, trademark licensing involves reputation and enhances consumer demand of a certain product due to brand association. The assumption is IP licensing can increase the demand for a sustainable product/service when the originator is in a renowned sustainable business. An example is the Fair Trade Tourism in South Africa (FTTSA), which applies trademarks to sustainable tourism companies [121,122] that potentially could act as a communication instrument for sustainability-oriented customers. Co-branding combining two brands to create an ecolabel that goes on all products or services is another communication tool for sustainability [123].

Domain names, open access, and reuse of online platforms for sustainable value delivery: Reuse of freely accessible online platforms and open access contents have been shown to be channels to deliver sustainable social value to customers. In the education sector, Nanayakkara [88] showed that reuse of existing online platforms like Moodle for education in Sri Lanka reduced millions of papers used per year, saved hundreds of gigawatt hours of energy, and reduced e-waste related to generating new software contents. Popescu [124] mentioned e-commerce as a useful channel for enhancing social sustainability through customer-led online transactions.

Customer relationships refers to relationships a company maintains with its different customer segments for customer acquisition, retention, and increasing sales [26]. We identified four IP-related activities relevant for customer relationships. The first is the use of open source IP sharing involving users in the innovation process. The second is open source IP sharing and crowdsourcing to retain customers. Third is the sharing of IP, product end-life cycle, and related post-sale service towards sustainable value delivery. Fourth is the use of trademarks for communicating sustainability messages to relevant customer segments.

Open source IP sharing for user innovation with expert customers: Compared to internal R&D development companies may reveal their innovations to customers and allow access to related IP rights in order to gain benefits such as improvement and diffusion of technologies, and cost savings [104]. For instance, open source software allows customers to access IP and further develop to improve software as “developers and problem solvers” [100]. Open source is appealing to the customer segment that takes pride in using it but more so in contributing their IP back to the community freely [125]. Generally, customers freely share their innovations in software without IP protection. From this perspective, establishing good relationships with customers is essential for companies in order to create value [94], and they need to consider customers as users rather than buyers [97]. An open source philosophy is relevant for sustainability in terms of addressing collective interests and to scale-up sustainable solutions [83].

Open source IP sharing and crowdsourcing for customer retention: Involving users in the innovation process is one way of retaining and maintaining strong customer relationships. Involving users in the innovation process as in the case of open source models [100] and obtaining valuable feedback from customers for sustainable solutions through crowdsourcing may help strengthen the relationship with customers [126]. Throughout history, there has been evidence that inventions from users have been critical in, for example, the textile and machine manufacturing industries [104]. The milling machine is an example of an invention developed by user companies needing to improve operations. Usually, users create different innovative products and processes that can be patented to use in-house, e.g., semiconductor processing [104]. Nik-Bakht and El-Diraby [126] created a gaming platform called “Sustweetability” to obtain a public perspective on sustainability of urban infrastructure.

IP sharing, end-of-life cycle and post-sale service in B2B market: Product end-life cycle and post-product sale service are other forms of customer engagement in the B2B market, in which case companies establish agreements to provide services in order to deliver more value to customers (e.g., other companies). Through agreements, companies allow IP access to help extend product lifetime through repairing, recycling, and remanufacturing services, which are aligned to circular economy [97]. However, if the companies possess trade secrets, e.g., design secrets, then they may engage in recycling or remanufacturing their products on their own to reduce the risk of trade secret leakage when outsourced to third parties [82,127]. In this case, customer relationships are through post-sale service, but decisions on doing in-house remanufacturing or recycling may be driven by the IP asset involved and its associated risks.

Trademark, certified marks, and co-labelling for branding and communicating sustainability value to build customers relationships: This strategy involves ownership and own use of IP, particularly trademark as a branding tool to convey brand messages to build customer relationships. According to Landes and Posner [128], a trademark strategy is important for customers because of its “reputational capital associated with an original mark”. Certified marks can help customers make informed choices about products or services. For sustainability, trademark, certified marks, and co-labelling can send strong sustainability messages to customers when associated with sustainable value propositions. FTTSA (as an example previously mentioned and presented in Section 3.3.3) applies trademarks to those tourism companies that meet certain sustainability criteria [121,122], trademarks that may be appealing and easy to identify for customers looking for sustainable value propositions. Businesses need to be strategic about their trademark distinction as use of different trademarks by a company to offer its value propositions in different countries [128] and use of similar trademarks by competing organizations [123] both confuse consumers when trying to identify the source and increase search cost for customers, especially when the customer segment targeted is the same. At the same time, a company may use different trademarks to differentiate its value propositions in different customer segments.

