Impact of Industry 4.0 on Corporate Financial Performance: A Moderated Mediation Model

Abstract

:1. Introduction

2. Research Background

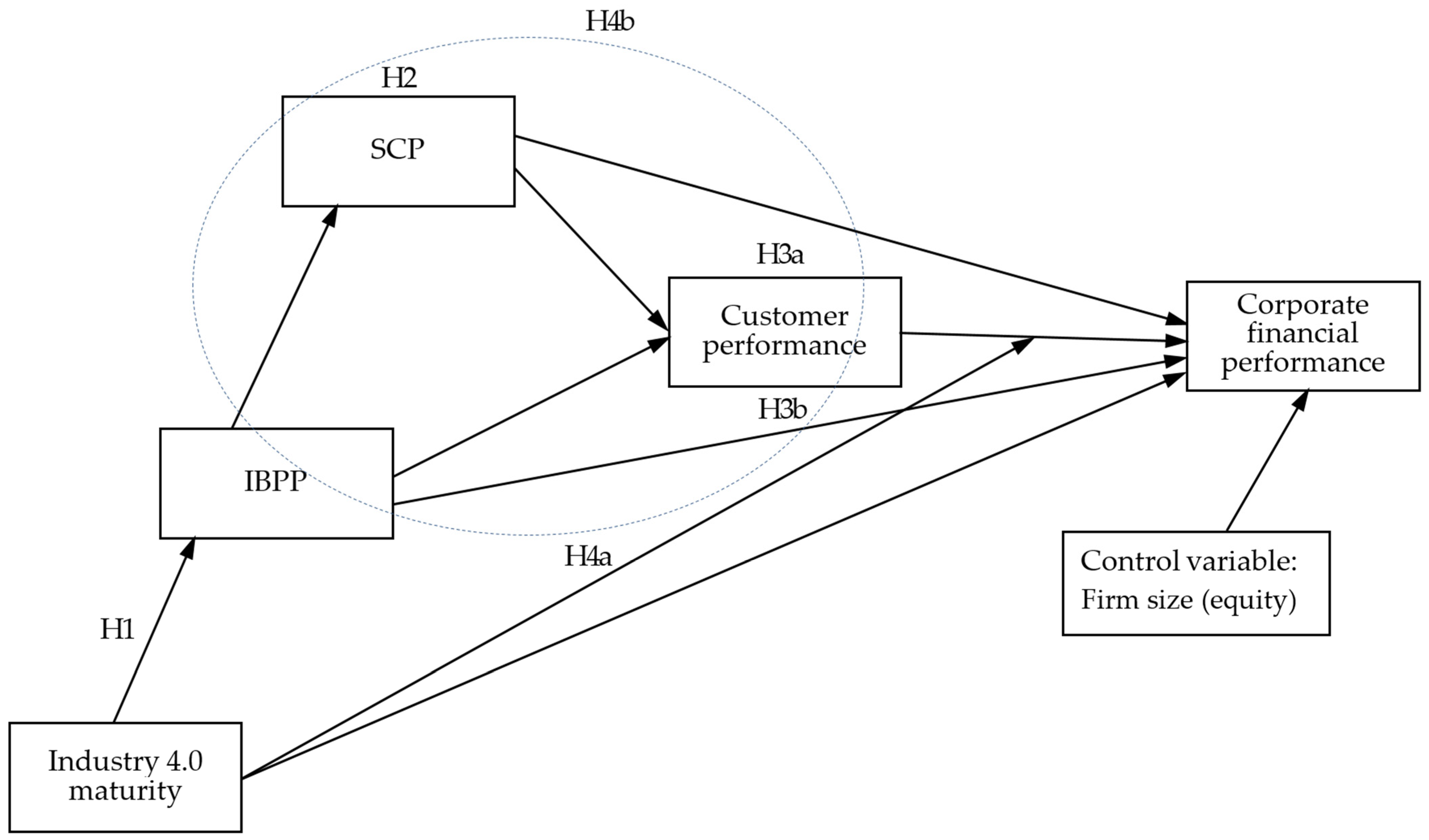

3. Research Hypotheses

4. Research Methodology

4.1. Participants and Procedures

