The Sustainable Effect of Operational Performance on Financial Benefits: Evidence from Chinese Quality Awards Winners

Abstract

1. Introduction

2. Theory and Hypothesis

2.1. Quality Management Practices and Financial Performance

2.2. Effects of Operational Performance and Financial Performance

2.2.1. Flexibility and Financial Performance

2.2.2. Efficiency and Financial Performance

2.2.3. Delivery and Financial Performance

2.2.4. Inventory and Financial Performance

3. Methodology

3.1. Data Collection

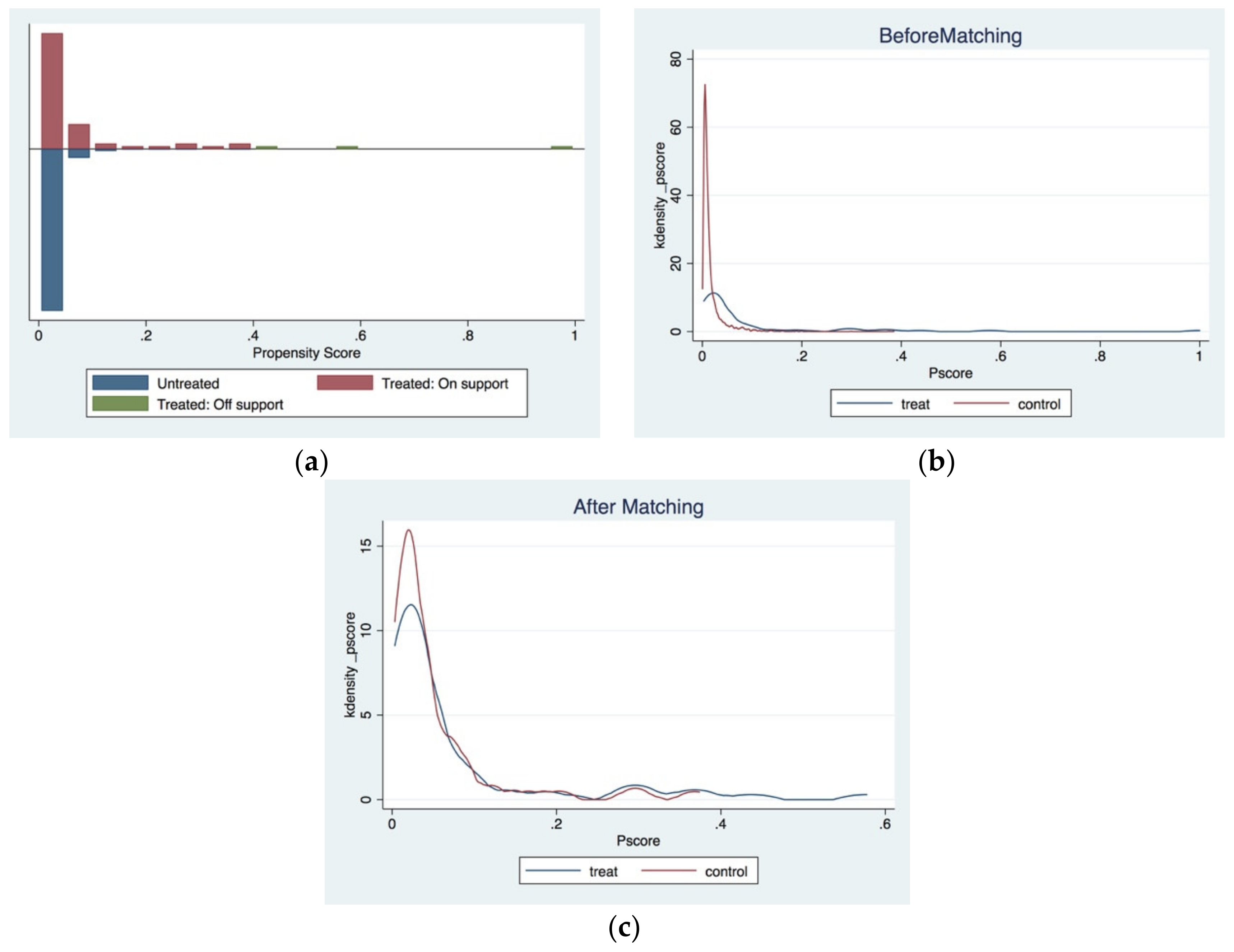

3.2. Propensity Score Matching

3.3. Difference-in-Difference Approach

3.4. Hierarchical Regression Analysis

4. Results

4.1. Propensity Score and Data Balance

4.2. D-in-D Estimate after Matching

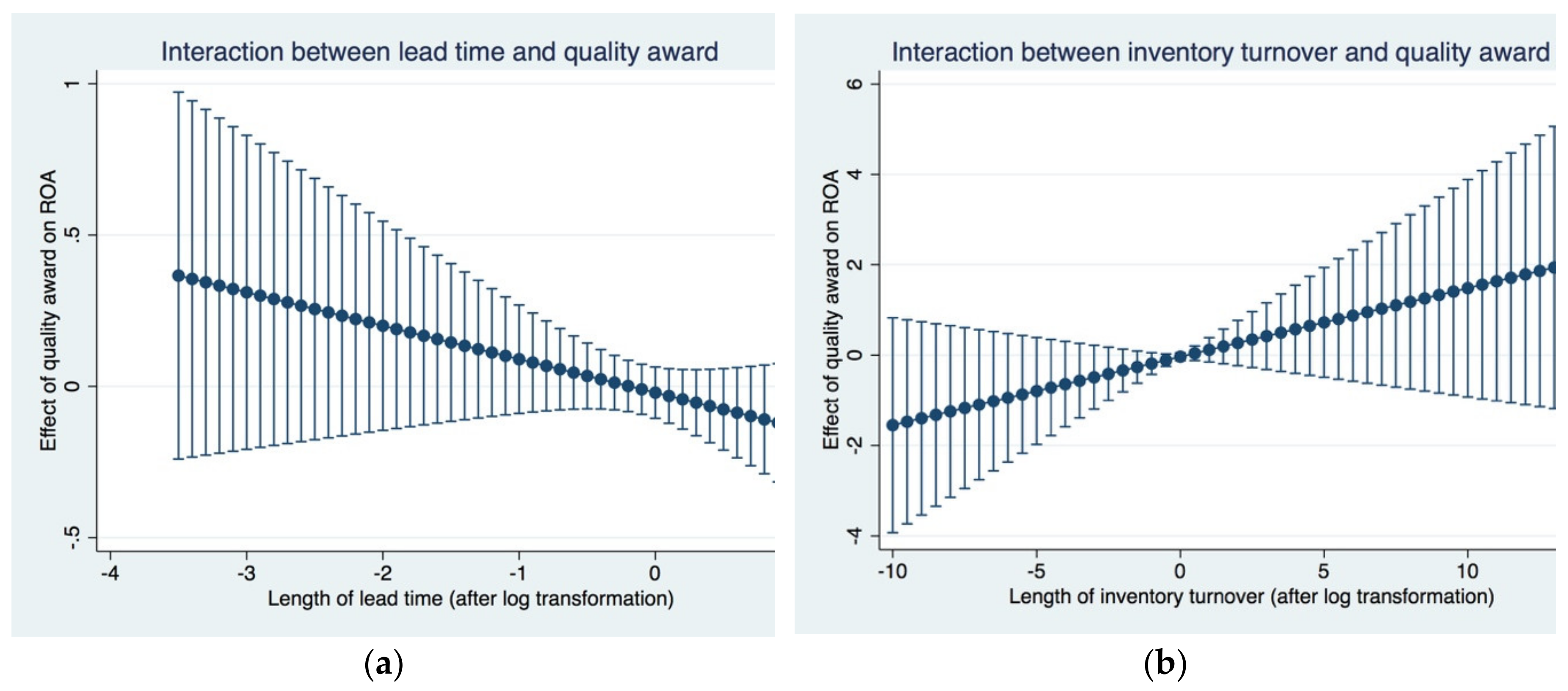

4.3. Analysis of the Effect of Operational Performance

5. Discussion and Implications

5.1. Discussion

5.2. Implications

5.3. Limitations

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Esgarrancho, S.; Cândido, C. Firm preparation for iso 9001 certification–the case of the hotel industry in portugal. Total Qual Manag Bus. 2017, 31, 1–20. [Google Scholar] [CrossRef]

