Income Heterogeneity and the Environmental Kuznets Curve Turning Points: Evidence from Africa

Abstract

:1. Introduction

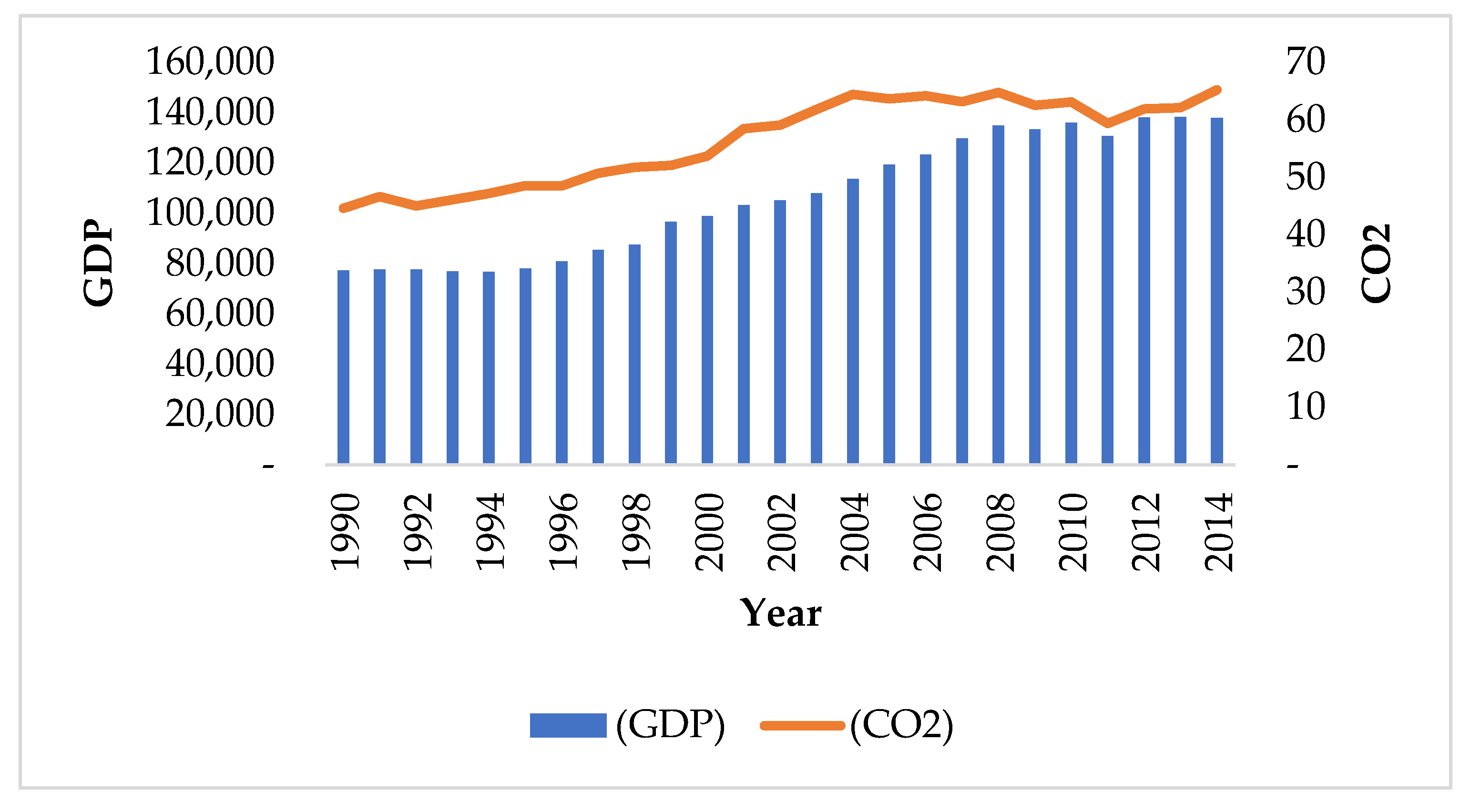

1.1. Economic Growth and CO2 Emissions

1.2. Agriculture and CO2 Relationship

1.3. Renewable and Non-Renewable Energy Use and CO2 Emissions

2. Literature Review

3. Materials and Methods

3.1. Data

3.2. Methodology

3.2.1. Panel Unit Root Tests

3.2.2. Panel Cointegration Tests

3.2.3. Panel Long-Run Parameter Estimates

3.2.4. The Turning Point of GDP per Capita

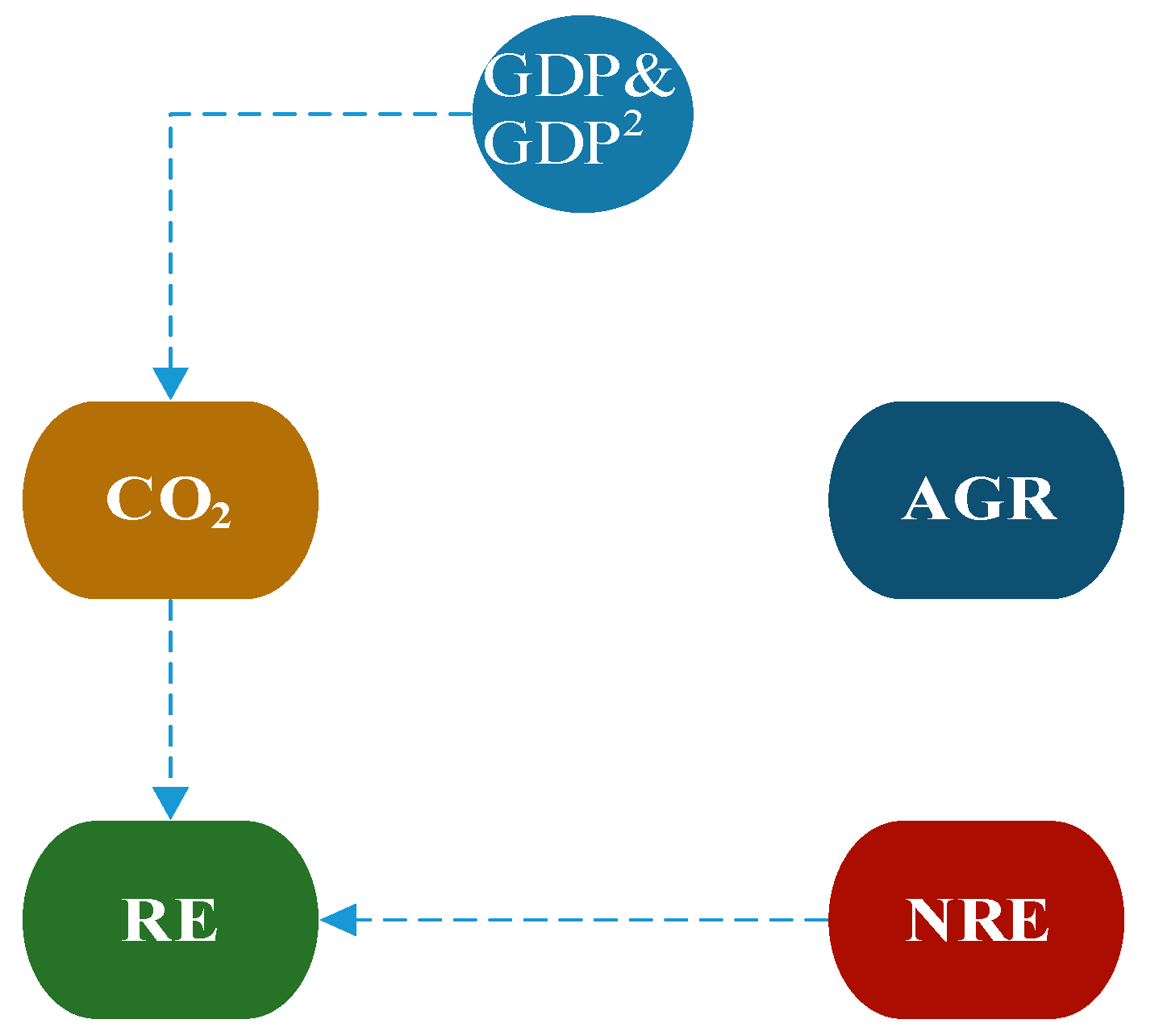

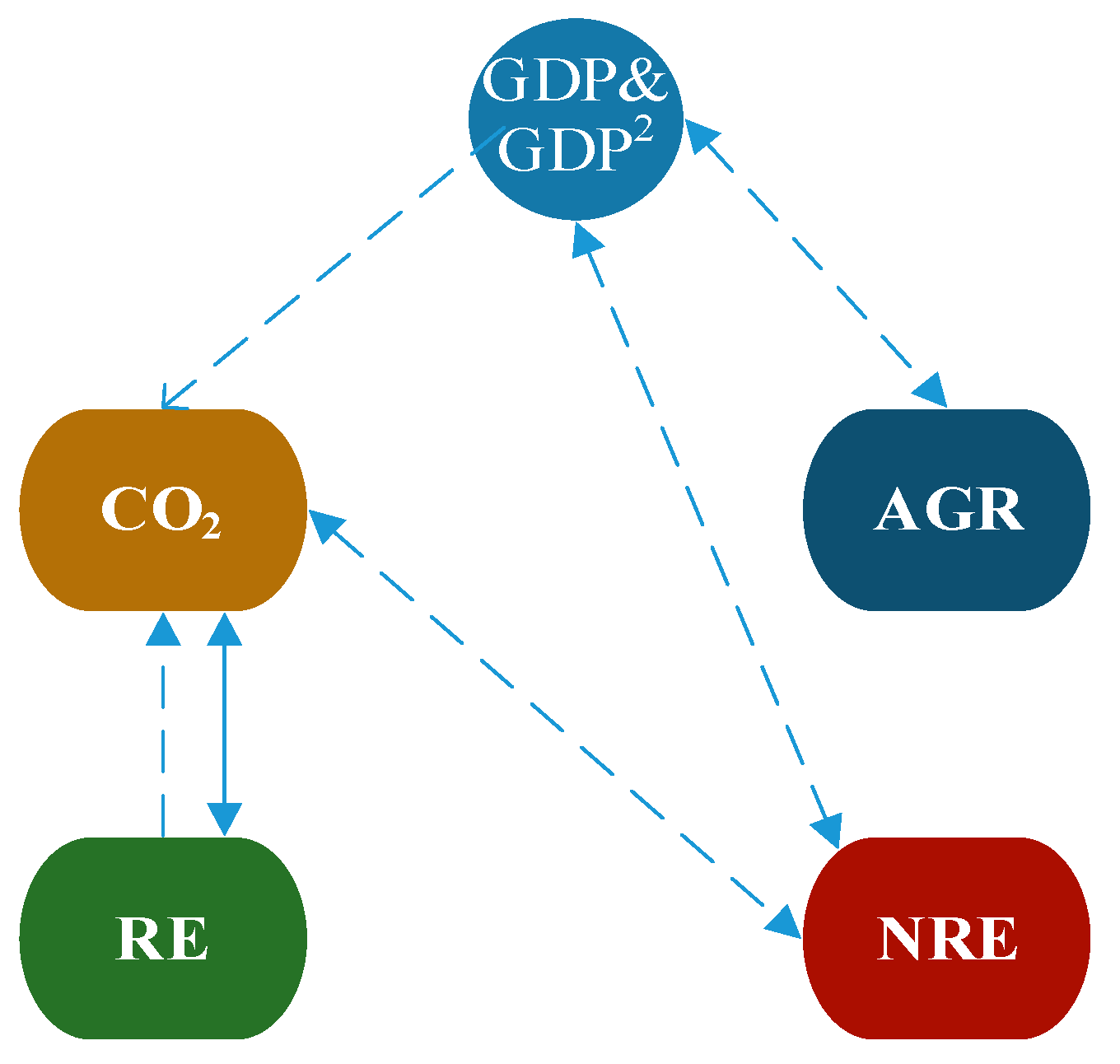

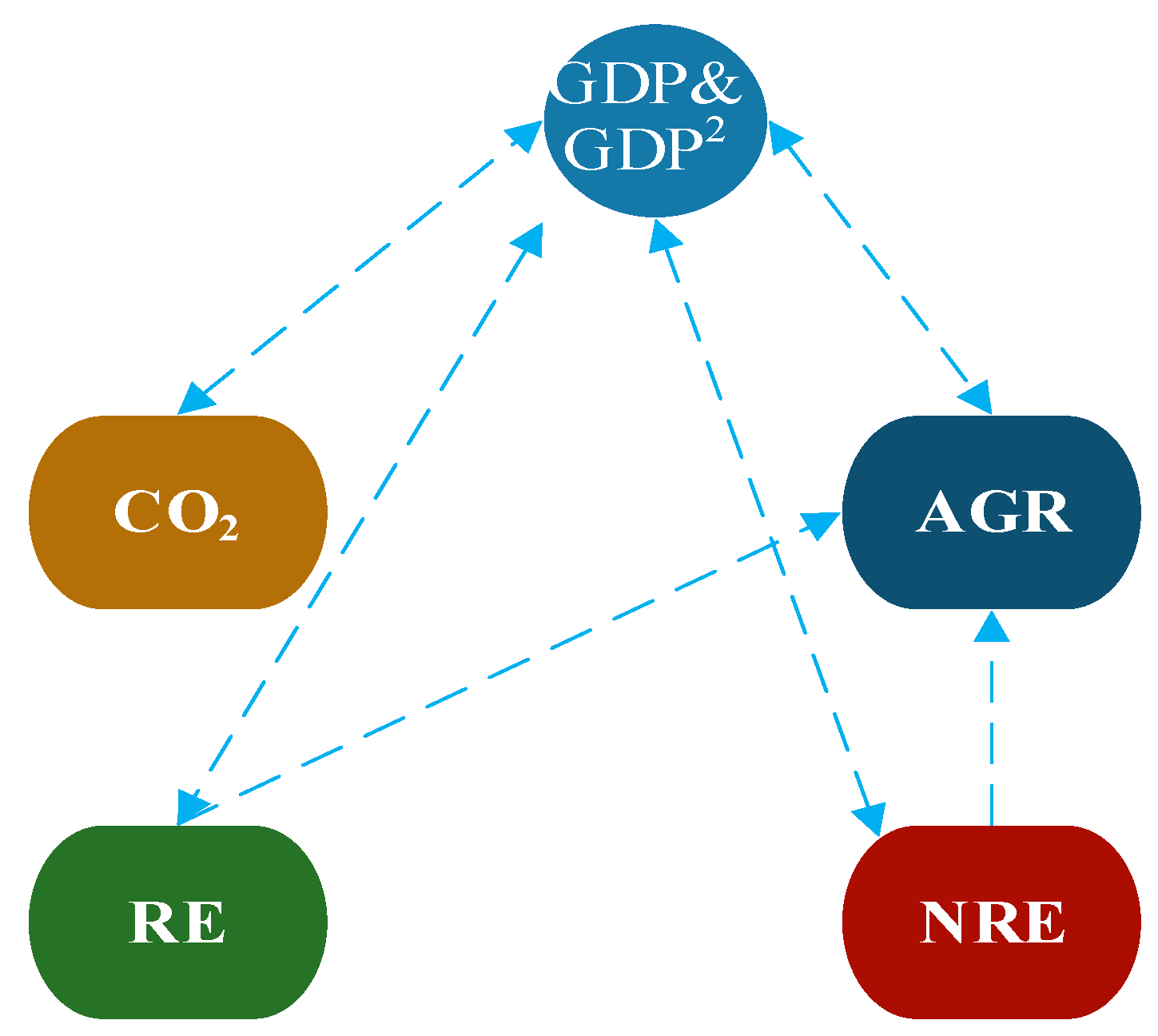

3.2.5. Vector Error Correction Model (VECM) Panel Granger Causality Test

4. Results

4.1. Panel Unit Root Test Results

4.2. Panel Cointegration Test Results

4.3. Panel Long-Run Parameter Results

4.4. VECM Panel Granger Causality Test Results

5. Further Discussion

5.1. CO2 Emissions and Economic Growth

5.2. CO2 Emissions and Agriculture

5.3. CO2 Emissions and Renewable Energy Consumption

5.4. CO2 Emissions and Non-Renewable Energy Consumption

6. Conclusions and Policy Recommendations

- (1)

- From the estimations, the results substantiated the EKC hypothesis in the low-income, lower-middle-income, and upper-middle-income economies in Africa. In these income groups, and its square term coefficients were significantly positive and negative respectively, signifying that as GDP growth deepens, emissions at the different income levels will increase before peaking and then decrease with rising GDP growth. Also, it connotes that the EKC phenomenon’s validity is not income group-specific, meaning that the EKC phenomenon can occur in any region/economy, irrespective of the income status. However, the long-run estimates for ln GDP and failed to meet the EKC assumption in the full African sample and the high-income economy even though their GDP per capita reached their turning points. As a matter of policy, African governments should focus on achieving the threshold of their total carbon emission rather than carbon emission per capita in these groups.

- (2)

