Freight Transportation and Economic Growth for Zones: Sustainability and Development Strategy in China

Abstract

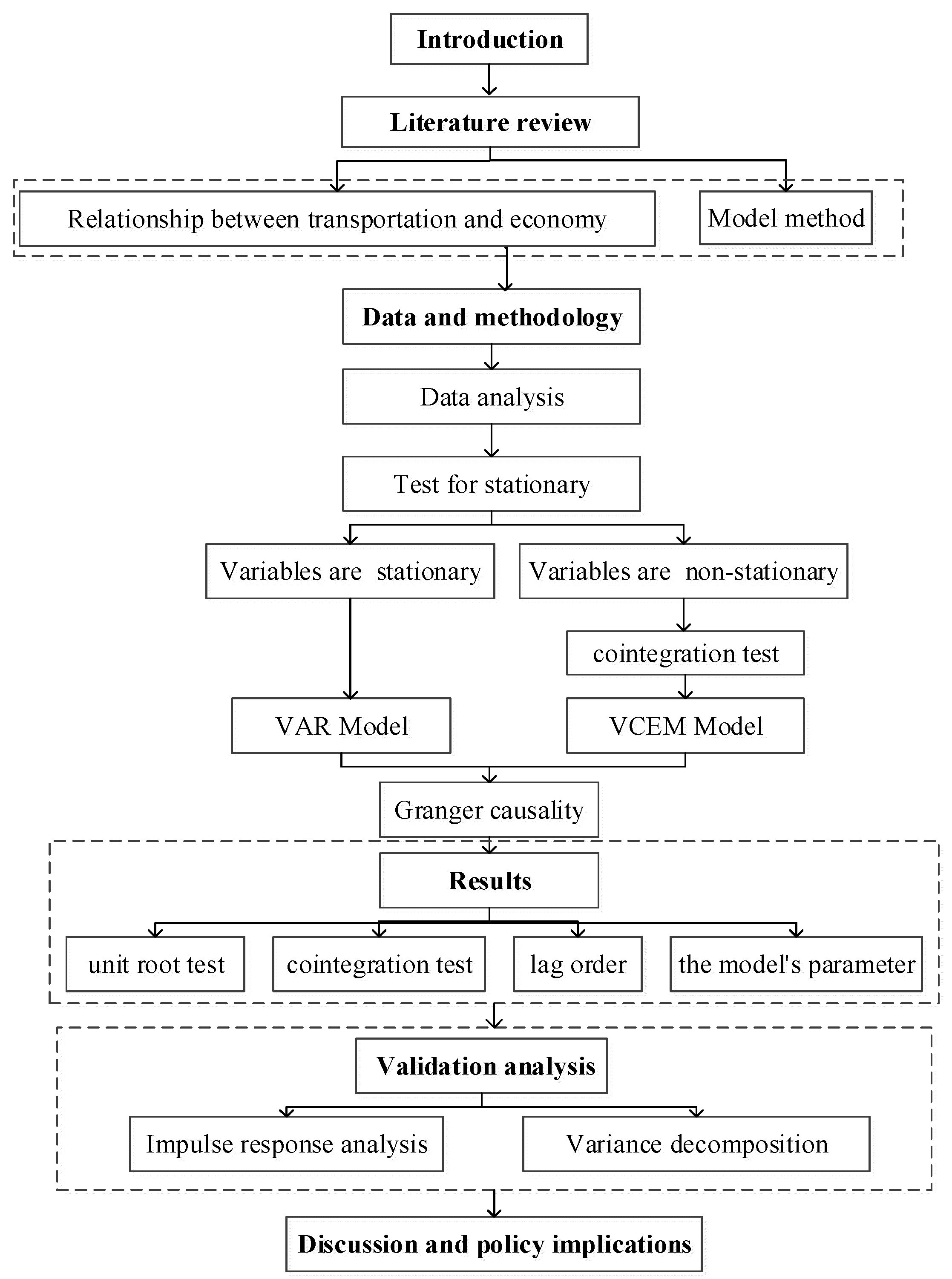

1. Introduction

2. Literature Review

2.1. Relationship between Transportation and Economy

2.2. Model Method

3. Data and Methodology

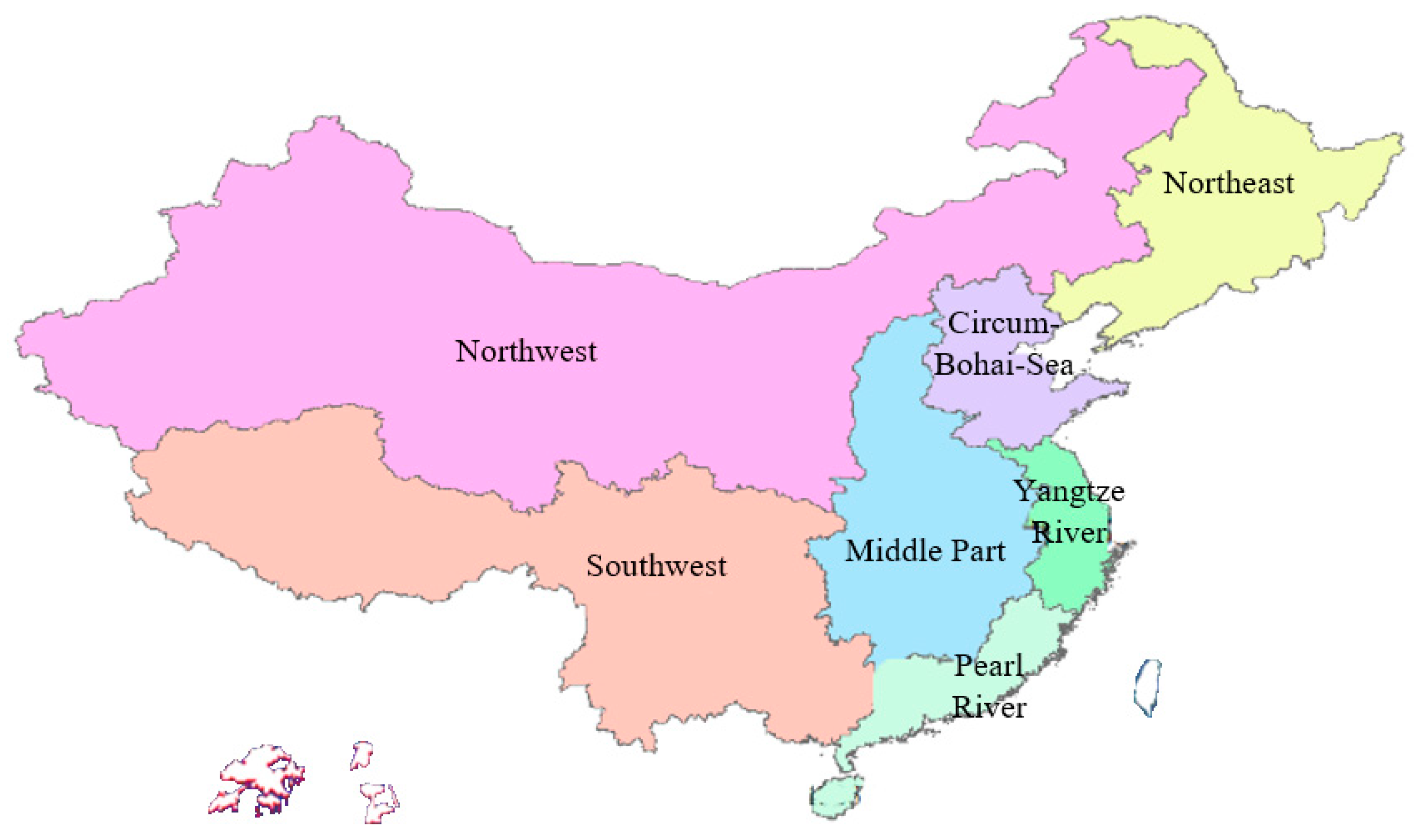

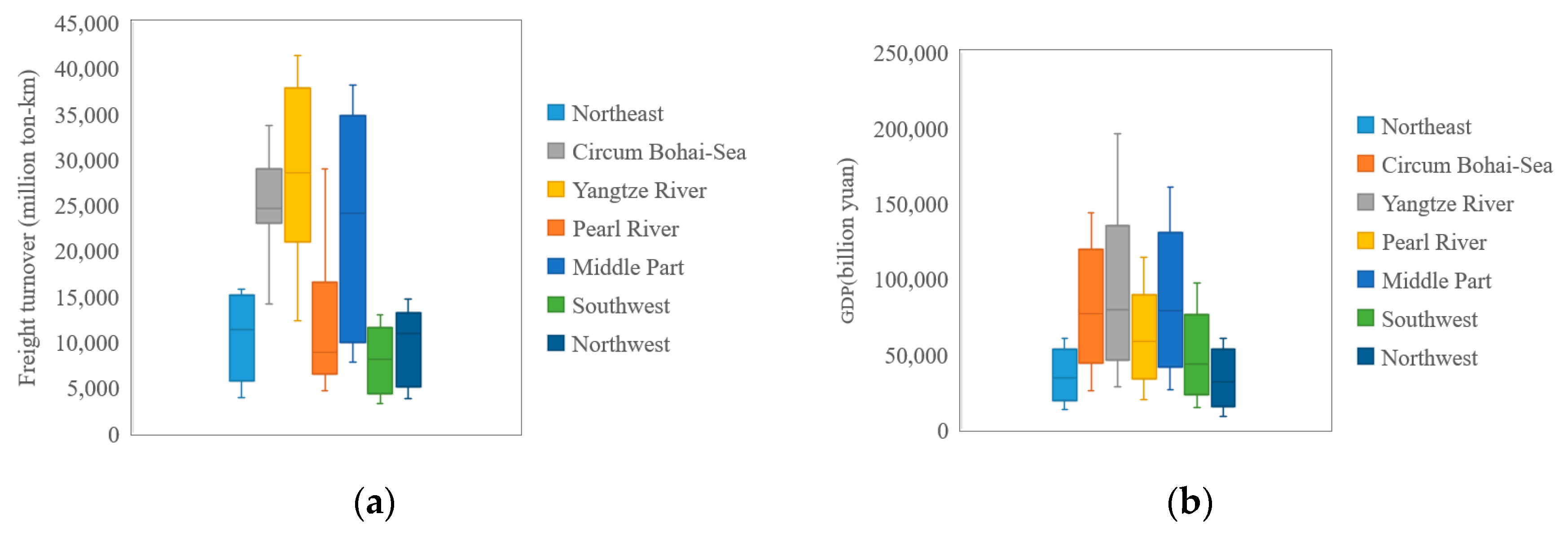

3.1. The Characteristic of the Research Area

3.2. Test for Stationary

3.3. Co-Integration Analysis

3.4. Granger Causality

4. Results and Model Validation

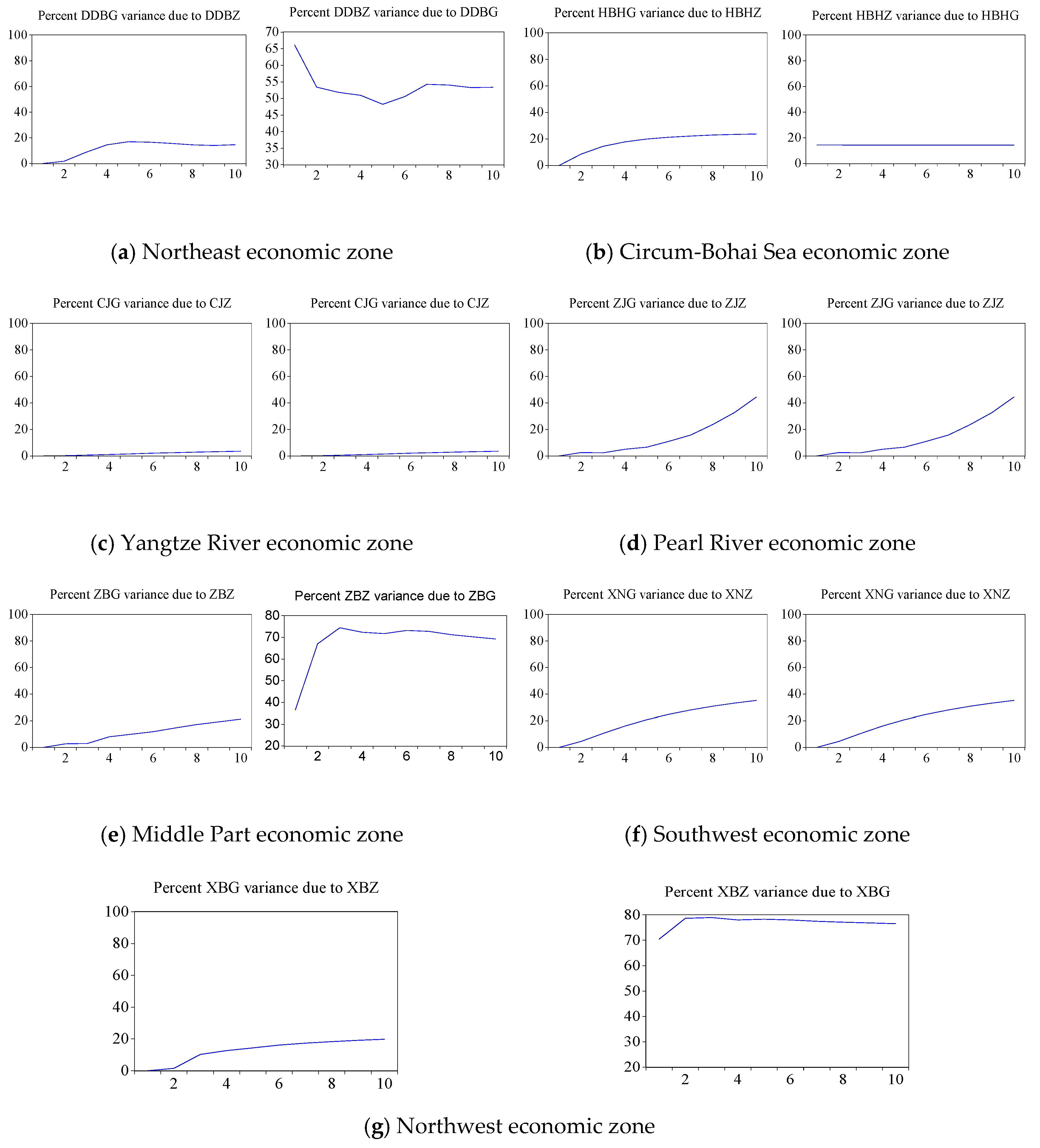

4.1. Results

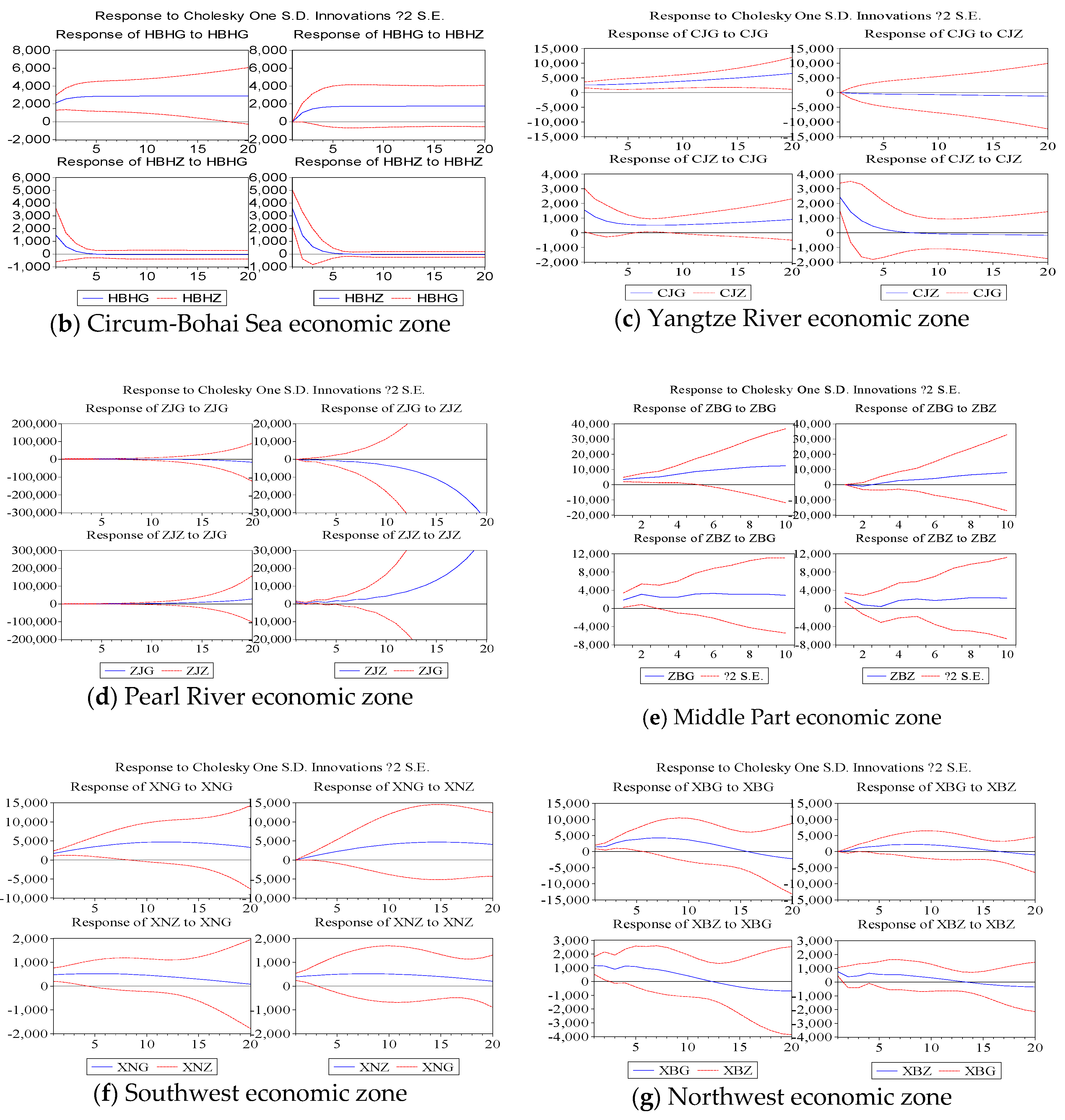

4.2. Model Validation

5. Discussion and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- He, D.; Yin, Q.; Zheng, M.; Gao, P. Transport and zonal economic integration: Evidence from the Chang–Zhu–Tan zone in China. Transp. Policy 2019, 79, 193–203. [Google Scholar] [CrossRef]

