Supply Chain Strategy Analysis of Low Carbon Subsidy Policies Based on Carbon Trading

Abstract

1. Introduction

- When the government provides low-carbon subsidies to different entities, will the company’s optimal strategy change? What are the relationships between several different situations?

- What will happen to the total carbon emissions, consumer utility, and retail price of products when a government offers different subsidies? How do these metrics compare to when there is no government subsidy?

2. Literature Review

2.1. Research on Independent Low-Carbon Technology Innovations

2.2. Impact of Government Carbon Policy on Low-carbon Technology Innovation

2.3. Impact of Government Subsidies on Low-Carbon Technology Innovation

3. Model

3.1. Problem Description, Basic Assumptions, and Parameters

- Assume that only manufacturers in the entire supply chain will produce carbon emissions when producing products.

- The information between the government and the enterprise and the supply chain members is completely symmetrical, and there is no deception

3.2. Decision Analysis Based on a Manufacturer’s Independent Technological Innovation

3.3. Direct Governmental Subsidies for Technological Innovation to Manufacturers

3.3.1. Problem Description

3.3.2. Model Building

3.4. Government Subsidies for Retailers to Stimulate Manufacturers’ Technological Innovations

3.4.1. Problem Description

3.4.2. Model Building

3.5. Government Subsidies to Consumers to Stimulate Technological Innovations from Manufacturers

3.5.1. Problem Description

3.5.2. Model Building

4. Results

5. Analysis Example

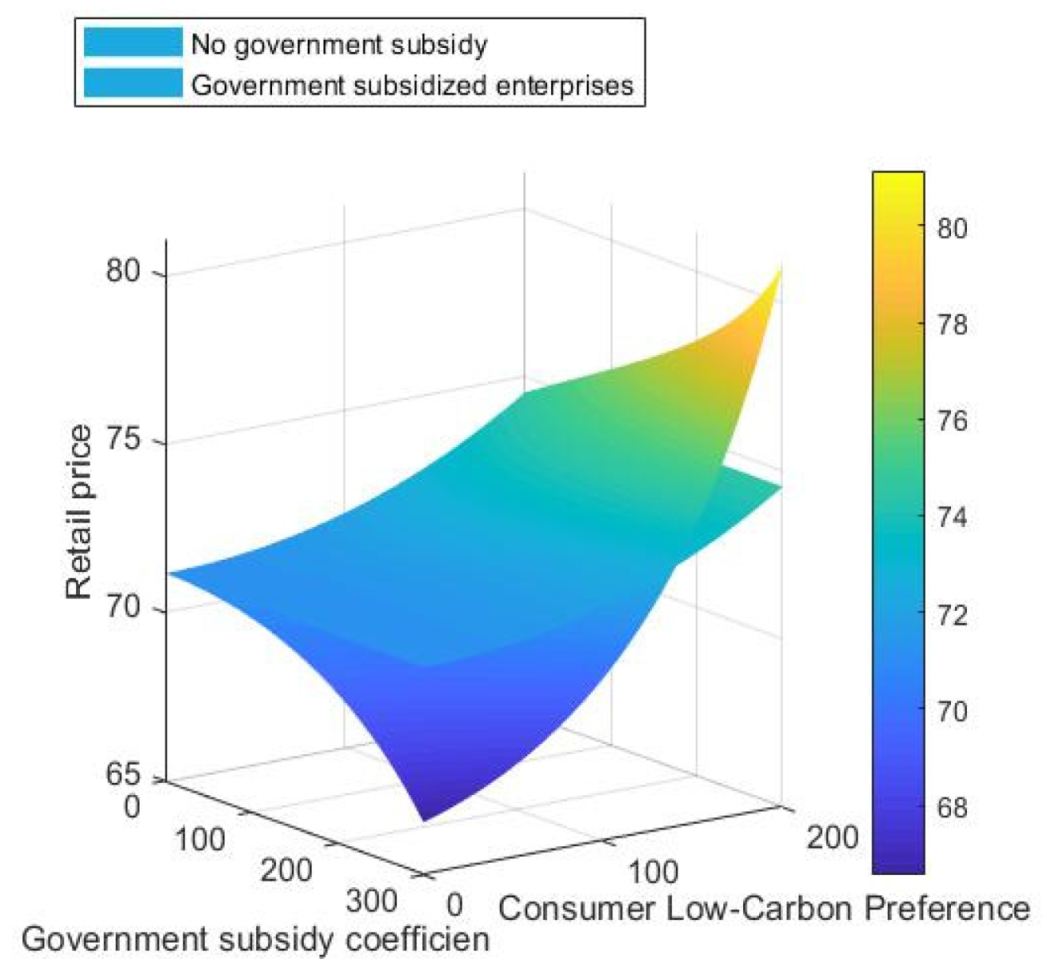

5.1. Product Retail Price Analyses

5.2. Analysis of Social Welfare Influencing Factors

6. Discussion

6.1. Conclusions

- When governmental subsidies are implemented and market capacity is in the proper range, enterprises can obtain greater profits, and manufacturers’ low-carbon technological innovation levels will increase based on the intensity of the subsidies. Regardless of who the subsidy is intended for, as long as other conditions remain unchanged, a same subsidy effect can be implemented for any other object by adjusting the wholesale and retail prices. In a secondary supply chain, where only manufacturers produce carbon emissions, the three categories of subsidy policies can be interchangeable without absolute advantages or disadvantages.

- The retail prices of goods are always positively related to consumers’ low-carbon preferences. With manufacturers’ independent technological innovations and government subsidies to consumers, the retail prices of goods are positively correlated with the intensity of subsidies. However, with government subsidies to enterprises, retail prices are positively correlated with the subsidies only when consumers have strong low-carbon preferences, and retail prices are negatively correlated with the subsidies when consumers have weak low-carbon preferences. Therefore, with high subsidies and strong preferences, the retail price exceeds the product price when there is no government subsidy, and at high subsidies and weak preferences, the retail price is lower than the product price when there is no government subsidy.

