Credit Absorption Capacity of Businesses in the Construction Sector of the Czech Republic—Analysis Based on the Difference in Values of EVA Entity and EVA Equity

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

- Identification of business: company registration number, company name and period of financial statement.

- Financial statement report for a specific business period.

- EBIT = profit before taxation and interests;

- WACC = weighted average cost of capital;

- C = total invested capital (from an operational perspective).

- = costs of external sources of finance (or interest);

- t = corporate income tax rate;

- D = external sources of finance;

- C = total invested capital;

- = cost of equity (expected profitability E; the calculation is in the form of a rating model (see EVA equity));

- E = equity.

- ROE = return on equity;

- = cost of equity.

- = cost of equity;

- WACC = weighted average cost of capital;

- UZ = payable sources (E + BL + B), i.e., equity that must be paid for;

- A = total assets;

- E = equity;

- BL = bank loans (or external sources of finance);

- B = bonds;

- = interest rate;

- d = corporate income tax rate (since 2010, the tax rate is 19%).

- = risk-free rate;

- = function of indicators describing the size of a business;

- = function of indicators describing the formation of production power;

- = function of indicators describing the relationships between assets and liabilities.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Du, F.; Erkens, D.H.; Young, S.M.; Tang, G. How adopting new performance measures affects subjective performance evaluations: Evidence from EVA adoption by Chinese state-owned enterprises. Acc. Rev. 2017, 93, 161–185. [Google Scholar] [CrossRef]

- Belas, J.; Gavurova, B.; Toth, P. Impact of selected characteristics of SMEs on the capital structure. J. Bus. Econ. Manag. 2018, 19, 592–608. [Google Scholar] [CrossRef] [Green Version]

- Vrbka, J. The use of neural networks to determine value based drivers for SMEs operating in the rural areas of the Czech Republic. Oeconomia Copernic. 2020, 11, 325–346. [Google Scholar] [CrossRef]

- Vrbka, J.; Nica, E.; Podhorska, I. The application of Kohonen networks for identification of leaders in the trade sector in Czechia. Equilib. Q. J. Econ. Econ. Policy 2019, 14, 739–761. [Google Scholar] [CrossRef]

- Vochozka, M.; Rowland, Z.; Vrbka, J. Financial analysis of an average transport company in the Czech Republic. Nase More 2016, 63, 227–236. [Google Scholar] [CrossRef]

- Esch, M.; Schnellbächer, B.; Wald, A. Does integrated reporting information influence internal decision making? An experimental study of investment behavior. Bus. Strategy Environ. 2019, 28, 599–610. [Google Scholar] [CrossRef]

- Vochozka, M.; Machova, V. Determination of value drivers for transport companies in the Czech Republic. Nase More 2018, 65, 197–201. [Google Scholar] [CrossRef] [Green Version]

- Rajesh, R.; Rajendran, C. Relating environmental, social, and governance scores and sustainability performances of firms: An empirical analysis. Bus. Strategy Environ. 2019, 29, 1247–1267. [Google Scholar] [CrossRef]

- Machova, V.; Vrbka, J. Value generators for businesses in agriculture. In Proceedings of the 12th International Days of Statistics and Economics Conference Proceedings, Prague, Czech Republic, 6–8 September 2018; Loster, T., Pavelka, T., Eds.; Melandrium: Slany, Czech Republic, 2018; pp. 1123–1132. [Google Scholar]

- Lafont, J.; Ruiz, F.; Gil-Gómez, H.; Oltra-Badenes, R. Value creation in listed companies: A bibliometric approach. J. Bus. Res. 2020, 115, 428–434. [Google Scholar] [CrossRef]

- Orazalin, N.; Mahmood, M.; Narbaev, T. The impact of sustainability performance indicators on financial stability: Evidence from the Russian oil and gas industry. Environ. Sci. Pollut. Res. 2019, 26, 8157–8168. [Google Scholar] [CrossRef]

- Vochozka, M.; Machova, V. Enterprise value generators in the building industry. In Proceedings of the SHS Web of Conferences—Innovative Economic Symposium 2017: Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; Vachal, J., Vochozka, M., Horak, J., Eds.; EDP Sciences: Les Ulis, France, 2017. [Google Scholar] [CrossRef] [Green Version]

- Stehel, V.; Vochozka, M. The analysis of the economical value added in transport. Nase More 2016, 63, 185–188. [Google Scholar] [CrossRef]