4.2. Measures and Analysis

5. Research Results

5.1. Measurement Results

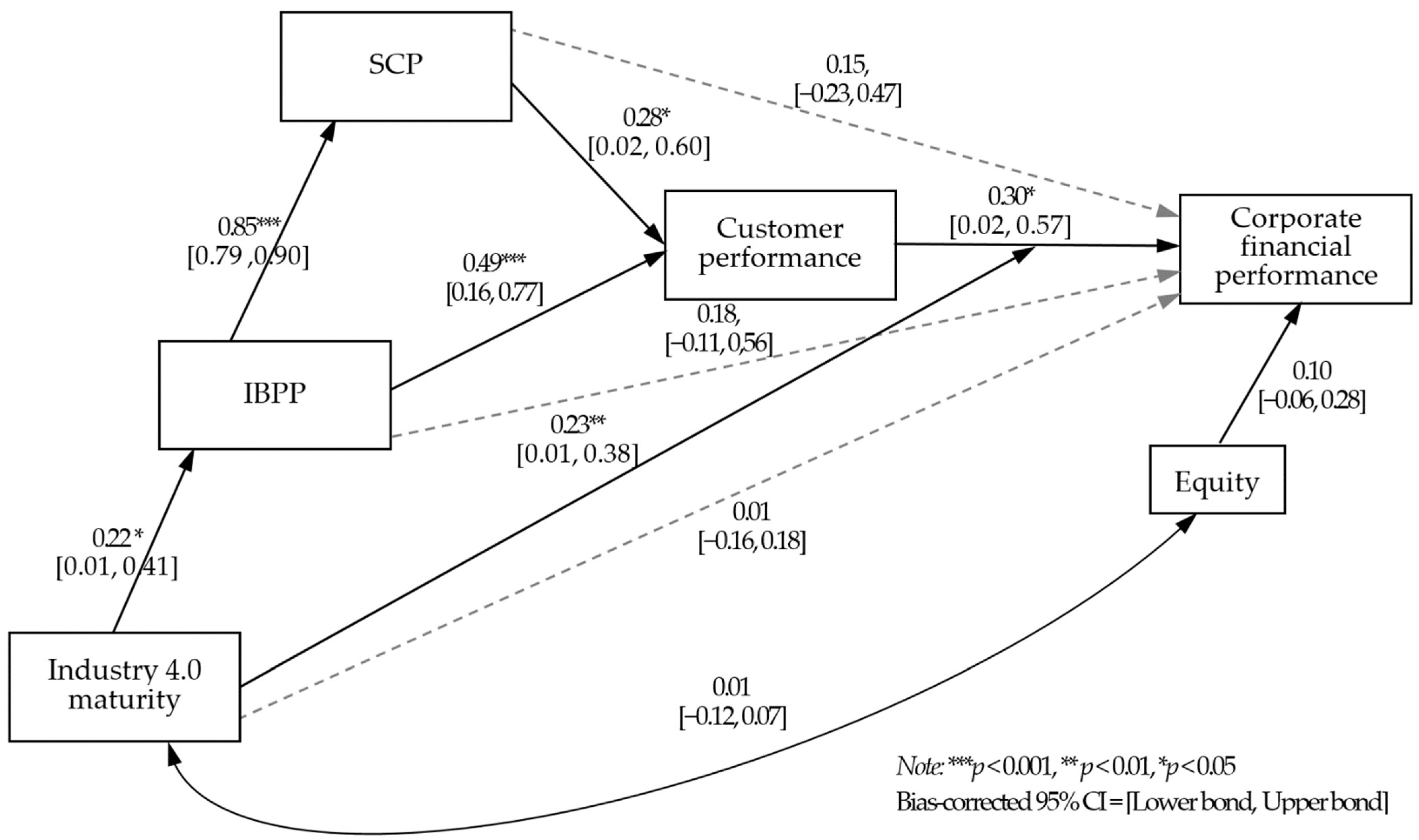

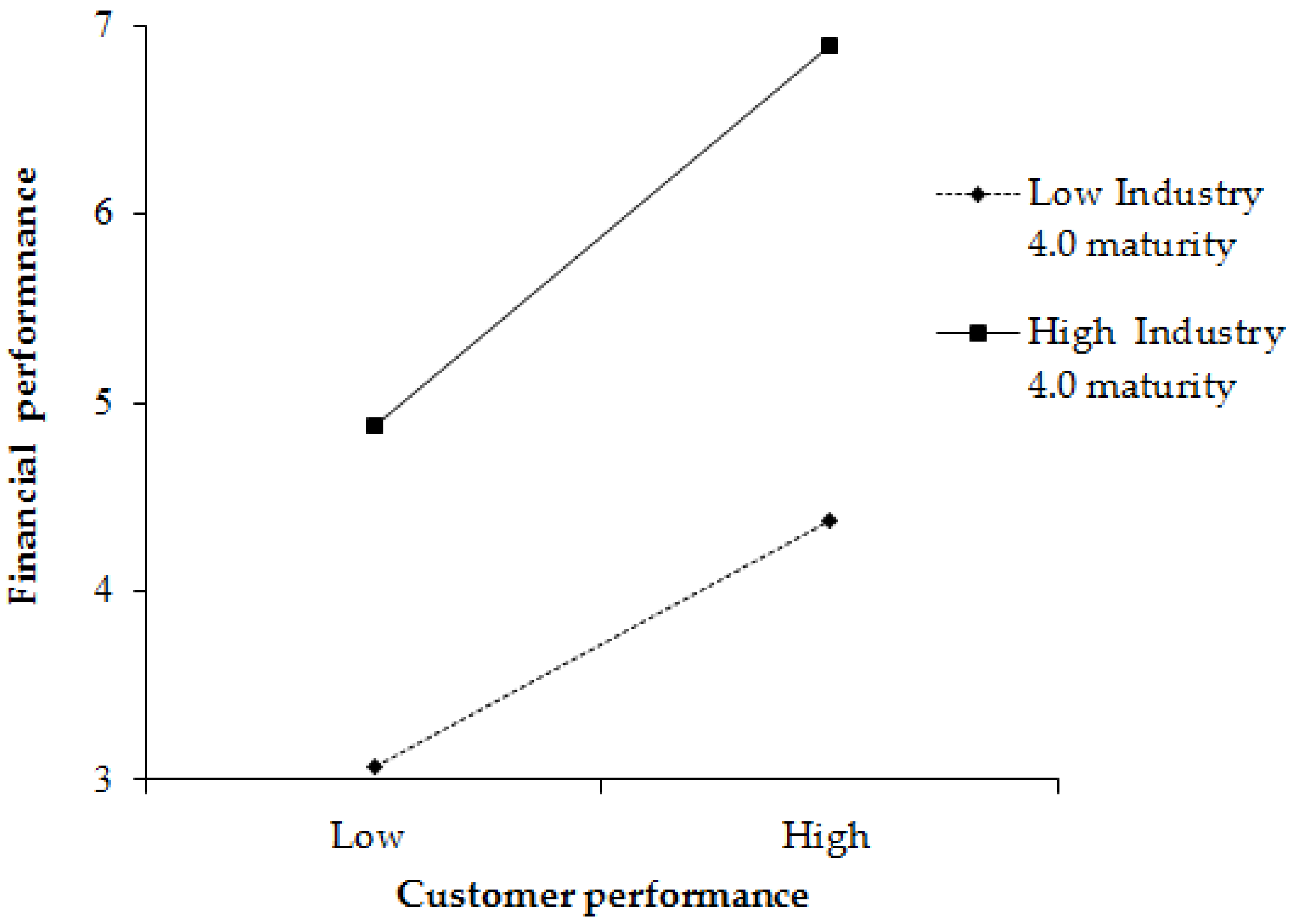

5.2. Hypotheses Testing

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hermann, M.; Pentek, T.; Otto, B. Design principles for Industry 4.0 scenarios. In Proceedings of the 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar]

- Büchi, G.; Cugno, M.; Castagnoli, R. Smart factory performance and Industry 4.0. Technol. Forecast. Soc. Chang. 2020, 150, 119790. [Google Scholar] [CrossRef]

