Accounting for the Life Cycle Cost of Power Grid Projects by Employing a System Dynamics Technique: A Power Reform Perspective

Abstract

1. Introduction

- (1)

- This article mainly studies the impact of changes in depreciation and the operation and maintenance cost accounting methods on the current electricity reform policy on the LCC of China’s power grid projects. Through setting up different scenarios, analysis is made of the impact of key factors on the LCC in the power reform environment and their impact mechanisms so as to provide a basis for LCC cost control.

- (2)

- This paper introduces system dynamics into the LCC accounting framework of China’s power grid engineering to clearly show the influence factors and the mechanisms between the different cost accounting in each stage of LCC.

- (3)

- Based on the influence relationships and action mechanisms of the various stages of costs established by system dynamics, this paper takes the LCC of the power grid project as an integrated system and establishes the LCC dynamic cost accounting model of the Chinese power grid project under the electricity reform policy.

2. Impact Mechanism of Electricity Reform on LCC of Power Grid Engineering

2.1. The Core of Electricity Reform

2.2. Impact of Electricity Reform on LCC Accounting of Power Grid Engineering

2.2.1. Impact on Depreciation Expense Accounting

2.2.2. Impact on Operation and Maintenance Cost Accounting

3. Life Cycle Cost Calculation Model of Power Grid Engineering Considering Power System Reform

3.1. Model Construction Ideas and Variable Selection

