Does Administrative Approval Impede Low-Quality Innovation? Evidence from Chinese Manufacturing Firms

Abstract

1. Introduction

2. Theory and Hypotheses Development

2.1. Related Literature

2.2. Theoretical Framework

2.3. Research Hypotheses

3. Data and Measurement

3.1. Data

3.1.1. Firm-Level Panel Data

3.1.2. China Patent Database

3.1.3. Data Matching

3.1.4. City Statistics

3.1.5. Data of Administrative Approval Center

3.2. Measurement

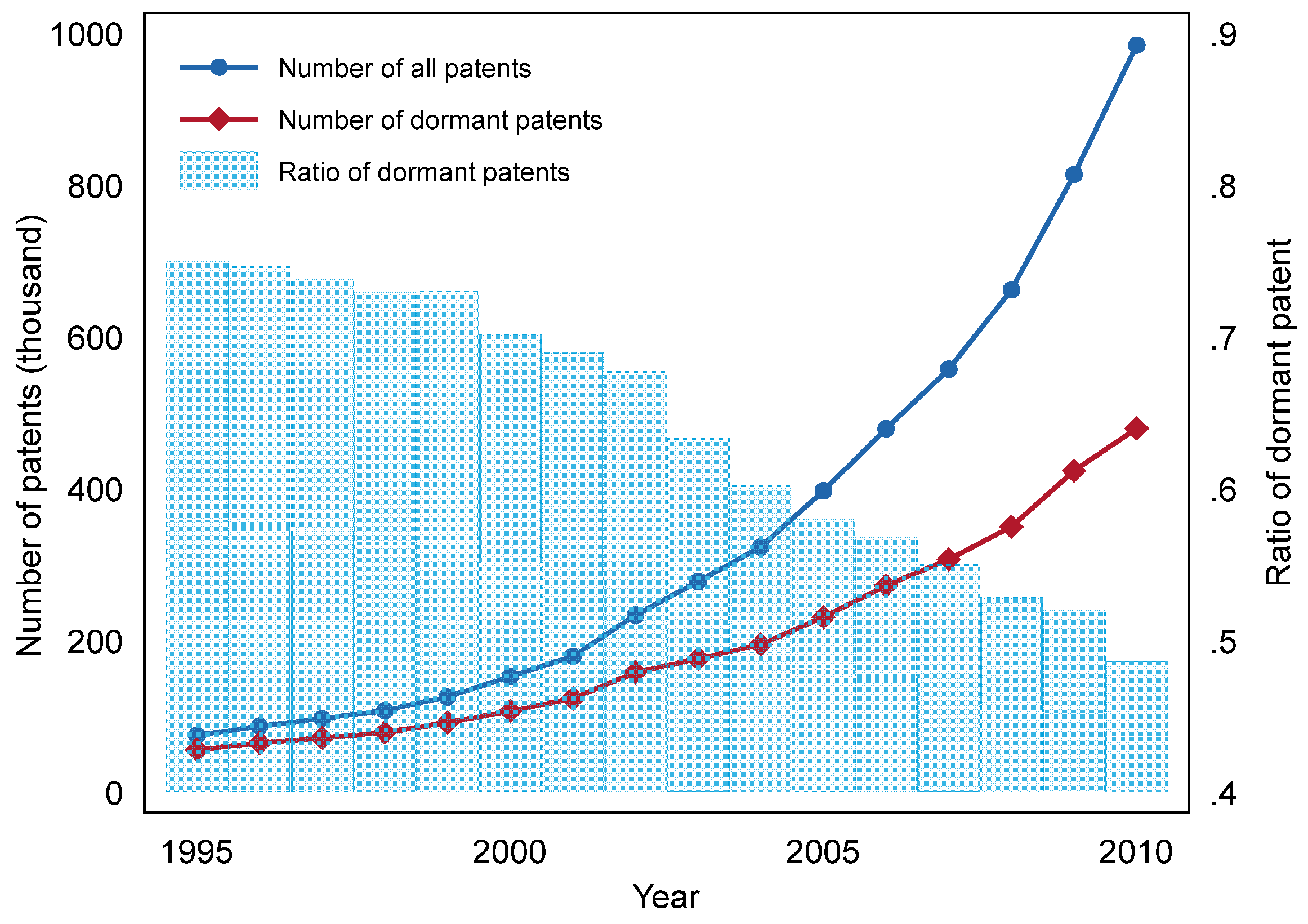

3.2.1. Low-Quality Innovation

3.2.2. Administrative Approval

4. Empirical Analysis

4.1. Empirical Model Setting

4.2. Empirical Analysis

4.2.1. City-level Determinants of the AAC Establishment

4.2.2. Baseline Regression Results

4.2.3. Pre-Treatment Trends

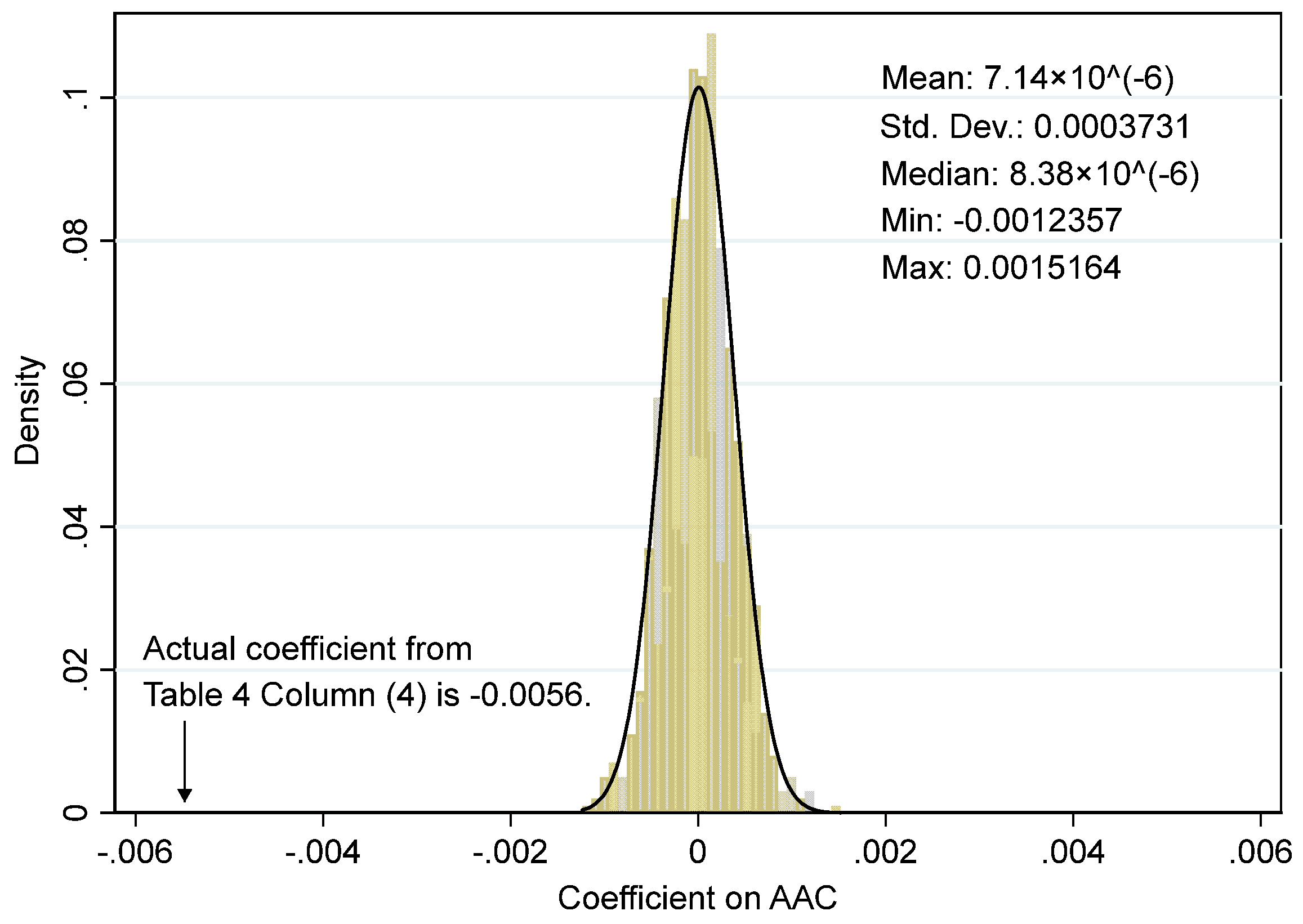

4.2.4. Placebo Test

4.3. Administrative Approval Intensity

5. Robustness Tests, Heterogeneity Effects, and Mechanisms

5.1. Robustness Tests

5.2. Heterogeneity Effects

5.3. Mechanisms

5.3.1. Enhancing Market Competition

5.3.2. Changing Direction of Innovation

5.3.3. Optimizing R&D Investment Strategy

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Year | Number of Cities Establishing AAC | Percentage (%) |

|---|---|---|

| Before 1998 | 3 | 0.95 |

| 1998 | 1 | 0.32 |

| 1999 | 2 | 0.63 |

| 2000 | 17 | 5.38 |

| 2001 | 57 | 18.04 |

| 2002 | 75 | 23.73 |

| 2003 | 28 | 8.86 |

| 2004 | 26 | 8.23 |

| 2005 | 25 | 7.91 |

