The Risk Monitoring of the Financial Ecological Environment in Chinese Outward Foreign Direct Investment Based on a Complex Network

Abstract

:1. Introduction

2. Theoretical Analysis

2.1. Financial Risk and OFDI

2.2. Research Status of Financial Risk Monitoring

2.3. Monitoring of Financial Ecological Environment based on Complex Network

3. The Risk Monitoring Model of Financial Ecological Environment in OFDI Based on Complex Network

3.1. Ideas and Theoretical Prerequisites for Model Construction

3.2. Indicator System Construction

3.3. Construction of Correlation Coefficient Matrix and Adjacency Matrix

3.4. Construction of Financial Risk Network in OFDI

3.5. Key Parameters of Risk Monitoring Model of Financial Ecological Environment

3.5.1. Key Risk Factors for OFDI

Degree Centrality

Closeness Centrality

Betweenness Centrality

Eigenvector Centrality

3.5.2. Relevance of Financial Risk Indicators for OFDI

Faction Analysis

Density Analysis

3.5.3. Overall Evolution Characteristics of Financial Risks of OFDI

Correlation of Risk

Transitivity of Risk

Risk Propagation Efficiency

4. Sample Selection and Network Construction

4.1. Data and Sample

- (1)

- Is the investment activity true? The purpose of Chinese investment in these areas is not to take the place as a capital operation center for investment transfer or tax avoidance, but to conduct real investment activities.

- (2)

- Is the investment amount large? These 20 sample countries selected in this paper cover a wide range of regions, and Chinese enterprises have a large amount of investment in these countries, so they are widely representative.

- (3)

- Is the data available? The financial risk indicators in this paper are all quantitative indicators, which require a large amount of data support. Therefore, in this paper, the countries with large data missing are also excluded.