3.2. LCC-CLD Module

3.3. LCC Model Formulation

3.3.1. CI Module

3.3.2. O&M Module

3.3.3. D&D Module

4. Case Application

4.1. Basic Data

4.2. Analysis of Simulation Results

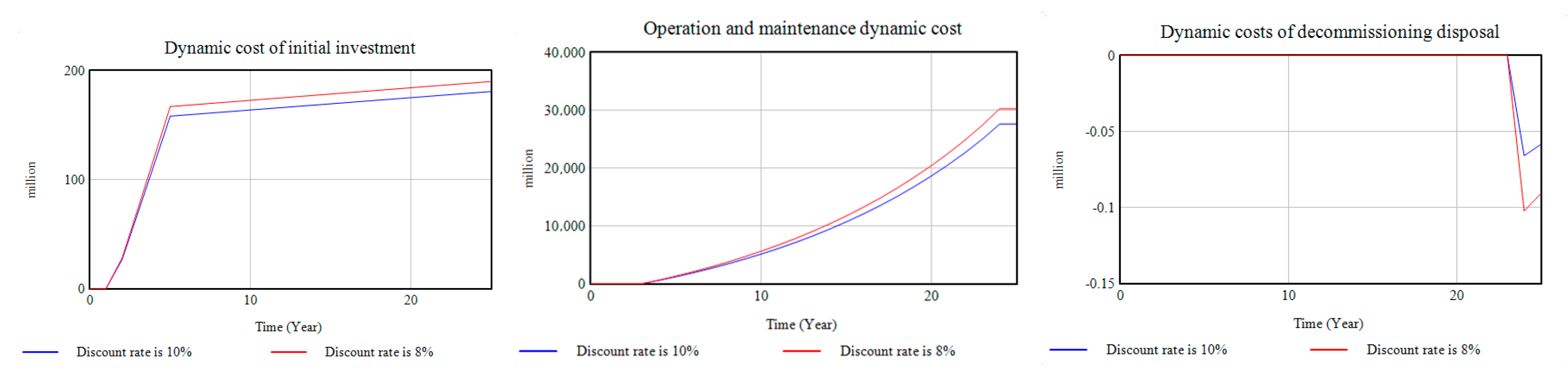

4.2.1. CI Module

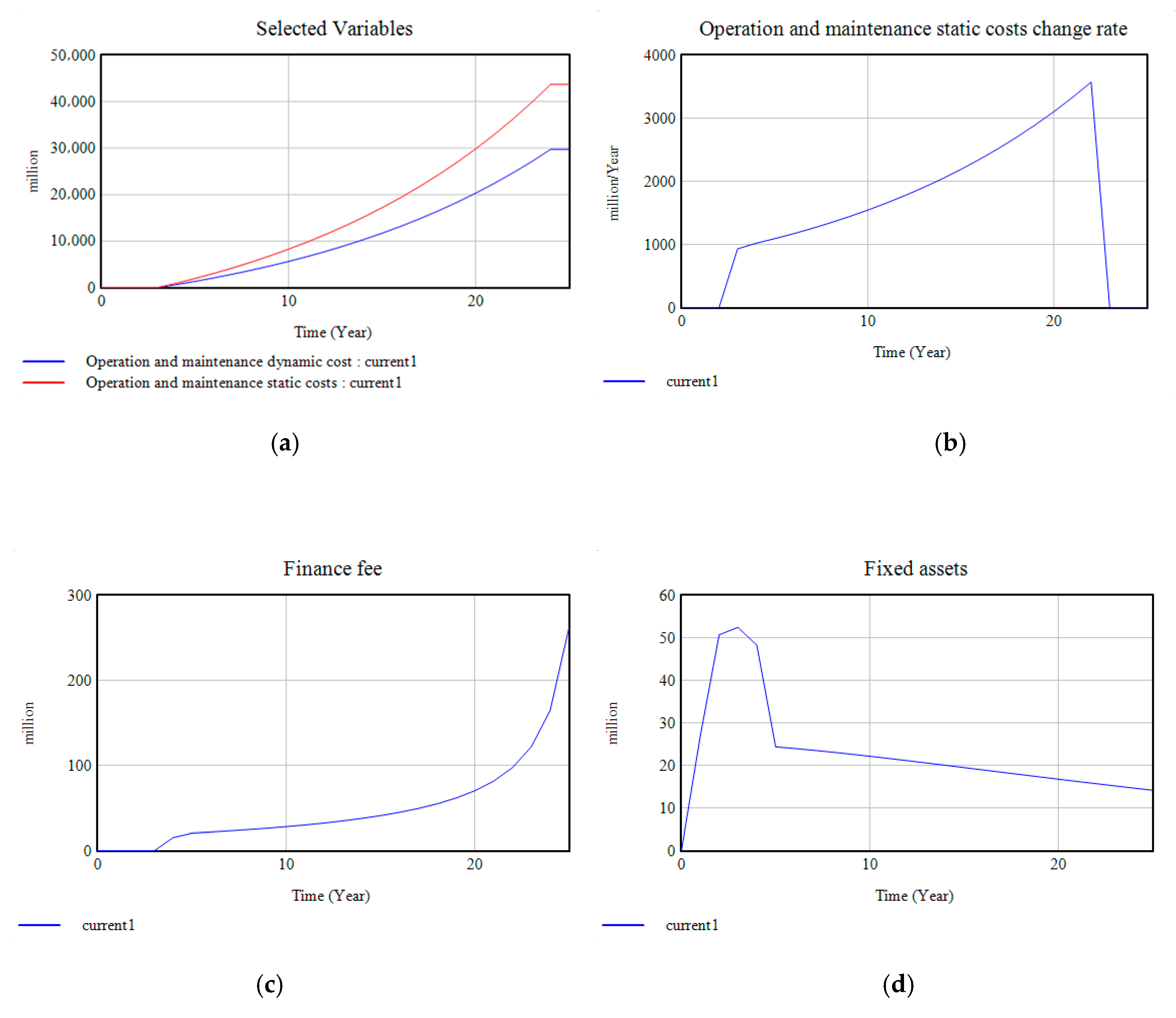

4.2.2. O&M Module

4.2.3. D&D Module

4.3. Model Validation

5. Sensitivity Analysis

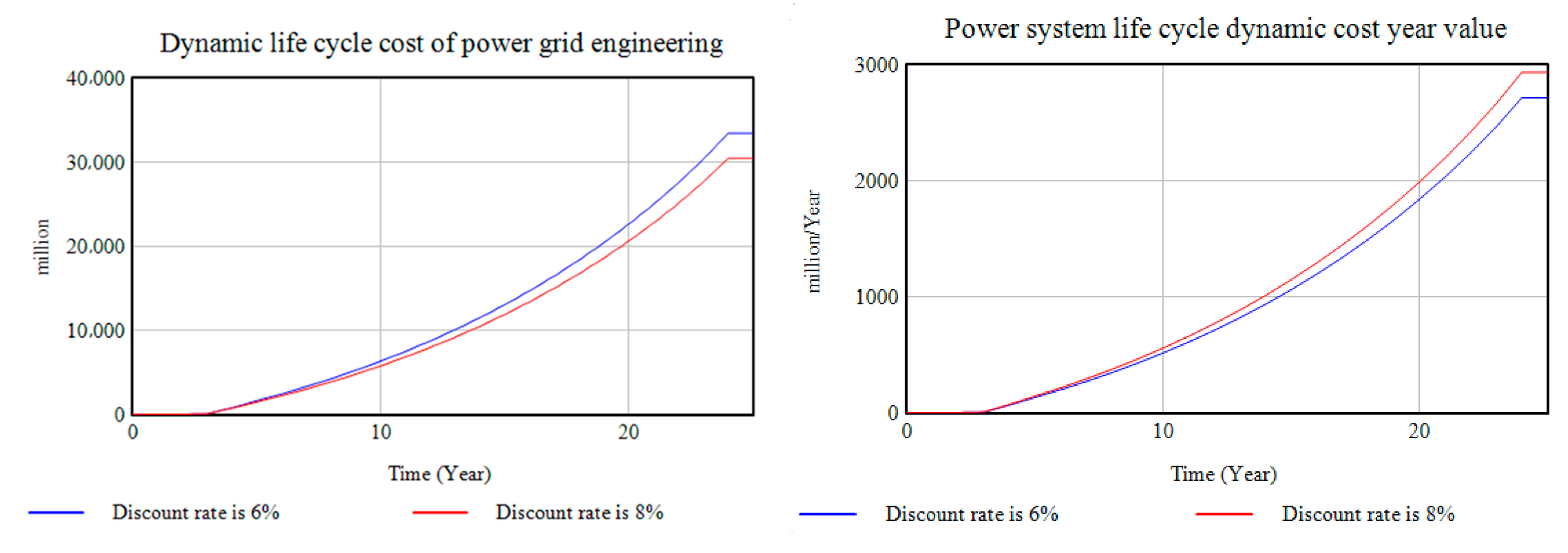

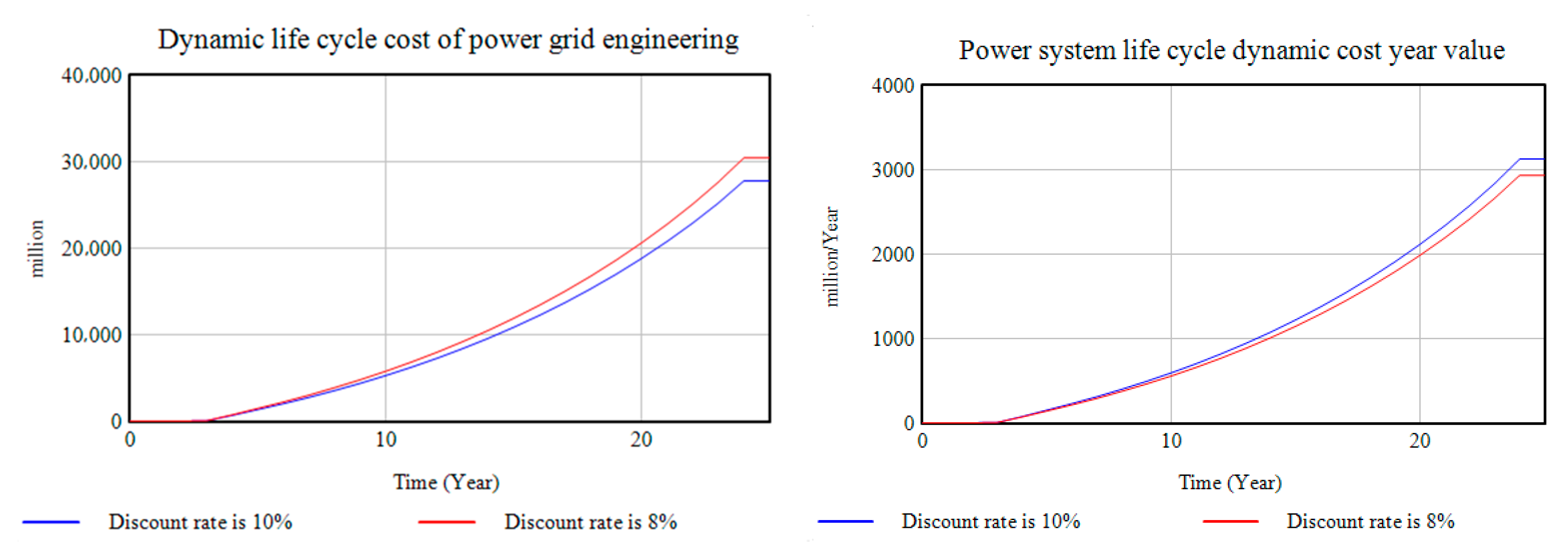

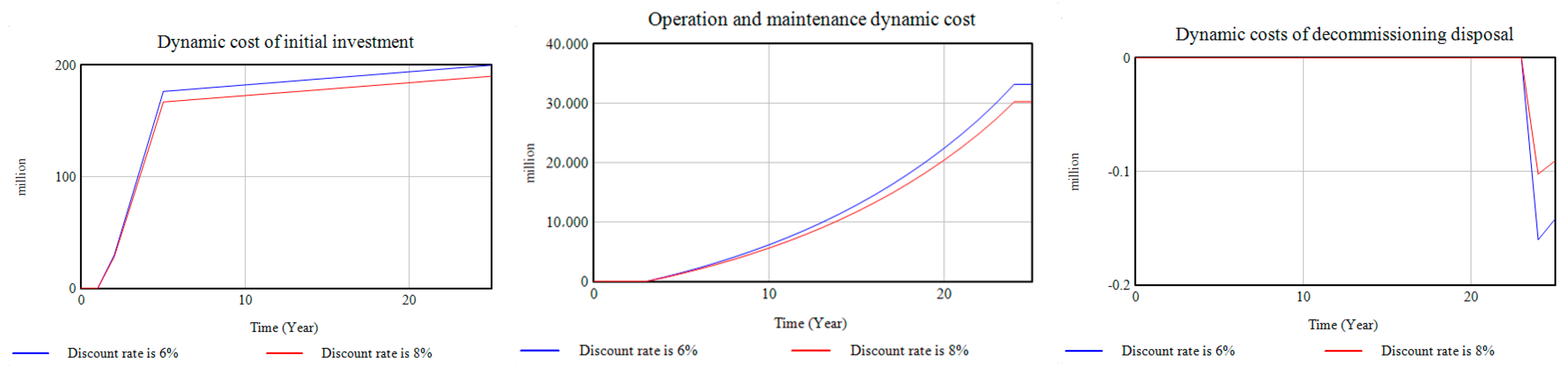

5.1. Scenario 1: Discount Rate

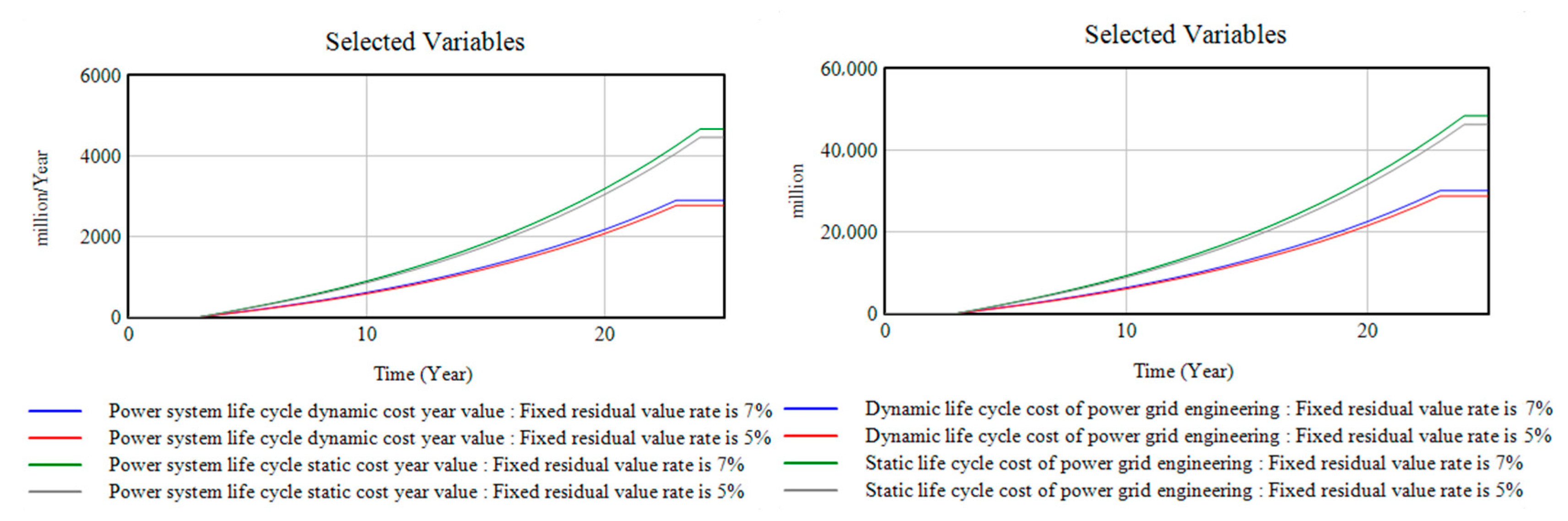

5.2. Scenario 2: Fixed Residual Value Rate

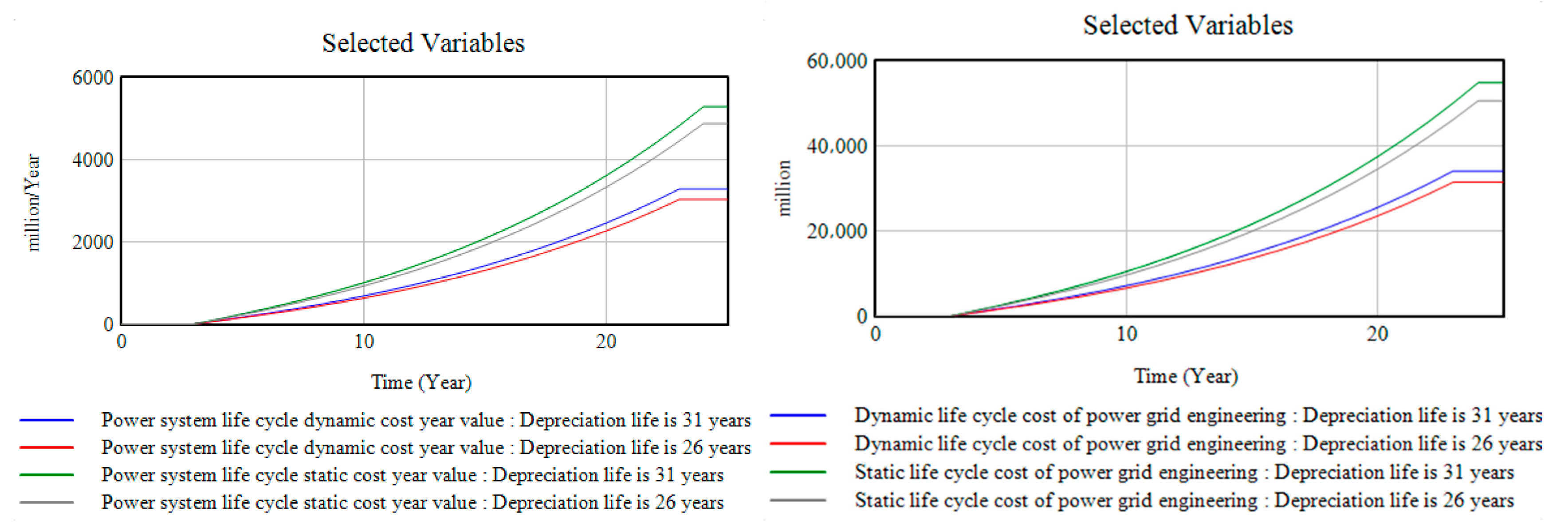

5.3. Scenario 3: Depreciation Period

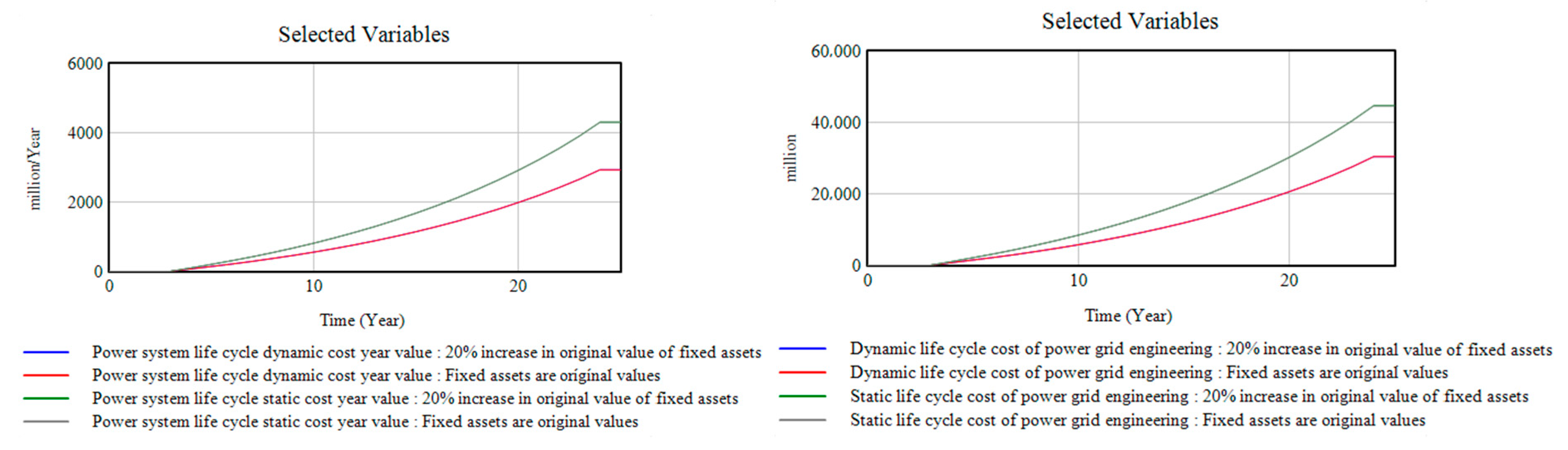

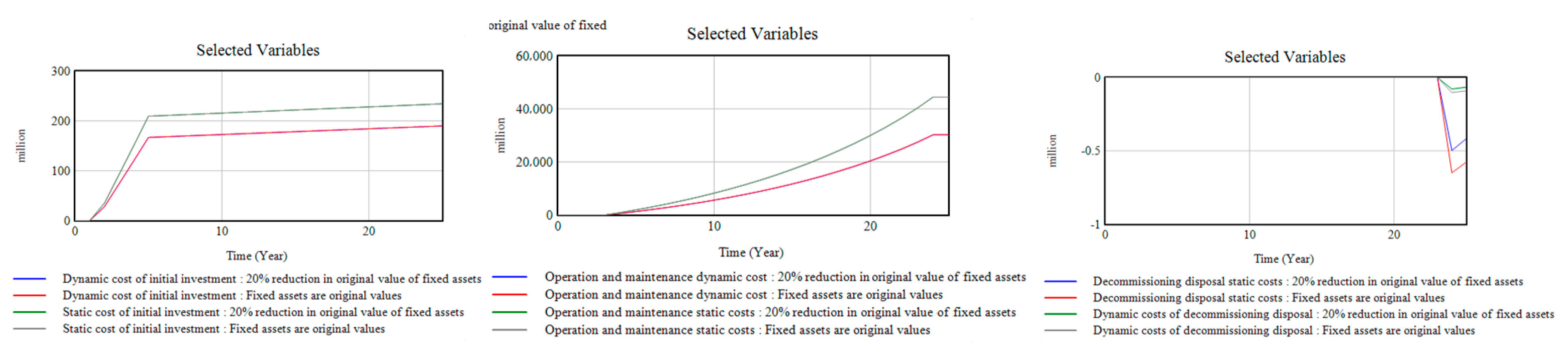

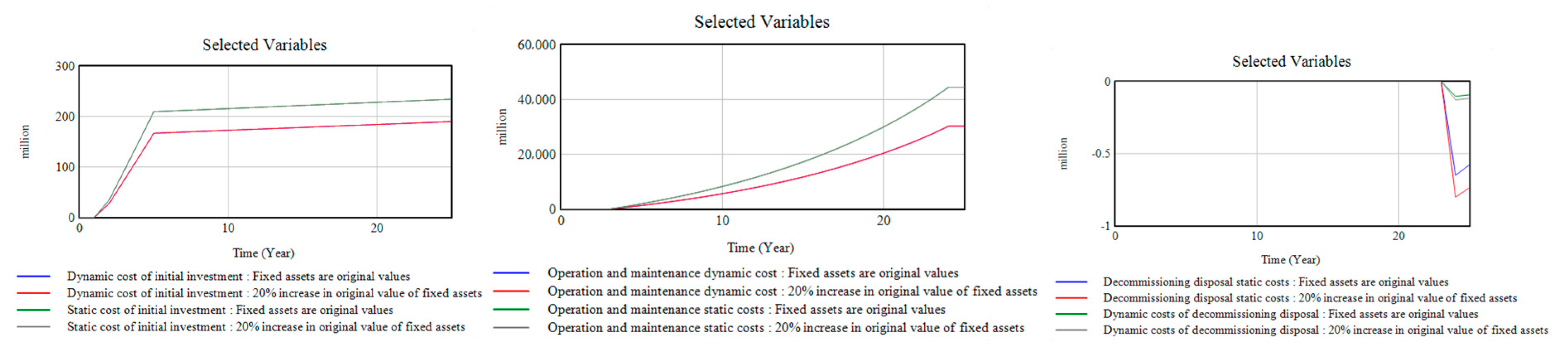

5.4. Scenario 4: Accrued Fixed Assets

6. Conclusion

- Under the power reform, the depreciation period, deductible fixed assets, operation and maintenance costs, and residual value rate are the main factors affecting cost accounting, which may lead to a decrease in the effective assets and an increase in the total cost of grid business accounting.

- In cost accounting, operation, maintenance, decommissioning, and disposal cannot be ignored. In the empirical study, compared with the original billing method, the fixed assets will be relatively reduced under strict verification of assets, and the residual value will be changed due to the provision of depreciation period.

