Sustainable Banking; Evaluation of the European Business Models

Abstract

1. Introduction

2. Research Background

Banking and Sustainability

- What are the components of a sustainable banking business model?

- How effective are the components of the sustainable banking business model in the sustainability performance of the banks?

- How sustainable are the European banking business models?

3. Research Methodology

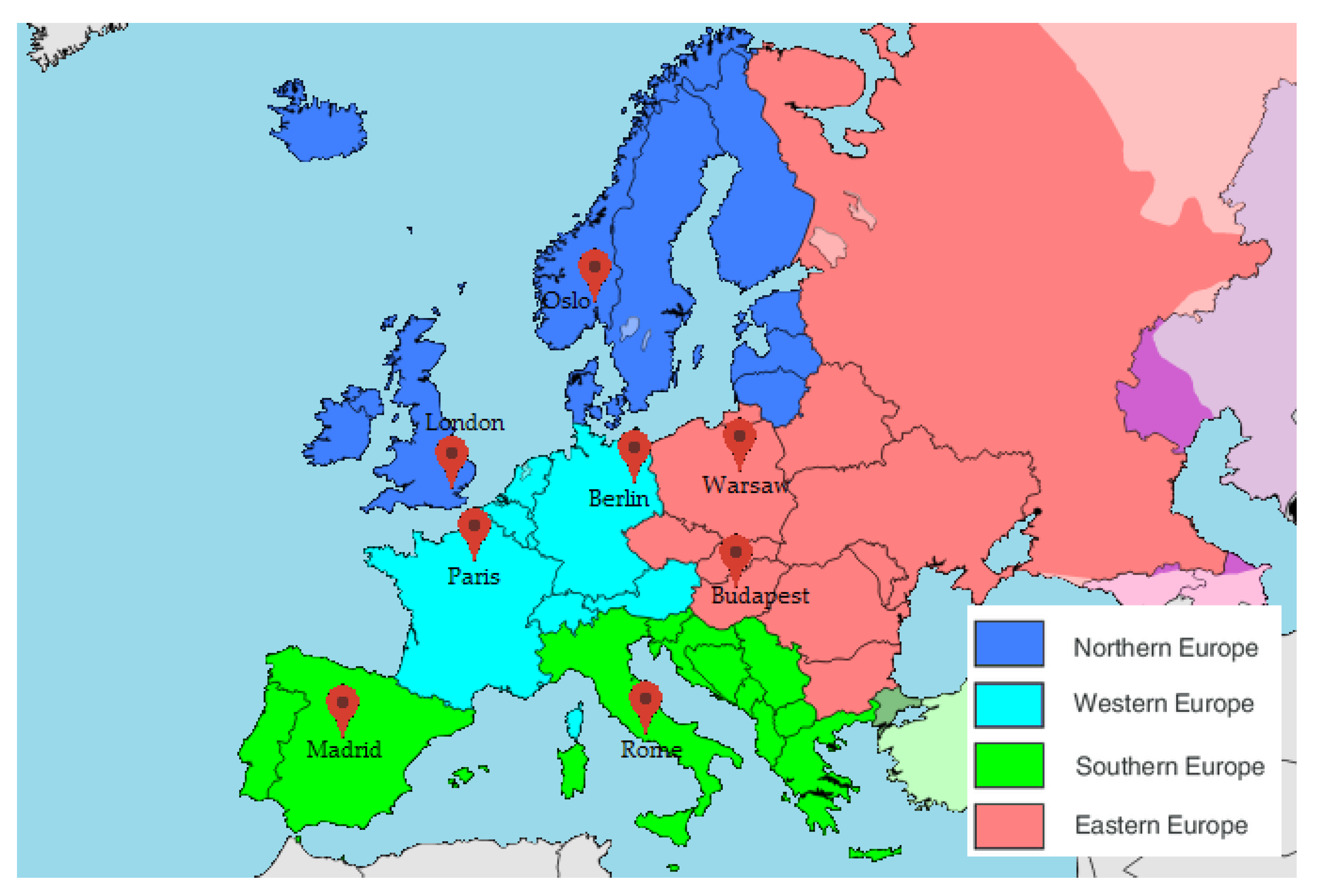

3.1. Sample Selection

3.2. Delphi Method

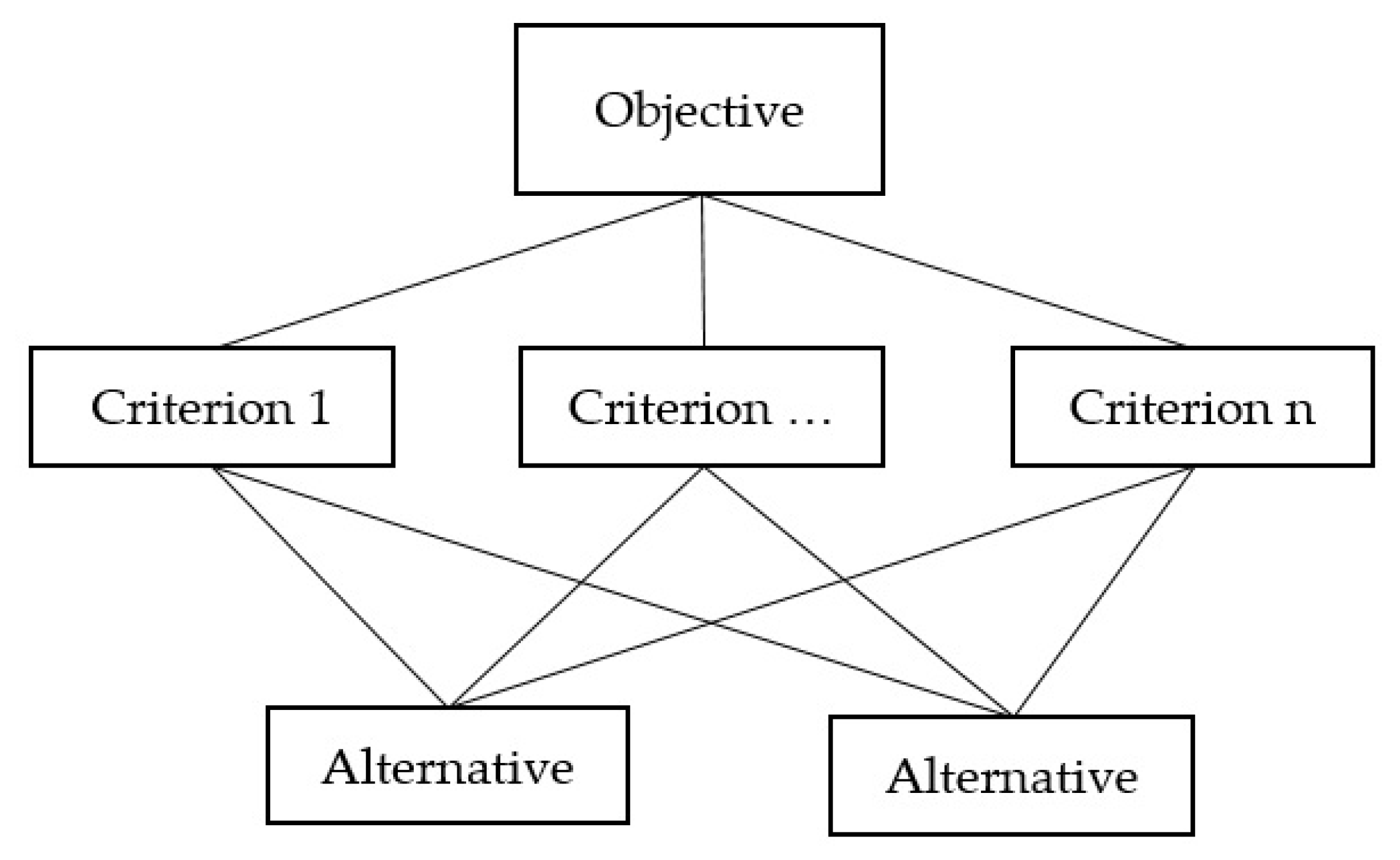

3.3. Analytic Hierarchy Process (AHP)

4. Results and Discussion

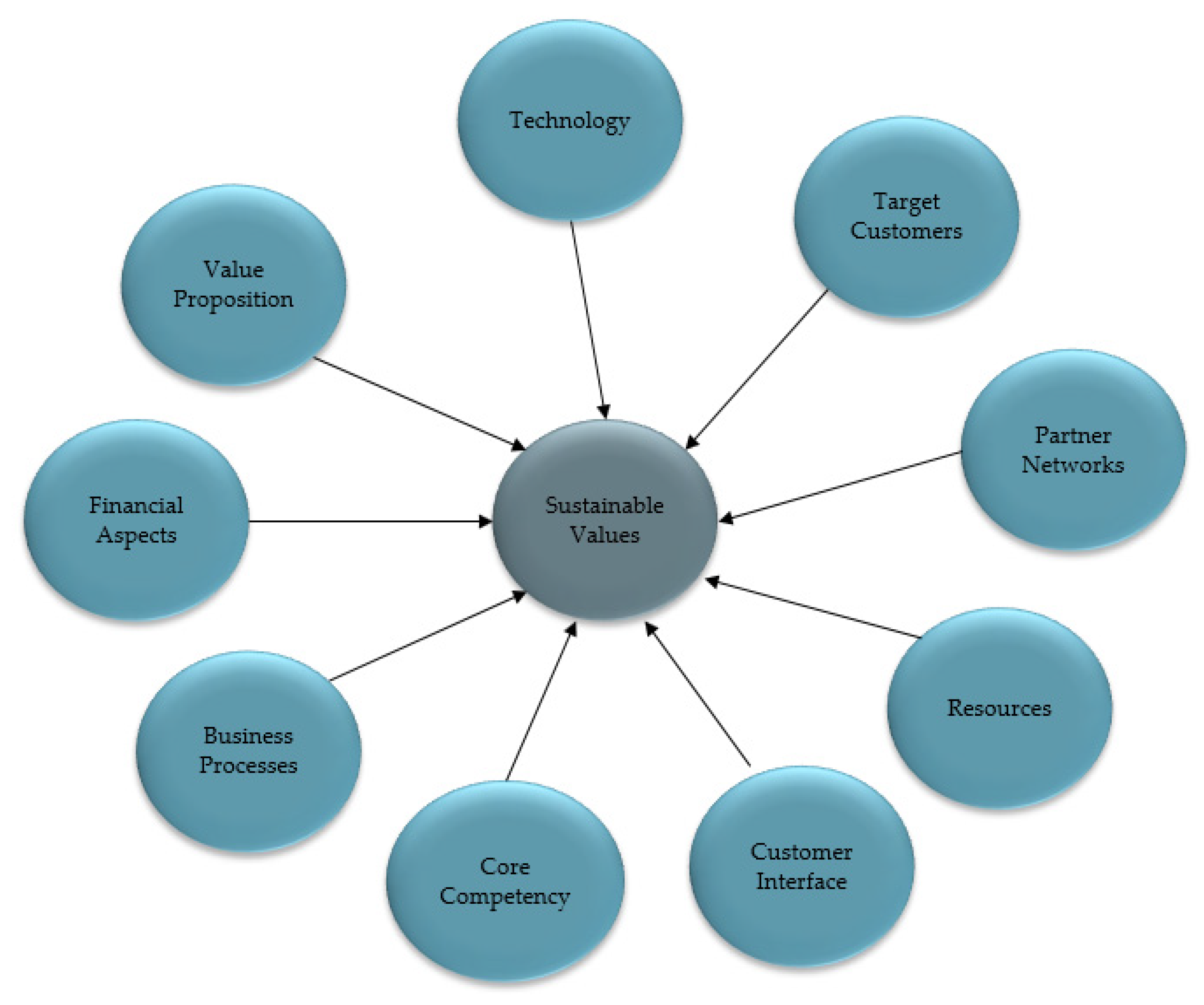

4.1. Phase 1: Recognition of the Key Components of a Bank Business Model

4.2. Phase 2: Prioritization of the Bank Business Model Components

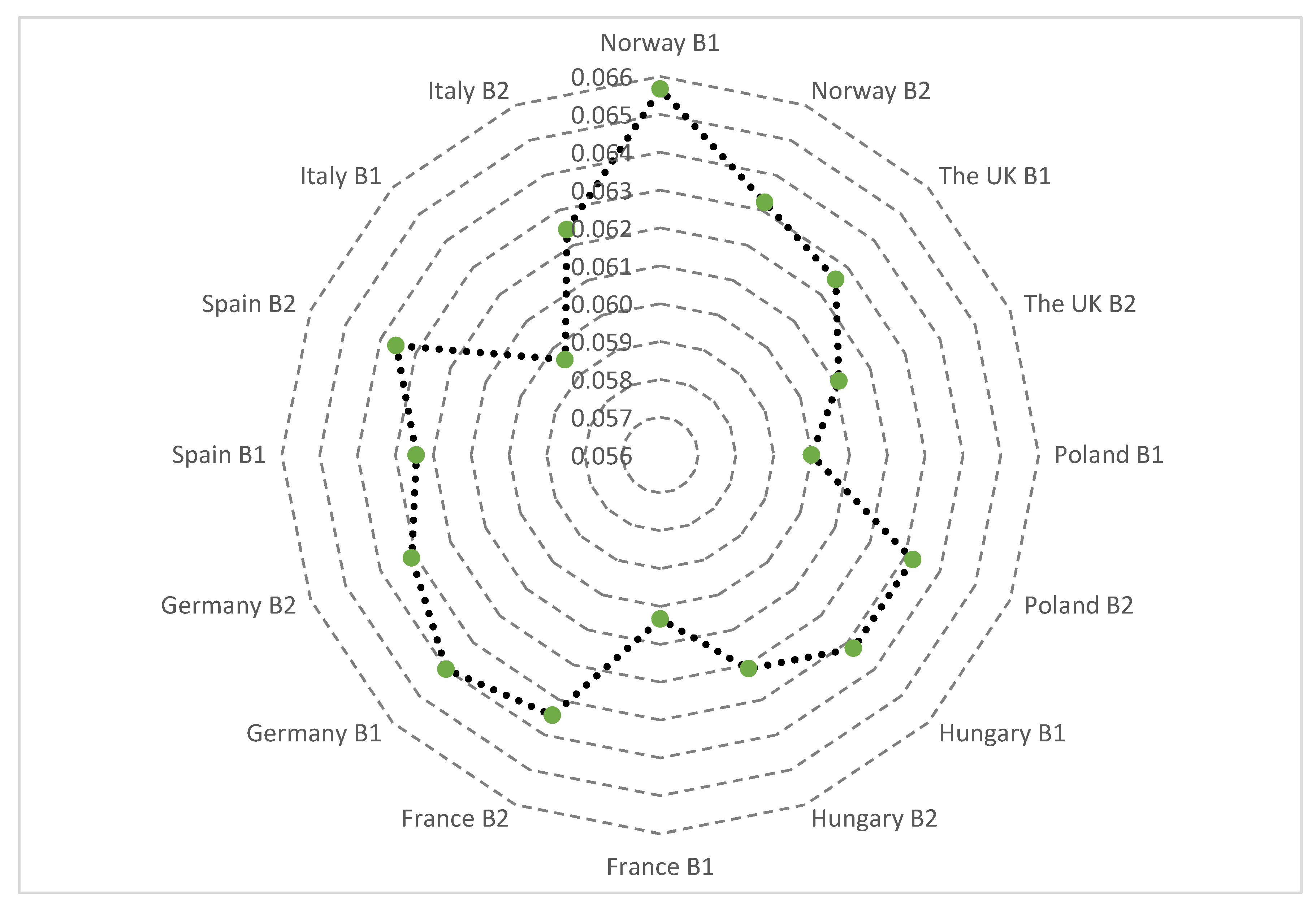

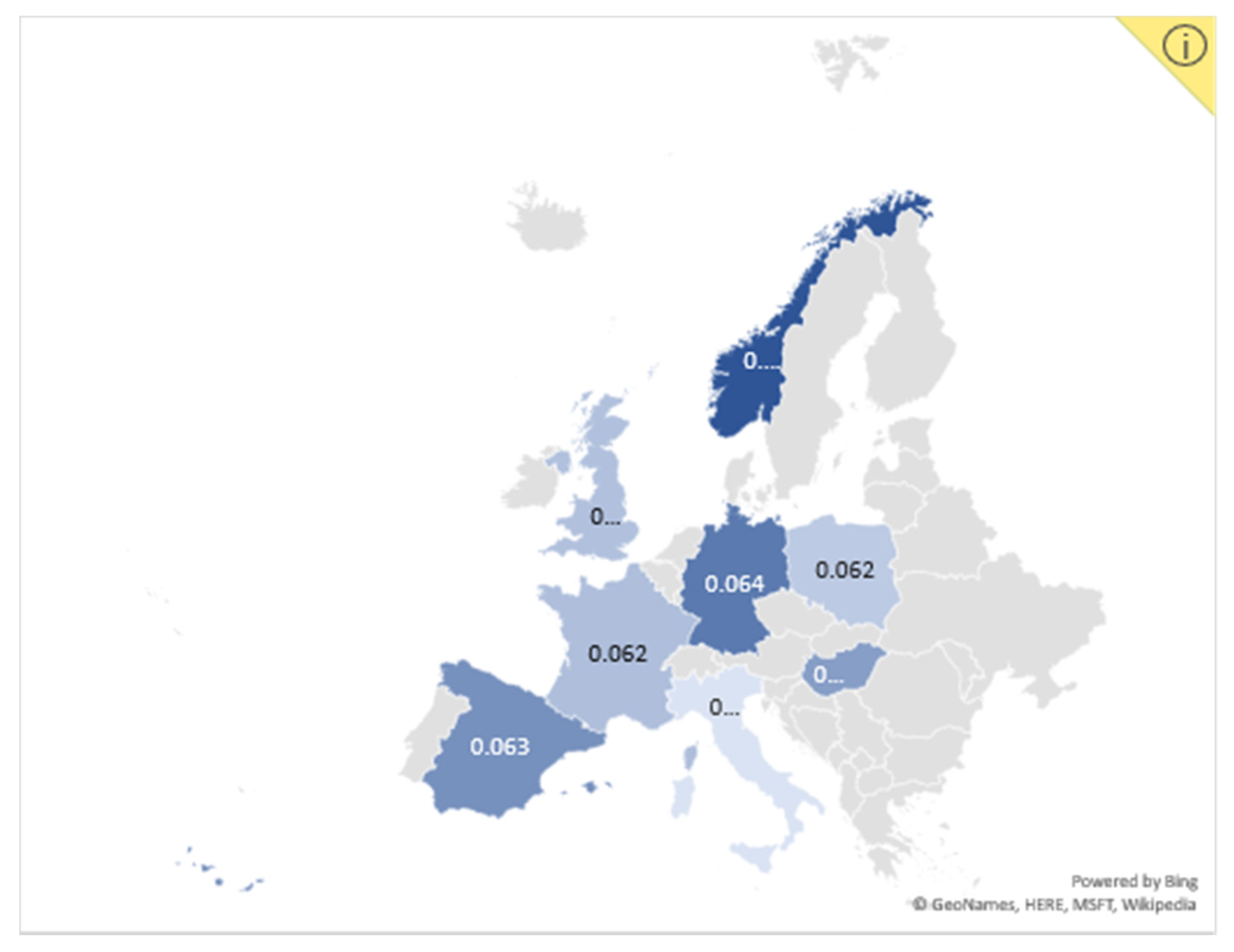

4.3. Phase 3: Comparing the Performance of Banks Across Europe

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Nosratabadi, S.; Mosavi, A.; Keivani, R.; Ardabili, S.F.; Aram, F. State of the Art Survey of Deep Learning and Machine Learning Models for Smart Cities and Urban