Coal Industrial Supply Chain Network and Associated Evaluation Models

Abstract

:1. Introduction

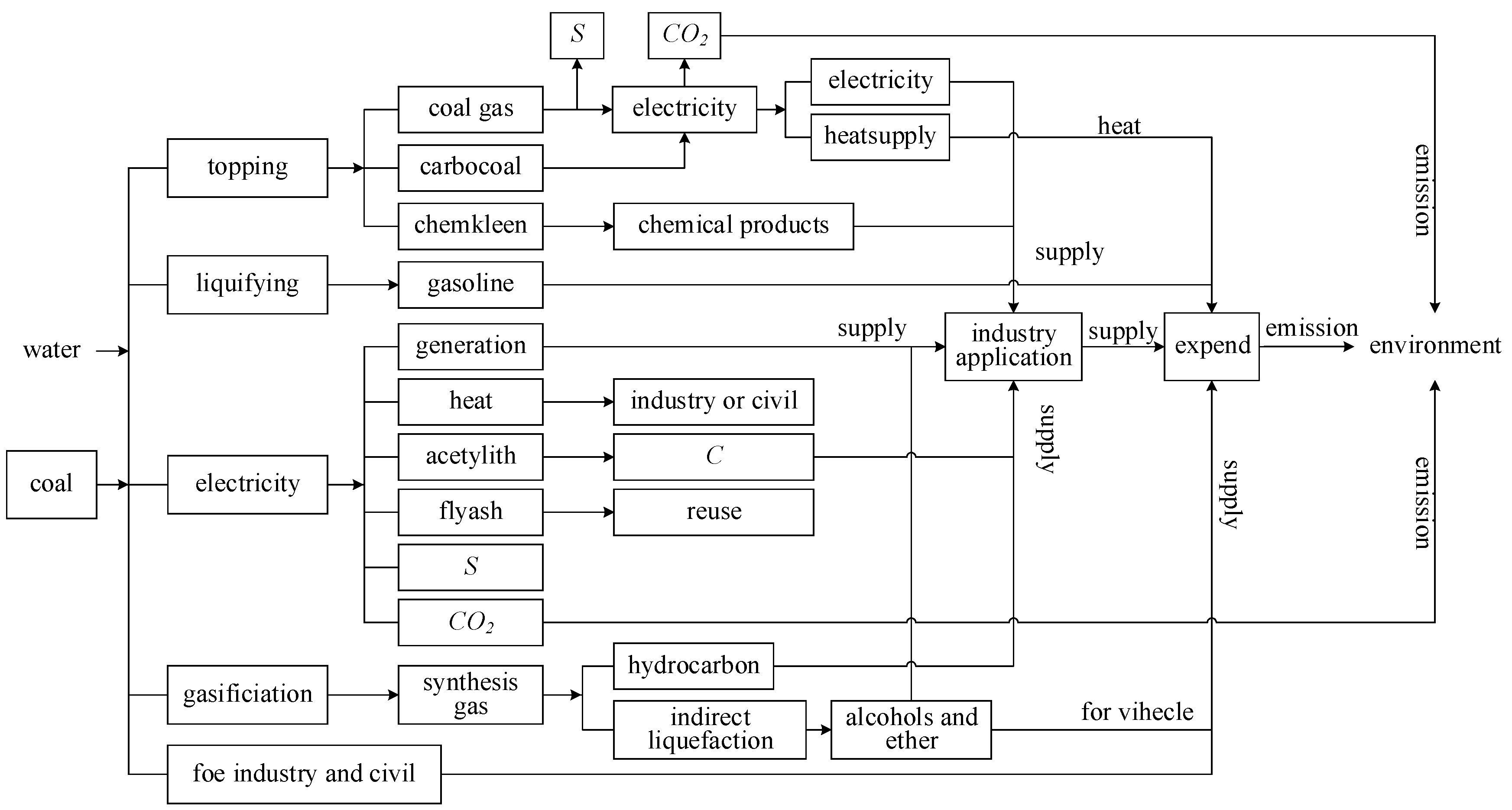

2. Multinode Supply Chain and Collaborative Evaluation Models