- Waxin, M.-F.; Knuteson, S.; Bartholomew, A. Outcomes and Key Factors of Success for ISO 14001 Certification: Evidence from an Emerging Arab Gulf Country. Sustainability 2019, 12, 258. [Google Scholar] [CrossRef]

- Zhang, G.P.; Xia, Y. Does Quality Still Pay? A Reexamination of the Relationship Between Effective Quality Management and Firm Performance. Prod. Oper. Manag. 2012, 22, 120–136. [Google Scholar] [CrossRef]

- Boulter, L.; Bendell, T.; Dahlgaard, J. Total quality beyond North America. Int. J. Oper. Prod. Manag. 2013, 33, 197–215. [Google Scholar] [CrossRef]

- Sabella, A.; Kashou, R.; Omran, O. Quality management practices and their relationship to organizational performance. Int. J. Oper. Prod. Manag. 2014, 34, 1487–1505. [Google Scholar] [CrossRef]

- Akgün, A.E.; Ince, H.; Imamoglu, S.Z.; Keskin, H.; Kocoglu, I. The mediator role of learning capability and business innovativeness between total quality management and financial performance. Int. J. Prod. Res. 2013, 52, 888–901. [Google Scholar]

- Zeng, J.; Phan, C.A.; Matsui, Y. The impact of hard and soft quality management on quality and innovation performance: An empirical study. Int. J. Prod. Econ. 2015, 162, 216–226. [Google Scholar] [CrossRef]