| 2006 | 11 | 3.48 |

| 2007 | 10 | 3.16 |

| 2008–2015 | 61 | 19.30 |

| Total | 316 | 100 |

| Variable | N | Mean | Std. Dev. | Definition |

|---|---|---|---|---|

| Panel A. firm-level variables | ||||

| Allpatent | 1,864,694 | 0.046 | 0.292 | Natural logarithm of one plus firm’s total number of patents |

| Dormant | 1,864,694 | 0.032 | 0.236 | Natural logarithm of one plus firm’s number of dormant patents (patent rights are terminated due to non-payment of renewal fees) |

| Output | 1,864,694 | 3.042 | 1.399 | Natural logarithm of one plus firm’s output |

| Capital_labor | 1,864,694 | 0.078 | 0.413 | Firm’s paid-in capital divided by number of employees |

| Age | 1,864,694 | 3.185 | 0.398 | Natural logarithm of one plus firm’s age |

| Exporter | 1,864,694 | 0.282 | 0.450 | A dummy variable that equals to one if the amount of firm’s export is greater than zero, and zero otherwise |

| SOE | 1,864,694 | 0.118 | 0.322 | A dummy variable that equals to one if the ratio of firm’s state-owned capital is greater than fifty percent, and zero otherwise |

| Panel B. City-level variables | ||||

| AAC | 3478 | 0.398 | 0.489 | A dummy variable that equals to one for the year after first establishment time of administrative approval center, and zero otherwise |

| AAC_dpt | 3478 | 0.017 | 0.024 | Dummy variable AAC multiplies by the number of stationed departments of administrative approval |