- The discount rate is the key sensitivity factor of the system, and the impact of the total life cycle cost and the cost in each stage is significant, especially in the decommissioning and disposal stage. Empirical evidence shows that when the discount rate increases 2%, the LCC decreases by about 4.53%–8.79%, and the decommissioning and disposal cost decreases by about 21%. Furthermore, when the discount rate decreases, the LCCA decreases, and the initial investment cost of the LCC increases. Moreover, the change of fixed residual value rate causes no obvious change to the initial investment cost, but has obvious influence on the operation and maintenance stage and decommissioning and disposal stage. The depreciation period has little effect on the initial investment cost, but it has a significant impact on the life cycle cost, annual cost value, operation and maintenance cost, and decommissioning and disposal cost; at the same time, the impact on decommissioning and disposal costs is about 66.41%. The impact of accruable fixed assets on the LCC of the project is generally not obvious, but it is critical to the formation of effective assets for grid companies.

- A cost accounting system that fits the institutional background needs to be constructed. Grid companies need to strictly define the cost structure of transmission and distribution pricing and to try to transform investment into effective assets recognized by the state so as to reduce the operating costs of power grid companies.

- Under the situation of power reform, power grid enterprises should pay attention to the discount rate, flexibly grasp the values of residual value rate and depreciation period according to the enterprise’s situation, and further divide the range of fixed assets that can be depreciated.