- Social welfare does not always increase with increasing government subsidies. In the price-sensitive consumer group, once the subsidy intensity exceeds a certain level, the social benefits provided by technological innovations are not proportional to the government’s input, so social welfare begins to decline rapidly. At this time, the government’s optimal subsidy intensity positively correlates with consumers’ low-carbon preferences. In price-insensitive consumer groups, the government should not provide any subsidies.

6.2. Managerial Implications

6.3. Suggestions for Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Grubb, M.; Butler, L.; Twomey, P. Diversity and security in UK electricity generation: The influence of low-carbon objectives. Energy Policy 2005, 34, 4050–4062. [Google Scholar] [CrossRef]

- Baranzini, A.; van den Bergh, J.C.J.M.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef]

- Jeremy, C.; Fedor, D. Tracking global carbon revenues: A survey of carbon taxes versus cap-and-trade in the real world. Energy Policy 2016, 96, 50–77. [Google Scholar]

- Zakeri, A.; Dehghanian, F.; Fahimnia, B.; Sarkis, J. Carbon pricing versus emissions trading: A supply chain planning perspective. Int. J. Prod. Econ. 2015, 164, 197–205. [Google Scholar] [CrossRef]

- Lian-Biao, C.; Fan, Y.; Zhu, L.; Bi, Q.-H. How will the emissions trading scheme save cost for achieving China’s 2020 carbon intensity reduction target? Appl. Energy 2014, 136, 1043–1052. [Google Scholar]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Cong, R.; Lo, A.Y. Emission trading and carbon market performance in Shenzhen, China. Appl. Energy 2017, 193, 414–425. [Google Scholar] [CrossRef]

- Chaabane, A.; Ramudhin, A.; Paquet, M. Design of sustainable supply chains under the emission trading scheme. Int. J. Prod. Econ. 2010, 135, 37–49. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Jafari, A. Reverse and closed loop supply chain coordination by government role. Transp. Res. Part D-Transp. Environ. 2017, 52, 379–398. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 139, 347–360. [Google Scholar] [CrossRef]

- Peng, X.R.; Liu, Y. Behind eco-innovation: Managerial environmental awareness and external resource acquisition. J. Clean. Prod. 2016, 139, 347–360. [Google Scholar] [CrossRef]

- Kuo, T.C.; Tseng, M.L.; Chen, H.M.; Chen, P.S.; Chang, P.C. Design and Analysis of Supply Chain Networks with Low Carbon Emissions. Comput. Econ. 2018, 52, 1353–1374. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- El Ouardighi, F.; Sim, J.E.; Kim, B. Pollution accumulation and abatement policy in a supply chain. Eur. J. Oper. Res. 2016, 248, 982–996. [Google Scholar] [CrossRef]

- Hoen, K.M.R.; Tan, T.; Fransoo, J.C.; Van Houtum, G.J. Effect of carbon emission regulations on transport mode selection under stochastic demand. Flex. Serv. Manuf. J. 2014, 26, 170–195. [Google Scholar] [CrossRef]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Xie, X.P.; Zhao, D.Z. Research on Cooperation Strategy of Enterprises’ Carbon Emission Reduction in Low Carbon Supply Chain. J. Manag. Sci. 2013, 26, 108–119. [Google Scholar]

