Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts

Abstract

1. Introduction

2. Literature Review

2.1. Green Building Implementation and Cost of Equity Capital

2.2. Corporate Governance and Green Building Practice Intensity

3. Methodology

3.1. Data

3.2. Variables

3.2.1. Cost of Equity Capital (CC)

3.2.2. Greenness Score

3.2.3. Institutional Ownership (IO) and Ownership Concentration (HHI)

3.2.4. Control Variables

3.3. Empirical Model Specification

4. Empirical Results and Analysis

4.1. Descriptive Statistics Analysis

4.2. Correlation Analysis

4.3. Analysis of Results

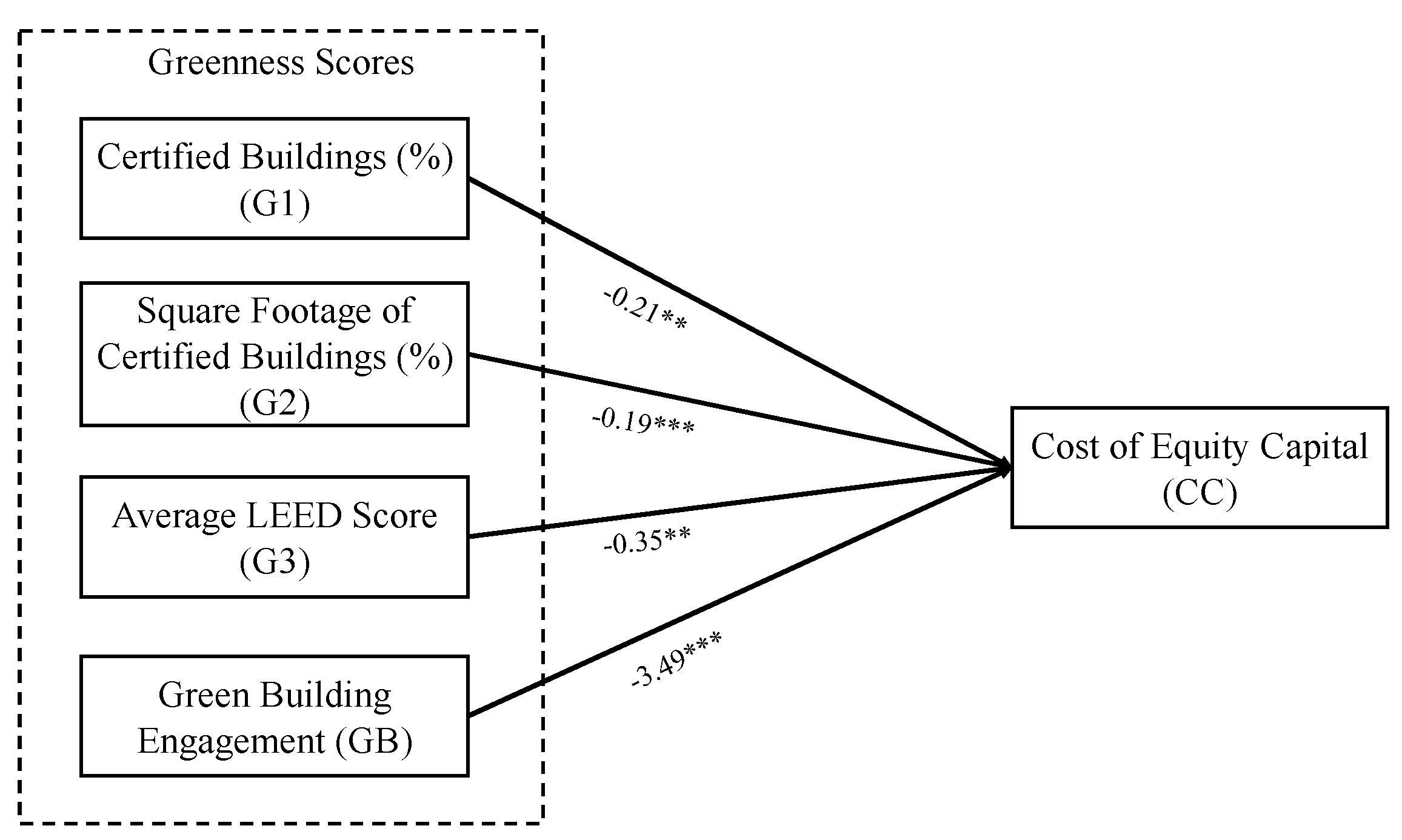

4.3.1. Green Building Certification’s Impact on Cost of Equity

4.3.2. Effects of Corporate Governance Practices on Green Building Implementation Intensity

4.3.3. Robustness Check

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Freeman, R.E.; Reed, D.L. Stockholders and stakeholders: A new perspective on Corporate governance. Calif. Manag. Rev. 1983, 25, 88–106. [Google Scholar] [CrossRef]

- Wistanley, C.S.D. Stakeholding: Confusion or utopia? Mapping the conceptual terrain. J. Manag. Stud. 2001, 38, 603–626. [Google Scholar]

- REN21 Renewables Now. Available online: https://www.ren21.net/wp-content/uploads/2019/05/GSR2017_Full-Report_English.pdf (accessed on 31 March 2020).

- World Green Building Council. Available online: https://www.worldgbc.org/news-media/world-green-building-trends-2018-smartmarket-report-publication (accessed on 31 March 2020).

- Bond, S.A.; Devine, A. Certification matters: Is green talk cheap talk? J. Real Estate Financ. Econ. 2016, 52, 117–140. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Green noise or green value? Measuring the effects of environmental certification on office values. Real Estate Econ. 2011, 39, 45–69. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing well by doing good? Green office buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J. Income, value, and returns in socially responsible office properties. J. Real Estate Res. 2010, 32, 243–270. [Google Scholar]

