How Small- and Medium-Sized Enterprise Innovation Affects Credit Accessibility: The Case of Vietnam

Abstract

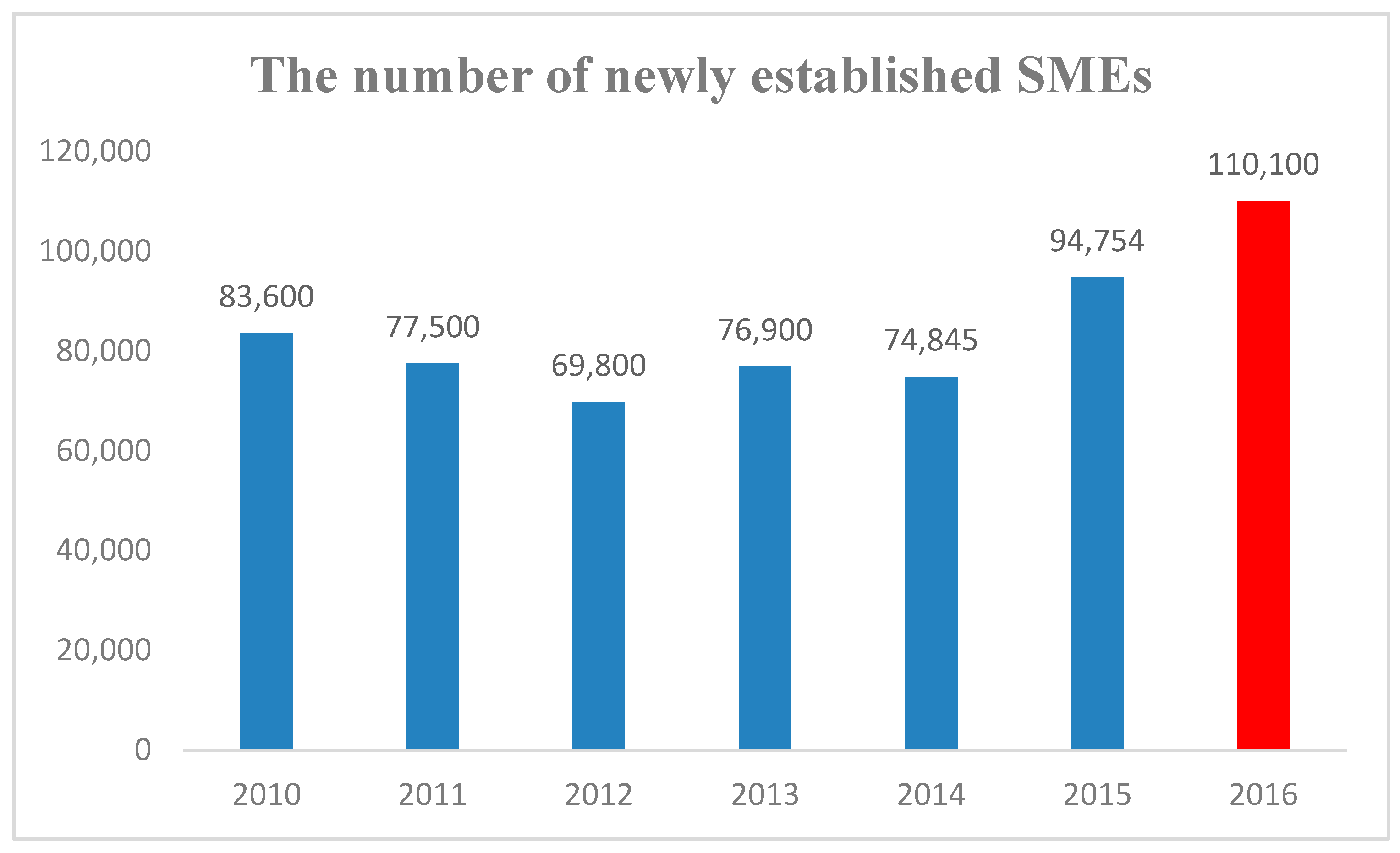

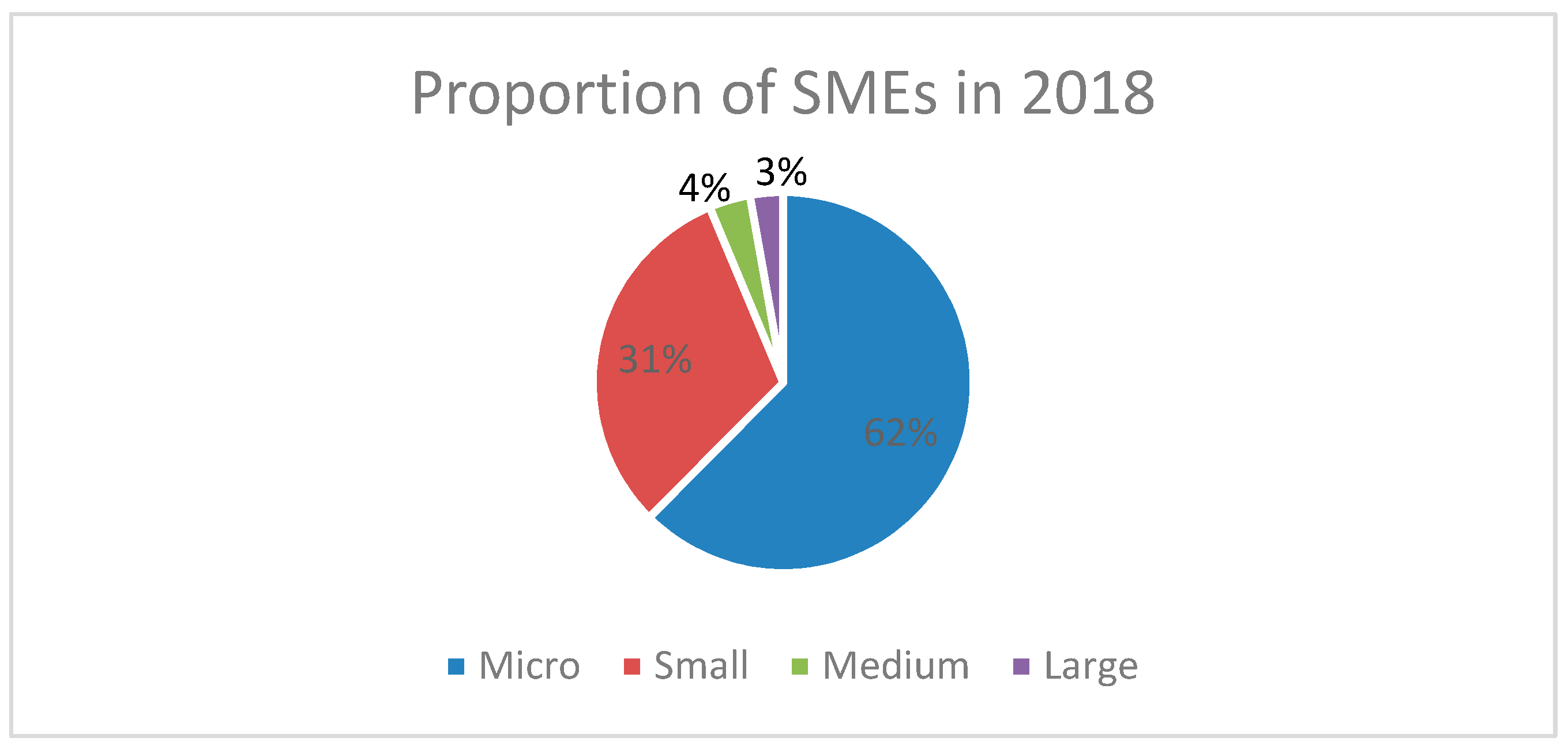

:1. Introduction

2. Literature Review

2.1. SMEs Concepts

2.2. Access to Finance and the Demand of SMEs’ Credit

2.3. Innovative SMEs