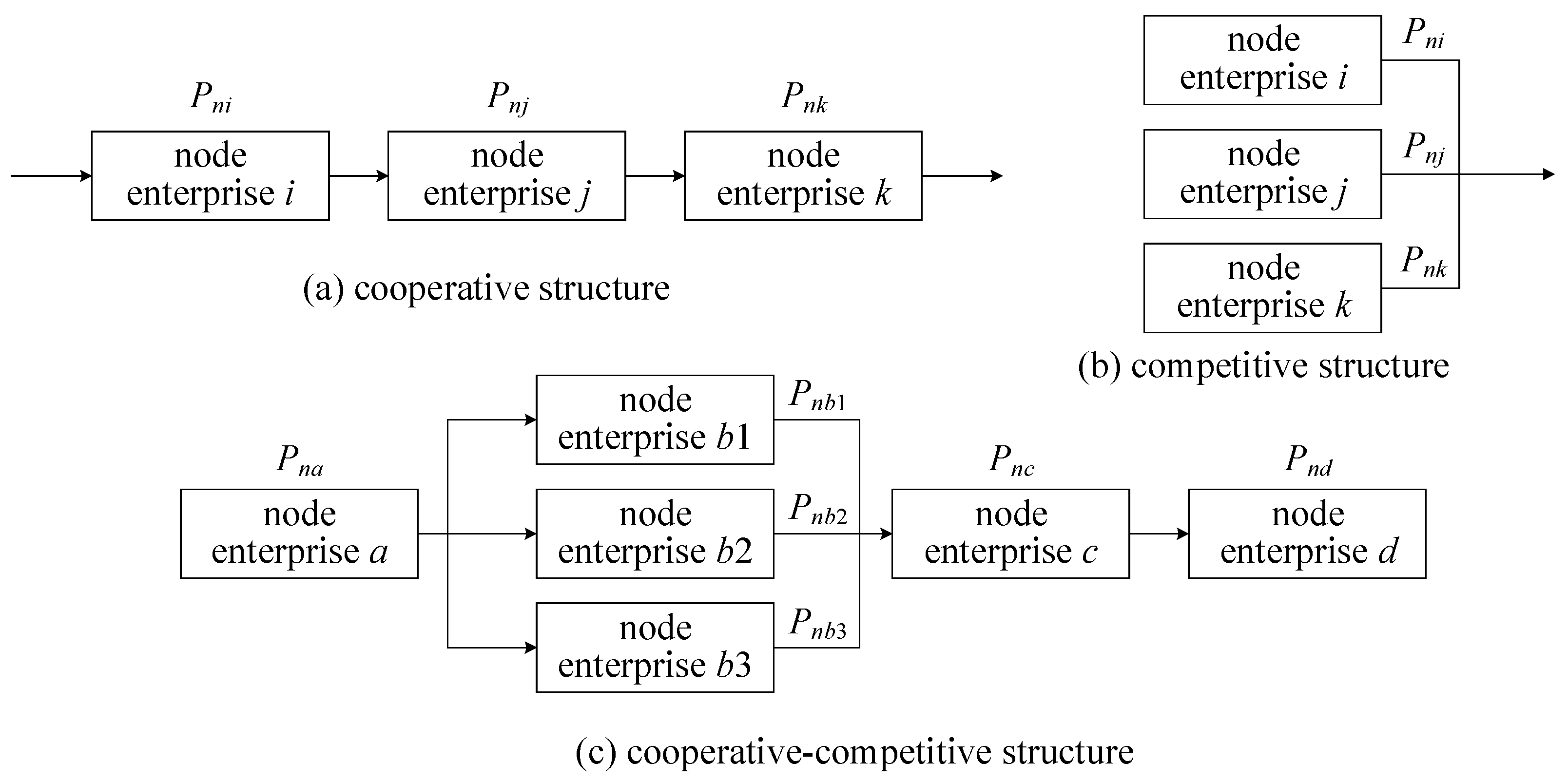

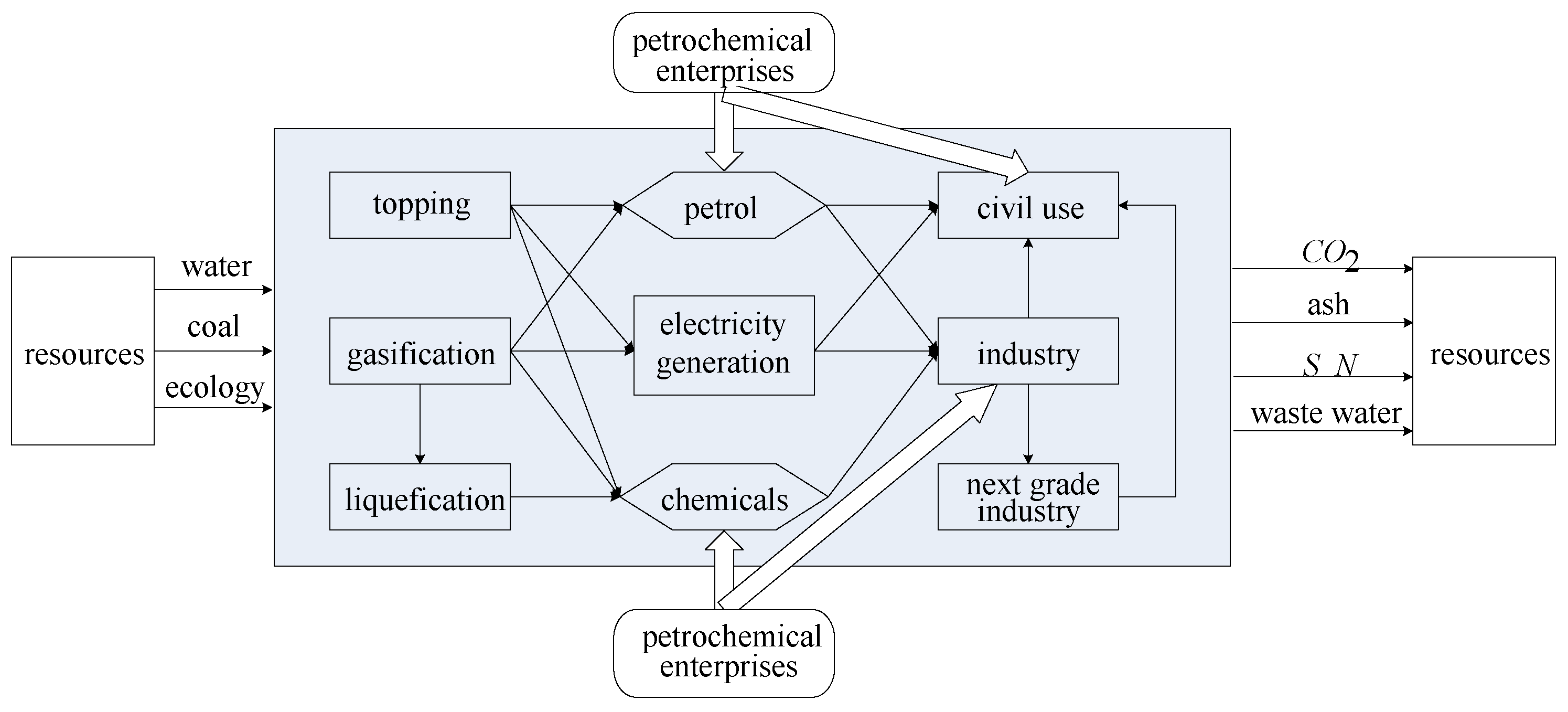

2.1. Multinode Supply Chain

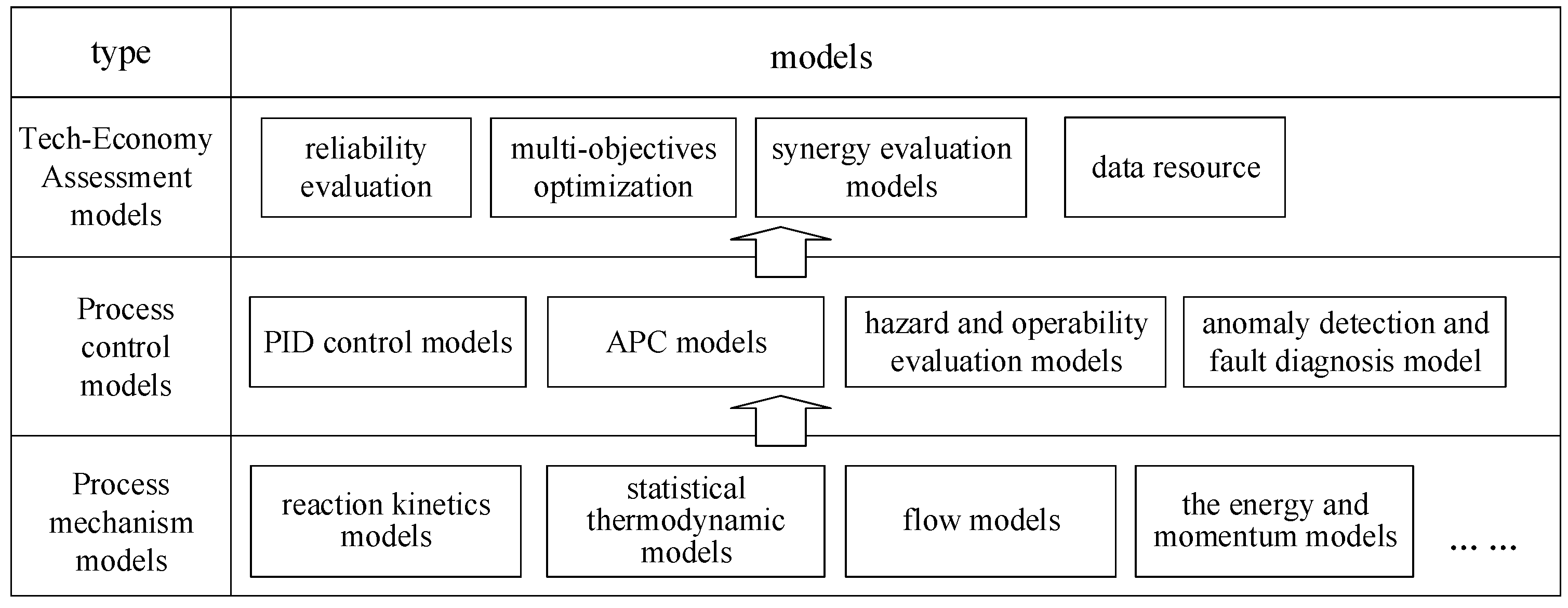

2.2. SCN Coordinated Evaluation Models

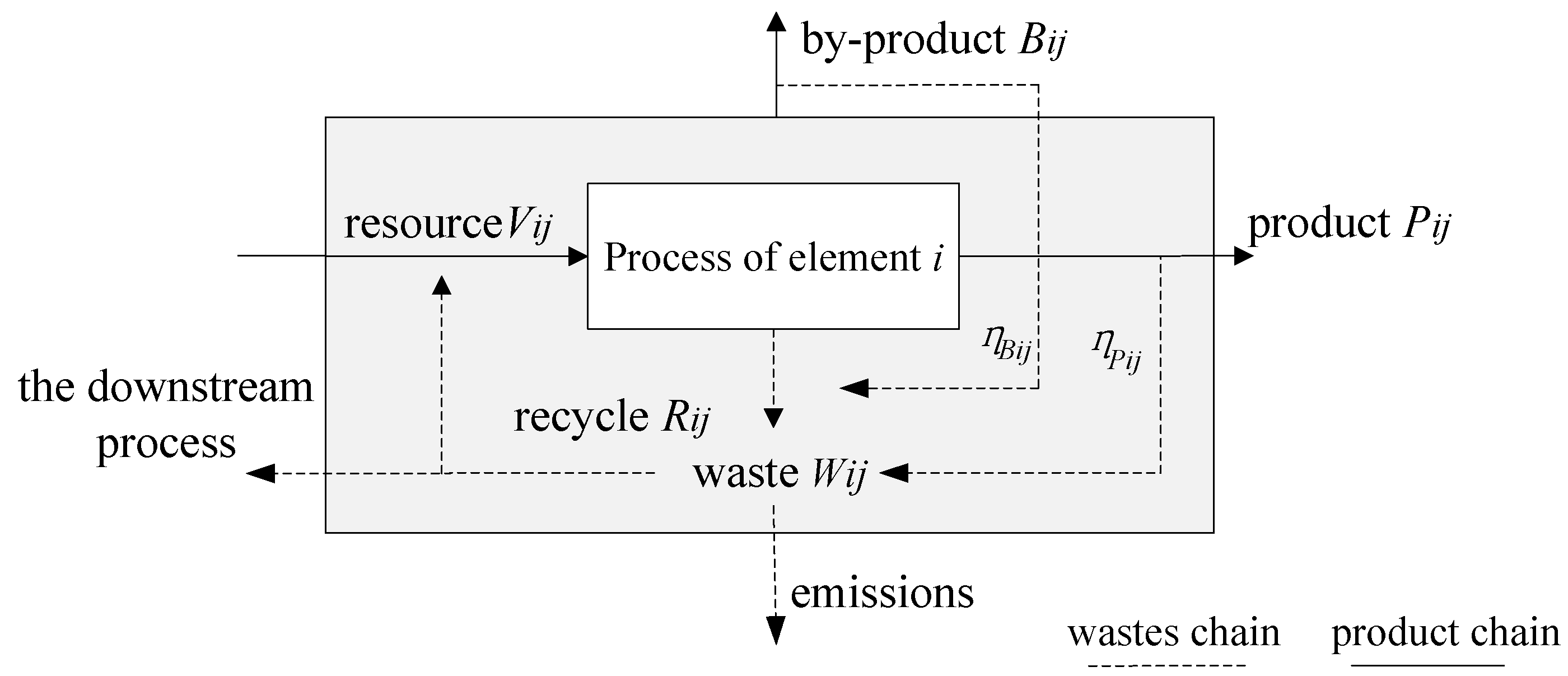

2.2.1. Models for SCN Industrial Metabolic Balance

2.2.2. SCN Evaluation Models for Sustainable Profitability

- (1).

- Development Ability Evaluation Models

- (2).

- Industrial Collaboration Degree Evaluation

- (3).