| AAC_item | 3478 | 0.125 | 0.206 | Dummy variable AAC multiplies by the number of items of administrative approval |

| Tertiary | 2654 | 35.704 | 7.746 | Ratio of output of the tertiary industry to city’s total output |

| FDI | 2543 | 8.523 | 2.018 | Natural logarithm of one plus city’s inward foreign direct investment |

| FA | 2662 | 13.844 | 1.136 | Natural logarithm of one plus city’s fixed asset investment |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Dependent Variable: | AAC | AAC | AAC | AAC | AAC | AAC |

| Dormant | −0.0294 | −0.0207 | ||||

| (0.0196) | (0.0283) | |||||

| GDP | −0.0108 | 0.0142 | 0.1050 | 0.0984 | 0.1213 | |

| (0.0253) | (0.0489) | (0.0944) | (0.0996) | (0.1028) | ||

| Tertiary | −0.0058 * | −0.0056 * | −0.0057 * | −0.0061 * | −0.0058 * | |

| (0.0031) | (0.0032) | (0.0032) | (0.0033) | (0.0035) | ||

| FDI | −0.0378 ** | −0.0460 *** | −0.0458 *** | −0.0436 ** | ||

| (0.0177) | (0.0169) | (0.0172) | (0.0174) | |||

| FA | −0.1061 ** | −0.1098 ** | −0.1161 ** | |||

| (0.0466) | (0.0504) | (0.0527) | ||||

| Population | −0.0767 | −0.0902 | −0.1001 | |||

| (0.0567) | (0.0785) | (0.0784) | ||||

| Sales | 0.0615 | 0.0617 | 0.0682 | |||

| (0.0590) | (0.0581) | (0.0588) | ||||

| Wage | 0.0015 | −0.0166 | ||||

| (0.1713) | (0.1886) | |||||

| Passenger | 0.0278 | 0.0352 | ||||

| (0.0358) | (0.0363) | |||||

| Constant | 1.1058 *** | 1.2945 *** | 1.8352 ** | 1.7700 | 0.9085 *** | 1.8135 |