- Fuerst, F.; Gabrieli, T.; McAllister, P. A green winner’s curse? Investor behavior in the market for eco-certified office buildings. Econ. Model. 2017, 61, 137–146. [Google Scholar] [CrossRef][Green Version]

- Eichholtz, P.; Kok, N.; Yonder, E. Portfolio greenness and the financial performance of REITs. J. Int. Money Financ. 2012, 31, 1911–1929. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Stock market driven acquisitions. J. Financ. Econ. 2003, 70, 295–311. [Google Scholar] [CrossRef]

- Lauesen, L.M. CSR in publicly owned enterprises: Opportunities and barriers. Soc. Responsib. J. 2011, 7, 558–577. [Google Scholar] [CrossRef]

- Chhaochharia, V.; Laeven, L. Corporate governance norms and practices. J. Financ. Intermed. 2009, 18, 405–431. [Google Scholar] [CrossRef]

- Saini, N.; Singhania, M. Corporate governance, globalization and firm performance in emerging economies. Int. J. Product. Perform. Manag. 2018, 67, 1310–1333. [Google Scholar] [CrossRef]

- Iqbal, S.; Nawaz, A.; Ehsan, S. Financial performance and corporate governance in microfinance: Evidence from Asia. J. Asian Econ. 2019, 60, 1–13. [Google Scholar] [CrossRef]

- Gompers, P.; Ishii, J.; Metricks, A. Corporate governance and equity prices. Q. J. Econ. 2003, 118, 107–156. [Google Scholar] [CrossRef]

- Chung, K.H.; Elder, J.; Kim, J.-C. Corporate governance and liquidity. J. Financ. Quant. Anal. 2010, 45, 265–291. [Google Scholar] [CrossRef]

- William, H.; Michael, J. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar]

- Dhaliwal, D.; Zhen, O.; Tsang, L.A.; Yang, Y.G. Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. J. Account. Public Policy 2014, 33, 328–355. [Google Scholar] [CrossRef]