- The findings of the panel FMOLS evaluations revealed agriculture to have a significant positive influence on emissions in the high-income economy, while it reduced CO2 emissions in the lower-middle-income, low-income, and full sample sub-groups. In the full-sample and high-income economy, renewable energy use mitigated CO2 emissions, while it had no statistically significant effects in reducing emissions for the upper- and lower-middle-income economies. Lastly, in all the sub-groups, except for the low-income subpanel, NRE exerted a positive effect on emissions. The following policy options are advised on renewable energy, agriculture, and non-renewable energy, respectively:

- (a)

- Agriculture policy: African governments, particularly in the high-income economy, should invest in agricultural research and extension services to promote environmentally sustainable farming practices and adopt agricultural policies that target the use of solar-powered biogas plants and power stations as an alternative to NRE sources in generating heat and electricity to power agricultural activities. The other subpanels where agriculture ameliorates emissions’ effect should be a model for the high-income economy.

- (b)

- Renewable energy policy: policy framers in Africa should initiate and adopt effective policies to optimize the RE consumption potential in those sub-categories where RE has no emission mitigation effect. Budgetary allocations and renewable expansion plans must be adopted to maximize the share of renewable energies in the total energy mix, especially in the low- and lower-middle-income economies, where there is a tremendous and unexploited potential for renewable energy sources. The following pragmatic actions can be taken to promote renewable energy:

- (i)

- African governments can directly undertake wide-ranging reassessment, identification, and mapping out of the renewable energy resources and their sources. It will enable private energy investors, the public, and entrepreneurs to access and reliably exploit these potentials.

- (ii)

- Adopting tax holidays policy to promote investors’ interest in the “clean” energy markets can largely boost investment in the sector and low prices of clean energy sources.

- (c)