- Attention should be paid to the reform of the electric power system, attaching importance to the operation and maintenance stage and the decommissioning and disposal stage. At present, power grid enterprises generally pay attention to the initial investment cost and neglect the operation, maintenance, decommissioning, and disposal. However, empirical evidence shows that power reform has a great impact on operation and decommissioning, so it is necessary to strengthen the collection and accumulation of data. At the same time, the Chinese government should further improve the supervision and examination mechanism for transmission and distribution costs, and continuously improve the institutionalization and standardization of cost supervision and examination.

Author Contributions

Funding

Conflicts of Interest

References

- Liao, Z.; Chen, C.; Zang, X. Research on comparison of power grid planning program based on life cycle cost. In Proceedings of the 2016 IEEE International Conference on High Voltage Engineering and Application (ICHVE), Chengdu, China, 19–22 September 2016. [Google Scholar]

- Yang, C.; Su, Z.; Wang, X.; Liu, Y.; Qi, Y. Design of investment management optimization system for power grid companies under new electricity reform. In AIP Conference Proceedings; AIP Publishing LLC.: Long Island, NY, USA, 2017. [Google Scholar]

- Li, W.; Zhu, J.; Zhu, Z. The Energy-saving Benefit Evaluation Methods of the Grid Construction Project Based on Life Cycle Cost Theory. Energy Procedia 2012, 17, 232. [Google Scholar] [CrossRef]

