1. Introduction

Efforts to adopt corporate social responsibility (CSR) standards have increased within firms worldwide, including those concerning the environment. Initiatives in this regard can also be found among actors of the banking sector. Banks are no longer perceived as organizations, which provide only intermediation services between companies and consumers. They are seen as actors in the economic and social processes. Banks worldwide now have to undertake annual CSR reporting [

1].

Based on the Web of Science, we find a large literature concerning CSR and the banking sector but only a few concern CSR and bank performance [

2,

3,

4,

5,

6,

7]. Yet, no studies seem to examine bank ecologization through the link between environmental responsibility and financial performance. By environmental responsibility we mean respect for natural resources at all three levels of the bank’s activity (supporting activities, internal management and products addressing pro-environmental projects, these levels will be discussed in more detail later in this article). By ecologization we mean a process consisting of taking action to protect natural resources, therefore it is a manifestation of the environmental responsibility of banks.

The main purpose of this study is to address the apparent research gap concerning environmental responsibility of banks in the context of their financial effectiveness. Financial efficiency determines the financial position of a bank based on its reports and a set of specific indicators [

8].

We also address these aspects in relation to the pending EU regulations in the field of disclosure of non-financial and diversity information by certain large undertakings and groups, as defined in the European Union (EU) directive and implemented by Member States in state legislature.

The importance of the line of research used here is confirmed by the recent (2018) award of the Bank of Sweden’s Prize in Economic Sciences in Memory of Alfred Nobel to William D. Nordhaus (Yale University) for the inclusion of climate change into the long-term macroeconomic analyses (the prize was shared with Paul M. Romer of New York University).

We used a variety of sources, including scientific articles and statistical data, financial and CSR reports of banks, and reporting principles (e.g., Global Reporting Initiative—GRI Standards) as well. We applied the following methods of research: Analytic Hierarchy Process (AHP), linear ordering methods: standardized sum method and synthetic measure of development, Pearson’s and Spearman’s correlation coefficients, Student’s t and Mann-Whitney U tests and boxplots. These were supported by analyses of financial and non-financial reports of banks and ratio analyses of banks. The AHP is a structured technique for organizing and analysing complex decisions, based on mathematical calculations [

9]. It represents the most accurate approach to the quantification of weights in tested criteria. Linear ordering methods offer a potential for classifying and ordering the studied entities (financial institutions) based on the displayed level of any compound phenomenon—in this case: by the level of their environmental involvement. Pearson’s correlation coefficient is a measure of the linear correlation between two variables. While Spearman’s correlation coefficient is a nonparametric measure of rank correlation, it can be used to signify statistical dependence between the rankings of two separate variables. Student’s t-test is used when means in two independent groups are compared. And the Mann-Whitney U test is the nonparametric equivalent of the independent t-test and it is used to compare two independent groups from the same population that do not require large normally distributed samples [

10,

11].

The scope of research was structured through formulation and subsequent verification of three research hypotheses related to the evaluation of banks’ environmental involvement (ecologization) and to correlations between financial effectiveness of the financial sector and the level of its environmental involvement. Empirical implementation of the above research plan was performed on the basis of commercial banks operating on the Polish market. According to the NBP (the National Bank of Poland), commercial banks represent nearly 65% of total assets of the financial sector and 90% of total banking sector assets in Poland. The study presented in this paper is a pioneering attempt at performing detailed analyses for the entire segment of commercial banking in Poland, as a revised extension of earlier concepts presented in Reference [

12]. In addition, the literature revealed a significant research gap with respect to this angle of study in a global dimension. The paper accentuates some of the more promising prospects for further examination, also in relation to other sectors of the banking industry.

The paper consists of five parts, with the following structure: introduction, environmental responsibility in the banking sector—literature review, materials and research methodology, results and the last part: discussion and conclusions. The second section: environmental responsibility in the banking sector—literature review presents the most popular approaches to the problem, as reported in the professional literature. The justification of the study is also presented in this section. The third section covers materials and research methodology, with presentation of research goals and hypotheses as well as plan of research. The fourth part of the paper discusses results obtained in the course of research. According to the plan of research, this section is divided into the objective scope of empirical verification of the research process, the measurement of banks’ environmental involvement, financial effectiveness of the banking sector and analytical evaluation of correlations between banks’ financial effectiveness and their environmental involvement. And the last part of the paper presents discussion and conclusions resulting from the article.

2. Literature Review and Research Goals

2.1. Environmental Responsibility in the Banking Sector

Modern banking operations have increasingly incorporated social, cultural and environmental goals, especially over the last four decades [

13]. In this context, CSR is very widely addressed aspects in modern research and literature. Additionally, the number of publications confirms the increasing importance of this particular area of research, in close association with CSR and global sustainable development issues.

The literature addresses many different topics related to CSR. In fact, many of these aspects can be used interchangeably. The following aspects were identified based on literature reviews: responsible business conduct, socially responsible investing, corporate responsibility, business responsibility, sustainability, corporate sustainability, community relations, corporate community engagement, global business citizenship, corporate citizenship, corporate strategic responsibility, corporate sustainability and responsibility, corporate stakeholder responsibility [

12].

Table 1 summarizes results of queries for scientific papers related to CSR and global sustainable development issues, as returned by the Web of Science database for the period of 1900–2019.

The number of publications confirms the increasing importance of research associated with CSR and global sustainable development issues. At the same time, data summarized in

Table 1 provide evidence of a research gap in relation to studies relating environmental protection and banking activity. CSR is defined in many ways, due to the multidisciplinary nature of the concept, formulated in response to specific cultural, organizational and geographic determinants. Some studies emphasize the complex and multidisciplinary character of the notion at the most basic level of their postulated CSR definition. A. Dahlsrud in “How Corporate Social Responsibility is Defined: an Analysis of 37 Definitions” provides an interesting analysis of as many as 37 explications of the CSR term [

14]. Within the narrow context of the banking industry, environmental responsibility—one of the fundamental dimensions of CSR—is defined as eco-banking, green banking, climate-banking, environmental banking and sustainable banking.

An extended analysis of research related to CSR can be found in a review of the best research from 2009 to 2014 by W. Visser et al. [

15]. This aspect of research is also well represented in the context of financial institutions [

16]. The context of environmental responsibility of modern banks is not very often described in the literature, while about CSR we have go more than 18.5 thousands papers (

Table 1). There are some studies about this topic [

1,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28,

29]. Additionally, there are not so many papers concerning correlations between CSR involvement of the banking sector and the financial effectiveness of entities. There are few papers [

2,

3,

4,

5,

6,

7,

30,

31,

32]. The authors confirm in paper [

7] that the financial condition of the banks also does not impact the CSR engagement. Additionally, their study confirms, that banks from Central and Eastern European Countries (CEEC) with better financial efficiency have higher efficiency of CSR activities. Our study revealed a marked absence (both in domestic research and globally) of studies related specifically to the measurement of practical environmental involvement by entities or analytical evaluation of the findings in correlation with their disclosed financial result [

12]. Our paper fulfils a gap in the literature in this research area.

The problems of environmental responsibility of business institutions, including banks, become especially important in the light of the EU strategy already mentioned and the 2014/95/EU Directive on disclosure of non-financial information, including environmentalist actions. These laws come into force for Polish institutions on the 1st of January 2017 and include public interest institutions, commercial banks among them. All member countries have until the 6th of December 2016 to implement the directive. According to the Directive text, the public interest institutions, including banks, must disclose, in their reports or separate documents, important information concerning environmental data, social and human resources (HR) data, respecting human rights and counteracting corruption and bribery [

33,

34].

