Environmental Regulation and Financial Performance in China: An Integrated View of the Porter Hypothesis and Institutional Theory

Abstract

1. Introduction

2. Theoretical Background and Hypothesis Development

2.1. Porter Hypothesis

2.2. Institutional Theory

2.3. Hypothesis Development

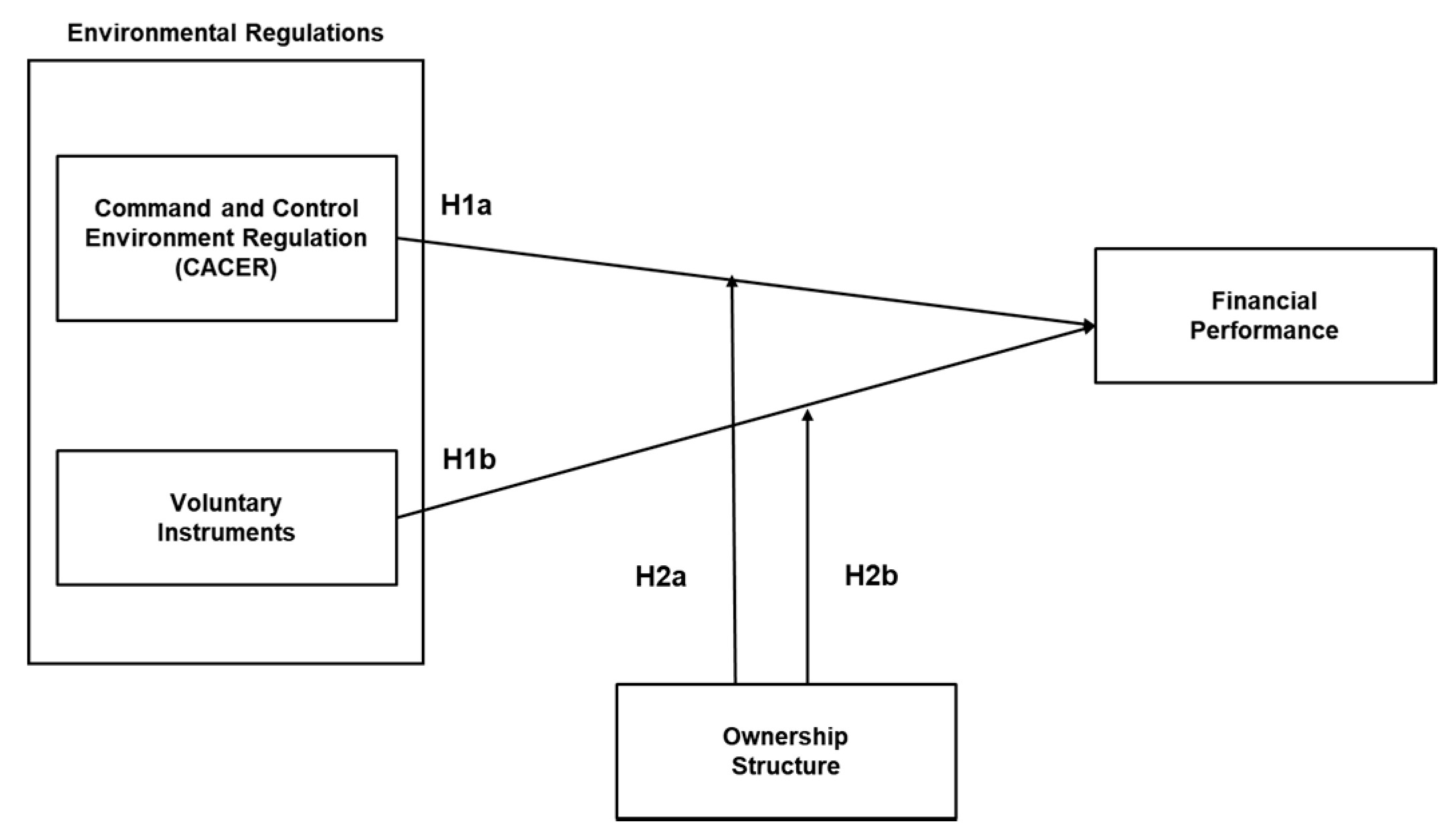

2.3.1. CACER, Voluntary Instruments, and Financial Performance

2.3.2. The Moderating Effect of Ownership Structure

3. Data and Methods

3.1. Research Setting

3.2. Sample and Data Collection

3.3. Measures

3.3.1. Dependent Variable

3.3.2. Independent Variable

3.3.3. Moderating Variable

3.3.4. Control Variables

4. Results

4.1. Descriptive Statistics

4.2. Hypotheses Testing Results

4.3. Endogenous Analysis

4.4. Robustness Test

5. Practical Implications

6. Conclusions

7. Limitations and Future Directions

Funding

Conflicts of Interest

References

- Wong, C.W.Y.; Miao, X.; Cui, S.; Tang, Y. Impact of corporate environmental responsibility on operating income: Moderating role of regional disparities in China. J. Bus. Ethics 2016, 149, 363–382. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building & construction sector in some EU regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The potential of environmental regulation to change managerial perception, environmental management, competitiveness and financial performance. J. Clean. Prod. 2010, 18, 963–974. [Google Scholar] [CrossRef]

