Resource-Based Product and Process Innovation Model: Theory Development and Empirical Validation

Abstract

:1. Introduction

2. Theory and Hypotheses Development

2.1. What Is Innovation

2.2. PLC-Based Innovation Models

2.3. Limitations of PLC-based Innovation Models

2.4. Resource-Based Perspective for Alternative Innovation Paradigm

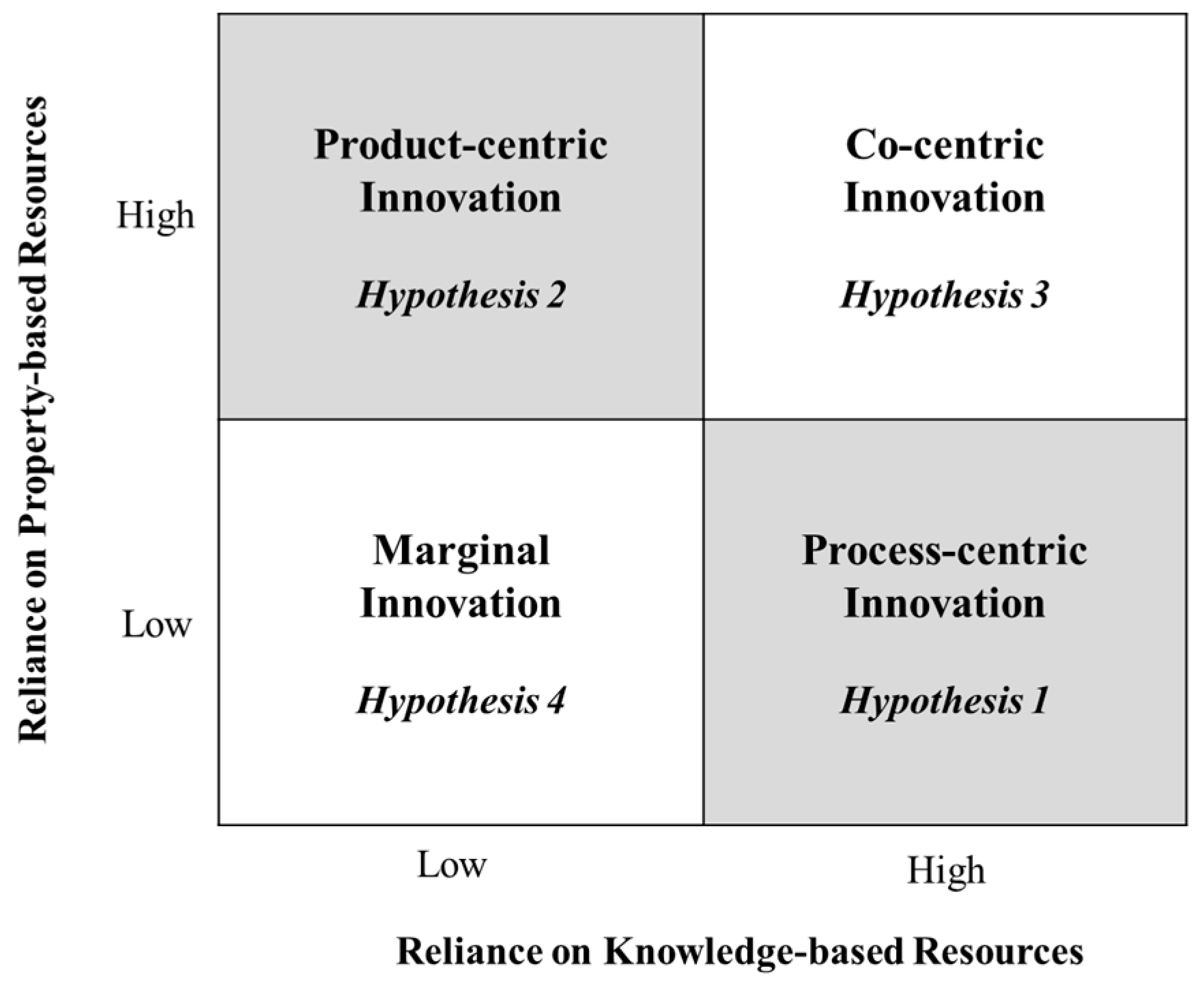

2.5. Resource-based Innovation Model

2.5.1. Process-Centric Innovation

2.5.2. Product-Centric Innovation

2.5.3. Co-Centric Innovation

2.5.4. Marginal Innovation

3. Methodology

3.1. Measures

3.1.1. Product Innovation Intensity

3.1.2. Process Innovation Intensity

3.1.3. Property-Based Resource

3.1.4. Knowledge-Based Resource

3.2. Sample

3.3. Assessment of Sample Data

4. Data Analysis

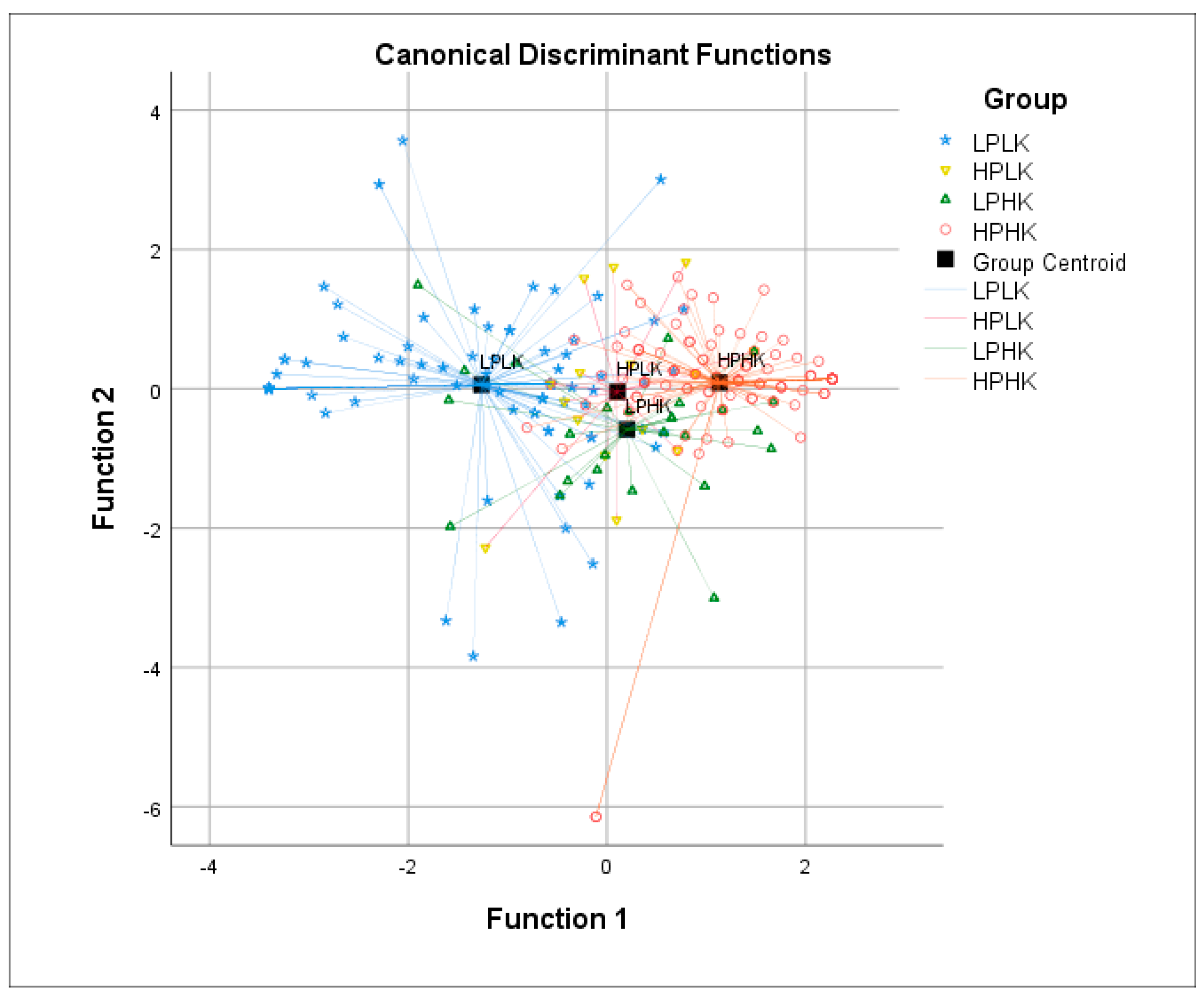

4.1. Assessment of Measures

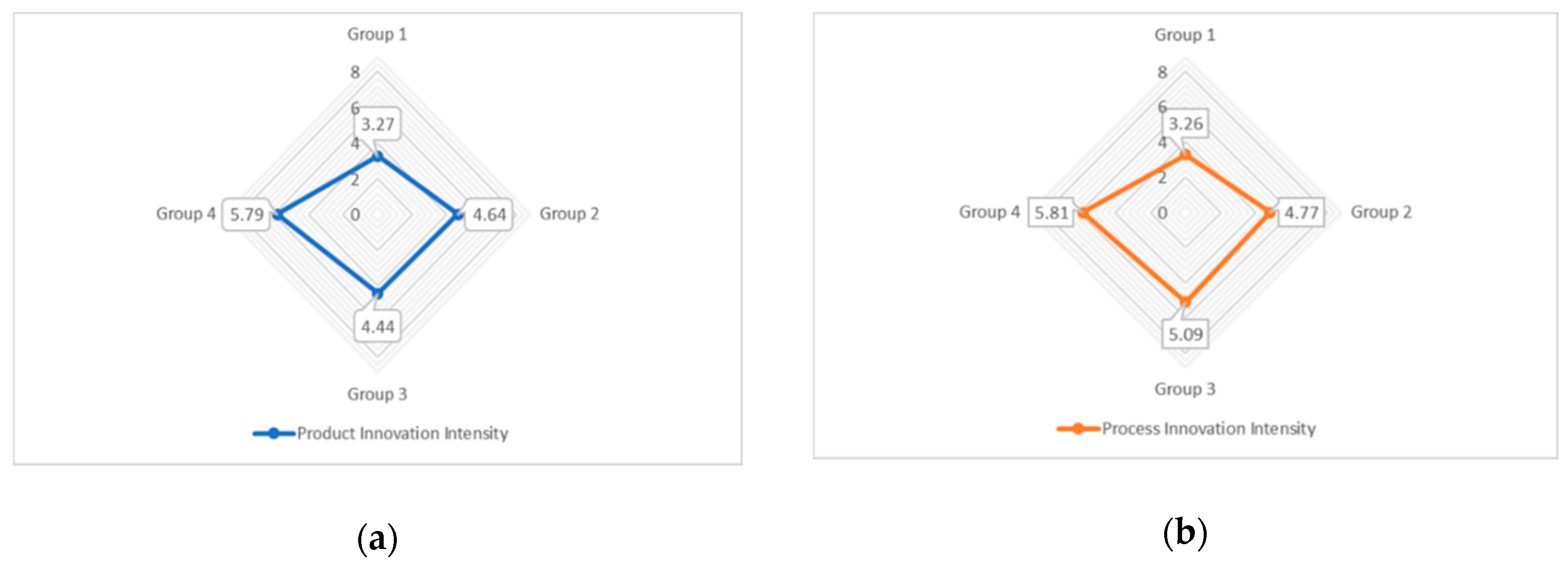

4.2. Hypotheses Test

4.3. Post hoc Analysis

5. Discussions and Conclusions

5.1. Implications for Research and Practice

5.2. Limitations and Suggestions for Future Research

5.3. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Survey Questionnaire (Measure Items)

Appendix A.1. Product Innovation Intensity

- PRODUCT Innovation is defined as: (i) the changes made to existing products or services for the benefit of customers or clients, or (ii) the creation of entirely new products or services. Please consider your company’s PRODUCT Innovation activities, and then indicate your agreement with each statement on a scale of 1 to 7.

- PdI1:

- PRODUCT innovations introduced by our company during the last three years have been extensive.

- PdI2:

- Our company’s PRODUCT improvements during the last three years have been radical.

- PdI3:

- In dealing with our competitors, our company tends to sustain competitive advantages through more intensive PRODUCT innovations than our competitors.

- PdI4:

- In general, our company tends to be ahead of our competitors in introducing new or improved products or services.

