Investment Game Model Analysis of Emission-Reduction Technology Based on Cost Sharing and Coordination under Cost Subsidy Policy

Abstract

1. Introduction

2. Literature Review

3. Differential Game Model

3.1. Problem Description

- (1)

- The government determines the carbon quota based on carbon emission intensity and then takes the maximization of social welfare as the goal. The government works with manufacturers to determine the optimal R&D ratio of emission reduction technology.

- (2)

- Manufacturers control the carbon emission of products, reduce carbon emissions through emission reduction technology investment, and play a cost-sharing game with retailers.

- (3)

- Manufacturers sell products to retailers at wholesale prices.

- (4)

- According to market demand, the retailer purchases from the manufacturer, the purchase quantity is Q at the price P. In the process between manufacturer and retailer, the manufacturer has an initial position. Both sides of the game have symmetrical information and they make decisions to maximize their interests.

- (5)

- Consumers have a low carbon preference and a relatively high preference for products with low carbon emissions.

- (6)

- The paper makes the parameter conventions as shown in Table 1.

3.2. Model Assumptions

3.3. The Basic Expression of Economic Relations

3.4. Differential Game Model

4. Equilibrium Analysis and Path Evolution

4.1. Equilibrium Results

4.2. Evolution Path Analysis

5. Parameter Sensitivity Analysis

5.1. Boundary Condition Determination

5.2. Sensitivity Analysis

6. Numerical Example

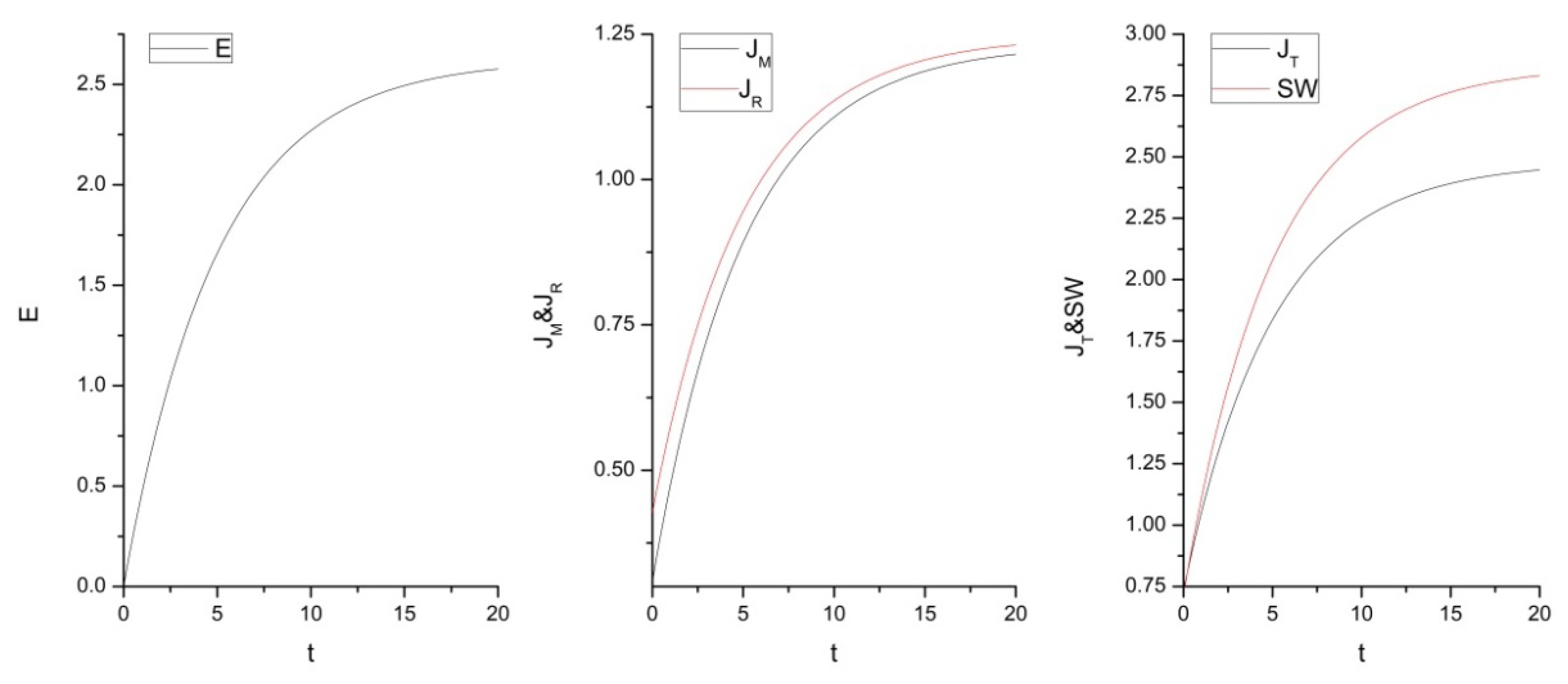

6.1. Evolution Path Analysis

6.2. Sensitivity Analysis

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Loeser, J.D.; Treede, R.D. The Kyoto protocol of IASP basic pain terminology. Pain 2008, 137, 473–477. [Google Scholar] [CrossRef]