Sustainability; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2020; Volume 101, pp. 228–238. [Google Scholar]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Bathmanathan, V.; Hironaka, C. Sustainability and business: What is green corporate image? In Proceedings of the International Conference on Advances in Renewable Energy and Technologies, Putrajaya, Malaysia, 23–25 February 2016; p. 012049. [Google Scholar] [CrossRef]

- Bowers, T. From image to economic value: A genre analysis of sustainability reporting. Corp. Commun. Int. J. 2010, 15, 249–262. [Google Scholar] [CrossRef]

- Kumar, V.; Christodoulopoulou, A. Sustainability and branding: An integrated perspective. Ind. Mark. Manag. 2014, 43, 6–15. [Google Scholar] [CrossRef]

- Castleton, H.F.; Stovin, V.; Beck, S.B.; Davison, J.B. Green roofs; building energy savings and the potential for retrofit. Energy Build. 2010, 42, 1582–1591. [Google Scholar] [CrossRef]

- Dravigne, A.; Waliczek, T.M.; Lineberger, R.; Zajicek, J. The effect of live plants and window views of green spaces on employee perceptions of job satisfaction. HortScience 2008, 43, 183–187. [Google Scholar] [CrossRef]

- McCunn, L.J.; Gifford, R. Do green offices affect employee engagement and environmental attitudes? Archit. Sci. Rev. 2012, 55, 128–134. [Google Scholar] [CrossRef]

- Epstein, M.J. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental and Economic Impacts; Routledge: London, UK, 2018. [Google Scholar]

- Chang, N.-J.; Fong, C.-M. Green product quality, green corporate image, green customer satisfaction, and green customer loyalty. Afr. J. Bus. Manag. 2010, 4, 2836–2844. [Google Scholar]

- Yip, A.W.; Bocken, N.M. Sustainable business model archetypes for the banking industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Li, X.; Poon, C.; Lee, S.; Chung, S.; Luk, F. Waste reduction and recycling strategies for the in-flight services in the airline industry. Resour. Conserv. Recycl. 2003, 37, 87–99. [Google Scholar] [CrossRef]

- Kumar, S. Resource use and waste management in Vietnam hotel industry. J. Clean. Prod. 2005, 13, 109–116. [Google Scholar]

- Li, J.; Chen, G. Water footprint assessment for service sector: A case study of gaming industry in water scarce Macao. Ecol. Indic. 2014, 47, 164–170. [Google Scholar] [CrossRef]