- Chavez, R.; Yu, W.; Gimenez, C.; Fynes, B.; Wiengarten, F. Customer integration and operational performance: The mediating role of information quality. Decis. Support Syst. 2015, 80, 83–95. [Google Scholar] [CrossRef]

- Kortmann, S.; Gelhard, C.; Zimmermann, C.; Piller, F.T. Linking strategic flexibility and operational efficiency: The mediating role of ambidextrous operational capabilities. J. Oper. Manag. 2014, 32, 475–490. [Google Scholar] [CrossRef]

- Rumyantsev, S.; Netessine, S. What Can Be Learned from Classical Inventory Models? A Cross-Industry Exploratory Investigation. Manuf. Serv. Oper. Manag. 2007, 9, 409–429. [Google Scholar] [CrossRef]

- Martinezcosta, M.; Choi, T.Y.; Martinez, J.A.; Martinezlorente, A.R. Iso 9000/1994, iso 9001/2000 and tqm: The performance debate revisited. J. Oper. Manage. 2009, 27, 495–511. [Google Scholar] [CrossRef]

- Chung, Y.-C.; Tien, S.-W.; Hsieh, C.-H.; Tsai, C.-H. A study of the business value of Total Quality Management. Total. Qual. Manag. Bus. Excel. 2008, 19, 367–379. [Google Scholar] [CrossRef]

- Duh, R.-R.; Hsu, A.W.-H.; Huang, P.-W. Determinants and performance effect of TQM practices: An integrated model approach. Total. Qual. Manag. Bus. Excel. 2012, 23, 689–701. [Google Scholar] [CrossRef]

- García-Alcaraz, J.L.; Flor-Montalvo, F.; Avelar-Sosa, L.; Sánchez-Ramírez, C.; Jimenez-Macias, E. Human Resource Abilities and Skills in TQM for Sustainable Enterprises. Sustainability 2019, 11, 6488. [Google Scholar] [CrossRef]

- Oliveira, G.S.; Corrêa, J.; Balestrassi, P.; Martins, R.; Turrioni, J.B. Investigation of TQM implementation: empirical study in Brazilian ISO 9001-registered SMEs. Total. Qual. Manag. Bus. Excel. 2017, 30, 641–659. [Google Scholar] [CrossRef]

- Parvadavardini, S.; Vivek, N.; Devadasan, S. Impact of quality management practices on quality performance and financial performance: evidence from Indian manufacturing companies. Total. Qual. Manag. Bus. Excel. 2015, 27, 507–530. [Google Scholar] [CrossRef]

- Iqbal, A.; Asrar-Ul-Haq, M. Establishing relationship between TQM practices and employee performance: The mediating role of change readiness. Int. J. Prod. Econ. 2018, 203, 62–68. [Google Scholar] [CrossRef]

- Candido, C.; Coelho, L.; Peixinho, R. Why firms lose their ISO 9001 certification: Evidence from Portugal. Total. Qual. Manag. Bus. Excel. 2019, 1–20. [Google Scholar] [CrossRef]

- Gray, J.; Anand, G.; Roth, A.V. The Influence of ISO 9000 Certification on Process Compliance. Prod. Oper. Manag. 2014, 24, 369–382. [Google Scholar] [CrossRef]

- Kober, R.; Subraamanniam, T.; Watson, J. The impact of total quality management adoption on small and medium enterprises’ financial performance. Account. Finance 2011, 52, 421–438. [Google Scholar] [CrossRef]

- Baird, K.; Hu, K.J.; Reeve, R. The relationships between organizational culture, total quality management practices and operational performance. Int. J. Oper. Prod. Manag. 2011, 31, 789–814. [Google Scholar] [CrossRef]

- Lau, A.K.W.; Lee, S.H.; Jung, S. The Role of the Institutional Environment in the Relationship between CSR and Operational Performance: An Empirical Study in Korean Manufacturing Industries. Sustainability 2018, 10, 834. [Google Scholar] [CrossRef]

- Santos, H.; Lannelongue, G.; Gonzalez-Benito, J. Integrating Green Practices into Operational Performance: Evidence from Brazilian Manufacturers. Sustainability 2019, 11, 2956. [Google Scholar] [CrossRef]

- Shou, Y.; Hu, W.; Kang, M.; Li, Y.; Park, Y.W. Risk management and firm performance: the moderating role of supplier integration. Ind. Manag. Data Syst. 2018, 118, 1327–1344. [Google Scholar] [CrossRef]

- Prajogo, D.; Toy, J.; Bhattacharya, A.; Oke, A.; Cheng, E. The relationships between information management, process management and operational performance: Internal and external contexts. Int. J. Prod. Econ. 2018, 199, 95–103. [Google Scholar] [CrossRef]

- Al-Shboul, M.A.R.; Barber, K.D.; Garza-Reyes, J.A.; Kumar, V.; Abdi, M.R.; Steenhuis, H.-J. The effect of supply chain management practices on supply chain and manufacturing firms’ performance. J. Manuf. Technol. Manag. 2017, 28, 577–609. [Google Scholar] [CrossRef]