- PdI5:

- Our company is well known by our customers for outstanding PRODUCT innovations.

Appendix A.2. Process Innovation Intensity

- PROCESS Innovation is defined as the changes in the way that a firm produces products or services. Please consider your company’s PROCESS Innovation activities, and then indicate your agreement with each statement on a scale of 1 to 7.

- PcI1:

- Our company’s PROCESS improvements during the last three years have been radical.

- PcI2:

- In dealing with our competitors, our company tends to sustain competitive advantages through more intensive PROCESS innovations than our competitors.

- PcI3:

- In general, our company tends to be ahead of our competitors in introducing new or significantly improved PROCESSES (e.g., information technology, productive process, and machinery and equipment) for producing products or services.

- PcI4:

- Our company has a superior capability to develop a new product or service in a shorter time compared to our competitors.

Appendix A.3. Reliance on Property-based Resources

- Property-based Resources are defined as resources that can be protected by property rights such as patent, ownership, contracts, copyrights, trademarks, and registered designs. Please consider your company’s Property-based Resources, and then indicate your agreement with each statement on a scale of 1 to 7.

- Pr1:

- The reliance of our business on ‘Property-Based Resources’ (e.g., patent, ownership, contracts, copyrights, trademarks, and registered designs) has been significant.

- Pr2:

- In dealing with our competitors, our company tends to sustain our competitive edge by strengthening “Property-Based Resources.”

- Pr3:

- Our company tends to introduce new products or services into the market more frequently than our competitors.

- Pr4:

- Our company is superior to our competitors in terms of product variety.

- Pr5:

- Our product brands are typically considered more prestigious than those of our competitors.

- Pr6:

- Our company is well known by our customers for dominant legal properties such as registered designs, technical patents, and copyrights.

Appendix A.4. Reliance on Knowledge-based Resources

- Knowledge-based Resources are defined as resources that can be protected by knowledge barriers such as a firm’s specialized skills, processes, technical and managerial systems, and know-hows that cannot easily be identified or imitated by market competitors. Please consider your company’s Knowledge-based Resources, and then indicate your agreement with each statement on a scale of 1 to 7.

- Kr1:

- The reliance of our business on ‘Knowledge-Based Resources’ (e.g., a firm’s specialized skills, processes, technical and managerial systems, and know-hows) has been significant.

- Kr2:

- In dealing with our competitors, our company tends to sustain our competitive edge by strengthening ‘Knowledge-Based Resources.’

- Kr3:

- Our company has a strong position regarding technical expertise compared to our competitors.

- Kr4:

- Our company has a strong position regarding expertise in marketing compared to our competitors.

- Kr5:

- Our company has a strong position regarding expertise in customer service compared to our competitors.

- Kr6:

- Our company has a strong position regarding highly productive staffs compared to our competitors.

Appendix A.5. Sustainable Competitive Advantage

- Please consider your firm’s performance over the last three years, and then indicate your opinion about how your firm’s performance compares with its competition in your industry on a scale of 1 to 7 (e.g., 1 = low end of the industry, 2 = much worse than average, 3 = worse than average, 4 = average, 5 = better than average, 6 = much better than average, 7 = superior).

- Sca1:

- Sales growth

- Sca2:

- Market share growth

- Sca3:

- Net profit margin

- Sca4:

- Return on assets

- Sca5:

- Customer satisfaction

- Sca6:

- Customer retention

Appendix A.6. Market Dynamism

- Please consider your company’s Business Environment, and then indicate your agreement with each statement on a scale of 1 to 7.

- Md1:

- The needs and wants of our customers are changing very fast.

- Md2:

- Our competitive pressures are extremely high.

- Md3:

- The demand for our products/services is unstable and unpredictable.

Appendix B

| Category | Count | ||

|---|---|---|---|

| Industry (2-digit SIC codes) | Agriculture, Forestry and Fishing (01–09) | 11 | 4.3% |

| Construction (15–17) | 29 | 11.3% | |

| Apparel and Fabricated Textile Products (23) | 7 | 2.7% | |

| Papers and Allied Products (26) | 3 | 1.2% | |

| Printing and Publishing (27) | 5 | 1.9% | |

| Pharmaceuticals (28) | 3 | 1.2% | |

| Chemical Products (28) | 1 | 0.4% | |

| Petroleum Refining (29) | 2 | 0.8% | |

| Semiconductors and Related Devices (36) | 8 | 3.1% | |

| Transportation Services (47) | 15 | 5.8% | |

| Communications Services (48) | 17 | 6.6% | |

| Wholesale Trade (50–51) | 5 | 1.9% | |

| Retail Trade (52–59) | 24 | 9.3% | |

| Financial Services (60–64) | 20 | 7.8% | |

| Hotels and Other Lodging Places (70) | 4 | 1.6% | |

| Prepackaged Software (73) | 7 | 2.7% | |

| Healthcare (80) | 24 | 9.3% | |

| Legal Services (81) | 4 | 1.6% | |

| Education (82) | 24 | 9.3% | |

| Accounting and Business Consulting Services (87) | 8 | 3.1% | |

| Others | 32 | 12.5% | |

| Missing responses | 4 | 1.6% | |

| Length of Time in Business | <5 years | 19 | 7.4% |

| 5~10 years | 41 | 16.0% | |

| 11~20 years | 43 | 16.7% | |

| 21~30 years | 50 | 19.5% | |

| 31~50 years | 45 | 17.5% | |

| 51~100 years | 37 | 14.4% | |

| >100 years | 18 | 7.0% | |

| Missing responses | 4 | 1.6% | |

| Number of Employees | <10 employees | 23 | 8.9% |

| 11~50 employees | 20 | 7.8% | |

| 51~100 employees | 28 | 10.9% | |

| 101~500 employees | 42 | 16.3% | |

| 501~1000 employees | 59 | 23.0% | |

| 1001~10,000 employees | 46 | 17.9% | |

| >10,000 employees | 35 | 13.6% | |

| Missing responses | 4 | 1.6% | |

| Respondent’s Age | <18 | 0 | 0.0% |

| 18~29 | 45 | 17.5% | |

| 30~44 | 92 | 35.8% | |

| 45~60 | 98 | 38.1% | |

| >60 | 17 | 6.6% | |

| Missing responses | 5 | 1.9% | |

References

- Cardozo, R.; McLaughlin, K.; Harmon, B.; Reynolds, P.; Miller, B. Product-market choices and growth of new businesses. J. Prod. Innov. Manag. 1993, 10, 331–340. [Google Scholar] [CrossRef]