- Jeromin, I.; Balzer, G.; Backes, J.; Huber, R. Life Cycle Cost Analysis of Transmission and Distribution Systems. In Proceedings of the 20th International Conference and Exhibition on Electricity Distribution (CIRED 2009), Prague, Czech Republic, 8–11 June 2009; pp. 1–6. [Google Scholar]

- Wang, Y.; Wang, G.; Zuo, Y.; Fan, L.; Wei, J. Comprehensive evaluation of power grid enterprises’ credit rating under the reform of transmission and distribution price. In AIP Conference Proceedings; AIP Publishing LLC.: Long Island, NY, USA, 2017. [Google Scholar]

- Wu, J.F. The Frame of Informational Reform in the Supervision System of Power Operation-The District-Level Power Supervising Organs of Chinese Cities for Example. Appl. Mech. Mater. 2011, 71–78, 3246–3252. [Google Scholar] [CrossRef]

- Robertson, G.P.; Grace, P.R. Greenhouse Gas Fluxes in Tropical and Temperate Agriculture: The need for a Full-Cost accounting of Global Warming Potentials. Environ. Dev. Sustain. 2004, 6, 51–63. [Google Scholar] [CrossRef]

- Wu, Y.N.; Huang, Z.J. Application of a Case-Based Reasoning Method in Estimating the Power Grid Project Cost. In Proceedings of the 2008 4th International Conference on Wireless Communications, Networking and Mobile Computing, Dalian, China, 12–14 October 2008. [Google Scholar]

- Goto, M.; Inoue, T.; Sueyoshi, T. Structural reform of Japanese electric power industry: Separation between generation and transmission & distribution. Energy Policy 2013, 56, 186–200. [Google Scholar]

