Impacts of the FLEGT Action Plan and the EU Timber Regulation on EU Trade in Timber Product

Abstract

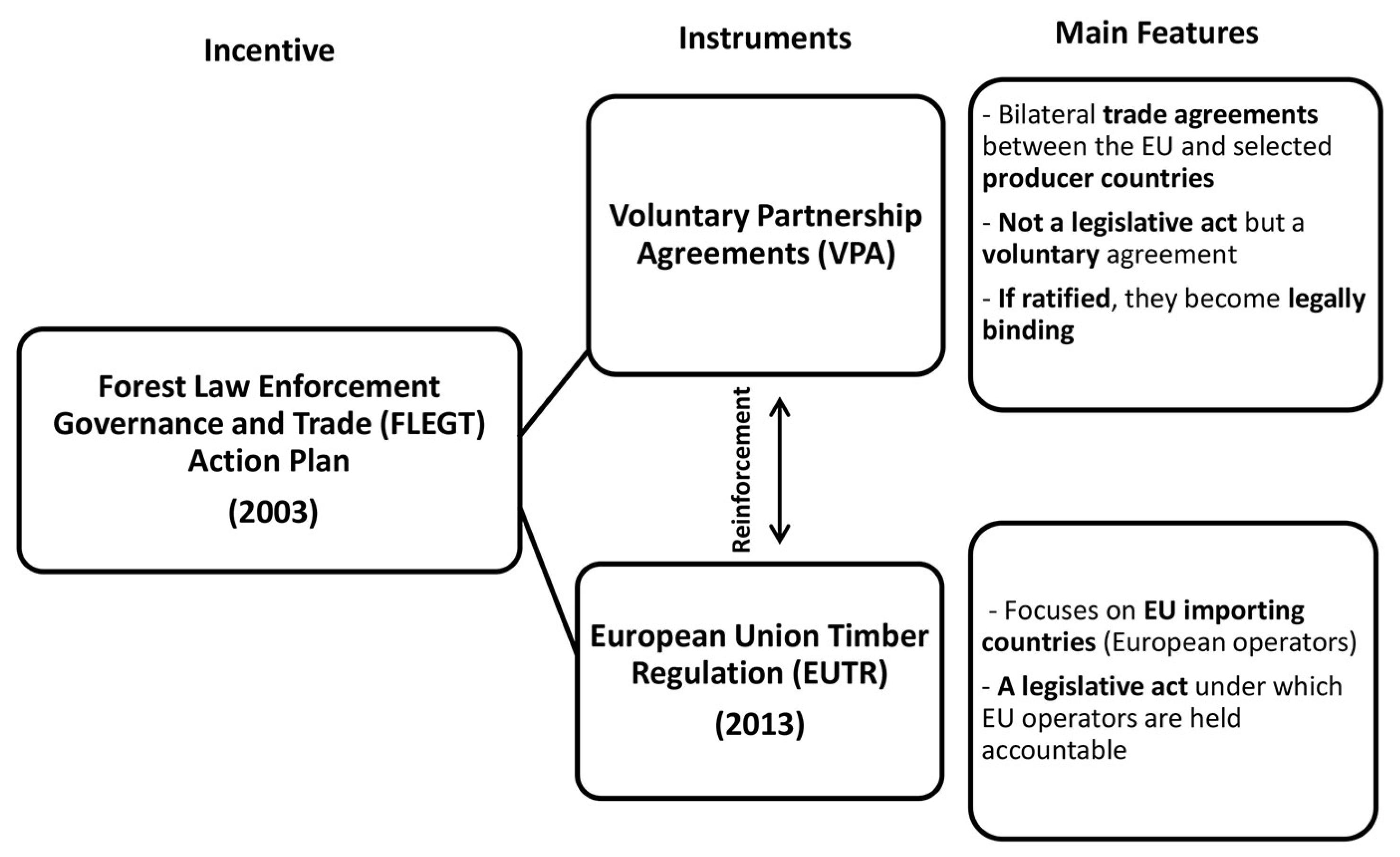

:1. Introduction

2. Materials and Methods

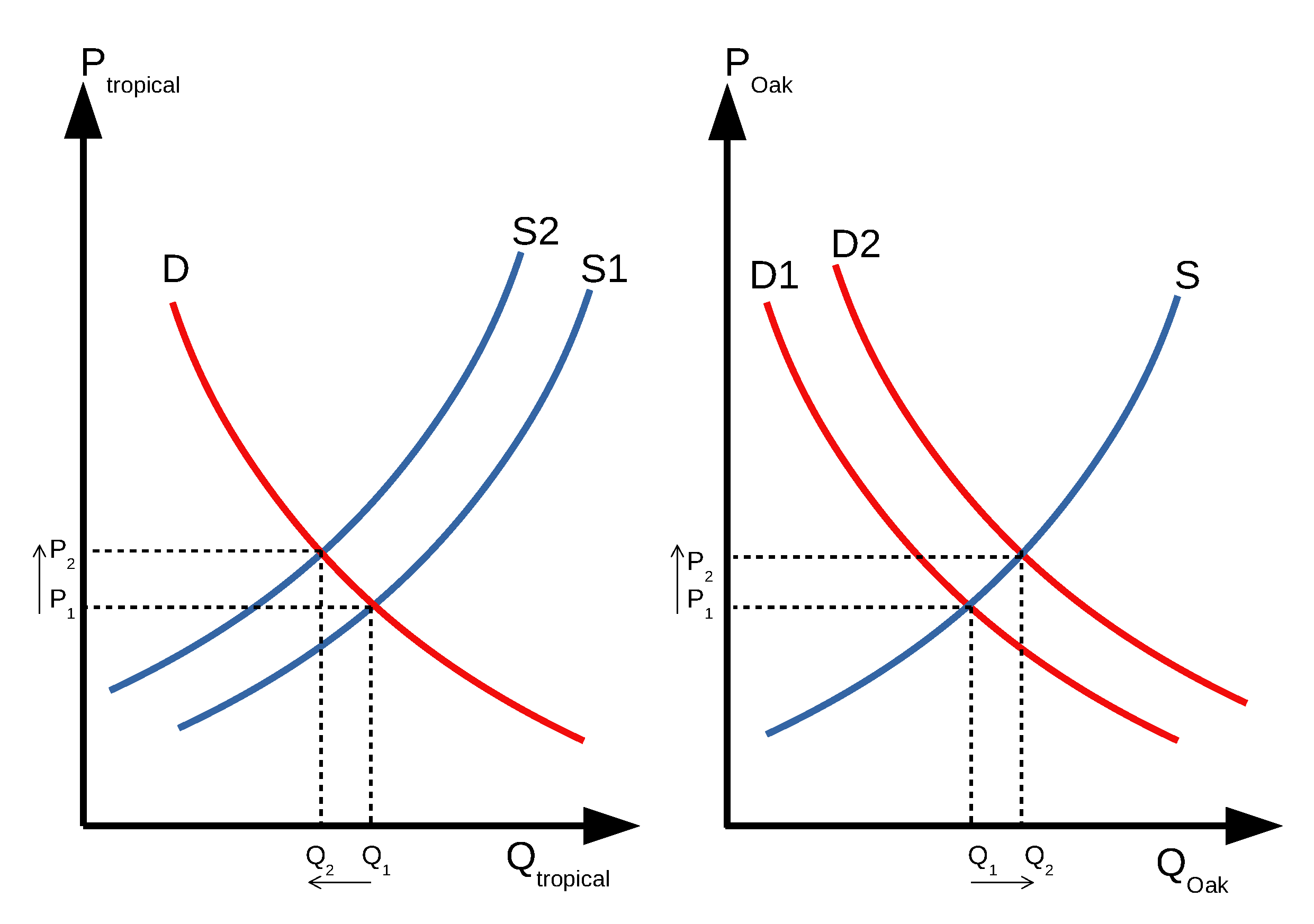

2.1. Shock Model

2.2. Demand Model

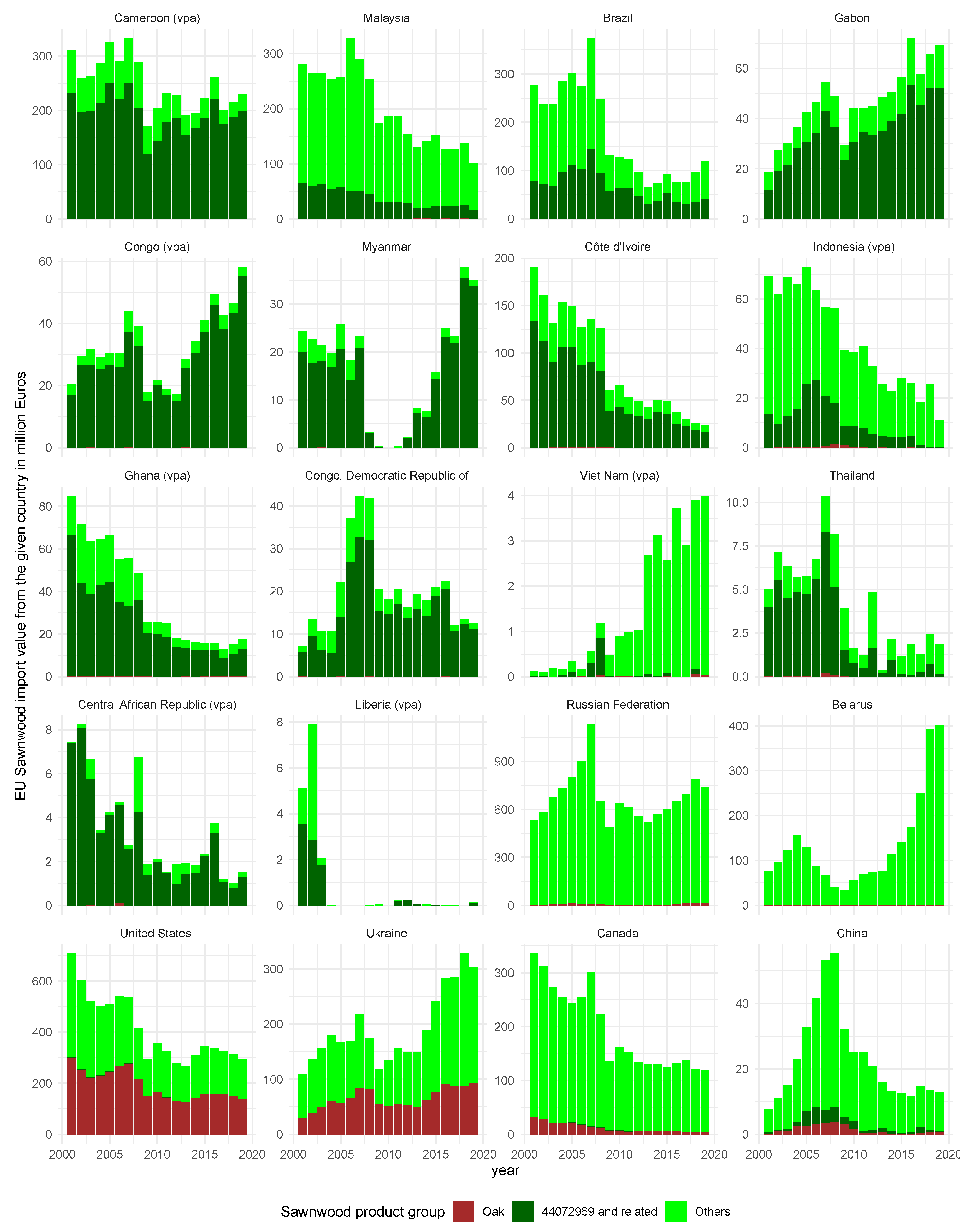

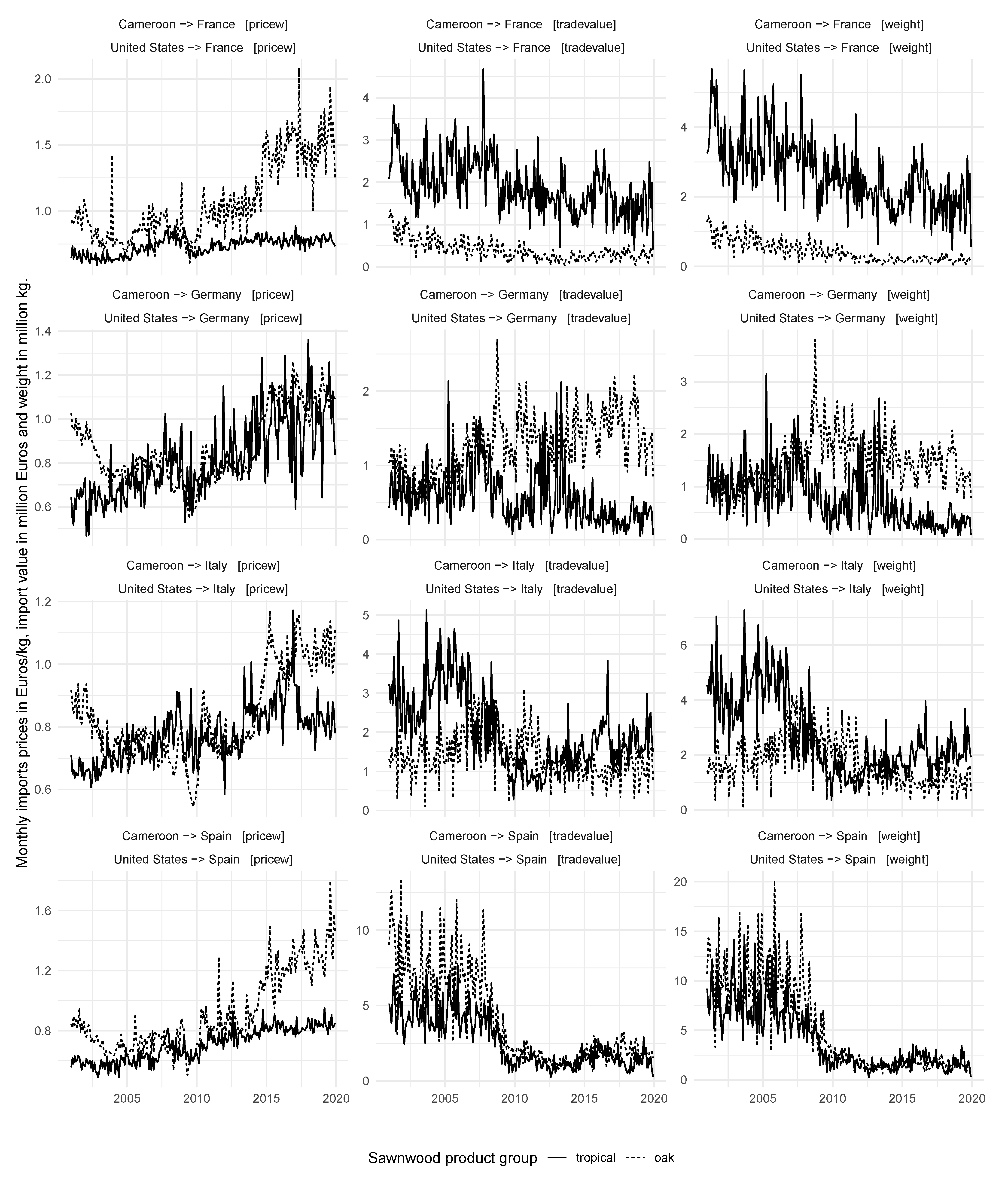

3. Data Preparation

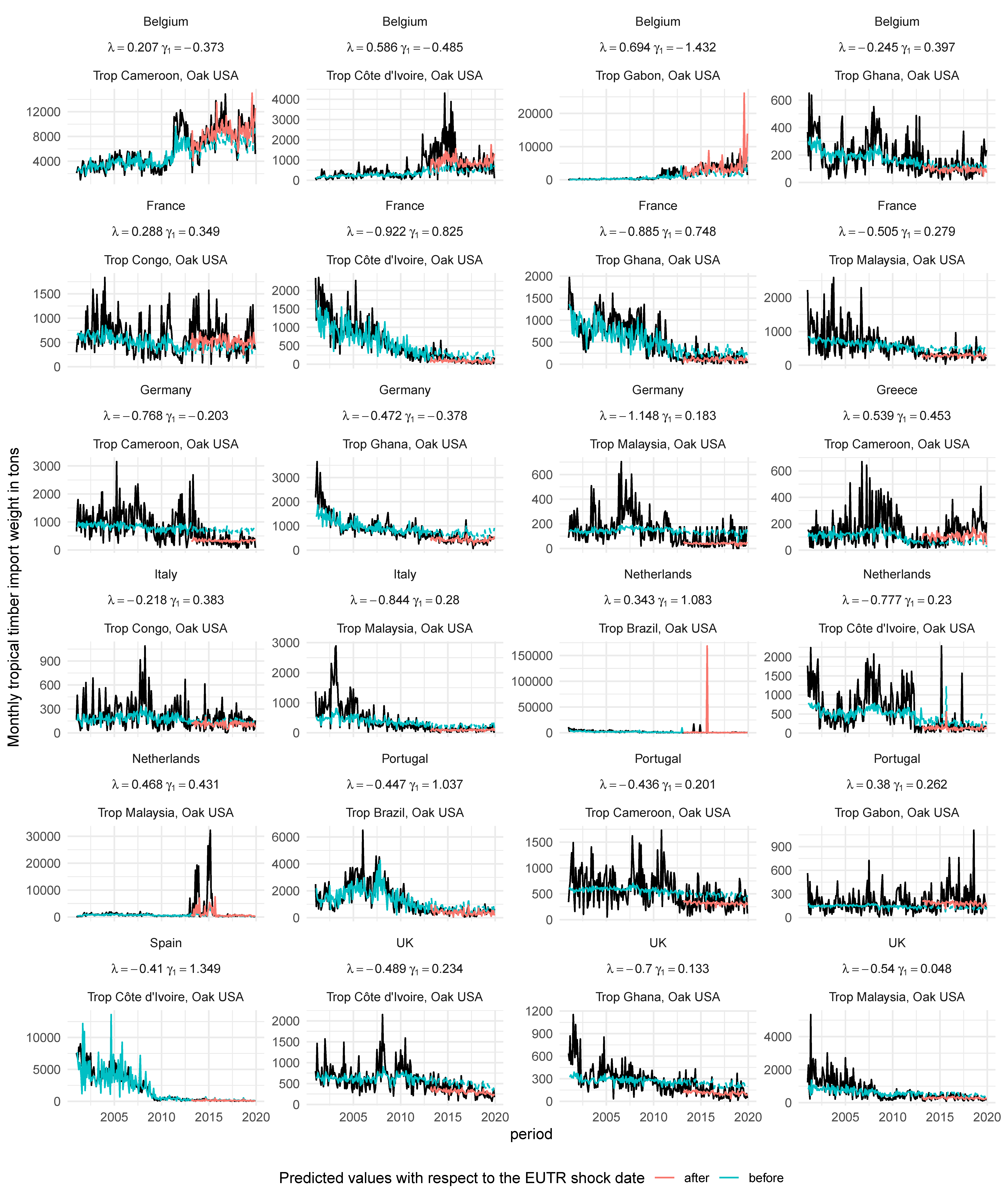

4. Results and Discussion

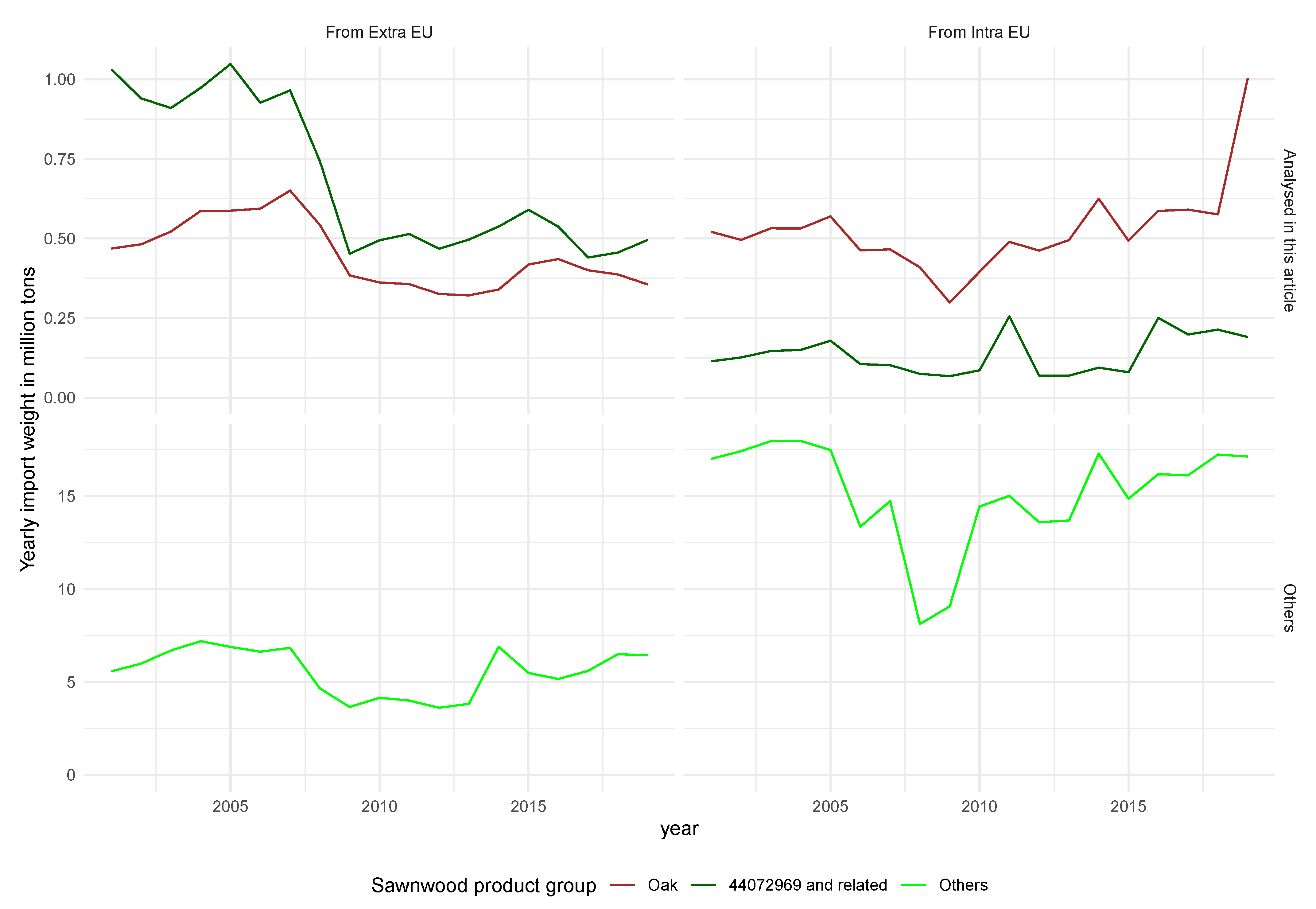

4.1. Shock Model Estimated on Time Series

4.2. Demand Model Estimated on Panel Data

5. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ADF | Augmented Dickey Fuller |

