Research on the Construction of Performance Indicators for the Marketing Alliance of Catering Industry and Credit Card Issuing Banks by Using the Balanced Scorecard and Fuzzy AHP

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. Delphi

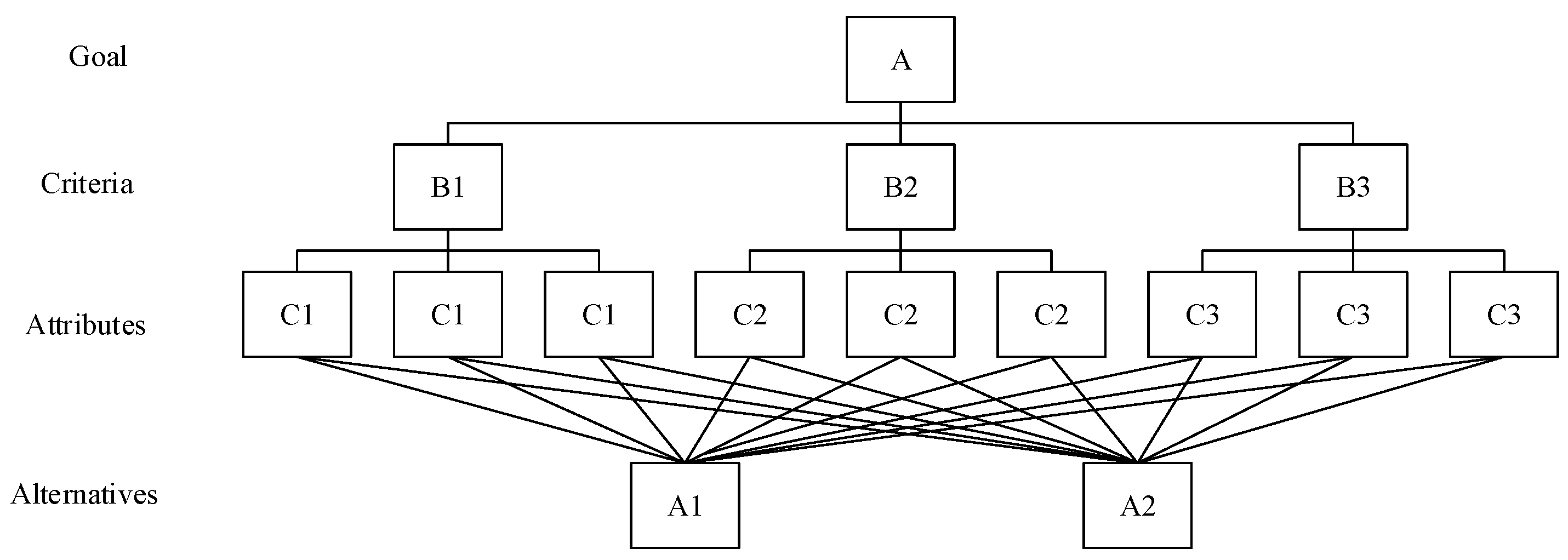

3.2. AHP and Fuzzy AHP

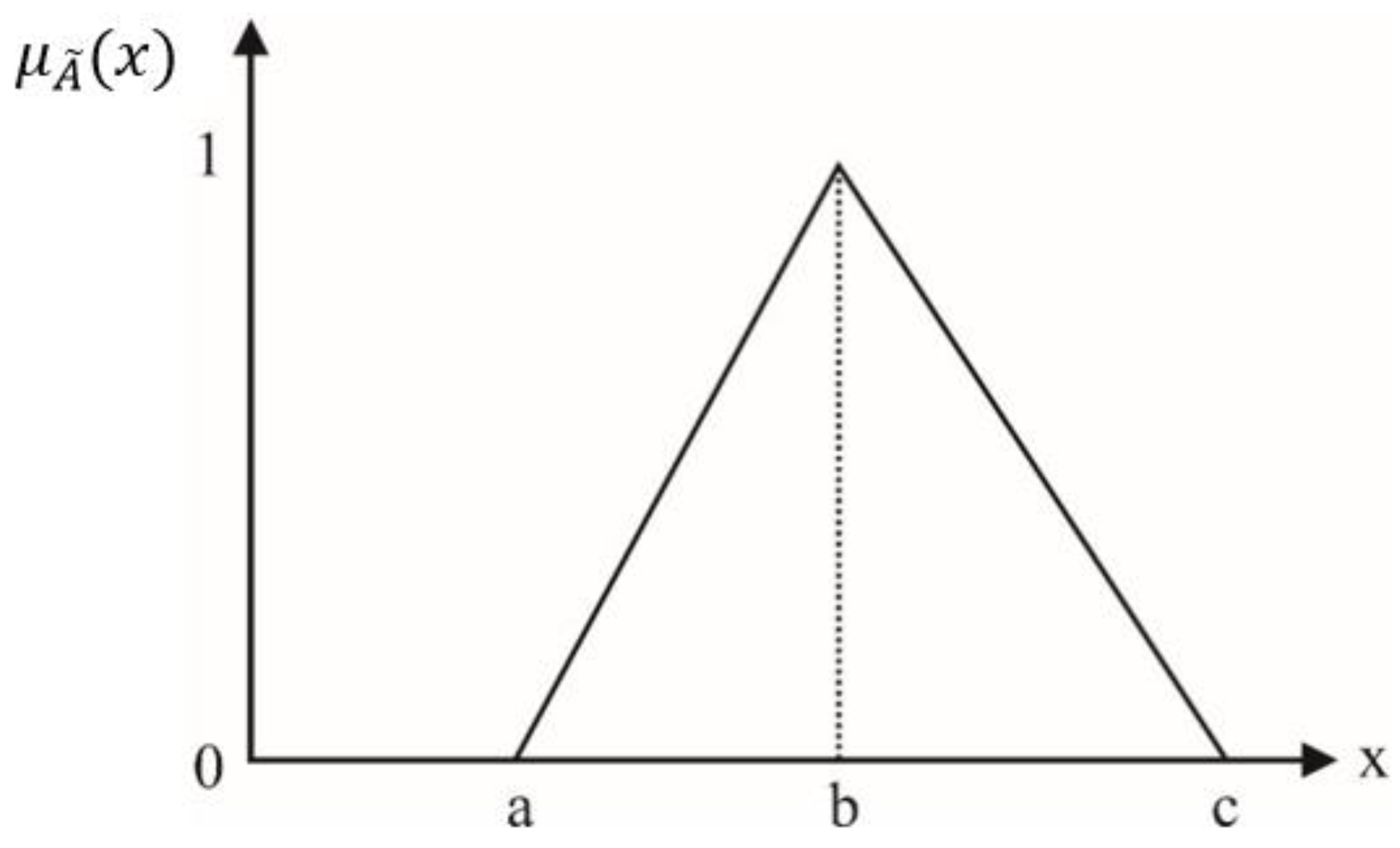

- Attribution function: Fuzzy set refers to a set of things with unclear boundaries and specific properties. The concept of the fuzzy set is that whether an element, , belongs to a set, , is no longer a question of “if it is or not “, but rather an attribute value of 0 to 1 is used to indicate the degree of belonging to . Expressed as a function as Formula (1):is called the attribute function of in fuzzy set . It can be understood from the formula of (1) that any function value can become a membership function as long as it is between 0 and 1 and conforms to common sense. If is closer to 1, it means a higher degree of belonging to . Suppose U is a universe of discourse, and is a fuzzy subset of U. If a number, , is assigned to each , it is used to represent the degree of belonging of to , referred to as the degree of belonging of ; that is , and is called the attribution function of [79].When the attribution function is determined, the fuzzy set is also determined. How to choose an appropriate attribution function is often the key to determining whether the attribution function can be successfully applied. The most commonly used attribute function is the triangular fuzzy attribution function. The triangular fuzzy attribution function graph is shown in Figure 2, and the three value points (a,b,c) are denoted as fuzzy events. The attribution function can be defined as Formula (2) [72,80]:A fuzzy number can always be given by its corresponding left and right representation of each degree of membership [71,80]:where l(y)and r(y) denote the left side representation and the right side representation of a fuzzy number, respectively. The algebraic operations with fuzzy numbers can be found in Kahraman, Ruan, and Tolga [81] and Kahraman, Cebeci, and Ulukan [82].

- Semantic variables: The language used in human thinking and communication is called natural language, and an important feature of natural language is its vagueness [79]. Semantic variables are the use of words in human natural language to express the degree of perception of someone or something, rather than conveying them in a numerical form. For example, we often use the language “very good”, “good”, “normal”, “poor”, “very bad”, etc. to express the subjective judgment of the evaluator. Therefore, we divide the semantic variables into several appropriate semantic scales and let the evaluators choose the semantic meaning they thought was appropriate to describe their feelings about a certain evaluation item. Furthermore, the fuzzy number was expressed through various semantic scales designed in advance, and it was used to calculate the actual feeling value of all the judges on the evaluation item.

- Defuzzication: Defuzzification is to convert fuzzy set data into clear data. There are many different ways of defuzzification, and there is no definite method, which depends on the nature of the problem. The commonly used methods are as follows:

- (1)