- Liao, Y.; Deschamps, F.; Loures, E.D.F.R.; Ramos, L.F.P. Past, present and future of Industry 4.0—A systematic literature review and research agenda proposal. Int. J. Prod. Res. 2017, 55, 3609–3629. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B. The impact of digital technology and Industry 4.0 on the ripple effect and supply chain risk analytics. Int. J. Prod. Res. 2019, 57, 829–846. [Google Scholar] [CrossRef]

- Majeed, A.A.; Rupasinghe, T.D. Internet of things (IoT) embedded future supply chains for Industry 4.0: An assessment from an ERP-based fashion apparel and footwear industry. Int. J. Supply Chain Manag. 2017, 6, 25–40. [Google Scholar]

- Wang, J.; Li, D.; Hu, M.Y. Fog Nodes Deployment Based on Space-Time Characteristics in Smart Factory. IEEE Trans. Ind. Inform. 2021, 17, 3534–3543. [Google Scholar] [CrossRef]

- Marcucci, G.; Antomarioni, S.; Ciarapica, F.E.; Bevilacqua, M. The impact of Operations and IT-related Industry 4.0 key technologies on organizational resilience. Prod. Plan. Control 2021, 1–15. [Google Scholar] [CrossRef]

- Neumann, W.P.; Winkelhaus, S.; Grosse, E.H.; Glock, C.H. Industry 4.0 and the human factor—A systems framework and analysis methodology for successful development. Int. J. Prod. Econ. 2021, 233, 107992. [Google Scholar] [CrossRef]

- Rossit, D.A.; Tohmé, F.; Frutos, M. Industry 4.0: Smart Scheduling. Int. J. Prod. Res. 2019, 57, 3802–3813. [Google Scholar] [CrossRef]

- Vrchota, J.; Pech, M. Readiness of Enterprises in Czech Republic to Implement Industry 4.0: Index of Industry 4.0. Appl. Sci. 2019, 9, 5405. [Google Scholar] [CrossRef] [Green Version]

- Cascio, W.F.; Montealegre, R. How Technology Is Changing Work and Organizations. Annu. Rev. Organ. Psychol. Organ. Behav. 2016, 3, 349–375. [Google Scholar] [CrossRef]

- Murray, A. The New Industrial Revolution. Fortune 2015, 1, 6. [Google Scholar]

- Brougham, D.; Haar, J. Smart technology, artificial intelligence, robotics, and algorithms (STARA): Employees’ perceptions of our future workplace. J. Manag. Organ. 2017, 24, 239–257. [Google Scholar] [CrossRef] [Green Version]

- Yin, Y.; Stecke, K.E.; Li, D. The evolution of production systems from Industry 2.0 through Industry 4.0. Int. J. Prod. Res. 2018, 56, 848–861. [Google Scholar] [CrossRef] [Green Version]

- Shrouf, F.; Ordieres, J.; Miragliotta, G. Smart factories in Industry 4.0: A review of the concept and of energy management approached in production based on the Internet of Things paradigm. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management, Selangor, Malaysia, 9–12 December 2014; pp. 697–701. [Google Scholar]

- Ungurean, I.; Gaitan, N.C.; Gaitan, V.G. An IoT architecture for things from industrial environment. In Proceedings of the 10th International Conference on Communications (COMM), Bucharest, Romania, 29–31 May 2014; pp. 1–4. [Google Scholar]

- Imtiaz, J.; Jasperneite, J. Scalability of OPC-UA down to the chip level enables Internet of Things. In Proceedings of the 2013 11th IEEE International Conference on Industrial Informatics (INDIN), Bochum, Germany, 29–31 July 2013; pp. 500–505. [Google Scholar]

- Găitan, V.G.; Popa, V.; Turcu, C.; Gaitan, N.C.; Ungureanu, I.; Cristina, G.N. The Uniform Engineering of Distributed Control Systems Using the OPC Specification. Adv. Electr. Comput. Eng. 2008, 8, 71–77. [Google Scholar] [CrossRef]

- Mazak, A.; Huemer, C. A standards framework for value networks in the context of Industry 4.0. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Singapore, 6–9 December 2015; pp. 1342–1346. [Google Scholar]