| CN | Combined Nomenclature |

| FLEGT | Forest Law Enforcement, Governance and Trade |

| EUTR | European Union Timber Regulation |

Appendix A. Extra Tables and Graphs

| Code | Description |

|---|---|

| 44072180 | Meranti bakau, white seraya, yellow meranti, alen, keruing, ramin, kapur, teak, jongkong, merbau, jelutong and kempas, sawn or cut lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or finger-jointed) |

| 44072190 | Dark red meranti, light red meranti, meranti bakau, white lauan, white meranti, white seraya, yellow meranti, alen, keruing, ramin, kapur, teak, jongkong, merbau, jelutong, and kempas, sawn or cut lengthwise, sliced or barked, with a thickness of >6 mm (excl. planed, sanded, or finger-jointed) |

| 44072260 | Azobé, sawn or cut lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or finger-jointed) |

| 44072280 | Okoumé, obeche, sapelli, sipo, acajou d’Afrique, makoré, iroko, tiama, mansonia, ilomba, dibétou, and limba woods, sawn or cut lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or finger-jointed) |

| 44072290 | Okoume, obeche, sapele, utile, african mahogany, makore, iroko, tiama, mansonia, ilomba, dibetou, limba, and azobe, sawn or cut lengthwise, sliced or barked, with a thickness of > 6mm (excl. planed, sanded, or finger-jointed) |