- Center of Gravity Method: This method is used to calculate the attribution function of the fuzzy number and the center of gravity of the area enclosed by the domain of the attribution function, and then uses the center of gravity as the definite value of the fuzzy number, which is the attribution degree of the semantic variable. Assuming that the attribution function of fuzzy set is , the weight is also a fuzzy function, denoted by , and F is the position of the center of gravity of the fuzzy set, as in Formula (4):

- (2)

- Mean of Maximum Method: This method uses the element value with the highest membership value in the attribution function as the clear value for the defuzzification of the fuzzy set. However, if there is more than one element with the highest membership value, all corresponding element values must be taken as an average, and this average represents the defuzzification value.

3.3. The Combining of Fuzzy AHP and Balance Scorecard

4. Results and Discussion

4.1. Performance Evaluation Indicators for the Marketing Alliance between the Catering Industry and Credit Card Issuing Banks

| First Level Indicators | Second Level Indicators | Definition | Reference |

|---|---|---|---|

| Customer aspect | 1. customer source | Customer source level: whether occupation, social status, education level, age, different residence, etc., have changed | Rothaermel and Boeker (2008) [121] |

| 2. customer growth rate | Annual growth rate of new customers using alliance credit cards | Fyall, Garrod, and Leask (2002) [31] | |

| 3. customer satisfaction | Customer satisfaction with alliance credit cards | Fyall, Garrod, and Leask (2002) [31] | |

| 4. service quality | Customer satisfaction with the service quality of the catering industry and the issuing banks | Fyall, Garrod, and Leask (2002) [31] | |

| 5. reuse (purchase) willingness | Customers’ willingness to use or reuse credit cards. | Fyall, Garrod, and Leask (2002) [31] | |

| 6. the willingness to recommend others | The willingness of customers to recommend alliance credit cards to others. | Fyall, Garrod, and Leask (2002) [31] | |

| 7. the perceived image of the catering industry and banks | For every one hundred people, the number who know the catering industry and the issuing banks | Fyall, Garrod, and Leask (2002) [31] | |

| Alliance cooperation aspect | 1. commitment of partners | The degree of mutual commitment between the catering industry and the bank | Wittman, Hunt and Arnett (2009) [112] |

| 2. value of partners | The degree of contribution to market value and customer value that may be generated after the marketing alliance | Franco (2012) [17] | |

| 3. loyalty of partners | Degree of trust and loyalty with partners and willingness to maintain long-term cooperative relations | Solesvik and Westhead (2010) [18] | |

| 4. satisfaction of partners | The degree of mutual satisfaction between the catering industry and the banks | Das and Teng (2003) [116] | |

| 5. value of corporate image | The degree of influence of the catering industry and bank cooperation on corporate image value | Chen and Tseng (2005) [109] | |

| 6. industry relation | Whether the cooperation relationship and experience with other industries have been improved | Hitt et al. (2004) [122] | |

