An Artificial Intelligence-Based Model for Prediction of Parameters Affecting Sustainable Growth of Mobile Banking Apps

Abstract

:1. Introduction

2. Materials and Methods

2.1. Mobile Devices, Mobile Banking, and Mobile Banking Apps

2.2. Security and Privacy Issues of Mobile Banking Apps

2.3. Artificial Intelligence (AI) Based Techniques

2.4. Method

2.4.1. Research Models

2.4.2. Reliability Analysis of the Study Classic Model

2.4.3. Artificial Neural Network (ANN) Model of the Study

2.5. Hypotheses Formulation

2.5.1. Information Quality

2.5.2. Service Quality

2.5.3. System Quality

2.5.4. Trust

2.5.5. Legal Framework

2.5.6. Risk

2.5.7. Facilitating Conditions

2.5.8. Social Influence

2.5.9. Satisfaction and Intention to Use

2.6. Participants

2.7. Data Gathering Procedure

2.8. Data Analysis Methods

2.9. Sensitivity Analysis

3. Results

3.1. Pre-Processing and Performance Assessment of the Study Input Parameters

Sensitivity Examination Results

3.2. Results of Structural Equation Modeling (SEM)

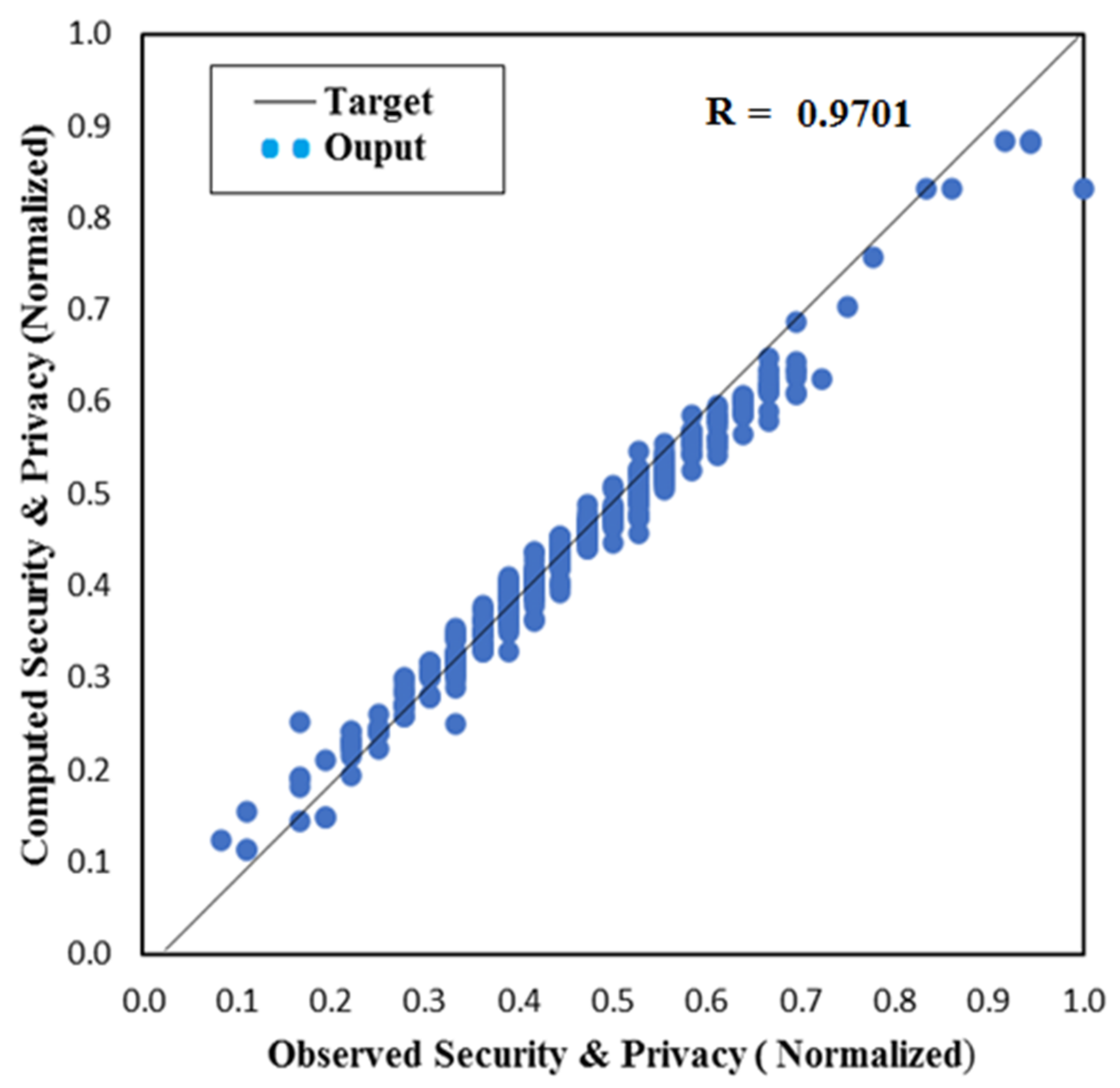

3.3. Results of Artificial Neural Network (ANN) Modeling

4. Discussion

5. Conclusions, Recommendations, and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Inputs Parameters | Items (Strongly Disagree–Strongly-Agree, 1–5 Scale) | Source |

|---|---|---|

| Information quality | “The information provided by mobile banking is up-to-date” | [25,29] |

| “The information provided by m-banking is easy to understand” | ||

| “The information provided by m-banking is complete” | ||

| Service quality | “The call center representatives always help me when I need support with m-banking” | [25,29] |

| “The call center representatives always pay personal attention when I experience problems with m-banking” | ||

| “The call center representatives have adequate knowledge to answer my queries related to m-banking” | ||

| System quality | “The mobile banking app is easy to navigate”. | [25,29] |

| “The mobile banking app is well structured” | ||

| “The mobile banking is easy to use” | ||

| Trust | “I trust my bank to offer secure m-banking” | [16,31,34] |

| “I find m-banking is secure in conducting transactions” | ||

| “I find m-banking is safe for receiving bank statements” | ||

| Legal framework | “The country’s laws covered Internet environment” | [33,44] |

| “Laws that govern mobile banking provide adequate protection for my cash” | ||

| “Penalties stipulated in mobile banking laws make me feel comfortable with the service channel” | ||