- Non-renewable energy policy: On NRE, considering the significant influence of NRE on increasing CO2, there is an urgent need to implement a range of policies that would significantly increase the RE stake in the total energy mix time and limit the over-reliance on NRE.

- (3)

- The VECM Granger causality evaluations provided mixed outcomes. The results found a hypothetical unidirectional causality from output to CO2 in the high-income, lower-middle-income, and the full samples. In contrast, a bidirectional relationship from output to CO2 in the low and upper-middle-income economies existed in the short-run. There was also a unidirectional relationship from RE to CO2 and bidirectional causality from NRE to CO2 in the lower-middle-income economies. Moreover, this study observed a short-run Granger causality from CO2 to RE in the high-middle-income category.

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Adu, D.T.; Denkyirah, E.K. Economic growth and environmental pollution in West Africa: Testing the Environmental Kuznets Curve hypothesis. Kasetsart J. Soc. Sci. 2018. [Google Scholar] [CrossRef]

- Yao, X.; Kou, D.; Shao, S.; Li, X.; Wang, W.; Zhang, C. Can urbanization process and carbon emission abatement be harmonious? New evidence from China. Environ. Impact Assess. Rev. 2018, 71, 70–83. [Google Scholar] [CrossRef]

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Uddin, G.A.; Salahuddin, M.; Alam, K.; Gow, J. Ecological footprint and real income: Panel data evidence from the 27 highest emitting countries. Ecol. Indic. 2017, 77, 166–175. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets Curve Hypothesis: A Survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef] [Green Version]

- Sharma, S.S. Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Appl. Energy 2011, 88, 376–382. [Google Scholar] [CrossRef]

- Marsiglio, S.; Ansuategi, A.; Gallastegui, M.C. The environmental Kuznets curve and the structural change hypothesis. Environ. Resour. Econ. 2016, 265–288. [Google Scholar] [CrossRef] [Green Version]

- Sinha, A.; Bhatt, M.Y. Environmental Kuznets Curve for Co2and Nox Emissions: A Case Study of India. Eur. J. Sustain. Dev. 2017, 6. [Google Scholar] [CrossRef]

