Abstract

Anaerobic digestion is one of the most sustainable and promising technologies for the management of organic residues. China plays an important role in the world’s biogas industry and has accumulated rich and valuable experience, both positive and negative. The country has established relatively complete laws, policies and a subsidy system; its world-renowned standard system guarantees the implementation of biogas projects. Its prefabricated biogas industry has been developed, and several biogas-linked agricultural models have been disseminated. Nonetheless, the subsidy system in China’s biogas industry is inflexible and cannot lead to marketization, unlike that of its European counterpart. Moreover, the equipment and technology levels of China’s biogas industry are still lagging and underdeveloped. Mono-digestion, rather than co-digestion, dominates the biogas industry. In addition, biogas upgrading technology is immature, and digestate lacks planning and management. China’s government subsidy is reconsidered in this work, resulting in the recommendation that subsidy should be based on products (i.e., output-oriented) instead of only input subsidy for construction. The policy could focus on the revival of abandoned biogas plants as well.

1. Introduction

Waste management is a global issue and one of the essential utility services underpinning society linked directly with the public health and the environment [1]. Biogas technology has become increasingly popular worldwide in view of the multiple benefits gained from anaerobic digestion (AD), such as alleviating energy shortage, controlling environmental pollution, reducing greenhouse gas emission, and promoting agricultural structural adjustment [2]. AD is one of the most sustainable and promising technologies for management of organic residues [3,4]. Many large-scale biogas plants can be found in developed countries. Biogas is commonly used for power generation (mostly combined with heat and power) and other industrial applications or upgraded as substitute for natural gas [5,6]. By contrast, the technology and equipment for biogas plants are still lagging, and household biogas digesters dominate the biogas industry in developing countries. Domestic biogas technology is effectively and widely implemented in countries where governments and institutions are involved in the subsidy, planning, design, construction, operation, and maintenance of biogas plants [7,8]. A number of countries in Asia and Africa have launched massive campaigns to popularize biogas technology via government support and international aid (Table 1) [9,10]. Globally, it is estimated that 50 million micro-digesters (family size), 132,000 biogas engineering projects (about 15,000 in Europe [11]) and 700 biogas upgrading plants are operating [12]. Promotion of biogas technology has several opportunities and obstacles. Numerous studies have focused on these aspects to discuss the country scenario. Many case and field studies have aimed to assess biogas technology to verify its multiple benefits [13,14] and identify potential barriers [8,15,16,17,18,19,20,21]. However, these studies are limited to individual country scenarios. The progress and prospect of the biogas industry in different nations vary widely. Nearly no crosswise comparisons have been made for different countries. The current study intends to fill this gap.

Table 1.

Number of domestic biogas digesters installed under national biogas programs of selected Asian and African countries.

China leads the world in domestic biogas technology. With the expansion of the biogas industry, lessons learned, whether positive or negative, would be valuable and abundant for countries whose biogas industry is still at the initial stage, including nations mainly in South and Southeast Asia, Africa, and Latin America. Meanwhile, along with the development of medium- and large-scale biogas plants (MLBPs), progress is not trouble-free [22]. (According to the Chinese biogas standard NY/T 667-2011 Classification of Scale for Biogas Engineering, the thresholds of medium-scale and large-scale biogas plant are 300 m3 and 500 m3 for total digester volume respectively, with a minimum daily biogas production of 150 m3 and 500 m3 respectively. By comparison, in Germany, most biogas plants are based on farms and aim at power generation; the small biogas plant is below 150 kWel while the large biogas plant is above 500 kWel [23] An up-to-date national surrey on German biogas plants mentioned that average installed capacity in small- to medium-scale installations on farms in the agricultural sector is ca. 500 kWel while average installed capacity in larger anaerobic AD plants is ca. 800kWel.) The development model, especially governmental subsidiaries, should be reconsidered, despite the scarcity of studies focusing on this aspect. Moreover, developed countries would accumulate experiences, and China would also benefit from these valuable lessons learned.

This study aims to provide references for the biogas industry of not only China but also other developing countries, in the hope of promoting the sound dissemination of the biogas technology in the developing world more or less.

2. Status Quo of the Biogas Industry in China

Biogas has a long history in China. The development stages are shown in Table 2 [31]. Since the “Rural Ecological Enrichment Project” was proposed by the Ministry of Agriculture (MOA) (MOA was renamed as Ministry of Agriculture and Rural Affairs after the governmental reshuffle in 2018) at the beginning of this century, biogas construction projects have been implemented all over the country. Support is provided via rural small-scale public infrastructure and basic construction projects, particularly since the implementation of the “National Debt Project for Rural Biogas Construction” in 2003. The biogas industry has accomplished great achievements to date. Table 3 presents the key figures in the biogas industry of China. A new pattern has been established, i.e., different kinds of biogas plants are developed simultaneously, including domestic biogas projects, MLBPs attached to animal farms, biogas plants attached to breeding communities, biogas plants attached to primary and secondary schools, combined household biogas plants, and centralized biogas supply plants [32].

Table 2.

Development stages of Chinese biogas industry.

Table 3.

Key figures showing the status quo of Chinese biogas industry (updated to 2018).

Before 2008, the central government prioritized the domestic biogas sector. After 2009, the government has increasingly focused on MLBPs. For instance, the proportion of domestic biogas to total biogas investment decreased from 81.6% in 2008 to 47.6% in 2009, whereas that of MLBPs increased from 3% in 2008 to 35.1% in 2009 [22]. China started to support bio-natural gas (BNG; also known as biogas upgrading or biogas-to-biomethane) projects for the first time in 2015 at the central government level. In the same year, MOA and the National Development and Reform Commission (NDRC) published a document entitled “2015 Working Plan of Upgrading and Transforming Rural Biogas Project,” which explains their aim to find a suitable area where they can build large-scale biogas projects (with daily biogas production of above 500 m3) and implement BNG demonstration projects (where the methane content exceeds 95%; 1 m3 biogas can usually be upgraded to 0.6 m3 BNG) [33]. The central government funded the building of 25 BNG demonstration projects for the first time in 2015, and this initiative was followed by the approval of 22 and 18 other BNG projects in 2016 and 2017, respectively [34].

3. Lessons Learned from the Frontrunners

The Chinese biogas industry deviates from the usual development path in comparison with those of developed countries, such as Germany, Sweden, Austria, Denmark, and the Netherlands. China can learn numerous lessons from these frontrunners, and such lessons should be reconsidered.

3.1. Financial Support System

3.1.1. Current Scenarios in Europe/Germany and China

Financial support systems vary by country. Different systems with feed-in tariffs (FITs), investment grants, and tax exemptions can be found in Europe. Each financial support system is correlated with the way biogas is utilized. In the United Kingdom, Austria and Germany, where FITs are provided for electricity, most of the biogas is used to produce electricity. In Austria, support is provided for electricity production via the Green Electricity Law (Ökostromgesetz 2012) while a minimum of 30% manure is required to be used as a substrate to qualify for FIT [41]. In Demark, the main elements of the Danish support system for biogas are 0.056 EUR/kWh (115 DKK/GJ) for biogas used in a combined heat and power (CHP) unit or injected into the grid, and 0.037 EUR/kWh (75 DKK/GJ) for direct usage for transport or industrial purposes [42]. Sweden has the largest share of produced biogas to be upgraded and used for transport in Europe [43]. Alternatively, Sweden’s system, which offers tax exemption, favors the utilization of biogas as vehicle fuel. For instance, CO2 and energy tax exemptions for biomethane as transportation fuel are about 0.72 SEK/kWh (~68 €/MWh) and 2.4 SEK/Nm3 (~21 €/MWh) against corresponding taxes for petrol until the end of 2020. Subsidy in Europe has an added focus on output. Germany leads the world in industrial biogas. To promote renewable energy in Germany, the Renewable Energy Sources Act (EEG) came into being in 2000 and introduced FIT into the power generation price frame [44]. EEG has been revised five times (Table 4), and amendments show a decrease in subsidy. The conclusion is that EEG is updated along with the transformation of the country’s subsidy mechanism from being government-dominant to having a market orientation. The biogas industry in Germany has undergone complete marketization.

Table 4.

Evolution of Germany’s FIT for biogas plants in EEG 2000, EEG 2004, EEG 2009, EEG 2012, EEG 2014, and EEG 2017.

By comparison, in China, most of the financial support is provided during construction (i.e., input subsidy). Most owners focus only on the initial construction rather than on operation and maintenance under the existing subsidy policy, leading to the low efficiency of MLBPs. Several projects do not operate at all once the buildings are constructed. The same situation occurs in household biogas digesters.

Electricity produced by most biogas power plants in China is used by the biogas power plants themselves, despite the issuance of two governmental documents by NDRC, which indicate the subsidy to grid-connected plants. Table 5 presents China’s grid FIT and tax privileges for biogas power plants. Scenarios include livestock and poultry or agro- and forestry biomass waste management. However, the choice of scenario that can be adopted in implementation depends on the understanding of the local government. The subsidy cannot be uniform nationwide. In addition, the subsidy baseline has not been updated while prices continue to rise due to currency inflation.

Table 5.

China’s grid FIT and tax privileges for biogas power plants.

