1. Introduction

Corporate governance, a term documented by Eells in 1960 [

1], is a central element of the global economy, which has witnessed marked development over the last decades [

2]. Corporate governance can be considered as a set of internal and external rules that support a company in achieving its goals, and it also helps to create and manage links with the shareholders, the state and its legislative framework and the board of directors, as well as the public sector in general [

3]. The adoption of corporate governance practices favors investors by gaining a competitive advantage and attracting more capital [

4]. A well-known case, that of the Lehman Brothers, shows how the failure to use corporate governance principles caused the company’s bankruptcy [

5].

The present paper traces the evolution of corporate governance coherently and concisely [

6]. Literature reviews highlight that in developing countries [

7] financial markets are affected if there are macro changes in corporate governance at a national level [

8]. These studies inspired scholars to understand how to manage heterogeneous and homogenous banking sectors [

9]. Empirical and conventional instruments were suggested to be implemented in the banking sector in order to support companies in seeing the advantages of using corporate governance principles [

10]. For governments interested in strengthening the banking sectors, this analysis provides methods to quantify the implications for stakeholders to condense the asymmetric information with the banks and institutions into a comprehensive legislative framework [

11]

Due to the complexity of the subject matter, we have divided the research work into a two-step approach [

12]. Firstly, we identify the correlation between corporate governance and financial performance [

13] through a theoretical analysis of published literature [

14]. This step allows for the identification of a composite index that includes return on assets (ROA), general liquidity, capital adequacy and company size expressed as total assets in the banking sector for a developing and a developed country.

In addition, we have developed a case study that attempts to investigate the effect of corporate governance on homogenous and heterogeneous banking systems, because it is common knowledge that the adoption of a corporate governance code can affect the very survival of a company [

15].

In our opinion, a homogenous banking sector is represented by a small number of banks, the first 5 to 8 of which hold over 50 percent of the banking market, while a heterogeneous banking sector is one with a large number of banks with widely differing market quotas, as in the case of the Italian Banking sector.

Therefore, these two banking systems are different as they are homogenous for the Romanian banking system and heterogeneous for the Italian one; we have analyzed the manner of how corporate governance is affecting financial performance. Furthermore, most of the banking systems in the EU are either homogenous (Romania, Hungary, Slovenia, Croatia, Bulgaria etc.) or heterogeneous (Italy, Austria, Poland or Germany) as we can observe in the following.

| Country | N° |

| Germany | 1531 |

| Poland | 627 |

| Austria | 522 |

| Italy | 485 |

| France | 406 |

| United Kingdom | 401 |

| Ireland | 312 |

| Finland | 241 |

| Spain | 196 |

| Sweden | 154 |

| Portugal | 147 |

| Luxembourg | 127 |

| Denmark | 100 |

| Netherlands | 93 |

| Belgium | 84 |

| Lithuania | 83 |

| Romania | 75 |

| Czechia | 58 |

| Latvia | 54 |

| Hungary | 46 |

| Estonia | 38 |

| Greece | 35 |

| Cyprus | 29 |

| Slovakia | 27 |

| Malta | 25 |

| Bulgaria | 25 |

| Croatia | 24 |

| Slovenia | 17 |

| Number of banks in the EU per country as of 2020. Source. Statista, 2021. |

To assess the impact of IGC on financial performance we used a panel data analysis of Romanian and Italian banking systems, between 2007 and 2018. We have selected this time interval as it corresponds to the interval when Romania has become member of the EU and adopted the European legislation.

The Romanian banking system is a very homogenous system, which to date, hosts 75 banks, while the Italian banking system is a heterogeneous system, comprised of approximately 500 banks. In this way we use one model for a developing country and one for a developed economy in the baking system to bridge the existing gap. The results of this study, focusing on the need to understand the impact of the corporate governance index on the financial performance in the Romanian and Italian Banking Systems, will be used for further comparative studies on culture and special aspects of the two country (politics, business, health).

Corporate governance in Romania is based on a set of principles and rules that were compiled in the first Corporate Governance Code adopted in 2001 by the Bucharest Stock Exchange. Improvements to this code were made in 2008, when the Bucharest Stock Exchange introduced a new one, based on the Corporate Governance Code of the Warsaw Stock Exchange. The principles and recommendations of this Code provided a better understanding of the role and composition of a company’s board of directors and management and, their relationship with the company’s stakeholders [

16].

The corporate governance system in Italy is a typical example of a control-oriented system and has a few important characteristics. In Italy ownership is centered in small and medium-sized enterprises. For this reason, Italian business depends heavily on bank finance, and it is difficult to obtain financing for companies without a consequent loss of control. In addition, the adoption of corporate principles should have the same healthy impact on both countries banking systems; for this reason, our research proposes to verify this hypothesis, in caeteris paribus conditions, in the Model and the Results sections.