| 44072799 | Sapelli, sawn, or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. planed, sanded, or end-jointed) |

| 44072899 | Iroko, sawn, or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. planed, sanded, or end-jointed) |

| 44072960 | Keruing, ramin, kapur, teak, jongkong, merbau, jelutong, kempas, okoumé, obeche, sipo, acajou d’Afrique, makoré, tiama, mansonia, ilomba, dibétou, limba, azobé, palissandre de Rio, palissandre de Para, and palissandre de rose, sawn or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or end-jointed) |

| 44072961 | Azobé, sawn or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or end-jointed) |

| 44072968 | Keruing, ramin, kapur, teak, jongkong, merbau, jelutong, kempas, okoumé, obeche, sipo, acajou d’Afrique, makoré, tiama, mansonia, ilomba, dibétou, limba, palissandre de Rio, palissandre de Para, and palissandre de rose, sawn or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or end-jointed) |

| 44072969 | Keruing, ramin, kapur, teak, jongkong, merbau, jelutong, kempas, okoumé, obeche, sapelli, sipo, acajou d’Afrique, makoré, iroko, tiama, mansonia, ilomba, dibétou, limba, palissandre de Rio, palissandre de Para, and palissandre de rose, sawn or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. such products planed, sanded, or end-jointed) |

| 44072995 | Abura, afrormosia, ako, andiroba, aningré, avodiré, balau, bossé clair, bossé foncé, cativo, cedro, dabema, doussié, framiré, freijo, fromager, fuma, geronggang, ipé, jaboty, jequitiba, kosipo, kotibé, koto, louro, maçaranduba, mahogany (excl. “Swietenia spp.”), mandioqueira, mengkulang, merawan, merpauh, mersawa, moabi, niangon, nyatoh, onzabili, orey, ovengkol, ozigo, padauk, paldao, palissandre de Guatemala, pau Amarelo, pau marfim, pulai, punah, quaruba, saqui-saqui, sepetir, sucupira, suren, tauari, tola, keruing, ramin, kapur, teak, jongkong, merbau, jelutong, kempas, okoumé, obeche, sipo, acajou d’Afrique, makoré, tiama, mansonia, ilomba, dibétou, limba, azobé, palissandre de Rio, palissandre de Para, and palissandre de Rose, sawn or chipped lengthwise, sliced or peeled, of a thickness of >6 mm (excl. end-jointed, planed, and sanded) |

| 44072999 | Abura, afrormosia, ako, andiroba, aningré, avodiré, balau, bossé clair, bossé foncé, cativo, cedro, dabema, doussié, framiré, freijo, fromager, fuma, geronggang, ipé, jaboty, jequitiba, kosipo, kotibé, koto, louro, maçaranduba, mahogany (excl. “Swietenia spp.”), mengkulang, merawan, merpauh, mersawa, moabi, niangon, nyatoh, onzabili, orey, ovengkol, ozigo, padauk, paldao, palissandre de Guatemala, pau marfim, pulai, punah, saqui-saqui, sepetir, sucupira, suren, and tola, sawn or chipped lengthwise, sliced or peeled, of a thickness >6 mm (excl. finger-jointed, planed, or sanded) |

| Brazil | Cameroon | Central African Republic | China | Congo | Côte d’Ivoire | Gabon | Ghana | Indonesia | Malaysia | Myanmar | Thailand | Viet Nam | Congo, Democratic Republic of | Liberia | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Austria | 179 | 207 | 227 | 212 | 215 | 212 | 227 | 165 | 167 | 214 | 223 | 227 | 227 | ||

| Belgium | 0 | 0 | 102 | 181 | 34 | 2 | 6 | 6 | 56 | 1 | 128 | 202 | 225 | 2 | 226 |

| Bulgaria | 227 | 193 | 226 | 220 | 208 | 225 | 211 | 226 | 227 | 227 | |||||

| Croatia | 200 | 104 | 227 | 218 | 201 | 169 | 215 | 157 | 194 | 203 | 173 | 223 | 227 | 212 | 227 |

| Cyprus | 204 | 148 | 227 | 227 | 219 | 103 | 199 | 190 | 223 | 227 | 166 | ||||

| Czech Republic | 181 | 170 | 226 | 227 | 202 | 225 | 182 | 167 | 219 | 215 | 226 | 225 | 227 | ||

| Denmark | 0 | 49 | 223 | 196 | 49 | 174 | 206 | 85 | 124 | 53 | 94 | 174 | 224 | 202 | 227 |

| Estonia | 216 | 225 | 223 | 196 | 221 | 225 | 224 | 226 | |||||||

| Finland | 206 | 167 | 222 | 184 | 172 | 220 | 188 | 127 | 132 | 202 | 184 | 227 | 224 | ||

| France | 0 | 0 | 132 | 169 | 1 | 6 | 0 | 9 | 46 | 0 | 140 | 210 | 222 | 95 | 185 |

| Germany | 29 | 0 | 201 | 192 | 46 | 26 | 100 | 0 | 42 | 17 | 91 | 174 | 225 | 157 | 224 |

| Greece | 191 | 14 | 227 | 215 | 192 | 2 | 152 | 135 | 171 | 156 | 175 | 217 | 204 | 225 | |

| Hungary | 225 | 219 | 223 | 224 | 221 | 225 | 214 | 212 | 222 | 225 | |||||

| Ireland | 206 | 3 | 219 | 171 | 50 | 216 | 108 | 222 | 215 | 225 | 216 | ||||

| Italy | 65 | 0 | 174 | 103 | 9 | 0 | 0 | 9 | 87 | 6 | 49 | 145 | 213 | 65 | 210 |

| Latvia | 225 | 227 | 225 | ||||||||||||

| Lithuania | 207 | 155 | 226 | 220 | 214 | 199 | 226 | 186 | 144 | 215 | 223 | 218 | |||

| Luxembourg | 227 | 227 | 227 | ||||||||||||

| Malta | 221 | 138 | 224 | 220 | 136 | 222 | 159 | 226 | 226 | 223 | 219 | ||||

| Netherlands | 0 | 0 | 218 | 205 | 96 | 14 | 39 | 54 | 75 | 0 | 114 | 129 | 226 | 125 | 223 |

| Poland | 125 | 111 | 221 | 219 | 79 | 112 | 171 | 154 | 82 | 138 | 148 | 220 | 187 | ||

| Portugal | 0 | 1 | 200 | 224 | 33 | 77 | 14 | 193 | 222 | 225 | 223 | 52 | 227 | ||

| Romania | 225 | 157 | 221 | 225 | 202 | 181 | 217 | 214 | 206 | 215 | 226 | 223 | |||

| Slovakia | 223 | 219 | 225 | 221 | 227 | 219 | 223 | 227 | 221 | 227 | |||||

| Slovenia | 199 | 191 | 226 | 221 | 222 | 212 | 224 | 211 | 211 | 222 | 180 | 224 | 227 | 220 | 227 |

| Spain | 2 | 0 | 99 | 200 | 21 | 4 | 39 | 83 | 146 | 186 | 186 | 211 | 99 | 222 | |

| Sweden | 172 | 201 | 205 | 202 | 214 | 222 | 185 | 126 | 108 | 110 | 192 | 226 | |||

| Utd. Kingdom | 119 | 0 | 206 | 193 | 26 | 2 | 198 | 0 | 116 | 0 | 145 | 206 | 227 | 84 | 225 |

| Brazil | Cameroon | Central African Republic | China | Congo | Côte d’Ivoire | Gabon | Ghana | Indonesia | Malaysia | Myanmar | Thailand | Viet Nam | Congo, Democratic Republic of | Liberia | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Austria | 78 | 31 | 92 | 113 | 34 | 38 | 153 | 18 | 155 | ||||||

| Belgium | 9967 | 75,169 | 1017 | 178 | 9949 | 8501 | 6362 | 23,497 | 1267 | 675 | 55 | 1802 | 957 | 78 | |