| Risk | “I fear that while I am paying a bill by mobile phone, I might make mistakes since the correctness of the inputted information is difficult to check from the screen” | [16,31,34] |

| “I fear that while I am using mobile banking services, the battery of the mobile phone will run out or the connection will otherwise be lost” | ||

| “I fear that while I am using mobile banking services, third parties can access my account or see my account information” | ||

| “I fear that the list of PIN codes may be lost and end up in the wrong hands” | ||

| Facilitating condition | “I have the resources necessary to use Mobile banking apps” | [30,35] |

| “I have the knowledge necessary to use Mobile banking apps” | ||

| “Mobile banking apps is compatible with other technologies I use” | ||

| Social influence | “People who are important to me think that I should use Mobile banking apps” | [30,35] |

| “People who influence my behavior think that I should use Mobile banking apps” | ||

| “People whose opinions that I value prefer that I use Mobile Banking” | ||

| Satisfaction | “I am satisfied that m-banking apps meets my requirements” | [29] |

| “I am satisfied with m-banking apps effectiveness” | ||

| “I am satisfied with m-banking apps efficiency” | ||

| Intention to use | “I plan to use m-banking apps regularly” | [29] |

| “I intend to recommend m-banking apps to peers and relatives” | ||

| “I intend to use m-banking apps when the opportunity arises” | ||

| Actual usage | “I use m-banking apps multiple times in a week” | [29] |

| “I use m-banking apps frequently” | ||

| “I have many weekly requirements of m-banking apps” |

References

- Malaquias, R.F.; Hwang, Y. Mobile banking use: A comparative study with Brazilian and US participants. Int. J. Inf. Manag. 2019, 44, 132–140. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Cugurullo, F. The sustainability of artificial intelligence: An urbanistic viewpoint from the lens of smart and sustainable cities. Sustainability 2020, 12, 8548. [Google Scholar] [CrossRef]

- Zhang, X. Exploring the patterns and determinants of the global mobile divide. Telemat. Inform. 2017, 34, 438–449. [Google Scholar] [CrossRef]

- Bagudu, H.D.; Khan, M.; Jan, S.; Roslan, A.-H. The Effect of Mobile Banking on the Performance of Commercial Banks in Nigeria. Int. Res. J. Manag. IT Soc. Sci. 2017, 4, 71–76. Available online: https://creativecommons.org/licenses/by-sa/4.0/ (accessed on 31 March 2021).