This research paper is organized as follows: the theoretical framework section outlines the relationship between corporate governance and a company’s financial performance; the materials and methods section highlight the data used, the variables and the model adopted to analyze them; followed by the results section; the discussion of results; and finally the conclusion.

2. Theoretical Framework

By carefully researching the specialized literature on the relationship between corporate governance and a company’s financial performance [

17], we observed that it has generated real interest from researchers with widely differing results. Drobetz, Schillhofer and Zimmermann [

18] developed an index of corporate governance for 91 German companies using a survey (from March 2002) with a 64% rate of non-response. The index is largely based on the German code recommendations. Tobin’s Q, which was measured in 2001, was found to be positively related to the 2002-based governance rating.

Further evidence of the relationship between corporate governance and the financial value of companies is presented below through the reviewing of selected relevant documents regarding the relationship between governance and a company’s value, without the benefits of introducing a good governance code at national level. Two notable specialized papers published in literature, are those by Love and Klapper [

7] and Durnev and Kim [

19], which conduct a transnational study on governance and the value of companies using government ratings provided by Credit Lyonnais Securities Asia analysts for 495 large companies listed on the stock exchange in 25 countries. Both studies concluded that the performance and value of companies are positively correlated with corporate governance, and that the relationship is more powerful in countries with fewer investor protection standards and weaker legal systems. Therefore, Durnev and Kim [

19] reported that an increase in the standard deviation of the global governance index is accompanied with an average 9% increase in the company’s market value, with an even healthier impact on less developed regions [

20].

Other studies at national level, in less developed countries, with relatively weak investor protection and weaker legal systems, such as Russia [

21] and Korea [

22], have shown a strong positive relationship between a company’s value and corporate governance measures. Moreover, the studies of Black, Love and Rachinsky [

21] and Black, Jang and Kim [

22] address the potential endogenous issues. The evidence in both studies supports a causal link between stricter corporate governance and higher company value. Based on the above-mentioned studies, it can be said that an effective corporate governance initiative on a less well-developed market will have a positive impact on the company’s value. However, there are many studies conducted in different countries worldwide that highlight the value of a company and the different aspects of corporate governance (for example, Gompers, Ishii and Metick [

23], Bauer, Guenster and Otten [

24] to name just a few. Besides, our main focus was on research directly linked to our research issues, i.e., to address voluntary corporate governance codes [

25] or the financial value of companies in terms of corporate governance in less developed markets [

26]

The research of Anand, Milne and Purda [

27] focuses on the extent to which Canadian firms adopted recommendations on corporate governance between 1995 and 2003. The authors consider that the presence of a majority shareholder, or an executive shareholder, represents a barrier to the voluntary adoption of corporate governance. Investment opportunities, research, and development spending are positively linked to an index that reflects the quality of the board of directors. The same authors define the results as evidence that companies implement governance standards voluntarily to attract investors.

Based on these results and the conclusions of the transnational studies carried out by Love and Klapper [

7] and by Durnev and Kim [

19], is to say that countries which have a weak legal system [

28] assess the efficiency of the judiciary system in Thailand with a score of 3.25 on a scale from 0 to 10. Even though Romania is not an example of a very powerful legal system, a company’s financial value and corporate governance are positively correlated and strong, as reported in the case of emergent countries [

29]. In fact, the code of good governance regulates their development (also) even when the law is both inaccurate and incomprehensive [

30]

From an assessment of specialized literature, we can say that scholars over the years have focused their attention on the relationship between corporate governance and the value of companies. Therefore, with the help of Da Silva and Leal’s research [

31], we have computed an IGC applicable to companies in the Romanian and Italian economy.

To quantify the impact of the IGC on a company’s performance, we started with the assumption that a credit institution that has adopted and implemented the code of corporate governance will have a better financial evolution. Therefore, these companies will have a better financial performance than companies that have not adopted such a code, as well as a more sustainable development [

32], both in terms of total assets profitability and return on assets (ROA).

The index is a percentage in compliance with certain corporate governance principles. The index was composed of a total of 20 principles. For example: being quoted on the stock exchange, belonging to an international consortium, having applied accounting standards, having been audited by a Big Four auditing company and having a board of directors or audit committee [

33].

During the period of analysis, we observed the evolution of total assets, liquidity and the adequacy of capital and ROA in the main banks of the Romanian banking system, as well as the impact of the corporate governance index (IGC) on them during this period [

34]

The reasons that led us to choose these variables are linked to research in literature regarding the robustness of IGC. This consideration is in line with the idea that the chosen variables can be easily found in balance sheets and can be compared among different companies and different states.