- Green, K.W.; Zelbst, P.J.; Meacham, J.; Bhadauria, V.S.; Jr, K.W.G. Green supply chain management practices: impact on performance. Supply Chain Manag. Int. J. 2012, 17, 290–305. [Google Scholar] [CrossRef]

- Croom, S.; Vidal, N.; Spetic, W.; Marshall, D.; McCarthy, L. Impact of social sustainability orientation and supply chain practices on operational performance. Int. J. Oper. Prod. Manag. 2018, 38, 2344–2366. [Google Scholar] [CrossRef]

- O’Neill, P.; Sohal, A.; Teng, C.W. Quality management approaches and their impact on firms׳ financial performance–An Australian study. Int. J. Prod. Econ. 2016, 171, 381–393. [Google Scholar] [CrossRef]

- Karapetrovic, S.; Casadesus, M.; Heras-Saizarbitoria, I. What happened to the ISO 9000 lustre? An eight-year study. Total. Qual. Manag. Bus. Excel. 2010, 21, 245–267. [Google Scholar] [CrossRef]

- Lo, C.K.Y.; Yeung, A.C.L.; Cheng, E. ISO 9000 and supply chain efficiency: Empirical evidence on inventory and account receivable days. Int. J. Prod. Econ. 2009, 118, 367–374. [Google Scholar] [CrossRef]

- Ataseven, C.; Prajogo, D.; Nair, A. ISO 9000 Internalization and Organizational Commitment—Implications for Process Improvement and Operational Performance. IEEE Trans. Eng. Manag. 2013, 61, 5–17. [Google Scholar] [CrossRef]

- Cai, S.; Jun, M. A qualitative study of the internalization of ISO 9000 standards: The linkages among firms’ motivations, internalization processes, and performance. Int. J. Prod. Econ. 2018, 196, 248–260. [Google Scholar] [CrossRef]

- Swink, M.; Jacobs, B.W. Six Sigma adoption: Operating performance impacts and contextual drivers of success. J. Oper. Manag. 2012, 30, 437–453. [Google Scholar] [CrossRef]

- Lo, C.K.Y.; Pagell, M.; Fan, D.; Wiengarten, F.; Yeung, A.C.L. OHSAS 18001 certification and operating performance: The role of complexity and coupling⋆. J. Oper. Manag. 2014, 32, 268–280. [Google Scholar] [CrossRef]

- Treacy, R.; Humphreys, P.; McIvor, R.; Lo, C.K.Y. ISO14001 certification and operating performance: A practice-based view. Int. J. Prod. Econ. 2019, 208, 319–328. [Google Scholar] [CrossRef]

- Goyal, M.; Netessine, S.; Randall, T. Deployment of Manufacturing Flexibility: An Empirical Analysis of the North American Automotive Industry. SSRN Electron. J. 2012. [Google Scholar] [CrossRef]

- Patel, P.C. Role of manufacturing flexibility in managing duality of formalization and environmental uncertainty in emerging firms. J. Oper. Manag. 2010, 29, 143–162. [Google Scholar] [CrossRef]

- Patel, P.C.; Terjesen, S.; Li, D. Enhancing effects of manufacturing flexibility through operational absorptive capacity and operational ambidexterity. J. Oper. Manag. 2011, 30, 201–220. [Google Scholar] [CrossRef]

- Jin, Y.; Vonderembse, M.; Ragu-Nathan, T.; Smith, J.T. Exploring relationships among IT-enabled sharing capability, supply chain flexibility, and competitive performance. Int. J. Prod. Econ. 2014, 153, 24–34. [Google Scholar] [CrossRef]

- Nadkarni, S.; Narayanan, V.K. Strategic schemas, strategic flexibility, and firm performance: The moderating role of industry clockspeed. Strateg. Manag. J. 2007, 28, 243–270. [Google Scholar] [CrossRef]

- Cachon, G.P.; Olivares, M. Drivers of Finished-Goods Inventory in the U.S. Automobile Industry. Manag. Sci. 2010, 56, 202–216. [Google Scholar] [CrossRef]

- Moreno, A.; Terwiesch, C. Pricing and production flexibility: An empirical analysis of the us automotive industry. Manuf. Serv. Oper. Manag. 2015, 17, 428–444. [Google Scholar] [CrossRef]

- Kenyon, G.; Meixell, M.; Westfall, P. Production outsourcing and operational performance: An empirical study using secondary data. Int. J. Prod. Econ. 2016, 171, 336–349. [Google Scholar] [CrossRef]

- Jayaram, J.; Xu, K. Determinants of quality and efficiency performance in service operations. Int. J. Oper. Prod. Manag. 2016, 36, 265–285. [Google Scholar] [CrossRef]

- Modi, S.B.; Mishra, S. What drives financial performance-resource efficiency or resource slack? J. Oper. Manag. 2011, 29, 254–273. [Google Scholar] [CrossRef]