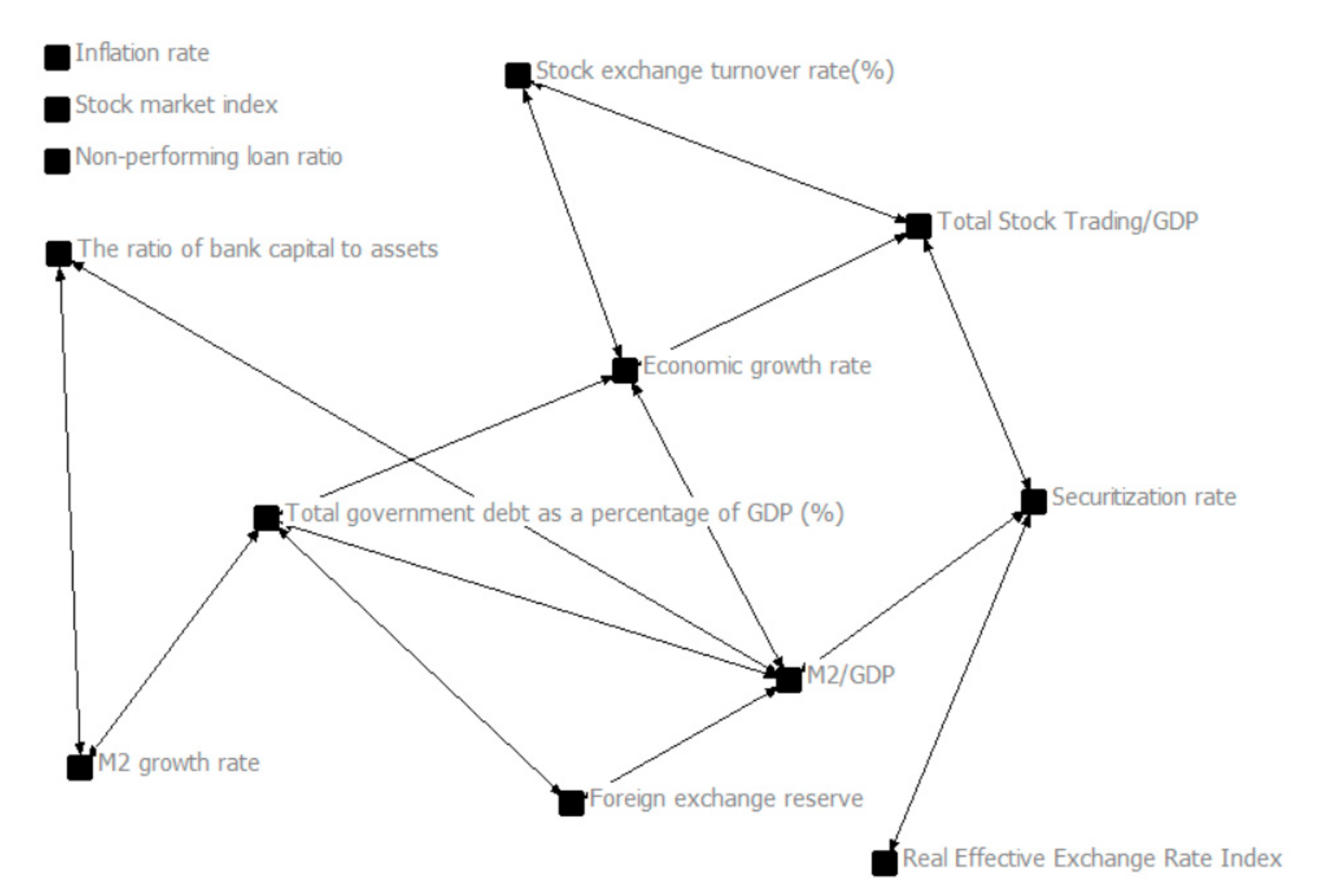

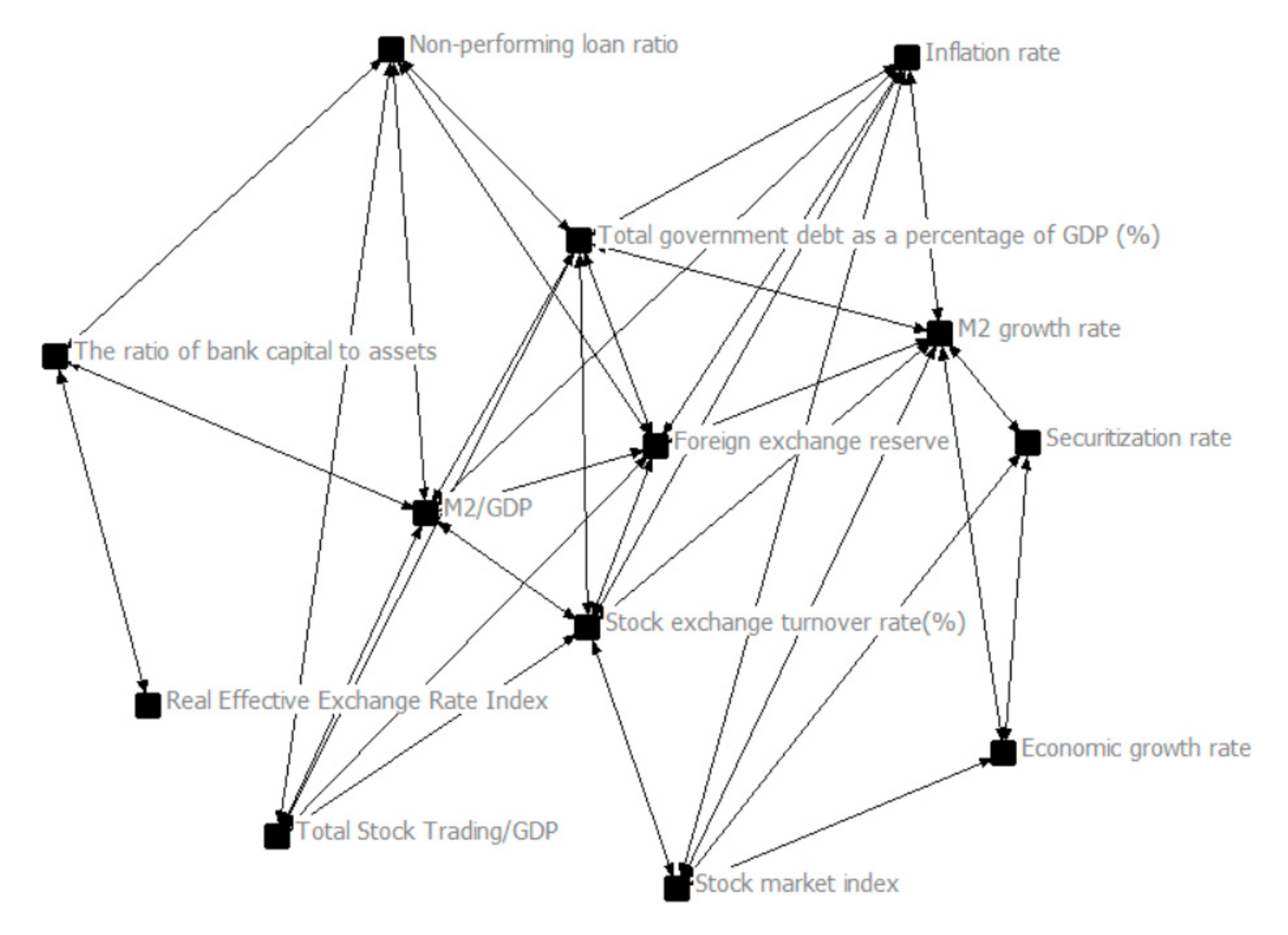

4.2. Network Construction

5. Empirical Results and Discussion

5.1. Key Risk Factors

5.1.1. Degree Centrality

5.1.2. Closeness Centrality

5.1.3. Betweenness Centrality

5.1.4. Eigenvector Centrality

5.2. Correlation of Risk Indicators

5.2.1. Faction Analysis

5.2.2. Density Analysis

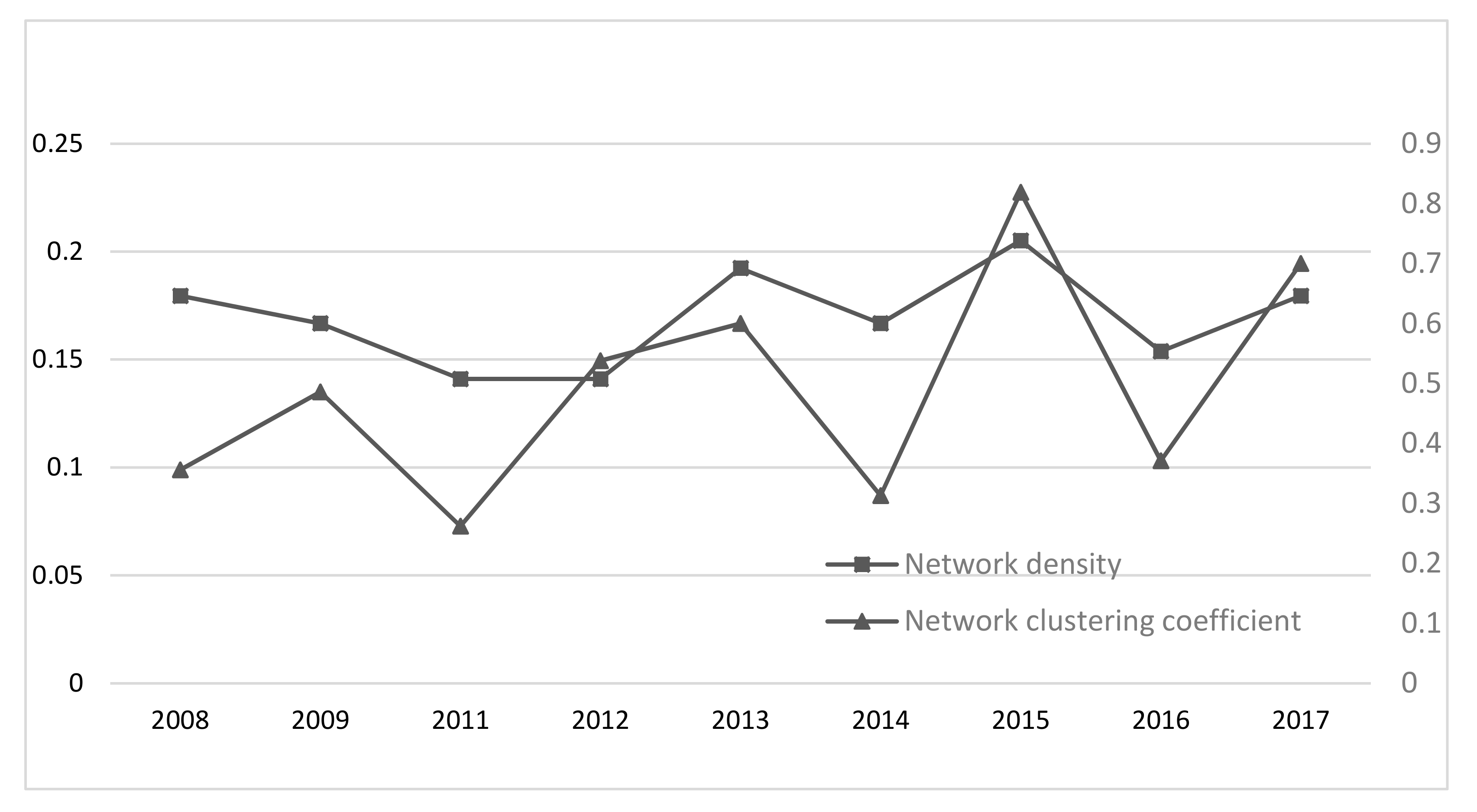

5.3. The Overall Law of Risk Evolution

5.3.1. Time Law of Risk Evolution

5.3.2. Spatial Law of Risk Evolution

Analysis of Risk Characteristics

Risk Transmission Path

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. The Critical Code to Generate MST

|

//Pearson correlation coefficient. double PearsonCorrelation(vector<double> &A, vector<double> &B) { //Check! if(A.size() != B.size()) { cout << “Error input!” << endl; exit(-1); } //Calculate average value. double sumA(0), sumB(0), aveA(0), aveB(0); sumA = std::accumulate(A.begin(), A.end(), 0); sumB = std::accumulate(B.begin(), B.end(), 0); aveA = sumA/A.size(); aveB = sumB/B.size(); //Calculate correlation coefficient. double Cov(0), VarA(0), VarB(0); size_t length = A.size(); for (size_t i = 0; i < length; i++) { Cov += (A[i]–aveA) * (B[i]–aveB); VarA += pow((A[i]–aveA), 2); VarB += pow((B[i]–aveB), 