The Heterogeneous Impacts of R&D on Innovation in Services Sector: A Firm-Level Study of Developing ASEAN

Abstract

:1. Introduction

2. Theory and Hypotheses Development

3. Data and Descriptive Statistics

4. Empirical Model

5. Result

5.1. The Impact of R&D on Innovation

5.2. Robustness Check

6. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

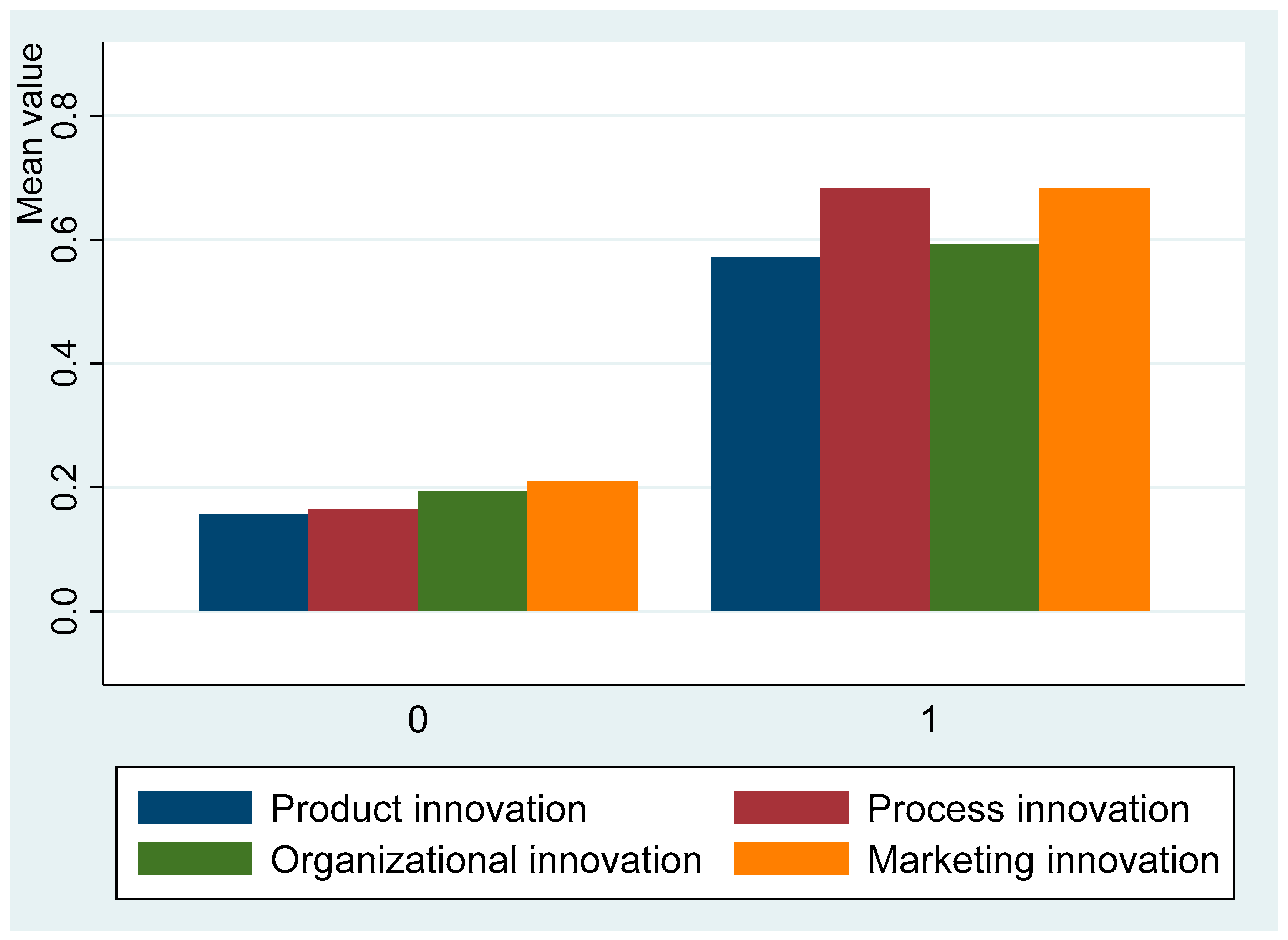

| Innovation over R&D (0/1) | Mean (RD = 0) | Mean2 (RD = 1) | Dif | St_Err | t_Value | p_Value |

|---|---|---|---|---|---|---|

| Product | 0.157 | 0.572 | −0.415 | 0.039 | −10.65 | 0 |

| Process | 0.165 | 0.684 | −0.519 | 0.04 | −13.15 | 0 |

| Organization | 0.194 | 0.592 | −0.398 | 0.042 | −9.45 | 0 |

| Marketing | 0.209 | 0.684 | −0.474 | 0.043 | −11.05 | 0 |

| Technological | 0.089 | 0.439 | −0.35 | 0.032 | −11.05 | 0 |

| Nontechnological | 0.122 | 0.449 | −0.327 | 0.035 | −9.15 | 0 |

| Country | Number of Firms | Percent |

|---|---|---|

| Cambodia | 126 | 8.37 |

| Indonesia | 228 | 15.14 |

| Lao PDR | 226 | 15.01 |

| Malaysia | 305 | 20.25 |

| Philippines | 200 | 13.28 |

| Thailand | 174 | 11.55 |

| Vietnam | 247 | 16.4 |

| Total | 1506 | 100 |

| Variable | Definition | Previous Research |

|---|---|---|

| R&D propensity (rd_d) | Dummy with a value 1 if firms engage in R&D, 0 otherwise | According to endogenous growth models, the accumulation of R&D and human capital is the main source of long-term economic growth [50,51]. R&D expenditures represent the key engine of technological progress, innovation, and economic growth [4,52]. The importance of R&D to innovation activity within firms is established by Roper, Du [53]. |

| R&D intensity (ln_intensity) | Logarithm of R&D expenditure per worker | |

| Innovation outcomes The OSLO manual [33] defines innovation as “the implementation of a new or significantly improved product (good or service), or process, a new marketing method, or a new organisational method in business practices, workplace organisation or external relations.” (OECD, 2005). | ||