- Tong, Y.E.; Zhi-Min, G.; Jin, T.A.O.; You, Q.U. Dynamic Optimization and Coordination about Joint Emission Reduction in a Supply Chain Considering Consumer Preference to Low Carbon and Reference Low-carbon Level Effect. Chin. J. Manag. Sci. 2017, 25, 52–61. [Google Scholar]

- Pu, X.J.; Song, Z.P.; Han, G.H. Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference. Int. J. Environ. Res. Public Health. 2018, 15, 1985. [Google Scholar] [CrossRef]

- Jorgensen, S.; Zaccour, G. Incentive equilibrium strategies and welfare allocation in a dynamic game of pollution control. Automatica 2001, 37, 29–36. [Google Scholar] [CrossRef]

- Takashima, N. Cooperative R&D investments and licensing breakthrough technologies: International environmental agreements with participation game. J. Clean. Prod. 2020, 248, 12. [Google Scholar]

- Brauneis, A.; Mestel, R.; Palan, S. Inducing low-carbon investment in the electric power industry through a price floor for emissions trading. Energy Policy 2013, 53, 190–204. [Google Scholar] [CrossRef]

- Wang, Q.; Zhao, D. Cooperative strategy of carbon emissions reduction and promotion in a two-echelon supply chain. Control Decis. 2014, 29, 307–314. [Google Scholar]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Luo, R.L.; Fan, T.J.; Xia, H. The Game Analysis of Carbon Reduction Technology Investment on Supply Chain under Carbon Cap-and-Trade Rules. Chin. J. Manag. Sci. 2014, 22, 44–53. [Google Scholar]

- Deng, Y.L.; You, D.M.; Wang, J.J. Optimal strategy for enterprises’ green technology innovation from the perspective of political competition. J. Clean. Prod. 2019, 235, 930–942. [Google Scholar] [CrossRef]

- Subramanian, R.; Gupta, S.; Talbot, B. Compliance strategies under permits for emissions. Prod. Oper. Manag. 2007, 16, 763–779. [Google Scholar] [CrossRef]

- Konur, D.; Schaefer, B. Integrated inventory control and transportation decisions under carbon emissions regulations: LTL vs. TL carriers. Transp. Res. Part E-Logist. Transp. Rev. 2014, 68, 14–38. [Google Scholar] [CrossRef]

- Toptal, A.; Ozlu, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- Jaber, M.Y.; Glock, C.H.; El Saadany, A.M.A. Supply chain coordination with emissions reduction incentives. Int. J. Prod. Res. 2013, 51, 69–82. [Google Scholar] [CrossRef]

- Zhang, G.X.; Zhang, X.T.; Cheng, S.J.; Chai, G.R.; Wang, L.L. Signaling Game Model of Government and Enterprise Based on the Subsidy Policy for Energy Saving and Emission Reduction. Chin. J. Manag. Sci. 2013, 21, 129–136. [Google Scholar]

- Zhao, R.; Neighbour, G.; Han, J.; McGuire, M.; Deutz, P. Using game theory to describe strategy selection for environmental risk and carbon emissions reduction in the green supply chain. J. Loss Prev. Process Ind. 2012, 25, 927–936. [Google Scholar] [CrossRef]

- Li, Y.; Zhao, D. Research on R&D Cost Allocation Comparison for Low-carbon Supply Chain Based on Government’s Subsidies. Soft Sci. 2014, 28, 21–26+31. [Google Scholar]

- Montero, J.P. A note on environmental policy and innovation when governments cannot commit. Energy Econ. 2011, 33, S13–S19. [Google Scholar] [CrossRef]

- Lou, G.X.; Zhang, J.Q.; Fan, T.J.; Zhou, W.X. Supply chain’s investment strategy of emission reducing and incentive mechanism design under asymmetric information. J. Manag. Sci. China 2016, 19, 42–52. [Google Scholar]

- Xie, X.M.; Zhu, Q.W.; Wang, R.Y. Turning green subsidies into sustainability: How green process innovation improves firms’ green image. Bus. Strategy Environ. 2019, 28, 1416–1433. [Google Scholar] [CrossRef]

- Chen, W.T.; Hu, Z.H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Cao, K.Y.; Xu, X.; Wu, Q.; Zhang, Q. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Hou, Q.; Sun, J.Y. Investment strategy analysis of emission-reduction technology under cost subsidy policy in the carbon trading market. Kybernetes 2019, 49, 252–284. [Google Scholar] [CrossRef]