2); } return (Cov/sqrt(VarA * VarB)); } //Find the connected component of vertex v. int FindRoot(int parent[], int v) { int s; for(s = v; parent[s] >= 0; s = parent[s]); while(s != v) { int tmp = parent[v]; parent[v] = s; v = tmp; } return s; } //Implementation of Kruskal’s algorithm void Kruskal(Graph &G) { int vex1, vex2; double mstSum = 0; int *parent = new int[G.m_vertexs.size()]; for(size_t i = 0; i < G.m_vertexs.size(); ++i) { parent[i] = -1; } for(size_t num = 0, i = 0; i < G.m_edges.size(); ++i) { vex1 = FindRoot(parent, G.m_edges[i].u); vex2 = FindRoot(parent, G.m_edges[i].v); if(vex1 != vex2) { cout << “<“ << G.m_vertexs[G.m_edges[i].u].country << “-” << G.m_edges[i].u << “ --> “ << G.m_vertexs[G.m_edges[i].v].country << “-” << G.m_edges[i].v << “> : “ << G.m_edges[i].weight << endl; mstSum += G.m_edges[i].weight; parent[vex2] = vex1; if(++num == G.m_vertexs.size()–1) { cout << “The sum of the minimum spanning tree weights is:” << mstSum << endl; break; } } } } //Usage: you need to name the data file data.txt int main() { ifstream input(“data.txt”); if(!input.good()) { cerr << “Cann’t open file: “ << argv[1] << endl; return -1; } //Build graph based on data content. Graph G(input); //Construction of minimum spanning tree using Kruskal’s algorithm. Kruskal(G); return 0; } |