| (0.1879) | (0.2330) | (0.7398) | (1.5020) | (0.0474) | (1.6954) | |

| R-squared | 0.017 | 0.071 | 0.106 | 0.108 | 0.014 | 0.118 |

| Observations | 255 | 211 | 211 | 211 | 222 | 206 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Dependent Variable: | Dormant | Dormant | Dormant | Dormant | Dormant | Dormant |

| AAC × SOE | 0.0049 *** | |||||

| (0.0018) | ||||||

| AAC_dpt × SOE | 0.0826 ** | |||||

| (0.0378) | ||||||

| AAC_item × SOE | 0.0085 ** | |||||

| (0.0041) | ||||||

| AAC × FIE | 0.0030 | |||||

| (0.0019) | ||||||

| AAC_dpt × FIE | 0.0552 | |||||

| (0.0393) | ||||||

| AAC_item × FIE | 0.0047 | |||||

| (0.0040) | ||||||

| AAC | −0.0063 *** | −0.0062 *** | ||||

| (0.0009) | (0.0009) | |||||

| AAC_dpt | −0.1014 *** | −0.1007 *** | ||||

| (0.0174) | (0.0173) | |||||

| AAC_item | −0.0077 *** | −0.0076 *** | ||||

| (0.0020) | (0.0020) | |||||

| SOE | −0.0056 *** | −0.0051 *** | −0.0049 *** | |||

| (0.0016) | (0.0015) | (0.0015) | ||||

| FIE | 0.0005 | 0.0009 | 0.0011 | |||

| (0.0021) | (0.0020) | (0.0020) | ||||

| Firm control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.514 | 0.514 | 0.514 | 0.514 | 0.514 | 0.514 |

| Observations | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 |

Appendix B

References

- Jin, S.; Ma, H.; Huang, J.; Hu, R.; Rozelle, S. Productivity, efficiency and technical change: Measuring the performance of China’s transforming agriculture. J. Product. Anal. 2010, 33, 191–207. [Google Scholar] [CrossRef]

- Zhu, X. Understanding China’s growth: Past, present, and future. J. Econ. Perspect. 2012, 26, 103–124. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Acemoglu, D. Directed technical change. Rev. Econ. Stud. 2002, 69, 781–809. [Google Scholar] [CrossRef]

- Naughton, B. China’s experience with guidance planning. J. Comp. Econ. 1990, 14, 743–767. [Google Scholar] [CrossRef]

- Liu, X.; White, S. Comparing innovation systems: A framework and application to China’s transitional context. Res. Policy 2001, 30, 1091–1114. [Google Scholar] [CrossRef]

- Hu, A.; Jefferson, G. A great wall of patents: What is behind China’s recent patent explosion? J. Dev. Econ. 2009, 90, 57–68. [Google Scholar] [CrossRef]

- Wallsten, S.J. The Effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. RAND J. Econ. 2000, 31, 82–100. [Google Scholar] [CrossRef]

- Jaffe, A.B. Building program evaluation into the design of public research support programs. Oxf. Rev. Econ. Policy 2002, 18, 22–34. [Google Scholar] [CrossRef]

- Lach, S. Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. J. Ind. Econ. 2002, 50, 369–390. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R. Politicians and firms. Q. J. Econ. 1994, 109, 995–1025. [Google Scholar] [CrossRef]

- Dosi, G.; Marengo, L.; Pasquali, C. How much should society fuel the greed of innovators? On the relations between appropriability, opportunities and rates of innovation. Res. Policy 2006, 35, 1110–1121. [Google Scholar] [CrossRef]