Companies are free to choose the means of reporting that suit them and their standards. The most popular guideline standards for social reporting were established by the Global Reporting Initiative (GRI), with their newest standard being GRI Standards. GRI guidelines contain general rules of communicating the influence of business activities and detailed indicators related to specific parts of reports [

33,

35]. In the literature there exist papers concerning the role of non-financial reports, including integrated reports, in banking sector [

1,

24,

36,

37,

38].

The postulate of environmental involvement does raise a certain degree of criticism [

39]. The opponents place emphasis on the cost associated with such activities; they also question some of the motives behind the ecological movements. However, based on analyses and research conducted over the course of this project, it may safely be concluded that many of the stakeholder groups identified within the banking sector seem to attach great significance to the issue of environmental responsibility.

2.2. Goals and Hypotheses of the Research

An analysis of the literature reveals, as previously mentioned, a significant lack of scientific papers and research into the matter of environmental responsibility of banks in the light of their financial effectiveness. Our goal was to provide a method for the measurement of the extent of banks’ involvement in ecologization and to examine the relationship between their ecological responsibility and their financial results. This aspect of research seems very important in the light of the aforementioned 2014/95/EU Directive coming into force in state legislatures of the EU Member States. In accordance with the above conditions we can thus state two main goals of our research [

33]:

Measuring the extent to which commercial banks are involved in ecologization based on a pre-established procedure.

Examining the relationship between the environmental responsibility of banks and their financial effectiveness. This relationship will be examined using a selection of statistical tools. This will also be an attempt to answer the question whether environmentally responsible banks are economically effective.

Fulfilling these main goals will also entail fulfilling certain specific goals:

Establishing a procedure for creating a synthetic indicator of a bank’s involvement in ecologization.

Measuring the extent to which banks are committed to meeting the goals of a modern, environmentally-oriented credit institution.

Analysing the economic effectiveness of the commercial banking sector.

Examining the relationship between financial results of banks and the depth of the banking sector’s involvement in environmental protection.

The above objectives correspond with the following research hypotheses, to be validated or rejected in the course of this study:

Hypothesis 1 (H1). For banks listed on the Warsaw Stock Exchange, the Bank Ecologization Index (BEI) will be higher compared to other banks in the same time period.

Hypothesis 2 (H2). There is a positive correlation between the bank’s financial result and the Bank Ecologization Index (BEI). Therefore, economically effective banks display more involvement in natural environment protection.

Hypothesis 3 (H3). There is a threshold to the value of the aggregated index that describes the bank’s financial standing that marks a point of significant increases in the value of the BEI index.

Research hypotheses were prepared based on a literature review and observations of contemporary phenomena in the financial sector, including banking sector and stock exchanges. Some environmentally-oriented stock market indices exist to measure performance, including the WSE-Warsaw Stock Exchange is WIG-ESG (Warszawski Indeks Giełdowy-Environmental Social Government) Index, the Dow Jones Sustainability Index series (DJSI), the Calvert Social Index (CSI), the FTSE Johannesburg Stock Exchange Socially Responsible Index (JSE SRI) and the Sao Paulo Stock Exchange Corporate Sustainability Index (ISE).

In the domestic and foreign literature, few papers exist describing correlations between CSR performance of the banking sector and the financial effectiveness of entities. Also, there are no studies about:

- -

the measurement of ecological involvement of banking sector in pro-environmental activities,

- -

the correlation between environmental involvement (as a part of CSR) of banks and their financial ratios.

3. Research Methodology

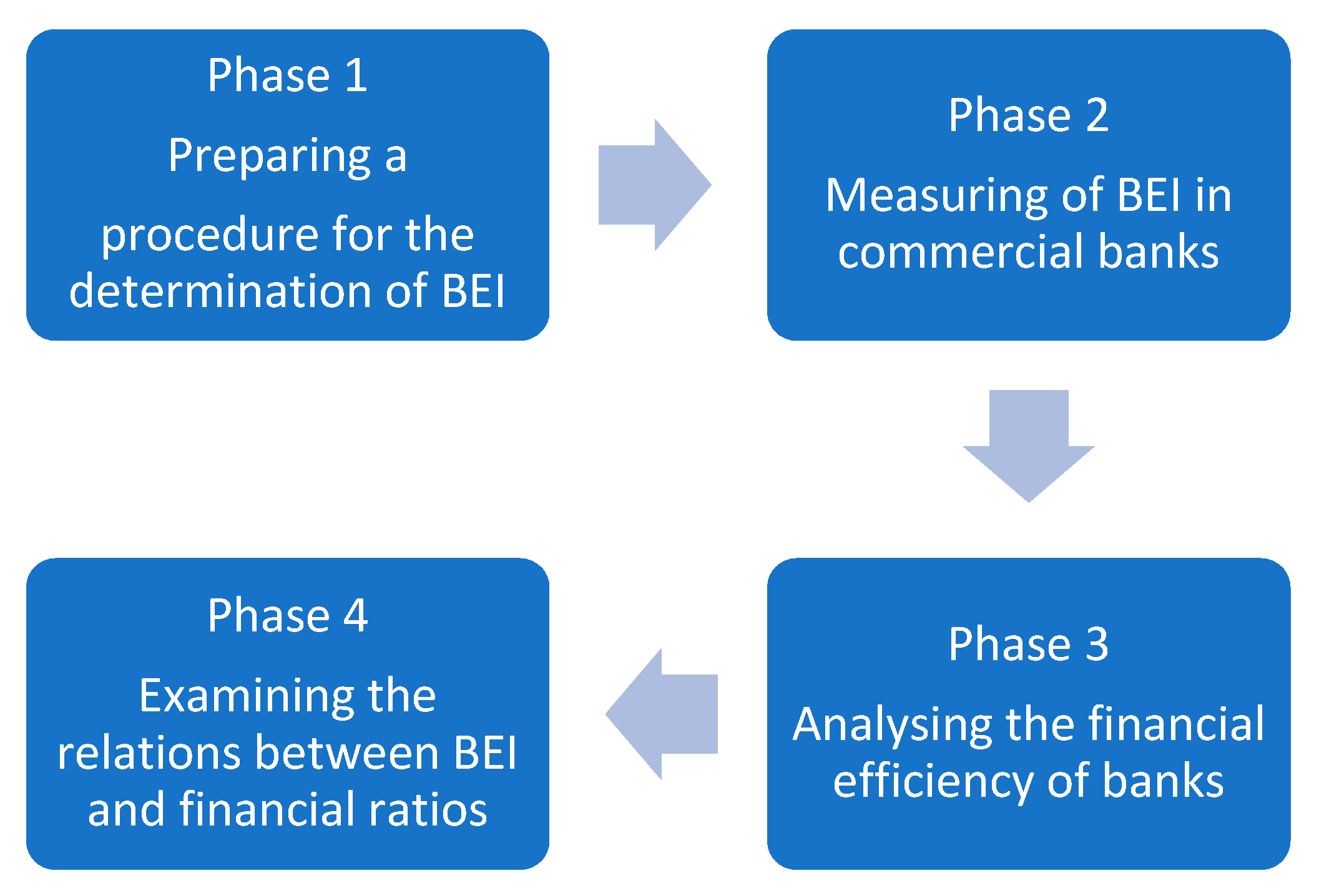

These actions form the research plan, segmented into four phases as shown in

Figure 1.

As shown in

Figure 1. the four phases include:

Phase 1. The phase concerns preparing a procedure for the determination of a synthetic BEI indicator (Bank Ecologization Index). The synthetic BEI indicator (Bank Ecologization Index) will be used to check which banks are involved in ecologization processes. The preparation phase will proceed on the basis of the Analytic Hierarchy Process (Saaty’s method) and the linear ordering method (multidimensional comparative analysis). In the last step of procedure creation, three stages of bank ecologization will be established. The procedure itself will entail five stages:

1. A set of criteria will be established to properly describe the involvement of banks in pro-environmental activities at each of the three identified levels [

18,

40]:

Level I—Supporting activities,

Level II—Internal management,

Level III—Products addressing ecological risk and those designed to protect natural environment.