Appendix B. Centrality Measurement Results

| Indicator Name | 2008 | 2009 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|

| Real Effective Exchange Rate Index | 19.048 | 9.023 | 9.836 | 8.333 | |||||

| Foreign exchange reserve | 20.690 | 17.391 | 20.690 | 18.182 | 22.222 | 16.000 | 12.371 | 18.182 | 15.789 |

| M2/GDP | 23.077 | 18.750 | 21.818 | 18.182 | 23.529 | 15.789 | 12.500 | 18.750 | 16.216 |

| M2 growth rate | 20.000 | 8.333 | 19.672 | 16.901 | 19.672 | 8.333 | |||

| Total government debt as a percentage of GDP (%) | 22.222 | 17.143 | 20.690 | 17.391 | 22.222 | 15.190 | 12.245 | 18.182 | 15.789 |

| Inflation rate | 18.462 | 20.339 | 16.667 | 21.053 | 9.917 | 17.391 | 15.385 | ||

| Economic growth rate | 22.222 | 8.333 | 17.391 | 18.462 | 9.091 | 10.000 | |||

| Stock market index | 15.584 | 9.023 | 8.333 | 8.333 | |||||

| Total Stock Trading/GDP | 21.053 | 18.462 | 16.901 | 16.216 | 22.642 | 15.584 | 12.500 | 17.647 | 16.000 |

| Securitization rate | 21.818 | 16.667 | 16.438 | 14.815 | 19.672 | 14.815 | 12.121 | 16.000 | 14.815 |

| Stock exchange turnover rate (%) | 20.339 | 17.647 | 19.048 | 17.391 | 22.642 | 16.000 | 12.245 | 19.048 | 15.789 |

| Non-performing loan ratio | 17.143 | 18.462 | 15.190 | 9.917 | 17.647 | 14.286 | |||

| The ratio of bank capital to assets | 20.690 | 16.667 | 20.339 | 14.634 | 16.901 |

| Indicator Name | 2008 | 2009 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|

| Real Effective Exchange Rate Index | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Foreign exchange reserve | 0.000 | 0.500 | 6.000 | 15.000 | 0.000 | 4.667 | 0.333 | 0.000 | 0.000 |

| M2/GDP | 15.167 | 11.000 | 26.000 | 15.500 | 20.000 | 7.000 | 1.833 | 10.500 | 10.000 |

| M2 growth rate | 0.500 | 0.000 | 8.000 | 0.500 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Total government debt as a percentage of GDP (%) | 6.833 | 0.000 | 6.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Inflation rate | 0.000 | 12.000 | 14.000 | 0.000 | 8.000 | 0.000 | 0.000 | 1.000 | 6.000 |

| Economic growth rate | 8.667 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 2.000 | 0.000 | 0.000 |

| Stock market index | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Total Stock Trading/GDP | 3.000 | 8.500 | 0.000 | 7.000 | 8.000 | 3.833 | 1.833 | 7.000 | 6.000 |

| Securitization rate | 9.333 | 0.000 | 0.000 | 0.000 | 0.000 | 0.500 | 0.000 | 0.000 | 0.000 |

| Stock exchange turnover rate (%) | 0.000 | 1.000 | 8.000 | 12.000 | 8.000 | 6.833 | 0.000 | 15.000 | 0.000 |

| Non-performing loan ratio | 0.000 | 7.000 | 8.000 | 0.000 | 0.000 | 1.167 | 0.000 | 1.500 | 0.000 |

| The ratio of bank capital to assets | 1.500 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 2008 | 2009 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|

| Real Effective Exchange Rate Index | 11.377 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Foreign exchange reserve | 40.348 | 52.689 | 69.485 | 49.084 | 59.28 | 70.882 | 61.992 | 59.463 | 61.102 |

| M2/GDP | 70.634 | 77.428 | 69.686 | 83.542 | 65.454 | 63.264 | 69.256 | 70.968 | 64.369 |

| M2 growth rate | 27.972 | 0 | 28.321 | 60.112 | 14.791 | 0 | 0 | 0 | 0 |

| Total government debt as a percentage of GDP (%) | 61.414 | 39.33 | 69.485 | 44.373 | 59.28 | 42.251 | 51.476 | 59.463 | 61.102 |

| Inflation rate | 0 | 46.284 | 28.924 | 48.063 | 16.52 | 0 | 0 | 29.673 | 16.676 |

| Economic growth rate | 62.036 | 0 | 10.058 | 0 | 3.933 | 0 | 0 | 0 | 0 |

| Stock market index | 0 | 4.654 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Stock Trading/GDP | 39.845 | 60.3 | 20.058 | 7.079 | 62.124 | 51.73 | 69.256 | 23.051 | 64.166 |

| Securitization rate | 37.234 | 18.227 | 4.175 | 2.369 | 14.791 | 25.554 | 35.561 | 6.788 | 15.636 |

| Stock exchange turnover rate (%) | 31.13 | 57.556 | 56.479 | 18.791 | 62.124 | 67.805 | 51.476 | 71.484 | 61.102 |

| Non-performing loan ratio | 0 | 15.397 | 11.755 | 0 | 0 | 29.405 | 0 | 29.79 | 4.064 |

| The ratio of bank capital to assets | 30.13 | 0 | 0 | 48.063 | 15.584 | 19.926 | 0 | 20.9 | 0 |