| Financial aspect | 1. cost | Direct and indirect costs of the catering industry and bank marketing alliance cooperation | Hitt et al. (2004) [122] |

| 2. net profit | The profit generated after the catering industry and the bank cooperate | Hitt et al. (2004) [122] | |

| 3. market share | Market share after catering industry and bank cooperation | Hitt et al. (2004) [122] | |

| 4. sale revenue | Increase or decrease in operating income after catering industry and bank cooperation | Hitt, et al. (2004) [122] | |

| 5. average consumption per customer | The average amount spent and the number of credit card uses per customer | Chen and Tseng (2005) [109] | |

| Internal process aspect | 1. resource integration ability | Enhancement of the ability of the catering industry and banks to integrate internal and external resources | Chand and Katou (2012) [16] |

| 2. diversified operating capacity | Whether the diversified management capabilities of the catering industry and banks will be improved after the strategic alliance | Chand and Katou (2012) [16] | |

| 3. brand equity | Customers’ recognition of brand equity after the catering industry and bank jointly issued credit cards | Biel (1992) [123] | |

| 4. number of customer complaints | The number of customers complaints about the effectiveness of the joint issuance of credit cards by the catering industry and banks | Kaplan and Norton(1996) [51] | |

| 5. marketing strategy and management ability | Whether the marketing strategy and management capabilities of the catering industry and bank cooperation have been improved. | Hitt et al. (2004) [122] | |

| 6. efficiency | Whether the management efficiency of the catering industry or bank cooperation with different industries has been improved | Rothaermel and Boeker (2008) [121] | |

| 7. departure rate | Customers abandon or increase the usage rate of credit cards every year | Fyall, Garrod, and Leask (2002) [31] | |

| Learning and growth aspect | 1. employee productivity | Whether the marketing ability, management ability, and productivity of employees after the catering industry and bank marketing cooperation have improved | Kusluvan and Kusluvan (2000) [119] |

| 2. employee satisfaction | Employee satisfaction after catering industry and bank marketing cooperation | Kim, Suh, and Hwang (2003) [120] | |

| 3. increase in employees | The number of employees increased after catering industry and bank marketing cooperation | Kim, Suh, and Hwang (2003) [120] | |

| 4. human quality improvement | Improved manpower quality after catering industry and bank cooperation | Kusluvan and Kusluvan (2000) [119] | |

| 5. employee loyalty | Employee loyalty after catering industry and bank marketing cooperation | Kim, Suh, and Hwang (2003) [120] |

4.2. The Relative Importance Ranking of Five Performance Aspect

4.3. The Relative Importance Ranking of Performance Indicators for the Customer Aspect

4.4. The Relative Importance Ranking of Performance Indicators for the Financial Aspect

4.5. The Relative Importance Ranking of Performance Indicators for the Alliance Cooperation Aspect

4.6. The Relative Importance Ranking of Performance Indicators for the Learning and Growth Aspect

4.7. The Relative Importance Ranking of Performance Indicators for the Internal Process Aspect

4.8. Extended Discussion of Marketing Alliances between the Service Industry and the Banking Industry

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Hoffmann, W. Strategies for managing a portfolio of alliances. Strateg. Manag. J. 2007, 28, 827–856. [Google Scholar] [CrossRef]

- Kiessling, T.; Harvey, M. Global marketing networks and the development of trust: A dynamic capabilities perspective. J. Mark. Channels 2004, 11, 21–41. [Google Scholar] [CrossRef]

- Teng, B.S.; Das, T.K. Governance structure choice in strategic alliances: The roles of alliance objectives, alliance management experiences and international partners. Manag. Decis. 2008, 46, 725–742. [Google Scholar] [CrossRef]

- Beritelli, P. Cooperation among prominent actors in a tourist destination. Tour. Manag. 2011, 38, 607–629. [Google Scholar] [CrossRef]

- Sarkar, M.B.; Aulakh, P.S.; Madhok, A. Process capabilities and value generation in alliance portfolios. Organ. Sci. 2009, 20, 583–600. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Lane, P.J. A Model of Cultural Differences and International Alliance Performance. J. Int. Bus. Stud. 2004, 35, 306–319. [Google Scholar] [CrossRef]

- Greve, H.R.; Baum, J.A.C.; Mitsuhashi, H.; Rowley, T.J. Built to last but falling apart: Cohesion, friction, and withdrawal from interfirm alliances. Acad. Manag. J. 2010, 53, 302–322. [Google Scholar] [CrossRef]

- Lazzarini, S.G. The impact of membership in competing alliance constellations: Evidence on the operational performance of global airlines. Strateg. Manag. J. 2007, 28, 345–367. [Google Scholar] [CrossRef]

- Lavie, D.; Miller, S.R. Alliance portfolio internationalization and firm performance. Organ. Sci. 2008, 19, 623–646. [Google Scholar] [CrossRef]

- Goerzen, A. Alliance networks and firm performance: The impact of repeated partnerships. Strateg. Manag. J. 2007, 28, 487–509. [Google Scholar] [CrossRef]

- Heimeriks, K.H.; Duysters, G. Alliance capability as mediator between experience and alliance capability. J. Manag. Stud. 2007, 44, 25–49. [Google Scholar] [CrossRef] [Green Version]

- Judge, W.Q.; Dooley, R.S. Strategic alliance outcomes: A transaction-cost economics perspective. Br. J. Manag. 2005, 16, 1–15. [Google Scholar] [CrossRef]

- Kandemir, D.; Yaprak, A.; Cavusgil, S.T. Alliance orientation: Conceptualization, measurement, and impact on market performance. J. Acad. Mark. Sci. 2006, 34, 324–340. [Google Scholar] [CrossRef]

- Lane, P.; Salk, J.; Lyles, M. Absorptive capacity, learning, and performance in international joint ventures. Strateg. Manag. J. 2001, 22, 1139–1161. [Google Scholar] [CrossRef]

- Shah, R.H.; Swaminathan, V. Factors influencing partner selection in strategic alliances: The moderating role of alliance context. Strateg. Manag. J. 2008, 29, 471–494. [Google Scholar] [CrossRef]

