1. The Italian Real Estate Market

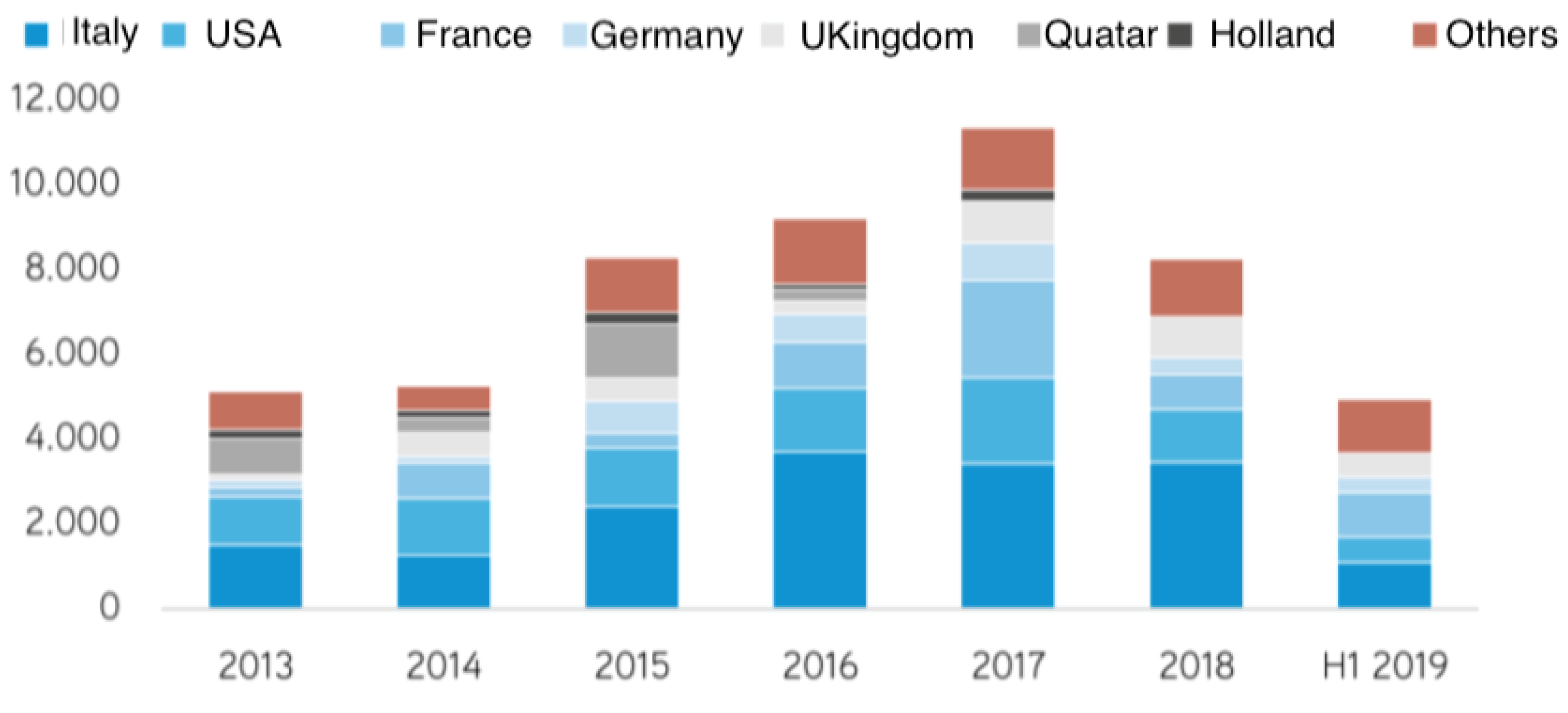

From 2008, the Italian real estate market has suffered a setback compared to previous decades. In 2018, real estate transactions in Italy fell by around 22%, in the context of an EU market that gained some ground. The Italian real estate market, which now sees a stable share of more than 60% in the hands of foreign capital (as shown in

Figure 1), remains below the potential of the real economy, especially due to high taxation and heavy bureaucracy and an almost total dependence on the banking sector for financing, factors which continue to slow down an industry otherwise capable of significant and continuous growth over time [

1].