- Frambach, R.T.; Schillewaert, N. Organizational innovation adoption: A multi-level framework of determinants and opportunities for future research. J. Bus. Res. 2002, 55, 163–176. [Google Scholar] [CrossRef]

- Hall, J.; Vredenburg, H. The challenges of innovating for sustainable development. MIT Sloan Manag. Rev. 2003, 45, 61–68. [Google Scholar]

- Cho, H.J.; Pucik, V. Relationship between innovativeness, quality, growth, profitability, and market value. Strateg. Manag. J. 2005, 26, 555–575. [Google Scholar] [CrossRef]

- Gunday, G.; Ulusoy, G.; Kilic, K.; Alpkan, L. Effects of innovation types on firm performance. Int. J. Prod. Econ. 2011, 133, 662–676. [Google Scholar] [CrossRef] [Green Version]

- Utterback, J.M.; Abernathy, W.J. A dynamic model of process and product innovation. Omega 1975, 3, 639–656. [Google Scholar] [CrossRef]

- Barras, R. Towards a theory of innovation in services. Res. Policy 1986, 15, 161–173. [Google Scholar] [CrossRef]

- Lawrence, P.R.; Lorsch, J.W. Differentiation and integration in complex organizations. Adm. Sci. Q. 1967, 12, 1–47. [Google Scholar] [CrossRef]

- Child, J. Organizational structure, environment and performance: The role of strategic choice. Sociology 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Donaldson, L. Strategy and structural adjustment to regain fit and performance: In defense of contingency theory. J. Manag. Stud. 1987, 24, 1–24. [Google Scholar] [CrossRef]

- Chandler, A.D. Strategy and structure. In The History of the Industrial Enterprise; MIT Press: Cambridge, MA, USA, 1990; Volume 120. [Google Scholar]

- Porter, M.E. What is strategy? Harvard Business Review, November–December. 1996; 61–78. [Google Scholar]

- Hayes, R.; Pisano, G.; Upton, D.; Wheelwright, S. Operation, Strategy, and Technology: Pursuing the Competitive Edge; John Wiley & Sons: Indianapolis, IN, USA, 2004. [Google Scholar]

- Gagnon, S. Resource-based competition and the new operations strategy. Int. J. Oper. Prod. Manag. 1999, 19, 125–138. [Google Scholar] [CrossRef]

- Barney, J.; Arikan, A. The resource-based view: Origins and implications. In The Blackwell Handbook of Strategic Management; John Wiley & Sons: Hoboken, NJ, USA, 2005; pp. 124–188. [Google Scholar]

- Meredith, J.R.; Pilkington, A. Assessing the exchange of knowledge between operations management and other fields: Some challenges and opportunities. J. Oper. Manag. 2018, 60, 47–53. [Google Scholar] [CrossRef]

- Gopalakrishnan, S.; Damanpour, F. A review of innovation research in economics, sociology and technology management. Omega 1997, 25, 15–28. [Google Scholar] [CrossRef]

- Schroeder, R.G.; Scudder, G.D.; Elm, D.R. Innovation in manufacturing. J. Oper. Manag. 1989, 8, 1–15. [Google Scholar] [CrossRef]

- Kim, D.Y.; Kumar, V.; Kumar, U. Relationship between quality management practices and innovation. J. Oper. Manag. 2012, 30, 295–315. [Google Scholar] [CrossRef]

- Hsu, C.C.; Tan, K.C.; Jayaram, J.; Laosirihongthong, T. Corporate entrepreneurship, operations core competency and innovation in emerging economies. Int. J. Prod. Res. 2014, 52, 5467–5483. [Google Scholar] [CrossRef]

- Capon, N.; Farley, J.U.; Lehmann, D.R.; Hulbert, J.M. Profiles of product innovators among large U.S. manufacturers. Manag. Sci. 1992, 38, 157–169. [Google Scholar] [CrossRef]

- Jayaram, J.; Oke, A.; Prajogo, D. The antecedents and consequences of product and process innovation strategy implementation in Australian manufacturing firms. Int. J. Prod. Res. 2014, 52, 4424–4439. [Google Scholar] [CrossRef]

- Knight, K.E. A descriptive model of the intra-firm innovation process. J. Bus. 1967, 40, 478–496. [Google Scholar] [CrossRef]

- Kaynak, H. Total Quality Management and Just-in-Time Purchasing: Their Effects on Performance of Firms Operating in the U.S.; Garland Publishing: New York, NY, USA, 1997. [Google Scholar]

- Jajja, M.S.S.; Kannan, V.R.; Brah, S.A.; Hassan, S.Z. Linkages between firm innovation strategy, suppliers, product innovation, and business performance: Insights from resource dependence theory. Int. J. Oper. Prod. Manag. 2017, 37, 1054–1075. [Google Scholar] [CrossRef] [Green Version]

- Zhang, M.; Qi, Y.; Guo, H. Impacts of intellectual capital on process innovation and mass customisation capability: Direct and mediating effects. Int. J. Prod. Res. 2017, 55, 6971–6983. [Google Scholar] [CrossRef]

- De Propris, L. Types of innovation and inter-firm co-operation. Entrep. Reg. Dev. 2002, 14, 337–353. [Google Scholar] [CrossRef]

- Utterback, J.M. Mastering the Dynamics of Innovation; Harvard Business School Press: Boston, MA, USA, 1994. [Google Scholar]

- Koberg, C.S.; Detienne, D.R.; Heppard, K.A. An empirical test of environmental, organizational, and process factors affecting incremental and radical innovation. J. High Technol. Manag. Res. 2003, 14, 21–45. [Google Scholar] [CrossRef]

- Kach, A.; Busse, C.; Azadegan, A.; Wagner, S.M. Maneuvering through hostile environments: How firms leverage product and process innovativeness. Decis. Sci. 2016, 47, 907–956. [Google Scholar] [CrossRef]

- Abernathy, W.J.; Utterback, J.M. Patterns of industrial innovation. Technol. Rev. 1978, 80, 40–47. [Google Scholar]

