Abstract

The widespread use of renewable energy sources and the growing concern about climate change, together with Spain’s exceptional weather and solar radiation conditions, have led to an increase in the use of photovoltaics for energy production in the country. Solar power generation has been tightly regulated, although the legal framework has changed frequently over the years. When assessing the potential financial performance of any business venture, legal as well as financial aspects must be considered, but a critical factor is the discount rate used, which must reflect the company’s capital cost. Other factors are the period of interest, the firm’s activity, market risk, and the level of debt of firms in the sector. The main objective of this study is thus to estimate the discount rate for companies using photovoltaics to produce solar power. We calculate it by employing two financial techniques: capital asset pricing model and historical return analysis. We then evaluate the investment in a photovoltaic plant with a capacity of 5000 kW located in eastern Spain, assuming it started its activity in different years which coincide with changes in the regulatory framework. The results show the relevance of the initial outlay costs for the profitability of photovoltaic power plants.

1. Introduction

For more than a century, energy has been obtained from fossil fuels which are now nearly exhausted and are causing severe environmental problems. Hence, many countries, especially EU member states, have set themselves the target of producing energy through renewable energy sources (REs). This energy transition to REs can also help in policy and spatial planning [1].

In an effort to build a sustainable future, developed countries designing energy policies have proposed to reach a target where 20% of the global energy consumed will be through renewable energy sources. An important source among REs is the energy obtained from the sun using photovoltaic (PV) technology. The rapid evolution of this technology [2], together with changes in energy policy targets, have led to its expansion in Europe in a remarkable way.

Spain’s geographic location, between latitude 43.5° and longitude 36° in the northern hemisphere, is excellent for installing PV systems due to its high solar radiation and temperatures. All these favorable conditions, as well as Spanish energy policies launched more than two decades ago, have resulted in a very significant increase in the number of PV installations.

When energy policy measures began to be implemented in Spain at the end of the last century, many business investments were driven by financial incentives to install PV systems. These measures focused mainly on a long-term tariff regulation which guaranteed investment profitability.

The financial viability of investment projects depends on various factors, which can lead to greater or lesser profitability. In the case of PV installations, the factors that determine the returns on investment are:

- The initial investment cost, which in PV systems depends largely on the level of development of the technology employed. Technological advances, large-scale production, and competition among Asian countries have resulted in substantial reductions in the initial outlay needed to get the investment going.

- Energy policies have brought greater stability to the market by creating the appropriate market entry conditions as well as by setting very stable electricity tariffs or prices over longer periods.

- The discount rate used for calculating the return on PV investments must be calculated in a way that guarantees financial rigor, and where profitability is neither overrated nor underrated. Thus, all the parameters that might influence discount rates, such as potential risks and the company’s size and capital structure, must be considered.

To date, academic works analyzing the profitability of PV installations have mainly used subjective discount rates for this purpose and have not taken into account the financial reality of the companies nor market uncertainties. For instance, Sorgato et al. (2018) employed a discount rate of 5.5%, whereas the Brazilian National Bank for Economic and Social Development [3] and Espinosa and Rojo (2015) [4] set it at 10%. In this study, we aim to find a more financially rigorous way of calculating the discount rates for PV investments, bearing in mind the company’s size and its market. The academic literature uses the weighted average cost of capital (WACC) (i.e., the weighted average ratio between the investing company’s debt and equity) as a tool to calculate the discount rates.

After obtaining the discount rates, we apply them to a case study. In this paper, we examine the profitability of a standard PV installation with 5000 kW peak production and also focus on the changing market conditions set by the Spanish government energy policies, which have been regulated through royal decrees and ministerial orders on PV installations [5]. Specifically, we have analyzed the profitability of PV systems for the following years:

- 2002: Royal Decree No. 841/2002 [6] which first fostered REs and PV installations.

- 2004: Royal Decree No. 436/2004 [7] designed a financially sustainable system for PV installations.

- 2007: Royal Decree No. 661/2007 [8] was issued with the aim of achieving sustainable growth for REs.

- 2008: Royal Decree No. 1578/2008 [9] promoted the use of REs while also fostering competition in order to reduce investment costs. This decree set a variable tariff according to the installed power capacity fixed by four annual calls.