- Zaitseva, N.A.; Larionova, A.A.; Takhumova, O.V.; Eroshenko, V.I.; Lebedeva, J.A.; Stadolin, M.E. Problems and directions of application of environmental technologies in the service sector. Ekoloji 2019, 28, 489–494. [Google Scholar]

- Ramasubramanian, S.; Avinash, Y.; Chitra, S.P.; Geetha, T.; Anand, S. An activity based approach to minimize energy usage of service sector infrastructure. In Proceedings of the Second International Conference on Infrastructure Systems and Services: Developing 21st Century Infrastructure Networks (INFRA), Nager, India, 9–11 December 2009; pp. 1–6. [Google Scholar]

- Schleich, J. Barriers to energy efficiency: A comparison across the German commercial and services sector. Ecol. Econ. 2009, 68, 2150–2159. [Google Scholar] [CrossRef]

- Al Marzouqi, A.H.; Khan, M.; Hussain, M. Employee social sustainability: Prioritizing dimensions in the UAE’s airlines industry. Soc. Responsib. J. 2019. [Google Scholar] [CrossRef]

- Moslehpour, M.; Altantsetseg, P.; Mou, W.; Wong, W.-K. Organizational climate and work style: The missing links for sustainability of leadership and satisfied employees. Sustainability 2019, 11, 125. [Google Scholar] [CrossRef]