3.1.2. Reconsidering Governmental Subsidy in China

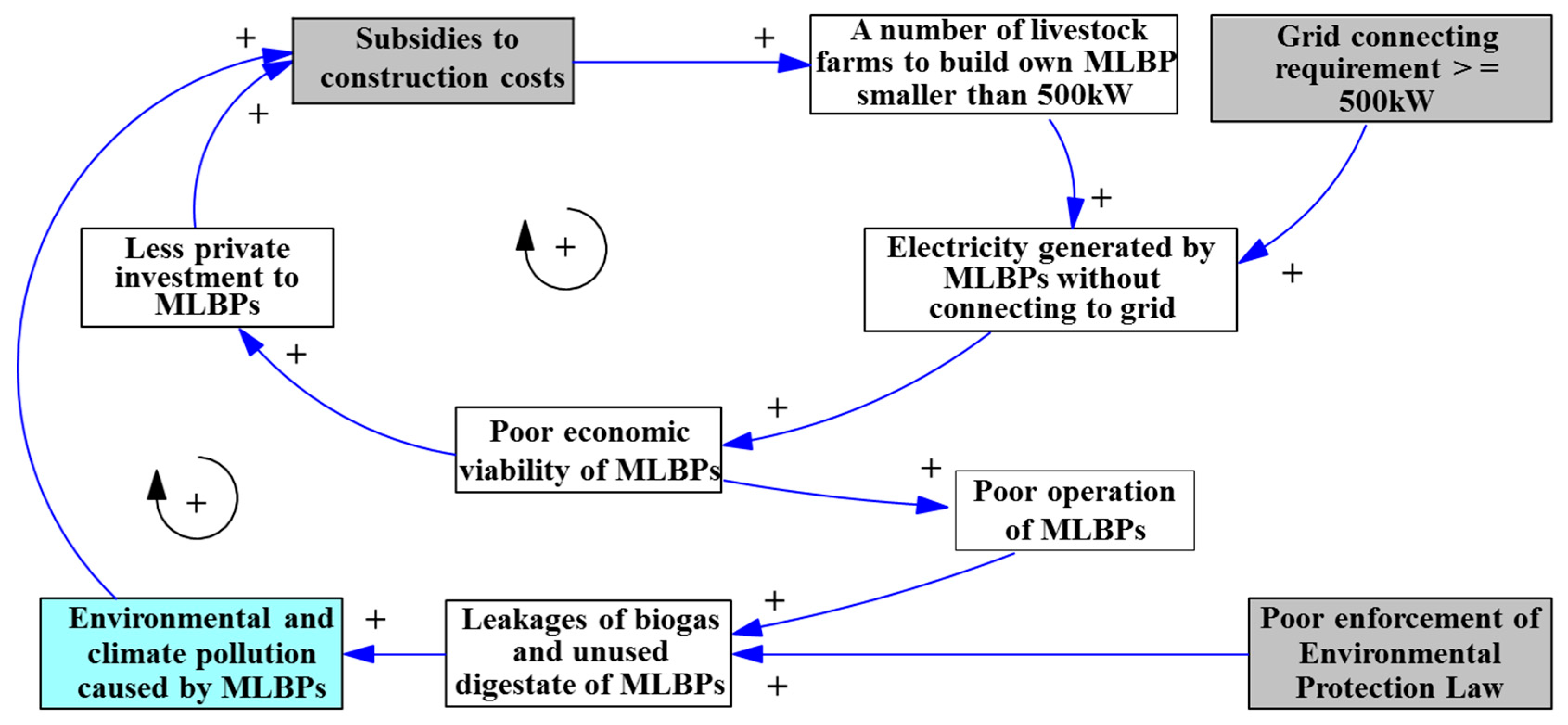

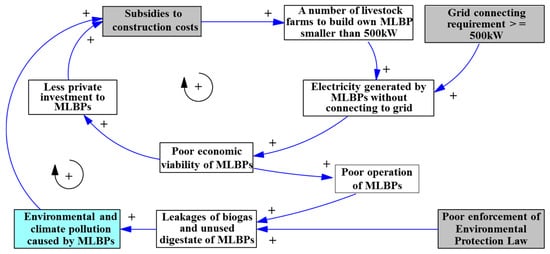

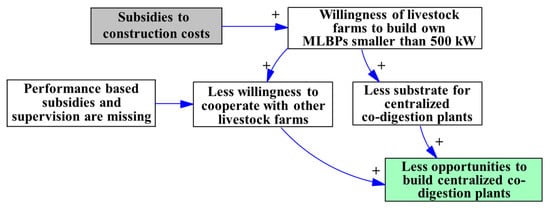

The development of the China’s biogas industry will be unsuccessful without the aid of government subsidy, which could even satisfy the demand of MLBP construction without any problem. The question arises, why is the development of China’s biogas industry inefficient? Figure 1 shows an extensive analysis of the influence of construction subsidy on China’s MLBPs. According to the current subsidy model, under the poor enforcement of Environmental Protection Law, high construction subsidies may result in considerable amounts of pollutants, thereby requiring high subsidies because of reduced private investments [52].

Figure 1.

Influence of construction subsidy on China’s MLBPs. Note: Causal loop “+” shows that the process indicated by the high level of the arrow tail side will result in the process indicated by the high level of the arrowhead side, showing an “increasing” relationship.

China’s decision-makers have been aware of the defect resulting from “input subsidy.” According to lessons learned from Europe, especially in Germany, a new subsidy policy is under discussion. Policymakers are considering abolishing the total CNY limit for the construction subsidy to create incentives for the investment in super-large biogas plants (fermenter volume > 5000 m3). The new percentage of the proposed construction subsidy will cover 25% to 40% of the total investment. On one hand, the subsidy system should be based on demand response, whilst a reasonable subsidy rate is the premise of the effectiveness of the financial support policy [53]. Approximately 0.9 CNY/Nm3 biogas is discussed as output subsidy. However, the end subsidy has not been launched yet. On the other hand, an effective subsidy system should also be based on the local actual situation. In terms of the China biogas industry, input subsidy and output subsidy are both of significance. Without an input subsidy for construction, the willingness to build a biogas plant for stakeholders would be not strong, even if environmental protection is becoming mainstream. Without output subsidy, the operation and maintenance (O and M) of a biogas plant is always neglected. The output subsidy should cover both products of a biogas plant, i.e., biogas and digestate. A combination of input subsidy and output subsidy could not only initiate the construction of a biogas plant but also sustain the operation.

The success of a biogas power plant lies in its economic viability. Currently, the sale of electricity could contribute the profitability in a large part [54]. However, only a few biogas plants can be connected to the grid due to the hinder of monopoly enterprises. Moreover, the digestate cannot be treated as commercial organic fertilizer and enjoy preferential policy. It is suggested that biogas industry refer to the policies on municipal solid waste and wastewater management, which adopts government procurement and professional bidding, so that the biogas plant owners can also acquire fiscal subsidy for feedstock collection and treatment. Processed bio-fertilizer from digestate should be subsided as normal organic fertilizer.

The subsidy is indispensable for promoting the biogas industry, especially in the initial stage. By output subsidy, a primary end market could be cultivated. The regulations were adjusted along with the change in the market. However, the market-oriented biogas industry in China has not been formed, so that the market cannot be treated as the key player to allocate resources and change policies. By comparison, EEG in Germany is updated along with the transformation of the country’s subsidy mechanism from being government-dominant to having a market orientation. Subsidy-free mechanism towards marketization is the ultimate direction for the Chinese biogas industry.