3.2.5. IP for Sustainable Value Capture

Sustainable value capture emphasizes how the company makes money and generates other forms of value, such as societal and environmental value [39]. Sustainable value capture includes the cost structure and revenue streams, value for key actors (including society and the environment), and growth strategy [40].

Cost structure of sustainable business refers to different expenditures a company has, related to business operations and sustainability. Almost all types of IP assets, including formal IP like patents, trademarks, copyrights, and design rights, or informal IP like data and know-how, become relevant to the cost structure of an SBM. Three linkages between IP and cost structure were observed from literature. They are the cost involved in generating and obtaining IP protection, cost involved in IP sharing and transaction, and IP litigation cost.

Cost of generating and obtaining IP protection: The direct IP-related cost is the cost involved in generating and obtaining IP protection itself. IP protection can be expensive, and it can represent profit loss rather than capturing value for companies [129]. For instance, patent protections for an invention could be acquired via several routes, like the national filing or Patent Cooperation Treaty (PCT) filing routes [130]. Seeking protection across multiple countries may involve significant costs, including official fees, agent fees, maintenance fees, and translation fees if filed in different native languages, unaffordable to many start-ups and small companies [130]. Without wider geographic protection, a patented invention can be imitated and reproduced in countries where the invention is not protected [131], possibly compromising value capture.

IP sharing or transaction-related costs: Under open innovation conditions, companies join R&D efforts to minimize costs [8]. Thus, companies choose to either restrict or share IP access with other parties to reduce costs. Further, companies may own several patents, and they may donate those patents that do not represent strategic value to the company—as a cost reduction strategy [68]. Hence technology acquisition cost is another relevant consideration for a business. Technologies from external sources represent opportunities for companies as well as transaction costs that involve IP protection and sharing, establishment of contracts, transfers, and compensations [104]. In-licensing of IP and associated royalty payment is another IP-related cost of relevance. Other IP access-related costs are membership fees for companies who are part of consortiums or partnerships. For this reason, companies need to evaluate whether there are more benefits within a network than producing in-house innovations.

IP litigation costs: Lastly, the use of IP can result in patent infringement or trade secret misappropriation, which can involve expensive litigation [91]. Litigation can be a defensive mechanism to stop third parties from infringement or misappropriation (such as the Mitsubishi Heavy Industries example in Section 3.3.4) [129], which supports maximizing one’s own profits through wider marker capture that would otherwise be occupied by counterfeit products. Some companies invest in ownership to control the use of innovation and monetize IP through litigation [90].

Revenue streams for a sustainable business denotes the sources of revenue from operating a business in a sustainable manner. IP can be sold either as a discreet asset as part of a product or as an IP right itself to access and use any innovation [101]. Accordingly, for sustainability we identified the following two relevant IP linkages for revenue streams of an SBM.

IP for profit maximization through exclusivity: The privilege of exclusivity through IP protection offers competitive advantage and helps maximize value capture (as Lontra’s licensing example in Section 3.3.4 shows). For a sustainable business, IP can be a revenue maximizing tool by keeping counterfeit products at bay, which could be less sustainable, for example, made of less sustainable materials. Companies hence protect their products, services and/or technologies with IP. Customers need to see value on the product itself to pay for it [104]. New products and services developed by using green technologies and IP can increase value perception in customers and therefore increase sales and profits for companies [89].

IP licensing royalty for revenue generation: Companies that internally develop technologies, can sell/license IP rights (a patent) to generate value for the company [119]. Indeed, patents are considered a valuable business as companies can exploit them when there are financial constraints, as in the case of IBM in licensing IP rights to use technologies [90]. Companies such as manufacturers can decide and agree on licensing design or patents to other companies to increase profits [82]. There are companies, namely, patent aggregating companies, that invest in the acquisition and ownership of patents to further license them as the main source of income generation. For those IP rights that can be of value to others, companies may choose to monetize those assets through IP licensing or sale as a revenue generation strategy [68]. License agreements may grant IP rights to use only in specific regions and domains, therefore, agreements need to be clear among partners in order to ensure the patent holder monetizes from agreed royalties and the patent receiver obtains the IP to use accordingly [90,91]. Patent aggregating companies with IP-centred business models can play a role here. Aggregators purchase and control inventions to broadly monetize patents through licensing or litigation [90]. Within open innovation initiatives, members share IP rights and may get some revenues by negotiating licenses to use patents, especially with outsiders, to cover membership fees [64].