- Bayus, B.L. Optimal dynamic policies for product and process innovation. J. Oper. Manag. 1995, 12, 173–185. [Google Scholar] [CrossRef]

- Rothaermel, F.T. Strategic Management: Concepts and Cases; McGraw-Hill Irwin: New York, NY, USA, 2013. [Google Scholar]

- Damanpour, F.; Gopalakrishnan, S. The dynamics of the adoption of product and process innovations in organizations. J. Manag. Stud. 2001, 38, 45–65. [Google Scholar] [CrossRef]

- Barras, R. Interactive innovation in financial and business services: The vanguard of the service revolution. Res. Policy 1990, 19, 215–237. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors, 1st ed.; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Porter, M.E. Competitive Advantage; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Donaldson, L. The Contingency Theory of Organizations; Sage Publications: Southend Oaks, CA, USA, 2001. [Google Scholar]

- Hayes, R.; Wheelwright, S.C. The dynamics of process-product life cycles. Harvard Business Review, March 1979; 127–136. [Google Scholar]

- Anderson, J.C.; Cleveland, G.; Schroeder, R.G. Operations strategy: A literature review. J. Oper. Manag. 1989, 8, 133–158. [Google Scholar] [CrossRef]

- Porter, M.E. Competition in Global Industries; Harvard Business School Press: Boston, MA, USA, 1986. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Barney, J. Gaining and Sustaining Competitive Advantage; Prentice Hall: Upper Saddle River, NJ, USA, 2002. [Google Scholar]

- Reed, R.; DeFillippi, R.J. Causal Ambiguity, Barriers to Imitation, and Sustainable Competitive Advantage. Acad. Manag. Rev. 1990, 15, 88–102. [Google Scholar] [CrossRef]

- Peteraf, M.A. The cornerstone of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Powell, T.C. Firm-specific competitive advantage in high technology firms. J. High Technol. Manag. Res. 1993, 4, 197–209. [Google Scholar] [CrossRef]

- Barney, J.B.; Hesterly, W.S. Strategic Management and Competitive Advantage: Concepts and Cases; Pearson: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Hitt, M.A.; Ireland, R.D.; Hoskisson, R.E. Strategic Management: Competitiveness & Globalization: Concepts, 9th ed.; Cengage Learning: Mason, OH, USA, 2011. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Gouda, S.K.; Saranga, H. Sustainable supply chains for supply chain sustainability: Impact of sustainability efforts on supply chain risk. Int. J. Prod. Res. 2018, 56, 5820–5835. [Google Scholar] [CrossRef]

- Conner, K. A historical comparison of resource-based theory and five schools of thought within industrial organization economics: Do we have a new theory of the firm? J. Manag. 1991, 17, 121–154. [Google Scholar] [CrossRef]

- McEvily, S.K.; Chakravarthy, B. The persistence of knowledge-based advantage: An empirical test for product performance and technological knowledge. Strateg. Manag. J. 2002, 23, 285–305. [Google Scholar] [CrossRef]

- Wiggins, R.R.; Ruefli, T.W. Sustained competitive advantage: Temporal dynamics and the incidence and persistence of superior economic performance. Organ. Sci. 2002, 13, 82–105. [Google Scholar] [CrossRef]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef] [Green Version]

- Das, T.K.; Teng, B. Resources and risk management in the strategic alliance making process. J. Manag. 1998, 24, 21–42. [Google Scholar] [CrossRef]

- Castanias, R.P.; Helfat, C.E. Managerial resources and rents. J. Manag. 1991, 17, 155–171. [Google Scholar] [CrossRef]

- Fiol, C.M. Managing culture as a competitive resource: An identity-based view of sustainable competitive advantage. J. Manag. 1991, 17, 191–211. [Google Scholar] [CrossRef]

- Lado, A.A.; Boyd, N.G.; Wright, P. A Competency-based model of sustainable competitive advantage: Toward a conceptual integration. J. Manag. 1992, 18, 77–91. [Google Scholar] [CrossRef]

- Miller, D.; Shamsie, J. The resource-based view of the firm in two environments: The Hollywood film studios from 1936 to 1965. Acad. Manag. J. 1996, 39, 519–543. [Google Scholar]

- Das, T.K.; Teng, B. A resource-based theory of strategic alliance. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Palmeri, C. Trader Joe’s Recipe for Success. Bloomberg Businessweek. 20 February 2008. Available online: https://www.bloomberg.com/news/articles/2008-02-20/trader-joes-recipe-for-success (accessed on 15 January 2020).

- Llopis, G. Why Trader Joe’s Stands Out from All the Rest in the Grocery Business. Forbes. 5 September 2011. Available online: https://www.forbes.com/sites/glennllopis/2011/09/05/why-trader-joes-stands-out-from-all-the-rest-in-the-grocery-business/#45d5286a4dec (accessed on 15 January 2020).

- Krajewski, L.J.; Ritzman, L.P.; Malhotra, M.K. Operations Management: Processes and Supply Chains, 10th ed.; Pearson/Prentice Hall: Upper Saddle River, NJ, USA, 2013. [Google Scholar]

- P&G 2012 Annual Report. Available online: http://annualreport.pg.com/annualreport2012 (accessed on 15 January 2020).

- P&G Company Website. Available online: http://www.pg.com/en US/company/corestrengths.shtml (accessed on 30 April 2013).

- Kang, J. A Study of the DRAM Industry. Master’s Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2010. [Google Scholar]

- Bozarth, C.; Handfield, R.B. Introduction to Operations and Supply Chain Management, 4th ed.; Pearson: Upper Saddle River, NJ, USA, 2015. [Google Scholar]

- Weerawardena, J. The role of marketing capability in innovation-based competitive strategy. J. Strateg. Mark. 2003, 11, 15–35. [Google Scholar] [CrossRef]

- Prajogo, D.I.; Sohal, A.S. The relationship between organization strategy, total quality management (TQM), and organization performance—The mediating role of TQM. Eur. J. Oper. Res. 2006, 168, 35–50. [Google Scholar] [CrossRef]

- Gopalakrishnan, S.; Bierly, P.; Kessler, E.H. A reexamination of product and process innovations using a knowledge-based view. J. High Technol. Manag. Res. 1999, 10, 147–166. [Google Scholar] [CrossRef]