- Fontini, F.; Pavan, G. The European Union Emission Trading System and technological change: The case of the Italian pulp and paper industry. Energy Policy 2014, 68, 603–607. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, Y. Research on international carbon emission trading system and Its Enlightenment to China. Eco Econ. 2018, 66–70. [Google Scholar]

- Zeng, S.; Jiang, C.; Ma, C.; Su, B. Investment Efficiency of the New Energy Industry in China. Energy Econ. 2018, 70, 536–544. [Google Scholar] [CrossRef]

- Sun, M.; Wang, Y.; Shi, L.; Klemeš, J.J. Uncovering energy use, carbon emissions and environmental burdens of pulp and paper industry: A systematic review and meta-analysis. Renew. Sustain. Energy Rev. 2018, 92, 823–833. [Google Scholar] [CrossRef]

- Li, M.; Mi, Z.; Coffman, D.M.; Wei, Y.M. Assessing the policy impacts on non-ferrous metals industry’s CO2 reduction: Evidence from China. J. Clean. Prod. 2018, 192, 252–261. [Google Scholar] [CrossRef]

- Zhu, B.; Shan, H.Y. Impacts of industrial structures reconstructing on carbon emission and energy consumption: A case of Beijing. J. Clean. Prod. 2020, 245, 118916. [Google Scholar] [CrossRef]

- Minx, J.C. Input-output analysis and carbon footprinting: An overview of applications. Econ. Syst. Res. 2009, 21, 187–216. [Google Scholar] [CrossRef]

- Sundarakani, B.; De Souza, R.; Goh, M.; Wagner, S.M.; Manikandan, S. Modeling carbon footprints across the supply chain. Int. J. Prod. Econ. 2010, 128, 43–50. [Google Scholar] [CrossRef]

- Bian, X.H.; Zhang, S.L. Review of Carbon Footprint Research. Manag. Mod. 2015, 3, 127–129. [Google Scholar]

- Jaegler, A.; Burlat, P. Carbon friendly supply chains: A simulation study of different scenarios. Prod. Plan. Control 2012, 23, 269–278. [Google Scholar] [CrossRef]

- Park, H.; Lim, J. Valuation of marginal CO2 abatement options for electric power plants in Korea. Energy Sources 2009, 37, 1834–1841. [Google Scholar] [CrossRef]

- Lin, T.; Ning, J.F. Research on the efficiency of carbon emission allocation in EU countries based on DEA model. Quant. Econ. Technol. Study 2011, 28, 36–50. [Google Scholar]

- Ingram, R.; Frazier, K. Environmental performance and corporate disclosure. J. Account. Res. 1980, 18, 614–623. [Google Scholar] [CrossRef]

- Boemare, C.; Quirion, P. Implementing greenhouse gas trading in Europe: Lessons from economic literature and international experiences. Ecol. Econ. 2002, 43, 213–230. [Google Scholar] [CrossRef]

- Rehdanz, K.; Tol, R.S.J. Unilateral Regulation of Bilateral Trade in Greenhouse Gas Emission Permits. Ecol. Econ. 2005, 54, 397–416. [Google Scholar] [CrossRef]

- Smale, R.; Hartley, M.; Hepburn, C. The impact of CO2 emissions trading on firm profits and market prices. Clim. Policy 2006, 6, 31–48. [Google Scholar] [CrossRef]

- Bode, S. Multi-period emissions trading in the electricity sector-winners and losers. Energy Policy 2006, 34, 680–691. [Google Scholar] [CrossRef]

- Bonacina, M. Electricity pricing under carbon emissions trading: A dominant firm with a competitive fringe model. Energy Policy 2007, 35, 4200–4220. [Google Scholar] [CrossRef]

- Wei, D.; Yue, J. Research on the efficiency of carbon emission decentralization under the low carbon economy model. Shandong Soc. Sci. 2010, 08, 90–92. [Google Scholar]

- Zeng, M.; He, S.; Yang, L.L. Auction scheme design of emission trading market. Hydropower Energy Sci. 2010, 28, 161–163. [Google Scholar]

- Lee, Y.B.; Lee, C.K. A Study on International Emissions Trading. J. Am. Acad. Bus. 2011, 16, 173–181. [Google Scholar]