In order to summarize the results from the literature review, we hereby list the variables identified:

Capital adequacy [

17,

27];

Return on assets [

32,

34].

3. Materials and Methods

The data used to analyze the model were taken from financial statements that were made public in the Romanian and in the Italian banking system for the period 2007–2018. The data were centralized for each credit institution; therefore, the following banks were selected for Romania: Banca Comerciala Romana SA, Banca Transilvania SA, Raiffeisen Bank SA, Banca Romana de Dezvoltare Groupe Societe Generale SA, Unicredit Bank SA and Banca Comerciala Intesa SanPaolo Romania SA. For Italy, the banks chosen were Intesa SanPaolo, Banca Popolare, BNL, Banca Carige, Mediobanca, Unicredit and Banca Sella.

The variables used in the model were as follows: company size (referred to as total assets with the values being logarithms), ROA (considered as Net profit/Total assets × 100), general liquidity (considered as Current assets divided by Short-term debt) and of course, IGC.

Regarding these variables, we considered the specificity of each domain, for example, the banking system is also focused on the capital adequacy (equity divided by Total Assets). The choice of this variable was motivated by the fact that the credit institution’s governance needs to gauge the investments in line with the standards set by the Basel Agreement and the assumption of a risk profile correlated with organizational performance [

35].

6. Discussion

Taking the research of the authors Da Silva and Leal [

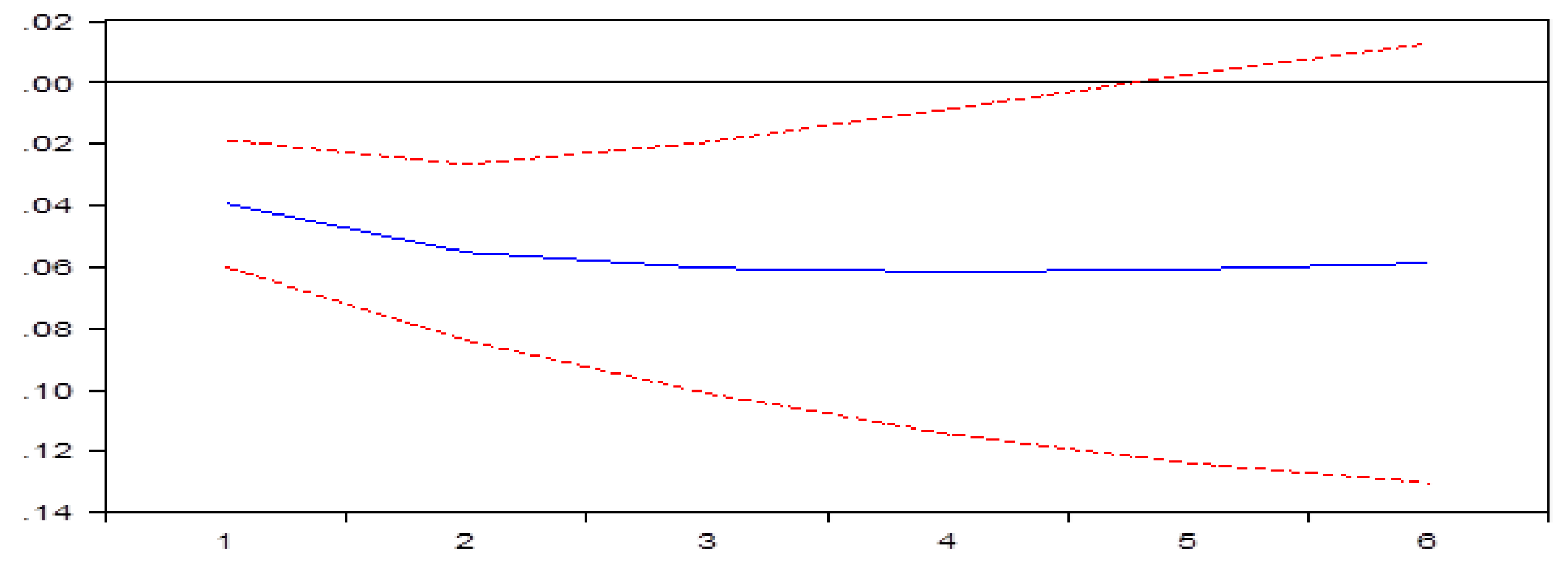

14], a starting point we have computed is an IGC applicable to banks in Romania and Italy. According to the initial hypothesis the identification of a composite index to measure the impact of corporate governance includes return on assets (ROA), general liquidity, capital adequacy and company size expressed as total assets in the banking sector in both a developing and a developed country. The impact of the IGC on capital adequacy in the Romanian banking system could not be highlighted since capital adequacy is an indicator of compliance with a prudential target set exogenously by international regulators (the Basel Committee). The negative impact of the IGC on bank liquidity

Figure 8 does not come as a surprise at all in an environment characterized by over-liquidity and negative interest rates charged by the most important central banks (e.g., European Central Bank). In addition, credit institutions can receive either the deposit facility or the credit facility daily, depending on the current liquidity situation.