- Atuahene-Gima, K.; Ko, A. An empirical investigation of the effect of market orientation and entrepreneurship orientation alignment on product innovation. Organ. Sci. 2001, 12, 54–74. [Google Scholar] [CrossRef]

- Real, K.; Poole, M.S. Innovation implementation: Conceptualization and measurement in organizational research. Res. Organ. Chang. Dev. 2005, 15, 63–134. [Google Scholar]

- Valle, S.; Vázquez-Bustelo, D. Concurrent engineering performance: Incremental versus radical innovation. Int. J. Prod. Econ. 2009, 119, 136–148. [Google Scholar] [CrossRef]

- Ettlie, J.E.; Reza, E.M. Organizational integration and process innovation. Acad. Manag. J. 1992, 35, 795–827. [Google Scholar]

- Armstrong, C.E.; Shimizu, K. A review of approaches to empirical research on the resource-based view of the firm. J. Manag. 2007, 33, 959–986. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Wiklund, J. Entrepreneurial Small Businesses: A Resource-Based Perspective; Edward Elgar Publishing: Northampton, MA, USA, 2005. [Google Scholar]

- Wernerfelt, B. The resource-based view of the firm: Ten years after. Strateg. Manag. J. 1995, 16, 171–174. [Google Scholar] [CrossRef]

- Cho, Y.S.; Linderman, K. Metacognition-Based Process Improvement Practices. Int. J. Prod. Econ. 2019, 211, 132–444. [Google Scholar] [CrossRef]

- Guo, L.; Tobias, J.; Bendoly, E.; Hu, Y. Different departments, different drivers: Asymmetry in antecedents and outcomes of voluntary knowledge exchange between sales and production functions. Int. J. Oper. Prod. Manag. 2017, 37, 1031–1053. [Google Scholar] [CrossRef] [Green Version]

- Damanpour, F. Organizational size and innovation. Organ. Stud. 1992, 13, 375–402. [Google Scholar] [CrossRef]

- Martinez-Ros, E. Explaining the decisions to carry out product and process innovations: The Spanish case. J. High Technol. Manag. Res. 1999, 10, 223–242. [Google Scholar] [CrossRef] [Green Version]

- Camisón-Zornoza, C.; Lapiedra-Alcamí, R.; Segarra-Ciprés, M.; Boronat-Navarro, M. A meta-analysis of innovation and organizational size. Organ. Stud. 2004, 25, 331–361. [Google Scholar] [CrossRef]

- Kach, A.; Azadegan, A.; Wagner, S.M. The influence of different knowledge workers on innovation strategy and product development performance in small and medium-sized enterprises. Int. J. Prod. Res. 2015, 53, 2489–2505. [Google Scholar] [CrossRef]

- Calantone, R.J.; Cavusgil, S.T.; Zhao, Y. Learning orientation, firm innovation capability, and firm performance. Ind. Mark. Manag. 2002, 31, 515–524. [Google Scholar] [CrossRef]

- Pagell, M.; Krause, D.R. A multiple-method study of environmental uncertainty and manufacturing flexibility. J. Oper. Manag. 1999, 17, 307–325. [Google Scholar] [CrossRef]

- Zhang, D.; Linderman, K.; Schroeder, R.G. The moderating role of contextual factors on quality management practices. J. Oper. Manag. 2012, 30, 12–23. [Google Scholar] [CrossRef]

- Dillman, D.A.; Smyth, J.D.; Christian, L.M. Internet, Phone, Mail and Mixed-Mode Surveys: The Tailored Design Method, 4th ed.; Wiley: New York, NY, USA, 2014. [Google Scholar]

- Miller, D.; Toulouse, J.M. Chief executive personality and corporate strategy and structure in small firms. Manag. Sci. 1986, 32, 1389–1409. [Google Scholar] [CrossRef]

- Zahra, S.A.; Covin, J.G. Business strategy, technology policy and firm performance. Strateg. Manag. J. 1993, 14, 451–478. [Google Scholar] [CrossRef]

- Craighead, C.W.; Ketchen, D.J.; Dunn, K.S.; Hult, G.T.M. Addressing common method variance: Guidelines for survey research on information technology, operations, and supply chain management. IEEE Trans. Eng. Manag. 2011, 58, 578–588. [Google Scholar] [CrossRef]

- Wagner, S.M.; Bode, C. Supplier relationship-specific investments and the role of safeguards for supplier innovation sharing. J. Oper. Manag. 2014, 32, 65–78. [Google Scholar] [CrossRef]

- Escrig-Tena, A.B.; Segarra-Ciprés, M.; García-Juan, B.; Beltrán-Martín, I. The impact of hard and soft quality management and proactive behaviour in determining innovation performance. Int. J. Prod. Econ. 2018, 200, 1–14. [Google Scholar] [CrossRef]

- Miller, J.G.; Roth, A.V. A taxonomy of manufacturing strategies. Manag. Sci. 1994, 40, 285–304. [Google Scholar] [CrossRef] [Green Version]

- Cho, Y.S.; Jung, J.Y.; Linderman, K. The QM Evolution: Behavioral Quality Management as a Firm’s Strategic Resource. Int. J. Prod. Econ. 2017, 191, 233–249. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef] [Green Version]

- Akgün, A.E.; Ince, H.; Imamoglu, S.Z.; Keskin, H.; Kocoglu, İ. The mediator role of learning capability and business innovativeness between total quality management and financial performance. Int. J. Prod. Res. 2014, 52, 888–901. [Google Scholar] [CrossRef]

- Prajogo, D.; Mena, C.; Nair, A. The fit between supply chain strategies and practices: A contingency approach and comparative analysis. IEEE Trans. Eng. Manag. 2018, 65, 168–180. [Google Scholar] [CrossRef]

- Segars, A.H.; Grover, V. Strategic information systems planning success: An investigation of the construct and its measurement. MIS Q. 1998, 22, 139–163. [Google Scholar] [CrossRef]

- Byrne, B.M. Structural Equation Modeling with LISREL, PRELIS, and SIMPLIS: Basis Concepts, Application and Programming; Lawrence Erlbaum Associates Inc.: Mahwah, NJ, USA, 1998. [Google Scholar]