Growth strategy: In order to achieve greater levels of sustainability, companies need to reduce negative environmental impact and stimulate sustainable production and consumption [102]. In doing so, it is necessary to rethink business and IP [113] since a number of innovations (e.g., product, production method, logistics, activity) under IP protection can benefit society and the environment [83,106]. IP protection can lead to the creation of monopolies [104]. However, companies such as the hydrogen fuel cell car company Riversimple uses an open approach by sharing IP rights to improve their technology rather than creating a monopoly [44]. Moreover, Riversimple also encourages suppliers to share their IP rights through licensing or contracts and motivates customers to reduce consumption by ownership of cars [44]. Another example is Zola Electric [132].

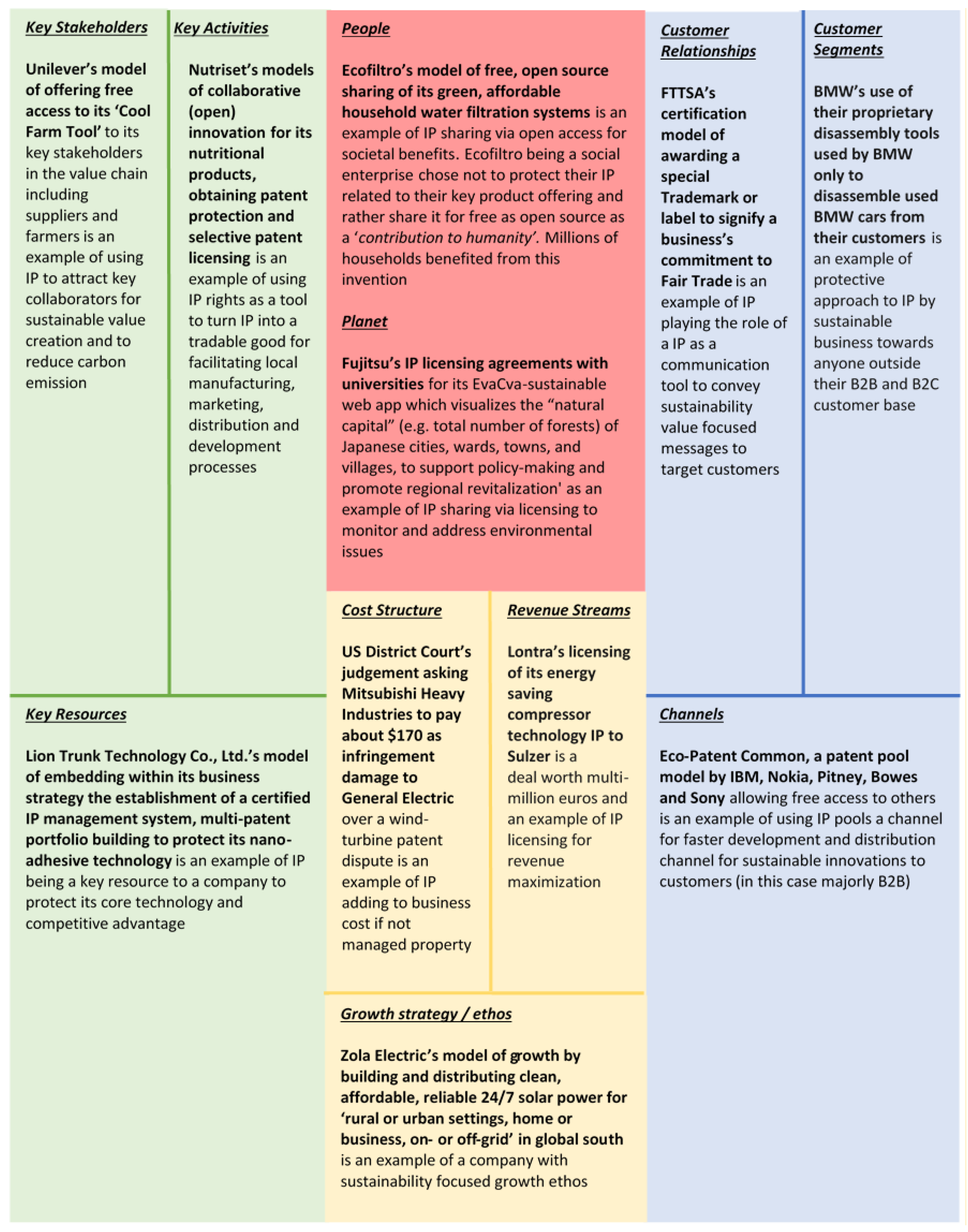

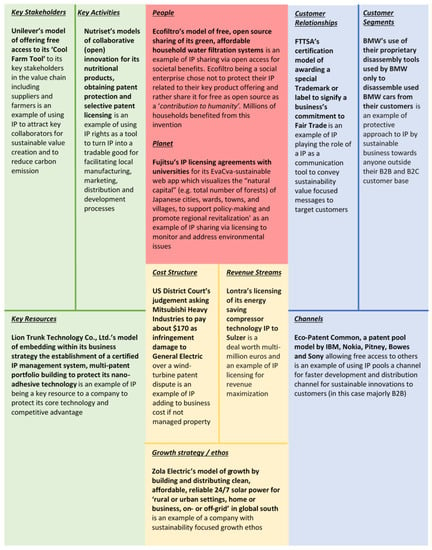

3.3. Results Step 3: Illustrative Case Examples for the SBM-IP Canvas

Having established and described the IP activities and aspects for SBM building blocks in the previous section, we present in this section a set of case examples from secondary sources to illustrate the integrated framework. The examples demonstrate the diversities in IP strategies implemented by companies for their SBMs. The scope of the cases is restricted to exploring what IP strategies are used by companies for each of the SBM components and does not include whether the choice of IP strategies resulted in creating the impact foreseen by the business. We use the conceptualized SBM-IP canvas as a framework to describe the SBM’s value mechanisms of the companies, the relevant IP assets, and IP activities.

Figure 4 provides a collection of case examples compiled from secondary sources illustrating the relevance of a range of IP activities to each of the SBM-IP building blocks. These are discrete examples to illustrate the use of IP by sustainable businesses to achieve different goals within each of the value mechanisms of the SBM canvas. The examples are not related to each other. The figure has to be interpreted accordingly based on the connection and analysis in the previous section. As evidenced from these examples, companies use IP strategically to achieve different strategic business objectives.