References

- Carlson, D. Matrix Decompositions Involving the Schur Complement. Siam J. Appl. Math. 1975, 28, 577–587. [Google Scholar] [CrossRef]

- Goldberg, L.S.; Kolstad, C.D. Foreign Direct Investment, Exchange Rate Variability and Demand Uncertainty. Int. Econ. Rev. 1995, 36, 855–873. [Google Scholar] [CrossRef]

- Wang, H.J.; Qi, L. Country Economic Risks and FDI: Evidence from China. J. Financ. Econ. 2011, 10, 3–10. [Google Scholar]

- Levis, M. Does political instability in developing countries affect foreign investment flow? An empirical examination. Manag. Int. Rev. 1979, 19, 59–68. [Google Scholar]

- Darendeli, I.S.; Hill, T.L. Uncovering the complex relationships between political risk and MNE firm legitimacy: Insights from Libya. J. Int. Bus. Stud. 2016, 47, 68–92. [Google Scholar] [CrossRef]

- Globerman, S.; Shapiro, D.M. The impact of government policies on foreign direct investment: The Canadian experience. J. Int. Bus. Stud. 1999, 30, 513–532. [Google Scholar] [CrossRef]

- Egger, P.; Winner, H. How corruption influences foreign direct investment: A panel data study. Econ. Dev. Cult. Chang. 2006, 54, 459–486. [Google Scholar] [CrossRef]

- Alon, I.; Herbert, T.T. A stranger in a strange land: Micro political risk and the multinational firm. Bus. Horiz. 2009, 52, 127–137. [Google Scholar] [CrossRef]

- Liu, X.; Song, H.; Wei, Y.; Romilly, P. Country characteristics and foreign direct investment in China: A panel data analysis. Rev. World Econ. 1997, 133, 313–329. [Google Scholar] [CrossRef]

- Hayakawa, K.; Kimura, F.; Lee, H.H. How does country risk matter for foreign direct investment? Dev. Econ. 2013, 51, 60–78. [Google Scholar] [CrossRef] [Green Version]

- Schmidt, C.W.; Broll, U. Real exchange-rate uncertainty and US foreign direct investment: An empirical analysis. Rev. World Econ. 2009, 145, 513. [Google Scholar] [CrossRef]

- Takagi, S.; Shi, Z. Exchange rate movements and foreign direct investment (FDI): Japanese investment in Asia, 1987–2008. Jpn. World Econ. 2011, 23, 265–272. [Google Scholar] [CrossRef]

- Li, C.; Liu, H.; Jiang, Y. Exchange rate risk, political environment and Chinese outward FDI in emerging economies: A panel data analysis. Economics 2015, 3, 145–155. [Google Scholar]

- Altman, E.I.; Haldeman, R.G.; Narayanan, P. ZETATM analysis A new model to identify bankruptcy risk of corporations. J. Bank. Financ. 1977, 1, 29–54. [Google Scholar] [CrossRef]

- Miller, K.D. A framework for integrated risk management in international business. J. Int. Bus. Stud. 1992, 23, 311–331. [Google Scholar] [CrossRef]

- Lin, C.T.; Tsai, M.C. Location choice for direct foreign investment in new hospitals in China by using ANP and TOPSIS. Qual. Quant. 2010, 44, 375–390. [Google Scholar] [CrossRef]

- Memon, M.S.; Lee, Y.H.; Mari, S.I. Group multi-criteria supplier selection using combined grey systems theory and uncertainty theory. Expert Syst. Appl. 2015, 42, 7951–7959. [Google Scholar] [CrossRef]

- Duan, F.; Ji, Q.; Liu, B.Y.; Fan, Y. Energy investment risk assessment for nations along China’s Belt & Road Initiative. J. Clean. Prod. 2018, 170, 535–547. [Google Scholar]

- Sobczyk, E.J.; Kicki, J.; Sobczyk, W.; Szuwarzyński, M. Support of mining investment choice decisions with the use of multi-criteria method. Resour. Policy 2017, 51, 94–99. [Google Scholar] [CrossRef]

- Meldrum, D. Country risk and foreign direct investment. Bus. Econ. 2000, 35, 33–40. [Google Scholar]

- Thomas, D.E.; Grosse, R. Country-of-origin determinants of foreign direct investment in an emerging market: The case of Mexico. J. Int. Manag. 2001, 7, 59–79. [Google Scholar] [CrossRef]

- Al Khattab, A.; Anchor, J.; Davies, E. Managerial perceptions of political risk in international projects. Int. J. Proj. Manag. 2007, 25, 734–743. [Google Scholar] [CrossRef] [Green Version]

- Harris, R.S.; Ravenscraft, D. The role of acquisitions in foreign direct investment: Evidence from the U.S. Stock Market. J. Financ. 1991, 46, 825–844. [Google Scholar] [CrossRef]

- Kiymaz, H. The impact of country risk ratings on U.S. firms in large cross-border acquisitions. Glob. Financ. J. 2009, 20, 235–247. [Google Scholar] [CrossRef]