- 2010: Due to the excessive growth of the number of PV installations, urgent measures were established to reduce the tariff deficit. Royal Decree No. 14/2010 [10] limited production to a certain number of hours per day, dividing the Spanish territory into five areas.

- 2012: Incentives for installing new PV systems were removed.

This study is divided into the following sections. After the introduction, Section 2 describes the methodology employed for the calculation of the discount rate, where two different approaches are proposed: the capital assets pricing model (CAPM), and a method in which the sector’s historical financial performance is analyzed. Section 3 shows the results obtained for a selected sample of companies, while in Section 4 we apply the obtained discount rates to several investment projects. Finally, Section 5 concludes.

2. Discount rate Methodology

Investment analyses of PV power stations are no different from other studies carried out for other productive sectors, but certain characteristics must be considered [11]: photovoltaic power ventures are long-term investments, and manufacturers of solar panels guarantee at least 80% of the initial production over the PV system’s 25-year lifetime. Thus, in long-range planning, economic analysis and assessment of the investment depend mainly on the discounted cash flows obtained through the investment.

With respect to the economic evaluation of investments in solar PV plants, in our review of the academic literature, we did not find any studies that provided either a detailed nor justified account of the discount rate used to carry out this type of assessment. Karasmanaki et al. (2019) [12], for instance, explore the factors that influence the desire to invest in renewable energy ventures, but they only take into account demographic aspects and do not consider financial ones such as the cost of capital. Blanco-Diez et al. (2020) [5] have recently analyzed how changes in Spanish legislation have impacted remuneration, but only in terms of revenue and without considering profitability, and hence, cost of capital. Pavel Atănăsoae (2020) [13] uses a discount rate of 5% for his financial assessment but does not justify it, similarly to García-Gusano et al. (2016) [14], who do not justify the discount rates employed for the financial methodology used in their study either.

Capital budgeting and profitability accounting techniques are used to estimate the investment’s cash flows (CF) and update them so as to obtain the return on investment. For assessing long-term infrastructure investments such as solar photovoltaic projects, the NPV (net present value) and IRR (internal rate of return) criteria are widely used in the academic literature [3,15]. The absolute net return of the project is measured by the NPV, which may be expressed as follows:

where CO is the initial cost of the investment, n is the lifetime of the investment, and k is the discounted cash flow at the time of the initial investment. For its part, IRR allows us to measure the project’s relative annual return:

where r refers to the project’s gross return.

Both returns are obtained by updating the CFs generated each year by the investment. Hence, the discount rate employed should reflect accurately and objectively the cost of capital of the investing company. From the point of view of the investment’s profitability, the discounted cash flows, at the time of the initial investment, k, also include the money that must be returned to investors, the opportunity cost of the funds invested in the project, and the cost of the project’s sources of finance. The discount rate is, therefore, a key component when comparing and assessing projects. It is also used to reflect the passage of time of CFs by reducing the value of those furthest away in time. Thus, determining a discount rate requires taking into account several market and firm-related variables and factors, and although its estimation may not seem complicated in theory, when real data is used, some hypotheses must be formulated, which imply making value judgments that can modify the results of the discount rate obtained and, consequently, affect the profitability assessment.

In Ibbotson’s [16] opinion, the discount rate is determined by the type of investment and not by the investor. In other words, the discount rate is established by the market, since it is there that investors will demand a return on their investments with a certain risk. In this sense, discount rates are linked to the cost of capital of companies.

3. Discount Rate. Conceptual Framework

Weighted average cost of capital (WACC) [17] is a widely used financial tool for decision-making and updating CFs. WACC is obtained as the weighted average of the company’s various sources of finance [18], as shown by Equation (3):

From Equation (3), it follows that in order to obtain the discount rate, or WACC, we need to know both the level of equity, E, and the level of debt, D, as well as the cost of these sources of finance (ke, the cost of equity and, kd, the cost of debt). The tax rate, t, reflects the effect of the tax savings achieved through tax-deductible expenses.

The strategy to be followed when it comes to the capital structure of a firm or sector activity is linked to the decision-making on real and financial investments, in that the level of debt desired by the firm will depend on the market value this firm wants to achieve. Sector activity is a factor that can influence these decisions; and since each sector has a different intensity of physical capital, a greater or smaller share of the company’s resources may be tied up [19].