- Alexandridis, G.; Antypas, N.; Gulnur, A.; Visvikis, I. Corporate financial leverage and M&As choices: Evidence from the shipping industry. Transp. Res. Part E Logist. Transp. Rev. 2020, 133. [Google Scholar] [CrossRef]

- Strýčková, L. Debt policy of companies in Czech Republic. J. Int. Stud. 2019, 12, 183–197. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kliestik, T.; Vrbka, J.; Rowland, Z. Bankruptcy prediction in Visegrad group countries using multiple discriminant analysis. Equilib. Q. J. Econ. Econ. Policy 2018, 13, 569–593. [Google Scholar] [CrossRef]

- Wang, J.L. Joing effect of debt financing and credit rating on corporation´s performance. Int. Conf. Econ. Manag. Innov. (ICEMI) 2017, 1, 21–23. [Google Scholar]

- Pavelkova, D.; Homolka, L.; Knapkova, A.; Kolman, K.; Pham, H. EVA and key performance indicators: The case of automotive sector in pre-crisis, crisis and post-crisis periods. Econ. Sociol. 2018, 11, 78–95. [Google Scholar] [CrossRef] [PubMed]

- Limarev, P.V.; Limarev, Y.A.; Zinovyeva, E.G.; Usmanova, E.G. Methodical motivation of the using EVA (Economic value added) as instrument of cost-performance management in organizations. Mediterr. J. Soc. Sci. 2015, 6, 489–494. [Google Scholar] [CrossRef] [Green Version]

- Behera, S. Does the EVA valuation model explain the market value of equity better under changing required return than constant required return? Financ. Innov. 2020, 6, 1–23. [Google Scholar]

- Vochozka, M.; Stehel, V.; Rowland, Z. Determining development of business value over time with the identification of factors. Ad Alta J. Interdiscip. Res. 2019, 9, 358–363. [Google Scholar]

- Tang, Q.; Han, H. Can material asset reorganizations affect acquirers’ debt financing costs?—Evidence from the Chinese merger and acquisition market. China J. Account. Res. 2018, 11, 71–90. [Google Scholar] [CrossRef]

- Mihov, A.; Naranjo, A. Corporate internationalization, subsidiary locations, and the cost of equity capital. J. Int. Bus. Stud. 2019, 50, 1544–1565. [Google Scholar] [CrossRef]

- Liu, Z.J.; Wang, Y.S. Effect of earnings management on economic value added: G20 and African countries study. South Afr. J. Econ. Manag. Sci. 2017, 20, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Salvi, A.; Vitolla, F.; Raimo, N.; Rubino, M.; Petruzzella, F. Does intellectual capital disclosure affect the cost of equity capital? An empirical analysis in the integrated reporting context. J. Intellect. Cap. 2020, 21, 985–1007. [Google Scholar] [CrossRef]

- Belkhir, M.; Saad, M.; Samet, A. Stock extreme illiquidity and the cost of capital. J. Bank. Financ. 2020, 112. [Google Scholar] [CrossRef]

- Penman, S.; Zhang, X.J. A theoretical analysis connecting conservative accounting to the cost of capital. J. Account. Econ. 2020, 69, 1–25. [Google Scholar] [CrossRef]

- Xu, Z. Economic policy uncertainty, cost of capital, and corporate innovation. J. Bank. Financ. 2020, 111, 1–59. [Google Scholar] [CrossRef]

- Gao, P. Idiosyncratic information, moral hazard, and the cost of capital. Contemp. Account. Res. 2019, 36, 2178–2206. [Google Scholar] [CrossRef]

- Callen, J.L.; Lyle, M.R. The term structure of implied costs of equity capital. Rev. Account. Stud. 2020, 25, 342–404. [Google Scholar] [CrossRef]

- Tagliapietra, S.; Zachmann, G.; Fredriksson, G. Estimating the cost of capital for wind energy investments in Turkey. Energy Policy 2019, 131, 295–301. [Google Scholar] [CrossRef] [Green Version]

- Yao, M.F.; Di, H.; Zheng, X.R.; Xu, X.B. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Change 2018, 135, 199–207. [Google Scholar] [CrossRef]