- Freudenreich, B.; Lüdeke-Freund, F.; Schaltegger, S. A stakeholder theory perspective on business models: Value creation for sustainability. J. Bus. Ethics 2019. [Google Scholar] [CrossRef]

- Olawumi, T.O.; Chan, D.W. A scientometric review of global research on sustainability and sustainable development. J. Clean. Prod. 2018, 183, 231–250. [Google Scholar] [CrossRef]

- Dembek, K.; York, J.; Singh, P.J. Creating value for multiple stakeholders: Sustainable business models at the base of the pyramid. J. Clean. Prod. 2018, 196, 1600–1612. [Google Scholar] [CrossRef]

- Khan, S.Z.; Yang, Q.; Waheed, A. Investment in intangible resources and capabilities spurs sustainable competitive advantage and firm performance. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 285–295. [Google Scholar] [CrossRef]

- Shen, L.; Shuai, C.; Jiao, L.; Tan, Y.; Song, X. A global perspective on the sustainable performance of urbanization. Sustainability 2016, 8, 783. [Google Scholar] [CrossRef]

- Marcel, J. Sustainable Finance and Banking: The Financial Sector and the Future of the Planet; Earthscan: London, UK; Stirling, VA, USA, 2001. [Google Scholar]

- Hermes, N.; Lensink, R.; Mehrteab, H.T. Peer monitoring, social ties and moral hazard in group lending programs: Evidence from Eritrea. World Dev. 2005, 33, 149–169. [Google Scholar] [CrossRef]

- Masud, M.; Bae, S.; Kim, J. Analysis of environmental accounting and reporting practices of listed banking companies in Bangladesh. Sustainability 2017, 9, 1717. [Google Scholar] [CrossRef]

- Oh, C.H.; Park, J.-H.; Ghauri, P.N. Doing right, investing right: Socially responsible investing and shareholder activism in the financial sector. Bus. Horiz. 2013, 56, 703–714. [Google Scholar] [CrossRef]

- Mocan, M.; Rus, S.; Draghici, A.; Ivascu, L.; Turi, A. Impact of corporate social responsibility practices on the banking industry in Romania. Procedia Econ. Financ. 2015, 23, 712–716. [Google Scholar] [CrossRef]

- Dittmer, K. 100 percent reserve banking: A critical review of green perspectives. Ecol. Econ. 2015, 109, 9–16. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K.; Jeong, E.; Zhao, X. The role of a business model in market growth: The difference between the converted industry and the emerging industry. Technol. Forecast. Soc. Chang. 2019, 146, 534–562. [Google Scholar] [CrossRef]

- Priem, R.L.; Wenzel, M.; Koch, J. Demand-side strategy and business models: Putting value creation for consumers center stage. Long Range Plan. 2018, 51, 22–31. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Bohnsack, R.; Breuer, H.; Massa, L. Research on sustainable business model patterns: Status quo, methodological issues, and a research agenda. In Sustainable Business Models; Springer: Berlin/Heidelberg, Germany, 2019; pp. 25–60. [Google Scholar]

- Anwar, M. Business model innovation and SMEs performance—Does competitive advantage mediate? Int. J. Innov. Manag. 2018, 22, 1850057. [Google Scholar] [CrossRef]

- Albertini, E. Does environmental management improve financial performance? A meta-analytical review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Slater, D.J.; Johnson, J.L.; Ellstrand, A.E.; Romi, A.M. Beyond “does it pay to be green?” A meta-analysis of moderators of the CEP-CFP relationship. J. Bus. Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does it pay to be good? A meta-analysis of the relationship between corporate social and financial performance. SSRN Electron. J. 2007, 1001. [Google Scholar] [CrossRef]

- Orlitzky, M. Does firm size comfound the relationship between corporate social performance and firm financial performance? J. Bus. Ethics 2001, 33, 167–180. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Wu, M.-W.; Shen, C.-H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Abor, J.Y.; Gyeke-Dako, A.; Fiador, V.O.; Agbloyor, E.K.; Amidu, M.; Mensah, L. Sustainable banking. In Money and Banking in Africa; Springer: Cham, Switzerland, 2019; pp. 311–331. [Google Scholar]

- Nepomuceno, T.C.C.; Daraio, C.; Costa, A.P.C.S. Combining multi-criteria and directional distances to decompose non-compensatory measures of sustainable banking efficiency. Appl. Econ. Lett. 2020, 27, 329–334. [Google Scholar] [CrossRef]

- Belasri, S.; Gomes, M.; Pijourlet, G. Corporate social responsibility and bank efficiency. J. Multinatl. Financ. Manag. 2020, 54, 100612. [Google Scholar] [CrossRef]

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Wu, M.-W.; Shen, C.-H.; Chen, T.-H. Application of multi-level matching between financial performance and corporate social responsibility in the banking industry. Rev. Quant. Financ. Account. 2017, 49, 29–63. [Google Scholar] [CrossRef]

- Cornett, M.M.; Erhemjamts, O.; Tehranian, H. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of US commercial banks around the financial crisis. J. Bank. Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Oyewumi, O.R.; Ogunmeru, O.A.; Oboh, C.S. Investment in corporate social responsibility, disclosure practices, and financial performance of banks in Nigeria. Future Bus. J. 2018, 4, 195–205. [Google Scholar] [CrossRef]

- Weber, O. Sustainable Banking—History and Current Developments; University of Waterloo: Waterloo, ON, Canada, 2012. [Google Scholar]

- Nwagwu, I. Driving sustainable banking in Nigeria through responsible management education: The case of lagos business school. Int. J. Manag. Educ. 2020, 18, 100332. [Google Scholar] [CrossRef]

- Seyfang, G.; Gilbert-Squires, A. Move your money? Sustainability transitions in regimes and practices in the UK retail banking sector. Ecol. Econ. 2019, 156, 224–235. [Google Scholar] [CrossRef]

- Rebai, S.; Azaiez, M.N.; Saidane, D. A multi-attribute utility model for generating a sustainability index in the banking sector. J. Clean. Prod. 2016, 113, 835–849. [Google Scholar] [CrossRef]