- Yong, H.; Wenxu, T.; Zhongfu, T. A Long-Term Marginal Cost Based Transmission and Distribution Pricing Model for Power Transmission and Distribution in Various Voltage Classes and Its Application. Power Syst. Technol. 2011, 35, 175–180. [Google Scholar]

- Zhao, H.; Zhao, H.; Guo, S. Comprehensive Performance Evaluation of Electricity Grid Corporations Employing a Novel MCDM Model. Sustainability 2018, 10, 2130. [Google Scholar] [CrossRef]

- Deng, X. Regulation of Transmission and Distribution Charges and Utility Practice in Texas USA. Power Technol. Econ. 2007, 1, 37–41. [Google Scholar]

- Giulietti, M.; Grossi, L.; Waterson, M. Price transmission in the UK electricity market: Was NETA beneficial? Energy Econ. 2010, 32, 1165–1174. [Google Scholar] [CrossRef]

- Bueno-Lorenzo, M.; Moreno, M.Á.; Usaola, J. Analysis of the imbalance price scheme in the Spanish electricity market: A wind power test case. Energy Policy 2013, 62, 1010–1019. [Google Scholar] [CrossRef]

- Sichao, K.; Yamamoto, H.; Yamaji, K. Evaluation of CO2 free electricity trading market in Japan by multi-agent simulations. Energy Policy 2010, 38, 3309–3319. [Google Scholar] [CrossRef]

- Li, A.; Qing, X.; Zheng, H.W. Method of Third Party Supervision on Transmission and Distribution Costs. Autom. Electr. Power Syst. 2016, 40, 1–7. [Google Scholar]

- Lai, C.L.; Ip, W.H.; Lee, W.B. The system dynamics model for engineering services. Manag. Serv. Qual. 2001, 11, 191–199. [Google Scholar] [CrossRef]

- Roesfiansjah, R.; Arun, K.; Firoz, A.; Shougi, A. A System Dynamics Conceptual Model on Retail Electricity Supply and Demand System to Minimize Retailer’s Cost in Eastern Australia. Procedia Eng. 2012, 49, 330–337. [Google Scholar]

- Zhou, L.C.; Lisha Li, N.; Zeng, M. Modelling and Simulation of Power Grid Engineering Project based on System Dynamics on the Background of Smart Grid. Syst. Eng. Procedia 2012, 3, 92–99. [Google Scholar]

- Khataie, A.H.; Bulgak, A.A.; Segovia, J.J. Activity-Based Costing and Management applied in a hybrid Decision Support System for order management. Decis. Support Syst. 2012, 52, 142–156. [Google Scholar] [CrossRef]

- Khataie, A.H.; Bulgak, A.A.; Segovia, J.J. Advanced decision support tool by integrating activity-based costing and management to system dynamics. In Proceedings of the Picmet Technology Management for Global Economic Growth, Phuket, Thailand, 18–22 July 2010. [Google Scholar]

- Niu, D.X.; Wang, W.J. Based on sustainable development about thermal power project life cycle cost evaluation. Sci. Sci. Technol. Manag. 2009, 6, 145–148. [Google Scholar]

- Dong, J.J.; Li, J. Application of Full Life Cycle Cost Management Theory in Power Engineering Cost Management. Electr. Power Constr. 2009, 7, 88–91. [Google Scholar]

- Zhang, H.; Wang, J.X.; Cao, X.Y. Replacement and Investment strategy of rural distribution transformer replacement using life cycle cost and risk analysis. J. Xi’an Jiaotong Univ. 2015, 8, 133–140. [Google Scholar]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; McGraw-Hill Higher Education: New York, NY, USA, 2000. [Google Scholar]

- Marzouk, M.; Seleem, N. Assessment of existing buildings performance using system dynamics technique. Appl. Energy 2018, 211, 1308–1323. [Google Scholar] [CrossRef]

- National Development and Reform Commission of the People’s Republic of China. Available online: http://www.nea.gov.cn/2015-11/30/c_134867851.htm (accessed on 30 November 2015).

- Measures for Pricing of Transmission and Distribution Price of Provincial Power Grid (for Trial Implementation). Available online: http://www.gov.cn/xinwen/2019-05/28/content_5395367.htm (accessed on 28 November 2015).

- Measures for Pricing of Transmission and Distribution Price of Provincial Power Grid (for Trial Implementation). Available online: http://www.gov.cn/gongbao/content/2015/content_2953958.htm (accessed on 9 June 2015).

- Measures for Supervision and Examination of Transmission and Distribution Pricing Cost (for Trial). Available online: http://www.gov.cn/xinwen/2017-01/04/content_5156506.htm (accessed on 22 December 2016).

- Opinions on Comprehensively Deepening the Reform of Price Mechanism. Available online: http://www.gov.cn/xinwen/2017-11/11/content_5238855.htm (accessed on 11 November 2017).

- Measures for Pricing Transmission Prices of Regional Power Grids (for Trial Implementation). Available online: https://www.ndrc.gov.cn/xwdt/tzgg/201912/t20191224_1216085.html (accessed on 29 December 2017).

- Measures for Supervision and Examination of Transmission and Distribution Pricing Cost. Available online: http://www.gov.cn/xinwen/2019-05/28/content_5395367.htm (accessed on 28 May 2019).

- Zhang, L.; Ye, H.; Chen, X. Transmission and Distribution Pricing Method Based on Peak-load Pricing. Autom. Electr. Power Syst. 2017, 41, 92–98. [Google Scholar]

- Einhorn, M.A. The Effect of Load Management upon Transmission and Distribution Costs: A Case Study. Energy J. 1988, 9, 73–87. [Google Scholar] [CrossRef]

- Electric Power System Reform Plan. Available online: http://www.gov.cn/zhengce/content/2017-09/13/content_5223177.htm (accessed on 10 February 2002).

- Electricity Price Reform Plan. Available online: http://www.gov.cn/zhengce/content/2018-04/17/content_5281575.htm (accessed on 3 July 2002).