- Schuetz, S.; Venkatesh, V. Blockchain, adoption, and financial inclusion in India: Research opportunities. Int. J. Inf. Manag. 2019, 101936. [Google Scholar] [CrossRef]

- Raza, S.A.; Umer, A.; Shah, N. New determinants of ease of use and perceived usefulness for mobile banking adoption. Int. J. Electron. Cust. Relatsh. Manag. 2017, 11, 44–65. [Google Scholar] [CrossRef]

- Dandena, S.; Abera, T.M.; Mengesha, T. Factors affecting the adoption of mobile banking: The case of United Bank Addis Ababa city customers. J. Process. Manag. New Technol. 2020, 8, 30–37. Available online: http://scindeks.ceon.rs/article.aspx?artid=2334-735X2001030D (accessed on 31 March 2021). [CrossRef]

- Verkijika, S.F. Factors influencing the adoption of mobile commerce applications in Cameroon. Telemat. Inform. 2018, 35, 1665–1674. [Google Scholar] [CrossRef]

- Malaquias, R.F.; Hwang, Y. An empirical study on trust in mobile banking: A developing country perspective. Comput. Hum. Behav. 2016, 54, 453–461. [Google Scholar] [CrossRef]

- Baptista, G.; Oliveira, T. A weight and a meta-analysis on mobile banking acceptance research. Comput. Hum. Behav. 2016, 63, 480–489. [Google Scholar] [CrossRef]

- Merhi, M.; Hone, K.; Tarhini, A. A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust. Technol. Soc. 2019, 59, 101151. [Google Scholar] [CrossRef]

- Abayomi, O.J.; Olabode, A.C.; Reyad, M.A.H.; Teye, E.T.; Haq, M.N.; Mensah, E.T. Effects of Demographic Factors on Customers’ Mobile Banking Services Adoption in Nigeria. Int. J. Bus. Soc. Sci. 2019, 10, 63–77. [Google Scholar] [CrossRef] [Green Version]

- Osho, O.; Mohammed, U.L.; Nimzing, N.N.; Uduimoh, A.A.; Misra, S. Forensic Analysis of Mobile Banking Apps. In Proceedings of the International Conference on Computational Science and Its Applications, Saint Petersburg, Russia, 1–4 July 2019; pp. 613–626. [Google Scholar] [CrossRef]

- Satrya, G.B.; Shin, S.Y. Proposed method for mobile forensics investigation analysis of remnant data on Google Drive client. J. Internet Technol. 2018, 19, 1741–1751. Available online: https://jit.ndhu.edu.tw/article/view/1795 (accessed on 31 March 2021).

- Cavus, N.; Christina, D.N.C. Information technology in the banking sector: Review of mobile banking. Glob. J. Inf. Technol. Emerg. Technol. 2015, 5, 62–70. [Google Scholar] [CrossRef]

- Sharma, S.K.; Sharma, M. Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int. J. Inf. Manag. 2019, 44, 65–75. [Google Scholar] [CrossRef]

- Tijani, J.; Ilugbemi, A. Electronic payment channels in the Nigeria banking sector and its impacts on national development. Asian Econ. Financ. Rev. 2015, 5, 521–531. [Google Scholar] [CrossRef] [Green Version]

- Shaikh, A.A.; Karjaluoto, H. Mobile banking adoption: A literature review. Telemat. Inform. 2015, 32, 129–142. [Google Scholar] [CrossRef] [Green Version]

- Hassan, H.E.; Wood, V.R. Does country culture influence consumers’ perceptions toward mobile banking? A comparison between Egypt and the United States. Telemat. Inform. 2020, 46, 101312. [Google Scholar] [CrossRef]