- Kassem, E.; Trenz, O.; Hrebicek, J.; Faldik, O. Sustainability assessment using sustainable value added. In Proceedings of the 19th International Conference Enterprise and Competitive Environment, Brno, Czech Republic, 10–11 March 2016; Kapounek, S., Krutilova, V., Eds.; Elsevier Science: Amsterdam, The Netherlands, 2016; pp. 177–183. [Google Scholar] [CrossRef]

- Li, L. Private sector participation and performance of county water utilities in China. China Econ. Rev. 2018, 52, 30–53. [Google Scholar] [CrossRef]

- Marecek, J.; Rowland, Z. The importance of ROE for calculating EVA equity: The case of Motor Jikov Strojirenska, a.s. In Proceedings of the SHS Web of Conferences—Innovative Economic Symposium 2017 (IES2017): Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; Vachal, J., Vochozka, M., Horak, J., Eds.; EDP Sciences: Les Ulis, France, 2017. [Google Scholar] [CrossRef] [Green Version]

- Bazyliuk, V. Theoretical approaches to assess efficiency of the transformation of the key business processes in the publishing and printing activities in the region. Balt. J. Econ. Stud. 2016, 2, 4–9. [Google Scholar] [CrossRef]

- Lunardi, M.A.; Barbosa, E.T.; Rodrigues, M.M.; Silva, T.P.; Nakamura, W.T. Foundation of value in the economic performance of family and non-family Brazilian companies. Rev. Evid. Contab. Financ. 2017, 5, 94–112. [Google Scholar] [CrossRef]

- Psarska, M.; Haskova, S.; Machova, V. Performance management in small and medium-sized manufacturing enterprises operating in automotive in the context of future changes and challenges in SR. Ad Alta J. Interdiscip. Res. 2019, 9, 281–287. [Google Scholar]

- Vrbka, J.; Rowland, Z. Assessing the financial health of companies engaged in mining and extraction using methods of complex evaluation of enterprises. Contrib. Econ. 2019, 13, 321–333. [Google Scholar]

- Khan, M. Corporate governance, ESG, and stock returns around the world. Financ. Anal. J. 2019, 75, 103–123. [Google Scholar] [CrossRef] [Green Version]

- Miralles-Quirós, J.L.; Miralles-Quirós, M.M.; Nogueira, J.M. Diversification benefits of using exchange-traded funds in compliance to the sustainable development goals. Bus. Strategy Environ. 2019, 28, 244–255. [Google Scholar] [CrossRef] [Green Version]

- Marin, G.; Marino, M.; Pellegrin, C. The impact of the European emission trading scheme on multiple measures of economic performance. Environ. Resour. Econ. 2018, 71, 551–558. [Google Scholar] [CrossRef]

- Bui, B.; Moses, O.; Houqe, M.N. Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Account. Financ. 2020, 60, 47–71. [Google Scholar] [CrossRef]

- Lemma, T.T.; Feedman, M.; Mlilo, M.; Park, J.D. Corporate carbon risk, voluntary disclosure, and cost of capital: South African evidence. Bus. Strategy Environ. 2019, 28, 111–126. [Google Scholar] [CrossRef] [Green Version]

- Jankalová, M.; Kurotová, J. Sustainability assessment using economic value added. Sustainability 2020, 12, 318. [Google Scholar] [CrossRef] [Green Version]

- Rodríguez-Fernández, M.; Sánchez-Teba, E.; López-Toro, A.A.; Borrego-Domínguez, S. Influence of ESGC indicators on financial performance of listed travel and leisure companies. Sustainability 2019, 11, 5529. [Google Scholar] [CrossRef] [Green Version]

- Gangi, F.; Daniele, L.M.; Varrone, N. How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus. Strategy Environ. 2020, 29, 1975–1991. [Google Scholar] [CrossRef]

- Cubilla-Montilla, M.I.; Galindo-Villardón, P.; Nieto-Librero, A.B.; Galindo, M.P.V.; García-Sánchez, I.M. What companies do not disclose about their environmental policy and what institutional pressures may do to respect. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1181–1197. [Google Scholar] [CrossRef]

- Oduro, S.; Haylemariam, L.G. Market orientation, CSR and financial and marketing performance in manufacturing firms in Ghana and Ethiopia. Sustain. Account. Manag. Policy J. 2019, 10, 398–426. [Google Scholar] [CrossRef]

- Hou, T.C. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 19–28. [Google Scholar] [CrossRef] [Green Version]