Based on expert interviews, analyses of non-financial information reporting standards used in the segment (with particular focus on the GRI-Global Reporting Initiative standard) and reviews of domestic and foreign literature on the subject, we produced a set of criteria that best describe the ideal model of an environmentally responsible banking institution. The set consists of 9 criteria related directly to pro-environmental orientation of banks, assigned to the aforementioned three levels of pro-environmental involvement.

Table 2 presents the initial set of criteria determined in this manner.

The criteria from level II were associated with matching indices, in accordance with the recommendations of GRI (Global Reporting Initiative): GRI G4 or GRI Standards. For each criterion in the set, respondents were asked to provide an estimate of its value as per the end of 2017, complete with the unit of measurement used (e.g., in thousands PLN, tons, Kw/hour, etc.).

2. To determine the importance of particular criteria, the Analytic Hierarchy Process (AHP method) will be used. This method makes it possible to solve a task related to multicriteria decisions if the issue at hand involves, among others, selection between various variants of decisions or determining the influence of particular criteria upon the result, such as a synthetic index.

The use of the AHP method for measuring the degree of a bank’s ecologization involvement will make it possible to determine the weights of the determined criteria. This phase will be conducted in six steps, as follows [

41]:

Developing questionnaires serving to compare ecological criteria with the use of marking in

Table 3.

Expert evaluation of chosen criteria and then ordering them in specific tables.

Making the assessments of particular criteria by experts and then placing their elements in appropriate tables. Choosing importance for the chosen criteria by calculating the arithmetic median of the rows in each table containing normalized grades given by all the experts.

Creating tables with the importance grades of all criteria graded by the experts.

Verifying the credibility of each expert, with the help of the ICI index (the inconsistency index), followed by determination of weights for each expert opinion. The ICI index will be calculated from the following Equation (1) [

9] (p. 130):

where:

Value of the ICI index will provide information on the degree of cohesion displayed by experts in preparation of their matrices of priorities [

9]. In accordance with Saathy’s approach, if the ICI index is found to be in excess of 10%, the associated matrix is rejected and the process of establishing priorities is repeated.

Determining synthetic weights for each of the groups of criteria representing each of the three levels of pro-environmental involvement of banks. A synthetic weight for each group of criteria will be determined in accordance with the market share of each bank (represented by an expert authority), measured as a balance sum in the studied group of banking institutions.

3. The next stage of the procedure will involve measurement of each criterion for each of the banking institutions included in the study. The procedure will be based on questionnaire surveys collected from each studied entity, supported by analyses of their respective non-financial disclosures. Values of level I criteria will be related to the balance sum of each entity, while those included in level II will be examined in relation to the entities’ reported employment.

4. Determining the value of a synthetic Bank Ecologization Index (BEI) will be carried out based on the standardized sum method as one of the available linear ordering methods in multidimensional comparative analyses. The multidimensional comparative analysis (MCA) is a discipline of science associated with the study of comparability between objects (companies, countries, regions) described by multiple properties [

42] (p. 250). The resulting value will be used to measure and evaluate the level of pro-environmental involvement in entities under study. It is assumed that all variables are normalized and take the form of stimulants of development [

43] (p. 260). A stimulant is defined as the larger-the-better variable and destimulant as the smaller-the-better variable. The method used in research involves a two-step approach based on [

43] (p. 260–261).

4.1. For each object (i.e., bank), a sum of variable values is calculated from the following Equation (2):

where:

—value of the i-th object’s j-th normalized variable

—number of studied criteria,

—weight of the j-th variable, with assigned weights satisfying the following requirements:

- 1)

- 2)

The weights will be determined in accordance with the requirements of the AHP method. In the project at hand, the variables take the form of criteria reflecting each bank’s involvement in pro-environmental activities.

4.2. For each studied object, a measure of development will be calculated as a value of the BEI index, from the following Equation (3):

where (4,5):

For the method used in the research, it is necessary to appoint two abstract objects:

- -

—pattern, which is characterized by the best values of the analysed features,

- -

—anti-pattern, which is characterized by the weakest values of the analysed features,

- -

and represent values of criteria for each of the two abstract objects. that is, pattern and anti-pattern, respectively.

Values of the BEI index are contained in the range of [0;1], while the measure of development will equal 1 for pattern and 0 for anti-pattern. The higher the value obtained in this manner, the higher the rank level of the studied multi-dimensional object: in this case—the level of pro-environmental involvement of a banking institution. Based on the calculated values, the broad sample of banks may be ordered from worst to best in terms of their pro-environmental involvement.

5. The next stage of the procedure concerns formulating the three classes of a bank’s environmental maturity model. At the last stage of procedure development, in accordance with the procedure assumptions, the following three classes of bank ecologization will be determined:

first class (best class)—this class includes banks having the highest values of BEI: (2/3* (BEImax-BEImin); BEImax],

second class—this class covers banks with the medium value of BEI: (1/3* (BEImax-BEImin); 2/3*(BEImax-BEImin)]

third class—this class includes banks having the lowest values of BEI, for which the value of the researched index is in the range: [BEImin; 1/3* (BEImax-BEImin)]. The width of each of these three classes is the same and amounts to 33.33%.

Phase 2. The phase concerns investigating the degree of all commercial banks’ involvement in the realization of tasks resulting from the ecological orientation of banks. The study will be conducted in accordance with the aforementioned procedure. Based on data collected from analytical evaluations of non-financial disclosures and from expert evaluations, a Bank Ecologization Index (BEI) will be calculated for each of the entities under examination. The resulting values will then be related to stock exchange information and Respect Index rankings. The Respect Index is the first CSR index in the Central and Eastern Europe. The RESPECT Index project is designed to identify companies (also banks) which are managed in a responsible and sustainable manner. In addition, the index places strong emphasis on improving the investment attractiveness of companies based on such criteria as reporting quality, level of investor relations or information governance [

44].

For the purpose of verifying the first research hypothesis, average values of the BEI index will be established for the group of entities under study and for those listed on the Stock Exchange. This part of the project will be based on Student’s t and Mann-Whitney U tests.

Phase 3. The phase concerns conducting an analysis of financial efficiency of environmentally responsible banks by applying financial analysis indicators typically adopted in the study of financial efficiency of contemporary loan institutions, namely:

Interest margin ratio is calculated this way: interest revenue minus interest cost to total assets. Total Capital Ratio (TCR), according art. 92 CRR (Capital Requirements Regulations) is the own funds of the institution expressed as a percentage of the total risk exposure amount. In the context of financial efficiency of banks, indicators: ROA, ROE, IMR are the larger-the-better variables and C/I is the smaller-the-better variable. In the context of bank solvency TCR is the larger-the-better variable. Analyses of financial performance indicators such as ROA, ROE, C/I, IMR will be performed on the basis of descriptive statistical measures, including arithmetic and modal average, median, quantile, minimum and maximum values.

This phase will also include determination of an aggregate indicator representing the financial situation of a commercial banking institution and estimation of the threshold ratio above which the BEI index grows significantly. For the calculation of the aggregate indicator will be used a method of development pattern [

43]. The latter, along with the already mentioned standardized sum method, represents one of the common approaches to the linear ordering of variables. The more similar to the pattern is the bank, the higher is the level of its financial efficiency.