3.1. Cost of Equity (ke)

The component of WACC that requires a more thorough analysis is the cost of equity. Next, we discuss two different methodologies employed for its estimation: the CAPM (capital asset pricing model) and historical return analysis.

While the CAPM-based model has its origin in stock market analysis methods, the financial performance model follows a chiefly accounting approach. This ratio represents the internal rate of return [20] an investment project must be able to yield in order to pay investors back their money or to encourage them to risk their capital further in the purchase of shares issued ad hoc to finance the project.

3.1.1. Model 1: ke Obtained through CAPM

The CAPM was constructed by Sharpe [21] and further developed by Fama and French [22], who studied its validity in detail by applying Equation (4) to the analysis of the return on assets:

where:

- E(ri) is the expected rate of return on the asset (i.e., the demanded rate of return on equity).

- Rf represents the risk-free rate of return that may be obtained in the market without taking the risk of losing the investment nor the interests that could be earned from it.

- E(Rm−Rf) denotes the market-risk premium, which is the difference between the expected rate of return on the market and the risk-free rate. Historical data are generally used for this component.

- measures the market’s systematic risk in relation to the asset being valued. Mathematically, it may be defined as:where is the variance of the market returns.

Beta is considered an essential and critical factor in determining the cost of equity, as it provides information on how the sector activity has behaved (in terms of the variance in returns) towards market developments. In other words, it reflects the sector’s sensitivity to market fluctuations.

It is also important to note that if betas are low, the cost of equity obtained through the CAPM will also be lower, and this will lead to a more moderate discount rate, the final effect being an increase in the sector’s value. Nevertheless, the trend for the future seems to be that beta values will continue to increase, which would have an impact in the opposite direction.

3.1.2. Model 2. ke Calculated by Means of the Sector’s Historical Return Analysis

A prevalent approach for computing the cost of equity is to associate it with the minimum return required [22], by which the cost of equity is defined as shown as follows:

where: ke = cost of equity,

= historical market risk premium (Equation (7)), defined as the difference between the 5-year moving average of the financial returns on the sector and 10-year government bonds:

Rf = risk-free rate at time n (government bonds, treasury bonds, etc.)

From this point of view, the cost of equity is considered as an opportunity cost that is the result of the sum of a risk-free rate plus the risk premium, which can vary according to each company or sector activity [22,23].

3.2. A Discount Rate for the Photovoltaic Industry

To calculate the discount rate for the Spanish photovoltaic industry, we will use a specific sector of Spanish SMEs (Small and medium-sized enterprises), which corresponds to the industry category No. 3519 according to the Spanish nomenclature of economic activities (CNAE): Production of electricity through other sources of energy, specifically, production of electricity by means of solar energy. In addition, we use the financial statements from these SMEs for the period of 1999–2017. Hence, the sample includes 67 companies, whose turnover was EUR 1 million in at least one of the years of the 2013–2017 period. Additionally, the business activity of these enterprises developed in Spain generated profits in the last three years of the sample (2015, 2016 and 2017).

In order to estimate the discount rate, we must first analyze the trend of each of the factors that make up the equations defined previously for the period 1999–2017.

Parameters of Equation (3) are described in detail below:

a. Capital structure (D and E)

Over the said period, the capital structure of the sample firms experienced a leverage increase, with a minimum equity of 9.17% over total liabilities in 2002. On average, the sector had equity of 19.96%, the median being 17.95%. In contrast, in 1999, the sector’s total equity amounted to 48.70% (a break-even point). Thus, it can be said that this sector covers its needs with bank financing.

b. Cost of debt

To analyze this factor, we use as a yardstick the data published by the Bank of Spain on the preferential interest rates issued by banks from 1999 to 2013. This is a historical series of real lending rates (i.e., rates of interest charged by banks for borrowing money) reported to the European Central Bank, Regulation (EC) No 63/2002 of the European Central Bank of 20 December 2001, concerning statistics on interest rates applied by monetary financial institutions to deposits and loans vis-à-vis households and non-financial corporations. However, because this information has no longer been reported since 2013, from that year onwards, we use the rates of interest charged by financial organizations to residents of the Economic and Monetary Union (i.e., the annual percentage rates (APR) charged for new loans and credits granted to non-financial companies). Table 1 shows the available data on the cost of debt from 1999 to 2017.