- Tarashev, N.A.; Borio, C.E.V.; Tsatsaronis, K. The Systemic Importance of Financial Institutions. BIS Q. Rev. 2009, 9, 75–87. [Google Scholar]

- Tobias, A.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705. [Google Scholar]

- Acharya, V.V.; Pedersen, L.H.; Philippon, T.; Richardson, M. Measuring Systemic Risk. Rev. Financ. Stud. 2017, 30, 2–47. [Google Scholar] [CrossRef]

- Brownlees, C.; Engle, R.F. SRISK: A Conditional Capital Shortfall Measure of Systemic Risk. Rev. Financ. Stud. 2017, 30, 48–79. [Google Scholar] [CrossRef]

- Karimalis, E.N.; Nomikos, N.K. Measuring systemic risk in the European banking sector: A Copula CoVaR approach. Eur. J. Financ. 2018, 24, 944–975. [Google Scholar] [CrossRef] [Green Version]

- Frankel, J.A.; Rose, A.K. Currency crashes in emerging markets:an empirical treatment. J. Int. Econ. 1996, 41, 35–66. [Google Scholar] [CrossRef] [Green Version]

- Sachs, J.; Tornell, A.; Velasco, A. Financial crises in emerging markets: The lessons from 1995. Natl. Bur. Econ. Res. 1996. [Google Scholar] [CrossRef]

- Kaminsky, G.; Lizondo, S.; Reinhart, C.M. Leading Indicators of Currency Crises; IMF Staff Paper: Washington, DC, USA, 1998; Volume 45. [Google Scholar]

- Illing, M.; Liu, Y. Measuring Financial Stress in a Developed Country: An Application to Canada. J. Financ. Stab. 2006, 2, 243–265. [Google Scholar] [CrossRef]

- Kumar, M.; Moorthy, U.; Perraudin, W. Predicting emerging market currency crashes. J. Empir. Financ. 2003, 10, 427–454. [Google Scholar] [CrossRef] [Green Version]

- Fioramanti, M. Predicting Sovereign Debt Crises Using Artificial Neural Networks:A Comparative Approach. J. Financ. Stab. 2008, 4, 164. [Google Scholar] [CrossRef]

- Ahn, J.J.; Oh, K.J.; Kim, T.Y.; Kim, D.H. Usefulness of support vector machine to develop an early warning system for financial crisis. Expert Syst. Appl. 2011, 38, 2966–2973. [Google Scholar] [CrossRef]

- Gandy, A.; Veraart, L.A. A Bayesian methodology for systemic risk assessment in financial networks. Manag. Sci. 2017, 63, 4428–4446. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Financial contagion. J. Political Econ. 2000, 108, 1–33. [Google Scholar] [CrossRef]

- Gai, P.; Kapadia, S. Contagion in financial networks. Proc. R. Soc. A 2010, 466, 2401–2423. [Google Scholar] [CrossRef] [Green Version]

- Dastkhan, H.; Gharneh, N.S. How the ownership structures cause epidemics in financial markets: A network-based simulation model. Phys. A Stat. Mech. Appl. 2018, 492, 324–342. [Google Scholar] [CrossRef]

- León, C.; Machado, C.; Sarmiento, M. Identifying central bank liquidity super-spreaders in interbank funds networks. J. Financ. Stab. 2018, 35, 75–92. [Google Scholar] [CrossRef] [Green Version]

- Watts, D.J.; Strogatz, S.H. Collective dynamics of ‘small-world’networks. Nature 1998, 393, 440. [Google Scholar] [CrossRef] [PubMed]

- Barabási, A.L.; Albert, R. Emergence of scaling in random networks. Science 1999, 286, 509–512. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, T.; He, J.; Li, X. An evolving network model of credit risk contagion in the financial market. Technol. Econ. Dev. Econ. 2017, 23, 22–37. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, S.; Wang, X. Comparison analysis on vulnerability of metro networks based on complex network. Phys. A Stat. Mech. Appl. 2018, 496, 72–78. [Google Scholar] [CrossRef]

- Firth, J.A.; Sheldon, B.C.; Brent, L.J.N. Indirectly connected: Simple social differences can explain the causes and apparent consequences of complex social network positions. Proc. R. Soc. B Biol. Sci. 2017, 284, 20171939. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Nowzari, C.; Preciado, V.M.; Pappas, G.J. Analysis and control of epidemics: A survey of spreading processes on complex networks. IEEE Control Syst. Mag. 2016, 36, 26–46. [Google Scholar]

- Kim, J.; Rasouli, S.; Timmermans, H.J.P. Social networks, social influence and activity-travel behaviour: A review of models and empirical evidence. Transp. Rev. 2018, 38, 499–523. [Google Scholar] [CrossRef] [Green Version]

- Liu, N.; An, H.; Gao, X.; Li, H.; Hao, X. Breaking news dissemination in the media via propagation behavior based on complex network theory. Phys. A Stat. Mech. Appl. 2016, 453, 44–54. [Google Scholar] [CrossRef]

- Liu, C.; Arunkumar, N. Risk prediction and evaluation of transnational transmission of financial crisis based on complex network. Clust. Comput. 2019, 22, 4307–4313. [Google Scholar] [CrossRef]

- Erb, C.B.; Harvey, C.R.; Viskanta, T.E. Political risk, economic risk, and financial risk. Financ. Anal. J. 1996, 52, 29–46. [Google Scholar] [CrossRef] [Green Version]