In our research procedure, the determination of an aggregate index of financial situation is based on the use of the following variables: ROA, ROE, C/I, IMR and TCR. It is assumed that all variables are normalized and take the form of larger-the-better variable. The pattern method used in research requires the use of two abstract objects (similarly as in the standardized sum method): pattern (), which is characterized by the best values of the analysed features and anti-pattern (), which is characterized by the weakest values of the analysed features.

The next step involves examination of similarities between objects (banks) with the purpose of establishing a point of reference for the evaluation of banks. Distance from this point (e.g., Euclidean) can be used as measure of each bank’s departure from the model pattern of development. Distance from the pattern is calculated using the following Equation (6):

where:

—value of the i-th object of the j-th normalized variable

—Euclidean distance between the i-th object and the model pattern of development,

The last step in method of development pattern involves determination of development measure for each of the studied objects, based on the following Equation (7):

where:

The development measure presented above is construed to provide information on effective ordering of the studied entities, from the most effective to the least effective in financial terms. The DM (Development Measure) values are contained in the range of [0;1]. The higher the DM value, the more pronounced is the level of the studied complex phenomenon or in this case—the higher is the financial effectiveness of banking institutions under examination.

Phase 4. The phase covers investigating the relations between the degree of involvement in the process of increasing environmental responsibility of these institutions and their financial results. This relation will be analysed using selected statistical tools, such as Pearson’s and Spearman’s correlation coefficient and box plot. Activities conducted in this phase of research correspond with verification of the second and the third research hypotheses.

The four-stage process included in our plan of research on environmental responsibility of the banking sector on a national level can be regarded as universal. Due to including of the specific of the banking sector, it can be implemented in each country. In our example, the empirical verification of the research plan (including the implementation of the procedure used in the first phase) was performed on the basis of the Polish banking sector. Results of measurements and analyses are presented in the next section of this paper.

4. The Findings

4.1. The Objective Scope of the Empirical Verification of the Research Process

Empirical verification of the research plan described in section three above was performed with reference to the Polish banking sector. The implementation of the research procedure comprised of representatives of commercial banking institutions in Poland. Measurement and evaluation of the studied banks’ involvement in environmental activities was conducted on the basis of reports produced at the end of 2017. This particular timeframe was selected on purpose, to reflect the fact that practical recommendations of the 2014/95/EU Directive had been included in Polish legislature from January 1, 2017. With respect to reasons behind our decision to include only commercial banks, it must be noted that institutions of this type represent nearly 65% of total assets of the Polish financial sector and 90% of the total assets of the Polish banking sector [

45].

Table 4 presents the number and the structural composition of banks in Poland between the years 2011–2017.

Due to the fact that the affiliating banks, namely—Bank Polskiej Spółdzielczości S.A. and SGB-Bank S.A.—act in the capacity of public limited companies but are recognized as commercial banks by the Polish Financial Supervision Authority, we decided to include them in our study, raising the total number of studied entities to 35.

At the end of 2017, assets of institutions comprising the Polish financial sector stood at PLN 2.47 trillion, representing a 5.9% increase compared to the previous year [

45]. In the same period, assets held by all commercial banks were at PLN 1,603.7 billion, constituting 90% of total assets held by the banking sector in Poland [

45,

46]. Based on data presented in

Table 2, the sector includes a large representation of cooperative banks (553 as per the end of 2017) but these entities represent a mere 7.3% of total assets of the banking sector [

46]. On the other hand, reports from European countries show a notable trend of increased environmental responsibility on the part of cooperative banks [

47]. Analyses of the banking sector, regardless of their research context, typically explore the segment of cooperative banking in separation from other commercial banking institutions, to reflect the specificity of this segment which largely determines their choice of methods of operation [

48] (p. 11). Taking account of the above determinants, we decided to exclude this group from the study. Thus, the study of pro-environmental involvement was ultimately focused on the segment of commercial banks, due to their large share in the market of banking services and their overall economic significance.

The study, based on procedures described above, included all commercial banks operating on the Polish market. The previous section of this paper described our approach in the design of a procedure for effective measurement and evaluation of pro-environmental involvement of the studied entities (constituting the first phase of the planned research). The next section presents findings obtained from empirical studies based on the postulated procedure, as part of the second phase of this research project.

4.2. Measuring the Pro-Environmental Involvement of the Banking Sector

Measurement of the pro-environmental involvement of the banking sector represents the second phase (Phase 2) of the planned research project. Based on the wealth of empirical evidence collected from the sector, we initiated a measurement procedure to evaluate this form of involvement among the studied entities, in the form of the following steps sequence:

- 1)

Verification of the set of criteria formulating a model pattern of an environmentally responsible banking institution.

- 2)

Selection of weights for the included criteria, using the AHP method.

- 3)

Determination of the Bank Ecologization Index.

Ad. 1. On the grounds of expert interviews held with representatives of CSR-related departments of all banks included in the project, we performed a verification procedure to evaluate the suitability of set of criteria as basis for establishing a model profile of an environmentally responsible bank. The early draft of the set was prepared on the basis of the literature and analyses of non-financial disclosures submitted annually by the studied entities before proper authorities, based on [

12,

33]. Then this set was corrected and criteria 3.3. and 3.4 were excluded. The final version of the set consists of seven criteria: 1.1., 2.1., 2.2., 2.3., 2.4., 3.1. and 3.2. (see

Table 2 for a detailed recount).

Ad.2. In accordance with the established procedure, this phase took the form of a six-step sequence. The process of weight selection was based on responses from expert representatives of CSR- and environment-related departments of the studied entities, formally used by banks. This part of the study involved representatives of 22 banks representing 90.68% share in total balance sum of the commercial banking sector in Poland.

For each group of criteria (correspondent with three levels of environmental involvement: Level I—Expenses associated with promotion of pro-environmental activities, Level II—Internal management and Level III—Products addressing ecological risk and those designed to protect natural environment), five of the experts in their pair-selection comparisons displayed preference for a single group of criteria. For the remaining 17 respondents, no preferences were stated for any of the three groups, with each perceived as equally significant.

Table 5 presents the weights established for each group of criteria, in accordance with the adopted method for the above five respondents, along with their respective ICI consistency index and with information on the experts’ home institutions (in the form of their share in total assets of the studied segment).

For four of the experts, the ICI coefficient was below the 10% value and exceeded the value of 19.6% for one other respondent. Since the ICI value for one expert was in excess of the 10% mark, the conclusive determination of weights had to include responses from the four remaining experts. Weights for detailed criteria within each group were established in the same manner.

Table 6 presents a detailed overview of results obtained for Level II criteria.

With regard to Level III, one of the experts displayed a clear preference for this group of criteria, resulting in ICI value of 0.00 (as a representation of a bank with 9.74% share in total assets of the segment), with criterion 3.1. weighted at 0.465 and 3.2.—at 0.535. The remaining responders placed relatively equal significance to each of the criteria included in this group.

Table 7 presents aggregate data on weights established for the main groups of criteria and for each detailed criterion.

Ad.3. Information pertaining to values of each detailed criterion was collected on the basis of analytical evaluations of non-financial disclosures submitted by the studied entities before proper authorities as well as results of expert interviews conducted with bank representatives employed in departments responsible for the realization of activities related to corporate social and environmental responsibility. Criteria from Level II (internal management) were used from non-financial reports of banks, especially from banks preparing non-financial-reports according to GRI Standards. The wealth of thus obtained data was then normalized through unitarization of each variable with proper recognition of their character (larger-the-better variables were transformed to smaller-the-better variables). Criteria included in Levels I and III are larger-the-better variables (or stimulants), while those in Level II take the form of smaller-the-better variables (or destimulants). From the viewpoint of the studied complex phenomenon, a decrease of destimulants value signifies an increase in the level of the studied occurrence. A reverse of the above relation can be observed for stimulants, where an increase in a stimulant’s value suggests an increase in the value of the studied complex phenomenon or, in our case, the level of environmental responsibility displayed by studied entities. Values of Level II criteria were related to employment figures (as per the end of 2017), while those in Level I were examined per each one thousand PLN of a bank’s share in total assets of the segment.