- Lu, Y.; Zhang, K. Resource dependence, government efficiency and quality of economic development. Res. Econ. Manag. 2019, 1, 3–13. [Google Scholar]

- Liao, F. Administrative reform and business environment: Evidence from enterprises survey. Public Adm. Policy Rev. 2019, 6, 80–96. [Google Scholar]

- Zhu, X.; Zhang, Y. Innovation and diffusion: The rise of new administrative examination and approval system in Chinese cities. Manag. World 2015, 10, 91–105. [Google Scholar]

- Xia, J.; Liu, C. Administrative approval reform, transaction costs and China’s economic growth. Manag. World 2017, 4, 47–59. [Google Scholar]

- Bi, Q.; Chen, X.; Xu, X.; Li, S. Administrative approval reform and firm entry. Econ. Res. J. 2018, 2, 140–155. [Google Scholar]

- Wang, Y.; Feng, X. The reform of administration approval system and firms’ innovation. China Ind. Econ. 2018, 2, 24–42. [Google Scholar]

- Xiao, W.; Han, S. The impact of changes in local government intensity on firms’ going global: An empirical research based on Chinese provincial panel data for 2004-2012. J. Zhejiang Univ. (Hum. Soc. Sci.) 2016, 1, 184–199. [Google Scholar]

- Li, W.; Zheng, M. Is it substantive innovation or strategic innovation-Impact of macroeconomic policies on micro-enterprises’ innovation. Econ. Res. J. 2016, 4, 60–73. [Google Scholar]

- Zhang, J.; Gao, D.; Xia, Y. Do patents drive economic growth in China-An explanation based on government patent subsidy policy. China Ind. Econ. 2016, 1, 83–98. [Google Scholar]

- Long, X.; Wang, J. The cause and quality effect of patent explosion in China. J. World Econ. 2015, 6, 115–142. [Google Scholar]

- Jiang, X. Decentralization of government and state-owned enterprises’ innovation: Research based on pyramid structure of local SOEs. Manag. World 2016, 9, 120–135. [Google Scholar]

- Lun, X.; Liu, Y.; Shen, K. The role of government and the development of medium small and micro-sized enterprise—Based on the survey data of 13 prefecture-level cities in Jiangsu province. Econ. Theory Bus. Manag. 2017, 4, 82–96. [Google Scholar]

- He, W.; Jiang, Y.; Tang, X. Does administrative examination and approval system reform improve local government performance? A panel data analysis on Chinese 15 sub-provincial cities from 2001 to 2005. J. Public Adm. 2019, 3, 118–138. [Google Scholar]

- Acemoglu, D. Introduction to economic growth. J. Econ. Theory 2012, 147, 545–550. [Google Scholar] [CrossRef]

- Acemoglu, D.; Akcigit, U.; Bloom, N.; Kerr, W. Innovation, reallocation and growth. Am. Econ. Rev. 2018, 108, 3450–3491. [Google Scholar] [CrossRef]

- Grossman, G.; Helpman, E. Quality ladders in the theory of growth. Rev. Econ. Stud. 1991, 58, 43–61. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A model of growth through creative destruction. Econometrica 1992. [Google Scholar] [CrossRef]

- Hasan, I.; Tucci, C.L. The innovation-economic growth nexus: Global evidence. Res. Policy 2010, 39, 1264–1276. [Google Scholar] [CrossRef]

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Gaurav, K.; Jayakumar, M.; Chatterjee, D. Does innovation promote economic growth? Evidence from European countries. J. Innov. Entrep. 2017, 6. [Google Scholar] [CrossRef]

- Hu, A.G.Z.; Png, I.P.L. Patent rights and economic growth: Evidence from cross-country panels of manufacturing industries. Oxf. Econ. Pap. 2013, 65, 675–698. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory Framework and Economic Development; Harvard University Press: Cambrige, MA, USA, 1934. [Google Scholar]

- Garcia-Macia, D.; Hsieh, C.-T.; Klenow, P.J. How destructive is innovation? Econometrica 2019, 87, 1507–1541. [Google Scholar] [CrossRef]

- Shapiro, C. Premiums for high quality products as returns to reputations. Q. J. Econ. 1983, 98, 659–680. [Google Scholar] [CrossRef]