The impact of the IGC on total assets and profitability, being both consistent and enduring, reinforces our belief that an improvement in corporate governance as well as an increase in decision-making transparency would result in an increase in Total Assets, growth in the bank’s capitalization, an increase in the quality of the loan portfolio and a higher profitability of the bank. In the second case study related to Italian banking system we observed a positive impact of the IGC on profitability, being consistent with other studies performed [

43]. About the importance of transparency, Shin assert that “Issues of transparency and impartiality are hotly debated subjects in algorithm research, and many users are concerned with these issues” [

44]. This confirms literature on the assumption that effective corporate governance implementation within the banking system will have a positive long-term impact on financial performance. Therefore, the hypothesis that corporate governance enhances profitability is confirmed for both the Italian banking sector and the Romanian one. A second observation is that the impact of IGC on capital adequacy over the Italian banking system is positive and on the increase. Considering the Basel Agreement and the limitations of (the) credit expansion, the shocks felt in the Italian banking sector could explain why the impact of these principles had a positive influence on capital adequacy, so measures were necessary. Therefore, the banking institutions are continually improving the credit portfolio qualitatively rather than quantitatively, with positive effects on the health of the banking sector. Finally, the impact of IGC on liquidity in the Italian banking sector is negative, though only in a small proportion, a sign that it is normal for bank management to be more concerned about investments and profit making rather than worrying about hypothetical liquidity problems, especially when the central bank is the last resort lender.

7. Conclusions

According to literature reviews, the developing countries’ financial markets are affected if there are national-level macro changes in corporate governance. In addition, the adoption of Corporate Governance Principals and Codes is important in order to obtain a comparative advantage as well as to attract capital, which leads to financial market growth. Our research computed an IGC based on the principles of corporate governance which were implemented and respected by the companies, to measure the impact of corporate governance on financial performance, focusing on the banking sector of Romania and Italy. The novelty of the study is a first trial to assess the impact of corporate governance considering two distinct types of banking systems: a homogenous banking system; the Romanian one, and a heterogeneous banking system; the Italian one. Regarding the banking system, it can be stated that the impact of IGC on company size, capital adequacy and profitability differs in some ways in Romania and Italy although they also share a lot of similarities. Even so, the IGC has a positive influence on the banking sector in Italy and Romania as regards organizational variables, such as shareholders, state and legislative framework (ROA and capital adequacy), board of directors (ROA and company size) and, not least, the general public, could not be highlighted when we consider an indicator of compliance with a prudential target, set exogenously by international regulators (the Basel Committee).

We identified a contradiction with the conclusions found in literature, according to which good corporate governance positively influences the size of the company, which has solid foundations. In addition, recent and important studies highlight that “comparative observations are useful to juxtapose how value is constructed in the countries and recognize which factors influence user confirmation and satisfaction” [

20,

45,

46]. Analyzing the impact of good corporate governance on total assets, one can state that the corporate governance principle applied in Italy does not encourage the build-up of big banks. Taking into consideration that the Italian banking system is not homogenous, but rather characterized by a high number of banks (640 in 2016 from 760 in 2010) we can say that the influence of corporate governance does not have a strong influence on the company size, with one possible explanation being the characteristics of the Italian banking system. Thus, we consider that although the adoption of the new corporate governance code in Italy does not contribute to the expansion of total assets, it is very important to the health of the Italian banking sector. The individual impact of the IGC on Total Assets in the banking system is seen to maintain the same trend as the cumulative impact; it is negative from the beginning of the survey period. In conclusion, the present study helps us to understand how two different countries (such as Italy and Romania) with substantial differences in the banking sector can be observed, using IGC, to harmonize corporate governance performances. Deciphering corporate governance phenomena with these assessment tools is coherent with a sustainable development that may help shareholders to take financial and non-financial decisions with more clarity. Furthermore, corporate governance in the banking system studies demonstrate limits that rely on indices, which are assumed to capture an underlying corporate governance aspects. The construct validity of these indices is rarely addressed. This paper is a first attempt to investigate how the construct validity of these indices can be assessed, and what can be learned about index construction in the two heterogeneous economies could change their financial performance under the impact of the corporate governance index.