- Sustainable Profitability Evaluation

2.2.3. Evaluation of Enterprise Contract Execution Ability

2.2.4. SCN Information Interactive Ability

3. Coal Industry SCN Evaluation Models

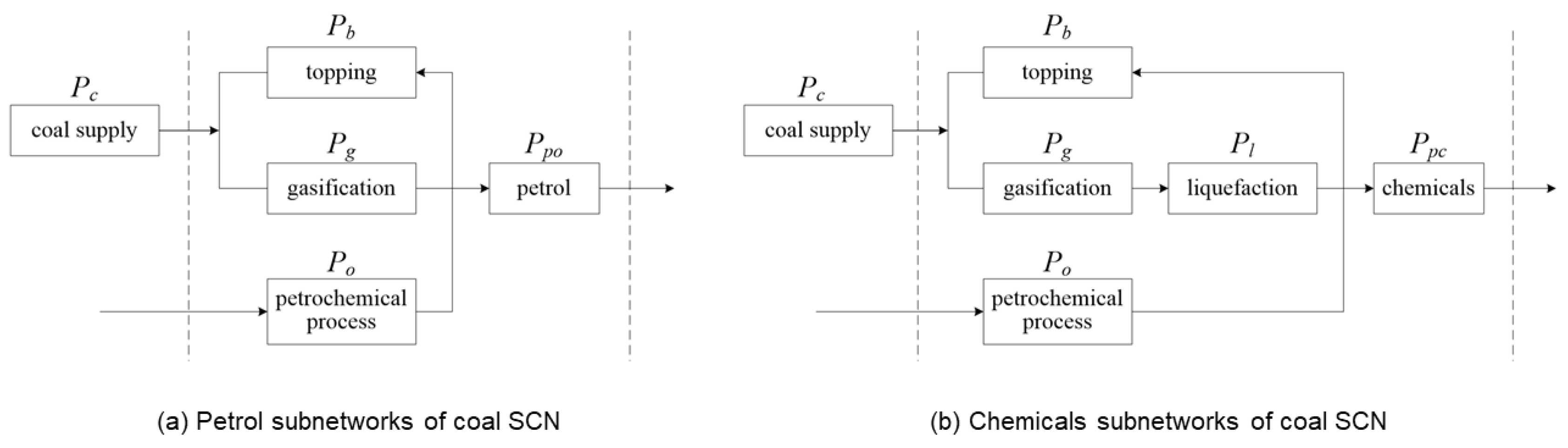

3.1. Industry Metabolic Balance Analysis

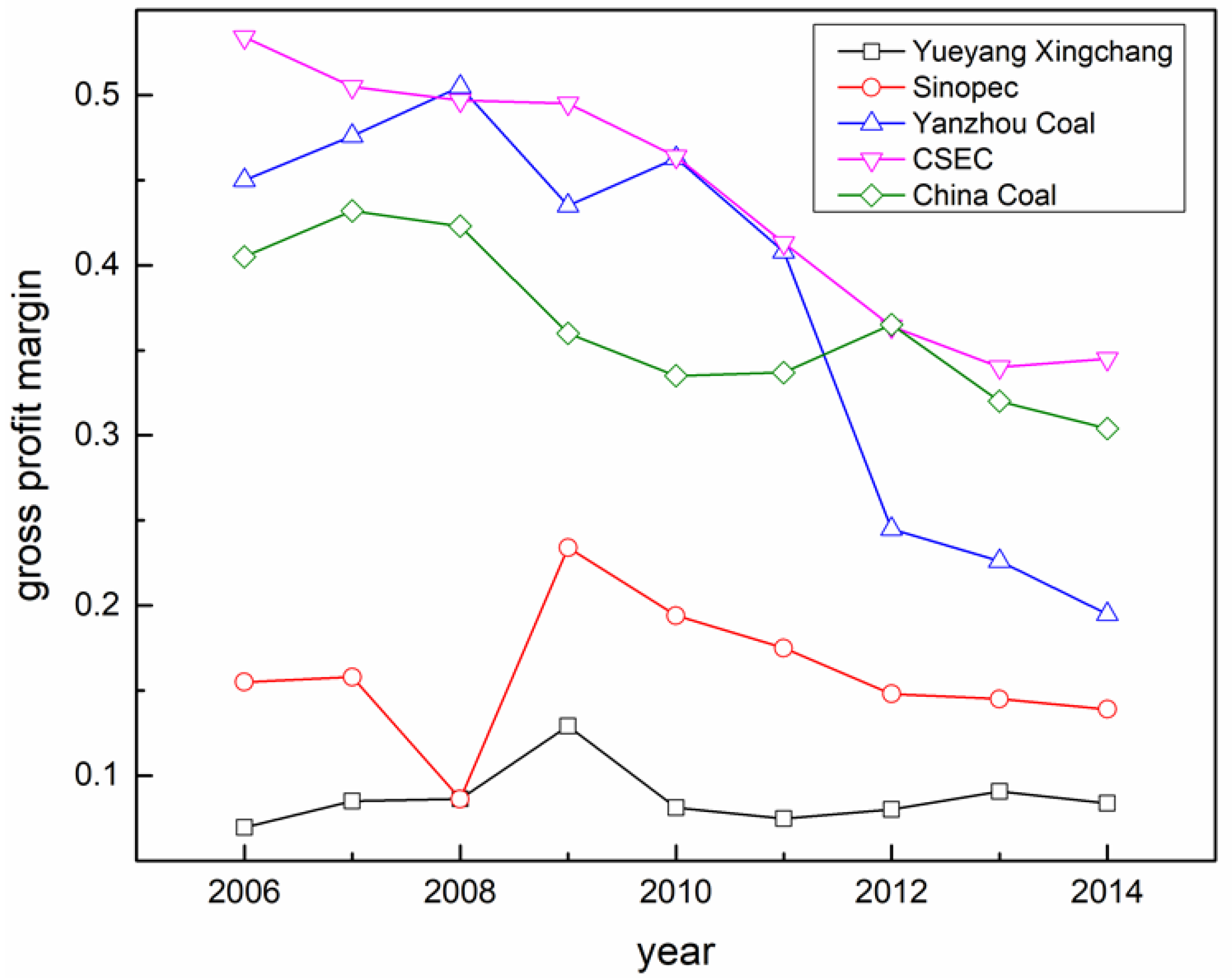

3.2. Enterprise Profitability Evaluation Based on Grey Relationship Analysis

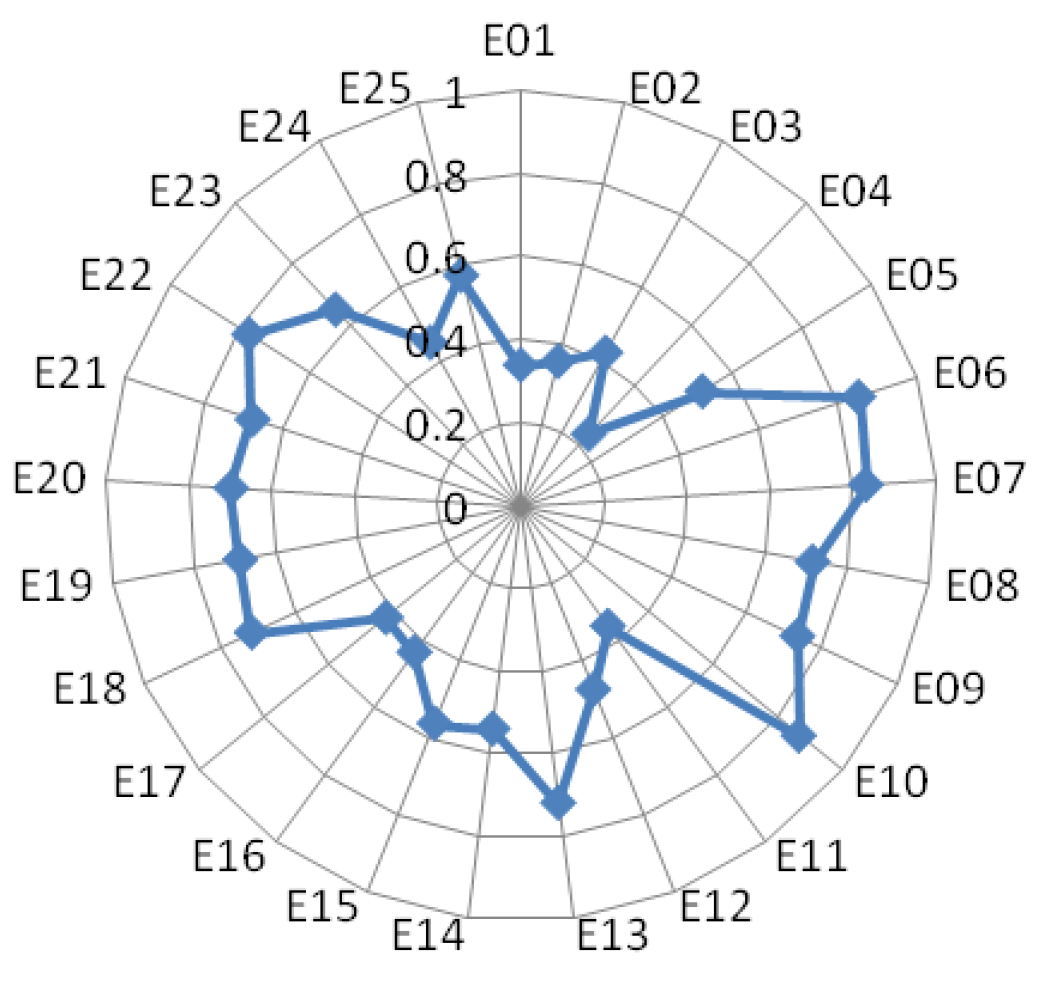

3.2.1. Grey Relational Analysis of the SCN Influencing Factors

3.2.2. Profitability Model Based on the GA-BP

3.3. Contract Execution Ability Evaluation

3.4. Information Interactive Ability Evaluation

4. Conclusions

- (1)

- For thermodynamic equilibrium, material balances, and process conditions, coal chemical processes must have rigid constraints and strong collaboration between the supply chain node enterprises; therefore, the multinode, no-core, correlation condition supply chain network mode is more suitable compared to previous modes which primarily focus on material flows. Cooperative, competitive and cooperative–competitive SCN modes were discussed and examined. Through the above mode analysis, the more reasonable supply chain could be constituted, and the operational risks could be precontrolled.

- (2)

- As a result of coal chemical industry characteristics such as correlation, conditionality and atomic economy, this paper examined the supply chain networks from the atomic level to system level, and established related evaluation models which took account of industrial metabolic balances, enterprise sustainable profitability, contract execution ability and information interaction abilities. In this study, the industrial metabolic balance degree, the enterprise profitability indexes and the contract execution ability indexes were defined, and respective computational formulas developed. The proposed evaluation models in this paper form the scientific and quantitative evaluation method of SC, which could be used for both SC planning and operations management helping detect and eliminate risks.

- (3)