| Product innovation (prod_i_d) | Dummy with value 1 if any new or significantly improved product or service is introduced by this establishment, 0 otherwise | Firms’ involvement in R&D increase their existing stock of knowledge, facilitating commercial gains with the introduction of new products, processes, and organizational innovation [53]. Numerous empirical studies captured favorable impacts of innovation effort on innovation output [34,54,55]. |

| Process innovation (proc_i_d) | Dummy with value 1 if any new or significantly improved process is introduced by a firm, 0 otherwise | |

| Organization and management innovation (org_m_i_d) | Dummy with value 1 if firms make any changes in their organizational and management structure, 0 otherwise | |

| Marketing innovation (mrk_i_d) | Dummy with value 1 if establishments make any changes in their marketing strategy, 0 otherwise | |

| Explanatory and control variables | ||

| Application of information technology (info_d) | Dummy if firms apply information technology (email, website, etc.) , 0 otherwise | R&D service firms make marked contributions to innovation in other businesses [56]. |

| Human capital1 (schooling_d) | Dummy if at least 80% employees received formal education, 0 otherwise | Studies report human capital such as schooling, training, etc., enhance knowledge (capabilities) and has a cumulative effect [57]. |

| Human capital2 (formal_train_d) | Dummy if employees of a firm receive formal training, 0 otherwise | |

| FDI (f_own_d) | Whether foreign stakeholders own at least 10 percent share of a firm | R&D activity by Multi-National Corporations (MNCs) are seen as significant factors for sustained economic growth and development of product and/or process innovation [58] |

| Exporter (ex_d) | A dummy variable takes value 1 if firms are exporter, 0 otherwise | In an influential study, Melitz [59] shows that exporting firms have relatively high productivity. Export performance and innovation have mainly employed the intensity of R&D as a measure of innovation [60]. |

| Quality certificate (qc_d) | Dummy with value 1 if firms acquire quality certificate, 0 otherwise | Quality certification provides information about “unobservable process characteristics” and help enterprises to boost their legitimacy [61]. ISO900 certification may have two opposing effects: it facilitates process innovation but stifles product innovation [62]. |

| Access to finance (credit_d) | Dummy with value 1 if firms have access to finance, 0 otherwise | In a competitive market, R&D and innovative activities are difficult to finance [63], however, Stephen, Harhoff [64] show investment in R&D is not sensitive to financial constraints. |

| Location (capitalcity_d) | Dummy with value 1 for those firms located in a capital city and 0 otherwise | Griffith, Harrison [65] provides evidence that the geographic location of firms’ R&D activity matters. |

| Subsidiary (partgroup_d) | Dummy with value 1 if the firm’s financial statement is audited, 0 otherwise | Subsidiaries “proactive innovation” is an important capability of competitive firms ([65]) and that R&D is a key source of such innovation [66]. Further, a major intent of many subsidiary-based innovation is to enhance the technical capabilities of the firm [67]. |

| Firm size (ln_emp) | The logarithm of level of employment | Firm size matters for the decision to invest in R&D as well as for subsequent innovation output [68]. |

| Firm age (ln_f_age) | The number of years a firm has been in operation (natural logarithm) | Huergo and Jaumandreu [69] find new firms are more innovative, however, Galende and de la Fuente [70] argue that “age reflects the experience and accumulated knowledge in the performance of R&D activities.” |

| Sales from first or main product (firstp_sale) | Percentage of sales derived from firms’ main product | |

| Top managers’ experience (exp_m) | Year of experience that firms’ top managers possess | Capabilities of managers are identified as a key factor in determining firm-level innovation of technology firms [71]. |

| Labor force obstacle (Obstacle_labor) | A dummy variable takes value 1 if inadequately educated labor force is considered as high to severe obstacle, 0 otherwise | Firm obstacles are discussed in literature. It is hard for politically unstable countries to attract FDI, a factor to enhance firms’ innovativeness [72] |

| Political obstacle (obstacle_politics) | A dummy variable takes value 1 if political unrest is a high to severe obstacle, 0 otherwise | |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | (20) | (21) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) rd_d | 1.00 | ||||||||||||||||||||

| (2) ln_rdintensity | 0.95 | 1.00 | |||||||||||||||||||

| (3) prod_i_d | 0.25 | 0.22 | 1.00 | ||||||||||||||||||

| (4) proc_i_d | 0.32 | 0.30 | 0.48 | 1.00 | |||||||||||||||||

| (5) org_m_i_d | 0.23 | 0.22 | 0.34 | 0.54 | 1.00 | ||||||||||||||||

| (6) mrk_i_d | 0.28 | 0.26 | 0.37 | 0.54 | 0.49 | 1.00 | |||||||||||||||

| (7) ln_emp | 0.12 | 0.11 | 0.16 | 0.26 | 0.24 | 0.24 | 1.00 | ||||||||||||||

| (8) ln_ f_age | −0.01 | −0.01 | -0.05 | −0.02 | −0.01 | −0.05 | 0.20 | 1.00 | |||||||||||||

| (9) capitalcity_d | 0.04 | 0.04 | 0.11 | 0.01 | −0.03 | −0.00 | −0.03 | −0.00 | 1.00 | ||||||||||||

| (10) firstp_sale | −0.12 | −0.12 | -0.21 | −0.20 | −0.16 | −0.17 | −0.09 | 0.02 | 0.08 | 1.00 | |||||||||||

| (11) f_own_d | −0.01 | −0.01 | 0.09 | 0.00 | −0.01 | 0.02 | 0.17 | 0.07 | −0.01 | −0.12 | 1.00 | ||||||||||

| (12) ex_d | 0.07 | 0.08 | 0.04 | 0.10 | −0.00 | 0.04 | 0.14 | 0.07 | −0.02 | −0.19 | 0.23 | 1.00 | |||||||||

| (13) partgroup_d | 0.00 | 0.01 | 0.18 | 0.17 | 0.11 | 0.12 | 0.22 | 0.02 | 0.00 | −0.13 | 0.18 | 0.09 | 1.00 | ||||||||