- Lee, J.; Bagheri, B.; Kao, H.-A. A Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Schlechtendahl, J.; Keinert, M.; Kretschmer, F.; Lechler, A.; Verl, A. Making existing production systems Industry 4.0-ready. Prod. Eng. 2015, 9, 143–148. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B.; Werner, F.; Ivanova, M. A dynamic model and an algorithm for short-term supply chain scheduling in the smart factory industry 4.0. Int. J. Prod. Res. 2016, 54, 386–402. [Google Scholar] [CrossRef] [Green Version]

- Shiue, Y.-R.; Lee, K.-C.; Su, C.-T. Real-time scheduling for a smart factory using a reinforcement learning approach. Comput. Ind. Eng. 2018, 125, 604–614. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W.; Song, M. Industry 4.0: Driving factors and impacts on firm’s performance: An empirical study on China’s manufacturing industry. Ann. Oper. Res. 2019, 186, 1–21. [Google Scholar] [CrossRef]

- Michna, A.; Kmieciak, R. Open-Mindedness Culture, Knowledge-Sharing, Financial Performance, and Industry 4.0 in SMEs. Sustainability 2020, 12, 9041. [Google Scholar] [CrossRef]

- Birkel, H.S.; Hartmann, E. Impact of IoT challenges and risks for SCM. Supply Chain Manag. Int. J. 2019, 24, 39–61. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Using the balance scorecard as a strategic management system. Harv. Bus. Rev. 1996, 74, 75–85. [Google Scholar]

- Beamon, B.M. Designing the green supply chain. Logist. Inf. Manag. 1999, 12, 332–342. [Google Scholar] [CrossRef] [Green Version]

- Kaplan, R.S.; Norton, D.P. Having trouble with your strategy? Then map it. Harv. Bus. Rev. 2001, 78, 167–176. [Google Scholar]

- Fischer, T.M.; Sawczyn, A.A. The relationship between corporate social performance and corporate financial performance and the role of innovation: Evidence from German listed firms. J. Manag. Control 2013, 24, 27–52. [Google Scholar] [CrossRef]

- Cochran, P.L.; Wood, R.A. Corporate Social Responsibility and Financial Performance. Acad. Manag. J. 1984, 27, 42–56. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Moeuf, A.; Pellerin, R.; Lamouri, S.; Tamayo-Giraldo, S.; Barbaray, R. The industrial management of SMEs in the era of Industry 4.0. Int. J. Prod. Res. 2018, 56, 1118–1136. [Google Scholar] [CrossRef] [Green Version]

- Won, J.Y.; Park, M.J. Smart factory adoption in small and medium-sized enterprises: Empirical evidence of manufacturing industry in Korea. Technol. Forecast. Soc. Chang. 2020, 157, 120117. [Google Scholar] [CrossRef]

- Flynn, B.B.; Koufteros, X.; Lu, G. On Theory in Supply Chain Uncertainty and Its Implications for Supply Chain Integration. J. Supply Chain Manag. 2016, 52, 3–27. [Google Scholar] [CrossRef] [Green Version]

- Huo, B. The impact of supply chain integration on company performance: An organizational capability perspective. Supply Chain Manag. Int. J. 2012, 17, 596–610. [Google Scholar] [CrossRef]

- Ralston, P.M.; Blackhurst, J.; Cantor, D.E.; Crum, M.R. A Structure-Conduct-Performance Perspective of How Strategic Supply Chain Integration Affects Firm Performance. J. Supply Chain Manag. 2015, 51, 47–64. [Google Scholar] [CrossRef]

- Peng, J.; Quan, J.; Zhang, G.; Dubinsky, A.J. Mediation effect of business process and supply chain management capabilities on the impact of IT on firm performance: Evidence from Chinese firms. Int. J. Inf. Manag. 2016, 36, 89–96. [Google Scholar] [CrossRef]

- Ambroise, L.; Prim-Allaz, I.; Teyssier, C. Financial performance of servitized manufacturing firms: A configuration issue between servitization strategies and customer-oriented organizational design. Ind. Market Manag. 2018, 71, 54–68. [Google Scholar] [CrossRef]

- Liu, H.; Wei, S.; Ke, W.; Wei, K.K.; Hua, Z. The configuration between supply chain integration and information technology competency: A resource orchestration perspective. J. Oper. Manag. 2016, 44, 13–29. [Google Scholar] [CrossRef]