After the crisis that appeared to have affected the residential sector with negative signs throughout the last decade, the Italian residential market is showing the first positive results. This is confirmed by the number of real estate transactions detected by the Revenue Agency Observatory, which, compared to the third quarter of 2017, increased by 6.7% [

2].

In addition, the international Real Estate company CBRE (Coldwell Banker Richard Ellis) Italy confirms the attractiveness of the residential sector for investors in 2018, with the emergence of new forms of alternative living. In fact, as is represented in

Figure 2, 72% of investors declare that the residential sector represents an interesting asset class to invest in, a result of strong growth compared to 63% in 2018 and 33% in 2017 [

3].

There are cities including Milan and Rome where the residential market is more developed and livelier, unlike the internal areas and secondary cities where, however, this process, although slowly developing, is still at an early stage. In particular, short-term rents have driven the growth of the residential market: the economic crisis of recent years, combined with the new dynamics of a society where the keywords are mobility and flexibility, are increasingly pushing towards a model of a market based not only on buying but on renting for short periods, at least in the first markets. Considering the high returns that can be obtained through this new contractual method, the trend in this sector in the coming years will be that of a growing number of investors in entering the Italian market. The short-term rental sector will be the one of greatest interest since, contrary to the more traditional form of long-term rent, it guarantees a lower rental risk and an annual occupancy rate of around 85%, although these conditions are variable and depend on the state of the apartment, its location, and the ability of the owners to promote the property [

4]. This is also due to the constant demand for housing for single high-educated young workers (EYW) and university students (US). The young workers have a low income but high standard references even regarding environmental sensibility. University students are similar to the EYW class and their demand is still not satisfied by student housing structures. EYW and US could represent a driver for changes in housing demand. EYW and US can be considered a representative group for the demand for change with new needs that were not considered by the previous generations. This part of inhabitants of our cities is a sizable “community” in the major Italian cities: the US in Italy comprise 1.7 million, and the ones that do not live with their family are estimated to be about 33.5% (570,000), with this number somewhat increasing every year.

The average rents recorded by the statistic agencies Eurostudent and Federconsumatori are about 561 euro in Rome, 514 euro in Milan, 393 euro in Bologna, and 422 euro in Florence [

5]. As a result, the number of EYW is also a sizable influential number for the residential market of the main cities. The development of this phenomenon is leading investors to re-evaluate the recovery of promising properties by location and type, especially within the urban centers of greatest interest. Once the recovery phase is over, the properties will be sold on the market or rented; additionally, renting to third party operators who can enhance, manage, and promote the properties on the short-term rental market is a solution starting to acquire presence on the market [

6].

For this sector, therefore, exponential growth is expected, linked to two main factors: on the one hand the great unexpressed potential that characterizes Italian cities; and on the other hand, the strong latent demand for singles, young couples, students, immigrant workers, and tourists looking for accommodation for short periods. The spread of this new form of lease will be supported above all by new technology and IT platforms, which speed up the process of interaction between supply and demand and promote new forms of marketing with reduced transaction costs. In parallel to the logic of short rents, the sharing economy will be increasingly widespread, which will also completely change the paradigm of living: the house will no longer be seen as a "good" but can be conceived as a "service", with sharing as a basic element of the new residential forms [

7].

2. Analysis and Real Estate Assets

Man has an increasingly central role in the living environment that surrounds him, influencing his quality of life. Several international conferences on sustainable construction investigate the most current issues, which featured the issue of robotics; an example is the recent “Klimahouse Congress 2020” in Bolzano (Italy) or the “Home Together 2020 Congress” organized by the Gabetti Group in Milan, which addressed the great issue of the future of living with an innovative and deep approach using scenarios and market analysis. In recent years, the concept of sustainable housing has since gone on to acquire ever-greater importance, qualifying as a highly innovative element in a real estate market heavily affected by the economic crisis, and this is reflected in the manual of the Green Building Council of Italy [

8].