- Jacobs, B.W.; Kraude, R.; Narayanan, S. Operational productivity, corporate social performance, financial performance, and risk in manufacturing firms. Prod. Oper. Manag. 2016, 25, 2065–2085. [Google Scholar] [CrossRef]

- Alan, Y.; Lapré, M. Investigating Operational Predictors of Future Financial Distress in the US Airline Industry. Prod. Oper. Manag. 2018, 27, 734–755. [Google Scholar] [CrossRef]

- Tang, T.; You, J.; Sun, H.; Zhang, H. Transportation Efficiency Evaluation Considering the Environmental Impact for China’s Freight Sector: A Parallel Data Envelopment Analysis. Sustainability 2019, 11, 5108. [Google Scholar] [CrossRef]

- Lyu, G.; Chen, L.; Huo, B. Logistics resources, capabilities and operational performance: A contingency and configuration approach. Ind. Manage. Data Syst. 2019, 119, 230–250. [Google Scholar] [CrossRef]

- Fan, H.; Li, G.; Sun, H.; Cheng, E. An information processing perspective on supply chain risk management: Antecedents, mechanism, and consequences. Int. J. Prod. Econ. 2017, 185, 63–75. [Google Scholar] [CrossRef]

- Flynn, B.; Huo, B.; Zhao, X. The impact of supply chain integration on performance: A contingency and configuration approach. J. Oper. Manag. 2009, 28, 58–71. [Google Scholar] [CrossRef]

- Yeung, A.C. Strategic supply management, quality initiatives, and organizational performance. Journal of Operations Management 2008, 26, 490–502. [Google Scholar] [CrossRef]

- Ou, C.S.; Liu, F.-C.; Hung, Y.C.; Yen, D.C. A structural model of supply chain management on firm performance. Int. J. Oper. Prod. Manag. 2010, 30, 526–545. [Google Scholar] [CrossRef]

- Gorane, S.; Kant, R. Supply chain practices and organizational performance. Int. J. Logist. Manag. 2017, 28, 75–101. [Google Scholar] [CrossRef]

- Gaur, V.; Kesavan, S. The effects of firm size and sales growth rate on inventory turnover performance in the US retail sector. In Retail Supply Chain Management; Springer: Berlin, Germany, 2008. [Google Scholar]

- Chen, H.; Frank, M.Z.; Wu, O.Q. What actually happened to the inventories of american companies between 1981 and 2000? Manag. Sci. 2005, 51, 1015–1031. [Google Scholar] [CrossRef]

- Gaur, V.; Fisher, M.L.; Raman, A. An Econometric Analysis of Inventory Turnover Performance in Retail Services. Manag. Sci. 2005, 51, 181–194. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y. Green bonds, corporate performance, and corporate social responsibility. Sustainability 2019, 11, 6881. [Google Scholar] [CrossRef]

- Zhu, X.; Lin, Y. Does lean manufacturing improve firm value. J Manuf. Technol. Manag 2017, 28, 422–437. [Google Scholar] [CrossRef]

- Lui, A.K.; Lo, C.K.Y.; Ngai, E.W. Does mandated RFID affect firm risk? The moderating role of top management team heterogeneity. Int. J. Prod. Econ. 2019, 210, 84–96. [Google Scholar] [CrossRef]

- Liu, B.J. Do bigger and older firms learn more from exporting? — evidence from china ☆. China Econ. Rev. 2017, 45, 89–102. [Google Scholar] [CrossRef]

- Wan, Y.; Ha, H.-K.; Yoshida, Y.; Zhang, A. Airlines’ reaction to high-speed rail entries: Empirical study of the Northeast Asian market. Transp. Res. Part A: Policy Pr. 2016, 94, 532–557. [Google Scholar] [CrossRef]

- Siougle, E.; Dimelis, S.; Economidou, C. Does ISO 9000 certification matter for firm performance? A group analysis of Greek listed companies. Int. J. Prod. Econ. 2019, 209, 2–11. [Google Scholar] [CrossRef]

- Simeth, M.; Cincera, M. Corporate science, innovation, and firm value. Manag. Sci. 2016, 62, 1970–1981. [Google Scholar] [CrossRef]

- Blind, K.; Mangelsdorf, A.; Pohlisch, J. The effects of cooperation in accreditation on international trade: Empirical evidence on ISO 9000 certifications. Int. J. Prod. Econ. 2018, 198, 50–59. [Google Scholar] [CrossRef]

- Rho, B.-H.; Park, K.; Yu, Y.-M. An international comparison of the effect of manufacturing strategy-implementation gap on business performance. Int. J. Prod. Econ. 2001, 70, 89–97. [Google Scholar] [CrossRef]

- Maiga, A.S.; Nilsson, A.; Ax, C. Relationships between internal and external information systems integration, cost and quality performance, and firm profitability. Int. J. Prod. Econ. 2015, 169, 422–434. [Google Scholar] [CrossRef]