- Mulaik, S.A.; James, L.R.; Van Altine, J.; Bennett, N.; Lind, S.; Stilwell, C.D. Evaluation of goodness-of-fitness indices for structural equation models. Psychol. Bull. 1989, 105, 430–445. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Bollen, K.A.; Long, J.S. Testing Structural Equation Models; Sage Publications: Thousand Oaks, CA, USA, 1993. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef] [Green Version]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Ali, S.S. Exploring the relationship between leadership, operational practices, institutional pressures and environmental performance: A framework for green supply chain. Int. J. Prod. Econ. 2015, 160, 120–132. [Google Scholar] [CrossRef]

- Prajogo, D.I.; Sohal, A.S. The multidimensionality of TQM practices in determining quality and innovation performance-an empirical examination. Technovation 2004, 24, 443–453. [Google Scholar] [CrossRef]

- Hinkle, D.E.; Wiersma, W.; Jurs, S.G. Applied Statistics for the Behavioral Sciences, 5th ed.; Cengage Learning: Belmont, CA, USA, 2003. [Google Scholar]

- Scott, W.R.; Davis, G. Organizations and Organizing: Rational, Natural and Open System Perspectives; Pearson Prentice-Hall: Upper Saddle River, NJ, USA, 2007. [Google Scholar]

- Baldwin, W.L.; Scott, J.T. Market Structure and Technological Change; Psychology Press: London, UK, 1987. [Google Scholar]

- Fisher, R.J.; Price, L.L. An investigation into the social context of early adoption behavior. J. Consum. Res. 1992, 19, 477–486. [Google Scholar] [CrossRef]

- Porter, M.E. The five competitive forces that shape strategy. Harv. Bus. Rev. 2008, 86, 78–93. [Google Scholar] [PubMed]

- Aldieri, L.; Vinci, C. Green economy and sustainable development: The economic impact of innovation on employment. Sustainability 2018, 10, 3541. [Google Scholar] [CrossRef] [Green Version]

- Aldieri, L.; Makkonen, T.; Vinci, C.P. Spoils of innovation? Employment effects of R&D and knowledge spillovers in Finland. Econ. Innov. New Technol. 2019, 1–15. [Google Scholar] [CrossRef]

- OECD. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed.; OECD Publishing: Paris, France; Eurostat: Luxembourg, 2018. [Google Scholar]

| Market-Based View | Resource-Based View | Supporting Literature | |

|---|---|---|---|

| Assumption on resources | Mobility and homogeneity | Immobility and heterogeneity | [15,42] |

| Strategic approach | Fit to market rules | Change market rules | [10,13,14,36,41] |

| Source of competitive advantage | The power of a firm’s market position | The power of a firm’s strategic resource | [14,15,37,43,49] |

| Operating focus | Superior performance | Sustainability | [51,52,53] |

| Index | (Threshold) | Measurement Model (CFA) | CMV Testing Model (Single Factor) |

|---|---|---|---|

| Chi-square (X2) | 816.549 | 2109.014 | |

| The degree of Freedom (d.f.) | 314 | 324 | |

| X2/d.f. | <3.00 b | 2.600 | 6.509 |

| Comparative fit index | >0.90 c | 0.938 | 0.781 |

| Parsimony normed fit index | >0.50 d | 0.809 | 0.694 |

| Tucker-Lewis coefficient index | Close to 1.00 e | 0.931 | 0.762 |

| RMSEA a | <0.08 f | 0.079 (0.072~0.086) g | 0.147 (0.141~0.153) |

| Factor and Items | Loading a | S.E. b | t-Value | Sig. | AVE c |

|---|---|---|---|---|---|

| Product Innovation (Cronbach α = 0.945) | |||||

| PdI1 | 0.860 | 0.051 | 19.412 | *** | 0.774 |

| PdI2 | 0.856 | 0.050 | 19.240 | *** | |

| PdI3 | 0.888 | 0.048 | 20.804 | *** | |

| PdI4 | 0.912 | 0.045 | 22.131 | *** | |

| PdI5 | 0.883 | ||||

| Process Innovation (Cronbach α = 0.946) | |||||

| PcI1 | 0.884 | 0.048 | 21.409 | *** | 0.814 |

| PcI2 | 0.921 | 0.043 | 23.756 | *** | |

| PcI3 | 0.907 | 0.047 | 22.848 | *** | |

| PcI4 | 0.897 | ||||

| Product-Based Resource (Cronbach α = 0.959) | |||||

| Pr1 | 0.926 | 0.044 | 22.999 | *** | 0.795 |

| Pr2 | 0.914 | 0.045 | 22.301 | *** | |

| Pr3 | 0.902 | 0.047 | 21.615 | *** | |

| Pr4 | 0.861 | 0.048 | 19.509 | *** | |

| Pr5 | 0.865 | 0.045 | 19.698 | *** | |

| Pr6 | 0.879 | ||||

| Knowledge-Based Resource (Cronbach α = 0.952) | |||||

| Kr1 | 0.871 | 0.050 | 19.873 | *** | 0.767 |

| Kr2 | 0.879 | 0.049 | 20.280 | *** | |

| Kr3 | 0.906 | 0.049 | 21.686 | *** | |

| Kr4 | 0.896 | 0.048 | 21.125 | *** | |

| Kr5 | 0.823 | 0.053 | 17.775 | *** | |

| Kr6 | 0.878 | ||||

| Sustainable Competitive Advantage (Cronbach α = 0.934) | |||||

| Sca1 | 0.852 | 0.066 | 15.727 | *** | 0.702 |

| Sca2 | 0.868 | 0.065 | 16.126 | *** | |

| Sca3 | 0.866 | 0.063 | 16.078 | *** | |

| Sca4 | 0.842 | 0.065 | 15.465 | *** | |

| Sca5 | 0.801 | 0.067 | 14.456 | *** | |

| Sca6 | 0.796 | ||||

| Factors | 1 | 2 | 3 | 4 | 5 | 6 | 7 | Mean | S.D. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Product innovation | 0.880 a | 4.553 | 1.651 | ||||||

| 2 | Process innovation | 0.823 ** | 0.902 a | 4.635 | 1.638 | |||||

| 3 | PBR | 0.800 ** | 0.821 ** | 0.892 a | 4.496 | 1.648 | ||||

| 4 | KBR | 0.765 ** | 0.824 ** | 0.834 ** | 0.876 a | 4.835 | 1.548 | |||

| 5 | SCA | 0.638 ** | 0.669 ** | 0.677 ** | 0.780 ** | 0.838 a | 4.717 | 1.248 | ||