3.2. Equipment and Technology Innovation

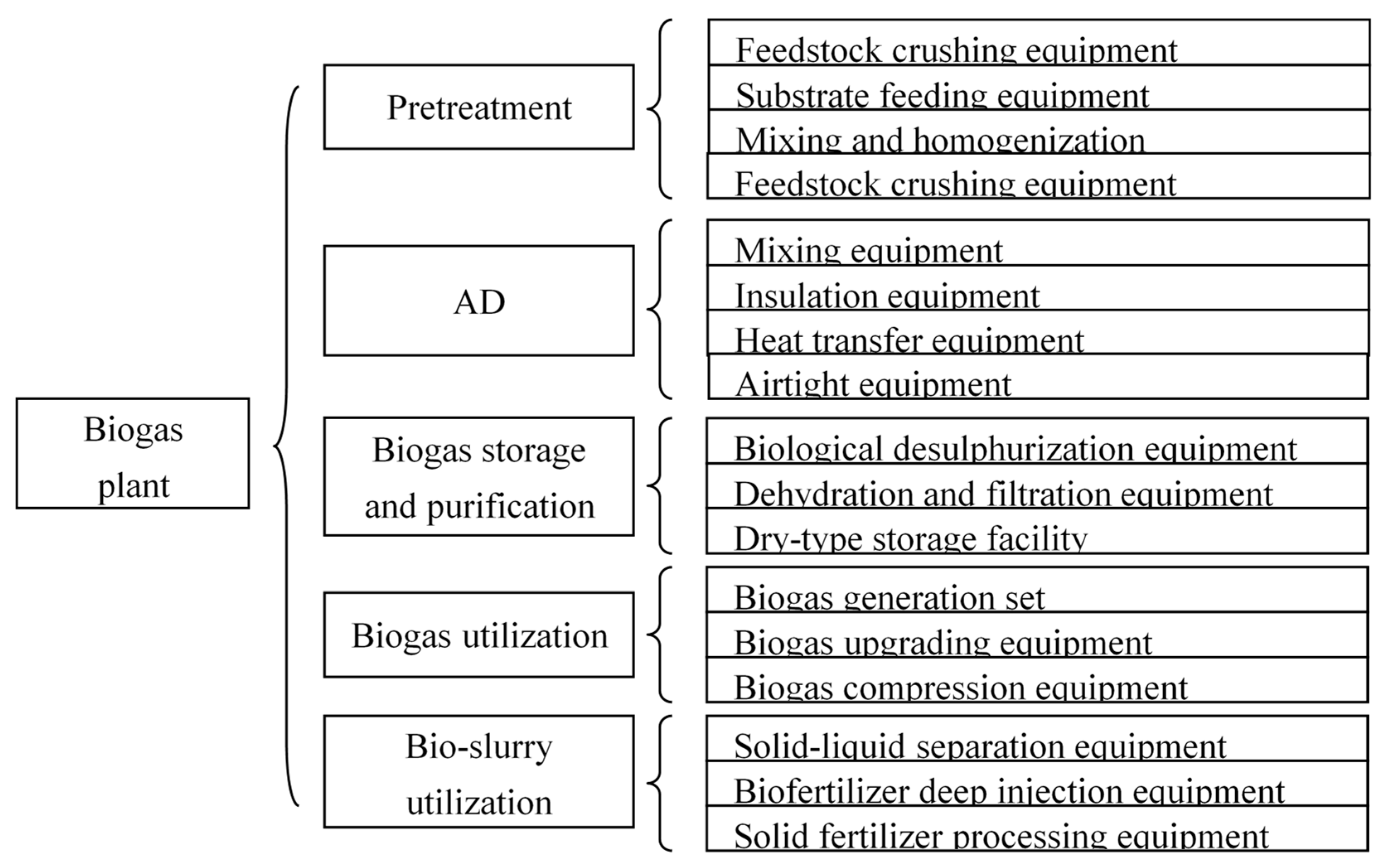

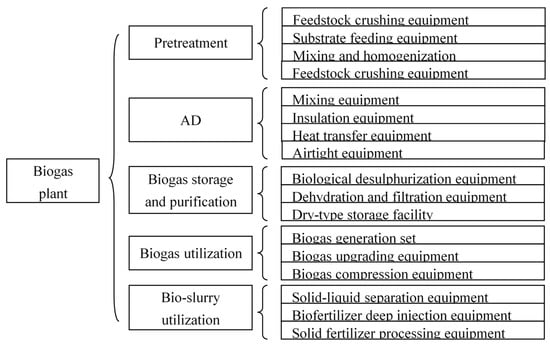

The industrialization level of China’s biogas industry remains low compared with that of Europe [55], even if the academic publications on biogas and AD technology by Chinese scholars are booming. Currently, the typical technical problems of biogas projects in China are low biogas production rate and utilization efficiency. Biogas projects commonly use mono-digestion technology, which uses only one kind of animal manure, and the volumetric gas production under mesophilic condition is only 0.3 m3/(m3d) to 1.0 m3/(m3d). By contrast, in Europe, with its advanced pre-treatment system and co-digestion technology, the volumetric gas production under mesophilic condition can reach 1.2 m3/(m3d) to 2.0 m3/(m3d). Equipment can guarantee normal MLBP operation. The use of advanced equipment can lead to high biogas production and utilization efficiency (Figure 2). For instance, the poor pre-treatment technology of feedstock leads directly to low gas production rates [56]. The key components should be feedstock crushing or chopping equipment for straw. The use of mixing devices is important to guarantee the homogenization of feedstock. Garage-type dry fermentation has been widely used in Europe, only few dry fermentation biogas plants can be found in China [57,58]. Moreover, biogas desulphurization efficiency is low in China, and solid chemical adsorption will be the mainstream technology. By contrast, H2S can be effectively removed by the injection of chemical agents or air into digestion, as well as microbial desulfurization bacteria. These technologies have been applied successfully in Europe.

Figure 2.

Key equipment used in MLBPs.

The cause of lagging innovation in equipment and technology is the malfunction between research and industry. Chinese researchers have made great contributions to biogas publication. However, the industrialization of laboratory work remains a big challenge in the country. Enterprise participation in R&D is far from sufficient. On the basis of the current subsidy model, a certain subsidy would be provided by the government, depending on the scale of a biogas plant with a ceiling of 50 million CNY according to up-to-date subsidy standards. The rest of the construction cost will be borne by the plant owners themselves. In order to invest less or nothing, the plant owners prefer to save construction costs, regardless of the long-term functional status. In such case, the bidding competition among biogas enterprises is based on low cost. As a result, R&D for biogas equipment and technology is ignored by professional biogas enterprises in China [52]. Many biogas enterprises in Europe have built special laboratories for small-scale pilot tests and have focused on R&D. Europe has thus set an example for China. In addition, monitoring the digestion process is a challenge [59,60]. Regular process monitoring and control are required to provide information about general process performance and safety, as well as to recognize and respond to process instabilities/disturbances [61,62,63]. Comprehensive and precise monitoring of biogas plant cannot be guaranteed in China because of the low-quality instrumentation used to detect technical and chemical parameters. Correspondingly, up-to-date measurement technologies have been employed in several biogas plants in Germany, such as spectral techniques [64].

3.3. Co-Digestion Plant

Co-digestion involves the treatment of several types of waste in a single treatment facility [65]. The benefit of co-digestion in AD is mainly attributed to increased biogas/methane yield and improved process stability. Co-digestion, or the simultaneous AD of two or more substrates, is a feasible option to overcome the drawbacks of mono-digestion and to improve the economic viability of biogas plants because of high biogas production. Co-digestion initially involves the mixing of substrates and favors positive interactions because of research perspectives, such as macro- and micro-nutrient equilibrium, moisture balance, and/or dilute inhibitory or toxic compounds. Studies focused on the co-digestion of organic wastes, as indicated by the increasing number of papers regarding co-digestion published in referred journals [66].

Animal manure is the most popular main substrate for co-digestion with high N concentration. In Europe, two main models can be chosen for the implementation of agriculture-based biogas plant: (i) centralized plants, which co-digest manure collected from several farms together with organic residues from industry and township, and (ii) on-farm plants, which co-digest manure with other farm waste and, increasingly, energy crops. Germany is the undisputed leader in the application of on-farm AD systems; more than 200 co-digestion plants are in operation utilizing organic waste in combination with animal manure or energy crops [67]. Sewage sludge ranks as the second main substrate of co-digestion. Co-digestion of sewage sludge and bio-waste is one of the most widely reported types of co-digestion in Europe.

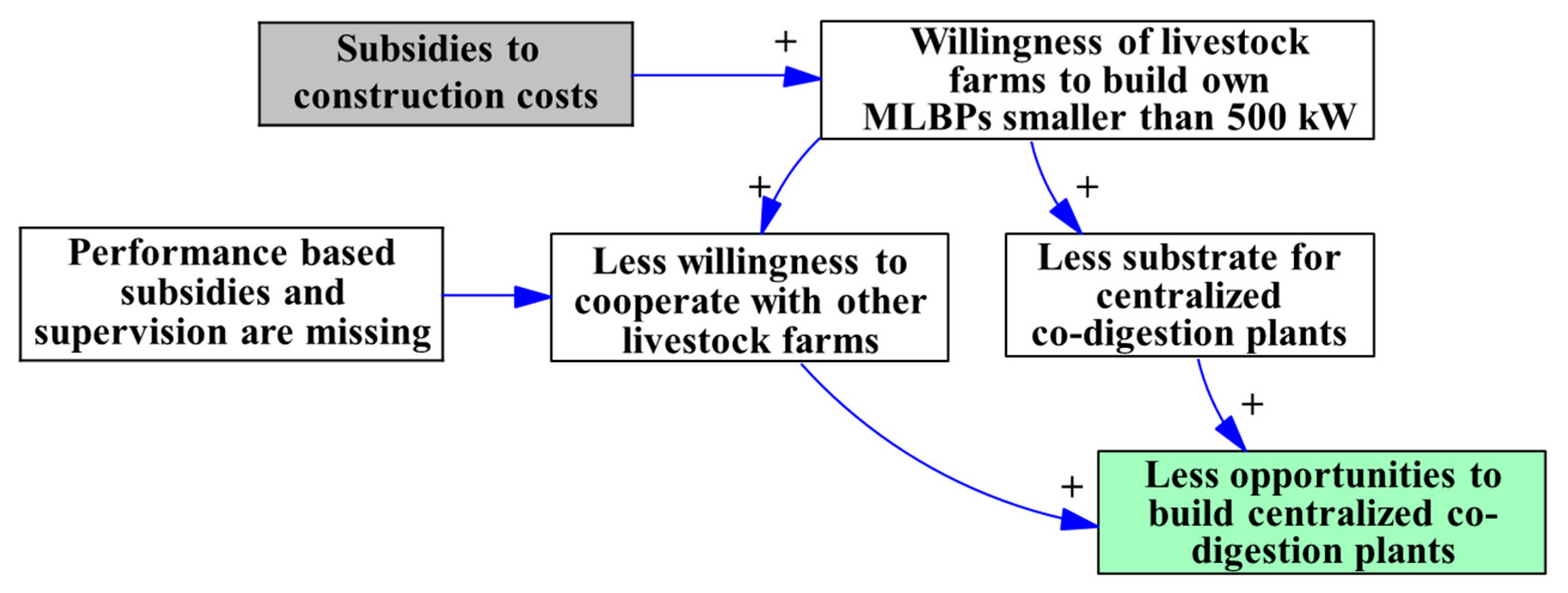

By comparison, very few biogas plants in China adopt co-digestion technology. Although numerous laboratory studies have been conducted to investigate co-digestion technology, the actual application of co-digestion in biogas engineering is rare. On the basis of the current subsidy model, Figure 3 shows that high subsidies correspond to numerous mono-substrate-based MLBPs and less opportunities to build centralized co-digestion plants [52]. Organic substrate for biogas plant is supervised by different departments. Coordination mechanism between agricultural and municipal departments is missing. Existing mono-digestion plants in China mainly use manure, straw stalk, and industrial wastewater. In China, agricultural residues are abundant, but most of these residues have not been applied efficiently to produce energy.

Figure 3.

Influence of construction subsidy on co-digestion plants. Note: Causal loop “+” shows that the process indicated by the high level of the arrow tail side will result in the process indicated by the high level of the arrowhead side, showing an “increasing” relationship.

Co-digestion provides great benefits for China. Table 6 and Table 7 [68] show the available agricultural waste potential, which could be used as co-digestion feedstock in the future. In China’s urbanization, the amount of household garbage and other organic wastes will increase significantly, such as food waste [69]. The sewage sludge production in cities reached 10.53 million tons (dry matter) in 2017 [70]. Co-digestion potential is huge, and the biogas plants should be encouraged and allowed to use and combine as many co-substrates as possible [71]. The key point lies in how to organize the feedstock availability. A combination of all related departments is required to optimize feedstock deployment to maximum energy output. In order to encourage building a centralized co-digestion plant, the special subsidy for feedstock should be introduced. A detailed category for different substrates could be built. If more types of substrate are fed into a biogas plant, the owner could acquire extra bonus besides feedstock subsidy.

Table 6.

Crop production and straw production potential (annual average between 2007 and 2011).

Table 7.

Livestock and poultry production and manure production potential (annual average between 2007 and 2011).