- Based on the technological economic characteristics of the coal chemical industry, the industrial metabolic balance was used as the efficiency index for SCN resource coordination, and as the evaluation models’ constraints on the system levels, the industrial metabolic balance met the requirements for clean efficient resource utilization. In this study, the SCN industrial metabolic balance was defined by the effective chemical element utilization rate, which was a combination of the product metabolism and waste metabolism rates. The industrial metabolic balance evaluation is the important distinction between the evaluations models of chemical industrial supply chain and that of other types of supply chains, such as the logistics industry.

- (4)

- As the enterprise evaluation indexes were complex and non-independent, on the basis of enterprise actual operation data, GRA was used to analyze the SCN influential factors to remove the weakly correlated factors and the independent factors. BP-ANN was used to deal with the unstructured and indeterminate collaborative relationships. In the case analysis, crude oil prices, coal prices and coal output were found to be the key factors affecting enterprise profitability in the three coal chemical enterprises, and the hybrid algorithm of GA and BP-ANN confirmed the relationships between the output layer and the input layers, with the RMSE calculated at 0.0231, the R2 at 0.998, and the average prediction error at −2.32%. The results indicated that the BP-ANN algorithm was feasible for SCN profitability analysis, and could also be used in other SC problems which are not suitable for fitting modeling method.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Zhou, R.-J.; Li, L.-J. Joint capacity planning and distribution network optimization of coal supply chains under uncertainty. AIChE J. 2018, 64, 1246–1261. [Google Scholar] [CrossRef]

- Qu, Y.; Yu, Y.; Appolloni, A.; Li, M.; Liu, Y. Measuring green growth efficiency for Chinese manufacturing industries. Sustainability 2017, 9, 637. [Google Scholar] [CrossRef] [Green Version]