| Bulgaria | 1 | 59 | 20 | 34 | 38 | 24 | |||||||||

| Croatia | 29 | 181 | 23 | 25 | 23 | 64 | 31 | 19 | 15 | 42 | 1009 | 36 | |||

| Cyprus | 29 | 329 | 58 | 183 | 244 | 295 | 67 | ||||||||

| Czech Republic | 51 | 49 | 18 | 197 | 14 | 11 | 29 | 25 | 7 | 13 | 929 | ||||

| Denmark | 3190 | 697 | 22 | 95 | 1212 | 120 | 52 | 39 | 249 | 246 | 648 | 1101 | 62 | ||

| Estonia | 81 | 60 | 15 | 27 | 268 | ||||||||||

| Finland | 26 | 178 | 1 | 190 | 30 | 10 | 177 | 432 | 274 | ||||||

| France | 14,778 | 19,207 | 217 | 94 | 5616 | 507 | 1873 | 2756 | 1876 | 1307 | 112 | 4403 | 108 | 14 | 27 |

| Germany | 1177 | 5511 | 77 | 90 | 1200 | 751 | 1109 | 231 | 5875 | 568 | 3567 | 3321 | 206 | ||

| Greece | 57 | 1268 | 120 | 65 | 34 | 1940 | 132 | 298 | 116 | 15 | 128 | 726 | 63 | ||

| Hungary | 0 | 2 | |||||||||||||

| Ireland | 27 | 8624 | 24 | 315 | 174 | 659 | 80 | 83 | 89 | 33 | |||||

| Italy | 308 | 17,472 | 100 | 448 | 1492 | 543 | 6674 | 10,342 | 866 | 242 | 2656 | 8673 | 115 | 4 | |

| Latvia | |||||||||||||||

| Lithuania | 24 | 110 | 2 | 25 | 19 | 37 | 52 | 523 | 70 | ||||||

| Luxembourg | |||||||||||||||

| Malta | 407 | 60 | 60 | 51 | 85 | 55 | 90 | 47 | |||||||

| Netherlands | 4700 | 10,728 | 49 | 130 | 2402 | 1523 | 1774 | 1638 | 345 | 246 | 5455 | 1255 | 467 | 113 | |

| Poland | 100 | 175 | 62 | 18 | 360 | 100 | 115 | 83 | 38 | 353 | 111 | 512 | 99 | ||

| Portugal | 4528 | 4067 | 240 | 11 | 1343 | 630 | 214 | 1938 | 48 | 46 | 112 | ||||

| Romania | 9 | 97 | 79 | 104 | 19 | 32 | 36 | 117 | 36 | 0 | |||||

| Slovakia | 38 | 51 | 20 | 10 | |||||||||||

| Slovenia | 142 | 60 | 37 | 125 | 40 | 26 | 49 | 21 | 19 | 159 | 12 | ||||

| Spain | 4377 | 16,352 | 226 | 46 | 909 | 365 | 2424 | 858 | 175 | 40 | 58 | 266 | |||

| Sweden | 88 | 39 | 10 | 223 | 280 | 517 | 0 | 67 | |||||||

| Utd. Kingdom | 195 | 19,235 | 47 | 142 | 7862 | 2147 | 6107 | 191 | 2148 | 238 | 57 | 4329 | 299 | 31 | 19 |

| Reporter | Partner T | ADF Test | Lag Order | p Value | Stationarity | N |

|---|---|---|---|---|---|---|

| Belgium | Côte d’Ivoire | −4.595 | 5 | 0.010 | I(0) | 146 |

| France | Gabon | −4.386 | 5 | 0.010 | I(0) | 146 |

| Ireland | Cameroon | −4.238 | 5 | 0.010 | I(0) | 146 |

| Italy | Ghana | −4.170 | 5 | 0.010 | I(0) | 146 |

| Denmark | Brazil | −4.080 | 5 | 0.010 | I(0) | 146 |

| Germany | Malaysia | −4.040 | 5 | 0.010 | I(0) | 146 |

| Utd. Kingdom | Ghana | −3.997 | 5 | 0.011 | I(0) | 146 |

| Portugal | Gabon | −3.942 | 5 | 0.014 | I(0) | 146 |

| Germany | Ghana | −3.914 | 5 | 0.015 | I(0) | 146 |

| Italy | Congo | −3.880 | 5 | 0.017 | I(0) | 146 |

| Greece | Cameroon | −3.851 | 5 | 0.018 | I(0) | 146 |

| France | Côte d’Ivoire | −3.752 | 5 | 0.023 | I(0) | 146 |

| Belgium | Congo DRC | −3.669 | 5 | 0.030 | I(0) | 146 |

| France | Brazil | −3.630 | 5 | 0.033 | I(0) | 146 |

| Utd. Kingdom | Malaysia | −3.591 | 5 | 0.037 | I(0) | 146 |

| Germany | Cameroon | −3.568 | 5 | 0.039 | I(0) | 146 |

| Italy | Malaysia | −3.562 | 5 | 0.039 | I(0) | 146 |

| Belgium | Malaysia | −3.548 | 5 | 0.041 | I(0) | 146 |

| Utd. Kingdom | Côte d’Ivoire | −3.543 | 5 | 0.041 | I(0) | 146 |

| Netherlands | Brazil | −3.501 | 5 | 0.045 | I(0) | 146 |

| Italy | Cameroon | −3.452 | 5 | 0.049 | I(0) | 146 |

| Spain | Cameroon | −3.412 | 5 | 0.055 | I(1) | 146 |

| France | Congo | −3.380 | 5 | 0.061 | I(1) | 146 |

| France | Malaysia | −3.334 | 5 | 0.068 | I(1) | 146 |

| Spain | Brazil | −3.198 | 5 | 0.091 | I(1) | 146 |

| Belgium | Ghana | −3.150 | 5 | 0.099 | I(1) | 146 |

| Belgium | Brazil | −3.082 | 5 | 0.126 | I(1) | 146 |

| Greece | Côte d’Ivoire | −2.839 | 5 | 0.227 | I(1) | 146 |

| Netherlands | Côte d’Ivoire | −2.748 | 5 | 0.265 | I(1) | 146 |

| Netherlands | Cameroon | −2.700 | 5 | 0.285 | I(1) | 146 |

| Spain | Côte d’Ivoire | −2.686 | 5 | 0.291 | I(1) | 146 |

| France | Ghana | −2.659 | 5 | 0.302 | I(1) | 146 |

| Belgium | Gabon | −2.510 | 5 | 0.364 | I(1) | 146 |

| Netherlands | Malaysia | −2.315 | 5 | 0.445 | I(1) | 146 |

| Portugal | Brazil | −2.252 | 5 | 0.472 | I(1) | 146 |

| Italy | Gabon | −2.172 | 5 | 0.505 | I(1) | 146 |

| Utd. Kingdom | Cameroon | −2.143 | 5 | 0.517 | I(1) | 146 |

| Italy | Côte d’Ivoire | −2.048 | 5 | 0.556 | I(1) | 146 |

| France | Cameroon | −1.949 | 5 | 0.598 | I(1) | 146 |

| Portugal | Cameroon | −1.915 | 5 | 0.612 | I(1) | 146 |

| Belgium | Cameroon | −1.897 | 5 | 0.619 | I(1) | 146 |

| Reporter | Partner T | ADF Test | Lag Order | p Value | Stationarity | N |

|---|---|---|---|---|---|---|

| Greece | United States | −3.729 | 5 | 0.024 | I(0) | 146 |

| Portugal | United States | −3.716 | 5 | 0.025 | I(0) | 146 |

| Belgium | United States | −3.613 | 5 | 0.035 | I(0) | 146 |

| Utd. Kingdom | United States | −3.540 | 5 | 0.041 | I(0) | 146 |

| Spain | United States | −3.445 | 5 | 0.050 | I(0) | 146 |

| Italy | United States | −3.223 | 5 | 0.087 | I(1) | 146 |

| Ireland | United States | −3.122 | 5 | 0.109 | I(1) | 146 |

| Germany | United States | −2.943 | 5 | 0.184 | I(1) | 146 |

| France | United States | −2.897 | 5 | 0.203 | I(1) | 146 |

| Denmark | United States | −2.623 | 5 | 0.317 | I(1) | 146 |

| Netherlands | United States | −2.446 | 5 | 0.391 | I(1) | 146 |

| Tropical Imports | Tropical Prices | Oak Imports | Oak Prices | GDP | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1000 tons/year | Euros/Ton | 1000 tons/year | Euros/Ton | Billion Euros | ||||||