Table 1.

Cost of debt, 1999–2017.

c. Cost of equity

As explained earlier in the discount rate methodology section, the cost of equity can be calculated in two different ways, through the CAPM and through the method based on companies’ financial returns. The results obtained are shown in Table 2, together with the performance of 10-year government bonds and Madrid’s stock exchange general index (IGBM).

Table 2.

Cost of equity, 1999–2017.

The performance of risk-free assets (Rf) is similar to that of 10-year government bonds, as they are issued by the State and thus offer maximum solvency or a top score in credit rating, profitability and sufficient liquidity, as well as being risk-free [1].

The market return (Rm) index is used as a reference in Spain for assessing market profitability and is quantified by the IGBM index.

Beta measures how sensitive a given asset (or investment project) of an economic sector is to fluctuations or changes in the market. In this study, we use betas calculated for the electric power industry. We work with unlevered betas, as obtained by Damodaran [24], and hence, we lever them, taking into account the capital structure of the sector under study.

To calculate ke, following the financial performance approach, in addition to calculating the returns on the risk-free asset, Rf, we also need to estimate the historical risk premium, which is the difference between the 5-year moving average of the financial returns on the sector and the 10-year government bonds:

d. Effect of corporate tax according to the tax rate

To also include the effect of corporate tax (t), we have examined its evolution since 1998 using data from the Spanish Tax Agency. During the period from 1998 to 2006, corporate tax was 35%, before being lowered to 32.5% in 2007. From 2008 to 2014, it was then further reduced to 30%. In 2015, the Royal Decree 634/2015 [1] of 10 July, which approved the Corporate Tax Regulation, was applied and a corporate tax of 28% was introduced. In 2016 it was cut to 25%.