| (14) fe_audit_d | 0.11 | 0.10 | 0.15 | 0.19 | 0.31 | 0.21 | 0.22 | 0.04 | -0.06 | −0.10 | 0.06 | −0.03 | 0.23 | 1.00 | |||||||

| (15) info_d | 0.12 | 0.11 | 0.18 | 0.19 | 0.16 | 0.20 | 0.44 | 0.06 | 0.04 | −0.05 | 0.12 | 0.10 | 0.22 | 0.19 | 1.00 | ||||||

| (16) qc_d | 0.09 | 0.10 | 0.05 | 0.10 | 0.08 | 0.10 | 0.25 | 0.10 | −0.04 | −0.10 | 0.18 | 0.15 | 0.18 | 0.12 | 0.18 | 1.00 | |||||

| (17) schooling_d | 0.08 | 0.08 | 0.08 | 0.08 | 0.09 | 0.12 | 0.11 | −0.05 | −0.04 | −0.07 | 0.03 | −0.04 | 0.02 | 0.08 | 0.12 | 0.06 | 1.00 | ||||

| (18) formal_train_d | 0.21 | 0.18 | 0.29 | 0.29 | 0.25 | 0.32 | 0.38 | 0.06 | −0.00 | −0.10 | 0.12 | 0.09 | 0.27 | 0.25 | 0.35 | 0.20 | 0.10 | 1.00 | |||

| (19) obstacle_labor | 0.07 | 0.08 | 0.11 | 0.07 | 0.04 | 0.04 | 0.03 | −0.01 | 0.01 | 0.01 | 0.03 | −0.03 | 0.02 | −0.04 | 0.02 | −0.00 | 0.07 | 0.04 | 1.00 | ||

| (20) obst_politics | −0.03 | −0.03 | -0.02 | −0.02 | −0.06 | −0.06 | 0.04 | 0.06 | 0.13 | 0.08 | −0.04 | −0.01 | 0.01 | −0.04 | 0.05 | 0.01 | −0.18 | −0.01 | −0.06 | 1.00 | |

| (21) credit_d | 0.14 | 0.15 | 0.10 | 0.18 | 0.23 | 0.24 | 0.25 | 0.04 | −0.10 | −0.11 | 0.03 | 0.05 | 0.01 | 0.11 | 0.17 | 0.12 | 0.09 | 0.17 | 0.03 | −0.03 | 1.00 |

References

- Paus, E. Escaping the Middle-Income Trap: Innovate or Perish; Working Paper no: 685; Asian Development Bank: Mandaluyong, Philippines, 2017. [Google Scholar]

- Schumpeter, J. The Theory of Economic Development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Original work published; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction; National Bureau of Economic Research: Cambridge, MA, USA, 1990. [Google Scholar]

- Trajtenberg, M. A penny for your quotes: Patent citations and the value of innovations. Rand J. Econ. 1990, 21, 172–187. [Google Scholar] [CrossRef]

- Cirera, X.; Maloney, W.F. The Innovation Paradox: Developing-Country Capabilities and the Unrealized Promise of Technological Catch-Up; World Bank Publications: Washington, DC, USA, 2017. [Google Scholar]

- Griffith, R.; Redding, S.; Reenen, J.V. Mapping the two faces of R&D: Productivity growth in a panel of OECD industries. Rev. Econ. Stat. 2004, 86, 883–895. [Google Scholar]

- Baumol, W.J. The Cost Disease: Why Computers Get Cheaper and Health Care Doesn’t; Yale University Press: New Haven, CT, USA, 2012. [Google Scholar]

- McKinsey. Services Innovation in a Digital World; McKinsey Global Institute: NewYork, NY, USA, 2015. [Google Scholar]

- Lööf, H.; Heshmati, A. On the relationship between innovation and performance: A sensitivity analysis. Econ. Innov. New Technol. 2006, 15, 317–344. [Google Scholar] [CrossRef]

- Mairesse, J.; Robin, S. Innovation and productivity: A firm-level analysis for French Manufacturing and Services using CIS3 and CIS4 data (1998–2000 and 2002–2004); CREST-ENSAE: Paris, France, 2009. [Google Scholar]

- Audretsch, D.B.; Hafenstein, M.; Kritikos, A.; Schiersch, A. Firm Size and Innovation in the Service Sector; IZA Institute of Labor Economics: Bonn, Germany, 2018. [Google Scholar]

- Mothe, C.; Nguyen-Thi, U.; Nguyen-Van, P. Complementarities in organizational innovation practices: Empirical evidence from Luxembourg; JMA G2: Tokyo, Japan, 2012. [Google Scholar]

- Pino, C.; Felzensztein, C.; Zwerg-Villegas, A.M.; Arias-Bolzmann, L. Non-technological innovations: Market performance of exporting firms in South America. J. Bus. Res. 2016, 69, 4385–4393. [Google Scholar] [CrossRef]

- Aboal, D.; Garda, P. Technological and non-technological innovation and productivity in services vis-à-vis manufacturing sectors. Econ. Innov. New Technol. 2016, 25, 435–454. [Google Scholar] [CrossRef]

- Vergori, A.S. Measuring innovation in services: The role of surveys. Serv. Ind. J. 2014, 34, 145–161. [Google Scholar] [CrossRef]

- Peneder, M. Technological regimes and the variety of innovation behaviour: Creating integrated taxonomies of firms and sectors. Res. Policy 2010, 39, 323–334. [Google Scholar] [CrossRef] [Green Version]

- González-Blanco, J.; Coca-Pérez, J.L.; Guisado-González, M. Relations between technological and non-technological innovations in the service sector. Serv. Ind. J. 2019, 39, 134–153. [Google Scholar] [CrossRef]

- Gallouj, F.; Savona, M. Innovation in services: A review of the debate and a research agenda. J. Evol. Econ. 2009, 19, 149. [Google Scholar] [CrossRef]

- Morrar, R. Innovation in services: A literature review. Technol. Innov. Manag. Rev. 2014, 4, 6–14. [Google Scholar] [CrossRef]