2.4. Factors Affecting Credit Accessibility

3. Methodology

3.1. Data

3.2. Research Model

3.3. Variables

3.3.1. Dependent Variables

3.3.2. Independent Variables

3.3.3. Control Variables

4. Results and Discussion

4.1. Descriptive Statistics

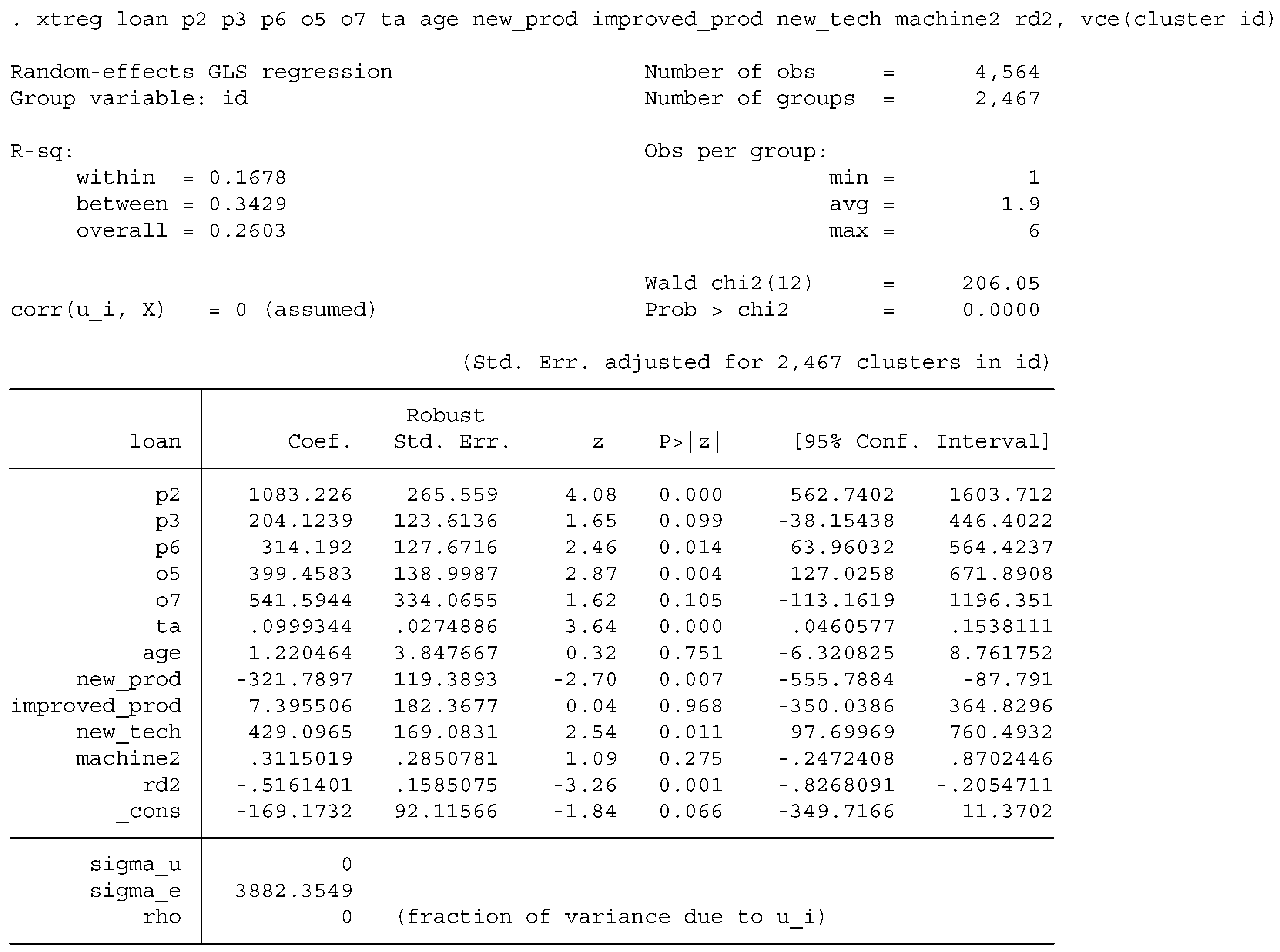

4.2. Empirical Results

− 169.17 + 1083.22 Province 2 + 204.12 Province 3 + 314.19 Province 6

+ 399.45 Ownership Type 5 + 0.099 Total Asset

− 321.78 New Product + 429.09 New Technology − 0.51 R&D investment + η it

4.3. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Hausman Test Comparing Fixed Effect Model and Random Effect Model