- Chand, M.; Katou, A.A. Strategic determinants for the selection of partner alliances in the Indian tour operator industry: A cross-national study. J. World Bus. 2012, 47, 167–177. [Google Scholar] [CrossRef]

- Franco, M. Determining factors in the success of strategic alliances: An empirical study performed in Portuguese firms. Eur. J. Int. Manag. 2012, 5, 608–632. [Google Scholar] [CrossRef]

- Solesvik, M.Z.; Westhead, P. Partner selection for strategic alliances: Case study insights from the maritime industry. Ind. Manag. Data Syst. 2010, 110, 841–860. [Google Scholar] [CrossRef]

- Cravens, K.; Piercy, N.; Cravens, D. Assessing the performance of strategic alliances: Matching metrics to strategies. Eur. Manag. J. 2000, 18, 529–541. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B. The dynamics of alliance conditions in the alliance development process. J. Manag. Stud. 2002, 39, 725–746. [Google Scholar] [CrossRef]

- Gill, J.; Butler, R.J. Managing instability in cross-cultural alliances. Long Range Plan. 2003, 36, 543–563. [Google Scholar] [CrossRef]

- Bharadwaj, S.; Varadarajan, P.R.; Fahy, J. Sustainable competitive advantage in service industries: A conceptual model and research propositions. J. Mark. 1993, 57, 83–99. [Google Scholar] [CrossRef]

- Dev, C.S.; Klein, S.; Fisher, R.A. A market-based approach for partner selection in marketing alliances. J. Travel Res. 1996, 35, 11–17. [Google Scholar] [CrossRef]

- Evans, N. Alliances in the international travel industry: Sustainable strategic options? Int. J. Cater. Tour. Adm. 2001, 2, 9–16. [Google Scholar] [CrossRef]

- Holmberg, S.R.; Cummings, J.L. Building successful strategic alliances: Strategic process and analytical tool for selecting partner industries and firms. Long Range Plan. 2009, 42, 164–193. [Google Scholar] [CrossRef]

- Meier, M. Knowledge management in strategic alliances: A review of empirical evidence. Int. J. Manag. Rev. 2011, 13, 1–23. [Google Scholar] [CrossRef]

- Pansiri, J. How company and managerial characteristics influence strategic alliance adoption in the travel sector. Int. J. Tour. Res. 2007, 9, 243–255. [Google Scholar] [CrossRef]

- Selin, S.; Myers, N. Tourism marketing alliances: Member satisfaction and effectiveness attributes of regional initiative. J. Travel Tour. Res. 1998, 7, 79–94. [Google Scholar] [CrossRef]

- Wong, E.P.Y.; Mistilis, N.; Dwyer, L. A framework for analyzing intergovernmental collaboration. The case of ASEAN tourism. Tour. Manag. 2011, 32, 367–376. [Google Scholar] [CrossRef] [Green Version]

- Das, T.; Teng, B. Instabilities of strategic alliances: An internal tensions perspective. Organ. Sci. 2000, 11, 77–101. [Google Scholar] [CrossRef]

- Fyall, A.; Garrod, B.; Leask, A. Scottish visitor attractions: Managing visitor impacts. Tour. Manag. 2002, 23, 265–279. [Google Scholar]

- Lambe, C.J.; Spekman, R.E.; Hunt, S.D. Alliance competence, resources, and alliance success: Conceptualization, measurement, and initial test. J. Acad. Mark. Sci. 2002, 30, 141–158. [Google Scholar] [CrossRef]

- Pangarkar, N. Do firms learn from alliance terminations? An empirical examination. J. Manag. Stud. 2009, 46, 982–1004. [Google Scholar] [CrossRef]

- Peng, X. Research on the Current Status, Difficulties and Development Strategies of Educational Marketing in Normal Schools. Master’s Thesis, National Education Institute, National Tainan University, Tainan City, Taiwan, 2000. [Google Scholar]

- Dyer, J.; Singh, H. The relational view: Cooperative strategies and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef] [Green Version]

- Ireland, R.D.; Hitt, M.A.; Vaidyanath, D. Alliance management as a source of competitive advantage. J. Manag. 2002, 28, 413–446. [Google Scholar] [CrossRef]

- Day, G.S. Advantageous alliances. J. Acad. Mark. Sci. 1995, 23, 297–300. [Google Scholar] [CrossRef]

- Geringer, J.M.; Hebert, L. Measuring performance of international joint ventures. J. Int. Bus. Stud. 1991, 22, 249–263. [Google Scholar] [CrossRef]

- Park, S.H.; Russo, M. When competition eclipses cooperation: An event history analysis of alliance failure. Manag. Sci. 1996, 42, 875–890. [Google Scholar] [CrossRef]

- Park, S.H.; Ungson, G.R. Interfirm rivalry and managerial complexity: A conceptual framework of alliance failure. Organ. Sci. 2001, 12, 37–53. [Google Scholar] [CrossRef]

- Cronin, M.J. Performance Measurement for Public Services in Academic and Research Libraries; Office of Management Studies, Association of Research Libraries: Washington, DC, USA, 2000. [Google Scholar]

- Beer, M.; Ruh, R.; Dawson, J.A.; McCaa, B.B.; Kavanagh, M.J. A performance management system: Research, design, introduction and evaluation. Pers. Psychol. 1978, 31, 505–535. [Google Scholar] [CrossRef]

- Mjoen, H.; Tallman, S. Control and performance in international joint ventures. Organ. Sci. 1997, 81, 257–274. [Google Scholar] [CrossRef]

- Mohr, J.; Spekman, R. Characteristics of partnership success. Strateg. Manag. J. 1994, 15, 135–152. [Google Scholar] [CrossRef]

- Contractor, F.J.; Lorange, P. Co-Operative Strategies in International Business; Lexington Press: Lexington, MA, USA, 1988. [Google Scholar]

- Tomlinson, J.W.C. The Joint Venture Process in International Business: India and Pakistan; MIT Press: Cambridge, MA, USA, 1970. [Google Scholar]