- Lee, C.; Narjoko, D. Escaping the Middle-Income Trap in Southeast Asia: Micro Evidence on Innovation, Productivity, and Globalization. Asian Econ. Policy Rev. 2015, 10, 124–147. [Google Scholar] [CrossRef]

- Crespi, G.; Tacsir, E.; Vargas, F. Innovation dynamics and productivity: Evidence for Latin America. In Firm Innovation and Productivity in Latin America and the Caribbean; Springer: Berlin/Heidelberg, Germany, 2016; pp. 37–71. [Google Scholar]

- Nelson, R.R.; Winter, S.G. The Schumpeterian tradeoff revisited. Am. Econ. Rev. 1982, 72, 114–132. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. In Strategic Learning in a Knowledge Economy; Elsevier: Amsterdam, The Netherlands, 2000; pp. 39–67. [Google Scholar]

- Grazzi, M.; Pietrobelli, C. Firm Innovation and Productivity in Latin America and the Caribbean: The Engine of Economic Development; Palgrave Macmillan: New York, NY, USA, 2016. [Google Scholar]

- Hall, R.E.; Jones, C.I. Why do some countries produce so much more output per worker than others? Q. J. Econ. 1999, 114, 83–116. [Google Scholar]

- Guloglu, B.; Tekin, R.B. A panel causality analysis of the relationship among research and development, innovation, and economic growth in high-income OECD countries. Eurasian Econ. Rev. 2012, 2, 32–47. [Google Scholar]

- Tether, B.S.; Tajar, A. The organisational-cooperation mode of innovation and its prominence amongst European service firms. Res. Policy 2008, 37, 720–739. [Google Scholar] [CrossRef]

- Camisón, C.; Villar-López, A. Organizational innovation as an enabler of technological innovation capabilities and firm performance. J. Bus. Res. 2014, 67, 2891–2902. [Google Scholar] [CrossRef]

- Reypens, C.; Lievens, A.; Blazevic, V. Leveraging value in multi-stakeholder innovation networks: A process framework for value co-creation and capture. Ind. Mark. Manag. 2016, 56, 40–50. [Google Scholar] [CrossRef]

- Tsuji, M.; Ueki, Y.; Shigeno, H.; Idota, H.; Bunno, T. R&D and non-R&D in the innovation process among firms in ASEAN countries: Based on firm-level survey data. Eur. J. Manag. Bus. Econ. 2018, 27, 198–214. [Google Scholar]

- Cirera, X. Catching Up to the Technological Frontier?: Understanding Firm-level Innovation and Productivity in Kenya; in Working Paper 94671; The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- Mortensen, P.S.; Bloch, C.W. Oslo Manual-Guidelines for Collecting and Interpreting Innovation Data: Proposed Guidelines for Collecting and Interpreting Innovation Data; Organisation for Economic Cooporation and Development, OECD: Paris, France, 2005. [Google Scholar]

- Crépon, B.; Duguet, E.; Mairessec, J. Research, Innovation And Productivi [Ty: An Econometric Analysis At The Firm Level. Econ. Innov. New Technol. 1998, 7, 115–158. [Google Scholar] [CrossRef]

- Lööf, H.; Mairesse, J.; Mohnen, P. CDM 20 years after. Econ. Innov. New Technol. 2017, 26, 1–2, 1–5. [Google Scholar]

- Pakes, A.; Griliches, Z. Patents and R&D at the Firm Level: A First Look, in R&D, Patents, and Productivity; University of Chicago Press: Chicago, IL, USA, 1984; pp. 55–72. [Google Scholar]

- Vancauteren, M.; Melenberg, B.; Bongard, R. Innovation and Productivity of Dutch Firms; Statistics Netherlands& Tilburg University: Tilburg, The Netherlands, 2017. [Google Scholar]

- Baumann, J.; Kritikos, A.S. The link between R&D, innovation and productivity: Are micro firms different? Res. Policy 2016, 45, 1263–1274. [Google Scholar]

- Heckman, J.J. Sample selection bias as a specification error. Econom. J. Econom. Soc. 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Maddala, G.S. Limited-Dependent and Qualitative Variables in Econometrics; Cambridge University Press: Cambridge, UK, 1986. [Google Scholar]

- Kassie, M.; Holden, S. Sharecropping efficiency in Ethiopia: Threats of eviction and kinship. Agric. Econ. 2007, 37, 179–188. [Google Scholar] [CrossRef]

- Cappellari, L.; Jenkins, S.P. Multivariate probit regression using simulated maximum likelihood. Stata J. 2003, 3, 278–294. [Google Scholar] [CrossRef] [Green Version]

- Belderbos, R.; Carree, M.; Diederen, B.; Lokshin, B.; Veugelers, R. Heterogeneity in R&D cooperation strategies. Int. J. Ind. Organ. 2004, 22, 1237–1263. [Google Scholar]

- Mullainathan, S.; Spiess, J. Machine learning: An applied econometric approach. J. Econ. Perspect. 2017, 31, 87–106. [Google Scholar] [CrossRef] [Green Version]

- Ahrens, A.; Hansen, C.B.; Schaffer, M.E. lassopack: Model selection and prediction with regularized regression in Stata. arXiv preprint 2019, arXiv:1901.05397. [Google Scholar]

- Fonti, V.; Belitser, E. Feature Selection using LASSO. In Research Paper in Business Analytics; Vrije Universiteit Amsterdam: Amsterdam, The Netherlands, 2017. [Google Scholar]

- Morris, D.M. Innovation and productivity among heterogeneous firms. Res. Policy 2018, 47, 1918–1932. [Google Scholar] [CrossRef] [Green Version]

- Mohnen, P.; Hall, B.H. Innovation and productivity: An update. Eurasian Bus. Rev. 2013, 3, 47–65. [Google Scholar]

- Roodman, D. Fitting fully observed recursive mixed-process models with cmp. Stata J. 2011, 11, 159–206. [Google Scholar] [CrossRef] [Green Version]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Romer, P.M. The origins of endogenous growth. J. Econ. Perspect. 1994, 8, 3–22. [Google Scholar] [CrossRef] [Green Version]