- Westermann, S.; Niblock, S.; Kortt, M. Corporate social responsibility and the performance of Australian REITs: A rolling regression approach. J. Asset Manag. 2018, 19, 222–234. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Chiang, K.C.H.; Wachtel, G.J.; Zhou, X. Corporate social responsibility and growth opportunity: The case of real estate investment trusts. J. Bus. Ethics 2017, 155, 463–478. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The effect of green investment on corporate behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Mackey, A.; Mackey, T.B.; Barney, J.B. Corporate social responsibility and firm performance: Investor preferences and corporate strategies. Acad. Manag. Rev. 2007, 32, 817–835. [Google Scholar] [CrossRef]

- Song, H.; Zhao, C.; Zeng, J. Can environmental management improve financial performance: An. empirical study of A-shares listed companies in China. J. Clean. Prod. 2017, 141, 1051–1056. [Google Scholar] [CrossRef]

- Starks, L.T. EFA keynote speech: “Corporate governance and corporate social responsibility: What do investors care about? What should investors care about?”. Financ. Rev. 2009, 44, 461–468. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Reverte, C. The impact of better corporate social responsibility disclosure on the cost of equity capital. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 253–272. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Deng, Y.; Li, Z.; Quigley, J.M. Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg. Sci. Urban Econ. 2012, 42, 506–515. [Google Scholar] [CrossRef]

- Holtermans, R.; Kok, N. On the value of environmental certification in the commercial real estate market. Real Estate Econ. 2019, 47, 685–722. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E.; Saccani, F. Does sustainability affect. Real estate market. Values? Empirical evidence from the office buildings market. in Milan (Italy). Sustainability 2018, 11, 12. [Google Scholar] [CrossRef]

- An, X.; Pivo, G. Green buildings in commercial mortgage-backed securities: The effects of LEED and energy star certification on default risk and loan terms. Real Estate Econ. 2020, 48, 7–42. [Google Scholar] [CrossRef]

- Burr, A.C. Studies Suggest More Gains for Green Building in 2009; CoStar Group: Washington, DC, USA, 2008. [Google Scholar]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Cespa, G.; Cestone, G. Corporate social responsibility and managerial entrenchment. J. Econ. Manag. Strategy 2007, 16, 741–771. [Google Scholar] [CrossRef]

- Jensen, M.C. The modern industrial revolution, exit, and the failure of internal control systems. J. Financ. 1993, 48, 831–880. [Google Scholar] [CrossRef]

- Grossman, S.J.; Hart, O.D. The costs and benefits of ownership: A theory of vertical and lateral integration. J. Political Econ. 1986, 94, 691–719. [Google Scholar] [CrossRef]

- Chung, K.H.; Zhang, H. Corporate governance and institutional ownership. J. Financ. Quant. Anal. 2011, 46, 247–273. [Google Scholar] [CrossRef]

- Davis, E.P. Institutional investors, corporate governance and the performance of the corporate sector. Econ. Syst. 2002, 26, 203–229. [Google Scholar] [CrossRef]

- Gillan, S.L.; Starks, L.T. Corporate governance proposals and shareholder activism: The role of institutional investors. J. Financ. Econ. 2000, 57, 275–305. [Google Scholar] [CrossRef]

- McCahery, J.A.; Sautner, Z.; Starks, L.T. Behind the scenes: The corporate governance preferences of institutional investors. J. Financ. 2016, 71, 2905–2932. [Google Scholar] [CrossRef]

- Ciftci, I.; Tatoglu, E.; Wood, G.; Demirbag, M.; Zaim, S. Corporate governance and firm performance in emerging markets: Evidence from Turkey. Int. Bus. Rev. 2019, 28, 90–103. [Google Scholar] [CrossRef]

- Easton, P.D. PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. Account. Rev. 2004, 79, 73–95. [Google Scholar] [CrossRef]

- Li, S. Does mandatory adoption of international financial reporting standards in the European union reduce the cost of equity capital? Account. Rev. 2010, 85, 607–636. [Google Scholar] [CrossRef]