- Saidi, S.; Hammami, S. Modeling the causal linkages between transport, economic growth and environmental degradation for 75 countries. Transp. Res. Part D Transp. Environ. 2018, 53, 415–427. [Google Scholar] [CrossRef]

- Khadaroo, J.; Seetanah, B. Transport and economic performance: The case of Mauritius. J. Transp. Econ. Policy 2008, 42, 255–267. [Google Scholar]

- Beyzatlar, M.A.; Karacal, M.; Yetkiner, H. Granger-causality between transportation and GDP: A panel data approach. Transp. Res. Part A 2014, 63, 43–55. [Google Scholar] [CrossRef]

- Yu, N.; Jong, M.D.; Storm, S.; Mi, J. Transport infrastructure, spatial clusters and zonal economic growth in China. Transp. Rev. 2012, 32, 3–28. [Google Scholar] [CrossRef]

- Sahoo, P.; Dash, R.K. Economic growth in South Asia: Role of infrastructure. J. Int. Trade Econ. Dev. 2012, 21, 217–252. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Bagchi, T.P. Effect of transportation infrastructure on economic growth in India: The VECM approach. Res. Transp. Econ. 2013, 38, 139–148. [Google Scholar] [CrossRef]

- Hurlin, C. Testing Granger Causality in Heterogeneous Panel Data Models with Fixed Coefficients; University of Orléans: Orleans, France, 2004. [Google Scholar]

- Saidi, S.; Shahbaz, M.; Akhtar, P. The long-run relationships between transport energy consumption, transport infrastructure, and economic growth in MENA countries. Transp. Res. Part A Policy Pract. 2018, 111, 78–95. [Google Scholar] [CrossRef]

- Achour, H.; Belloumi, M. Investigating the causal relationship between transport infrastructure, transport energy consumption and economic growth in Tunisia. Renew. Sustain. Energy Rev. 2016, 56, 988–998. [Google Scholar] [CrossRef]