- Nelson, C.; Winter, S. Organizational Capabilities and Behavior: An Evolutionary Theory of Economic Change; Belknap Press of Harvard University Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Roper, S.; Du, J.; Love, J.H. Modelling the innovation value chain. Res. Policy 2008, 37, 961–977. [Google Scholar] [CrossRef] [Green Version]

- Acemoglu, D.; Linn, J. Market size in innovation: Theory and evidence from the pharmaceutical industry. Q. J. Econ. 2004, 119, 1049–1090. [Google Scholar] [CrossRef]

- Hashi, I.; Stojcic, N. Knowledge spillovers, innovation activities, and competitiveness of industries in EU member and candidate countries. Econ. Ann. 2013, 58, 7–34. [Google Scholar] [CrossRef] [Green Version]

- Li, X.; Gagliardi, D.; Miles, I. Innovation in R&D service firms: Evidence from the UK. Technol. Anal. Strateg. Manag. 2019, 31, 732–748. [Google Scholar]

- Østergaard, C.R.; Timmermans, B.; Kristinsson, K. Does a different view create something new? The effect of employee diversity on innovation. Res. Policy 2011, 40, 500–509. [Google Scholar] [CrossRef] [Green Version]

- Gorodnichenko, Y.; Svejnar, J.; Terrell, K. When does FDI have positive spillovers? Evidence from 17 transition market economies. J. Comp. Econ. 2014, 42, 954–969. [Google Scholar] [CrossRef] [Green Version]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef] [Green Version]

- Sterlacchini, A. Do innovative activities matter to small firms in non-R&D-intensive industries? An application to export performance. Res. Policy 1999, 28, 819–832. [Google Scholar]

- Pekovic, S. The determinants of ISO 9000 certification: A comparison of the manufacturing and service sectors. J. Econ. Issues 2010, 44, 895–914. [Google Scholar] [CrossRef]

- Terziovski, M.; Guerrero, J.-L. ISO 9000 quality system certification and its impact on product and process innovation performance. Int. J. Prod. Econ. 2014, 158, 197–207. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; pp. 609–639. [Google Scholar]

- Stephen, B.; Harhoff, D.; van Reenen, J. Investment, R&D and financial constraints in Britain and Germany. Ann. Econ. Stat. 2005, 433–460. [Google Scholar]

- Griffith, R.; Harrison, R.; van Reenen, J. How special is the special relationship? Using the impact of US R&D spillovers on UK firms as a test of technology sourcing. Am. Econ. Rev. 2006, 96, 1859–1875. [Google Scholar]

- Medcof, J.W. Resource-based strategy and managerial power in networks of internationally dispersed technology units. Strateg. Manag. J. 2001, 22, 999–1012. [Google Scholar] [CrossRef]

- Chung, W. Identifying technology transfer in foreign direct investment: Influence of industry conditions and investing firm motives. J. Int. Bus. Stud. 2001, 32, 211–229. [Google Scholar] [CrossRef]

- Hall, B.H.; Lotti, F.; Mairesse, J. Innovation and productivity in SMEs: Empirical evidence for Italy. Small Bus. Econ. 2009, 33, 13–33. [Google Scholar] [CrossRef] [Green Version]

- Huergo, E.; Jaumandreu, J. How does probability of innovation change with firm age? Small Bus. Econ. 2004, 22, 193–207. [Google Scholar] [CrossRef] [Green Version]

- Galende, J.; de la Fuente, J.M. Internal factors determining a firm’s innovative behaviour. Res. Policy 2003, 32, 715–736. [Google Scholar] [CrossRef]

- Makri, M.; Scandura, T.A. Exploring the effects of creative CEO leadership on innovation in high-technology firms. Leadersh. Q. 2010, 21, 75–88. [Google Scholar] [CrossRef]

- Globerman, S.; Shapiro, D. Governance infrastructure and US foreign direct investment. J. Int. Bus. Stud. 2003, 34, 19–39. [Google Scholar] [CrossRef]

| Variable | N | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| A. Dependent variable | |||||