Italy is confirmed at the top of the European ranking of countries with an older population and this is directly reflected in Italy’s real estate market. “Today, 60 or 65 year-olds are very different from their counterparts half a century earlier and are likely to be very different from what they will be like half a century in the future. People are living longer, healthier lives and have better cognition. In any year, people are also different geographically and across population subgroups. It is not only that “40 is the new 30”, but today “70 is the new 60”. This is why 21st century aging can be better addressed using 21st century tools” [

9].

According to ISTAT data from 2015, 15% of Italian buildings are more than 100 years old and 65% were built before the entry into force of the regulations dated to 1976 on the containment of energy consumption in buildings. Real estate assets also remain at the center of Italian non-financial wealth: in 2017, properties made up 84% of the total stock of non-financial assets in Italy, and 60% relate solely to residential buildings (

Figure 3 and

Figure 4) [

10]. The current situation of the Italian stock of buildings is represented in detail in

Figure 5: more than half of the Italian buildings on sale in 2017 were still part of the less efficient energy class. Due to the lack of more quantitative data on Italy’s real estate properties stock, we could assume as a scale of reference the energy class of the buildings, where the higher the class is, the greater the level of the quality of sustainability of the asset. A detailed representation of the Italian situation is provided by immobiliare.it (the first real estate sale adverts website in Italy), which reports a clear situation where the low energy class properties are still more than half of the whole market (

Figure 5).

The picture of the growing age of Italian real estate is demonstrated by the decline in their physical value: during the 2011–2017 monitoring period, housing wealth decreased by 1.4% on average annually [

11]. The real estate sector, however, is characterized by market dynamics at two distinct speeds: while the new accelerates with rising prices, the old one, which however holds the greatest weight in the volumes of sales, slows down, yielding value (

Figure 6) [

12].

In Italy, the potential for the renovation sector is estimated at over 120 million square meters with the possibility of significant property value increases; this can also be sustained by the current low interest on housing loans as represented on

Figure 7 [

13].

“The existing residential stock has characteristics, for example dimensional, construction, energy, such that it risks being increasingly distant from the demands of today’s market. This also explains why the prices of the used product continue to fall, also in 2017, while the price of the new product is growing, driven by the demand that, especially in some geographic areas, is strengthening, albeit with new characteristics” [

14].

However, it is not only the energy aspect associated with the use of the building that is of concern, but it is the whole way of understanding the inefficient construction process: the planning, construction, use and decommissioning of buildings. Furthermore, the continuous urbanization and waterproofing of soils creates serious problems with urban microclimates with too high temperatures in the summer season, water scarcity, and air and water pollution, but also problems related to the use of techniques and materials with high gray energy content and characterized by very short life cycles. Today’s challenge is to make residential real estate assets efficient according to a logic of sustainability by intervening in the energy efficiency of buildings and the sustainability of the production process and reaching levels of excellence in consumption through all the technologies available for heating and cooling [

15].

As exposed before, the rising generation of EYW and US are representing the new demand for housing and able to respond to the characteristics of these generations that have in common a new sensibility toward the environment, a low income, strong social connections and interrelationships, and a flexible lifestyle, and are fast in changing their job and location.

This group of persons is demanding a low cost of the lease at the same time as demanding that the properties satisfy their requests, in which the most important aspect is the sustainable design. This has been confirmed by the interviews we have conducted with real estate agents in the period of the survey reported in

Section 3.1.

Sustainable design focuses on the construction of buildings characterized by social and environmental sustainability, always improving the performance of buildings. Each object considered “sustainable” has to show ecological awareness; therefore its functionality shall be related to the environment through its appearance.

Green building is a philosophy, a way of thinking and acting, not a style; the elements of sustainability should not dominate the architecture of the building. Efficiency and sustainability measures can be harmoniously inserted or even hidden in any design solution. The main objective of this new design approach is to promote the health and comfort of the building’s tenants and to reduce the negative effects of the building on the environment. By minimizing waste, limiting the consumption of non-renewable resources and using environmentally friendly materials, building designers can build ecological and more energy-efficient constructions.