- Wu, X.F.; Chen, G.Q. Coal use embodied in globalized world economy: From source to sink through supply chain. Renew. Sustain. Energy Rev. 2018, 81, 978–993. [Google Scholar] [CrossRef]

- Appolloni, A.; Sun, H.; Jia, F.; Li, X. Green Procurement in the private sector: A state of the art review between 1996 and 2013. J. Clean. Prod. 2014, 85, 122–133. [Google Scholar] [CrossRef]

- Cheng, W.; Appolloni, A.; D’Amato, A.; Zhu, Q. Green public procurement, missing concepts and future trends—A critical review. J. Clean. Prod. 2017, 176, 770–784. [Google Scholar] [CrossRef]

- Wang, C.; Zhang, L.; Zhou, P.; Chang, Y.; Zhou, D.; Pang, M.; Yin, H. Assessing the environmental externalities for biomass- and coal-fired electricity generation in China: A supply chain perspective. J. Environ. Manag. 2019, 246, 758–767. [Google Scholar] [CrossRef] [PubMed]

- Rioux, B.; Galkin, P.; Murphy, F.; Pierru, A. Economic impacts of debottlenecking congestion in the Chinese coal supply chain. Energy Econ. 2016, 60, 387–399. [Google Scholar] [CrossRef] [Green Version]

- Hu, S.; Chen, D.; Jin, Y.; Zhu, B.; Ma, S.; Song, X.; Chen, Z. Green development strategies for chemical industry in China: Based on analysis of fertilizer industry and coal chemical industry. Huagong Xuebao CIESC J. 2014, 65, 2704–2709. [Google Scholar]

- Wang, S.K.; Chen, G.H. Risk assessment of industry chain and its application in chemical industrial parks. J. Chem. Eng. Chin. Univ. 2014, 28, 1097–1104. (In Chinese) [Google Scholar]

- Kong, Y.; Xie, C.; Zheng, S.; Jiang, P.; Guan, M.; Wang, F. Dynamic early warning method for major hazard installation systems in chemical industrial park. Complexity 2019, 2019, 6250483:1–6250483:18. [Google Scholar] [CrossRef]

- Cooper, M.C.; Lambert, D.M.; Pagh, J.D. Supply chain management: More than a new name for logistics. Int. J. Logist. Manag. 1997, 8, 1–14. [Google Scholar] [CrossRef]

- Manzini, R.; Gamberi, M.; Gebennini, E.; Regattieri, A. An integrated approach to the design and management of a supply chain system. Int. J. Adv. Manuf. Technol. 2008, 37, 625–640. [Google Scholar] [CrossRef]

- Carter, C.; Easton, P. Sustainable supply chain management: Evolution and future directions. Int. J. Phys. Distrib. Logist. Manag. 2011, 41, 46–62. [Google Scholar] [CrossRef]

- Silvestre, B. Sustainable supply chain management in emerging economies: Environmental turbulence, institutional voids and sustainability trajectories. Int. J. Prod. Econ. 2015, 167, 156–169. [Google Scholar] [CrossRef]

- Ralston, P.; Blackhurst, J.; Cantor, D.; Crum, M. A structure-conduct-performance perspective of how strategic supply chain integration affects firm performance. J. Supply Chain Manag. 2014, 51. [Google Scholar] [CrossRef]

- Gong, J.; Yang, Y.; Wang, J. Meeting the challenges to sustain capacity through process integration—Process systems engineering review. Chem. Ind. Eng. Prog. 2006, 25, 721–728. [Google Scholar]

- Gardner, T.A.; Benzie, M.; Borner, J.; Dawkins, E.; Fick, S.; Garrett, R.; Godar, J.; Grimard, A.; Lake, S.; Larsen, R.K.; et al. Transparency and sustainability in global commodity supply chains. World Dev. 2019, 121, 163–177. [Google Scholar] [CrossRef]

- Lambert, D.; Cooper, M.; Pagh, J. Supply chain management: Implementation issues and research opportunities. Int. J. Logist. Manag. 1998, 9, 1–20. [Google Scholar] [CrossRef]

- Gharaei, A.; Karimi, M.; Shekarabi, S.A.H. An integrated multi-product, multi-buyer supply chain under penalty, green, and quality control polices and a vendor managed inventory with consignment stock agreement: The outer approximation with equality relaxation and augmented penalty algorithm. Appl. Math. Model. 2019, 69, 223–254. [Google Scholar] [CrossRef]

- Lingron, Z. Influence factors and action mechanism of supply chain technology spillover: A multi-case study based on the self-organizing process of supply chain. J. Manag. Case Stud. 2014, 7, 182–194. [Google Scholar]

- Kristianto, Y.; Gunasekaran, A.; Helo, P.; Sandhu, M. A decision support system for integrating manufacturing and product design into the reconfiguration of the supply chain networks. Decis. Support Syst. 2012, 52, 790–801. [Google Scholar] [CrossRef]

- Anbanandam, R.; Banwet, D.K.; Shankar, R. Evaluation of supply chain collaboration: A case of apparel retail industry in India. Int. J. Product. Perform. Manag. 2011, 60, 82–98. [Google Scholar] [CrossRef]

- Zokaee, S.; Jabbarzadeh, A.; Fahimnia, B.; Sadjadi, S.J. Robust supply chain network design: An optimization model with real world application. Ann. Oper. Res. 2017, 257, 15–44. [Google Scholar] [CrossRef]

- Arampantzi, C.; Minis, I. A new model for designing sustainable supply chain networks and its application to a global manufacturer. J. Clean. Prod. 2017, 156, 276–292. [Google Scholar] [CrossRef]

- Tian, Y. Opinions on the development of China’s Coal Chemical Industry—Remarks drawn before the 13th five-year plan. Coal Chem. Ind. 2014, 175, 1–8. (In Chinese) [Google Scholar]

- Vanany, I.; Zailani, S.; Pujawan, N. Supply chain risk management: Literature review and future research. IJISSCM 2009, 2, 16–33. [Google Scholar] [CrossRef]

- Hong, Z.F.; Guo, X.L. Green product supply chain contracts considering environmental responsibilities. Omega Int. J. Manag. Sci. 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Laeequddin, M.; Sardana, G.D.; Sahay, B.S.; Abdul Waheed, K.; Sahay, V. Supply chain partners’ trust building process through risk evaluation: The perspectives of UAE packaged food industry. Supply Chain Manag. Int. J. 2009, 14, 280–290. [Google Scholar] [CrossRef]