| R&D Propensity (rd_d) | 1506 | 0.0650 | 0.2467 | 0 | 1 |

| R&D Intensity (rd_intensity) | 1506 | 34.672 | 312.99 | 0 | 6218.76 |

| Product innovation (prod_i_d) | 1506 | 0.1832 | 0.3870 | 0 | 1 |

| Process innovation (proc_i_d) | 1506 | 0.1985 | 0.3990 | 0 | 1 |

| Organization innovation (org_m_i_d) | 1506 | 0.2197 | 0.4142 | 0 | 1 |

| Marketing innovation (mrk_i_d) | 1506 | 0.2403 | 0.4274 | 0 | 1 |

| Technological innovation (ti_d) | 1506 | 0.1115 | 0.3149 | 0 | 1 |

| Nontechnological innovation (nti_d) | 1506 | 0.1434 | 0.3506 | 0 | 1 |

| B. Explanatory and control variable | |||||

| Number of Employees (Emp) | 1506 | 47.6706 | 109.9060 | 3 | 1800 |

| Firm age (f_age) | 1476 | 16.8292 | 10.4171 | 2 | 93 |

| Location (capitalcity_d) | 1506 | 0.3027 | 0.4596 | 0 | 1 |

| Sales from first product (firstp_sale) | 1506 | 92.19 | 16.3522 | 6 | 100 |

| Foreign Direct Investment (FDI) (f_own_d) | 1506 | 0.0617 | 0.2407 | 0 | 1 |

| Exporter (ex_d) | 1506 | 0.0723 | 0.2591 | 0 | 1 |

| Subsidiary (partgroup _d) | 1505 | 0.1255 | 0.3314 | 0 | 1 |

| Audited financial statement (audit_d) | 1500 | 0.3766 | 0.4847 | 0 | 1 |

| Application of infotech (info_d) | 1503 | 0.4058 | 0.4912 | 0 | 1 |

| Acquire of quality certificate (qc_d) | 1506 | 0.0830 | 0.2759 | 0 | 1 |

| Human capital1 (schooling_d) | 1506 | 0.7483 | 0.4341 | 0 | 1 |

| Human capital2 (formal_train_d) | 1506 | 0.2881 | 0.4530 | 0 | 1 |

| Credit line (credit_d) | 1506 | 0.2994 | 0.4581 | 0 | 1 |

| Top manager’s experience (mg_exp) | 1471 | 16.1 | 9.3637 | 1 | 55 |

| Obstacle labor (Obstacle_labor) | 1496 | 0.1277 | 0.3334 | 0 | 1 |

| Obstacle politics (Obstacle_politics) | 1456 | 0.1016 | 0.3022 | 0 | 1 |

| With Respect to R&D Propensity (2–7) | With Respect to R&D Intensity (8–11) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| lassologit, lic(ebic) | cvlassologit, lopt * | cvlassologit, lse** | lasso2, lic(ebic) | rlasso | ||||||

| λ = 1.73 | λ = 4.41 | λ = 20.79 | Lambda = 127.8 | |||||||

| Selected variable | Logistic Lasso | Post logit | Logistic Lasso | Post logit | Logistic Lasso | Post logit | Lasso Post-est | OLS | Lasso | Post-est OLS |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Firm size (Medium) | 0.765 | 0.765 | 0.731 | 0.706 | 0.488 | 0.929 | 0.045 | 0.125 | 0.027 | 0.125 |

| Firm size (Large) | −0.165 | −0.269 | −0.101 | −0.396 | ||||||

| Human capital2 | 1.343 | 1.405 | 1.173 | 1.261 | 1.029 | 1.384 | 0.113 | 0.183 | 0.096 | 0.183 |

| Credit line | 0.662 | 0.700 | 0.668 | 0.787 | 0.397 | 0.754 | 0.060 | 0.129 | 0.043 | 0.129 |

| Sales from first product | −0.020 | −0.022 | −0.017 | −0.019 | −0.009 | −0.018 | −0.001 | −0.003 | 0.000 | −0.003 |

| Audited firm | 0.597 | 0.665 | 0.385 | 0.488 | 0.080 | 0.427 | ||||

| Location | 0.633 | 0.729 | 0.477 | 0.685 | ||||||

| Export | 0.624 | 0.725 | 0.327 | 0.456 | ||||||

| Infotech | 0.237 | 0.276 | 0.158 | 0.252 | ||||||

| Quality certificate | 0.565 | 0.660 | 0.280 | 0.435 | ||||||

| Obstacle—politics | −0.261 | −0.359 | −0.155 | −0.401 | ||||||

| Human capital 1 | 0.426 | 0.487 | 0.345 | 0.478 | ||||||

| Obstacle—worker | 0.636 | 0.717 | 0.435 | 0.567 | ||||||

| Firm age | −0.135 | −0.164 | ||||||||

| FDI | −0.835 | −1.001 | ||||||||

| Subsidiary | −0.722 | −0.827 | ||||||||

| _cons | −2.799 | −2.803 | −3.130 | −3.315 | −2.637 | −2.588 | 0.153 | 0.294 | 0.121 | 0.294 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Probit (1–2) | Heckman | Tobit (4–5) | Poisson (6–7) | ||||

| R&D Propensity | R&D intensity | R&D Intensity | R&D Intensity | ||||

| Coefficient | Marginal Effect | Coefficient | Coefficient | Marginal Effect | Coefficient | Marginal Effect | |

| Firm size | 0.319 *** | 0.017 *** | 0.139 ** | 0.973 *** | 0.063 *** | 0.300 ** | 0.024 ** |

| (0.088) | (0.005) | (0.068) | (0.281) | (0.019) | (0.128) | (0.010) | |

| Firm age | −0.053 | -0.003 | −0.030 | −0.181 | −0.011 | 0.013 | 0.001 |

| (0.178) | (0.010) | (0.037) | (0.585) | (0.039) | (0.309) | (0.025) | |

| Location | 0.570 ** | 0.030 * | 0.185 | 1.917 ** | 0.126 ** | 1.059 ** | 0.086 * |

| (0.275) | (0.016) | (0.131) | (0.915) | (0.058) | (0.515) | (0.050) | |

| Sales from | −0.013 *** | −0.001 *** | −0.006 | −0.044 *** | −0.003 *** | −0.020 *** | −0.002 *** |

| (0.004) | (0.000) | (0.004) | (0.013) | (0.001) | (0.006) | (0.001) | |

| FDI | −0.526 | −0.028 | −0.349 * | −1.812 | −0.119 | −0.980 | −0.079 |

| (0.427) | (0.023) | (0.203) | (1.393) | (.087) | (0.946) | (0.078) | |

| Export | 0.464 | 0.025 | 0.249 | 1.562 * | 0.103 * | 0.851 ** | 0.069 ** |

| (0.313) | (0.016) | (0.205) | (0.937) | (0.059) | (0.422) | (0.034) | |

| Subsidiary | 0.226 | 0.012 | 0.174 | 0.848 | 0.056 | 0.575 | 0.047 |

| (0.249) | (0.014) | (0.159) | (0.755) | (0.049) | (0.354) | (0.031) | |

| Audited firm | 0.124 | 0.007 | −0.006 | 0.448 | 0.029 | 0.088 | 0.007 |

| (0.241) | (0.013) | (0.045) | (0.824) | (0.054) | (0.573) | (0.046) | |

| Infotech | 0.276 | 0.015 | 0.138 * | 1.016 | 0.067 | 0.577 * | 0.047 |

| (0.194) | (0.011) | (0.071) | (0.638) | (0.042) | (0.348) | (0.030) | |

| Quality certificate | 0.449 * | 0.024 * | 0.210 | 1.531 * | 0.101 * | 0.830 ** | 0.067 ** |

| (0.258) | (0.014) | (0.178) | (0.791) | (0.053) | (0.379) | (0.032) | |

| Human capital1 | −0.256 | −0.014 | −0.079 | −0.744 | −0.049 | −0.275 | −0.022 |