- Blasi, S.; Caporin, M.; Fontini, M. A multidimensional analysis of the relationship between corporate social responsibility and firms’ economic performance. Ecol. Econ. 2018, 147, 218–229. [Google Scholar] [CrossRef]

- Compton, Y.L.; Kang, S.H.; Zhu, Z. Gender stereotyping by location, female director appointments and financial performance. J. Bus. Ethics 2019, 160, 445–462. [Google Scholar] [CrossRef]

- Gan, H.; Park, M.S.; Suh, S.H. Non-financial performance measures, CEO compensation, and firms’ future value. J. Bus. Res. 2020, 110, 213–227. [Google Scholar] [CrossRef]

- Omran, M.; Khallaf, A.; Gleason, K.; Tahat, Y. Non-financial performance measures disclosure, quality strategy, and organizational financial performance: A mediating model. Total Qual. Manag. Bus. Excell. 2019, 31, 1–24. [Google Scholar] [CrossRef]

- Grassmann, M.; Fuhrmann, S.; Guenther, T.W. Drivers of the disclosed “connectivity of the capitals”: Evidence from integrated reports. Sustain. Account. Manag. Policy J. 2019, 10, 877–908. [Google Scholar] [CrossRef]

- Zhou, S.; Simnett, R.; Green, W. Does integrated reporting matter to the capital market? Abacus 2017, 53, 94–132. [Google Scholar] [CrossRef] [Green Version]

- Vena, L.; Sciascia, S.; Cortesi, A. Integrated reporting and cost of capital: The moderating role of cultural dimensions. J. Int. Financ. Manag. Account. 2020, 31, 191–214. [Google Scholar] [CrossRef]

- Vitolla, F.; Salvi, A.; Raimo, N.; Petruzzella, F.; Rubino, M. The impact on the cost of equity capital in the effects of integrated reporting quality. Bus. Strategy Environ. 2020, 29, 519–529. [Google Scholar] [CrossRef]

- Lee, J.E.; Glasscock, R.; Park, M.S. Does the ability of operating cash flows to measure firm performance improve during periods of financial distress? Account. Horiz. 2016, 31, 23–35. [Google Scholar] [CrossRef]

- Hong, S.J.; Najmi, H. The relationships between supply chain capability and shareholder value using financial performance indicators. Sustainability 2020, 12, 3130. [Google Scholar] [CrossRef] [Green Version]

- Bolos, M.-I.; Bradea, I.-A.; Delcea, C. Modeling the performance indicators of financial assets with Neutrosophic fuzzy numbers. Symmetry 2019, 11, 1021. [Google Scholar] [CrossRef] [Green Version]

- Chiwamit, P.; Modell, S.; Scapens, R.W. Regulation and adaptation of management accounting innovations: The case of economic value added in Thai state-owned enterprises. Manag. Account. Res. 2017, 37, 30–48. [Google Scholar] [CrossRef]

- Li, X.; Tian, L.; Han, L.; Cai, H. Interest rate regulation, earnings transparency and capital structure: Evidence from China. Int. J. Emerg. Mark. 2019, 15, 923–947. [Google Scholar] [CrossRef]

- Krishnamoorthy, S. Sentiment analysis of financial news articles using performance indicators. Knowl. Inf. Syst. 2018, 56, 373–394. [Google Scholar] [CrossRef] [Green Version]

- Halov, N.; Heider, F. Capital structure, risk and asymmetric information. Q. J. Financ. 2011, 1, 767–809. [Google Scholar] [CrossRef]

- Hahn, K. Innovation in times of financialization: Do future-oriented innovation strategies suffer? Examples from German industry. Res. Policy 2019, 48, 923–935. [Google Scholar]

- Aras, G.; Tezcan, N.; Kutlufurtuna, O. The value relevance of banking sector multidimensional corporate sustainability performance. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1062–1073. [Google Scholar] [CrossRef]

- Stewart, J.; Wang, T. Predicting private company failure: A multi-class analysis. J. Int. Financ. Mark. Inst. Money 2019, 61, 161–188. [Google Scholar]

- Jiang, Y.; Jones, S. Corporate distress prediction in China: A machine learning approach. Account. Financ. 2018, 58, 1063–1109. [Google Scholar] [CrossRef] [Green Version]

- Serrano-Cinca, C.; Gutiérrez-Nieto, B.; Bernate-Valbuena, M. The use of accounting anomalies indicators to predict business failure. Eur. Manag. J. 2019, 37, 353–375. [Google Scholar] [CrossRef]