- Alfaro, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. FDI and economic growth: The role of local financial markets. J. Int. Econ. 2004, 64, 89–112. [Google Scholar] [CrossRef]

- Oet, M.V.; Bianco, T.; Gramlich, D.; Ong, S.J. SAFE: An early warning system for systemic banking risk. J. Bank. Financ. 2013, 37, 4510–4533. [Google Scholar] [CrossRef]

- Tao, L.; Zhu, Y. On China’s Financial Systemic Risks. J. Financ. Res. 2016, 6, 18–36. (In Chinese) [Google Scholar]

- Mantegna, R.N. Hierarchical structure in financial markets. Eur. Phys. J. B-Condens. Matter Complex Syst. 1999, 11, 193–197. [Google Scholar] [CrossRef] [Green Version]

| Author (Year) [Reference] | Models | Core Content | Limitations | |

|---|---|---|---|---|

| Model method based on market data | Tarashev et al. (2009) [25] | Shapley value | Made full use of the theoretical basis of the game theory of Shapley value, individually consider the risk generated by each bank and its contribution to the risks of other banks in the system. | Only the systematic importance of a single institution is considered. |

| Adrian and Brunnermeier (2016) [26] | CoVaR | Explored systemic financial risks from the risk spillover status of a single financial institution to other financial institutions and the entire financial market. | The result is not additive. | |

| Acharya et al. (2017) [27] | SES | It measured the systemic risk impact on the economy that a single financial institution has been in trouble. | Only applicable to post-event observation | |

| MES | It examined the marginal contribution of a single institution to systemic financial risks under the circumstance of the decline in the overall market yield. | |||

| Brownlees and Engle (2017) [28] | SRISK | On the basis of MES, the SRISK indicator (loss of financial institutions under the scenario of a certain drop in stock price) was constructed. | Only pay attention to local interdependence | |

| Karimalis and Nomikos (2018) [29] | Copula | Examined common market factors that trigger systemic risk events. | The issue of risk spillover between individual banks is not considered | |

| Index method based on macro data | Frankel and Rose (1996) [30] | FR | Analyzed the triggering factors of the financial crisis through historical data and judged the probability of the crisis. | The degree of influence of various variables on the crisis cannot be directly measured. |

| Sachs et al. (1996) [31] | STV | Selected the cross-sectional data of 20 countries and used linear regression to establish an early warning model. | Need to meet linear correlation conditions | |

| Kaminsky et al. (1998) [32] | KLR | Judged the possibility of a financial crisis based on the number of warning indicators exceeding the threshold. | The selection of the critical value has a great influence on the reliability of the results | |

| Illing and Liu (2006) [33] | FSI | Selected 11 relevant indicators of the stock market, bonds, banks and other markets to construct Canada’s comprehensive financial stress index. | Unable to analyze the internal correlation between risks | |

| Kumar, Moorthy and Perraudin (2002) [34] | Simple Logit | Early warning model based on lagging macroeconomic and financial data. | Indicators may have multicollinearity problems | |

| Fioramanti (2008) [35] | ANN | A neural network early warning system with parameters and non-parameters was constructed, and the data of 46 developing countries from 1980 to 2004 were used to test the system. | When there are many observation samples, the efficiency is not very high | |

| Ahn, et al. (2011) [36] | SVM | Took the South Korean financial market as the research object, the SVM financial market risk early warning system is established. | ||

| Gandy and Veraart (2017) [37] | Bayesian network | Constructed a financial network in the inter-bank market to measure the contagious effects of systemic financial risks. | The premise is to assume that the attributes are independent of each other |

| First-Level Indicators | Second-Level Indicators | Number | Data Sources |

|---|---|---|---|

| Exchange rate risk | Real effective exchange rate index | X1 | WDI 1 |

| Foreign exchange reserve | X2 | EPS 2 | |

| M2/GDP | X3 | WDI | |

| M2 growth rate | X4 | WDI | |

| Interest rate risk | Total government debt as a percentage of GDP (%) | X5 | Guo Yan Net 3 |

| Inflation rate | X6 | WDI | |

| Economic growth rate | X7 | WDI | |

| Capital market risk | Stock market index | X8 | WDI |

| Total Stock Trading/GDP | X9 | Sina Finance 4 | |

| Securitization rate | X10 | Sina Finance | |

| Stock exchange turnover rate (%) | X11 | EPS | |

| Financing risk | Non-performing loan ratio | X12 | WDI |

| The ratio of bank capital to assets | X13 | WDI |

| Indicator Name | 2008 | 2009 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|

| Real Effective Exchange Rate Index | 1 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 1 |

| Foreign exchange reserve | 2 | 3 | 3 | 3 | 4 | 4 | 4 | 3 | 4 |

| M2/GDP | 5 | 5 | 4 | 5 | 6 | 4 | 5 | 5 | 5 |

| M2 growth rate | 2 | 1 | 2 | 3 | 1 | 0 | 1 | 0 | 0 |

| Total government debt as a percentage of GDP (%) | 4 | 2 | 3 | 2 | 4 | 2 | 3 | 3 | 4 |

| Inflation rate | 0 | 3 | 2 | 2 | 2 | 0 | 2 | 2 | 2 |

| Economic growth rate | 4 | 1 | 1 | 0 | 1 | 2 | 3 | 0 | 0 |

| Stock market index | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 0 | 1 |