- Zhuge, D.; Yu, S.; Zhen, L.; Wang, W. Multi-Period distribution center location and scale decision in supply chain network. Comput. Ind. Eng. 2016, 101, 216–226. [Google Scholar] [CrossRef]

- Tang, L.; Jing, K.; He, J.; Stanley, H. Robustness of assembly supply chain networks by considering risk propagation and cascading failure. Phys. A Stat. Mech. Appl. 2016, 459, 129–139. [Google Scholar] [CrossRef]

- Ma, Y.; Yan, F.; Kang, K.; Wei, X. A novel integrated production-distribution planning model with conflict and coordination in a supply chain network. Knowl. Based Syst. 2016, 105, 119–133. [Google Scholar] [CrossRef]

- Winkler, H. How to improve supply chain flexibility using strategic supply chain networks. Logist. Res. 2009, 1, 15–25. [Google Scholar] [CrossRef]

- Farahani, R.Z.; Rezapour, S.; Drezner, T.; Fallah, S. Competitive supply chain network design: An overview of classifications, models, solution techniques and applications. Omega Int. J. Manag. Sci. 2014, 45, 92–118. [Google Scholar] [CrossRef]

- Amin, S.H.; Zhang, G.Q. A multi-objective facility location model for closed-loop supply chain network under uncertain demand and return. Appl. Math. Model. 2013, 37, 4165–4176. [Google Scholar] [CrossRef]

- Amin, S.H.; Baki, F. A facility location model for global closed-loop supply chain network design. Appl. Math. Model. 2017, 41, 316–330. [Google Scholar] [CrossRef]

- Talaei, M.; Moghaddam, B.F.; Pishvaee, M.S.; Bozorgi-Amiri, A.; Gholamnejad, S. A robust fuzzy optimization model for carbon-efficient closed-loop supply chain network design problem: A numerical illustration in electronics industry. J. Clean. Prod. 2016, 113, 662–673. [Google Scholar] [CrossRef]

- Li, J.Y.; Wang, L.; Tan, X. Sustainable design and optimization of coal supply chain network under different carbon emission policies. J. Clean. Prod. 2020, 250, 119548. [Google Scholar] [CrossRef]

- Ghahremani-Nahr, J.; Kian, R.; Sabet, E. A robust fuzzy mathematical programming model for the closed-loop supply chain network design and a whale optimization solution algorithm. Expert Syst. Appl. 2019, 116, 454–471. [Google Scholar] [CrossRef] [Green Version]

- Ahmadzadeh, E.; Vahdani, B. A location-inventory-pricing model in a closed loop supply chain network with correlated demands and shortages under a periodic review system. Comput. Chem. Eng. 2017, 101, 148–166. [Google Scholar] [CrossRef]

- Jin, Y.; Wei, F. Sustainable development and ecological process engineering. China J. Nonferous Met. 2004, 14, S1. (In Chinese) [Google Scholar]

- Korhonen, J. On the ethics of corporate social responsibility—Considering the paradigm of industrial metabolism. J. Bus. Ethics 2003, 48, 301–315. [Google Scholar] [CrossRef]

- Fan, Y.P.; Qiao, Q.; Fang, L. Network analysis of industrial metabolism in industrial park—A case study of Huai’an economic and technological development area. J. Clean. Prod. 2017, 142, 1552–1561. [Google Scholar] [CrossRef]

- Zhe, Z. Coal-Based industrial metabolism and ecological optimization. Comput. Appl. Chem. 2001. [Google Scholar] [CrossRef]

- Liu, T.; Han, Y.-J. Exploring the relationship among the enterprise operation ability, profitability and development ability. In Proceedings of 2012 3rd International Asia Conference on Industrial Engineering and Management Innovation (IEMI2012); Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013; pp. 813–821. [Google Scholar]

- Cheng, X.J. Simple analysis on some evaluating indexes for enterprise development ability. Pet. Petrochem. Today 2015, 244, 34–39. [Google Scholar]

- Li, Y.-Q.; Fang, P.; Deng, B.-G.; Li, Y. The collaboration evolution mechanism research of industrial chain and innovation chain based on system dynamics. Value Eng. 2015, 21, 79–82. (In Chinese) [Google Scholar]

- Mercure, J.-F.; Salas, P. An assessement of global energy resource economic potentials. Energy 2012, 46, 322–336. [Google Scholar] [CrossRef] [Green Version]

- Yang, Y.Q.; Jiang, X.Y. Development strategy of China’s chemical industries in Merge of Industrialization and Information. Mod. Chem. Ind. 2009, 29, 9–14. (In Chinese) [Google Scholar]

- SiWei, C. Improving integration of enterprises by relying on process systems engineering. Mod. Chem. Ind. 1998, 7, 1–5. (In Chinese) [Google Scholar]

- Brito Alves, R.; Nascimento, C. Analysis and detection of outliers and systematic errors in industrial plant data. Chem. Eng. Commun. 2007, 194, 382–397. [Google Scholar] [CrossRef]

- Ji, X.; He, G.; Xu, J.; Guo, Y. Study on the mode of intelligent chemical industry based on cyber-physical system and its implementation. Adv. Eng. Softw. 2016, 99, 18–26. [Google Scholar] [CrossRef]

- Shen, L.; Sun, Y. Review on carbon emissions, energy consumption and low-carbon economy in China from a perspective of global climate change. J. Geogr. Sci. 2016, 26, 855–870. [Google Scholar] [CrossRef] [Green Version]

- Xie, H.; Xie, L.; Wang, Y.; Zhu, J.; Liang, B.; Ju, Y. CCU: A more feasible and economic strategy than CCS for reducing CO2 emissions. J. Sichuan Univ. (Eng. Sci. Ed.) 2012, 44, 1–5. [Google Scholar]

- Fritsche, U.; Kuzin, V. Analysing convergence in Europe using the non-linear single factor model. Empir. Econ. 2011, 41, 343–369. [Google Scholar] [CrossRef] [Green Version]

- Chang, P.-C.; Liu, C.-H.; Wang, Y.-W. A hybrid model by clustering and evolving fuzzy rules for sales decision supports in printed circuit board industry. Decis. Support Syst. 2006, 42, 1254–1269. [Google Scholar] [CrossRef]