- Scalzer, R.; Rodrigues, S.; Álvaro, M.; Macedo, D.; Wanke, P. Financial distress in electricity distributors from the perspective of Brazilian regulation. Energy Policy 2019, 125, 250–259. [Google Scholar] [CrossRef]

- Eling, M.; Jia, R. Business failure, efficiency, and volatility: Evidence from the European insurance industry. Int. Rev. Financ. Anal. 2018, 59, 58–76. [Google Scholar] [CrossRef]

- Ministry of Industry and Trade. Finanční Analýza Podnikové Sféry za Rok 2018 [Financial Analysis of the Business Sphere for the Year 2018]; Ministry of Industry and Trade: Prague, Czech Republic, 2019.

- Vochozka, M. Metody Komplexního Hodnocení Podniku [Methods of Comprehensive Evaluation of the Company]; Grada Publishing: Prague, Czech Republic, 2011; ISBN 978-80-247-3647-1. [Google Scholar]

- Jones, S.; Wright, C.; Smith, T. Fashion or future: Does creating shared value pay? Account. Financ. 2018, 58, 1111–1139. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S. Organization capital and the cost of equity financing in medium-sized manufacturing firms. Contemp. Account. Res. 2018, 35, 1616–1644. [Google Scholar] [CrossRef]

| Year | Modified Dataset |

|---|---|

| 2012 | 7070 |

| 2013 | 6678 |

| 2014 | 6330 |

| 2015 | 5997 |

| 2016 | 2562 |

| 2017 | 6359 |

| 2018 | 3687 |

| Total | 38,683 |

| Year | Risk-Free Rate |

|---|---|

| 2012 | 2.31% |

| 2013 | 2.26% |

| 2014 | 1.58% |

| 2015 | 0.58% |

| 2016 | 0.43% |

| 2017 | 0.98% |

| 2018 | 1.98% |

| Balance Sheet Item | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|

| (Values in TCZK) | |||||||

| Total assets | 23,983.99 | 24,857.86 | 22,609.22 | 22,232.99 | 31,787.65 | 27,815.70 | 27,808.83 |

| Total liabilities | 23,982.78 | 24,857.99 | 22,609.22 | 22,232.22 | 31,790.03 | 27,814.54 | 27,808.81 |

| Current assets | 15,387.15 | 16,054.67 | 14,787.71 | 13,970.84 | 20,226.14 | 17,716.70 | 17,470.89 |

| Equity | 11,328.73 | 11,663.09 | 10,334.55 | 9468.46 | 14,483.94 | 12,289.11 | 13,037.82 |

| External sources | 12,354.48 | 12,790.29 | 11,975.95 | 12,498.33 | 16,767.09 | 15,197.64 | 14,433.32 |

| Issued bonds | 214.39 | 127.55 | 370.65 | 632.82 | 624.66 | 939.16 | 867.37 |

| Current liabilities | 8080.41 | 8129.36 | 7573.17 | 7133.25 | 9981.46 | 9711.61 | 27,573.11 |

| Bank loans and assistance | 2319.51 | 2288.90 | 2324.15 | 2757.64 | 2844.45 | 2523.08 | 3027.42 |

| Interest expense | 145.79 | 136.80 | 131.56 | 152.71 | 175.05 | 169.42 | 173.81 |

| Profit or loss for the accounting period (±) | 765.63 | 898.32 | 891.84 | 1112.26 | 1518.77 | 1661.90 | 1911.86 |

| Profit before tax (±) | 987.56 | 1142.46 | 1119.30 | 1393.97 | 1926.09 | 2022.96 | 2324.23 |

| Designation | Description | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|

| T | Estimate of income tax rate | 22.47% | 21.37% | 20.32% | 20.21% | 21.15% | 17.85% | 17.74% |

| Costs of external sources of finance | 6.29% | 5.98% | 5.66% | 5.54% | 6.15% | 6.71% | 5.74% | |

| Costs of equity | 8.18% | 7.65% | 7.70% | 7.24% | 5.66% | 8.02% | 19.85% | |

| C | Total invested capital | 15,902.36 | 16,728.64 | 15,036.05 | 15,098.98 | 21,808.57 | 18,102.93 | 235.70 |