| (0.249) | (0.013) | (0.078) | (0.730) | (0.047) | (0.375) | (0.030) | |

| Human capital2 | 0.437 ** | 0.023 ** | 1.363 ** | 0.089 ** | 0.535 * | 0.043 * | |

| (0.183) | (0.010) | (0.615) | (0.042) | (0.305) | (0.024) | ||

| Obstacle: Labor | 0.287 | 0.015 | 0.161 ** | 1.040 | 0.068 | 0.672 * | 0.054 * |

| (0.217) | (0.011) | (0.067) | (0.702) | (0.047) | (0.362) | (0.029) | |

| Obstacle: Politics | −0.260 | −0.014 | −0.112 | −0.655 | −0.043 | −0.056 | −0.004 |

| (0.278) | (0.015) | (0.070) | (0.873) | (0.058) | (0.494) | (0.040) | |

| Credit line | 0.413 ** | 0.022 * | 0.198 * | 1.351 ** | 0.089 ** | 0.875 ** | 0.071 ** |

| (0.208) | (0.011) | (0.119) | (0.651) | (0.040) | (0.358) | (0.031) | |

| lambda | 0.281 | ||||||

| (0.217) | |||||||

| _cons | −1.828 ** | −0.240 | −5.814 ** | −5.814 ** | −2.534 ** | ||

| (0.815) | (0.354) | (2.687) | (2.687) | (1.144) | |||

| (2.122) | (2.122) | ||||||

| N | 1242 | 1242 | 1242 | 1409 (left censored 1,317) | 1409 | 1409 | 1409 |

| Wald chi2 | 6.54 | 2.18 | 24.06 | 341.91 | |||

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | |||

| Log likelihood | |||||||

| ISIC dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R&D Propensity | R&D Intensity |

|---|---|

| Positively (highly) related | |

|

|

| Positively (marginally) related | |

|

|

| Negatively (highly) related | |

|

|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Innovation | Process Innovation | Organization innovation | Marketing Innovation | Technological Innovation | Non-technological innovation | |||||||

| Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | Coefficients | Marginal effects | |

| R&D intensity (predicted) | 0.238 *** | 0.029 *** | 0.175 *** | 0.030 *** | 0.152 *** | 0.028 *** | 0.205 *** | 0.039 *** | 0.214 *** | 0.017 *** | 0.203 *** | 0.024 *** |

| (0.043) | (0.006) | (0.046) | (0.008) | (0.040) | (0.007) | (0.045) | (0.009) | (0.051) | (0.005) | (0.044) | (0.005) | |

| Firm size | −0.085 | −0.010 | −0.043 | −0.007 | 0.010 | 0.002 | −0.109 | −0.021 | −0.061 | −0.005 | −0.116 | −0.014 |

| (0.113) | (0.014) | (0.117) | (0.020) | (0.108) | (0.020) | (0.108) | (0.021) | (0.150) | (0.012) | (0.109) | (0.013) | |

| Firm age | −0.140 | −0.017 | −0.292 * | −0.049 * | 0.028 | 0.005 | −0.099 | −0.019 | −0.242 | −0.019 | 0.117 | 0.014 |

| (0.150) | (0.018) | (0.158) | (0.027) | (0.217) | (0.040) | (0.150) | (0.029) | (0.172) | (0.014) | (0.165) | (0.020) | |

| Manager experience | 0.054 | 0.006 | 0.300 ** | 0.051 ** | 0.022 | 0.004 | 0.081 | 0.016 | 0.253 | 0.020 | 0.194 | 0.023 |

| (0.147) | (0.018) | (0.147) | (0.026) | (0.201) | (0.037) | (0.138) | (0.027) | (0.173) | (0.014) | (0.172) | (0.021) | |

| FDI | −0.016 | −0.002 | −0.368 | −0.062 | −0.719 ** | −0.132 ** | −0.501 | −0.096 | −0.191 | −0.015 | −0.889 *** | −0.107 *** |

| (0.309) | (0.037) | (0.299) | (0.051) | (0.290) | (0.054) | (0.328) | (0.063) | (0.341) | (0.027) | (0.284) | (0.037) | |

| Infotech | 0.191 | 0.023 | 0.011 | 0.002 | 0.263 | 0.048 | 0.588 *** | 0.113 *** | 0.162 | 0.013 | 0.521 ** | 0.063 ** |

| (0.210) | (0.025) | (0.215) | (0.036) | (0.206) | (0.037) | (0.197) | (0.037) | (0.218) | (0.017) | (0.227) | (0.026) | |

| Export | −0.179 | −0.022 | −0.031 | −0.005 | −0.798 *** | −0.146 *** | −0.470 | −0.090 | 0.254 | 0.020 | −0.793 ** | −0.095 ** |

| (0.305) | (0.037) | (0.305) | (0.051) | (0.294) | (0.055) | (0.323) | (0.062) | (0.324) | (0.025) | (0.318) | (0.040) | |

| Human capital 2 | −0.118 | −0.014 | 0.121 | 0.020 | −0.292 | −0.054 | −0.037 | −0.007 | 0.287 | 0.022 | −0.092 | −0.011 |

| (0.193) | (0.023) | (0.175) | (0.029) | (0.180) | (0.034) | (0.165) | (0.032) | (0.235) | (0.019) | (0.214) | (0.026) | |

| _cons | 0.853 | 0.592 | 0.234 | 0.792 | −0.075 | −0.482 | ||||||

| (0.775) | (0.677) | (0.706) | (0.703) | (0.868) | (0.748) | |||||||

| N | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 |

| Wald chi2 | 169.28 | 113.88 | 181.47 | 145.55 | 162.12 | 116.52 | ||||||

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||||||

| Log likelihood | −72171.936 | −100375.77 | −107022.88 | −112155.31 | −47760.726 | −70819.301 | ||||||

| Pseudo R2 | 0.2677 | 0.1833 | 0.2830 | 0.2590 | 0.2872 | 0.2884 | ||||||

| ISIC dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Product Innovation | Process Innovation | Organization Innovation | Marketing Innovation | |