- Uduma, K.; Tomasz, A. Sustainable Energy Development: The Key to a Stable Nigeria. Sustainability 2010, 2, 1558–1570. [Google Scholar] [CrossRef]

- Sakdirat, K.; Jessada, S.; Peng, J.Y. Life Cycle Cost, Energy and Carbon Assessments of Beijing-Shanghai High-Speed Railway. Sustainability 2020, 12, 206. [Google Scholar]

- Wang, Y.; Wang, X.H.; Wang, S.; Yu, H.Y.; Zhang, F.L.; Li, R.P. Power Grid Operation and Maintenance Cost Allocation Method Based on Power Transmission and Distribution Price Reform. Grid Technol. 2020, 44, 332–339. [Google Scholar]

- Xue, Z.; Liu, H.; Zhang, Q.; Wang, J.; Fan, J.; Zhou, X. The Impact Assessment of Campus Buildings Based on a Life Cycle Assessment–Life Cycle Cost Integrated Model. Sustainability 2019, 12, 294. [Google Scholar] [CrossRef]

- Zhou, B.Y.; Hu, H.; Dai, L. Assessment of the Development of Time-Sharing Electric Vehicles in Shanghai and Subsidy Implications: A System Dynamics Approach. Sustainability 2020, 12, 345. [Google Scholar] [CrossRef]

- Fu, J.J.; Tong, Y.H. Economics of Industrial Technology, 3rd Ed. ed; Tsinghua University Press: Beijing, China, 1996; pp. 100–101. [Google Scholar]

- Duan, K.Y. Calculation Model of Comprehensive Plan Balance of Power Grid Enterprises Based on System Dynamics. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2014. [Google Scholar]

- Li, J. Research on Cost Control of Power Grid Construction Project Based on Life Cycle. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2015. [Google Scholar]

- Wang, L. Research on Investment Decision Support Model of Power Grid Enterprise Based on System Dynamics. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2015. [Google Scholar]

- Lu, Y. Research on dynamic management model of power grid project cost based on target control. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2016. [Google Scholar]

- Kong, J.T. Evaluation of Distribution Network Investment Effect Based on System Dynamics. Ph.D. Thesis, Beijing Jiaotong University, Beijing, China, 2016. [Google Scholar]

- Liu, Y.X. Research on Decision Support System of Power Grid Enterprise Operation Based on System Dynamics. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2016. [Google Scholar]

- Xu, X.M. Research on Investment Decision-Making of Complex Power Grid Optimization Based on Power Demand and Investment Capacity. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2017. [Google Scholar]

- Zhao, W.B.; Han, Y.; Niu, D.X. Analysis of economic benefit of wind power based on system dynamics. In AIP Conference Proceedings; AIP Publishing LLC.: Long Island, NY, USA, 2018. [Google Scholar]

| 2015 | Some Opinions on Further Deepening the Reform of the Electric Power System (NDRC of PRC, 2015a, b) √ The implementation of the transmission and distribution price reform needs to clarify the composition of electricity costs and clarify the interests of all parties. |

| 2015 | Supervision and Examination Method of Transmission and Distribution Tariff Costs (Trial Implementation) (NDRC of PRC, 2015a, b) √ The Measures stipulate the principles, composition, and verification methods for the cost supervision and audit of transmission and distribution pricing. |

| 2016 | Pricing Method of Power Transmission and Distribution Tariff Costs (Trial Implementation) (NDRC of PRC, 2016a, b) √ The regulatory permitted income is based on strict cost supervision and examination, and the permitted income of the grid enterprise is equal to the permitted cost plus reasonable income. |

| 2017 | Opinions on Comprehensively Deepening the Reform of the Price Mechanism (NDRC of PRC, 2017) √ The policy stipulates the principle of regional grid transmission price compliance, the calculation method of permitted income, and the calculation method and adjustment mechanism of transmission price. |

| 2019 | Supervision and Examination Method of Transmission and Distribution Tariff Costs (NDRC, NEA, 2019) √ The policy clearly stipulates that it cannot be included in the transmission and distribution cost project, and refines the classification, boundary, and audit method of transmission and distribution pricing costs. |

| Before the Electricity Reform | After Electricity Reform | |

|---|---|---|

| Calculation formula | Original value of fixed assets × depreciation rate | Depreciable original value of fixed assets for transmission and distribution × pricing depreciation rate |

| Depreciable fixed assets | All fixed assets | The scope of depreciable fixed assets that need to be approved in accordance with the planning and construction of decision-making procedures, including lines, transformer equipment, and other assets related to power transmission and distribution business. |

| Depreciation life | Calculated according to the experience of the grid assets | The depreciation life is determined on 1 January 2015, based on the actual conditions of the local natural environment and the development level of the power grid. The rate of residual value of fixed assets is determined at 5%. |

| Charge Details | Before Electricity Reform | After Electricity Reform | ||

|---|---|---|---|---|

| Stock | Increment | |||

| Operation and maintenance costs | Material fee | According to the actual calculation, it does not consider the relevance to the transmission and distribution business. | The original value of the fixed assets at the end of the year before the audit and examination × the average material rate for the three years. | Not higher than 1% of the original value of new fixed assets in the forecast year. |

| Repair fee | According to the actual calculation, it does not consider whether the relevant asset is a valid asset. | The original value of fixed assets at the end of the year before the audit × the average repair rate for three years | Not higher than 1.5% of the original value of new fixed assets in the forecast year. | |

| Employee’s salary | According to employee performance appraisal methods, employees’ salaries and welfare expenses are calculated. | In accordance with the Ministry of Enterprise Human Resources. | Employee’s salary will fluctuate from the original employee’s salary to labor costs, and the original employee’s salary will be included in the labor costs along with the expenses for agricultural electrical, labor dispatch, and temporary employment. Among them, employee benefits, housing provident funds, employee education funds, and union funds must not exceed 14%, 12%, 2.5%, and 2% of the total wages included in the pricing cost. | |

| Other fee | Actually counted | The original value of the fixed assets at the end of the year before the audit and audit × the average three-year rate of other expenses. | Other fee shall not be higher than 70% of the historical rate level of the three years before the beginning of the supervision period of the grid operation enterprise, and shall not be higher than 2.5% of the original value of new fixed assets during the supervision period. | |

| Variables | Meanings | Variables | Meanings |

|---|---|---|---|

| Basic preparation cost | Project insurance | ||

| Construction and installation cost | Traffic engineering cost | ||

| Construction and implementation cost | Basic engineering cost | ||

| Dynamic cost of construction | Construction auxiliary engineering cost | ||

| Static cost of construction | Building construction cost | ||

| Initial investment | Basic preparation cost | ||

| Project construction investment | Fixed assets | ||

| Construction land cost | Purchase cost of equipment and tools | ||

| Dynamic cost | Equipment fee | ||

| Annual cost-rising index | Freight and miscellaneous expenses of equipment | ||