- Botosan, C.A.; Plumlee, M.A. A re-examination of disclosure level and the expected cost of equity capital. J. Account. Res. 2002, 40, 21–40. [Google Scholar] [CrossRef]

- Lopes, A.B.; de Alencar, R.C. Disclosure and cost of equity capital in emerging markets: The Brazilian case. Int. J. Account. 2010, 45, 443–464. [Google Scholar] [CrossRef]

- Herfindahl, O. Concentration in the USA Steel Industry. Ph.D. Thesis, Columbia University, New York, NY, USA, 1950. [Google Scholar]

- Azizkhani, M.; Monroe, G.S.; Shailer, G. Audit partner tenure and cost of equity capital. Audit. A J. Pract. Theory 2013, 32, 183–202. [Google Scholar] [CrossRef]

- Francis, J.R.; Khurana, I.K.; Pereira, R. Disclosure incentives and effects on cost of capital around the world. Account. Rev. 2005, 80, 1125–1162. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Bowen, R.M.; Chen, X.; Cheng, Q. Analyst coverage and the cost of raising equity capital: Evidence from underpricing of seasoned equity offerings. Contemp. Account. Res. 2008, 25, 657–700. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Webb, E. Agency costs, leverage, and corporate social responsibility: A test of causality. Financ. Decis. 2005, 3, 1–19. [Google Scholar]

- Botosan, C.A.; Plumlee, M.A. Assessing alternative proxies for the expected risk premium. Account. Rev. 2005, 80, 21–53. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef]

- Cao, Y.; Myers, J.N.; Myers, L.A.; Omer, T.C. Company reputation and the cost of equity capital. Rev. Account. Stud. 2015, 20, 42–81. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. J. Mark. 2009, 73, 198–213. [Google Scholar] [CrossRef]

- Hwang, B.G.; Tan, J.S. Green building project management: Obstacles and solutions for sustainable development. Sustain. Dev. 2012, 20, 335–349. [Google Scholar] [CrossRef]

| Variables | Mean | Median | S.D. | Min | Max | N |

|---|---|---|---|---|---|---|

| G1 | 1.3145 | 0.0000 | 4.1673 | 0.0000 | 45.0000 | 1011 |

| G2 | 1.9601 | 0.0000 | 5.8788 | 0.0000 | 48.5787 | 1011 |

| G3 | 0.7932 | 0.0000 | 2.5271 | 0.0000 | 26.5250 | 1011 |

| GB | 0.2275 | 0.0000 | 0.4194 | 0.0000 | 1.0000 | 1011 |

| CC | 11.7965 | 8.7072 | 10.2007 | 0.0000 | 85.0812 | 1011 |

| IO | 0.7657 | 0.8522 | 0.2480 | 9.53E-06 | 1.0000 | 1011 |

| HHI | 0.0713 | 0.0521 | 0.0833 | 0.0224 | 1.0000 | 1011 |

| ROA | 1.8497 | 1.7380 | 2.8937 | −16.3811 | 30.5580 | 1011 |

| SIZE | 15.0837 | 15.0908 | 1.0578 | 11.9048 | 18.7093 | 1011 |

| LEV | 0.5309 | 0.5201 | 0.1652 | 0.0033 | 1.0821 | 1011 |

| MBR | 2.3005 | 1.7363 | 3.6512 | −6.2259 | 77.7728 | 1011 |

| BETA | 1.0305 | 0.9564 | 0.6387 | −1.0999 | 3.9142 | 1011 |

| RETVAR | 7.5837 | 5.8467 | 6.0000 | 2.2358 | 69.3270 | 1011 |

| INT | 2.6619 | 1.7430 | 9.2558 | 0.0000 | 274.9620 | 1011 |

| Correlation | G1 | G2 | G3 | CC | IO | HHI | ROA | SIZE | LEV | MBR | BETA | RETVAR | INT |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| G1 | 1 | ||||||||||||