- Chen, Y.; Pan, S.; Zhang, T. Patentability, R&D direction, and cumulative innovation. Int. Econ. Rev. 2018, 59, 1969–1993. [Google Scholar] [CrossRef]

- Aghion, P.; Angeletos, G.M.; Banerjee, A.; Manova, K. Volatility and growth: Credit constraints and the composition of investment. J. Monet. Econ. 2010, 57, 246–265. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Brandt, L.; Van Biesebroeck, J.; Zhang, Y. Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 2012, 97, 339–351. [Google Scholar] [CrossRef]

- He, Z.; Tong, T.; Zhang, Y. Constructing a Chinese patent database of listed firms in China: Descriptions, lessons, and insights. J. Econ. Manag. Strateg. 2018, 27, 579–606. [Google Scholar] [CrossRef]

- Wang, S.; Ding, Y. Defects, expansion and evolution of the administrative service center: An empirical research based on the view of administrative process reengineering. J. Public Manag. 2010, 4, 24–30. [Google Scholar]

- Magliocca, G.N. Blackberries and barnyards: Patent trolls and the perils of innovation. Notre Dame Law Rev. 2006, 82, 1809–1838. [Google Scholar]

- Pakes, A. Patents as options: Some estimates of the value of holding European patent stocks. Econometrica 1986, 54, 755–784. [Google Scholar] [CrossRef]

- Schankerman, M.; Pakes, A. Estimates of the value of patent rights in European countries during the post-1950 period. Econ. J. 1986, 96, 1052–1076. [Google Scholar] [CrossRef]

- Lanjouw, J.O. Patent protection in the shadow of infringement: Simulation estimations of patent balue. Rev. Econ. Stud. 1998, 64, 671–710. [Google Scholar] [CrossRef]

- Cornelli, F.; Schankerman, M. Patent renewals and R&D incentives. RAND J. Econ. 1999, 30, 197–213. [Google Scholar] [CrossRef]

- Blanco, I.; Wehrheim, D. The bright side of financial derivatives: Options trading and firm innovation. J. Financ. Econ. 2017, 125, 99–119. [Google Scholar] [CrossRef]

- Gentzkow, M. Television and voter turnout. Q. J. Econ. 2006, 121, 931–972. [Google Scholar] [CrossRef]

- Alder, S.; Shao, L.; Zilibotti, F. Economic reforms and industrial policy in a panel of Chinese cities. J. Econ. Growth 2016, 21, 305–349. [Google Scholar] [CrossRef]

- Moser, P.; Voena, A. Compulsory licensing: Evidence from the trading with the enemy act. Am. Econ. Rev. 2010, 94, 115–133. [Google Scholar] [CrossRef]

- Priks, M. The effects of surveillance cameras on crime: Evidence from the Stockholm subway. Econ. J. 2015, 125, 289–305. [Google Scholar] [CrossRef]

- Kogan, L.; Papanikolaou, D.; Seru, A.; Stoffman, N. Technological innovation, resource allocation, and growth. Q. J. Econ. 2017, 665–712. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

- Cornaggia, J.; Mao, Y.; Tian, X.; Wolfe, B. Does banking competition affect innovation? J. Financ. Econ. 2015, 115, 189–209. [Google Scholar] [CrossRef]

- Bertrand, M.; Duflo, E.; Mullainathan, S. How much should we trust differences-in- differences estimates? Q. J. Econ. 2004, 119, 249–275. [Google Scholar] [CrossRef]

- Png, I. Law and innovation: Evidence from state trade secrets laws. Rev. Econ. Stat. 2017, 99, 167–179. [Google Scholar] [CrossRef]

- Nunn, N.; Wantchekon, L. The slave trade and the origins of mistrust in Africa. Am. Econ. Rev. 2011, 101, 3221–3252. [Google Scholar] [CrossRef]

- Fang, L.; Lerner, J.; Wu, C.; Zhang, Q. Corruption, government subsidies, and innovation: Evidence from China. NBER Work. Pap. 2018. [Google Scholar] [CrossRef]

- Hall, B.; Jaffe, A.; Trajtenberg, M. The NBER patent citations data file: Lessons, insights and methodological tools. NBER Work. Pap. 2001. [Google Scholar] [CrossRef]