The key tenets of sustainable architecture include the ability to:

Optimize the potential of the site;

Minimize the consumption of non-renewable energy;

Protect and conserve water;

Improve internal environmental quality;

Optimize operational practices and maintenance [

17].

All of these principles are designed to inform every phase of the structure’s life cycle, from planning to operation, and to limit the negative impact it has on the surrounding environment.

The sustainability of the project should be a requirement, not a feature. In addition to the traditional safety, usability, comfort and management requirements, to design sustainably, a series of requirements are needed, relating to the general conception of the building, such as the shape, plan, and distribution, and relating to the building systems, the choice of construction style concerning possible changes during the life cycle (flexibility and reversibility of the technological concept), and indoor air quality.

As for the requirements relating to the general design of the building and systems, those relating to the flexibility, distribution, and equipment of each building are important. Each building has changed over the years due to changes in its users or usage practices. Some of these changes can be controlled with the architectural project and can be guided through a project capable of predicting the subsequent behaviors of the users to whom they respond with appropriate articulations, spaces, and devices. This applies to the distribution concept and, almost even more, to the plant engineering concept.

As for the requirements relating to the choice of construction style based on possible changes to the building during the life cycle, the first requirement to be respected concerns the need to ensure maximum reversibility of the technological concept. All this entails the use of a construction style capable of satisfying at least the following three key requirements: accessibility, disassembly, and recoverability [

18].

3. Guidelines for the New Offer

In an increasingly fluid job and study market, where mobility transfers thousands of people every year from one city to another, in Italy and worldwide, a house to rent can certainly represent an interesting complementary income. In addition, renting a house brings with it another advantage to take into account: having issues in one’s home taken care of, contrary to what happens by leaving it vacant, by keep the systems in function and avoiding deterioration.

There are those who own a property but do not have the time to manage it; there are those who inherit it but do not want to risk having negative experiences; there are those, however, who have financial resources and prefer to invest by buying a property to be rented and guaranteeing an additional income. In any case, it is an investment whose success depends on the ability to generate income. It is not easy but necessary to analyze the market, know the needs of the tenants, deal with the restructuring and the search for tenants, and, in this context, the management of relationships and contractual agreements.

Starting from this base, we try to highlight the opportunity of investing in sustainable residential assets and the consequential possibility of using a property management company to assure a guaranteed return on the investment in order to allow an income and maintain the value over time. In the current Italian market, this opportunity is prominently based on five key questions that we have identified in the research “Sustainable buildings market study 2019” published by Ramboll in 2019, where it is interesting how, enquiring about both tenants’ and landlords’ perspectives, there are clear interests that are matching: the first group is related to economic reasons, such as realizing the savings of operational costs, the easier liquidation of assets, and better financing (mortgage) opportunities; the second group of desiderata can be identified with technical standards, like regarding the use of sustainable quality materials, the layout of the units, the increased resilience (flexibility for a future change), and other relevant factors [

19].

3.1. Data Survey

To inquire how the level of sensibility towards the themes anticipated by the generation of EYW and US meets the sentiment of the developers, investors, and owners we decided to proceed with a survey.

This research surveyed 50 Italian operators specialized in real estate agency services. They have been selected according to three simple criteria: (1) licensed real estate agents; (2) more than 10 years of activity in the residential sector; and (3) extensions of their operations to the whole Italian territory connect to a network of agencies. We also specify that the real estate agents we interviewed are allowed to operate according to the Italian law and are enrolled in the specific register of the Chambers of Commerce. We picked this cross-section of operators because we believe that the agents are the privileged observers toward the residential market and its signals of mutations.