- Shenbiao, P.; Mark, A.T.; Nelson, A.; Wilhermina, A. The Relationship Between Foreign Aid and Growth: A Comparative Analysis of Low Income, Lower Middle Income and Upper-Middle-Income African Countries. J. Econ. Sustain. Dev. 2018, 9, 60–80. [Google Scholar]

- Ben Jebli, M.; Ben Youssef, S. The role of renewable energy and agriculture in reducing CO2 emissions: Evidence for North Africa countries. Ecol. Indic. 2017, 74, 295–301. [Google Scholar] [CrossRef] [Green Version]

- Osabuohien, E.S.; Efobi, U.R.; Gitau, C.M.W. Beyond the Environmental Kuznets Curve in Africa: Evidence from Panel Cointegration. J. Environ. Policy Plan. 2014, 16, 517–538. [Google Scholar] [CrossRef]

- Ogundipe, A.A.; Olurinola, O.I.; Odebiyi, J.T. Examining the Validity of EKC in Western Africa: Different Pollutants Option. Environ. Manag. Sustain. Dev. 2015, 4. [Google Scholar] [CrossRef] [Green Version]

- Perman, R.; Stern, D.I. Evidence from panel unit root and cointegration tests that the Environmental Kuznets Curve does not exist. Aust. J. Agric. Resour. Econ. 2003, 47, 325–347. [Google Scholar] [CrossRef] [Green Version]

- Ogundipe, A.A.; Alege, P.O.; Ogundipe, O.M. Income Heterogeneity and Environmental Kuznets Curve in Africa. J. Sustain. Dev. 2014, 7. [Google Scholar] [CrossRef] [Green Version]

- Azam, M.; Khan, A.Q. Testing the Environmental Kuznets Curve hypothesis: A comparative empirical study for low, lower middle, upper middle and high income countries. Renew. Sustain. Energy Rev. 2016, 63, 556–567. [Google Scholar] [CrossRef]

- Uddin, M.M.M. What are the dynamic links between agriculture and manufacturing growth and environmental degradation? Evidence from different panel income countries. Environ. Sustain. Indic. 2020, 7. [Google Scholar] [CrossRef]

- Bah, M.M.; Abdulwakil, M.M.; Azam, M. Income heterogeneity and the Environmental Kuznets Curve hypothesis in Sub-Saharan African countries. GeoJournal 2019, 85, 617–628. [Google Scholar] [CrossRef]

- Qiao, H.; Zheng, F.; Jiang, H.; Dong, K. The greenhouse effect of the agriculture-economic growth-renewable energy nexus: Evidence from G20 countries. Sci. Total Environ. 2019, 671, 722–731. [Google Scholar] [CrossRef]

- Dong, K.; Jiang, H.; Sun, R.; Dong, X. Driving forces and mitigation potential of global CO2 emissions from 1980 through 2030: Evidence from countries with different income levels. Sci. Total Environ. 2019, 649, 335–343. [Google Scholar] [CrossRef]

- WorldBank. World Bank Country and Lending Groups. Available online: http://Datahelpdesk.worldbank.org/knowledgebase/articles/906519 (accessed on 7 December 2019).

- Le, T.-H.; Nguyen, C.P. Is energy security a driver for economic growth? Evidence from a global sample. Energy Policy 2019, 129, 436–451. [Google Scholar] [CrossRef]

- Aye, G.C.; Edoja, P.E.; Charfeddine, L. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5. [Google Scholar] [CrossRef]

- Khan, M.T.I.; Ali, Q.; Ashfaq, M. The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew. Energy 2018, 118, 437–451. [Google Scholar] [CrossRef]

- Chen, L.; Yang, Z.; Chen, B. Decomposition Analysis of Energy-Related Industrial CO2 Emissions in China. Energies 2013, 6, 2319–2337. [Google Scholar] [CrossRef]

- FOA. Food and Agriculture Organization of the United Nations, The state of Food and Agriculture. Available online: http://www.fao.org/3/a-i6030e (accessed on 7 November 2019).

- Liu, X.; Zhang, S.; Bae, J. The nexus of renewable energy-agriculture-environment in BRICS. Appl. Energy 2017, 204, 489–496. [Google Scholar] [CrossRef]

- Reynolds, L.; Wenzlau, S. Climate-Friendly Agriculture and Renewable Energy: Working Hand-in-Hand toward Climate Mitigation. Available online: https://www.renewableenergyworld.com/baseload/climate-friendly-agriculture-and-renewable-energy-working-hand-in-hand-toward-climate-mitigation/#gref (accessed on 9 November 2019).

- Johnson, J.M.; Franzluebbers, A.J.; Weyers, S.L.; Reicosky, D.C. Agricultural opportunities to mitigate greenhouse gas emissions. Environ. Pollut. 2007, 150, 107–124. [Google Scholar] [CrossRef]

- FOA. FOA. Food and Agriculture Organization of the United Nations, the State of Food and Agriculture. Available online: http://www.fao.org/faostat/en/home (accessed on 9 November 2019).

- Shuai, C.; Chen, X.; Wu, Y.; Tan, Y.; Zhang, Y.; Shen, L. Identifying the key impact factors of carbon emission in China: Results from a largely expanded pool of potential impact factors. J. Clean. Prod. 2018, 175, 612–623. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Li, H.; Liao, H. Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew. Sustain. Energy Rev. 2018, 94, 419–429. [Google Scholar] [CrossRef]

- Shuai, C.; Chen, X.; Wu, Y.; Zhang, Y.; Tan, Y. A three-step strategy for decoupling economic growth from carbon emission: Empirical evidences from 133 countries. Sci. Total Environ. 2019, 646, 524–543. [Google Scholar] [CrossRef]

- Ma, M.; Cai, W. Do commercial building sector-derived carbon emissions decouple from the economic growth in Tertiary Industry? A case study of four municipalities in China. Sci. Total Environ. 2019, 650, 822–834. [Google Scholar] [CrossRef]

- Bayrakcı, A.G.; Koçar, G. Utilization of renewable energies in Turkey’s agriculture. Renew. Sustain. Energy Rev. 2012, 16, 618–633. [Google Scholar] [CrossRef]

- BP. Statistical Review of World Energy. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 5 October 2019).