- Raut, R.; Cheikhrouhou, N.; Kharat, M. Sustainability in the banking industry: A strategic multi-criterion analysis. Bus. Strategy Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Täuscher, K. Business models for sustainability from a system dynamics perspective. Organ. Environ. 2016, 29, 74–96. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Lai, V.S.; Wong, B.K.; Cheung, W. Group decision making in a multiple criteria environment: A case using the AHP in software selection. Eur. J. Oper. Res. 2002, 137, 134–144. [Google Scholar] [CrossRef]

- Tang, Y.; Sun, H.; Yao, Q.; Wang, Y. The selection of key technologies by the silicon photovoltaic industry based on the Delphi method and AHP (analytic hierarchy process): Case study of China. Energy 2014, 75, 474–482. [Google Scholar] [CrossRef]

- Meesapawong, P.; Rezgui, Y.; Li, H. Planning innovation orientation in public research and development organizations: Using a combined Delphi and Analytic Hierarchy Process approach. Technol. Forecast. Soc. Chang. 2014, 87, 245–256. [Google Scholar] [CrossRef]

- Vidal, L.-A.; Marle, F.; Bocquet, J.-C. Using a Delphi process and the Analytic Hierarchy Process (AHP) to evaluate the complexity of projects. Expert Syst. Appl. 2011, 38, 5388–5405. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, C.-T.; Lu, J.-H. The analytic network process for the banking sector: An approach to evaluate the creditability of emerging industries. Afr. J. Bus. Manag. 2011, 5, 1343–1352. [Google Scholar]

- Kumar, A.; Zavadskas, E.K.; Mangla, S.K.; Agrawal, V.; Sharma, K.; Gupta, D. When risks need attention: Adoption of green supply chain initiatives in the pharmaceutical industry. Int. J. Prod. Res. 2019, 57, 3554–3576. [Google Scholar] [CrossRef]

- Joshi, R.; Banwet, D.; Shankar, R. A Delphi-AHP-TOPSIS based benchmarking framework for performance improvement of a cold chain. Expert Syst. Appl. 2011, 38, 10170–10182. [Google Scholar] [CrossRef]

- Worrell, J.L.; Di Gangi, P.M.; Bush, A.A. Exploring the use of the Delphi method in accounting information systems research. Int. J. Account. Inf. Syst. 2013, 14, 193–208. [Google Scholar] [CrossRef]

- Mardani, A.; Zavadskas, E.K.; Streimikiene, D.; Jusoh, A.; Nor, K.M.; Khoshnoudi, M. Using fuzzy multiple criteria decision making approaches for evaluating energy saving technologies and solutions in five star hotels: A new hierarchical framework. Energy 2016, 117, 131–148. [Google Scholar] [CrossRef]

- Okoli, C.; Pawlowski, S.D. The Delphi method as a research tool: An example, design considerations and applications. Inf. Manag. 2004, 42, 15–29. [Google Scholar] [CrossRef]

- Adini, B.; Cohen, O.; Eide, A.W.; Nilsson, S.; Aharonson-Daniel, L.; Herrera, I.A. Striving to be resilient: What concepts, approaches and practices should be incorporated in resilience management guidelines? Technol. Forecast. Soc. Chang. 2017, 121, 39–49. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Bui, T.-D. Identifying eco-innovation in industrial symbiosis under linguistic preferences: A novel hierarchical approach. J. Clean. Prod. 2017, 140, 1376–1389. [Google Scholar] [CrossRef]

- Barnes, S.J.; Mattsson, J. Understanding current and future issues in collaborative consumption: A four-stage Delphi study. Technol. Forecast. Soc. Chang. 2016, 104, 200–211. [Google Scholar] [CrossRef]

- Nambisan, S.; Agarwal, R.; Tanniru, M. Organizational mechanisms for enhancing user innovation in information technology. MIS Q. 1999, 44, 365–395. [Google Scholar] [CrossRef]

- Czinkota, M.R.; Ronkainen, I.A. International business and trade in the next decade: Report from a Delphi study. J. Int. Bus. Stud. 1997, 28, 827–844. [Google Scholar] [CrossRef]

- Kumar, A.; Sah, B.; Singh, A.R.; Deng, Y.; He, X.; Kumar, P.; Bansal, R. A review of multi criteria decision making (MCDM) towards sustainable renewable energy development. Renew. Sustain. Energy Rev. 2017, 69, 596–609. [Google Scholar] [CrossRef]

- Kumar, A.; Kaviani, M.A.; Hafezalkotob, A.; Zavadskas, E.K. Evaluating innovation capabilities of real estate firms: A combined fuzzy Delphi and DEMATEL approach. Int. J. Strateg. Prop. Manag. 2017, 21, 401–416. [Google Scholar] [CrossRef]

- Dos Santos, P.H.; Neves, S.M.; Sant’Anna, D.O.; de Oliveira, C.H.; Carvalho, H.D. The analytic hierarchy process supporting decision making for sustainable development: An overview of applications. J. Clean. Prod. 2018, 212, 119–138. [Google Scholar] [CrossRef]

- Vaidya, O.S.; Kumar, S. Analytic hierarchy process: An overview of applications. Eur. J. Oper. Res. 2006, 169, 1–29. [Google Scholar] [CrossRef]

- Turskis, Z.; Zavadskas, E.K.; Kutut, V. A model based on ARAS-G and AHP methods for multiple criteria prioritizing of heritage value. Int. J. Inf. Technol. Decis. Mak. 2013, 12, 45–73. [Google Scholar] [CrossRef]

- Nikou, S.; Mezei, J. Evaluation of mobile services and substantial adoption factors with Analytic Hierarchy Process (AHP). Telecommun. Policy 2013, 37, 915–929. [Google Scholar] [CrossRef]

- Byun, D.-H. The AHP approach for selecting an automobile purchase model. Inf. Manag. 2001, 38, 289–297. [Google Scholar] [CrossRef]