- Porter, M.; van der Linde, C. Toward a new conception of the environment competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Xing, X.; Liu, T.; Wang, J.; Shen, L.; Zhu, Y. Environmental regulation, environmental commitment, sustainability exploration/exploitation innovation, and firm sustainable development. Sustainability 2019, 11, 6001. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, W.; Zhang, L.; She, K. Can environmental regulation flexibility explain the Porter hypothesis?—An empirical study based on the data of China’s listed enterprises. Sustainability 2019, 11, 2214. [Google Scholar] [CrossRef]

- Liu, A.; Gu, X. Environmental regulation, technological progress and corporate profit: Empirical research based on the threshold panel regression. Sustainability 2020, 12, 1416. [Google Scholar] [CrossRef]

- Cohen, M.A.; Tubb, A. The impact of environmental regulation on firm and country competitiveness: A meta-analysis of the Porter hypothesis. J. Assoc. Environ. Resour. Econ. 2018, 5, 371–399. [Google Scholar] [CrossRef]

- Iraldo, F.; Testa, F.; Melis, M.; Frey, M. A literature review on the links between environmental regulation and competitiveness. Environ. Policy Gov. 2011, 21, 210–222. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green innovation and financial performance. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Zeng, Y. Can voluntary environmental regulation promote corporate technological innovation? Bus. Strategy Environ. 2020, 29, 390–406. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate environmental responsibility and firm performance in the financial services sector. J. Bus. Ethics 2014, 131, 257–284. [Google Scholar] [CrossRef]

- Horváthová, E. Does environmental performance affect financial performance? A meta-analysis. Ecol. Econ. 2010, 70, 52–59. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-Lucchetti, J.; Johnstone, N.; Ambec, S. Environmental policy, innovation and performance: New insights on the Porter Hypothesis. J. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Tan, J. Institutional structure and firm social performance in transitional economies: Evidence of multinational corporations in China. J. Bus. Ethics 2009, 86, 171. [Google Scholar] [CrossRef]

- Ali, S.; Zhang, J.; Usman, M.; Khan, F.U.; Ikram, A.; Anwar, B. Sub-national institutional contingencies and corporate social responsibility performance: Evidence from China. Sustainability 2019, 11, 5478. [Google Scholar] [CrossRef]

- Du, M.; Boateng, A. State ownership, institutional effects and value creation in cross-border mergers & acquisitions by Chinese firms. Int. Bus. Rev. 2015, 24, 430–442. [Google Scholar]

- Lardy, N.R. Markets over Mao: The Rise of Private Business in China; Peterson Institute for International Economics: Washington, DC, USA, 2014. [Google Scholar]

- Ralston, D.A.; Terpstra-Tong, J.; Terpstra, R.H.; Wang, X.; Egri, C. Today’s state-owned enterprises of China: Are they dying dinosaurs or dynamic dynamos? Strateg. Manag. J. 2006, 27, 825–843. [Google Scholar] [CrossRef]

- Lin, K.J.; Lu, X.; Zhang, J.; Zheng, Y. State-owned enterprises in China: A review of 40 years of research and practice. China J. Account. Res. 2020, 13, 31–55. [Google Scholar] [CrossRef]

- Lu, M.; Zhang, Y.; Luo, C. China’s Economic Development: Institutions, Growth and Imbalances; Edward Elger: Northampton, UK, 2013. [Google Scholar]

- Zhang, Y.; Wang, J.; Xue, Y.; Yang, J. Impact of environmental regulations on green technological innovative behavior: An empirical study in China. J. Clean. Prod. 2018, 188, 763–773. [Google Scholar] [CrossRef]

- Stewart, R.B. Regulation, innovation, and administrative law: A conceptual framework. Calif. Law Rev. 1981, 69, 1256–1377. [Google Scholar] [CrossRef]