| Intangible assets | Reserve for price difference | ||

| Installation cost | Project construction management fee | ||

| Basic preparation cost | Project supervision cost | ||

| Bidding fee | Equipment supervision cost | ||

| Management fee for quota preparation of power transmission and transformation project | PCD | Dynamic cost of pre-preparation | |

| Management fee for preparation of electric power construction standards | PCS | Pre-preparation static cost | |

| Feasibility study cost | Preparation cost | ||

| Installation cost of other equipment | Rate | ||

| Installation cost of substation equipment | Change rate of construction cost | ||

| Installation of transmission equipment | Change rate of pre-preparation cost | ||

| Installation cost of communication and control equipment | PCR | Change rate of pre-preparation cost | |

| Cost of large transport measures | Freight rate of equipment | ||

| Other expenses | Change rate of reserve for price difference | ||

| Technical service fee of construction project | Survey and design cost | ||

| Survey and design cost | t1 | Discount period in the preparatory stage | |

| Design document review fee | t2 | Discount period of construction | |

| Pre-project work cost | y | Discount rate | |

| Management expense | Year of construction | ||

| Time interval from construction budget preparation level to project year |

| Variables | Meanings | Variables | Meanings |

|---|---|---|---|

| Project construction investment | OT | Number of major repairs | |

| CPI | Interest during construction | PC | Own funds |

| Other charges | Q | Artificial quantity | |

| Labor cost | Growth rate of operation and maintenance costs | ||

| Maintenance cost | Maintenance rate | ||

| Financial charges | Proportion of working capital loans | ||

| Per capita wage | Annual wage growth rate | ||

| Fixed assets | PCS | The average wage | |

| i | Interest rate in construction period | SWG | Wage growth rate |

| Loan amount of construction investment | T | Time | |

| LC | Working capital | End year of construction period | |

| LOAOM | Long term loan amount in operation period | Duration in multi-pulse | |

| MR | Overhaul cost | Service life | |

| Repayment period | t2 | Discount period of construction | |

| OMCD | Dynamic cost of pre-preparation | t3 | Discount period of operation and maintenance stage |

| Operation and maintenance static cost | WOAOM | Working capital loan amount | |

| y | Discount rate |

| Variables | Meanings | Variables | Meanings |

|---|---|---|---|

| Demolition cost | Fixed residual value rate | ||

| Other expenses such as waste disposal | Change rate of demolition cost | ||

| Residual value of fixed assets | t4 | Discount period of decommissioning and disposal stage | |

| Useful life of fixed assets | Service life | ||

| Original value of fixed assets | y | Discount rate | |

| Salvage rate | DCS | Static demolition cost | |

| DCD | Dynamic demolition cost |

| Data Name | Numerical Value | Data Sources | Data Name | Numerical Value | Data Sources |

|---|---|---|---|---|---|

| Feasibility study fee | 0.1838 million yuan | Provisions of the National Development and Reform Commission Interim Provisions on consulting fees for preliminary work of construction projects | Building construction cost | 15.007796 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Design document evaluation fee | 0.124 million yuan | Guo Guan Fang Di [2006] No. 37 charging standard for preliminary design review | Installation fee | 11.933005 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Basic reserve rate | 10% | The basic reserve fee rate of the power transmission and transformation project | Equipment fee | 22.2245 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Survey and design cost | 1.978514 million yuan | Charging standard for engineering design | Basic engineering cost | 4.525385 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| 2016–2017 national average wage growth rate | 7.3% | According to the salary statistics of 2016–2018 | Traffic engineering cost | 0.5 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Management fee for establishment of power construction quota | 0.1347 million yuan | No more than 0.5%–1.5% of construction and installation workload | Construction auxiliary engineering cost | 1.803328 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Basic cost rate of civilized construction | 6% | China 2004 list fixed rate | Installation cost of other equipment | 0.3 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Basic cost rate of safety construction | 9% | China 2004 list fixed rate | Installation cost of substation equipment | 0.4 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Basic cost rate of temporary facilities | 9% | China 2004 list fixed rate | Construction site acquisition and cleaning fee | 0.761689 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Salvage rate | 5% | Document No. 9 of electricity reform | Survey and design cost | 1.978514 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Interest rate during construction | 7% | Relevant report data of a 110 kV power transmission and transformation project of grid company A | Supervision fee | 0.985539 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Annual cost-rising index | 5% | Relevant report data of a 110 kV power transmission and transformation project of grid company A | Production preparation cost | 0.01401 million yuan | Relevant report data of a 110 kV power transmission and transformation project of grid company A |

| Variables | Items | 2016 (Million Yuan) | 2017 (Million Yuan) | 2018 (Million Yuan) |

|---|---|---|---|---|

| CI | Actual values | 33.7243 | 91.4039 | 148.2536 |

| Simulation values | 33.7243 | 88.7224 | 144.199 | |

| Relative errors | 0.0000% | −0.030223484 | −0.028118087 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Song, S.; Gao, M.; Wang, J.; Zhu, J.; Tan, Z. Accounting for the Life Cycle Cost of Power Grid Projects by Employing a System Dynamics Technique: A Power Reform Perspective. Sustainability 2020, 12, 3297. https://doi.org/10.3390/su12083297

Wang Y, Song S, Gao M, Wang J, Zhu J, Tan Z. Accounting for the Life Cycle Cost of Power Grid Projects by Employing a System Dynamics Technique: A Power Reform Perspective. Sustainability. 2020; 12(8):3297. https://doi.org/10.3390/su12083297

Chicago/Turabian StyleWang, Yongli, Shanshan Song, Mingchen Gao, Jingyan Wang, Jinrong Zhu, and Zhongfu Tan. 2020. "Accounting for the Life Cycle Cost of Power Grid Projects by Employing a System Dynamics Technique: A Power Reform Perspective" Sustainability 12, no. 8: 3297. https://doi.org/10.3390/su12083297

APA StyleWang, Y., Song, S., Gao, M., Wang, J., Zhu, J., & Tan, Z. (2020). Accounting for the Life Cycle Cost of Power Grid Projects by Employing a System Dynamics Technique: A Power Reform Perspective. Sustainability, 12(8), 3297. https://doi.org/10.3390/su12083297