| Reporter | min | max | min | max | min | max | min | max | min | max |

| Austria | 1 | 7 | 855 | 1851 | 48 | 114 | 350 | 722 | 289 | 374 |

| Belgium | 54 | 250 | 668 | 1172 | 11 | 85 | 553 | 2943 | 339 | 444 |

| Bulgaria | 0 | 1 | 616 | 1489 | 1 | 18 | 247 | 581 | 30 | 52 |

| Croatia | 1 | 3 | 738 | 2778 | 4 | 53 | 294 | 612 | 38 | 51 |

| Czech Republic | 1 | 2 | 706 | 3488 | 2 | 24 | 403 | 4037 | 119 | 193 |

| Denmark | 9 | 25 | 859 | 1840 | 7 | 23 | 857 | 1295 | 240 | 305 |

| Estonia | 0 | 1 | 958 | 2549 | 1 | 9 | 452 | 1010 | 14 | 25 |

| Finland | 0 | 4 | 1178 | 3028 | 4 | 23 | 724 | 1412 | 184 | 230 |

| France | 49 | 206 | 584 | 933 | 9 | 31 | 724 | 2859 | 1902 | 2349 |

| Germany | 28 | 85 | 738 | 1476 | 64 | 97 | 422 | 959 | 2575 | 3232 |

| Greece | 2 | 11 | 756 | 1540 | 4 | 40 | 535 | 872 | 175 | 240 |

| Hungary | 0 | 1 | 743 | 1597 | 12 | 39 | 158 | 625 | 90 | 132 |

| Ireland | 5 | 42 | 668 | 1154 | 3 | 13 | 1001 | 1583 | 160 | 335 |

| Italy | 46 | 167 | 735 | 1264 | 99 | 180 | 507 | 760 | 1643 | 1795 |

| Latvia | 0 | 0 | 930 | 13,865 | 1 | 7 | 353 | 1255 | 16 | 28 |

| Lithuania | 0 | 3 | 491 | 1662 | 9 | 91 | 320 | 639 | 23 | 43 |

| Netherlands | 54 | 247 | 212 | 986 | 29 | 532 | 85 | 1383 | 596 | 755 |

| Poland | 1 | 14 | 799 | 1693 | 40 | 116 | 229 | 503 | 262 | 513 |

| Portugal | 13 | 62 | 491 | 769 | 13 | 39 | 645 | 1054 | 175 | 200 |

| Romania | 0 | 1 | 530 | 1544 | 2 | 22 | 324 | 837 | 102 | 196 |

| Slovenia | 0 | 1 | 1188 | 4646 | 16 | 42 | 299 | 741 | 31 | 45 |

| Spain | 26 | 257 | 557 | 963 | 25 | 165 | 557 | 1078 | 935 | 1194 |

| Sweden | 0 | 11 | 918 | 5419 | 5 | 54 | 661 | 1354 | 341 | 492 |

| Utd. Kingdom | 43 | 96 | 689 | 1183 | 62 | 106 | 706 | 1510 | 2143 | 2806 |

| Reporter | Lweight_Trop | Lpricew_Trop | Lpricew_oak | Lgdp_Const_Eur |

|---|---|---|---|---|

| Austria | 0.542 I(1) | 0.704 I(1) | 0.859 I(1) | 0.464 I(1) |

| Belgium | 0.645 I(1) | 0.211 I(1) | 0.635 I(1) | 0.433 I(1) |

| Bulgaria | 0.178 I(1) | 0.199 I(1) | 0.360 I(1) | 0.237 I(1) |

| Croatia | 0.962 I(1) | 0.978 I(1) | 0.632 I(1) | 0.446 I(1) |

| Czech Republic | 0.495 I(1) | 0.427 I(1) | 0.051 I(1) | 0.229 I(1) |

| Denmark | 0.907 I(1) | 0.335 I(1) | 0.398 I(1) | 0.799 I(1) |

| Estonia | 0.193 I(1) | 0.719 I(1) | 0.963 I(1) | 0.417 I(1) |

| Finland | 0.990 I(1) | 0.949 I(1) | 0.934 I(1) | 0.477 I(1) |

| France | 0.498 I(1) | 0.277 I(1) | 0.242 I(1) | 0.596 I(1) |

| Germany | 0.049 I(0) | 0.122 I(1) | 0.010 I(0) | 0.458 I(1) |

| Greece | 0.833 I(1) | 0.980 I(1) | 0.537 I(1) | 0.437 I(1) |

| Hungary | 0.010 I(0) | 0.461 I(1) | 0.398 I(1) | 0.840 I(1) |

| Ireland | 0.920 I(1) | 0.807 I(1) | 0.859 I(1) | 0.890 I(1) |

| Italy | 0.871 I(1) | 0.817 I(1) | 0.164 I(1) | 0.749 I(1) |

| Latvia | 0.615 I(1) | 0.089 I(1) | 0.323 I(1) | 0.243 I(1) |

| Lithuania | 0.209 I(1) | 0.133 I(1) | 0.305 I(1) | 0.296 I(1) |

| Netherlands | 0.754 I(1) | 0.577 I(1) | 0.261 I(1) | 0.586 I(1) |

| Poland | 0.010 I(0) | 0.934 I(1) | 0.010 I(0) | 0.644 I(1) |

| Portugal | 0.765 I(1) | 0.754 I(1) | 0.976 I(1) | 0.746 I(1) |

| Romania | 0.294 I(1) | 0.956 I(1) | 0.299 I(1) | 0.467 I(1) |

| Slovenia | 0.366 I(1) | 0.404 I(1) | 0.898 I(1) | 0.567 I(1) |

| Spain | 0.926 I(1) | 0.812 I(1) | 0.651 I(1) | 0.370 I(1) |

| Sweden | 0.864 I(1) | 0.871 I(1) | 0.456 I(1) | 0.518 I(1) |

| Utd. Kingdom | 0.434 I(1) | 0.460 I(1) | 0.097 I(1) | 0.471 I(1) |

| Variable | Madwu | Levinlin | Hadri |

|---|---|---|---|

| lweight_trop | 0.000 | 0.021 | 0.000 |

| I(0) | I(0) | I(1) | |

| lpricew_trop | 0.000 | 0.081 | 0.000 |

| I(0) | I(1) | I(1) | |

| lpricew_oak | 0.003 | 0.070 | 0.000 |

| I(0) | I(1) | I(1) | |

| lgdp_const_eur | 0.625 | 0.020 | 0.000 |

| I(1) | I(0) | I(1) |

References

- Jonsson, R.; Giurca, A.; Masiero, M.; Pepke, E.; Pettenella, D.; Prestemon, J.; Winkel, G. Assessment of the EU timber regulation and FLEGT action plan. Sci. Policy 2015, 1, 32. [Google Scholar]

- European Union. EU Action Plan for Forest Law Enforcement, Governance and Trade (FLEGT). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52003DC0251 (accessed on 18 February 2021).

- European Union. Regulation (EU) No 995/2010 of the European Parliament and of the Council of 20 October 2010 Laying Down the Obligations of Operators Who Place Timber and Timber Products on the Market. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32010R0995 (accessed on 18 February 2021).

- Meyfroidt, P.; Rudel, T.K.; Lambin, E.F. Forest transitions, trade, and the global displacement of land use. Proc. Natl. Acad. Sci. USA 2010, 107, 20917–20922. [Google Scholar] [CrossRef] [Green Version]

- Lawson, S.; MacFaul, L. Illegal Logging and Related Trade: Indicators of the Global Response; Chatham House London: London, UK, 2010. [Google Scholar]

- Prestemon, J.P. The impacts of the Lacey Act Amendment of 2008 on U.S. hardwood lumber and hardwood plywood imports. For. Policy Econ. 2015, 50, 31–44. [Google Scholar] [CrossRef]

- Giurca, A.; Jonsson, R. The opinions of some stakeholders on the European Union Timber Regulation (EUTR): An analysis of secondary sources. iFor. Biogeosci. For. 2015, 8, 681. [Google Scholar] [CrossRef] [Green Version]

- ITTO. Market Information Service. Available online: www.itto.int/marketinformationservice (accessed on 1 October 2018).