- Pekar, P., Jr. How battle-tested managers assess strategic alliances. Plan. Rev. 1989, 17, 34–37. [Google Scholar] [CrossRef]

- Anderson, E. Two firms, one frontier: On assessing joint venture performance. Sloan Manag. Rev. 1990, 31, 19–30. [Google Scholar]

- Harrigan, K. Joint ventures and competitive strategy. Strateg. Manag. J. 1988, 2, 141–158. [Google Scholar] [CrossRef]

- Ariño, A. Measures of strategic alliance performance: An analysis of construct validity. J. Int. Bus. Stud. 2003, 34, 66–79. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Linking the balanced scorecard to strategy. Calif. Manag. Rev. 1996, 39, 53–79. [Google Scholar] [CrossRef]

- Balkovskaya, D.; Filneva, L. The use of the balanced scorecard in bank strategic management. Int. J. Bus. Excell. 2016, 9, 48–67. [Google Scholar] [CrossRef]

- Keshavarz, E.; Ftahikenari, M.; Rohani, A.; Bagheri, S.M. Performance evaluation of banks using balanced scorecard. Int. J. Bus. Excell. 2014, 7, 371–393. [Google Scholar] [CrossRef]

- Karasneh, A.A.-F.; Al-Dahir, A. Impact of IT- balanced scorecard on financial performance: An empirical study on Jordanian banks. Eur. J. Econ. Financ. Adm. Sci. 2012, 46, 54–70. [Google Scholar]

- Kim, W.G.; Lee, S. Developing a new hotel performance measurement system: Application of the balanced-scorecard and the fuzzy-analytic hierarchy process model. In Proceedings of the First Hospitality and Leisure: Business Advances and Applied Research Conference, Lausanne, Switzerland, 5 July 2007; pp. 89–98. [Google Scholar]

- Lucie, S.; Iveta, Š. Key performance indicators as a basic element for a marketing efficiency measurement. In Proceedings of the 7th International Scientific Conference Business and Management, Vilnius, Lithuania, 10–11 May 2012. [Google Scholar]

- Linstone, H.A.; Turoff, M. The Delphi Method: Techniques and Applications; Addison-Wesley Publishing Company: Houston, TX, USA, 1975. [Google Scholar]

- Rowe, G.; Wright, G. The delphi technique as a forecasting tool: Issues and analysis. Int. J. Forecast. 1999, 15, 353–375. [Google Scholar] [CrossRef]

- Briedenhann, J.; Butts, S. Application of the Delphi technique to rural tourism project evaluation. Curr. Issues Tour. 2006, 9, 171–190. [Google Scholar] [CrossRef]

- Garrod, B.; Fyall, A. Managing heritage tourism. Ann. Tour. Res. 2000, 27, 682–708. [Google Scholar] [CrossRef]

- Miller, G. The development of indicators for sustainable tourism: Results of a Delphi survey of tourism researchers. Tour. Manag. 2001, 22, 351–362. [Google Scholar] [CrossRef] [Green Version]

- Park, D.B.; Yoon, Y.S. Developing sustainable rural tourism evaluation indicators. Int. J. Tour. Res. 2011, 13, 401–415. [Google Scholar] [CrossRef]

- Bonnemaizon, A.; Cova, B.; Louyot, M. Relationship marketing in 2015: A Delphi approach. Eur. Manag. J. 2007, 25, 50–59. [Google Scholar] [CrossRef]

- Fan, T.; Vigeant-Langlois, L.; Geissler, C.; Bosler, B.; Wilmking, J. Evolution of global airline strategic alliance and consolidation in the twenty-first century. J. Air Transp. Manag. 2001, 7, 349–360. [Google Scholar] [CrossRef]

- Whipple, J.S.; Gentry, J.J.A. Network comparison of alliance motives and achievements. J. Bus. Ind. Mark. 2000, 15, 301–322. [Google Scholar] [CrossRef]

- Wu, W.Y.; Shih, H.-A.; Chan, H.-C. The analytic network process for partner selection criteria in strategic alliances. Exp. Syst. Appl. 2009, 36, 4646–4653. [Google Scholar] [CrossRef]

- Saaty, T.L. An Analytic Hierarchy Process; McGraw-Hill: New York, NY, USA, 1980. [Google Scholar]

- Zamparas, M.; Kapsalis, V.C.; Kyriakopoulos, G.L.; Aravossis, K.G.; Kanteraki, A.E.; Vantarakis, A.; Kalavrouziotis, I.K. Medical waste management and environmental assessment in the Rio University Hospital, Western Greece. Sustain. Chem. Pharm. 2019, 13, 100163. [Google Scholar] [CrossRef]

- Deng, J.-Y.; Tzeng, G.-H. The Analytic Hierarchy Process: Concepts, Techniques and Applications(I). J. Chin. Stat. Assoc. 1989, 27, 13707–13724. [Google Scholar]

- Ghodsypour, S.H.; O’Brien, C. A decision support system for supplier selection using an integrated analytic hierarchy process and linear programming. Int. J. Prod. Econ. 1998, 56, 199–212. [Google Scholar] [CrossRef]

- Zahedi, F. The analytic hierarchy process-A survey of the method and its applications. Interfaces 1986, 16, 96–108. [Google Scholar] [CrossRef]

- Kilincci, O.; Onal, S.A. Fuzzy AHP approach for supplier selection in a washing machine company. Exp. Syst. Appl. 2011, 38, 9656–9664. [Google Scholar] [CrossRef]

- Saaty, T.L.; Takizawa, M. Dependence and independence: From linear hierarchies to nonlinear networks. Eur. J. Oper. Res. 1986, 26, 229–237. [Google Scholar] [CrossRef]

- Zadeh, L.A. The concept of a linguistic variable and its application to approximate reasoning. Inform. Sci. 1975, 8, 199–249. [Google Scholar] [CrossRef]

- Xu, J.; Yu, L.; Gupta, R. Evaluating the performance of the government venture capital guiding fund Using the intuitionistic fuzzy analytic hierarchy process. Sustainability 2020, 12, 6908. [Google Scholar] [CrossRef]