3.4. High Value-Added Utilization of Biogas and Digestate Management

In developing countries, biogas is normally used directly in cooking. Numerous MLBPs in China also use biogas in boilers or in power generation. The efficiency of this technology is less than that of high-value utilization after purification. In the direct burning of biogas, energy loss may exceed 40%; in the use of biogas in CHP units or upgrading of biogas to natural gas level, energy loss may be merely 20%. High value-added utilization of biogas is necessary in energy conservation [72]. Moreover, construction of new biomethane plants is profitable [73]. Biogas upgrading is not considered a new technology in Europe anymore. In Germany, approximately 196 biomethane feed-in plants were operating with an installed capacity of 115,400 Nm3/h in 2016. In Sweden, 64% of the produced biogas was upgraded and mainly used as transportation fuel in 2016. In Austria, approximately 1000 natural gas vehicles exist and approximately 172 compressed natural gas (CNG) filling stations are found nationwide. CNG cars have also become popular in Switzerland, the Netherlands, France, Denmark, Norway, Finland, and Ireland. Moreover, numerous biogas upgrading projects are at various planning stages. Hence, numerous European countries focus on the high value-added utilization of biogas, in which biogas is upgraded to biomethane. Statistics from IEA 2017 biogas upgrading plant indicates that water scrubbers dominate among upgrading technologies, followed by membranes, chemical scrubbers, pressure swing adsorption, organic physical scrubbers, and cryogenic upgrading [74]. One of the biogas sector’s ambitions is to form a European biomethane market that can stimulate the production, exchange, and use of biomethane.

In 2015, the Chinese central government also upgraded its biogas policy to promote BNG projects. With the permeation of advanced biogas upgrading technology and government support, 65 biogas demonstration projects are in operation and under construction. Nonetheless, China’s BNG industry still needs additional improvement. In addition, BNG standardization is only at the initial stage. The standard requirements for BNG grid injection or for using BNG as vehicle fuel have been developed in a number of countries such as France, Germany, Sweden, Switzerland, Austria, Netherland and Brazil [75,76]. China is expected to follow the pace of BNG standardization.

AD feedstock occasionally contains plant nutrients (macro- and micro-nutrients). Thus, the effluent or bio-slurry from digesters (also known as digestate) can be recycled and reused as bio-fertilizer, which is a substitute for mineral fertilizer. However, bio-slurry is problematic for Chinese MLBPs when land is limited. Bio-slurry could cause serious environmental pollution once discharged without any treatment. In Europe, N is the main nutrient considered, although all nutrients should be considered in fertilization. Digestate management with integrated solutions has received increasing attentions [77]. Digestate is produced throughout the year and should be stored until the growing season, which is the only appropriate time when this material could be applied as fertilizer [78]. In several countries, set periods for digestate storage are compulsory [79]. Intensive bio-slurry processing methods, such as application of liquid-to-solid fertilizers, should be developed when storage space is limited. The following utilization techniques of bio-slurry are promising: liquid fertilizer for planting in eco-farming, nutrient solution for soil-less cultivation, soil restoration agent, and solid organic compound fertilizer.

In the updated 2015 policy, digestate is taken into consideration in the beginning. Digestate from the project should be comprehensively evaluated to guarantee environmental load for digestate application. Sufficient farmland should be matched to biogas plants with a capacity of 0.5 mu (Chinese areas unit, 1 mu = 667 m2) for each daily biogas production capacity. For instance, a 10,000 m3/d biogas plant must be attached to a 5000 mu farmland. Agreements also need to be signed between plant owners and digestate users to make full use of digestate.

4. Experience for Developing Nations

Although China’s biogas industry has problems, several positive experiences could be used for reference, particularly by developing countries whose biogas industries are still in the initial stages.

4.1. Government and Policy Support

A biogas industry cannot be developed successfully without government and policy support in its initial stages [80]. Multi-level support is essential, given that numerous developing countries implement national biogas programs. Policies are mainly implemented by legal means. The Chinese government has enacted five main laws and regulations to promote its biogas industry, including Agricultural Law, Renewable Energy Law, Animal Husbandry Law, Energy Conservation Law, and the Act on the Development of Circular Economy. The Energy Law is currently under revision. These laws explicitly aim to support the biogas industry [81].

Economy-stimulating policies—which are known as subsidy—can be an effective means of developing the biogas industry in China. More than 42 billion CNY was subsidized by the central government between 2000 and 2017. During the biogas booming decade (2003 to 2012), approximately 91.8 billion CNY was invested into the biogas industry, 31.5 and 13.9 billion CNY of which were from the central and local governments, respectively; farmers provided the remaining 46.4 billion CNY. In 2015, the deployment of the biogas industry entered a new era. The central government stopped giving subsidy to household digesters. (However, subsidy for household digesters from local governments remains, depending on local biogas deployment strategies.) Instead, additional subsidy shifted to large-scale biogas plant and BNG demonstration projects. The subsidy standards of different types of biogas projects and service stations are presented in Table 8.

Table 8.

Subsidy standard of biogas industry from central government in China.

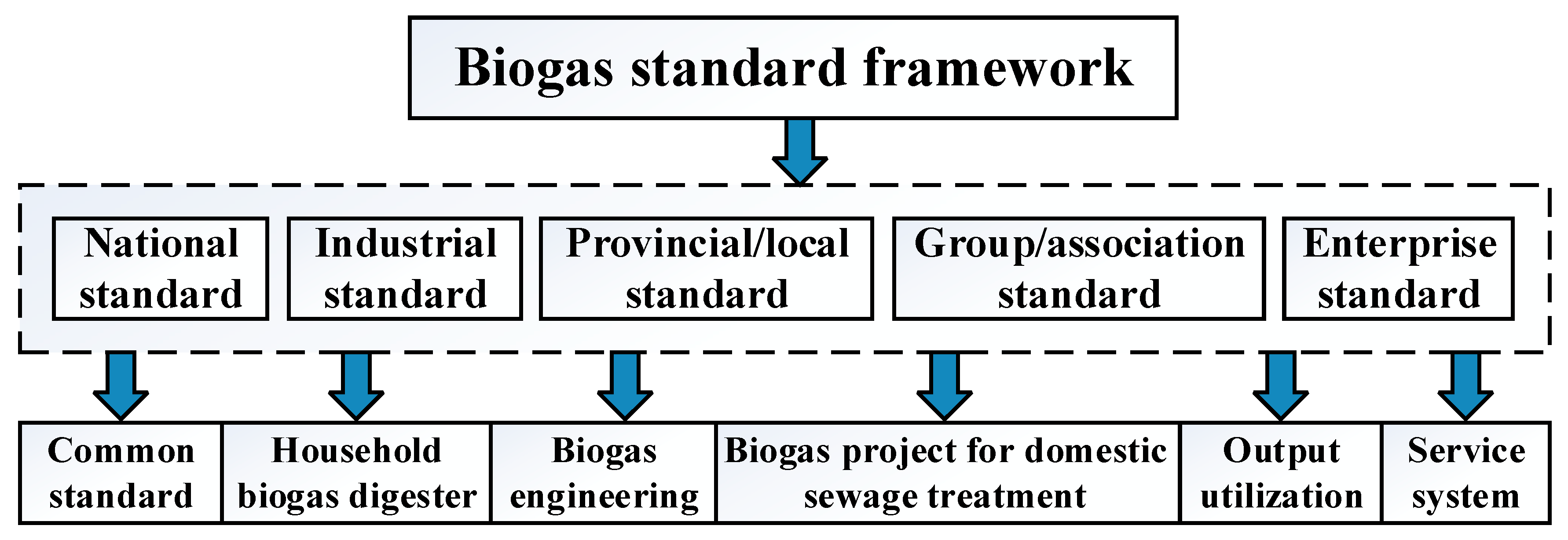

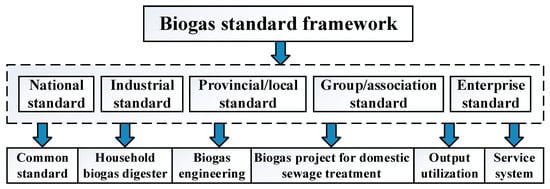

4.2. Standard of Biogas Industry

China has established a world-renowned standard system for its biogas industry. Since the first biogas standard Domestic Biogas Stove (GB/T 3606-83) was implemented on April 7, 1983, more than 70 biogas standards have been issued. These standards stipulate the design, construction, operation, and facility production of biogas plants and provide a strong guarantee to promote biogas industrialization. These standards cover different aspects of biogas industry, including digester design drawings, construction specification and household biogas checklist, biogas stove and accessory products, biogas project combined with agricultural production, scale classification for biogas engineering, process design, quality evaluation, construction and acceptance, safety operation, biogas power generator, biogas slurry application, and prefabricated digester. In 2011, National Biogas Standardization Technical Committee (SAC/TC 515) was established by Standardization Administration of China (SAC). Biogas Technical Committee of International Standard Organization (ISO/TC 255) was also established to provide liberalization and facilitation for international trade, develop international cooperation, curb discriminatory technical requirements, and reduce the technical barriers from international trade [82]. China successfully applied for the chairperson and secretariat positions of ISO/TC 255. Figure 4 presents the standard framework that has been promulgated and implemented in the country [83].

Figure 4.

Biogas standard framework in China.

In numerous developing countries, standard systems are incomplete or even non-existent. Several countries adopted biogas standards from China, such as Vietnam and Bangladesh, and gradually set up corresponding standard systems in accordance with local conditions. For instance, the dissemination model of a digester structure greatly varies in different nations. Even if digester design have been standardized in numerous countries, a comprehensive standard problem should be developed as well. Biogas appliances, pipe connection materials and fittings, O and M of biogas plant, digestate application, and other socioeconomic aspects should also be standardized, to realize the full lifecycle control and management.

4.3. Application of Prefabricated Digesters

Since the 1980s, China has developed numerous kinds of commercialized or half-commercialized domestic biogas digesters to overcome the weaknesses of traditional brick and concrete household digesters. Contrary to onsite-constructed digesters (OCD), a prefabricated biogas digester (PBD) is produced offsite by using materials with special physical properties. In China, prefabricated digesters are often called “commercialized digesters”; these digesters are also called the “three new digesters,” as new production materials, processes, and techniques are usually adopted [84]. Table 9 presents a comparison of PBDs and OCDs.

Table 9.