- Demissew Beyene, S.; Kotosz, B. Testing the environmental Kuznets curve hypothesis: An empirical study for East African countries. Int. J. Environ. Stud. 2019, 77, 636–654. [Google Scholar] [CrossRef] [Green Version]

- Sarkodie, S.A.; Strezov, V. A review on Environmental Kuznets Curve hypothesis using bibliometric and meta-analysis. Sci. Total Environ. 2019, 649, 128–145. [Google Scholar] [CrossRef]

- Ike, G.N.; Usman, O.; Sarkodie, S.A. Testing the role of oil production in the environmental Kuznets curve of oil producing countries: New insights from Method of Moments Quantile Regression. Sci. Total Environ. 2020, 711, 135208. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Hochman, G.; Zeng, X.; Li, H.; Jiang, H. Impact of natural gas consumption on CO2 emissions: Panel data evidence from China’s provinces. J. Clean. Prod. 2017, 162, 400–410. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Dong, X. CO2 emissions, natural gas and renewables, economic growth: Assessing the evidence from China. Sci. Total Environ. 2018, 640–641, 293–302. [Google Scholar] [CrossRef] [PubMed]

- Al-mulali, U.; Tang, C.F.; Ozturk, I. Estimating the Environment Kuznets Curve hypothesis: Evidence from Latin America and the Caribbean countries. Renew. Sustain. Energy Rev. 2015, 50, 918–924. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Phimphanthavong, H. The Impacts of Economic Growth on Environmental Conditions in Laos. Int. J. Bus. Manag. Econ. Res. 2013, 4, 766–774. [Google Scholar]

- Liu, X.; Zhang, S.; Bae, J. The impact of renewable energy and agriculture on carbon dioxide emissions: Investigating the environmental Kuznets curve in four selected ASEAN countries. J. Clean. Prod. 2017. [Google Scholar] [CrossRef]

- Olusegun, O.A. Economic Growth and Environmental Quality in Nigeria: Does Environmental Kuznets Curve Hypothesis Hold? Environ. Res. J. 2009, 3, 14–18. [Google Scholar]

- Omojolaibi, J.A. Environmental Quality And Economic Growth In Some Selected West African Countries: A Panel Data Assessment of The Environmental Kuznets Curve. J. Sustain. Dev. Afr. 2010, 12, 35–48. [Google Scholar]

- Lin, B.; Omoju, O.E.; Nwakeze, N.M.; Okonkwo, J.U.; Megbowon, E.T. Is the environmental Kuznets curve hypothesis a sound basis for environmental policy in Africa? J. Clean. Prod. 2016, 133, 712–724. [Google Scholar] [CrossRef]

- Magazzino, C. CO2 emissions, economic growth, and energy use in the Middle East countries: A panel VAR approach. Energy Sourcespart B Econ. Plan. Policy 2016, 11, 960–968. [Google Scholar] [CrossRef]

- Sunday, O.J. Environmental-Kuznets-Curve-Hypothesis-in-Sub-Saharan-African-Countries-Evidence-from-Panel-Data-Analysis. Int. J. Environ. Pollut. Res. 2016, 4, 39–51. [Google Scholar]

- Kais, S.; Ben Mbarek, M. Dynamic relationship between CO2 emissions, energy consumption and economic growth in three North African countries. Int. J. Sustain. Energy 2015, 36, 840–854. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Hochman, G. Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 2017, 141, 1466–1478. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- Shahbaz, M.; Sarwar, S.; Chen, W.; Malik, M.N. Dynamics of electricity consumption, oil price and economic growth: Global perspective. Energy Policy 2017, 108, 256–270. [Google Scholar] [CrossRef] [Green Version]

- Sarkodie, S.A. The invisible hand and EKC hypothesis: What are the drivers of environmental degradation and pollution in Africa? Environ. Sci. Pollut. Res. Int. 2018, 25, 21993–22022. [Google Scholar] [CrossRef] [PubMed]

- WorldBank. World Development Indicators. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 7 December 2019).

- WorldBank. Sustainable Energy for All. Available online: https://databank.worldbank.org/source/sustainable-energy-for-all (accessed on 7 December 2019).

- Paramati, S.R.; Mo, D.; Gupta, R. The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ. 2017, 66, 360–371. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests With Panel Data And A New Simple Test. Oxf. Bull. Econ. Stat. 1999. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Paramati, S.R.; Alam, M.S.; Chen, C.-F. The Effects of Tourism on Economic Growth and CO2 Emissions: A Comparison between Developed and Developing Economies. J. Travel Res. 2016, 56, 712–724. [Google Scholar] [CrossRef] [Green Version]

- Banerjee, A. Panel Data Unit Roots and Cointegration: An Overview. Oxf. Bull. Econ. Stat. 1999, 0305–9049. [Google Scholar] [CrossRef]

- Jaunky, V.C. The CO2 emissions-income nexus: Evidence from rich countries. Energy Policy 2011, 39, 1228–1240. [Google Scholar] [CrossRef]

- Cerdeira Bento, J.P.; Moutinho, V. CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew. Sustain. Energy Rev. 2016, 55, 142–155. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E.; Menyah, K.; Wolde-Rufael, Y. On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol. Econ. 2010, 69, 2255–2260. [Google Scholar] [CrossRef]

- Shuai, C.; Chen, X.; Shen, L.; Jiao, L.; Wu, Y.; Tan, Y. The turning points of carbon Kuznets curve: Evidences from panel and time-series data of 164 countries. J. Clean. Prod. 2017, 162, 1031–1047. [Google Scholar] [CrossRef]

- Hassan, S.A.; Nosheen, M. Estimating the Railways Kuznets Curve for high income nations—A GMM approach for three pollution indicators. Energy Rep. 2019, 5, 170–186. [Google Scholar] [CrossRef]

| Variables | GDP | CO2 | AGR | NRE | RE |

|---|---|---|---|---|---|

| 1990 | |||||

| World Total | 14,195.14 | 5.621 | 323.662 | 0.054 | 0.009 |

| African High-Income Countries | 7542.559 | 2.163 | 414.204 | 0.018 | 0.001 |

| Share | 53.1% | 38.5% | 128% | 33.7% | 9% |

| African Upper-Middle Countries | 4677.346 | 3.525 | 303.086 | 0.019 | 0.011 |

| Share | 33% | 62.7% | 93.6% | 36.2% | 129.5% |

| African Lower-Middle Countries | 1484.587 | 0.57 | 243.601 | 0.005 | 0.009 |

| Share | 10.5% | 10.1% | 75.3% | 10.1% | 100.3% |

| African Low-Income Countries | 444.066 | 0.104 | 137.277 | 0.009 | 0.01 |

| Share | 3.1% | 1.8% | 42.4% | 17% | 113.9% |

| Full Africa | 1646.222 | 0.858 | 211.149 | 0.022 | 0.064 |

| Share | 11.6% | 15.3% | 65.2% | 41.6% | 744.5% |

| 2014 | |||||

| World Total | 19,474.91 | 6.278 | 625.506 | 0.053 | 0.011 |

| African High-Income Countries | 12,850.49 | 5.419 | 288.164 | 0.046 | 0.001 |

| Share | 66% | 86.3% | 46.1% | 86.6% | 5.2% |

| African Upper-Middle Countries | 8449.037 | 4.696 | 299 | 0.035 | 0.015 |

| Share | 43.4% | 74.8% | 47.8% | 66.9% | 131.6% |

| African Lower-Middle Countries | 2222.563 | 0.874 | 288.508 | 0.008 | 0.009 |

| Share | 11.4% | 13.9% | 46.1% | 14.8% | 77.7% |

| African Low-Income Countries | 592.939 | 0.169 | 166.8 | 0.008 | 0.008 |

| Share | 3% | 2.7% | 26.7% | 14.7% | 68% |

| Full Africa | 2704.68 | 1.23 | 236.419 | 0.035 | 0.066 |

| Share | 13.9% | 19.6% | 37.8% | 67.1% | 571.3% |

| Authors | Countries | Years | Variables | Methods | Results | EKC Hypothesis |

|---|---|---|---|---|---|---|

| Lin [47] | 5 African economies | 1980–2011 | CO2, Y, Y2, POP, EI/S UBR | STIRPAT model | EI/S → CO2 | ˟ |