During the “Home Together 2020 Congress” organized in Milan, on the 30th and 31st of January 2020 we interviewed these companies with a qualitative enquiry in order to get the sentiment of the real estate executor and the one perceived by the market. The survey aims were to gather opinions relating to the most important values associated with sustainable residential buildings. The data survey was composed of multiple-choice answers, which correspond to five values related to sustainable houses, and each respondent was asked to choose which value they considered most important in choosing a new eco-friendly home. The survey is a self-assessment, and all replies are based on the respondents’ own experiences. The result of the survey revealed a strong interest linked to the reduction of operating costs in sustainable buildings, but also an easily salable house (with high realizations in a short time), healthier and more comfortable spaces, a flexible layout for future changes, and an easily rented house (with high annuities). These five characteristics depicted in

Figure 8 represent the new valuable components to consider in a house:

Reduced operating costs. The data collection shows an interest in saving during the rental period (see graph below). Low operating costs are the most important added value of sustainable buildings. If buildings are designed following various sustainability standards e.g., DGNB (German Sustainable Building Council), LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), the probability of reducing operating costs should be high. This is because these certification schemes lead the building to be economically sustainable in the long term thanks to renewable, alternative, and efficient energy sources [

20]. The results are also confirmed by the survey carried out by REbuild, a company recognized in the construction market as a reference player for innovation in Italian construction, in which it specifies that LEED certifications increase real estate value from 7% to 11%, stating that sustainability is not an extra cost, but a different way of thinking about development [

21].

Easier to sell. The purchase of ecological wooden houses or houses in energy class A and with parameters that respect the environment is a way to invest in this sector and to earn through the sale of eco-friendly houses. Even buying houses to renovate and readjusting them according to more ecological standards is an operation that can bring high benefits, not only for tax relief but also for the possibility of taking advantage of "green" mortgages granted for this type of investment. In addition to the evident energy saving of an eco-sustainable house, as declared by the World Green Building Council, there is also the aspect of greater attractiveness of the home on the real estate market, which is saturated with houses with low energy standards. For this reason, having an energy certification increases the probability of selling the home by reducing its sales time from 8 to 4 months.

Healthier and more comfortable space. The survey reveals an interest in ensuring a healthy living environment, where the indoor climate and materials together offer high levels of comfort. Improving the quality of the interior spaces increases the wellbeing of the people who use them, with positive returns also on health. Ventilation systems are currently designed with very high efficiency and recovery levels.

The facades of the buildings are designed with the highest possible thickness of insulation and the windows are positioned to allow the use of daylight and passive heat gain as much as possible. Indoor air quality, daylight, and quality lighting and thermal comfort are the main factors of wellbeing and health. In a sustainable building, there should be a strong focus on ensuring a clean environment for the occupants, but also on the importance of using "clean" building materials that can be used in different "building cycles". The requirements relating to the selection of building materials are established by environmental certification standards such as DGNB, LEED, and BREEAM. Liveability is an emerging concept that embraces the wellbeing of people by observing factors such as the design elements used and the surrounding structures with which we interact daily. Buildings are part of a person’s daily routine and experience and must meet daily needs. This survey demonstrates and supports the need to focus on real-life experience in buildings.

Flexible layout and intended use. The eco-sustainable house should meet the requirements of high standards, but in detail, what is essential for this type of development is the flexibility of the structures. To be successful one therefore needs to be able to make the property adaptable according to the user who will live there, because the needs change throughout life. Already in the design phase, it is important to ensure a flexible configuration for future changes. The users of reference have changed over the last few years, moving from creating spaces for the traditional family to the housing units of singles that require different typologies, and this is visible both in Milan and in secondary cities such as Florence, Chieti, Bologna, and Bari with the construction of student houses with co-living areas.

Higher rents. According to the interview’s results, renting a home can be significantly more attractive than owning one depending on where you live. A sustainable building is easily rented and generates high returns. Eco-friendly apartments and sustainable building materials are conquering the market: both buyers and renters prefer environmentally conscious houses. These houses have lower energy costs, such as water, heating, and cooling, as well as an ecological footprint. There are numerous rental homes that are not only built in a sustainable way but also offer renters options that can make them feel good in the place where they live. Having high-efficiency appliances lead to savings on energy costs. Technology has started to play an important role in sustainable homes. For example, smart thermostats and Wi-Fi connected with lights can help keep energy consumption under control. Some smart thermostats can detect how many people are in a specific room and adjust the temperature accordingly, making sure not to radiate heat or air conditioning in unused rooms.