Comparison between PBDs and OCDs.

The most common PBDs in China are plastic soft digesters (PSDs) and composite material digesters (CMDs). PSDs are also known as bag digesters (BDs) worldwide and include the plastic tubular digester used in Latin America [85,86]. BDs are the most popular PBDs; they have been widely applied successfully because of their low cost and easy implementation and handling. BD digesters have also been proved to be an appropriate and environmentally friendly technology at high altitude [87]. A BD consists of a long cylinder made of polyvinyl chloride, polyethylene, or red mud plastic. Meanwhile, CMDs originated from China. These new digesters offer many advantages, such as easy mobility, long-term durability, and high productivity. Fiberglass-reinforced plastic (FRP) digesters are a common representative of CMDs. Raw materials of FRP digesters comprise unsaturated polyester, gel-coated resin, chopped strand mat, and high-quality glass fiber cloth. The inner surface of the FRP digester is painted with a gel-coated resin to ensure tightness. CMDs are relatively new in countries such as Bangladesh, Cambodia, Nepal, Vietnam, and particularly African countries. Most CMD models are introduced and modified locally [88].

Since 2000, PBDs have entered the real commercial stage, and several manufacturers have emerged in the industrial scene. At present, several industrial standards for PBDs are in place, such as NY/T 1699-2009 Technical Specifications for Household Anaerobic Digesters of Fiberglass Reinforced Plastic, NY/T 2910-2016 Rigid plastics household biogas digester, QB/T 5260-2018 Reprocessed plastic assembled biogas digester.

Other types of PBDs are also applied in China, among which portable and onsite-assembled digesters are promising. These digesters are dismountable units mainly used to treat green and kitchen wastes. A plug-and-play method of applying AD technology is provided by this type of digester. Besides, China has also applied CMDs in prefabricated wastewater treatment systems [89].

Several countries implement national biogas programs and also investigate PBDs, including Nepal, Bangladesh, Vietnam, and Myanmar. Initial models are mostly imported from China because factory production of PBDs is non-existent in other developing countries; the quality of locally produced PBDs is relatively low. International trade and cooperation could establish new markets for the PBD industry in China and biogas industry in other countries. China exports large numbers of PBDs, thereby making these products accessible to local users. Therefore, additional product marketing activities from local suppliers and distributors are necessary to increase the number of people who are aware of the product and the number of potential customers. The PBD industry requires substantial effort to become highly prominent in developing countries. An increased demand for PBDs in the future is expected in other developing countries.