A request for participation in the study was placed with each of the 35 banking entities operating in the segment (according to

Table 4) but return information describing criteria of banks’ environmental involvement was only collected from 19 commercial banks—and these were directly included in the study. These 19 banks delivered necessary information. Therefore, methods of statistical inference were used to supplement statistical description of the sample. Banks included in the study represent a joint market share of 75% (expressed in balance sum) and joint employment of 79.22% of the entire Polish sector of commercial banking. Ultimately, we were able to include a sizeable selection of the most dominant market participants constituting the core of the studied population and representing a significant share in the sector’s market. In accordance with the amended regulations of the Accounting Act (as required following the implementation of the 014/95/EU Directive), the banks included in the study are required to provide reports of their non-financial activities as part of their annual reporting obligations—these also comprise information on projects of social and environmental involvement. At present, the participating banks may be regarded as benchmarks for the formulation of model solutions, strategies of development and financial policies. The remaining entities (i.e., those that chose not to participate in this project) represent a marginal market share. This group is predominantly populated by small providers of highly specialized services (such as car finance)—as such, they are exempt from the above requirement of non-financial reporting. Hence, it may be assumed that the findings obtained in the course of this study may safely be extrapolated to cover the entire segment under examination.

Values of the studied criteria were collated in the form of a matrix of variables. Faced with absence of data for some of the variables, we considered a possibility of imputing the missing values. However, because of the non-uniform character of the studied entities, the typical solutions (averaging between available values or interpolation from a linear regression model) proved inadequate for the purpose, due to large irregularities in distribution of properties, large number of outliers and the relatively small size of the studied population. In effect, imputation of data was deemed unreliable and was ultimately replaced by linear ordering, as a method resistant (to some extent) to the absence of data. Consequently and taking account of the weights obtained in the previous steps of the process, measurements were performed for the three pre-established levels of bank ecologization to produce a synthetic measure of a bank’s environmental responsibility (BEI-Bank Ecologization Index). The findings, along with information on the listed status (the Warsaw Stock Exchange) and Respect Index values, are presented in

Table 8.

The lack of information on expenses related to promotion of pro-environmental activities can be related to the fact that this form of evidencing is not always included in the budget assigned formally for promotion of activities associated with CSR.

In accordance with the research plan, this stage also involved determination of candidates for the three classes of bank’s environmental maturity model:

I class (0.484–0.626]—4 banks,

II class (0.343–0.484]—12 banks,

III class [0.202–0.343]—3 banks.

Banks with I class classification may be perceived as benchmarks for the remaining financial institutions.

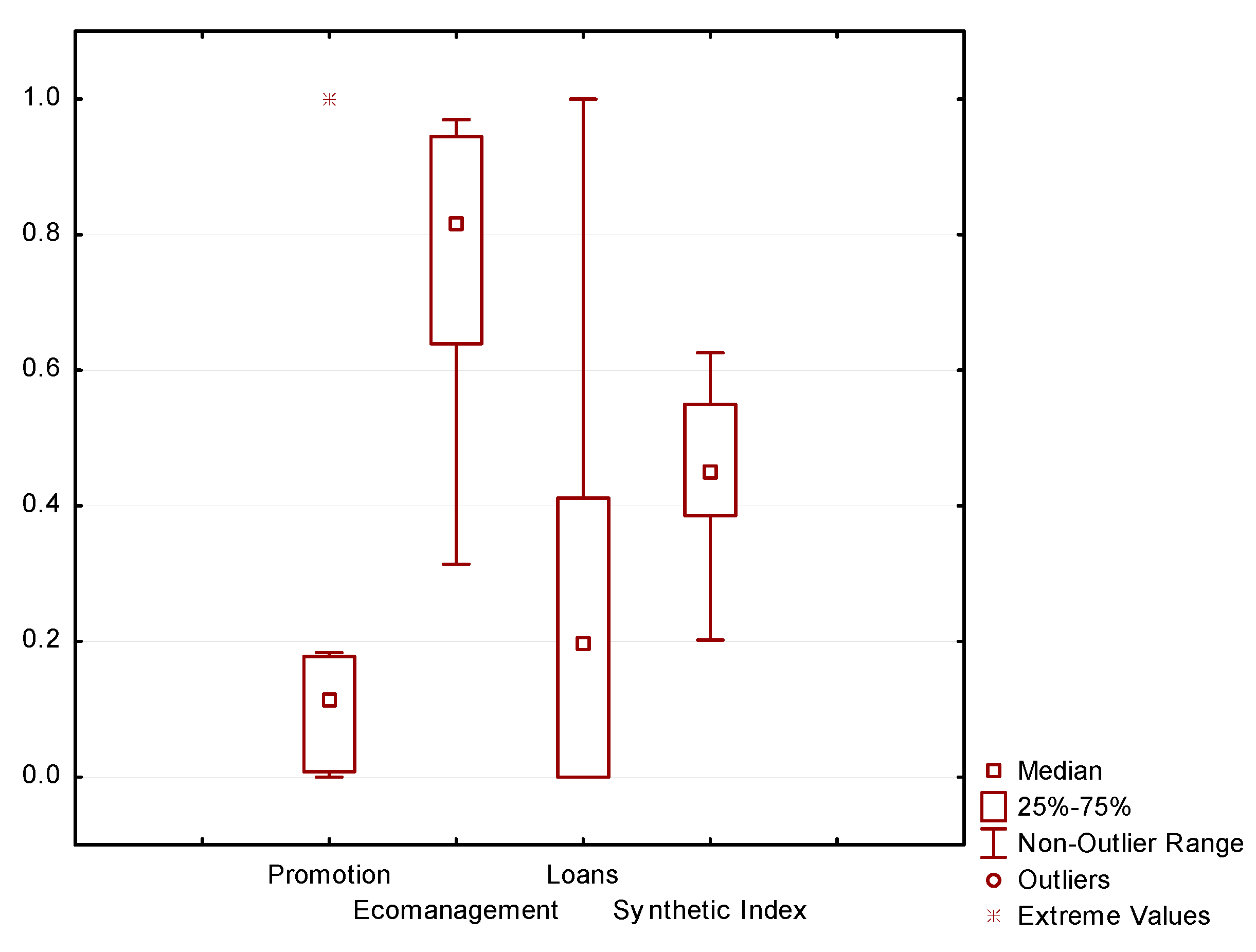

Figure 2 presents a box-plot visualisation of the BEI index findings and its components (classes).

As seen in

Figure 2, only the II level, that is, the set of criteria related to pro-environmental management of operational activities, shows a relatively symmetric distribution; consequently, the dispersion between entities measured by any of the criteria included in this set will be fairly limited. The other two levels show an opposite relation: both for Promotion and for Credits, the range of unitarized data is from 0 to 1, with marked presence of outliers and extreme value readings. The synthetic index, as an averaged measure of the three levels, shows a more symmetric distribution. The asymmetric shape of variable distribution is the reason for using non-parametric statistical methods, like Spearman’s rank correlation coefficient and Mann-Whitney U test.