- Eshet, E.; Bouwman, H. Addressing the Context of Use in Mobile Computing: A Survey on the State of the Practice. Interact. Comput. 2015, 27, 392–412. [Google Scholar] [CrossRef]

- Lange, R.; Burger, E.W. Long-term market implications of data breaches, not. J. Inf. Priv. Secur. 2017, 13, 186–206. [Google Scholar] [CrossRef]

- Kim, Y.; Wang, Q.; Roh, T. Do information and service quality affect perceived privacy protection, satisfaction, and loyalty? Evidence from a Chinese O2O-based mobile shopping application. Telemat. Inform. 2020, 101483. [Google Scholar] [CrossRef]

- Rahi, S.; Ghani, M.A. A structural equation modeling (SEM-AMOS) for investigating brand loyalty and customer’s intention towards adoption of internet banking. In Proceedings of the 29th International Scientific Conference on Economic and Social Development, Rabat, Morocco, 10–11 May, 2018; pp. 206–220. Available online: https://www.esd-conference.com/conference/30 (accessed on 18 December 2018).

- Shaikh, A.A.; Glavee-Geo, R.; Karjaluoto, H. How relevant are risk perceptions, effort, and performance expectancy in mobile banking adoption? Int. J. E-Bus. Res. 2018, 14, 39–60. [Google Scholar] [CrossRef]

- Urbach, N.; Ahlemann, F. Structural equation modeling in information systems research using partial least squares. J. Inf. Technol. Theory Appl. 2010, 11, 5–40. Available online: https://aisel.aisnet.org/jitta/vol11/iss2/2 (accessed on 31 March 2021).

- Nourani, V.; Gökçekuş, H.; Umar, I.K. Artificial intelligence based ensemble model for prediction of vehicular traffic noise. Environ. Res. 2020, 180, 108852. [Google Scholar] [CrossRef]

- Cavus, N.; Mohammed, Y.B.; Yakubu, M.N. Determinants of Learning Management Systems during COVID-19 Pandemic for Sustainable Education. Sustainability 2021, 13, 5189. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information systems success revisited. In Proceedings of the 35th Annual Hawaii International Conference on System Sciences, Big Island, HI, USA, 10 January 2002; pp. 2966–2976. [Google Scholar] [CrossRef]

- Tam, C.; Oliveira, T. Understanding the impact of m-banking on individual performance: DeLone & McLean and TTF perspective. Comput. Hum. Behav. 2016, 61, 233–244. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Munoz-Leiva, F.; Climent-Climent, S.; Liébana-Cabanillas, F. Determinants of intention to use the mobile banking apps: An extension of the classic TAM model. Span. J. Mark. ESIC 2017, 21, 25–38. [Google Scholar] [CrossRef]

- Ntseme, O.J.; Nametsagang, A.; Chukwuere, J.E. Risks and benefits from using mobile banking in an emerging country. Risk Gov. Control Financ. Mark. Inst. 2016, 6, 355–363. [Google Scholar] [CrossRef] [Green Version]

- Weber, R.H.; Darbellay, A. Legal issues in mobile banking. J. Bank. Regul. 2010, 11, 129–145. [Google Scholar] [CrossRef]

- Luo, X.; Li, H.; Zhang, J.; Shim, J.P. Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decis. Support Syst. 2010, 49, 222–234. [Google Scholar] [CrossRef]

- Abbas, S.K.; Hassan, H.A.; Asif, J.; Ahmed, B.; Haider, S.S. Integration of TTF, UTAUT, and ITM for mobile Banking Adoption. Int. J. Adv. Eng. Manag. Sci. 2018, 4. [Google Scholar] [CrossRef] [Green Version]

- Calisir, N.; Basak, E.; Calisir, F. Key drivers of passenger loyalty: A case of Frankfurt–Istanbul flights. J. Air Transp. Manag. 2016, 53, 211–217. [Google Scholar] [CrossRef]

- Zhou, Y.; Wang, H.; Xu, F.; Jin, Y.-Q. Polarimetric SAR image classification using deep convolutional neural networks. IEEE Geosci. Remote Sens. Lett. 2016, 13, 1935–1939. [Google Scholar] [CrossRef]

- Lee, H.S.; Lee, J. Applying Artificial Intelligence in Physical Education and Future Perspectives. Sustainability 2021, 13, 351. [Google Scholar] [CrossRef]