- Petrakis, E.; Poyago-Theotoky, J. R&D Subsidies versus R&D Cooperation in a Duopoly with Spillovers and Pollution. Aust. Econ. Pap. 2002, 41, 37–52. [Google Scholar]

- Zhang, B.; Xu, L. Multi-item production planning with carbon cap and trade mechanism. Int. J. Prod. Econ. 2013, 144, 118–127. [Google Scholar] [CrossRef]

- Ma, Q.Z.; Song, H.Q.; Chen, G.Y. Low carbon product pricing and optimal carbon emission strategy under carbon quota trading system. J. Manag. Eng. 2014, 28, 127–136. [Google Scholar]

- Zhao, D.Z.; Yuan, B.Y.; Xu, C.Q. Research on supply chain coordination mechanism considering product carbon emission constraints. Forecast 2014, 33, 76–80. [Google Scholar]

- Dong, C.; Shen, B.; Chow, P.S.; Yang, L.; Ng, C.T. Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 2016, 240, 509–531. [Google Scholar] [CrossRef]

- Luo, R.L.; Fan, T.J.; Xia, H.Y. Game analysis of supply chain carbon emission reduction technology investment under carbon emission trading policy. Chin. Manag. Sci. 2014, 22, 44–53. [Google Scholar]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Li, Y.D.; Zhao, D.Z.; Xia, L.J. Government subsidy strategy under vertical emission reduction cooperation of low carbon supply chain. Oper. Res. Manag. 2014, 23, 1–11. [Google Scholar]

- Liu, J.; Qiu, G.B. Research on the game between manufacturer and retailer under the background of government subsidy. Soft Sci. 2011, 25, 48–53. [Google Scholar]

- Yang, S.H.; Fu, J. Optimization of supply chain carbon emission reduction based on consumer subsidies. Econ. Comment. 2015, 6, 104–115. [Google Scholar]

- Li, J.; Du, W.; Yang, F.; Hua, G. The Carbon Subsidy Analysis in Remanufacturing Closed-loop Supply Chain. Sustainability 2014, 6, 3861–3877. [Google Scholar] [CrossRef]

- Laroche, M.; Bergeron, J.; Barbaroforleo, G. Targeting consumers who are willing to pay more for environmentally friendly products. J. Consum. Mark. 2001, 6, 503–520. [Google Scholar] [CrossRef]

- Ouardighi, F.E.; Kogan, K. Dynamic conformance and design quality in a supply chain: An assessment of contracts’ coordinating power. Ann. Oper. Res. 2013, 1, 137–166. [Google Scholar] [CrossRef]

- Ouardighi, F.E. Supply quality management with optimal wholesale price and revenue sharing contracts: A two-stage game approach. Int. J. Prod. Econ. 2014, 5, 260–268. [Google Scholar] [CrossRef]

- Sherrill, S. Selective cost-reducing innovation. Rev. Ind. Organ. 1984, 3, 240–245. [Google Scholar]

| Variable | Description | Variable | Description |

|---|---|---|---|

| product retail price | manufacturer’s wholesale price | ||

| market size of the product | marginal demand for the product | ||

| quantity demanded considering consumers’ low carbon desires | emission reduction effort by the manufacturer | ||

| manufacturer’s abatement cost coefficient | carbon emission reduction | ||

| impact coefficient of the manufacturer’s emission reduction effort | relative attenuation rate for the product emission reduction function | ||

| per unit product emissions quotas set by the government | level of carbon emissions per unit product without a carbon emission reduction investment | ||

| manufacturer’s unit production cost | discount rate | ||

| profits of the manufacturer | profits of the retailer | ||

| profits of the supply chain | profit value of coordinated decision-making | ||

| social welfare | retailer emission reduction cost-sharing proportion | ||

| product subsidy coefficient |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, S.; Hou, Q.; Sun, J. Investment Game Model Analysis of Emission-Reduction Technology Based on Cost Sharing and Coordination under Cost Subsidy Policy. Sustainability 2020, 12, 2203. https://doi.org/10.3390/su12062203

Yu S, Hou Q, Sun J. Investment Game Model Analysis of Emission-Reduction Technology Based on Cost Sharing and Coordination under Cost Subsidy Policy. Sustainability. 2020; 12(6):2203. https://doi.org/10.3390/su12062203

Chicago/Turabian StyleYu, Shan, Qiang Hou, and Jiayi Sun. 2020. "Investment Game Model Analysis of Emission-Reduction Technology Based on Cost Sharing and Coordination under Cost Subsidy Policy" Sustainability 12, no. 6: 2203. https://doi.org/10.3390/su12062203

APA StyleYu, S., Hou, Q., & Sun, J. (2020). Investment Game Model Analysis of Emission-Reduction Technology Based on Cost Sharing and Coordination under Cost Subsidy Policy. Sustainability, 12(6), 2203. https://doi.org/10.3390/su12062203