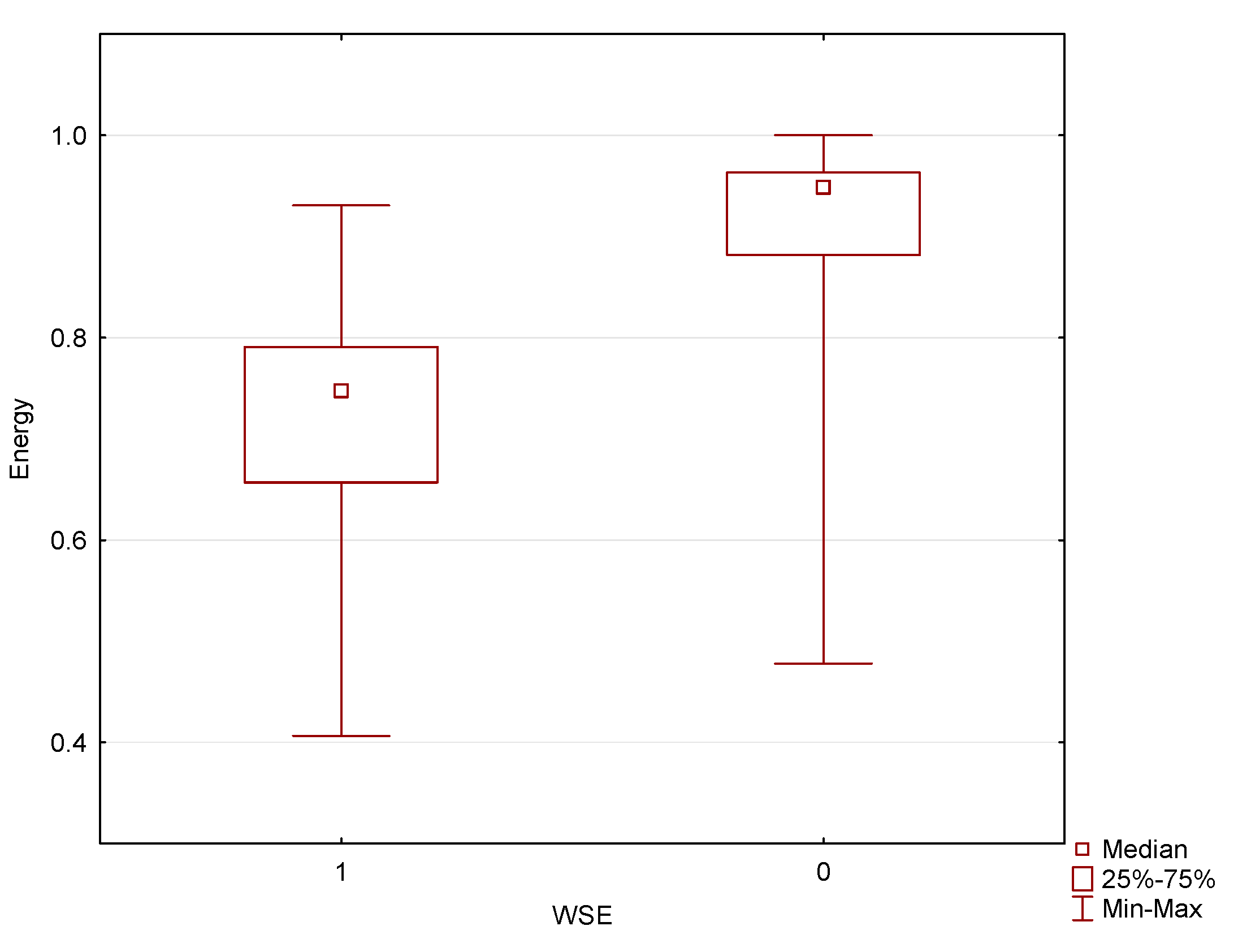

Verification of the research hypothesis “H1 For banks listed on the Warsaw Stock Exchange, the values of the BEI index will be higher compared to those of the remaining banks within the studied period” was performed using the Student’s t and Mann-Whitney U tests. Correlations were only found with regard to energy consumption (as a component of Level II—eco-management) in the group of entities not listed on the WSE and only after removing the outliers: Nest Bank S.A. and Santander Consumer Bank S.A. (see

Section 4.3 for details). Surprisingly, the observed correlation was of a reverse character: the value of the Energy variable (after unitarization) is higher for non-listed entities than for those listed on the WSE. Evidence for this correlation can be observed on the box-plot representing distribution of this variable between the two categories of entities (

Figure 3).

The above findings allowed us to reject the research hypothesis that, over the studied period, values of the BEI index would be higher for banks listed on the WSE, compared to those for non-listed entities. In addition, no correlations of this type were found for any of the individual components of the synthetic BEI index. The only correlation found in this phase was the negative correlation of the Energy criterion for non-listed entities, which was only manifested after the outliers had been removed from the equation.

4.3. Financial Effectiveness of the Banking Sector

Our procedure utilized some of the most common indices used in the evaluation of financial standing of companies, namely: ROA, ROE, IMR, C/I and TCR.

Table 9 and

Table 10 present descriptive statistical data for the above indices in the group of all commercial banks in Poland over the period of 2016–2017. The presentation of financial data in this particular timeframe was dictated by the amended regulations of the Polish Accounting Act and the EU Directive concerning disclosure of non-financial and diversity information by certain large undertakings and groups [

34], where the duty to report non-financial information was related to specific financial thresholds for the last two reporting years.

Due to the presence of outlier observations in the studied group of variables, we decided to include trimmed means as a supplementary measure to the arithmetic mean. High results of the variation coefficient suggest a large variation in the studied set of variables.

Determination of an aggregate indicator (Development measure) to reflect the financial situation of studied banks proceeded in accordance with a procedure described in the earlier section. The aggregate indicator of financial effectiveness was construed on the basis of ROA, ROE, C/I, IMR and TCR. The resulting values of indices, calculated in a sequence of steps described in Phase 2 of the research procedure, are presented in

Table 11.

4.4. Analysis of Correlations between Financial Effectiveness and Envoronmental Involvement of Entities

In line with the postulated plan of research, the next stage involved testing of correlations between the aggregated synthetic index of ecologization and the three identified levels of environmental involvement against a number of financial indices describing the entities’ financial situation: ROA, ROE, IMR, C/I and DM in the year 2017 and in the previous reporting year of 2016. Testing of correlations was performed based on the use of matrices of Pearson’s linear correlation and Spearman’s rank correlation (as a method relatively resistant to the presence of outlier observations).

With respect to the second research hypothesis presented in the initial section of this paper (H2: There is a correlation between financial indices describing the effectiveness of entities and their respective BEI indices. Thus, banks characterized by better financial standing will be more likely to show involvement in protection of natural resources”), it may be concluded that the hypothesis holds true when studied in the context of the distinction into: Group 1—WSE-listed and Group 2-not listed. Analysis of the two correlation coefficients (Pearson’s and Spearman’s) provided grounds for positive verification of the above hypothesis for the group of banks listed on the Warsaw Stock Exchange and for the following pairs of variables:

C/I 2017 and Credits (Level III),

C/I 2017 and BEI (Synthetic Index),

ROA 2017 and Eco-management (Level II),

ROE 2017 and Eco-management (Level II).

Correlation coefficients calculated for banks listed on the WSE are presented below:

Table 12—Pearson’s and

Table 13—Spearman’s.

After excluding the outlier observations for Nest Bank S.A. and Santander Consumer (based on the differentiating criterion of the DM synthetic indicator), analyses of both Pearson’s and Spearman’s correlation coefficients provided evidence for correlations only in the case of entities not listed on the WSE and only with respect to the pair of variables C/I 2017 and Promotion (Level II).