Appendix B. Breusch-Pagan Lagrange Multiplier Test Comparing Pooled OLS and Random Effect Model

Appendix C. VIF

Appendix D. Correlation Coefficients among Variables

Appendix E. The Results with Robust Standard Error

References

- OECD. Enhancing the Contributions of SMEs in a Global and Digital Economy. In Proceedings of the 2017 Meeting of the OECD Council at Ministerial Level, Paris, France, 7–8 June 2017; pp. 7–8. [Google Scholar]

- Hobohm, S. Small and medium-sized enterprises in economic development: The UNIDO experience. J. Econ. Coop. 2001, 22, 1–42. [Google Scholar]

- Tuan, N.H. Enhancing Accessibility of Bank Capital for Small and Medium-Sized Enterprises. Rev. Financ. 2019. Available online: http://static.tapchitaichinh.vn/files/phamthuytrang/11192019/ml-thang-11-2019-ky-1.pdf (accessed on 13 November 2020). (In Vietnamese).

- Nzove, E.M. Effect of Financial Innovations on the Growth of Small and Medium Enterprises. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2013. [Google Scholar]

- Beck, T.; Demirguc-Kunt, A. Small and medium-size enterprises: Access to finance as a growth constraint. J. Bank. Financ. 2006, 30, 2931–2943. [Google Scholar] [CrossRef]

- Hay, M.; Kamshad, K. Small Firm Growth: Intentions, Implementation and Impediments. Bus. Strat. Rev. 1994, 5, 49–68. [Google Scholar] [CrossRef]

- Archibugi, D.; Filippetti, A.; Frenz, M. Investment in innovation for European recovery: A public policy priority. Sci. Public Policy 2019, 47, 92–102. [Google Scholar] [CrossRef]

- Eniola, A.A.; Entebang, H. Small and Medium Business Management-Financial Sources and Difficulties. Int. Lett. Soc. Humanist. Sci. 2015, 58, 49–57. [Google Scholar] [CrossRef] [Green Version]

- Trinh, P.T.; Thanh, N.D. Development Characteristics of SME Sector in Vietnam: Evidence from the Vietnam Enterprise Census 2006; Working Paper WP-18; VEPR [Viet Nam Institute for Economic and Policy Research, Supported by the Friedrich Naumann Foundation for Freedom]: Hanoi, Vietnam, 2017; Available online: http://vepr.org.vn/upload/533/20171222/EN_VEPR%20WP%2018.pdf (accessed on 13 November 2020).

- Ayyagari, M.; Demirgüç-Kunt, A.; Beck, T. Small and Medium Enterprises across the Globe: A New Database; World Bank Group: Washington, DC, USA, 2003. [Google Scholar] [CrossRef] [Green Version]

- Khanh, H.C.G.; Canh, N.T.; Chau, L.H.A.; Liem, N.T.; Nghia, H.T.; Ngoc, D.T.; Nhan, N.T.; Phong, N.A.; Que, N.T.D.; Quoc, P.P.; et al. Annual Report of Finance Market 2007: Access to Finance; University of Economics and Law, Center for Economic and Financial Research, National University: Ho Chi Minh City, Vietnam, 2018. (In Vietnamese) [Google Scholar]

- Asia Pacific Foundation of Canada. 2017 Survey of Entrepreneurs and MSMES in Vietnam—Building the Capacity of MSMEs through Technology and Innovation. 2017. Available online: https://apfcanada-msme.ca/sites/default/files/2017-11/2017%20Survey%20of%20Entrepreneurs%20and%20MSMES%20in%20Vietnam%20Final7.pdf (accessed on 13 November 2020).