| G2 | 0.8993 *** | 1 | |||||||||||

| G3 | 0.9965 *** | 0.9005 *** | 1 | ||||||||||

| CC | −0.1825 *** | −0.1867 *** | −0.1805 *** | 1 | |||||||||

| IO | 0.1318 *** | 0.1509 *** | 0.1375 *** | −0.0697 ** | 1 | ||||||||

| HHI | −0.0171 | −0.0312 | −0.019 | 0.0108 | −0.5908 *** | 1 | |||||||

| ROA | 0.0316 | −0.018 | 0.024 | −0.2115 *** | −0.0854 *** | −0.0339 | 1 | ||||||

| SIZE | 0.0461 | 0.0566 * | 0.0498 | 0.017 | 0.3776 *** | −0.1672 *** | −0.0722 ** | 1 | |||||

| LEV | −0.0985 *** | −0.1115 *** | −0.1061 *** | 0.0766 ** | −0.0269 | 0.0001 | −0.2904 *** | 0.2627 *** | 1 | ||||

| MBR | 0.0001 | −0.017 | −0.0058 | −0.1327 *** | −0.026 | 0.0456 | 0.0167 | −0.015066 | 0.1706 *** | 1 | |||

| BETA | −0.0368 | −0.0171 | −0.0346 | 0.1993 *** | 0.2127 *** | −0.0517 | −0.3482 *** | 0.0662** | 0.0861 *** | −0.0462 | 1 | ||

| RETVAR | −0.0869 *** | −0.0858 *** | −0.0867 *** | 0.27219 *** | 0.024693 | −0.01307 | −0.2713 *** | −0.0160 | 0.0836 *** | −0.1009 *** | 0.568 *** | 1 | |

| INT | −0.0072 | −0.0204 | −0.0075 | −0.0211 | −0.1001 *** | 0.0015 | 0.2051 *** | −0.1344*** | −0.2645 *** | −0.0228 | −0.1183 *** | −0.0504 | 1 |

| Variables | Cost of Equity Capital (CC) | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| G1 | −0.2105 ** | |||