It may be observed that all the financial indices for which correlations were found linking them to both the synthetic index and the selected levels of pro-environmental involvement (Level II and Level III) belonged to the data set representing the year 2017. It must be remembered that the BEI index and its constituent levels were also calculated on the basis of data as per the end of 2017, which may lead to a conclusion that more correlations of this type can be expected in the years to come, showing a higher level of correlation between financial indices of entities and their involvement in pro-environmental activities.

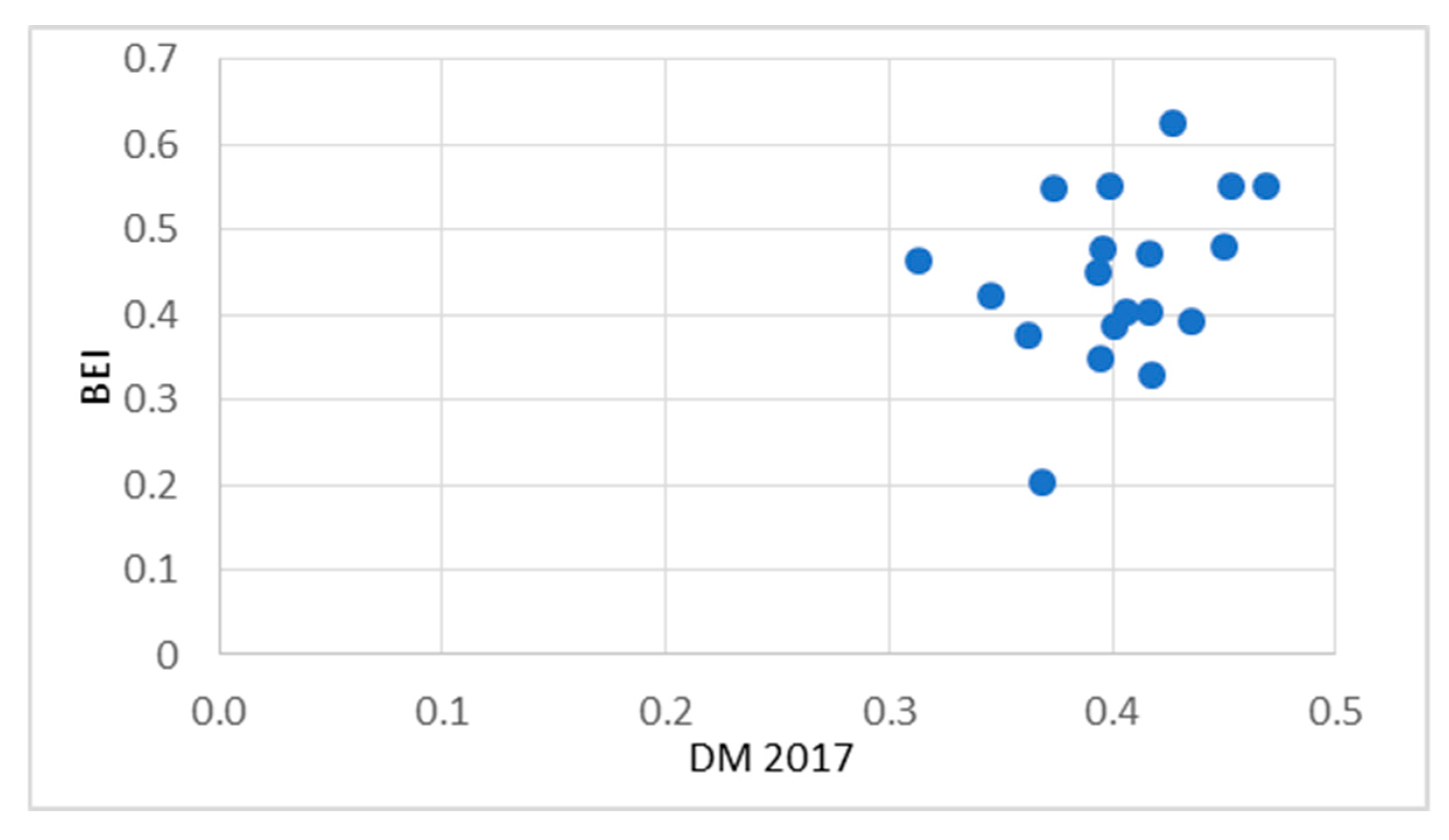

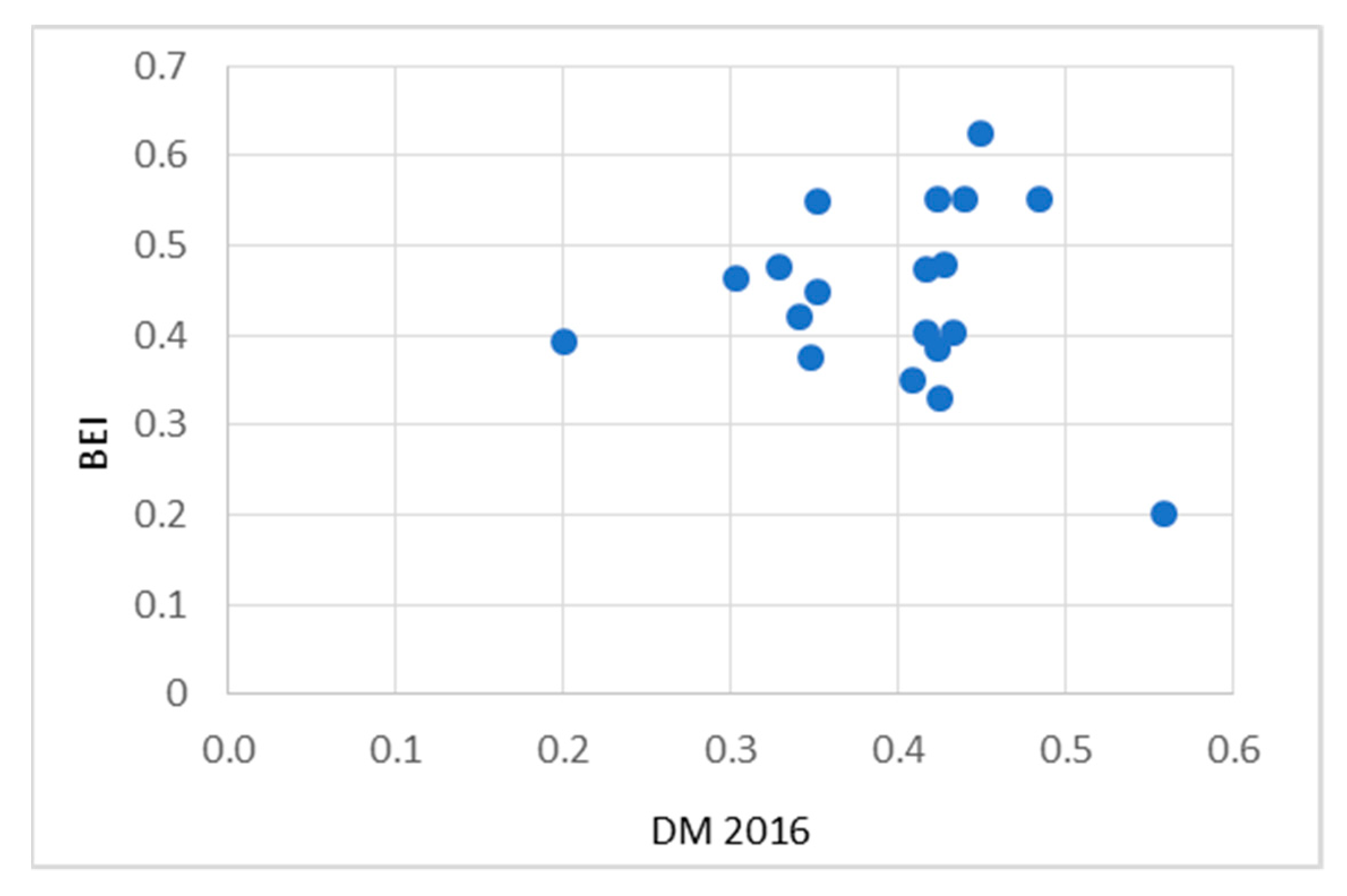

In the context of the third research hypothesis (“H3 There is a threshold value of the aggregated index describing the entity’s financial situation, above which the level of the BEI index increases by a significant value”), we tested for correlations between the value of DM for the years 2016 and 2017 against the BEI index. A graphical presentation of the revealed correlations between the two measures is shown in

Figure 4 and

Figure 5.