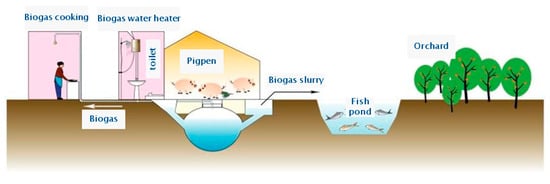

4.4. Biogas-Linked Agricultural Models

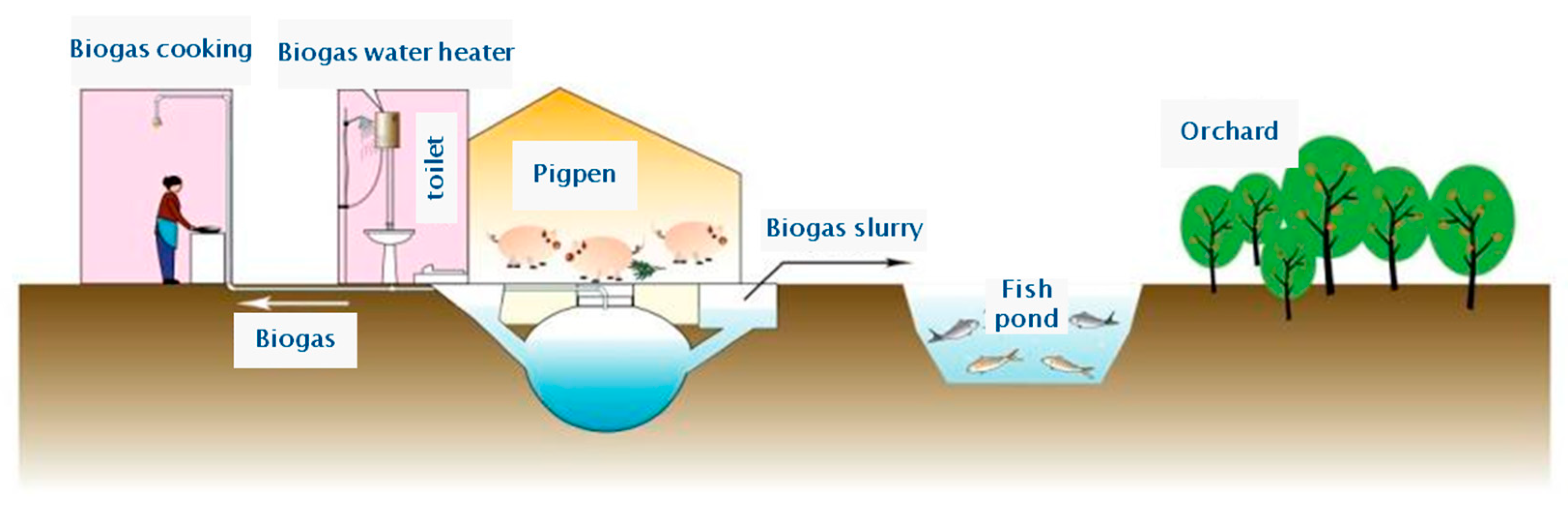

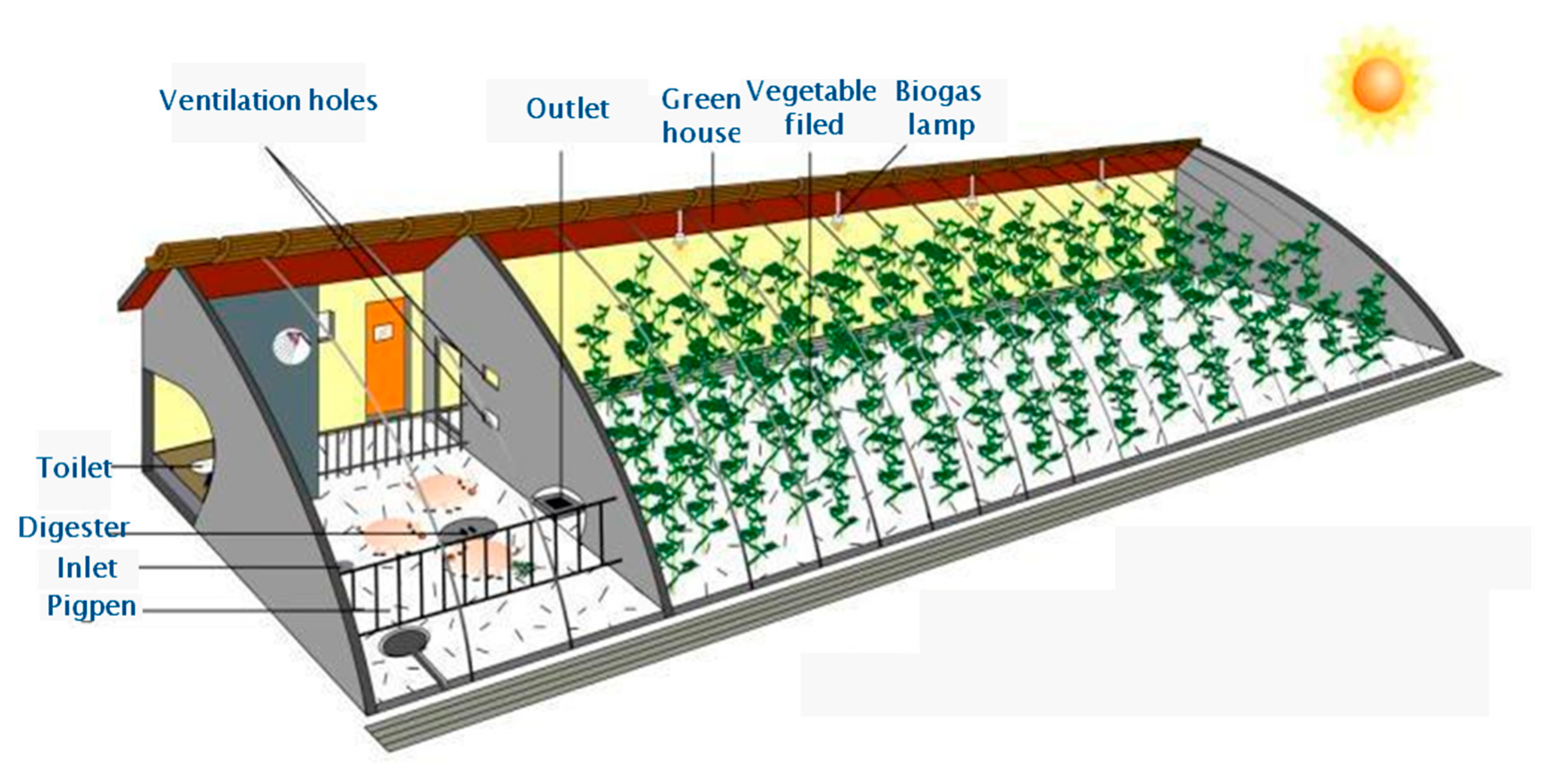

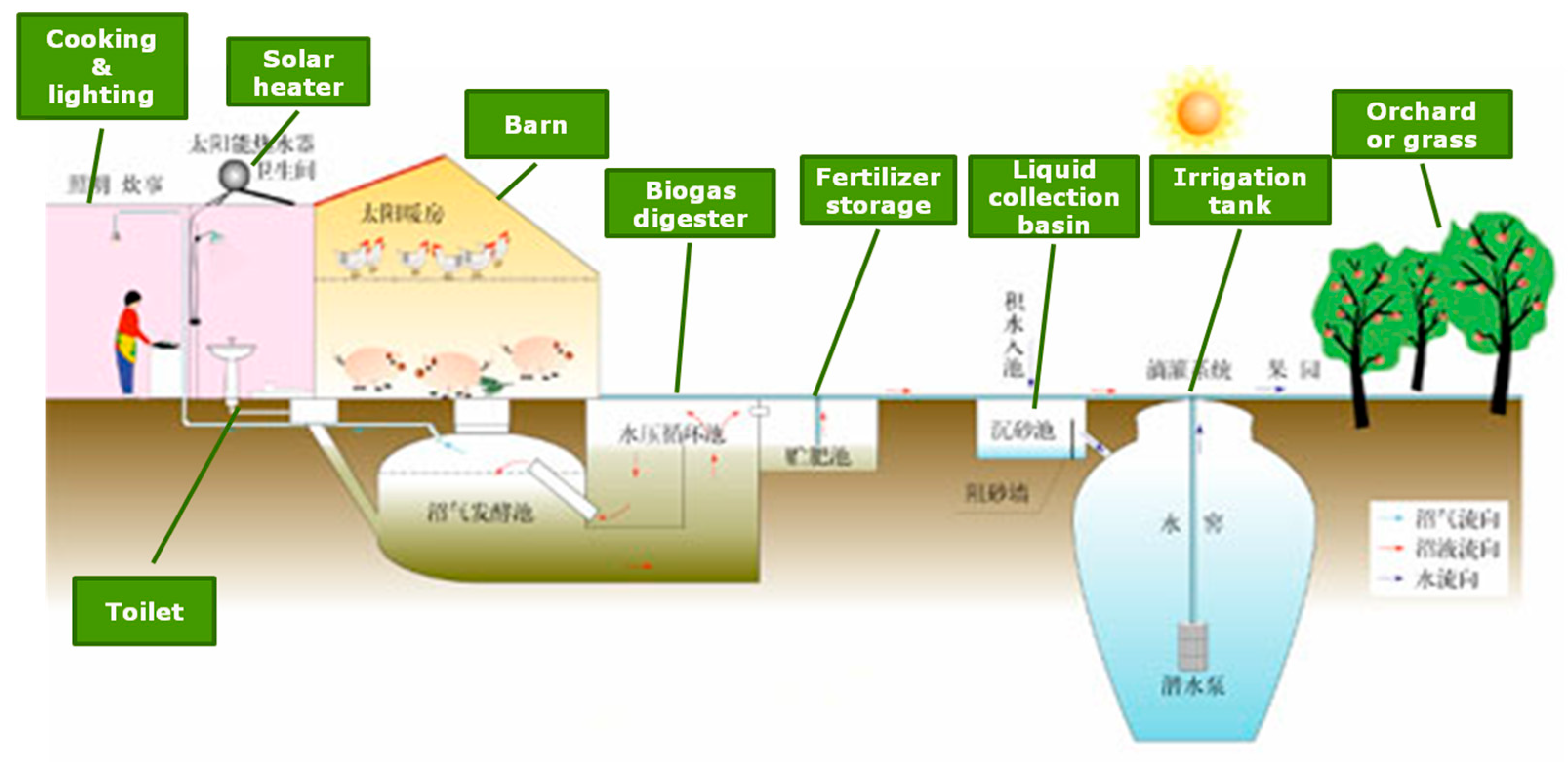

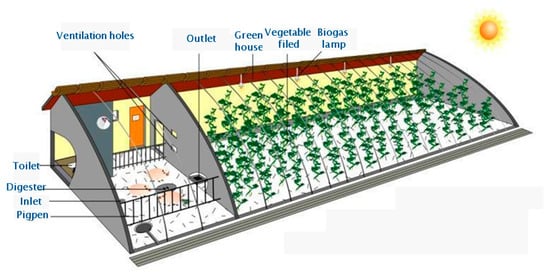

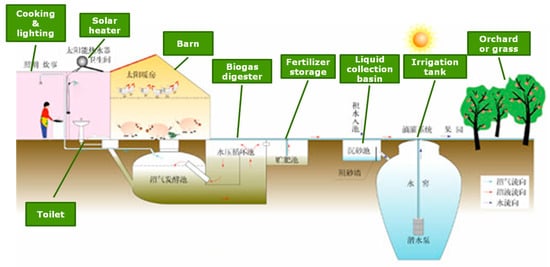

Biogas construction projects have been implemented all over China since the “Rural Ecological Enrichment Project” was proposed by the MOA. A good model combining biogas digester with agricultural production has been developed. Several models have also been established, including 3-in-1 [36], 4-in-1 [37,90], and 5-in-1 models [91] (Figure 5,Figure 6, and Figure 7). An overview of these models is shown in Table 10. These models would be copied and applied in other countries as examples. For instance, Mongolia shares a similar climate with Northeast China, numerous African countries with Northwest China, and Southeast Asian countries with South China. These models would be valuable and reproducible technologies adopted from China.

Figure 5.

Biogas-linked 3-in-1 model.

Figure 6.

Biogas-linked 4-in-1 model.

Figure 7.

Biogas-linked 5-in-1 model.

Table 10.

Scenarios of three biogas-linked agricultural models.

5. Conclusions and Outlook

Due to the production of methane rich energy and recycling of nutrients, biogas technology through AD is one of the most promising technologies for management of organic waste. China’s biogas industry was reconsidered and re-appraised. Unlike Europe, China currently uses underdeveloped equipment and technology. Furthermore, the subsidy system is inflexible, co-digestion application is in its initial stages, biogas upgrading technology is immature, and planning and management of digestate is insufficient. Moreover, subsidy should be based on products (i.e., output-oriented) instead of construction costs. Nevertheless, China’s biogas industry shows several positive features that can be considered by other developing countries. These positive features include relatively complete laws, policies and subsidy system, world-renowned standard system, well-developed prefabricated biogas industry, and efficient biogas-linked agricultural models.

Whether it is in China or in other developing countries, the future of the biogas industry is projected to be marketized. An integrated whole industry chain should be explored, including collection and storage of feedstocks, O and M of plant, and sale and utilization of end products. A number of demonstration projects should be built to innovate project construction and operation mechanism. On one hand, the specialized enterprises, rather than the government, should be treated as the main bodies of the industry chain. They can invest, operation or sell the project in accordance with the market mechanism. On the other hand, the government, which plays an assistant role, could provide output subsidies to project owners, according to production/sale capacity of biogas/biomethane, utilization capacity of digestate or processed capacity of organic fertilizer from digestate. Last but not least, China is a big country with quite different situations due to the large latitude range and the complex topography. Some factors affecting the deployment of a biogas project include the availability of feedstocks, the stability of local policy, the willingness to use biogas/biomethane and bio-fertilizer, the participation of stakeholders, etc. Regional differentiation had been taken into consideration when the government developed the subsidy system before 2015. Nevertheless, the upgrading policy from the central government in 2015 only subsidized the large-scale biogas plants and BNG projects without considering household digesters and small/medium-scale biogas plants anymore. Due to regional differentiation, some poor areas still could develop household digester or distributed small/medium-scale biogas plants for local energy supply, even if the percentage is smaller. In such cases, local government should take over the critical role and continue to support them.

The innovation in biogas equipment and technology is lagging as a result of the malfunction between research and industry. Actually, many technologies and equipment suppliers from developed countries such as Germany, Austria, Sweden, France, Italy, etc., can be found in China. Proven technologies, such as garage-type dry fermentation and plug-flow dry fermentation, are feasible and promising especially for municipal solid organic wastes and agricultural straw. However, further research and technological improvements are required to improve the flexibility, adaptability, and efficiency of a dry fermentation biogas plant. China should R&D biogas equipment and technology with self-relied intellectual property, rather than only copy from other countries.

The function of the biogas plant should be reconsidered. Before, the construction of a biogas plant aimed to alleviate energy shortage and agricultural pollution. At present, under the background of the circular economy, biogas should be integrated into energy supply-side reform, modern agriculture, resource utilization, and environmental protection. Plenty of biogas plants were abandoned as a result of technical, institutional and socio-cultural barriers. Actually, we do not need to build more biogas plants if the abandoned plants can be revived. If agricultural residues and animal manure are not sufficient, is alternative substrate available, for instance, kitchen waste or human waste? Doubtlessly, the revival of abandoned biogas plants could save resources and be beneficial to sound development of the Chinese biogas industry, towards building a conservation-minded society

Author Contributions

S.C. and L.-P.W. constructed the concept and structure, L.Z. wrote the original draft, J.C. and M.Z. collected data and performed data analysis, H.-P.M. and Z.L. reviewed and edited the draft. All authors have read and agreed to the published version of the manuscript.

Acknowledgments

This research work was supported and funded by International Scientific and Technological Cooperation and Exchange Project (2016YFE0115600), Beijing Science and Technology Plan (Z181100002418016), NTUT-USTB Joint Research Program under Grant No. TW201704 and NTUT-USTB-106-06. The authors would like to take this opportunity to express our sincere appreciation for the support of the National Environment and Energy International Science and Technology Cooperation Base.

Conflicts of Interest

The authors declare no conflict of interest.