- Rajapathirana, R.J.; Hui, Y. Relationship between innovation capability, innovation type, and firm performance. J. Innov. Knowl. 2018, 3, 44–55. [Google Scholar] [CrossRef]

- Van Looy, A.; Shafagatova, A. Business process performance measurement: A structured literature review of indicators, measures and metrics. SpringerPlus 2016, 5, 1797. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, H.L. Supply chain risk’s impact on corporate financial performance. Int. J. Oper. Prod. Manag. 2018, 38, 713–731. [Google Scholar] [CrossRef]

- Delic, M.; Eyers, D.R.; Mikulic, J. Additive manufacturing: Empirical evidence for supply chain integration and performance from the automotive industry. Supply Chain Manag. Int. J. 2019, 24, 604–621. [Google Scholar] [CrossRef]

- Feng, T.; Wang, D.; Lawton, A.; Luo, B.N. Customer orientation and firm performance: The joint moderating effects of ethical leadership and competitive intensity. J. Bus. Res. 2019, 100, 111–121. [Google Scholar] [CrossRef]

- Hutahayan, B. The mediating role of human capital and management accounting information system in the relationship between innovation strategy and internal process performance and the impact on corporate financial performance. Benchmarking Int. J. 2020, 27, 1289–1318. [Google Scholar] [CrossRef]

- Napoleone, A.; Macchi, M.; Pozzetti, A. A review on the characteristics of cyber-physical systems for the future smart factories. J. Manuf. Syst. 2020, 54, 305–335. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Agca, O.; Gibson, J.; Godsell, J.; Ignatius, J.; Davies, C.W.; Xu, O. An Industry 4 Readiness Assessment Tool; WMG-The University of Warwick: Coventry, UK, 2017. [Google Scholar]

- Veza, I.; Mladineo, M.; Peko, I. Analysis of the current state of Croatian manufacturing industry with regard to industry 4.0. In Proceedings of the 15th International Scientific Conference on Production Engineering—CIM’2015: Computer Integrated Manufacturing and High Speed Machining, Vodice, Croatia, 10–13 June 2015; pp. 249–254. [Google Scholar]

- Butler, A.; Letza, S.R.; Neale, B. Linking the balanced scorecard to strategy. Long Range Plan. 1997, 30, 242–253. [Google Scholar] [CrossRef]

- Grigoroudis, E.; Orfanoudaki, E.; Zopounidis, C. Strategic performance measurement in a healthcare organisation: A multiple criteria approach based on balanced scorecard. Omega 2012, 40, 104–119. [Google Scholar] [CrossRef]

- Drongelen, I.C.K.; Bilderbeek, J. R&D performance measurement: More than choosing a set of metrics. R&D Manag. 1999, 29, 35–46. [Google Scholar] [CrossRef]

- Lee, H.L.; Billington, C. Material Management in Decentralized Supply Chains. Oper. Res. 1993, 41, 835–847. [Google Scholar] [CrossRef] [Green Version]

- Noordewier, T.; John, G.; Nevin, J. Performance outcomes of purchasing arrangement in industrial buyer-vendor relationships. J. Mark. 1990, 54, 80–93. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Mackenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Aral, S.; Weill, P. IT assets, organizational capabilities and firm performance: How resource allocations and organisational differences explain performance variation. Organ. Sci. 2007, 18, 763–780. [Google Scholar] [CrossRef]

- Dang, C.; Li, Z.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; The Guilford Press: New York, NY, USA, 2015. [Google Scholar]

- Olya, H.G.; Altinay, L. Asymmetric modeling of intention to purchase tourism weather insurance and loyalty. J. Bus. Res. 2016, 69, 2791–2800. [Google Scholar] [CrossRef]

- Kim, Y.H.; Schoenherr, T. The Effects of Supply Chain Integration on the Cost Efficiency of Contract Manufacturing. J. Supply Chain Manag. 2018, 54, 42–64. [Google Scholar] [CrossRef]

- Srinivasan, R.; Swink, M. An investigation of visibility and flexibility as complements to supply chain analytics: An organizational information processing theory perspective. Prod. Oper. Manag. 2018, 27, 1849–1867. [Google Scholar] [CrossRef]