| Magazzino [48] | 10 Middle East economies | 1971–2006 | CO2, Y, EC | Panel VAR | CO2 → Y EC → CO2 | ˟ |

| Ojewumi [49] | 33 Sub-Saharan African countries | 1980–2012 | CO2, Y, Y2, CIN, CLQ, CSF | Panel cointegration | Y → CSF Y → CFE | ˟ |

| Kais [50] | 3 North African economies | 1980–2012 | CO2, Y, Y2, EC | VECM | Y → CO2 UR → CO2 | Not investigated |

| Ogundipe [12], | 16 West Africa Countries | 1990–2012 | CO2, Y, Y2, WA, SA | WA | Y → CO2 | ˟ |

| Mehdi [10] | North Africa economies | 1980−2011 | CO2, RE, AGR, Y | VECM Granger causality | RE → CO2 (LR) | ✓ |

| Dong [51] | BRIC | 1985−2016 | CO2, RE, NG, Y, Y2 | Panel VECM causality | RE → CO2 | ˟ |

| Adu [1] | 16 West Africa Countries | 1970−2013 | CO2, Y, Y2, COWASTE, TO, POP, OER | fixed effects model (FEM), | Y → CO2 | ˟ |

| Zoundi [52] | 25 African countries | 1980–2012 | Y, Y2, CO2, RE | FMOLS, DOLS | RE → CO2 (LR) | ✓ |

| Shahbaz [53] | 19 African countries | 1971–2012 | CO2, Y, Y2, EI, GL | ARDL | EI → CO2 GL → CO2 | ✓ |

| Sarkodie [54] | 17 African countries | 1971–2013 | CO2, Y, Y2, AGLND, CBRT, ECF, ENC, | Panel cointegration | Y → CO2 AGLND → CO2 | ✓ |

| Dong [40] | 128 Economies | 1990–2014 | Y, CO2, POP, RE | Panel Granger Causality | P → CO2 Y → CO2 | Not investigated |

| Dong [31] | 14 Asia-Pacificcountries | 1970–2016 | Y, Y2, CO2, NG | Panel Granger Causality | NG → CO2 | ✓ |

| Qiao [18] | 19 nations of G20 countries | 1990−2014 | Y, Y2, CO2, AGR, RE | FMOLS VECM | RE → CO2 AGR → CO2 Y → CO2 | ✓ |

| Our Contribution | 54 African countries | 1990−2015 | Y, Y2, CO2, AGR, RE, NRE | FMOLS VECM | RE → CO2 AGR → CO2 Y → CO2 NRE → CO2 | ✓-income group-specific |

| Variables | Symbol | Unit | Definition of Measuring method | Data Source |

|---|---|---|---|---|

| Carbon dioxide emissions | CO2 | Metric Tons | Primarily from the consumption of fossil fuels and other emissions | World Development Indicators [55] |

| Agricultural value-added | AGR | US$ | The net outputs minus intermediate primary agricultural sector inputs | World Development Indicators [55] |

| Renewable energy | RE | TJ | Energy consumption from all renewable resources | Sustainable Energy for All [56] |

| Non-renewable energy | NRE | TJ | Total final energy consumption—renewable energy consumption | Sustainable Energy for All [56] |

| Gross domestic product | GDP | US$ | GDP | World Development Indicators [55] |

| Variables | Different Income Levels of African Countries | |||||||

|---|---|---|---|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |||||

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | Intercept | Intercept and Trend | Intercept | Intercept and Trend | |

| IPS | High Income | Lower-Middle-Income | ||||||

| −1.815 | −1.027 | −3.929 a | −3.739 b | −0.202 | −0.807 | −17.508 a | −16.592 a | |

| −0.334 | −3.143 | −3.587 a | −3.515 b | 0.628 | −3.140 a | −14.628 a | −9.571 a | |

| −1.440 | −0.145 | −4.583 a | −5.241 a | 0.503 | 2.518 | −12.467 a | −12.299 a | |

| −1.884 | −0.972 | −4.269 a | −4.690 a | 1.461 | 0.189 | −18.250 a | −16.808 a | |

| −0.334 | −3.143 | −3.587 a | −3.515 c | 5.097 | 0.033 | −11.952 a | −8.721 a | |

| −0.379 | −0.575 | −3.287 b | −5.122 a | 1.788 | 0.190 | −8.680 a | −8.444 a | |

| Fisher-ADF | ||||||||

| −1.189 | −1.091 | −3.885 a | −4.345 a | 51.840 | 54.175 b | 317.20 a | 279.02 a | |

| −1.633c | −2.591 | −4.485 a | −4.643 a | 45.931 | 88.938 a | 279.13 a | 233.35 a | |

| −1.191 | −0.746 | −4.685 a | −5.415 a | 40.271 | 30.494 | 245.77 a | 213.04 a | |

| −1.259 | −1.040 | −4.222 a | −4.909 a | 34.760 | 41.953 | 331.10 a | 278.91 a | |

| −0.447 | −3.288 b | −3.660 a | −3.679 b | 23.401 | 52.050 c | 199.41 a | 152.57 a | |

| −0.554 | −0.876 | −3.331 a | −4.952 a | 42.544 | 42.448 | 154.21 a | 142.94 a | |

| Fisher-PP | ||||||||

| −1.810 | −1.142 | −17.944 a | −4.132 a | 30.002 | 48.134 | 465.46 a | 604.80 a | |

| −2.489 | −2.740 | −4.502 a | −4.410 a | 49.824 | 83.670 a | 361.81 a | 628.53 a | |

| −1.440 | −0.145 | −4.583 a | −5.241 a | 26.151 | 22.263 | 264.28 a | 312.83 a | |

| −1.884 | −0.972 | −4.269 a | −4.690 a | 25.347 | 40.438 | 370.61 a | 419.52 a | |

| −0.334 | −3.143 | −3.587 b | −3.515 c | 14.056 | 42.817 | 198.16 a | 244.98 a | |

| −0.379 | −0.575 | −3.287 b | −5.122 a | 24.823 | 31.192 | 184.30 a | 219.83 a | |

| IPS | Upper−Middle-Income | Low Income | ||||||

| −1.516 | −11.132 a | 327.94 a | −16.349 a | 2.961 | 0.567 | −14.605 a | −12.545 a | |

| −1.011 | −4.256 a | −13.966 a | −8.270 a | 0.788 | −1.198 | −16.67 1a | −9.602 a | |