- Dröge, C.; Jayaram, J.; Vickery, S.K. The effects of internal versus external integration practices on time-based performance and overall firm performance. J. Oper. Manag. 2004, 22, 557–573. [Google Scholar] [CrossRef]

- Sadikoglu, E.; Olcay, H. The Effects of Total Quality Management Practices on Performance and the Reasons of and the Barriers to TQM Practices in Turkey. Adv. Decis. Sci. 2014, 2014, 1–17. [Google Scholar] [CrossRef]

- Chatzoglou, P.; Chatzoudes, D.; Kipraios, N. The impact of ISO 9000 certification on firms’ financial performance. Int. J. Oper. Prod. Manag. 2015, 35, 145–174. [Google Scholar] [CrossRef]

- Gramani, M.C. Efficiency decomposition approach: A cross-country airline analysis. Expert Syst. Appl. 2012, 39, 5815–5819. [Google Scholar] [CrossRef]

- Scopus. In Proceedings of the 6th International Conference on Industrial Engineering and Applications, Tokyo, Japan, 29 April 2019.

- Lin, C.-S.; Su, C.-T. The Taiwan national quality award and market value of the firms: An empirical study. Int. J. Prod. Econ. 2013, 144, 57–67. [Google Scholar] [CrossRef]

| Panel A: Frequency of Chinese Quality Awards Winning Yead | |||

| Year | Frequency | Year | Frequency |

| 2011 | 11 | 2015 | 6 |

| 2012 | 9 | 2016 | 10 |

| 2013 | 11 | 2017 | 7 |

| 2014 | 8 | ||

| Panel B: Industry Distribution of Chinese Quality Awards Winners | |||

| Two-digit SIC code | Industry | Frequency | |

| 13 | Food and kindred products | 7 | |

| 26 | Chemicals and allied products | 4 | |

| 27 | Medicine products | 7 | |

| 29 | Rubber and plastics products | 3 | |

| 30 | Non-metal mineral products | 4 | |

| 33 | Metal mineral products | 4 | |

| 34 | Equipment products | 11 | |

| 36 | Automobile products | 6 | |

| 37 | Transportation equipment | 2 | |

| 38 | Electronic equipment | 8 | |

| 39 | Telecommunication products | 6 | |

| DV: Winning Award This Year (Dummy) | Logit Coefficient |

|---|---|

| Firm Size | 0.208 (0.202) |

| Liquidity Ratio | 0.568 *** (0.125) |

| Return to Asset | 0.037 ** (0.017) |

| Employees | 0.001 *** (0.001) |

| Age | 0.096 ** (0.044) |

| Debt-to-asset ratio | 0.021 * (0.011) |

| Year dummy | Yes |

| Intercept | −12.969 (4.237) |

| Pseudo R squared | 0.1412 |

| Number of observations | 3476 |

| LR chi-squared | 88.96 ** |

| Log likelihood | −270.608 *** |

| Variables | Method 1 (One-to-One nearest Neighborhood Matching) | Method 2 (Mahalanobis Matching) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Means of Variables | t-Test | Means of Variables | t-Test | ||||||

| Treatment | Control | t | p > t | Treatment | Control | t | p > t | ||

| Firm Size | U | 22.464 | 21.749 | 5.95 | 0.000 | 22.464 | 21.749 | 5.95 | 0.000 |

| M | 22.421 | 22.474 | −0.28 | 0.778 | 22.464 | 22.375 | 0.53 | 0.594 | |

| Liquidity Ratio | U | 2.129 | 1.852 | 2.06 | 0.040 | 2.129 | 1.852 | 2.06 | 0.040 |

| M | 1.996 | 2.148 | −0.56 | 0.575 | 2.128 | 1.915 | 0.70 | 0.486 | |

| Return to Asset | U | 8.859 | 6.664 | 2.31 | 0.021 | 8.859 | 6.664 | 2.31 | 0.021 |

| M | 8.565 | 10.494 | −1.02 | 0.309 | 8.859 | 7.453 | 1.70 | 0.092 | |

| Employees | U | 7304.9 | 3213.9 | 10.92 | 0.000 | 7304.9 | 3213.9 | 10.92 | 0.000 |

| M | 6142.5 | 6132.8 | 0.01 | 0.990 | 7304.9 | 5854.8 | 1.16 | 0.248 | |

| Age | U | 15.603 | 14.054 | 2.33 | 0.020 | 15.603 | 14.054 | 2.33 | 0.020 |

| M | 15.150 | 14.383 | 1.00 | 0.319 | 15.603 | 14.857 | 0.27 | 0.784 | |

| Debt-to-asset ratio | U | 45.919 | 43.182 | 1.27 | 0.203 | 45.919 | 43.182 | 1.27 | 0.203 |