- Pauer, F.; Schmidt, K.; Babac, A.; Damm, K.; Frank, M.; von der Schulenburg, J.-M.G. Comparison of different approaches applied in analytic hierarchy process–An example of information needs of patients with rare diseases. BMC Med. Inform. Decis. Mak. 2016, 16, 117. [Google Scholar] [CrossRef] [PubMed]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Ye, G.; Wan, Q.; Chen, J. Political resources, business model and headquarters location of private enterprises. Nankai Bus. Rev. Int. 2011, 2, 172–194. [Google Scholar] [CrossRef]

- Weiner, N.; Weisbecker, A. A business model framework for the design and evaluation of business models in the internet of services. In Proceedings of the Annual SRII Global Conference, San Jose, CA, USA, 29 March–2 April 2011; pp. 21–33. [Google Scholar]

- McIntosh, M.; Popovski, V.; Yarime, M.; Jupesta, J.; Harayama, Y.; Parayil, G. Sustainable business model for biofuel industries in Indonesia. Sustain. Account. Manag. Policy J. 2011, 2, 231–247. [Google Scholar]

- Gummesson, E.; Mele, C.; Polese, F.; Nenonen, S.; Storbacka, K. Business model design: Conceptualizing networked value co-creation. Int. J. Qual. Serv. Sci. 2010, 2, 43–59. [Google Scholar]

- McCarthy, B. Case study of an artists’ retreat in Ireland: An exploration of its business model. Soc. Enterp. J. 2008, 4, 136–148. [Google Scholar] [CrossRef]

- Pousttchi, K.; Schiessler, M.; Wiedemann, D.G. Analyzing the elements of the business model for mobile payment service provision. In Proceedings of the International Conference on the Management of Mobile Business (ICMB), Toronto, ON, Canada, 9–11 July 2007; p. 44. [Google Scholar]

- Kandampully, J. The new customer-centred business model for the hospitality industry. Int. J. Contemp. Hosp. Manag. 2006, 18, 173–187. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying business models: Origins, present, and future of the concept. Commun. Assoc. Inf. Syst. 2005, 16. [Google Scholar] [CrossRef]

- Bouwman, H.; Faber, E.; Van der Spek, J. Connecting future scenarios to business models of insurance intermediaries. In Proceedings of the 18th Bled Electronic Commerce Conference, Bled, Slovenia, 6–8 June 2005; Volume 16. [Google Scholar]

- Currie, W.L. Value creation from the application service provider e-business model: The experience of four firms. J. Enterp. Inf. Manag. 2004, 17, 117–130. [Google Scholar] [CrossRef]

- Moore, C.M.; Birtwistle, G. The burberry business model: Creating an international luxury fashion brand. Int. J. Retail. Distrib. Manag. 2004, 32, 412–422. [Google Scholar] [CrossRef]

- Pateli, A. A framework for understanding and analysing ebusiness models. In Proceedings of the 16th Bled Electronic Commerce Conference, Bled, Slovenia, 9–11 June 2003; Volume 4. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. An eBusiness model ontology for modeling eBusiness. In Proceedings of the 15th Bled Electronic Commerce Conference, Bled, Slovenia, 17–19 June 2002; Volume 2. [Google Scholar]

- Chesbrough, H.; Rosenbloom, R.S. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Value creation in e-business. Strateg. Manag. J. 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Giaglis, G.M.; Papakiriakopoulos, D.A.; Doukidis, G. An analytical framework and a development method for inter-organisational business process modelling. Int. J. Simul. 2002, 2, 5–15. [Google Scholar]

- Gordijn, J.; Akkermans, H. Designing and evaluating e-business models. IEEE Intell. Syst. 2001, 16, 11–17. [Google Scholar] [CrossRef]

- Hacklin, F.; Wallnöfer, M. The business model in the practice of strategic decision making: Insights from a case study. Manag. Decis. 2012, 50, 166–188. [Google Scholar] [CrossRef]

- Methlie, L.B.; Pedersen, P.E. Business model choices for value creation of mobile services. Info 2007, 9, 70–85. [Google Scholar] [CrossRef]

- Iñiguez de Onzoño, S.; Carmona, S. The changing business model of B-schools. J. Manag. Dev. 2007, 26, 22–32. [Google Scholar] [CrossRef]

- Tikkanen, H.; Lamberg, J.-A.; Parvinen, P.; Kallunki, J.-P. Managerial cognition, action and the business model of the firm. Manag. Decis. 2005, 43, 789–809. [Google Scholar] [CrossRef]

- Mahadevan, B. Business models for Internet-based e-commerce: An anatomy. Calif. Manag. Rev. 2000, 42, 55–69. [Google Scholar] [CrossRef]

- Wu, C.-R.; Lin, C.-T.; Tsai, P.-H. Evaluating business performance of wealth management banks. Eur. J. Oper. Res. 2010, 207, 971–979. [Google Scholar] [CrossRef]

- Hu, B. Linking business models with technological innovation performance through organizational learning. Eur. Manag. J. 2014, 32, 587–595. [Google Scholar] [CrossRef]

| Row | Components | Sources |

|---|---|---|

| 1 | Value proposition | [81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97] |

| 2 | Financial domain | [81,82,84,85,86,88,89,92,93,94,98,99,100,101,102] |

| 3 | Business processes | [82,83,87,88,89,92,93,95,96,97,100,101] |

| 4 | Distribution channel | [82,83,86,87,88,91,93,97,98,100,101] |

| 5 | Market segment | [84,85,92,94,97,99,100] |

| 6 | Core competencies | [81,84,85,87,96,99] |

| 7 | Supply chain management | [83,87,98,101,102] |

| 8 | Resources | [83,84,91,92,98] |

| 9 | Value chain structure | [84,92,94,102] |

| 10 | Customer interface | [85,90,96] |

| 11 | Strategy | [85,94,101] |

| 12 | Partner Network | [87,93,97] |

| 13 | Organizational form | [97,98] |

| 14 | Governance form | [95,99] |

| 15 | Market communication | [91,93] |

| 16 | Technology | [89] |

| 17 | Competitive position | [100] |

| 18 | Empowered employee | [87] |

| 19 | Mission | [92]. |

| 20 | Value exchange | [97] |

| 21 | Market model | [86] |

| 22 | Implementation model | [86] |

| 23 | Thread model | [86] |

| 24 | Knowledge management | [83] |

| Region | Country | Bank | No of Questionnaires Distributed | Usable Completed Questionnaires | Response Rate |