| WACC | Weighted average cost of capital | 9.61% | 8.92% | 8.88% | 8.20% | 7.49% | 10.08% | 1387.30% |

| EBIT | Earnings before interest and taxation | 1133.35 | 1279.26 | 1250.86 | 1546.68 | 2101.15 | 2192.38 | 2498.05 |

| EVA entity | −650.23 | −486.98 | −338.80 | −3.42 | 23.66 | −23.02 | −1214.99 | |

| Designation | Description | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|

| Risk-free rate | 2.31% | 2.26% | 1.58% | 0.58% | 0.43% | 0.98% | 1.98% | |

| Indicator characterizing the size of business | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | |

| Indicator characterizing production power | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| ROA | Return on assets | 4.73% | 5.15% | 5.53% | 6.96% | 6.61% | 7.88% | 8.98% |

| −XP | 3.33% | 3.21% | 2.81% | 2.61% | 2.85% | 2.77% | 2.72% | |

| Indicator characterizing relationship between assets and liabilities | 1.58% | 1.23% | 1.33% | 1.30% | 1.00% | 2.03% | 10.00% | |

| Current liquidity | 1.90 | 1.97 | 1.95 | 1.96 | 2.03 | 1.82 | 0.63 | |

| −XL1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| −XL2 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | |

| WACC | Weighted average cost of capital | 8.89% | 8.49% | 7.91% | 6.88% | 6.43% | 8.01% | 16.98% |

| ROE | Return on equity | 6.76% | 7.70% | 8.63% | 11.75% | 10.49% | 13.52% | 14.66% |

| Costs of equity | 8.18% | 7.65% | 7.70% | 7.24% | 5.66% | 8.02% | 19.85% | |

| UZ | Payable sources (E + BL + B) | 13,862.63 | 14,079.54 | 13,029,35 | 12,858.92 | 17,953.05 | 15,751.35 | 16,932.61 |

| D | Corporate income tax rate | 19% | 19% | 19% | 19% | 19% | 19% | 19% |

| EBIT | Earnings before interest and taxation | 1133.35 | 1279.26 | 1250.86 | 1546.68 | 2101.15 | 2192.38 | 2498.05 |

| EVA equity | −161.24 | 6.54 | 96.53 | 426.98 | 699.28 | 676.16 | −676.33 | |

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|

| Credit absorption | −488.99 | −493.52 | −435.33 | −430.40 | −675.62 | −699.18 | −538.67 |