| 2.187 | −2.074 a | −9.466 a | −7.711 a | 1.627 | −4.941 a | −14.321 a | −16.086 a | |

| 0.147 | 1.089 | −7.814 a | −7.246 a | 3.543 | −4.307 a | −14.573 a | −16.337 a | |

| 2.373 | −0.571 | −9.125 a | −6.750 a | 1.584 | −1.513 c | −14.557 a | −10.729 a | |

| −2.491c | 1.840 | −6.348 a | −7.063 a | −0.783 | −0.628 | −13.166 a | −17.139 a | |

| Fisher-ADF | ||||||||

| 28.403 b | 286.66 a | 551.84 a | 356.91 a | 27.658 | 56.466 | 278.01 a | 223.76 a | |

| 22.444 b | 48.335 a | 154.81 a | 154.09 a | 46.081 | 70.950a | 327.82 a | 296.01 a | |

| 8.739 a | 28.435 b | 106.35 a | 81.899 a | 39.506 | 117.651a | 277.84 a | 314.81 a | |

| 20.033 | 10.912 | 86.864 a | 73.180 a | 32.922 | 108.340a | 275.21a | 307.36 a | |

| 9.955 | 24.337 c | 98.095 a | 70.376 a | 45.647 | 65.353b | 287.84 a | 242.49 a | |

| 55.917 a | 8.667 | 71.543 a | 69.609 a | 302.28 a | 75.563 a | 272.09 a | 535.08 a | |

| Fisher-PP | ||||||||

| 66.450 b | 296.13 a | 1126.2 a | 617.51 a | 26.740 | 48.400 | 317.55 a | 300.76 a | |

| 28.172 a | 34.276 a | 139.91 a | 249.74 a | 56.736 | 85.252 a | 388.94 a | 830.53 a | |

| 10.749 a | 12.734 | 108.42 a | 98.509 a | 54.556 | 54.116 | 314.87 a | 359.35 a | |

| 17.160 | 12.007 | 97.525 a | 141.17 a | 39.566 | 40.138 | 317.11 a | 344.40 a | |

| 9.266 | 24.597 c | 125.92 a | 306.51 a | 45.122 | 66.437 b | 319.86 a | 388.92 a | |

| 12.215 a | 15.160 | 70.643 a | 72.056 a | 46.405 | 53.180 | 315.32 a | 568.82 a | |

| IPS | Full Africa Sample | Full World Sample | ||||||

| 1.192 | −4.229 a | −27.982 a | −25.336 a | −3.519 a | −2.538 a | −41.275 a | −35.262 a | |

| 0.417 | −4.254 a | −26.015 a | −15.743 a | 0.976 | −3.556 a | −37.000 a | −26.698 a | |

| 1.444 | −4.304 a | −22.234 a | −19.997 a | 1.347 | −4.494 | −43.966 a | −35.549 a | |

| 2.126 | −0.841 | −26.012 a | −23.604 a | −1.230 | −2.561 a | −42.063 a | −36.094 a | |

| 5.290 | −1.422 c | −21.002 a | −15.385 a | 7.891 | −3.492 a | −30.857 a | −25.345 a | |

| 1.092 | −0.370 | −18.326 a | −16.259 a | 1.905 | −6.014 a | −29.637 a | −26.316 a | |

| Fisher-ADF | ||||||||

| 109.923 | 397.46 a | 933.16 a | 867.74 a | 503.81 a | 462.346 a | 2034.77 a | 1736.3 a | |

| 118.54 c | 211.16 a | 774.60 a | 692.84 a | 283.189 | 409.701 a | 1737.51 a | 1360.6 a | |

| 88.599 | 217.17 a | 653.54 a | 546.49 a | 348.96 a | 497.023 a | 2118.80 a | 1850.3 a | |

| 198.41 a | 128.58 c | 743.81 a | 619.98 a | 476.54 a | 487.352 a | 2082.78 a | 1758.2 a | |

| 79.201 | 145.99 a | 593.89 a | 471.06 a | 215.398 | 711.262 a | 1568.76 a | 1218.7 a | |

| 145.78 a | 131.83 b | 541.03 a | 494.95 a | 432.63 a | 760.972 a | 1538.18 a | 1367.0 a | |

| Fisher-PP | ||||||||

| 125.200 | 392.88 a | 1345.1 a | 1531.1 a | 435.75 a | 718.816 a | 3060.07 a | 5034.0 a | |

| 138.81 a | 206.13 a | 903.42 a | 1718.0 a | 254.500 | 343.177 b | 1994.65 a | 2375.2 a | |

| 99.079 | 96.702 | 667.47 a | 584.05 a | 405.41 a | 404.183 a | 2255.14 a | 3766.8 a | |

| 65.796 | 110.220 | 803.34 a | 818.56 a | 517.17 a | 566.913 a | 2334.32 a | 3695.1 a | |

| 68.700 | 134.86 b | 651.82 a | 945.38 a | 241.896 | 389.078 a | 1485.72 a | 1618.1 a | |

| 108.217 | 112.817 | 631.50 a | 946.59 a | 595.43 a | 759.302 a | 1489.38 a | 1876.3 a | |

| AHIC | AUMICs | ALMICs | ALICs | Full Africa Sample | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Hypothesized | Trace Test | Max-Eigen Test | Trace Test | Max-Eigen Test | Trace Test | Max-Eigen Test | Trace Test | Max-Eigen Test | Trace Test | Max-Eigen Test |

| None | 145.7 a | 0.923 a | 134.5 a | 88.28 a | 660.6 a | 364.9 a | 741.8 a | 387.5 a | 1385.0 a | 780.7 a |

| At most 1 | 86.73 a | 0.794 a | 60.70 a | 43.96 a | 370.3 a | 201.9 a | 396.9 a | 220.2 a | 752.2 a | 422.3 a |

| At most 2 | 50.3 b | 0.69b | 25.83 a | 24.97 a | 209.4 a | 116.3 a | 219.5 a | 126.3 a | 414.2 a | 226.3 a |

| At most 3 | 23.01 | 0.375 | 9.180 | 6.499 | 119.2 a | 64.51 a | 120.9 a | 77.70 a | 246.3 a | 152.7 a |

| At most 4 | 12.18 | 0.275 | 7.796 | 7.844 | 85.50 a | 67.87 a | 72.54 a | 59.21 a | 155.3 a | 138.2 a |

| At most 5 | 4.767 | 0.187 | 9.328 | 9.328 | 66.70 a | 66.70 a | 60.36 a | 60.36 a | 111.6 a | 111.6 a |

| Variables | AHICs | AUMICs | ALMICs | ALICs | FULL AFRICA |

|---|---|---|---|---|---|

| 0.1512 [1.163] | 0.426 [1.531] | 0.847 [2.332] | 0.2191 [1.245] | 9.053 [8545.768] | |

| ln GDP | 0.235 a (0.001) | 0.636 a (0.000) | 0.586 a (0.000) | 0.466 a (0.000) | 0.851 a (0.000) |