- Han, C. Research on the relationship between railway network development and economic growth in central China. In Proceedings of the 18th International Conference on Parallel and Distributed Computing, Applications and Technologies (PDCAT), Taipei, Taiwan, 18–20 December 2017; pp. 238–242. [Google Scholar]

- Wetwitoo, J.; Kato, H. High-speed rail and regionzonal economic productivity through agglomeration and network externality: A case study of inter-regionzonal transportation in Japan. Case Stud. Transp. Policy 2017, 5, 549–559. [Google Scholar] [CrossRef]

- Halaszovich, T.; Kinra, A. The impact of distance, national transportation systems and logistics performance on FDI and international trade patterns: Results from Asian global value chains. Transp. Policy 2020, 98, 35–47. [Google Scholar] [CrossRef]

- Kuzu, S.; Önder, E. Research into the long-run relationship between logistics development and economic growth in Turkey. Soc. Sci. Electron. Publ. 2014, 3, 11–16. [Google Scholar]

- Gao, Y.; Zhang, Y.; Li, H.; Peng, T.; Hao, S. Study on the relationship between comprehensive transportation freight index and GDP in China. Procedia Eng. 2016, 137, 571–580. [Google Scholar] [CrossRef]

- Guo, J.; Xia, J. Econometrical investigation on infrastructure investment and economic development in China: A case study using vector autoregression approach. KSCE J. Civil Eng. 2011, 15, 561–567. [Google Scholar] [CrossRef]

- Chi, J.; Baek, J. Dynamic relationship between air transport demand and economic growth in the United States: A new look. Transp. Policy 2013, 29, 257–260. [Google Scholar] [CrossRef]

- Banister, D.; Berechman, Y. Transport investment and the promotion of economic growth. J. Transp. Geogr. 2001, 9, 209–218. [Google Scholar] [CrossRef]