- Baumol, W.J.; Oates, W.E. Economics, Environmental Policy, and the Quality of Life; Center for Applied Economics: New York, NY, USA, 1993. [Google Scholar]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Xing, X.; Liu, T.; Shen, L.; Wang, J. Linking environmental regulation and financial performance: The mediating role of green dynamic capability and sustainable innovation. Sustainability 2020, 12, 1007. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Firm Value; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Scott, W.R. The adolescence of institutional theory. Adm. Sci. Q. 1987, 32, 493–511. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. J. Int. Bus. Stud. 2012, 43, 264–284. [Google Scholar] [CrossRef]

- Peng, M.W. Institutional transitions and strategic choices. Acad. Manag. Rev. 2003, 28, 275–296. [Google Scholar] [CrossRef]

- Peng, M.W.; Wang, D.Y.L.; Jiang, Y. An institution-based view of international business strategy: A focus on emerging economies. J. Int. Bus. Stud. 2008, 39, 920–936. [Google Scholar] [CrossRef]

- Nair, A.K.S.; Bhattacharyya, S.S. Mandatory corporate social responsibility in India and its effect on corporate financial performance: Perspectives from institutional theory and resource-based view. Bus. Strategy Dev. 2019, 2, 106–116. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- Peng, M.W. Towards an institution-based view of business strategy. Asia Pac. J. Manag. 2002, 19, 251–267. [Google Scholar] [CrossRef]

- Paavola, J. Institutions and environmental governance: A reconceptualization. Ecol. Econ. 2007, 63, 93–103. [Google Scholar] [CrossRef]

- Paavola, J. Interdependence, Pluralism and Globalization: Implications for Environmental Governance. In Environmental Values in a Globalizing World: Nature, Justice and Governance; Paavola, J., Lowe, I., Eds.; Routledge: London, UK, 2005. [Google Scholar]

- Paavola, J.; Adger, W.N. Institutional ecological economics. Ecol. Econ. 2005, 53, 353–368. [Google Scholar] [CrossRef]

- Zhao, M. CSR-based political legitimacy strategy: Managing the state by doing good in China and Russia. J. Bus. Ethics 2012, 111, 439–460. [Google Scholar] [CrossRef]

- Albertini, E. Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Hart, S. A natural-resource-based view of the firm. Acad. Manag. J. 1995, 20, 986–1014. [Google Scholar]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2016, 62, 375–404. [Google Scholar] [CrossRef]

- Inoue, C.F.K.V.; Lazzarini, S.G.; Musacchio, A. Leviathan as a minority shareholder: Firm-level implications of state equity purchases. Acad. Manag. J. 2013, 56, 1775–1801. [Google Scholar] [CrossRef]

- Perkins, D. East Asian Development: Foundations and Strategies; Harvard University Press: Cambridge, UK; London, UK, 2013. [Google Scholar]

- Boyer, R.; Uemura, H.; Isogai, A. Diversity and Transformations of Asian Capitalisms; Routledge: New York, NY, USA, 2012. [Google Scholar]

- Davies, K. China Investment Policy: An Update; OECD Working Papers on International Investment; OECD Publishing: Paris, France, 2020. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhang, S.; Ding, Z.; Hao, Y. Does government expenditure affect environmental quality? Empirical evidence using Chinese city-level data. J. Clean. Prod. 2017, 161, 143–152. [Google Scholar] [CrossRef]

- Clò, S.; Massimo Florio, M.F. Ownership and environmental regulation: Evidence from the European electricity industry. Energy Econ. 2017, 61, 298–312. [Google Scholar] [CrossRef]

- Yi, M.; Wang, Y.; Yan, M.; Fu, L.; Zhang, Y. Government R&D subsidies, environmental regulations, and their effect on green innovation efficiency of manufacturing industry: Evidence from the Yangtze River economic belt of China. Int. J. Environ. Res. Public Health 2020, 17, 1330. [Google Scholar]

- Chen, J.; Cheng, J.; Dai, S. Regional eco-innovation in China: An analysis of eco-innovation levels and influencing factors. J. Clean. Prod. 2017, 153, 1–14. [Google Scholar] [CrossRef]

- Du, J.L.; Liu, Y.; Diao, W.X. Assessing regional differences in green innovation efficiency of industrial enterprises in China. Int. J. Environ. Res. Public Health 2019, 16, 940. [Google Scholar] [CrossRef]

- Javorcik, B.S.; Wei, S.J. Pollution havens and foreign direct investment: Dirty secret or popular myth? Be J. Econ. Anal. Policy 2004, 3. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Millimet, D.L. Is there a ‘California effect’ in US Environmental policy making. Reg. Sci. Urban Econ. 2002, 32, 737–764. [Google Scholar] [CrossRef]