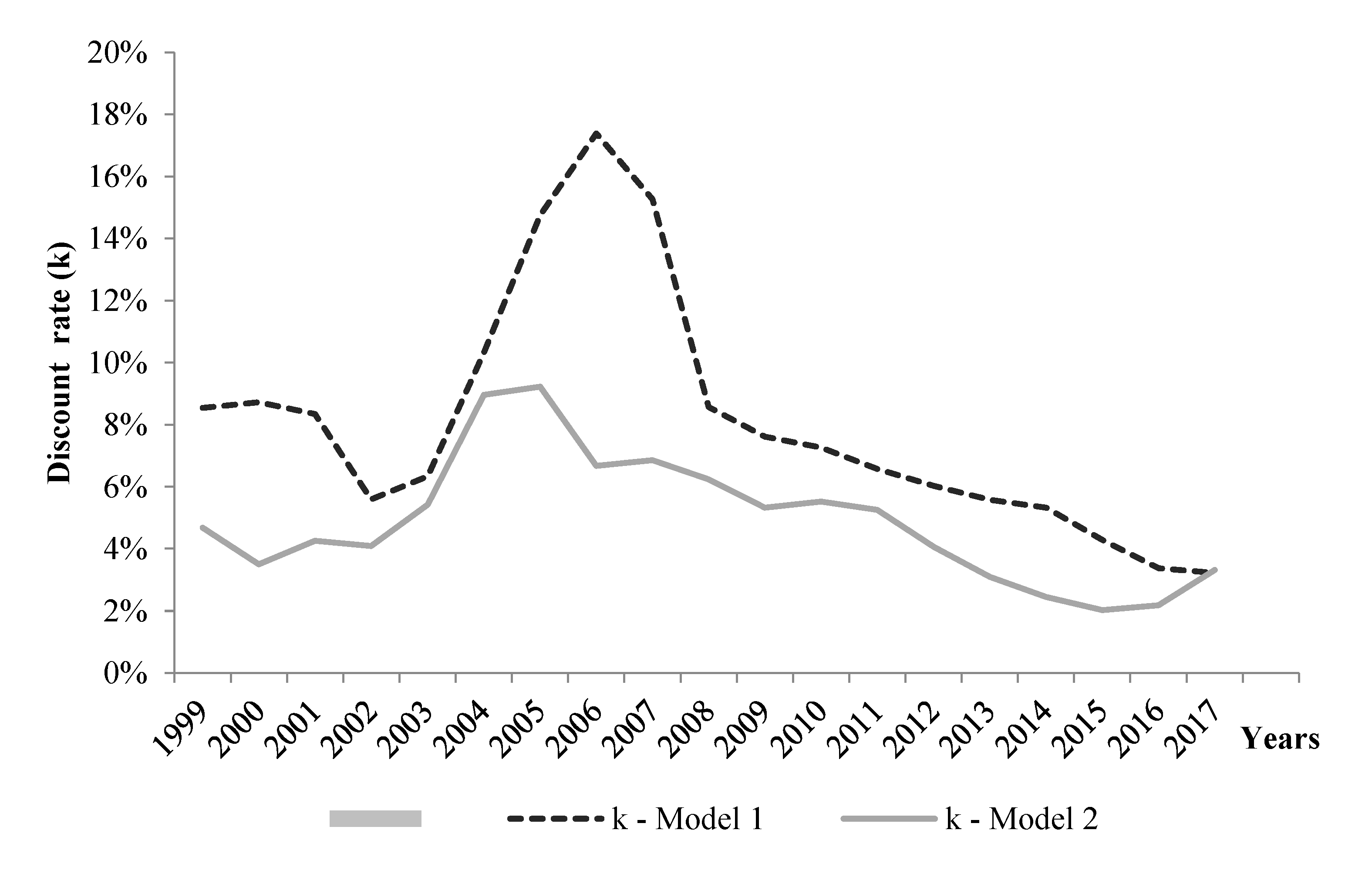

Figure 1 depicts the evolution of discount rates for the sector under study. As can be seen, rates computed through Model 1 (CAPM) are always higher than Model 2 discount rates since the CAPM also incorporates the market risk factor.

Figure 1.

Evolution of discount rates for the photovoltaic industry, 1999–2017.

As shown by Model 1 (which obtains ke by applying the CAPM), the period from 2004 to 2007 was the phase with the highest discount rates, when 17.39% was reached in 2006, mainly due to the higher risk premium. This was a period of turmoil in the financial markets. In 2008, a third period began showing a prolonged decline in the value of discount rates. The cause of this decline lies in two factors: beta values were more stable, as they returned to the levels of the first period, and the reduction in the differential returns of the market risk premium.

The calculation of the discount rate with Model 2, which is an accounting-based approach that mainly focuses on obtaining the cost of equity, has a direct impact on the level of discount rates achieved. Their values remain more stable than those computed with Model 1. For the entire period, the discount rates obtained by this methodology show lower values, which implies higher values in the discounted cash flows of any investment project launched by companies in this sector.

In short, in the case of models with a leveraged structure, the weight of the cost of debt significantly influences the estimation of the discount rate. The cost of debt is reduced as a result of a monetary policy that boosts the economy. The fall in oil prices and the risk this fall poses to global growth has led the European Central Bank to implement a policy of minimum interest rates.

Consequently, for any rational investor in the market, investment in projects related to solar power generation will seem attractive, since only a minimum quantity of resources is needed (most of the financing being provided by monetary financial institutions), and the financial returns obtained are 12.66% on average.

4. The Case Study

The case study involves a standard solar PV plant set up on a piece of land located inland the province of Valencia. The PV system has a capacity of 5000 kW for which an area of about 140,000 square meters is needed. We have estimated the value of this installation, presuming it started its activity at different moments (2002, 2004, 2007, 2008, 2010 and 2012). The beginning of production of each solar PV plant coincides with changes in legislation where new tariffs, as well as changes in market conditions, were introduced [25]. As usual, we assumed that the technical conditions of the PV system remained the same during its useful life [26]. For this reason, we have estimated that the investment will last 25 years since, generally, manufacturers of PV modules guarantee a power output of 80% for this length of time. Bearing in mind these conditions, we estimated the energy production in kWh for each year in which the activity begins, considering a decrease in energy production of 0.5% per year [1] due to the system’s deterioration. We calculated the power output using PVGIS software which provides data on electricity production according to geographical locations and power stations installed capacity.

The cost of installing PV solar plants varies depending on each year [27]. As expected, the cost of solar PV plants diminishes with each year, thanks to technological advancement, and because of new economies of scale participating in solar panel production, as well as international competition, since eastern Asian countries, like China, have entered the solar panel market. Table 3 shows the investment costs estimated, taking into account each year’s market average.