The house is a very strong symbol of the identity of each individual. The house has always been part of everyone’s life and has always been the first and true reference of those who live there. The house, however, is not only a place, but is also a way of life, a concept that changes and evolves together with the habits of those who live there and those of the society in which we live. The house represents a tool for spreading a culture of sustainability and it is, therefore, important to understand how our way of living will change in the coming years. Each building changes over the years due to the change in its users or usage practices.

The Italian reality, in terms of territorial specificity, intrinsic characteristics of cities, and urban aggregations, as well as peculiarities of housing typologies, presents a variability which is in itself already a considerable challenge for those who want to offer the market a support tool for the design of sustainable housing. Taking into account also the large real estate assets already present in Italy and the real estate pressure recorded in recent years, although mitigated by the economic crisis that has affected the entire European area, the overwhelming need to produce an adequate tool for sustainable change emerges in the residential market.

The current and future challenge is to make the house efficient according to the logic of sustainability. Investments in energy and water-efficient solutions result in savings in operating costs when operating a building. Besides, sustainability throughout the building’s lifecycle can be further addressed with carefully selected building materials and robust solutions that reduce the risks and costs associated with cleaning, maintenance, and recyclability. Higher quality leads to higher real estate values, higher rental levels, and lower vacancy rates in the long run [

22].

3.2. Recognized Incentives and Certification Schemes

The new demand for housing that is currently being pushed in the market by the generation of EYW and US as mentioned above, bringing a high request of sustainable living standards, is also supported by international protocols. These standards that are effectively gaining more importance in the construction market can guarantee a good return in comfort and cost saving for the residential asset class.

A driving factor for the construction of sustainable buildings has to be economic: if the return on investment is positive, "green" solutions will emerge and grow exponentially. Other factors are the incentives proposed in the construction sector, such as the Ecobonus 2020, a tax relief that provides for a 65% deduction on the expenses incurred by the taxpayer for energy retrofit interventions.

The Ecobonus also includes the bonus for replacing fixtures, windows, floors, insulation, heating systems, curtains and solar screens, home automation systems, and multimedia devices, and the possibility of opting for the assignment of credit for construction works that increase the level of energy efficiency of existing buildings, also for 2020.

Furthermore, in an increasingly green-oriented international market, it is possible to observe how many sustainability certification systems exist in the world. The certification guarantees high-quality process documentation, as well as detailed and quality solutions for the documentation of the building owner, who is often incomplete or missing in uncertified projects.

Over the years, several environmental certification protocols have been established, but the main reason for the wide variety of certification schemes is the sensitivity to the context. The certifications are different between the various countries and cultures and each of them has its areas of interest. Making a comparison between the different schemes is not easy due to the complexity in their application, the difficulty in making the evaluation procedure objective, and the lack of shared databases (product life cycle, the energy content of materials, etc.). In Italy, the framework of the assessment protocols for sustainable living is rather fragmented and the ITACA (Italian Institute for the Innovation and Transparency of Procurement and Environmental Compatibility) protocol is affirming itself at a public level, while the LEED protocol is affirming itself on the international private market. Each of these certifications has specific characteristics in their content and application methods but also an affinity and common ground. Both certification schemes are based on a scoring system with a list of requirements assigned to an evaluation judgment, and the global score defines the environmental sustainability of the building (

Figure 9) [

23].

Several protocols developed in the last years anticipated and have helped in defining the new construction standards now regulated by laws (e.g., UNI EN 15232). This presented an incentive for the market to push up the standards in redefining the new qualities of environmental sustainability and tenants’ mutated needs.

4. The Market Value of a Sustainable House

Investing in a sustainable building is increasingly convenient. An investment in a sustainable real estate operation involves increases in construction or renovation costs between 5% and 10% of the total, but allows for an increases in value (between 2% and 10%), significantly higher rents (between 2% and 8%), and a sharp decrease in sales times (from 8 to 4 months).