- Thanh, V.; Cuong, T.T.; Dung, B.; Chieu, T.D. Small and medium enterprises access to finance in Vietnam. In Small and Medium Enterprises (SMEs) Access to Finance in Selected East Asian Economies; ERIA: Jakarta, Indonesia, 2011; pp. 151–192. [Google Scholar]

- Kira, A.R.; He, Z. The Impact of Firm Characteristics in Access of Financing by Small and Medium-sized Enterprises in Tanzania. Int. J. Bus. Manag. 2012, 7, 108. [Google Scholar] [CrossRef] [Green Version]

- Lee, N.; Sameen, H.; Cowling, M. Access to finance for innovative SMEs since the financial crisis. Res. Policy 2015, 44, 370–380. [Google Scholar] [CrossRef] [Green Version]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and Legal Constraints to Growth: Does Firm Size Matter? J. Financ. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Harelimana, J.B. Role of Access to Finance for the Performance of Small and Medium Enterprises in Muhoza Sector, Rwanda. Acc. Financ. Manag. J. 2017, 2, 559–567. [Google Scholar] [CrossRef]

- Becchetti, L.; Trovato, G. The Determinants of Growth for Small and Medium Sized Firms. The Role of the Availability of External Finance. Small Bus. Econ. 2002, 19, 291–306. [Google Scholar] [CrossRef]

- Coad, A.; Rao, R. Innovation and firm growth in high-tech sectors: A quantile regression approach. Res. Policy 2008, 37, 633–648. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, A.N.; Pham, N.Q.; Nguyen, C.D.; Nguyen, N.D. Innovation and exports in Vietnam’s SME sector. Eur. J. Dev. Res. 2008, 20, 262–280. [Google Scholar] [CrossRef]

- Le, D.V.; Le, H.T.T.; Pham, T.; Van Vo, L. Access to Financing and Innovation in Small and Medium Enterprises in Vietnam. 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3450916 (accessed on 13 November 2020).

- Tran, Q.T.; Vu, V.H. Impact of government support on innovation of Vietnamese small and medium enterprises. Vietnam Natl. Univ. Hanoi Mag. Econ. Bus. Adm. 2018, 34, 9–16. [Google Scholar]

- Hall, B.H.; Moncada-Paternò-Castello, P.; Montresor, S.; Vezzani, A. Financing constraints, R&D investments and innovative performances: New empirical evidence at the firm level for Europe. Econ. Innov. New Technol. 2016, 25, 183–196. [Google Scholar] [CrossRef]

- Močnik, D. Asset specificity and a firm’s borrowing ability: An empirical analysis of manufacturing firms. J. Econ. Behav. Organ. 2001, 45, 69–81. [Google Scholar] [CrossRef]

- Freel, M.S. Are Small Innovators Credit Rationed? Small Bus. Econ. 2007, 28, 23–35. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. The benefits of lending relationships: Evidence from small business data. J. Financ. 1994, 49, 3–7. [Google Scholar] [CrossRef]

- Hernández-Cánovas, G.; Martínez-Solano, P. Relationship lending and SME financing in the continental European bank-based system. Small Bus. Econ. 2008, 34, 465–482. [Google Scholar] [CrossRef]

- Mina, A.; Lahr, H.; Hughes, A. The demand and supply of external finance for innovative firms. Ind. Corp. Chang. 2013, 22, 869–901. [Google Scholar] [CrossRef]

- Abdullah, M.A. Small and Medium Enterprises and Their Financing Patterns: Evidence from Malaysia. J. Econ. Coop. Dev. 2011, 32, 1–18. [Google Scholar]

- Cull, R.; Li, W.; Sun, B.; Xu, L.C. Government Connections and Financial Constraints: Evidence from a Large Representative Sample of Chinese Firms. J. Corp. Financ. 2013, 32, 271–294. [Google Scholar] [CrossRef] [Green Version]

- Drakos, K.; Giannakopoulos, N. On the determinants of credit rationing: Firm-level evidence from transition countries. J. Int. Money Financ. 2011, 30, 1773–1790. [Google Scholar] [CrossRef]

- Nguyen, N.; Gan, C.; Hu, B. An Empirical Analysis of Credit Accessibility of Small and Medium Sized Enterprises in Vietnam. Mekong Development Research Institute, Lincoln University, MPRA. 2015. Available online: https://mpra.ub.uni-muenchen.de/81911/1/MPRA_paper_81911.pdf (accessed on 13 November 2020).