- Williams, B.D.; Roh, J.; Tokar, T.; Swink, M. Leveraging supply chain visibility for responsiveness: The moderating role of internal integration. J. Oper. Manag. 2013, 31, 543–554. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef] [PubMed]

- Chen, H.L.; Lin, Y.L. Goal orientations, leader-leader exchange, trust, and the outcomes of project performance. Int. J. Proj. Manag. 2018, 36, 716–729. [Google Scholar] [CrossRef]

- Li, F. Endogeneity in CEO power: A survey and experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Zwikael, O.; Meredith, J.R. The role of organizational climate in setting project goals. Int. J. Oper. Prod. Manag. 2019, 39, 1281–1294. [Google Scholar] [CrossRef]

| Variables | Total Responses | Percentage | Cumulative Percentage |

|---|---|---|---|

| Industry | |||

| Chemicals | 3 | 3.2 | 3.2 |

| Biotechnology | 7 | 7.4 | 10.6 |

| Petrochemical | 2 | 2.1 | 12.8 |

| Automotive | 6 | 6.4 | 19.1 |

| Textiles | 4 | 4.3 | 23.4 |

| Food | 4 | 4.3 | 27.7 |

| Rubber | 2 | 2.1 | 29.8 |

| Optoelectronic | 7 | 7.4 | 37.2 |

| Semiconductor | 5 | 5.3 | 42.6 |

| Electrical distribution | 2 | 2.1 | 44.7 |

| Electronics | 20 | 21.3 | 66.0 |

| Iron and steel | 4 | 4.3 | 70.2 |

| Electric machinery | 13 | 13.8 | 84.0 |

| Construction and building materials | 2 | 2.1 | 86.2 |

| Miscellaneous | 13 | 13.8 | 100.0 |

| Firm size (Equity: $ millions) | |||

| 1.00–10.00 | 11 | 11.8 | 11.8 |

| 10.01–50.57 | 15 | 16.1 | 28.0 |

| 50.58–892.14 | 14 | 15.1 | 43.0 |

| 892.15–1871.43 | 13 | 14.0 | 57.0 |

| 1871.44–4254.29 | 14 | 15.1 | 72.0 |

| 4254.30–14,764.00 | 13 | 14.0 | 86.0 |

| 14,764.00+ | 13 | 14.0 | 100.0 |

| Job title | |||

| CEOs/General managers | 9 | 9.7 | 9.7 |

| Senior managers | 41 | 44.1 | 53.8 |

| Managers | 15 | 16.1 | 69.9 |

| Directors | 22 | 23.7 | 93.5 |

| Others | 6 | 6.5 | 100.0 |

| Construct | Mean | Min. | Max. | SD | CR | AVE | ASV |

|---|---|---|---|---|---|---|---|

| Industry 4.0 maturity | 2.58 | 1 | 4 | 0.66 | 0.91 | 0.64 | 0.02 |

| Financial performance | 4.98 | 3 | 7 | 0.94 | 0.86 | 0.74 | 0.21 |

| Customer performance | 5.23 | 4 | 7 | 0.74 | 0.83 | 0.60 | 0.33 |

| IBPP | 5.21 | 4 | 7 | 0.77 | 0.80 | 0.64 | 0.40 |

| SCP | 5.29 | 4 | 7 | 0.74 | 0.89 | 0.68 | 0.38 |

| Sources | Parameter Estimates | Bootstrapping Bias-Corrected 95% CI | |||||

|---|---|---|---|---|---|---|---|

| Dependent | Independent | B | SE | CR | p | Lower | Upper |

| IBPP | Industry 4.0 maturity | 0.26 | 0.12 | 2.21 | 0.027 | 0.01 | 0.51 |

| SCP | IBPP | 0.82 | 0.05 | 15.73 | <0.001 | 0.71 | 0.91 |

| Customer performance | IBPP | 0.47 | 0.13 | 3.68 | <0.001 | 0.16 | 0.75 |

| Customer performance | SCP | 0.28 | 0.13 | 2.06 | 0.040 | 0.016 | 0.62 |

| Financial performance | SCP | 0.19 | 0.20 | 0.96 | 0.335 | −0.29 | 0.59 |

| Financial performance | Customer performance | 0.38 | 0.15 | 2.47 | 0.014 | 0.02 | 0.71 |