The extraordinary maintenance of the buildings has recently shown a steady increase in investments, in the face of stable contractions in the other construction sectors. In the case of a renovation, the cost of green interventions is on average 40 euros per square meter. In Italian cities alone, with a heritage built after 1946 of around 18 million homes, this would entail an additional investment of 40 billion euros and an increase in the value of not less than 100 billion.

Buildings are fundamental drivers of energy demand, and in Italy those with over 40 years of life, which require extraordinary maintenance, represent 70% of the total; this, on the one hand, constitutes a problem, but on the other hand also presents a great opportunity [

24].

The green economy has spread in ten years in Italy with unexpected results. The number of made-in-Italy eco-sustainable patents has increased by more than 22%, and 17% of energy consumption is derived from renewable sources, with results still far from Denmark and Germany, but higher than France and Holland.

Building technology represents a fundamental added value of sustainability that is leading to particularly attractive and interesting real estate sectors for investors: hotels, student houses, and stadiums [

25].

In a context of the constant weakness of the Italian economy, Lombardy is confirmed as the main engine for the development of the country. The real estate market in Lombardy is confirmed to be the most dynamic at the national level for 2019 with sales growing by 13.3% in the last year, against an Italian average of positive variation of 9.8%. Prices also reversed the downward trend, triggered from 2007, three years ahead of the rest of the country.

Already in 2016, the average selling prices of residential properties had shown weak signs of recovery, which have subsequently consolidated over the past four years, while at the national level the trend reversal is expected in the coming months, with prospects for a slight improvement for the end of 2020 [

26].

Hedonic Pricing: Value

Sustainable design can significantly increase the value of a property. Eco-sustainable homes are regularly listed and sold at higher prices than conventional homes. Energy-efficient properties generally cost more in the construction phase, but an owner can compensate for the construction cost when selling his property. Therefore, buyers are willing to pay more for sustainability because they recognize the long-term economic and environmental benefits.

Investing in efficient buildings, even before being sustainable, allows one to free up resources to be allocated to the implementation of solutions for improving comfort within the buildings, offering the tenants more competitive solutions. If in a phase like the present one a certified sustainable building is sold before a traditional building, in the not too distant future a traditional building will be placed on the market with great difficulties; on the other hand, as demonstrated by the research represented in

Figure 10, increasing the quality of the building and also the market’s willingness to pay is directly related to an evident advantage for the seller or the owner. It is enough to look at a situation like the one of Milan to verify the strong acceleration underway towards a model of greater sustainability that does not only concern buildings, but also important parts of the territory: Milan is becoming one of the most sustainable European cities together with Espoo (Finland) that currently is at the first place [

27].

The strong interest in energy and environmental recovery of existing buildings demonstrates how this step is essential and how the point of no return has already been overcome for some time.

It is possible to identify for the main functional elements of a building their contribution to the final market value; this could include elements intrinsic and extrinsic, like the type and quality of the windows, the age of the building, the neighborhood, and its services. In this context, certainly, the costs of construction or renovation are easily quantifiable thanks to a vast amount of literature (that is normally published by the Chamber of Commerce) that identify parametric standard costs for each work or element [

28].

However, it appears of a different level of difficulty to quantify how much the investment supported by the owner or landlord is reflected in the income that will be generated by every single functional element that is able to raise the appeal of the asset. These elements generate values that are called hedonic prices; the single values are part of the total value and cannot be separated, but they can be analyzed using a methodology like the one for the construction of the Profitability Index [

30]. This index could help the investor, in a theoretical way, in the decision process of designing the actions (costs) to include in the investment (asset).

All of our efforts and all of our actions go in the direction of an improvement of the environmental quality not only inside, or restricted to the building envelope, but also outside. While the indoor environmental quality is for the benefit of those who live in these buildings, the outdoor environmental quality is for everyone. The value of certified "green" buildings, therefore, goes far beyond a percentage which remains an indispensable parameter to accelerate a concrete transformation in a world where the economy is important, but which today more than yesterday, cannot be separated from taking environmental and social aspects into consideration [

31].