- Brandt, K.; Rand, J.; Sharma, S.; Tarp, F.; Trifkovic, N. Characteristics of the Vietnamese Business Environment: Evidence from a SME Survey in 2015. Available online: https://www.wider.unu.edu/sites/default/files/SME2015-report-English.pdf (accessed on 13 November 2020).

- Rand, J.; Tarp, F.; Trifkovic, N. Characteristics of the Vietnamese Business Environment: Evidence from a Survey in 2013. Available online: https://www.econ.ku.dk/labor-market-performance/?pure=en%2Fpublications%2Fcharacteristics-of-the-vietnamese-business-environment-evidence-from-a-survey-in-2013(851978c2-f9fa-436a-a5fc-d322174d24a8)%2Fexport.html (accessed on 13 November 2020).

- Malesky, E.J.; Taussig, M. Where Is Credit Due? Legal Institutions, Connections, and the Efficiency of Bank Lending in Vietnam. J. Law Econ. Organ. 2008, 25, 535–578. [Google Scholar] [CrossRef]

- Industry Innovation and Science Australia. Stimulating Business Investment in Innovation Australian Government: Department of Industry, Science, Energy and Resources. 2020. Available online: https://www.industry.gov.au/sites/default/files/2020-02/stimulating-business-investment-in-innovation.pdf (accessed on 13 November 2020).

| Micro Enterprise | Small Enterprise | Medium Enterprise | |||

|---|---|---|---|---|---|

| Number of Laborers | Total Capital | Number of Laborers | Total Capital | Number of Laborers | |

| Agriculture, Forestry and Fishery | ≤10 | ≤20 bill VND | 11–200 | ≤100 bill VND | 201–300 |

| Industry and Construction | ≤10 | ≤20 bill VND | 11–200 | ≤100 bill VND | 201–300 |

| Trade and Service | ≤10 | ≤10 bill VND | 11–50 | ≤50 bill VND | 51–100 |

| Year | Total Number of SMEs |

|---|---|

| 2005 | 1039 |

| 2007 | 935 |

| 2009 | 979 |

| 2011 | 704 |

| 2013 | 612 |

| 2015 | 1006 |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Formal Loan | 5275 | 765.3216 | 4125.537 | 0.05 | 172,316.6 |

| Province 2 | 5275 | 0.1819905 | 0.3858733 | 0 | 1 |

| Province 3 | 5275 | 0.0788626 | 0.2695497 | 0 | 1 |

| Province 6 | 5275 | 0.1279621 | 0.3340793 | 0 | 1 |

| Ownership Type 5 | 5275 | 0.2686256 | 0.4432867 | 0 | 1 |

| Ownership Type 7 | 5275 | 0.0545972 | 0.2272138 | 0 | 1 |

| Total Asset | 5275 | 4844.218 | 23358.57 | 2.35 | 1,045,000 |

| Firm Age | 5275 | 12.86408 | 9.009828 | 2 | 72 |

| New Product | 5275 | 0.1636019 | 0.369949 | 0 | 1 |

| Improved Product | 5275 | 0.4341232 | 0.4956882 | 0 | 1 |

| New Technology | 5275 | 0.2079621 | 0.405888 | 0 | 1 |

| Machine Innovation | 4567 | 55.58546 | 125.3854 | 0 | 1683.111 |

| R&D investment | 4564 | 25.912 | 132.7345 | 0 | 2953.121 |

| Formal Loan | Province 2 | Province 3 | Province 6 | Ownership Type 5 | Ownership Type 7 | Total Asset | |

|---|---|---|---|---|---|---|---|

| Formal Loan | 1.0000 | ||||||

| Province 2 | 0.1426 | 1.0000 | |||||

| Province 3 | 0.0121 | −0.1380 | 1.0000 | ||||

| Province 6 | −0.0251 | −0.1807 | −0.1121 | 1.0000 | |||

| Ownership 5 | 0.1476 | 0.1997 | −0.0028 | −0.1233 | 1.0000 | ||

| Ownership 7 | 0.0561 | −0.0312 | 0.0783 | −0.0121 | −0.1456 | 1.0000 | |

| Total Asset | 0.5120 | 0.0789 | 0.0291 | −0.0368 | 0.1526 | 0.0422 | 1.0000 |

| Firm Age | −0.0371 | −0.1378 | 0.0236 | −0.0069 | −0.2053 | −0.0458 | −0.0157 |