| (0.0862) | ||||

| G2 | −0.1894 *** | |||

| (0.0561) | ||||

| G3 | −0.3493 ** | |||

| (0.1438) | ||||

| GB | −3.4896 *** | |||

| (0.9032) | ||||

| ROA | −0.2845 * | −0.3096 ** | −0.2870 * | −0.2932 * |

| (0.1526) | (0.1507) | (0.1530) | (0.1528) | |

| SIZE | −0.8073 | −0.7569 | −0.8035 | −0.4366 |

| (0.936) | (0.9164) | (0.9372) | (0.9549) | |

| LEV | 6.5877 | 6.5736 | 6.5193 | 5.5606 |

| (5.0183) | (4.9906) | (5.0196) | (4.8736) | |

| MBR | −0.1029 ** | −0.099 ** | −0.1011 ** | −0.0948 ** |

| (0.0455) | (0.0435) | (0.0453) | (0.0436) | |

| BETA | 0.5899 | 0.6149 | 0.5903 | 0.9810 |

| (0.8316) | (0.8256) | (0.8316) | (0.8583) | |

| RETVAR | 0.3679 *** | 0.3620 *** | 0.3680 ** | 0.3488 *** |

| (0.1248) | (0.1251) | (0.1248) | (0.1265) | |

| INT | 0.0257 ** | 0.0266** | 0.0256 ** | 0.0249 ** |

| (0.0109) | (0.0107) | (0.0108) | (0.0109) | |

| Constant | 18.0493 | 17.4439 | 18.0293 | 13.2620 |

| (14.8865) | (14.6156) | (14.890) | (15.2273) | |

| N | 1011 | 1011 | 1011 | 1011 |

| R-squared | 0.5814 | 0.5828 | 0.5813 | 0.5868 |

| Adj R-square | 0.5281 | 0.5298 | 0.5281 | 0.5343 |

| F-stat | 10.9156 | 10.9808 | 10.9135 | 11.1634 |

| Fixed effect | Yes | Yes | Yes | Yes |

| Variables | Greenness Scores | |||

|---|---|---|---|---|

| G1 | G2 | G3 | GB | |

| IO | 3.9128 * | 5.6883 ** | 2.3299 * | 0.4334 ** |

| (2.3103) | (2.77066) | (1.3981) | (0.1786) | |

| HHI | 5.9688 * | 8.4735 * | 3.7182 * | 0.9201 *** |

| (3.4270) | (4.3233) | (2.0461) | (0.3510) | |

| ROA | −0.0380 | −0.1690 | −0.0303 | −0.0039 |

| (0.0941) | (0.1614) | (0.0549) | (0.0071) | |

| SIZE | 1.7131 *** | 2.0199 *** | 1.0458 *** | 0.1858 *** |

| (0.5571) | (0.6609) | (0.3480) | (0.0499) | |

| LEV | −1.4618 | −1.6899 | −1.0650 | −0.3589 |

| (3.4972) | (4.2289) | (2.1328) | (0.2654) | |

| MBR | −0.0469 ** | −0.0326 | −0.0232 * | −0.0008 |

| (0.0239) | (0.0354) | (0.0133) | (0.0040) | |

| BETA | −0.4626 * | −0.4311 | −0.2769 * | 0.0766 ** |

| (0.2651) | (0.3404) | (0.1607) | (0.0346) | |

| RETVAR | −0.0265 | −0.0569* | −0.0161 | −0.0065 ** |

| (0.0195) | (0.0305) | (0.0118) | (0.0025) | |

| INT | 0.0118 * | 0.0185** | 0.0068* | 0.0006 |

| (0.0065) | (0.0083) | (0.0038) | (0.0010) | |

| Constant | −26.3466 *** | −31.3552 *** | −15.9665 *** | −2.8052 *** |

| (8.4251) | (9.8722) | (5.2067) | (0.7150) | |

| N | 1011 | 1011 | 1011 | 1011 |

| R-squared | 0.5312 | 0.5917 | 0.5428 | 0.5778 |

| Adj R-square | 0.4710 | 0.5392 | 0.4840 | 0.5236 |

| F-stat | 8.8185 | 11.2774 | 9.2388 | 10.6518 |

| Fixed effect | Yes | Yes | Yes | Yes |

| US LEED Green Building Certified REITs | ||||

|---|---|---|---|---|

| Variables | Cost of Equity Capital | |||

| (1) | (2) | (3) | (4) | |

| G1 | −0.2102 ** | |||

| (0.0941) | ||||

| G2 | −0.1828 *** | |||

| (0.0619) | ||||

| G3 | −0.3462 ** | |||

| (0.1563) | ||||

| GB | −3.9585 *** | |||

| (0.8486) | ||||

| ROA | 0.0097 | −0.0326 | 0.0058 | 0.0073 |

| (0.0911) | (0.0930) | (0.0903) | (0.0975) | |

| SIZE | −1.2133 ** | −1.1547 ** | −1.2149 ** | −0.2803 |

| (0.5714) | (0.4831) | (0.57265) | (0.6526) | |