- He, W.; Shen, R. ISO 14001 certification and corporate technological innovation: Evidence from Chinese firms. J. Bus. Ethics 2017, 158, 97–117. [Google Scholar] [CrossRef]

- Lin, H.; Zeng, S.X.; Ma, H.Y.; Qi, G.Y.; Tam, V.W.Y. Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 2014, 64, 63–72. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis; Prentice Hall: London, UK, 1988. [Google Scholar]

- Bramati, M.C.; Croux, C. Robust estimators for the fixed effects panel data model. Econom. J. 2007, 10, 521–540. [Google Scholar] [CrossRef]

- Frondel, M.; Horbach, J.; Rennings, K. What triggers environmental management and innovation? Empirical evidence for Germany. Ecol. Econ. 2008, 66, 153–160. [Google Scholar] [CrossRef]

- Gollop, F.M.; Roberts, M.J. Environmental regulations and productivity growth: The case of fossil-fueled electric power generation. J. Political Econ. 1983, 91, 654–674. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Sato, M. The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. Policy 2017, 11, 183–206. [Google Scholar] [CrossRef]

- Kim, H.; Park, K.; Ryu, D. Corporate environmental responsibility: A legal origins perspective. J. Bus. Ethics 2017, 140, 381–402. [Google Scholar] [CrossRef]

- Thornton, D.; Kagan, R.A.; Gunningham, N. When social norms and pressures are not. Law Soc. Rev. 2009, 43, 405–436. [Google Scholar] [CrossRef]

- Westerlund, J.; Basher, S.A. Testing for convergence in carbon dioxide emissions using a century of panel data. Environ. Resour. Econ. 2008, 40, 109–120. [Google Scholar] [CrossRef]

| Variables | Observation | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| ROA | 915 | 22.6493 | 1.26953 | 19.58 | 27.08 |

| CACER | 915 | 15.0960 | 1.73668 | 8.55 | 19.98 |

| VI | 915 | 16.5044 | 2.51329 | 2.77 | 22.71 |

| Ownership | 915 | 0.42 | 0.526 | 0 | 3 |

| Debt ratio | 915 | −0.8057 | 0.58372 | −4.16 | −0.22 |

| Firm size | 915 | 8.2503 | 1.18076 | 4.06 | 11.81 |

| Firm age | 915 | 2.8058 | 0.31368 | 1.39 | 3.43 |

| City GDP | 915 | 17.1791 | 1.12262 | 14.06 | 19.46 |

| City population | 915 | 6.0592 | 0.87142 | 2.77 | 8.13 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|

| 1 ROA | 1 | ||||||||

| 2 CACER | 0.599 ** | 1 | |||||||

| 3 VI | 0.457 ** | 0.317 ** | 1 | ||||||

| 4 Ownership | 0.315 ** | 0.229 ** | 0.308 ** | 1 | |||||

| 5 Firm size | 0.827 ** | 0.558 ** | 0.410 ** | 0.302 ** | 1 | ||||

| 6 Firm age | 0.051 ** | 0.033 | 0.067 * | 0.102 ** | 0.028 | 1 | |||

| 7 Debt ratio | 0.436 ** | 0.290 ** | 0.339 ** | 0.261 ** | 0.432 ** | 0.105 ** | 1 | ||

| 8 City GDP | 0.153 ** | 0.023 | −0.167 ** | −0.170 ** | 0.074 * | 0.019 | 0.031 | 1 | |

| 9 City population | 0.050 | −0.049 | −0.176 ** | −0.132 ** | 0.004 | 0.049 | 0.007 | 0.804 ** | 1 |

| Dependent Variable | ROA | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | ||||||

| Beta (t-Value) | VIF | Beta (t-Value) | VIF | Beta (t-Value) | VIF | Beta (t-Value) | VIF | Beta (t-Value) | VIF | |

| Control variable | ||||||||||

| Firm size | 0.832 ** (38.354) | 1.245 | 0.723 ** (30.192) | 1.655 |

0.771 ** (34.455) | 1.382 |

0.704 ** (29.263) | 1.712 | 0.755 ** (33.444) | 1.429 |

| Firm age |

0.084 (1.145) | 1.015 | 0.072 (1.021) | 1.016 | 0.023 (0.318) | 1.013 |

0.048 (0.684) | 1.023 | −0.001 (−0.010) | 1.020 |

| Debt ratio |

0.207 ** (4.724) | 1.243 | 0.182 ** (4.338) | 1.248 | 0.134 * (3.053) | 1.276 |

0.160 ** (3.802) | 1.269 |

0.116 * (2.662) | 1.289 |

| City GDP |

0.181 ** (5.227) | 2.872 | 0.167 ** (5.024) | 2.878 | 0.220 ** (6.364) | 2.999 | 0.187 ** (5.617) | 2.940 |