Figure 4.

Illustrative case examples [105,130,132,133,134,135,136,137,138,139,140,141,142].

3.3.1. Examples Illustrating IP for Sustainable Value Proposition

An example of IP sharing for value proposition with societal benefits is the open access model by Ecofiltro, a social enterprise offering green, affordable household water filtration systems. The founder decided not to claim the IP for the invention but rather give free access. Despite the filter’s great success, the IP remains free and the founder’s mindset has not changed. “Fernando has humbly shared how pleased he was when a group of Harvard graduates who founded a factory in Uganda told him to ‘feel good’ about the 2.5 million more people who were going to be added to the long list of those who had already benefited from his invention.” [130]. Hence, the IP activity of IP generation and sharing through open access can be an integral part of the value proposition, enabling a transition of the sector as the IP is accessible by competitors.

An example of IP sharing for value proposition with environmental benefits is the IP licensing agreement by Fujitsu for regional and societal revitalization [105]. Fujitsu signed IP licensing agreements for technologies with Kyushu University and University of the Ryukyus. The universities will use Fujitsu’s EvaCva sustainable web app, which visualizes the “natural capital” (e.g., total number of forests) of Japanese cities, wards, towns, and villages, to support policy making and promote regional revitalization. The licensing agreement was facilitated by the WIPO Green platform [120], where all three organizations participated and Fujitsu registered about 200 IP assets related to sustainable technologies. Hence, different from Ecofiltro, the company has not made all IP assets accessible to anyone interested but provides a set of sustainable technology-related IP assets to specific partner organizations [130].

The above two examples indicate that IP generation and sharing through mechanisms like open access and licensing not only offer economic benefits but also promote people and planet-oriented value propositions.