- Van Laarhoven, P.J.M.; Pedrycz, W. A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst. 1983, 11, 229–241. [Google Scholar] [CrossRef]

- Yu, F.J.; Wei, Y.J. Ranking model for used car selection employing a fuzzy analytic hierarchy process and the technique for order preference by similarity to ideal solution. J. Sci. Eng. Technol. 2017, 13, 1–11. [Google Scholar]

- Buckley, J. Fuzzy Hierarchical Analysis. Fuzzy Sets Syst. 1985, 17, 33–247. [Google Scholar] [CrossRef]

- Que, S.L. Applied Fuzzy Mathematics; Scientific & Technical Publishing Co., Ltd.: Taipei City, Taiwan, 2001. [Google Scholar]

- Kahraman, C.; Cebecia, U.; Ruan, D. Multi-attribute comparison of catering service companies using fuzzy AHP: The case of Turkey. Int. J. Prod. Econ. 2004, 87, 171–184. [Google Scholar] [CrossRef]

- Kahraman, C.; Ruan, D.; Tolga, E. Capital budgeting techniques using discounted fuzzy versus probabilistic cashflows. Inform. Sci. 2002, 42, 57–76. [Google Scholar] [CrossRef]

- Kahraman, C.; Cebeci, U.; Ulukan, Z. Multi-criteria supplier selection using fuzzy AHP. Logist. Inform. Manag. 2003, 16, 382–394. [Google Scholar]

- Chang, D.Y. Applications of the extent analysis method on fuzzy AHP. Eur. J. Oper. Res. 1996, 95, 649–655. [Google Scholar] [CrossRef]

- Lai, V.S.; Wong, B.K.; Cheung, W. Group decision making in a multiple criteria environment: A case using the AHP in software selection. Eur. J. Oper. Res. 2002, 37, 134–144. [Google Scholar] [CrossRef]

- Lucas, D.S.M.; Sandra Mara, I.V.; Vinicius, A.M.; Sandra, R.E. Development of performance evaluation theme: A systematic analysis of the literature. Contextus Rev. Contemp. Econ. Gest. 2019, 17, 63–97. [Google Scholar]

- Whipple, J.M.; Frankel, R. Strategic alliance success factors. J. Supply Chain Manag. 2000, 36, 21–28. [Google Scholar] [CrossRef]

- Cebeci, U. Fuzzy AHP-based decision support system for selecting ERP systems in textile industry by using balanced scorecard. Exp. Syst. Appl. 2012, 36, 8900–8909. [Google Scholar] [CrossRef]

- Wu, H.Y.; Tzeng, G.H.; Chen, Y.H. A fuzzy MCDM approach for evaluating banking performance based on balanced scorecard. Exp. Syst. Appl. 2009, 36, 10135–10147. [Google Scholar] [CrossRef]

- Feili, H.R.N.; Farahani, V.; Vesaghi, N. Integration of fuzzy analytic hierarchy process (FAHP) with balance score card (BSC) in order to evaluate the performance of information technology in industry. J. Math. Comput. Sci. 2011, 2, 271–283. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, H.; Zeng, Y.R. Fuzzy analytic hierarchy process (FAHP) and balanced scorecard approach for evaluating performance of Third-Party Logistics (TPL) enterprises in Chinese context. Afr. J. Bus. Manag. 2012, 6, 521–529. [Google Scholar]

- Sharma, M.K.; Bhagwat, R. An integrated BSC-AHP approach for supply chain management evaluation. Meas. Busi Excell. 2007, 11, 57–68. [Google Scholar] [CrossRef]

- Abdolshah, M.; Javidnia, M.; Astanbous, M.A.; Eslami, M. An integrated approach to analyze strategy map using BSC–FUZZY AHP: A case study of auto industry. Manag. Sci. Lett. 2012, 2, 705–712. [Google Scholar] [CrossRef]

- Grigoroudis, E.; Orfanoudaki, E.; Zopounidis, C. Strategic performance measurement in a healthcare organization: A multiple criteria approach based on balanced score. Omega 2012, 40, 104–119. [Google Scholar] [CrossRef]

- Pan, F.C. Escalate BSC Power by AHP: Innovative Approach for Strategy Implementation. Int. J. Manag. Decis. Mak. 2006, 7, 337–351. [Google Scholar] [CrossRef]

- Lee, S.; Brownlee, E.; Kim, Y.; Lee, S. Ticket sales outsourcing performance measures using balanced scorecard and analytic hierarchy process combined model. Sport Mark. Quart. 2017, 26, 110–120. [Google Scholar]

- Ahmad, K.; Zabri, S. The application of non-financial performance measurement in Malaysian manufacturing firms. Proc. Econ. Financ. 2016, 35, 476–484. [Google Scholar] [CrossRef] [Green Version]

- Kaplan, R.S.; Norton, D. The balanced scorecard: Measures that drive performance. Harv. Bus. Rev. 1992, 71, 71–79. [Google Scholar]

- Kaplan, R.S.; Norton, D. The Strategy-Focus Organization: How Balanced Scorecard Companies Thrive in the New Business Environment; Harvard Business School Publishing Corporation: Boston, MA, USA, 2001. [Google Scholar]

- Kaplan, R.S. Strategic performance measurement and management in nonprofit organizations. Nonprofit Manag. Leadersh. 2001, 11, 353–370. [Google Scholar] [CrossRef] [Green Version]

- Kasie, F.M.; Belay, A.M. The impact of multi-criteria performance measurement on business performance improvement. J. Ind. Eng. Manag. 2013, 6, 595–625. [Google Scholar] [CrossRef] [Green Version]

- Morten, J. Consequences of intensive use of non-financial performance measures in Danish family farm holdings. Qual. Res. Account. Manag. 2017, 14, 137–156. [Google Scholar]

- Gan, H.; Simerly, M.C. The use of non-financial performance measures: Does the strength of corporate governance matter? Am. J. Manag. 2019, 19, 10–30. [Google Scholar]