- Deng, T.; Shao, S.; Yang, L.; Zhang, X. Has the transport led economic growth effect reached a peak in China? A panel threshold regression approach. Transportation 2014, 41, 567–587. [Google Scholar] [CrossRef]

- Park, J.S.; Seo, Y.; Ha, M. The role of maritime, land, and air transportation in economic growth: Panel evidence from OECD and non-OECD countries. Res. Transp. Econ. 2019, 78, 100765. [Google Scholar] [CrossRef]

- Meng, L.; Li, L.; Liu, S. Research on relationship between regional railway freight volume and GDP. In Proceedings of 4th International Conference on Logistics, Informatics and Service Science; Springer: Heidelberg, Germany, 2015; pp. 345–350. [Google Scholar]

- Lei, M.C.Q. Research prospect on the relationship between transportation and regional economy in the Hui nationality agglomeration of China. Mod. Transp. 2014, 3, 56–61. [Google Scholar]

- Muller, S.; Klauenberg, J.; Wolfermann, A. How to translate economic activity into freight transportation. Transp. Res. Procedia 2015, 8, 155–167. [Google Scholar] [CrossRef][Green Version]

- Zhu, F.; Wu, X.; Gao, Y.E. Decomposition analysis of decoupling freight transport from economic growth in China. Transp. Res. Part D Transp. Environ. 2020, 78, 102201. [Google Scholar] [CrossRef]

- Jiang, X.; He, X.; Zhang, L.; Qin, H.; Shao, F. Multimodal transportation infrastructure investment and regional economic development: A structural equation modeling empirical analysis in China from 1986 to 2011. Transp. Policy 2017, 54, 43–52. [Google Scholar] [CrossRef]

- Listiono, L. The relationship between transport, economic growth and environmental degradation for ninety countries. J. Environ. Sustain. 2018, 2, 1–64. [Google Scholar] [CrossRef]

- Tong, T.; Yu, T.E. Transportation and economic growth in China: A heterogeneous panel co-integration and causality analysis. J. Transp. Geogr. 2018, 73, 120–130. [Google Scholar] [CrossRef]

- Pradhan, R.P. Investigating the causal relationship between transportation infrastructure, financial penetration and economic growth in G-20 countries. Res. Transp. Econ. 2019, 78, 100766. [Google Scholar] [CrossRef]

- Klaassen, L.H. Regional science: Some dutch experiences. Pap. Reg. Sci. Assoc. 2010, 40, 7–15. [Google Scholar] [CrossRef]

- MacKinnon, J.G. Numerical distribution functions for unit root and co-integration tests. J. Appl. Econ. 1996, 11, 601–618. [Google Scholar] [CrossRef]

- Jian, Q.L.; Jing, H.E. Empirical analysis on the relationship between transportation industry and the national economy. Commun. Transp. Syst. Eng. Inf. 2002, 2, 1025–1032. [Google Scholar]

- Hall, A.R.; Inoue, A.; Jana, K.; Shin, C. Information in generalized method of moments estimation and entropy-based moment selection. J. Econ. 2007, 138, 488–512. [Google Scholar] [CrossRef]

- Jovanovic, B. Economic growth: Theory. Int. Encycl. Soc. Behav. Sci. 2001, 5, 4098–4101. [Google Scholar]

- Kourtellos, A.; Stengos, T.; Tan, C.M. Structural threshold regression. SSRN Electron. J. 2016, 1, 827–860. [Google Scholar] [CrossRef]

- Sharif, A.; Shahbaz, M.; Hille, E. The Transportation-growth nexus in USA: Fresh insights from pre-post global crisis period. Transp. Res. Part A Policy Pract. 2019, 121, 108–121. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Baltagi, B.H. Heterogeneity and cross section dependence in panel data models: Theory and applications introduction. J. Appl. Econ. 2010, 22, 229–232. [Google Scholar]

- Dormady, N.; Roa-Henriquez, A.; Rose, A. Economic resilience of the firm: A production theory approach. Int. J. Prod. Econ. 2019, 208, 446–460. [Google Scholar] [CrossRef]

- Fisk, C.S. A conceptual framework for optimal transportation systems planning with integrated supply and demand models. Transp. Sci. 1986, 20, 37–47. [Google Scholar] [CrossRef]

- Hakim, M.M.; Merkert, R. The causal relationship between air transport and economic growth: Empirical evidence from South Asia. J. Transp. Geogr. 2016, 56, 120–127. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China (NBS). 2018. Available online: http://data.stats.gov.cn/easyquery.htm?cn=E0103 (accessed on 6 December 2020).