3.3.2. Examples Illustrating IP for Sustainable Value Creation

An example of a company using IP for key stakeholder engagement toward sustainable value creation is that of the Cool Farm Tool (CFT) by Unilever, developed in collaboration with the University of Aberdeen and the Sustainable Food Lab. The CFT measures the greenhouse gas profiles of farmlands. The IP of the tool is jointly developed and owned by the three collaborators. They then licensed the proprietary tool to Cool Farm Alliance with the mission to enable millions of farmers to make informed on-farm decisions to reduce their environmental impact. The tool is given free of charge to farmers, key stakeholders in Unilever’s sustainable agriculture mission [133].

When handled strategically IP generation and selective licensing as key activities of a company will facilitate the local development process of a society. In the case of French nutrition company Nutriset, the company selectively blocks developed-country manufacturers from entering African markets while licensing patents of its peanut paste product to local manufacturers in Africa for only a minimal fee to promote the local economy and tackle malnutrition. The peanut paste invention, jointly developed in collaboration with a research institution and coupled with strategic IP licensing activity, led to Nutriset achieving its mission of “nutritional autonomy” in the African regions [134]. Collaborative R&D for green technology development is another key activity that can be instrumental in generating IP for sustainable value creation. For instance, Kaffe Bueno, a biotech company, engaged in open innovation collaboration with the Dansk Teknologisk Institut to develop a zero CO2 emissions biorefinery process based on waste coffee grounds [135]. The green process is used for producing its upcycled products sold in markets through collaborations with large companies.

The above examples demonstrate that joint IP generation activities through co-development and open innovation collaborations with actors having required competencies such as industrial partners (e.g., Unilever’s Cool Farm Tool) and research institutions (e.g., Nutriset’s peanut paste, Kaffee Bueno’s biorefinery process) facilitate sustainable value creation. Further, the successful implantation of selective, strategic licensing of these jointly developed IPs to relevant stakeholders like farmers and suppliers in the case of Unilever’s Cool Farm Tool and local African manufacturers in the case of Nutriset illustrates that IP access and sharing can act as a tool to magnify value creation by facilitating stakeholder engagement. IP as a protection tool can be a key resource for value creation (e.g., Lion Trunk Technology’s patent protected technology to clean polluted air [136]).

3.3.3. Example of IP for Sustainable Value Delivery

Fair Trade in Tourism South Africa’s (FTTSA) certification model of awarding a special trademark or label to signify a business’s commitment to fair trade is an example of IP as a communication tool to convey sustainability value-focused messages and to target customers [137]. Hence, trademarks are a key marketing tool to build customer relationships and create awareness of customers also for non-sustainable businesses. The fair trade label may leverage international sustainability communication efforts and thereby improve the cost structure of the business model by attracting social business investors as well as reducing own marketing expenditures for branding.

BMW’s use of their proprietary disassembly tools used by them only to disassemble used BMW cars from their customers is an example of a protective approach to IP. The sustainability focus to improve the recycling rate of their products is not shared with anyone outside their B2B and B2C customer bases [138]. Accordingly, the question remains whether BMW will use the IP to set up strategic partners and increase the impact with them or will retain control and slow down the sustainable value delivery.

Eco-Patent Common, a patent pool model by IBM, Nokia, Pitney Bowes, and Sony allowing free access to others is an example of using an IP pool as a channel for faster development and distribution of sustainable innovations to customers (in this case majorly B2B). However, this is an example of an unsuccessful approach. It never reached broad value delivery, as it lacked resources to bundle relevant IP packages and identify applicable licensees [139].

The above three examples indicate that non-technical IP like trademark and its sharing, as in the case of FTTSA, is successful in maximizing sustainable value delivery to target customers and maintaining customer relationships. In contrast, technical IP like patents is less successfully used in facilitating sustainable value delivery as in the case of BMW and Eco-patent, either due to the lack of patent owner willingness to share IP (e.g., BMW) or due to lack of a market to absorb the shared IP (e.g., Eco-Patent Common). The relevant IP type and activities for value delivery thus differ from those of other value mechanisms.