- Van Gerven, M.; Bohte, S. Artificial neural networks as models of neural information processing. Front. Comput. Neurosci. 2017, 11, 114. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mohammed, Y.B.; Karagozlu, D. A Review of Human-Computer Interaction Design Approaches towards Information Systems Development. Brain. Broad Res. Artif. Intell. Neurosci. 2021, 12, 229–250. [Google Scholar] [CrossRef]

- Rahman, A.; Hasan, M.; Mia, M.A. Mobile banking service quality and customer satisfaction in Bangladesh: An analysis. Cost Manag. 2017, 45, 25–32. [Google Scholar]

- Baabdullah, A.M.; Alalwan, A.A.; Rana, N.P.; Kizgin, H.; Patil, P. Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. Int. J. Inf. Manag. 2019, 44, 38–52. [Google Scholar] [CrossRef] [Green Version]

- Gupta, S.; Yun, H.; Xu, H.; Kim, H.-W. An exploratory study on mobile banking adoption in Indian metropolitan and urban areas: A scenario-based experiment. Inf. Technol. Dev. 2017, 23, 127–152. [Google Scholar] [CrossRef]

- Han, C.; Yang, S. Value-based adoption of mobile banking service: A multi-channel perspective. In Proceedings of the 2010 International Conference on Information, Networking and Automation (ICINA), Kunming, China, 18–19 October 2010; pp. V2-506–V2-510. [Google Scholar] [CrossRef]

- Rasull, A.; Jantan, A.H.; Ali, M.H.; Jaharudin, N.S.; Mansor, Z.D. Benefit and Sacrifice Factors Determining Internet Banking Adoption in Iraqi Kurdistan Region. J. Int. Bus. Manag. 2020, 3, 1–20. [Google Scholar] [CrossRef]

- Sharma, S.K. Integrating cognitive antecedents into TAM to explain mobile banking behavioral intention: A SEM-neural network modeling. Inf. Syst. Front. 2019, 21, 815–827. [Google Scholar] [CrossRef]

- Tarute, A.; Nikou, S.; Gatautis, R. Mobile application driven consumer engagement. Telemat. Inform. 2017, 34, 145–156. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Osabutey, E.L.; Egbetokun, A. Contemporary challenges and opportunities of doing business in Africa: The emerging roles and effects of technologies. Technol. Forecast. Soc. Chang. 2018, 131, 171–174. [Google Scholar] [CrossRef] [Green Version]

- Uduimoh, A.A.; Osho, O.; Ismaila, I.; Shafi’i, M.A. Forensic Analysis of Mobile Banking Applications in Nigeria. i-Manag. J. Mob. Appl. Technol. 2019, 6, 9–20. [Google Scholar] [CrossRef]

- Inegbedion, H.E. Factors that influence customers’ attitude toward electronic banking in Nigeria. J. Internet Commer. 2018, 17, 325–338. [Google Scholar] [CrossRef]

- Hanafizadeh, P.; Behboudi, M.; Koshksaray, A.A.; Tabar, M.J.S. Mobile-banking adoption by Iranian bank clients. Telemat. Inform. 2014, 31, 62–78. [Google Scholar] [CrossRef]

- Chyung, S.Y.; Roberts, K.; Swanson, I.; Hankinson, A. Evidence-based survey design: The use of a midpoint on the Likert scale. Perform. Improv. 2017, 56, 15–23. [Google Scholar] [CrossRef] [Green Version]

- Zhou, T.; Lu, Y.; Wang, B. Integrating TTF and UTAUT to explain mobile banking user adoption. Comput. Hum. Behav. 2010, 26, 760–767. [Google Scholar] [CrossRef]

- Haider, M.J.; Changchun, G.; Akram, T.; Hussain, S.T. Exploring gender effects in intention to islamic mobile banking adoption: An empirical study. Arab Econ. Bus. J. 2018, 13, 25–38. [Google Scholar] [CrossRef]

- Taber, K.S. The use of Cronbach’s alpha when developing and reporting research instruments in science education. Res. Sci. Educ. 2018, 48, 1273–1296. [Google Scholar] [CrossRef]