|---|---|---|---|---|

| GHK algorithm (Cappellari and Jenkins method) | ||||

| Predicted value of R&D intensity | 0.236 *** | 0.174 *** | 0.142 *** | 0.200 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Wald chi2 | 624.16 | |||

| Prob > chi2 | 0.000 | |||

| Log likelihood | −332809.4 | |||

| N | 1381 | |||

| GHK algorithm (Roodman method) | ||||

| Predicted value of | 0.258 *** | 0.194 *** | 0.195 *** | 0.193 *** |

| R&D intensity | (0.00) | (0.00) | (0.00) | (0.00) |

| Wald chi2 | 797.30 | |||

| Prob > chi2 | 0.000 | |||

| Log-likelihood | -1875.8 | |||

| N | 1381 | |||

| Correlation coefficients of error terms of dependent variables | ||||

| Cappellari and Jenkins | Roodman | |||

| coefficients | p-value | coefficients | p-value | |

| rho21 | 0.63 | 0.000 | 0.66 | 0.000 |

| rho31 | 0.57 | 0.000 | 0.55 | 0.000 |

| rho41 | 0.59 | 0.000 | 0.47 | 0.000 |

| rho32 | 0.73 | 0.000 | 0.73 | 0.000 |

| rho42 | 0.79 | 0.000 | 0.68 | 0.000 |

| rho43 | 0.56 | 0.000 | 0.62 | 0.000 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poisson model (1–6) | Negative binomial model (7–12) | |||||||||||

| Product Innovation | Process Innovation | Organization Innovation | Marketing Innovation | Technological Innovation | Nontechnological Innovation | Product Innovation | Process Innovation | Organization Innovation | Marketing Innovation | Technological Innovation | Nontechnological Innovation | |

| R&D intensity (predicted) | 0.082 *** | 0.082 ** | 0.162 *** | 0.129 *** | 0.030 * | 0.111 *** | 0.131 *** | 0.152 *** | 0.235 *** | 0.215 *** | 0.049 ** | 0.159 *** |

| (0.029) | (0.039) | (0.048) | (0.049) | (0.017) | (0.033) | (0.039) | (0.053) | (0.062) | (0.072) | (0.023) | (0.044) | |

| Firm size | 0.035 *** | 0.039 *** | 0.042 *** | 0.041 *** | 0.022 *** | 0.022 ** | 0.032 *** | 0.036 *** | 0.037 ** | 0.037 ** | 0.021 *** | 0.019 * |

| (0.010) | (0.013) | (0.015) | (0.015) | (0.008) | (0.010) | (0.010) | (0.014) | (0.015) | (0.015) | (0.008) | (0.010) | |

| Firm age | −0.023 | −0.050 * | 0.004 | −0.021 | −0.024 | 0.010 | −0.025 | −0.050 * | 0.002 | −0.022 | −0.025 | 0.007 |

| (0.020) | (0.027) | (0.039) | (0.029) | (0.015) | (0.021) | (0.020) | (0.027) | (0.039) | (0.029) | (0.015) | (0.021) | |

| Manager experience | −0.000 | 0.041 | −0.005 | 0.001 | 0.017 | 0.018 | −0.000 | 0.040 | −0.006 | 0.000 | 0.017 | 0.018 |

| (0.018) | (0.026) | (0.036) | (0.028) | (0.014) | (0.021) | (0.018) | (0.026) | (0.036) | (0.028) | (0.014) | (0.021) | |

| FDI | −0.019 | −0.077 | −0.130 ** | −0.120 * | −0.030 | −0.109 *** | −0.013 | −0.069 | −0.120 ** | −0.110 | −0.027 | −0.101 *** |

| (0.035) | (0.055) | (0.054) | (0.068) | (0.029) | (0.037) | (0.034) | (0.055) | (0.053) | (0.067) | (0.029) | (0.037) | |

| Infotech | 0.052 ** | 0.030 | 0.072 ** | 0.153 *** | 0.028 * | 0.085 *** | 0.052 ** | 0.027 | 0.071 ** | 0.150 *** | 0.028 * | 0.083 *** |

| (0.024) | (0.034) | (0.034) | (0.036) | (0.016) | (0.024) | (0.024) | (0.034) | (0.034) | (0.036) | (0.016) | (0.024) | |

| Export | 0.039 | 0.071 | −0.108 ** | −0.002 | 0.057 ** | −0.062 | 0.029 | 0.058 | −0.132 *** | −0.018 | 0.053 ** | −0.086 * |

| (0.034) | (0.062) | (0.049) | (0.080) | (0.023) | (0.040) | (0.035) | (0.065) | (0.051) | (0.084) | (0.024) | (0.045) | |

| Human capital 2 | −0.023 | 0.009 | −0.061 * | −0.021 | 0.019 | −0.016 | −0.024 | 0.008 | −0.062 * | −0.021 | 0.019 | −0.017 |

| (0.025) | (0.031) | (0.034) | (0.034) | (0.019) | (0.026) | (0.025) | (0.030) | (0.034) | (0.034) | (0.019) | (0.026) | |

| Obs. | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 | 1381 |

| ISIC dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Islam, M.S. The Heterogeneous Impacts of R&D on Innovation in Services Sector: A Firm-Level Study of Developing ASEAN. Sustainability 2020, 12, 1643. https://doi.org/10.3390/su12041643

Zhang J, Islam MS. The Heterogeneous Impacts of R&D on Innovation in Services Sector: A Firm-Level Study of Developing ASEAN. Sustainability. 2020; 12(4):1643. https://doi.org/10.3390/su12041643

Chicago/Turabian StyleZhang, Jianhua, and Mohammad Shahidul Islam. 2020. "The Heterogeneous Impacts of R&D on Innovation in Services Sector: A Firm-Level Study of Developing ASEAN" Sustainability 12, no. 4: 1643. https://doi.org/10.3390/su12041643

APA StyleZhang, J., & Islam, M. S. (2020). The Heterogeneous Impacts of R&D on Innovation in Services Sector: A Firm-Level Study of Developing ASEAN. Sustainability, 12(4), 1643. https://doi.org/10.3390/su12041643