- FLEGT IMM. Substitution, Economic Crisis and Diversion of Supply, Main Drivers of EU Tropical Timber Market Decline. Available online: https://www.flegtimm.eu/index.php?view=article&id=109:imm-survey-substitution-economic-crisis-and-diversion-of-supply-main-drivers-of-eu-timber-market-decline&catid=67 (accessed on 18 February 2021).

- ITTO. Tropical Timber Market Report. Volume 21 Number 13. Available online: https://www.itto.int/files/user/mis/MIS_1-15_July2017.pdf (accessed on 16 February 2021).

- Gan, J.; Cerutti, P.O.; Masiero, M.; Pettenella, D.; Andrighetto, N.; Dawson, T. Quantifying illegal logging and related timber trade. IUFRO World Ser. 2016, 35, 37–59. [Google Scholar]

- Turner, J.A.; Buongiorno, J. Estimating price and income elasticities of demand for imports of forest products from panel data. Scand. J. For. Res. 2004, 19, 358–373. [Google Scholar] [CrossRef]

- Houthakker, H.S. New Evidence on Demand Elasticities. Econometrica 1965, 33, 277–288. [Google Scholar] [CrossRef]

- Tajdini, A.; Tavakkoli, A.; Latibari, A.J.; Roohnia, M.; Tayeb, S.A. Application of simultaneous equations model to estimate particle board demand and supply. BioResources 2011, 6, 3199–3209. [Google Scholar]

- Toppinen, A. Incorporating Cointegration Relations in a Short-Run Model of the Finnish Sawlog Market. Can. J. For. Res. 2011, 28, 291–298. [Google Scholar] [CrossRef]

- Chas-Amil, M.L.; Buongiorno, J. The demand for paper and paperboard: Econometric models for the European Union. Appl. Econ. 2000, 32, 987–999. [Google Scholar] [CrossRef]

- Kangas, K.; Baudin, A. Modelling and Projections of Forest Products Demand, Supply and Trade in Europe; United Nations: Geneva, Switzerland, 2003; Volume 30. [Google Scholar]

- Eurostat. RAMON—Reference And Management of Nomenclatures. Available online: https://ec.europa.eu/eurostat/ramon/relations/index.cfm?TargetUrl=LST_REL (accessed on 1 July 2020).

- Eurostat. Annual National Accounts (nama10). Available online: https://ec.europa.eu/eurostat/cache/metadata/en/nama10_esms.htm (accessed on 1 March 2020).

- Heiss, F. Using R for Introductory Econometrics; Florian Heiss: Düsseldorf, Germany, 2016; pp. 216–217. [Google Scholar]

- Giurca, A.; Jonsson, R.; Rinaldi, F.; Priyadi, H. Ambiguity in timber trade regarding efforts to combat illegal logging: Potential impacts on trade between South-East Asia and Europe. Forests 2013, 4, 730–750. [Google Scholar] [CrossRef] [Green Version]