- Li, X.; Ding, Q.; Sun, J.-Q. Remaining useful life estimation in prognostics using deep convolution neural networks. Reliab. Eng. Syst. Saf. 2018, 172, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Li, G.; Shi, J. On comparing three artificial neural networks for wind speed forecasting. Appl. Energy 2010, 87, 2313–2320. [Google Scholar] [CrossRef]

- Reim, W.; Åström, J.; Eriksson, O. Implementation of Artificial Intelligence (AI): A Roadmap for Business Model Innovation. AI 2020, 1, 180–191. [Google Scholar] [CrossRef]

| Construct | Items | Load. (std.) | CA | CR |

|---|---|---|---|---|

| Information Quality (IQ) | IQ1 | 0.902 | 0.853 | 0.872 |

| IQ2 | 0.892 | |||

| IQ3 | 0.913 | |||

| Service Quality (SQ) | SQ1 | 0.844 | 0.786 | 0.797 |

| SQ2 | 0.894 | |||

| SQ3 | 0.950 | |||

| System Quality (SYSQ) | SYSQ1 | 0.861 | 0.847 | 0.873 |

| SYSQ2 | 0.851 | |||

| SYSQ3 | 0.958 | |||

| Trust (TR) | TR1 | 0.713 | 0.850 | 0.887 |

| TR2 | 0.630 | |||

| TR3 | 0.640 | |||

| Legal Framework (LF) | LF1 | 0.892 | 0.802 | 0.843 |

| LF2 | 0.787 | |||

| LF3 | 0.701 | |||

| Risk (R) | R1 | 0.935 | 0.893 | 0.913 |

| R2 | 0.878 | |||

| R3 | 0.920 | |||

| Facilitating Conditions (FC) | FC1 | 0.978 | 0.819 | 0.830 |

| FC2 | 0.907 | |||

| FC3 | 0.932 | |||

| Social Influence (SI) | SI1 | 0.967 | 0.773 | 0.789 |

| SI2 | 0.982 | 0.853 | 0.872 | |

| SI3 | 0.868 |

| Demographic Variable | Frequencies | Percentage |

|---|---|---|

| Gender | ||

| Male | 454 | 59.3 |

| Female | 311 | 40.7 |

| Age group | ||

| 18–25 | 347 | 45.4 |

| 26–35 | 272 | 35.6 |

| 36 and above | 146 | 19 |

| Educational Level | ||

| SSCE | 70 | 9.2 |

| ND | 190 | 24.8 |

| Bachelor/HND | 398 | 52 |

| Masters and above | 107 | 14 |

| Employment status | ||

| Academics | 72 | 9.4 |

| Other civil servants | 284 | 37.1 |

| Students | 265 | 34.7 |

| Business peoples | 144 | 18.8 |

| Input Parameters | Average DC Values | Rank |

|---|---|---|

| Risk | 0.9710 | 1 |

| Trust | 0.9501 | 2 |

| Facilitating conditions | 0.9492 | 3 |

| Legal framework | 0.8920 | 4 |

| System quality | 0.8831 | 5 |

| Information quality | 0.8112 | 6 |

| Social influence | 0.6820 | 7 |

| Service quality | 0.6533 | 8 |

| Hypotheses | Parameters | Std. | S.E. | p-Value | Results |

|---|---|---|---|---|---|

| H1a | Information quality → Intention to use | 1.124 | 0.041 | 0.000 | Supported |

| H1b | Information quality → Satisfaction | 1.128 | 0.044 | 0.023 | Supported |

| H2a | Service quality → Intention to use | 0.855 | 0.030 | 0.004 | Supported |

| H2b | Service quality → Satisfaction | 0.895 | 0.038 | 0.011 | Supported |

| H3a | System quality → Intention to use | 0.871 | 0.032 | 0.000 | Supported |

| H3b | System quality → Satisfaction | 0.912 | 0.063 | 0.018 | Supported |

| H4a | Trust → Intention to use | 0.644 | 0.023 | 0.000 | Supported |

| H4b | Trust → Satisfaction | 0.651 | 0.037 | 0.026 | Supported |

| H5a | Legal framework → Intention to use | 0.862 | 0.029 | 0.002 | Supported |

| H5b | Legal framework → Satisfaction | 0.712 | 0.018 | 0.020 | Supported |

| H6a | Risk → Intention to use | 0.921 | 0.033 | 0.000 | Supported |

| H6b | Risk → Satisfaction | 0.873 | 0.038 | 0.006 | Supported |

| H7a | Facilitating condition → Intention to Use | 0.936 | 0.034 | 0.012 | Supported |