| (Control Variables) | ||||||||||

| 6 | Firm age | −0.092 | −0.134 * | −0.102 | −0.128 * | −0.016 | 3.964 | 1.705 | ||

| 7 | Firm size | 0.160 * | 0.112 | 0.201 ** | 0.132 * | 0.128 * | 0.446 ** | 4.470 | 1.800 | |

| 8 | Market dynamism | 0.588 ** | 0.587 ** | 0.660 ** | 0.648 ** | 0.607 ** | −0.154 * | 0.118 | 4.726 | 1.426 |

| Variable | Sum of Squares | d.f. | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| Product Innovation | Between Groups | 342.832 | 3 | 114.277 | 81.441 | 0.000 |

| Within Groups | 355.008 | 253 | 1.403 | |||

| Total | 697.840 | 256 | ||||

| Process Innovation | Between Groups | 356.988 | 3 | 118.996 | 91.265 | 0.000 |

| Within Groups | 329.876 | 253 | 1.304 | |||

| Total | 686.864 | 256 |

| Variable | Group | Group | Mean Difference | Std. Error | Sig. |

|---|---|---|---|---|---|

| Product innovation | 1 | 2 | −1.373 * | 0.326 | 0.000 |

| 1 | 3 | −1.171 * | 0.259 | 0.000 | |

| 1 | 4 | −2.518 * | 0.161 | 0.000 | |

| 2 | 3 | 0.201 | 0.384 | 0.953 | |

| 2 | 4 | −1.145 * | 0.325 | 0.003 | |

| 3 | 4 | −1.347 * | 0.258 | 0.000 | |

| Process innovation | 1 | 2 | −1.504 * | 0.315 | 0.000 |

| 1 | 3 | −1.824 * | 0.250 | 0.000 | |

| 1 | 4 | −2.548 * | 0.155 | 0.000 | |

| 2 | 3 | −0.319 | 0.370 | 0.823 | |

| 2 | 4 | −1.044 * | 0.314 | 0.006 | |

| 3 | 4 | −0.724 * | 0.248 | 0.020 |

| Path | Dynamic Market (n = 162) | Stable Market (n = 94) | ||||

|---|---|---|---|---|---|---|

| Beta a | t-Value b | Beta | t-Value | |||

| Second-Order Factors (Latent Variables) | ||||||

| SCA | ← | Product innovation | 0.112 | 1.049 | 0.573 | 4.182 |

| SCA | ← | Process innovation | 0.628 | 5.281 | 0.152 | 1.193 |

| Process innovation | ← | PBR | 0.347 | 3.702 | 0.371 | 3.486 |

| Product innovation | ← | PBR | 0.610 | 4.675 | 0.379 | 4.198 |

| Process innovation | ← | KBR | 0.620 | 6.222 | 0.509 | 4.629 |

| Product innovation | ← | KBR | 0.231 | 1.833 | 0.591 | 6.120 |

| First-Order Factors (Measure Items) | ||||||

| pd5 | ← | Product innovation | 0.846 | 0.873 | ||

| pd1 | ← | Product innovation | 0.849 | 13.725 | 0.836 | 10.796 |

| pd2 | ← | Product innovation | 0.834 | 13.310 | 0.837 | 10.841 |

| pd3 | ← | Product innovation | 0.877 | 14.514 | 0.861 | 11.436 |

| pd4 | ← | Product innovation | 0.892 | 14.955 | 0.893 | 12.313 |

| pc3 | ← | Process innovation | 0.882 | 16.842 | 0.924 | 12.829 |

| pc1 | ← | Process innovation | 0.822 | 14.474 | 0.912 | 12.473 |

| pc2 | ← | Process innovation | 0.890 | 17.226 | 0.943 | 13.387 |

| pc4 | ← | Process innovation | 0.898 | 0.857 | ||

| kr5 | ← | KBR | 0.763 | 11.520 | 0.772 | 9.140 |

| pr2 | ← | PBR | 0.874 | 15.497 | 0.964 | 11.848 |

| kr1 | ← | KBR | 0.813 | 12.706 | 0.874 | 11.295 |

| pr6 | ← | PBR | 0.869 | 0.800 | ||

| pr3 | ← | PBR | 0.884 | 15.881 | 0.862 | 9.963 |

| pr1 | ← | PBR | 0.900 | 16.466 | 0.967 | 11.907 |

| kr6 | ← | KBR | 0.838 | 0.851 | ||

| kr2 | ← | KBR | 0.830 | 13.131 | 0.908 | 12.145 |

| kr3 | ← | KBR | 0.879 | 14.485 | 0.907 | 12.122 |

| kr4 | ← | KBR | 0.868 | 14.164 | 0.870 | 11.193 |

| pr5 | ← | PBR | 0.856 | 14.883 | 0.733 | 7.967 |

| pr4 | ← | PBR | 0.860 | 15.006 | 0.783 | 8.698 |

| Market share growth | ← | SCA | 0.840 | 9.971 | 0.873 | 10.818 |

| Net profit margin | ← | SCA | 0.778 | 9.281 | 0.949 | 12.578 |

| Customer retention | ← | SCA | 0.710 | 0.828 | ||

| Customer satisfaction | ← | SCA | 0.725 | 8.667 | 0.808 | 9.557 |

| Return on assets | ← | SCA | 0.755 | 9.016 | 0.906 | 11.556 |

| Sale growth | ← | SCA | 0.729 | 8.715 | 0.971 | 13.155 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cho, Y.S.; Linderman, K. Resource-Based Product and Process Innovation Model: Theory Development and Empirical Validation. Sustainability 2020, 12, 913. https://doi.org/10.3390/su12030913

Cho YS, Linderman K. Resource-Based Product and Process Innovation Model: Theory Development and Empirical Validation. Sustainability. 2020; 12(3):913. https://doi.org/10.3390/su12030913

Chicago/Turabian StyleCho, Young Sik, and Kevin Linderman. 2020. "Resource-Based Product and Process Innovation Model: Theory Development and Empirical Validation" Sustainability 12, no. 3: 913. https://doi.org/10.3390/su12030913