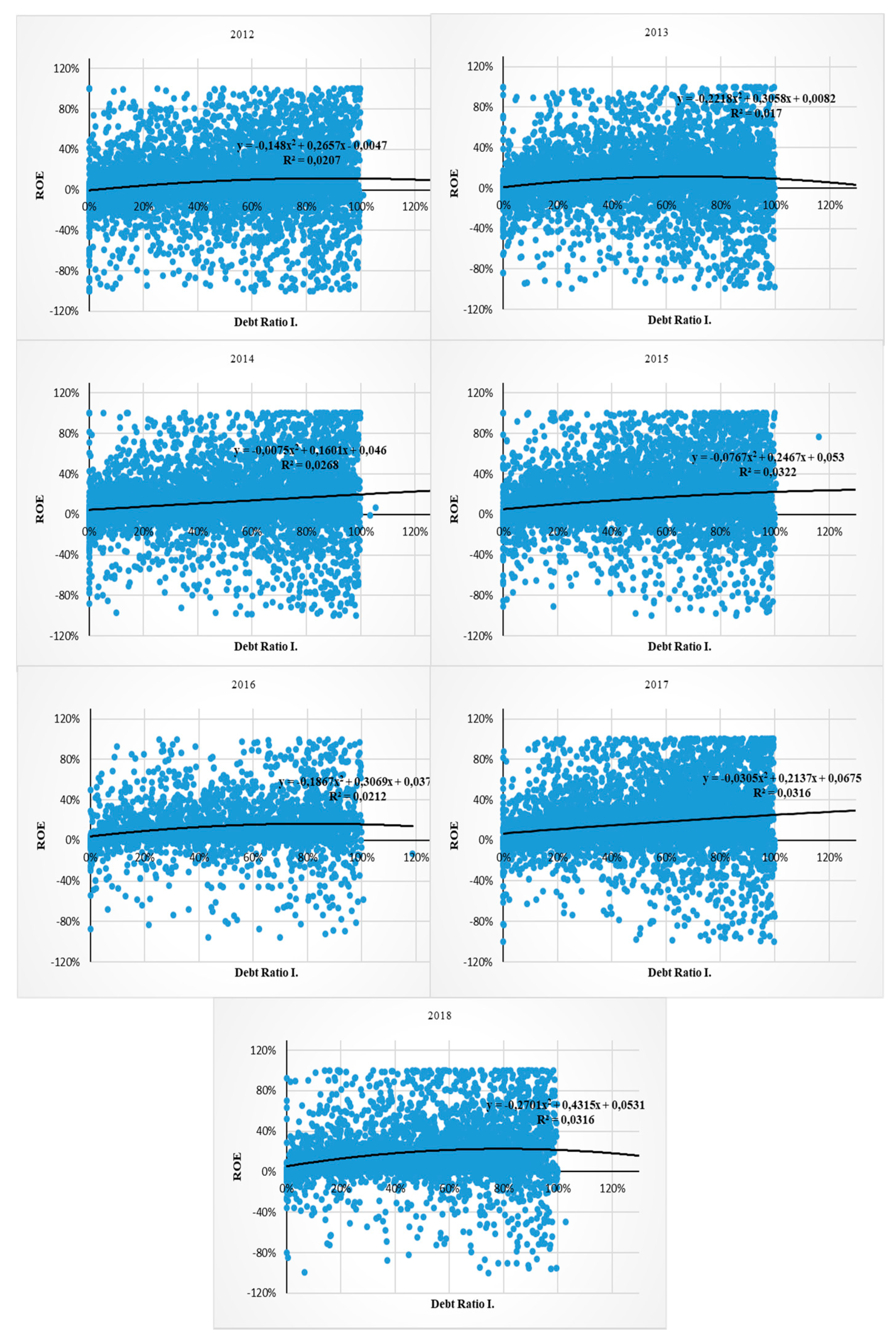

| Year | Return on Equity = Earnings after Taxes/Equity | Debt Ratio I. = Debts/Assets | Growth |

|---|---|---|---|

| 2012 | 7.24% | 45.97% | Above proportional |

| 2013 | 8.18% | 46.74% | Above proportional |

| 2014 | 12.12% | 48.49% | Above proportional |

| 2015 | 15.03% | 50.08% | Above proportional |

| 2016 | 12.92% | 50.15% | Below proportional |

| 2017 | 17.01% | 53.32% | Above proportional |

| 2018 | 18.11% | 51.59% | Below proportional |

| Description of State | Interpretation of Results |

|---|---|

| EVA Equity > 0 (EVA Entity—EVA Equity) > 0 | This is the most desirable state for businesses with long-term prospects. They represent an attractive investment opportunity and generate value added for business owners and creditors. This state did not occur during the monitored period. |

| EVA Equity > 0 (EVA Entity—EVA Equity) < 0 | Although this state generates value for owners, it does not represent an attractive investment opportunity, either for the business owner or creditors. It has a negative influence on obtaining credit, with an optimal level of risk. This state occurred in the period from 2013 to 2017. |

| EVA Equity < 0 (EVA Entity—EVA Equity) < 0 | This state is undesirable. Businesses add no value, and the owners take a high degree of risk. At the same time, the businesses do not provide an attractive investment opportunity, either for the business owners or creditors. During the monitored period, this detrimental state occurred in 2012 and 2018. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horak, J.; Suler, P.; Kollmann, J.; Marecek, J. Credit Absorption Capacity of Businesses in the Construction Sector of the Czech Republic—Analysis Based on the Difference in Values of EVA Entity and EVA Equity. Sustainability 2020, 12, 9078. https://doi.org/10.3390/su12219078

Horak J, Suler P, Kollmann J, Marecek J. Credit Absorption Capacity of Businesses in the Construction Sector of the Czech Republic—Analysis Based on the Difference in Values of EVA Entity and EVA Equity. Sustainability. 2020; 12(21):9078. https://doi.org/10.3390/su12219078

Chicago/Turabian StyleHorak, Jakub, Petr Suler, Jaroslav Kollmann, and Jan Marecek. 2020. "Credit Absorption Capacity of Businesses in the Construction Sector of the Czech Republic—Analysis Based on the Difference in Values of EVA Entity and EVA Equity" Sustainability 12, no. 21: 9078. https://doi.org/10.3390/su12219078