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

| Economic Zone | Provinces | No. of Provinces | Mean of GDP | Std of GDP | Mean of Freight Turnover | Std. of Freight Turnover |

|---|---|---|---|---|---|---|

| Northeast | Liaoning, Jilin, Heilongjiang | 3 | 38,513 | 17,304 | 11,251 | 4454 |

| Circum-Bohai-Sea | Beijing, Tianjin, Hebei, Shandong | 4 | 90,850 | 45,089 | 25,327 | 4739 |

| Yangtze River | Jiangsu, Shanghai, Zhejiang | 3 | 105,153 | 60,950 | 30,823 | 10,796 |

| Pearl River | Fujian, Guangdong, Hainan | 3 | 70,695 | 37,234 | 14,957 | 10,750 |

| Middle Part | Shanxi, Anhui, Jiangxi, Henan, Hubei, Hunan | 6 | 98,347 | 54,655 | 25,244 | 12,307 |

| Southwest | Chongqing, Sichuan, Yunnan, Xizang, Guizhou, Guangxi | 6 | 56,863 | 32,542 | 8934 | 3934 |

| Northwest | Shanxi, Gansu, Ningxia, Qinghai, Xinjiang, Inner Mongolia | 6 | 37,637 | 20,655 | 10,388 | 4256 |

| Economic Zone | Northeast | Circum Bohai-Sea | Yangtze River | Pearl River | Middle Part | Southwest | Northwest |

|---|---|---|---|---|---|---|---|

| The correlation coefficient correlation coefficient | 0.973 | 0.390 | 0.919 | 0.956 | 0.957 | 0.985 | 0.944 |

| Test Critical Values | 1% Level | 5% Level | 10% Level | t-Statistic | Prob.* |

|---|---|---|---|---|---|

| DBG | −5.295384 | −4.008157 | −3.460791 | 1.620717 | 0.9998 |

| DBZ | −4.992279- | 3.875302 | −3.388330 | −2.238045 | 0.4305 |

| HBHG | −2.792154 | −1.977738 | −1.602074 | −3.945168 | 0.0010 |

| HBHZ | −2.792154 | −1.977738 | −1.602074 | −6.351351 | 0.0000 |

| CJG | −4.124875 | −3.933364 | −3.420030 | −4.261709 | 0.0321 |

| CJZ | −2.771926 | −1.974028 | −1.602922 | −3.413854 | 0.0027 |

| ZJG | −2.816740 | −1.982344 | −1.601144 | −3.970537 | 0.0011 |

| ZJZ | −2.792154 | −1.977738 | −1.602074 | −13.00547 | 0.0001 |

| ZBG | −4.200056 | −3.175352 | −2.728985 | −3.652541 | 0.0236 |

| ZBZ | −4.200056 | −3.175352 | −2.728985 | −5.939760 | 0.0008 |

| XNG | −4.200056 | −3.175352 | −2.728985 | −3.218158 | 0.0467 |

| XNZ | −4.200056 | −3.175352 | −2.728985 | −6.399243 | 0.0004 |

| XBG | −2.792154 | −1.977738 | −1.602074 | −3.708465 | 0.0016 |

| XBZ | −2.792154 | −1.977738 | −1.602074 | −6.182968 | 0.0000 |

| Unrestricted Co-Integration Rank Test (Trace) | |||||

|---|---|---|---|---|---|

| DB | Hypothesized No. of CE(s) | Eigenvalue | Trace | 0.05 Critical Value | Prob.** |

| None | 0.637449 | 15.30734 | 15.49471 | 0.0533 | |

| At most 1 * | 0.314074 | 4.146847 | 3.841466 | 0.0417 | |

| Lag | LogL | LR | FPE | AIC | SC | HQ | |

|---|---|---|---|---|---|---|---|

| DB | 0 | −229.7916 | NA | 2.06 × 1014 | 38.63194 | 38.71276 | 38.60202 |

| 1 | −199.5515 | 45.36020 * | 2.65 × 1012 * | 34.25858 * | 34.50104 * | 34.16882 * | |

| 2 | −196.9798 | 3.000365 | 3.66 × 1012 | 34.49663 | 34.90071 | 34.34702 | |

| HBH | 0 | −258.0663 | NA | 2.29 × 1016 | 43.34439 | 43.42520 | 43.31446 |

| 1 | −221.2552 | 55.21662 * | 9.86 × 1013 * | 37.87587 * | 38.11833 * | 37.78611 * | |