5. The Assessment Result

The demand for energy-efficient homes is increasing in Italy, with more people interested in green design than in previous years.

As a result, it is highlighted that the most common characteristics of eco-sustainable projects, which can increase the value of a property, include passive solar design, solar panels, ultra-efficient windows, cooling and heating systems, high-performance appliances, and the use of reconditioned or recycled materials. As awareness of the effects of climate change grows, people are becoming increasingly interested in sustainable design and eco-sustainable housing. Reducing the environmental impact caused by the construction sector with particular regard to energy consumption, drinking water, and waste production also regarding the life cycle of materials and buildings is an important feature that leads to investing in sustainable construction. The need to invest in sustainable construction is essential to providing an environmental certification that makes the environmental performance and therefore the quality of the building visible, differentiating it on the real estate market; it serves to stimulate the demand for sustainable buildings, and finally, it is useful for increasing the awareness of owners, tenants, designers, and real estate operators of the benefits of a building with high environmental performance.

Investing in sustainable construction is beneficial to citizens as a tool for an increase in the quality of life, an effective saving of environmental and economic resources, and a reduction of pollution, to designers as a tool to provide and evaluate the quality of the project, to construction companies to restore quality and transparency to the real estate market, and finally also to public bodies as the basic prerequisite for any planning action in territorial and building transformations.

What do We Need from the New Housing Units

All of the aspects just mentioned are moving a new demand for housing: today, in the residential market, there is a greater tendency to prefer buildings that promote social cohesion and support communities, focusing on the values, health, and well-being of mixed generations with flexible solutions for each individual. The "revolution" of the residential market is influencing the investment strategies of the players: the operators in recent years have focused their attention on the groups of young people ranging from 20 to 40 years old that express the need for much more flexible residential layouts, where the community is the reference driver. Among the alternative residential forms, beyond the more consolidated student housing and senior living markets, we also find alternative assets such as micro-living, residential rental (multi-family), and all forms of co-housing where the drivers are not only the provision of additional services but also the presence of spaces where the sharing of experiences is possible [

32].

Many citizens are well informed, value-oriented, and want to contribute to sustainable change in their lifestyle and choice of housing. These trends are supported by a report published by the World Green Building Council, in which it emerges that the main drivers are “Client Demands”, “Environmental Regulation” and in third place “Healthier Buildings” [

33].

The layout of residential buildings has always followed the needs and the organization of society, for several reasons such as individuals of a family living together, energy consumption, and design trends.

6. Conclusions

Although there is still no reliable data to demonstrate whether sustainable buildings generate a positive return on investment, what we can do is observe that choosing the best direction to follow, the one most consistent with environmental objectives, and the one that goes towards more sustainable living opens the asset to a more dynamic market. Observing the residential demand generated by the cluster of EYW and US present in the cities with a positive trend in the recent years, the research conducted suggests to the investor or the owner to lease their assets to short rent solutions. Sustainable investment has to guarantee maximum value for the investor: investing in more efficient buildings means pursuing the aim of creating value not only for the investor by improving the quality of the asset increasing its value and durability over time, but also for the tenants, satisfying their mutated needs represented by the results of the survey we conducted. Establishing a connection between sustainable real estate investment and the acquisition of long-term added value is extremely complex to define. However, having this awareness is crucial for investors and decision-makers to make informed decisions. Regardless of the practical usefulness of the projects in which there is investment, it is now clear that the choices of the market and investors influence governance policies both in social and environmental matters. This is the trend we predict that can be the driver for the improvement of buildings’ quality in relation to environmental sustainability in the next years for the major Italian cities. The above-mentioned wide growth in the last years of short-term rent operators in the market of the main cities underlines the need for new offers able to intercept the new client demand standards now anticipated and represented by the group of EYW and US. For this reason, spreading a business culture that looks to long term investment can also make it possible to match the new demands of the society expressed by the new generation of tenants: flexibility, high-quality standards, services, and technology.