| (ln GDP)2 | 0.777 a (0.019) | −0.747 a (0.001) | −0.346 a (0.001) | −1.063 a (0.000) | −0.047 (0.232) |

| ln AGR | 0.207 a (0.003) | −0.201 (0.228) | −0.154 a (0.000) | −0.447 a (0.004) | −1.068 a (0.000) |

| ln RE | −0.072 a (0.013) | −0.003 (0.924) | −0.033 a (0.182) | 10.894 a (0.000) | −0.120 a (0.000) |

| ln NRE | 0.780 a (0.000) | 0.837 a (0.000) | 0.790 a (0.000) | −10.289 a (0.00) | 0.346 a (0.000) |

| R2 | 0.991690 | 0.594493 | 0.871796 | 0.244991 | 0.638930 |

| Adjusted R-squared | 0.989940 | 0.582653 | 0.870569 | 0.237918 | 0.63746 |

| Dependent Variable | Short-Run | Long-Run | ||||

|---|---|---|---|---|---|---|

| F-Stat (p-Value) | t-Stat (p-Value) | |||||

| High-Income Countries | ||||||

| - | 2.875 (0.109) | 0.295 (0.594) | 0.056 (0.815) | 4.039 c (0.061) | −1.350 b (0.052) | |

| 0.032 (0.858) | - | 0.157 (0.696) | 0.253 (0.620) | 0.341 (0.566) | 0.145 (0.636) | |

| 18.854 a (0.000) | 0.078 (0.782) | - | 23.649 a (0.0001) | 0.329 (0.573) | 1.695 a (0.000) | |

| 0.892 (0.358) | 1.563 (0.228) | 0.068 (0.796) | - | 2.951 (0.103) | −0.953 (0.198) | |

| 0.052 (0.822) | 1.178 (0.292) | 0.645 (0.432) | 0.307 (0.586) | - | 0.044 (0.791) | |

| Causality Direction | GDP → CO2, CO2 → RE, NRE → RE | CO2 | ||||

| Upper-Income Countries | ||||||

| - | 0.789 (0.375) | 0.820 (0.366) | 0.002 (0.960) | 0.054 (0.815) | −0.081 a (0.003) | |

| 0.029 (0.864) | - | 0.460 (0.498) | 0.677 (0.411) | 6.393 b (0.012) | −0.021 b (0.014) | |

| 0.687 (0.408) | 0.084 (0.771) | - | 1.250 (0.265) | 1.958 (0.164) | 0.002 (0.480) | |

| 0.490 0.484 | 0.014 (0.905) | 0.542 (0.462) | - | 0.897 (0.345) | −0.021a (0.001) | |

| −0.009 a (0.001) | 0.129 (0.719) | 0.336 (0.562) | 0.839 (0.361) | - | 0.943 (0.333) | |

| Causality Direction | GDP → AGR, CO2 → GDP | CO2 → AGRCO2 → NRE | ||||

| Lower-Middle-Income Countries | ||||||

| - | 0.103 (0.901) | 3.091 b (0.046) | 2.652 c (0.071) | 3.392 b (0.034) | −0.090 b (0.003) | |

| 1.384 (0.251) | - | 0.212 (0.808) | 0.118 (0.888) | 5.203 a (0.005) | −0.001 (0.943) | |

| 1.533 (0.217) | 0.151 (0.859) | - | 0.449 (0.638) | 0.110 (0.895) | −0.029 b (0.056) | |

| 3.848 b (0.022) | 1.241 (0.290) | 1.844 (0.159) | - | 5.466 a (0.004) | 0.039 (0.162) | |

| 0.853 (0.426) | 10.644 a (0.000) | 0.130 (0.877) | 0.225 (0.798) | - | −0.003 (0.565) | |

| Causality Direction | RE → CO2, NRE → CO2, GDP → CO2, GDP → AGR, GDP → NRE | CO2 → RE | ||||

| Low-Income Countries | ||||||

| - | 0.458 (0.498) | 0.435 (0.509) | 0.392 (0.531) | 2.794 c (0.095) | 0.0004 (0.511) | |

| 2.342 (0.126) | - | 6.391 b (0.011) | 6.503 b (0.011) | 4.714 b (0.030) | 0.001 b (0.021) | |

| 0.466 (0.494) | 0.050 (0.821) | - | 1.109 (0.292) | 8.693 a (0.003) | 4.080 (0.932) | |

| 0.480 (0.488) | 0.069 (0.792) | 1.509 (0.219) | - | 8.954 a (0.002) | −6.460 (0.894) | |

| 3.189 b (0.074) | 4.170 b (0.041) | 3.072 c (0.080) | 10.454 a (0.001) | - | 0.421 a (0.008) | |

| Causality Direction | GDP → CO2, RE → AGR, NRE → AGR, GDP → AGR, GDP → RE, GDP → NRE | |||||

| Full Africa Sample | ||||||

| - | 0.104 (0.747) | 0.587 (0.443) | 1.906 (0.167) | 5.245 b (0.022) | −0.034 b (0.000) | |

| 1.850 (0.999) | - | 0.137 (0.710) | 0.628 (0.428) | 4.183 b (0.041) | 0.009 c (0.074) | |

| 1.525 (0.217) | 0.122 (0.726) | - | 0.016 (0.898) | 0.0008 (0.976) | 0.007 (0.114) | |

| 1.484 (0.223) | 0.243 (0.621) | 0.680 (0.409) | - | 0.618 (0.431) | 0.0017 (0.817) | |

| 1.720 (0.189) | 9.532 a (0.002) | 0.060 (0.805) | 3.506 c (0.061) | - | 0.004 (0.124) | |

| Causality Direction | GDP → CO2, GDP → AGR, NRE → GDP | ln CO2 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tachega, M.A.; Yao, X.; Liu, Y.; Ahmed, D.; Ackaah, W.; Gabir, M.; Gyimah, J. Income Heterogeneity and the Environmental Kuznets Curve Turning Points: Evidence from Africa. Sustainability 2021, 13, 5634. https://doi.org/10.3390/su13105634

Tachega MA, Yao X, Liu Y, Ahmed D, Ackaah W, Gabir M, Gyimah J. Income Heterogeneity and the Environmental Kuznets Curve Turning Points: Evidence from Africa. Sustainability. 2021; 13(10):5634. https://doi.org/10.3390/su13105634

Chicago/Turabian StyleTachega, Mark Awe, Xilong Yao, Yang Liu, Dulal Ahmed, Wilhermina Ackaah, Mohamed Gabir, and Justice Gyimah. 2021. "Income Heterogeneity and the Environmental Kuznets Curve Turning Points: Evidence from Africa" Sustainability 13, no. 10: 5634. https://doi.org/10.3390/su13105634

APA StyleTachega, M. A., Yao, X., Liu, Y., Ahmed, D., Ackaah, W., Gabir, M., & Gyimah, J. (2021). Income Heterogeneity and the Environmental Kuznets Curve Turning Points: Evidence from Africa. Sustainability, 13(10), 5634. https://doi.org/10.3390/su13105634