- Guo, Y.Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Sustainability 2018, 10, 940. [Google Scholar]

- Wang, C.; Nie, P.Y.; Peng, D.H.; Li, Z.H. Green insurance subsidy for promoting clean production innovation. J. Clean. Prod. 2017, 148, 111–117. [Google Scholar] [CrossRef]

- Cohen, M.C.; Lobel, R.; Perakis, G. The Impact of Demand Uncertainty on Consumer Subsidies for Green Technology Adoption. Manag. Sci. 2016, 62, 1235–1258. [Google Scholar] [CrossRef]

- Bi, G.B.; Jin, M.; Ling, L.; Yang, F. Environmental subsidy and the choice of green technology in the presence of green consumers. Ann. Oper. Res. 2017, 255, 547–568. [Google Scholar] [CrossRef]

- Nielsen, I.E.; Majumder, S.; Saha, S. Game-Theoretic Analysis to Examine How Government Subsidy Policies Affect a Closed-Loop Supply Chain Decision. Appl. Sci. 2020, 10, 145. [Google Scholar] [CrossRef]

- Saha, S.; Majumder, S.; Nielsen, I.E. Is It a Strategic Move to Subsidized Consumers Instead of the Manufacturer? IEEE Access 2019, 7, 169807–169824. [Google Scholar] [CrossRef]

- Hussain, J.; Pan, Y.; Ali, G.; Xiaofang, Y. Pricing behavior of monopoly market with the implementation of green technology decision under emission reduction subsidy policy. Sci. Total Environ. 2020, 709, 136110. [Google Scholar] [CrossRef]

- Hutchinson, E.; Kennedy, P.W.; Martinez, C. Subsidies for the Production of Cleaner Energy: When Do They Cause Emissions to Rise? B E J. Econ. Anal. Policy 2010, 10. [Google Scholar] [CrossRef]

- Chen, J.Y.; Dimitrov, S.; Pun, H. The impact of government subsidy on supply Chains’ sustainability innovation. Omega-Int. J. Manag. Sci. 2019, 86, 42–58. [Google Scholar] [CrossRef]

- Meng, W. Comparation of Subsidy and Cooperation Policy Based on Emission Reduction R&D. Syst. Eng. 2010, 28, 123–126. [Google Scholar]

- Song, Y.; Zhao, D.-Z. The Product Portfolio Optimization of Manufacturers Based on Low-carbon Economy. Syst. Eng. 2012, 30, 75–81. [Google Scholar]

- Xiong, Y.; Huang, T.; Yanni, S.U. Difference of NEV Incentive Policies’ Effect toward Manufacturers: From Perspectives of ‘Government Purchasing’ and ‘Consumption Subsidy’. Sci. Sci. Manag. S T 2018, 39, 33–41. [Google Scholar]

| Symbol | Meaning |

|---|---|

| Government’s free carbon quota for enterprises | |

| Emission reduction technology innovation level | |

| Manufacturer unit cost | |

| Product wholesale price | |

| Product retail price | |

| Retailer unit cost of sales | |

| Carbon trading price | |

| Carbon emissions per unit product without technological innovation | |

| Carbon emission reduction per unit product after technological innovation | |

| Demand | |

| Market capacity | |

| Consumer price sensitivity coefficient | |

| Consumers’ low-carbon preferences | |

| Manufacturer carbon emission reduction technology investment | |

| Difficulty factor of carbon emission reduction technology innovation | |

| Manufacturer profit | |

| Retailer profit | |

| Consumer utility | |

| Consumer utility value for common products | |

| Social Welfare | |

| Government subsidies, | |

| Government subsidy program, |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Guo, C.; Wang, L. Supply Chain Strategy Analysis of Low Carbon Subsidy Policies Based on Carbon Trading. Sustainability 2020, 12, 3532. https://doi.org/10.3390/su12093532

Zhang Y, Guo C, Wang L. Supply Chain Strategy Analysis of Low Carbon Subsidy Policies Based on Carbon Trading. Sustainability. 2020; 12(9):3532. https://doi.org/10.3390/su12093532

Chicago/Turabian StyleZhang, Yinjie, Chunxiang Guo, and Liangcheng Wang. 2020. "Supply Chain Strategy Analysis of Low Carbon Subsidy Policies Based on Carbon Trading" Sustainability 12, no. 9: 3532. https://doi.org/10.3390/su12093532

APA StyleZhang, Y., Guo, C., & Wang, L. (2020). Supply Chain Strategy Analysis of Low Carbon Subsidy Policies Based on Carbon Trading. Sustainability, 12(9), 3532. https://doi.org/10.3390/su12093532