| New Product | −0.0054 | 0.0172 | 0.0132 | −0.0145 | 0.0095 | 0.0020 | 0.0177 |

| Improved Product | 0.0672 | 0.0637 | 0.0275 | −0.0229 | 0.0965 | 0.0134 | 0.0876 |

| New Tech | 0.1255 | 0.0828 | 0.0026 | −0.0802 | 0.1384 | 0.0352 | 0.1441 |

| Machine Innovation | 0.0256 | 0.0278 | −0.0143 | 0.0024 | 0.0491 | 0.0184 | 0.0081 |

| R&D invest. | −0.0336 | 0.0300 | −0.0329 | −0.0079 | 0.0534 | 0.0504 | −0.0465 |

| Firm Age | New Product | Improved Product | New Technology | Machine Innovation | R&D Investment | ||

| Firm Age | 1.0000 | ||||||

| New Product | −0.0300 | 1.0000 | |||||

| Improved Product | −0.1143 | 0.2082 | 1.0000 | ||||

| New Technology | −0.0929 | 0.2406 | 0.3598 | 1.0000 | |||

| Machine Innovation | −0.1165 | 0.0997 | 0.0899 | 0.2261 | 1.0000 | ||

| R&D investment | 0.0290 | −0.0751 | −0.0703 | −0.653 | −0.0431 | 1.0000 | |

| Variable | VIF | 1/VIF |

|---|---|---|

| New Technology | 1.28 | 0.784121 |

| Improved Product | 1.18 | 0.846303 |

| Ownership Type 5 | 1.16 | 0.863572 |

| Province 2 | 1.10 | 0.910489 |

| Firm Age | 1.08 | 0.925286 |

| New Product | 1.07 | 0.930725 |

| Province 6 | 1.07 | 0.932857 |

| Total Asset | 1.07 | 0.935077 |

| Machine Innovation | 1.07 | 0.935961 |

| Ownership Type 7 | 1.05 | 0.950892 |

| Province 3 | 1.05 | 0.952301 |

| R&D investment | 1.03 | 0.975570 |

| Mean VIF | 1.10 |

| Variables | Access to Credit |

|---|---|

| New Product | −321.78 *** (119.38) |

| Improved Product | 7.39 (182.36) |

| New Technology | 429.09 ** (169.08) |

| Machine Innovation | 0.31 (0.28) |

| R&D investment | −0.51 *** (0.15) |

| Firm Age | 1.22 (3.84) |

| Total Asset | 0.099 *** (0.027) |

| Ownership Type 5 (Limited Liability company) | 399.45 *** (138.99) |

| Ownership Type 7 (Joint-Stock Company without state capital) | 541.59 (334.06) |

| Province 2 (Ho Chi Minh City) | 1083.22 *** (265.55) |

| Province 3 (Hai Phong City) | 204.12 * (123.61) |

| Province 6 (Phu Tho province) | 314.19 ** (127.67) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, P.A.; Uong, T.A.T.; Nguyen, Q.D. How Small- and Medium-Sized Enterprise Innovation Affects Credit Accessibility: The Case of Vietnam. Sustainability 2020, 12, 9559. https://doi.org/10.3390/su12229559

Nguyen PA, Uong TAT, Nguyen QD. How Small- and Medium-Sized Enterprise Innovation Affects Credit Accessibility: The Case of Vietnam. Sustainability. 2020; 12(22):9559. https://doi.org/10.3390/su12229559

Chicago/Turabian StyleNguyen, Phuong Anh, Thuy Anh Tram Uong, and Quang Dung Nguyen. 2020. "How Small- and Medium-Sized Enterprise Innovation Affects Credit Accessibility: The Case of Vietnam" Sustainability 12, no. 22: 9559. https://doi.org/10.3390/su12229559