- Kaplan, R.S. The Balanced Scorecard: Translating Strategy into Action; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Kalagnanam, S.; Krueger, C. Reporting nonfinancial performance measures: A survey of electric and electronic firms. Int. J. Strateg. Cost Manag. 1999, 2, 55–71. [Google Scholar]

- Hussain, M.; Hoque, Z. Understanding non-financial performance measurement practices in Japanese banks: A new institutional sociology perspective. Accout. Audi. Account. 2002, 15, 162–183. [Google Scholar] [CrossRef]

- Režňáková, M.; Karas, M.; Strnadová, M. Non-financial factors of performance: The case of mechanical engineering companies in the Czech Republic. Ser. D Fac. Econ. Adm. 2017, 24, 188–198. [Google Scholar]

- Medina-Munoz, D.; Garcia-Falcon, J.M. Successful relationships between hotels and agencies. Ann. Tour. Res. 2000, 27, 737–762. [Google Scholar] [CrossRef]

- Hoffman, W.H.; Schlosser, R. Success factors of strategic alliances in small and medium-sized enterprises: An empirical survey. Long Range Plan. 2001, 34, 357–381. [Google Scholar] [CrossRef]

- Chen, H.M.; Tseng, C.H. The performance of marketing alliances between the tourism industry and credit card issuing banks in Taiwan. Tour. Manag. 2005, 26, 15–24. [Google Scholar] [CrossRef]

- Pansiri, J. The effects of characteristics of partners on strategic alliance performance in the SME dominated travel sector. Tour. Manag. 2008, 29, 101–115. [Google Scholar] [CrossRef]

- Nielsen, B.B. Determining international strategic alliance performance: A multidimensional approach. J. Bus. Rev. 2007, 16, 337–361. [Google Scholar] [CrossRef]

- Wittman, C.M.; Hunt, S.D.; Arnett, D.B. Explaining alliance success: Competences, resources, relational factors, and resource-advantage theory. Ind. Mark. Manag. 2009, 38, 743–756. [Google Scholar] [CrossRef]

- Narasimhan, R.; Nair, A. The antecedent role of quality, information sharing and supply chain proximity on strategic alliance formation and performance. Int. J. Prod. Econ. 2005, 96, 301–313. [Google Scholar] [CrossRef]

- Muthusamy, S.K.; White, M.A. Does power sharing matter? The role of power and influence in alliance performance. J. Bus. Res. 2006, 59, 811–819. [Google Scholar] [CrossRef]

- Suseno, Y.; Ratten, V. A theoretical framework of alliance performance: The role of trust, social capital and knowledge development. J. Manag. Organ. 2007, 13, 4–23. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B. Partner analysis and alliance performance. Scand. J. Manag. 2003, 19, 279–308. [Google Scholar] [CrossRef]

- Carlo, M.D.; Cugini, A.; Zerbini, F. Assessment of destination performance: A strategy map approach. Tour. Rev. 2008, 63, 25–37. [Google Scholar] [CrossRef]

- Turanli, M.; Güneren, A.G.E. Turizm sektöründe talep tahmin modellemesi. Istanb. Ticaret Üniversitesi Sos. Bilimler Derg. 2003, 2, 1–13. [Google Scholar]

- Kusluvan, S.; Kusluvan, Z. Perceptions and attitudes of undergraduate tourism students towards working in the tourism industry in Turkey. Tour. Manag. 2000, 21, 251–269. [Google Scholar] [CrossRef]

- Kim, J.; Suh, E.; Hwang, H. A model for evaluating the effectiveness of CRM using the balanced scorecard. J. Inter. Mark. 2003, 17, 5–19. [Google Scholar] [CrossRef]

- Rothaermel, F.; Boeker, W. Old technology meets new technology: Complementarities, similarities and alliance formation. Strateg. Manag. J. 2008, 29, 47–77. [Google Scholar] [CrossRef] [Green Version]

- Hitt, M.A.; Ahlstrom, D.; Dacin, M.T.; Levitas, E.; Svobodina, L. The institutional effects on strategic alliance partner selection in transition economies: China vs Russia. Organ. Sci. 2004, 15, 173–185. [Google Scholar] [CrossRef]

- Biel, A.L. How brand image drives brand quality. J. Advert. Res. 1992, 32, 6–12. [Google Scholar]

- Oluwafemi, O.J.; Adebiyi, S.O. Customer loyalty and integrated marketing communications among subscribers of telecommunication firms in Lagos Metropolis, Nigeria. J. Compet. 2018, 10, 101–118. [Google Scholar] [CrossRef] [Green Version]

- Lai, S.W. A Study of Management Opportunity Grid in Banking Industry. Master’s Thesis, Advanced Management Master’s Program in the Accounting Department of National Changhua Normal University, Changhua County, Taiwan, 2006. [Google Scholar]

- Qasem, A.; Alhakimi, W. The impact of service quality and communication in developing customer loyalty: The mediating effect of customer satisfaction. J. Soc. Stud. 2019, 25, 137–172. [Google Scholar]

- Lewandowski, R.A. Cost control of medical care in public hospitals-A comparative analysis. Int. J. Contemp. Manag. 2014, 13, 125–136. [Google Scholar]

- Ramsbottom, G.; Horan, B.; Berry, D.P.; Roche, J.R. Factors associated with the financial performance of spring-calving, pasture-based dairy farms. J. Dairy Sci. 2015, 98, 3526–3540. [Google Scholar] [CrossRef] [Green Version]

- Cengiz, E.; Cengiz, F.; Demirciftci, T.; Cobanoglu, C. Do food and beverage cost-control measures increase hotel performance? A case study in Istanbul, Turkey. J. Foodserv. Bus. Res. 2018, 21, 610–627. [Google Scholar] [CrossRef]

- Tavalaei, M.M.; Santalo, J. Pure versus hybrid competitive strategies in the airport industry. Transp. Res. Part A Policy Pract. 2019, 124, 444–455. [Google Scholar] [CrossRef]