3.3.4. Example of IP for Sustainable Value Capture

IP litigation cost and trade secret theft has cost the wind industry billions, according to an analysis by a private law firm [140]. A US District Court’s judgement asking Mitsubishi Heavy Industries to pay about USD 170 as infringement damage to General Electric over a wind-turbine patent dispute is an example of IP adding to business cost if not managed properly [141]. The infringement damages could have been invested in R&D for improving the technology. The case illustrates that competitive companies may litigate as harshly as in the non-sustainable sector.

Lontra’s licensing of its energy saving compressor technology IP to Sulzer is a deal worth multi-millions of dollars and an example of IP licensing for revenue maximization [142]. Hence, different from the examples of licensing for free or for very small fees, this example illustrates that for sustainable businesses IP may be an attractive additional revenue stream to their product sales.

The Mitsubishi and Lontra examples highlight the direct relevance of IP both as a contributor to the company’s cost structure (e.g., litigation cost) as well as a revenue generating engine (e.g., licensing income). Strategic management of IP can support the economic viability of SBMs through increased revenue, but can also maximize environmental and social value capture. For instance, had Lontra not licensed its energy efficient compressor to Sulzer, it not only might have missed the licensing revenue but also the possibility of widening the diffusion of its sustainable compressor technology and the associated environmental value capture.

4. Discussion and Conclusions

In this paper we conceptualize the relevance of IP assets and their strategic use for the building blocks of the SBM through an inductive and integrative approach using concepts from the IP, business model, innovation, and sustainability literature. As a major result we present an integrated firm-level SBM-IP canvas.

Based on our analysis, we identify IP activities that are relevant for different SBM building blocks, which, however, depend on the specific SBM. While some of these IP activities have been mentioned in previous studies related to conventional business models (e.g., [79,106]), they remain largely under explored in relation to sustainable business models. Our paper aims to help bridge the gap by increasing the understanding of linkages between IP activities and SBM building blocks. The proposed framework provides opportunities to further develop this research and increase the understanding of IP activities and the SBM for sustainability transitions. While our analysis suggests that there are different IP rights (IPR) and IP activities rather than a best practice that fits all SBMs, we provide a starting point to further explore what IP activities under which conditions are most appropriate to support and build sustainable business models.

Our contribution is two-fold: First, we contribute to the SBM literature (e.g., [25,39]) by integrating IP aspects in the SBM canvas, focusing on the four value mechanisms to address environment, society issues, and profitability in the long term [40]. Our framework sheds light on the relationships between IP activities and the SBM building blocks to achieve strategic sustainable business objectives. Second, we contribute empirically through a collection of secondary case examples to illustrate the SBM-IP linkages. These examples provide managerial insights into how businesses use IP strategically linked to the different value mechanisms of their SBMs for promoting sustainability.

IP for sustainable value propositions calls for responsible innovations offering positive value to people, planet, and profit [91,113] by addressing the needs of society, environment, and business [2,29]. Such innovations can embed IP in the form of patents, design rights, copyrights, trademarks, know-how, and data. Some companies, such as start-ups with a strong environmental and social sustainable focus, share this IP with others, making it openly and freely available. They do this to increase the environmental impact of their technology by sharing IP even with competitors. Others, in the cases that we identified, large multinationals and start-ups alike, license IP only to selected organizations in non-competing fields. As it sounds logical that companies need to protect IP to gain competitive advantage [101], we can only speculate whether more sustainable companies adopt more open IP strategies to support a sustainable value proposition than less sustainable companies. Accordingly, we lack evidence to conclude whether for sustainable value propositions a more open IP approach is more prevalent than a closed IP approach. This would require more analysis of large numbers of sustainable businesses.

IP for sustainable value creation calls for decision-making that considers not only the maximisation of profits, but also social and environment impacts. This relates to the responsible use of IP as a tool for engagement with employees, intellectual resources, open innovation involvement and collaborators, partners, suppliers, in-house R&D, and user innovation. Specific examples include the adjustment of scoring models for the selection of R&D projects to prioritise those with societal and environmental impact. Another example relates to the incentives for R&D teams to work on projects with environmental or social benefits, but also the fair remuneration of inventive engineers, whether internal R&D team members or external collaborators (such as academics or independent inventors), beyond what is required by the law, particularly for inventions with additional societal and environmental impact. We also notice that customers can play the role of stakeholders in the sustainable value creation mechanism, particularly when companies adopt an open IP strategy, thus allowing customers to co-create value, e.g., by improving software or hardware that is shared with them.