| M | 46.569 | 42.864 | 1.15 | 0.252 | 45.919 | 48.227 | −0.76 | 0.450 | |

| Variables | OLS | PSM-DID | OLS | PSM-DID | ||

|---|---|---|---|---|---|---|

| DV = ROA (Return of Asset) (nearest neighborhood) | DV = Return of Asset (Return of Asset) (nearest neighborhood) | DV = Return of Asset (Return of Asset) (Mahalanobis) | DV = Return of Asset (Return of Asset) (Mahalanobis) | |||

| Award | −0.0060 (0.0043) | 0.0126 (0.0108) | −0.0070 (0.0033) * | −0.0020 (0.0058) | ||

| Post | −0.1416 (0.0843) | −0.0601 (0.0233) | ||||

| Before1 | −0.0147 (0.0150) | 0.0045 (0.0091) | ||||

| Current | −0.0064 (0.0119) | 0.0101 (0.0095) | ||||

| After1 | 0.0035 (0.0154) | 0.0068 (0.0097) | ||||

| After2 | −0.0081 (0.0085) | −0.0083 (0.0083) | ||||

| Firm Size | 0.0163 (0.0036) *** | 0.0263 (0.0192) | 0.0263 (0.0190) | 0.0018 (0.0029) | −0.0018 (0.0093) | −0.0026 (0.0096) |

| Liquidity Ratio | −0.0057 (0.0025) ** | −0.0071 (0.0033) * | −0.0071 (0.0032) ** | −0.0006 (0.0002) *** | −0.0008 (0.0003) *** | −0.0008 (0.0003) *** |

| Debt-to-asset ratio | −0.0023 (0.0002) *** | −0.0025 (0.0006) *** | −0.0024 (0.0005) *** | −0.0019 (0.0001) *** | −0.0024 (0.005) *** | −0.0024 (0.0005) *** |

| Asset turnover | 0.0067 (0.0008) *** | 0.0084 (0.0031) *** | 0.0084 (0.0031) *** | 0.0027 (0.0005) *** | 0.0037 (0.0009) *** | 0.0038 (0.0009) *** |

| Employees | 0.0035 (0.00335) | 0.0004 (0.0129) | 0.0002 (0.0130) | 0.0158 (0.0029) *** | 0.0021 (0.0109) | 0.0025 (0.0109) |

| Age | −0.0008 (0.0005) | 0.0123 (0.0106) | −0.0051 (0.0027) * | −0.0001 (0.0004) | 0.0076 (0.0029) | 0.0073 (0.0025) ** |

| Year dummy | No | Yes | Yes | No | Yes | Yes |

| Intercept | −0.2505 (0.05552) *** | −0.6048 (0.3414) | −0.3650 (0.3218) | −0.0480 (0.0475) | 0.0635 (0.1770) | 0.0839 (0.1813) |

| F−statistics | 46.40 | 5.59 | 6.00 | 54.04 | 3.75 | 4.55 |

| R square | 0.3083 | 0.2408 | 0.2390 | 0.3335 | 0.2600 | 0.2547 |

| # of observations | 714 | 714 | 714 | 743 | 743 | 743 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Research & Development | 0.0047 (0.0184) | 0.0044 (0.0184) | 0.0020 (0.0183) | 0.0020 (0.0186) | −0.0037 (0.0191) | −0.0054 (0.0182) | −0.0007 (0.0190) | −0.0043 (0.0187) | 0.0098 (0.0213) | 0.0086 (0.0208) |

| Asset Turnover | 0.0228 (0.0143) | 0.0226 (0.0143) | 0.0216 (0.0143) | 0.0209 (0.0144) | 0.0220 (0.0135) | 0.0205 (0.0131) | 0.0106 (0.0122) | 0.0114 (0.0116) | 0.0183 (0.0143) | 0.0201 (0.0145) |

| Employees | −0.2528 (0.0824) *** | −0.2504 (0.0829) *** | −0.2464 (0.0816) *** | −0.2337 (0.0828) *** | −0.2337 (0.0828) *** | −0.2391 (0.0872) ** | −0.2250 (0.0769) *** | −0.2312 (0.0774) *** | −0.2103 (0.0782) *** | −0.2048 (0.0752) *** |

| Age | −0.0388 (0.0136) *** | −0.0381 (0.0135) *** | −0.0406 (0.0135) *** | −0.0431 (0.0134) *** | −0.0361 (0.0136) *** | −0.0367 (0.0133) *** | −0.0444 (0.0120) *** | −0.0421 (0.0127) *** | −0.0385 (0.0126) *** | −0.0372 (0.0130) *** |

| Profit | 0.9748 (0.0257) *** | 0.9741 (0.0259) *** | 0.9758 (0.0260) *** | 0.9767 (0.0256) *** | 0.9479 (0.0252) *** | 0.9568 (0.0230) *** | 0.9625 (0.0252) *** | 0.9616 (0.0253) *** | 0.9711 (0.0242) *** | 0.9698 (0.0244) *** |