Table 3.

Investment costs for each year in which a photovoltaic (PV) system is installed.

Revenue arises from the sale of electricity. Depending on the system’s technology, production levels will be higher or lower. Electricity prices are established according to the government’s energy policy goals, which are regulated by royal decrees and ministerial orders concerning electricity tariffs. In order to take the changes in tariffs due to inflation into account, we have estimated the inflation rate for each year when activity begins in each solar PV plant. To do so, we used the historical data from the National Statistics Institute (INE) from 1993 to the year when the investment is made. Table 4 presents the results.

Table 4.

Inflation rates. Spain, 2002–2012.

With respect to the investment costs of the solar PV plant, we also considered maintenance and insurance costs, 6% and 9% respectively. Additionally, we considered including the rent of 14 hectares of land (which is the surface area required by the plant) in accordance with the market prices of rural areas of the province of Valencia. Currently, land rental is about EUR 40,000 per year. We deflated this price using the market land rentals to obtain the price for similar pieces of land at different times. Moreover, depreciation of the PV system was also taken into view, even though it is not really an expense in that it can be deducted from tax. We calculated depreciation using the linear method. Therefore, the installation’s initial cost was spread over an estimated useful life of 25 years. Finally, we calculated CFs as the difference between collections and payments, where we considered each year’s tax rate effect.

To calculate the absolute return using NPV, Equation (1) requires the CFs and the discount rate as calculated in Section 3 by the two methodologies. Consequently, for each investment, two returns are obtained, as shown in Figure 2. First, we computed the absolute return by means of the WACC method, obtaining the cost of equity through the CAPM. With the second methodology, the absolute return was obtained using the ROI approach to calculate the cost of equity.

Figure 2.

Financial returns by starting year of the investment; (a) absolute returns (b) annual net internal rates of return.

The internal rate of return (IRR) was computed with Equation (2) and the CFs provided in Table 5. To obtain the annual net return, we subtracted the cost of capital from IRR. Again, two results were obtained for each PV installation.

Table 5.

After-tax cash flows of each PV installation by starting year of the investment.

If we look at the results shown in Figure 2, we may see that although the two methodologies employed to obtain absolute and relative net profitability provide different information, both methodologies arrived at similar results. Despite a positive performance in several different years, very significant returns were only achieved from 2010 onwards.

Thus, profitability depends on all the investment factors: (a) The initial investment has a significant impact on profitability and this weight decreases over the study period; (b) initial investment costs decreased by more than 25% in 2009 which translated into returns above 10% from 2010 onwards; (c) higher profitability was obtained from the year 2010 onwards, which coincided with lower initial investment costs and the relaxation of electricity production regulations that have moved closer to market criteria. This leads to the conclusion that, currently, the most appropriate policy to promote the production of renewable energies is to give the market free rein, which will lead to a price drop thanks to substantial improvements in PV technology.

5. Conclusions

Energy policies in developed countries focus on targets related to securing energy supply, reducing energy dependence, and diminishing the environmental impact of energy production, especially by fossil fuels. In this sense, renewable energy sources can contribute significantly to achieving these objectives. Furthermore, because recent technological advances have allowed a greater use of REs, many developed economies, as is also the case in Spain, have issued regulations concerning RE power systems. Spain’s advantage over other European countries lies in its geographical location. As a result, energy generation from solar PV plants in Spain has grown prominently over the past two decades.

To be able to analyze the economic and financial results of solar PV plant investments, we need to conduct a detailed study bearing in mind all the parameters involved in assessing the financial viability of investments and the effectiveness of energy policies. One particular variable that is often forgotten, or has not been analyzed rigorously enough, is the discount rate which allows us to obtain the absolute and net relative return on investments. Discount rates should reflect both the capital structure of companies and the market’s volatility. A widespread approach used in practice and in the academic literature is the WACC model

This study was carried out with a sample of 67 PV panel installation companies operating in the market. The WACC has been calculated using two different financial techniques to calculate the cost of own resources (financial profitability and CAPM), neither of both results showing great differences, except for the rates of 2006 and 2007, years in which the economic crisis began. The evolution of rates in both cases, behaves according to forecasts, is higher in times of recession and decreases in times of expansion.