| H7b | Facilitating condition → Satisfaction | 0.883 | 0.047 | 0.022 | Supported |

| H8a | Social influence → Intention to use | 0.926 | 0.033 | 0.003 | Supported |

| H8b | Social influence → Satisfaction | 0.712 | 0.016 | 0.017 | Supported |

| Training | Testing | |||||||

|---|---|---|---|---|---|---|---|---|

| MODEL | R | RMSE | NSE | PBIAS | R | RMSE | NSE | PBIAS |

| ANN | 1.0000 | 0.0012 | 0.9998 | 0.0011 | 0.9998 | 0.0013 | 0.9998 | 0.0012 |

| Inputs | Parameters | Model | Target | Training | Testing | Prediction | |

|---|---|---|---|---|---|---|---|

| H1a | Information quality → Intention to use | 1 | 1.0 | 0.9362 | 0.9280 | 0.9334 | Supported |

| H1b | Information quality → Satisfaction | 2 | 1.0 | 0.9476 | 0.9132 | 0.9570 | Supported |

| H2a | Service quality → Intention to use | 3 | 1.0 | 0.6238 | 0.6510 | 0.6881 | Not-Supported |

| H2b | Service quality → Satisfaction | 4 | 1.0 | 0.7124 | 0.6338 | 0.7812 | Not-Supported |

| H3a | System quality → Intention to use | 5 | 1.0 | 0.9646 | 0.9548 | 0.9614 | Supported |

| H3b | System quality → Satisfaction | 6 | 1.0 | 0.9614 | 0.9136 | 0.9780 | Supported |

| H4a | Trust → Intention to use | 7 | 1.0 | 0.9863 | 0.9794 | 0.9816 | Supported |

| H4b | Trust → Satisfaction | 8 | 1.0 | 0.9894 | 0.9361 | 0.9872 | Supported |

| H5a | Legal framework → Intention to use | 9 | 1.0 | 0.9836 | 0.9812 | 0.9653 | Supported |

| H5b | Legal framework → Satisfaction | 10 | 1.0 | 0.9681 | 0.9682 | 0.9791 | Supported |

| H6a | Risk → Intention to use | 11 | 1.0 | 0.9786 | 0.9710 | 0.9683 | Supported |

| H6b | Risk → Satisfaction | 12 | 1.0 | 0.9613 | 0.9286 | 0.9741 | Supported |

| H7a | Facilitating condition → Intention to Use | 13 | 1.0 | 0.9771 | 0.9673 | 0.9538 | Supported |

| H7b | Facilitating condition → Satisfaction | 14 | 1.0 | 0.9816 | 0.9654 | 0.9730 | Supported |

| H8a | Social influence → Intention to use | 15 | 1.0 | 0.6330 | 0.6884 | 0.6260 | Not-Supported |

| H8b | Social influence → Satisfaction | 16 | 1.0 | 0.6110 | 0.6379 | 0.7310 | Not-Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cavus, N.; Mohammed, Y.B.; Yakubu, M.N. An Artificial Intelligence-Based Model for Prediction of Parameters Affecting Sustainable Growth of Mobile Banking Apps. Sustainability 2021, 13, 6206. https://doi.org/10.3390/su13116206

Cavus N, Mohammed YB, Yakubu MN. An Artificial Intelligence-Based Model for Prediction of Parameters Affecting Sustainable Growth of Mobile Banking Apps. Sustainability. 2021; 13(11):6206. https://doi.org/10.3390/su13116206

Chicago/Turabian StyleCavus, Nadire, Yakubu Bala Mohammed, and Mohammed Nasiru Yakubu. 2021. "An Artificial Intelligence-Based Model for Prediction of Parameters Affecting Sustainable Growth of Mobile Banking Apps" Sustainability 13, no. 11: 6206. https://doi.org/10.3390/su13116206