References

- UNEP; ISWA. Global Waste Management Outlook; United Nations Environment Programme and International Solid Waste Association: Nairobi, Kenya; Vienna, Austria, 2015. [Google Scholar]

- WBA. The Contribution of Anaerobic Digestion and Biogas towards Achieving the UN Sustainable Development Goals; World Biogas Association: London, UK, 2016. [Google Scholar]

- Zhang, L.; Loh, K.-C.; Zhang, J. Enhanced biogas production from anaerobic digestion of solid organic wastes: Current status and prospects. Bioresour. Technol. Rep. 2019, 5, 280–296. [Google Scholar] [CrossRef]

- Lin, L.; Xu, F.; Ge, X.; Li, Y. Improving the sustainability of organic waste management practices in the food-energy-water nexus: A comparative review of anaerobic digestion and composting. Renew. Sustain. Energy Rev. 2018, 89, 151–167. [Google Scholar] [CrossRef]

- Angelidaki, I.; Treu, L.; Tsapekos, P.; Luo, G.; Campanaro, S.; Wenzel, H.; Kougias, P.G. Biogas upgrading and utilization: Current status and perspectives. Biotechnol. Adv. 2018, 36, 452–466. [Google Scholar] [CrossRef] [PubMed]

- Scarlat, N.; Dallemand, J.-F.; Fahl, F. Biogas: Developments and perspectives in Europe. Renew. Energy 2018, 129, 457–472. [Google Scholar] [CrossRef]

- Cheng, S.; Li, Z.; Mang, H.-P.; Neupane, K.; Wauthelet, M.; Huba, E.-M. Application of fault tree approach for technical assessment of small-sized biogas systems in Nepal. Appl. Energy 2014, 113, 1372–1381. [Google Scholar] [CrossRef]

- Ortiz, W.; Terrapon-Pfaff, J.; Dienst, C. Understanding the diffusion of domestic biogas technologies. Systematic conceptualisation of existing evidence from developing and emerging countries. Renew. Sustain. Energy Rev. 2017, 74, 1287–1299. [Google Scholar] [CrossRef]

- Kemausuor, F.; Adaramola, M.; Morken, J. A Review of Commercial Biogas Systems and Lessons for Africa. Energies 2018, 11, 2984. [Google Scholar] [CrossRef]

- Ghimire, P.C. SNV supported domestic biogas programmes in Asia and Africa. Renew. Energy 2013, 49, 90–94. [Google Scholar] [CrossRef]

- EBA. EBA Statistical Report 2018; European Biogas Association: Brussels, Belgium, 2019. [Google Scholar]

- WBA. Global Potential of Biogas; World Biogas Association: London, UK, 2019. [Google Scholar]

- Gao, M.; Wang, D.; Wang, Y.; Wang, X.; Feng, Y. Opportunities and Challenges for Biogas Development: A Review in 2013–2018. Curr. Pollut. Rep. 2019, 5, 25–35. [Google Scholar] [CrossRef]

- Mutungwazi, A.; Mukumba, P.; Makaka, G. Biogas digester types installed in South Africa: A review. Renew. Sustain. Energy Rev. 2018, 81, 172–180. [Google Scholar] [CrossRef]

- Kamp, L.M.; Bermúdez Forn, E. Ethiopia׳s emerging domestic biogas sector: Current status, bottlenecks and drivers. Renew. Sustain. Energy Rev. 2016, 60, 475–488. [Google Scholar] [CrossRef]

- Rupf, G.V.; Bahri, P.A.; de Boer, K.; McHenry, M.P. Barriers and opportunities of biogas dissemination in Sub-Saharan Africa and lessons learned from Rwanda, Tanzania, China, India, and Nepal. Renew. Sustain. Energy Rev. 2015, 52, 468–476. [Google Scholar] [CrossRef]

- Edwards, J.; Othman, M.; Burn, S. A review of policy drivers and barriers for the use of anaerobic digestion in Europe, the United States and Australia. Renew. Sustain. Energy Rev. 2015, 52, 815–828. [Google Scholar] [CrossRef]

- Diouf, B.; Miezan, E. The Biogas Initiative in Developing Countries, from Technical Potential to Failure: The Case Study of Senegal. Renew. Sustain. Energy Rev. 2019, 101, 248–254. [Google Scholar] [CrossRef]

- Roopnarain, A.; Adeleke, R. Current status, hurdles and future prospects of biogas digestion technology in Africa. Renew. Sustain. Energy Rev. 2017, 67, 1162–1179. [Google Scholar] [CrossRef]

- Uhunamure, S.E.; Nethengwe, N.S.; Tinarwo, D. Correlating the factors influencing household decisions on adoption and utilisation of biogas technology in South Africa. Renew. Sustain. Energy Rev. 2019, 107, 264–273. [Google Scholar] [CrossRef]

- Nevzorova, T.; Kutcherov, V. Barriers to the wider implementation of biogas as a source of energy: A state-of-the-art review. Energy Strategy Rev. 2019, 26, 100414. [Google Scholar] [CrossRef]

- Song, Z.; Zhang, C.; Yang, G.; Feng, Y.; Ren, G.; Han, X. Comparison of biogas development from households and medium and large-scale biogas plants in rural China. Renew. Sustain. Energy Rev. 2014, 33, 204–213. [Google Scholar] [CrossRef]

- Li, Z.; Yu, M.; Fan, X. Current status of biogas projects in Germany. Renew. Energy Resour. 2010, 28, 141–144, (In Chinese with English abstract). [Google Scholar]

- Dhussa, A. Domestic Biodigester Development in India. In Proceedings of the Africa Biogas and Clean Cooking Conference, Addis Ababa, Ethiopia, 5–7 April 2016. [Google Scholar]

- Araldsen, T.P.R.L.J. Biogas in Nepal: Limitations for the Expansion of Community Plants; Norwegian University of Life Sciences: Oslo, Norway, 2016. [Google Scholar]

- Khan, E.U.; Martin, A.R. Review of biogas digester technology in rural Bangladesh. Renew. Sustain. Energy Rev. 2016, 62, 247–259. [Google Scholar] [CrossRef]

- Hyman, J.; Bailis, R. Assessment of the Cambodian National Biodigester Program. Energy Sustain. Dev. 2018, 46, 11–22. [Google Scholar] [CrossRef] [PubMed]

- SNV. Domestic Biogas Newsletter (Issue 8); Netherlands Development Organization: Hague, The Netherlands, 2013. [Google Scholar]

- Hivos. Biogas Indonesia. Available online: https://www.hivos.org/program/biogas-indonesia/ (accessed on 23 April 2019).

- ABBP. Africa Biogas Partnership Programme. Available online: https://www.africabiogas.org (accessed on 20 April 2019).

- Gao, Y.; Kuang, Z.; Pan, M.; Huang, X.; Che, N.W.; Ye, M.; Xu, Z.; Zhang, M.; Xiao, G. Development progress and current situation analysis of the rural household biogas in China. Guangdong Agric. Sci. 2006, 11, 22–27, (In Chinese with English abstract). [Google Scholar]

- Chen, L.; Zhao, L.; Ren, C.; Wang, F. The progress and prospects of rural biogas production in China. Energy Policy 2012, 51, 58–63. [Google Scholar] [CrossRef]

- MOA; NDRC. 2015 Working Plan of Upgrading and Transforming Rural Biogas Project; National Development and Reform Commission (NDRC) and Ministry of Agriculture (MOA): Beijing, China, 2015. [Google Scholar]

- Li, J.; Li, B.; Xu, W. Analysis of the Policy Impact on China’s Biogas Industry Development. China Biogas 2018, 36, 3–10, (In Chinese with English abstract). [Google Scholar]

- Guo, S. Early Development History of Chinese Biogas; Science and Technology Literature Press: Chongqing, China, 1988. [Google Scholar]

- Chen, R. Livestock-biogas-fruit systems in South China. Ecol. Eng. 1997, 8, 19–29. [Google Scholar] [CrossRef]

- Cheng, S.; Li, Z.; Shih, J.; Du, X.; Xing, J. A field study on acceptability of 4-in-1 biogas systems in Liaoning Province, China. Energy Procedia 2011, 5, 1382–1387. [Google Scholar] [CrossRef]

- CAREI. Encyclopedia of China Biogas Industry; China Association of Rural Energy Industry: Beijing, China, 2013. (In Chinese) [Google Scholar]

- NDRC; MOA. National Rural Biogas Development 13th Five-Year Plan; National Development and Reform Commission (NDRC) and Ministry of Agriculture (MOA): Beijing, China, 2017. [Google Scholar]

- National Bureau of Statistics. China Rural Statistical Yearbook; China Statistics Press: Beijing, China, 2018.

- Bochmann, G. Country Report Austria; IEA Bioenergy task 37: Seoul, Korea, 2019. [Google Scholar]

- Seadi, T.A.; Lorenzen, J. Country Report Denmark; IEA Bioenergy Task 37: Paris, France, 2019. [Google Scholar]

- Dahlgren, S.; Kanda, W.; Anderberg, S. Drivers for and barriers to biogas use in manufacturing, road transport and shipping: A demand-side perspective. Biofuels UK 2019. [Google Scholar] [CrossRef]

- Balussou, D.; McKenna, R.; Möst, D.; Fichtner, W. A model-based analysis of the future capacity expansion for German biogas plants under different legal frameworks. Renew. Sustain. Energy Rev. 2018, 96, 119–131. [Google Scholar] [CrossRef]

- IEA. Biogas Country Report—Germany; IEA Bioenergy: Paris, France, 2017. [Google Scholar]

- BMWI. Renewable Energy Sources Act—RES Act 2014; German Federal Ministry for Economic Affairs and Energy (BMWI): Berlin, Germany, 2014. [Google Scholar]

- BMWI. Renewable Energy Sources Act (EEG 2017); German Federal Ministry for Economic Affairs and Energy (BMWI): Berlin, Germany, 2017. [Google Scholar]

- Qiao, W.; Li, B.; Dong, R.; Sun, L.; Li, J. Biogas Industry Development and Renewable Energy Policy in Germany. China Biogas 2016, 34, 74–80, (In Chinese with English abstract). [Google Scholar]

- Britz, W.; Delzeit, R. The impact of German biogas production on European and global agricultural markets, land use and the environment. Energy Policy 2013, 62, 1268–1275. [Google Scholar] [CrossRef]

- NDRC. Trial Method for Administration of Price and Cost-Sharing for Renewable Energy Power Generation; National Development and Reform Commission: Beijing, China, 2006. [Google Scholar]

- NDRC. Notice on Improve Agriculture and Forestry Biomass Power Generation Pricing Policies; National Development and Reform Commission: Beijing, China, 2010. [Google Scholar]

- Lu, H. Technical economical analysis of agricultural demo case biogas projects in China. In Proceedings of the GIZ/FECC Training VII on ‘Performance and Support Policy of Biogas Energy generating Biogas Plants’for Biogas Plant Designers and Decision Makers, Nanjing, China, 16–18 May 2012. [Google Scholar]

- Wang, Q.; Dogot, T.; Wu, G.; Huang, X.; Yin, C. Residents’ Willingness for Centralized Biogas Production in Hebei and Shandong Provinces. Sustainability 2019, 11, 7175. [Google Scholar] [CrossRef]