With the intention of promoting RE, especially solar PV power, energy policies in Spain have attempted to regulate the installed power capacity and the electricity tariffs through bids from the very beginning. The first energy policy measures related to PV plants in Spain with large incentives in the form of regulated tariffs were activated in 2002, and an indefinite period was maintained. In 2004, the new regulations adopted limited the incentives by type of installation and limited the incentives to 25 years. Starting in 2010, the regulation focused on a general lowering of tariffs for energy produced in PV plants. Finally, in 2012 the economic incentives for energy production with the PV system were cancelled. However, the analysis of profitability does not proceed in the same way as the economic incentives contained in energy regulations. In the analysed period, the incentives were not enough for the PV plants to be profitable. For the most extreme cases, years 2002 and 2012 (pre-crisis and post-crisis years, a year with many incentives and without incentives), the discount rates obtained were similar for the two models. The CFs of the investment made in 2002 were higher than those of the 2012 investment, mainly due to economic incentives. Despite all the investment in 2002, the year was not profitable and on the other hand, in 2012 there is profitability (around 15%). Thus, we conclude that, in this case, the most significant factor for the improvement in profitability is the large decrease that the cost of the installation has registered due to technological improvements.

This study carried out on discount rates can be applied to the evaluation of investments made by companies using solar PV systems to produce energy and with a capacity of 5000 kW. To be able to obtain the discount rate, we used market and firm economic and financial data from the period analyzed, which makes the study only valid for that period. For further studies considering different periods, discount rates should be recalculated.

Future research on discount rates could focus on renewable energy produced by wind-power companies. This could help assess economic disparities among investments in the REs sector according to the energy source used.

Author Contributions

Both authors have participated in the entire research process. Conceptualization, I.G.-P. and A.B.-R.; Data curation, I.G.-P. and A.B.-R.; Formal analysis, I.G.-P. and A.B.-R.; Investigation, I.G.-P. and A.B.-R.; Methodology, I.G.-P. and A.B.-R.; Validation, I.G.-P. and A.B.-R.; Writing—original draft, I.G.-P. and A.B.-R.; Writing—review & editing, I.G.-P. and A.B.-R. All authors have read and agreed to the published version of the manuscript.

Funding

The translation has been funded by Facultad de Administración y Dirección de Empresas (Universitat Politècnica de València).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Fama, E.F.; French, K.R. Financing decisions: Who issues stock? J. Financ. Econ. 2005, 76, 549–582. [Google Scholar] [CrossRef]

- Guaita-Pradas, I.; Marques-Perez, I.; Gallego, A.; Segura, B. Analyzing territory for the sustainable development of solar photovoltaic power using GIS databases. Environ. Monit. Assess. 2019, 191, 764–781. [Google Scholar] [CrossRef] [PubMed]

- Sorgato, M.J.; Schneider, K.; Rüther, R. Technical and economic evaluation of thin-film CdTe building-integrated photovoltaics (BIPV) replacing façade and rooftop materials in office buildings in a warm and sunny climate. Renew. Energy 2018, 118, 84–98. [Google Scholar] [CrossRef]

- Espinoza, R.D.; Rojo, J. Using DNPV for valuing investments in the energy sector: A solar project case study. Renew. Energy 2015, 75, 44–49. [Google Scholar] [CrossRef]

- Díez, P.B.; Tristán, C.A. Review of the legislative framework for the remuneration of photovoltaic production in Spain: A case study. Sustinability 2020, 12, 1214–1230. [Google Scholar] [CrossRef]

- Government of Spain. Royal Decree 17369/2002, 2 Agosto 2002. BOE Number 210. pp. 31968–31974. Available online: https://www.boe.es/eli/es/rd/2002/08/02/841 (accessed on 10 January 2020).

- Government of Spain. Royal Decree 436/2004, 27 Marzo 2004. BOE Number 75. pp. 13217–13238. Available online: https://www.boe.es/eli/es/rd/2004/03/12/436 (accessed on 10 January 2020).

- Government of Spain. Royal Decree 661/2007, 25 Mayo 2004. BOE Number 126. pp. 22846–22886. Available online: https://www.boe.es/eli/es/rd/2007/05/25/661/con (accessed on 10 January 2020).