|---|---|---|---|---|---|

| Northern Europe | Norway | NB1 | 9 | 8 | 87% |

| NB2 | 11 | 10 | 92% | ||

| The UK | BB1 | 9 | 8 | 89% | |

| BB2 | 8 | 7 | 89% | ||

| Eastern Europe | Poland | PB1 | 9 | 8 | 89% |

| PB2 | 12 | 11 | 89% | ||

| Hungary | HB1 | 9 | 8 | 89% | |

| HB2 | 13 | 11 | 84% | ||

| Western Europe | France | FB1 | 10 | 9 | 89% |

| FB2 | 10 | 9 | 90% | ||

| Germany | GB1 | 12 | 11 | 90% | |

| GB2 | 10 | 9 | 88% | ||

| Southern Europe | Spain | SB1 | 9 | 8 | 84% |

| SB2 | 13 | 12 | 89% | ||

| Italy | IB1 | 10 | 9 | 89% | |

| IB2 | 12 | 11 | 90% | ||

| Total | 16 | 166 | 147 | 88% | |

| First Component | Preferred Rates | Second Component | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Paired Comparisons Based on Sustainability | ||||||||||||||||||

| Value Proposition | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | Financial Aspect |

| Value Proposition | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | Business Process |

| Priority Ranking | Business Model Components | Weight |

|---|---|---|

| 1 | Value proposition | 0.129 |

| 2 | Core competencies | 0.127 |

| 3 | Financial aspects | 0.123 |

| 4 | Business processes | 0.12 |

| 5 | Target customers | 0.113 |

| 6 | Resources | 0.11 |

| 7 | Technology | 0.109 |

| 8 | Customer interface | 0.094 |

| 9 | Partner networks | 0.075 |

| Total | 1 |

| Value Proposition | Core Competency | Financial Aspects | Business Process | Target Customers | Resources | Technology | Customer Interface | Partner Network | Business Model | |

|---|---|---|---|---|---|---|---|---|---|---|

| NB1 | 0.067 | 0.063 | 0.068 | 0.064 | 0.066 | 0.063 | 0.064 | 0.069 | 0.067 | 0.066 |

| NB2 | 0.062 | 0.064 | 0.066 | 0.061 | 0.068 | 0.061 | 0.065 | 0.061 | 0.061 | 0.063 |

| BB1 | 0.064 | 0.065 | 0.066 | 0.061 | 0.057 | 0.063 | 0.069 | 0.059 | 0.059 | 0.063 |

| BB2 | 0.054 | 0.062 | 0.064 | 0.068 | 0.058 | 0.059 | 0.067 | 0.059 | 0.059 | 0.061 |

| PB1 | 0.063 | 0.059 | 0.059 | 0.058 | 0.059 | 0.059 | 0.061 | 0.066 | 0.056 | 0.060 |

| PB2 | 0.057 | 0.066 | 0.059 | 0.064 | 0.063 | 0.063 | 0.066 | 0.062 | 0.069 | 0.063 |

| HB1 | 0.069 | 0.058 | 0.067 | 0.060 | 0.069 | 0.063 | 0.059 | 0.065 | 0.059 | 0.063 |

| HB2 | 0.068 | 0.061 | 0.062 | 0.064 | 0.065 | 0.059 | 0.059 | 0.062 | 0.059 | 0.062 |

| FB1 | 0.054 | 0.060 | 0.058 | 0.063 | 0.058 | 0.060 | 0.066 | 0.061 | 0.063 | 0.060 |

| FB2 | 0.067 | 0.056 | 0.066 | 0.065 | 0.066 | 0.068 | 0.058 | 0.059 | 0.066 | 0.063 |

| GB1 | 0.070 | 0.062 | 0.059 | 0.061 | 0.063 | 0.068 | 0.062 | 0.066 | 0.065 | 0.064 |

| GB2 | 0.066 | 0.069 | 0.064 | 0.062 | 0.059 | 0.061 | 0.063 | 0.059 | 0.065 | 0.063 |

| SB1 | 0.067 | 0.062 | 0.062 | 0.062 | 0.062 | 0.060 | 0.062 | 0.066 | 0.059 | 0.062 |

| SB2 | 0.054 | 0.068 | 0.061 | 0.062 | 0.062 | 0.069 | 0.065 | 0.067 | 0.064 | 0.064 |

| IB1 | 0.055 | 0.060 | 0.053 | 0.063 | 0.065 | 0.061 | 0.056 | 0.056 | 0.067 | 0.060 |

| IB2 | 0.063 | 0.065 | 0.066 | 0.062 | 0.060 | 0.063 | 0.058 | 0.063 | 0.062 | 0.062 |

| Total | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nosratabadi, S.; Pinter, G.; Mosavi, A.; Semperger, S. Sustainable Banking; Evaluation of the European Business Models. Sustainability 2020, 12, 2314. https://doi.org/10.3390/su12062314

Nosratabadi S, Pinter G, Mosavi A, Semperger S. Sustainable Banking; Evaluation of the European Business Models. Sustainability. 2020; 12(6):2314. https://doi.org/10.3390/su12062314

Chicago/Turabian StyleNosratabadi, Saeed, Gergo Pinter, Amir Mosavi, and Sandor Semperger. 2020. "Sustainable Banking; Evaluation of the European Business Models" Sustainability 12, no. 6: 2314. https://doi.org/10.3390/su12062314

APA StyleNosratabadi, S., Pinter, G., Mosavi, A., & Semperger, S. (2020). Sustainable Banking; Evaluation of the European Business Models. Sustainability, 12(6), 2314. https://doi.org/10.3390/su12062314