| 2 | −219.0201 | 2.607690 | 1.44 × 1014 | 38.17001 | 38.57410 | 38.02040 | |

| CJ | 0 | −253.9408 | NA | 1.15 × 1016 | 42.65681 | 42.73762 | 42.62689 |

| 1 | −219.2436 | 52.04582 * | 7.05 × 1013 * | 37.54061 * | 37.78306 * | 37.45084 * | |

| 2 | −216.3316 | 3.397424 | 9.21 × 1013 | 37.72193 | 38.12601 | 37.57232 | |

| ZJ | 0 | −249.0171 | NA | 5.07 × 1015 | 41.83618 | 41.91700 | 41.80626 |

| 1 | −213.1090 | 53.86217 | 2.54 × 1013 | 36.51816 | 36.76062 | 36.42840 | |

| 2 | −203.1057 | 11.67052 * | 1.02 × 1013 * | 35.51761 * | 35.92170 * | 35.36801 * | |

| ZB | 0 | −258.5152 | NA | 2.47 × 1016 | 43.41919 | 43.50001 | 43.38927 |

| 1 | −223.6444 | 52.30612 * | 1.47 × 1014 | 38.27407 | 38.51652 * | 38.18430 | |

| 2 | −218.7918 | 5.661323 | 1.39 × 1014 * | 38.13197 * | 38.53606 | 37.98237 * | |

| XN | 0 | −234.2122 | NA | 4.30 × 1014 | 39.36870 | 39.44952 | 39.33878 |

| 1 | −191.9129 | 63.44897 * | 7.41 × 1011 * | 32.98548 * | 33.22794 * | 32.89572 * | |

| 2 | −188.7879 | 3.645878 | 9.35 × 1011 | 33.13131 | 33.53540 | 32.98170 | |

| XB | 0 | −238.1499 | NA | 8.28 × 1014 | 40.02498 | 40.10580 | 39.99506 |

| 1 | −200.4769 | 56.50941 * | 3.09 × 1012 | 34.41282 | 34.65528 | 34.32306 | |

| 2 | −194.1180 | 7.418757 | 2.27 × 1012 * | 34.01967 * | 34.42376 * | 33.87006 * |

| Causal Relation | Chi-sq | df | Prob | Remarks | Level of Significance |

|---|---|---|---|---|---|

| DDBZ→DDBG | 24.22322 | 1 | 0.0000 | Causality exit | 5% |

| DDBG→DDBZ | 5.275952 | 1 | 0.0216 | Causality exit | 5% |

| HBHZ→HBHG | 4.544825 | 1 | 0.0330 | Causality exit | 5% |

| HBHG→HBHZ | 0.059351 | 1 | 0.8075 | Not significant | 15% |

| CJZ→CJG | 0.695359 | 1 | 0.6953 | Not significant | 15% |

| CJG→CJZ | 0.082237 | 1 | 0.7743 | Not significant | 15% |

| ZJZ→ZJG | 1.251868 | 2 | 0.5348 | Not significant | 15% |

| ZJG→ZJZ | 3.969250 | 2 | 0.1374 | Causality exit | 15% |

| ZBZ→ZBG | 3.186822 | 2 | 0.2032 | Not significant | 15% |

| ZBG→ZBZ | 4.153193 | 2 | 0.1254 | Causality exit | 15% |

| XNZ→XNG | 4.376111 | 1 | 0.0364 | Causality exit | 5% |

| XNG→XNZ | 0.173977 | 1 | 0.6766 | Not significant | 15% |

| XBZ→XBG | 6.499131 | 2 | 0.0388 | Causality exit | 5% |

| XBG→XBZ | 1.313752 | 2 | 0.5185 | Not significant | 15% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, Y.; Zhu, J.; Gu, G.; Chen, K. Freight Transportation and Economic Growth for Zones: Sustainability and Development Strategy in China. Sustainability 2020, 12, 10450. https://doi.org/10.3390/su122410450

Ma Y, Zhu J, Gu G, Chen K. Freight Transportation and Economic Growth for Zones: Sustainability and Development Strategy in China. Sustainability. 2020; 12(24):10450. https://doi.org/10.3390/su122410450

Chicago/Turabian StyleMa, Yanli, Jieyu Zhu, Gaofeng Gu, and Ke Chen. 2020. "Freight Transportation and Economic Growth for Zones: Sustainability and Development Strategy in China" Sustainability 12, no. 24: 10450. https://doi.org/10.3390/su122410450

APA StyleMa, Y., Zhu, J., Gu, G., & Chen, K. (2020). Freight Transportation and Economic Growth for Zones: Sustainability and Development Strategy in China. Sustainability, 12(24), 10450. https://doi.org/10.3390/su122410450