| Work–in - Construction | −0.0417 (0.0142) *** | −0.0420 (0.0143) *** | −0.0414 (0.0142) *** | −0.0412 (0.0143) ** | −0.0426 (0.0144) ** | −0.0431 (0.0142) ** | −0.0260 (0.0140) ** | −0.0258 (0.0135) * | −0.0398 (0.0145) *** | −0.0395 (0.0144) *** |

| Financial Cost | −0.0197 (0.0142) | −0.0196 (0.0142) | −0.0195 (0.0142) | −0.0197 (0.0145) | −0.0155 (0.01437) | −0.0155 (0.0148) | −0.0307 (0.0139) ** | −0.0304 (0.0137) ** | −0.0272 (0.0159) ** | −0.0267 (0.0158) ** |

| Sales Cost | −0.4422 (0.0678) *** | −0.4417 (0.0682) *** | −0.4478 (0.0675) *** | −0.4476 (0.0677) *** | −0.4444 (0.0681) *** | −0.4459 (0.0672) *** | −0.4742 (0.0637) *** | −0.4644 (0.0664) *** | −0.5274 (0.0639) *** | −0.5272 (0.0638) *** |

| Management Cost | −0.1330 (0.0631) ** | −0.1331 (0.0633) ** | −0.1306 (0.0621) ** | −0.1291 (0.0627) ** | −0.1301 (0.0629) ** | −0.1297 (0.0612) ** | −0.1017 (0.0565) * | −0.01038 (0.0554) * | −0.1152 (0.0590) ** | −0.1161 (0.0582) ** |

| Liquidity Ratio | −0.0335 (0.0268) | −0.0335 (0.0269) | −0.0314 (0.0258) | −0.0312 (0.0256) | −0.0315 (0.0260) | −0.0311 (0.0259) | −0.0619 (0.0246) ** | −0.0597 (0.0261) ** | −0.0176 (0.0221) | −0.0171 (0.0226) |

| Debt-to-asset ratio | −0.0032 (0.0026) | −0.0033 (0.0026) | −0.0033 (0.0025) | −0.0033 (0.0025) | −0.0018 (0.0026) | −0.0021 (0.0025) | −0.0025 (0.0025) | −0.0028 (0.0025) | −0.0024 (0.0023) | −0.0027 (0.0022) |

| Award | −0.0239 (0.0453) | −0.0254 (0.0446) | −0.0248 (0.0444) | −0.0312 (0.0439) | −0.0227 (0.0450) | −0.0181 (0.0423) | −0.0207 (0.0432) | −0.0356 (0.0453) | −0.0348 (0.0453) | |

| Production Flexibility (H2) | −0.0150 (0.0080) * | −0.0250 (0.0111) ** | ||||||||

| Production Flexibility × Award | 0.0201 (0.0171) | |||||||||

| Cost Efficiency (H3) | −0.8924 (0.3775) ** | −1.1538 (0.3942) *** | ||||||||

| Cost Efficiency × Award | 1.1967 (0.9261) | |||||||||

| Lead Time (H4) | −0.2269 (0.0601) *** | −0.1724 (0.0539) *** | ||||||||

| Lead Time × Award | −0.1105 (0.0901) * | |||||||||

| Inventory Turnover (H5) | 0.2570 (0.0708) *** | 0.2065 (0.0780) *** | ||||||||

| Inventory Turnover × Award | 0.1517 (0.1219) * | |||||||||

| Intercept | 0.0089 (0.0376) | 0.0122 (0.0378) | −3.5057 (0.0381) | −3.5107 (0.0376) | −3.513 (0.0397) | −3.5163 (0.0376) | −0.0145 (0.0334) | −0.0076 (0.0355) | −0.0011 (0.0338) | 0.0046 (0.0352) |

| R-square (within) | 0.9330 | 0.9331 | 0.9336 | 0.9338 | 0.9348 | 0.9359 | 0.9391 | 0.9396 | 0.9377 | 0.9381 |

| # of observations | 532 | 532 | 532 | 532 | 532 | 532 | 532 | 532 | 532 | 532 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Wu, S.; Zhong, C.; Liu, Y. The Sustainable Effect of Operational Performance on Financial Benefits: Evidence from Chinese Quality Awards Winners. Sustainability 2020, 12, 1966. https://doi.org/10.3390/su12051966

Liu H, Wu S, Zhong C, Liu Y. The Sustainable Effect of Operational Performance on Financial Benefits: Evidence from Chinese Quality Awards Winners. Sustainability. 2020; 12(5):1966. https://doi.org/10.3390/su12051966

Chicago/Turabian StyleLiu, Huiming, Su Wu, Chongwen Zhong, and Ying Liu. 2020. "The Sustainable Effect of Operational Performance on Financial Benefits: Evidence from Chinese Quality Awards Winners" Sustainability 12, no. 5: 1966. https://doi.org/10.3390/su12051966

APA StyleLiu, H., Wu, S., Zhong, C., & Liu, Y. (2020). The Sustainable Effect of Operational Performance on Financial Benefits: Evidence from Chinese Quality Awards Winners. Sustainability, 12(5), 1966. https://doi.org/10.3390/su12051966