- Crespo Marquez, A.; Blanchar, C. A decision support system for evaluating operations investments in high-technology business. Decis. Support Syst. 2006, 41, 472–487. [Google Scholar] [CrossRef]

- Han, X.; Li, B.; Guan, Z. Atmospheric quality prediction model based on RBF neural network-markov chain of grey correlational analysis filter indexes. Acta Sci. Nat. Univ. Nankaiensis 2013, 46, 22–27. [Google Scholar]

- Lin, H.-L. The use of the Taguchi method with grey relational analysis and a neural network to optimize a novel GMA welding process. J. Intell. Manuf. 2012, 23, 1671–1680. [Google Scholar] [CrossRef]

- Cao, X. Achieving a healthy development of coal-based chemicals and CTL in China. Chem. Ind. Eng. Prog. 2011, 30, 80–87. (In Chinese) [Google Scholar]

- Goldberg, D.E.; Holland, J.H. Genetic algorithms and machine learning. Mach. Learn. 1988, 3, 95–99. [Google Scholar] [CrossRef]

- Fu, Z.; Mo, J.-H.; Chen, L.; Chen, W. Using genetic algorithm-back propagation neural network prediction and finite-element model simulation to optimize the process of multiple-step incremental air-bending forming of sheet metal. Mater. Des. 2010, 31, 267–277. [Google Scholar] [CrossRef]

- Rao, D.S.H.; Reddy, S.P.V.; Ghorpade, D.V.G.; Reddy, D.C.T. Development of genetic algorithm based hybrid neural network model for predicting the ultimate flexural strength of ferrocement elements. Int. J. Eng. Sci. Technol. 2012, 4, 867–873. [Google Scholar]

- Xue, X.; Li, Y.; Yang, X.; Chen, X.; Xiang, J. Prediction of slope stability based on GA-BP hybrid algorithm. Neural Netw. World 2015, 25, 189–202. [Google Scholar] [CrossRef] [Green Version]

| Petrochemical Resource Consumption (Mtonne of Standard Coal Equivalent) | CO2 Emissions (Mtonne) | Carbon Balance—Degree of Industrial Metabolism | ||||

|---|---|---|---|---|---|---|

| 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | |

| CHN | 3171 | 3460 | 8324 | 8640 | 0.286 | 0.318 |

| USA | 2662 | 2620 | 5433 | 5341 | 0.443 | 0.444 |

| JAP | 576 | 591 | 1171 | 1180 | 0.445 | 0.455 |

| Item | Evaluation Indexes | Item | Evaluation Indexes |

|---|---|---|---|

| E01 | network density | E14 | current ratio |

| E02 | network centralization | E15 | ratio of liabilities to assets |

| E03 | viscosity of brand with customers | E16 | total assets turnover |

| E04 | product quality qualification rate | E17 | current asset turnover |

| E05 | product species diversity | E18 | accounts receivable turnover |

| E06 | products prices | E19 | rate of capital turnover |

| E07 | prices for the competitive products (crude oil) | E20 | inventory turnover |

| E08 | sales-output ratio | E21 | return on sales |

| E09 | production-demand balance | E22 | ratio of Profits to Cost |

| E10 | products output | E23 | raw material supply timeliness |

| E11 | revenue growth rate | E24 | purchasing lead time |

| E12 | market share | E25 | delivery timeliness |

| E13 | profit rate to net worth | … … |

| Quarter | E10 Coal Output (Gigatonne) | E06 Coal Price (RMB/Tonne) | E07 Oil Price (Dollar/bbl) | CCE | CSEC | YanzCoal | |||

|---|---|---|---|---|---|---|---|---|---|

| GPR | ANN Output | GPR | ANN Output | GPR | ANN Output | ||||

| 2012Q1 | 0.838 | 501 | 118.49 | 37.4% | - | 36.9% | - | 31.9% | - |

| 2012Q2 | 1.072 | 491 | 108.42 | 34.3% | - | 37.4% | - | 27.2% | - |

| 2012Q3 | 0.97 | 442 | 109.61 | 35.5% | - | 37.8% | - | 23.3% | - |

| 2012Q4 | 0.77 | 438 | 110.09 | 36.2% | - | 36.0% | - | 24.1% | - |

| 2013Q1 | 0.83 | 448 | 112.49 | 35.4% | - | 36.1% | - | 24.4% | - |

| 2013Q2 | 0.96 | 424 | 102.58 | 33.3% | - | 36.3% | - | 21.4% | - |

| 2013Q3 | 0.98 | 400 | 110.27 | 32.8% | - | 35.0% | - | 21.7% | - |

| 2013Q4 | 0.91 | 416 | 109.21 | 31.8% | - | 33.9% | - | 22.3% | - |

| 2014Q1 | 0.85 | 401 | 108.17 | 35.1% | - | 34.8% | - | 17.1% | - |

| 2014Q2 | 0.966 | 363 | 109.70 | 32.6% | - | 35.0% | - | 17.2% | - |

| 2014Q3 | 1.034 | 340 | 101.82 | 30.7% | 29.9% | 34.0% | 34.9% | 18.7% | 18.6% |

| 2014Q4 | 0.102 | 364 | 76.40 | 30.0% | 28.8% | 34.3% | 35.4% | 19.1% | 21.2% |

| 2015Q1 | 0.85 | 347 | 53.92 | 29.8% | 28.7% | 39.8% | 35.9% | 28.0% | 23.2% |

| Evaluation Method | Evaluation Indexes |

|---|---|

| Qualitative evaluation | Information Openness Accuracy and agility of information Value of information sharing Information integration Information content and intensity |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, G.; Zhou, L.; Dai, Y.; Dang, Y.; Ji, X. Coal Industrial Supply Chain Network and Associated Evaluation Models. Sustainability 2020, 12, 9919. https://doi.org/10.3390/su12239919

He G, Zhou L, Dai Y, Dang Y, Ji X. Coal Industrial Supply Chain Network and Associated Evaluation Models. Sustainability. 2020; 12(23):9919. https://doi.org/10.3390/su12239919

Chicago/Turabian StyleHe, Ge, Li Zhou, Yiyang Dai, Yagu Dang, and Xu Ji. 2020. "Coal Industrial Supply Chain Network and Associated Evaluation Models" Sustainability 12, no. 23: 9919. https://doi.org/10.3390/su12239919