- Pun, K.F.; White, A.S. A performance measurement paradigm for integrating strategy formulation: A review of systems and frameworks. Int. J. Manag. Rev. 2005, 7, 49–71. [Google Scholar] [CrossRef]

- Wang, Y.; Fesenmaier, D. Collaborative destination marketing: A case study of Elkhart County, Indiana. Tour. Manag. 2007, 28, 863–875. [Google Scholar] [CrossRef]

- Abbas, A. Effects of human resource management on hotel performance using structural equation modeling. Comput. Hum. Behav. 2015, 43, 293–303. [Google Scholar]

- Taylor, A. An operations perspective on strategic alliance success factors. Int. J. Oper. Prod. Manag. 2005, 25, 469–490. [Google Scholar] [CrossRef]

| Pair Comparison of A and B | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Evaluating factor | Absolute unimportance | Very strong unimportance | Essential unimportance | Weak unimportance | Equal importance | Weak importance | Essential importance | Very strong importance | Absolute importance | Evaluating factor |

| A | 1/9 | 1/7 | 1/5 | 1/3 | 1 | 3 | 5 | 7 | 9 | B |

| Main Goal | First-Level Indicators | Weights | Rank |

|---|---|---|---|

| Performance indicators of the catering industry and the credit card issuing bank marketing alliance | Customer aspect | 0.264 | 1 |

| Alliance cooperation aspect | 0.188 | 3 | |

| Financial aspect | 0.231 | 2 | |

| Internal process aspect | 0.158 | 5 | |

| Learning and growth aspect | 0.159 | 4 |

| First-Level Indicator | Weight | Second-Level Indicators | Local Weights | Overall Weights | Rank |

|---|---|---|---|---|---|

| Customer aspect | 0.264 | 1. customer source | 0.116 | 0.031 | 5 |

| 2. customer growth rate | 0.097 | 0.026 | 6 | ||

| 3. customer satisfaction | 0.141 | 0.037 | 4 | ||

| 4. service quality | 0.167 | 0.044 | 3 | ||

| 5. reuse (purchase) willingness | 0.172 | 0.046 | 2 | ||

| 6. the willingness to recommend others | 0.190 | 0.050 | 1 | ||

| 7. the perceived image of the catering industry and banks | 0.117 | 0.031 | 5 |

| First-Level Indicator | Weight | Second-Level Indicators | Local Weights | Overall Weights | Rank |

|---|---|---|---|---|---|

| Financial aspect | 0.231 | 1. cost | 0.259 | 0.060 | 1 |

| 2. net profit | 0.237 | 0.055 | 2 | ||

| 3. market share | 0.187 | 0.043 | 3 | ||

| 4. sale revenue | 0.152 | 0.035 | 5 | ||

| 5. average consumption per customer | 0.165 | 0.038 | 4 |

| First-Level Indicator | Weight | Second-Level Indicators | Local Weights | Overall Weights | Rank |

|---|---|---|---|---|---|

| Alliance cooperation aspect | 0.188 | 1. commitment of partners | 0.140 | 0.026 | 5 |

| 2. value of partners | 0.125 | 0.024 | 6 | ||

| 3. loyalty of partners | 0.161 | 0.030 | 3 | ||

| 4. satisfaction of partners | 0.208 | 0.039 | 2 | ||

| 5. value of corporate image | 0.220 | 0.041 | 1 | ||

| 6. industry relation | 0.146 | 0.027 | 4 |

| First-Level Indicator | Weight | Second-Level Indicators | Local Weights | Overall Weights | Rank |

|---|---|---|---|---|---|

| Learning and growth aspect | 0.159 | 1. employee productivity | 0.247 | 0.039 | 2 |

| 2. employee satisfaction | 0.173 | 0.028 | 4 | ||

| 3. increase in employ | 0.103 | 0.017 | 5 | ||

| 4. human quality improvement | 0.260 | 0.041 | 1 | ||

| 5. employee loyalty | 0.217 | 0.035 | 3 |

| First-Level Indicator | Weight | Second-Level Indicators | Local Weights | Overall Weights | Rank |

|---|---|---|---|---|---|

| Internal aspect | 0.158 | 1. resource integration ability | 0.134 | 0.021 | 4 |

| 2. diversified operating capacity | 0.113 | 0.018 | 6 | ||

| 3. brand equity | 0.129 | 0.020 | 5 | ||

| 4. number of customer complaints | 0.147 | 0.023 | 3 | ||

| 5. marketing strategy and management ability | 0.167 | 0.026 | 2 | ||

| 6. efficiency | 0.185 | 0.029 | 1 | ||

| 7. departure rate | 0.125 | 0.020 | 5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiang, J.-T.; Chiou, C.-C.; Doong, S.-C.; Chang, I.-F. Research on the Construction of Performance Indicators for the Marketing Alliance of Catering Industry and Credit Card Issuing Banks by Using the Balanced Scorecard and Fuzzy AHP. Sustainability 2020, 12, 9005. https://doi.org/10.3390/su12219005

Chiang J-T, Chiou C-C, Doong S-C, Chang I-F. Research on the Construction of Performance Indicators for the Marketing Alliance of Catering Industry and Credit Card Issuing Banks by Using the Balanced Scorecard and Fuzzy AHP. Sustainability. 2020; 12(21):9005. https://doi.org/10.3390/su12219005

Chicago/Turabian StyleChiang, Jui-Te, Chei-Chang Chiou, Shuh-Chyi Doong, and I-Fang Chang. 2020. "Research on the Construction of Performance Indicators for the Marketing Alliance of Catering Industry and Credit Card Issuing Banks by Using the Balanced Scorecard and Fuzzy AHP" Sustainability 12, no. 21: 9005. https://doi.org/10.3390/su12219005

APA StyleChiang, J. -T., Chiou, C. -C., Doong, S. -C., & Chang, I. -F. (2020). Research on the Construction of Performance Indicators for the Marketing Alliance of Catering Industry and Credit Card Issuing Banks by Using the Balanced Scorecard and Fuzzy AHP. Sustainability, 12(21), 9005. https://doi.org/10.3390/su12219005