| LEV | 5.2691 | 5.3887 | 5.0958 | 2.1375 |

| (8.3085) | (8.2424) | (8.3296) | (7.3752) | |

| MBR | −0.0874* | −0.0852 * | −0.0854 * | −0.084 ** |

| (0.0493) | (0.0460) | (0.0490) | (0.0421) | |

| BETA | 1.2111 | 1.2545* | 1.2125 | 1.8915 ** |

| (0.7748) | (0.7372) | (0.7777) | (0.7616) | |

| RETVAR | 0.2592 *** | 0.2475 *** | 0.2593 *** | 0.2052 *** |

| (0.0775) | (0.0758) | (0.0775) | (0.0708) | |

| INT | −0.0049 | −0.0078 | −0.0082 | −0.0848 * |

| (0.0703) | (0.0626) | (0.0687) | (0.0509) | |

| Constant | 21.3302 ** | 20.6831 ** | 21.4507 ** | 10.02168 |

| (9.9547) | (8.9949) | 9.8858 | (12.24913) | |

| N | 471 | 471 | 471 | 471 |

| R-squared | 0.4216 | 0.4151 | 0.4525 | 0.4525 |

| Adj R-square | 0.3604 | 0.3532 | 0.3946 | 0.3946 |

| F-stat | 6.8847 | 6.7022 | 7.8068 | 7.8068 |

| Fixed effect | Yes | Yes | Yes | Yes |

| US LEED Green Building Certified REITs | ||||

|---|---|---|---|---|

| Variables | Greenness Scores | |||

| G1 | G2 | G3 | GB | |

| IO | 11.1341 ** | 15.5185 ** | 6.6523 ** | 1.1208 *** |

| (5.1683) | (6.0647) | (3.1179) | (0.3723) | |

| HHI | 11.8174 ** | 15.9192 ** | 7.3063 ** | 1.6341 *** |

| (5.7283) | (7.1691) | (3.5118) | (0.5538) | |

| ROA | −0.0530 | −0.2818 | 3.5118 | −0.0006 |

| (0.1426) | (0.2158) | (0.0813) | (0.0107) | |

| SIZE | 4.5189 *** | 5.2794 *** | 2.7473 *** | 0.4263 *** |

| (1.0096) | (1.2525) | (0.6263) | (0.0740) | |

| LEV | −4.1059 | −4.6134 | −2.9407 | −1.0388 ** |

| (7.4113) | (8.4582) | (4.5515) | (0.4204) | |

| MBR | -0.0560 ** | -0.0519 | −0.0283** | −0.0021 |

| (0.0234) | (0.0356) | (0.0139) | (0.0036) | |

| BETA | −2.2109 *** | −2.4552 *** | −1.3330 *** | 0.0239 |

| (0.6810) | (0.7607) | (0.4039) | (0.0710) | |

| RETVAR | −0.0112 | −0.0681 | −0.0068 | −0.0122 *** |

| (0.0389) | (0.0635) | (0.0234) | (0.0036) | |

| INT | 0.0593 | 0.0518 | 0.0265 | −0.0166 *** |

| (0.0903) | (0.0602) | (0.0478) | (0.0035) | |

| Constant | −70.8656 *** | −83.3912 *** | −42.7595 *** | −6.3359 *** |

| (15.1394) | (18.2028) | (9.2997) | (1.0723) | |

| N | 471 | 471 | 471 | 471 |

| R-squared | 0.5839 | 0.6257 | 0.5970 | 0.5279 |

| Adj R-square | 0.5388 | 0.5851 | 0.5533 | 0.4767 |

| F-stat | 12.9361 | 15.4066 | 13.6548 | 10.3082 |

| Fixed effect | Yes | Yes | Yes | Yes |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hsieh, H.-C.; Claresta, V.; Bui, T.M.N. Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts. Sustainability 2020, 12, 3680. https://doi.org/10.3390/su12093680

Hsieh H-C, Claresta V, Bui TMN. Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts. Sustainability. 2020; 12(9):3680. https://doi.org/10.3390/su12093680

Chicago/Turabian StyleHsieh, Hui-Ching, Viona Claresta, and Thi Minh Ngoc Bui. 2020. "Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts" Sustainability 12, no. 9: 3680. https://doi.org/10.3390/su12093680

APA StyleHsieh, H.-C., Claresta, V., & Bui, T. M. N. (2020). Green Building, Cost of Equity Capital and Corporate Governance: Evidence from US Real Estate Investment Trusts. Sustainability, 12(9), 3680. https://doi.org/10.3390/su12093680