- Tsydenova, N.; Vázquez Morillas, A.; Martínez Hernández, Á.; Rodríguez Soria, D.; Wilches, C.; Pehlken, A. Feasibility and Barriers for Anaerobic Digestion in Mexico City. Sustainability 2019, 11, 4114. [Google Scholar] [CrossRef]

- Grando, R.L.; de Souza Antune, A.M.; da Fonseca, F.V.; Sanchez, A.; Barrena, R.; Font, X. Technology overview of biogas production in anaerobic digestion plants: A European evaluation of research and development. Renew. Sustain. Energy Rev. 2017, 80, 44–53. [Google Scholar] [CrossRef]

- Yu, Q.; Liu, R.; Li, K.; Ma, R. A review of crop straw pretreatment methods for biogas production by anaerobic digestion in China. Renew. Sustain. Energy Rev. 2019, 107, 51–58. [Google Scholar] [CrossRef]

- Qian, M.Y.; Li, R.H.; Li, J.; Wedwitschka, H.; Nelles, M.; Stinner, W.; Zhou, H.J. Industrial scale garage-type dry fermentation of municipal solid waste to biogas. Bioresour. Technol. 2016, 217, 82–89. [Google Scholar] [CrossRef]

- Fu, Y.; Luo, T.; Mei, Z.; Li, J.; Qiu, K.; Ge, Y. Dry Anaerobic Digestion Technologies for Agricultural Straw and Acceptability in China. Sustainability 2018, 10, 4588. [Google Scholar] [CrossRef]

- Jiang, C.; Qi, R.; Hao, L.; McIlroy, S.J.; Nielsen, P.H. Monitoring foaming potential in anaerobic digesters. Waste Manag. 2018, 75, 280–288. [Google Scholar] [CrossRef]

- Sun, H.; Guo, J.; Wu, S.; Liu, F.; Dong, R. Development and validation of a simplified titration method for monitoring volatile fatty acids in anaerobic digestion. Waste Manag. 2017, 67, 43–50. [Google Scholar] [CrossRef]

- Jimenez, J.; Latrille, E.; Harmand, J.; Robles, A.; Ferrer, J.; Gaida, D.; Wolf, C.; Mairet, F.; Bernard, O.; Alcaraz-Gonzalez, V.; et al. Instrumentation and control of anaerobic digestion processes: A review and some research challenges. Rev. Environ. Sci. Bio/Technol. 2015, 14, 615–648. [Google Scholar] [CrossRef]

- Drosg, B. Process Monitoring in Biogas Plants; IEA Bioenergy Task 37: Paris, France, 2013. [Google Scholar]

- Casson Moreno, V.; Guglielmi, D.; Cozzani, V. Identification of critical safety barriers in biogas facilities. Reliab. Eng. Syst. Saf. 2018, 169, 81–94. [Google Scholar] [CrossRef]

- Theuerl, S.; Herrmann, C.; Heiermann, M.; Grundmann, P.; Landwehr, N.; Kreidenweis, U.; Prochnow, A. The Future Agricultural Biogas Plant in Germany: A Vision. Energies 2019, 12, 396. [Google Scholar] [CrossRef]

- Hagos, K.; Zong, J.P.; Li, D.X.; Liu, C.; Lu, X.H. Anaerobic co-digestion process for biogas production: Progress, challenges and perspectives. Renew. Sustain. Energy Rev. 2017, 76, 1485–1496. [Google Scholar] [CrossRef]

- Tyagi, V.K.; Fdez-Güelfo, L.A.; Zhou, Y.; Álvarez-Gallego, C.J.; Garcia, L.I.R.; Ng, W.J. Anaerobic co-digestion of organic fraction of municipal solid waste (OFMSW): Progress and challenges. Renew. Sustain. Energy Rev. 2018, 93, 380–399. [Google Scholar] [CrossRef]

- Daniel-Gromke, J.; Rensberg, N.; Denysenko, V.; Stinner, W.; Schmalfuß, T.; Scheftelowitz, M.; Nelles, M.; Liebetrau, J. Current Developments in Production and Utilization of Biogas and Biomethane in Germany. Chem. Ing. Tech. 2018, 90, 17–35. [Google Scholar] [CrossRef]

- Chang, I.S.; Wu, J.; Zhou, C.; Shi, M.; Yang, Y. A time-geographical approach to biogas potential analysis of China. Renew. Sustain. Energy Rev. 2014, 37, 318–333. [Google Scholar] [CrossRef]

- Cheng, H.; Hu, Y. Municipal solid waste (MSW) as a renewable source of energy: Current and future practices in China. Bioresour. Technol. 2010, 101, 3816–3824. [Google Scholar] [CrossRef]

- Ministry of Housing and Urban-Rural Construction. China Urban-Rural Construction Statistical Yearbook 2017; China Statistics Press: Beijing, China, 2018.

- Skovsgaard, L.; Jacobsen, H.K. Economies of scale in biogas production and the significance of flexible regulation. Energy Policy 2017, 101, 77–89. [Google Scholar] [CrossRef]

- Bekkering, J.; Broekhuis, A.A.; van Gemert, W.J.T. Optimisation of a green gas supply chain—A review. Bioresour. Technol. 2010, 101, 450–456. [Google Scholar] [CrossRef]

- Ferella, F.; Cucchiella, F.; D’Adamo, I.; Gallucci, K. A techno-economic assessment of biogas upgrading in a developed market. J. Clean. Prod. 2019, 210, 945–957. [Google Scholar] [CrossRef]

- IEA. Upgrading Plant List; International Energy Agency: Paris, France, 2018. [Google Scholar]

- Persson, M.; Jönsson, O.; Wellinger, A. Biogas Upgrading to Vehicle Fuel Standards and Grid Injection; International Energy Agency: Paris, France, 2006. [Google Scholar]

- Leme, R.M.; Seabra, J.E.A. Technical-economic assessment of different biogas upgrading routes from vinasse anaerobic digestion in the Brazilian bioethanol industry. Energy 2017, 119, 754–766. [Google Scholar] [CrossRef]

- Peng, W.; Lü, F.; Hao, L.; Zhang, H.; Shao, L.; He, P. Digestate management for high-solid anaerobic digestion of organic wastes: A review. Bioresour. Technol. 2019, 122485. [Google Scholar] [CrossRef] [PubMed]

- Ahlgren, S.; Bernesson, S.; Nordberg, Å.; Hansson, P.-A. Nitrogen fertiliser production based on biogas – Energy input, environmental impact and land use. Bioresour. Technol. 2010, 101, 7181–7184. [Google Scholar] [CrossRef] [PubMed]

- Stuermer, B.; Pfundtner, E.; Kirchmeyr, F.; Uschnig, S. Legal requirements for digestate as fertilizer in Austria and the European Union compared to actual technical parameters. J. Environ. Manag. 2020, 253, 109756. [Google Scholar] [CrossRef] [PubMed]

- Xue, S.; Song, J.; Wang, X.; Shang, Z.; Sheng, C.; Li, C.; Zhu, Y.; Liu, J. A systematic comparison of biogas development and related policies between China and Europe and corresponding insights. Renew. Sustain. Energy Rev. 2020, 117, 109474. [Google Scholar] [CrossRef]

- Feng, Y.; Guo, Y.; Yang, G.; Qin, X.; Song, Z. Household biogas development in rural China: On policy support and other macro sustainable conditions. Renew. Sustain. Energy Rev. 2012, 16, 5617–5624. [Google Scholar] [CrossRef]

- ISO/TC 255. ISO TC 255 Business Plan—Biogas; International Standardization Organization: Geneva, Switzerland, 2014. [Google Scholar]

- Dong, B.; Wang, J.; Li, J.; Li, B.; Sun, L.; Zhou, W.; Liu, X.; Xu, W. A Study on Biogas Standard System. China Biogas 2014, 32, 3–6, (In Chinese with English abstract). [Google Scholar]

- Cheng, S.; Li, Z.; Mang, H.-P.; Huba, E.-M. A review of prefabricated biogas digesters in China. Renew. Sustain. Energy Rev. 2013, 28, 738–748. [Google Scholar] [CrossRef]

- Garfí, M.; Martí-Herrero, J.; Garwood, A.; Ferrer, I. Household anaerobic digesters for biogas production in Latin America: A review. Renew. Sustain. Energy Rev. 2016, 60, 599–614. [Google Scholar] [CrossRef]

- Kinyua, M.N.; Rowse, L.E.; Ergas, S.J. Review of small-scale tubular anaerobic digesters treating livestock waste in the developing world. Renew. Sustain. Energy Rev. 2016, 58, 896–910. [Google Scholar] [CrossRef]

- Garfí, M.; Castro, L.; Montero, N.; Escalante, H.; Ferrer, I. Evaluating environmental benefits of low-cost biogas digesters in small-scale farms in Colombia: A life cycle assessment. Bioresour. Technol. 2019, 274, 541–548. [Google Scholar] [CrossRef]

- Cheng, S.; Li, Z.; Mang, H.-P.; Huba, E.-M.; Gao, R.; Wang, X. Development and application of prefabricated biogas digesters in developing countries. Renew. Sustain. Energy Rev. 2014, 34, 387–400. [Google Scholar] [CrossRef]

- Cheng, S.; Li, Z.; Mang, H.P.; Liu, X.; Yin, F. Prefabricated biogas reactor-based systems for community wastewater and organic waste treatment in developing regions. J. Water Sanit. Hyg. Dev. 2014, 4, 153–158. [Google Scholar] [CrossRef]

- Qi, X.; Zhang, S.; Wang, Y.; Wang, R. Advantages of the integrated pig-biogas-vegetable greenhouse system in North China. Ecol. Eng. 2005, 24, 175–183. [Google Scholar] [CrossRef]

- Wu, X.; Wu, F.; Wu, J.; Sun, L. Emergy-Based Sustainability Assessment for a Five-in-One Integrated Production System of Apple, Grass, Pig, Biogas, and Rainwater on the Loess Plateau, Northwest China. Agroecol. Sustain. Food Syst. 2015, 39, 666–690. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).