- Government of Spain. Royal Decree 10556/2007, 25 Mayo 2004. BOE Number 126. pp. 1–26. Available online: https://www.boe.es/eli/es/rd/2007-10556 (accessed on 10 January 2020).

- Government of Spain. Royal Decree 14/2010, 23 Diciembre 2010. BOE Number 312. pp. 106386–106394. Available online: https://www.boe.es/eli/es/rdl/2010/12/23/14 (accessed on 10 January 2020).

- Zhang, D.; Chai, Q.; Zhang, X.; He, J.; Yue, L.; Dong, X.; Wu, S. Economical assessment of large-scale photovoltaic power development in China. Energy 2012, 40, 370–375. [Google Scholar] [CrossRef]

- Karasmanaki, E.; Galatsidas, S. An investigation of factors affecting the willingness to invest in renewables among environmental students: A logistic regression approach. Sustinability 2019, 11, 5012–5030. [Google Scholar] [CrossRef]

- Atănăsoae, P. Technical and economic assessment of micro-cogeneration systems for residential applications. Sustainability 2020, 12, 1074–1093. [Google Scholar] [CrossRef]

- García-Gusano, D.; Espegren, K.; Lind, A.; Kirkengen, M. The role of the discount rates in energy systems optimisation models. Renew. Sustain. Energy Rev. 2016, 59, 56–72. [Google Scholar] [CrossRef]

- Bustos, F.; Toledo, A.; Contreras, J.; Fuentes, A. Sensitivity analysis of a photovoltaic solar plant in Chile. Renew. Energy 2016, 87, 145–153. [Google Scholar] [CrossRef]

- Ibbotson, R.G.; Chen, P. Long-run stock returns: Participating in the real economy. Financ. Anal. J. 2003, 59, 88–98. [Google Scholar] [CrossRef]

- Olson, G.T.; Pagano, M.S. The empirical average cost of capital: A new approach to estimating the cost of corporate funds. J. Appl. Corp. Financ. 2017, 29, 101–110. [Google Scholar] [CrossRef]

- Jacoby, G.; Fowler, D.J.; Gottesman, A.A. The capital asset pricing model and the liquidity effect: A theoretical approach. J. Financ. Mark. 2000, 3, 69–81. [Google Scholar] [CrossRef]

- Maudos Villarroya, J.; Fernández de Guevara Radoselovics, J. Endeudamiento de las Empresas Españolas en el Contexto Europeo: El Impacto de la Crisis; Fundación BBVA: Bilbao, Spain, 2014. [Google Scholar]

- Gupta, A.; Maranas, C.D. Real-options-based planning strategies under uncertainty. Ind. Eng. Chem. Res. 2004, 43, 3870–3878. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital asset prices: A theory of market equilibrium under conditions of risk. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Carmichael, D.G.; Balatbat, M.C.A. Probabilistic DCF analysis and capital budgeting and investment—A survey. Eng. Econ. 2008, 53, 84–102. [Google Scholar] [CrossRef]

- Damodaran, A. Damodaran on Valuation, 2rd ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2016. [Google Scholar]

- Guaita Pradas, I.; Bartual San Feliu, I.; Marí Soucase, B. Profitability and sustainability of photovoltaic energy plants in Spain. Int. J. Sustain. Econ. 2015, 7, 169–186. [Google Scholar] [CrossRef]

- Guaita-Pradas, I.; Marí Soucase, B. Energy production in PV plants regarded as economic investments. In Proceedings of the 2014 International Renewable and Sustainable Energy Conference, Rabat, Morocco, 17–19 October 2014. [Google Scholar]

- UNEF. “El auge mundial de la fotovoltaica,” Inf. Anu. 2017. 2017. Available online: https://unef.es/wp-content/uploads/dlm_uploads/2017/07/informe-anual-unef-2017_web.pdf?utm_source=Ndp%20informe%20anual&utm_medium=ndp (accessed on 9 January 2020).

- Honrubia-Escribano, A.; Ramirez, F.J.; Gómez-Lázaro, E.; Garcia-Villaverde, P.M.; Ruiz-Ortega, M.J.; Parra-Requena, G. Influence of solar technology in the economic performance of PV power plants in Europe. A comprehensive analysis. Renew. Sustain. Energy Rev. 2018, 82, 488–501. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).