- Xu, G.; Yano, G. How Does Anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. J. Comp. Econ. 2017, 45, 498–519. [Google Scholar] [CrossRef]

- Lu, Y.; Tao, Z.; Zhu, L. Identifying FDI spillovers. J. Int. Econ. 2017, 107, 75–90. [Google Scholar] [CrossRef]

- Degryse, H.; Ongena, S. Distance, lending relationships, and competition. J. Financ. 2005, 60, 231–266. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and innovation: An inverted-U relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef]

- Bryan, K.; Lemus, J. The direction of innovation. J. Econ. Theory 2017, 172, 247–272. [Google Scholar] [CrossRef]

- Mansfield, E. Academic research and industrial innovation. Res. Policy 1991, 20, 1–12. [Google Scholar] [CrossRef]

- Silvestre, B.S.; Ţîrcă, D.M. Innovations for sustainable development: Moving toward a sustainable future. J. Clean. Prod. 2019, 208, 325–332. [Google Scholar] [CrossRef]

- Almeida, C.; Stepkowska, A.; Alegre, A.; Nogueira, J.M.F. Determination of trace levels of benzophenone-type ultra-violet filters in real matrices by bar adsorptive micro-extraction using selective sorbent phases. J. Chromatogr. A 2013, 1311, 1–10. [Google Scholar] [CrossRef] [PubMed]

- Hsieh, C.-T.; Klenow, P. Misallocation and manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dependent Variable: | Dormant | Dormant | Dormant | Dormant |

| AAC | −0.0046 *** | −0.0047 *** | −0.0054 *** | −0.0056 *** |

| (0.0008) | (0.0008) | (0.0008) | (0.0008) | |

| Output | 0.0097 *** | 0.0101 *** | ||

| (0.0004) | (0.0004) | |||

| Capital_labor | −0.0023 | −0.0023 | ||

| (0.0020) | (0.0020) | |||

| Age | 0.0009 | 0.0006 | ||

| (0.0014) | (0.0016) | |||

| Exporter | 0.0057 *** | 0.0057 *** | ||

| (0.0009) | (0.0009) | |||

| SOE | −0.0036 *** | −0.0040 *** | ||

| (0.0013) | (0.0014) | |||

| Tertiary | −0.0003 *** | |||

| (0.0001) | ||||

| FDI | 0.0013 *** | |||

| (0.0004) | ||||

| FA | −0.0033 *** | |||

| (0.0011) | ||||

| Constant | 0.0341 *** | 0.0341 *** | 0.0011 | 0.0499 *** |

| (0.0004) | (0.0004) | (0.0046) | (0.0178) | |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| City FE | No | Yes | Yes | Yes |

| R-squared | 0.511 | 0.512 | 0.512 | 0.514 |

| Observations | 1,864,694 | 1,864,681 | 1,864,681 | 1,758,900 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Dependent Variable: | Dormant | Dormant | Dormant |

| AAC (before 3 years) | 0.0008 | ||

| (0.0012) | |||

| AAC (before 2 years) | 0.0010 | 0.0012 | |

| (0.0010) | (0.0012) | ||

| AAC (before 1 year) | −0.0005 | −0.0006 | −0.0005 |

| (0.0008) | (0.0009) | (0.0012) | |

| AAC (current year) | −0.0034 *** | −0.0037 *** | −0.0036 *** |

| (0.0007) | (0.0009) | (0.0011) | |

| AAC (after 1 year) | −0.0033 *** | −0.0038 *** | −0.0037 *** |

| (0.0008) | (0.0009) | (0.0011) | |

| AAC (after 2 years) | −0.0023 ** | −0.0023 ** | |

| (0.0009) | (0.0011) | ||

| AAC (after 3 years) | −0.0004 | ||

| (0.0012) | |||

| Firm control variables | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| R-squared | 0.514 | 0.514 | 0.514 |