| Reporter | Partner T | VPA | Ndiffs | Coint Stat | Coint | p-Value | |||

|---|---|---|---|---|---|---|---|---|---|

| Belgium | Cameroon | vpa | 1 | –3.20 | 0.03 | 0.04 | 0.27 | 18.40 | |

| Brazil | 1 | –2.81 | 0.05 | 0.04 | 0.54 | 2.06 | |||

| Denmark | Brazil | 1 | −2.35 | 0.15 | 0.00 | 0.70 | 0.93 | ||

| France | Brazil | 1 | −2.39 | −0.02 | 0.37 | 0.51 | 6.27 | ||

| Cameroon | vpa | 1 | −3.11 | 0.01 | 0.31 | 0.34 | 9.60 | ||

| Italy | Gabon | 1 | −2.87 | 0.09 | 0.00 | 0.71 | 0.78 | ||

| Côte d’Ivoire | 1 | −2.96 | 0.09 | 0.00 | 0.65 | 0.46 | |||

| Netherlands | Cameroon | vpa | 1 | −3.06 | 0.12 | 0.00 | 0.61 | 2.83 | |

| Brazil | 1 | −2.05 | 0.34 | 0.00 | 0.11 | 1.76 | |||

| Portugal | Brazil | 1 | −2.27 | 0.09 | 0.00 | 0.66 | 0.56 | ||

| Spain | Cameroon | vpa | 1 | −3.10 | 0.04 | 0.00 | 0.44 | 1.08 | |

| Côte d’Ivoire | 1 | −2.73 | 0.21 | 0.00 | 0.42 | 0.14 | |||

| Utd. Kingdom | Cameroon | vpa | 1 | −3.20 | 0.15 | 0.00 | 0.75 | 0.51 | |

| Belgium | Côte d’Ivoire | 0 | −5.52 | coint | −0.18 | 0.00 | 0.27 | 2.14 | |

| Ghana | vpa | 1 | −7.50 | coint | 0.01 | 0.81 | 0.03 | 0.32 | |

| Gabon | 1 | −7.75 | coint | 0.08 | 0.00 | 0.07 | 6.80 | ||

| Malaysia | 1 | −3.58 | coint | 0.13 | 0.00 | 0.19 | 0.29 | ||

| Congo DRC | 1 | −5.36 | coint | 0.15 | 0.00 | 0.43 | 1.89 | ||

| France | Malaysia | 1 | −4.80 | coint | 0.01 | 0.74 | 0.25 | 1.73 | |

| Côte d’Ivoire | 1 | −3.65 | coint | 0.03 | 0.34 | 0.13 | 0.79 | ||

| Ghana | vpa | 1 | −3.49 | coint | 0.04 | 0.14 | 0.02 | 0.97 | |

| Gabon | 1 | −6.18 | coint | 0.05 | 0.01 | 0.08 | 1.31 | ||

| Congo | vpa | 1 | −5.01 | coint | 0.06 | 0.00 | 0.16 | 2.67 | |

| Germany | Ghana | vpa | 1 | −5.18 | coint | 0.12 | 0.00 | 0.77 | 0.34 |

| Cameroon | vpa | 1 | −5.07 | coint | 0.27 | 0.00 | 0.59 | 0.34 | |

| Malaysia | 1 | −4.40 | coint | 0.83 | 0.00 | 0.25 | 0.06 | ||

| Greece | Côte d’Ivoire | 1 | −5.84 | coint | 0.08 | 0.00 | 0.11 | 0.74 | |

| Cameroon | vpa | 1 | −6.44 | coint | 0.10 | 0.00 | 0.10 | 0.65 | |

| Ireland | Cameroon | vpa | 1 | −7.87 | coint | 0.22 | 0.00 | 0.23 | 2.72 |

| Italy | Congo | vpa | 0 | −5.44 | coint | 0.12 | 0.00 | 0.14 | 0.12 |

| Cameroon | vpa | 1 | −4.77 | coint | 0.13 | 0.00 | 0.69 | 1.24 | |

| Ghana | vpa | 1 | −4.95 | coint | 0.16 | 0.00 | 0.32 | 0.06 | |

| Malaysia | 1 | −4.55 | coint | 0.24 | 0.00 | 0.08 | 0.10 | ||

| Netherlands | Malaysia | 1 | −4.79 | coint | −0.30 | 0.00 | 0.43 | 5.02 | |

| Côte d’Ivoire | 1 | −6.17 | coint | 0.07 | 0.20 | 0.02 | 0.77 | ||

| Portugal | Cameroon | vpa | 1 | −3.66 | coint | 0.04 | 0.03 | 0.33 | 0.46 |

| Gabon | 1 | −7.23 | coint | 0.10 | 0.00 | 0.11 | 0.22 | ||

| Spain | Brazil | 1 | −3.74 | coint | −0.02 | 0.53 | 0.30 | 0.26 | |

| Utd. Kingdom | Malaysia | 1 | −3.80 | coint | 0.12 | 0.00 | 0.39 | 0.11 | |

| Côte d’Ivoire | 1 | −4.34 | coint | 0.15 | 0.00 | 0.66 | 0.13 | ||

| Ghana | vpa | 1 | −6.08 | coint | 0.16 | 0.00 | 0.16 | 0.05 |

| Reporter | Partner T | VPA | Ndiffs | Coint Stat | Coint | p-Value | |||

|---|---|---|---|---|---|---|---|---|---|

| France | Brazil | 1 | −3.24 | −0.24 | 0.00 | 0.61 | 6.27 | ||

| Italy | Ghana | vpa | 1 | −2.18 | −0.42 | 0.00 | 0.57 | 0.06 | |

| Côte d’Ivoire | 1 | −1.74 | −0.17 | 0.01 | 0.77 | 0.46 | |||

| Cameroon | vpa | 1 | −2.33 | −0.08 | 0.13 | 0.53 | 1.24 | ||

| Belgium | Ghana | vpa | 0 | −5.12 | coint | −0.22 | 0.01 | 0.07 | 0.32 |

| Congo DRC | 1 | −5.75 | coint | −0.12 | 0.29 | 0.13 | 1.89 | ||

| Malaysia | 1 | −5.54 | coint | 0.06 | 0.64 | 0.07 | 0.29 | ||

| Brazil | 0 | −5.51 | coint | 0.17 | 0.03 | 0.21 | 2.06 | ||

| Cameroon | vpa | 1 | −4.33 | coint | 0.23 | 0.00 | 0.35 | 18.40 | |

| Côte d’Ivoire | 0 | −5.53 | coint | 0.80 | 0.00 | 0.23 | 2.14 | ||

| Gabon | 1 | −5.91 | coint | 1.00 | 0.00 | 0.22 | 6.80 | ||

| Denmark | Brazil | 0 | −7.22 | coint | 0.15 | 0.18 | 0.07 | 0.93 | |

| France | Côte d’Ivoire | 1 | −5.52 | coint | −0.60 | 0.00 | 0.29 | 0.79 | |

| Ghana | vpa | 1 | −3.95 | coint | −0.59 | 0.00 | 0.25 | 0.97 | |

| Malaysia | 0 | −7.72 | coint | −0.40 | 0.00 | 0.17 | 1.73 | ||

| Cameroon | vpa | 0 | −6.11 | coint | −0.16 | 0.00 | 0.06 | 9.60 | |

| Gabon | 1 | −5.64 | coint | −0.12 | 0.16 | 0.02 | 1.31 | ||

| Congo | vpa | 0 | −5.64 | coint | 0.33 | 0.00 | 0.09 | 2.67 | |

| Germany | Malaysia | 1 | −4.96 | coint | −0.68 | 0.00 | 0.29 | 0.06 | |

| Cameroon | vpa | 1 | −7.31 | coint | −0.54 | 0.00 | 0.31 | 0.34 | |

| Ghana | vpa | 1 | −4.42 | coint | −0.38 | 0.00 | 0.57 | 0.34 | |

| Greece | Côte d’Ivoire | 1 | −7.50 | coint | 0.14 | 0.17 | 0.01 | 0.74 | |

| Cameroon | vpa | 0 | −7.28 | coint | 0.71 | 0.00 | 0.09 | 0.65 | |

| Ireland | Cameroon | vpa | 1 | −5.32 | coint | 0.00 | 0.99 | 0.09 | 2.72 |

| Italy | Malaysia | 1 | −3.78 | coint | −0.57 | 0.00 | 0.40 | 0.10 | |

| Congo | vpa | 0 | −7.62 | coint | −0.20 | 0.07 | 0.08 | 0.12 | |

| Gabon | 1 | −4.20 | coint | −0.01 | 0.93 | 0.18 | 0.78 | ||

| Netherlands | Côte d’Ivoire | 0 | −4.63 | coint | −0.54 | 0.00 | 0.23 | 0.77 | |

| Cameroon | vpa | 1 | −4.85 | coint | 0.14 | 0.20 | 0.12 | 2.83 | |

| Brazil | 1 | −4.45 | coint | 0.41 | 0.07 | 0.12 | 1.76 | ||

| Malaysia | 1 | −5.45 | coint | 0.60 | 0.00 | 0.37 | 5.02 | ||

| Portugal | Brazil | 1 | −5.13 | coint | −0.36 | 0.00 | 0.28 | 0.56 | |

| Cameroon | vpa | 0 | −8.06 | coint | −0.35 | 0.00 | 0.13 | 0.46 | |

| Gabon | 0 | −7.20 | coint | 0.46 | 0.00 | 0.07 | 0.22 | ||

| Spain | Côte d’Ivoire | 1 | −4.82 | coint | −0.34 | 0.00 | 0.33 | 0.14 | |

| Brazil | 1 | −5.79 | coint | 0.00 | 0.99 | 0.03 | 0.26 | ||

| Cameroon | vpa | 1 | −6.67 | coint | 0.12 | 0.06 | 0.06 | 1.08 | |

| Utd. Kingdom | Ghana | vpa | 1 | −4.81 | coint | −0.50 | 0.00 | 0.32 | 0.05 |

| Malaysia | 1 | −4.18 | coint | −0.42 | 0.00 | 0.34 | 0.11 | ||

| Côte d’Ivoire | 0 | −5.77 | coint | −0.39 | 0.00 | 0.40 | 0.13 | ||

| Cameroon | vpa | 0 | −8.05 | coint | −0.08 | 0.20 | 0.01 | 0.51 |

| Dependent Variable: | ||||||

|---|---|---|---|---|---|---|

| Lweight_Trop | Diff(Lweight_Trop) | |||||

| 2002–2019 | 2002–2013 | 2014–2019 | 2003–2019 | 2003–2013 | 2015–2019 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| lpricew_trop | −1.239 *** | −1.373 *** | −0.278 | |||

| (0.313) | (0.392) | (0.226) | ||||

| lpricew_oak | 0.041 | 0.328 | −0.081 | |||

| (0.187) | (0.213) | (0.191) | ||||

| lgdp_const_eur | 0.029 | 0.820 | −0.162 | |||

| (0.494) | (0.532) | (0.990) | ||||

| diff(lpricew_trop) | −0.830 *** | −1.004 *** | −0.695 *** | |||

| (0.107) | (0.140) | (0.143) | ||||

| diff(lpricew_oak) | −0.091 | 0.004 | −0.219 | |||

| (0.086) | (0.171) | (0.201) | ||||

| diff(lgdp_const_eur) | 5.240 *** | 5.785 *** | −0.300 | |||

| (0.739) | (0.759) | (1.404) | ||||

| Observations | 432 | 288 | 144 | 408 | 264 | 120 |

| R | 0.270 | 0.233 | 0.021 | 0.287 | 0.383 | 0.130 |

| Dependent Variable: | ||||||

|---|---|---|---|---|---|---|

| Lweight_Oak | Diff(Lweight_Oak) | |||||

| 2002–2019 | 2002–2013 | 2014–2019 | 2003–2019 | 2003–2013 | 2015–2019 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| lpricew_trop | −0.186 | −0.323 | 0.304 ** | |||

| (0.248) | (0.251) | (0.150) | ||||

| lpricew_oak | −0.727 *** | −0.753 *** | −0.713 *** | |||

| (0.102) | (0.221) | (0.105) | ||||

| lgdp_const_eur | 2.302 *** | 2.745 *** | 1.603 * | |||

| (0.679) | (0.615) | (0.897) | ||||

| diff(lpricew_trop) | 0.033 | −0.038 | 0.043 | |||

| (0.039) | (0.084) | (0.068) | ||||

| diff(lpricew_oak) | −0.898 *** | −0.820 *** | −0.920 *** | |||

| (0.064) | (0.123) | (0.038) | ||||

| diff(lgdp_const_eur) | 4.095 *** | 4.599 *** | −0.251 | |||

| (0.686) | (0.690) | (0.637) | ||||

| Observations | 432 | 288 | 144 | 408 | 264 | 120 |

| R | 0.271 | 0.321 | 0.364 | 0.527 | 0.504 | 0.642 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rougieux, P.; Jonsson, R. Impacts of the FLEGT Action Plan and the EU Timber Regulation on EU Trade in Timber Product. Sustainability 2021, 13, 6030. https://doi.org/10.3390/su13116030

Rougieux P, Jonsson R. Impacts of the FLEGT Action Plan and the EU Timber Regulation on EU Trade in Timber Product. Sustainability. 2021; 13(11):6030. https://doi.org/10.3390/su13116030

Chicago/Turabian StyleRougieux, Paul, and Ragnar Jonsson. 2021. "Impacts of the FLEGT Action Plan and the EU Timber Regulation on EU Trade in Timber Product" Sustainability 13, no. 11: 6030. https://doi.org/10.3390/su13116030