| Total Stock Trading/GDP | 3 | 4 | 1 | 2 | 5 | 3 | 5 | 2 | 5 |

| Securitization rate | 3 | 1 | 1 | 1 | 1 | 2 | 2 | 1 | 1 |

| Stock exchange turnover rate (%) | 2 | 3 | 3 | 2 | 5 | 4 | 3 | 5 | 4 |

| Non-performing loan ratio | 0 | 2 | 2 | 0 | 0 | 2 | 2 | 2 | 1 |

| The ratio of bank capital to assets | 2 | 0 | 0 | 2 | 1 | 1 | 0 | 1 | 0 |

| Clique | 2008 | 2009 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | X2 X3 X4 X5 X13 | X2 X3 X5 X9 X10 X11 | X2 X3 X5 X9 X11 | X2 X3 X4 X5 X6 X13 | X2 X3 X5 X9 X10 X11 | X3 X5 X6 X13 | X2 X3 X5 X9 X10 X11 | X2 X3 X5 X11 X13 | X2 X3 X5 X9 X11 |

| 2 | X1 X7 X9 X10 X11 | X4 X7 X13 | X1 X4 X7 X13 | X8 X9 X10 X11 | X4 X6 X7 | X1 X4 X7 X8 | X4 X8 X13 | X1 X4 X7 X8 | X1 X7 X8 X10 |

| 3 | X6 X8 X12 | X1 X6 X8 X12 | X6 X8 X10 X12 | X1 X7 X12 | X1 X8 X12 X13 | X2 X9 X10 X11 X12 | X1 X6 X7 X12 | X6 X9 X10 X12 | X4 X6 X12 X13 |

| Clique | 2008 | 2009 | 2011 | ||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | |

| 1 | 0.60 | 0.12 | 0.00 | 0.53 | 0.00 | 0.08 | 0.60 | 0.05 | 0.05 |

| 2 | 0.12 | 0.50 | 0.00 | 0.00 | 0.33 | 0.00 | 0.05 | 0.17 | 0.00 |

| 3 | 0.00 | 0.00 | 0.00 | 0.08 | 0.00 | 0.33 | 0.05 | 0.00 | 0.33 |

| Clique | 2012 | 2013 | 2014 | ||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | |

| 1 | 0.53 | 0.04 | 0.00 | 0.73 | 0.11 | 0.04 | 0.33 | 0.00 | 0.15 |

| 2 | 0.04 | 0.33 | 0.00 | 0.11 | 0.33 | 0.00 | 0.00 | 0.33 | 0.00 |

| 3 | 0.00 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 0.15 | 0.00 | 0.60 |

| Clique | 2015 | 2016 | 2017 | ||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | |

| 1 | 0.73 | 0.00 | 0.00 | 0.70 | 0.00 | 0.15 | 1.00 | 0.05 | 0.05 |

| 2 | 0.00 | 0.33 | 0.00 | 0.00 | 0.00 | 0.00 | 0.05 | 0.17 | 0.00 |

| 3 | 0.00 | 0.00 | 0.67 | 0.15 | 0.00 | 0.33 | 0.05 | 0.00 | 0.17 |

| Country Name | Network Density | Clustering Coefficient | Global Efficiency |

|---|---|---|---|

| Australia | 0.4321 | 0.709 | 0.661 |

| Pakistan | 0.6282 | 0.819 | 0.812 |

| Brazil | 0.4359 | 0.682 | 0.688 |

| Bulgaria | 0.2692 | 0.555 | 0.469 |

| Poland | 0.4487 | 0.611 | 0.707 |

| The Philippines | 0.4359 | 0.776 | 0.564 |

| Czech Republic | 0.3462 | 0.603 | 0.624 |

| Romania | 0.3462 | 0.692 | 0.613 |

| Malaysia | 0.3718 | 0.652 | 0.588 |

| The United States | 0.5128 | 0.777 | 0.741 |

| Mexico | 0.2051 | 0.483 | 0.397 |

| South Africa | 0.4231 | 0.622 | 0.686 |

| Nigeria | 0.3462 | 0.630 | 0.567 |

| Japan | 0.3974 | 0.779 | 0.603 |

| Saudi Arabia | 0.4103 | 0.644 | 0.690 |

| Ukraine | 0.3462 | 0.685 | 0.553 |

| Singapore | 0.4359 | 0.625 | 0.641 |

| Israel | 0.4872 | 0.900 | 0.494 |

| The United Kingdom | 0.4359 | 0.605 | 0.692 |

| Zambia | 0.2308 | 0.587 | 0.441 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Min, J.; Zhu, J.; Yang, J.-B. The Risk Monitoring of the Financial Ecological Environment in Chinese Outward Foreign Direct Investment Based on a Complex Network. Sustainability 2020, 12, 9456. https://doi.org/10.3390/su12229456

Min J, Zhu J, Yang J-B. The Risk Monitoring of the Financial Ecological Environment in Chinese Outward Foreign Direct Investment Based on a Complex Network. Sustainability. 2020; 12(22):9456. https://doi.org/10.3390/su12229456

Chicago/Turabian StyleMin, Jian, Jiaojiao Zhu, and Jian-Bo Yang. 2020. "The Risk Monitoring of the Financial Ecological Environment in Chinese Outward Foreign Direct Investment Based on a Complex Network" Sustainability 12, no. 22: 9456. https://doi.org/10.3390/su12229456