| Observations | 1,758,900 | 1,758,900 | 1,758,900 |

| (1) | (2) | |

|---|---|---|

| Dependent Variable: | Dormant | Dormant |

| AAC_dpt | −0.0904 *** | |

| (0.0168) | ||

| AAC_item | −0.0068 *** | |

| (0.0019) | ||

| Firm control variables | Yes | Yes |

| City control variables | Yes | Yes |

| Firm FE | Yes | Yes |

| Year FE | Yes | Yes |

| City FE | Yes | Yes |

| R-squared | 0.514 | 0.514 |

| Observations | 1,758,900 | 1,758,900 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable: | Dormant | Dormant | Dormant | Dormant | Dormant | Dormant | Scaled Dormant | Scaled Dormant | Scaled Dormant |

| AAC | −0.0056 *** | −0.0056 *** | −0.0026 *** | ||||||

| (0.0014) | (0.0008) | (0.0005) | |||||||

| AAC_dpt | −0.0904 *** | −0.0912 *** | −0.0436 *** | ||||||

| (0.0272) | (0.0168) | (0.0096) | |||||||

| AAC_item | −0.0068 ** | −0.0070 *** | −0.0033 *** | ||||||

| (0.0030) | (0.0019) | (0.0011) | |||||||

| Subsidy | 0.0021 *** | 0.0021 *** | 0.0021 *** | ||||||

| (0.0002) | (0.0002) | (0.0002) | |||||||

| Firm control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.514 | 0.514 | 0.514 | 0.514 | 0.514 | 0.514 | 0.533 | 0.533 | 0.533 |

| Observations | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 | 1,758,900 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Dependent Variable: | Dormant | Dormant | Dormant |

| AAC × Competition | −0.6502 *** | ||

| (0.1703) | |||

| AAC_dpt × Competition | −12.1294 *** | ||

| (3.5112) | |||

| AAC_item × Competition | −1.1763 *** | ||

| (0.3565) | |||

| AAC | 0.6429 *** | ||

| (0.1699) | |||

| AAC_dpt | 12.0069 *** | ||

| (3.5041) | |||

| AAC_item | 1.1663 *** | ||

| (0.3559) | |||

| Competition | 0.7074 *** | 0.6695 *** | 0.6588 *** |

| (0.1741) | (0.1727) | (0.1735) | |

| Firm control variables | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| R-squared | 0.514 | 0.514 | 0.514 |

| Observations | 1,758,900 | 1,758,900 | 1,758,900 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Dependent variable: | Direction | Direction | Direction |

| AAC | −0.0129 *** | ||

| (0.0030) | |||

| AAC_dpt | −0.2304 *** | ||

| (0.0569) | |||

| AAC_item | −0.0200 *** | ||

| (0.0060) | |||

| Firm control variables | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| R-squared | 0.285 | 0.285 | 0.285 |

| Observations | 1,758,900 | 1,758,900 | 1,758,900 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Dependent Variable: | Long-term Investment | Long-term Investment | Long-term Investment |

| AAC | 0.0289 *** | ||

| (0.0078) | |||

| AAC_dpt | 0.3309 ** | ||

| (0.1651) | |||

| AAC_item | 0.0232 | ||

| (0.0192) | |||

| Firm control variables | Yes | Yes | Yes |

| City control variables | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes |

| R-squared | 0.695 | 0.695 | 0.695 |

| Observations | 1,758,343 | 1,758,343 | 1,758,343 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, H.; Pan, S.; Ren, X. Does Administrative Approval Impede Low-Quality Innovation? Evidence from Chinese Manufacturing Firms. Sustainability 2020, 12, 1910. https://doi.org/10.3390/su12051910

Jiang H, Pan S, Ren X. Does Administrative Approval Impede Low-Quality Innovation? Evidence from Chinese Manufacturing Firms. Sustainability. 2020; 12(5):1910. https://doi.org/10.3390/su12051910

Chicago/Turabian StyleJiang, Haiwei, Shiyuan Pan, and Xiaomeng Ren. 2020. "Does Administrative Approval Impede Low-Quality Innovation? Evidence from Chinese Manufacturing Firms" Sustainability 12, no. 5: 1910. https://doi.org/10.3390/su12051910

APA StyleJiang, H., Pan, S., & Ren, X. (2020). Does Administrative Approval Impede Low-Quality Innovation? Evidence from Chinese Manufacturing Firms. Sustainability, 12(5), 1910. https://doi.org/10.3390/su12051910