0.237 ** (6.875) | 3.048 |

| City population |

−0.122 ** (−2.729) | 2.862 | −0.092 * (−2.157) | 2.878 | −0.118 * (−2.668) | 2.960 | −0.098 * (−2.302) | 2.881 |

−0.125 * (−2.836) | 2.964 |

| Main Effect | ||||||||||

| CACER | 0.141 ** (9.181) | 1.469 | 0.131 ** (8.560) | 1.500 | ||||||

| VI | 0.079 ** (7.705) | 1.323 | 0.069 ** (6.620) | 1.400 | ||||||

| Moderating effect | ||||||||||

| CACER * ownership | 0.012 ** (4.152) | 1.244 | ||||||||

| VI * ownership | 0.011 ** (4.002) | 1.276 | ||||||||

| Model statistics | ||||||||||

| R2 | 0.728 | 0.722 | 0.733 | 0.727 | ||||||

| F value | 84.287 ** | 59.368 ** | 17.236 ** | 16.018 ** | ||||||

| Instrumental Variable | Regions | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Coeff. (z-Value) | Coeff. (z-Value) | Coeff. (z-Value) | |

| Control variable | |||

| Firm size | 2638 ** (46.62) | 1761 ** (6.94) | 2348 ** (15.30) |

| Firm age | −1.35 × 108 (−0.89) | −5.32 × 107 (−0.41) | −6.22 × 108 * (−2.06) |

| Debt ratio | 6.99 × 109 * (1.97) | 8.91 × 109 ** (2.90) | −5.14 × 109 (−0.70) |

| City GDP | 89.940 ** (5.69) | 93.341 ** (6.90) | 78.561 ** (3.56) |

| City population | −3904 * (−1.66) | −4259 * (−2.13) | 3710 (0.79) |

| Independent variable | |||

| CACER | 423.137 ** (3.52) | ||

| VI | 55.986 * (2.20) | ||

| Model Statistics | |||

| R2 | 0.767 | 0.830 | 0.571 |

| Dependent Variable | EBITDA | ||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Coeff. (t-Value) | Coeff. (t-Value) | Coeff. (t-Value) | Coeff. (t-Value) | Coeff. (t-Value) | |

| Control variable | |||||

| Firm size | −0.037 (−1.44) | −0.064 * (−2.42) | −0.024 (−0.98) | −0.069 ** (−2.64) | −0.024 (−0.99) |

| Firm age | 113.222 ** (2.68) | 102.345 * (2.48) | 99.951 * (2.47) | 112.768 ** (2.76) | 89.934 * (2.24) |

| Debt ratio | −2139.905 ** (−3.02) | −2235.985 ** (−3.23) | −2004.611 ** (−2.95) | −2175.075 ** (−3.18) | −1805.602 ** (−2.68) |

| City GDP | 0.000 ** (4.52) | 0.000 ** (3.50) | 0.000 ** (4.67) | 0.000 ** (3.13) | 0.000 ** (4.74) |

| City population | −2.248 (−0.44) | −2.002 (−0.40) | −3.959 (−0.81) | −2.077 (−0.42) | −2.582 (−0.53) |

| Main Effect | |||||

| CACER | 17.221 ** (4.18) | 15.011 ** (3.63) | |||

| VI | 1.431 ** (5.54) | 4.144 ** (4.57) | |||

| Moderating effect | |||||

| CACER * ownership | 21.822 ** (3.08) | ||||

| VI * ownership | −7.336 ** (−3.12) | ||||

| Model statistics | |||||

| Prob > F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, E. Environmental Regulation and Financial Performance in China: An Integrated View of the Porter Hypothesis and Institutional Theory. Sustainability 2020, 12, 10183. https://doi.org/10.3390/su122310183

Lee E. Environmental Regulation and Financial Performance in China: An Integrated View of the Porter Hypothesis and Institutional Theory. Sustainability. 2020; 12(23):10183. https://doi.org/10.3390/su122310183

Chicago/Turabian StyleLee, Eunmi. 2020. "Environmental Regulation and Financial Performance in China: An Integrated View of the Porter Hypothesis and Institutional Theory" Sustainability 12, no. 23: 10183. https://doi.org/10.3390/su122310183

APA StyleLee, E. (2020). Environmental Regulation and Financial Performance in China: An Integrated View of the Porter Hypothesis and Institutional Theory. Sustainability, 12(23), 10183. https://doi.org/10.3390/su122310183