Based on analytical evaluations of data presented in

Figure 4 and

Figure 5, the above research hypothesis escapes verification. No threshold values of the financial effectiveness were found to mark any significant change in the value of the BEI index.

5. Discussion

Based on the examination of the level of pro-environmental involvement of banks (involving calculations of the Bank Ecologization Index (BEI) for each studied entity, banks were ordered from the most to the least responsible in their environmental involvement. A maximum value of the synthetic BEI index (0.626) was recorded for Bank Zachodni WBK SA (presently: Santander Bank Polska SA). The range of possible BEI values is contained between [0;1]. The next stage of the research involved analyses of financial standing of the commercial banks included in the study, based on the use of standard financial measures of ROA, ROE, IMR, C/I and TCR. Also, at this stage, synthetic measures were calculated to describe the financial standing of each entity. In the next stage, this was followed by testing of correlations between the synthetic BEI index and the three pre-established levels of the index against financial measures that describe their financial effectiveness: ROA, ROE, IMR, C/I, TCR and DM in the years 2016-2017. Correlations were tested using matrices of Pearson’s linear correlation and Spearman’s rank correlation.

With reference to the first research hypothesis “H1 For banks listed on the Warsaw Stock Exchange, the values of the BEI index will be higher compared to those of the remaining banks within the studied period”—correlations were only found for energy consumption (as a component of Level II—eco-management) in the group of entities not listed on the WSE. Thus, the fact of being listed on the stock exchange does not seem to directly determine the value of the associated Bank Ecologization Index BEI compared to the mean values for this index observed in non-listed entities.

As for the research hypothesis (H2: There is a correlation between financial indices describing the effectiveness of entities and their respective BEI indices. Thus, banks characterized by better financial standing will be more likely to show involvement in protection of natural resources), it may be observed that it only holds true for selected pairs of variables and it is only evident in the group of entities listed on the WSE. Based on analytical evaluations, no linear correlations were found to confirm this conclusion for the set of studied entities.

In the context of the third research hypothesis (H3 There is a threshold value of the aggregated index describing the entity’s financial situation, above which the level of the BEI index increases by a significant value) no such values were found to confirm the above assumption.

Analytical evaluations failed to provide evidence of a threshold value to mark a significant increase in the value of the associated BEI index and no direct correlation was found to link it to the financial effectiveness. Thus, financial standing does not seem to determine the level of pro-environmental involvement of the studied entities and other factors may come into play in its stead (such as the internal pro-environmental policy). The list of such potential determinants should clearly include the attribute of participation in an international capital group, as members of such conglomerates are more likely to show active involvement in pro-environmental activities on a much larger scale compared to other entities in the studied segment. Good evidence of the above can be seen in the case of Bank Zachodni WBK SA (presently: Santander Bank Polska SA), with the highest BEI index result of 0.626 and the DM synthetic index scores of: 0.4488 in 2016 and 0.4271 in 2017. The high BEI ranking of this entity should be perceived in relation to the fact that the Santander Group (owner of the present Santander Bank Polska SA) was ranked as the world’s most pro-environmental banking institution according to the Dow Jones Sustainability Index 2019. The Santander Group received 86 of the possible 100 points, placing it at the top of the DJSI ranking for 2019. Dow Jones Index is a leading global expert on performance indices in the area of socially responsible investment. The ranking is based on economic, environmental and social criteria of evaluation. It must also be noted that the group is a founding signatory of the UNEP FI Responsible Banking Principles. The Principles for Responsible Banking were launched by 130 banks from 49 countries, representing more than USD47 trillion in assets [

49].

We should also be aware that 33 global institutions: Canadian, Chinese, European, Japanese and U.S. banks have financed fossil fuels with 1.9 trillion dollars since the Paris Agreement in 2015 was adopted. This report finds that fossil fuel financing is dominated by the big U.S. banks, with JPMorgan Chase as the world’s top funder of fossil fuels by a wide margin [

50]. On the other hand, the World Bank, as the first in 2013, called for less involvement in brown industry. A year later, Bank of America joined, which was one of the first commercial banks committed to reducing financial involvement in the mining industry. Also, in this context, it seems justified to support and emphasize those activities of banks that support pro-ecological investments. In the studies we can also find information about advantages of green project’s financing by equity [

51]. In the world exist critical point of view concerning environmental engagement in banking sector. The most important can be hear the cost associated with such activities.

As already mentioned, the BEI index and its components (levels) had also been determined as per the end of the year 2017, which may lead to a conclusion that more correlations of this type between the economic performance and pro-environmental involvement of banks will manifest themselves in the foreseeable future.

6. Conclusions

Modern banking institutions, as agents of public trust, are bearers of special responsibilities. These responsibilities arise, on the one hand, from the dominant role of the banking sector in the Polish financial segment and, on the other hand, from its role as a main depositary of financial assets held by households, institutions and other entities. Activities focused on protection and improvement of resources defined in the area of corporate social and environmental responsibility, although largely voluntary in this context, are nonetheless subject to strict regulations, such as those expressed in the reporting obligations of non-financial information. As already noted in the introductory section, the importance of the used line of research is confirmed by the recent (2018) award of the Bank of Sweden’s Prize in Economic Sciences in Memory of Alfred Nobel to William D. Nordhaus (Yale University). This fact alone seems to emphasize the legitimacy of scientific enquiries in this context.

As already mentioned, a distinct research gap can be observed in modern evaluation of the subject of measuring pro-environmental involvement of banks and the potential correlations between this type of involvement and the financial standing of entities. The scope of research presented in this paper can be seen as an attempt at levelling this gap, as the first study of this type in Poland to target the entire segment of commercial banking. The complex and multi-layered character of this project was a natural consequence of the compound nature of both the subject and the object of our studies.

The presented research procedure and results have an original and unique character. They are the first analyses of this type carried out in the banking sector.

Summarizing our research, it can be stated that the research hypothesis H1 has not been confirmed.

The research hypothesis H2 can be confirmed only partly, for selected pairs of variables for banks from WSE:C/I 2017 and Credits (Level III),C/I 2017 and BEI (Synthetic Index), ROA 2017 and Eco-management (Level II), ROE 2017 and Eco-management (Level II).After excluding the outlier observations of entities not listed on the WSE correlations can be observed only with respect to the pair of variables C/I 2017 and Promotion (Level II).We cannot confirm the research hypothesis H3 in 2016 and in 2017.

The research perspective shows promise in continuation of research on the matters presented in this paper, which should include examination of data from the consecutive reporting periods. The procedure of research has been verified for the Polish sector of commercial banking but is in no way determined by location and may be replicated in the context of other countries. In this sense, it may be useful to extend the scope of research to cover the banking sectors of other EU Member States, followed by identification and analytical evaluation of results.

Lastly, in the context of this research project and suggestions for further analyses, it must be noted that the area under examination is of great significance to many stakeholder groups investing in the banking sector and its role is expected to increase globally in the foreseeable future.