| Financial performance | IBPP | 0.22 | 0.20 | 1.07 | 0.285 | −0.13 | 0.70 |

| Financial performance | Industry 4.0 maturity | 0.02 | 0.12 | 0.18 | 0.860 | −0.23 | 0.27 |

| Financial performance | Industry 4.0 maturity*Customer performance | 0.19 | 0.07 | 2.89 | 0.004 | 0.01 | 0.32 |

| Financial performance | Equity | 0.09 | 0.08 | 1.20 | 0.234 | −0.07 | 0.29 |

| Chi-square | 3.89 | ||||||

| Degree of freedom (DF) | 10.00 | ||||||

| Incremental fit index (IFI) | 1.00 | ||||||

| Tucker–Lewis index (TLI) | 1.00 | ||||||

| Comparative fit index (CFI) | 1.00 | ||||||

| Standardized root mean square residual (SRMR) | 0.03 | ||||||

| Root mean square error of approximation (RMSEA) | 0.01 | ||||||

| Theoretical Relationship | Indirect Effect | Bootstrapping Bias-Corrected 95% CI | |||

|---|---|---|---|---|---|

| B | SE | Lower | Upper | p | |

| Hypothesis 2 | |||||

| IBPP → SCP → customer performance | 0.23 | 0.12 | 0.01 | 0.52 | 0.041 |

| Hypothesis 3a | |||||

| SCP → customer performance → financial performance | 0.10 | 0.10 | 0.01 | 0.33 | 0.042 |

| Hypothesis 3b | |||||

| IBPP → customer performance → financial performance | 0.18 | 0.08 | 0.03 | 0.42 | 0.023 |

| Hypothesis 4b | |||||

| Industry 4.0 maturity → IBPP + SCP + customer performance → financial performance | 0.17 | 0.09 | 0.03 | 0.37 | 0.025 |

| Hypothesis 4b’s indirect effect paths | |||||

| Path 1: Industry 4.0 maturity → IBPP → financial performance | 0.06 | 0.06 | −0.02 | 0.27 | 0.145 |

| Path 2: Industry 4.0 maturity → IBPP → customer performance → financial performance | 0.05 | 0.04 | 0.01 | 0.20 | 0.028 |

| Path 3: Industry 4.0 maturity → IBPP → SCP → customer performance → financial performance | 0.02 | 0.03 | 0.01 | 0.11 | 0.042 |

| Path 4: Industry 4.0 maturity → IBPP → SCP → financial performance | 0.04 | 0.06 | −0.04 | 0.20 | 0.244 |

| Variable | Industry 4.0 Maturity | IBPP | SCP | Customer Performance | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MDE | MIE | MTE | MDE | MIE | MTE | MDE | MIE | MTE | MDE | MIE | MTE | |

| IBPP | 0.22 | 0.22 | ||||||||||

| SCP | 0.19 | 0.19 | 0.85 | 0.85 | ||||||||

| Customer performance | 0.16 | 0.16 | 0.49 | 0.24 | 0.73 | 0.28 | 0.28 | |||||

| Financial performance | 0.01 | 0.12 | 0.13 | 0.18 | 0.35 | 0.53 | 0.15 | 0.08 | 0.23 | 0.30 | 0.30 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.-L. Impact of Industry 4.0 on Corporate Financial Performance: A Moderated Mediation Model. Sustainability 2021, 13, 6069. https://doi.org/10.3390/su13116069

Chen H-L. Impact of Industry 4.0 on Corporate Financial Performance: A Moderated Mediation Model. Sustainability. 2021; 13(11):6069. https://doi.org/10.3390/su13116069

Chicago/Turabian StyleChen, Hong-Long. 2021. "Impact of Industry 4.0 on Corporate Financial Performance: A Moderated Mediation Model" Sustainability 13, no. 11: 6069. https://doi.org/10.3390/su13116069

APA StyleChen, H.-L. (2021). Impact of Industry 4.0 on Corporate Financial Performance: A Moderated Mediation Model. Sustainability, 13(11), 6069. https://doi.org/10.3390/su13116069